Abstract

Anticipatory trade effects of free trade agreements (FTAs) have been documented in various papers. One reason put forward trying to explain this phenomenon is reduced trade policy uncertainty. This paper is one of the first to explore the role of anticipation and trade policy uncertainty in the case of a recently concluded deep and comprehensive EU FTA, including significant behind the border measures. We use monthly data at a lower level of aggregation (8-digit level) compared to previous studies and we account for changes in the EU product classification over time. We also distinguish between the impact on products which are actually subject to liberalisation under the FTA as opposed to those which are already duty-free and we examine the effects on both the extensive margin and the intensive margin. We consider the impact of the FTA during three different periods of time (the start of negotiations, initialling of the agreement and entry into force), while comparing with the period before negotiations began. The results indicate that the FTA has had a positive impact on exports on both margins. The impact on the EU is somewhat higher indicating that EU exporters have more to gain in terms of increasing the predictability of the trade policy regime of the destination market and lowering its tariffs than vice versa. The results demonstrate that the impact of FTAs should not be assessed against the time period just prior to entry into force of the agreement, but much earlier to account for anticipation effects.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It may seem evident that trade effects of trade liberalisation occur once trade barriers start being reduced. By definition, this is also the assumption behind ex ante modelling exercises which require “shocks” in the form of tariff cuts or reduction of other forms of trade barriers to yield any effects.Footnote 1

However, there are several studies showing evidence of the existence of anticipatory trade effects in the context of negotiations of free trade agreements (FTAs). That is, trade between two partners appears to increase before a bilateral FTA between them has entered into force.

Croce et al. (2004) argue that a strong presumption that an FTA actually will be concluded may be sufficient to generate an increase in exports before conclusion and implementation of the agreement. Another reason put forward by Freund and McLaren (1999) is that adjustment effects in the business environment are needed for the actual later implementation of the FTA. They find, in the case of the EU that trade of countries joining the bloc started to increase 4 years before accession.

Along the same lines, estimates by Magee (2008) indicate that FTAs have significant anticipatory effects on trade flows. His results suggest that trade increases by about 25 % 4 years prior to entry into force of an FTA.

Coulibaly (2007) finds anticipation effects of various strength 5 years prior to entry into force of the Association of Southeast Asian Nations (ASEAN), the Economic Community of West African States (ECOWAS) and the Southern African Development Community (SADC). Mölders and Volz (2011) distinguish between different implementation stages of a number of East Asian FTAs. Their results generally point toward the existence of anticipatory trade effects during the negotiation stage, depending on regression technique used.

In a related vein, using a computable general equilibrium (CGE) model, Bergin and Lin (2012) empirically examine the European Monetary Union’s (EMU’s) ability to increase trade. In terms of number of products, they find that trade on the extensive margin increase years prior to the EMU entering into force and ahead of trade on the intensive margin.

While, undoubtedly, policy uncertainty in general and trade policy uncertainty in particular can have a negative impact on exporters’ decisions to enter markets, there is relatively little research on the sources and impact of trade policy uncertainty. This may partly be due to that statutory trade policy may be perceived to be stable, though applied trade policy in fact can be quite volatile. For example, applied tariff rates are far lower than bound rates in many countries and provide scope for substantial (legal) increases. In addition, tariffs are not the only type of protection countries may make use of.

Some policy instruments, ungoverned by the WTO or other bodies, may interact with economic shocks to generate substantial uncertainty. During the recent crisis Global Trade Alert (2009) noted an increase in the number of state measures taken, including such affecting trading partners’ commercial interests. In combination with other measures such as imports bans, export taxes or restrictions, non-tariff barriers (NTBs), quotas, etc., these tariff measures create uncertainties which affect decisions to export.

Handley and Limão (2012) provide theoretical and empirical evidence of the impact of uncertainty on exports and investment decisions.Footnote 2 They find an increase in Portugal’s exports to the EU following the 1986 enlargement, which, to 75 %, can be explained by uncertainty removal and to about 17 % of remaining tariff reduction.Footnote 3

In another paper, they examine the impact of policy uncertainty on trade and real income in the case of Chinese exports to the US following its WTO accession in 2001 (Handley and Limão 2013). China’s WTO accession is estimated to have reduced the threat of a trade war, thereby explaining 22 % of China’s export growth to the US. More generally, the authors’ findings provide evidence of large effects of policy uncertainty on economic activity and the importance of agreements in reducing it.

