Abstract

Mountain landslides have occurred in countries such as Italy regularly throughout recorded history, often resulting in fatalities. Because of this, policies that would reduce landslide fatality risk need to be carefully formulated. As a first step in the exploration of preferences for these risk-reducing policies, we examine public perceptions of risk for landslides and related events. Subjective probabilities for others who might die in a landslide, as well as one’s own subjective probability of death, are elicited for a sample of visitors and residents of a region in Italy prone to landslides. We present one portion of the sample with scientific information and allow them to update their risk estimate if they so choose, allowing the role of such information to be tested. The subjective probabilities are then used to construct risk-related attributes in a pivot-design version of a conventional stated choice model. Larger risk changes as departures from the baseline risk are found to be significant in explaining choices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In this manuscript, we present the results of a survey on risk perceptions of mountain landslides in Italy and results from stated choice or preference (SP) models for policy programs to reduce these risks. The SP modeling allows recovery of maximum willingness to pay (WTP) to reduce these risks. To our knowledge, while there is a good deal of literature published on the science of landslides, there is very little literature on the economic damages of these and less so on empirical estimates of WTP to reduce landslide risks. Exceptions are Vranken et al. (2013) and other papers that consider the costs associated with repair and rebuilding or lost property values. Vranken et al. (2013) also consider changes in amenity values for forests and grasslands. To our knowledge, no one prior to our study has considered WTP to reduce landslide risks using the SP or discrete choice experiment (DCE) approach (hereafter DCE) that we use, and which is explained below.

Landslides frequently occur in the Dolomites (Italian north-eastern Alps): two people died inside their house in the summer of 2009, hit by a landslide. Floods and mountain region landslides also result in many casualties in Taiwan every year (Ho et al. 2008; Lin et al. 2008). Extreme weather events contribute to this frequency and are on the increase. Future policy actions require better guidance on risk preferences to become more efficient. Some more background on landslide science, admittedly a simple overview, may help motivate the reader.

In mountainous regions, as in the area under this investigation, landslides can be very fast and when this is the case, they are perhaps better known as debris flows. Such flows take the form of rapid, gravity-induced mass movements consisting of a mixture of water, sediment, wood, and anthropogenic debris propagating along channels on mountain slopes or debris fans. Flows in the Dolomites region of Italy (Gregoretti and Dalla Fontana 2008), as well as in the French Alps (Theule et al. 2012) and in the Rocky Mountains of the USA (Coe et al. 2008; McCoy et al. 2012), usually occur because of the mobilization of sediment accumulated in the bed of channels incising a debris fan, caused by runoff descending from upstream cliffs and slopes.

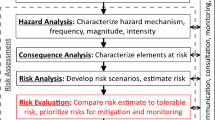

Hydrodynamic forces exerted by stream flow over a debris bed on very steep slopes cause the entrainment of a large quantity of sediments after which a solid-liquid mixture forms (Gregoretti 2000). The routing path of debris flows in the upper part of the fan is usually straight, but it can deviate in the medium and in the lower part: when the slope decreases, the debris flow usually spreads out (Iverson et al. 1998; Takahashi 2007; D’Agostino et al. 2010, Gregoretti et al. 2016). These phenomena severely impact the areas they cross, due to the high speed (up to 10 m per second (m/s)) and the large volumes of mobilized sediment. The design of carefully constructed hazard maps therefore plays a crucial role for any risk analysis against debris flows. Hazard mapping involves the identification of those areas historically or potentially threatened by debris flows.

These problems are common in parts of Italy, the country providing the data and focus for this paper. Each year, Italian landslides and related mountain area floods do not only occur regularly but they also frequently kill or injure people (Salvati et al. 2010). In the period from 1950 to 2008, the two Italian regions that experienced the highest number of events that caused human casualties were Trentino-Alto Adige and Campania. Though there is some uncertainty associated with estimates, the information provided by the historical records is of good quality: the first landslide for which the exact number of deaths is known occurred in the year 843. Salvati et al. (2010) suggest that during the 1166-year period from 843 to 2008, there were 1562 known landslide events, resulting in almost 16,000 casualties.

Steps can be taken to reduce the risks from debris flow related to property damage, injury, or loss of human life. These range in scale and expense, as well as for specific target populations. For example, some policies would reduce damage to residential homes, while others mainly focus on reducing damage to public roads and to actual people exposed to landslide risk.

In this study, we collect preference data in order to implement our DCE approach. By making choices during a survey, our sample respondents evaluate programs to reduce landslide risks. Such experiments, and the resulting empirical models, can make use of direct scientific estimates of the probability of landslides and fatal landslides such as those found in Salvati et al. (2010). Such an approach leads to a class of economic models known based on expected utility (EU) theory, or to some derivations of the EU theory model. In such EU models, individuals are assumed to be expected utility maximizers and are assumed to face well-known and understood risks (i.e., known population or average probabilities of the risky events).

Despite the widespread use of the EU framework, individuals very often have been found to make decisions based on what they believe risks to be and not on the basis of what scientists estimate risks to be, and these might be quite different. For example, a person who builds a beautiful mountain home in the path of debris (in the middle of a steep mountain valley) might believe the probability of a landslide destroying their home is quite small, while a scientist might estimate this probability to be much larger. The mountain home is likely built for its scenic view and access to mountain trails. The home owner probably focuses on these positive amenities and not on what are perhaps strongly correlated landslide risks. This homeowner’s belief could be biased in favor of the outcome that the individual desires (i.e., belief that there will be few or no landslides in the area where his or her otherwise beautifully situated home is).

In what follows, we assume that individuals choosing among programs to reduce risks from landslides, or not, do so according to their own beliefs about these risks. Thus, as a first step, we elicit several estimates of what people believe the related probabilities of landslides and their impacts are. We can then determine how different these beliefs are from what the best available science suggests landslides are for the region.

