Abstract

With the steadily growing health burden of obesity in Germany, the measuring and quantification of its costs and relevant economic consequences have become increasingly important. The usual quantifications via previous cost-of-illness approaches mostly have several weaknesses, e.g., applying “indirect methods” by using “population-attributable fractions” to identify parts of costs that can be accrued to obesity, second using highly aggregated data and third often only displaying part of the costs. This article presents a new approach and a new estimation of the cost and consequences of obesity in Germany using claims data from a German health insurance company. A sample of 146,000 individuals was analyzed with both a prevalence and a life-cycle focus on the cost and consequences of obesity. With additional data sets, we calculate the deaths per year due to obesity, the excess costs per year and several intangible consequences usually referred to as “pain and suffering”. Our results show that the cost estimations of obesity in Germany so far have been largely underestimated. The annual direct costs of obesity in Germany amount to approximately €29.39 billion and the indirect costs to an additional €33.65 billion. A total of 102,000 subjects die prematurely each year because of obesity, and there is a significant excess of unemployment, long-term nursing care, and pain and suffering due to obesity. From a lifetime perspective, every obese man is equal to an additional burden of €166,911 and each woman of €206,526 for the social security system in Germany. Obesity due to unhealthy eating is thus about to replace tobacco consumption in terms of costs and consequences as the main hazardous lifestyle factor and thus should be more intensively focussed by public health policy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In almost all high-income countries, obesity is a serious concern for health policy. The problem is still increasing and the WHO recently released a report stating that the consequences of obesity are among the highest ranking threats to health in developed countries [1]. In Germany, the proportion of people suffering from obesity has been increasing since the 1980s [2] and currently peaks at about 24 % of the adult population [3]. In relation to the USA with a prevalence of approximately 33 %, the figures are converging. The sum of negative economic consequences caused by obesity that reach also beyond the health dimension are usually referred to as the “social costs” of obesity, to emphasize that consequences not only affect the individual but also the society as a whole in different ways. Given that every negative consequence can be quantified and converted in a common commensurate measure—most might think of a dollar or euro value or some utility-based currency—obesity with all its negative outcomes can be compared to other health-related problems and risky lifestyles thus serving as an indicator for health policy. Some researchers consider obesity along with overweight (or pre-obesity) as a risk factor or manifestation of risky, unhealthy eating habits rather than a disease itself, which leads to severe comorbidities [4, 5]. Sometimes confusion arises about whether or not to include these comorbidities when quantifying costs [6]. However, to encompass the problem properly, it is important not only to focus on obesity as a disease on its own, but also to widen the scope and clearly account for all possible consequences that can result from it.

This article gives an estimation of the social costs of obesity in Germany. For this estimation, insurance claim data is used for a bottom-up approach that captures every section of the German social insurance system: health, unemployment, retirement, accidents and nursing care. Furthermore, some intangible aspects of obesity are shown. There are two different analytical views in this article, one prevalence-based view showing the annual social cost of obesity in Germany and a second view that displays the expected net present costs of an obese person at age 15.

Health economic aspects regarding obesity

Despite the complex matter of interplays of different factors contributing to obesity and its evolvement paths, it is mostly agreed that the majority of obesity cases result from a persistent unbalanced positive energy account, mostly due to the consumption of “non-core” food high in salt, sugar or fat [7]. In Germany especially children display rather unhealthy eating patterns [8]. Although obesity is classified as a disease in the ICD-10-GM, it is often regarded as a risk factor leading to comorbidities [4]. The comorbidities caused by obesity are well known: arteriosclerosis, diabetes type 2, different cancers and dementia [9]. Especially for children and adolescents obesity can lead to psychosocial problems such as depression, eating disorders and low self-esteem. Further health impairments are sleep apnea, asthma, gallstones, steatohepatitis, glomerulosclerosis, musculoskeletal defects, cardiovascular diseases such as chronic inflammation, hypertension, early onset of puberty and other health problems [9–11].

However, from a health economic perspective, not only the health consequences are of interest, but also other outcomes that substantially affect the economy. These consequences are mostly referred to as “costs” whenever resources are reallocated or destroyed because of obesity, e.g., premature death, involuntary unemployment, etc. In line with smoking and alcohol consumption, an early onset of obesity in childhood or adolescence increases the likelihood of staying obese as an adult [12]. Several past studies have dealt with the costs of obesity in Europe [13]: seven [14–20] have focused on the situation in Germany, but employ different methods to assess obesity and thus yield estimations that constitute a large bandwidth. Konnopka et al. [14] sum the direct and indirect costs of obesity to €9.9 billion annually. A recent update [15] estimates a total of €16.8 bn. which equals an increase of 70 % with newer data and the same methods. Von Lengerke et al. [18] estimate excess medical costs depending on the socioeconomic background and severity of obesity range from €538.62 to €3120.87 for extremely obese individuals. Another study by Von Lengerke et al. [19] finds significant incremental costs for different types of diabetes between €454 and €812 if additionally the individuals are obese. Pendergast et al. [20] obtain similar estimates using waist circumferences as main focus of their analysis. Liebl et al. [17], only indirectly focusing on the costs of obesity, studied subjects suffering from diabetes type 2 before and after a diabetes-specific treatment and estimated a figure of ca. €400 additional financial burden because of obesity, summing in total to €1047 of annual costs of pure diabetes treatment when obesity was additionally present. Knoll and Hauner [16] estimated approximately €11 billion direct costs annually and an additional €1656.28 indirect costs per capita. The “Deutsche Adipositas Gesellschaft” (German Obesity Association) has released a figure of €13 billion p.a. Cost studies for obese children in Germany are also available: Batschneider et al. [21] report annual excess costs of €354 per obese child using a standard cost approach [22]. For international comparisons, Birmingham et al. [23] estimated costs of obesity in Canada using population-attributable fractions (PAFs) as $1.8 billion, which equals 2.4 % of the total health budget. For the USA, Hammond und Levine [24] estimated an annual cost figure of about $US 147 billion excess direct medical costs and an additional $US 14.3 billion for children. The indirect costs are $US 66 billion, which with the direct costs add up to $US 215 billion per year. The differences between the estimations illustrate a crucial caveat, namely that cost studies which lack essential cost components or apply different methods might under- or overestimate the costs of obesity.

