Abstract

The primary objective of this research is to estimate the willingness to pay in Ghana for reliable piped water services. Three competing economic valuation approaches are used to do this: the contingent valuation method (CVM), the hedonic pricing method (HPM) and the travel cost method (TCM). These methods allow for easy robustness tests of the estimates and serves as an improvement on previous research. Using survey data from a sample of 1,650 urban households, we obtain estimates of the willingness of households to pay every month for urban piped water services of: GHS 47.80 or US$15.25 (CVM), GHS 44.73 or US$14.27 (HPM) and GHS 22.72 or US$725 (TCM). Such sums account for 3–8% of household income. These empirical calculations are then used to inform policy choices by determining the economic viability of the participation of the private sector in the water sector in Ghana.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There have been substantial improvements in global initiatives to resolve drinking water protection issues over the past few decades. One prominent example is the halving of the proportion of the global population without access to sustainable clean drinking water and basic sanitation between 2000 and 2015.Footnote 1 For another example, between 1990 and 2010, more than 2 billion people received improved sources of drinking water, meeting the 7th millennium development goal target (88%) 5 years before the expected deadline of 2015. However, unfortunately, many countries are still lagging, with an estimated 780 million people lacking access to safe drinking water, mostly from developing countries (Salaam-Blyther 2012). Paradoxically, some of these countries are naturally endowed with abundant water resources.

In 2012, UNICEF/WHO reported that while 91% of the urban population have access to improved water supply, only 33% of households have piped water systems in their homes. Moreover, piped water tends to be intermittent and unreliable for non-public sector households and middle/lower income users. This is evidenced by Owusu and Lundehn (2006), who noted that, of Ghanaian households with a secure piped water supply, 87% are officials of the public service or within higher income brackets. It is, therefore, evident that a significant proportion of the urban population remains without access to a reliable supply of piped water. This draws our attention to Sustainable Development Goal 6: “Ensure water and sanitation availability and sustainability management for everyone by 2030”.

Evidence from the literature reveals that key factors impeding access to piped water supply are high operational costs and low revenue returns (Water Aid 2005), unrealistic pricing (MWRWH 2007), and private sector exclusion. To address the situation, studies by the World Bank (1991), and Brookshire and Whittington (1993), have sought to propose a full-cost recovery model to bridge the cost–revenue gap, and in turn the supply-deficit gap. However, due to information asymmetry among market agents and perhaps lack of political will, these suggestions have largely been overlooked. The main uncertainty relates to how much consumers are willing to pay for the quality and quantity (piped water) of water supply.

Two key research questions we seek to investigate are therefore as follows. First, even if consumers are interested in this full-cost recovery proposal, how much are they actually willing to pay for reliable water services? Second, is the incentive—in terms of a cost–benefit analysis—sufficient to attract private sector suppliers? We seek to fill these informational gaps for the benefit of actors in the water sector. To answer the first question, we provide estimates of households’ average willingness to pay (WTP) for reliable piped water, obtained using a variety of methods. We then deduce the associated cost–benefit estimates to provide an answer to the second question.

We consider it important to apply several different valuation methods for two reasons. First, the choice between methods tends to be subjective, the application of several valuation methods to the same choice set provides some degree of neutrality (see Carson et al. 1996). Second, a comparison of estimates obtained using different methods amounts to a useful validation exercise. The concept of validity and its relevance in economics research has been highlighted by Roe and Just (2009). They argue that validity ensures that a finding or conclusion reflects a good approximation of the reality or truth. That is, validity authenticates an empirical finding. They further distinguish between internal and external validity: internal validity is “the ability of a researcher to argue that observed correlations are causal” (Roe and Just 2009, p. 1266); external validity is “the ability to generalize the relationships found in a study to other persons, times, and settings” (p. 1267).

