Abstract

Carbon emission abatement is a hot topic in environmental sustainability and cap-and-trade regulation is regarded as an effective way to reduce the carbon emission. According to the real industrial practices, sustainable product implies that its production processes facilitate to reduce the carbon emission and has a positive response in market demand. In this paper, we study the sustainability investment on sustainable product with emission regulation consideration for decentralized and centralized supply chains. We first examine the order quantity of the retailer and sustainability investment of the manufacturer for the decentralized supply chain with one retailer and one manufacturer. After that, we extend our study to the centralized case where we determine the production quantity and sustainability investment for the whole supply chain. We derive the optimal order quantity (or production quantity) and sustainability investment, and find that the sustainability investment efficiency has a significant impact on the optimal solutions. Further, we conduct numerical studies and find surprisingly that the order quantity may be increasing in the wholesale price due to the effects of the sustainability and emission consideration. Moreover, we investigate the achievability of supply chain coordination by various contracts, and find that only revenue sharing contract can coordinate the supply chain whereas the buyback contract and two-part tariff contract cannot. Important insights and managerial implications are discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Carbon emission accelerates global warming. After Kyoto Protocol in 1997, many countries such as Australia and USA have attempted to design carbon trading mechanism such as cap-and-trade for carbon emission reduction (Stavins 2008; Zhang and Xu 2013). Cap-and-trade policy implies that a firm is allocated a limit or cap on carbon emissions by national government. More specifically, the firm has to buy the right to emit extra carbon if it produces more than the prescribed capacity; otherwise, it can sell its surplus carbon credit (Du et al. 2011; Hua et al. 2011). Reducing carbon emission is significantly important when environmental sustainability is receiving more and more public awareness all around the globe (Nagurney and Yu 2012).

However, only implementing the carbon cap-and-trade policy is still not effective enough to reduce carbon emission (Samaras et al. 2009). In order to be more effective, the investment on the adoption of cleaner technologies is also implemented by responsible firms (Drake and Spinler 2013). For example, in the fashion apparel industry, it is well-known that the fashion supply chain produces all kinds of pollutants including carbon (de Brito et al. 2008; Lo et al. 2012). Companies such as H&M, Marks & Spencer, and Levis all promise to protect environment and reduce carbon emission. For example, H&M, the Sweden fast fashion company, has taken many approaches to minimize carbon emission in its production process by adopting new technologies and meanwhile, H&M launches the green label products which are claimed to be produced in a sustainable way (H&M conscious actions sustainability report 2010 and 2012). From the environmental perspective, producing the sustainable product could reduce the emission and is beneficial to the environment, whereas from the marketing perspective, it could stimulate the market demand. Consumers have strong willingness to purchase the more sustainable products (Luchs et al. 2010; Thøgersen et al. 2012; Shen et al. 2012; Grimmer and Bingham 2013). Hence, the positive impact of sustainability on market demand should not be neglected in managing carbon emission abatement.

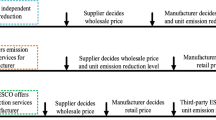

Motivated by the real industrial practices, in this paper, we study a two-echelon decentralized supply chain and its centralized channel in which the channel members determine the order quantity (or production quantity) and sustainability investment with a sustainability-dependent market demand under carbon cap-and-trade regulation. For the decentralized supply chain, we consider a classical newsvendor setting in which the manufacturer, as a Stackelberg leader, determines the sustainability investment, and then the retailer, as a follower, places the decision of the order quantity. We consider that the manufacturer is operating on make-to-order basis, under which the manufacturer’s production quantity is equal to the retailer’s order quantity. For the centralized supply chain, we consider that the manufacturer and the retailer are fully aligned to achieve the channel’s maximal profit by determining the production quantity and sustainability investment. To the best of our knowledge, this study is the first one to examine the impact of the order quantity (or production quantity) and sustainability investment in a supply chain under the carbon cap-and-trade regulation.

This paper contributes to the literature by constructing a model in which both the order quantity (or production quantity) and the sustainability investment are considered under the carbon cap-and-trade regulation. The optimal order quantity and sustainability investment are derived for the decentralized supply chain, and the production quantity and sustainability investment are derived for the centralized supply chain as well. The effects of some emission related parameters on the optimal solutions and profits are analytically analyzed. Moreover, by comparing the optimal solutions and the profits for the decentralized and centralized supply chains, the managerial insights in the significance of carbon emission regulation in a supply chain are discussed. Finally, the coordination of the supply chain is studied under several contracts.

This paper is organized as follows. In Sect. 2, we review the related literature. Section 3 analyzes the decentralized supply chain and Sect. 4 examines the centralized supply chain. Section 5 compares the optimal solutions and the profits for the decentralized and centralized supply chains. Section 6 studies the coordination of the supply chain. The conclusion and managerial insights are given in Sect. 7. All of the technical proofs are relegated to the Appendix.

2 Literature review

Cap-and-trade policy started to receive considerable attentions from 1970s (Montgomery 1972; Tietenberg 1985) and is regarded as an effective way to mitigate climate change (Stern 2008). Lately, cap-and-trade regulation has been extensively discussed by scholars in the field of supply chain management due to its huge impact on supply chain performance (Choi 2013). Zhao et al. (2010) study a supply chain in which the equilibrium production is affected by the allowance allocation under perfect competition and the cap-and-trade setting. Hua et al. (2011) investigate how companies optimally manage inventory under carbon cap-and-trade regulation by integrating the consideration of carbon emission into the classical economic order quantity model. They find carbon cap and carbon price have a great impact on the retailer’s order decisions. Zhang et al. (2011) derive the manufacturer’s optimal production policy with a stochastic demand under the cap-and-trade regulation. Further, Song and Leng (2012) examine the optimal inventory decision in a single-period production problem under carbon cap-and-trade regulation and find that under which the firm could not only reduce carbon emission, but also enhance its business performance under some conditions. Zhang and Xu (2013) also examine a single-period but multi-item production planning supply chain under the carbon cap-and-trade regulation and find the firm tends to produce more carbon efficient products under the carbon cap-and-trade regulation.

Du et al. (2013) investigate a two-echelon supply chain in which the emission-dependent manufacturer trades with emission permit supplier under the cap-and-trade regulation. They prove that the manufacturer’s profit increases while the supplier’s profit decreases with the emission cap. More interestingly, they find in the centralized system, there is a condition under which the supply chain can achieve coordination. Benjaafar et al. (2013) examine the impact of cap-and-trade regulation in a supply chain and find the possibility that the firms can earn additional revenue under carbon cap-and-trade regulation by leveraging differences between their emission reduction costs and the market carbon price. In addition, they explore the impact of technology adoption on carbon emission reduction and find that if the gains from alternative technologies are substantial, the carbon cap-and-trade regulation could be effective in motivating the firms to adopt the energy-efficient technologies.

