Abstract

The success of online auctions is founded on bidders enjoying shopping benefits and on creating bidders’ loyalty. This study investigates the importance of bidders’ repurchase intention along with the corresponding cost and benefit aspects. Therefore, this study integrates transaction cost economics and expectancy confirmation theory to understand the determinants of bidders’ repurchase intention in online auctions. We collected data from a survey questionnaire, and a total of 594 valid questionnaires were analyzed. Partial least squares structural equation modeling was used to assess the relationships of the research model. The findings show that satisfaction has a significant influence on bidders’ repurchase intention, while transaction cost is negatively associated with repurchase intention. Bidders’ satisfaction is determined by confirmation and by the e-service quality of both auctioneers and sellers. Moreover, an auctioneer’s asset specificity and product uncertainty are positively associated with the bidder’s perceived transaction cost. The interaction frequency between bidder and seller is negatively associated with the bidder’s transaction costs. The research results provide a novel approach to understanding bidders’ benefit and cost dimensions in online auction marketplaces. Our findings could guide online auctioneers and sellers in enhancing their offerings.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Consumer-to-consumer (C2C) commerce has become vitally important owing to its popularity in e-commerce. A prime example of C2C is the online auction, which is a unique phenomenon in the realm of e-commerce and one of the most successful business innovations on the web. The primary role of an online auction (i.e. auctioneer) is to serve as an intermediary website between buyers (i.e. bidders) and sellers. The auctioneer provides the institutional basis for the exchange by establishing the electronic trading system (Lee et al. 2009). With low cost of operation, flexible operating times, low barriers to entry, and widespread media coverage of the operations of online auction sellers, the success of various online auctions has inspired numerous new market entrants (Yang and Huang 2011). Specifically, many famous online auctions such as TaoBao (http://www.taobao.com) and Yahoo! Taiwan auction (http://tw.bid.yahoo.com) have attracted many small and medium enterprises (SMEs) which run on those platforms. The Business Next Company, a well-known e-commerce institute which provides information on technology trends in Taiwan, found that more than 20 % of the Top 100 online stores (as ranked by customers) had a presence in both Yahoo! Taiwan auction and Ruten auction, a joint venture of PChome and eBay (Lo 2011).

In recent years, online auction marketplaces have become not only places for individuals to sell their used goods, but also a blue ocean in which SMEs can expand their marketing channels. Online auction marketplaces provide effective platforms for customers to repeat purchase from individual sellers (i.e. part-time sellers), professional sellers (i.e. SMEs), or both. In addition, a well-designed and run online auction can actually encourage bidders to repeat purchase and help sellers increase website stickiness. The concept of repeat-buying provides a useful guideline for understanding the dynamics of consumer purchasing behavior, and it can also provide valuable help in predicting the sales performance of products (Frevert 1967). For the purposes of this study, we define repurchase intention as a bidder’s favorable intention toward the online auction market that may result in repeat buying behavior in the future.

Prior studies have considered the predictive validity of repurchase intention for subsequent repurchase behavior (Bemmaor 1995; Morwitz et al. 1993; Mittal and Kamakura 2001). Various marketing researchers have discussed repurchase intention in different ways. Some studies have concentrated on determining the basic antecedent variables for repurchase intention. For example, many studies have tested the relationship between quality, satisfaction, and intention-based loyalty (Olsen 2002; Szymanski and Henard 2001; Dick and Basu 1994; Taylor and Baker 1994). Some information systems (IS) and marketing field studies have paid increasing attention to the issue of online customer retention in the context of e-service or e-commerce (Parasurman et al. 2005; Srinivasan et al. 2002; Anderson and Srinivasan 2003). However, most studies have explored repurchase intention from the standpoint of benefits such as satisfaction, trust, and value (Kim et al. 2009). Relatively few studies have examined online customer repurchase intention from a cost perspective. Thus, the present study attempts to address this gap by proposing a model and empirically testing bidders’ repurchase intention from both cost and benefit perspectives.

We propose a bidders’ repurchase intention model which integrates transaction cost economics (TCE) to describe bidders’ costs, and expectancy confirmation theory (ECT) to understand their benefits. The studies by Peter and Tarpey (1975), as well as Kim et al. (2009), claimed that perceived cost and perceived benefit are fundamental aspects of consumer decision-making. Dodds and Monroe (1985) and Dodds et al. (1991) proposed a value-intention model in which individuals’ intentions to take certain actions are affected by the value of the actions. They argued that a customer’s buying intention is affected by perceived positive value, but negatively affected by the customer’s sacrifices. Recognizing that cost and benefit have been identified as vital dimensions for the impacts on customer repurchase intention, we applied the TEC and ECT research to investigate the bidders’ repurchase intention in a cost-benefit analysis. In particular, perceived benefits refer to bidders’ subjective perceptions of their satisfaction from the online transaction with a certain buyer, such as quality, benefits, and utilities. Perceived costs include monetary payments and nonmonetary sacrifices such as time consumption and energy consumption (Yang and Peterson 2004). However, there is no study to date that attempts to understand consumer repurchase intention from cost to benefit perspectives by integrating TCE and ECT. To fill this gap, this study addresses the repurchase intention issue in the C2C context by synthesizing these two theories.

Transaction cost economics asserts that the total cost incurred by a party can be broken down largely into transaction costs and production costs. Transaction costs are well-defined as the costs of all the information processing necessary to coordinate the work of people and machines that perform the primary processes (Williamson 1975). The transaction cost perspective deals with the exchange of intangible social costs, and characterizes bidders as being motivated to minimize, or least reduce, any expected negative utility associated with purchasing behavior (Kim et al. 2009). A number of studies have indicated that consumers’ willingness to buy online is negatively associated with their perceived transaction cost (Devaraj et al. 2002b; Liang and Huang 1988; Devaraj et al. 2006). Previous e-commerce studies have investigated the cost dimension as a barrier, which can reduce purchase intention. Some studies have focused on risk (Kim et al. 2009), and some have emphasized the role of switching costs (Tsai et al. 2006). Instead of examining a single construct, TCE provides a sound theoretical background along with solid constructs.

