Abstract

The study focuses on the nonlinear Granger causality between cement production, economic growth and carbon dioxide emissions by Markov-switching vector autoregressive (MScVAR) and Markov-switching Granger causality approach for the period of 1960–2017 for China and the USA. The empirical findings from MSIA(2)-VAR(2) for the USA and MSIA(3)-VAR(3) for China suggest that cement production has an important impact on CO2 emissions and economic growth. Markov-switching causality approach determines the evidence of unidirectional causality running from cement production to carbon dioxide emissions in all regimes for the USA and China. The cement production is an important source of environmental pollution. The USA and China have global responsibility for cement production determined as one of the central sources of carbon dioxide emissions. Moreover, MS-Granger causality results were compared with ones determined by traditional causality method. It was determined that to employ traditional method instead of MS-causality method can cause wrong policy applications if the tested series has nonlinearity.

Graphical abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Anthropogenic CO2 emissions emerge from three key sources: (1) land usage changes and deforestation (2) carbonate decomposition (Andrew 2018) (3) consumption of non-renewable energy. The most important source of emissions caused by the decomposition of carbonates is cement production.

Huge quantities of environmental pollutant, including SO2, NOX, CO and PM, are emitted from cement production (Lei et al. 2011). When the cement is produced, the high-temperature calcination of carbonate minerals causes clinker, and CO2 is emitted into the atmosphere (Xi et al. 2016). The CO2 emissions from cement production emerge in two aspects. Firstly, it is a rising chemical reaction during the production of the major component of cement. The cement is causing oxides (lime, CaO) and CO2 in the effect of heat. These “process” emissions lead ~ 5% of total anthropogenic CO2 emissions not including land-use alteration (Boden et al. 2017). Secondly, it is the combustion of non-renewable energy to produce the energy required to heat the raw materials over 1000 °C (IEA 2016).

The process of CO2 emissions from the cement contains ~ 90% of universal CO2 emissions from industrial procedures (Xi et al. 2016) and the total emissions of the cement industry form ~ 8% of global CO2 emission (Le Quéré et al. 2016, 2017; Andrew 2018).

The USA and China are the world’s top cement producers and CO2 emitters. In particular, China’s cement production rose dramatically from 2005 to 2010 (Long et al. 2015a, b). China was one of the largest cement producers in 2017. For China, estimations of the United States Geological Survey (USGS) indicate the 2.5 Bnt/yr capacity, while some foundations give cement production of China as nearly 3.5 Bnt/yr. In 2017, the USA has well-structured and large cement production in the capacity of 120.5 Mt/yr. The USGS indicates that the USA generated 82.9 Mt cement by utilizing 109 Mt/yr clinker capacity (Global Cement 2018). In China, the human-induced CO2 emissions are ~ 30% of global emissions (Shan et al. 2018). The cement industry of China uses ~ 10% of total fossil fuel energy of the country (CCA 2010, 2011; NBS 2014), and this sector is the primary sources of emissions (Shan et al. 2018). In this condition, three-quarters of the increase in universal CO2 emissions emerge from cement production and the burning of fossil fuels in the process of cement production between 2010 and 2012 in China (Liu et al. 2015). According to Wen et al. and Chen et al. (2015), cement sector in China is responsible for 7% of total fossil fuel usage and 15% of total CO2 emissions. In the USA, this sector that has the most energy intensive in manufacturing industries consumes one-quarter of one percent of total energy. Share in energy consumed by the cement sector is ~ 10 times the share of goods and services (IEA 2013).

The cement production is one of the important factors affecting environmental pollution, though the relationship has not been analyzed sufficiently in the environmental economics literature. The study aims to analyze the causality based on regime switching in the relationship between economic growth, cement production and CO2 emissions. To that end, the Markov-switching vector autoregressive (MScVAR) and MScGranger causality methodologies are evaluated for datasets available corresponding to 1960–2017 for the USA and China. The selected countries are the main cement producers in the world. The USA and China have different levels of economic development. The USA, known as the world’s biggest economy, has 24% of the world’s GDP in 2016. China is an emerging country and its economy is growing at ~ 7% and this rate has almost three times higher than the rate of the USA. China’s GDP is ~ 61.7% of the size of the USA GDP, according to IMF estimates in 2017, and China is the second-largest economy all over the world in nominal terms.

In many papers, the real GDP and per capita GDP are used as a measure of economic growth, which is shown to possess a nonlinear structure, i.e., asymmetry between expansionary and recessionary regimes in addition to regimes of accelerated growth and economic crises. The size and magnitude of GDP growth rates are subject to nonlinear adjustments during the phases of the business cycles (Bildirici 2012, 2013a, b). Linear time series do not take into regime changes and regime-dependent asymmetry into consideration. If the stages of the business cycles and/or fluctuations in economic growth are not taken into consideration, policy recommendations determined by the models will be erroneous. While the majority of the literature utilizes controlling the impact of crises with dummy variables, this approach prevents us from getting accurate results. The main difficulty in employing dummy variables is that the breaking points must be identified a priori in addition to assuming linear and constant slope parameters. Major gains of MScVAR method are to examine the model without employing the dummy variables, to explore various regimes of the economy instead of considering the economy in the same level through the analysis period and to determine different coefficients and Granger causalities for each regime of the economy. Moreover, the MScGC analysis presents flexibility in terms of investigating the nonlinear causal relationship between the variables without supposing a stable and linear relationship. In the context of this paper, in particular, the cement production itself is strongly influenced by many irregular events, such as the effect of the construction sector, economic growth and people’s psychological expectations. Within this scope, the major reason of employing MScVAR method is to investigate the relationship among cement production, environmental pollution and economic growth in addition to provide important insights regarding the evolution of this relation in different regimes of the economy such as the crisis and expansion regimes. Each regime of the economy needs regime-specific policies, and instead of common and linear policy recommendations, modeling the characteristics of each distinct regime becomes a priority.

