Abstract

Styrene is an important commodity chemical used in polymers and resins, and is typically produced from the petrochemical feedstocks benzene and ethylene. Styrene has recently been produced biosynthetically for the first time using engineered Escherichia coli, and this bio-based route may represent a lower energy and renewable alternative to petroleum-derived styrene. However, the economics of such an approach has not yet been investigated. Using an early-stage technoeconomic evaluation tool, a preliminary economic analysis of bio-based styrene from C6-sugar feedstock has been conducted. Owing to styrene’s limited water solubility, it was assumed that the resulting fermentation broth would spontaneously form two immiscible liquid phases that could subsequently be decanted. Assuming current C6 sugar prices and industrially achievable biokinetic parameter values (e.g., product yield, specific growth rate), commercial-scale bio-based styrene has a minimum estimated selling price (MESP) of 1.90 USD kg−1 which is in the range of current styrene prices. A Monte Carlo analysis revealed a potentially large (0.45 USD kg−1) standard deviation in the MESP, while a sensitivity analysis showed feedstock price and overall yield as primary drivers of MESP.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Biorenewable fuels and chemicals have recently received significant attention due to concerns about depleting petroleum supplies and are increasingly being looked towards with the hopes of creating biorefineries; the biological equivalent of a petroleum refinery [16, 26]. Although the traditional focus has been on the development of biorenewable fuels, such as ethanol or biodiesel, the production of chemicals from biomass is increasingly of interest [29]. There are many reasons for this increased interest, not least of which is that bulk chemicals have slightly to greatly higher value on a per unit mass basis than do fuels, and serve markets that are significantly smaller on the basis of total demand for carbon. This is exemplified by the observation that the bulk chemicals market is approximately the same economic value as the fuels market, despite using only 1/20th as much carbon [23]. Many methods for producing bulk chemicals from biomass have been proposed—including thermochemical, biochemical, and catalytic approaches, as well as hybrids of these methods [5, 16, 23, 31]—and some have been successfully implemented at commercial scale.

Chemical production via biochemical routes is recognized as potentially viable due in part to the historical success of ethanol fermentation, and from ongoing improvements in the fields of synthetic biology and metabolic engineering. Ever-expanding genetic toolkits and novel predictive tools have led to enhanced fermentation kinetics, elevated titers and yields, improved tolerance to environmental stresses and product toxicities, and novel metabolic pathways for the production of non-natural compounds [22]. Several products have been successfully commercialized with the aid of these new technologies, including polylactide (NatureWorks™), 1,3-propanediol (DuPont), and succinic acid (BioAmber). Many other bio-based chemicals currently in development may also have the potential to reach commercial success; however, not before significant improvements can be made with respect to critical biological parameters and cost-effective scale-up methods. As technoeconomic assessments (TEAs) can provide necessary insight into relationships between process parameters and process economics, they are of particular interest at early stages of process development where they can help bridge the gap between research and commercialization by illuminating bottlenecks and opportunities in bioprocessing [12, 15, 16]. A challenge for early-stage TEAs is that they require significantly more information than is typically available in the early stages of process development. This lack of information leads to unrecognized uncertainties and errors in the TEA results [6]. To overcome opaque and complex models typically used for conducting a TEA, simplified models can instead be developed to generate a greater level of transparency of the various assumptions and inherent uncertainty in the process evaluation, with minor sacrifices in the precision of the estimate. Incases relevant to early stages of development, a simpler model can perform in a similar manner as the commercially available tools such as IntelligenSuperPro Designer® [8].

Styrene has recently emerged as a bio-derived chemical candidate with commercial potential by achieving proof of concept [20]. With an annual consumption >5.8 million metric tons in the US alone, styrene is an important monomer and platform chemical in multiple industries, and is produced primarily from petroleum-derived ethylene and benzene [7]. With current styrene prices in the range of 1.86–1.95 USD kg−1 [2], and future price increases expected, bio-based styrene may represent an economically competitive alternative in the future. While the current productivities, titers, and yields of bio-based styrene are far from those necessary for commercial-scale production, investigation into the economic performance of this new pathway is relevant to both the research community and industry.

