Abstract

In order to more accurately predict the global solar energy consumption, a new grey prediction model FDGM(1,1,\(t^{\alpha }\)) is proposed in this paper. The grey wolf optimizer (GWO) is used to optimize the fractional-order \(r\) and the time power \(\alpha\) in the model. The proposed FDGM(1,1,\(t^{\alpha }\)) model, two statistical models and other five existing grey models are used to simulate and predict the solar energy consumption in the four economies (France, South Korea, OECD and Asia Pacific region) from 2010 to 2029. The simulation results show that our proposed FDGM(1,1,\(t^{\alpha }\)) has higher accuracy than the other seven models. The prediction results based on FDGM(1,1,\(t^{\alpha }\)) show that in 2029, the solar energy consumption in South Korea, the OECD and the Asia Pacific region will reach 33,935.32 Ten-trillion J, 1,222,123.45 Ten-trillion J and 2,297,274.45 Ten-trillion J, respectively, but that in France will slowly increase in the next few years and will gradually decrease after reaching a peak of 14,727.34 Ten-trillion J in 2026. The better forecasting solar energy consumption by using the proposed model can provide useful information for the policy-makers to formulate and improve energy policies and measures.

Graphical abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Since the energy crisis and environmental degradation have attracted worldwide attention, the search for new clean energy sources has become a popular topic in energy research. For example, electric vehicles are used to replace traditional fuel vehicles (Ehsani et al. 2021; Singh et al. 2021). Solar energy is the most abundant energy resource on Earth. The energy radiated by the sun to the Earth’s atmosphere is only a fraction of the total solar radiation energy, but it accounts for 173,000 TW. In other words, the energy radiated by the sun to the Earth per second is equivalent to 5 million tons of standard coal, which is more than 10,000 times the total energy consumption of the entire world (Pierce 2016). As an important renewable energy source, solar energy is clean, efficient, endless and relatively stable and is therefore considered to be an effective way to solve the energy crisis (Singh et al. 2019). Solar energy has become an emerging industry of common concern and high priority worldwide. Photovoltaic power generation technology has been widely promoted and applied in countries with abundant solar energy resources, such as Japan, France, the UK and the USA. In addition, various countries have implemented incentive measures to promote the use of solar energy, such as electricity price subsidies and bank discount loans, which are conducive to the large-scale promotion of solar energy.

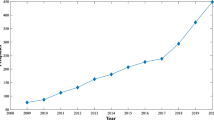

According to data from the International Renewable Energy Agency, the total scale of global photovoltaic installation is increasing year by year. By the end of 2019, the global grid-connected solar energy capacity reached 580.1 GW. According to the BP Statistical Review of World Energy 2020, global solar energy consumption (SEC) increased from 0.32 EJ in 2010 to 6.45 EJ in 2019, a nearly 20-fold increase in ten years. Table 1 shows the SEC of the economies of France, South Korea, the OECD and the Asia Pacific region from 2010 to 2019. From 2010 to 2019, the SEC of France, South Korea, the OECD and the Asia Pacific region increased significantly, with increases of 1697%, 1320%, 1036% and 5419%, respectively. In 2019, the SEC of the OECD and Asia Pacific region accounted for 53.5% and 54.4% of global SEC, respectively. Forecast of energy consumption is an essential basis for policymakers to formulate and improve energy policies and measures. Therefore, accurate prediction of SEC in developed economies, such as France, South Korea, the OECD and the Asia Pacific region, in the next 10 years will help us to understand the global trend of solar energy utilization in the future, provide data support for the formulation of sound solar energy industry development policies and have considerable significance for ensuring the sustainable development of global energy and the economy.

In existing research, various models are used to predict energy consumption, for example, the hybrid forecasting system (Du et al. 2018), computational intelligence technology (Meenal and Selvakumar 2018), Granger causality analysis (Pinzón, 2018), NEMS model (Soroush et al. 2017), LEAP model (Dong et al. 2017), LSTM model (Chen et al. 2019) and grey prediction model (Tsai 2016; Zeng et al. 2018; Wu et al. 2019; Ye et al. 2019; Guo et al. 2020; Wang et al. 2020; Xie et al. 2020; Liu et al. 2021; Şahin 2021). In all the prediction models, the grey prediction model has attracted substantial attention due to its advantages of convenient use, simple modelling process and high accuracy (Wu et al. 2019).

An important prediction model, the grey model was proposed by Professor Deng. The grey differential prediction model was established based on a little incomplete information to more accurately describe development laws (Deng 1982). Professor Deng initially proposed a first-order univariate model GM(1,1) and its whitening equation \({\text{d}}x^{(1)} (t)/{\text{d}}t + ax^{(1)} (t) = b\), where \(a\) is the development coefficient and \(b\) is the grey action quantity. However, GM (1,1) model can only realize the simulation of homogeneous exponential series (Liu et al. 2015). In order to overcome the limitations of the GM (1,1) model, scholars have successively proposed grey extended models suitable for various data forms. For example, Cui et al. (2013) built NGM (1,1,k) model with a grey action quantity of \(bt\) suitable for nonhomogeneous exponential series. Chen and Yu (2014) proposed NGM (1,1,k,c) model with a grey action quantity of \(bt + c\) suitable for approximate nonhomogeneous exponential series. Qian et al. (2012) established GM (1,1,\(t^{\alpha }\)) model with a grey action quantity of \(bt^{\alpha } + c\) suitable for partial exponential series. Luo and Wei (2017) proposed GMP (1,1,N) model with a polynomial grey action quantity of \(\beta_{0} + \beta_{1} t + \ldots + \beta_{N} t^{N}\) suitable for partial exponential and polynomial series. The above studies showed that the model with improved grey action quantity had good prediction accuracy.