This paper aims at not only making contributions to the theoretical but also to the empirical application aspects. Theoretically, it analyzes simultaneously the causal relation between economic growth, cement production and environmental pollution in different regimes of the economy. From an application aspect, the proposed model allows different policy recommendations for different stages of the economy since different regimes of the economy require different policy recommendations.

This paper is configured as follows: The second section gives the literature review. The causal link between cement production and environmental damage in China and the USA is covered in Sect. 3. Section 4 introduces the data and econometric methodology. Section 5 covers the empirical results. And lastly, the policy discussion and conclusions are presented.

Literature review

The literature that addresses the relationships between economic development and environmental pollution focuses on the impact of pollutants, such as carbon dioxide (CO2), sulfur dioxide emissions and various suspended particles. Accordingly, the possible intensification of pollution was analyzed as economic development strengthens. Grossman and Krueger (1991) provided an analysis evaluating the relation between GDP growth and emission and noted that pollution increases at low levels of per capita GDP and decreases at comparatively higher levels. Shafik (1994) and Shafik and Bandyopadhyay (1992) investigated the environmental Kuznets curve (EKC) and they found that an inverted U-shaped EKC cannot be rejected.

Stern et al. (1996) and Selden and Song (1994) showed that ecological pollutants could decline at higher development levels. Stern (2004) accented that this state could happen in the condition of both the decentralization of industry and the fall in urban population densities. Pettersson et al. (2013) discussed the convergence of carbon emissions and they accepted three convergence approaches: sigma, stochastic and beta. Anjum et al. (2014) suggested the approach covered both beta convergences in addition to findings suggesting EKC-type relations. Their model allowed the analysis of possible convergence, the contributions of economic growth to pollution and time impacts to the progress of pollution.

Keene and Deller (2015) tested an EKC analysis in the USA by making use of the particulate matter (PM 2.5). According to their results, the turning point that defined the existence of the inverted U-shaped EKC wanders between US$24,000 and US$25,500 depending on the estimator employed. Van Donkelaar (2010) found that the uppermost concentrations of PM 2.5 were in eastern China compared to other countries of the world. Chen et al. (2017) focused on the synergy between greenhouse gas (GHG) emissions and local air pollutants (LAPs). Long et al. (2015a, b) analyzed the relationship among CO2 emissions, energy consumption and economic growth for the 1952–2012 period in China. Naminse and Zhuang (2018) found an inverted U-shaped curve and determined the presence of the EKC hypothesis in China. Luo et al. (2017) tested CO2 emissions from agricultural economic growth in the period between 1997 and 2014 in 30 Chinese provinces. Long et al. (2018) explored the CO2 emission intensity in agriculture sector for the 1997–2014 period.

Aside from the papers that test the environmental pollution at the domestic level, there are other papers analyzing the environmental pollution of specific industries. Sun et al. (2011) and Lin and Wang (2015) tested the effects on the environmental pollution of China’s iron and steel industry.

For the cement industry, the number of papers evaluating the environmental impacts is rather limited and one conclusion regarding the sector is the increasing energy efficiency. Wang et al. (2013) determined the effects on GHG emission of China’s cement sector and showed the central driving reasons of change in GHG releases in the cement sector were cement and clinker productions’ activity effect. Teller et al.(2000) found that the CO2 emission of China’s cement sector is higher than CO2 releases of many countries and the cement sector is one of the main CO2-releasing manufacturing industry both in China-wide and worldwide. Hanke et al. (2004) analyzed the geographic locations of CO2 emissions sources in the USA cement industry. Lin and Zhang (2016) tested the CO2 emission of the cement industry during 1991–2010 in China. The results determined the labor productivity was the main factor in the rise of CO2 emission in the cement industry in China.

Hasanbeigi et al. (2012) tested an evaluation of China’s cement firms following an international scale. Hasanbeigi et al. (2013a, b) explored the decrease in CO2 emissions and produced policy suggestions regarding the emergence of energy efficiency in cement production. Ke et al. (2012) also concluded huge potential of carbon emission mitigation and energy consumption reduction though energy efficiency measures in China’s cement industry. Xu et al. (2012) analyzed the energy consumption of the cement sector and the CO2 emissions in China and they produced policy implications including cutting down old pollutant plants and encouraging energy efficiency.

Cement production and environmental pollution

Cement production is one of the most important sectors in the development process of a country. The twentieth century witnessed the emergence of big structures, hydroelectric dams, high bridges and highways. Skyscrapers, like the World Trade Center and the Empire State Building in New York City and the Sears Tower in Chicago, used huge amounts of cement, ceramic tiles, etc. In the last of the century, the building of skyscrapers grew in Asia. Another advance of the twentieth century was a rise in home ownership. For example, while less than one-half of the USA population owned their own homes in 1900, (Morse and Glove 2000) approximately two-thirds owned their own residences in 2017.