Our contribution to the existing literature in this area is multi-fold. Firstly, using an econometric framework, this paper is one of the first to explore the role of anticipation and trade policy uncertainty in the case of a recently concluded deep and comprehensive EU FTA, including significant behind the border measures. We do so separately considering the time periods following the start of the negotiations, the initialling of the agreement and the entry into force using monthly data at a lower level of aggregation (8-digit level) compared to previous studies.

Secondly, we account for changes in the EU product classification over time. Such considerations do not seem to have been a source of concern in previous studies, but if not properly handled analytically this can lead to wrongful conclusions. Thirdly, we distinguish between the impact on products which are subject to liberalisation under the FTA as opposed to those which are not. Finally, we examine the effects on both the extensive margin (probability to export a specific product) and the intensive margin (change in the value of products exported).

The next section briefly describes the EU-Korea FTA and trade and protection patterns. Section 2 presents the data, Sect. 3 the empirical framework and Sect. 4 the detailed results of the econometric analysis. Section 5 summarises the main findings and draws some conclusions.

2 The EU-Korea FTA and trade and protection patterns

2.1 The EU-Korea FTA

The EU-Korea FTAFootnote 4 is the first agreement concluded in the new wave of deep and comprehensive FTAs that the EU launched following the lifting of the its self-imposed moratorium on such agreements in favour of a comprehensive multilateral round in the late 1990s.

Negotiations on an FTA between the EU and Korea were launched in May 2007 in Seoul. After eight formal rounds of talks, the FTA was initialled by both sides on 15 October 2009.Footnote 5 The agreement was signed during the EU-Korea Summit in Brussels on 6 October 2010. The European Parliament gave its consent to the FTA on 17 February 2011 and it was provisionally applied as of 1 July 2011 until it entered into force on 13 December, 2015.Footnote 6,Footnote 7 At the time of conclusion, the EU-Korea FTA was one of the most ambitious trade agreement ever negotiated by the EU.

Before the entry into force of the FTA in 2010, average trade weighted tariffs applied to EU exports in Korea were 6.2 %, compared to 2.5 % on Korean exports to the EU.Footnote 8 Furthermore, about 68 % of the value Korean exports entered the EU duty free compared to 15 % of the value of EU exports to Korea (see footnote 8).

Compared to previous EU FTAs in force, the agreement is unprecedented both in its scope and in the speed at which trade barriers are removed. The majority of customs duties on goods were removed at the entry into force of the agreement and by 1 July 2016, practically all EU customs duties on industrial goods will be removed. This corresponds to almost 99 % of all duties paid by Korea exporters before the entry into force of the agreement.Footnote 9

As shown in Fig. 1, the staging of the elimination of customs duties is more front-loaded on the EU side than in the case of Korea. In the first year of the entry into force of the agreement, 94 % of all EU tariff lines were liberalized corresponding to about 90 % of the value of Korean exports to the EU. The figures for Korean liberalisation were 80 % corresponding to 65 % of the value of EU exports.

Furthermore, the agreement tackles non-tariff barriers to trade, with a specific focus on the automotive, pharmaceuticals, medical devices and electronics sectors. The FTA also eliminates quantitative import restrictions and all forms of duties, taxes, charges and restrictions on exports and includes provisions on issues ranging from services and investments, competition and government procurement to intellectual property rights.

The EU-Korea FTA will also serve as an additional insurance and enhance predictability and stability of the trade policy environment in the two markets. To this end, the preamble includes language in which the parties state that they are “Convinced that this Agreement will create […] a stable and predictable environment for investment…” while Article 12.2 lays down that the parties shall pursue “…an efficient and predictable regulatory environment for economic operators…”.Footnote 10

2.2 Trade between the EU and Korea

Korea is the EU’s eighth largest trading partner and the EU is Korea’s second trading partner after China. The most important category of goods traded is Machinery and mechanical appliances, which accounts for close to 35 % of total EU exports to Korea and about as much in terms of EU imports.