Background literature on DCE

The review here focuses on the discrete choice experiment model. We are aware that there is a very long literature on eliciting and modeling subjective risks or risk perceptions, and space simply does not allow that here. The reader unfamiliar with this is referred to Shaw and Woodward (2008), or more recently, Shaw (Shaw 2013, 2016) and Wibbenmeyer et al. (2013), for reviews of relevant literature on perceived risks. In this section, we very briefly review the relevant DCE literature, discussing previous efforts to incorporate risk into the DCE framework.

Stated discrete choice experiments

DCE approaches present alternative hypothetical and/or real scenarios to individuals that feature attributes that vary and allow individuals to choose between the alternative. The central idea is that individuals make choices as a function of the characteristics of the scenarios, similar to the way that individuals choose to purchase goods and services on the basis of the cost and characteristics they offer. DCEs are especially valuable when the scenarios involve choice alternatives we might be interested in but which are not actually available at the present time. Examples are newly proposed roads and transportation routes or brand new products being test-marketed.

DCE studies are now quite common in many areas of applied economics (marketing, transportation, health, environment, and medicine—see for example, Louviere and Woodworth 1983; Hensher et al. 2005, 2011; Adamowicz et al. 1998; Scarpa et al. 2010). DCEs have been shown to be potentially consistent with incentive compatibility and/or that the choices that people make have consequences (e.g., Carlsson and Martinsson 2001; Lusk and Schroeder 2004; Vossler et al. 2012). One way of testing for the validity of responses to hypothetical scenarios is to blend these with real scenarios. For example, in transportation studies, subjects can be asked about actual commuting routes or choices they recently made, as well as newly proposed routes, and formal tests of the difference in responses can be constructed (see Adamowicz et al. 1998, for example). We cannot include real scenarios in the current study because there is currently no actual data to allow this, and no subject would volunteer to actually experience a risky landslide in some dreadfully constructed experiment; such morbid experiments are of course now banned by human subject research boards around the world.

The standard DCE model assumes that the person making the decision faces certainty. Errors that are part of the model are assumed to be measurement error or unobservables on the part of the researcher. The estimating equation that allows us to estimate the probability of a particular choice follows the discrete choice literature because the subject is typically only provided with a few discrete choices to make in the context of a survey (as opposed to a continuous quantity of choices). These situations lead nicely to the conditional logit or probit models (when there is a simple binary choice) or the multinomial logit model, for several (more than two) choices.

Underlying these DCE models are theory-based random utilities, i.e., utility that a person derives conditional on a choice being made, coupled with an error term. Essentially, the utility from choice A is compared to the utility from choice B, leading to a “utility difference” model. The probability that a person chooses alternative A versus B, versus C or D takes a mathematical form that is based on the error terms. We postpone further discussion of the DCE to a section below, where we can also include the introduction of risk.

Risk in choice experiments

Several efforts have now been made to incorporate risk into the context of DCEs (there has been a rapid explosion in the transportation choice literature: see Huang et al. 2016 for many references). These efforts include specifying the risk or probability that a program among those to choose from will actually be successful, and also including outcome-related risk (e.g., Glenk and Colombo 2013; Wibbenmeyer et al. 2013). Ideally, we want the specification and development of a DCE to adhere to economic theory under conditions of risk or uncertainty. A DCE may conform carefully to the expected utility framework or one of its variants, such as cumulative prospect theory (e.g., Huang et al. 2016; Wibbenmeyer et al. 2013; Hensher et al. 2011). Several previous DCE studies are eloquently described in Rolfe and Windle (2015), Huang et al. (2016), Shaw (2016), or Cerroni (2013) and will not be repeated here.

To our knowledge, no previous studies have elicited stated risks or subjective probabilities and used these within a CE model, with the exception of Cerroni et al. (2016). The latter paper formally elicits probabilities using the somewhat complicated exchangeability method (see Cerroni et al. 2012) and then incorporates those into a CE context to determine whether subjects cling to their own estimates of subjective probability and mentally adjust those which are externally provided to them as baseline risk conditions in the survey.

This phenomenon is consistent with the idea behind probability weighting, wherein a person might be told that the best scientific estimate of the probability of an event is 0.02, and then the person weights that number so that it is processed internally to be a much higher or lower number. This non-linear probability weighting is of course central to non-expected utility theories such as prospect theory (Kahneman and Tversky 1979; Huang et al. 2016), but the use of subjective probabilities in non-EU models, while desirable, is not necessary. For example, Wibbenmeyer et al. (2013) incorporate such probability weighting in their prospect-theory style DCE, but do not use subjective probabilities that wildfire managers might have to model their choices for strategies that might protect resources from wildfires. Similarly, Huang et al. 2016 allow for probability weighting of risks of arriving late in commuting, but they do not use subjective probabilities either.

To incorporate subjective probabilities into our DCE, we just ask individuals to state what they believe the probabilities of landslides and associated mortality are. This is likely the most commonly used and simplest approach in elicitation of the probabilities that people believe hold for events. It does have the possible advantage over more complicated methods of reduced respondent fatigue, which is important when surveys (such as ours) involve several other decision-making tasks.

A simple, two-choice or two-state model helps the reader see what we do in a utility difference model with subjective probabilities or risks (see Shaw 2016 for a more complete description of this type of model). Let indirect utility be V. Let the subjective probability of a landslide be π. Suppose income is Y, and a vector of other variables that influence a choice be X. The usual additive error term is ε.

In other words, the landslide happens if I = 1, and 0 if not. Thus, utility in Eq. (1) represents the case where the landslide does not happen, and in Eq. (2) it happens with subjective probability, π. In Eq. (1), a WTP is C, and it is subtracted from income if one is willing to choose an alternative with safety and with a payment option (see the two-choice “contingent valuation” model of Riddel and Shaw (2006), which is quite similar to that above; in fact, a binary choice contingent valuation is a special case of a two-alternative DCE model, where one of the alternatives has the “status quo” attribute levels.