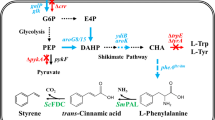

Through de novo pathway design, the non-natural styrene biosynthesis pathway was recently engineered using the bacterium Escherichia coli as the biocatalyst platform [20]. By extension of the endogenous l-phenylalanine pathway, styrene is produced via trans–cinnamate with the aid of two heterologous enzymes as shown in Fig. 1 [20]. As the maximum theoretical yield of l-phenylalanine on glucose is 0.55 gg−1 [1, 20], styrene could therefore be produced at a maximum theoretical yield of 0.26 gg−1. One critical problem that currently hinders high-yield and high-titer production of bio-styrene is its significant toxicity against E. coli as toxicity to first-generation strains are predicted to be ~300 mg L−1 [20], and current titers are already approaching this concentration. However, since the solubility of styrene in water is just 320 mg L−1 at 32 °C, which is very close to fermentation operating conditions, if hosts with just slightly higher styrene tolerance could be engineered, evolved, or isolated, the resultant ability of styrene to spontaneously phase separate from cultures would ultimately help to circumvent the toxicity issue. Furthermore, because water is highly insoluble in styrene, it is anticipated that styrene yielded via spontaneous phase separation would likely to be of extremely high purity (>99.8 %), suitable even for most polymer standards [7]. However, further studies would of course be required to fully characterize the quality of the styrene organic phase recovered in such a manner.

In this work, we have applied the Biorenewables Process Evaluation Tool (BioPET)—a spreadsheet-based tool for early-stage evaluation of biorenewable processes—to examine the potential of bio-styrene production and to illustrate key process bottlenecks [8]. Combining the available knowledge of the physical properties of styrene, as well as factors relevant to and influencing styrene biosynthesis, BioPET facilitates an evaluation of the commercial-scale economics of such a venture. The objective of this paper was to use BioPET to evaluate the economics of bio-based styrene at a typical biochemical plant size, to characterize the uncertainty in the TEA, and to highlight the parameters that are most important to the estimated final cost of production.

Methods

Styrene bioproduction will incorporate both fermentation and separation processes. The method of separation at commercial scale is likely to exploit the mutual insolubilities of styrene and water, much like between fatty acid esters and glycerin in biodiesel production [19]. To implement this economic analysis, BioPET was modified to include a decanter separation technique downstream of fermentation. While there is likely to be more unit operations incorporated into a commercialized process, such as filtration of cell debris not captured during centrifugation, given the state of commercialization existing at proof-of-concept stage and the uncertainties in the research and development process, no further elements were incorporated. Using published sizing rules and economic equations as previously presented in BioPET, a decanter was sized and capital costs estimated [8, 30]. As BioPET fermentation vessel volume was previously set for an anaerobic process, maximum vessel volume was adjusted to 757 m3 to reflect vessel size limitations on aerobic processes [11].

The decanter was assumed to operate at 32 °C and to have two phases represented by styrene and water. The two phases assume all properties of water and styrene, respectively, and a bubble diameter of styrene in the continuous water phase of 150 µm. As the properties of these two components led to a settling velocity greater than 4 mm s−1, a terminal settling velocity of 4 mm s−1 was chosen [30]. Due to expected low flow rates over the range of operation and the large settling velocity, a vertical column decanter was assumed. The necessary area of interface between the two phases was calculated using Eq. 1.

where A i is the area of interface (m2), u d is the terminal settling velocity (m s−1) and V c is the volumetric flow rate of the continuous phase (m3 s−1).

