Abstract

When substantial numbers of consumers claim to be “green”, firms face the choice of whether to develop green products which are more environmental than their traditional counterparts. In many cases, consumers may differ in their willingness-to-pay for the green products that firms should determine which segment to sell the green products to. This paper examines the role of costs, consumer’s green segmentation, and competition in firm’s green production decisions. We find that the cost conditions for green production is relaxed in competition cases compared with the monopolist case. Under competition, the traditional firm would possibly to defend his market share via decreasing the traditional product’s price, which leading to an equilibrium that green products are sold to green segment solely. And we show that in some cases, both traditional and green firms can benefit from a large green segment ratio and consumer’s premium differentiation.Big data contains huge value through which we can better understand consumers. Based on big data technologies development, consumers can be accurate segmented with improved indexes of green premium and segment ratio, thus these conclusions can provide guidance to green production in practice.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Some traditional production are criticized as being seriously polluting our air, earth and water. Now markets may demand more environmental products. Consumers are sophisticated at reading the labels attached in the products such as “low-carbon”, “ecologically friendly”, “energy efficient” or “renewable”. It represents an important marketing opportunity for firms to develop green products targeting the emerging green needs. Governments and many environmental organizations are advising consumers to buy “green” products. For example, the US Environmental Protection provides individual greenhouse gas emissions calculator for the public, encouraging green purchasing (EPA 2014). According to the surveys of the European Commission in 2008 and 2009 (Eurobarometer 2008), 75 % responders say they are ready to buy environmental friendly products even if they are more expensive. The green consumer segment is growing rapidly because the ratio in 2005 is only 31 %.

Big data do help for demand management and forecasting. “Big data represents the end of mass democracy, of mass communications, and, when applied not to politics but to marketing, of mass consumption (Giansante 2015)”. Such as the Global Forest Watch, which is now monitoring every forests online and it can alert us when even a tree falls (GFW 2016). Big data provides “personal” green information in a market composed of individuals, each one different form the others on environmental consciousness and premiums. The green premiums are varying significant among consumer segments distinguished by demographics, ages, and knowledge, etc (Laroche et al. 2001). For environmentally certified wood products, the price premium consumers are willing to pay is vary from 10 to 25 % (Aguilar and Vlosky 2007). As a result, some consumer group in the market is “greener” than the others, the green segment shows stronger preference and higher premiums for product environmental attributes (Vlosky et al. 1999; Do Paço and Raposo 2009). For firms, it is important to learn the green segmentation when they determine the green product price. No doubt, if the green product is priced high, only those consumers with high enough green premiums will buy it. And to enlarge the demand, the firm would price the green product low enough to attract the primary consumers who are not willing to pay too much for the product’s environment attribute.

In this paper, we consider the cases of green and traditional products competing in the market with two segments who are differing in green valuations in both monopoly and duopoly settings. Each product could be offered for both segments in the market. When the firm decides to develop the green product, he faces the problem of targeting which segment. The firm can sell the green product to the green segment at a high price to earn a high marginal profit. Or, he can price the green product low to sell to not only the green segment but also the primary segment, in which way the potential demands enlarged but the green segment can not be price discriminated. In this paper, we develop models to support decision making concerning green position under the existence of green segmentation. In particular, we provide insights into the following questions:

-

With consumer difference, should a firm, in monopoly and in duopoly cases, provide green products only to the green segment (with high premium for green products) or to both segments? If yes, how to price two products?

-

How does competition affect the firm’s choice of green production? How does the green firm, as a competitor with simultaneous choice or as a later entry, affect the traditional product’s price and demands? Is there price equilibrium in competition?

-

How do the green segment size and premiums difference affect the firm’s production choices?

The rest of this paper is organized as follows: Sect. 2 positions the relevant literature on green segmentation and product competition. Section 3 characterises the problem and notations. In Sect. 4, we model the internal competition between traditional and green products in a monopolist case. We give the cost thresholds and green segment size conditions that green product are sold to different segments. In Sects. 5 and 6, green decisions are made in competition cases with simultaneous choices and sequential choices respectively. Section 7 gives a further discussion with big data.

2 Relevant literature

This paper models the product competition facing consumer segmentation by their green premiums. It is mainly related to two streams of literature: green segmentation and product competition. In this section, we give some examples of prominent research in each stream and position our research at their intersection.

Consumers are growing environmental conscious, and many surveys and studies on consumer’s environmental consciousness can be found in Laroche et al. (2001), Kim and Choi (2005) and Minton and Rose (1997). For products, environmental attributes has become one of the most important factors that affect consumers’ purchase decisions (Kashmanian 1991). If consumers are offered greener product with similar prices and technical performance to conventional one, consumers would discriminate in favor of the green product (Peattie 1995; Straughan and Roberts 1999). Do Paço and Raposo (2009) take a research to identify distinct green segmentation in Portuguese consumer market. Their results show that the “greener” segment can be significant differentiated from the other segments. The greener segment care more about the product environmental attributes and are willing to pay more for the environmental product. D’Souza et al. (2007) advised manufacturers use the premium pricing strategy commensurate with the higher costs of green production because consumer are more likely to compromise on a higher prices of green products.

The researches on product competition have been quite abundant. In the influential paper, Moorthy (1984) studies how a monopolist prices two replaceable products differentiated by quality. Consumers are willing to pay more for a higher quality but differ in how much they are willing to pay. Extending to external competition, Moorthy (1988) studies the competitive product strategies in a duopoly case. In his model he found each firm always differentiate his product from his competitor and cannibalization has different effects in monopolist and competition. The cannibalization effect is also analysed by Desai (2001), who studies the quality segmentation in a market characterized by both quality (vertical) and taste (horizontal) differentiation.

Several papers investigate the impact of consumers environmental consciousness in the green production setting. Chen (2001) develops a quality-based model analysing the decision on product’s environmental attributes which conflicts with the traditional attributes. On formulating the demand, he uses the framework of conjoint analysis to structure the valuation of the traditional and green customers. Atasu et al. (2008) study the remanufacturing problem when there exists a green segment in the market which consists of consumers who do not discount the value of the remanufactured product, the existence of green segment has significant effect on the manufacturer’s price strategies. In this paper, we not only consider the exists of the green segment, we also take the premiums difference into account. We show that the premium differentiation plays an important role in the competition between the green and traditional product. This paper provides the green manufacturers with important guidance on how to price the green product especially when facing competition from the traditional manufacturers. Zhang et al. (2015) focus on the channel coordination with two substitutable products with internal competition in a single environmental contributes. This paper learned a lot from the former important literature and extended the demands aspect into a more realistic case that consumers are not only heterogenous in their willingness-to-pay for the traditional contributes, but also differ in their premiums for the green products. In this case, green products are no longer only sold to the green segment–if the price is low enough, the green product can also be sold to the primary segment. Enlightened by Ferguson and Toktay (2006) and Atasu et al. (2008), we investigate the competition effects on green production. Our findings show that competition has very significant effects on green production (along with the traditional production) on the production probability and market division.

Regarding big data, it has generated discourse in very recent years. The quantity of data has been increasingly rapidly because of science and technology developments (Tien 2013). However, at present, no precise and uniform definition of big data exists. Some literature has deliberated that big data has five important characteristics (the 5Vs), i.e., volume, velocity, variety, as well as the problems of veracity and valorization, where the huge volume is the most fundamental and principal (Ohlhorst 2012). Traditional theories and methods in operation research and management are challenged by the big data development (Chen et al. 2012; Provost and Fawcett 2013). Wamba et al. (2015) investigate the operational and strategic impacts of big data and present an interpretive framework analyzing the applications of big data in OR realm. Song et al. (2016) discussed the opportunities and applications with big data in environmental performance evaluation. Hazen et al. (2014) study the application of big data in supply chain management.

3 Problem characteristics and notations

Consider a market served with two products, the traditional and the green products, donated by subscripts t and g respectively. The two products perform the same in their traditional attributes but differ in their environmental attributes. In this product performance assumption, the green product incurs a higher unit cost compared to its traditional counterpart due to the effort for environmental improvement. We assume the cost of the traditional product is zero. The cost of green product is \({c_g}\) and \({c_g}>0\), which represents the cost of distinct additional environmental effort.

On the demand side, there are A consumers in the market. Consumers are heterogeneous regarding their willingness-to-pay \(\theta \) for the traditional product and \(\theta \) is uniformly distributed over [0, 1]. The market is made up of two segments differing in their premiums for the green product, a green segment and a primary segment, donated by superscripts P and G respectively. The green segment is willing to pay a price premium \(k_h\) for the green product, which is greater than the primary segment’s price premium \(k_l\), i.e., \(k_h>k_l>0\). The ratio of green segment is \(\beta \) of the market, then the ratio of primary segment is \(1-\beta \), i.e., \(\beta \le 1\). When a consumer values the traditional product at \(\theta \), she values the green product at \(\left( {1 + k_l} \right) \theta \) if she is in the primary segment and \(\left( {1 + k_h} \right) \theta \) if she is in the green segment. Let the notations p, q and U denote the price, demand and utility for product respectively. Based on the valuations, both primary and green consumers get utility \({U_t}=\theta - {p_t}\) from the traditional product. A primary consumer gets utility \(U_g^P =({1 + k_l} )\theta - {p_g}\) from the green product and a green consumer gets utility \(U_g^G =( {1 + k_h} )\theta - {p_g}\) from the green product. A primary consumer purchases the green product if \(U_g^P>{U_t}\) and \(U_g^P>0\). Otherwise, she purchases the traditional product if \(U_t>0\) or purchases nothing if \(U_t\le 0\). Similarly, a green consumer purchases the green product if \(U_g^G>{U_t}\) and \(U_g^G>0\). Otherwise, she purchases the traditional product if \(U_t>0\) or purchases nothing if \(U_t\le 0\).

Based on the analysis above, we can specify demands for two products in different products’ price regimes. Throughout our models we consider cases where the green products are priced higher than the traditional product, i.e., \(p_g>p_t\), which is prevalent in practice due to its higher production cost.