Drake and Spinler (2013) indicate that the effectiveness of technology adoption should not be underestimated in a sustainable economic. To develop green supply chain such as carbon emission reduction, making investment on cleaner technologies to reduce emission, namely, sustainability investment, has been discussed and proposed in the existing literature. Krass et al. (2010) consider the case in which the environmental regulator as a Stackelberg leader firstly decides the tax level and the firm as a follower selects emission control technology, production quantity and price. They find that an initial increase in taxes may motivate a switch to a cleaner technology and if the capital cost of cleaner technologies is subsidized, the negative environmental effect would disappear and taxation becomes efficient. Drake et al. (2012) study the impact of emission tax and emissions cap-and-trade regulation on a firm’s long-run technology choice and capacity decisions. They find emissions would be reduced under cap-and-trade regulation with technology choice and by embedding the option value into the firm’s production decision, and cap-and-trade could help firm to earn greater expected profits than emission tax due to the uncertainty of emissions price and the option of no production under the former. Similar with Drake et al. (2012), we also consider the emission could be reduced by investing on the sustainable technology in production. In addition, consistent with industrial practices, we consider the consumers will be motivated to purchase if the product is produced with lower emission, namely, the market demand is dependent on product sustainability.

Supply chain coordination represents the scenario under which the individual supply chain members will behave in a way which maximizers the total supply chain system’s profitability (Xiao et al. 2005; Chopra and Meindl 2007). Some papers have discussed the supply chain coordination with carbon emission consideration. Jaber et al. (2013) investigate the problem of supply chain coordination when considering greenhouse gap emissions generated from the manufacturer’s processes under the European Union Emissions Trading System. Zhang and Liu (2013) consider a supply chain in which the market demand correlates with the green degree of green product. They find that the revenue sharing contract can coordinate the supply chain and encourage positive response of the participating members to the cooperation strategy. Swami and Shah (2013) examines a two-echelon supply chain in which both supply chain members can design the greening effort. Under the deterministic demand setting, they find that a two-part tariff contract can coordinate the supply chain. In this paper, we consider under the stochastic demand setting, whether the supply chain contracts such as revenue sharing contract, buyback contract and two-part tariff contract can achieve supply chain coordination.

As reviewed above, even though the existing literature has examined various important aspects of sustainable supply chain management with cap-and-trade regulation, how the product sustainability and cap-and-trade regulation affect the decision making in a supply chain is not yet fully known. In addition, it is important to know how such a supply chain can be coordinated. To the best of our knowledge, the above important research issues have not yet been explored in the literature. Addressing these open research questions hence outlines the contribution of this paper. Table 1 shows the literature positioning of this paper.

3 The decentralized supply chain

In this section, we consider a two-echelon decentralized supply chain, where a manufacturer (she) produces the product and trades with a retailer (he) by a wholesale price contract in a single period. The retailer is responsible for selling the product to the customer market. The decisions are made in two sequential steps. In the first step, the manufacturer decides the product’s sustainability level in terms of carbon emission abatement. In the second step, given the sustainability level, the retailer decides the order quantity of the product from the manufacturer. Please note that, in this paper, we focus on examining the optimal decisions of the sustainability level of the manufacturer and the order quantity of the retailer. So we consider that the wholesale price is exogenously given and will analyze its effects in Sect. 5.

Let p denote the market price of a product sold by the retailer, c denote the unit production cost, and w denote the wholesale price per unit product. Given the wholesale price, the retailer decides to order x units of the product from the manufacturer. Under the make-to-order setting, the manufacturer will produce the amount of product exactly as the retailer’s order quantity. We assume that there are no constraints on the order quantity and production capability. The manufacturer produces the x units of the product (it is equal to the retailer’s order quantity under the make-to-order setting.) which results in a carbon emission level (a−bs)x, where 0≤s≤a/b is the sustainability level determined by the manufacturer, a is the base emission when sustainability level is zero, and b is the coefficient of the sustainability effect on reducing the emission. Here, we assume a linear function of carbon emission reduction model, and it indicates that improving the sustainability level has diminishing return on emission. Similar models of reducing the carbon emission level by the investment can be found in Jiang and Klabjan (2012).

Consistent with the existing literature (e.g., Swami and Shah 2013), we consider a linear demand function affected by the sustainability level,

where d is the base demand and irrelevant to s, coefficient β>0 indicates that the sustainability level has a positive effect on the demand, and ϵ is a random factor with PDF f(⋅), CDF F(⋅), a mean value of μ, and in the range [A,B], A≤0 and B≥0. Similar models of the positive effects on the demand function can also be found in the existing literature, such as Gurnani et al. (2007) and Gurnani and Erkoc (2008), etc. In order to assure the non-negative demand, we further set A≥−d. If the demand does not exceed the order quantity x, then the leftover x−D is disposed at the unit cost c h (it may be negative, in which it represents a per-unit salvage value). Without loss of generality, we assume the shortage cost is equal to zero even if the demand exceeds x.

We consider the cap-and-trade regulation for the emission in this paper. Let K denote the total permissible emission level, which is given by the regulator and assumed to be exogenous. Let c e denote the emission price per unit emission, and we assume that emission amount can always buy or sold at this price. Similar to Savaskan and Van Wassenhove (2006), Gurnani and Erkoc (2008), Li et al. (2013), and Swami and Shah (2013), we assume that the sustainability investment cost for the manufacturer is a quadratic function, i.e., c I s 2/2, where c I is the sustainability investment coefficient.

In current business practice, it is true that the investment cost for improving the sustainability level usually is high. So we assume that c I is high enough such that c I ≥2c e bβ, though we can obtain analytical results even if without this assumption. Specifically, if c I <2c e bβ, we have the results that the lower bound or upper bound of the sustainability are optimal to the manufacturer, i.e., s ∗=0 under which the manufacture will not invest on the sustainability, or s ∗=a/b under which the manufacture will invest a very high sustainability level such that no carbon emission will be produced. So in order to avoid these trivial cases and make our results more elegant, we only present our results for the case of c I ≥2c e bβ hereafter.Footnote 1

Table 2 summarizes some major notations used in this paper.

We use the backward sequential decision-making approach to analyze the problems. First, we assume that the sustainability level is given by the manufacturer, under which we solve the retailer’s problem and obtain the optimal response of the order quantity, i.e., x(s). In the second step, we solve the manufacturer’s problem and obtain the optimal sustainability level, i.e., s ∗, given the optimal response of the order quantity.