In a formal risk context, we want to take the expected utility difference, or

where αX = α 1 X − α o X ; ε = ε 1 − ε o

The expected utility difference in Eq. (3) leads to the estimating equation, which takes the form of the probability of choosing state 0 or state 1. In our model below, we have several alternatives from which the individual can choose, so the structure is similar, but it is more complicated than the above because of having more than two alternatives. The main thing to note is that having a “probability” like π as an explanatory variable in a discrete choice model can indeed be motivated formally from the above.

Survey and samples design

All data collection efforts used for our study involved a survey conducted using in-person interviews. Unlike the potential in a mail survey, the respondent could not peek ahead to later parts of the survey and possibly go back and change initial responses. Peeking ahead in a survey could be a problem when asking for a raw prior estimate of probability, as some individuals may wish to look ahead at information, then go back and change their original answer to avoid looking silly or uninformed. Our survey questionnaire broadly encompassed two sections: the first part collected information about risk beliefs or perceptions and involved the elicitation of each individual’s numerical estimates of probability as well as the socioeconomic data. The second part of the survey involved the DCE application. The DCE part of the survey is described extensively in the design section (below).

Survey and samples

Eight different versions of the survey were given to a sample of respondents in the region during the summer of 2012. Two broad categories or versions are the surveys intended for those who own homes in the region, and second, those intended for visitors. We might expect some key differences between these two broad target groups, in terms of both risk beliefs or perceptions, and support for risk reduction programs. As compared to temporary visitors, the home owners are expected to be more familiar with the region, depending on the length of time they have owned a home for, and they are expected to be exposed to landslide risks more often because of either their residential location and/or their more frequent or extensive travel within a region subjected to such risk. Each of these might lead to different estimates of landslide risk for the two groups of people.

Thus, while many of the same questions were asked of each and every respondent, several specific questions were specifically catered to the homeowners, and others were only given to visitors. For example, visitors were asked about the distance of their home from the region, and the number of trips they take to the region, while homeowners were asked questions about the property they own within the region.

Table 1 describes the key general features of these eight versions and shows the number of respondents for each version. Further versions of the survey were produced depending on whether the survey provided scientific information about landslides (mostly historical but also presenting some information on how they occur and when). Naturally, the information an individual is given might affect his or her belief about what the risks are, and providing information to some, but not all of the samples, allows examination of this. Four versions also offered actual payment for elicited risks that came close to the true risks (approximately following the probability scoring method approach—see discussion in Shaw 2013, 2016). Those who are given this scientific information were told that between the years from 1960 to 2011, scientists estimated that an average of about 9 out of 1 million people per year was killed by a landslide.

Many previous studies of risk perception suggest that risks as small as the landslide risk are difficult for people to process and understand fully. Subjects who accurately predicted risk estimates connected to landslides had a chance of being drawn randomly, and paid, although unlike a lottery outcome, there is no direct and tight corresponding relationship between the monetary award and the risk outcome. For example, a probability scoring approach could be used to devise a reward and penalty scheme where the reward shrinks when larger errors are made by the respondent compared to the “true” mortality risk ranking. We do not do this, but we still expect that the chance of winning some money for correct guesses inspired more care and effort by respondents when forming the risk estimate.

Table 2 reports simple demographic statistics for each of the survey versions, homeowners, and visitors. Figures 1 and 2 provide more detailed information about the distribution of age and income for both of the subsamples. We might have expected that visitors are younger, in general, than homeowners, but there is a noticeable spike in the oldest visitor group. While we might expect some other key differences, there are in fact similarities between the two subgroups in most overlapping descriptive variables. However, about one sixth of the visitor sample reports sometimes engaging in risky activities, whereas that fraction is twice as large, at about one third for the homeowner sample. In addition, while both groups have a huge proportion of people who have heard of landslide problems in Italy, a much larger percentage of homeowners had lost a friend or relative due to these than had those in the visitor group.

DCE question design

The second part of the survey offered each individual in the sample the opportunity to choose among policies to reduce landslide risks. These ranged from the status quo (do nothing new so that status quo conditions continue to pertain) to fairly aggressive risk reduction policy programs that come at a substantial cost. There are many experimental design and survey issues to address in the context of choice experiments (e.g., Scarpa and Rose 2008; Louviere et al. 2000; Rose et al. 2011), but virtually, none of the studies we know of incorporate the subject’s perceived risks or subjective probabilities, as we do below. As mentioned above, one important exception is the new work by Cerroni et al. (2016), which builds on the earlier PhD dissertation by Cerroni (2013) (we are aware that several researchers have incorporated subjective probabilities into other types of behavioral models, such as contingent valuation).

As noted above, the stated choice surveys differed, depending on whether the respondent lived in the region (homeowners) or was a temporary visitor or a tourist: the key attributes used to explain differences in alternatives were catered to fit the category for the respondent (see the list of attributes in Table 3).

One attribute of a choice alternative was used for both groups, which is the risk reduction variable or attribute. All respondents were presented with operational and realistic programs aiming at reducing risks of debris flows. They were all presented with baseline (status quo) levels or characterizations of the debris flows. They are then told that the programs would reduce their own estimate of risk by certain percentage levels. In both groups, the subjects see programs involving a 25, 50, and 75 % reduction in their baseline risk, and the tourists additionally see a 33 % (1/3) risk reduction program. Homeowners face different levels of a reduction in their house insurance premium of the house of increased safety (3, 5, 7, and 10 %). They also see different levels of potential increase in the value of their home because of the risk reduction (0.5, 1, and 3 %), relative to the baseline value of their own home.

The payment mechanism used to support the risk reductions for the homeowners was a new property tax increase, with levels which were 5, 10, 15, and 20 %. In the case of visitors instead, the payment mechanism was a toll (in euros, the Italian currency) on the road used to gain access to the region. It was explained to the survey respondent that the toll would be used to collect revenue in order to support the debris flow risk reduction program. Toll rates were .50, 1, 2, or 3 euros. Visitors also are presented with other commuting or route attributes: levels of scenic beauty (low, medium, and high) and travel times of 2, 3, and 4 h.