Case 1 If \(p_g\ge k_l+p_t\), the green product is only sold to the green segment; the primary consumers do not buy green products because \(p_g \ge k_l + p_t \Rightarrow U_g^P \le U_t\). Thus demands from primary segment are:

For the green segment, if \((1+k_h)p_t\le p_g<k_h+p_t\), green consumers with high willingness-to-pay buy the green products and the price sensitive consumers buy the traditional products. Then, demands from the green segment are:

If \(p_g\ge k_h +p_t\), no green consumer will buy the green product, i.e., \(q_g^G =0\). Thus, in the price equilibrium in our following analysis, the inequality \(p_g\le k_h +p_t\) gives the condition for green production. If \(p_g<(1+k_h)p_t\), green consumers’s utility from the green product is always higher than the utility from the traditional product, i.e., \( U_g^G \ge U_t\), thus,

Case 2 If \(p_g< k_l+p_t\), the green product is sold to both green and primary segments. In this price regimes, the green product is price relatively low, making it also attractive to some primary consumers. Demands from primary segment are:

To be specific, we summarize the parameters and decision variables in Table 1.

4 Monopoly analysis

We start our analysis with a monopoly case where the monopolist is providing traditional products to the market. When consumers show premiums for the green product, the monopolist will consider whether to provide green products to the same market. Thus, we model the internal competition between the traditional and green products to give conditions where it is profitable for green production. In this section, we answer the following questions: Should a monopolist develop green products to serve the market? and if yes, which segment is his target and how to price two products in different targets?

To address the above issues, it is necessary to take the traditional case without green segmentation into account as a benchmark. In this case, only the traditional products are provided, then the the monopolist’s objective is: \(\mathop {\max }\limits _{p_t } \varPi = p_t (1 - p_t )\), and the solution is \((p^*,q^* )=( 1/2,A/2 )\), the maximized profit is A / 4.

If green products are provided to the same market, the monopolist prices the traditional and green products simultaneously to maximize his profit, thus the objective is:

The demands in different pricing regions are given in the Eqs. 1 to 4 , the optimal solutions in different price regions can be obtained by solving Eq. 5. When the green costs are such that the monopolist can sell green products to the market simultaneously(see Corollary 1), the monopolist compares his profits in different target segments and his price solutions are given in Proposition 1.

Proposition 1

Condition 1. Suppose \( \varDelta < k_l\), \({\tilde{\beta }_1} = \frac{{{{({c_g} - {k_l})}^2}{k_h}}}{{\varDelta (c_g^2 - 2{c_g}{k_l} + {k_l}{k_h})}}\) exists that a monopolist’s optimal solutions are summarized in Table 2, where we define \(\varDelta \buildrel \textstyle .\over = k_h-k_l\) for simplicity. \(\varDelta \) is the premium differentiation of two segments.

Condition 2. Suppose \(\varDelta \ge k_l\), \(\tilde{\beta }_2 \) exists that the optimal solutions are summarized in Table 3.

Proof

See A for proof and further discussion on the existence and uniqueness of the solutions. \(\square \)

Proposition 1 shows that the monopolist has different pricing regimes depending on the green segment ratio. When the green segment is small, i.e., \(\beta < \tilde{\beta }_i \) , \(i=1\) when \( \varDelta < k_l\) and \(i=2\) when \( \varDelta \ge k_l\), the firm prices green product low to sell to both segments. It is because when \(\beta \) is small, the demands from the green segment is so small that the monopolist find it more profitable to use the low pricing regime which could capture the high willingness-to-pay consumers in the primary segment. Notice that, even \(\beta =0\), green products can be sold to the primary segment uses the low price regime.

When the green segment is sufficient large, i.e., \(\beta \ge \tilde{\beta }_i \), the manufacture price green products high to get high marginal profit out of the green segment only. There is a trade off between the profit margin and the sales of the green product. When the green segment size is large enough, the monopolist find it more profitable to get a large profit margin, and the primary segment are purchasing only the traditional product.

The premiums’ differentiation also has effect on the price decisions. In condition 1 the difference of two segments’ premiums is not large, i.e., \(\varDelta < k_l\). When the green products are priced in low price regime to attract primary consumers, the price-sensitive consumers in green segment will buy traditional products that \(q_t^G>0\); In condition 2 the difference of the two segments’ premiums is large, i.e., \(\varDelta > k_l\). When the monopolist uses the low price regime, all the green segment prefers green products to traditional products that \(q_t^G=0\). And we find in this situation, the monopolist would price the traditional product higher than other situations, to improve the sales of the green products.

Corollary 1

To guarantee the nonempty of demand for the green product, green cost should be lower than thresholds. To be specific,

-

1.

When \(\beta >0\), green products can be sold to the green segment if the green cost is not higher than the green consumer’s premium, i.e., \(c_g \le k_h\), otherwise, no green products will be sold in the market.

-

2.

When \(\beta =0\), green products can be sold to the primary segment only if \(c_g\le k_l \), otherwise, no green products will be sold in the market.

Proof

See A for proofs. \(\square \)

When \(\beta >0\), the monopolist can sell green products to the green segment if \(c_g\le k_h \). It implies that the marginal profit from the green product should be at least as high as the traditional product’ marginal profit, i.e., \(p_g-c_g \ge p_t\), in order to overcome the cannibalization impact. Otherwise, green production is not as profitable as the traditional production that no green products are sold. If \(\beta \) is small that the monopolist would sell green products to both the green and primary segments, cost conditions are \({c_g} \le \frac{{{k_l}\left( {{k_h} - 2\beta \varDelta } \right) }}{{{k_h} - \beta \varDelta }}\) if \(\varDelta < k_l\), and \({c_g} \le \frac{{{k_l}\left( {1 + {k_h} - 2\beta \varDelta } \right) }}{{1 + {k_h} - \beta \varDelta }}\) if \(\varDelta \ge k_l\). Otherwise, the green products can be only sold to the green segment, which requires \(c_g\le k_h \).

When \(\beta =0\) , the green product can be only sold to the primary segment, the threshold is \({c_g} <{k_l}\). It implies that it is harder to sell to the primary segment because they will pay less for products’ green performance. When \(\beta >0\) the thresholds are decreasing in \(\beta \), which implies that as the green segment increases, the green cost should be even lower than \({k_l}\) to overcome the negative impact of internal competition in the primary segment. This is because the green product sales prices will be higher (than \(p_{g\left| {\beta = 0} \right. }^*=\frac{1+c_g+k_l}{2}\)) to extract the consumer surplus from the green segment, which decreases the profits from the primary segment. As Proposition 1 states, when the green segment size becomes sufficient high, the monopolist changes his price regime, i.e., selling green products to the green segment only to extract high consumer surplus from the green segment.

Corollary 2

With green production, no matter the green products are sold to green segment or both segments, the monopolist’s profit is increasing in \(\beta \) and \({k_h}\).

Proof

See B for proofs. \(\square \)

5 Competition analysis with simultaneous choices

Having get the solutions in which there is only one decision-maker, we now consider the effect of competition between two decision-makers: Firm 1 and Firm 2. If both firms provide the same product, the only price equilibrium is for each firm to price at marginal cost and both firms make no profit (Moorthy 1988). Thus, the competitors will choose to provide different products to the same market, i.e., if Firm 1 choose to provide traditional product, Firm 2 will choose to provide green product, and vice versa. Let Firm 1 be the traditional producer and Firm 2 be the green producer. There exists external competition between two products and two firms choose their prices simultaneously.

Let \(p_1\), \(p_2\) and \( \varPi _1\), \(\varPi _2\) represent the prices and profits of Firm 1 and Firm 2 respectively. Each firm will compare his profits in different pricing regimes to determine his best response function.

For Firm 1, his profit is \(\varPi _1={p_1 }(q_t^P + q_t^G )\), where \(q_t^P\) and \(q_t^G\) is given in Eqs. 1 to 4. Given Firm 2’s price, Firm 1’s price region determines which demands function can be used. If he prices the traditional product lower than Firm 2’s price subtract the primary consumer’s premium, i.e., \({p_1} \le {p_2} - {k_l}\), he would deter Firm 2 from selling the green product to the primary segment through a low price response. In this way, Firm 1 can defend his market share in the primary segment. Firm 2 would also consider that he can price the traditional product high, i.e., \({p_1} > {p_2} - {k_l}\). In this price region, he will get higher marginal profit but lose some market share to his competitor because the primary consumers will purchase the green product. In the trade-off between marginal profit and market share, Firm 1 compares his profits in different price regimes and chooses the best response. In the competition case with simultaneous choices, when \(\varDelta \ge {k_l}\), if \(0< \beta < \frac{{4{\varDelta ^2} - 4{k_l}^2}}{{1 + 4{\varDelta ^2} + 4{k_l}}}\), and \({p_2^I}=\frac{{ - \left( {1 - \beta } \right) {k_h} + \sqrt{\left( {1 - \beta } \right) {k_h}\left( {\beta + {k_h}} \right) } }}{\beta }\), Firm 1’s best response function is given as:

If \(\frac{{4{\varDelta ^2} - 4{k_l}^2}}{{1 + 4{\varDelta ^2} + 4{k_l}}}\le \beta < \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\), Firm 1’s best response function is given as:

When \(\varDelta \ge {k_l}\) and \(\beta \ge \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\), or \(\varDelta <{k_l} \), Firm 1’s best response function is given as:

Firm 1 would first price the traditional product low to prevent Firm 2’s encroachment on the primary segment if Firm 2’s price is high enough, i.e., \({p_1} \le {p_2} - {k_l}\). When Firm 2 decreases the green product price, Firm 1 change his response to price his product high, i.e., \({p_1} > {p_2} - {k_l}\). From the response function, we find Firm 1’s response is effected by the premium differentiation \(\varDelta \) and the green segment size \(\beta \).

For Firm 2, his profit is \(\varPi _2={p_2 }(q_g^P + q_g^G )\). Similarly, Firm 2 gets his optimal solutions in different pricing regions and compares the profits to obtain his best response of the entire problem. When Firm 1’s price is low enough, i.e., \({p_1}\le {p_1^I}\), Firm 2 will price the green product high to sell to the green segment only; when Firm 1’s price is higher than \({p_1^I}\), Firm 2 uses his low price response selling his products to both segments. Then Firm 2’s best response function is given in Eq. 9.

Proposition 2

In the competition with simultaneously choice, there exist Nash equilibrium.

-

1.