Additionally, a very important part of the negative consequences of obesity are "intangible" in nature, i.e., they are not reflected by market-valued transactions, but are the subjectively felt “pain and suffering” or “hedonic impairments” that obesity causes. Referring to Puhl and King [25], besides the pain and suffering from comorbidities, these are foremost stigmatization and bullying [26]. Additionally prejudices against obese people may lead to indirect costs, e.g., they might not get a job because of obesity [27]. Puhl and King [25] furthermore stress the worse medical treatment due to stigmatization [28, 29], also in education and schooling [30, 31]. All these consequences have tangible and intangible aspects that should be taken into account.

Limitations of previous cost estimations

Concerning the potential burden to the economy, most past studies have limitations that we would like to mention briefly: First, top-down conducted cost-of-illness studies use so-called indirect methods [32], which calculate PAFs or adapt them from other sources. The PAFs function as “converters” that display a cost fraction that is avoided if no obesity occurs. The cost fractions for different diseases are then summed up accordingly. Besides the problem that this figure is mostly derived in a setting that does not display causality (although it should), this often leads to the problem that only the costs of the most severe diseases are calculated, i.e., no PAF is available and thus is assumed to be zero for diseases not sufficiently associated with obesity. However, minor health impairments caused by obesity, such as heartburn and nausea, might comprise a majority of physician visits and thus reflect a large proportion of health costs. Hence, leaving out these cost contributors leads to underestimations of the social costs of obesity. Second, the concepts of PAFs and derived cost estimations hinge on their aggregation level: if the fractions are calculated for all cardiovascular diseases and all cancers, this might exclude information concerning a possible disproportional distribution of costs within the spectrum of cancers or cardiovascular diseases for the obese vs. nonobese individuals. Third, only a few studies contain all health costs and go beyond this sphere; obesity can lead to rehabilitations, nursing care and accidents, which are direct costs most studies do not include. Some researchers argue that obesity, causing higher mortality, might lead to savings in the health sector [33]. The answer to this question hinges crucially on the valid and comprehensive assessment of all costs. Fourth, some studies use so-called “standard costs” or costs that can be accrued by “Diagnosis Related Groups” (DRGs) as a factor to be multiplied by PAFs or survey-assessed usage of health services. This might be a fallacy, since it is quite plausible that the treatment of cardiovascular diseases for example incurs higher costs if someone is additionally obese compared to nonobese patients. Fifth, using data from surveys and questionnaires in which subjects are asked how many physician visits they had during the past year and how much they spent on medication might be subject to inaccuracies. Even small inaccuracies and biases in the subjects' memories might result in distorted total estimations. Subjects with very severe diseases might not even be in the sample because they were not able to answer the questions correctly or simply were not available to be included in the survey because of their situation.

Aspects concerning the PAF, standard cost and neglected cost components, especially within the health cost segment, contribute to rather conservative estimations and increased critiques of the survey data approach. An additional point is that PAFs may also be inadequately high and might result in biased estimates that do not really fit the real cost situation of obesity. With the approach presented in this article, we want to overcome these limitations by directly assessing data on personal information and costs in the health system by using a rich data set from the German Statutory Health Insurance (SHI).

Costs and consequences of obesity

To derive the relevant consequences of obesity that need to be accounted for, we start by focusing on the common components used in the cost-of-illness approach and then expand the components, integrating seldom-used cost aspects and intangible parts. These components can also intuitively be deduced from the health production model used by Cutler and Richardson [34]. The following components are included in this analysis:

Health care costs

Health care costs cover all direct monetary spending for health services and products such as pharmaceuticals and auxiliary health means in the German health sector.

Sick leave

When an employee gets sick, the person is usually absent from work. This reflects that in a state of illness, productivity is decreased or even assumed to be zero since the individual is supposed to recover from the illness or injury to regain full productivity. By convention, this time of absence is valued by the income that usually would be earned during this time. We follow this usual convention of the human-capital approach; however, if one is interested in assessing all the lost productivity during the time of illness, one has to include the productivity loss in “non-working time” as well. The convention of not counting this free time is rooted in the concepts of national accounting and gross domestic product calculation, which do not consider productive aspects of free home time, e.g., home production or child care, as productive time. Newer approaches [35, 36] recommend their inclusion for total welfare.

Long-term nursing care

Costs for nursing care include direct costs that cover medical treatments to compensate for functional loss mainly for older people or those severely injured and disabled after an accident.

Rehabilitation

Only a small part of the costs of rehabilitation treatments is included in the covered benefits of the health insurance system in Germany. Most rehabilitation costs as well as accompanying benefits such as income compensation and aids for employment participation benefits (“Leistungen zur Teilhabe am Arbeitsleben”) are funded by the German mandatory pension fund (“Gesetzliche Rentenversicherung,” GRV). Besides the direct costs of the rehabilitation treatment and resources spent for employment participation benefits due to obesity, as an indirect cost component, rehabilitations also require some time off with—according to convention—no productivity. The income compensation while in rehabilitation (“Übergangsgeld”) is redistributive in nature and not counted as direct costs. We consider it to be part of the lost productivity due to rehabilitation that is borne by society, subtracting it from the loss the individual suffers.

