Abstract

This paper investigates the role of CDS volatility in providing information concerning the credit quality of a company.

In Castellano and D’Ecclesia (J. Financ. Decis. Mak. 2:27, 2011) a first analysis of how CDS quotes respond to rating announcements is provided and it showed that market participants do not rely much on Rating Agencies, especially during periods characterized by very high volatility, i.e. during a financial crisis. Here, a more accurate analysis of the CDS’s ability to provide timely information on the creditworthiness of reference entities is performed, estimating the volatility of CDS quotes by using Exponential GARCH(1,1) models. The event study methodology is applied to a sample of CDS quotes for US and European markets, over the period 2004–2009. Results provide an accurate understanding of market behavior in the presence of news released by Rating Agencies. Overall, market participants seem to provide timely reactions around the event date and we show that the key element of signaling is represented by the changing volatility in CDS quotes, before and after the rating event.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The effect of rating announcements on financial market dynamics has been widely discussed in the literature. Earlier studies concentrated on the analysis of stock and bond price dynamics and investigated how rating changes could affect market behavior (Bremer and Pettway 2002; Steiner and Heinke 2001; Gropp and Richards 2001; Kliger and Sarig 2000; only to cite a few). The introduction of Credit Default Swaps (CDSs) provides useful information regarding the creditworthiness of a company. Consequently the analysis of how rating changes may affect CDS quote dynamics may reveal additional information regarding the investor’s perception of the changing creditworthiness of a company. When pronouncing on an issuer’s creditworthiness, rating agencies face a trade-off between timeliness and possibly creating adverse volatility. Information to assess an issuer’s creditworthiness arrives at a high frequency, and so credit ratings must be continually updated since they have to incorporate the latest information. Rating agencies attempt to balance these conflicting goals by making multiple announcements, some of which reflect the latest information and others, following the through-the-cycle methodology, provide a stable signal of credit quality.

In Castellano and D’Ecclesia (2011) the effects caused by rating announcements (rating changes and reviews) on CDS quotes have been analyzed using standard Event Study methodology. The results of the analysis were not always in line with expectations and, in some cases, inconclusive. In some studies (Norden and Weber 2004; Hull et al. 2004; to cite the most relevant) evidences of abnormal changes in CDS quotes have been found, showing that markets anticipate rating announcements in case of “bad news”. In addition, in most cases no post announcements effects were found. Some other studies (Micu et al. 2006) find that reviews, rating changes and outlooks affect market behavior and the market does not anticipate any rating agency actions.

In our opinion, the aforementioned studies have a major constraint as they assume constant volatility of market quotes, while heteroscedasticity often characterizes the real market. Hence, the assumption of constant volatility causes biases in the results. When bad news on creditworthiness reach the market, CDS quotes increase and, in line with the volatility clustering issue, also the volatility of CDS quotes increases. Castellano and Scaccia (2010, 2012), relax the assumption of omoscedasticity by exploiting the ability of Hidden Markov Models to model state-dependent means and variances of CDS returns. They find that CDS return series build around negative rating events are characterized by very different temporal dynamics. This heterogeneity may cause a general underestimation of the market anticipations and reactions, when abnormal returns are cumulated over time and averaged over series as in classical Event Study analysis.

In this paper, we extend Castellano and D’Ecclesia (2011) results, by taking into account the role played by stochastic volatility. Following Yamaguchi (2008), and Corhay and Rad (1996), we estimate the volatility of CDS quotes using the E-GARCH models (Nelson 1991) and we then use the Event Study methodology to investigate market reactions. This approach offers a more reliable instrument to interpret the signals supplied by CDS markets trough the exploitation of the information linked with stochastic volatilities and CDS return levels, which allow to identify abnormal market conditions.

The analysis is performed using a larger set of data than previous studies and the effects of rating announcements, reviews and effective changes, on CDS quotes are investigated. The data covers the period 2004–2009 for 60 international companies belonging to different credit grades.