Oliver (1980) originally developed his ECT to explain and predict consumer satisfaction and loyalty intention. Bhattacherjee (2001) and Bhattacherjee and Premkumar (2004) focused on the congruence between individuals’ continued IS usage decisions and consumers’ repeat purchase decisions, and suggested ECT as a way to explain how consumers’ post-purchase satisfaction is jointly determined by pre-purchase expectation and confirmation (Lee and Kwon 2011). Bhattacherjee and Premkumar’s (2004) landmark work represented an early theoretical study of continued IS usage, the results of which were subsequently examined by several other studies in various web-based service contexts (Limayem et al. 2007; Hsu et al. 2006; Lin et al. 2005; Lee and Kwon 2011; Venkatesh and Goyal 2010). Recently, many studies have applied the ECT framework and provided evidence that satisfaction is the main predictor of customer repurchase intention in the e-commerce environment (Kim et al. 2009; Atchariyachanvanich et al. 2007). To date, however, there has been relatively little research into the C2C area.

We chose the TCE and ECT as the theoretical frameworks in our research for the following reasons. First, TCE provides a good theoretical background for exploring the cost dimension in the C2C context. Second, ECT has been verified by many sound IS studies related to information technology (IT) usage (Limayem et al. 2007; Venkatesh and Goyal 2010). Finally, because of the similarity between re-purchasing products/services in a consumer context and the continued usage of IT products/services, ECT posits an equivalent relationship in the latter context (Lee 2010).

In this study then the research questions to be addressed are: (1) What are the causal relationships among transaction cost, satisfaction, and repurchase?; (2) What impact do the bidders’ cost dimensions, based on TCE constructs, have on repurchase intention?; and (3) What influence do the bidders’ benefit dimensions, based on ECT constructs, have on repurchase intention?

2 Theoretical background

2.1 Repurchase intention

Much theoretical and empirical literature explores customer repurchase intention and examines the effect of its antecedents on it (Frevert 1967; Mittal et al. 1998; Mittal and Kamakura 2001; Olsen 2002). Fishbein and Ajzen (1975) argued that “the single best predictor of an individual’s behavior will be a measure of his intention to perform that behavior.” Consumer buying behavior can be understood in two stages: the first stage is primarily concerned with encouraging people to purchase, and the second involves encouraging them to repurchase (Frevert 1967; Zhang et al. 2011). First-time purchase (i.e. trial) is often used as a predictive measure of subsequent purchase (i.e. repeat) behavior. Purchase intention refers to a consumer’s judgment about buying some service or product, and focuses on incorporating all possible factors that may contribute to a purchase decision (Morwitz et al. 1993). In contrast, repurchase intention describes the consumer who takes into account his current situation and possible circumstances when evaluating whether or not to buy a service or product again from the same company. Initial purchase intentions are particularly well suited for short-term predictions (Morwitz and Schmittlein 1992), such as forecasting (Infosino 1986) and new product testing (Silk and Urban 1978). Thus, the proportion of trial buyers who become repeat buyers can be considered as a criterion for evaluating long-term sales potential (Frevert 1967).

Some studies have concentrated on determining the basic antecedent variables to repurchase intention (Reichheld and Teal 1996; Hellier et al. 2003). Other studies have considered single critical encounters and longitudinal relationships between these variables (Olsen 2002; Mittal and Kamakura 2001). Most of the research examines the direct or moderating effects on repurchase intention of buyer’s past experience (Rose et al. 2012), perceived price (Jiang and Rosenbloom 2005), service quality, satisfaction, value, trust, or loyalty (Reichheld and Teal 1996; Bloemer and Kasper 1995; Taylor and Baker 1994). Dick and Basu (1994) examined the sequential order of relative attitude, customer loyalty, and repeat purchasing, and concluded that repurchase patronage is an outcome of customer loyalty. A great number of studies have been conducted to investigate the processes by which customers make a choice between several competing products, and emphasizes customers’ assessments taking into account their evaluation of the disconfirmation or confirmation of their expectations (Oliver 1980; Oliver et al. 1994). Recently, scholars have paid increased attention to the issue of online customer repurchase intention. The literature suggests that customers are motivated to remain with a particular provider by benefit-based drivers, such as example, satisfaction, e-loyalty, and e-service quality (Parasuraman and Grewal 2000; Anderson and Srinivasan 2003; Szymanski and Henard 2001), trust, and value (Kim et al. 2009). On the other hand, customers are often inhibited by cost-based factors and obstacles such as switching cost and risk (Tsai et al. 2006; Kim et al. 2009). Therefore, understanding bidders’ repurchase intentions is crucial for both online auctioneers and sellers.

2.2 Transaction cost economics

The theory of TCE was originally proposed by Coase (1973), and can be used to explain why a transaction subject chooses a particular form of transaction instead of others (Williamson 1975). Rooted in economic theory, TCE theoretically explain the buyer–supplier relationship in empirical studies of both management and marketing (Rindfleisch and Heide 1997; Ghoshal and Moran 1996). Two assumptions underlie the choice between market and hierarchy, namely, bounded rationality and opportunism. Bounded rationality refers to the fact that people have limited memories and limited cognitive processing power. People therefore cannot fully process all the information they have, and cannot accurately work out the consequences of this information. Opportunism, on the other hand, holds that people will act to further their own self-interest. The caveat is, some people may not always be entirely honest and truthful about their intentions (Williamson 1981; Teo and Yu 2005).

Moreover, TCE considers three situational conditions, i.e. uncertainty, asset specificity, and frequency (Williamson 1975). There is uncertainty in the transaction when one cannot be sure that the other party will not go out of business or try to renegotiate the contract at some future time during the life of the contract (Teo and Yu 2005). Specific assets are regarded to be locked into a particular exchange relationship, such that a specific asset which meets a particular customer’s needs cannot be offered by others (Williamson 1985). In addition, buying frequency with exchanges refers to the number of times that an economic actor has dealings (Kim and Li 2009).