3.1 Retailer’s problem

For a given sustainability level, the retailer maximizes his own expected profit by deciding the order quantity x. Denote Π r (x) as the retailer’s expected profit function. We have

In the above profit function, the first term is the revenue from selling the product in the customer market, the second term is the cost of ordering the product from the manufacturer, and the last term is the leftover cost. After deriving Eq. (1) with respect to order quantity x, we can have the following proposition.

Proposition 1

Given s, the unique optimal response of the order quantity x(s) is as follow:

The optimal response of the order quantity is obtained by the first-order condition of the retailer’s profit function. The solution is essentially the same to the well-known newsvendor solution in the literature. Given a sustainability level s, the order quantity is increasing in the base demand d, and decreasing in the unit leftover cost c h and wholesale price w, which are consistent with our intuitive understanding.

Corollary 1

dx(s)/ds=β>0.

Corollary 1 indicates that the order quantity is increasing in the sustainability level. This result could be potentially explained by the fact that when the sustainability level is higher, the market demand would be also higher, which induces the retailer to order more from the manufacturer.

3.2 Manufacturer’s problem

The manufacturer’s profit function, denoted by Π m (s), is given by

In the above profit function, the first term is the revenue generated from selling the product to the retailer, the second term is the production cost, the third term is the cost or revenue from buying or selling the extra allowances of the emission, and the last term is the sustainability investment cost. Knowing that the retailer orders the product x according to Eq. (2) in response to a given sustainability level s, the manufacturer decides on s to maximize her own expected profit. By substituting x(s) into Eq. (3) and differentiating it with respect to sustainable level s, we can have the following proposition.

Proposition 2

The manufacturer’s optimal sustainability level is given by

Proposition 2 shows the optimal sustainability level for the manufacturer, i.e., Eq. (4), which is solved by the first-order condition of the manufacturer’s profit function. Obliviously, the optimal value is increasing in the base demand d, and decreasing in the unit production cost c and unit leftover cost c h .

Next we analyze the effects of the parameters b,β,c e , and c I , which are related to the sustainability investment or the emission, on the optimal decisions x ∗ and s ∗, the retailer’s optimal profit \(\varPi_{r}^{*}\), the manufacturer’s optimal profit \(\varPi _{m}^{*}\), and the optimal profit of the whole supply chain \(\varPi_{d}^{*}\) (i.e., \(\varPi_{d}^{*}=\varPi_{r}^{*}+\varPi_{m}^{*}\)).

Proposition 3

x ∗ and s ∗ are increasing in b, and decreasing in c I .

Proposition 3 indicates that, if the coefficient of the sustainability effect on reducing the emission b is larger, then the manufacturer will invest more on the sustainability level s ∗ to reduce the emission. Meanwhile, a higher sustainability level will induce a larger demand, which will lead to a higher order quantity x ∗. So the order quantity is increasing in the coefficient b. Intuitively, if the sustainability investment coefficient c I is large, then the manufacturer will invest less on the sustainability level, which will lead to a lower order quantity.

Remark 1

For the effects of the coefficient of the sustainability effect on increasing the demand β and unit emission price c e , we can obtain that

which may be positive or negative. And the way by which \(\varPi_{r}^{*}\), \(\varPi_{m}^{*}\), and \(\varPi_{d}^{*}\) depend on b,β,c e , and c I are more complex and are not monotone in general also.

4 The centralized supply chain

In this section, we consider a centralized supply chain, where the manufacturer and the retailer are fully aligned to achieve the channel’s maximal profit. Our objective is to maximize the expected profit of the whole supply chain by optimally choosing the production quantity and sustainability investment.

In the above profit function, the first term is the revenue generated from selling the product in the customer market, the second term is the production cost, the third term is the leftover cost, the fourth term is the cost or revenue from buying or selling the extra allowances of the emission, and the last term is the sustainability investment cost.

We use the sequential decision-making approach to analyze the problem. Under this approach, the original optimization problem, i.e., Eq. (5), can be reduced to an optimization problem over the single variable s by first solving for the optimal value of x as a function of s, and then substituting the result back in to Π c (x,s). This approach can guarantee the optimality of the solution, and is widely used in the literature, such as Petruzzi and Dada (1999), Wang et al. (2004), etc. Thus, we solve our problem by two steps. In the first step, we assume that the sustainable level is given, under which we solve the problem and obtain the optimal response of the production quantity, x(s). In the second step, we obtain the optimal sustainability level, s ∗, given the optimal response of the production quantity.

Proposition 4 shows the optimal response of the production quantity for a given sustainability level.

Proposition 4

Given s, the unique optimal response of production quantity x(s) is as follow:

The optimal response of the production quantity is obtained by the first-order condition of the channel’s profit function, for a given s. Similar to the decentralized supply chain, the solution of the production quantity for the centralized supply chain is essentially the same to the well-known newsvendor solution in the literature. Given a sustainability level s, the order quantity is increasing in the base demand d, and decreasing in the unit leftover cost c h , unit production cost c, and unit emission price c e .

Corollary 2

dx(s)/ds=β+(c e b)/((p+c h )f(x−d−βs))>0.

Similar to Corollary 1, Corollary 2 indicates that the production quantity is increasing in the sustainability level.

Substituting x=x(s) into Eq. (5), the optimization problem becomes a maximization over the single variable s: max s Π c (x(s),s). By taking and rearranging the first and second derivatives of Π c (x(s),s) over s, we obtain

As shown in Proposition 5, Π c (x(s),s) might have multiple optimal values of the sustainability level, depending on the parameters of the problem.

Proposition 5

There is at most one optimal point of s that satisfies the first-order condition of the channel’s profit function Π c (x(s),s) when f(⋅) is monotonous.

There may be multiple points that satisfy the first-order optimality condition of the channel’s profit function Π c (x(s),s), i.e., dΠ c (x(s),s)/ds=0, where dΠ c (x(s),s)/ds is represented in Eq. (7). If f(⋅) is a non-decreasing distribution function (i.e., f′(⋅)≥0), then we obtain d 3 Π c (x(s),s)/ds 3≤0, implying that dΠ c (x(s),s)/ds is concave in s. So dΠ c (x(s),s)/ds=0 has at most two roots and the larger of the two makes a change of sign for dΠ c (x(s),s)/ds from positive to negative that corresponds to a local maximum of Π c (x(s),s); if f(⋅) is a decreasing distribution function (i.e., f′(⋅)<0), then the smaller of the two makes a change of sign for dΠ c (x(s),s)/ds from positive to negative that corresponds to a local maximum of Π c (x(s),s). We consider three general distributions of the demand: uniform, exponential, and normal distribution in Corollary 3.