The paper is organized as follows: in Sect. 2, some relevant literature in rating announcements is reviewed; Sect. 3 describes the methodology, showing the importance of introducing E-GARCH estimations to measure the conditional variance of abnormal spread changes; Sect. 4 describes the data set, while Sect. 5 provides a brief description of the results; finally, Sect. 6 reports our conclusions.

2 Some recent literature

The main goal of credit rating is to facilitate the comparison of an issuer’s underlying long-term creditworthiness by means of standardized categories, so rating decisions are typically not influenced by events whose impact on credit quality is expected to be temporary (Micu et al. 2006; Weinstein 1977). For this reason, rating agencies provide various kinds of announcements. Outlooks and reviews were introduced in the 80’s to meet investor demand for more timely indicators and forewarn investors of possible changes in creditworthiness. More precisely, outlooks reflect the likely direction of an issuer’s credit quality over the medium term (usually two years). It is modified when a change in the issuer’s risk profile is observed, but it is not regarded as permanent enough to review the credit rating. Reviews, on the other hand, provide stronger signals than outlooks about future changes in rating, highlighting a high probability of upgrading or downgrading. Reviews are usually concluded within 90 days, after the receipt of additional information, clarifying the impact of a particular event on credit quality. Credit ratings need not be on review to be changed so reviews or changes in outlook do not always imply changes in rating.

The variety of research papers related to our study is diverse. The effects of rating announcements on market quotes have been investigated mainly using stock (Best 1997; Akhigbe et al. 1997) and bond prices (Bremer and Pettway 2002; Gropp and Richards 2001; Kliger and Sarig 2000). Since bond markets are related to credit markets, results obtained for bond markets can be directly compared to those obtained for CDS markets.

Covitz and Harrison (2003) estimate that almost 75 per cent of the changes in bond prices occur six months before the rating downgrade. Only few studies find that rating announcements have different effects on equity markets compared to credit markets. Goh and Ederington (1993) find that the potential impact of rating announcements on equity prices is ambiguous and depends on the motivation of the announcement. When rating announcements are motivated by changes in the issuer’s financial perspectives, they should have the same impact on equity and bond markets; negative (positive) rating announcements should cause a fall (rise) in equity prices. By contrast, rating announcements caused by changes in leverage should have opposite effects in equity and bond markets; negative (positive) announcements motivated by an increase in leverage should result in a rise (fall) in equity prices. Kliger and Sarig (2000) find that rating announcements cause bond and equity prices to move in opposite directions.

As we focus on the effects that ratings announcements have on CDS quotes, we mainly refer to studies which have been applied to similar data sets, including Hull et al. (2004), Norden and Weber (2004), Ammer and Clinton (2004), Micu et al. (2006), and Ismailescu and Kazemi (2010). Hull et al. (2004) and Norden and Weber (2004), conclude that the reaction of CDS prices is most pronounced in the case of reviews for downgrade. Ammer and Clinton (2004) conclude for a significant negative reaction of asset-backed securities’ prices to downgrades. Generally, with a few notable exceptions (Katz 1974; Kliger and Sarig 2000; Micu et al. 2006), findings show that upgrades or reviews for upgrade do not have a significant impact on prices. Ismailescu and Kazemi (2010) find that CDS markets anticipate negative events while positive events have a positive impact on CDS markets only in the two day period surrounding the event. Even though results show that negative announcements impact prices, most of the price adjustments takes place before the announcements.

3 The Event Study methodology

Empirical tests of market efficiency examine price adjustments before, during and after a rating announcement. In short, if credit ratings convey new information, prices should react after a rating event causing CDS quotes to increase in the presence of a deterioration in the creditworthiness of a company. Since increases in CDS quotes cause changes in the volatility level in line with the argument of volatility clustering, this has to be taken into account when estimating abnormal CDS spread changes with respect to a chosen benchmark.