This process accelerated the cement production. In China, the cement industry developed fast especially in recent 30 years in the effect of rapid economic growth and urbanization. Nowadays, China is the main cement producer resulting from rapid urbanization and industrialization which cause fast growth in the construction sector. In effect of this process, the production of cement that is used in the construction sector in all over the world increased through the twentieth century and continues to increase. For example, 76.2 billion tons of cement between 1930 and 2013 and 4.0 billion tons in 2013 alone were produced. Between 1990 and 2014, cement production rose from 209.7 million tons (Mt) to 2476 Mt (CEIC 2017; USGS 2017). Chinese cement production is 2.38 Bnt in 2017. The USA has a large cement production with 120.5 Mt/yr in 2017 (Global Cement 2018).

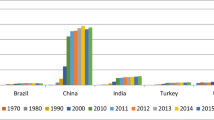

Figure 1 gives knowledge about the growth of emissions from cement production (Units: kilotonnes).

Source: Andrew (2018)

The emissions from cement production.

As the cement production rise, CO2 emissions from cement production increase. So Baxter and Walton (1970) supplied the estimations for CO2 emissions from cement production and fossil fuels for the period of 1860–1969. Keeling (1973) specified a systematic analysis of CO2 emission from non-renewable energy (1860–1969) and cement production (1949–1969). A CaO content estimation for cement production was reported as 64.1% approximately which was found as 272 Mt in 1969. Remarkably, Marland and Rotty (1984) determined the CaO content at the rate of 63.8% in the period of 1950–1982 for the USA.

In the 2000’s, in China, 13%–15% of CO2 emission emerges from the cement production (Xu et al. 2012; Li and Li 2013). In China, the emissions of PM, NOx, SO2 are 15–27%, 8–12% and 3–4%, respectively (MEP 2014; Zhang et al. 2015a, b). The calcination is the main source of 50–60% of the CO2 emission and the rest of the emission is caused by burning fossil fuels using for heating the raw materials in the kiln (NRMCA 2012).

Data and methodology

Data

The data of GDP, CO2 emissions are given in their respective per capita levels. The cement production for China and the USA covers the 1960–2017 period, and the data are taken from USGS and CEIC for China. The CO2 emissions per capita data are taken from the CDIAC and USGS. GDP per capita data are taken from the World Bank. The variables are subject to natural logarithms and differentiation which results in obtaining their respective growth rates. As a typical, the cement production data is subject to lcpt = ln(cpt) where ln(.) shows the natural logarithms. Similarly, other series are converted as \({{ly}}_{t} = \ln ({\text{GDP}}_{t} )\) and dlco2t = \(l{\text{CO}}_{2t} = ln ({\text{CO}}_{2t} )\).

Markov-switching VAR models

In the study, the MScVAR and MScGC models discussed by Krolzig (1998), Fallahi (2011) and Bildirici (2012, 2013a, b) are to be investigated for the analysis of the causal nexus between the analyzed series. The above-mentioned methodology assumes the variables to be estimated with MSIA(.)-VAR(.) or MSIAH(.)-VAR(.) models to achieve state-dependent causality. The MSIAH(.)-VAR(.) model is stated as

where \({{u_{t} } \mathord{\left/ {\vphantom {{u_{t} } {s_{t} }}} \right. \kern-0pt} {s_{t} }}\,\sim\,N\left( {0,\,\delta^{2} \left( {s_{t} } \right)} \right)\) and Ai (.) represents the coefficients of the lagged variables in differentiated regimes. The conditional variance \(\delta^{2} \left( {s_{t} } \right)\) of the residuals is regime dependent. \(\mu \left( {s_{t} } \right)\) describes the dependence of the conditional mean \(\mu\) of the K-dimensional time series vector on the regime variable \(s_{t}\). For a two-variate case, the variables are defined in matrix form, \({\mathbf{x}}_{{\mathbf{t}}} = \left[ {{\mathbf{x}}_{t}^{\prime } } \right]^{\prime } = \left( {y_{t - 1} , \ldots ,y_{t - p} ,x_{t - 1} , \ldots ,x_{t - p} } \right)^{\prime }\) for t = 1, 2, …, n. For the purposes of the study, the variable set includes the GDP growth rates, the cement production growth rates and CO2 emission growth rates, denoted as \(ly_{t} ,l{\text{cp}}_{t} ,l{\text{CO}}_{2t}\). As a result, \({\mathbf{x}}_{{\mathbf{t}}} = \left[ {{\mathbf{x}}_{t}^{\prime } } \right]^{\prime } = \left( {ly_{t - 1} , \ldots ,ly_{t - p} ,lcp_{t - 1} , \ldots ,lcp_{t - p} ,l{\text{CO}}_{2t - 1} , \ldots ,l{\text{CO}}_{2t - p} } \right)^{\prime }\)where the optimum lag length p is selected by depending on an information criterion, such as SIC, AIC or the FPE final prediction error criterion to control for autocorrelation. Assume that Pj is the order of the VAR model, i.e., the number of included lags in regime j. The matrix of transition probabilities \(P = \left\{ {p_{ij} } \right\}\), where i, j = 1,…, s is determined by and the state variable \(s_{t}\) denotes the regime prevailing at time t. The residuals are assumed to follow independent and identical distribution in each regime determined by \(s_{t}\), therefore, \(u_{t} \sim {\text{i}} . {\text{i}} . {\text{d}} .\,N\left( {0,\,\delta^{2} \left( {s_{t} } \right)} \right)\) if \(\left| \phi \right|\, < 1\). It should be noted that, \(s_{t}\) is a discrete variable taking values of 1 or 2 in a two-regime model. In an MScVAR model, \(s_{t}\) is governed by a Markov chain,