Compared to the field of economics, there have been relatively few IS studies which apply TCE in the e-commerce context. Several studies have emphasized the importance of transaction costs and implied that transaction cost influences a customer’s buying intention. Kim and Li (2009) relied on TCE in examining the online travel market, and investigated customer satisfaction and loyalty with respect to the transaction cost of dealing over the Internet. Their findings suggest that customers’ satisfaction and loyalty are affected negatively by transaction costs. Devaraj et al. (2002b) take the view that TCE explains the external cost, while the technology acceptance model represents internal cost/benefit; together, the two theories capture consumers’ perceptions in an e-commerce environment. Jones and Leonard (2007) also indicate that the amount of information provided to eliminate uncertainty, the additional avenues provided for buying and selling, and the time saved in accomplishing a purchase predict buyer satisfaction. Although some earlier IS research has investigated and tested TCE in e-commerce contexts, the conceptualization and application of TCE in the C2C context remains far from complete. The principal objective of our study was therefore to examine TCE and extend this theoretical framework in the C2C context.

2.3 Expectancy confirmation theory

Oliver (1980) proposed that consumers form an initial expectation regarding a specific product prior to purchase. Following a period of initial consumption, they form perceptions about the product’s performance based on its salient attributes. After that, they compare these perceptions of product performance with their prior expectation levels and determine the extent to which their expectations are confirmed. When perceived performance exceeds expectations, consumers’ positive confirmation results, whereas when perceived performance falls short of expectations, their expectations are negatively confirmed. Finally, consumers form a feeling of satisfaction or dissatisfaction based on their disconfirmation level. Satisfied consumers form intentions to reuse the product in the future, while dissatisfied users discontinue its use (Bhattacherjee 2001).

Expectancy confirmation theory has been applied in many fields, including marketing and consumer behavior (Kopalle and Lehmann 2001; Szymanski and Henard 2001), service quality (Kettinger and Lee 2005), psychology (Phillips and Baumgartner 2002) and human resources (Hom et al. 1998). Recently, ECT has been used to understand individuals’ intentions in the IS context, including e-service usage (Liao et al. 2007; Thong et al. 2006), e-learning (Lee 2010; Roca et al. 2006), and e-commerce (Hsu et al. 2006; Atchariyachanvanich et al. 2007). Studies in the e-commerce context share a common thread, in identifying customers’ level of satisfaction as a major reason for the decision to repurchase products or patronize services (Hsu et al. 2006; Kim et al. 2009). Hsu et al. (2006) proposed a model by incorporating constructs drawn from ECT and to examine the antecedents of users’ intention to continue using online shopping. They conducted a longitudinal study to validate that confirmation plays an important role in shaping users’ belief during the pre-usage and usage stages. Although most prior studies verified ECT in predicting consumer behavior, few studies yet explore the impacts on the online bidding environment. To fill this gap, this study applies ECT to identify how satisfaction facilitates bidders’ repurchase intentions.

3 Research model and hypotheses

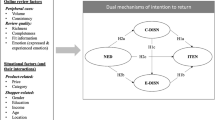

Bidders make decisions, which will maximize net benefits and reduce costs. Therefore, the model takes into account both positive and negative attributes attaching to decisions. The research model and hypotheses are shown in Fig. 1.

According to TCE, three variables are employed to characterize any transaction—product uncertainty, asset specificity and interaction frequency. First, product uncertainty reflects the degree to which the outcome of a transaction cannot be accurately predicted by the bidder due to product-related factors (Pavlou et al. 2007). Given that online auctioneer has to ensure every transaction works smoothly, the auction marketplace not only establishes technical standards and security procedures to make the website reliable, but also acts as an intermediary between bidders and sellers to construct effective protection policies and warranty programs; however, the auctioneer cannot guarantee complete and accurate information on every product. Successful fulfillment typically suggests that a seller delivers a product identical to the one promised, does so in a timely manner, and honors refund and product guarantees. In contrast, there are numerous possibilities that a transaction may not be fulfilled successfully due to product quality uncertainty (Pavlou et al. 2007). Bidders are likely to wonder if purchased products will meet their expectation upon ordering and whether they will perform well. When consumers shop physically, they can examine a product and then decide whether they will take it home. In the case of online bidding, they rely on the product information that is provided by sellers (Teo and Yu 2005). Therefore, this study highlighted the impact of product uncertainty in the online auction context.

Second, asset specificity refers to the lack of ease with which the human capital, physical assets, and facilities specifically tied to the manufacturing of an item can be used by alternative users or put to alternative uses. As asset specificity increases due to transactors’ fears of opportunism, more complex governance structures are required to eliminate or attenuate costly bargaining over profits from specialized assets. Thus, transaction costs are presumed to increase with an increase in asset specificity (Williamson 1981; Teo and Yu 2005).

Third, the influence of interaction frequency is evidenced by the fact that when making a renewal or another contract with the same counterparty, the contractors can reduce transaction costs in the current process (compared to the previous one) because they already possess information about each other, and the resulting closer relationship can reduce the perceived risk of opportunism. Prior studies suggest that interaction frequency reduces consumers’ perceived transaction cost and has an influence on their willingness to buy online (Teo and Yu 2005; Manchala 2000). C2C e-commerce highlights the importance of interpersonal communication through the interactions between bidders and sellers. This leads to the following hypotheses:

H1:

Bidders’ perceptions of product uncertainty are positively associated with the transaction costs of online auctions.

H2:

Bidders’ perceptions of auctioneers’ asset specificity is positively associated with the transaction costs of online auctions.

H3:

The frequency of bidders’ interactions with sellers and auctioneers is negatively associated with the transaction costs of online auctions.

For this study, repurchase intention is defined as the bidder’s judgment about buying a designated service or product from the same auction marketplace that he has already bought a product or service from. On the one hand, several studies have revealed that online shopping intention and purchasing behavior are related positively to the reduced transaction costs which are identified as a significant advantage of online shopping (Bharadwaj and Matsuno 2006; Cannon and Homburg 2001; Kim and Li 2009; Liang and Huang 1988). Cannon and Homburg (2001) identified a direct relationship between customers’ costs and desire to increase purchase intention. Bharadwaj and Matsuno (2006) showed that low transaction costs positively influence both customer satisfaction and their future intentions.

On the other hand, satisfaction can be described as the bidder having a positive emotional state resulting from purchasing through an auctioneer or from transacting with the seller. Historically, satisfaction has been used to explain loyalty as a kind of behavioral intention (e.g. the likelihood of repurchasing and recommending), and satisfaction has a strong positive effect on repurchase behavior across a wide range of product and service categories. Moreover, satisfaction, as an overall evaluation that is built up over time, typically mediates the effects of product quality, service quality, and price or payment equity on repurchase intention (Fornell et al. 1996; Gustafsson et al. 2005). Therefore, we formulate the following hypotheses:

H4:

Bidders’ transaction costs in online auctions are negatively associated with their repurchase intentions.