This area was assumed to be the cross-sectional area of the column with an L/D of five. The cost calculations were then as follows using values from a previously described decanter with a continuous phase flow rate of 12 L s−1 at an original adjusted cost for stainless 304 of 285,000 USD [30]. The exponential relationship for decanters follows an exponent of 0.84 and follows Eq. 2 [24].

where C n is the new cost for newly sized piece of equipment, S n is the new size of equipment, S o is the size of equipment where previous cost data exists, C o is the cost of equipment where previous data exists and n is the empirically derived cost exponent.

This equation uses the previous knowledge of the decanter cost and applies it over a range of continuous phase flow rates between 1.2 and 40 L s−1 [30].

A 45 Gg per year styrene bioproduction process was designed using the expected values in Table 1 and examined over the entire range, worst case to best case, using a Monte Carlo approach with 2,000 simulations.

Results and discussion

Using the base-case assumptions (‘Expected Values’ in Table 1), BioPET estimated an MESP of 1.90 USD kg−1 for 99.9 % pure styrene monomer. It is predicted that the process will employ six fermenters of approximately 680 m3 each operating for 276 batches per year at a total 30 h fermentation cycle (includes downtime for cleaning and loading). Due to the estimated ease of separation, it is expected that a single decanter should be adequate for the size and titer values estimated. No alternative products are considered to be produced or to interfere with product purity [20].

The total capital investment for all installed equipment for the expected values was 29.6 million USD. The largest capital expenditure arose out of fermentation with an installed cost of 14.7 million USD, as seen in Table 2. These capital expenditures are under the estimated Lang Factor of 5 [24]. However, the Lang Factor may be closer to 3 as is estimated for corn-grain ethanol [21, 24]—it therefore, seems probable our capital cost estimates are conservative. Lack of prior information to further guide the estimates is not available and leads to a large range of uncertainty.

Feedstock was a dominating factor in the operation of the styrene plant accounting for 63 %, or 54 Million USD, of the total annual expenditures, as seen in Table 3. In line with the comparison to biodiesel, simple processing systems become heavily dependent on feedstock and can be estimated at upwards of 90 % of the annual expenses [19]. These estimates from BioPET for bio-based styrene also result in approximately similar breakdown of costs as a percentage, as the estimate of ethanol from BioPET [8]. The cost of feedstock (assumed to be pure glucose) corresponds to approximately 6.00 USD bu−1, or 240 USD Mg−1. Although any glucose feedstock could be chosen, if corn is used, the required number of bushels would be approximately 60,000 acres of corn or <1 % of the harvested land in Iowa for corn grain in 2011 [9]. This would correspond to a styrene plant in Iowa being able to acquire all necessary feedstock within a 14-km (8.8 mile) radius of the plant.

The huge scale of typical petrochemical plants drives down the unit costs of processing, and therefore, continues to be critical to their economic viability [10], but the production of bio-based styrene does not appear to experience the same level of sensitivity. With the feedstock already dominating much of the respective cost of the product, and the economy of scale of the fermenter already realized at production outputs as low as 25 Gg per year, optimization of bio-based styrene will ultimately come at a balance between feedstock transportation and fermenter costs. This has significant implications in understanding the economics of bio-based chemicals, and not just styrene, as new plants will become largely modular in their design and the scale of process will likely be controlled significantly by feedstock costs and by feedstock and product transportation costs.

With scale playing a less significant role in the economic viability of bio-based chemical plants, it seems likely that smaller production facilities (relative to typical petrochemical plants) will become the normal design. This is largely in part due to two major reasons: capital investments are reduced and market saturation is minimized. Petrochemical styrene plants have been constructed up to scales of 600 Gg per year, which represents over 10 % of the current market size, but construction of a plant of only 45 Gg per year only represents less than 1 % of the current market [7, 27]. Commercially, this equates to less market saturation and increased probability that the assumption that all product synthesized reaches market is realistic. Smaller scales also imply reduced risk regarding capital investments.