The aim of this paper is to investigate the effects of rating announcements on CDS markets in the presence of stochastic volatility. We expect significant positive changes in CDS quotes, together with an increase in volatility’s level, at or after the negative rating events (the opposite holds for positive rating events). In some cases, credit markets may anticipate rating announcements and so abnormal performances may be detected before the event.

The following hypothesis are made:

-

Markets react after review announcements because they reveal new information. Reviews in most cases anticipate the actual rating changes, therefore markets should react. No effective reactions are therefore expected around actual rating changes following the reviews.

-

Markets react only after rating change announcements and do not show any abnormal reaction before it.

The results presented in Castellano and D’Ecclesia (2011) show that, in some cases, changes in CDS quotes may not have reflected announcements made by rating agencies. This has been particularly true in periods of very volatile quotes such as during the recent financial crisis. Standard Event Study methodology assumes constant volatility of abnormal returns and this may cause bias in the results. In financial time series it has been proven that volatility clustering occurs, so that in period of large changes, volatility reaches high levels. In order to take into account the role played by the volatility of CDS quotes, in this paper we suggest to use an E-GARCH model.

The main idea is to compare, for each reference entity i, the CDS daily changes, defined as S i,t :

with some chosen benchmark, assuming that residuals can be measured by E-GARCH models.

The chosen benchmark for each reference entity i, for the purpose of our analysis, is the mean change, E(S i,0), computed over a period of “normal behavior” identified as the estimation period.

Following Armitage (1995), to capture the effects of any rating announcement on CDS quotes we define:

-

the event date, t ∗=0, for a sample of CDS subject to rating announcements;

-

the estimation period, EP, where the “normal behavior” or “benchmark” of CDS changes is measured;

-

a test period, TP, or event window where the abnormal reactions of CDS quotes to announcements are analyzed.

The EP in this analysis has to be chosen in order to have a time span which could provide an efficient measure of normal behavior, given the large number of rating events occurred. For the sample of data used in this paper an interval of 100 days results to be the average maximum length to identify what can be considered normal behavior. The TP is set equal to 110 days divided in 6 subintervals:

Each I j measures the number of business days before, after and around the rating announcement.

An example of EP and TP is reported in Scheme 1.

The effective abnormal spread changes are calculated within the TP (for further details see Norden and Weber 2004) which starts 90 business days before the event’s occurrence, t ∗=0, and ends 20 business days after the event.

We test the following hypothesis:

-

If rating announcements are fully anticipated, then CDS quotes should adjust prior to the announcement in one of the four subintervals, I 1,…,I 4.

-

If no anticipation occurs, announcements should have an effect on quotes only around the day of the event, i.e. subinterval I 5.

-

In cases of illiquidity, the impact of rating announcements might be delayed to I 6, i.e. after the event occurrence.

3.1 Abnormal spread changes

In order to investigate the effects of an event it is necessary to evaluate the abnormal spread, AS it , which measures the difference between the realized returns in the TP and the chosen benchmark:

After totaling the abnormal spreads of firm i, for each t, the cumulative abnormal spreads, CAS i , are calculated over the various subperiods, I j , ∀j=1,…,6:

The cross-sectional average CAS can be computed for each subperiods, I j , and all the firms, i:

where N s is the number of firms subject to disclosure.

3.2 Volatility dynamics

We assume that abnormal spreads, AS it , are conditionally heteroscedastic:

According to Batchelor and Orakcioglu (2010), three sources of heteroscedasticity may be observed. The first two are well recognized in the Event Study literature, while the third is very familiar in empirical finance, but relatively neglected in Event Study applications.

First, the model pools data from a number of different companies and time periods. The classical Event Study methodology means one necessarily constrains the effects of rating announcements on CDS abnormal spreads to be equal across companies. However, the variance of AS it may not be constant across companies subject to disclosure. As it is shown in Figs. 1 and 2, we observe sizable differences in the behavior of variances of abnormal CDS spreads for the companies in the sample. This type of heteroscedasticity can be easily handled by normalizing the data—that is, by dividing all the observations on each company or event by the standard deviation of observations across that company.