H5:

Bidders’ satisfaction with online auctions is positively associated with their repurchase intentions.

Perceived performance can be viewed as customers’ perceptions of how a product’s performance fulfills their needs, wants, and desires (Cadotte et al. 1987). Confirmation can be described as bidders’ subjective judgments resulting from comparing their expectations and their perceptions of a received service or product’s performance. Generally speaking, the role of performance has been to serve as a standard of comparison included in the confirmation of expectations. Given the auctioneer’s and seller’s performance as perceived by bidders, service confirmation increases if the bidders’ expectations are fulfilled, suggesting the existence of a positive relationship between performance and confirmation. A moderate satisfaction level will be maintained by confirmation, whereas satisfaction will be enhanced by the delight of positive confirmation, and decreased by the disappointment of negative confirmation. In this respect, Churchill and Surprenant (1982) showed that actual performance exerts independent effects on satisfaction beyond its impact via confirmation.

McKinney et al. (2002) developed constructs for measuring perceived performance and disconfirmation in terms of information quality and system quality. Khalifa and Liu (2003) interpreted perceived performance in terms of information quality, system quality, and service quality aspects. Fornell et al. (1996) suggested perceived quality as a distinct construct for operationalizing perceived performance. Therefore, in this study, we assume that overall e-service quality can be viewed as being represented by auctioneers’ and sellers’ performances. McKinney et al. (2002) and Chiu et al. (2005) proved that quality has a direct influence both on confirmation and satisfaction. Lin et al. (2009) also found that perceived service performance becomes an influential factor that decides the level of service confirmation of customers.

In this study, the process by which bidders arrive at a level of satisfaction could be described as follows by the ECT theory. First, prior to obtaining the service, a bidder forms an initial expectation of a specific product from a seller. Second, the buyer obtains the service provided by the seller. Following a period of experience with using the service, the buyer forms perceptions about the service quality from that seller. Third, the buyer assesses the perceived service quality vis-a-vis his original expectation and determines the extent to which his expectation is confirmed (Lin et al. 2009). The end result is that bidders’ perceived service quality and confirmation subsequently influence their satisfaction. Therefore, we set out to test the following hypotheses:

H6:

Overall e-service quality of online auctions is positively associated with bidders’ confirmation.

H7:

Bidders’ confirmation is positively associated with their satisfaction in online auctions.

Moreover, prior research has studied the effect of e-service quality on satisfaction and developed measurement scales (Wolfinbarger and Gilly 2003; Bauer et al. 2006). Parasurman et al. (2005) results indicated that e-service quality had a significant effect on user satisfaction. Many e-commerce studies have applied the above scale and found that e-service quality can positively influence online customer satisfaction and loyalty (Tsai et al. 2006; Devaraj et al. 2002a). Therefore, we set out to test the following hypotheses:

H8:

Overall e-service quality of online auctions is positively associated with bidders’ satisfaction.

Control variables were included in our model to rule out the possibility that empirical results were due to covariance with other variables. Prior studies have shown that demographics variables such as gender and age play a significant impact on customer acceptance of technology (Venkatesh et al. 2003). Therefore, we suppose bidders’ gender, age, and education may have influence on repurchase intention. The study also controlled for average purchase price because it influences repurchase (Jiang and Rosenbloom 2005). As studies have shown that online experience is a key factor in online behavior (Hoffman et al. 1999), this study controls for the role of bidding experience on repurchase intention. Finally, as noted in the discussion of the conceptual model, we included product type was considered as a control variable since products type should have an influence on product as a control variable since products type should have an influence on product uncertainty (Rhee et al. 2009).

4 Methodology and data analysis

4.1 Instrument development and research design

Measurement items for the research constructs were compiled from previously validated instruments to represent each construct, and the wording was modified to fit the context of an online auction. All transaction cost constructs were based on the economics literature and derived from prior e-commerce studies. Items for measuring product uncertainty and asset specificity were adapted from Liang and Huang (1988) as well as from Devaraj et al.(2002a). Items for measuring interaction frequency were developed following Teo and Yu (2005). Items for measuring transaction cost were based on Liang and Huang (1988) as well as on Teo and Yu (2005). Items for measuring repurchase intention were adapted from Ajzen (1991) and Davis et al. (1989). Scale items for satisfaction were adapted from Oliver’s (1980) work, as well as from Bhattacherjee and Premkumar’s (2004). Items for measuring confirmation were adapted from Bhattacherjee (2001) as well as from Bhattacherjee and Premkumar (2004). Items for measuring overall e-service quality were based on Parasuraman et al. (2005) definition.

Except for demographic questions, most items were measured using a five-point Likert scale with anchors ranging from strongly disagree (1) to strongly agree (5). Items of product uncertainty were adapted from Teo and Yu’s (2005). In contrast to Teo and Yu’s (2005) and Liang and Huang’s (1988) positive wording scales, in the present study items relating to transaction cost used negative wording. As to items of asset specificity, we use subjective sentences to capture respondents’ perceptions, rather than objective wording. Thus, items of asset specificity and transaction cost require reverse coding.

In order to target buyers of online marketplaces, a web-based survey was employed. This study was greatly supported by Yahoo! Kimo Auction, which is the most famous online auction marketplace in Taiwan. Yahoo! Kimo Auction is owned by Yahoo! Taiwan (http://tw.yahoo.com), a subsidiary of Yahoo! US, and has become the biggest portal site in Taiwan. Even though the Yahoo! US and Yahoo! Canada Auction sites were closed down in June 2007, Yahoo! Auctions still exist in Hong Kong, Japan, Singapore and Taiwan. When users register for a Yahoo! Taiwan account, doing so provides users with access to all services, including Yahoo! Kimo Auction.