However, GM (1,1) and the above models still do not overcome the inherent error of grey model from discrete estimation to continuous prediction. The discrete grey prediction model DGM(1,1) proposed by Xie and Liu(2009) avoided the mutation from difference equation to differential equation, and was unbiased for the fitting of pure exponential series. Similarly, Xie et al. (2013) established NDGM(1,1) model on the basis of DGM(1,1) with a grey action quantity of \(bt + c\). Yang and Zhao (2016) proposed a discrete grey power model DGM(1,1,\(t^{\alpha }\)) based on DGM(1,1) with a grey action quantity of \(bt^{\alpha } + c\). Luo and Wei (2019) proposed DGMP (1,1,N) model based on DGM(1,1) with a polynomial grey action quantity of \(\beta_{0} + \beta_{1} t + \ldots + \beta_{N} t^{N}\). Luo et al. (2020) introduced a trigonometric function into a discrete grey prediction model and proposed a discrete grey model with a time periodic term that is suitable for composite series data with periodicity and trends.

Although the method of establishing discrete model can improve the prediction accuracy of the model to a certain extent, there is still room for optimization in the model. The new information priority principle holds that new information plays a greater role in system cognition than old information. In the process of modelling, giving new information greater weight can improve the efficiency of grey modelling (Liu et al. 2017). There are two ways to introduce new information: One way is to introduce the fractional accumulation operator into the grey model. Wu et al. (2013) proposed a new fractional order cumulative grey system model, in which the modelling sequence is no longer limited to first-order accumulation, but fractional accumulation, so as to better reflect the priority of new information in the accumulation process. Due to its excellent performance and accuracy, this approach has attracted the attention of many scholars. Mao et al. (2015) proposed a fractional-order cumulative delay model GM(1,N,\(\tau\)). Wu et al. (2019) first proposed the fractional-order nonlinear grey Bernoulli model FANGBM(1,1). Liu et al. (2021) established a new fractional order grey polynomial model FPGM (1,1, \(t^{\alpha }\)). These models greatly enrich the fractional-order models of continuous equations. Fractional accumulation operator has also been widely used in discrete grey model. For example, Wu et al. (2014) proposed a fractional order cumulative discrete grey model. Gao (2015) proposed a discrete fractional-order accumulation model FAGM(1,1,D) to predict China’s carbon emissions. Liu et al. (2016) proposed a fractional-order inverse model RDGM(1,1). Ma et al. (2019) proposed a novel fractional discrete multivariate grey model FDGM(1,1). The other way is to introduce new information in grey models including the rolling mechanism (Zhao et al. 2016) and metabolism (Zhao et al. 2012; Ma et al. 2013). The main difference between these approaches is that when the oldest data in the sequence are deleted, the new data added by the rolling grey model are real data, while the new data added by the metabolism model are predicted data (Yuan et al. 2017). Therefore, the rolling mechanism can only be used to predict one period, while a metabolic model can be used to predict multiple periods.

The above research has greatly promoted the development and application of grey models. However, the improved GM(1,1) model group is suitable only for the fitting and prediction of series data with the accumulated rule; it cannot reflect the priority of new information and is rarely used for the prediction of SEC. Therefore, combining the advantages of existing grey models and processing methods, a new grey model FDGM(1,1,\(t^{\alpha }\)) is proposed and used to forecast SEC in France, South Korea, the OECD and the Asia Pacific region. The empirical results show that the new model outperforms the Holt, Power, GM(1,1), FGM(1,1) (Wu et al. 2013), DGM(1,1) (Xie and Liu 2009), (Ma and Liu 2017), NGM(1,1,k,c) (Chen and Yu 2014), ARGM(1,1) (Wu et al. 2015) models. The main contributions of this paper are as follows.

(1) In the FDGM(1,1,\(t^{\alpha }\)) model, \(bt^{\alpha } + c\) is used as the grey action quantity of the model to capture the exponential and power term characteristics of the data. The discretization technology is introduced to reduce the error caused by model jump. Fractional order accumulation and subtraction operators are introduced to make better use of new data and improve the prediction accuracy of the model.

(2) The optimal model structure parameters are obtained by GWO algorithm.

(3) The new model is used to fit six groups of numerical sequences with different forms, and compared with the other seven models showing the excellent fitting effect of the new model.

(4) The new model is used to predict the SEC of four countries or regions over the next 10 years.

The rest of this paper is organized as follows. The second section introduces the basic theory of fractional-order accumulation generation and the basic knowledge of the FDGM(1,1,\(t^{\alpha }\)) model, including the modelling mechanism, model characteristics and solution method, and describes the process of using the grey wolf optimizer to solve the model and the error measurement. In the third section, the feasibility and effectiveness of the model are verified by numerical examples and cases. The fourth section forecasts the SEC of France, South Korea, the OECD and the Asia Pacific region in the next ten years. Finally, the fifth section concludes the paper.