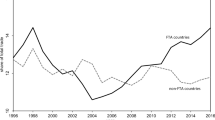

Figure 2 shows that beginning in 2005, EU exports to Korea increased until the start of the negotiations in approximately mid-2007. Except for a short re-bound in spring 2008, they then decreased until early 2009, but have been on an upward trend since then and reached some € 3.5 billion in June 2014. Since the implementation of the agreement, EU exports to Korea have increased more compared to EU exports to other main partners in Asia.Footnote 11

EU imports from Korea increased from the beginning of the period until the time of the start of the negotiations in 2007. Imports then decreased until early 2009 and have shown several ups and downs since that point in time. EU imports from Korea stood somewhat higher by the first half of 2014 compared to 2009, potentially still being affected by the crisis. One should recall, however, that part of this development is due to investment and location of Korean production in the EU e.g. of cars.Footnote 12 Similar to above, EU imports from Korea show a less negative development compared to EU imports from other main partners in Asia, except for Asean.Footnote 13

Figure 3 shows the development of the number of monthly EU and Korean products exported over the pre-negotiation period until mid-2014 which the end of 2013.Footnote 14 Between 2005 and mid-2007, we see a fairly stable number of about 4700 EU products exported to Korea every month, but there is a drop shortly after the negotiations started in May 2007 which by and large corresponds to the start of the global financial crisis and which lasts until late 2008. We then witness a substantial and steady increase in the number of products exported to Korea, reaching close to 5400 by mid-2014.

Both the initialling of the agreement in October 2009 and the entry into force of its provisional application in July 2011 are followed by increases in the number of EU products exported. The development in the number of products exported is reflected in the change in the value of EU exports to Korea as witnessed in Fig. 2.

The number of Korean products exported to the EU is lower, around some 3500 on average. The evolution of the number of products imported from Korea is also different. There is a drop in the number of products imported in mid-2007 which is then reversed and the following increase lasts past initialling of the agreement in October 2009. After that, the number of products remains by and large unchanged until the end of the period, including after provisional application of the agreement in mid-2011. Contrary to the EU case, there is no real parallel with this development to the evolution of the value of products exported as seen in Fig. 2.

2.3 Bound and applied tariffs

Exporting involves both variable and fixed costs and, as a result, uncertainty related to the trade policy environment of the destination country affects exporters decisions about entry, exit and the amount traded.

Bound tariffs are a first guarantee of trade policy stability and both the EU and Korea are members of the WTO, which lists “Predictability: through bindings and transparency” as one of its functions and principles.Footnote 15 Recently, Handley (2014) has shown that binding trade policy commitments at the WTO can indeed make a difference by increasing entry into new markets even if there is no change in applied tariff levels.

The EU has bound 100 % of its tariff lines while Korea has a binding coverage of 89.9 %. However, the binding coverage in the case of Korea is significantly lower in manufacturing sectors which play an important role in EU exports to Korea such as Electrical machinery (74 %) and Transport equipment (81 %) (WTO 2014a, b).

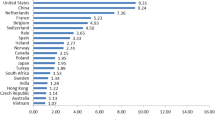

Another aspect to consider in this context is that bound WTO commitments are often well above applied levels of protection providing policy space for an increase in tariffs. The simple average bound rates are 6.6 % in the EU and 17.6 % in Korea (see Table 1).

In Korea the average gap of 4.3 % points between applied and bound MFN rates translates into a potential (legal) increase in tariffs of some 40–50 % in sectors such as Electrical machinery and Transport equipment. This so called “binding overhang”Footnote 16 is argued to be positively correlated with trade policy uncertainty (Groppo 2013). For the EU essentially all applied rates equal the bound rates.Footnote 17

Overall, EU exporters have more to gain in terms of removing trade policy uncertainty. As a result, we expect EU exports to Korea to increase relatively more compared to Korean exports to the EU.