Corollary 3

For the uniform, exponential, and normal distribution of the demand, there is at most one optimal point of s that satisfies dΠ c (x(s),s)/ds=0.

The following proposition describes how the optimal decision x ∗ and s ∗, and the optimal profit of the whole supply chain \(\varPi_{c}^{*}\) change with system parameters b,β, and c I .

Proposition 6

x ∗, s ∗, and \(\varPi_{c}^{*}\) are increasing in b and β, and are decreasing in c I .

Similar to the decentralized supply chain, the centralized supply chain will invest more on the sustainability level s ∗ and increase the production quantity x ∗, if the coefficient of the sustainability effect on reducing the emission b is large and the sustainability investment coefficient c I is small. Besides, Proposition 6 indicates that, if the coefficient of the sustainability effect on increasing the demand β increases, then the centralized supply chain will increase the sustainability level and the production quantity, and the channel’s profit will be increased as well, and if the sustainability investment coefficient c I increases, then the channel’s profit will be decreased. Note that b, β, and c I are the parameters related to sustainability level or emission, so Proposition 6 implies that, in order to increase the centralized supply chain profit, enhancing the efficiency of sustainability investment is significant.

Remark 2

For the effects of the unit emission price c e , we can obtain that

where \(\hat{f}=f(x^{*}-d-\beta s^{*})\). Here, ds ∗/dc e , dx ∗/dc e , and \(d \varPi_{c}^{*}/d c_{e}\) may be positive or non-positive, and the effects of the unit emission price are complicate and are not monotone in general.

5 The comparison of decentralized and centralized supply chains

In this section, we numerically compare the profit of the whole supply chain and the optimal solutions under the decentralized case with those under the centralized case. Some interesting results are presented in the following subsection.

5.1 Numerical examples

As shown in Corollary 3, there is at most one optimal solution of s that satisfies the first-order condition of the profit function, for the centralized supply chain, for the uniform, normal, and exponential distributions of the demand. Figures 1 and 2 show the numerical results for the uniform and normal distributions, respectively. For the exponential distribution, we can obtain the similar numerical results.

In the literature, the wholesale price is usually assumed to be larger than the unit production cost, i.e., w>c. However, in this paper, after considering the cap-and-trade regulation, we could relax this assumption and set that the wholesale price can be not lager than the unit production cost. For example, if the manufacturer could obtain a higher profit by selling the quota of the allowances of the emission, rather than by selling product, then she would invests a high sustainability level to reduce the emission in production, although the wholesale price is very small.

In all numerical examples, we set p=120, c=50, d=10, a=5, b=0.5, c e =10, β=1, and c I =25. Without loss of generality, we let the total permissible emission level equals to zero, i.e., K=0. Then the manufacturer’s profit would be negative if the wholesale price is lower, e.g., w<c. (Alternatively, if we set a high total permissible emission level, e.g., K=500, the manufacturer can get a positive profit even if the wholesale price is very low.) For the uniform distribution, we let ϵ∽U[0,10], and for the normal distribution, we let ϵ∽Normal(10,1). We benchmark our results with the consideration of the sustainability and the emission, to the results without considering the sustainability and the emission (i.e., c e =c I =a=b=s d =s c =0). We use ‘SE’ to stand for the ‘Sustainability and emission’, so ‘with SE’ means ‘with the consideration of the sustainability and the emission’ and ‘without SE’ means ‘without considering the sustainability and the emission’.

Figure 1 shows the effects of the wholesale price on the optimal solutions and the corresponding profits for the uniform distribution of the demand. Obviously, the optimal solutions and the corresponding profits for the centralized case are not affected by the wholesale price. Figures 1(a) and 1(b) show that the optimal sustainability level and order quantity for the decentralized case are non-decreasing and decreasing, respectively, in the wholesale price. Figure 1(c) shows that the manufacturer’s profit and the retailer’s profit are increasing and decreasing, respectively, in the wholesale price. Besides, the manufacturer’s profit with SE is smaller than that without SE, but the retailer’s profit with SE is larger than that without SE. Because, with the consideration of the sustainability and the emission, the manufacturer need to pay the emission cost and the sustainability investment cost, while the retailer can get the benefit of the sustainability effect on increasing the demand. As shown in Fig. 1(d), the optimal profit of the whole supply chain for the decentralized case is not larger than that for the centralized case. If we do not consider the sustainability investment and the emission issues, the optimal profit of the whole supply chain is obtained when the wholesale price equals to the unit production cost (i.e., w=c=50). However, as shown in Fig. 1(d), our results indicate that the optimal profit of the whole supply chain obtains its maximum at w=94 which is almost double of the unit production cost, due to the effects of the sustainability and emission consideration. Those differences are mainly due to the effects of the sustainability investment and emission consideration.

Figure 2 shows the effects of the wholesale price on the optimal solutions and the corresponding profits for the normal distribution of the demand. The effects are almost the same with that for the uniform distribution, except for the effects on the sustainability level and the order quantity. As shown in Figs. 2(a) and 2(b), the optimal sustainability level and the order quantity for the decentralized case are not monotonous in the wholesale price, with the consideration of the sustainability and the emission. If we do not consider the sustainability issue, then the order quantity will be decreasing in the wholesale price. However, in this paper, we consider that the sustainability level has the direct effect on the demand which would further affect the order quantity. Besides, as shown in Eqs. (2) and (4), the order quantity is increasing in the sustainability level which may be increasing or decreasing in the wholesale price, depending on the CDF of the distribution of the demand and the value of the coefficient of the sustainability effect on increasing the demand (i.e., β). For the normal distribution of the demand, we thus obtain the above result, which is different from the other distributions and the situations without the sustainability and the emission consideration.

6 Coordinating the supply chain

This section studies the coordination in a supply chain with the consideration of the sustainability and the emission. In the previous literature, several contracts have been proposed for coordinating a supply chain, including the buyback contract, the revenue sharing contract, the two-part tariff contract, etc. (Cachon 2003; Cachon and Lariviere 2005). In this paper, we consider three contracts, i.e., buyback, revenue sharing, and two-part tariff contracts, and verify that whether they can coordinate the supply chain. Recalling that this paper determiners the optimal order quantity (or production quantity) and sustainability level. So a key question is that whether the contracts that coordinate the retailer’s order quantity and also coordinate the manufacture’s sustainability level. We restrict our attention to the case in which the sustainability level are determined by the first-order condition of the profit functions. Note that under some contracts, such as the buyback contract, the manufacturer need to depose the unsold products, which may causes carbon emission. However, in this paper we will not consider such issues, and only focus on the situation where the emission is caused when the manufacturer produces the products.