For these reasons, the present study employs three different economic valuation methods to estimate the WTP for a reliable piped water supply. These methods are: the travel cost method (TCM); the hedonic pricing method (HPM); and the contingent valuation method (CVM). One of the study’s contributions is the comparison of the three sets of results being used to establish their external validity. We provide evidence that households are willing to pay 3–8% of income for reliable piped water supply, and these robust estimates are consistent with previous literature (Van Den Berg and Nauges 2012; Choumert et al. 2014b).

The usefulness of our estimates is mainly in providing a key input to the cost–benefit analysis required to establish the net benefit from investing in reliable piped water supply in Ghana. The cost–benefit analysis reveals that consumers’ WTP is easily sufficient to generate positive net benefits from investing in reliable piped water supply in Ghana.

The rest of this paper is structured as follows. Section 2 presents a review of the empirical literature. Section 3 describes the data collection procedure and econometric methodology. Section 4 presents and interprets the results. Section 5 concludes.

2 Review of empirical literature

Notable previous studies on residential demand for water date back to the 1920s. Most of the earlier studies focused on developed countries. For example, Metcalf (1926), using a cross-sectional study of 30 US cities, found a positive relationship between city size and per capita water consumption. The study further reported a price elasticity of − 0.65 suggesting that demand for water is inelastic. Similarly, Gottlieb (1963) estimated demand for urban domestic water in Kansas, USA, finding that income elasticity ranges from 0.28 to 0.58 while price elasticity ranges from − 0.66 to − 1.24. Howe and Linaweaver (1967), in a cross-section country-level study, found that demand for residential water is price inelastic (− 0.23) for off peak periods. The validity of some of these earlier studies is, however, subject to debate. For example, Barkatullah (1999) has raised concerns that the use of average prices instead of marginal prices may lead to an exaggeration of price effect. Moreover, there is clearly a wide range of elasticity estimates. According to Dalhuisen et al. (2003), differences in the elasticities can be attributed to differences in functional forms, data features, aggregation levels and other estimation issues.

The pioneering work of White et al. (1972) on drawers of water is considered to be the first study on demand for water in a developing country. The authors used observations of 34 study sites obtained from 1966 to 1968 in Uganda, Tanzania and Kenya. They find evidence that the practice of connecting pipes to springs, while ideal for dispersed highland areas, is not feasible in high-density urban areas. Subsequently, Katzman (1977), using a cross section of 1400 households in Malaysia, find price elasticity to lie in the range of − 0.2 to − 0.1, and income elasticity in the range of 0.2–0.4. More recently, Nauges and Van Den Berg (2009), applying probit and Tobit models to cross-sectional household-level data from Sri Lanka, reported price elasticities of − 0.15 for piped water, and − 0.37 for a composite of piped water and water from other sources.

Turning to WTP studies in developing countries, which is the focus of our own study, we find that many previous studies have estimated WTP using one of the three methods of interest. The CVM has been used by Whittington et al. (1990a) who applied the ordered probit model to CV data from Haiti to estimate individuals’ WTP for improved water services. The CVM has been used for the same purpose by Briscoe et al. (1990), Whittington et al. (2002), Soto Montes de Oca et al. (2003), and Amoah and Dorm-Adzobu (2013). The HPM has been used by Anselin et al. (2008), Nauges and Van Den Berg (2009), Vásquez (2013, ) and Amoah (2018). The TCM has been used by Brown and Mendelsohn (1984), Smith and Desvousges (1985), and Bockstael et al. (1987).

As made clear in Sect. 1, an important contribution of the present study is to estimate WTP using different methods. We, therefore, consider previous literature in which more than one method has been used to estimate the same WTP. The earliest example appears to be Knetsch and Davis (1966) who compared the CVM and TCM for forest recreation evaluation, with data from 185 users interviewed in Maine, USA. They found that CVM estimates are around 12% greater than TCM estimates. Choe et al. (1996) estimated the economic benefits of surface water quality improvements in developing countries using CVM and TCM methods. They found that these methods provide similar estimates that are quite low, both in absolute terms and as a share of income. Brookshire et al. (1985) investigated the valuation of earthquake risks in Los Angeles and San Francisco using CVM and HPM, and found similarity between the two. Studies comparing CVM and HPM are also made by Cummings et al. (1986), Carson et al. (1996), and MacNair and Desvousges (2007).