The survey questionnaire was put at the head of the forum to promote this survey. The questionnaire consisted of an instruction page that opened a separate web browser window containing the items to be assessed. Buyers whose feedback ratings were higher than two were welcomed to participate in this survey, and prizes were offered to increase the number of high quality responses. Because we are interested in buyers’ repurchase intention, we only considered respondents who had sufficient online auction experience, including browsing, gathering product information, evaluating the bidding prices, making bidding decisions, completing transactions by offering payment and address information, and then leaving feedback ratings to score the sellers. Buyers’ having feedback ratings >2 means they had positive bidding histories from at least two auctions, and had made at least one repurchase in the auction marketplace. By the time this survey was closed, 594 valid questionnaires had been received, and these were subsequently analyzed. Respondents’ profiles are shown in Table 1.

4.2 Reliability and validity of research constructs

The results were analyzed using a partial least squares structural equation modeling (PLS-SEM) approach, supported by SmartPLS (Ringle et al. 2005). PLS-SEM combines a factor analysis with multiple linear regressions to estimate the parameters of the measurement model (item loadings on constructs) together with those of the structural model (regression paths among the constructs) by minimizing residual variance. The t-values are then estimated using a jackknife method (Gefen and Straub 2004). PLS-SEM places minimal restrictions on measurement scales, sample size and residual distribution (Chin and Newsted 1999). Therefore, an increasing number of IS studies (Marcoulides and Saunders 2006) and marketing research studies (Hair et al. 2012) have employed the PLS-SEM technique (Ringle et al. 2012), and SmartPLS has become an important application for handling structural and measurement models. PLS-SEM is especially suited for exploratory research (Chin 1998), such as the current study.

The adequacy of the measurement model was evaluated based on the criteria of reliability, convergent validity, and discriminant validity. First, reliability is examined using the composite reliability values. As shown in Table 2, the values of composite reliability ranged from 0.87 to 0.93, which is well above the recommended level of 0.70 and indicate adequate reliability. Second, convergent validity is adequate when constructs have an average variance extracted (AVE) of at least 0.5 (Fornell and Larcker 1981). All AVEs ranged from 0.57 to 0.78, suggesting the principal constructs capture a higher amount of construct-related variance than error variance. Third, for satisfactory discriminant validity, the square root of the AVE should exceed the correlation shared between the construct and other constructs in the model (Fornell and Larcker 1981). The correlations among all constructs are all well below the 0.90 threshold, suggesting that all constructs are distinct from each other (Hair et al. 2006). Comparison of construct correlation and the square root of the AVE are shown in Table 3. Off-diagonal elements are the correlations among constructs, which ranged from −0.03 to 0.73. Diagonal elements are the square root of the AVE, and all these values exceed the inter-construct correlations. Moreover, the cross-loadings for the items were calculated and are presented in Table 4. To further test for multicollinearity, we computed variance inflation factors (VIFs) which were found to be from 1.2 to 3.0 and less than the conservative threshold of 5, thus suggesting that multicollinearity was not a major issue in our study.

4.3 Model testing results

The PLS-SEM approach was used to test the hypothesized relationships in the research model. Figure 2 illustrates the estimated coefficients and their significance in the structural model, showing that all relationships were statistically significant. Product uncertainty, asset specificity and interaction frequency all had significant effects on transaction cost (β = 0.117, 0.214, −0.229; t = 2.718, 4.608, 5.178, respectively). Thus, H1, H2, and H3 were supported. Repurchase intention was strongly predicted by transaction cost and satisfaction (β = −0.163, 0.645; t = 4.616, 19.383, respectively), meaning that H4 and H5 were supported. The path between overall e-service quality and confirmation was significant (β = 0.564; t = 15.356), supporting H6. Confirmation and overall e-service quality positively influenced satisfaction (β = 0.571, 0.232; t = 13.427, 5.071, respectively), supporting H7 and H8. Overall, the results show that the research model can explain 55.2 percent of variance in repurchase intention, 15.4 percent of variance in transaction cost and 52.9 percent of variance in satisfaction, and 31.8 percent of variance in confirmation. The control variables were also modeled as one-item constructs with zero error variance. The path coefficients indicated that bidding product type does not impact on product uncertainty, nor do bidders’ gender, age, education, average purchase price, or bidding experience have a significant effect on repurchase intention.

5 Discussion, implementation, and conclusion

5.1 Discussion

This study provides several important findings. First, the results show that satisfaction has a significant influence on bidders’ repurchase intention, while transaction cost is negatively associated with repurchase intention. When bidders make decisions, they undertake a cost-benefit analysis to determine which option offers the greatest net benefits and the least cost. Bidder satisfaction is not only a critical performance outcome, but also a primary predictor of bidder loyalty and, thus, of the online auctioneer’s longevity and success. Most studies emphasize the role of satisfaction on loyalty; however, the dimension of sacrifice is still lacking. While most of the literature related to repurchase intention treats only positive factors, such as satisfaction and commitment, we introduced the notion of a negative factor in terms of transaction cost. The success of an online auction depends not only on its ability to provide consumer value in terms of shopping, but also on its ability to provide a convenient and efficient way of decreasing transaction costs.

Second, the study theorized a novel view of transaction cost that posits product uncertainty, asset specificity, and interaction frequency as strong predictors of bidders’ transaction cost. Consistent with prior work related to TCE (Liang and Huang 1988; Teo and Yu 2005; Kim and Li 2009), auctioneers’ asset specificity and product uncertainty are both positively associated with bidders’ perceived transaction cost. The frequency of bidders’ interactions with sellers is negatively associated with their transaction cost. From the bidders who shop for practical needs or for fun, to the sellers who do business online as a source of income, the nature of online auctions is to conduct transactions. In the context of online auctions, transactions involve costs related to ease of access and navigation, shopping time, competence, flexibility, personalization, and convenience. Under the high uncertainty of conducting transactions over the Internet, auctioneers and sellers have to minimize bidder’s transaction costs.

Finally, the findings also confirm that overall e-service quality and confirmation help bidders achieve feelings of satisfaction with online auctions. The constructs of e-service quality, satisfaction, and repurchase intention have been gaining prominence, both in the literature (Parasuraman and Grewal 2000) and in business practice. A common theme in the ECT literature is that satisfaction is a function of the size and direction of disconfirmation. In other words, consumers are satisfied in the case of positive confirmation and dissatisfied in the case of negative confirmation. Our findings also show that confirmation is the determinant of satisfaction. Therefore, auctioneers and sellers have to promote e-service quality and delineate several strategies for adding value to their products and services. Moreover, auctioneers and sellers should lower transaction risks to facilitate the establishment of trust in the online C2C environment.

