Abstract

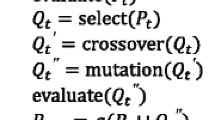

The complexity of the financial systems inevitably leads to the uncertain information and random information simultaneously. Because asset returns frequently show excessive kurtosis and tend to be skewed, we consider an uncertain random higher moments portfolio optimization problem in this paper, in which uncertain and random return rates exist simultaneously. First, the concept of kurtosis for uncertain random variable is defined and the deterministic expressions of kurtosis under three kinds of distributions are derived. Then, an uncertain random mean-variance-skewness-kurtosis-entropy model is formulated with two auxiliary models for portfolio optimization problem. After solving the equivalent deterministic model with NSGA-II algorithm, we propose a new optimal solution criterion for finding a single optimal solution in Pareto optimal solution set. Finally, we present a numerical simulation and obtain the following results: (i) the practicability and the validity of the proposed model, the NSGA-II algorithm and the optimal selection criterion have verified; (ii) the size of population has an obvious influence on the single optimal solution; (iii) the parameter adjustment has a significant impact on the results, and the results are in perfect agreement with the actual situation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Data availibility

The authors confirm that the data supporting the findings of this study are available within the article and its supplementary materials.

References

Ahmadzade H, Gao R, Dehghan MH (2018) Partial triangular entropy of uncertain random variables and its application. J Amb Intel Hum Comp 9(5):1455–1464

Arditti FD (1971) Another look at mutual fund performance. J Financ Quant Anal 6(3):909–912

Chang J-H, Sun L, Zhang B, Peng J (2020) Multi-period portfolio selection with mental accounts and realistic constraints based on uncertainty theory. J Comput Appl Math 377:112892

Chen S-X (2008) Nonparametric estimation of expected shortfall. J Financ Economet 6(1):87–107

Chen W, Yun W, Zhang J, Lu S (2017) Uncertain portfolio selection with high-order moments. J Intell Fuzzy Syst 33(3):1397–1411

Chen W, Wang Y, Gupta P, Mehlawat MK (2018) A novel hybrid heuristic algorithm for a new uncertain mean-variance-skewness portfolio selection model with real constraints. Appl Intell 48(9):2996–3018

Chen W, Li D, Liu Y-J (2019) A novel hybrid ICA-FA algorithm for multi-period uncertain portfolio optimization model based on multiple criteria. IEEE T Fuzzy Syst 27(5):1023–1036

Clarke RG, Harindra DS, Steven T (2006) Minimum-variance portfolios in the US equity market. J Portfolio Manage 33(1):10–24

Deb K, Agrawal S, Pratab A, Meyunivan T (2002) A fast elitist non-dominated sorting algorithm for multi-objective optimization NSGA-II. IEEE T Evolut Comput 6:182–197

Demiguel V, Garlappi L, Nogales FJ, Uppal R (2009) A generalized approach to portfolio optimization: improving performance by constraining portfolio norms. Manag Sci 55(5):798–812

Deng X, Li R (2012) A portfolio selection model with borrowing constraint based on possibility theory. Appl Soft Comput 12(2):754–758

Deng X, Liu Y-L (2018) A high-moment trapezoidal fuzzy random portfolio model with background risk. J Sys Sci Info 6(1):1–28

Dhanalakshmi S, Kannan S, Mahadevan K, Baskar S (2011) Application of modified NSGA-II algorithm to combined economic and emission dispatch problem. Int J Elec Power 33(4):992–1002

El-Abbasy MS, Elazouni A, Zayed T (2020) Finance-based scheduling multi-objective optimization: benchmarking of evolutionary algorithms. Automat Constr 120:103392

Hao F-F, Liu Y-K (2009) Mean-variance models for portfolio selection with fuzzy random returns. J Appl Math Comput 30(1):9–38

Harvey CR, Liechty J, Liechty M, Muller P (2010) Portfolio selection with higher moments. Quant Financ 10(5):469–485

Huang X-X (2007) A new perspective for optimal portfolio selection with random fuzzy returns. Inf Sci 177(23):5404–5414

Huang X-X, Jiang G-W (2021) Portfolio management with background risk under uncertain mean-variance utility. Fuzzy Optim Decis Mater 20(3):315–330

Huang X-X, Wang X-T (2021) International portfolio optimization based on uncertainty theory. Optimization 70(2):225–249

Kannan S, Baskar S, Mccalley JD (2009) Application of NSGA-II algorithm to generation expansion planning. IEEE Trans Power Syst 24(1):454–461

Konno H, Suzuki KI (1995) A mean-variance-skewness portfolio optimization model. J Oper Res Soc Jpn 38(2):173–187

Konno H, Shirakawa H, Yamazaki H (1993) A mean-absolute deviation-skewness portfolio optimization model. Ann Oper Res 45(1):205–220

Kwakernaak H (1978) Fuzzy random variables-I. definitions and theorems. Inf Sci 15(1):1-29

Li B, Shu Y-D (2022) The skewness for uncertain random variable and application to portfolio selection problem. J Manag Optim 18(1):457–467

Li J, Xu J-P (2009) A novel portfolio selection model in a hybrid uncertain environment. Omega Int J Manag Sci 37(2):439–449

Li B, Zhang R-R (2021) A new mean-variance-entropy model for uncertain portfolio optimization with liquidity and diversification. Chaos Soliton Fract 146:110842

Li B, Zhu Y-G, Sun Y-F, Aw G, Teo KL (2018) Multi-period portfolio selection problem under uncertain environment with bankruptcy constraint. Appl Math Model 56:539–550

Liu B-D (2007) Uncertainty theory, 2nd edn. Springer, Berlin, pp 1–79

Liu B-D (2009) Some research problems in uncertainty theory. J Uncertainity Syst 3(1):3–10