When \(\varDelta \ge {k_l}\) and \(\beta <\frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\) there exist unique Nash equilibrium. If \({c_g} >c_g^I\), the green product is sold to the green segment only and the traditional product is sold to both segments. The price at equilibrium is:

$$\begin{aligned} ({p_{1}^*},{p_{2}^*})=\left( \frac{{ \beta {c_g} + 2{k_h} - \beta {k_h}}}{{3\beta + 4{k_h}}},\frac{{{c_g} + {k_h}+{p_{1}^*}}}{2}\right) \end{aligned}$$If \({c_g} <c_g^{II}\), the green product are sold to both primary and green segments and the traditional product is sold to both segments. The price at equilibrium is:

$$\begin{aligned} ({p_{1}^*},{p_{2}^*})=\left( \frac{{{c_g}{k_h} - \beta {c_g}\varDelta + {k_h}{k_l}}}{{3{k_h} - 3\beta \varDelta + 4{k_h}{k_l}}}, \frac{{2\left( {{k_h} - \beta \varDelta + {k_h}{k_l}} \right) }}{{{k_h} - \beta \varDelta }}{p_{1}^*}\right) \end{aligned}$$If \(\frac{{\left( {1 + {k_h}} \right) {k_l}\left( {1 - \beta + {k_h} - 2\beta \varDelta } \right) }}{{{k_h}\left( {1 - \beta + {k_h} - \beta \varDelta } \right) }}< {c_g} < \frac{{{k_l}\left( {{k_h}\left( {1 + {k_h}} \right) - \beta \varDelta + 2\beta {k_h}\varDelta } \right) }}{{{k_h}\left( {{k_h} - \beta \varDelta } \right) }}\), the green product is sold to green segment only and the traditional product is sold to primary segment only. The price at equilibrium is:

$$\begin{aligned} ({p_{1}^*},{p_{2}^*})=\left( \frac{{{k_l}}}{{{k_h}}},{k_l}\mathrm{{ + }}\frac{{{k_l}}}{{{k_h}}}\right) \end{aligned}$$ -

2.

If \(\varDelta < {k_l}\), or \(\varDelta \ge {k_l}\) and \(\beta \ge \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\), the only Nash equilibrium exists under the condition \({c_g} <c_g^{II}\) and the price at equilibrium is:

$$\begin{aligned} ({p_{1}^*},{p_{2}^*})=\left( \frac{{{c_g}{k_h} - \beta {c_g}\varDelta + {k_h}{k_l}}}{{3{k_h} - 3\beta \varDelta + 4{k_h}{k_l}}}, \frac{{2\left( {{k_h} - \beta \varDelta + {k_h}{k_l}} \right) }}{{{k_h} - \beta \varDelta }}{p_{1}^*}\right) \end{aligned}$$

Proof

See C for proofs. \(\square \)

When \(\varDelta \ge {k_l}\) and \(\beta \ge \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\), the green segment ratio is high. The high price equilibrium does not exist because if Firm 2 want to sell the green product to the green segment at a high price, the high price leading to a zero demand. If \(\varDelta < {k_l}\), where the primary consumer’s premium is relatively high, there is a strong niche in the primary segment that Firm 2 would always lower his price to reach the equilibrium that he can encroach on the primary segment. The cost thresholds to sell green product to different targets are stated in Corollary 3.

Corollary 3

In price equilibrium with simultaneously choice, green cost should be lower than a threshold to sell in the market. To be specific,

-

1.

When \(\beta >0\), green products can be sold to the green segment when \({c_g} < {k_h} + \frac{{{k_h}}}{{\beta + 2{k_h}}} \). Otherwise, no green products are sold. The threshold is increasing in green consumer’s premium \({k_h}\) but decreasing in green segment size \(\beta \).

-

2.

When \(\beta =0\), green products can be sold to the primary segment if and only if \(c_g\le 2{k_l} \).

Proof

See C for proofs. \(\square \)

In this competition with simultaneously choice, the cost threshold to sell to green segment is larger than the threshold in the monopolist case (\({c_g} < {k_h}\) in the monopolist case). It implies that when the cost is too high for a monopolist to profit from green production, it can be profitable for a competitor. The threshold is decreasing in \(\beta \), because at equilibrium, both firms lower their prices as \(\beta \) increases that a lower green cost is required to sell to the green segment. In the equilibrium that the green product is sold to both segments, the cost condition is \({c_g} < c_g^{II}\). When \(\beta =0 \), the green product can only be sold to the primary segment and the cost threshold is \({c_g} < c_{g\left| {\beta = 0} \right. }^ {II} =2 {k_l}\).

Corollary 4

In the equilibrium green product is sold to green segment only, Firm 2’s profit is concave in \(\beta \). In the equilibrium the green product is sold to both segment, Firm 2’s profit is increasing in \(\beta \). Firm 1’s profit is always decreasing in \(\beta \).

Proof

See D for proofs. \(\square \)

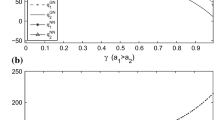

Corollary 4 suggests that a large green segment ratio \(\beta \), does not necessarily increase Firm 2’ s profit, but it will decrease Firm 1’s profit. We give Figs. 1 and 2 to facilitate the impact of green segment ratio on firms’ profits. In Fig. 1 Firm 1’s profit is decreasing in \(\beta \) and increasing in the green cost \(c_g\). In Fig. 2 Firm 2’s profit is concave in \(\beta \). Firm 2 would first benefit from the increasing green segment ratio, which implies a larger potential market. But Firm 2’ s profit decreases when \(\beta \) is sufficient large. It is because when \(\beta \) is large, competition in the green segment between two products increases. In this example, when \(\beta =0\), the highest green cost threshold is \({c_g} <{k_h} + \frac{{{k_h}}}{{\beta + 2{k_h}}}= 0.8\), and when \(\beta =0.18\), the threshold is \({c_g} < 0.685\). While, in the monopoly case, the cost threshold to sell to the green segment is \({c_g} < {k_h}=0.3\). We see that under competition, the cost threshold is greatly enhanced.

6 Competition case with sequential entry

In this section, we suppose the traditional manufacturer is Firm 1 providing traditional products to the market, and Firm 2 is the later entrant who is going to encroach on the market by providing green products. We examine the price equilibrium in this sequential entry context. In sequential entry, Firm 2’s best response function is the same as in Eq. 9. In Firm 2’s response function, when he make his price high that Firm 2 can sell the green product to the primary segment, there are two pricing choices. The two response differs in whether Firm 2 will lower his price to the degree that no green consumer will purchase the traditional product, i.e., \({p_2}<({1 + {k_h}}){p_1}\). Since we focus on Firm 1’ s decision whether he will deter Firm 2 from selling the green product to the primary segment, i.e., \({p_2} \le {k_l}+{p_1}\), we would first neglect Firm 2’ s response that he price at \(\frac{{{c_g}}}{2} + \frac{{\left( {\left( {1 - \beta } \right) {p_1} + {k_l}} \right) \left( {1 + {k_h}} \right) }}{{2(1 - \beta + {k_h} - \beta \varDelta )}}\), and this response will be discussed briefly later.

If Firm 1 price the traditional product at \({p_1^I}\), Firm 2 is indifferent between his two price regimes—his profit from selling the green product to green segment only is the same as the profit from selling green products to both segments. If Firm 1’s price is lower than the indifferent point, Firm 2 will use the high price regime to get high marginal profit. If Firm 1’s price is sufficient high, firm 2 finds low price regime better because the demands increment overweighs the loss in marginal profit. Notice that Firm 2’s indifferent point is increasing in \(\beta \), i.e., \(\frac{{d{p_1^I}}}{{d\beta }} = \frac{{\varDelta {k_l}{k_h}}}{{2\sqrt{\beta {k_l}({k_h} - \beta \varDelta )} \left( {\beta \varDelta - {k_h}} \right) }}>0\). Because if \(\beta \) is small, the demands from the green segment is so small that Firm 2 will lower his price to encroach on the primary segment.

Proposition 3

If Firm 1 does not anticipate the later entry of Firm 2, Firm 1 provides traditional products at the monopoly price, i.e., \( p_1^*=1/2\). If \({c_g}\ge \frac{1}{2}\left( {1 + 2{k_l}} \right) - \varDelta \sqrt{\frac{{\beta {k_l}}}{{{k_h} - \beta \varDelta }}} \), the price equilibrium is \(\left( {p_1^*,p_2^*} \right) = \left( {\frac{1}{2},\frac{{2({c_g} + {k_h}) + 1}}{4}} \right) \) . Otherwise, the price equilibrium is \(\left( {p_1^*,p_2^*} \right) = \left( {\frac{1}{2},\frac{{2{c_g} + 1}}{4} + \frac{{{k_l}{k_h}}}{{2\left( {{k_h} - \beta \varDelta } \right) }}} \right) \) .

In Proposition 3, the green product can be sold to the primary segment when \({p_1^I}< 1/2 \), which is met when \({c_g}< \frac{1}{2}\left( {1 + 2{k_l}} \right) - \varDelta \sqrt{\frac{{\beta {k_l}}}{{{k_h} - \beta \varDelta }}} \). When \(\beta =0\), the cost condition to sell to the primary segment is \(c_g<k_l+1/2\). From the constraint \({p_2}< {p_1}+ {k_h}\), we get the cost threshold to sell the green product to the green segment, i.e., \(c_g<k_h+1/2\).

Now suppose Firm 1 anticipates the later entry of Firm 2 and Firm 1 know Firm 2’s response functions. If Firm 1 wants to deter Firm 2’s encroachment on primary segment, he will keep the traditional product’s price not higher than Firm 2’s indifferent price, i.e., \( {p_1} \le {p_1^I}\). Here we define \(c_g^{III} \buildrel \textstyle .\over = \frac{{2{k_h} + 4{k_h}{k_l}\mathrm{{ + }}\beta \left( {\varDelta - {k_l}} \right) }}{{\beta + 4{k_h}}} - 2\frac{{\varDelta \left( {\beta + 2{k_h}} \right) }}{{\beta + 4{k_h}}}\sqrt{\frac{{\beta {k_l}}}{{{k_h} - \beta \varDelta }}} \). Then Firm 1’s optimal price is given by:

If Firm 1 keep the traditional product’s price higher than Firm 2’s indifferent price, i.e., \( {p_1} > {p_1^I}\). The green product can be sold to the primary segment. Then Firm 1’s optimal price is given by:

Here, \( c_g^{IV} \buildrel \textstyle .\over = \frac{{{k_l}\left( {3{k_h} - 2\beta \varDelta + 4{k_l}{k_h}} \right) }}{{{k_h} - \beta \varDelta + 4{k_l}{k_h}}} - 2\varDelta \frac{{{k_h} - \beta \varDelta + 2{k_l}{k_h}}}{{{k_h} - \beta \varDelta + 4{k_l}{k_h}}}\sqrt{\frac{{\beta {k_l}}}{{\left( {{k_h} - \beta \varDelta } \right) }}} \). In this situation, green products compete with traditional products not only in the green segment but also in the primary segment. For Firm 1, he prices the traditional product high to get a high profit margin, but his market share decreases not only in the green segment but also in the primary segment.