Let x d and s d be the optimal solutions of the order quantity and sustainability level, respectively, for the decentralized supply chain, and x c and s c be the optimal solutions of the production quantity and sustainability level, respectively, for the centralized chain.

6.1 Revenue sharing contract

We consider that, under a revenue sharing contract (w,ϕ), the retailer pays the manufacturer a unit wholesale price w for each unit ordered plus a proportion of his revenue from selling the products to the customers, where ϕ is the proportion of the revenue the retailer keeps, and thus 1−ϕ is the proportion shared to the manufacturer. See Cachon (2003) and Cachon and Lariviere (2005) for detailed discussions of this contract. The retailer’s and the manufacturer’s expected profit functions are given by

Proposition 7

For a given revenue sharing contract (w,ϕ), the optimal decision of the order quantity and sustainability investments (x d ,s d )=(x ∗,s ∗) are determined as follows:

Comparing Eqs. (8) with (6) and (9) with (7), we find that (x d ,s d ) can be the centralized supply chain’s optimal solution (x c ,s c ) if w=ϕp and ϕ=(p+c h )/(p(p−c−c e (a−bs c )))−c h /p. Therefore, a revenue sharing contract with reasonable contract parameters is sufficient to coordinate the supply chain with the sustainability and emission consideration. Besides, our result shows that there is a single coordinating revenue-sharing contract such that provides only one allocation of the supply chain’s profit. This result is similar to the coordination result of the revenue-sharing contract with price dependent demand and non-zero lost sales penalty (Cachon 2003).

6.2 Buyback contract

With a buyback contract (w,b c ), the manufacturer charges the retailer a unit wholesale price w for each unit purchased, but pays the retailer b c per unit remaining at the end of the season. See Pasternack (1985) and Cachon (2003) for detailed analysis of this contract in the context of the newsvendor problem. The retailer’s and the manufacturer’s expected profit functions are given by

Proposition 8

For a given buyback contract (w,b c ), the optimal decision of the order quantity and sustainability investments (x d ,s d )=(x ∗,s ∗) are determined as follows:

Comparing Eqs. (10) with (6) and (11) with (7), we find that (x d ,s d ) can be the centralized supply chain’s optimal solution (x c ,s c ) only if w=p and b=(p+c h ). Therefore, the coordination can only occur if w=p, which is not desirable. With w=p the retailer earns a non-positive profit, so the retailer certainly cannot be better off with buyback contract. Cachon and Lariviere (2005) prove that the revenue sharing contract is equivalent to the buyback contract with the fixed-price newsvendor setting. However, our results show that the revenue sharing contract can coordinate the supply chain with the consideration of the sustainability and the emission whereas the buyback contract cannot.

6.3 Two-part tariff contract

With a two-part tariff contract (w,G), the manufacturer charges the retailer a per unit wholesale price w and a fix fee G. See Cachon and Lariviere (2005) and Cachon and Kök (2010) for detailed analysis of this contract. The retailer’s and the manufacturer’s expected profit functions are given by

Proposition 9

For a given two-part tariff contract (w,G), the optimal decision of the order quantity and sustainability investment (x d ,s d )=(x ∗,s ∗) are determined as follows:

Comparing Eqs. (12) with (6) and (13) with (7), we find that (x d ,s d ) can be the centralized supply chain’s optimal solution (x c ,s c ) only if w=p=c+c e (a−bs c ). With p=c+c e (a−bs c ), the manufacture can get the positive profit only if the total permissible emission level K is sufficient large such that the manufacture can earn some profit by selling the extra allowances of the emission. With w=p the retailer earns a non-positive profit, so the retailer cannot be better off with two-part tariff contract. Hence, the two-part tariff contract does not coordinate the supply chain with the consideration of the sustainability and the emission.

7 Conclusions

Motivated by the real industrial practices, in this paper, we considered supply chains in which a high level of product’s sustainability not only increases the market demand, but also reduces the carbon emission, and its sustainability production of carbon emission abatement requires the sustainability investment as a cost. We first investigated a two-echelon decentralized supply chain in which the manufacturer firstly decides the product’s sustainability level and then the retailer places an order under the cap-and-trade regulation. We also examined the supply chain in the centralized setting and then compared their performance with those in the decentralized one.

We derived the optimal ordering quantity and sustainability investment for decentralized setting, and the optimal production quantity and sustainability investment for centralized setting as well. We found that the sustainability investment coefficient has a significant impact on the optimal order quantity (or production quantity) and sustainability investment. If the sustainability investment and the emission issues are not considered, the optimal profit of the whole supply chain will be theoretically obtained when the wholesale price equals to the unit production cost. However, by examining the effects of the wholesale price, we found that, due to the effects of the sustainability and the emission consideration, the optimal profit of the whole supply chain obtains its maximum at a wholesale price which is almost double of the unit production cost. On the other hand, if we do not consider the sustainability and the emission issues, then the order quantity will be decreasing in the wholesale price. However, our results show that the order quantity may be unexpectedly increasing in the wholesale price, because the order quantity is increasing in the sustainability level, but which may be decreasing in the wholesale price, depending on the CDF of the distribution of the demand and the value of the coefficient of the sustainability effect on increasing the demand. Moreover, with the consideration of the sustainability and the emission, the manufacturer’s profit is smaller than that without considering the sustainability and the emission, but the retailer’s profit has the inverse result. It is because that, with the consideration of the sustainability and the emission, the manufacturer need to pay the emission cost and the sustainability investment cost, while the retailer can get the benefit of the sustainability effect on increasing the demand.

Finally, we studied the coordination in the supply chain by considering three contracts, i.e., buyback, revenue sharing, and two-part tariff contracts. We verified that whether the contracts that coordinate the retailer’s order quantity and also coordinate the manufacturer’s sustainability level. It is shown that with the consideration of the sustainability and the emission, the buyback and two-part tariff contracts cannot coordinate the supply chain but revenue sharing contract can. The allocation of the supply chain’s profit in revenue sharing contract is unique. From the coordination perspective, this finding implies that the revenue sharing contract should be suggested to be adopted in sustainable supply chain.