Methodology

The basic theory of fractional-order accumulation

The definitions of the fractional-order accumulation operator and subtract operator are as follows (Wu et al. 2013; Meng et al. 2016):

Definition 1.

Given an original nonnegative sequence \(X^{(0)} = \{ x^{(0)} (1),x^{(0)} (2), \ldots ,x^{(0)} (n)\} ,\quad r \in R^{ + }\), its \(r{\text{-th}}\) fractional-order accumulation sequence (FOA) is \(X^{(r)} = \{ x^{(r)} (1),x^{(r)} (2), \ldots ,x^{(r)} (n)\}\), where

When \(r = 1\), the fractional-order accumulation operator is the first-order accumulation operator (1-FOA), and \(x^{(1)} (k) = \mathop \sum \limits_{i = 1}^{k} x^{(0)} (i)\).

Definition 2

Given an original nonnegative sequence \(X^{(0)} = \left\{ {x^{(0)} (1),x^{(0)} (2), \ldots ,x^{(0)} (n)} \right\}\), \(r \in R^{ + }\), its inverse fractional-order accumulation sequence (IFOA) is \(X^{( - r)} = \left\{ {x^{( - r)} (1),x^{( - r)} (2), \ldots ,x^{( - r)} (n)} \right\}\), where

When \(r = 1\), IFOA is a first-order differential, also known as the first inverse fractional-order accumulation operator (1- IFOA), and \(x^{( - 1)} (k) = x^{(0)} (k) - x^{(0)} (k - 1)\).

Definition 3

Assume that \(X^{(0)} = \left\{ {x^{(0)} (1),x^{(0)} (2), \ldots ,x^{(0)} (n)} \right\}\), \(r \in R^{ + }\) is an original sequence, the \(r{\text{-th}}\) order accumulation operator is \(X^{(r)} = \left\{ {x^{(r)} (1),x^{(r)} (2), \ldots ,x^{(r)} (n)} \right\}\), and the \(r{\text{-th}}\) order inverse accumulation operator is \(X^{( - r)} = \left\{ {x^{( - r)} (1),x^{( - r)} (2), \ldots ,x^{( - r)} (n)} \right\}\); then, they have the following relations:

FDGM(1,1,\(t^{\alpha }\)) model

Suppose \(x^{(r)} (t)\) is defined by Definition 1; then, the expression of the FDGM(1,1,\(t^{\alpha }\)) model is

It can be seen from the expression of the model that when the parameters \(r,\alpha\) change, the model is transformed into other models.

Scenario 1: \(r = 1,\alpha = 0\).

When \(r = 1,\alpha = 0\), the FDGM(1,1,\(t^{\alpha }\)) model can be converted to the DGM(1,1) model.

Assume there are \(Y,B\) as mentioned at the end of the current Section, and that \([\hat{a},\hat{b},\hat{c}]^{T} = \left( {B^{T} B} \right)^{ - 1} B^{T} Y\).

The time response function in the DGM(1,1) model \(x^{(1)} (t) = ax^{(1)} (t - 1) + b\) is

Additionally, the reduction value is:

Scenario 2: \(r = 0,\alpha = 0\).

When \(r = 0,\alpha = 0\), the FDGM(1,1,\(t^{\alpha }\)) model can be converted to the ARGM(1,1) model.

Assume there are \(Y,B\) as mentioned at the end of the current Section, and that \([\hat{a},\hat{b},\hat{c}]^{T} = \left( {B^{T} B} \right)^{ - 1} B^{T} Y\).

The time response function of the ARGM(1,1) model \(x^{(0)} (t) = ax^{(0)} (t - 1) + b\) is

Given the original sequence \(X^{(0)} = \{ x^{(0)} (1),x^{(0)} (2), \ldots ,x^{(0)} (n)\} ,\quad r \in R^{ + }\), the least square criterion of the FDGM(1,1,\(t^{\alpha }\)) model can be described as the following unconstrained optimization problem.

The solution of this optimization problem is \([\hat{a},\hat{b},\hat{c}]^{T} = \left( {B^{T} B} \right)^{ - 1} B^{T} Y\), where

Solution of the model

Given \(\hat{x}^{(r)} (1) = x^{(r)} (1) \, \), according to Eq. (4):

When \(t = 2\), we have

When \(t = 3\), we have

Inserting Eq. (10) into Eq. (11) yields

From the above calculation process, it can be concluded that

According to Definition 3, \(\hat{x}^{(0)} (t)\), the restored value of \(\hat{x}^{(r)} (t)\), is

To minimize the error of the model, the optimal values of the parameters \(r\),\(\alpha \) must be determined.

The above optimization problems are essentially nonlinear programming problems with equality constraints, which can be solved by intelligent optimization algorithms or heuristic algorithms. In this paper, the GWO is used to solve the problem. The following figure shows the solution process of the model (Fig. 1).

Grey Wolf Optimizer (GWO)

The GWO is a population intelligent optimization algorithm proposed by Mirjalili in 2014. Inspired by the preying activity of the grey wolf, this algorithm is an optimized search method with many advantages.