All respondents were asked to choose among three alternatives in each choice set, where one alternative was the status quo (SQ) that involved no additional cost. The SQ alternative gave them the opportunity to reject all the attribute levels offered within the risk-reducing alternatives. An example of one choice-set for homeowners is given in Table 4.Footnote 1

Two different experimental designs were developed for the homeowners and visitors to arrange attributes and levels in choice sets. In both cases, the designs have 58 combinations (choice tasks), which are blocked into 7 blocks of 8 choice tasks each. The designs were constructed using a Bayesian D-efficient optimal criterion (see Sandor and Wedel 2001; Ferrini and Scarpa 2007; Rose and Bliemer 2009) based on parameter estimates obtained from pilot studies previously conducted on visitors and homeowners. The point and interval estimates from the pilot study surveysFootnote 2 were used to inform the prior distribution for the Bayesian design. The pilot and the final designs were developed by using the Ngene v.1© (Choice Metrics 2010) software package.Footnote 3

Results

Basic risk results are offered in the section below, and the results of a conventional empirical CE model are also presented under the heading of “Stated Choices.”

Risk responses

Each survey, whether given to homeowners or visitors, asked several different risk questions of each respondent, allowing recovery of estimates of an individual’s risk belief or subjective probability. Some descriptive statistical results are reported in Table 5. After asking about familiarity with landslides (e.g., exposure to television or media coverage), each respondent was initially asked what they believed the typical annual probability of a landslide happening in the region was, providing an estimate of probability without providing any information. We call this variable PRL. The average response for PRL was higher for the homeowners, who thought the chance was about 70 %, than for the visitors, who thought this to be about 64 %, on average. Though it is certainly not the same risk concept, the reader here should remember that the science-based mortality risk is 9 in 1 million, so these estimates are orders of magnitude larger. However, landslides of course do not always end up resulting in mortality. We would expect that PRL is greater than or equal to the probability of fatalities from landslides: logically, it cannot be smaller. Still, this difference in magnitude is quite large. This kind of overestimation is not unusual in the risk elicitation literature (e.g., Riddel and Shaw 2006 find that respondents overestimate the risks associated with nuclear waste storage by orders of magnitude, as compared to science-based estimates).

Next, each respondent was asked what they thought the chance of a landslide which would actually kill at least one person was, in a typical year. By taking these incremental steps in building up to mortality risk, which combines the probability of a landslide with the probability of deaths, we believed people could better understand the risk. We label this second probability the probability of a fatal landslide (PRFL). Subjects were reminded that a landslide could happen, but not kill anyone, so our a priori expectation was that that PRFL should be smaller, or equal to but not larger than the first landslide risk estimate (PRL). For both groups, the number was indeed considerably smaller and almost identical for both groups: homeowners estimated a 46 % chance of a fatal landslide and visitors, a 47 % chance. Recall that each respondent was provided no information by us at this point in their taking of the survey, about anything pertaining to the scientists’ thoughts about risks. However, again note that these estimates are orders of magnitude larger than science-based estimates of the mortality risk from landslides. The probabilities are not directly comparable because PRFL only asks about chances of any fatal landslide. All that we would expect here is that subjects would not make gross contradictory statements, such as PRFL = 0, coupled with an estimate of huge death rates, or PRFL = 100 %, coupled with a zero death rate.

Many specialists in risk communication have found that the simplest, or least confusing task, for laypersons is to estimate a number of fatalities, out of some population (e.g., Gigerenzer and Hoffrage 1995). Thus, following these landslide probability elicitation tasks, each respondent was asked how many people in the region, out of about 5 million residents plus the annual visitors, would be killed in the next year (2013) following the data collection year (2012). Again, here, they were initially provided no scientific information, so this death rate (DR1) might be considered their prior estimate of subjective probability (roughly a death rate of X (their estimate) per 5 million). After recoding the categorical data, the data suggested that homeowners estimated there would be about 9.3 deaths, while visitors estimated that there would be about 13 deaths. These then, are much closer to the science-based estimates of mortality or death rates from landslides, which are 9 per million (or scaling up, 45 per 5 million). They are a bit lower than the science-based estimates: for homeowners, the prior estimate is about 1.8 deaths per million. The numbers are similar for the visitors’ sample.

Following this particular question, a subsample of both groups was provided with the survey information that described what scientists knew about landslide frequency, and how these occur, as well as the historical rates of fatalities.Footnote 4 It would be reasonable for a person who digested and believed the information provided, to conclude that there would be at least an average of 9 deaths per million people in a typical year, and then factor in a population of 5 million, and then perhaps estimate a number five times the annual 9 to arrive at a second estimate of the death rate (DR2), as 45 deaths.

Of the 105 homeowners, 72 were provided with the scientific information, and of the 63 visitors, 46 were provided with the information. They were actually first asked about their own annual (in a typical year) chance of dying in conjunction with a landslide, which is a probability of own death we deem as PROD. Note that this question was not asked before information was given, and thus, those not provided information (50 in total) were not asked this “your own chance of death” question at all. Many risk elicitation researchers (e.g., Slovic 2001) expect that one’s estimate of one’s own chance of death will be found to be smaller than a similar estimate for the population, or using our definitions, if we agreed, we would expect that PROD < DR1 or DR2. This is what some psychologists deem optimism bias, and this kind of bias has been found in the context of hurricanes, as well as other contexts such as cigarette smoking. The thought is that for a risk-taking behavior like smoking, or owning a home or hiking in a landslide-prone region, the individual believes “it will not happen to me.” Of course, dread can play a role and result in the overestimation of one’s own chance of death, as compared to scientific evidence, so this is an empirical issue.

Caution might be used in comparing an elicited chance in percentage terms with a death rate in frequency terms. However, note that for both groups, the average estimated chance of their own death is in fact far larger than the average subjective estimate they provided for the region. We are not suggesting that this simple comparison of means approach is flawless, and of course, we are not yet controlling for other factors that might explain variation in subjective probability estimates.Footnote 5 For example, a particular homeowner might reasonably and accurately place her own chance of dying in a landslide to be zero because she knows her home is well out of the path of debris and that she rarely drives on roads where exposure to landslide debris would be possible. Conversely, she might put a huge probability on the chance of death because her home is directly in the path of potential debris should it slide.