This research can be extended in several directions. In this paper, we focused on investigating the optimal decisions of order quantity (or production quantity) and sustainability investment, and set the wholesale price is given. Although the effects of wholesale price on the optimal solutions and profits are studied in this paper, it is worth considering the setting under which the wholesale price is determined endogenously in the future research (Dong and Rudi 2004). Besides, the consideration of the joint decision of the price and the substantiality investment may provide additional useful insights (Swami and Shah 2013). Moreover, it is also interesting to study the risk issues in a supply chain under the cap-and-trade regulation (Shen et al. 2013; Chiu and Choi 2013).

Notes

See the separate supplementary material for technical notes for the case of c I <2c e bβ.

References

Benjaafar, S., Li, Y. Z., & Daskin, M. (2013). Carbon footprint and the management of supply chains: insights from simple models. IEEE Transactions on Automation Science and Engineering, 10(1), 99–116.

Cachon, G. P. (2003). Supply chain coordination with contracts. In S. Graves & T. de Kok (Eds.), Handbooks in operations research and management science: supply chain management (pp. 229–340). Amsterdam: North Holland.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue-sharing contracts: strengths and limitations. Management Science, 51(1), 30–44.

Cachon, G. P., & Kök, A. G. (2010). Competing manufacturers in a retail supply chain: on contractual form and coordination. Management Science, 56(3), 571–589.

Choi, T. M. (2013). Local sourcing and fashion quick response system: the impacts of carbon footprint tax. Transportation Research, Part E, 55(1), 43–54.

Chiu, C. H., & Choi, T. M. (2013). Supply chain risk analysis with mean-variance models: a technical review. Annals of Operations Research. doi:10.1007/s10479-013-1386-4.

Chopra, S., & Meindl, P. (2007). Supply chain management: strategy, planning, and operation. New York: Pearson Prentice Hall.

de Brito, M. P., Carbone, V., & Blanquart, C. M. (2008). Towards a sustainable fashion retail supply chain in Europe: organization and performance. International Journal of Production Economics, 114(2), 534–553.

Dong, L., & Rudi, N. (2004). Who benefits from transshipment? Exogenous vs. endogenous wholesale price. Management Science, 50(5), 645–657.

Drake, D., & Spinler, S. (2013). Sustainable operations management: an enduring stream or a passing fancy? Manufacturing & Service Operations Management, 15(4), 689–700.

Drake, D., Kleindorfer, P. R., & Van Wassenhove, L. N. (2012). Technology choice and capacity portfolios under emissions regulation. Harvard Business School Working Paper, Harvard University.

Du, S., Ma, F., Fu, Z., Zhu, L., & Zhang, J. (2011). Game-theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’ system. Annals of Operations Research. doi:10.1007/s10479-011-0964-6.

Du, S., Zhu, L., Liang, L., & Ma, F. (2013). Emission-dependent supply chain and environment-policy-making in the ‘cap-and-trade’ system. Energy Policy, 57(2), 61–67.

Grimmer, M., & Bingham, T. (2013). Company environmental performance and consumer purchase intentions. Journal of Business Research, 66(10), 1945–1953.

Gurnani, H., & Erkoc, M. (2008). Supply contracts in manufacturer-retailer interactions with manufacturer-quality and retailer effort-induced demand. Naval Research Logistics, 55(3), 200–217.

Gurnani, H., Erkoc, M., & Luo, Y. (2007). Impact of product pricing and timing of investment decisions on supply chain co-opetition. European Journal of Operational Research, 180(1), 228–248.

Hua, G., Cheng, T. C. E., & Wang, S. (2011). Managing carbon footprints in inventory control. International Journal of Production Economics, 132(2), 178–185.

Li, Y., Xu, L., & Li, D. (2013). Examining relationships between the return policy, product quality, and pricing strategy in online direct selling. International Journal of Production Economics, 132(2), 178–185.

Jiang, Y., & Klabjan, D. (2012). Optimal emissions reduction investment under green house gas emissions regulations. Northwestern University Working Paper, Northwestern University.

Jaber, M. Y., Glock, C. H., & El Saadany, A. M. A. (2013). Supply chain coordination with emission reduction incentives. International Journal of Production Research, 51(1), 69–82.

Krass, D., Nedorezov, T., & Ovchinnikov, A. (2010). Environmental taxes and the choice of green technology. University of Virginia Working Paper, University of Virginia.

Lo, C. K. Y., Yeung, A. C. L., & Cheng, T. C. E. (2012). The impact of environmental management systems on financial performance in fashion and textiles industries. International Journal of Production Economics, 135(2), 561–567.

Luchs, M. G., Naylor, R. W., Irwin, J. R., & Raghunathan, R. (2010). The sustainability liability: potential negative effects of ethicality on product preference. Journal of Marketing, 74(5), 18–31.

Montgomery, W. D. (1972). Markets in licenses and efficient pollution control programs. Journal of Economic Theory, 5(3), 395–418.

Nagurney, A., & Yu, M. (2012). Sustainable fashion supply chain management under oligopolistic competition and brand differentiation. International Journal of Production Economics, 135(2), 532–540.

Pasternack, B. (1985). Optimal pricing and returns policies for perishable commodities. Marketing Science, 4, 166–176.

Petruzzi, N. C., & Dada, M. (1999). Pricing and the newsvendor problem: a review with extensions. Operations Research, 47(2), 183–194.

Samaras, C., Apt, J., Azevedo, I., Lave, L., Morgan, M., & Rubin, E. (2009). Cap and trade is not enough: Improving U.S. climate policy. A briefing note from the Department of Engineering and Public Policy. Carnegie Mellon University.

Savaskan, R. C., & Van Wassenhove, L. N. (2006). Reverse channel design: the case of competing retailers. Management Science, 52(1), 1–14.

Shen, B., Choi, T. M., Wang, Y., & Lo, C. (2013). The coordination of fashion supply chains with a risk averse supplier under the markdown money policy. IEEE Transactions on Systems, Man, and Cybernetics, 43(2), 266–276.

Shen, B., Wang, Y., Lo, C., & Shum, M. (2012). The impact of ethical fashion on consumer purchase behavior. Journal of Fashion Marketing and Management, 16(2), 234–245.

Song, J., & Leng, M. (2012). Analysis of the single-period problem under carbon emission policies. International series in operations research & management science: Vol. 176 (pp. 297–312).

Stavins, R. (2008). A meaningful U.S. cap-and-trade system to address climate change. Harvard Environmental Law Review, Harvard University Working Paper, Harvard University.

Stern, N. (2008). The economics of climate change. The American Economic Review, 92(2), 1–37.

Swami, S., & Shah, J. (2013). Channel coordination in green supply chain management. Journal of the Operational Research Society, 64, 336–351.