3 Econometric estimation

3.1 Data

The dataset used in the econometric estimation includes monthly EU27-Korea bilateral trade data for the period January 2005–June 2014 at the 8-digit level of the Combined Nomenclature (CN8).

Product classification systems are regularly modified by government authorities and underlying physical goods may be classified in different categories in different years. Some products may not even be part of the classification system in all years. Given our objectives to estimate the impact of the various stages of the FTA lifespan on (i) the probability to export a given product and on (ii) the value of exported products, establishing a database that uses a consistent product classification over time is crucial.

The aggregate number of CN8 product codes is relatively stable over time (10,096 CN8 lines in 2005 compared to 9349 in 2013), but certain codes corresponding to certain products have become obsolete while other, new, codes have been introduced. Such changes are usually not one-to-one changes. In 2012, for example, there were 959 old CN8 codes replaced by 1048 new codes, see Fig. 4. Ignoring changes in the product classification could result in a significant bias in our estimations.Footnote 18

As a first step, we therefore account for changes in the CN8 nomenclatureFootnote 19 over time using a concordance algorithm developed by Van Beveren et al. (2012). Secondly, we create a fully balanced panel dataset by assuming that missing values in a given month-year for a given product represent zero trade.

Finally, we complement the trade data with bilateral EU-Korea tariff data from the WTO Regional Trade Agreements Information System (RTA-IS) database.Footnote 20 Note that while matching tariffs applied by the EU to Korean exports was a relatively straightforward task (both the trade and tariffs data are in CN8 classification); assumptions had to be made to match the tariff data applied by Korea using its 10-digit nomenclature to EU exports.Footnote 21

The matching was made at the HS6 level, since there is no harmonisation of national product codes at a lower level of aggregation, assuming that if there was at least one product in a given HS6 sub-heading that will be liberalised under the FTA then the whole 6-digit sub-heading is considered to be liberalised.Footnote 22 The decomposition of the results by type of tariff for EU exports to Korea below therefore needs to be interpreted bearing in mind that we may overestimate the number of liberalised products.

3.2 Estimation methodology

To measure the impact of the various stages of the EU-Korea FTA on the probability to export product i in month m and year y, we use a binary logit model. The econometric specification is as follows:

where:

-

X is a dummy variable that takes value 1 if CN8 product i is exported in month m and year y, and 0 otherwise.

-

α is constant

-

Negotiation a dummy variable corresponding to different stages of the negotiations as follows:

-

s = 1 (omitted dummy), represents the period before the negotiations began (January 2005–April 2007)

-

s = 2, represents the period after beginning of negotiations and before initialling of the agreement (May 2007–October 2009)

-

s = 3, represents the period between initialling of the agreement and before entry into force (November 2009–June 2011)

-

s = 4, represents the period after entry into force of the agreement (July 2011–June 2014)

-

-

T represent month x year fixed effects.

-

HS correspond to HS2 chapter fixed effects.

Finally \(\alpha , \beta_{n} ,\gamma_{p} ,\delta_{r} \,{\text{and}}\,\phi\) are parameters to be estimated. The econometric specification for the intensive margin is of the same general form, except for the dependent variable which is not binary but the actual value of product i traded in month m and year y, using a Poisson estimator.

It is important here to recall that variable T representing month x year fixed effects will pick a number of factors, observable as well as unobservable, influencing bilateral EU–Korea trade which are not explicitly modelled, including tariff cuts as of July 2011.

4 Empirical results

4.1 The extensive margin

The first objective of the paper is to disentangle the effects of the various stages of the EU-Korea FTA on trade on the probability to export (the extensive margin). The results of the logit estimations assessing that probability for the EU are presented in Appendix Table 3. The first column includes results of running the regression on all products, while columns two and presents results of regressions run on products which are liberalised under the agreement and those which are not, respectively. To facilitate the interpretation of the results, the associated marginal effects are presented in Fig. 5.