where p includes the probability parameters, i.e., the state in period t depends only on the state in period t − 1. Conversely, the conditional probability distribution of \(y_{t}\) is independent of \(s_{t - 1}\), that is, \(P(y_{t} \left| {Y_{t - 1} ,s} \right._{t - 1} ) = P_{r} (y_{t} \left| {Y_{t - 1} } \right.)\).

The Markov chain is ergodic and irreducible, and an absorbing state does not exist, i.e., \(\bar{\xi }_{p} \, \in (0,\,\,1)\) for all m = 1, …, M and \(\bar{\xi }_{p} \,\) is an ergodic or unconditional probability of regime q. The transition matrix is defined as

pij that has unconditional distribution is represented as

and

Following (Hamilton 1990), the EM algorithm is accepted in many empirical analyses. The EM algorithm is designed to estimate the parameters of a model \(Pr \,\left( {s_{t} = j} \right)\) represents the restructured (filtered) probability that \(s_{t} = j\) given the information set \(y_{t}\). Following (Hamilton 1990), \(\varepsilon_{{t{\text{l}}t}}\) denotes the vector of forecast probabilities. Optimal forecast probabilities are obtained using

\(\varepsilon_{t + 1\left| t \right.} = P^{\prime } \varepsilon_{t\left| t \right.}\) and \(\varphi_{t}\) are the vector of conditional densities, 1 is a unit column vector with element-by-element multiplication. The estimation is conducted with,

MScVAR nonlinear Granger causality

Bildirici (2012, 2013a, b) and Fallahi (2011) utilize the MS-GC for MSIA(H)(.)-VAR(.) models. Dependent upon the coefficients of the lagged values of \(dly_{t}\)\(dl{\text{cp}}_{t}\) and \(dl{\text{CO}}_{2t}\) in the equations, one can determine the presence of causalities. The model is given as,

In the \(dly_{t}\) vector, \(dl{\text{CO}}_{2t}\) and/or \(dl{\text{cp}}_{t}\) is/are Granger-cause of \(dly_{t}\) in each jth regime if the parameter set or sets of \(\phi_{12}^{(j)}\) and \(\phi_{21}^{(j)}\), and \(\phi_{13}^{(j)}\) and \(\phi_{31}^{(j)}\) are statistically different than zero. Accordingly, Granger causalities are detected by testing \(H_{0} :\,\phi_{\,12}^{(k)} \,\, = 0\) and \(H_{0} :\,\phi_{\,21}^{(k)} \,\, = 0\), \(H_{0} :\,\phi_{\,23}^{(k)} \,\, = 0\) and \(H_{0} :\,\phi_{\,32}^{(k)} \,\, = 0\), and \(H_{0} :\,\phi_{\,13}^{(k)} \,\, = 0\) and \(H_{0} :\,\phi_{\,31}^{(k)} \,\, = 0\) for the vector of \(dly_{t}\) (Bildirici and Gökmenoglu 2017).

The empirical results

The study focused on the following steps in the empirical section.

-

1.

NG Perron test is conducted to determine if the variables are stationarity.

-

2.

In the second step, the Johansen cointegration test was evaluated to obtain causality based on the MScVAR models. If the Johansen test fails to produce a cointegrated vector, the innovations of the series are used for MScCausality. Within this approach, the direction of causality is determined as an accuracy model.

-

3.

After testing for the appropriate architecture of the MScVAR model with LL an LR tests, the dating obtained from the MScVAR model is evaluated if the crisis years are captured accurately. In addition to the LL and LR tests, if the dating produced by the model coincides with the crisis dates determined by ECRI, the model will be selected.

-

4.

And lastly, the direction of causality determined by MS-Granger Causality will be compared with the ones determined by traditional causality method.

Unit root test results

Firstly, the unit root tests for the integration order of the variables were applied. The results by NG tests were exhibited in Table 1. The results indicated the lyt, lcpt and lCO2t variables follow I(1) processes.

Johansen cointegration test results

At the second stage, Johansen’s procedure was employed to find the existence of cointegration among lyt, lcpt and lCO2t.

The results determined by the Johansen test were exhibited in Table 2 where the null hypothesis of no cointegration was not rejected for the variable under analysis. Since no cointegration relation exists among the variables, the first-differenced or innovation variables, dlyt, dlcpt, and dlCO2t, will be investigated with MS-Granger causality.