It is quite interesting to note that subjects were apparently unable or unwilling, however, to lower their risk estimate to correspond to the percentage chance implied by the scientific estimate of average deaths per year. Using one million as the base, we can roughly compare the scientific rate of 9 per million to 15 % or the implied 150,000 deaths per one million. Thus, the subjects, on average, hugely overestimate even their own chance of being killed. The visitor’s average rate is lower but is still consistent with huge death rates (90,000 out of one million) as compared to science-based estimates. This result corroborates previous research findings that people have difficulty thinking in probabilistic terms and perhaps make math mistakes when converting mortality rates to death probabilities and vice versa.

After this own estimate, subjects were asked to consider again the number of expected deaths in the coming year, for the region. As noted above, they may well have guessed as many as 45 out of 5 million people would die in 2013, corresponding to the scientific information. Note that in both cases, after reading the information provided, the average estimates actually do increase slightly, although not up to the 45 in 5 million estimate. In some cases (with the risk information provided), these could be considered to be akin to Bayesian updates of the earlier response, following the processing of the information provided to them. For example, in simple Bayesian learning models, several economists have formulated a model of a posterior risk as a function that combines the respondent’s prior risk estimate and information content given to them.

Quite often, the prior is unavailable in empirical studies and must be substituted for in an empirical model by using a simple constant term; however, it is available to us here. We note that while on average the second estimate of deaths went up as compared to the prior, some people indeed reduced their estimate of risk or did not adjust it up or down from their prior, perhaps reflecting individual heterogeneity in Bayesian updating.

As mentioned above, about one half of the survey respondents were offered a chance to be randomly drawn and receive actual payment if their risk estimate corresponded with events that unfold the next year. Knowing whether this is the case required waiting until the end of 2013, but we did explore the effect of the offered payment. Conditional means are not significantly different between the group that was offered payment and the group that was offered no payment.

To further explore cross-sectional variation in risk estimates we estimated some simple regression models with the stated risk estimates being the dependent variable and various independent or explanatory variables used as additional controls. Previous works by risk researchers in various fields, including psychology, sociology, medical science, and economics, have found several factors that correlate with stated or revealed subjective probability estimates.Footnote 6 Common findings are that the characteristics of the risky event matter (e.g., Ho et al. 2008), that women often believe risks to be higher than men, that race may matter (e.g., Finucane et al. 2000), and that age and education may influence estimates of risk, although the pattern in the latter two is not simply in one direction. As an example of investigating the role of education, Katapodi et al. (2004) conduct a meta-analysis of studies of the perceived risk of breast cancer and find mixed results (i.e., sometimes, there is no influence, and sometimes, more or fewer years of education does influence estimates of risk), while Finucane et al. (2000) note that race and education may be correlated and lead to confusion about effects. One cannot say that it is always true that more educated people believe risks to be lower or higher than those with less education. Still, some factors may serve as substitutes for the ability to cognitively process information or for emotional reactions (e.g., Wibbenmeyer et al. 2013), or for experiences that people have had that may be closely related to the risky situation being assessed, or for exposure to information provided by the media or other sources.

Respondents were asked what their fear of certain phenomena was, on a scale of 1 (not at all frightened) to 5 (very frightened). Fear or dread can be related to subjective risk estimates: more fear of some event or activity often leads a person to overestimate risk. The fear of a particular event, such as having a car accident, might be correlated with fear of other events, such as a fire or having an accident at work. Table 6 reports frequencies for the fear variables and correlations between these for the entire pooled sample.

The highest single percentage category in the top half of Table 6 is for those who do not fear having an accident at work, which reflects occupations with low risks of accidents, or possible unemployment. For the strongest fears in the group, it appears that serious illnesses, earthquakes, and floods are about equally strongly feared by a third of the sample. The strongest pairwise correlation is between fear of floods and fear of earthquakes. Avalanche and fire and avalanche and accidents at work are also noteworthy in the correlation.

Much of the previous work that explores correlations like this, most particularly by psychologists, has involved simple pairwise correlations between one factor and the stated risk estimate, but more recently, economists (in contrast to many psychologists) have estimated regression-style models that control for several factors at once. There is no exact economic theory underlying model specification, so we rely on previous indications that some variables might matter, as well as intuition. Unfortunately, the visitor sample is somewhat small at 63 subjects, and thus, subsamples, such as the number (46) of those who answered the own death chance and the updated death chance questions, do not lend themselves to trying huge numbers of independent variables in regression analysis.

We explored the variation in the subjective probability and death estimates using simple ordinary least squares (OLS) regression models. Stated probabilities are actually variables that might not conform to the normal distribution assumed in OLS regressions (the bounds on possible values are zero and one, not minus and plus infinity, as with the normal distribution), but more sophisticated econometric approaches, such as using maximum likelihood and the beta distribution (see Riddel and Shaw 2006), are not pursued here.

Some interesting key regression results for the visitor sample were that higher levels of education significantly increased the samples’ basic landslide risk estimate, while distance traveled to the region was significantly and negatively related to this estimate. No other variables proved to be robust in terms of their significance in the various models we tried. The distance variable maintained its sign and importance in the first of the fatal landslide models, and fear of avalanches was positively and significantly associated with higher estimates. In a model of the first risk response (the prior, for those receiving later information) to estimate the number of annual deaths, the avalanche variable had the same effect, and interestingly, income had a weakly significant and negative effect on the death estimate.

For the homeowner sample, the most consistent variable of any significance in the landslide risk regressions was gender: women in all estimated models had higher subjective estimates of the risk than men did. In the fatal landslide model, this gender result was maintained, and fear of avalanches had a positive and significant influence on the stated probabilities. Results were similar for the first estimate of death rates for the region. Perhaps surprisingly, age and education did not prove to be significant determinants of risk for the homeowner sample.