Step 1: Fitness function. This paper evaluates the adaptability of each grey wolf’s position (parameter) in the contemporary group and evaluates the grey wolf’s position through adaptability. Moreover, MAPE is used as the fitness function to evaluate the position.

Step 2: Social hierarchy. In the design of the GWO, we build the grey wolf social hierarchy model, calculate the fitness of each individual in the population and mark the three grey wolves with the best fitness as \( \alpha \beta \delta\) and the remaining grey wolves as ω. The optimization process of the GWO is guided mainly by the best three solutions (\( \alpha \beta \delta\)).

Step 3: Surround the prey. Under the guidance of the three currently optimal grey wolves, the other candidate wolves update their positions randomly near their prey. As the grey wolves search for prey (the optimal parameter), they will gradually approach the prey and surround it. The mathematical model is expressed as follows:

where \(t\) represents the current iteration, \(\vec{V}_{p(t)}\) represents the current position of the prey, \(\vec{V}(t)\) represents the current position of the grey wolf, and \(\vec{D}\) represents the distance between the grey wolf and prey. Furthermore, \(\vec{A}\) and \(\vec{C}\) are synergy coefficient vectors defined as:

In the whole iteration process, \(\vec{a}\) is reduced from 2 to 0, and \(\vec{r}_{1}\) and \(\vec{r}_{2}\) are random vectors in [0,1].

Step 4: Optimal location update. In each iteration, the best three grey wolves in the current population and their position information are retained to update the positions of the other candidate wolves. The mathematical model is expressed as follows:

Step 5: Iteration stop criterion. Steps 3 and 4 are repeated until the specified maximum number of iterations is reached. The maximum number of iterations is set to \(T = 200\), and when \(t > T\), the iterative update is stopped.

Metabolic idea

Because the grey model has some error in predicting long-term data, the introduction of metabolism can make the long-term prediction more accurate. The mechanism of metabolism is as follows:

Step 1: Build a model with the original sequence and predict the data of two periods.

Step 2: Delete the first two data points of the original sequence, add the predicted two periods of data, establish the model and predict the next two periods of data.

Step 3: Repeat step 2 to obtain all the predicted values (Fig. 2).

Error metric

This section considers several error measures widely used in the prediction model to test the effectiveness and applicability of the grey prediction model, as shown in Table 2.

Validation of FDGM(1,1,\(t^{\alpha }\))

This section uses a number of examples to verify the accuracy of the proposed model and the Holt, Power, GM(1,1), FGM(1,1), DGM(1,1), NGM(1,1,k,c) and ARGM(1,1) models. Numerical simulations are conducted in section "The SEC of the OECD", and the raw data and grey model in Table 1 are used in Sects. 3.2–3.5 to simulate and forecast the SEC of France, South Korea, the OECD and the Asia Pacific region. The original data of the 2010–2017 time series are used to build the prediction models, and the data of 2018–2019 are used to verify the accuracy of the prediction models.

Numerical examples

To study the fitting performance of the FDGM(1,1,\(t^{\alpha }\)), Holt, Power, GM(1,1), FGM(1,1), DGM(1,1), NGM(1,1,k,c), ARGM(1,1) models, six different forms of data were fitted: rising convex, rising concave, falling convex, falling concave, strictly nonhomogeneous and nearly nonhomogeneous. The results of these models are shown in Tables 3, 4, 5, 6 and 7 and Fig. 3. It can been seen that the fitting accuracy and prediction accuracy of the FDGM(1,1,\(t^{\alpha }\)) model proposed in this paper are higher than those of the other grey prediction models. The FDGM(1,1,\(t^{\alpha }\)) model has strong adaptability because it can adapt to different numerical sequences by adjusting parameters \(\alpha\) and \(r\) (Table 8).

The SEC of France

According to the data of the Statistical Review of World Energy 2020, France’s energy consumption has long been at the forefront of the world. In 2019, France’s total primary energy consumption was 9.68 EJ, second in Europe, after Germany. However, France’s renewable energy consumption is 0.61 EJ, ranking only fifth in Europe. Therefore, in recent years, the French government has focused on the development and application of clean energy. By 2050, wind power will account for 63%, photovoltaic 17%, hydropower 13%, geothermal and other renewable energy 7% of the French power structure. In addition, from 2010 to 2019, the growth rate of SEC in France was as high as 1697%. Therefore, this section takes France as an example to test the accuracy of the proposed model and other grey prediction models.

First, we take FDGM(1,1,\(t^{\alpha }\)) as an example to describe the modelling process:

The GWO algorithm is used to obtain the optimal \(r = - 1.4883{,}\alpha { = 2}{{.3255}}\) and generate \(X^{(r)} = \{ 581.96,2804.75,7686.78,14749.19,24387.92,37001.81,52464.25,70914.39\}\) via fractional accumulation.

Then, according to the \(X^{\left( r \right)}\), matrices \(Y\) and \(B\) are established:

The parameter \(\mathop \varphi \limits^{ \wedge }\) is calculated by the least squares method.

According to the parameter \(\mathop \varphi \limits^{ \wedge }\), the prediction model is as follows.

Then, the prediction sequence can be obtained via the fractional subtraction in Definition 3.

By adopting the same modelling method for GM(1,1), FGM(1,1), DGM(1,1), NGM(1,1,k,c) and ARGM(1,1), the following prediction models are obtained.