MS-VAR results

To determine the number of regimes, the tests based on information criteria (AIC/HQ) were employed. It was estimated MSIA(2)-VAR(2) model for the USA and MSIA(3)-VAR(3) for China with 2 and 3 regimes and 2 and 3 lags models, respectively. While regime 1 describes the recession stage, regime 2 depicts the moderate growth and regime 3 characterizes high-growth stages. According to the results, the total time in the growth periods accepted as regime 2 and 3 is longer than the total period of regime 1. It is noted that the transition probability matrix is ergodic and could not be irreducible. In the state of two regimes, the classification rule suggests transmission of the observation as

The business cycle characteristics

Table 3 displays the business cycle dates found by the MScVAR model and those given by Economic Cycle Research Institute (ECRI). And it exhibits coincidence ratios that suggested by Altuğ and Bildirici (2012) to assess the achievement of the model dating by matching it with ECRI dating. For the coincidence ratios, it is permitted maximum inconsistency of two (three) quarters between ECRI dating for China and the USA, and the coincidence ratios were determined as 100% for China and 86% for the USA. The crisis dating results of the model track fairly well the crisis dates given by the ECRI. The results exhibit significant levels of asymmetries.

MScVAR estimation and MScGranger causality results Footnote 1

The MS-VAR model has two regimes, both of which are defined with three vectors, where the included variables are dlyt, dlCO2t and dlcpt, respectively. Furthermore, it should be noted that the variables dlyt, dlCO2t and dlcpt are innovations of economic growth, cement production and CO2 emissions.

To determine regime numbers for the USA, firstly, a linear VAR model was tested against a MScVAR with 2 regimes, and the H0 hypothesis, which hypothesizes linearity, was rejected by using the LR test statistics. H0 hypothesis implies that there are 2 regimes that were not rejected, and MScVAR model with 2 regimes was accepted as the optimal model because LR statistic was greater than the 5% critical value of χ2. To determine regime numbers in China, firstly, a linear VAR model was tested against a MScVAR with 2 regimes, and the H0 hypothesis, which hypothesizes linearity, was rejected by using the LR test statistics. Secondly, a MScVAR model with 2 regimes was tested against a MScVAR model with 3 regimes; H0 hypothesis implied that there are 2 regimes that were not accepted and MScVAR model with 3 regimes was accepted as the optimal model because LR statistic was greater than the 5% critical value of χ2. Therefore, the number of regimes was determined as 3. The results of the MSIA(2)-VAR(2) model for the USA were exhibited in Table 4. The computed regime probabilities are Prob(st = 2|st−1=2) = 0.82 and Prob(st = 1|st−1=1) = 0.65. The growth stage of the economy in regime 2 is persistent. The computed probability that the crisis regime is followed by growth period was determined as 0.33. By considering the conditions depicted above, the existence of asymmetry cannot be rejected.

In China, the results of the MSIA(3)-VAR(3) model are given in Table 5. The computed regime probabilities are Prob(st = 1|st−1=1) = 0.62, Prob(st = 2|st−1=2) = 0.81 and Prob(st = 3|st−1=3) = 0.55. The growth stage of the economy in regime 2 is persistent. The existence of asymmetry cannot be rejected. Ergodic probabilities reveal that dominant regime is the second regime and p11 = 0.20, p22 = 0.52 and p33 = 0.267 report an important asymmetry.

The dependent variable of the first vector is dlcpt, the innovations of cement production. It should be noted, since China and the USA are cement producers, and additionally, if considered the size of the economies of the USA and China, the GDP on cement production is expected to have important effects. In regime 1, the overall effect of GDP innovations on innovations of cement production is positive in lag (− 1), but negative in lag (2) for both countries. The dependent variable of the second vectors in all regimes is dlCO2t, that is, innovations of carbon dioxide emissions. In the second vector, the majority of the parameters are statistically significant at the conventional levels that in regime 1; the innovations of cement production and economic growth on carbon dioxide emissions cannot be rejected. In regime 1, once the parameter estimations and their statistical significances are evaluated, the overall effects of GDP growth and cement production innovations on carbon dioxide emissions innovations are statistically significant, leading to the conclusion that GDP growth and cement production have both positive and negative impacts on carbon dioxide emissions. For China, in lag (− 2) and lag (− 3) in regime 1, 2 and 3, the coefficients are positive and very high in lag (− 2) with 0.98 and 0.849 values in both regime 1 and regime 3, respectively. For the USA, in lag (− 1) in regimes 1 and 2, the coefficients are positive and close to 0.6, but the coefficients in lag (− 2) in regime 1 and regime 2 exhibit differentiated values and signs of coefficients with − 0.83 and + 0.84.

In all regimes, the cement industry has important effects on CO2 emissions.

Following Bildirici (2012, 2013) and Fallahi (2011), the estimation results of the MS-VAR model were used to obtain MS-Granger causality. As pointed out by Bildirici (2012, 2013a, b) and Fallahi (2011), the estimation results of the MScVAR model can be extended to MScVAR-based nonlinear Granger causality. The results were reported in Table 7.

Traditional and MScCausality results

In this section, the potential similarities and differences of causality results determined by two different methods are compared because the determination of the direction of causality offers important visions about the policy recommendations. The traditional causality results are exhibited in Table 6. For China and the USA, the cement production is not the Granger-cause of CO2 emissions and CO2 emissions are not the Granger-cause of cement production. For China, the results determined that there is the evidence of unidirectional causal nexus from cement production to economic growth and from economic growth to carbon dioxide emissions. For the USA, the evidence of non-causality between cement production and economic growth, and between carbon dioxide emissions and economic growth was found.