Second, there is no reason why the variance of abnormal spreads should be constant throughout the TP. Indeed, previous results by Castellano and D’Ecclesia (2011) did not provide any support to the hypothesis of specific effects of rating announcements, mainly because a constant variance assumption was made. In our opinion, an adequate Event Study analysis has to consider a time varying variance over the pre- and post-event periods. In principle, this may be handled through data normalization—for instance, by dividing each observation not by the whole-event sample standard deviation, but by the standard deviation within the relevant inside-event window to which the observation belongs, as suggested by Boehmer et al. (1991). Heteroscedasticity of this kind is termed “event induced conditional heteroscedasticity”.

Third, the GARCH model of Bollerslev (1986) has been found to provide a good description of the variance in daily stock returns (see, for instance: Akgiray 1989; de Santis and Imrohoroglu 1997). In GARCH models, any large shock to a share price which causes an exceptionally high or low abnormal return on a particular day, also causes the variance of returns to be high on the following day, and to decay slowly back to its long run average ‘unconditional’ value. So, if a dividend event causes a large mispricing on the post-dividend day, say, prices are likely to be volatile for many days thereafter. Although there is much discussion of event-induced variance in the Event Study literature (Batchelor and Orakcioglu 2010), few studies take the step of modeling the variance of returns through a GARCH process, given the large computational problems which may arise.

Assuming that the AS it , are conditionally heteroscedastic

we find that the E-GARCH(1,1) specification proposed by Nelson (1991) adequately fits the volatility process, h it , of the sampled series:

The main feature of the E-GARCH models is that in (7) the log of the variances, ln(h it ), will be positive regardless of whether the coefficients on the right side are positive. The conditional variance (7) is constrained to be non-negative by the assumption that the logarithm of h it is a function of past innovations, ε it . The second and third term in the RHS take into account the magnitude and the sign of ε it . This enables h it to respond asymmetrically to positive and negative values of ε it . This feature is very important to model the behavior of CDS’s spread changes (i.e. positive changes of CDS show a worsening in the credit quality of a company and vice versa).

After estimating the parameters in (7), we can obtain the conditional variance, h it , for each firm, i, and time t. To apply Event Study methodology, the average variances over each subinterval, I j , are estimated:

where \(N_{I_{j}}\) is the number of days in each corresponding time interval. The cross sectional variance of the average CAS is given by:

A cross-sectional J-test aimed at verifying the null hypothesis, H 0, that the event does not affect the spread changes (H 0:AS it =0; H 1:AS it ≶0) is defined by:

4 The data set

The data set is entirely obtained from Bloomberg and consists of:

-

5 years maturity single name (CMA) CDS daily quotesFootnote 1 over the period 2004–2009;

-

credit rating data and events, considering effective rating changes and reviews, provided by the three major international rating agencies, Standard & Poors, Fitch and Moody’s.

The total sample is composed of 89.103 CDS quotes linked to 60 firms, 32 from Europe and 28 from the USA. All the 60 market-wide CDS contracts refer to senior unsecured reference obligation. Companies are further divided into different rating classes to investigate the possibility of different reactions to rating announcements.

Negative rating events clearly dominate the period given the occurrence of financial crisis. The total number of events we were able to select for our analysis is 420. The events were selected taking into account the size of the EP in order to avoid the presence of overlapping events. It is worth noticing here that, even though most of the announcements for the same company are released by each credit rating agency in different days, in some cases announcements were released simultaneously. In order to avoid contamination effects due to simultaneous or multiple rating events in the TP and EP, we start with the first rating event for each firm and analyze subsequently TP and EP which include only one observation of a particular event type. A description of the sample is reported in Table 1.

We selected 420 events of which 155 reviews and 265 rating changes. Out of 155 reviews, 120 were followed by an effective rate change (either downgrading or upgrading). The average number of days between a review and an effective rate change was 44 days. More than the 80 % of the events refer to a worsening in credit quality, i.e. reviews for downgrading or downgradings. Precisely:

-

132 negative reviews out of 155 (85 %);

-

228 downgradings out of a total of 265 (86 %) actual rating changes (positive or negative).