The inequality \(c_g^{IV}<c_g^{III}\) always holds. If \(c_g\ge c_g^{IV}\), Firm 1’s optimal price is given in Eq. 11, i.e., \({p_1^*} = \min \{ {p_1^I},\frac{{\beta \left( {{c_g} - {k_h}} \right) + 2{k_h}}}{{2\left( {\beta + 2{k_h}} \right) }}\}\), where Firm 1 prices the traditional product low to make the primary consumers do not purchase the green product. If \(c_g<c_g^{IV}\), Firm 1 has two price choices and compares his profits at two price choices to determine his optimal price as given in Proposition 4.

Proposition 4

When \(\frac{{{k_h}{k_l}}}{{{k_h} - \beta \varDelta + 4{k_h}{k_l}}}\le {c_g}< c_g^{IV}\), there exists \(\tilde{\beta }_3\), when \(\beta < \tilde{\beta }_3\), the green product can be sold to the primary segment and the price equilibrium is \((p_1^*,p_2^*)=\frac{{{k_l}{k_h} + {c_g}\left( {{k_h} - \beta \varDelta } \right) }}{{2\left( {{k_h} - \beta \varDelta + 2{k_l}{k_h}} \right) }}, \frac{{{c_g} + {p_1^*}}}{2} + \frac{{{k_l}{k_h}}}{{2({k_h} - \beta \varDelta )}}\), when \(\beta \ge \tilde{\beta }_3\), the green product is sold to the green segment only and \((p_1^*,p_2^*)=({p_1^I}, \frac{{{c_g} + {k_h} + {p_1^I}}}{2})\).

Proof

See E for proofs. \(\square \)

Proposition 4 implies that the green segment ratio \(\beta \) will effect Firm 1’s price decision whether to deter Firm 2 from selling green product to the primary segment. When \(\beta < \tilde{\beta }_3\), Firm 1 would first price the traditional product high; When \(\beta >\tilde{\beta }_3\), Firm 1 lower his price that just no primary consumer purchasing the green product.

Figure 3 represents the profit of Firm 1 affected by \(\beta \) when the green product can be sold to the primary segment. We use \(\varPi _1^H\) to denote the profit in this price \(p_1^*=\frac{{{k_l}{k_h} + {c_g}\left( {{k_h} - \beta \varDelta } \right) }}{{2\left( {{k_h} - \beta \varDelta + 2{k_l}{k_h}} \right) }}\); and \(\varPi _1^L\) to denote the profit in this price \(p_{1}^*= {p_1^I}\). When \(\beta < \tilde{\beta }_3\), Firm 1’ profit sell to both segments is higher than that only sell to green segment. When \(\beta \ge \tilde{\beta }_3\), the profits reverse. Firm 1’s reaction determines how the price equilibrium exists as stated in Proposition 4.

Corollary 5

In price equilibrium with sequential entry, green cost threshold is enlarged compared to the one in simultaneously choice if \({k_l}<1/4\). To be specific,

-

1.

When \(\beta >0\), green products can be sold to the green segment when \({c_g} < {k_h} + \frac{{2{k_h}}}{{\beta + 4{k_h}}} \). Otherwise, no green products are sold. The threshold is increasing in green consumer’s premium \({k_h}\) but decreasing in green segment ratio \(\beta \).

-

2.

When \(\beta =0\), green products can be sold to the primary segment only. Green production is profitable if \(c_g\le {k_l} + \frac{{2{k_l}}}{{1 + 4{k_l}}}\).

Comparing the cost thresholds to sell green products in different competition cases, if \(\beta >0\), the cost threshold is enlarged. In the monopoly case, the cost condition is \({c_g} <{k_h}\), in the competition case with simultaneous choice the condition is \({c_g} < {k_h} + \frac{{{k_h}}}{{\beta + 2{k_h}}} \), the inequality \({k_h}<{k_h} + \frac{{{k_h}}}{{\beta + 2{k_h}}} <{k_h} + \frac{{2{k_h}}}{{\beta + 4{k_h}}} \) holds when \(\beta >0\).

If \(\beta =0\), there is no green segment in the market, the green product can be sold only to the primary segment and the cost threshold is \(c_{g\left| {\beta = 0} \right. }^{IV} = \frac{{{k_l}\left( {3 + 4{k_l}} \right) }}{{1 + 4{k_l}}} = {k_l} + \frac{{2{k_l}}}{{1 + 4{k_l}}}\). In the monopoly case, the cost condition is \({c_g} <{k_l}\), in the competition case with simultaneous choice the condition is \({c_g} < 2{k_l} \). When \({k_l}<1/4\), the inequality \(2{k_l}< {k_l} + \frac{{2{k_l}}}{{1 + 4{k_l}}}\) always holds.

Corollary 6

In the competition with sequential entry, there are conditions that Firm 2 can profit from a large \(\beta \) and \(k_h\), to be specific,

-

1.

When \(c_g\ge c_g^{IV}\), Firm 1’s profit is decreasing in \(\beta \) and \(k_h\). Firm 2’s profit is concave in \(\beta \) and increasing in \(k_h\).

-

2.

When \(\frac{{{k_h}{k_l}}}{{{k_h} - \beta \varDelta + 4{k_h}{k_l}}}\le c_g< c_g^{IV}\), if \(\beta < \tilde{\beta }_3\), Firm 1’s profit is decreasing in \(\beta \) and \(k_h\). if \(\beta \ge \tilde{\beta }_3\), Firm 1’s profit is concave in \(\beta \) and increasing in \(k_h\). Firm 2’s profit is increasing in \(\beta \) and \(k_h\).

-

3.

When \( c_g< \frac{{{k_h}{k_l}}}{{{k_h} - \beta \varDelta + 4{k_h}{k_l}}}\), Firm 1’s and Firm 2’s profits are increasing in \(\beta \) and \(k_h\).

From Fig. 3 we know that when \(\beta < \tilde{\beta }_3\), Firm 1’ profit is decreasing in the green segment ratio. When \(\beta \ge \tilde{\beta }_3\), Firm 1’s profit would first increases in the green segment ratio and then decreases in \(\beta \). It implies that a large \(\beta \) does not necessarily decrease Firm 1’s profit. This is due to the fact that an increasing green segment ratio would alleviate the competition between two products. While, as more consumers are growing green, Firm 1’s profit decreases because more traditional product’s market share loses.

Figure 4 illustrates that Firm 1’s profit increases in the green consumer’s premium \(k_h\) when Firm 1 choose to price at Firm 2’s indifferent price. In this situation, Firm 1 and Firm 2’s profits are both increasing in the green consumers’ premium. It also implies that a large premium differentiation \(\varDelta \) would increase both firms’ profits.

7 Big data research relating to green production and discussions

Currently, consumers’ environmental evaluation data generated by network-based investigation or computer modeling are increasing rapidly, and even social contact media platforms including Facebook, Twitter, LinkedIn and so on have attracted researchers’ attention. For different kinds of manufacturers, either the traditional firms or the new entrants, they can directly release various environmental information through network platforms in which way consumers can obtain information quickly and consequently select more environmental products. Consumers are paying more attention on the aspects of maintaining individual health and protecting the environment. Moreover, consumer selections will be transmitted or fed back through these network platforms, thus encouraging merchants and production manufacturers to improve the environmental quality of their products. During this process, big data contains abundant information. The manufacturers can obtain much more than ever before about consumers’ purchasing behavior on the environmental aspects. No doubt, the progressing of big data helps the green manufacturers and the green consumers in both demands and supply aspects.

In this paper, we develop insights for manufacturers who face the choice whether to take green production. We model the competition between the traditional product and the green product, in particular, we focus on market characteristics and cost drivers. We consider a market where consumers are differ in their willingness-to-pay and premiums for product’s environmental attributes. Green product outperforms the traditional product because it emits less carbon emissions. Extra costs are incurred during the green progressing. We first considered a monopolist case where it is internal competition between green and traditional products. Then we considered external competition cases, especially when the green product is introduced to the market later than the traditional product. Our research shows that green production decision is driven by the key factors: cost, cannibalization and competition.

Extra cost is the main reason that firms are not going to providing green products. We give the cost thresholds that make green production a profitable alternative. These thresholds are shaped different depending on firm’s targeting segment and competition. We showed that under competition, the cost threshold is enlarged a lot. Therefore, green cost is not sufficient low under monopoly can be sufficient under competition.

For the cannibalization concerns, a monopolist can overcome the negative impact by using different pricing regimes. When the ratio of green segment who are willing to pay a high premium is expected to be high, the monopolist can use a high price regime. Otherwise, the monopolist uses a low price regime to capture the low premium consumers in the primary segment. However, facing external competition, the traditional producer would usually make a deterrence decision to defend his market share in the primary segment. Competition changes the cost thresholds of green production, not only the threshold to sell to the high premium segment but also the one to sell to the primary segment.

Under competition, traditional firms loses market shares to their competitors as well as their profits. As we showed, the cost threshold under competition is larger than that in monopoly. If the monopolist does not develop green products, it is quite possible for his competitor to. With new carbon regulations adopted by various countries and consumers are growing more environmental conscious, it is important for the manufacturers to think twice about their green decisions. Big data research that relates to environmental management, such as the data generated by remote sensing, network-based investigation and computer modeling are increasing rapidly, which makes the data needed for green segmentation much more available and precise than ever before. Regarding to product’s green performance, consumers can obtain such information not only from the product label but also from big data information on internet platforms. Consumers purchasing behavior is affected by the information they can obtain. Moreover, the fed back through network platforms can effectively make firm’s green segmentation possible. With the progressing of big data, this paper’s conclusions can be easier applied in practice with much more precise information about consumer’s green premium and the green segment ratio.