5.2 Implications

Both theoretical and practical implications can be drawn from this research. First, this study has devoted much effort to developing an integrated model based on the concepts of TCE and ECT in order to predict and explain a bidder’s repurchases intention in the online auction marketplace. The research results provide a novel approach to understanding bidders’ benefit and cost dimensions in the online auction marketplace. From a theoretical standpoint, few empirical studies in C2C e-commerce have considered both transaction cost and the satisfaction of bidders. Our findings help in the theoretical understanding of the repurchase intention of bidders in the online auction context.

Second, while past studies related to ECT have largely focused on business to customer (B2C) e-commerce, this study moves forward and further identifies the factors that drive bidders toward a repurchase intention in the C2C online auction marketplace. Building on the buyer–seller relationships in B2C, C2C not only has bidder-seller relationships, but also has a bidder-auctioneer nexus. Online auctioneers act as intermediaries to connect bidders and sellers. Our findings validate ECT as a way to show that overall e-service quality of sellers/auctioneers and bidders’ confirmation are positively associated with bidders’ satisfaction, and bidder satisfaction is also positively associated with repurchase intention.

Third, in practice, from the bidder’s perspective, the strength of the relationship between satisfaction and repurchase intention has been found to vary significantly. Therefore, how to increase the bidders’ satisfaction becomes the most important issue in the online auction marketplace. Furthermore, an auctioneer’s performance is important in influencing bidders’ satisfaction. The auctioneer should construct a safe, efficient, and legally compliant environment to facilitate online trading activities. Poor evaluations of e-service quality influence bidder satisfaction. Sellers can offer bidder’s value by providing new value-added services online and by emphasizing unique products or activities, proprietary content, superior product knowledge, and strong personal service (Chircu and Mahajan 2006).

Fourth, the transaction cost of online bidding via auction sites is lower than any alternative. The effectiveness of service in this regard can be improved by examining the seller’s influence on the bidder’s purchase (Lin et al. 2011). Our findings could help guide online auctioneers and sellers in augmenting their offerings. In particular, this study highlights the importance of establishing trust mechanisms to allow transactions to take place smoothly between geographically separated strangers. As suggested by past studies, high transaction costs are related negatively to purchasers’ willingness to buy online. The transaction costs in electronic marketplaces are lower, resulting in more competitive prices for the bidders. The reduction in transaction costs not only increases the likelihood that bidders will compare prices, but also enables the bidders to compare the array of benefits that they will derive from the products and services that they buy (Anderson and Srinivasan 2003).

5.3 Conclusion

Customer repurchase intention is a key issue due to its influence on future repeat purchase patterns. Understanding repurchase intention and the factors influencing it can provide sufficient information from customers to guide auctioneer and sellers on how to respond to bidders’ needs. Moreover, bidders have more bargaining power, lower switching costs, and a number of choices available (Chen and Dubinsky 2003), identifying what leads to repurchase intentions has become a challenge for researchers. Despite its importance, however, only limited attempts have been made to understand online bidder’ repurchase intentions and investigate its factors and interrelationships. Our findings show that satisfaction has a significant influence on bidders’ repurchase intentions, while transaction cost is negatively associated with repurchase intentions. Bidders’ satisfaction is determined by confirmation and by the e-service quality of both auctioneers and sellers. Moreover, an auctioneer’s asset specificity and product uncertainty are positively associated with the bidder’s perceived transaction cost. The interaction frequency between bidders and sellers is negatively associated with the bidders’ transaction costs.

References

Ajzen I (1991) The theory of planned behavior. Org Behav Human Decis Process 50(2):179–211

Anderson RE, Srinivasan SS (2003) E-satisfaction and e-loyalty: a contingency framework. Psychol Mark 20(2):123–138. doi:10.1002/mar.10063

Atchariyachanvanich K, Okada H, Sonehara N (2007) What keeps online customers repurchasing through the internet? ACM SI. Gecom Exch 6(2):47–57. doi:10.1145/1228621.1228626

Bauer HH, Falk T, Mammerschmidt M (2006) eTransQual: a transaction process-based approach for capturing service quality in online shopping. J Bus Res 59:866–875

Bemmaor AC (1995) Predicting behavior from intention-to-buy measures: the parametric case. J Mark Res 32(2):176–191

Bharadwaj N, Matsuno K (2006) Investigating the antecedents and outcomes of customer firm transaction cost savings in a supply chain relationship. J Bus Res 59(1):62–72

Bhattacherjee A (2001) Understanding information systems continuance: an expectation-confirmation model. MIS Q 25(3):351–370

Bhattacherjee A, Premkumar G (2004) Understanding changes in belief and attitude toward information technology usage: a theoretical model and longitudinal test. MIS Q 28(2):229–254

Bloemer JMM, Kasper HDP (1995) The complex relationship between consumer satisfaction and brand loyalty. J Econ Psychol 16:311–329

Cadotte ER, Woodruff RB, Jenkins RL (1987) Expectations and norms in models of consumer satisfaction. J Mark Res 24(3):305–314

Cannon JP, Homburg C (2001) Buyer-supplier relationships and customer firm costs. J Mark 65:29–43

Chen Z, Dubinsky AJ (2003) A conceptual model of perceived customer value in e-commerce: a preliminary investigation. Psychol Mark 20(4):323–347. doi:10.1002/mar.10076

Chin WW (1998) Issues and opinion on structural equation modeling. MIS Q 22(1):vii–xvi

Chin WW, Newsted PR (eds) (1999) Structural equation modeling analysis with small samples using partial least squares statistical strategies for small sample research. Sage Publications, Thousand Oaks

Chircu AM, Mahajan V (2006) Managing electronic commerce retail transaction costs for customer value. Decis Support Syst 42(2):898–914

Chiu C-M, Hsu M-H, Sun S-Y, Lin T-C, Sun P-C (2005) Usability, quality, value and e-learning continuance decisions. Comput Educt 45(4):399–416

Churchill JGA, Surprenant C (1982) An investigation into the determinants of customer satisfaction. J Mark Res 19(4):491–504

Coase RH (1973) The nature of the firm. Economica 4:386

Davis FD, Bagozzi RP, Warshaw PR (1989) User acceptance of computer technology: a comparisson of two theoretical models. Manag Sci 35(8):982–1003