The largest occurrence of negative events was during 2007–2009. As would be expected. S&P and Moody’s were almost equal in the number of events for each class and both provide a larger set of announcements than Fitch.

4.1 Dynamics of CDS changes

In Table 2 some statistics regarding the CDS average daily spreads by class of rating are reported.

It is interesting to note that, on average, daily CDS spreads increase with the reduction of credit quality. However, we should point out that when looking at speculative grade companies, the expected relationship between CDS quotes and credit quality is violated, highlighting the presence of cases of spread reversal. For instance, the average spread for B rated companies is lower than the average spread for Ba rated companies.

The abnormal spread changes over the sample period show no stationarity. A preliminary study of the stationarity of the AS it , was performed.Footnote 2 All the series of Abnormal Spreads for each of the examined companies, were found to be I(1), as can be seen clearly in Figs. 1 and 2. To estimate for each company the variance of the abnormal spread changes we use the E-GARCH(1,1) model. Precisely, the E-GARCH(1,1) variance is estimated by maximum likelihood using the 210 day interval (EP + TP).

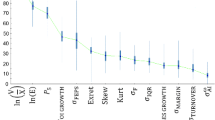

For each company, the model performs well and almost all of the E-GARCH(1,1) parameters were statistically significant. Table 3 reports the percentages of statistically significant parameters and the percentages of positive parameters for the 210 day interval, divided by rating class and region. The tested null Hypothesis is H 0:θ=[α,β 1,β 2,η]=0.

The E-GARCH(1,1) model performs well for both downgrades or reviews. For each estimated vector θ, the parameters, β 1, β 2, η and α were found to be statistically significant more than 80 % of the time. Some differences were found between A rated and B rated companies. In the former case, the percentage of significance is higher for the GARCH parameter, β 1 (100 %); while in the latter it is higher for the leverage parameter, β 2 (90,2 %). So the variance of CDS quotes for A rated companies depends more on the size of the abnormal spread changes, while in the case of B rated companies the sign of the spread changes has higher impact. We may state that in the case of A rated companies a rating event causes large changes in CDS quotes which affect the variance behavior and, in the case of B rated companies, the sign of the changes may have a relevant influence.

In order to test the robustness of the estimation we performed a sensitivity analysis by considering larger time intervals of up to 350 days. In this way we are able to study how the E-GARCH parameters change with increasing interval length. For each company and each event, the vector of parameters θ was estimated using different time intervals t s , s=1,…,5. Where s=1 refers to the initial time length, t 1=210. The interval length is increased of 35 days each time s is increased, in order to have t 2=245, t 3=280, t 4=315, t 5=350. For each element of θ, a t-test was used to investigate possible significant differences due to the different time length. The t-statistics estimated to test the null hypothesis \(( H_{0}:\theta_{t_{s}}=\theta_{t_{s+1}} ) \) yield no statistically significant results. For each company, using the vectors of parameters \(\theta_{t_{s}}\) the conditional variance in Eq. (7) was also estimated.

Some examples of the estimated parameters for a sample of A rated companies using different time intervals are reported in Figs. 3, 4 and 5. Figures 6, 7 and 8 show the same for B rated companies.

The E-GARCH(1,1) variance of the AS it , for each event, is defined by (7). The variance on day t, h it , is conditional on the variance of the previous day, h i,t−1, the size, |ϵ it−1| and the sign, ϵ it−1, of the most recent Abnormal Spread, AS it =ϵ it . In a steady state, assuming the ϵ it is set equal to its expected value, E(ϵ it )=0, and the variance constant over time: h i,t−1=h it =h i , the unconditional variance for each company, i, subject to disclosure is:

According to the E-GARCH model, a large change in the abnormal spread, ϵ it , causes an increase of volatility of CDS quotes which is measured by the GARCH coefficient β 1 and by the asymmetry coefficient, β 2. Any big change in the abnormal spread will have a persistent effect on the CDS dynamics, raising abnormal spread changes for a number of days afterwards. The degree of persistence depends on the size of the coefficient η. When η is relatively large, volatility takes a long time to fade away following an announcement in the market.