Our research focus on the demand side of this problem and there are some limitations for future research. For example, in our models, consumers’ premiums are positive. Products are competing on a single product attribute–the carbon emissions. In practice, products can differ in their traditional attributes, or consumers are not sure about whether the green product can perform as well as the traditional product in its traditional attributes. Relaxing our assumption that consumers may discount the green product where some consumer segment are willing to pay less for the green product. Similarly, we could consider the assumption that green is not costly but cost-saving. It is possible to decrease the production cost as well as cut the carbon emissions, such as the recycle. Carbon regulations are not considered in our model, which is an important reason for green production. Such as the carbon cap-and-trade regulation and the carbon tax, these regulations would make green production more competitive.

References

Aguilar, F. X., & Vlosky, R. P. (2007). Consumer willingness to pay price premiums for environmentally certified wood products in the us. Forest Policy and Economics, 9(8), 1100–1112.

Atasu, A., Sarvary, M., & Wassenhove, L. N. V. (2008). Remanufacturing as a marketing strategy. Management Science, 54(10), 1731–1746.

Chen, C. (2001). Design for the environment: A quality-based model for green product development. Management Science, 47(2), 250–263.

Chen, H., Chiang, R. H., & Storey, V. C. (2012). Business intelligence and analytics: From big data to big impact. MIS Quarterly, 36(4), 1165–1188.

Desai, P. (2001). Quality segmentation in spatial markets: When does cannibalization affect product line design? Marketing Science, 3(20), 265–283.

Do Paço, A., & Raposo, M. (2009). “Green” segmentation: An application to the portuguese consumer market. Marketing Intelligence & Planning, 27(3), 364–379.

D’Souza, C., Taghian, M., & Khosla, R. (2007). Examination of environmental beliefs and its impact on the influence of price, quality and demographic characteristics with respect to green purchase intention. Journal of Targeting, Measurement and Analysis for Marketing, 15(2), 69–78.

EPA (2014) Individual greenhouse gas emissions calculator. http://www.epa.gov/climatechange/ghgemissions/individual.html, 2014 carbon footprint

Eurobarometer, S. (2008). Attitudes of European citizens towards the environment. European Commission 295.

Ferguson, M. E., & Toktay, L. B. (2006). The effect of competition on recovery strategies. Production and Operations Management, 15(3), 351–368.

GFW (2016) Global forest watch. http://www.globalforestwatch.org/, updated 2016-03-14.

Giansante, G. (2015). Online political communication: How to use the web to build consensus and boost participation. In Web analytics: Using the web to save resources and obtain better results (p. 129). Springer International Publishing, Switzerland.

Hazen, B. T., Boone, C. A., Ezell, J. D., & Jones-Farmer, L. A. (2014). Data quality for data science, predictive analytics, and big data in supply chain management: An introduction to the problem and suggestions for research and applications. International Journal of Production Economics, 154, 72–80.

Kashmanian, R. M. (1991). Assessing the environmental consumer market. US Environmental Protection Agency [Office of] Policy, Planning and Evaluation.

Kim, Y., & Choi, S. M. (2005). Antecedents of green purchase behavior: An examination of collectivism, environmental concern, and PCE. Advances in Consumer Research, 32(1), 592–599.

Laroche, M., Bergeron, J., & Barbaro-Forleo, G. (2001). Targeting consumers who are willing to pay more for environmentally friendly products. Journal of Consumer Marketing, 18(6), 503–520.

Minton, A. P., & Rose, R. L. (1997). The effects of environmental concern on environmentally friendly consumer behavior: An exploratory study. Journal of Business Research, 40(1), 37–48.

Moorthy, K. S. (1984). Market segmentation, self-selection, and product line design. Marketing Science, 3(4), 288–307.

Moorthy, K. S. (1988). Product and price competition in a duopoly. Marketing Science, 2(7), 141–168.

Ohlhorst, F. J. (2012). Big data analytics: Turning big data into big money. New York: Wiley.

Peattie, K. (1995) Environmental marketing management: Meeting the green challenge. London: Pitman.

Provost, F., & Fawcett, T. (2013). Data science and its relationship to big data and data-driven decision making. Big Data, 1(1), 51–59.

Song, M. L., Fisher, R., Wang, J. L., & Cui, L. B. (2016). Environmental performance evaluation with big data: Theories and methods. Annals of Operations Research. doi:10.1007/s10479-016-2158-8.

Straughan, R. D., & Roberts, J. A. (1999). Environmental segmentation alternatives: A look at green consumer behavior in the new millennium. Journal of Consumer Marketing, 16(6), 558–575.

Tien, J. M. (2013). Big data: Unleashing information. Journal of Systems Science and Systems Engineering, 22(2), 127–151.

Vlosky, R. P., Ozanne, L. K., & Fontenot, R. J. (1999). A conceptual model of us consumer willingness-to-pay for environmentally certified wood products. Journal of Consumer Marketing, 16(2), 122–140.

Wamba, S. F., Akter, S., Edwards, A., Chopin, G., & Gnanzou, D. (2015). How big datacan make big impact: Findings from a systematic review and a longitudinal case study. International Journal of Production Economics, 165, 234–246.

Zhang, L., Wang, J., & You, J. (2015). Consumer environmental awareness and channel coordination with two substitutable products. European Journal of Operational Research, 241(1), 63–73.

Acknowledgments

The authors gratefully acknowledge Dr. Murthy Halemane for his patience and valuable suggestions. This research was supported by National Natural Science Foundation of China (Grant Nos. 71571171, 71271199, 71631006, 71601175), Program for New Century Excellent Talents in University (Grant No. NCET-13-0538), Key International (Regional) Joint Research Program (Grant No. 7152107002) and the Fundamental Research Funds for the Central Universities of China (Grant Nos. WK2040160008, WK2040160016).

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by National Natural Science Foundation of China (Grant Nos. 71571171, 71271199, 71631006, 71601175), Program for New Century Excellent Talents in University (Grant No. NCET-13-0538), Key International (Regional) Joint Research Program (Grant No. 7152107002) and the Fundamental Research Funds for the Central Universities of China (Grant Nos. WK2040160008, WK2040160016).

Appendices

Appendixes

1.1 Proof of Proposition 1 and Corollary 1

Proof

We solve the problem in different pricing regimes and give the global optimal decisions buy maximizing the manufacturer’s profit in different pricing regimes. \(\square \)

1.2 Case 1: \({{p_g}}\ge {{k_l}}+{{p_t}}\) and \({{p_g}}\ge (1+k_h)p_t\)

In this price regime, primary segment’s demand is given in Eq. 1 and green segment’s demand is given in Eq. 2. Then the manufacturer’s problem is:

The first and second derivation of \(\varPi \) regarding \({p_t}\) and \({p_g}\) respectively are:

The determinant of Hessian can be written as: \(\left| H \right| \mathrm{{ = }}A^2\frac{{\beta (1\mathrm{{ + }}2\beta {k_h})}}{{{k_h}^2}}>0\). Thus, the solution to the first order conditions gives the unique maximizer. The monopolist’s optimal prices under Case 1 can be obtained as:

where the sales quantities can be obtained as:

The constraint \({{p_g}}\ge {{k_l}}+{{p_t}}\) is satisfied when \(c_g\ge 2k_l-k_h\). The constraint \({{p_g}}\ge (1+k_h)p_t\) is satisfied of \(c_g>0\). To guarantee positive demand, \(c_g<k_h\) is required. Otherwise, no green products are sold. There is only traditional products offered to the market and \( p_t^*=\frac{1}{2}\).

1.3 Case 2: \({{p_g}}\ge {{k_l}}+{{p_t}}\) and \({{p_g}}< (1+k_h)p_t\)

In this price regime, primary segment’s demand is given in Eq. 1 and green segment’s demand is given in Eq. 3. Then the manufacturer’s problem is:

The monopolist’s optimal prices under Case 2 is the same as the solutions in Case 1 that:

The constraint \({{p_g}}< (1+k_h)p_t\) is satisfied only when \(c_g<0\). The optimal price is on the boundary and thus is suboptimal to Case 1.

1.4 Case 3: \((1+k_h)p_t\le p_g<k_l+p_t\)

In this price regime, primary segment’s demand is given in Eq. 4 and green segment’s demand is given in Eq. 2. We define \(\varDelta \buildrel \textstyle .\over = {k_h} - {k_l}\) for simplicity. Then the manufacturer’s problem is:

The determinant of Hessian can be written as: \(\left| H \right| = {A^2}\frac{{4\left( {{k_h} - \beta \varDelta } \right) }}{{{k_l}{k_h}}}>0\). Thus, the monopolist’s optimal prices under the low-price regime can be obtained as:

The constraint \( p_g\ge (1+k_h)p_t\) is satisfied when \({c_g}>\frac{{{k_h} \varDelta \left( {1 - \beta } \right) }}{{k_h} - \beta \varDelta }\). The constraint \( p_g< k_l+ p_t\) is satisfied when \(\varDelta <k_l\) and \( {c_g} < \frac{{{k_l}\left( {{k_h} - 2\beta \varDelta } \right) }}{{{k_h} - \beta \varDelta }}\). Then, the solutions in this case is feasible when \(\varDelta <k_l\) and \(\frac{{{k_h} \varDelta \left( {1 - \beta } \right) }}{{k_h} - \beta \varDelta }< {c_g} < \frac{{{k_l}\left( {{k_h} - 2\beta \varDelta } \right) }}{{{k_h} - \beta \varDelta }}\). If the constraints are not satisfied, this solutions are suboptimal to the solutions in other cases.

1.5 Case 4: \({{p_g}}<{{k_l}}+{{p_t}}\) and \(p_g<(1+k_h)p_t\)

In this price regime, primary segment’s demand is given in Eq. 4 and green segment’s demand is given in Eq. 3. Then the manufacturer’s problem is:

The determinant of Hessian can be written as: \(\left| H \right| ={A^2}\frac{{4\left( { - 1 + \beta } \right) \left( { - 1 + \left( { - 1 + \beta } \right) \varDelta - {k_l}} \right) }}{{{k_l}\left( {1 + {k_h}} \right) }} > 0\). Thus, the monopolist’s optimal prices in this case can be obtained as:

The solutions in this case are feasible when \(\varDelta >k_l\) and \(0<{c_g} < \frac{{{k_l}\left( {1 + {k_h} - 2\beta \varDelta } \right) }}{{1 + {k_h} - \beta \varDelta }}\), where the constraints \({{p_g}}<{{k_l}}+{{p_t}}\) and \(p_g<(1+k_h)p_t\) are satisfied. Otherwise, this case gives the boundary solutions which are suboptimal to other cases.