Liu B-D (2010) Uncertainty theory: a branch of mathematics for modeling human uncertainty. Springer, Berlin

Liu Y-H (2013) Uncertain random variables: a mixture of uncertainty and randomness. Soft Comput 17(4):625–634

Liu S, Wang S-Y, Qiu W (2003) Mean-variance-skewness model for portfolio selection with transaction costs. Int J Syst Sci 34(4):255–262

Liu X-M, Latif Z, Wang C-F, Latif S, Wang X (2018) Mean-variance-kurtosis hybrid multi-objective portfolio optimization model with a defined investment ratio. J Eng Technol 6(1):293–306

Mardia KV (1970) Measures of multivariate skewness and kurtosis with applications. Biometrika 57(3):519–530

Maringer D, Parpas P (2009) Global optimization of higher order moments in portfolio selection. J Global Optim 43(2):219–230

Markowitz HM (1952) Portfolio selection. J Financ 7(1):977–91

Martel JM, Khoury NT, Bergeron M (1988) An application of a multicriteria approach to portfolio comparisons. J Oper Res Soc 39(7):617–628

Mehlawat MK, Gupta P, Khan AZ (2021) Portfolio optimization using higher moments in an uncertain random environment. Inf Sci 567:348–374

Mittal SK, Srivastava N (2021) Mean-variance-skewness portfolio optimization under uncertain environment using improved genetic algorithm. Artif Intell Rev 54(8):6011–6032

Pahade JK, Jha M (2021) Credibilistic variance and skewness of trapezoidal fuzzy variable and mean-variance-skewness model for portfolio selection. Results Math 11:100159

Qin Z-F (2015) Mean-variance model for portfolio optimization problem in the simultaneous presence of random and uncertain returns. Eur J Oper Res 245(2):480–488

Qin Z-F, Kar S, Zheng H (2016) Uncertain portfolio adjusting model using semiabsolute deviation. Soft Comput 20(3):717–725

Qin Z, Dai Y, Zheng H (2017) Uncertain random portfolio optimization models based on value-at-risk. J Intell Fuzzy Syst 32(6):4523–4531

Rui Q, Hao F-F (2008) Computing the mean chance distributions of fuzzy random variables. J Uncertain Syst 2(4):299–312

Samuelson P (1970) The fundamental approximation theorem of portfolio analysis in terms of means, variances and higher moments. Rev Econ Stud 37(4):537–542

Sanford A (2022) Optimized portfolio using a forward-looking expected tail loss. Financ Res Lett 46:102421

Sheng Y-H, Yao K (2014) Some formulas of variance of uncertain random variable. J Uncertain Anal Appl 2(1):1–10

Srinivas N, Deb K (1994) Multiobjective optimization using nondominated sorting in genetic algorithms. Evol Comput 2(3):221–248

Sun Y-F, Aw G, Teo KL, Zhou G-L (2015) Portfolio optimization using a new probabilistic risk measure. J Ind Manag Optim 11(4):1275–1283

Tasche D (2002) Expected shortfall and beyond. J Bank Financ 26(7):1519–1533

Wilcox J (2020) Better portfolios with higher moments. J Asset Manag 21(7):569–580

Zadeh LA (1965) Fuzzy sets. Inform Control 8(3):338–353

Zhai J, Bai M (2018) Mean-risk model for uncertain portfolio selection with background risk. J Comput Appl Math 330:59–69

Zhang P (2016) Multiperiod mean absolute deviation uncertain portfolio selection. Soft Comput 15(1):1–18

Zhang Q-F, Hui L (2008) MOEA/D: a multiobjective evolutionary algorithm based on decomposition. IEEE Trans Evolut Comput 11(6):712–731

Acknowledgements

This work is supported by the Natural Science Foundation of Jiangsu Province (Nos. BK20190787 and BK20210605).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

The proof of Theorem 2

Proof

Based on Definition 5 in Liu (2013a) and Definition 3, we have

where Ch is the chance measure of uncertain random event. Because \(\left( \eta -E[\eta ]\right) ^{4}\) is non-negative, it holds that

Here, it follows from Stipulation 2.3 in Liu (2007) that

Letting \(x=E[\eta ]+\root 4 \of {r}\) (\(r=\left( x-E[\eta ]\right) ^{4}\)) and taking integration by parts, we have

The proof is completed. \(\square\)

The proof of Theorem 3

Proof

According to Definition 3, we have

The proof is completed. \(\square\)

The proof of Theorem 7

Proof

We construct a Lagrange function to calculate the maximum value of investment diversification in (5.8)

Taking the partial derivatives of \(L(u_{1},u_{2},\cdots ,u_{m},u_{m+1},u_{m+2},\cdots ,u_{m+n},\lambda )\) with respect to \(u_{1},u_{2},\) \(\cdots ,u_{m+n}\) and \(\lambda\), we can get

Then, set all the partial derivatives equal to zero, it follows that

We can get the result that \(u_{1}=u_{2}=\cdots =u_{m+n}=\displaystyle \frac{1}{m+n}\), and the maximum value of the corresponding investment diversification is \(-\ln \left( \displaystyle \frac{1}{m+n}+\varepsilon \right)\). Conversely, when investors invest all their assets in a single asset, the value of investment diversification will reach a minimum of zero. The proof is completed. \(\square\)

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Li, X., Li, B., Jin, T. et al. Uncertain random portfolio optimization with non-dominated sorting genetic algorithm-II and optimal solution criterion. Artif Intell Rev 56, 8511–8546 (2023). https://doi.org/10.1007/s10462-022-10388-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10462-022-10388-x