The estimated time dependent variance differs across companies and events. The values of θ estimated for each company and each event are reported in Tables 4 and 5. Specifically, in Table 4, are reported the average values of each parameter computed for companies of different rating class in the case of downgradings for the entire sample, which is divided into two subperiods: pre-crisis and post-crisis. In Table 5, corresponding statistics refer to the reviews.

The various E-GARCH parameters across the various companies show the dominant impact of the occurrence of shocks, or large changes in Abnormal Spreads. The estimates of the GARCH coefficient, β 1, and the asymmetry component, β 2, show the largest average values showing that Abnormal Spread’s volatility is driven by the occurrence of a change in the AS t−1. For instance, in the case of A rated companies the mean value of the β 1 coefficients across companies is 0.906, and the mean value for β 2 is 0.532. The degree of persistence, measured by the coefficient η is on average much lower. In the case of announcements regarding the downgrading η=0.266, while for reviews the average η is equal to 0.092.

The class of rating was not found to influence changes in volatility, the main driver is the occurrence of shocks at time t−1, which affects the variance for a number of days afterwards.

5 Some results

We carried out the J-test on the events in the sample. Tests for subgroups of events were also performed by rating class and geographical area. It is clear that European and US markets have different features in terms of liquidity and investors reaction may depend on the credit grade of the company.

The analysis aims to verify the assumption that market participants somehow anticipate rating announcements. Table 6 gives the results of the J-test for the entire sample.

For all the companies (A + B rated), the J-test was statistically significant for both reviews for downgrading and effective downgradings in intervals I 5 and I 6. This clearly demonstrates that CDS quotes show Abnormal changes right around the event date and in the days following. However, some evidence suggests a different reaction by the market to reviews compared to downgrades. In the case of reviews significant changes were found in the intervals I 1 and I 2, but no effects were detected in the intervals I 3 and I 4. The opposite results were found for downgradings. We conclude that market participants anticipate the occurrence of reviews for downgrading sixty to ninety business days before the event and then react heavily, as shown by the size of the average Abnormal Spread changes, around and after the event date. We further conclude that the effective downgrading is reflected in the change of CDS quotes up to forty business days before the event and some effects take place also after that.

For companies belonging to different classes of rating (Panels A and B in Table 6), it is interesting to note different results for reviews for downgrading and downgradings. For A rated companies which were downgraded the CDS markets seem to anticipate the occurrence of the event three months in advance, the only significant statistics refer to I 2. In the case of B rated companies the CDS markets seem to anticipate the downgrading over a shorter time interval (I 3 = two months), but the effects continue to be relevant given the significant statistics reported also in the intervals I 4, I 5 and I 6. This shows that downgrading of B rated companies strongly affects investor reactions, who perceive the downgrading as the beginning of serious risk and therefore keep requiring an additional spread. This may also be due to the special period considered in the analysis given the gravity of the current financial crisis making investors more sensitive to poor company performances. This was not found to occur with A rated companies which may be perceived as safe havens at this time.

Tables 7 and 8 report the results of the J-test by geographical area. Different results are found for the US market where CDS quotes seem to react promptly to rating announcements. In the case of A rated companies (Panel A, Table 7) it is interesting to note that reviews for downgrading are reflected in market quotes some one to three months ahead of the event, while no post-announcement effect was found. For B rated companies (Panel B, Table 7) effective downgradings seem to affect the market’s behavior only in the intervals around the event and no great anticipation occurs.

Results for the European markets (Table 8) show that participants anticipate reviews in the intervals I 1, I 2, I 3 and I 5, showing significant abnormal spread changes. Specifically, market participants price an increase in CDS quotes ninety days before the occurrence of a review, anticipating official announcements.