Several simple OLS regression models were also estimated for the pooled sample of both the homeowners and visitors. Table 7 reports results for two of the more interesting models: the first is the basic annual probability of any landslide occurring, and the second is the probability of a deadly landslide in a typical year for people in the region. Note that the level of education is significant in both models but has the opposite sign in each: more education raises basic landslide risk estimates, but being more educated lowers the estimate of the probability of fatal landslides. We can only speculate as to why this is so. It may be that higher education leads subjects to think harder about more complex and unlikely phenomena such as the combined event of a landslide and fatalities. It may also be that more education reduces the role of fear or emotions which might otherwise be stronger when fatalities are involved.

Fear of avalanches is significantly and positive correlated with the variation in risk estimates, and in the first model, whether the respondent has lost a friend or relative, raises the risk estimation by about 12 percentage points. In the fatal landslide model, females believe risks to be higher than males do. Ho et al. (2008) also find that females express a higher likelihood that their lives will be threatened by floods or landslides, that they will experience a large financial loss, and a higher sense of fear or dread. In both of our models, a good deal of the variation is being captured in the constant term: it is the largest single contributor to the risk estimate, capturing other influences that are not random, but for which we have no data.

Finally, the second estimate of deaths in the region could be considered a possible Bayesian update for the group provided with the risk information (the own chance of death is also asked after information is provided but was not asked before the information was given to the respondent). In very simple models of Bayesian learning, the updated, or posterior estimate, of risk is a function of the prior, formed with no or at least less information provided, and information that is given. Those who cling to their prior, not changing their minds after being given information, will weigh the prior heavily, while those who are strongly influenced by information of course weight it more heavily. The source of information provided to the subject may matter to some respondents, but our respondents are not given different sources of information. Because sample sizes are small, we pool the homeowners and visitors and compare the pre- and post-information risk estimates for the subsample that is provided with the information. Table 8 compares risk estimates for the 118 people who received the science-based risk information.

In another related regression (with results not reported in table form here), we found that the initial death estimate (the prior) was positive and strongly significant in a regression using the second fatality estimate as the dependent variable; other variables were included as controls, but their influence was dominated by the first death estimate. The prior was quite significant for this group, and the higher the prior, the higher the second, updated estimate.

Stated choices for debris risk reduction programs

Separate CE models for the two groups (visitors vs. homeowners) were estimated. Table 9 reports the results of a simple (multinomial logit or MNL) model for homeowners, and Table 10 reports the same for the visitor sample. The usual MNL is based on the assumption that the respondents face certainty when they make their choices. Randomness typically arises only from our perspective, as researchers, who cannot see all that the decision maker can see. This is not consistent with a more formal model of decision-making under conditions of risk or uncertainty. However, our use of the MNL can be seen as a reasonably appropriate model that includes risk beliefs.

In the survey, individual respondents see the attribute levels in relation to baseline levels and proportional changes in the baseline. An intercept variable is used to indicate a status quo choice (SQ); a positive significant coefficient indicates average preference for the status quo.

The model results for homeowners (Table 9) suggest that the tax, risk, and status quo variables all are significant in their influence on the choice of alternatives, and all have the anticipated direction of influence on the choices. Higher taxes decrease the probability of choosing an alternative (holding other things equal), while larger risk reductions increase it. The negative sign on SQ indicates that on average, the sample is not in fact more likely to choose the status quo. The literature on this has suggested that respondents looking for an “easy” set of tasks just consistently choose the SQ option, but we do not find that here. Changes in insurance premiums do not seem to affect the choice of alternatives, perhaps because this monetary incentive is outweighed by the tax, in terms of importance, or perhaps because the premiums are small in comparison to the baseline values of the home.

The basic marginal WTP can be inferred by taking the ratio of one coefficient to the monetary coefficient. This naturally stems from the “value” concept in economics and the ratio of marginal utilities in the context of certainty. Ideally, one would want to construct a more carefully derived risk-related WTP measure, such as an option price, but this would be more important when the estimated model strictly conformed with an EU model or one of its variants.

Most choice models assume no income effects and a simple monetary cost. The marginal rate of substitution between other attributes and the cost variable defines a marginal WTP. The calculation is simple in linear models because it is just the ratio of coefficients on the respective variables. Our calculation is different. First, because our monetary coefficient is computed as a percentage increase in the tax; column four of Table 9 reports estimates of the marginal rate of substitution of the attributes in percentage terms for the sample rather than for the population (in euro). The four columns on the far right of Table 9 report four descriptive statistics of the sample welfare measures: the first and third quartile, the mean, and the median. Our welfare measures are calculated by multiplying the marginal rate of substitution of the attributes by the actual monetary tax rate for each respondent. It can be noted, for example, that three quarters of the sample is willing to pay up to almost 80 euros per year to reduce the risk by 50 %, and the same proportion of respondents is willing to pay a larger amount of money (90 euros) for a 75 % risk reduction. This is consistent with economic theory, suggesting that WTP should increase, the larger the risk reduction.

In the case of visitors, almost all of the attribute variables are significant with the expected direction of influence on route choices. Increased tolls and travel times decrease the probability of choosing an alternative, although the travel time levels that are significant are the 3- and 4-h times. Scenic beauty is an important attractant to a route choice alternative, as expected. Some visitors get pleasure out of a scenic drive, holding other factors constant. The two higher risk reductions are significant and on average, respondents do not choose the status quo in lieu of the alternatives.

In this case, the monetary variable that generates the marginal WTP is the toll rate. The implied marginal WTP for a 50 % reduction in risk is 3.23 euros, and for a 75 % reduction, this rises to 5.68 euros. One would expect that a larger risk reduction leads to a larger WTP. The marginal WTP with respect to travel time is what transportation economists deem the “value of travel time saved,” or VTTS (see Patil et al. 2011, for example). The VTTS to avoid a 4-h increase is 4.85 euros.