Holt model: trend line prediction

Power model:

GM(1,1) model:

FGM(1,1) model:

DGM(1,1) model:

NGM(1,1,k,c) model:

ARGM(1,1) model:

According to Eqs. (22) to (29), the prediction results of the models are shown in Fig. 4 and Table 9, and the error metrics of each model are shown in Fig. 5 and Table 10. The estimated value of the GM(1,1), DGM(1,1) model is significantly higher than the actual value, the estimated value of the Holt, Power, FGM(1,1), NGM(1,1,k,c), ARGM(1,1) model is significantly lower than the actual value, and the predicted value of the model FDGM(1,1,\(t^{\alpha }\)) is the closest to the actual value. On the basis of the prediction value and fitting value, the four error metrics of the FDGM(1,1,\(t^{\alpha }\)) model are the best among the eight prediction models. Moreover, the FDGM(1,1,\(t^{\alpha }\)) model is more precise than the other prediction models in predicting SEC in France.

The SEC of South Korea

According to the Statistical Review of World Energy 2020, in 2019, South Korea was the world’s tenth largest energy consumer and eighth largest carbon dioxide emitter. Therefore, the South Korean government is facing the dual challenges of improving energy security and reducing greenhouse gas emissions. One of the most effective solutions is to strengthen the role of renewable energy in power production. To this end, the South Korean government plans to increase investment in green energy and set a target of 20% renewable energy by 2030 to ensure that renewable energy, such as solar energy and wind energy, plays a decisive role in meeting the energy demand. Therefore, this section takes South Korea as an example to test the accuracy of the proposed model and other grey prediction models.

First, we take FDGM(1,1,\(t^{\alpha }\)) as an example to describe the modelling process:

The GWO algorithm is used to obtain the optimal \(r = 0.2641{,}\alpha { = 2}{{.7608}}\) and generate \(X^{(r)} = \{ 761.94,1137.19,1471.16,2139.09,3301.13,5084.92,6786.94,9385.02\}\) via fractional accumulation. Then, according to \(X^{\left( r \right)}\), matrices \(Y\) and \(B\) are obtained:

The parameter \(\mathop \varphi \limits^{ \wedge }\) is calculated by the least squares method.

According to the parameter \(\mathop \varphi \limits^{ \wedge }\), the prediction model can be calculated as follows.

Then, the prediction sequence can be obtained via the fractional subtraction in Definition 3.

By adopting the same modelling method for GM(1,1), FGM(1,1), DGM(1,1), NGM(1,1,k,c) and ARGM(1,1), the following prediction models are obtained.

Holt model: trend line prediction

Power model:

GM(1,1) model:

FGM(1,1) model:

DGM(1,1) model:

NGM(1,1,k,c) model:

ARGM(1,1) model:

According to Eqs. (30) to (37), the prediction results of the models are shown in Fig. 6 and Table 11, and the error metrics of each model are shown in Fig. 7 and Table 12. The estimated value of the Power, GM(1,1), FGM(1,1), DGM(1,1), NGM(1,1,k,c), ARGM(1,1) model is significantly higher than the actual value, the estimated value of the Holt model is significantly lower than the actual value, and the predicted value of the FDGM(1,1,\(t^{\alpha }\)) model is the closest to the actual value. Similarly, according to the predicted values and fitted values, the four error metrics of the FDGM(1,1,\(t^{\alpha }\)) model are the best among the eight prediction models. Moreover, the proposed FDGM(1,1,\(t^{\alpha }\)) model is more precise than the other prediction models in predicting SEC in South Korea.

The SEC of the OECD

According to the data of the Statistical Review of World Energy 2020, the primary energy consumption of the OECD in 2019 was 233.43 EJ, accounting for 40% of the world’s total, and the SEC was 3.45 EJ, accounting for 53.4% of the world’s total. According to the International Energy Agency, renewable energy will provide one-third of the OECD’s total power generation by 2035. OECD countries have rich experience in the development and utilization of renewable energy. Therefore, this section takes the OECD as an example to test the accuracy of the proposed model and other grey prediction models.

First, we take FDGM(1,1,\(t^{\alpha }\)) as an example to describe the modelling process:

The GWO algorithm is used to obtain the optimal \(r = - 0.3775{,}\alpha { = } - {31}{{.8017}}\) and generate \(X^{(\gamma )} = \{ 30390.00,67997.34,114536.14,164784.30,227593.98,294547.37,363259.69,449651.01\}\) via fractional accumulation.

Then, according to \(X^{\left( r \right)}\), the matrices \(Y\) and \(B\) are obtained:

The parameter \(\mathop \varphi \limits^{ \wedge }\) is calculated by the least squares method.

Additionally, the following is obtained based on parameter \(\mathop \varphi \limits^{ \wedge }\)

Then, the prediction sequence is obtained via fractional subtraction (Definition 3).

By adopting the same modelling method for GM(1,1), FGM(1,1), DGM(1,1), NGM(1,1,k,c) and ARGM(1,1), the following prediction models are obtained.