A sensitivity analysis was conducted by adjusting individual parameters by ±1 %, and measuring a percent change in the output of the MESP. The top five most sensitive parameters were identified and displayed in Fig. 2, and feedstock purchase price and yield of product on substrate were the most sensitive parameters. With purchase price of sugars changing and uncertainty of the yield of product on substrate stemming from the uncertainty in the yield of l-phenylalanine [1, 14], further evaluation of these parameters prior to commercialization must be conducted.

The Monte Carlo simulation produced an estimated MESP of 1.93 USD kg−1 product with a standard deviation of 0.45 USD kg−1. As shown in Fig. 2, the yield of product on substrate and cost of feedstock can cause significant variations in MESP, and are likely the driver for the significant amount of variation seen in the Monte Carlo analysis. Under the specified range for Monte Carlo, the maximum MESP was 3.09 USD kg−1. Under uniformly optimistic assumptions, MESP values as low as 1.00 USD kg−1 were possible and would have the potential for a very successful venture even facing current, petrochemical styrene prices.

Overall, the economic analysis of styrene bioproduction revealed potential commercial feasibility at modest fermentation productivities, titers, and yields. Smaller bio-based chemical plants, such as succinic acid, are being built with annual production rates of 34 Gg per year and this smaller scale may be beneficial for reducing risk with regards to invested capital on such items as bio-based styrene [3]. It seems likely that production values out of fermentation can likely exceed predicted values due to the phase separation limiting product inhibition, which can be seen in other fermentations where no phase separation occurs [17]. However, toxicity is currently the limiting case to production and must be overcome to achieve any competitive commercial values.

Toxicity has presented issues historically and one method of keen interest to researchers is to use in situ extraction, or in situ product removal (ISPR), that extracts the toxic product of interest into a second phase, typically a biocompatible solvent, in order to limit the effect of the toxic product [4]. While the economics of ISPR might become practical when the product of interest is of high value, the cost of biocompatible ISPR agents and their respective reduction in fermentation volumes per purchased volume, it does not seem a likely path for economically competitive bio-based styrene production. Alternative methods of overcoming the toxicity must be sought, as discussed previously [13].

Another key risk is feedstock purchase price. Over the past decade, corn prices have ranged 1.75 to nearly 7 USD bu−1 (fourfold) while oil prices have ranged from approximately 25–125 USD bbl−1 (fivefold). The volatility for the petroleum-derived styrene, however, has ties into multiple types of petrochemical feedstocks (i.e., ethylene and benzene) and can experience volatility from each feedstock independently as a result. This may be a benefit to the future of bio-based styrene, whereas even though its economics are sensitive to feedstock cost they are only tied to a single feedstock and with improvements in the decomposition of lignocellulosic feedstocks alternative cost competitive sources for fermentable sugars soon be available [25]. Projected costs for these lignocellulosic feedstocks have even been estimated as being three times less expensive than corn starch at 2.50 USD bu−1 from corn grain [18]. It seems probable that between corn grains historical price and estimated prices for lignocellulosic sugars, the estimated cost to produce bio-based styrene has a potential future with a variety of feedstocks.

While the major costs are associated with feedstock and yields, alternative driving factors are capital costs. Bio-based styrene represents a fairly simple process design that mimics corn-grain ethanol in that the general process consists of fermentation and a single separation unit operation. Another factor that may also mimic ethanol is the Lang factor of which will reduce the estimates to produce bio-based styrene [21]. The push to create new bio-based products can have a major impact on its own industry by driving the capital costs of fermenters down via an increased available supply, although the demand may outweigh this benefit.

While no life-cycle assessment has yet been conducted on the process, the very nature of the bioproduction of styrene appears to inherently use significantly less energy than the upgrading of ethylene and benzene to styrene [7, 28]. Even though the benefit of capturing the carbon in the biomass would largely be diminished due to low-yielding fermentation, the minimal processing energy requirements may still allow bio-based styrene to be a net-negative carbon process; however, further investigation into this claim is warranted.