EU exports to Korea: evolution of the probability to export (marginal effects). Note: Estimate and 95 % confidence interval. Relative to respective products traded before the start of negotiations. All estimates are significant at the 1 % level. Start: May 2007–October 2009, Initialling: November 2009–June 2011, Entry into force: July 2011–June 2014

For all products, we note that the period after the beginning of negotiations but before initialling of the agreement (May 2007–October 2009), triggers an increase in the probability to export to Korea of 7.8 % compared to the reference period [before the negotiations began (January 2005–April 2007)]. For the following period, between initialling and entry into force (November 2009–June 2011), the estimate is 9.3 %. After the entry into force of the agreement (July 2011–June 2014), the probability to export increases to 13.4 %.

We proceed to analyse if the impact is different if we contrast the impact on products that will be liberalised under the agreement with those already duty-free (the MFN rate equals zero), something that seems to have been omitted in the existing literature.

The results show that there are significant and positive effects on EU exports to Korea on the extensive margin of products being liberalised under the FTA. The impact is almost identical to the overall impact as seen in the left-hand side of Fig. 5. The same by and large holds for products which are not subject to any liberalisation, albeit with somewhat higher figures.

The regression results for the probability of Korea to export to the EU during the three stages of the FTA analysed are found in Appendix Table 4, while the marginal effects of are presented in Fig. 6 below. Overall, compared to the EU, the change in the probability of Korea to export is lower. In the first period, the estimate is insignificant. It reaches 5.7 % in the period between initialling and entry into force and 7.3 % in the period following entry into force of the FTA.

Korean exports to the EU: evolution of the probability to export (marginal effects). Note: Estimate and 95 % confidence interval. Relative to all respective products traded before the start of negotiations. All estimates are significant at the 1 % level, except where indicated with double asterisk (5 % level). Start: May 2007–October 2009, Initialling: November 2009–June 2011, Entry into force: July 2011–June 2014

Splitting the sample into liberalised products and duty-free products reveals that there is an increased probability to export both types of products throughout the three periods compared to the reference period, with the estimated impact being higher for exports of duty free products to the EU. The estimate for the liberalised products for the first period is again insignificant, while it is significant at the 5 % level for the duty-free products.

4.2 The intensive margin

The second objective of this paper is to examine potential export effects on the intensive margin along the different stages of the EU-Korea FTA. The econometric analysis is carried out using a Poisson estimator, which compared to OLS accounts for zero trade flows. The regression results for the EU are presented in Appendix Table 5 and the marginal effects in Fig. 7.

EU exports to Korea: evolution of the intensive margin (marginal effects). Note: Estimate and 95 % confidence interval. Relative to all respective products traded before the start of negotiations. All estimates are significant at the 1 % level. Start: May 2007–October 2009, Initialling: November 2009–June 2011, Entry into force: July 2011–June 2014

There are statistically significant anticipatory effects on EU exports on the intensive margin which are positive and growing over the lifespan of the FTA. The figures indicate that compared to the reference period, the EU has increased its exports to Korea by 5.6 % in the period after the beginning of negotiations, by 9.9 % between initialling and entry into force and by more 14.4 % following entry into force of the FTA.Footnote 23

Looking at the impact in terms of liberalised and duty-free products, the results suggest that EU exports of liberalised products increased by 3.4 % in the first period compared to the reference period and 7.4 % in the period from initialling to entry into force. After entry into force, the figure increases further to 12.2 %. The results for the duty-free products are different. The figures suggest a higher impact in each stage of the FTA compared to the liberalised products, with most of the impact emerging in the period after initialling and then staying at a similar level after entry into force.

As far as the results on the intensive margin for Korean exports to the EU are concerned (see Appendix Table 6 and marginal effects in Fig. 8), the first period shows an insignificant estimate. The period following initialling of the agreement brings an increase in exports of Korean exports to the EU of 2.4 %. This figure increases to 4.4 % after entry into force (see footnote 23).