Holt model: trend line prediction

Power model:

GM(1,1) model:

FGM(1,1) model:

DGM(1,1) model:

NGM(1,1,k,c) model:

ARGM(1,1) model:

According to Eqs. (38) to (45), the prediction results of the models are shown in Fig. 8 and Table 13, and the error metrics of each model are shown in Fig. 9 and Table 14. The estimated value of the GM(1,1), DGM(1,1) models is significantly higher than the actual value, the estimated value of the Holt, Power, FGM(1,1), NGM(1,1,k,c) and ARGM(1,1) models is significantly lower than the actual value, and the predicted value of the FDGM(1,1,\(t^{\alpha }\)) model is the closest to the actual value. Similarly, the four error metrics of the FDGM(1,1,\(t^{\alpha }\)) model are the best. The results indicate that the proposed FDGM(1,1,\(t^{\alpha }\)) model is more precise than the other prediction models in predicting the SEC of the OECD.

The SEC of the Asia Pacific region

According to the data of the Statistical Review of World Energy 2020, the primary energy consumption in the Asia Pacific region reached 257.56 EJ in 2019, ranking first in the world, and accounting for approximately 44% of the world’s total. Furthermore, SEC reached 3.51 EJ, accounting for approximately 54.4% of the world’s total. In the Asia Pacific region, China, India, Japan and South Korea are among the top solar energy consumers in the world. Therefore, this section takes the Asia Pacific region as an example to test the accuracy of the proposed model and other grey prediction models.

First, we take FDGM(1,1,\(t^{\alpha }\)) as an example to describe the modelling process:

The GWO algorithm is used to obtain the optimal \(r = {0}{{.6089,}}\alpha = 3.2181\) and generate \(X^{(r)} = \{ 6362.61, \, 15298.99, \, 26415.67, \, 48178.99, \, 91267.32, \, 150504.56, \, 234754.23, \, 366314.41\}\) via fractional accumulation.

Then, according to \(X^{\left( r \right)}\), the matrices \(Y\) and \(B\) are obtained:

The parameter \(\mathop \varphi \limits^{ \wedge }\) is calculated by the least square method \(\mathop \varphi \limits^{ \wedge } = (B^{T} B){}^{ - 1}B^{T} Y = [0.1048,407.1159,10844.6]\).

The results are calculated according to the parameter \(\mathop \varphi \limits^{ \wedge }\).

Then, the prediction sequence can be obtained via the fractional subtraction in Definition 3.

By adopting the same modelling method for GM(1,1), FGM(1,1), DGM(1,1), NGM(1,1,k,c) and ARGM(1,1), the following prediction models are obtained.

Holt model: trend line prediction

Power model:

GM(1,1) model:

FGM(1,1) model:

DGM(1,1) model:

NGM(1,1,k,c) model:

ARGM(1,1) model:

According to Eqs. (46) to (53), the prediction results of the models are shown in Fig. 10 and Table 15, and the error metrics of each model are shown in Fig. 11 and Table 16. The estimated value of the Power, GM(1,1), FGM(1,1), DGM(1,1) and ARGM(1,1) models is significantly higher than the actual value, the estimated value of the Holt, NGM(1,1,k,c) models is significantly lower than the actual value, and the predicted value of the FDGM(1,1,\(t^{\alpha }\)) model is the closest to the actual value. Moreover, the proposed FDGM(1,1,\(t^{\alpha }\)) model is more accurate than the other prediction models in predicting the SEC of the Asia Pacific region.

Forecasting SEC in the next ten years

In this section, we build an FDGM(1,1,\(t^{\alpha }\)) model that includes metabolism to forecast the SEC of France, South Korea, the OECD and the Asia Pacific region in the next 10 years (2020–2029). The prediction results are shown in Table 17 and Figs. 12, 13, 14 and 15. The SEC in South Korea, the OECD and the Asia Pacific region will gradually increase in the next decade. However, the SEC in France will rise slowly before 2026 and then begin to decline after reaching its peak in 2026. The consumption of the two major economies of the OECD and the Asia Pacific region was basically the same in 2019; however, after 2029, the distance between the two will rapidly increase, and the SEC in the Asia Pacific region will be almost twice that of the OECD. The main reason for this difference may be that the OECD is composed mainly of developed countries, and the utilization and industrial construction of solar energy are relatively mature compared to that in developing countries. The growth rate of SEC will drop from 17.02% in 2020 to 10.17% in 2029. In addition to developed countries, the Asia Pacific region also contains some developing countries, such as China and India, which are in the stage of rapid development of the solar energy industry. Thus, the average growth rate of SEC from 2020 to 2029 in the Asia Pacific region is higher than that of the OECD.