Summary/conclusion

Subjective probabilities, or what psychologists deem risk beliefs or “perceived risks,” may matter a great deal when an individual makes choices that depend on risks. That is the case here, as the subjective probabilities for the sample are found to be different from so-called science-based risks (objective probabilities) for our study of landslide or mountain debris risks in Italy. Our focus is on use of these subjective probabilities in a choice model and as a first step, we have simply used these stated subjective probabilities as explanatory variables in a conventional stated choice model. To our knowledge, we are among the first economists to do so (again, we note the discussion paper by Cerroni et al. 2016 is at least one exception), although many have incorporated subjective probabilities into other types of behavioral models (e.g., contingent valuation and revealed preference), and of course, many DCE modelers have included objective or science-based risk measures as attributes.

Our results have some implications for programs to reduce risks. First, for homeowners, they are sensitive to tax increases, so if cooperation from homeowners is sought, large taxes may not be a wise way to proceed. Changing insurance premium may be a better payment mechanism because of a lower sensitivity. Second, small risk changes do not get much favor, so programs should likely try for larger risk reductions, if possible, while balancing that against cost. Third, policies or programs for visitors might be tied to toll rates. As scenic beauty is important to road users, an ideal program might try to reduce risk while at the same time enhance, or at least not interfere with, the scenic beauty of the viewscapes on access roads.

In future research, it would be interesting to try to more carefully flush out reasons for why respondents overestimate most of the probabilities and death rates in this study, as compared to science-based risks. One possibility is that they were confused by the survey asking perhaps too many risk questions, which differed from one another, but the pattern of overestimation of risks is quite common across the literature we are familiar with.

As final caveats, first, we note that the ideal empirical WTP or DCE model may be more formal than what we have developed here, in that it could also specifically and carefully allow for violations of the expected utility assumptions. These assumptions include the usual assumption that the expected utility function is linear in probability. Our DCE model is consistent with the EU framework. Future work could involve one of the non-EU variants such as cumulative prospect theory (e.g., the earlier version by Kahneman and Tversky 1979; also see Huang et al. 2016) or rank-dependent expected utility. Further investigations should allow for the possibility that non-expected utility behavior may be at work here, as has been previously found in other studies.

Second, we are aware that some thorny issues in econometrics may arise when incorporating such stated risks into behavioral models. We acknowledge that these might include potential endogeneity in the risk variable, as well as measurement error (see Kalisa et al. 2016). Dealing with these issues fully goes well beyond what we have done in this paper (see Riddel 2011). Nevertheless, intuition suggests that using subjective, instead of objective, risks will better explain choices that people make when the beliefs are quite different than what scientists estimate.

Finally, we note that the simple random utility model we use cannot easily incorporate individual characteristics that might more richly explain choices. Further research might more deeply explore the connections between different types of people, their tendency to perceive risks, and their decisions to make choices that involve risks.

Notes

An example of a typical choice set for a visiting tourist is available from the authors on request.

Two orthogonal designs were developed for the pilot surveys in order to address homeowners and visitors, respectively. In both cases, 18 respondents were interviewed in order to derive priors for the following Bayesian designs.

Design statistics can be obtained upon request from the corresponding author.

The complete survey versions are available at this link xxx, whereas additional statistical results can be obtained upon request from the authors.

For example, a problem with the comparison of one’s own chance of death to the chance for the average person is that the presumption is that the subject doing the evaluation knows everything about what the average person in the population is like.

There are hundreds of relevant papers. We take a space-saving measure and refer the reader to dozens of references and discussion in the lengthy survey paper by Shaw (2016).

References

Adamowicz W, Boxall P, Williams M, Louviere J (1998) Stated preference approaches for measuring passive use values: choice experiments and contingent valuation. Am J Agric Econ 80(1):64–75

Carlsson F, Martinsson P (2001) Do hypothetical and actual marginal WTP differ in choice experiment? J Environ Econ Manag 41:179–192

Cerroni S, Notaro S, Shaw WD (2012) Eliciting and estimating valid subjective probabilities: an experimental investigation of the exchangeability method. J Econ Behav Organ 84(1):201–215

Cerroni S, Notaro S, Raffaelli R, Shaw WD (2016) The effect of good and bad news on preferences: a discrete choice model of reductions in pesticide residue risk. Revised discussion paper. Queen’s University of Belfast, Ireland

Cerroni S (2013) Food safety, risk and the exchangeability method. In: Completed PhD dissertation. University of Trento, Italy

Choice Metrics (2010) Ngene 1.0.2, user manual and reference guide

Coe JA, Kinner DA, Godt JW (2008) Initiation conditions for debris flows generated by runoff at chalk cliffs, Central Colorado. Geomorphology 96:270–297

D’Agostino V, Cesca M, Marchi L (2010) Field and laboratory investigations of runout distances of debris flows in the Dolomites (eastern Italian alps). Geomorphology 115:294–304

Ferrini S, Scarpa R (2007) Designs with a priori information for nonmarket valuation with choice-experiments: a Monte Carlo study. J Environ Econ Manag 53(3):342–363

Finucane ML, Slovic P, Mertz CK, Flynn J, Satterfield TA (2000) Gender, race, and perceived risk: the ‘white male’ effect. Health, Risk Soc 2:159–173

Gigerenzer G, Hoffrage U (1995) How to improve Bayesian reasoning without instruction: frequency formats. Psychol Rev 102(4):684

Glenk K, Colombo S (2013) Modeling outcome-related risk in choice experiments. Agric Resour Econ 57(4):559–578

Gregoretti C, Dalla Fontana G (2008) The triggering of debris flow due to channel-bed failure debris flow in some alpine headwater basins of the Dolomites: analyses of critical runoff. Hydrol Process 22:2248–2263

Gregoretti C (2000) The initiation of debris flow at high slopes: experimental results. J Hydraul Res 38(2):83–88

Gregoretti CM, Degetto M, Boreggio M (2016) GIS-based cell model for simulating debris flow runout on a fan. J Hydrol 534:326–340