Early retirement pensions

Early retirement is a status usually achieved if the ability to earn money is significantly and mostly irreversibly reduced. We value this indirect cost component “time in retirement” with the loss of earnings. The pensions paid as income compensation by the German mandatory pension fund are again redistributive in nature and can be considered as the part of lost productivity borne by society.

Pensions for widows and orphans

Other redistributed components of costs are pensions for widows and orphans of prematurely deceased obese subjects. They reflect in part the lost productivity of the deceased person and are borne by society, which compensates the family.

Unemployment compensation and welfare

Unemployment is only seldom accounted for in “cost-of-illness” or “social cost” studies. The reason for this might be the friction cost approach [37], which states that lost productivity due to unemployment of one obese individual can be compensated directly by other unemployed individuals that replace him. However, if the unemployment occurs because of decreased productivity in which the marginal return of productivity is smaller than the income paid, the lost productivity can be measured by the income foregone.

Accident costs

Due to decreased health or fitness, it is possible that obesity also influences the likelihood of accidents and thus might result in higher costs.

Mortality

Mortality is a central issue for the analysis for both the prevalence and life-cycle perspectives. From the prevalence approach early mortality displays lost resources. We use the human capital approach, which values the resources lost with the earnings foregone and a standardized wage payment for housekeeping and other productive activities in free time with parameters derived from the German Federal Statistical Office. An intangible component of life lost, i.e., the value of life less productivity time, should be included in our analysis, but is left out here.

Pain

We searched the data for physicians' codings of ICD diagnoses related to pain. Relevant diagnoses are shown in the appendix. For every quarter in which a pain diagnosis was counted, a dummy variable was set to one, and to zero if no such diagnosis occurred. This method gives a rough insight into the frequency of pain during the life cycle of obese persons.

Suffering from comorbidities

To measure the amount of “burden of disease” due to obesity, the Charlson Comorbidity Index [38] was calculated for every quarter and individual. The index scores increase with more severe comorbidities. Of course, besides “pain and suffering,” one can imagine other hedonic impairments due to obesity, but these components comprise the relevant majority of the resources being transferred and the intangibles considered here.

Materials and methods

Data

About 87 % of the German population is insured via the SHI, the main and mandatory mutual health insurance system that covers most of the health costs. The data used in this study contain the most important cost components of the German health insurance system with the exception of costs for dental treatment, which only comprise a small fraction of the cost. The remaining 13 % are mostly insured via private health insurances that usually offer a wider scope of health services or they are uninsured. For the privately insured persons, health costs are higher on average for the same treatments because physicians are allowed by law to charge more. To assess health care costs, a sample of 146,000 insured persons from the Techniker Krankenkasse (TK), the largest statutory health insurance (SHI) in Germany, currently with more than 9 million insured persons, was investigated. Half of the sample constituted the “treatment” group with harmful consumption patterns [i.e., individuals displaying relevant diagnoses associated with obesity (E66) and further hazardous alcohol consumption (F10) or smoking (F17)]; the other half comprised individuals without such a diagnosis. This was done to ensure that enough individuals with risky consumption patterns were in the sample. Chances of being selected were independent of any other restrictions. Using the estimated figures as a representative estimation for Germany constitutes a lower bound since costs will even be higher for privately insured subjects. Out-of-pocket payments for OTC pharmaceuticals or other health services not borne by the SHI were not assessed.

The selected subjects were continuously insured from 2008 to mid-2012 and thus only left the sample when deceased. The data set consists of so-called “routinely generated data” within the German social insurance system [39]. This kind of data is “routinely” generated within the IT systems of the SHI and is comprised of data on the costs that occur in the different health sectors (hospital, pharmaceutics, etc.). It assesses personal parameters of the insured person, such as age, sex and family status, and additionally contains information on employment and other conditions relevant for social insurance such as retirement and the possible status of nursing care with the corresponding health costs. We identified 21.25 % (31,032 persons) with the corresponding ICD diagnosis E66 in the different medical sectors as a representation of obesity during the observed time period. Different severity levels of obesity were assessed by the BMI category, also encoded in the ICD data. If obesity was not coded between different quarters or before the first or last obesity coding, we replaced the missing values by the respective value that occurred at the nearest point in time. This simplification was done to avoid data loss. We make the assumption that given the 4.5-year observation period and due to individual robust eating habits, it is very likely that obese individuals are already obese before the first coding and stay in this condition after the last coding. Even if this assumption is not accurate in some cases, the possible resulting higher costs after obesity should still be associated with obesity and their likely cause compared to individuals without an obesity diagnosis. Thus, defining the treatment group by “displaying an obesity diagnosis during the observation period” seems acceptable for sufficient classification. The coding might still yield some misclassifications; although from our experience with SHI data the likelihood of classifying an individual as obese while in fact not being obese seems small, the opposite might occur. Therefore, some obese individuals might not be identified with an E66 diagnosis during the observation period. We thus conducted several consistency checks: we assessed data on physician visits by obese and nonobese individuals from the PASS data set provided by the German Federal Employment Agency. Furthermore, we compared the prevalence of obesity from survey data with the obesity ICD codes within the total insurance collective from the Techniker Krankenkasse, which yielded an average congruence between 0.77 and 1.13. In Germany mandatory health insurance and nursing care insurance are linked, i.e.. the health insurance company automatically provides nursing care services in case of disability. The data on nursing care can be provided by the same insurance company that holds the health data; hence, the nursing care information can be linked to the health-insured subjects. Health insurance data usually contains information not only on diseases, but also injuries from accidents. When accidents happen in connection with employment in Germany, the German mandatory accident insurance (“Gesetzliche Unfallversicherung, GUV”) covers most of the costs. For both work and free time, the mandatory health insurance has the data on all accidents in which individuals were harmed and received medical treatment. The SHI is also the disbursement institution for most of the payments and compensations for accidents that are covered by the GUV. Short- and long-term unemployment was also assessed from the SHI data. Additional data from the Robert Koch Institute (GEDA09 [40]) were used to extrapolate the estimations to the national level. This data set contains population weights to calculate the number of obese individuals in different BMI categories by age and sex. Thus, all costs on the population level were derived by multiplying the costs per person by gender and age with the population-representative number of obese individuals from the GEDA data. Costs for rehabilitation treatments as well as income-compensating payments (“Übergangsgeld”) and payments for job re-integration (“Leistungen zur Teilhabe am Arbeitsleben”) were directly assessed from the data set “Abgeschlossene Rehabilitation 2002–2009” from the German Statutory Pension Insurance,Footnote 1 which also contains diagnoses of the treatments. Necessary parameters for early retirement were obtained by the data set “Versichertenrentenzugang 2008—Erwerbsminderung und Diagnosen.” For calculating indirect costs, the monthly net income and average number of different kinds of pensions (regular, early retirement pensions and for orphans and widows) were assessed from the PASS data set. Additional parameters were assessed from the aggregate statistics of the German Federal Statistical Office (Statistisches Bundesamt).