Korean exports to the EU: evolution of the intensive margin (marginal effects). Note: Estimate and 95 % confidence interval. Relative to all respective products traded before the start of negotiations. All estimates are significant at the 1 % level, except where indicated with double asterisk (5 % level). Start: May 2007–October 2009, Initialling: November 2009–June 2011, Entry into force: July 2011–June 2014

The decomposition of the results into Korean exports of liberalised and duty-free products reveals differences. In the period after the beginning of negotiations but before initialling the agreement, there is a statistically significant negative impact on Korean exports to the EU of 0.9 %. This effect is later reversed into an insignificant estimate after initialling and to a positive impact on Korean exports to the EU of 2.5 % after entry into force.

The picture is different for exports of duty-free products. The results indicate an increase of such Korean exports to the EU of 1.4 % in the first period, 5.3 % after initialling and 6.2 % after entry into force.

4.3 Some further elaboration and discussion of the results

Table 2 shows the outcome of testing whether the coefficients underlying the marginal effects in Figs. 5, 6, 7 and 8 are significantly different from each other. For the EU, overall, the results point to that each successive stage of the agreement has been important for boosting exports under both the extensive and intensive margins. The only exception being for products already exported duty free for which the bulk of the impact occurred once negotiations started and then remained by and large unchanged.

For Korea, the story is on the whole the same as far as the intensive margin is concerned, albeit there is positive impact across the different periods also for Korean exports of already duty free products. However, regarding the extensive margin, it seems like the impact on Korean exports took place primarily once the agreement had been initialled.

These results have implications for how the profession should think about how to quantify the gains from FTAs (in trade terms). For example, if a large share of the trade gains already materializes before the entry into force of an FTA, comparing the impact of the FTA with a reference period of years just before its entry into force may be underestimating the full effects of the agreement.

In this particular case, if we do just thatFootnote 24 we reduce the impact on EU exports (intensive margin) to less than one-third of the size. The same holds for the extensive margin. In the case of Korea, the impact on the intensive margin drops by about half, while for the extensive margin the coefficient becomes insignificant. These results clearly point to that the choice of reference period matters and should be borne in mind when ex post evaluations of FTAs are carried out.

The results with respect to the impact on duty-free products could be slightly puzzling at first sight. As these are not subject to tariff liberalization, one would not expect such important gains in terms of increase in exports. In this sense, it is important to point out that 30 % of the number of Korea’s tariff lines subject to MFN-0 rates were bound at rates higher than 0 % in 2012 and 2013. This suggests the FTA may boost trade by improving trade policy uncertainty and implicitly by having positive spill-overs on zero duty products.Footnote 25

Secondly, the EU-Korea FTA contains provisions on NTBs which affect some of the most important goods traded falling in product groups such as automotive, pharmaceuticals, medical devices and electronics. Goods in these groups (except for automotive)Footnote 26 are subject to positive MFN duties as well as MFN = 0 duties in both the EU and Korea. It is expected that the reduction of non-tariff barriers also contributed to the boost in exports of products traded duty free.

EU exports to Korea in these product groups figure among the most important goods exported overall as well as duty-free. Since most imported intermediates originate from within the same sector,Footnote 27 this may suggest positive spill-over effects from the products subject to liberalisation to the products already traded duty-free. The fact that more than 60 % of total imports in Asia were made up of intermediate goods in 2009 (WTO 2011), is in line with this hypothesis.

The finding that the impact on exports of duty-free products, generally, is always higher than the impact on exports of liberalized products supports the idea that the benefits from FTAs contribute significantly to reducing the uncertainty of the trade policy environment and thus reinforce the benefits of trade liberalization.

5 Summary and conclusions

This paper contributes to the somewhat unexplored economic literature which examines anticipatory effects of trade agreements and implicitly quantifies the impact of reductions in trade policy uncertainty. Expanding on previous approaches and accounting for changes in the product classification over time, we explore the trade effects on both the extensive and intensive margins during different stages of the EU-Korea FTA’s lifespan considering separately the start of negotiations, initialling of the agreement and entry into force.

In the case of the EU, the results indicate that there are statistically significant and positive effects across the three stages examined both in terms of trade on the extensive and intensive margins. The same holds for both margins when examining exports of liberalised and duty-free products separately. On average, our findings indicate that the FTA has increased the probability to export by about 10 %; the same figure holds for the increase in the value of exports.