Devaraj S, Fan M, Kohli R (2002a) Antecedents of B2C channel satisfaction and preference: validating e-commerce metrics. Inf Syst Res 13(3):316–333

Devaraj S, Ming F, Kohli R (2002b) Antecedents of B2C channel satisfaction and preference: validating e-commerce metrics. Inf Syst Res 13(3):316–333

Devaraj S, Fan M, Kohli R (2006) Examination of online channel preference: using the structure-conduct-outcome framework. Decis Support Syst 42:1089–1103

Dick AS, Basu K (1994) Customer loyalty: toward an integrated conceptual framework. J Acad Mark Sci 22(2):99–113

Dodds WB, Monroe KB (1985) The effect of brand and price information on subjective product evaluations. In: Hirschman EC, Holbrook MB (eds) Advances in consumer research, vol 12. Association for consumer research, Provo, pp 85–90

Dodds WB, Monroe KB, Grewal D (1991) Effects of price, brand, and store information on buyers’ product evaluations. J Mark Res 28(3):307–319

Fishbein M, Ajzen I (1975) Belief, attitude, intention, and behavior. Addison-Wesley Company, Reading

Fornell C, Larcker DF (1981) Evaluating structural equation models with unobservable and measurement error. J Mark Res 18(1):39–50

Fornell C, Johnson MD, Anderson EW, Cha J, Bryant BE (1996) The American customer satisfaction index: nature, purpose, and findings. J Mark 60(4):7–18

Frevert RF (1967) An observational criterion of repurchase performance. J Mark Res 4(3):249–251

Gefen D, Straub DW (2004) Consumer trust in B2C e-commerce and the importance of social presence: experiments in e-products and e-services. Omega 32(6):407–424

Ghoshal S, Moran P (1996) Bad for practice: a critique of the transaction cost theory. Acad Manag Rev 21(1):13–47

Gustafsson A, Johnson MD, Roos I (2005) The effects of customer satisfaction, relationship commitment dimensions, and triggers on customer retention. J Mark 69:210–218

Hair JF Jr, Black WC, Babin B, Anderson R, Tatham R (2006) Multivariate data analysis, 6th edn. Prentice Hall, Upper Saddle River

Hair J, Sarstedt M, Ringle C, Mena J (2012) An assessment of the use of partial least squares structural equation modeling in marketing research. J Acad Mark Sci 40(3):414–433. doi:10.1007/s11747-011-0261-6

Hellier PK, Geursen GM, Carr RA, Rickard JA (2003) Customer repurchase intention: a general structural equation model. Eur J Mark 37(11/12):1762–1800

Hoffman DL, Novak TP, Peralta M (1999) Building consumer trust online. Commun ACM 42(4):80–85. doi:10.1145/299157.299175

Hom PW, Griffeth RW, Palich LE, Bracker JS (1998) An exploratory investigation into theoretical mechanisms underlying realistic job previews. Pers Psychol 51(2):421–451

Hsu MH, Yen CH, Chiu CM, Chang CM (2006) A longitudinal investigation of continued online shopping behavior: an extension of the theory of planned behavior. Int J Human Comput Stud 64(9):889–904

Infosino W (1986) Forecasting new product sales from likelihood of purchase ratings. Mark Sci 5:372–384

Jiang P, Rosenbloom B (2005) Customer intention to return online: price perception, attribute-level performance, and satisfaction unfolding over time. Eur J Mark 39(1/2):150–174

Jones K, Leonard LNK (2007) Consumer-to-consumer electronic commerce: a distinct research stream. J Electron Commer Org 5(4):39–54

Kettinger WJ, Lee CC (2005) Zones of tolerance: alternative scales for measuring information systems service quality. MIS Q 29(4):607–621

Khalifa M, Liu V (2003) Determinants of satisfaction at different adoption stages of Internet-based services. J Assoc Inf Syst 4(5):206–232

Kim YG, Li G (2009) Customer satisfaction with and loyalty towards online travel products: a transaction cost economics perspective. Tour Econ 15(4):825–846

Kim DJ, Ferrin DL, Rao HR (2009) Trust and satisfaction, two stepping stones for successful e-commerce relationships: a longitudinal exploration. Inf Syst Res 20(2):237–257. doi:10.1287/isre.1080.0188

Kopalle PK, Lehmann DR (2001) Strategic management of expectations: the role of disconfirmation sensitivity and perfectionism. J Mark Res 38(3):386–394

Lee M-C (2010) Explaining and predicting users’ continuance intention toward e-learning: an extension of the expectation-confirmation model. Comput Educt 54(2):506–516

Lee Y, Kwon O (2011) Intimacy, familiarity and continuance intention: an extended expectation-confirmation model in web-based services. Electron Commer Res Appl 10(3):342–357

Lee M-Y, Kim Y-K, Fairhurst A (2009) Shopping value in online auctions: their antecedents and outcomes. J Retail Consumer Serv 16(1):75–82. doi:10.1016/j.jretconser.2008.11.003

Liang TP, Huang J (1988) An empirical study on consumer acceptance of products in electronic markets: a transaction cost model. Decis Support Syst 24(1):29–43

Liao C, Chen JL, Yen DC (2007) Theory of planning behavior (TPB) and customer satisfaction in the continued use of e-service: an integrated model. Comput Human Behav 23:2804–2822

Limayem M, Hirt SG, Cheung CMK (2007) How habit limits the predictive power of intention: the case of information systems continuance. MIS Q 31(4):705–737

Lin CS, Wu S, Tsai RJ (2005) Integrating perceived playfulness into expectation-confirmation model for web portal context. Inf Manag 42:683–693

Lin C-P, Tsai Y, Chiu C-K (2009) Modeling customer loyalty from an integrative perspective of self-determination theory and expectation–confirmation theory. J Bus Psychol 24(3):315–326. doi:10.1007/s10869-009-9110-8

Lin F-R, Po R-W, Orellan C (2011) Mining purchasing decision rules from service encounter data of retail chain stores. Inf Sys E-Bus Manag 9(2):193–221. doi:10.1007/s10257-010-0143-3

Lo S (2011) The best 100 online stores business next (in Chinese). Business next, Taipei