The results of MScCausality are given in Table 7. The results determined by traditional causality and MScGC tests are drastically distinguished from each other.

For China and the USA, the MScGC results found the evidence of one-way causal link from cement production to carbon dioxide emissions in all regimes. In all regimes, there is the evidence of two-way causal nexus between cement production and the economic growth for both China and the USA. And in all regimes in China and USA, there is the evidence of two-way causal nexus between carbon dioxide emissions and economic growth. As similar to the results of this paper, Lu (2017) determined bidirectional Granger causality between environmental pollution and economic growth for 16 Asian countries from 1990 to 2012. As similar to the result of the paper Teller et al. (2000), Lin and Zhang (2016) identified the importance on CO2 emission of the cement industry in China.

Discussion of empirical results and policy recommendations

Employed methods determined two different results. According to these empirical results, employing traditional method instead of MS-causality method can cause wrong policy applications when the tested series and relations have nonlinearity.

In MScVAR results, in both China and the USA, the evidence of a one-way causal relation from cement production to CO2 emissions was found and the evidence of a two-way causal relation between cement production and economic growth was noted. Two-way causal nexus postulates that cement production has a significant role in economic growth, decline of cement production can cause slowing economic growth. On the other hand, it can be said that in China and the USA, the cement sector is a main emitter of environmental pollution.

These results determined it will not be possible to reduce CO2 emissions without reducing cement production because the cement production is the source of CO2 emissions. But the cement sector can be accepted as the main player in the economic growth. If the environmental effects of cement industry are taken into account, identifying and measuring of the pollutants are as important as to create the effective environmental solutions.

Since a possible slowdown in cement production could be coupled with slowed economic growth, to achieve an improvement in terms of emissions resulting from cement production, it is possible to implement new production techniques and the energy efficiency must be improved by developing technology possessing the above-mentioned concerns (Ishak and Hashim 2015). Furthermore, fossil fuels could be replaced with alternative fuels (Rahman et al. 2015; McLellan et al. 2012). As a substitute to cement, dust from agricultural wastes that found in pozzolanic materials could be used (Aprianti et al. 2015).

The investments in new kiln technologies could decline the carbon dioxide emissions (Hasanbeigi et al. 2013a). Moreover, China’s and the USA’s cement sector must adopt new dry rotary kilns and they must abandon outdated kilns such as vertical wet kilns and shaft kilns. And new substitutes for the raw material are necessary.

Damages may be decreased by the addition of some materials and substances such as ash from coal furnaces, volcanic materials; blast furnace slag and limestone from steel and iron plants; kiln and pebble dust (Long et al. 2017). And it can be provided to recover by usage of wastes. Moreover, it can be decreased the cement production cost by technology of waste materials (Lamas et al. 2013; Long et al. 2017).

Conclusions

This paper is the first one examining the relation between economic growth, cement production and carbon dioxide emissions for China and the USA by employing MScVAR and MScGC methods. The main findings can be summarized as follows. The evidence of a two-way causal relation between cement production and economic growth was noted. Two-way causal nexus postulates that cement production has an important role in real per capita GDP. The unidirectional causality from cement production to CO2 emissions was found in all regimes in China and the USA. These results determined the impossibility of reducing CO2 emissions without decreasing cement production. The results determined by MScGC approaches were compared with the results determined by traditional causality approach. Traditional causality results found non-causality between cement production and CO2 emissions. According to the implications of these results, cement production would not significantly affect carbon dioxide emissions. The cement production is not a significant factor on CO2 emissions. If the governments track this suggestion, the determined strategies and policies could reverse the adverse effects on the environment.

Since MScVAR and MScGC approaches capture the phases of business cycles, the results determined with these approaches are superior to the ones determined with the traditional Granger causality test. According to the MScGC results, positive causal effects of economic growth and cement production on CO2 emissions could not be excluded in all regimes. According to the results determined by MS-Granger causality, the cement production is not the only a source for global CO2 emissions, but also is the most important one. The cement sector and economic growth have an important impact on the environmental pollution. The USA and China with global responsibility for cement production are determined as one of the central sources of global CO2 emissions.

Notes

The MScVAR and MScGC analyses are realized in Oxmetrics package 3.

References

Altuğ S, Bildirici M (2012) Business cycles in developed and emerging economies: evidence from a univariate Markov switching approach. Emerg Mark Financ Trade 48(6):73–106

Andrew R (2018) Global CO2 emissions from cement production. Earth Syst Sci Data 10:195–217

Anjum Z, Burke PJ, Gerlagh R, Stern DI (2014) Modeling the emissions-income relationship using long run growth rates. CCEP working papers 1403

Aprianti E, Shafigh P, Bahri S, Farahani JN (2015) Supplementary cementitious materials origin from agricultural wastes e a review. Constr Build Mater 74:176–187

Baxter MS, Walton A (1970) A theoretical approach to the Suess effect. Proc R Soc Lond Ser A Math Phys Sci 318:213–230

Bildirici M (2012) The relationship between economic growth and electricity consumption in Africa: MS-VAR and MS-Granger causality analysis. J Energy Dev 37(2):179–207

Bildirici M (2013a) Economic growth and electricity consumption in G7 Countries: MS-VAR and MS-Granger causality analysis. J Energy Dev 38:1