Thøgersen, J., Jørgensen, A. K., & Sandager, S. (2012). Consumer decision making regarding a “green” everyday product. Psychology & Marketing, 29(4), 187–197.

Tietenberg, T. H. (1985). Emissions trading: An exercise in reforming pollution policy. Resources for the Future, Washington, DC.

Wang, Y., Jiang, L., & Shen, Z. J. (2004). Channel performance under consignment contract with revenue sharing. Management Science, 50(1), 34–47.

Xiao, T., Yu, G., Sheng, Z., & Xia, Y. (2005). Coordination of a supply chain with one-manufacturer and two-retailers under demand promotion and disruption management decisions. Annals of Operations Research, 135, 87–109.

Zhang, B., & Xu, L. (2013). Multi-item production planning with carbon cap and trade mechanism. International Journal of Production Economics, 144(1), 118–127.

Zhang, J. J., Nie, T. F., & Du, S. F. (2011). Optimal emission-dependent production policy with stochastic demand. International Journal of Society Systems Science, 3(1), 21–39.

Zhang, C. T., & Liu, L. P. (2013). Research on coordination mechanism in three-level green supply chain under non-cooperative game. Applied Mathematical Modelling, 37(5), 3369–3379.

Zhao, J., Hobbs, B. F., & Pang, J. S. (2010). Long-run equilibrium modeling of emissions allowance allocation systems in electric power markets. Operations Research, 58(3), 529–548.

Acknowledgements

We would like to thank the editors and three anonymous reviewers for their constructive comments and suggestions that have greatly improved the paper. This research was supported in part by The Hong Kong Polytechnic University under grant number G-YN68. It was also supported in part by the National Natural Science Foundation of China (No. 71201028).

Author information

Authors and Affiliations

Corresponding author

Electronic Supplementary Material

Below is the link to the electronic supplementary material.

Appendix

Appendix

Proof of Proposition 1

Note that Eq. (1) is a newsvendor model, so we can obtain the results immediately. □

Proof of Proposition 2

By taking the first and second derivative of the profit function Π m (s) over s, we have

Then Π m (s) is concave in s, given that c I ≥2c e bβ. By solving the first-order condition, i.e., \(\frac{d \varPi_{m} (s)}{d s}=0\), we obtain that

□

Proof of Proposition 3

The effects of b and c I can be obtained by just looking at the formula of x ∗ and s ∗, i.e., Eqs. (2) and (4), respectively.

However, the effects of β and c e are more complex and not monotones in general. For completeness, we show the value of \(\frac{d s^{*}}{d \beta}\), \(\frac{d x^{*}}{d \beta}\), \(\frac{d s^{*}}{d c_{e}}\), and \(\frac{d x^{*}}{d c_{e}}\) in this proof as follows:

Recalling that x(s) is determined by the first-order condition of the retailer’s profit function:

and s ∗ is determined by the first-order condition of the manufacturer’s profit function:

Let \(G_{1}=\frac{\partial\varPi_{r} (x)}{\partial x} = (p+c_{h})F(x-d-\beta s)-p+w\) and \(G_{2}=\frac{d \varPi_{m} (s)}{d s} = (w-c)\beta +c_{e}bx(s)-c_{e}\beta(a-bs)-c_{I}s\).

By taking the first derivatives of G 1 and G 2 with respect to β, we have

where \(\hat{p}=p+c_{h}\) and \(\hat{f}=f(x^{*}-d-\beta s^{*})\). Solving the above two equations obtains that \(\frac{d s^{*}}{d \beta} = \frac {w-c-c_{e}(a-2bs^{*})}{2c_{e}b\beta-c_{I}}\), \(\frac{d x^{*}}{d \beta} = s^{*}+\frac {d s^{*}}{d \beta}\beta\), but they may be positive or non-positive. By taking the above approach to consider the effects of β and c e , we can obtain that , \(\frac{d s^{*}}{d c_{e}} = \frac{-bx^{*}+\beta (a-bs^{*})}{2c_{e}b\beta-c_{I}}\), and \(\frac{d x^{*}}{d c_{e}} = \frac{d s^{*}}{d c_{e}}\beta\), but they may be positive or non-positive too.

For the effects on the profits, by taking the first derivatives of \(\varPi_{r}^{*}\), \(\varPi_{m}^{*}\), and \(\varPi_{d}^{*}\) with respect to b, we have

In the first equation, the second equality holds because \(\frac {\partial\varPi_{r}}{\partial x}=0\) when (x=x ∗,s=s ∗), and in the second equation, the second equality holds because \(\frac{\partial \varPi_{m}}{\partial s}=0\) when (x=x ∗,s=s ∗). However, \(\frac{d \varPi _{r}^{*}}{d b}\), \(\frac{d \varPi_{m}^{*}}{d b}\), and \(\frac{d \varPi_{d}^{*}}{d b}\) may be positive or non-positive. Similarly, we can obtain the values of the first derivative of \(\varPi_{r}^{*}\), \(\varPi_{m}^{*}\), and \(\varPi_{d}^{*}\) with respect to β, c e , and c I . Unfortunately, they are complex and are not monotone in general. □

Proof of Proposition 4

By taking the first and second partial derivatives of the profit function Π c (x,s) with respect to x, we have

As the second partial derivative is non-positive, Π c (x,s) is convex in x, and the optimal response of the production quantity is uniquely determined by the first order condition of the profit function, i.e., \(\frac{\partial\varPi_{c} (x,s)}{\partial x}=0\). □

Proof of Corollary 2

By taking the derivative of \(\frac{\partial\varPi_{c} (x,s)}{\partial x}\) with respect to s, we have

Then, by the Implicit Function Theorem, i.e., \(\frac{d x(s)}{d s}=-\frac {\frac{\partial^{2} \varPi_{c} (x,s)}{\partial x \partial s}}{\frac{\partial ^{2} \varPi_{c} (x,s)}{\partial x^{2}}}\), we have

□

Proof of Proposition 5

Given that c I ≥2c e bβ, it is difficult to determine the sign of \(\frac {d^{2} \varPi_{c} (x(s),s)}{d x^{2}}\) directly. So we take the third derivative of Π c (x(s),s) over s, and we have

When f′(⋅)≥0, we have \(\frac{d^{3} \varPi_{c} (x(s),s)}{d s^{3}}\le 0\), it implies that \(\frac{d \varPi_{c} (x(s),s)}{d s}\) is concave in s. So \(\frac{d \varPi_{c} (x(s),s)}{d s}=0\) has at most two roots and the larger of the two makes a change of sign for \(\frac{d \varPi_{c} (x(s),s)}{d s}\) from positive to negative that corresponds to a local maximum of Π c (x(s),s).