1.6 Case 5: \(p_g<(1+k_l)p_t\)

In this case, only green products are offered to the market, then the optimal solution is

it is always suboptimal to the

1.7 Comparing the profits in different cases to give optimal solutions

Given the optimal prices in different pricing regimes, we first assume all the cost constraint is satisfied that the prices regimes are feasible. The manufacturer’s decision can be found as follows: If \(\varDelta <k_l\), Case 1 and Case 3 are feasible. The firm’s profit in case 1 is higher than the profit in case 3 when

When \(\beta \le {\tilde{\beta }_1}\), the profit in Case 3 is higher than the profit in Case 1. Thus, firm’s optimal solution changes in how large the green segment is.

If \(\varDelta >k_l\), Case 1 and Case 4 are feasible, the firm determines the optimal prices by comparing the profits in two cases. When \(\beta > {\tilde{\beta }_2}\), the manufacturer’s profit in Case 1 is higher than the profit in Case 4. Otherwise, the profit in Case 4 is higher than the profit in Case 1. Here \({\tilde{\beta }_2}\) is obtained by solving \({\varPi ^ * }(case1) = {\varPi ^ * }(case4)\), the expression of \( {\tilde{\beta }_2}\) is given as:

The optimal solutions implies that the firm should change the pricing regions in the consumers’ premium and the green segment size. With large green segment in the market, i.e., \(\beta > {\tilde{\beta }_1}({\tilde{\beta }_2})\) the price equilibrium exists in the region \({{p_g}} \ge {{k_l}}+{{p_t}}\) (see Case 1) where green products are only sold to green segment. With a small green segment i.e., \(\beta < {\tilde{\beta }_1}({\tilde{\beta }_2})\), the price equilibrium exists in the region \({{p_g}} \ge {{k_l}}+{{p_t}}\) (see Cases 3 and 4) where green products are sold to both segment. In this price switching strategy, the firm can get maximized profits from the whole market.

Proof of Corollary 2

Proof

In high price regime, cost conditions are such that the prices in Proposition 1 is feasible, the first order condition is:

In the low price regime in case 1, the first order condition is:

In the low price regime in case 2, the first order condition is:

\(\square \)

Proof of Proposition 2

1.1 Firm 1’s best response function

Proof

Firm 1’s best response function is obtained as follows.

Case 1. When \({p_1} \le {p_2} - {k_l}\) and \({p_1} \le \frac{{{p_2}}}{{(1 + {k_h})}}\), Firm 1 price the traditional product low and his problem is given by:

The optimal solution for the unconstraint problem is \({p_{1}}=\frac{{{k_h} - \beta {k_h} + \beta \;{p_2}}}{{2\left( {\beta + {k_h}} \right) }}\) and the optimal profit is:

Constraint (19) is met when \({p_2} \ge \frac{{{k_h}\left( {1 - \beta } \right) \left( {1 + {k_h}} \right) }}{{\beta \left( {1 - {k_h}} \right) + 2{k_h}}}\). Constraint (20) is met when \({p_2} > \frac{{{k_h} - \beta \varDelta + \beta {k_l} + 2{k_l}{k_h}}}{{\beta + 2{k_h}}}\).

When \(\frac{{{k_h}\left( {1 - \beta } \right) \left( {1 + {k_h}} \right) }}{{\beta \left( {1 - {k_h}} \right) + 2{k_h}}}>\frac{{{k_h} - \beta \varDelta + \beta {k_l} + 2{k_l}{k_h}}}{{\beta + 2{k_h}}}\), (the condition for this inequity is \({k_l}< \varDelta \) and \(\beta < \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\).) if \({p_2} < \frac{{{k_h}\left( {1 - \beta } \right) \left( {1 + {k_h}} \right) }}{{\beta \left( {1 - {k_h}} \right) + 2{k_h}}}\), constraint (19) is violated and \({p_1} = \frac{{{p_2}}}{{1 + {k_h}}}\). Constraint (20) is met when \({p_2}\ge \frac{{{k_l}\left( {1 + {k_h}} \right) }}{{{k_h}}}\). Then, Firm 1’s optimal price is given by:

When \(\frac{{{k_h}\left( {1 - \beta } \right) \left( {1 + {k_h}} \right) }}{{\beta \left( {1 - {k_h}} \right) + 2{k_h}}} \le \frac{{{k_h} - \beta \varDelta + \beta {k_l} + 2{k_l}{k_h}}}{{\beta + 2{k_h}}} \) (the condition for this inequity is \({k_l}< \varDelta \) and \(\beta \ge \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\); or \({k_l} \ge \varDelta \)), \( \frac{{{k_l}\left( {1 + {k_h}} \right) }}{{{k_h}}}> \frac{{{k_h} - \beta \varDelta + \beta {k_l} + 2{k_l}{k_h}}}{{\beta + 2{k_h}}} \) always holds. Firm 1’s optimal price is given by:

Case 2. When \({p_1} \le {p_2} - {k_l}\), and \({p_1} >\frac{{{p_2}}}{{1 + {k_h}}}\), Firm 1’ problem is given by:

The optimal price of the unconstraint problem is: \({p_1}=\frac{1}{2}\) and \(\varPi _1^{case2} = \frac{{1 - \beta }}{4}\). The constraint is satisfied when \(\frac{1}{2} + {k_l} < {p_2} \le \frac{{1 + {k_h}}}{2}\). If \({k_l}>\varDelta \), \(\frac{1}{2} + {k_l} \ge \frac{{1 + {k_h}}}{2}\), no infeasible region for the price regime. in Case 2, we only consider the case \({p_2} <\frac{{1 + {k_h}}}{2}\). Otherwise, constraint \({p_1} >\frac{{{p_2}}}{{1 + {k_h}}}\) is violated and Case 1 is superior. When \({k_l}< \varDelta \), Firm 1’s optimal price is given by

Combining Case 1 and Case 2. If \({k_l}>\varDelta \), case 2 is infeasible and \(\frac{{{k_h}\left( {1 - \beta } \right) \left( {1 + {k_h}} \right) }}{{\beta \left( {1 - {k_h}} \right) + 2{k_h}}} > \frac{{{k_h} - \beta {k_h} + 2{k_h}{k_l}}}{{\beta + 2{k_h}}} \) is violated. The only feasible solution is Eq. 22 in Case 1.

If \({k_l}<\varDelta \), \(\varPi _1^{case2} >\varPi _1^{case1}\) when

Here we define \({p_2^I}=\frac{{ - \left( {1 - \beta } \right) {k_h} + \sqrt{\left( {1 - \beta } \right) {k_h}\left( {\beta + {k_h}} \right) } }}{\beta }\). Note that \( \max \{ \frac{{{k_h}\left( {1 - \beta } \right) \left( {1 + {k_h}} \right) }}{{\beta \left( {1 - {k_h}} \right) + 2{k_h}}},\frac{{{k_h} - \beta {k_h} + 2{k_h}{k_l}}}{{\beta + 2{k_h}}}\}<{p_2^I}< \frac{{1 + {k_h}}}{2}\) . Then, combining the two cases. When \(0< \beta < \frac{{4{\varDelta ^2} - 4{k_l}^2}}{{1 + 4{\varDelta ^2} + 4{k_l}}}\), \({p_{1}}=\frac{1}{2}\) is feasible, the response is given as:

When \(\beta > \frac{{4{\varDelta ^2} - 4{k_l}^2}}{{1 + 4{\varDelta ^2} + 4{k_l}}}\), \({p_{1}}=\frac{1}{2}\) is not feasible, the response is given in Case 1.

Case 3. When \({p_1} > {p_2} - {k_l}\) and \({p_1} \le \frac{{{p_2}}}{{1 + {k_h}}}\), Firm 1 price the traditional product high and his problem is given by:

The optimal solution of the unconstraint problem is \({p_{1}}=\frac{{{p_2}\left( {{k_h} - \beta \varDelta } \right) }}{{2\left( {{k_h} - \beta \varDelta + {k_l}{k_h}} \right) }}\) and

Constraint \({p_1} > {p_2} - {k_l}\) is satisfied when \({p_2} < \frac{{2{k_l}({k_h} - \beta \varDelta + {k_l}{k_h})}}{{{k_h} - \beta \varDelta + 2{k_l}{k_h}}}\). Constraint \({p_1} \le \frac{{{p_2}}}{{1 + {k_h}}}\) is always satisfied when \({p_2}\ge 0\). Then Firm 1’s optimal price is given by:

Case 4. When \({p_1} > {p_2} - {k_l}\) and \({p_1} > \frac{{{p_2}}}{{(1 + {k_h})}}\), Firm 1’s problem is given by \(A(1 - \beta )\mathrm{{(}}\frac{{{p_2} - {p_1}}}{{{k_l}}} - {p_1}\mathrm{{)}}{p_1}\). Solution of the unconstraint problem is \({p_1} = \frac{{{p_2}}}{{2\left( {1 + {k_l}} \right) }}\), Constraint \({p_1} > \frac{{{p_2}}}{{1 + {k_h}}}\) is violated when \({p_2}>0\). Then for any \({p_2}>0\), the objective function in Case 3 is superior and is achievable by choosing (31).