Hensher DA, Rose JM, Greene WH (2005) The implications on willingness to pay of respondents ignoring specific attributes. Transportation 32:203–222

Hensher DA, Greene WH, Li Z (2011) Embedding risk attitude and decision weights in non-linear logit to accommodate time variability in the value of expected travel time savings. Transp Res B 45(7):954–972

Ho M-C, Shaw D, Lin S, Chiu Y (2008) How do disaster characteristics influence risk perception? Risk Anal 28(3):635–643

Huang C, Burris M, Shaw WD (2016) Differences in probability weighting for individual travelers: a managed lane choice application. Forthcoming/Published online, Transportation, August 2015

Iverson RM, Schilling SP, Vallance JW (1998) Objective delineation of lahar-inundation hazard zones. GSA Bull 110(8):972–984

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica: J Econ Soc 47:263–291

Kalisa T, Riddel M, Shaw WD (2016) Willingness to pay to reduce arsenic-related risks: a special regressor approach. J Environ Econ Policy 5(2):143–162

Katapodi MC, Lee KA, Facione NC, Dodd MJ (2004) Predictors of perceived breast cancer risk and the relation between perceived risk and breast cancer screening: a meta-analytic review. Prev Med 38:388–402

Lin S, Shaw WD, Ho M (2008) Why are flood and landslide victims less willing to take mitigation measures than the public? Nat Hazards Rev 44:305–314

Louviere J, Woodworth G (1983) Design and analysis of simulated consumer choice or allocation experiments: an approach based on aggregate data. J Mark Res 20:350–367

Louviere J, Hensher DA, Swait J (2000) Stated choice methods and applications. Cambridge University Press, New York

Lusk JL, Schroeder TC (2004) Are choice experiments incentive compatible? A test with quality differentiated beef steaks. Am J Agric Econ 86(2):467–482

McCoy SW, Kean JW, Coe JA, Tucker GE, Staley DM, Wasklewicz WA (2012) Sediment entrainment by debris flows: in situ measurements from the headwaters of a steep catchment. J Geophys Res 117:F03016. doi:10.1029/2011JF002278

Patil S, Burris M, Shaw WD (2011) Travel using managed lanes: an application of a stated choice model for Houston, Texas. Transp Policy 18(4):595–603

Riddel M (2011) Uncertainty and measurement error in welfare models for risk changes. J Environ Econ Manag 61:341–354

Riddel M, Shaw WD (2006) A theoretically-consistent empirical model of non-expected utility: an application to nuclear waste transport. J Risk Uncertain 32(2/March):131–150

Rolfe J, Windle J (2015) Do respondents adjust their expected utility in the presence of an outcome certainty attribute in a choice experiment? Environ Resour Econ 60(1):125–142

Rose JM, Bliemer MCJ (2009) Stated preference experimental design strategies. Transp Rev 295:587–617

Rose JM, Bain S, Bliemer MCJ (2011) Experimental design strategies for stated preference studies dealing with non-market goods. In: Bennett J (ed) International handbook on non-marketed environmental valuation. Edward Elgar, Cheltenham

Salvati P, Bianchi C, Rossi M, Guzzetti F (2010) Societal landslide and flood risk in Italy. Nat Hazards Earth Syst Sci 10:465–483

Sandor Z, Wedel M (2001) Designing conjoint choice experiments using managers’ prior beliefs. J Mark Res 384:430–444

Scarpa R, Thiene M, Hensher DA (2010) Monitoring choice task attribute attendance in non-market valuation of multiple park management services: does it matter? Land Econ 86(4):817–839

Scarpa R, Rose JM (2008) Design efficiency for non-market valuation with choice modelling: how to measure it, what to report and why. Australian Journal of Agricultural Resource Economics 52:253–282

Shaw WD (2013) A chapter in the encyclopedia of energy, natural resource, and environmental economics. In: Shogren J (ed) Environmental and natural resource economics: decision-making under risk and uncertainty, vol 3. Elsevier Science Press, Inc, Amsterdam ISBN-13: 9780123750679, pp. 10–16

Shaw WD (2016) A survey of environmental and natural resource decisions under risk and uncertainty. International Review of Environmental and Resource Economics 9(1–2):1–130

Shaw WD, Woodward RT (2008) Why environmental and resource economists should care about non-expected utility models. Resour Energy Econ 30(1):66–89

Slovic P (2001) Chapter 6 in smoking: risk, perception and policy. In: Slovic P (ed) Cigarette smokers: rational actors or rational fools? Sage Publications, London

Takahashi T (2007) Debris flows: mechanics, prediction and countermeasures. Taylor and Francis/Balkema, Leiden

Theule JI, Liebault F, Loye A, Laigle D, Jaboyedoff M (2012) Sediment budget monitoring of debris flow and bedload transport in the Manival Torrent, SE France. Nat Hazard Earth Sci 12:731–749

Vossler CA, Doyon M, Rondeau D (2012) Truth in consequentiality: theory and field evidence on discrete choice experiments. Am Econ J: Microeconomics 4(4):145–171

Vranken L, Van Turnhout P, Den Eeckhaut M, Vandekerckhove L, Poesen J (2013) Economic valuation of landslide damage in hilly regions: a case study from Flanders, Belgium. Sci Total Environ 447:323–336

Wibbenmeyer MJ, Hand MS, Calkin DE, Venn TJ, Thompson MP (2013) Risk preferences in strategic wildfire decision making: a choice experiment with U.S. wildfire managers. Risk Anal 33(6):1021–1037

Acknowledgment

This work was supported by the projects: “Study of new early warning systems against hydrogeological risk and their social perception in a high valuable area for tourism and environment”, funded by the University of Padova (CPDA119318).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Thiene, M., Shaw, W.D. & Scarpa, R. Perceived risks of mountain landslides in Italy: stated choices for subjective risk reductions. Landslides 14, 1077–1089 (2017). https://doi.org/10.1007/s10346-016-0741-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10346-016-0741-3