Bildirici ME (2013b) Economic growth and electricity consumption: MS-VAR and MS-Granger causality analysis. OPEC Energy Rev 37(4):447–476

Bildirici M, Gökmenoğlu S (2017) Environmental pollution, hydropower energy consumption and economic growth: evidence from G7 countries. Renew Sustain Energy Rev 75:68–85

Boden TA, Andres RJ, Marland G (2017) Global, regional, and national fossil-fuel CO2 emissions, carbon dioxide information analysis center, Oak Ridge National Laboratory, U.S. Department of Energy, Oak Ridge, Tenn., USA. http://cdiac.ess-dive.lbl.gov/trends/emis/meth_reg.html. Last access: 28 June 2017

CCA (China Cement Association) (2010) China Cement Almanac 2009. Jiangsu People’s Publishing House, Nanjing

CCA (China Cement Association) (2011) China Cement Almanac 2010. Jiangsu People’s Publishing House, Nanjing

CEIC (2017) Accurate macro and micro economic data you can trust. https://www.ceicdata.com/

Chen W, Hong J, Xu C (2015) Pollutants generated by cement production in China, their impacts, and the potential for environmental improvement. J Clean Prod 103:61–69

Chen Y, Lee HF, Wang K, Pei Q, Zou J (2017) Synergy between virtual local air pollutants and greenhouse gases emissions embodied in China’s international trade. J Resour Ecol 8(6):571–583

Fallahi F (2011) Causal relationship between energy consumption (EC) and GDP: a Markov-switching (MS) causality. Energy 36(7):4165–4170

Global Cement (2018) Global cement top 100 report 2017–2018. http://www.globalcement.com/magazine/articles/1054-global-cement-top-100-report-2017-2018

Grossman G, Krueger A (1991) Environmental impacts of a North American free trade agreement, NBER Working Paper No. 3914 Issued in November 1991

Hamilton JD (1990) Analysis of time series subject to changes in regime. J Econom 45(1–2):39–70

Hanke et al (2004) CO2 emissions profile of the U.S. cement industry. https://www3.epa.gov/ttn/chief/conference/ei13

Hasanbeigi A, Price L, Lin E (2012) Emerging energy-efficiency and CO2 emission reduction technologies for cement and concrete production: a technical review. Renew Sustain Energy Rev 16:6220–6238

Hasanbeigi A, Morrow W, Masanet E, Sathaye J, Tengfang X (2013a) Energy efficiency improvement and CO2 emission reduction opportunities in the cement industry in China. Energy Pol 57:287–297

Hasanbeigi A, Morrow W, Sathaye J, Masanet E, Tengfang X (2013b) A bottom-up model to estimate the energy efficiency improvement and CO2 emission reduction potential in the Chinese iron and steel industry. Energy 50:315–325

IEA (2013) Today in energy. https://www.eia.gov/todayinenergy/detail.php?id=11911

IEA (2016) Energy Technology Perspectives. Towards sustainable urban energy systems, International Energy Agency, Paris. www.iea.org/etp2016

Ishak SA, Hashim H (2015) Low carbon measures for cement plant – a review. J Clean Prod 103:260–274

Ke J, Zheng N, Fridley D, Price L, Zhou N (2012) Potential energy savings and CO2 emissions reduction of china’s cement industry. Energy Policy 45(2012):739–751

Keeling CD (1973) Industrial production of carbon dioxide from fossil fuels and limestone. Tellus 25(2):174–198

Keene A, Deller SC (2015) Evidence of the environmental Kuznets’ curve among US counties and the impact of social capital. Int Reg Sci Rev 38(4):358–387

Krolzig H-M (1998) Econometric modelling of Markov-switching vector autoregressions using MSVAR for Ox. http://down.cenet.org.cn/upfile/28/2006491412164.pdf

Lamas WQ, Palau JCF, Camargo JR (2013) Waste materials co-processing in cement industry: ecological efficiency of waste reuse. Renew Sustain Energy Rev 19:200e7

Le Quéré C, Andrew RM, Canadell JG (2016) Global carbon budget 2016. Earth Syst Sci Data 8:605–649

Le Quéré C, Andrew RM, Friedlingstein P et al (2017) Global carbon budget 2017. Earth Syst Sci Data Discuss. https://doi.org/10.5194/essd-2017-123

Lei Y, Zhang Q, Nielsen C, He K (2011) An inventory of primary air pollutants and CO2 emissions from cement production in China, 1990–2020. Atmos Environ 45:147–154

Li J, Li G (2013) Present situation and countermeasures of nitrogen oxides emissions in Chinese cement industry. Appl Chem Ind 42(9):1687–1689

Lin B, Zhang Z (2016) Carbon emissions in China’s cement industry: a sector and policy analysis. Renew Sustain Energy Rev 58:1387–1394

Liu Z et al (2015) Reduced carbon emission estimates from fossil fuel combustion and cement production in China. Natura 524:335–346

Long X, Zhao X, Cheng F (2015a) The comparison analysis of total factor productivity and eco-efficiency in China’s cement manufactures. Energy Pol 81:61–66

Long X, Naminse E, Du J, Zhuang J (2015b) Nonrenewable energy, renewable energy, carbon dioxide emissions and economic growth in China from 1952 to 2012. Renew Sustain Energy Rev 52:680–688