Conclusions

In order to more accurately predict the global SEC, a new discrete grey prediction model FDGM(1,1,\(t^{\alpha }\)) is proposed in this paper. Based on the traditional discrete grey model, the new model combines fractional order accumulation operator, subtraction operator and time power term. Specifically, using fractional accumulation operator and subtraction operator to process the original data sequence can reduce the volatility and randomness of data, enhance the development trend of data and obtain more useful information from limited data. In addition, introducing the time power term into the grey action can better fit the nonlinear trend in the data and improve the prediction accuracy of the model. In order to further improve the accuracy of the model in fitting data, an intelligent optimization algorithm (GWO) is introduced to find the optimal parameters of the model. With the change of parameters, FDGM(1,1,\(t^{\alpha }\)) model can be transformed into DGM(1,1) and ARGM(1,1) models, so it has strong adaptability. Subsequently, the proposed FDGM(1,1,\(t^{\alpha }\)) model, two statistical models and other five existing grey models are used to simulate and predict the SEC in the four economies (France, South Korea, OECD and Asia Pacific region) from 2010 to 2029. The simulation results show that our proposed FDGM(1,1,\(t^{\alpha }\)) has higher accuracy than the other seven models. Although the grey prediction model has high prediction accuracy, it cannot meet the demand for future data because it is not suitable for long-term prediction. Therefore, this paper establishes a model based on a metabolism mechanism to predict SEC over the next 10 years. The prediction results based on FDGM(1,1,\(t^{\alpha }\)) show that the SEC in South Korea, the OECD and the Asia Pacific region will gradually increase from 2020 to 2029, but that in France will slowly increase in the next few years and will gradually decrease after reaching a peak in 2026. Notably, the FDGM(1,1,\(t^{\alpha }\)) model proposed in this paper can be used not only for the prediction of SEC but also for the prediction of other energy sources.

So far, the FDGM(1,1,\(t^{\alpha }\)) model has significant advantages compared with other prediction methods. However, the model can be further optimized in future research. For example, for data with periodic fluctuations, it is necessary to introduce a periodic function into the grey action quantity to capture the periodicity and volatility of the data. In addition, new fractional order accumulation and subtraction methods can be found to make the modelling data smoother and reduce the volatility and randomness of the data more effectively.

Abbreviations

- FOA:

-

Fractional order (r-order) accumulation

- IFOA:

-

Inverse fractional order (r-order) accumulation

- \(X^{(0)}\) :

-

Original series

- \(X^{(1)}\) :

-

First-order accumulated series

- GM(1,1):

-

Basic grey model

- FGM(1,1):

-

Fractional grey model

- DGM(1,1):

-

Discrete grey model

- NGM(1,1,k,c):

-

Nonhomogeneous grey model

- ARGM(1,1):

-

Autoregressive grey model

- FDGM(1,1,\(t^{\alpha }\)):

-

Fractional discrete grey model with time power term

- GWO:

-

Grey wolf optimizer

- MAPE:

-

Mean absolute percentage error

- RMSPE:

-

Root mean squares percentage error

- MAE:

-

Mean absolute percentage error

- IA:

-

Index of agreement

References

Chen JD, Yu J, Song ML, ValdmanisV, (2019) Factor decomposition and prediction of solar energy consumption in the United States. J Clean Prod 234:1210–1220

Chen PY, Yu HM (2014) Foundation settlement prediction based on a novel NGM model. Math Probl Eng 242809.

Cui J, Liu SF, Zeng B, Xie NM (2013) A novel grey forecasting model and its optimization. Appl Math Model 37:4399–4406

Deng J (1982) Control problems of grey systems. Syst Control Lett 1(5):288–294

Dong KY, Sun RJ, Li H, Jiang HD (2017) A review of China’s energy consumption structure and outlook based on a long-range energy alternatives modeling tool. Petrol Sci 14(1):214–227

Du P, Wang J, Yang W, Niu T (2018) Multi-step ahead forecasting in electrical power system using a hybrid forecasting system. Renew Energy 122:533–550

Ehsani M, Singh KV, Bansal HO, Mehrjardi RT (2021) State of the art and trends in electric and hybrid electric vehicles. Proc IEEE 109(6):967–984

Gao M, Mao S, Yan X, Wen J (2015) Estimation of Chinese CO2 emission based on a discrete fractional accumulation grey model. J Grey Syst 27(4):114–130

Guo H, Deng S, Yang J, Liu J, Nie C (2020) Analysis and prediction of industrial energy conservation in underdeveloped regions of China using a data pre-processing grey model. Energy Policy 139:111244

Liu C, Wu WZ, Xie WL, Zhang T, Zhang J (2021) Forecasting natural gas consumption of China by using a novel fractional grey model with time power term. Energy Rep 7:788–797

Liu JF, Liu SF, Wu LF, Fang ZG (2016) Fractional order reverse accumulative discrete grey model and its application. Syst Eng Electron 38(3):719–724

Liu SF, Zeng B, Liu JF, Xie NM, Yang YJ (2015) Four basic models of GM(1,1) and their suitable sequences. Grey Sys Theory Pract 5(2):141–156

Liu SF, Dang YG, Fang ZG et al (2017) Grey system theory and its application (8th Edition). Science Press

Luo D, Wang XL, Sun DC, Zhang GZ (2020) Discrete grey DGM(1,1, T) model with time periodic term and its application. Syst Eng Theory Pract 40(10):2737–2746

Luo D, Wei BL (2019) A unified treatment approach for a class of discrete grey forecasting models and its application. Syst Eng Theory Pract 39(2):451–462

Ma WM, Zhu XX, Wang MM (2013) Forecasting iron ore import and consumption of China using grey model optimized by particle swarm optimization algorithm. Resour Policy 38:613–620

Ma X, Liu Z (2017) Application of a novel time-delayed polynomial grey model to predict the natural gas consumption in China. J Comput Appl Math 324:17–24

Ma X, Xie M, Wu WQ, Zeng B, Wang Y, Wu XX (2019) The novel fractional discrete multivariate grey system model and its applications. Appl Math Model 70:402–424