Combining 4 Cases to obtain the best-response of Firm 1. When \({k_l}< \varDelta \), and \(0< \beta < \frac{{4{\varDelta ^2} - 4{k_l}^2}}{{1 + 4{\varDelta ^2} + 4{k_l}}}\), Firm 1’s best response function is given as:

\( \frac{{4{\varDelta ^2} - 4{k_l}^2}}{{1 + 4{\varDelta ^2} + 4{k_l}}}\le \beta < \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\), Firm 1’s best response function is given as:

When \(\beta \ge \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\), Firm 1’s best response function is the same as the case when \({k_l}\ge \varDelta \). When \({k_l}\ge \varDelta \), Firm 1’s best response function is given as:

\(\square \)

1.2 Firm 2’s best response function

Proof

Case 1. Given a \(p_1\), if Firm 2 wants to sell to the green segment only he can price his products high, i.e., \(p_2\ge k_l+p_1 \), if \(p_2\ge (1+ k_h)p_1 \), some green consumers purchase the traditional products, Firm 2’s problem is:

The optimal solution of the unconstraint problem is \({p_{2}} = \frac{1}{2}\left( {{c_g} + {k_h} + {p_1}} \right) \) and the maximized profit is given as:

Constraint \(p_2\ge k_l+p_1 \) is satisfied when \(p_1\le c_g+k_h-2k_l\). Constraint \(p_2\ge (1+ k_h)p_1 \) is satisfied when \({p_1} \le \frac{{{c_g} + {k_h}}}{{1 + 2{k_h}}}\).

Therefore, when \(c_g+k_h-2k_l\le \frac{{{c_g} + {k_h}}}{{1 + 2{k_h}}}\), (or equivalently, \({c_g} \le \frac{{ - {\varDelta ^2} + {k_l} + {k_l}^2}}{{{k_h}}}\)), if \(p_1> c_g+k_h-2k_l\), the candidate solution is \(p_{2}=k_l+p_1\) , constraint \({p_2} \ge ({1 + {k_h}}){p_1}\) is met when \(p_1 \le \frac{{{k_l}}}{{{k_h}}}\). Then, the optimal price for Firm 2 in this price region is given by:

When \(c_g+k_h-2k_l>\frac{{{c_g} + {k_h}}}{{1 + 2{k_h}}}\) (or equivalently, \({c_g}>\frac{{ - {\varDelta ^2} + {k_l} + {k_l}^2}}{{{k_h}}}\)). \( \frac{{{c_g} + {k_h}}}{{1 + 2{k_h}}}>\frac{{{k_l}}}{{{k_h}}} \) always holds. The optimal price for Firm 2 is given by

Case 2. When \(p_2\ge k_l+p_1 \) and \(p_2<(1+ k_h)p_1 \), where Firm 2’ s problem is \(A\left( {{p_2} - {c_g}} \right) \beta (1 - \frac{{{p_2}}}{{1 + {k_h}}})\), the optimal solution of the unconstraint problem is \(p_2=\frac{1+c_g+k_h}{2}\) and

The feasible region for the interior optimal solution is \(\frac{{1 + {c_g} + {k_h}}}{{2 + 2{k_h}}} \le {p_1} < \frac{1}{2}\left( 1 + {c_g} + {k_h} - 2{k_l} \right) \). Comparing the objects in Case 1 and Case 2, \(\varPi _2^{case2} > \varPi _2^{case1}\) when \({c_g} - {k_h}< {p_1} < \frac{{{c_g} + {k_h}}}{{1 + 2{k_h}}}\). This price region is not within the boundary of the feasible region of Case 2, i.e., \({p_1}\ge \frac{{1 + {c_g} + {k_h}}}{{2 + 2{k_h}}}\) (because the inequality \(\frac{{{c_g} + {k_h}}}{{1 + 2{k_h}}} < \frac{{1 + {c_g} + {k_h}}}{{2 + 2{k_h}}}\) always holds). Therefore, the solution in Case 2 is always suboptimal to the solution in Case 1.

Case 3. \(p_2<k_l+p_1 \) and \(p_2\ge (1+ k_h)p_1 \) . Firm 2’ s problem is:

The optimal solution of the unconstraint problem is \({p_{2}} = \frac{{{c_g} + {p_1}}}{2} + \frac{{{k_l}{k_h}}}{{2({k_h} - \beta \varDelta )}}\) and the profit is

Constraint \(p_2<k_l+p_1 \) is satisfied when \({p_1} > {c_g} - \frac{{{k_l}({k_h} - 2\beta \varDelta )}}{{{k_h} - \beta \varDelta }}\). Constraint \(p_2\ge (1+ k_h)p_1 \) is satisfied when \({p_1} \le \frac{{{c_g}\left( {{k_h} - \beta \varDelta } \right) + {k_l}{k_h}}}{{\left( {{k_h} - \beta \varDelta } \right) \left( {1 + 2{k_h}} \right) }}\). Then Firm 2’s optimal price is given by

Case 4. \(p_2<k_l+p_1 \) and \(p_2<(1+ k_h)p_1 \). Firm 2’s problem is given as:

The optimal price of the unconstraint problem is: \({p_2}\mathrm{{ = }}\frac{{{c_g}}}{2} + \frac{{\left( {\left( {1 - \beta } \right) {p_1} + {k_l}} \right) \left( {1 + {k_h}} \right) }}{{2(1 - \beta + {k_h} - \beta \varDelta )}}\) and the profit is

Constraint \(p_2<k_l+p_1 \) is satisfied when \({p_1} > \frac{{{c_g}\left( {1 - \beta + {k_h} - \beta \varDelta } \right) - {k_l}\left( {1 + {k_h} - 2\beta \left( {1 + \varDelta } \right) } \right) }}{{1 + {k_h} + \beta \left( { - 1 - \varDelta + {k_l}} \right) }}\). Constraint \(p_2<(1+ k_h)p_1 \) is satisfied when \({p_1} > \frac{{{c_g}\left( {1 - \beta + {k_h} - \beta \varDelta } \right) - {k_l}\left( {1 + {k_h}} \right) }}{{\left( {1 - \beta + 2{k_h} - 2\beta \varDelta } \right) \left( {1 + {k_h}} \right) }}\). We find only if the green cost is high enough that, Cases 3 and 4 are both feasible, i.e., \({c_g} > \frac{{{k_l} + {k_h}{k_l}}}{{{k_h} - \beta {k_h} + \beta {k_l}}}\). By solving the inequality \(\varPi _2^{case3} < \varPi _2^{case4}\) we have the condition Firm 2 will choose his response in Case 4 when

There is no Nash equilibrium in Case 4 because Firm 1’s profits at this price region is always suboptimal, that Firm 1 would not price at this region. If \({c_g} > \frac{{{k_l} + {k_h}{k_l}}}{{{k_h} - \beta {k_h} + \beta {k_l}}}\), Case 4 is superior to Case 3 but no equilibrium exists. Then, we only need to discuss the situation when \({c_g} < \frac{{{k_l} + {k_h}{k_l}}}{{{k_h} - \beta {k_h} + \beta {k_l}}}\). In this cost condition, Case 4 is feasible when Firm 1’s price is high enough.

Combining Cases to obtain Firm 2’s best response function

\(\varPi _2^{case1} >\varPi _2^{case3}\) when \({c_g} - {k_l} - \varDelta \sqrt{\frac{{\beta {k_l}}}{{{k_h} - \beta \varDelta }}}<{p_1}<{c_g} - {k_l} + \varDelta \sqrt{\frac{{\beta {k_l}}}{{{k_h} - \beta \varDelta }}}\).

Here we define \({p_1^I}={c_g} - {k_l} + \varDelta \sqrt{\frac{{\beta {k_l}}}{{{k_h} - \beta \varDelta }}}\). When \(p_{1}<{c_g} - {k_l} - \varDelta \sqrt{\frac{{\beta {k_l}}}{{{k_h} - \beta \varDelta }}}\), the inequality \({c_g} - {k_l} - \varDelta \sqrt{\frac{{\beta {k_l}}}{{{k_h} - \beta \varDelta }}} < {c_g} - \frac{{{k_l}({k_h} - 2\beta \varDelta )}}{{{k_h} - \beta \varDelta }}\) always holds, the candidate solution \(p_{2}={k_l} + {p_1}\) in Case 3 is infeasible because constraint \(p_{2}>{c_g}\) is violated. Then, Case 1 is the only feasible solution When \(p_{1}\le {p_1^I}\). When \({p_1^I}<{p_1} \le \frac{{{c_g}\left( {{k_h}- \beta \varDelta } \right) + {k_l}{k_h}}}{{\left( {{k_h} - \beta \varDelta } \right) \left( {1 + 2{k_h}} \right) }}\), Case 3 is superior, where \( \frac{{{c_g}\left( {{k_h}- \beta \varDelta } \right) + {k_l}{k_h}}}{{\left( {{k_h} - \beta \varDelta } \right) \left( {1 + 2{k_h}} \right) }}< \frac{{{c_g} + {k_h}}}{{1 + 2{k_h}}}\) and \({p_1^I}<{c_g} - 2{k_l}+ {k_h}\) always hold, Firm 2’s best response function is given as:

\(\square \)

1.3 Nash equilibrium if \( \varDelta >{k_l}\)

Proof

Case 1: When \(p_2\ge k_l+p_1 \), if \(p_2\ge (1+ k_h)p_1 \), \({p_{2}}=\frac{1}{2}\left( {{c_g} + {k_h} + {p_1}} \right) \) and \({p_{1}}=\frac{{{k_h} - \beta {k_h} + \beta \;{p_2}}}{{2\left( {\beta + {k_h}} \right) }}\) intersect at:

and the profits in equilibrium is:

When \(0< \beta < \frac{{4{\varDelta ^2} - 4{k_l}^2}}{{1 + 4{\varDelta ^2} + 4{k_l}}}\), constraint for Firm 1 is to price at the region is \({p_2} > {p_2^I}\). Constraint for Firm 2 to price at the region is \( {p_1} \le {{p_1}^I}\). The condition for the existence of the Nash equilibrium is \({c_g} >c_g^I\) which is obtained by solving the inequalities above. where \(c_g^I=\max \{ \frac{{2{k_h} - \beta {k_h} + 3\beta {k_l} + 4{k_h}{k_l}}}{{2\left( {\beta + 2{k_h}} \right) }} - \frac{{\varDelta (3\beta + 4{k_h})}}{{2(\beta + 2{k_h})}}\sqrt{\frac{{\beta {k_l}}}{{{k_h} - \beta \varDelta }}}, \frac{{ - 2{k_h} + \beta {k_h}}}{\beta } + \frac{{3\beta + 4{k_h}}}{{2\beta }}\sqrt{\frac{{\left( {1 - \beta } \right) {k_h}}}{{\beta + {k_h}}}} \} \). When \(\beta =0\), \(c_g^I=\max \{0,0\}=0\).