Method

In this article, a ‘bottom-up’ approach was chosen to identify costs and economic interdependencies between obesity and the aforementioned costs and consequences following the cost-of-illness framework by Rice [41]. For the analysis, health costs from all sectors of the German health system assessed from the SHI data were aggregated into quarterly data for each individual during the observation period. In order to model the costs of obesity in both the prevalence and incidence approach (life-cycle approach) at first the sum of all health insurance benefits (apart from dental benefits) was estimated using a generalized estimating equation (GEE) regression (normal distribution and log-link). Depending on the properties of the other dependent variable, we used different distribution families and link functions (for count, binary or skewed data). Days of sick leave per quarter were modeled with a negative binomial regression. All probabilities (e.g., for unemployment, nursing care, accidents, early retirement) were modeled with probit functions. Since the vast majority of quarters contained no accidents, we used a two-part model [42] with probit regression in the first part (whether an accident occurred or not) and a generalized linear model (GLM) with gamma distribution and log-link in the second part. The GEE models of the SHI data controlled for age, sex, smoking- and alcohol-related diseases (via F10 and F17 diagnoses in the ICD10), different modalities of the health insurance [39, 43], employment conditions and education. Time dummies for the different years were included as well as all interaction effects between obesity, smoking and alcohol-related diseases and age. Age was included in the estimations with its normal, quadratic, cubic and quartic term to account for typical developments in health treatments during the life cycle (e.g., higher health costs at birth, higher prevention treatments from age 50 onwards and others). Mortality of the obesity patients was modeled by means of event data regression. We used a full parametric Gompertz regression with weights for age, years and gender to account for possible deviations from a representative sample. For the determination of life-cycle costs the different BMI categories of obesity were used, and the cumulating costs over time were contrasted with the revenues of the Statutory Health Insurance (SHI), thus displaying a bandwidth of different profiles of obesity within the BMI categories. The revenues were derived from a GLM model assuming a gamma distribution of the net income and a log function for linking the linear equation with the outcome using the PASS data set, which contains the monthly net income for obese and nonobese individuals. Gross income figures plus employers' social expenses were calculated from the derived net income figures by applying the inverted income tax tariff accordingly for obese and nonobese individuals by age and gender. The figures were then multiplied by the employment rate per age and gender. The productivity within the non-working time was assessed via the “time budget assessment” of the German Federal Statistical OfficeFootnote 2 by multiplying the average wage rate for cleaning services with the time of productive activities in the household, which on average is 4:07 h for women and 2:51 h for men per day. This results in €8982.55 annual non-market income for men and €12,974.81 for women. To account for possible endogeneity, we adapted the “control function approach” [44]. This approach is similar to a two-stage least squares regression (2SLS) with the difference that the estimated residuals and not the estimated and considered endogenous variable are used in the second stage regression. It overcomes the estimation problems from measurement error, simultaneity or feedback from the dependent variable and the problem of omitted variables [45]. As instruments we used being “employed as blue collar worker,” having a “high school degree” and having a “university degree” for either the individuals themselves or the responsible main insured person, which then represents the milieu in which the insured person lives before becoming fully insured her-/himself. We consider these instruments as strong since the association between obesity and lower socioeconomic background is well known. Additionally, we consider the instruments as valid in the sense that they do not necessarily cause the outcome of the dependent variables in the second stage given that they are small extracts of socioeconomic status that only reflect the causes of health and human capital [46]. Other more complex modeling techniques are possible—for example, maximum likelihood estimations from a structural equation model, i.e., 3SLS, which also accounts for unobservable effects more efficiently. However, due to the numerical and computational limits that arise with the use of “big data,” we chose the aforementioned method, which yields robust and consistent but not efficient estimates, which we neglect with regard to the rather large data set. This trade-off is typical in statistics and thus has to be borne. Average values are calculated on weighted proportional BMI categories. Life-cycle calculations were undertaken in accordance with Basu and Manning [47] with a 2 % discount rate. Proportions and durations of pensions for orphans and widows by age were calculated from the data sets, respectively. Nursing care costs were calculated using a two-part/hurdle model, which in a first stage estimated the likelihood of being in a status receiving such care and second the costs if the nursing care status applies. For their assessment, we only used the costs that were documented in the SHI data, hence leaving out a valuation of the care given by relatives. Thus, these costs again constitute lower bounds.

To calculate widow and orphan pensions, we used the GEDA [40] cross-sectional data file to assess how many obese subjects are living with children under 18 in a household or are married. Another data source—the PASS-SUF PanelFootnote 3—was used to obtain the average duration of the pensions. All additional data sources covered the relevant population representatively. When summing up the total costs, we deducted the compensated income loss of the individual and displayed it at the appropriate external source to avoid double counting, e.g., the employers as cost bearers of the compensated income for the first 6 weeks of sick leave or the German pension funds for paid early retirement pensions in case of lost productivity.

Results

The results for the different cost categories and outcomes are shown in the following Tables 1, 2, 3 and 4 and Figs. 1, 2, 3, 4 and 5.

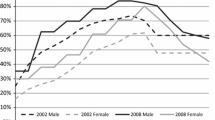

Mortality

The survival curves for the different BMI categories are displayed in Fig. 1. Obesity BMI type I results in a decrease of 0.5 years of life expectancy; BMI type II reduces life by 1 year and BMI type III by 4 years. In total 101,886 individuals die prematurely per year because of obesity. The summed remaining lifetime of all individuals that die prematurely because of obesity equals 2.072 million years of life lost each year and valued by the human capital approach sums to an annual loss of €23.12 bn. in productive resources.

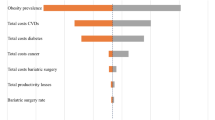

Health costs

The margins of the GEE model at the mean level of the covariates show health care costs of €545.20 per quarter for nonobese people. For obese patients with a BMI between 30 and 35, this amount is increased by additional costs of €314.96 (€342.54 in a GEE model without control functions), for a BMI between 35 and 40 additional costs of €530.64 (€541.04) are incurred, and for a BMI >40 the costs increase by €631.64 (€677.97) per quarter. The slightly higher average costs in the model without control of endogeneity display the bias that occurs because of possible feedback effects or omitted variables. This shows that obesity might also develop because of some other severe or chronic disease states, for example. However, the estimates are numerically close. Table 1 shows the estimates for both models; Tables 2 and 3 show the derivation of cost figures from the estimates of the nonlinear model. Figure 2 displays the costs in the life cycle of obese and nonobese persons starting at age 15. Taken together, the annual health costs sum up to €27.61 billion, which increase with age and BMI category. Figure 3 displays the developments of the net cash flows of insurance premiums and spent health costs. The net present value of an obese man at age 15 with BMI type I is €-94,193, with BMI type II-119,885 and with BMI type III €-166,512; for women, €-157,403, €-140,230 and €-117,308, respectively. Thus, obese individuals “do not pay their way.” A part of the medical costs due to obesity is borne by the nonobese society.

Sick leave

The costs due to sick leave are to a large extent borne by the employers. Their costs sum to €3.87 billion. The individual losses—when ruling out shirking, i.e., being absent although in full health—are €1.54 billion from lost productivity. The rest is borne by the employer.

Unemployment

Obesity negatively affects employment. The main reason might be an indirect effect of a worse health status. Indirect costs of unemployment are €2.01 billion for short-term and €1.22 billion for long-term unemployment. As discussed, the financial burden for nonobese individuals expressed in transfer payments within the German social security system amounts to €917.34 million annually for short-term unemployment and €377.60 million for long-term unemployment, which in total sums up to €1.29 billion redistributed each year. From a life-cycle perspective (figure not shown), an obese woman displays an additional financial burden of €15,005 and every man €2010 at age 15.

Long-term nursing care

Obesity also increases the need for nursing care. The payments from the Long-term Nursing Care Insurance in Germany are €298.29 million per year in total. Additionally €581 million accrue to the indirect cost component, i.e., being in need of long-term nursing care decreases the functionality and thus productivity especially of older persons. From a life-cycle perspective (figure not shown), the additional costs of an obese man starting at age 15 amounts to €3129 and of an obese woman €1835.

Rehabilitation, early and regular retirement pensions, and pensions for widows and orphans

We bundled the results for the benefits of rehabilitation, early retirement pensions and pensions for widows and orphans from the German pension funds. The direct costs of rehabilitation due to obesity-related diseases equal €1043 bn. each year; additional payments for getting the persons on the job again sum up to €393.56 million. Obesity increases the likelihood of early retirement. Annual redistributed early retirement payments due to obesity sum up to €51.09 million each year. Pensions for widows and orphans amount to €1 billion annually. We calculated 56,734 widows/widowers, whose husband or wife deceased prematurely because of obesity and 5864 children each year who lose a parent due to obesity. The net present value of the costs for the German Statutory Pension Insurance (figure not shown) is €59,520 for an obese man and €40,717 for an obese woman.

Accident costs

We calculated the probability of accidents among obese and nonobese persons. As mentioned, the costs in connection with employment are borne by the Statutory Accident Insurance (GUV) in Germany, which is completely funded by the employers. The annual costs amount to €48.85 million, of which €9.87 million are borne by the GUV, €6.71 million by other individuals and the rest by the SHI as well.

Pain

The likelihood of being diagnosed with acute or chronic pain conditions is increased significantly for obese persons. Figure 4 displays these likelihoods for pain diagnoses during the life cycle. Especially for older people, the likelihood of being in a pain state is increased when obese.

Suffering from comorbidities

Our assessment of comorbidities occurring in obese and nonobese persons measured by the Charlson Index is shown in Fig. 5, which displays the net differences between nonobese and obese individuals. Again it is clearly shown that being obese positively affects the likelihood of having a higher score on the Charlson Index Scale. One has to mention that the discrepancy in suffering from comorbidities between obese and nonobese individuals is at its maximum more than 2.5 points, which is more than the valued burden of diseases such as diabetes, leukemia or hemiplegia according to the Charlson Index.

The findings for pain and suffering are valuated “as is” and not in monetary terms. In total, direct costs of obesity per year amount to €29.39 bn. and the indirect cost components to €33.65 bn. Table 1 shows all the results. Averaging over the proportions of different BMI categories, from a life-cycle perspective an obese man, starting at age 15, equals a net financial loss of €166,911 and a woman €206,526 as net present values for the total of all social security systems, excluding accidents, which are small in number.

Discussion

Taken together, the tangible social costs of obesity amount to €63.04 bn. per year in Germany. This figure is by far higher than previous estimates [14–20], and the reason for this from our perspective is the more detailed and comprehensive data set that was used, as well as the fact that we added cost components that were in part not assessed by previous studies. With this in mind, it is however not possible to compare this estimation with other published figures, for example, the costs of tobacco or alcohol consumption, since the methods differ so vastly. In a direct comparison with the same data and method (Effertz 2015), the direct costs of obesity are nearly equal to the direct costs that result from tobacco consumption but far higher than the direct costs of hazardous alcohol consumption.

Discussing the single results, our findings for decreased mortality are not surprising at all. Recent research [48] showed that the mortality risk due to obesity is not as high as sometimes proposed to be. Lower mortality increases the lifetime costs of obese persons. The obvious higher health costs however sound an alarm and might initiate health policy action to take the problem of obesity more seriously, e.g., by implementing more effective prevention instruments such as advertising bans or taxes on unhealthy food. Obesity results from a gradual accumulation of diet-related positively impaired energy balances. These are consequences of habitual consumption patterns and thus difficult to change by means of education and information campaigns. The life cycle approach furthermore shows that for all five sectors of the German social security system obesity is a burden that is not compensated by the obese person’s premiums if the person stays obese until death; for the Statutory Accident Insurance this holds since all premiums are paid by the employers. The obese thus “do not pay their way.” Given the development of obesity pointed out in the introduction, an increase in SHI premiums seems certain if obesity is not sufficiently reduced by effective prevention instruments. Future research might be fruitful in simulating different scenarios for weight reduction during the life-cycle with associated cost savings.

Our study has several limitations that need to be mentioned and discussed. The power and accuracy of diagnoses from the ICD10 that are regularly encoded in the medical service sections in Germany might not be appropriate and contain measurement errors (wrong or omitted codings); we thus have to rely on a sufficient accuracy of the diagnoses made by physicians. As already mentioned in the method section, we compared the prevalence of obesity in the GEDA survey data with the frequencies of the ICD obesity codes in the insurance collective of the Techniker Krankenkasse by age and found an average congruence ratio from 0.77 to 1.13 when directly relating these two figures. The degree of congruence varies with the discarding of possible outliers in the different age groups. The SHI data set also contains the whole bandwidth of cost levels for obese individuals, even for small treatments. By assumption we treated individuals as being obese even when the relationship between obesity and a treated disease had yet to be revealed by the physician. Since we would not assume that financial incentives drive the diagnosis coding of obesity, the cost calculation presented here might still be rather a lower bound, given that obesity does increase health costs (or at least does not reduce health costs) and some obese individuals might not have been assessed by the diagnosis coding. Taken together, we would thus regard our methodological approach as being sufficient to calculate a valid figure for the social costs of obesity, although a small bias in either direction is possible. Second, our operationalization of the variable “being obese” might be noisy in such a way that changing from one BMI type to another is not accounted for accurately. This problem however is a question of interpretation: For most persons the BMI type did not change for the whole observation period. It thus seems consistent with the theories of obesity evolvement that rapid weight changes do not occur. Even in the case of a severe disease such as cancer in which a person loses weight in a short period of time, the costs resulting from the later nonobese periods can be treated as being associated and caused by obesity. By assessing the frequency of physician visits from the PASS data set, it is almost certain that every obese individual received at least one medical treatment during the observation period. Hence, our classification, although not perfect, displays a sufficiently accurate assessment of the costs due to obesity. There are several ways to value intangible costs of obesity. The most common approach is the “willingness to pay” concept used in a contingent valuation or lottery design frame; however, despite a sound theoretical basis, it displays several weaknesses when implemented in empirical research. Since intangible costs are different in quality from direct and indirect costs that employ market price-based figures, we refrain from imposing a monetary value for pain and suffering from obesity here (for an alternative valuation method, see [43]). Taken together, we consider the insurance claim data to be sufficient for use in cost analyses of obesity. The applied control function approach could be criticized because of the used instruments in the first stage regression. All instruments displayed a strong impact on the different BMI categories (all model F-Statistics were above 10) and might not directly—as argued—determine health; however, the validity condition cannot be tested. Following our argumentation, the control function regression yields slightly lower health costs for obesity. This is plausible since some omitted factors might influence obesity and health costs at the same time in the model without control functions.

Conclusions

With our approach, the costs of €63.04 billion per year for obesity alone clearly exceed the direct and indirect costs of previous estimations. Especially top-down conducted cost-analyses thus seem to contain the analytical weaknesses we mentioned here, which then result in downward biased obesity cost assessments. Our results also show a significantly higher intangible health burden for obese individuals in terms of pain and suffering during the life-cycle. Finally, obese individuals “do not pay their way” in the German Statutory Health Insurance or in any of the other social insurance systems. Given these findings and in view of the current developments—the increase of obesity in Germany—the need for action is urgent. Therefore, it is recommended to fight obesity with effective prevention treatments by implementing structural incentives such as taxes on unhealthy foods and thus to significantly reduce health care and other social costs.

Notes

See: http://www.fdz-rv.de/.

See the Internet site of the "Forschungsdatenzentrum der Bundesagentur für Arbeit" for a more detailed description of the data: http://fdz.iab.de/de/FDZ_Individual_Data/PASS.aspx.

References

World Health Organization (WHO) Global Status Report on noncommunicable diseases. Attaining the nine global noncommunicable diseases targets; a shared responsibility. Geneva 2014. www.who.int/nmh/publications/ncd-status-report-2014/en (2014). Accessed 08 May 2015

Mensink, G.B.M., Lampert, L., Bergmann, E.: Übergewicht und Adipositas in Deutschland 1984–2003. Bundesgesundheitsbl Gesundheitsforsch Gesundheitsschutz. 48, 1348–1356 (2005)

Mensink, G.B.M., Schienkiewitz, A., Haftenberger, M., Lampert, T., Ziese, T., Scheidt-Nave, C.: Übergewicht und Adipositas in Deutschland—Ergebnisse der Studie zur Gesundheit Erwachsener in Deutschland (DEGS1). Bundesgesundheitsblatt 56, 786–794 (2013)

Schellevis, F.G., Van der Velden, J., Van de Lisdonk, E., Van Eijk, T.H., Van Weel, M.C.: Comorbidity of chronic diseases in general practise. J. Clin. Epidemiol. 46(5), 469–473 (1993)

Lewis, C.E., McTigue, K.M., Burke, L.E., Poirier, P., Eckel, R.H.: Mortality, health outcomes, and body mass index in the overweight range. A science advisory from the American Heart Association. Circulation 119, 3263–3271 (2009)

Effertz, T., Mann, K.: The burden and cost of disorders of the brain in Europe with the inclusion of harmful alcohol use and nicotine addiction. Eur. Neuropsychopharmacol. 23(7), 742–748 (2013)

Gil-Lacruz, A.I., Gil-Lacruz, M.: El rol de la propensión al riesgo para fumadores y personas con sobrepeso. Rev Psiquiatr Salud Ment 5, 139–149 (2012)

Mensink, G.B.M., Bauch, A., Vohmann, C., Stahl, A., Six, J., Kohler, S., Fischer, J., Heseker, H.: EsKiMo—Das Ernährungsmodul im Kinder- und Jugendgesundheitssurvey. Bundesgesundheitsbl Gesundheits-forsch Gesundheitsschutz 50, 902–908 (2007)

Lee, Y.S.: Consequences of childhood obesity. Ann. Acad. Med. 38, 75–77 (2009)

Pulgarón, E.R.: Childhood obesity: a review of increased risk for physical and psychological comorbidities. Clin. Ther. 35(1), A18–A32 (2013)

Graber, J.: Pubertal timing and the development of psychopathology in adolescence and beyond. Horm. Behav. 64, 262–269 (2013)

Whitaker, R.C., Wright, J.A., Pepe, M.S.: Predicting obesity in young adulthood from childhood and parental obesity. N. Engl. J. Med. 37(13), 869–873 (1997)

Von Lengerke, T., Krauth, C.: Economic costs of adult obesity: a review of recent European studies with a focus on subgroup-specific costs. Maturitas 69(3), 220–229 (2011)

Konnopka, A., Bödemann, M., König, H.H.: Health burden and costs of obesity and overweight in Germany. Eur. J. Health Econ. 12(4), 345–352 (2011)

Lehnert, T., Streltchenia, P., Konnopka, A., Riedel-Heller, S.G., König, H.H.: Health burden and costs of obesity and overweight in Germany: an update. Eur. J. Health. Econ. 16, 957–967 (2015)

Knoll, K.P., Hauner, H.: Kosten der Adipositas in der Bundesrepublik Deutschland: Eine aktuelle Krankheitskostenstudie. Adipositas 2, 204–210 (2008)

Liebl, A., Breitscheidel, L., Nicolay, C., Happich, M.: Direct costs and health-related resource utilisation in the 6 months after insulin initiation in German patients with type 2 diabetes mellitus in 2006 INSTIGATE study. Curr. Med. Res. Opin. 24, 2349–2358 (2008)

Von Lengerke, T., John, J., Mielck, A., KORA Study Group: Excess direct medical costs of severe obesity by socioeconomic status in German adults. Psychosoc Med (2010). doi:10.3205/psm000063

Von Lengerke, T., Hagenmeyer, E.G., Gothe, H., Schiffhorst, G., Happich, M., Häussler, B.: Excess health care costs of obesity in adults with diabetes mellitus: a claims data analysis. Exp. Clin. Endocrinol. Diabetes 118, 496–504 (2010)

Pendergast, K., Wolf, A., Sherrill, B., Zhou, X., Aronne, L.J., Caterson, I., Finer, N., Hauner, H., Hill, J., Van Gaal, L., Coste, F., Despres, J.P.: Impact of waist circumference difference on healthcare cost among overweight and obese subjects: the PROCEED cohort. Value Health. 13, 402–410 (2010)

Batscheider, A., Rzehak, P., Teuner, C.M., Wolfenstetter, S.B., Leidl, R., von Berg, A., Berdel, D., Hoffmann, B., Heinrich, J.: Development of BMI values of German children and their healthcare costs. Economics and Human Biology. Econ. Hum. Biol. 12, 56–66 (2014)

Krauth, C., Hessel, F., Hansmeier, T., Wasem, J., Seitz, R., Schweikert, B.: Empirische Bewertungssätze in der gesundheitsökonomischen Evaluation—ein Vorschlag der AG Methoden der gesundheitsökonomischen Evaluation (AG MEG). Gesundheitswesen. 67, 736–746 (2005)

Laird Birmingham, C., Muller, J.L., Palepu, A., Spinelli, J.J., Anis, A.H.: The cost of obesity in Canada. CMAJ. 160, 483–488 (1999)

Hammond, R.A., Levine, R.: The economic impact of obesity in the United States, diabetes, metabolic syndrome and obesity. Targets Ther. 3, 285–295 (2010)

Puhl, R.M., King, K.M.: Weight discrimination and bullying. Best Pract. Res. Clin. Endocrinol. Metab. 27(2), 117e127 (2013)

Rudolph, C.W., Wells, C.L., Weller, M.D., Baltes, B.B.: A meta-analysis of empirical studies of weight bias in the workplace. J. Vocat. Behav. 74(1), 1–10 (2009)

Giel, K.E., Zipfel, S., Alizadeh, M., Schäffeler, N., Zahn, C., Wessel, D., Hesse, F.W., Thiel, S., Thiel, A.: Stigmatization of obese individuals by human resource professionals: an experimental study. BMC Public Health 12, 525 (2012)

Hebl, M.R., Xu, J.: Weighing the care: physicians’ reactions to the size of a patient. Int. J. Obes. 25, 1246–1252 (2001)

Huizinga, M.M., Cooper, L.A., Bleich, S.N., Clark, J.M., Beach, M.C.: Physician respect for patients with obesity. J. Gen. Intern. Med. 24, 1236–1239 (2009)

Neumark-Sztainer, D., Story, M., Harris, T.: Beliefs and attitudes about obesity among teachers and school health care providers working with adolescents. J. Nutr. Edu. 31, 3–9 (1999)

Greenleaf, C., Weiller, K.: Perceptions of youth obesity among physical educators. Soc. Psychol. Educ. 8, 407–423 (2005)

Pérez-Ríos, M., Montes, A.: Methodologies used to estimate tobacco-attributable mortality: a review. BMC Public Health 8(22), 1–22 (2008)

Van Baal, P.H., Polder, J.J., de Wit, G.A., Hoogenveen, R.T., Feenstra, T.L., Boshuizen, H.C., Engelfriet, P.M., Brouwer, W.B.: Lifetime medical costs of obesity: prevention no cure for increasing health expenditure. PLoS Med. 5, e29 (2008)

Cutler, D.M., Richardson, E., Keeler, T.E., Staiger, D.: Measuring the health of the US population brookings papers on economic activity. Microeconomics 1997, 217–282 (1997)

Sachverständigenrat zur Begutachtung der gesamtwirtschaftlichen Entwicklung Statistisches Bundesamt/Conseil d‘Analyse Économique. Wirtschaftsleistung, Lebensqualität und Nachhaltigkeit: Ein umfassendes Indikatorensystem. http://www.sachverstaendigenrat-wirtschaft.de/fileadmin/dateiablage/Expertisen/2010/ex10_de.pdf (2010). Accessed 08 May 2015

Fleurbaey, M.: Beyond GDP: the Quest for a Measure of Social Welfare. J. Econ. Lit. 47(4), 1029–1075 (2009)

Koopmanschap, M.A., Rutten, F.F.H., van Ineveld, B.M., van Roijen, L.: The friction cost method for measuring indirect costs of disease. J. Health Econ. 14, 171–189 (1995)

Charlson, M.E., Pompei, P., Ales, K.L., MacKenzie, C.R.: A new Method of classifying prognostic comorbidity in longitudinal studies: development and validation. J. Chron. Dis. 40(5), 373–383 (1986)

Swart, E., Ihle, P.: Routinedaten im Gesundheitswesen. Handbuch Sekundärdatenanalyse: Grundlagen, Methoden und Perspektiven 2. Auflage. Huber, Bern (2014)

Robert Koch Institut Beiträge zur Gesundheitsberichterstattung des Bundes Daten und Fakten: Ergebnisse der Studie» Gesundheit in Deutschland aktuell 2009 «http://www.rki.de/DE/Content/Gesundheitsmonitoring/Gesundheitsberichterstattung/GBEDownloadsB/GEDA09.pdf?__blob=publicationFile (2020). Accessed 08 May 2015

Rice, D.P.: Estimating the Cost of Illness. Health Economics Series, vol. 6. Department of Health Education and Welfare, Rockville (1966)

Mullahy, J.: Specification and testing of some modified count data models. Journal of Econometrics. 33(3), 341–365 (1986)

Effertz, T.: Die volkswirtschaftlichen Kosten gefährlicher Konsumgüter—Eine theoretische und empirische Analyse für Deutschland am Beispiel Alkohol, Tabak und Adipositas. Peter Lang Verlag Frankfurt am Main, Bern (2015)

Wooldridge, J.M.: Econometric Analysis of Cross Section and Panel Data, 2nd edn. MIT Press, Cambridge (2010)

Angrist, J.D., Krueger, A.B.: Instrumental variables and the search for identification: from supply and demand to natural experiments. J. Econ. Perspect. 15(4), 69–85 (2001)

Clark, D., Royer, H.: The effect of education on adult mortality and health: evidence from Britain. Am. Econ. Rev. 103(6), 2087–2120 (2013)

Basu, A., Manning, W.G.: Estimating lifetime or episode-of-illness-costs under censoring. Health Econ. 19, 1010–1028 (2010)

Flegal, K.M., Kit, B.K., Orpana, H., Graubard, B.I.: Association of all-cause mortality with overweight and obesity using standard body mass index categories—a systematic review and meta-analysis. JAMA 309(1), 71–82 (2013)

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interests.

Appendix

Rights and permissions

About this article

Cite this article

Effertz, T., Engel, S., Verheyen, F. et al. The costs and consequences of obesity in Germany: a new approach from a prevalence and life-cycle perspective. Eur J Health Econ 17, 1141–1158 (2016). https://doi.org/10.1007/s10198-015-0751-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10198-015-0751-4