In the case of Korea, results indicate the same positive impact, but lower magnitudes. Across the periods, the FTA has been found to increase the average probability to export by 4.9 % and the value of Korean exports by 2.2 %.

We also find that both the probability to export duty-free goods and the value of such exports have been positively impacted by the agreement. These products benefit from the reduction in trade policy uncertainty as the FTA eliminates the binding overhang, i.e. the gap between applied and bound tariffs, which in fact is the case for many of the duty-free tariff lines in Korea. Duty-free products may also face an increase in demand following an increase in demand for products liberalised under the agreement which use them as intermediates; hence a form of a positive spill-over effect.

The impact on EU exports is more substantial along all stages of negotiations and after entry into force compared to Korean exports. Such an asymmetry is to be expected given initial differences in the trade policy environment of the two countries. EU exporters have more to gain than Korean ones in terms of increasing the predictability of the trade policy regime of their destination market.

It thus seems that an announcement that an FTA will be negotiated, with sufficient credibility that negotiations will be concluded, may be enough to reduce uncertainty and to generate an increase in exports before the conclusion and actual implementation of an FTA.

Notes

For example, non-tariff barriers in goods and services and/or lower trade costs due to regulatory reforms.

They did not consider the potential existence of effects prior to Portugal's accession.

Tariffs facing Portugal were already low due to previous arrangement.

Official Journal (2011), http://eur-lex.europa.eu/legal-content/en/ALL/?uri=OJ:L:2011:127:TOC.

Under international treaty law, initialling an agreement demonstrates that the text is authentic and definitive (Article 10(b) of the Vienna Convention of the Law of Treaties).

The EU uses provisional application when an agreement falls partly under EU competence and partly under Member State competence. In the case of the EU-Korea FTA, virtually all of the agreement was provisionally applied as of 1 July 2011, except for provisions of the Protocol on Cultural Co-operation and certain provisions on the criminal enforcement of intellectual property rights. Hence, all provisions relevant for our analysis entered into force in July 2011 and were not affected by the different dates of Member States' ratification of the agreement.

DG Trade Integrated Statistical Database.

A limited number of agricultural and fisheries products have transitional periods longer than 7 years and rice and a few agricultural products are excluded from the agreement.

Official Journal (2011).

The compound annual growth rate for EU exports to Korea for the period July 2011 to June 2014 equals 10.6 %, while it is 7.3 % to China, 5.7 % to ASEAN and 4.9 % to Japan.

Copenhagen Economics (2014).

The compound annual growth rate for EU imports from Korea for the period July 2011 to June 2014 equals −0.3 %, while it is −1.5 % from China, 1.6 % from ASEAN and −7.7 % from Japan.

The number of products is expressed in terms of the 8-digit Combined Nomenclature (CN8).

The difference between bound and applied MFN rates.

Due to changes in the nomenclature, EU applied tariffs by section of the Harmonised System (HS) as displayed in Table 1 are higher than the bound tariffs, which are reported based on an earlier version of the HS.

Note that simply dropping the product codes that have been affected by changes in the nomenclature over our sample period results in the drop of more than 50 % of the value of EU-Korea trade.

The CN8 classification is subject to yearly revisions, however, the most significant revisions have occurred in the years when the HS (Harmonized System) classification has been revised, i.e. 2007 and 2012 as far as this paper is concerned.

http://rtais.wto.org/UI/PublicShowMemberRTAIDCard.aspx?rtaid=167. These tariffs are originally reported to the WTO from the EU's TARIC database (Tarif intégré de l’Union européenne).

These tariffs were obtained from the Market Access Database (MADB), http://madb.europa.eu/madb/indexPubli.htm.

In addition, we do not have information that would allow us to carry out the same concordance procedure on the Korean nomenclature.

Re-running the regression including a lagged dependent variable gives the same results.

I.e., using only one dummy variable for after entry into force of the agreement and merge the two time periods before entry into force into one reference period and ignore the period before negotiations. Full results are available from the authors.

Based on WTO tariff data. Ideally, this should be tested. However, the data does not allow us to define the difference between bound and applied Korean tariffs and match the outcome with EU exports at the same level of aggregation; c.f. the end of Sect. 3.1.