Mao SH, Gao MY, Xiao XP (2015) Fractional order accumulation time-lag GM(1, N, τ) model and its application. Syst Eng Theory Pract 35(2):430–436

Meenal R, Selvakumar AI (2018) Assessment of SVM, empirical and ANN based solar radiation prediction models with most influencing input parameters. Renew Energy 121(6):324–343

Meng W, Liu SF, Zeng B, Fang ZG (2016) Mutual invertibility of fractional order grey accumulating generation operator and reducing generation operator. Acta Anal Funct Appl 18(3):274–283

Pierce ER (2016) Top-6-things-you-didnt-know-about-solar-energy. https://www.energy.gov/articles/top-6-things-you-idnt-know-about-solar-energy. Accessed 6 Jan 2021

Pinzón K (2018) Dynamics between energy consumption and economic growth in Ecuador: A granger causality analysis. Econ Anal Policy 57(3):88–101

Qian WY, Dang YG, Liu SF (2012) Grey GM(1,1,) model with time power and its application. Syst Eng Theory Pract 32(10):2247–2252

Şahin U (2021) Future of renewable energy consumption in France, Germany, Italy, Spain, Turkey and UK by 2030 using optimized fractional nonlinear grey Bernoulli model. Sustain Prod Consump 25:1–14

Singh KV, Bansal HO, Singh D (2019) A comprehensive review on hybrid electric vehicles: architectures and components. J Mod Transport 27:77–107

Singh KV, Bansal HO, Singh D (2021) Development of an adaptive neuro-fuzzy inference system-based equivalent consumption minimisation strategy to improve fuel economy in hybrid electric vehicles. IET Electr Syst Trans 11:171

Soroush R, Koochi A, Keivani M, Abadyan M (2016) A bilayer model for incorporating the coupled effects of surface energy and microstructure on the electromechanical stability of NEMS. Int J Struct Stab Dyn 17(4):1771005

Tsai SB (2016) Using grey models for forecasting China’s growth trends in renewable energy consumption. Clean Technol Envir 18:563–571

Wang ZX, Wang ZW, Li Q (2020) Forecasting the industrial solar energy consumption using a novel seasonal GM(1,1) model with dynamic seasonal adjustment factors. Energy 200:117460

Wu LF, Liu SF, Chen HJ, Zhang N (2015) Using a novel grey system model to forecast natural gas consumption in China. Math Probl Eng 686501.

Wu LF, Liu SF, Yao LG (2014) Discrete grey model based on fractional order accumulate. Syst Eng Theory Pract 34(7):1822–1827

Wu LF, Liu SF, Yao LG, Yan SL, Liu DL (2013) Grey system model with the fractional-order accumulation. Commun Nonlinear Sci Numer Simul 18(7):1775–1785

Wu WQ, Ma X, Zeng B, Wang Y, Cai W (2019) Forecasting short-term renewable energy consumption of China using a novel fractional nonlinear grey Bernoulli model. Renew Energy 140:70–87

Xie N, Liu S (2009) Discrete Gray forecasting model and its optimization. Appl Math Model 33(2):1173–1186

Xie NM, Zhu CY, Liu SF, Yang YJ (2013) On discrete grey system forecasting model corresponding with polynomial time-vary sequence. J Grey Syst 25:1–18

Xie WL, Wu WZ, Liu C, Zhao JJ (2020) Forecasting annual electricity consumption in China by employing a conformable fractional grey model in opposite direction. Energy 202:117682

Yang BH, Zhao JS (2016) Optimized discrete grey power model and its application. Chin J Manag Sci 24(2):162–168

Ye J, Dang YG, Ding S, Yang YJ (2019) A novel energy consumption forecasting model combining an optimized DGM (1, 1) model with interval grey numbers. J Clean Prod 229:256–267

Yuan CQ, Zhu YX, Chen D, Liu S, Fang ZG (2017) Using the GM(1,1) model cluster to forecast global oil consumption. Grey Syst Theory Appl 7(2):286–296

Zeng B, Duan HM, Bai Y, Meng W (2018) Forecasting the output of shale gas in China using an unbiased grey model and weakening buffer operator. Energy 151:238–249

Zhao HR, Zhao HR, Guo S (2016) Using GM (1,1) optimized by MFO with rolling mechanism to forecast the electricity consumption of Inner Mongolia. Appl Sci 6:20

Zhao Z, Wang J, Zhao J, Su Z (2012) Using a grey model optimized by differential evolution algorithm to forecast the per capita annual net income of rural households in China. Omega 40:525–532

Funding

This research was funded by the National Natural Science Foundation of China for Young Scholars (No. 71603202), the Social Science Project of Shaanxi (No.2021D062), the Youth Innovation Team of Shaanxi Universities (No. 21JP044) and the Scientific Research Project of China (Xi’an) Institute for Silk Road Research (No. 2019YA08).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Data availability

The datasets of this paper are available from the corresponding author on reasonable request.

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wang, H., Wang, Y. Forecasting solar energy consumption using a fractional discrete grey model with time power term. Clean Techn Environ Policy 24, 2385–2405 (2022). https://doi.org/10.1007/s10098-022-02320-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-022-02320-2