Long X, Sun M, Cheng F, Zhang J (2017) Convergence analysis of eco-efficiency of China’s cement manufacturers through unit root test of panel data. Energy 134:709–717

Long X, Luo Y, Wu C, Zhang J (2018) The influencing factors of CO2 emission intensity of Chinese agriculture from 1997 to 2014. Environ Sci Pollut Res Int 25(13):13093–13101

Lu WC (2017) Greenhouse gas emissions, energy consumption and economic growth: a panel cointegration analysis for 16 Asian countries. Int J Environ Res Public Health 14(11):1436

Luo Y, Long X, Wu C (2017) Decoupling CO2 emissions from economic growth in agricultural sector across 30 Chinese provinces from 1997 to 2014. J Clean Prod 159:220–228

Marland G, Rotty RM (1984) Carbon dioxide emissions from fossil fuels: a procedure for estimation and results for 1950–1982. Tellus B 36:232–261

McLellan BC, Corder GD, Giurco DP, Ishihara KN (2012) Renewable energy in the minerals industry: a review of global potential. J Clean Prod 32:32–44

MEP of China (2014) MEP announces new emission standards for major industries—efforts to implement the ten major measures against air pollution. http://english.mep.gov.cn/News_service/news_release/201401/t20140115_266434.htm

Morse D, Glove A (2000) Minerals and materials in the 20th century—a review, USGS. https://minerals.usgs.gov/minerals/pubs/commodity/timeline/20th_century_review.pdf

Naminse EY, Zhuang J (2018) Economic growth, energy intensity, and carbon dioxide emissions in China. Pol J Environ Stud 27(5):2193–2201

NBS (National Bureau of Statistics) (2014) China Energy Statistical Yearbook 2014

NRMCA (2012) Concrete CO2 Fact Sheet, National Ready Mixed Concrete Association, No. PCO2

Pettersson F, Maddison D, Acar S, Söderholm P (2013) Convergence of carbon dioxide emissions: a review of the literature. Int Rev Environ Resour Econ 7:141–178

Rahman A, Rasul MG, Khan MMK, Sharma S (2015) Recent development on the uses of alternative fuels in cement manufacturing process. Fuel 145:84–99

Selden TM, Song D (1994) Environmental quality and development: is there a Kuznets curve for air pollution? J Environ Econ Environ Manag 27:147–162

Shafik N (1994) Economic development and environmental quality: an econometric analysis. Oxf Econ Pap 46:757–773

Shafik N, Bandyopadhyay S (1992) Economic growth and environmental quality: time series and cross-country evidence, background paper for World Development Report 1992. The World Bank, Washington

Shan Y, Guan D, Zheng H, Ou J, Li Y, Meng J, Mi Z, Liu Z, Zhang Q (2018) China CO2 emission accounts 1997–2015. Sci Data 5:170201

Stern DI (2004) The rise and fall of the environmental Kuznets curve. World Dev 32(8):1419–1439

Stern DI, Common MS, Barbier EB (1996) Economic growth and environmental degradation: the environmental Kuznets curve and sustainable development. World Dev 24:1151–1160

Sun W, Cai J, Mao H, Guan D (2011) Change in carbon dioxide (CO2) emissions from energy use in China’s iron and steel industry. J Iron Steel Res Int 18(6):31–36

Teller P, Denis S, Renzoni R, Germain A, Delaisse P, D’Inverno H (2000) Use of LCI for the decision-making of a Belgian cement producer: a common methodology for accounting CO2 emissions related to the cement life cycle. In: The 8th LCA case studies symposium SETAC-Europe

USGS: Mineral Commodity Summaries (2017) United States geological survey, Reston, Virginia, p 202. https://doi.org/10.3133/70140094

van Donkelaar A, Martin RV, Brauer M, Kahn R, Levy R, Verduzco C, Villeneuve PJ (2010) Global estimates of ambient fine particulate matter concentrations from satellite-based aerosol optical depth: development and application. Environ Heal Perspect 118:847–855

Wang Y, Zhu Q, Geng Y (2013) Trajectory and driving factors for GHG emissions in the Chinese cement industry. J Clean Prod 53:252–260

Xi F, Davis SJ, Ciais P, Crawford-Brown D, Guan D, Pade C, Shi T, Syddall M, Lv J, Ji L, Bing L, Wang J, Wei W, Yang KH, Galan I, Adrade C, Zhang Y, Liu Z (2016) Substantial global carbon uptake by cement carbonation. Nat Geosci 9:880–883

Xu J, Fleiter T, Eichhammer W, Fan Y (2012) Energy consumption and CO2 emission in China’s cement industry: a perspective from LMDI decomposition analysis. Energy Policy 50:821–832

Zhang S, Worrell E, Crijns-Graus W (2015a) Mapping and modeling multiple benefits of energy efficiency and emission mitigation in China’s cement industry at the provincial level. Appl Energy 155:35–58

Zhang S, Worrell E, Crijns-Graus W (2015b) Evaluating cobenefits of energy efficiency and air pollution abatement in China’s cement industry. Appl Energy 147:192–213

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Bildirici, M.E. Cement production, environmental pollution, and economic growth: evidence from China and USA. Clean Techn Environ Policy 21, 783–793 (2019). https://doi.org/10.1007/s10098-019-01667-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-019-01667-3