5.1 Conditional variance

The results of the J-test should be analyzed in conjunction with the behavior of the conditional volatility, which can provide very useful information. The conditional variance estimated for each Abnormal Spread series accurately describes the volatility dynamics over the entire period (EP + TP) for each company, successfully capturing the change in volatility occurring around the event date. In Figs. 9, 10, 11, 12 examples of how the conditional volatility behaves around the event date for four companies is shown.

Using the E-GARCH parameters, we calculated the long run unconditional variance, \(h_{i}=e^{ ( \frac{\alpha _{i}}{1-\eta _{i}} ) }\), and made a useful comparison with the conditional variance. In Figs. 9 and 10 we report the conditional and the unconditional variance around a specific downgrading event for two A rated companies. For these two companies the conditional volatility results are always larger than the unconditional volatility and different patterns occur some three months before the events. In the case of EON (see Fig. 9) the conditional volatility starts to show completely different dynamics some sixty days before the event, with a large spike occurring twenty days before the event. In the case of AMEX (Fig. 10) the change in volatility dynamics also occurs three months before the event, in this case the largest increase occurred sixty days before the event. In both examples no changes in volatility behavior is observed in the days following the event. This is found for all of the A rated companies. The E-GARCH model provides the most accurate measure of the Abnormal Spread volatility and this was also confirmed by the J test for A rated companies, results being statistically significant for only the I 2 interval, that spans from forty to sixty days before the event.

In Figs. 11 and 12 the conditional and unconditional variance for two B rated companies are reported. It is interesting to note that for B rated companies the variance dynamics changes forty days before the event and in some cases, as with MGM for example, the entire dynamics are subsequently altered. In this case a different approach to study the CDS volatility dynamics should be used, for instance a study of structural breaks in the volatility should provide more accurate results. This is beyond the scope of this study, but the authors are analyzing it for a subsequent paper. Similar results were found for other companies, confirming the results reported in Table 6 (Panel B), where the J-test for B rated companies was statistically significant for intervals I 3, I 4 and I 5. The results obtained support our assumption that CDS quotes are exceptionally volatile once a rating agency’s eye is put on a specific company. When this occurs, Abnormal Spread volatility changes should be monitored more than the Abnormal Spread changes, in and of itself.

6 Conclusions

We demonstrate how using conditional variance modeling in the Event Study methodology yields more accurate results. The volatility represents a key element in the assessment of Abnormal Spread changes.

Overall, rating announcements have an effect on CDS quotes mainly around the event date. In the case of reviews, some anticipatory effects, up to five months ahead, were found.

In general, European companies appear to be less sensitive to rating agency news when compared to US companies.

The critical factor is the conditional variance and the E-GARCH model which succeeds best in tracking the changes in variances around event dates. Additionally, the conditional variance of each company provided more effective signals of the feelings portrayed in the market place than the unconditional long run variance level.

Our results encourage us to further investigate the role of volatility in providing information about market behavior. Additional analysis will be conducted to investigate the existence of structural breaks in the conditional Abnormal Spread variance.

Notes

The CMA database quotes lead the price discovery process in comparison with quotes provided by other databases (Mayordomo et al. 2010).

The results of the ADF test performed on each company AS it series around every event are not reported in the article but available upon request.

References

Akgiray, V. (1989). Conditional heteroscedasticity in time series of stock returns. Journal of Business, 62, 55–80.

Akhigbe, A., Madura, J., & Whyte, A. M. (1997). Intra-industry effects of bond rating adjustment. The Journal of Financial Research, XX(4, Winter), 545–561.

Ammer, J., & Clinton, N. (2004). Good news in no news? The impact of credit rating changes on the pricing of asset-backed securities (International Finance Discussion Paper 809). Federal Reserve Board.

Armitage, S. (1995). Event study methods and evidence of their performances. Journal of Economic Surveys, 9(1), 25–52.