Manchala DW (2000) E-commerce trust metrics and models. Inter Comput IEEE 4(2):36–44. doi:citeulike-article-id:1018844

Marcoulides GA, Saunders C (2006) PLS: a silver bullet? MIS Q 30(2):iii–ix

Mckinney V, Yoon K, Zahedi FM (2002) The measurement of web-customer satisfaction: an expectation and disconfirmation approach. Inf Syst Res 13(3):296–315

Mittal V, Kamakura WA (2001) Satisfaction, repurchase intent, and repurchase behavior: investigating the moderating effect of customer characteristics. J Mark Res 38(1):131–142

Mittal V, Ross WT, Baldasare PM (1998) The asymmetric impact of negative and positive attribute-level performance on overall satisfaction and repurchase intentions. J Mark 62(1):33–47

Morwitz VG, Schmittlein D (1992) Using segmentation to improve sales forecasts based on purchase intent: which “Intenders” actually buy? J Mark Res 29(4):391–405

Morwitz VG, Johnson E, Schmittlein D (1993) Does measuring intent change behavior? J Consumer Res 20(1):46–61

Oliver RL (1980) A cognitive model of the antecedents and consequences of satisfaction decisions. J Mark Res 17:460–469

Oliver RL, Balakrishnan PVS, Barry B (1994) Outcome satisfaction in negotiation: a test of expectancy disconfirmation. Org Behav Human Decis Process 60(2):252–275

Olsen SO (2002) Comparative evaluation and the relationship between quality, satisfaction, and repurchase loyalty. J Acad Mark Sci 30(3):240–249

Parasuraman A, Grewal D (2000) The impact of technology on the quality-value-loyalty chain: a research agenda. J Acad Mark Sci 28(1):168–174. doi:10.1177/0092070300281015

Parasurman A, Zeithaml VA, Malhotra A (2005) E-S-QUAL: a multiple-item scale for assessing electronic service quality. J Serv Res 7(3):213–233

Pavlou PA, Liang H, Xue Y (2007) Understanding and mitigating uncertainty in online exchange relationships: a principal-agent perspective. MIS Q 31(1):105–136

Peter JP, Tarpey LX Sr (1975) A comparative analysis of three consumer decision strategies. J Consumer Res 2(1):29–37

Phillips DM, Baumgartner H (2002) The role of consumption emotions in the satisfaction response. J Consumer Psychol 12(3):243–252

Reichheld FF, Teal T (1996) The loyalty effect. Harvard Business School Press, Boston

Rhee H-S, Riggins FJ, Kim C (2009) The impact of product type and perceived characteristics of the web on multifaceted online shopping behavior. J Org Comput Electron Commer 19(1):1–29. doi:10.1080/10919390802198907

Rindfleisch A, Heide JB (1997) Transaction cost analysis: past, present, and future applications. J Mark 61(4):30–54

Ringle CM, Wende S, Will A (2005) SmartPLS. http://www.smartpls.de/.2012

Ringle CM, Sarstedt M, Straub DW (2012) A critical look at the use of PLS-SEM in MIS quarterly. MIS Q 36(1):3–106

Roca JC, Chiu CM, Martíneza FJ (2006) Understanding e-learning continuance intention: an extension of the technology acceptance model. Int J Human Comput Stud 64:683–696

Rose S, Clark M, Samouel P, Hair N (2012) Online customer experience in e-retailing: an empirical model of antecedents and outcomes. J Retail 88(2):308–322

Silk AJ, Urban GL (1978) Pre-test-market evaluation of new product goods: a model and measurement methodology. J Mark Res 15:171–191

Srinivasan SS, Anderson R, Ponnavolu K (2002) Customer loyalty in e-commerce: an exploration of its antecedents and consequences. J Retail 78(1):41–50

Szymanski DM, Henard DH (2001) Customer satisfaction: a meta-analysis of the empirical evidence. J Acad Mark Sci 29(1):16–35

Taylor SA, Baker TL (1994) An assessment of the relationship between service quality and customer satisfaction in the formation of consumers’ purchase intentions. J Retail 70(2):163–178

Teo TSH, Yu Y (2005) Online buying behavior: a transaction cost economics perspective: omega. Int J Manag Sci 33:451–465

Thong JYL, Hong SJ, Tam KY (2006) The effects of post-adoption beliefs on the expectation-confirmation model for information technology continuance. Int J Human Comput Syst 64:799–810

Tsai H, Juang H, Jaw Y, Chen W (2006) Why on-line customers remain with a particular e-retailer: an integrative model and empirical evidence. Psychol Mark 23(5):447–464

Venkatesh V, Goyal S (2010) Expectation disconfirmation and technology adoption: polynomial modeling and response surface analysis. MIS Q 34(2):281–303

Venkatesh V, Morris MG, Gordon BD, Davis FD (2003) User acceptance of information technology: toward a unified view. MIS Q 27(3):425–478

Williamson OE (1975) Markets and hierarchies: analysis and antitrust implications. Free Press, New York

Williamson OE (1981) The economics of organization: the transaction cost approach. Am J Sociol 87(3):548–577

Williamson OE (1985) The economic institutions of capitalism. Free Press, New York

Wolfinbarger M, Gilly MC (2003) eTailQ: dimensionalizing, measuring and predicting etail quality. J Retail 79:183–198

Yang C-L, Huang R-H (2011) Key success factors for online auctions: analysis of auctions of fashion clothing. Expert Syst Appl 38(6):7774–7783

Yang Z, Peterson RT (2004) Customer perceived value, satisfaction, and loyalty: the role of switching costs. Psychol Mark 21(10):799–822. doi:10.1002/mar.20030

Zhang Y, Fang Y, Wei KK, Ramsey E, McCole P, Chen H (2011) Repurchase intention in B2C e-commerce-a relationship quality perspective. Inf Manag 48(6):192–200

Author information

Authors and Affiliations

Corresponding author

Appendix: Survey questionnaire

Appendix: Survey questionnaire

Rights and permissions

About this article

Cite this article

Yen, C., Hsu, MH. & Chang, CM. Exploring the online bidder’s repurchase intention: a cost and benefit perspective. Inf Syst E-Bus Manage 11, 211–234 (2013). https://doi.org/10.1007/s10257-012-0201-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10257-012-0201-0