Conclusion

A 45 Gg per annum bio-based styrene plant is estimated to produce 99.9 % pure styrene monomer at a MESP of 1.90 USD kg−1. This price is competitive with current styrene monomer prices in today’s market [2]. Considering uncertainties of details around final construction costs and key fermentation parameters, the estimate for bio-based styrene is 1.93 ± 0.45 USD kg−1, which is in line with current petro-styrene prices. The bioproduction of styrene at this scale should create minimal risk with regards to transportation and market saturation. While an overarching amount of uncertainty in product yield can limit the competitiveness of the future selling price of commercial-scale bio-based styrene, initial toxicity presents a barricade to achieve the necessary production values. Future research should be targeted towards addressing or overcoming this limitation and investigating potential contaminants to any downstream processing equipment that uses styrene monomer as its feedstock.

References

Báez-Viveros JL, Osuna J, Hernández-Chávez G, Soberón X, Bolívar F, Gosset G (2004) Metabolic engineering and protein directed evolution increase the yield of l-phenylalanine synthesized from glucose in Escherichia coli. Biotechnol Bioeng 87(4):516–524. doi:10.1002/bit.20159

Balboa B (2014) US styrene suppliers not looking to raise prices in March. ICIS. http://www.icis.com/resources/news/2014/03/07/9760770/us-styrene-suppliers-not-looking-to-raise-prices-in-March/. Accessed 3 May, 2014 2013

BioAmber (2012) BioAmber. Accessed February, 2013

Brennan TCR, Turner CD, Krömer JO, Nielsen LK (2012) Alleviating monoterpene toxicity using a two-phase extractive fermentation for the bioproduction of jet fuel mixtures in Saccharomyces cerevisiae. Biotechnol Bioeng. doi:10.1002/bit.24536

Brown TR, Zhang Y, Hu G, Brown RC (2012) Techno-economic analysis of bio based chemicals production via integrated catalytic processing. Biofuels Bioprod Biorefining 6(1):73–87. doi:10.1002/bbb.344

Bunger M (2012) Breaking the model: why most assessments of bio based materials and chemicals costs are wrong. Ind Biotechnol 8(5):272–274

Chen S–S (2000) Styrene. In: Kirk-Othmer Encyclopedia of Chemical Technology. John Wiley & Sons, Inc., New York. doi:10.1002/0471238961.1920251803080514.a01.pub2

Claypool JT, Raman DR (2013) Development and validation of a technoeconomic analysis tool for early-stage evaluation of bio-based chemical production processes. Bioresour Technol 150(0):486–495

Department of Agriculture I (2011) Iowa agriculture quick facts 2011. http://www.iowaagriculture.gov/quickfacts.asp. Accessed 8 Feb, 2013

Haldi J, Whitcomb D (1967) Economies of scale in industrial plants. J Polit Econ 75(4):373–385

Hannon JR (2007) Comparing the scale-up of aerobic and anaerobic biological processes. In: The 2007 annual meeting

Hermann BG, Patel M (2007) Today’s and tomorrow’s bio-based bulk chemicals from white biotechnology—a techno-economic analysis. Appl Biochem Biotech 136(3):361–388

Jarboe LR, Liu P, Royce LA (2011) Engineering inhibitor tolerance for the production of biorenewable fuels and chemicals. Curr Opin Chem Eng 1(1):38–42. doi:10.1016/j.coche.2011.08.003

Juminaga D, Baidoo EEK, Redding-Johanson AM, Batth TS, Burd H, Mukhopadhyay A, Petzold CJ, Keasling JD (2012) Modular engineering of l-tyrosine production in Escherichia coli. Appl Environ Microb 78(1):89–98. doi:10.1128/aem.06017-11

Kazi FK, Fortman JA, Anex RP, Hsu DD, Aden A, Dutta A, Kothandaraman G (2010) Techno-economic comparison of process technologies for biochemical ethanol production from corn stover. Fuel 89:S20–S28. doi:10.1016/j.fuel.2010.01.001