HS2 chapters 30, 85 and 94.

This is e.g. the case for Korea according to GTAP v9.1.

References

Bergin, P., & Lin, C. Y. (2012). The dynamic effects of currency union on trade. Journal of International Economics, 87(2), 191–204.

Copenhagen Economics (2014). The impact of trade liberalisation on the EU automotive industry: Trends and prospects. Report prepared the European Commission, DG Trade, under framework contract (TRADE/07/A2).

Coulibaly, S. (2007). Evaluating the Trade effect of developing regional trade agreements: A semi-parametric Approach (World Bank Policy Research Working Paper 4220). Washington, DC: World Bank.

Croce, E., Juan Ramón, V. H., & Zhu, F. (2004). Performance of Western hemisphere trading blocs: A cost-corrected gravity approach (IMF Working Paper 04/109). Washington, DC: International Monetary Fund.

Freund, C. L., & McLaren, J. (1999). On the dynamics of trade diversion: Evidence from four trade blocs (International Finance Discussion Papers Number 637). Washington, DC: Board of Governors of the Federal Reserve System.

Global Trade Alert (2009). 1st Report, 8 July. http://www.globaltradealert.org/.

Groppo, V., & Piermartini (2013). Trade policy uncertainty and the WTO. In Presented at the 2nd Annual IMF/World Bank/WTO workshop, Geneva, Switzerland.

Handley, K. (2014). Exporting under trade policy uncertainty: Theory and evidence. Journal of International Economics, 94(1), 50–66. doi:10.1016/j.jinteco.2014.05.005.

Handley, K., & Limão, N. (2012). Trade and investment under policy uncertainty: Theory and firm evidence (NBER Working Paper No. 17790). Cambridge, MA: National Bureau of Economic Research.

Handley, K., & Limão, N. (2013). Policy uncertainty, trade and welfare: Theory and evidence for China and the US (NBER Working Paper No. 19376). Cambridge, MA: National Bureau of Economic Research.

Magee, C. S. (2008). New measures of trade creation and trade diversion. Journal of International Economics, 75(2), 349–362.

Mölders, F., & Volz, U. (2011). Trade creation and the status of FTAs: Empirical evidence from East Asia. Review of World Economics, 147(3), 429–456.

Official Journal of the European Union. (2011). L 127, Volume 54, 14 May.

Van Beveren, I., Bernard, A. B., & Vandenbussche, H. (2012). Concording EU trade and production data over time (NBER Working Paper 18604). Cambridge, MA: National Bureau of Economic Research. https://www.sites.google.com/site/ilkevanbeveren/Concordances

WTO (2011). Trade patterns and global value chains in East Asia: From trade in goods to trade in tasks. https://www.wto.org/english/res_e/booksp_e/stat_tradepat_globvalchains_e.pdf

WTO (2012). Trade policy review, Republic of Korea, WT/TPR/S/268.

WTO (2013). Trade policy review, European Union, WT/TPR/S/284.

WTO (2014a). Tariff profile European Union (28). http://stat.wto.org/TariffProfile/WSDBTariffPFView.aspx?Language=E&Country=E28

WTO (2014b). Tariff profile Korea. http://stat.wto.org/TariffProfile/WSDBTariffPFView.aspx?Language=E&Country=KR.

Author information

Authors and Affiliations

Corresponding author

Additional information

The bulk of this paper was written when Csilla Lakatos worked in the Chief Economist and Trade Analysis Unit in the European Commission’s Directorate General for Trade, for which Lars Nilsson is the Deputy Head. The opinions expressed in this paper are the authors’ own and do not necessarily reflect any views of the European Commission. We are grateful to comments from two anonymous referees, Hylke Vandenbussche and colleagues in the Chief Economist and Trade Analysis Unit.

About this article

Cite this article

Lakatos, C., Nilsson, L. The EU-Korea FTA: anticipation, trade policy uncertainty and impact. Rev World Econ 153, 179–198 (2017). https://doi.org/10.1007/s10290-016-0261-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-016-0261-1