Batchelor, R., & Orakcioglu, I. (2010). Event-related GARCH, the impact of stock dividends in Turkey. Applied Financial Economics, 13(4), 295–307.

Best, R. W. (1997). The role of default risk in determining the market reaction to debt announcements. Financial Review, 32(1), 87–105.

Bremer, M., & Pettway, R. H. (2002). Information and the market’s perceptions of Japanese bank risk: regulation, environment, and disclosure. Pacific-Basin Finance Journal, 10, 19–139.

Boehmer, E., Musumeci, J., & Poulse, A. (1991). Event-study methodology under conditions of event induced variance. Journal of Financial Economics, 50, 253–272.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31, 307–327.

Castellano, R., & D’Ecclesia, R. L. (2011). Credit default swaps and rating announcements. Journal of Financial Decision Making, 2, 27.

Castellano, R., & Scaccia, L. (2010). A Markov switching re-evaluation of Event-Study methodology. In Proceedings of COMPSTAT’2010—19th international conference on computational statistics. Heidelberg: Physica-Verlag.

Castellano, R., & Scaccia, L. (2012). CDS and rating announcements: changing signaling during the crisis? Review of Managerial Science 6, 239–264.

Corhay, A., & Rad, A. T. (1996). Conditional heteroskedasticity adjusted market model and an event study. Quarterly Review of Economics and Finance, 36(4), 529–538.

Covitz, M., & Harrison, P. (2003). Testing conflicts of interest at bond ratings agencies with market anticipation: evidence that reputation incentives dominates (Finance and Economics Discussion Series 68). Federal Reserve Board.

de Santis, G., & Imrohoroglu, S. (1997). Stock returns and volatility on emerging financial markets. Journal of International Money and Finance, 16, 561–597.

Goh, J., & Ederington, L. (1993). Is a bond rating downgrade bad news, good news, or no news for stockholders? Journal of Finance, 48, 2001–2008.

Gropp, R., & Richards, A. J. (2001). Rating agency actions and the pricing of debt and equity of European banks: what can we infer about private sector monitoring of bank soundness? (Working Paper 76). European Central Bank.

Hull, J., Predescu, M., & White, A. (2004). The relationship between credit default swap spreads, bond yields and credit rating announcements. Journal of Banking and Finance, 28, 2789–2811.

Ismailescu, I., & Kazemi, I. (2010). The reaction of emerging market credit default swap spreads to sovereign credit rating changes. Journal of Banking and Finance, 34, 2861–2873.

Katz, S. (1974). The price and adjustment process of bonds to rating reclassifications: a test of bond market efficiency. Journal of Finance, 29, 477–533.

Kliger, D., & Sarig, O. (2000). The information value of bond rating. Journal of Finance, 55, 2879–2902.

Mayordomo, S., Penã, J. I., & Schwartz, E. S. (2010). Are all credit default swap databases equal? (NBER Working Paper 16590).

Micu, M., Remolona, E., & Wooldridge, P. (2006). The price impact of rating announcements: which announcements matter? (BIS Working Paper 207).

Nelson, D. B. (1991). Conditional heteroskedasticity in asset returns: a new approach. Econometrica, 59, 347–370.

Norden, L., & Weber, M. (2004). Informational efficiency of credit default swap and stock markets: the impact of credit rating announcements. Journal of Banking and Finance, 28, 2813–2843.

Steiner, M., & Heinke, V. (2001). Event study concerning international bond price effects of credit rating actions. International Journal of Finance and Economics, 6, 139–157.

Weinstein, M. (1977). The effect of a rating change announcement on bond price. Journal of Financial Economics, 5, 329–350.

Yamaguchi, K. (2008). Reexamination of stock price reaction to environmental performance: a GARCH application. Ecological Economics, 56, 23–35.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Castellano, R., D’Ecclesia, R.L. CDS volatility: the key signal of credit quality. Ann Oper Res 205, 89–107 (2013). https://doi.org/10.1007/s10479-012-1244-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-012-1244-9