Kazi FK, Patel AD, Serrano-Ruiz JC, Dumesic JA, Anex RP (2011) Techno-economic analysis of dimethylfuran (DMF) and hydroxymethylfurfural (HMF) production from pure fructose in catalytic processes. Chem Eng J 169(1–3):329–338. doi:10.1016/j.cej.2011.03.018

Levenspiel O (1980) The monod equation—a revisit and a generalization to product inhibition situations. Biotechnol Bioeng 22(8):1671–1687

Lynd LR, Wyman CE, Gerngross TU (1999) Biocommodity Engineering. Biotechnol Progr 15(5):777–793. doi:10.1021/bp990109e

Marchetti JM, Miguel VU, Errazu AF (2008) Techno-economic study of different alternatives for biodiesel production. Fuel Process Technol 89(8): 740–748. doi:http://dx.doi.org/10.1016/j.fuproc.2008.01.007

McKenna R, Nielsen DR (2011) Styrene biosynthesis from glucose by engineered E. coli. Metab Eng 13(5):544–554. doi:10.1016/j.ymben.2011.06.005

National Renewable Energy L, United States. Dept. of E, United States. Dept. of Energy. Office of S, Technical I (2000) Determining the cost of producing ethanol from corn starch and lignocellulosic feedstocks. United States. Dept. of Energy; distributed by the Office of Scientific and Technical Information, US Dept. of Energy. Available via http://worldcat.org. http://www.osti.gov/servlets/purl/766198-WblxIL/native/

Nielsen J (2001) Metabolic engineering. Appl Microbiol Biot 55(3):263–283

Nikolau BJ, Perera MADN, Brachova L, Shanks B (2008) Platform biochemicals for a biorenewable chemical industry. Plant J 54(4):536–545. doi:10.1111/j.1365-313X.2008.03484.x

Peters MS, Timmerhaus KD, West RE (2003) Plant design and economics for chemical engineers. McGraw-Hill, New York

Rezaei F, Joh L, Kashima H, Reddy A, VanderGheynst J (2011) Selection of conditions for cellulase and xylanase extraction from switchgrass colonized by Acidothermus cellulolyticus. Appl Biochem Biotech 164(6):793–803. doi:10.1007/s12010-011-9174-6

Rogner H-H (2012) Energy Resources. In: Toth FL (ed) Energy for development, environment and policy, vol 54. Springer, Netherlands, pp 149–160. doi:10.1007/978-94-007-4162-1_12

Total (2001) Carville styrenics complex fact sheet. http://www.totalpetrochemicalsusa.com/

Turton R, Bailie RC, Whiting WB (2010) Analysis, synthesis and design of chemical processes. MyiLibrary. Available via http://worldcat.org

Werpy T, Petersen G (2004) Top value added chemicals from biomass: volume I—results of screening for potential candidates from sugars and synthesis gas. Other information: PBD: 1 Aug

Woods DR (2007) Rules of thumb in engineering practice. Wiley-VCH; John Wiley, Chichester

Xie DM, Shao ZY, Achkar JH, Zha WJ, Frost JW, Zhao HM (2006) Microbial synthesis of triacetic acid lactone. Biotechnol Bioeng 93(4):727–736

Acknowledgments

The authors wish to thank Kurt Rosentrater, Assistant Professor in Agricultural and Biosystems Engineering, for help regarding the incorporation of a Monte Carlo Analysis.

Author information

Authors and Affiliations

Corresponding author

Additional information

The material presented here is based upon work supported by the National Science Foundation under Award No. EEC-0813570. Any opinions, findings, and conclusions or recommendations expressed in this material are those of the author(s) and do not necessarily reflect the views of the National Science Foundation.

Rights and permissions

About this article

Cite this article

Claypool, J.T., Raman, D.R., Jarboe, L.R. et al. Technoeconomic evaluation of bio-based styrene production by engineered Escherichia coli . J Ind Microbiol Biotechnol 41, 1211–1216 (2014). https://doi.org/10.1007/s10295-014-1469-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10295-014-1469-5