When f′(⋅)<0, we have \(\frac{d^{3} \varPi_{c} (x(s),s)}{d s^{3}}>0\), it implies that \(\frac{d \varPi_{c} (x(s),s)}{d s}\) is convex in s. So \(\frac{d \varPi_{c} (x(s),s)}{d s}=0\) has at most two roots and the smaller of the two makes a change of sign for \(\frac{d \varPi_{c} (x(s),s)}{d s}\) from positive to negative that corresponds to a local maximum of Π c (x(s),s). □

Proof of Corollary 3

For the uniform distribution of the demand, ϵ∽U[A,B], then \(f(z)=\frac{1}{B-A}\) and f′(z)=0. We have

which means that Π c (x(s),s) is a convex function if \(c_{I}\le 2c_{e}b\beta+\frac{(c_{e}b)^{2}(B-A)}{(p+c_{h})}\), and concave otherwise. So there is at most one optimal point of s that satisfies dΠ c (x(s),s)/ds=0 for the uniform distribution.

For the exponential distribution, ϵ∽Exp(1/θ), then \(f(z)=\frac{1}{\theta}e^{-\frac{z}{\theta}}\) and \(f'(z)=-\frac{1}{\theta }f(s)=-\frac{1}{\theta^{2}}e^{-\frac{z}{\theta}}\). We have

So dΠ c (x(s),s)/ds=0 has at most two roots, and the smaller of the two makes a change of sign for dΠ c (x(s),s)/ds from positive to negative that corresponds to a local maximum of Π c (x(s),s).

For the normal distribution, ϵ∽Normal(μ,σ), then \(f(z)=\frac{1}{\sqrt{2\pi}\sigma}e^{-\frac{(z-\mu)^{2}}{2\sigma^{2}}}\) and \(f'(z)=-\frac{z-\mu}{\sigma^{2}}f(z)\). We have

By Corollary 2, we obtain that

which means that x(s)−d−βs increases in s. Let s t be the solution of x(s)−d−βs=μ. Then we have that, if s<s t , then dΠ c (x(s),s)/ds is concave in s; if s≥s t , then dΠ c (x(s),s)/ds is convex in s. In other words, dΠ c (x(s),s)/ds changes from a concave function to a convex function as s increases. Therefore, dΠ c (x(s),s)/ds has at most three roots, and the one (and has at most one) makes a changes of sign for dΠ c (x(s),s)/ds from positive to negative that corresponds to a local maximum of Π c (x(s),s). □

Proof of Proposition 6

(a) Recalling that x(s) is determined by

and s ∗ is determined by

Let \(G_{1}=-\frac{\partial\varPi_{c} (x,s)}{\partial x}=(p+c_{h})F(x-d-\beta s)-p+c+c_{e}(a-bs)\) and \(G_{2}=\frac{d \varPi_{c} (x(s),s)}{d s} = (p+c_{h})F(x-d-\beta s)\beta-c_{I}s+c_{e}bx(s)\).

By taking the first derivatives of G 1 and G 2 with respect to b, we have

where \(\hat{p}=p+c_{h}\) and \(\hat{f}=f(x^{*}-d-\beta s^{*})\).

Solving the above two equations obtains that

The inequalities hold because that, when s is obtained at the optimal point, \(2c_{e}b\beta-c_{I}+\frac{(c_{e}b)^{2}}{\hat{p}\hat{f}}=\frac{d^{2} \varPi _{c} (x(s),s)}{d s^{2}}\le0\).

Similarly, by taking the first derivatives of G 1 and G 2 with respect to c I , we have

Solving the above two equations obtains that

The inequalities hold because we have that, here, \(2c_{e}b\beta-c_{I}+\frac {(c_{e}b)^{2}}{\hat{p}\hat{f}}\le0\) when s=s ∗.

By taking the above approach to consider the effects of β and c e , we can obtain that, for β, \(\frac{d s^{*}}{d \beta} = \frac {-c_{e}bs^{*}}{2c_{e}b\beta-c_{I}+\frac{(c_{e}b)^{2}}{\hat{p}\hat{f}}}\ge0\) and \(\frac{d x^{*}}{d \beta} = s+\frac{\hat{p}\hat{f}\beta+c_{e}b}{\hat{p}\hat {f}}\frac{d s^{*}}{d \beta}\ge0\); for c e , \(\frac{d s^{*}}{d c_{e}} = \frac {-bx^{*}+\frac{\hat{p}\hat{f}\beta+c_{e}b}{\hat{p}\hat {f}}(a-bs^{*})}{2c_{e}b\beta-c_{I}+\frac{(c_{e}b)^{2}}{\hat{p}\hat{f}}}\) and \(\frac{d x^{*}}{d c_{e}} = \frac{-(a-bs^{*})+(\hat{p}\hat{f}\beta+c_{e}b)\frac {d s^{*}}{d c_{e}}}{\hat{p}\hat{f}}\), but which may be positive or non-positive.

By taking the first derivative of \(\varPi_{c}^{*}\) with respect to b, we have

The second equality holds because \(\frac{\partial\varPi_{c}}{\partial x}=\frac{\partial\varPi_{c}}{\partial s}=0\) when (x=x ∗,s=s ∗). Similarly, we can obtain that \(\frac{d \varPi_{c}^{*}}{d c_{I}}=-\frac {(s^{*})^{2}}{2}\le0\), \(\frac{d \varPi_{c}^{*}}{d \beta}=s^{*}\hat {p}F(x^{*}-d-\beta s^{*})\ge0\), and \(\frac{d \varPi_{c}^{*}}{d c_{e}}=K-(a-bs^{*})x^{*}\) but which may be positive or non-positive. □

Proof of Proposition 7

The retailer’s problem is a newsvendor problem, so we can easily obtain that

By substituting the x into the manufacturer’s profit function, and taking the derivatives with respect to s, we have

The inequality holds because in this section we restrict our attention to the case in which the sustainability level are determined by the first-order condition of the profit function for the centralized supply chain, i.e., c I ≥2c e bβ. Thus, the optimal s is uniquely determined by \(\frac{d \varPi_{m}}{d s}=0\). □

Proof of Proposition 8

The proof is similar to the proof for Proposition 7 and omitted. □

Proof of Proposition 9

The proof is similar to the proof for Proposition 7 and omitted. □

Rights and permissions

About this article

Cite this article

Dong, C., Shen, B., Chow, PS. et al. Sustainability investment under cap-and-trade regulation. Ann Oper Res 240, 509–531 (2016). https://doi.org/10.1007/s10479-013-1514-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-013-1514-1