When \( \frac{{4{\varDelta ^2} - 4{k_l}^2}}{{1 + 4{\varDelta ^2} + 4{k_l}}}\le \beta < \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\), the condition for Firm 1 to apply this response is \({p_2} \ge \frac{{{k_h}\left( {1 - \beta } \right) \left( {1 + {k_h}} \right) }}{{\beta \left( {1 - {k_h}} \right) + 2{k_h}}}\), which is always met when Firm 2 chooses his high price response. Then the condition for this equilibrium is \({c_g} >{\widetilde{{c_g^I}}}=\frac{{2{k_h} - \beta {k_h} + 3\beta {k_l} + 4{k_h}{k_l}}}{{2\left( {\beta + 2{k_h}} \right) }} - \frac{{\varDelta (3\beta + 4{k_h})}}{{2(\beta + 2{k_h})}}\sqrt{\frac{{\beta {k_l}}}{{{k_h} - \beta \varDelta }}}\). When \(\beta > \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\), the condition for Firm 1 to apply this response is \({p_2} \ge \frac{{{k_h} - \beta \varDelta + \beta {k_l} + 2{k_l}{k_h}}}{{\beta + 2{k_h}}}\), which is met when \({c_g} > \frac{{{k_h} - 2\beta {k_h} - 2k_h^2 + 3\beta {k_l} + 4{k_h}{k_l}}}{{\beta + 2{k_h}}}\).

More importantly, the cost threshold to sell the green product to green segment is \({c_g} < \frac{{{k_h} + \beta {k_h} + 2k_h^2}}{{\beta + 2{k_h}}}\) which is constraint by \( p_2<{k_h}+p_1\). Then, when \(\beta > \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\), the equilibrium does not exist, because the feasible region is always higher than the cost threshold.

Case 2: When \(p_2 < k_l+p_1 \), if \(p_2\ge (1+ k_h)p_1 \), \(p_2=\frac{{{c_g} + {p_1}}}{2} + \frac{{{k_l}{k_h}}}{{2({k_h} - \beta \varDelta )}}\) and \(p_1=\frac{{{p_2}\left( {{k_h} - \beta \varDelta } \right) }}{{2\left( {{k_h} - \beta \varDelta + {k_l}{k_h}} \right) }}\) intersect at

Profits in equilibrium is given as:

Constraint for Firm 2 to use the price regime is met when \( {c_g} <c_g^1\) where

Constraint for Firm 1 to use the price regime \({p_2} < \frac{{2{k_l}({k_h} - \beta \varDelta + {k_l}{k_h})}}{{{k_h} - \beta \varDelta + 2{k_l}{k_h}}}\) is met when \({c_g} < c_g^2\), where

We define \({c_g^{II}}=\min \{ c_g^1,c_g^2\}\), then \(c_g<{c_g^{II}}\) is the condition for the existence of the Nash equilibrium in this price region. Comparing the cost thresholds we find that the inequality \({c_g^{II}}<{c_g^I}\) always holds. Then the equilibriums in Case 1 and 2 do not exist simultaneously.

There exists no other price equilibrium. Except the two Nash equilibriums, Firm 2 would only possible to price in his Case 4, where Firm 1 will always find his profit in this price region is suboptimal. Therefore, if \({k_l}< \varDelta \), there exist two Nash equilibriums as given in Case 1 and Case 2.

Case 3: \({p_{2}}=(1+ k_h)p_1\) and \({p_{1}}={p_{2}}-{k_{l}}\) intersect at \(({p_{1}},{p_{2}})=(\frac{{{k_l}}}{{{k_h}}},{k_l}\mathrm{{ + }}\frac{{{k_l}}}{{{k_h}}})\).

Constraint for Firm 1 is met when \(\beta < \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\). Otherwise, Firm 1 does not choose to price at \({p_{1}}={p_{2}}-{k_{l}}\) . For Firm 2, constraints of \(p_1\) is met when \(\frac{{\left( {1 + {k_h}} \right) {k_l}\left( {1 - \beta + {k_h} - 2\beta \varDelta } \right) }}{{{k_h}\left( {1 - \beta + {k_h} - \beta \varDelta } \right) }}< {c_g} < \frac{{{k_l}\left( {{k_h}\left( {1 + {k_h}} \right) - \beta \varDelta + 2\beta {k_h}\varDelta } \right) }}{{{k_h}\left( {{k_h} - \beta \varDelta } \right) }}\). Then, under this cost condition and \(\beta < \frac{{{\varDelta ^2} - {k_l}^2}}{{{k_h}^2 + {k_l} - {k_h}{k_l}}}\), the Nash equilibrium exists. This Nash equilibrium is different to the one in Case 2 that whether green consumers will purchase the traditional product. In Case 2, traditional products are sold to both segments; in Case 3, traditional products are sold to the primary segment only. \(\square \)

1.4 Nash equilibrium if \(\varDelta <{k_l}\)

Proof

When \({k_l}>\varDelta \), the candidate solutions are the same as given in the situation \({k_l}<\varDelta \), we check the constraint to give the feasible regions. When \(p_2\ge k_l+p_1 \), and \(p_2\ge (1+ k_h)p_1 \), the constraint of Firm 2’s decision \({p_1}\) does not change. For Firm 1 to price at Case 1, constraint \({p_2} \ge \frac{{{k_h} - \beta \varDelta + \beta {k_l} + 2{k_l}{k_h}}}{{\beta + 2{k_h}}}\) is met when \({c_g} > \frac{{{k_h} - 2\beta {k_h} - 2k_h^2 + 3\beta {k_l} + 4{k_h}{k_l}}}{{\beta + 2{k_h}}}\). Note that this condition is violated with the condition \({c_g} < \frac{{{k_h} + \beta {k_h} + 2k_h^2}}{{\beta + 2{k_h}}}\) which is obtained by the constraint by \( p_2<{k_h}+p_1\). Then, there is no equilibrium exist in this price region \(p_2\ge k_l+p_1 \) and \(p_2\ge (1+ k_h)p_1 \). The equilibrium \(({p_{1}},{p_{2}})=(\frac{{{k_l}}}{{{k_h}}},{k_l}\mathrm{{ + }}\frac{{{k_l}}}{{{k_h}}})\) does not exist either, because the constraint of Firm 1 is always violated. The constraint does not change in the equilibrium where the green product is sold to both segments. Therefore, when \({k_l}>\varDelta \), the only Nash equilibrium is:

The Nash equilibrium exists when \(c_g<{c_g^{II}}\). Otherwise, no equilibrium exists. \(\square \)

Proof of Corollary 4

Proof

The profit functions are given in C. It is easy to get the first order conditions of the functions and specially, at the equilibrium in C.3, we give the optimal \(\beta \) at which Firm 2’ get his maximize profit.

\(\square \)

Proof of Proposition 4

Proof

Case 1: Now suppose Firm 1 anticipates the later entry and when \( {p_1} \le {p_1^I}\), Firm 1’s objective is:

The optimal solution for the unconstrained problem is \({p_1} = {\frac{{\beta \left( {{c_g} - {k_h}} \right) + 2{k_h}}}{{2\left( {\beta + 2{k_h}} \right) }}}\) and \({\varPi _1} = \frac{{{{\left( {\beta {c_g} + \left( {2 - \beta } \right) {k_h}} \right) }^2}}}{{8{k_h}\left( {\beta + 2{k_h}} \right) }}\). Constraint \( {p_1} \le {p_1^I}\) is satisfied when \({c_g} > c_g^{III} \buildrel \textstyle .\over = \frac{{2{k_h} + 4{k_h}{k_l}\mathrm{{ + }}\beta \left( {\varDelta - {k_l}} \right) }}{{\beta + 4{k_h}}} - 2\frac{{\varDelta \left( {\beta + 2{k_h}} \right) }}{{\beta + 4{k_h}}}\sqrt{\frac{{\beta {k_l}}}{{{k_h} - \beta \varDelta }}} \). Then Firm 1’s optimal price is given by:

The cost threshold is \({c_g} < {k_h} + \frac{{2{k_h}}}{{\beta + 4{k_h}}}\) to met the constraint \({p_2} < {k_h} + {p_1}\). In this cost condition,

Case 2: When \({p_1^I} <{p_1} \le \frac{{{c_g}\left( {{k_h}- \beta \varDelta } \right) + {k_l}{k_h}}}{{\left( {{k_h} - \beta \varDelta } \right) \left( {1 + 2{k_h}} \right) }}\), Firm 1 does not deter Firm 2’s encroachment on primary segment, Firm 1’ objective is:

The optimal solution for the unconstrained problem is \({p_{1}} = \frac{{{k_l}{k_h} + {c_g}\left( {{k_h} - \beta \left( {{k_h} - {k_l}} \right) } \right) }}{{2\left( {{k_h} - \beta \left( {{k_h} - {k_l}} \right) + 2{k_l}{k_h}} \right) }}\) and \({\varPi _1} = \frac{{{{\left( {{k_h}{k_l} + {c_g}\left( {{k_h} - \beta \varDelta } \right) } \right) }^2}}}{{8{k_h}{k_l}\left( {{k_h} - \beta \varDelta + 2{k_h}{k_l}} \right) }}\) . Constraint \({p_1} \le \frac{{{c_g}\left( {{k_h}- \beta \varDelta } \right) + {k_l}{k_h}}}{{\left( {{k_h} - \beta \varDelta } \right) \left( {1 + 2{k_h}} \right) }}\) is always met. Constraint \( {p_1} > {p_1^I}\) is satisfied when \({c_g} < c_g^{IV} \buildrel \textstyle .\over = \frac{{{k_l}\left( {3{k_h} - 2\beta \varDelta + 4{k_l}{k_h}} \right) }}{{{k_h} - \beta \varDelta + 4{k_l}{k_h}}} - 2\varDelta \frac{{{k_h} - \beta \varDelta + 2{k_l}{k_h}}}{{{k_h} - \beta \varDelta + 4{k_l}{k_h}}}\sqrt{\frac{{\beta {k_l}}}{{\left( {{k_h} - \beta \varDelta } \right) }}} \). When \(\beta = 0\), \(c_{L\left| {\beta = 0} \right. }^{IV} = \frac{{{k_l}\left( {3 + 4{k_l}} \right) }}{{1 + 4{k_l}}} = {k_l} + \frac{{2{k_l}}}{{1 + 4{k_l}}}\). Then firm 1’s optimal price is given by: