Abstract

This paper studies the impact of fiscal decentralization on public sector efficiency (PSE). We first use a theoretical framework that illustrates the two opposing forces that shape a non-monotonic effect of fiscal decentralization on PSE. Subsequently, we carry out an empirical analysis for 21 OECD countries, between 1970 and 2000. A country-level dataset is used to measure PSE in delivering education and health services and the new indices are regressed on well-established decentralization measures. Irrespective of whether PSE concerns education or health services, an inverted U-shaped relationship has been identified between government efficiency in providing these services and fiscal decentralization. This relationship is robust across several different specifications and estimation methods.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It has long been recognized that governments differ significantly in the efficiency of delivering public services (ref. Tanzi and Schuknecht 1998; Afonso et al. 2005). Some are extremely wasteful and ineffective in performing even basic activities, whereas others achieve their objectives systematically and comprehensively. The efforts to increase government productive efficiency, otherwise termed public sector efficiency (hereafter referred to as PSE), has spawned an output of vital theoretical literature on channels that may affect it. One of the most prominent channels is the design of fiscal relations across the various levels of government.

The theoretical literature on fiscal federalism identifies two benchmark channels through which fiscal decentralization is expected to affect PSE positively, namely (i) increased electoral control and (ii) yardstick competition among local governments that results from decentralization.Footnote 1 According to the electoral control mechanism, decentralization reduces the inclinations of officials to divert rents, and increases the probability of “bad” incumbents to be voted out of office, thus positively affecting the overall government efficiency (Hindriks and Lockwood 2009). Moreover, Seabright (1996) shows that rent-seeking politicians, when contesting in decentralized elections, use incentives to lure the voters in each (local) constituency. In contrast, to get re-elected in the national elections politicians would seek to please the voters only in a majority of the localities. Similar results are obtained by Hindriks and Lockwood (2009) and Myerson (2006). According to the theory of yardstick competition (see e.g., Shleifer 1985; Besley and Case 1995), citizens are at an advantage when they are able to evaluate the performance of their policy makers by comparing the policy choices of their own political representatives with the corresponding choices of the neighboring regions’ policy makers. Therefore, fiscal decentralization may increase PSE, as it offers citizens an opportunity to compare public services and taxes across jurisdictions and helps them to assess whether their government wastes resources through low human capital capacity or rent-seeking (Besley and Smart 2007).

However, fiscal decentralization may also exert a negative impact on government efficiency. This impact can be attributed to a number of potential advantages gained by the provision of public goods by central governments. First, in the presence of economies of scale, higher decentralization might lead to a higher average cost of production for the public good (Stein 1997). Second, national government bureaucracies are more likely to offer talented people better careers and promotion opportunities, which in turn attract higher quality individuals (Prud’homme 1995). Finally, other scholars emphasize the potential danger that local politicians and bureaucrats are likely to face, particularly an increase in pressure from local interest groups, with these groups being more influential when the size of the jurisdiction is small (Bardhan and Mookerjee 2000; Prud’homme 1995).

As the discussion above indicates, the theoretical literature is inconclusive about the relationship between fiscal decentralization and PSE. If the above considerations were to be consolidated, it becomes logical to argue that fiscal decentralization involves both negative and positive forces on PSE. Therefore, such arguments could also indicate a potential non-linearity. Particularly, in relatively centralized systems, an increase in the degree of fiscal decentralization can induce some costs due to diseconomies of scale in the provision of the public good, therefore reducing PSE; however, it will also create large gains from an increased electoral accountability. Interestingly, in highly decentralized jurisdictions, further increases in decentralization imply that diseconomies of scale would prevail over the positive effects of electoral accountability, consequently lowering PSE. In the theoretical section of this paper, we develop a simple theoretical model that formalizes the arguments of the relevant literature and illustrates an inverted U-shaped relationship between fiscal decentralization and PSE.

Over the recent years, a small, albeit growing, body of empirical work on the quality of governance-fiscal decentralization nexus (Fisman and Gatti 2002a; Enikolopov and Zhuravskaya 2007) has been observed. Most of these studies measure the quality of governance by some internationally comparable outcome of government policy, such as infant mortality, the literacy ratio, immunization of population, etc. Also, the key explanatory variable is fiscal decentralization, measured as the ratio of sub-national government expenditures (resp. tax revenues) to total public spending (resp. tax revenues). Although these studies offer contradicting evidence concerning the relationship between the outcomes of government policy and fiscal decentralization, the relationship identified (positive or negative) is always linear.Footnote 2 However, the theoretical hypotheses postulated above are probably not comprehensively addressed by employing socioeconomic indicators as measures of “good governance”. This is because such measures do not encompass the size of government spending and thus fail to reflect the level of efficiency in delivering government services. Barankay and Lockwood (2007) state, “[...] these regressions do not estimate government “production functions” because they do not control for the inputs to the output that is the dependent variable. [...] In the absence of controls for these inputs, these regressions cannot tell us much about the efficiency of government, as any observed correlation between decentralization and government output can be due to omitted variable bias.”

To cope with this problem, in the empirical section of the paper, we develop direct measures of PSE by employing data envelopment analysis (DEA) on a panel of 21 OECD countries, between 1970 and 2000. The PSE measures are constructed using information on the “inputs” and “outputs” of the public sector. Within this framework, we implicitly assume that these indicators are derived from an underlying government production relationship. We focus on public education and health and construct two alternative PSE indices reflecting government efficiency in delivering services in these two sectors. Subsequently, we use the PSE indices to identify the potential public sector efficiency-fiscal decentralization nexus.

We find that PSE increases with the degree of fiscal decentralization up to a certain degree of decentralization and thereafter decreases, i.e. revealing an inverted U-shaped relationship. This result appears to be robust across a number of different specifications and estimation methods that account, inter alia, for the potential reverse causality between fiscal decentralization and PSE. Notably, this is the first study to identify such a non-linear pattern, a finding consistent with both contradicting stands of the theoretical literature. Also, we are able to calculate the particular level of decentralization at which the relationship at hand turns negative and relate this value to certain countries.

The rest of the paper is organized as follows. Section 2 develops a theoretical framework that illustrates the effects of fiscal decentralization on public sector efficiency and derives the main testable hypotheses. Section 3 describes the empirical model and data used in the empirical analysis. Section 4 illustrates the various econometric methodologies employed and discusses the empirical results. Section 5 concludes.

2 Theoretical considerations

This section elaborates on the theoretical link between public sector efficiency and fiscal decentralization so as to formalize testable empirical implications of the relevant theoretical literature.

We build a simple model similar to that developed by Stegarescu (2009) and Liberati and Sciala (2011). We consider a federation with \(i=1, 2,{\ldots },N\) jurisdictions of equal population normalized to unity. The central government decides the level of the unit tax \(t_{i}\) imposed in each jurisdiction, raises the taxes and distributes them among jurisdictions. Thus, the central government gives to each local government an equal share \(\theta \) of total tax revenues \(\mathrm{T}_L =\frac{1}{\mathrm{N}}\left[ {\theta \sum _{i=1}^N {t_i } } \right] \), which is used by the local officials for the production of the local public good \(g_{L,i}\).Footnote 3

The local government in each jurisdiction decides the amount of inputs \(x_{i}\) to produce \(g_{L,i. }\)We assume that the production of local public goods exhibits falling marginal product, i.e. we assume that \(g_{L,i} =\left( {x_i } \right) ^{\varphi }\) where \(\varphi <1\) is a technology parameter. Local officials care about the utility of the electorate, but they also aim to extract resources from the local budget for their own benefit. Diverted rents are the difference between the revenues received from the central government \(\mathrm{T}_L\) minus the real cost of inputs \(x_{i}\). The ability of local officials to extract resources is negatively related to fiscal decentralization, since the latter implies increased electoral control for the local governments.

The rest (\(1-\theta )\) share of the budget is used by the central government to buy inputs, which are employed in the production of public services \(g_{C}\). Following the rationale of the relevant literature (Stein 1997; Prud’homme 1995) we assume that public services provided by the central government, are produced with superior technology compared to the corresponding public services provided by local governments. Specifically, we assume that \(g_{C}\) is produced with a linear technology.

Given the above, the model implies a negative impact of increased decentralization on public sector efficiency, and this comes as a result of the inferior technology and consequently increased per capita cost in the production of local public services. However, in highly decentralized systems, local governments face increased electoral control which in turn implies lower extraction of public resources and higher public sector efficiency (Hindriks and Lockwood 2009). Therefore, increased decentralization also induces a positive impact on public sector efficiency, due to increased electoral control and lower rents.

The sequence of events is as follows. First, the central government decides the level of the unit tax \(t_{i}\) and the corresponding amount of central public services \(g_{C}\). In turn, each local government decides the amount of inputs \(x_{i}\) in order to produce public good \(g_{L,i}\). In doing so it takes the level of the unit tax \(t_{i}\) and the distribution of taxes among regions as given. Working with backwards induction, we first solve the local government problem by taking the tax rate as given. In turn we solve the problem of the central government.

2.1 The local government decision problem

The local government in each jurisdiction receives an equal amount of taxes from the central government \(\mathrm{T}_L =\frac{1}{\mathrm{N}}\left[ {\theta \sum _{i=1}^N {t_i } } \right] \) and chooses the level of inputs \(x_{i}\) employed in order to produce the local public good \(g_{L,i}\). To obtain simple closed-form solutions we assume that local politician maximize the following log linear utility function:

where \(y\) is the exogenous private income, which is assumed equal across jurisdictions.

Local officials care also about the rents they can extract from the local budget, which is the difference between revenues received from the central government \(\mathrm{T}_L \) and the cost of inputs \(x_{i}\), the price of which is assumed to be fixed to unity. Parameter \(\lambda (\theta )\) is the relative weight that local politicians place on diverting rents. The higher the \(\lambda (\theta )\), the higher the weight placed on diverted rents and the lower the weight on voter’s welfare. Therefore a high \(\lambda (\theta )\) implies that voters are less able to control the local politicians (electoral accountability is lower) and the extraction of public resources becomes easier. We assume that \(\lambda \) is a function of fiscal decentralization \(\theta \) and that higher decentralization results into lower electoral accountability at an increasing rate, i.e. \(\lambda _\theta <0,\lambda _{\theta \theta } >0\). To obtain simplified results we can assume, without loss of generality, that \(\lambda (\theta )=\frac{\alpha }{\theta }\) with \(\alpha \) constant, \(\alpha >1\).

Inserting the production function of the local public good into (1) and maximizing with respect to \(x_{i}\) we take the following first order condition:

and this gives the equilibrium level of inputs in jurisdiction \(i\):

2.2 The central government’s decision problem

The central government chooses unit tax \(t_{i}\) that maximizes the utility of the individuals in the economy.Footnote 4 The utility function of each individual is given by:

Introducing (3) and the revenues allocated to the central government into (4) we can re-write the objective function of the central government as follows:

Maximizing with respect to \(t_{i}\) we get:

Given that the optimal tax rate for the central government does not depend on the jurisdiction-specific parameters, the optimal tax policies are symmetric ex-post. Specifically, the optimal tax rate in each jurisdiction is as follows:

2.3 The nexus between public sector efficiency and fiscal decentralization

Following the rationale of the relevant literature (e.g., Afonso et al. 2005; Adam et al. 2011b), we define total public sector inefficiency as the summation of the public good provided by the local and the central government to the summation of taxes. Therefore public sector efficiency (PSE) can be expressed as:

Inserting the production functions of the local, central public good and the Eqs. (3) and (7) into (8) we obtain:

Taking the first order derivative with respect to \(\theta \) we get:

the sign of which can be positive or negative. Thus, the effect of \(\theta \) on PSE is non-monotonic.

Moreover, by taking the second order derivative with respect to \(\theta \) we get:

which is always negative.

From (10) and (11) we conclude that the relationship between PSE and fiscal decentralization is non-monotonic and that the turning point is a maximum. The above discussion can be summarized in the following Fig. 1. In the following section we examine empirically whether decentralization has indeed a non-monotonic effect on PSE as this theoretical model predicts.

3 Empirical model and data

The empirical model used to study the relationship between fiscal decentralization and public sector efficiency is as follows,

where public sector efficiency \(pse_{it} \) in country \(i\) at time \(t\), is expressed as a function of fiscal decentralization, a set of control variables and a stochastic term \(u_{it}\). The inclusion of the quadratic term reflects the expected inverted U-shaped relationship between PSE and decentralization, as discussed above. To estimate Eq. (12) we first construct the PSE indicators. Next, we discuss the data on the variables used in this study.

We build an unbalanced panel dataset of 21 OECD countries spanning the 1970–2000 period.Footnote 5 The reason for our choice is because reliable data are available for these countries to construct the PSE indicators and obtain the main explanatory variables for the empirical analysis. The dependent and explanatory variables are discussed below. Explicit definitions and sources for the variables used are provided in “Appendix 1” and the descriptive statistics are reported in Table 1.

3.1 Measurement of public sector efficiency

The measurement of PSE and the resulting comparison of the individual countries in the context of the efficient functioning of their public sectors, presents a number of difficulties related to the scarcity of publicly available country-level data and the complicated problems that may emerge in the estimation procedure. In this study, we primarily opt for a direct estimation of PSE, using the linear programming technique of Data Envelopment Analysis (DEA), but we also check the robustness of our results using the Stochastic Frontier Approach (SFA).Footnote 6 DEA is a linear programming technique that provides a piecewise frontier, by enveloping the observed data points and yields a convex production possibilities set (for a thorough discussion, see Coelli et al. (2005). As such, it does not require the explicit specification of a functional form of the underlying production relationship. To introduce some notation, let us assume that for \(N\) observations there exist \(M\) inputs in the production of public goods, yielding \(S\) outputs. Hence, each observation \(n\) uses a nonnegative vector of inputs denoted \(x^{n}=(x_1^n ,x_2^n,\ldots ,x_m^n )\in R_+^M \) to produce a nonnegative vector of outputs, denoted \(y^{n}=(y_1^n ,y_2^n ,\ldots ,y_S^n )\in R_+^S \). Production technology \(F=\{(y,x):x \hbox {can produce y}\}\) describes the set of feasible input-output vectors.

To measure productive efficiency we use both the input- and the output-oriented DEA models.Footnote 7 Most of our results rely on the input-oriented model, which is of the following form (for exposition brevity subscripts \(t\) are dropped):

where public sector 0 represents one of the \(N\) public sectors under evaluation, and \(x_{i0}\) and \(y_{r0}\) are the \(i\)th input and \(r\)th output for public sector 0, respectively. If \(pse_{i}^{*}= 1\), then the current input levels cannot be proportionally reduced, indicating that public sector 0 is on the frontier. However, if \( pse_{i}^{*}<1\), then public sector 0 is inefficient and \(pse^{*}\) represents its input-oriented efficiency score. Thus, \(pse\in \) [0.1]. Finally, \(k\) is the activity vector denoting the intensity levels at which the \(N\) observations are conducted. Note that this approach, through the convexity constraint \(\Sigma k=1\) (which accounts for variable returns to scale) forms a convex hull of intersecting planes, as the frontier production plane is defined by combining some actual production planes.

To measure PSE we need to focus on specific areas of government activity. As it is impossible to consider all the areas of government activity and the corresponding government output, we construct two alternative PSE indicators as proxies of PSE: (i) PSE in providing education services and (ii) PSE in providing health services. In our view these two areas of government activity have the advantage that the output of both areas is directly measurable.

Following the rationale of the relevant literature (see e.g., Afonso et al. 2005; Adam et al. 2011a), we employ the following measures.Footnote 8 As an output of public education spending, we use the years of schooling provided by Barro and Lee (2001) multiplied by the educational quality indicator “cognitive” developed by Hanushek and Woessmann (2009). The “cognitive” indicator allows us to capture potential qualitative differences on education among different countries. Besides, as the educational systems of the OECD countries are far from being homogeneous in the sources of spending (private or public), it becomes important to account for the different shares of private to public spending on education.Footnote 9 As such, we multiply the outputs of public education spending (i.e., years of schooling multiplied by cognitive) by the ratio of public to total spending. In this way, we seek to mitigate the impact of private expenditure on output and consequently, we don’t give countries characterized by heavy private funding on education an undue advantage.Footnote 10

As an output of public spending on health, we employ the inverse of the infant mortality rate at birth (deaths/live 1,000 births) taken from OECD Health Data (2007). As in the case of education, we account for differences in the shares of private to public spending on health by multiplying the output of public spending on health by the ratio of public to total spending on health. We do this to mitigate the impact of private spending on the obtained outcomes.Footnote 11 As input, in the case of PSE in education, we employ public education spending as a share of GDP (taken from Busemeyer 2007), whereas in the case of PSE in health, we employ public spending on health as a share of GDP (taken from OECD Health Data 2007).

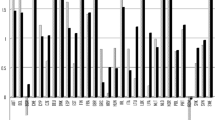

Estimation of program 2 is carried out on annual data to obtain annual indices of PSE in providing public education and health services. For each of the education and health variables, we pool all panel observations together. We end up with 492 observations for the PSE education variable and with 597 observations for the PSE health variable (see Table 1 for summary statistics). Space constraints prevent reporting the yearly values of the indices; therefore, 10-year averages are presented for each country in Fig. 2 (the full set of results is available on request). The first set of graphs presents the PSE index in providing education services (PSE education), while the second set shows the PSE index in providing health services (PSE health). Missing values on the PSE indices for some countries reflect missing data for the input or the output of the production process. The PSE education figures indicate that in the 1970s and 1980s, Australia, Japan, Switzerland and USA reflected high efficiency scores, while in earlier years Norway gained much ground. The results are similar in the PSE health figures, the exception being Greece and Finland, which were among the best-performing countries. Overall, these results appear to be reasonable approximations of prior academic belief and concur with the findings of earlier research (see e.g., Afonso et al. 2005). The yearly values of PSE education and PSE health are used as the dependent variable in the subsequent empirical analysis.

3.2 Fiscal decentralization measures

Approximating the degree of fiscal decentralization has been an issue of considerable disagreement in empirical studies. In this paper, we follow the method adopted by Stegarescu (2005), who develops a measure of fiscal decentralization based on the detailed data provided by OECD (1999). The advantage of the OECD (1999) survey is that it very analytically classifies sub-national government taxes based on the degree of decision-making autonomy. Specifically, it separates taxes that are set by sub-central governments (i.e. sub-central governments determine the tax rate and the corresponding tax base) from those that are determined by the central government at a national level and in turn shared with sub-national units. Therefore, Stegarescu’s measure of fiscal decentralization reflects the “real” tax-raising autonomy of sub-national units, as it includes as local tax revenues only those taxes strictly determined by sub-national governments. This measure has been used in the works by Stegarescu (2005, 2009) and Fiva (2006). As a sensitivity analysis we also experiment with the budgetary share of sub-national units as recorded by the IMF’s Government Financial Statistics (GFS).Footnote 12

The tax revenue decentralization indicator of Stegarescu is referred to as taxrevdec, while the GFS decentralization indicator as decindex. For explicit definitions of these measures, see “Appendix 2”. Higher values on the two indices reflect higher levels of decentralization. Countries with a high level of fiscal decentralization are Switzerland, Canada and Sweden, while Austria, Ireland and Netherlands show a low degree of decentralization. Overall, 522 observations are available for the taxrevedec index, while a smaller number of observations (481) are available for the decindex index.

3.3 Control variables

To ensure robust econometric identification, we use a number of control variables in the estimated equations. First, to control for the overall level of productivity and wealth in the economy, we employ the log of real GDP per capita. Data for this variable is from the World Banks’, World Development Indicators (WDI) (2004). Countries with higher real income are expected to have a more productive private and public sector. In addition, we account for the presence of economies of scale in the production of the public good at the country level, by controlling for (i) the logarithm of total population, (ii) population density (measured by the number of people per square km) and (iii) the share of urban population to total population. Data for these variables are from the WDI. Higher values for these variables imply higher potential economies of scale in the production of public goods, and thus we expect them to be positively associated with PSE indicators.

According to Alesina et al. (2003), Porta et al. (1999) and Alesina and Ferrara (2005), countries with high ethno-linguistic fractionalization are expected to exhibit inferior government performance for four reasons. First, high ethnic fractionalization results in pressures for redistribution between groups (Easterly and Levine 1997). Second, fractionalization may lead to a high demand for publicly-provided private goods, especially those that can be targeted towards specific groups (Alesina et al. 2003). Third, it is also possible that a relationship between fractionalization and corruption is formed, which will result in higher inefficiency. Finally, in more extreme circumstances, increased ethnic fractionalization may lead to ethnic hatred and, ultimately, to violent civil wars that disrupt the workings of government (see Fearon 2003). Following Easterly and Levine (1997), we control for ethno-linguistic fractionalization using the Herfindahl index, which is calculated on the basis of the share of each separate ethno-linguistic group over total population (data are from Porta et al. 1999).

To control for the structure of the political system we use two dummy variables. First, we use a dummy that takes the value 1 when the electoral system is considered to be majoritarian, and a value of 0 otherwise. PSE is expected to be higher in countries that use the majoritarian system, as the electoral outcome is generally more sensitive to the incumbent’s performance in majoritarian-type elections (Persson and Tabellini 2003; Persson et al. 2003). Second, we consider whether delegation of power affects PSE. Myerson (1993) and Persson and Tabellini (2003, 2004), suggest that as presidential regimes create a direct link between individual performance and re-appointment in office, the elected officials have strong incentives to perform well, which stimulates public sector performance. The potential impact of the presidential systems on PSE is captured by a dummy variable that takes the value 1 in countries with presidential systems, and 0 in those with parliamentary systems. Information on the majoritarian and presidential variables is from Persson and Tabellini (2004).

Another set of variables illustrates the structure of the elected government. First, we control for the number of ministers who directly use (spend) part of the government budget (i.e. the total number of ministers, excluding the minister of finance). As these ministers are expected to be concerned about the size of the budget they control,Footnote 13 the relationship between the number of spending ministers and PSE should be negative. This effect is consistent with the idea that diseconomies of scale may be present in the administration of government (see e.g. Stein 1997). Data for this variable is from Mierau et al. (2007). The variable coalition governments, which is obtained from Tavares (2004), is a dummy variable, taking the value 1 if a coalition cabinet that includes ministers from two or more parties is in power. As the number of parties involved in the government increases, the accountability of each of the parties usually diminishes, thus providing fewer incentives for efficiency. Also, coalition governments are typically associated with a shorter life span (Schofield 1993; Müller and Strøm 2000), and therefore are less concerned with superior performance. Finally, we account for the effect of electoral cycles by including a dummy variable in the empirical analysis, which takes the value of 1 when elections take place that particular year (data is from Tavares 2004).

Finally, to control for the regulatory environment in the economy we add another dummy variable among the regressors, which takes the value 1 when the country has British legal origin and zero otherwise. Data for this variable is taken from Porta et al. (1998). Studies like that of Djankov et al. (2003) suggest that countries with common law (British legal origin) take a more decentralized approach to solving social problems, whereas civil-law countries follow a more regulatory approach. Thus, common-law countries are expected to have less regulations and state intervention in the economy and such elements are usually associated with higher efficiency in providing public goods. Table 2 provides the correlation matrix of the variables.

4 Estimation and results

4.1 Estimation method and baseline results

As discussed above, the PSE indicators take values between 0 and 1 (inclusive), with values closer to 1 denoting higher efficiency levels. Therefore, an appropriate econometric specification corresponds to a censored model of the following general form:

where \(\lambda _{t}\) corresponds to time-effects common to all countries, \(\widehat{pse}\) are the predicted values of the regression and the rest of the variables are noted as in Eq. (12). By construction, the predicted values must be always lower than unity; otherwise they will need to be censored. As in the majority of literature that uses macroeconomic indicators over a large time frame, using time-effects is crucial to this analysis. In addition, pse has both time and cross-sectional (country) dimensions. Thus, panel estimation techniques are used to estimate Eq. (14). Given that we are dealing with a censored regression model, we resort here to the panel-data Tobit methodology with bootstrapped standard errors. As robustness check we also consider (i) a method similar to that proposed by Simar and Wilson (2007), (ii) a simple panel data fixed effects model and (iii) a GMM model for dynamic panels.Footnote 14

The baseline results are presented in Tables 3 and 4, where the dependent variables are the PSE education and PSE health indices, respectively. As inefficiency might cause reform over time, all estimated equations include time effects, the results of which are not reported for space constraints reasons. In column 1 of Table 3, the coefficient on the decentralization variable is positive and statistically significant at the 1 % level, suggesting a strong positive link between fiscal decentralization and PSE in providing education services. The same is true for the regression of PSE health (see column 1 of Table 4). Therefore, the results of this study are consistent with the part of the theoretical framework that highlights a positive effect of fiscal decentralization on PSE through, for example, enhanced electoral control and yardstick competition among local governments. Although no prior studies on this relationship using macroeconomic data and a direct measure of PSE exist, this result is in line with the findings of Barankay and Lockwood (2007), who use micro data on Swiss cantons.

Following this baseline equation, we examine whether the potential negative effects of decentralization prevail when decentralization levels are high. In other words, we look into the possible non-linearity in the fiscal decentralization-PSE nexus. In column 2 of Tables 3 and 4 we include the squared term of the decentralization variable and we find that the impact of decentralization on PSE is indeed non-linear (inverted U-shaped), as the level and the squared term of the decentralization variable are statistically significant at the 1 % level. Notably, this effect remains robust across all specifications in Tables 3 and 4, and thus is irrespective of the variable used to proxy PSE or the inclusion of different control variables in the estimated equations. Intuitively, although the positive forces of fiscal decentralization mentioned above exert a positive impact on PSE, this effect fades out after a certain level of decentralization is reached, probably owing to problems associated with the loss of benefits from economies of scale (Stein 1997) and the increasing dependence on local officials, who are selected from a lower quality pool of applicants (Prud’homme 1995).

In fact, the level of fiscal decentralization where its impact on PSE becomes negative, can be calculated using the ratio [(coefficient on decentralization)/(2*coefficient on the squared term of decentralization)]. For the last regression in Table 3, where all the control variables are included, this ratio yields a value of 34.46. This value represents the level of fiscal decentralization that optimizes PSE in the sample of this study, and is found to be very close to the average decentralization values of USA (0.37) and Japan (0.33). The equivalent value for the PSE health (last regression of Table 4) is 47.1, which is closer to the average fiscal decentralization levels of Canada and Sweden. Certainly, these values are related to estimations based on our sample and, thus, should be treated with caution, as they may not be applicable to other groups of countries.

The economic effect of fiscal decentralization on PSE is also quite large. According to the results in column (5) of Table 4, a one standard deviation increase in fiscal decentralization increases PSE in education by approximately 0.97 points for the countries with a level of decentralization lower than 34.46 within 1 year. The equivalent increase in PSE in the provision of health service is even larger, with a one unit increase in fiscal decentralization yielding an increase in PSE health of approximately 1.88 points.

Concerning the remaining explanatory variables, higher GDP per capita is observed to be usually associated with higher PSE in providing education and health services, which is intuitive because rich / productive countries tend to have a more efficient public sector. Population density and the logarithm of population are positive and significant determinants of PSE in both Tables 3 and 4, suggesting that higher economies of scale in the production of public goods benefit PSE education and health. The impact of urban population is insignificant in the PSE education regressions, while it is negative and highly significant in the PSE health regressions. The latter result appears puzzling and a plausible explanation may be that in overpopulated places, the health systems suffer from overcrowded public hospitals and other medical centers, and therefore, diseconomies of scale in the production of services related to health.

Ethno-linguistic fractionalization appears to affect PSE education negatively, indicating that higher population heterogeneity is associated with lower PSE in providing education services. This concurs with prior theoretical studies, as countries with a heterogeneous population resort to higher redistribution among groups and less spending on productive public goods. However, this seems to hold true concerning only the education services, as the fractionalization variable is insignificant in the PSE health equations. This finding may possibly be related to the different nature of the two services, with ethnic groups having clearly different cultural preferences regarding education services, while requesting homogeneous services in health.

In column (3) of Tables 3 and 4 we additionally control for the structure of the political system, whereas in column (4) we control for the structure of the elected government. Finally, specification (5) includes all the control variables. The results show that PSE is lower in countries with majoritiarian systems and higher in those with presidential systems; however, the effect of these variables is not robust across specifications.Footnote 15 Also, the public sectors of countries with a British legal origin are significantly more efficient in providing health and, more importantly, education services. Finally, among the three variables characterizing the structure of the elected government and the time of the elections, only the number of spending ministers is found to be significantly linked to the PSE measures in this study. In particular, a higher number of spending ministers lowers PSE, a result consistent with the idea that diseconomies of scale may be present within the government, leading to diminished government output (see Mierau et al. 2007).

4.2 Sensitivity analysis

In this section we inquire into the robustness of our baseline results. First, the issue of causality is tackled; the central authorities may grant more autonomy to efficient local governments (i.e. more fiscal decentralization). In order to treat this potential problem of reverse causality, we employ an instrumental variables approach. One obvious choice for an instrument is a measure of preference heterogeneity.Footnote 16 Higher preference heterogeneity leads to more decentralization (Alesina et al. 2005). On the other hand, preference heterogeneity per se is not expected to affect public sector efficiency: voters may have different preferences for the composition of public spending, but will always opt for efficient production by the public sector.

To capture voter preferences heterogeneity we construct two indices, using information from the World Values Survey (WVS). In particular, the WVS asks individuals how much confidence they have in different institutions and organizations. The question is as follows: “I am going to name a number of organizations. For each one, could you tell me how much confidence you have in them: (i) is it a great deal of confidence, (ii) quite a lot of confidence, (iii) not very much confidence or (iv) none at all?” Here, we focus on the answers given by the respondents about their confidence in two types of institutions, namely (a) Churches (item E069 in the database) and (b) Armed Forces (item E070), and we construct two alternative Herfindahl Concentration Indices:

where \(S_{i}\) is the share of group that gave each one of the four alternative answers. We use the two indices as instruments separately, but we also combine them linearly (using their average) as a single instrumental variable characterizing preference heterogeneity. We only report the results from the combined instrument, as the rest are very similar. Since we have both our decentralization variable and its square as endogenous, we also use the squared term of the instrument. In principle, heterogeneity in attitudes toward churches and armed forces is likely to signal a higher demand for decentralized governments with more local autonomy. In contrast, this variable should not have any direct causal effect on our indices of PSE. In other words, large variance in the beliefs about the confidence in the role of military forces and church are not likely to directly affect public sector’s performance in providing health and education services. If anything, the impact of these variables on our PSE indices will be through fiscal decentralization.

We report the results in Table 5. Estimation method is two-stage least squares (2SLS) for panel data with fixed effects and robust standard errors. Some observations drop out compared to previous tables because of the non-availability of our instrumental variable for three countries, namely Greece, Luxembourg and Switzerland. The first-stage results, reported in the upper part of Table 5 show that our instruments are highly significant determinants of fiscal decentralization in both the education and the health equations. The good fit of the instrumental variables is also confirmed by the under-identification and weak identification tests of Anderson (1951) and Kleibergen and Paap (2006), that report rejection of the relevant hypotheses (for more on these issues, see Baum et al. 2007. In both specifications, the coefficients on decentralization and decentralization squared remain statistically significant at the 1 % level. Thus, we can conclude that reverse causality does not drive the findings of the main analysis above.

Second, we consider using the decentralization measure of IMF’s Government Financial Statistics (GFS), which shows the sub-national revenues as a share of total revenues. The results are reported in column (1) of Tables 6 and 7, for both education and health equations, respectively, and show that the non-linear impact of fiscal decentralization on PSE is true only for the education equation. This probably indicates that using decentralization indicators adjusted for actual tax-raising autonomy (i.e. the results of Stegarescu 2005) describes the present relationship more accurately.

In columns (2) and (3) of Tables 6 and 7 we exclude in turn the Mediterranean and Scandinavian countries from our sample. In both the PSE education and PSE health equations, the relationship between fiscal decentralization and PSE remains an inverted U-shaped one, showing that our main result is not sensitive to the effect of specific regions.

In Eq. (4) of Tables 5 and 6, we investigate whether corruption is the element captured by our PSE indicators that primarily drives our results. Although PSE involves many types of non-productive spending (e.g. personnel expansion, inefficient bureaucratic organization etc.) it may also include actual corruption. Then, it may be argued that the effect of decentralization on PSE is driven by the effect of fiscal decentralization on corruption. We examine this hypothesis by running a simple OLS regression of PSE on corruption and using the residuals as our dependent variable.Footnote 17 The results remain practically unchanged, showing that the PSE indicator in this study is a broader measure that encompasses additional elements of public sector inefficiency that may include (but are not limited to) personnel expansion (Williamson 1964), lower effort (Wyckoff 1990) and excessive risk aversion (Peltzman 1973).Footnote 18

In the equations presented in columns (5)–(6) we examine whether our results are driven by the econometric method used. In column (5) we present the results obtained from a simple panel data fixed effects model and we observe that the non-linear relationship remains unaffected. The same is true when we estimate our empirical model using the method of Simar and Wilson (2007). These regressions are carried out using Algorithm 2, as done by Simar and Wilson (2007, pp. 42–43), but with a Tobit panel data method instead of the truncated cross-sectional regression method employed by Simar and Wilson. To obtain bootstrap estimates we follow the suggestion of Simar and Wilson in using 100 replications. Finally, bootstrap standard errors (needed to calculate t-statistics) are estimated using 1,000 replications. Again, the estimated coefficients and their significance are very similar to those reported in column (5) of Tables 3 and 4.

In column (7) of Tables 6 and 7 we present the results from the output-oriented method, which assesses by how much output can be increased, without varying the input quantities used. The coefficients on the decentralization variable and its squared term retain their statistical significance, as well as the positive and negative sign, respectively. The same holds for other variants of this equation, which suggests that the finding of the non-linear relationship between fiscal decentralization and PSE prevails for both input- and output-oriented DEA scores.

In column (8) of Tables 6 and 7 we employ the SFA approach to the efficiency measurement, instead of DEA. Specifically, we use the panel data model of Battese and Coelli 1995, which allows the simultaneous estimation of inefficiency with the modeling of the impact of “non-stochastic environmental variables” on this inefficiency. We consider a production technology of the form:

In Eq. (16) \(y\) and \(x\) are the vectors of outputs and inputs as in DEA, \(v\) is the stochastic disturbance and

is the inefficiency term, which depends on the vector of environmental variables \(z\). In our case, the vector \(z\) includes the right-hand side variables of Eq. (12). We estimate this model using the method of maximum likelihood and a translog specification, which is quite flexible and the one preferred by the majority of the literature on the SFA.

The results on some of the control variables do reflect some differences compared to the ones from the DEA method, but the coefficients on the level and squared term of fiscal decentralization still reflect a statistically significant non-linear relationship with PSE. Notably, the results in Tables 6 and 7 show that the value of fiscal decentralization where its impact on PSE becomes negative is similar compared to that of DEA for PSE in education (36.4 under SFA, 34.5 under DEA), but somewhat lower than that of DEA for PSE in health (38.1 under SFA, 47.1 under DEA).

As final exercises, we consider three further extensions. First, we consider a hybrid model where PSE is measured for education and health simultaneously. In other words, we measure PSE using DEA by including simultaneously the inputs and outputs from both education and health. We present the results from this exercise in column (9) of Table 6 and we find that the inverted U-shaped effect of fiscal decentralization on PSE holds. Second, in column (10) of Table 6 we present the results from a DEA model with the years of schooling as the only output of education. Similarly, in column (9) of Table 7 we use two outputs for the public spending in health, namely infant mortality and life expectancy. In both cases there are only minor changes in the results with respect to the non-linear effect of fiscal decentralization on PSE.

5 Conclusions

In this paper we specify an empirical framework to investigate the effect of fiscal decentralization on public sector efficiency (PSE). With this aim we (i) directly measure PSE at the country-level by specifying an underlying production process of public goods; and (ii) use the new indices and well-established measures of fiscal decentralization to examine their nexus. The analysis is carried out on a panel comprising 21 OECD economies for the period 1970–2000. Backed by strong empirical results, obtained from several different specifications and sensitivity analyses, we contend that public sector efficiency and fiscal decentralization are related in an inverted U-shaped way. Therefore, higher fiscal decentralization is beneficial for the efficiency of OECD public sectors in providing education and health services; however, if it rises too high further decentralization of the public sector is detrimental for PSE.

This is a new result and may possibly explain the many differences in the findings of previous empirical literature that uses either micro data or indirect measures of efficiency to characterize the current relationship. Policy implications are straightforward. Countries with relatively low levels of fiscal decentralization will benefit from transferring part of their powers to local governments. However, countries that already have a highly decentralized fiscal system may want to consider reducing the powers of local governments, especially if they face diseconomies of scale and/or increased pressure from local interest groups owing to decentralization. Clearly, these findings and policy implications call for a deeper understanding of the inter- and intra-country mechanisms that create the non-linear pattern and this definitely warrants future research.

Notes

Barankay and Lockwood (2007) suggest an additional mechanism through which fiscal decentralization may lead to increased efficiency, namely a decrease in lobbying by local interest groups. However, as the theoretical literature (e.g., Bardhan and Mookerjee 2000; Bordignon and Colombo 2003; Redoano 2003) appears to be rather inconclusive on this issue (mainly because under certain conditions there may be more lobbying with decentralization), we prefer not to refer to this mechanism as benchmark.

Fisman and Gatti (2002a) and Mello and Barenstein (2001) find that increased decentralization (measured as the budgetary share of subnational governments) is associated with lower levels of corruption. Similarly, Fisman and Gatti (2002b) and Henderson and Kuncoro (2004) using sub-national data for the US and Indonesia, respectively, show that decentralization of public expenditure is effective in reducing corruption only if it is accompanied by an increase in power to raise revenue (i.e. increased tax autonomy). Robalino et al. (2001) and Khalegian (2003) in cross-country studies, also find support that fiscal decentralization is associated with lower infant mortality and immunization rates (taken as measures of the quality of governance). Finally, Enikolopov and Zhuravskaya (2007) examine the effect of decentralization on a set of four indicators of governance quality (namely the three indicators used in the studies reviewed above, plus the illiteracy ratio) and conclude that the effects of fiscal decentralization are beneficial only in countries that are also characterized by a high degree of political centralization.

Thus, the degree of fiscal decentralization is defined as \(\theta \) (see also Stegarescu 2009).

Note that our results concerning the effect of fiscal decentralization would not change if we assumed that the central government also derives rents from the public budget.

The set of countries includes Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Japan, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, UK and USA.

A number of studies instigated an effort towards the computation of PSE indicators using DEA. Concerning OECD economies, Afonso et al. (2005) estimate relative efficiency scores for several parts of the public sector during the 1980s and the 1990s, while Afonso and St. Aubyn (2005) focused on the efficiency of government spending on education and health. Using similar techniques, Gupta and Verhoeven (2001), Sijpe and Rayp (2007) and Afonso et al. (2006) focused on developing countries. Finally, Balaguer-Coll et al. (2007) considered using DEA to analyze the efficiency of local governments in Spain.

DEA may be computed either as input or output oriented. Input-oriented DEA shows by how much input quantities can be reduced, without varying the output quantities produced. Output-oriented DEA assesses by how much output quantities can be proportionally increased, without changing the input quantities used. The two measures provide the same results under constant returns to scale but give slightly different values under variable returns to scale. Nevertheless, both output- and input-oriented models will identify the same set of efficient/inefficient public sectors (see Coelli et al. 2005). Also, a constant returns to scale assumption is only appropriate when all public sectors are operating on an optimal scale (imperfections, asymmetries, etc. are not present), and therefore, we select a variable returns to scale specification.

For details on the methodology used and for the summary statistics for the variables employed as outputs and inputs, see “Appendix 1”.

In this sample countries characterized by heavy private funding on education such as Australia or the United States are included, as well as countries that base the financing of their educational systems on public funds, such as Finland and Denmark.

The underlying assumption for the multiplication with the ratio of public to total schooling is that the private and the public spending are equally efficient in a single country. Although we recognize that this assumption can have some unrealistic elements, we note that our choice is already one step beyond compared with previous studies that do not take into account at all the impact of the private spending on education on the corresponding outputs (see e.g. Afonso et al. 2005; Afonso and St. Aubyn 2005). Ideally, we would like to have data capturing differences in productivity between private and public sector (in education and health) so as to address this issue.

The ratio of public to total spending on health is 41.6 % in the United States and 51.9 % in Greece, while it reaches 88.42 and 87.32 % in Sweden and Norway, correspondingly.

The GFS measure has been employed in Jin and Zou (2002), Davoodi and Zou (1998), Fisman and Gatti (2002a), Enikolopov and Zhuravskaya (2007). However, this widely employed measure includes major shortcomings, as it fails to integrate vital aspects of intergovernmental relations. Most importantly, it fails to capture the real degree of sub-national governments’ autonomy that is to reflect the degree to which decisions regarding revenues and expenditures are truly assigned to lower levels of government (see, Ebel and Yilmaz 2003; Stegarescu 2005; Barankay and Lockwood 2007). Evidently, Stegarescu (2005) finds that the GFS measure of tax revenues’ decentralization overestimates the extent of fiscal decentralization. This is evident, particularly in the case of Austria (28.4 vs. 3.5 %), Belgium (44.4 vs. 24.6 %) and Germany (49.4 vs. 7.3 %). The percentages refer to data for the year 2000.

Ministers care about the size of the budget they receive for many reasons, which may include participation in rent-seeking activities, increase in the size of the bureau they control and the ability to make income transfers as a means for controlling a larger political clientele.

Simar and Wilson (2007) improve on the econometric inference of models where the dependent variable is obtained from linear programming methods, like DEA. However, their exact method does not apply to panel data. Thus, instead of using a truncated regression for cross sectional data to implement the estimation algorithm of Simar and Wilson, we consider using the same algorithm, but with the Tobit method for panel data. Other recent studies (e.g., McDonald (2009)) suggest that least-squares based methods are also sufficient for an analysis of DEA scores into their determinants.

This lack of robustness can be attributed to the low variability of both variables, as they are both time invariant. Only two countries in the sample have a presidential system, while five countries have a majoritarian system. As columns (2) and (4) of Tables 3 and 4 reveal, the main argument presented in this study remains intact, even when these two variables are not included in the regression.

Previous empirical studies on fiscal decentralization (e.g., Panizza 1999; Treisman 2006) conclude that: (i) ethno-linguistic division, (ii) country size, (iii) colonial history and (iv) economic development are the basic determinants of fiscal decentralization. Unfortunately, as can be easily verified, in our analysis all these variables appear to be also determinants of PSE. Therefore, we decided to proceed by employing solely the heterogeneity of voter preference as our instrument. We feel that our decision is strongly supported by both empirical tests and economic intuition.

To capture corruption we employ data from the International Country Risk Guide (2009) database.

For a comprehensive review, see Wintrobe (1997).

References

Adam A, Delis M, Kammas P (2011a) Public Sector efficiency: leveling the playing field between OECD countries. Public Choice 146:163–183

Adam A, Delis M, Kammas P (2011b) Are democratic governemnts more efficient? Eur J Polit Econ 27:75–86

Alesina A, Angeloni I, Etro F (2005) International unions. Am Econ Rev 95:602–615

Alesina A, Devleeschauwer A, Easterly W, Kurlat S, Wacziarg R (2003) Fractionalization. J Econ Growth 8:155–194

Alesina A, La Ferrara E (2005) Preferences for redistribution in the land of opportunities. J Public Econ 89:897–931

Afonso A, St. Aubyn M (2005) Non-parametric approaches to education and health: expenditure efficiency in OECD countries. J Appl Econ 8:227–246

Afonso A, Schuknecht L, Tanzi V (2005) Public sector efficiency: an international comparison. Public Choice 123:321–347

Afonso A, Schuknecht L, Tanzi V (2006) Public sector efficiency: evidence for new EU member states and emerging markets. ECB Working Paper no. 581

Anderson TW (1951) Estimating linear restrictions on regression coefficients for multivariate normal distributions. Ann Math Stat 22:327–351

Balaguer-Coll MT, Prior D, Tortosa-Ausina E (2007) On the determinants of local government performance: a two-stage nonparametric approach. Eur Econ Rev 51:425–451

Barankay I, Lockwood B (2007) Decentralization and the productive efficiency of government: evidence from Swiss cantons. J Public Econ 91:1197–1218

Bardhan P, Mookerjee D (2000) Capture governance at local and national levels. Am Econ Rev 90:135–139

Barro R, Lee JW (2001) International data on educational attainment: updates and implications. Oxf Econ Papers 3:541–563

Battese GE, Coelli TJ (1995) A model for technical inefficiency effects in a stochastic frontier production function for panel data. Empir Econ 20:325–332

Baum CF, Schaffer ME, Stillman S (2007) Enhanced routines for instrumental variables/generalized method of moments estimation and testing. Stata J 7:465–506

Besley T, Case A (1995) Incumbent behavior: vote-seeking, tax-setting, and Yardsick competition. Am Econ Rev 85:25–45

Besley T, Smart M (2007) Fiscal restraints and voter welfare. J Public Econ 91:755–773

Bordignon C, Colombo L, Galmarini U (2003) Fiscal federalism and endogenous lobbies’ Formation, CESifo Working Paper no. 1017

Busemeyer M (2007) Determinants of public education spending in 21 OECD democracies, 1980–2001. J Eur Public Policy 14:582–611

Coelli T, Rao DSP, O’Donnell CC, Battese GE (2005) An introduction to efficiency and productivity analysis. Springer, New York

Davoodi H, Zou H (1998) Fiscal decentralization and economic growth: a cross-country study. J Urban Econ 43:244–257

Djankov S, La Porta R, Lopez-De-Silanes F, Shleifer A (2003) Courts. Q J Econ 118:453–517

Easterly W, Levine R (1997) Africa’s growth tragedy: policies and ethnic divisions. Q J Econ 111:1203–1250

Ebel RD, Yilmaz S (2003) On the measurement and impact of fiscal decentralization. In: Martinez-Vazquez J, Alm J (eds) Public finance in developing and transitional countries: essays in honor of Richard Bird. Elgar, Cheltenham

Enikolopov R, Zhuravskaya E (2007) Decentralization and political institutions. J Public Econ 91:2261–2290

Fearon J (2003) Ethnic and cultural diversity by country. J Econ Growth 8:195–222

Fisman R, Gatti R (2002a) Decentralization and corruption: evidence across countries. J Public Econ 83:325–346

Fisman R, Gatti R (2002b) Decentralization and corruption: evidence from US transfer programs. Public Choice 113:25–35

Fiva J (2006) New evidence on the effects of fiscal decentralization on the size and the composition of government spending. FinanzArchiv 62:250–280

Gupta S, Verhoeven M (2001) The efficiency of government expenditure: experiences from Africa. J Policy Model 23:433–467

Hanushek EA, Woessmann L (2009) Do better schools lead to more growth? cognitive skills, economic outcomes, and causation. NBER Working Paper No. 14633

Henderson JV, Kuncoro A (2004) Corruption in Indonesia. NBER Working Paper, no. 10674

Hindriks J, Lockwood B (2009) Decentralization and electoral accountability: incentives, separation, and voter welfare. Eur J Polit Econ 25:385–397

Jin J, Zou H (2002) How does fiscal decentralization affect aggregate, national and subnational government size? J Urban Econ 52:270–293

Khalegian P (2003) Decentralization and public services: the case of immunization. World Bank Policy Research Working Paper, no. 2989

Kleibergen F, Paap R (2006) Generalized reduced rank tests using the singular value decomposition. J Economet 127:97–126

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny R (1998) Law and finance. J Polit Econ 106:1113–1155

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny R (1999) The quality of government. J Law Econ Organ 15:222–279

Liberati P, Sciala A (2011) How economic integration affects the vertical structure of the public sector. Econ Gov 12:385–402

McDonald J (2009) Using least squares and tobit in second stage DEA efficiency analyses. Eur J Oper Res 197:792–798

Mello L, Barenstein M (2001) Fiscal decentralization and governance: a cross- country approach. IMF Working Paper, no. 01/71

Mierau J, Jong-A-Pin R, de Haan J (2007) Do political variables affect fiscal policy adjustment decisions? New empirical evidence. Public Choice 133:297–320

Müller W, Strøm K (2000) Coalition governments in western Europe. Oxford University Press, Oxford

Myerson R (1993) Effectiveness of electoral systems for reducing government corruption: a game theoretic analysis. Games Econ Behav 5:118–132

Myerson R (2006) Federalism and incentives for success of democracy. Q J Polit Sci 1:3–23

OECD (1999) Taxing powers of state and local government. OECD Tax Policy Studies no. 1, Paris

OECD (2007) Health Data

Panizza U (1999) On the determinants of fiscal centralization: theory and evidence. J Public Econ 74:97–139

Peltzman S (1973) The effect of government subsidies-in-kind on private expenditures: the case of higher education. J Polit Econ 81:1–27

Persson T, Tabellini G (2003) The economic effects of constitutions. MIT Press, Cambridge

Persson T, Tabellini G (2004) Constitutions and economic policy. J Econ Persp 18:75–98

Persson T, Tabellini G, Trebbi F (2003) Electoral rules and corruption. J Eur Econ Assoc 1:958–989

Prud’homme R (1995) On the dangers of decentralization. World Bank Res Obs 10:201–220

Redoano M (2003) Does centralization affect the number and the size of lobbies? Warwick Economic Research Paper, no. 674

Robalino DA, Picazo OF, Voetberg VA (2001) Does fiscal decentralization improve health outcomes? Evidence from a cross-country analysis. World Bank Policy Research Working Paper, no. 2565

Schofield N (1993) Political competition and multiparty coalition governments. Eur J Polit Res 23:1–33

Seabright P (1996) Accountability and decentralization in government: an incomplete contracts model. Eur Econ Rev 40:61–91

Shleifer A (1985) A theory of yardstick competition. Rand J Econ 16:319–327

Sijpe N, Rayp G (2007) Measuring and explaining government efficiency in developing countries. J Dev Stud 43:360–381

Simar L, Wilson P (2007) Estimation and inference in two-stage, semi-parametric models of production processes. J Economet 136:31–64

Stegarescu D (2005) Public Sector decentralization: measurement concepts and recent international trends. Fiscal Stud 26:301–333

Stegarescu D (2009) The effects of economic and political integration on fiscal decentralization: evidence from OECD countries. Can J Econ 42:694–718

Stein E (1997) Fiscal decentralization and government size in Latin America. In: Fukasaku K, Hausmann R (eds) Democracy, decentralization and deficits in Latin America. IDB-OECD, Oxford

Tanzi V, Schuknecht L (1998) Can small governments secure economic and social well-being? In: Grubel H (ed) How to spend the fiscal dividend: what is the optimal size of government?. Fraser Institute, Vancouver

Tavares J (2004) Does right or left matter? Cabinets, credibility and fiscal adjustments. J Public Econ 88:2447–2468

Treisman D (2006) Explaining fiscal decentralisation: geography, colonial history, economic development and political institutions. J Commonw Comp Polit 44:289–325

Williamson O (1964) The economics of discretionary behavior. Prentice-Hall, Englewood Cliffs

Wintrobe R (1997) Modern bureaucratic theory. In: Mueller D (ed) Perspectives in public choice: a handbook. Cambridge University Press, New York

World Bank (2004) World Bank Development Indicators. CD-ROM. Washington D.C, USA

Wyckoff G (1990) Bureaucracy, inefficiency, and time. Public Choice 67:169–179

Acknowledgments

We are indebted to Jon Fiva, Ben Lockwood and Efthymios Tsionas for valuable suggestions and to Marius Busemeyer, Richard Jong-A-Pin, Dan Stegarescu and Jose Tavares for generously giving us access to their data. We have benefited from comments by Konstantinos Angelopoulos, Vangelis Dioikitopoulos, George Economides, Ben Lockwood, Thomas Moutos, Apostolis Philippopoulos, Thanasis Stengos and Nikos Tsakiris, as well as participants at the CESifo Delphi Conference on “Government, Institutions and Macroeconomic Performance”.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Public sector efficiency indicators: formulation and sources

To measure public sector efficiency we follow the rationale of the methodology developed by Afonso et al. (2005). The basic insight of this methodology is to compare the performance of government in certain areas of economic activity with the associated expenditures that the government allocates to achieve this particular performance. Therefore, to construct a PSE index the following data are required: (i) some measure capturing Public Sector Performance (PSP) that serves as the output, and (ii) some measure of the associated Public Sector Expenditure (PEX) that serves as input. The performance (PSP) and expenditure measures (PEX) used to construct the PSE indicators for each policy area are described in Table 9 and the summary statistics are provided in Table 10 below.

Appendix 2

See Table 8.

Rights and permissions

About this article

Cite this article

Adam, A., Delis, M.D. & Kammas, P. Fiscal decentralization and public sector efficiency: evidence from OECD countries. Econ Gov 15, 17–49 (2014). https://doi.org/10.1007/s10101-013-0131-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10101-013-0131-4