Bateman (1993) compares TCM and HPM. Although he acknowledges that neither method captures non-use values, he shows that with certain assumptions they produce valid and similar welfare estimates. Carson et al. (1996) and Devicienti et al. (2004) find that CVM estimates are usually, but not always, smaller than revealed preference estimates (such as those obtained using HPM or TCM).

Regarding urban water valuation studies in Ghana, to the best of our knowledge, only one study has combined more than one of the valuation methods. Amoah (2017) compared two valuation methods (CVM and HPM) in the estimation of demand for water from an innovative borehole system in rural Ghana. Other notable water valuation studies had a different focus from urban water demand: Boadu (1992) studied rural households; Whittington et al. (1993) investigated sanitation services; Berry et al. (2012) estimated WTP for household water filters.

Several studies have, like the current study, conducted cost–benefit analyses of improved water services or projects. The net benefit is usually found to be positive. Briscoe et al. (1990), in a study of rural water supply in Brazil, found that increases in tariffs for yard taps can attract the private sector. Whittington et al. (2002) found a similar result for piped water services in Nepal. Subsequently, Nauges and Van Den Berg (2009) investigated both piped and non-piped water services in Sri Lanka and found that households’ WTP for improved services greatly exceed their current water costs.

However, it must be added that the net benefit is not always positive. Gramlich (1977) used CVM to estimate the demand for clean water from the Charles River, USA and found the benefit of the proposed project to be of similar order to the cost. Similarly, Pattanayak (2006) estimated the demand for piped water services using WTP data from 1800 households in Sri Lanka and found that demand was low, and hence predicted that private sector involvement would fail.

This mixture of conclusions from cost–benefit analysis strengthens our motivation to obtain robust and reliable estimates of WTP for use as inputs into the cost–benefit calculation performed in this study.

3 Data and econometric modelling of valuation methods

This study uses data from a representative sample of 1,650 urban households from the Greater Accra Region (GAR) of Ghana. GAR is the most populous region of the country, and contains the capital city, Accra. GAR also has the highest population density of all regions, with 31.2% of households being urban households (GSS 2012).

A multistage random sampling technique was considered suitable. To ensure sufficient geographical coverage and spatial variation, the region was first clustered into ten districts. From each of the ten districts, we randomly selected two communities (defined in accordance with the Town and Country Planning list of communities). From each selected community, a random sample of households was selected. In communal living housing units, not more than two households were interviewed. One sampling problem arose when collecting data from unplanned settlements,Footnote 2 which are widespread in most districts of urban GAR. In such settlements, the sampling rate was inevitably low and hence the sample was less likely to be representative.

For the unit of analysis, we considered household heads who were at least 18 years of age, not in prison, and assessed as having a stable mental state (not influenced by alcohol/drugs etc.) at the time of the survey. Furthermore, they should have been economically engaged for at least some of the previous 5-year period, and should be either currently employed, or unemployed for less than 7 days prior to the interview. All sampled individuals were given the right to decline participation.

Although the entire household is treated as the sampling unit, the interviewer’s first task was to identify the household head. This was in accordance with the definition prescribed by the GSS (2012), namely, the household member who is economically and socially responsible for the entire household. For households with more than one economically active member, the interviewer identified the household member who bears the costs of water, and interviewed that member. This method of identifying the household head differs from that recommended by Whittington and Pagiola (2012), in which the household members themselves are asked to designate an interviewee.

The household head of each sampled household was interviewed in-person in a questionnaire administered survey. In using an in-person survey, we were following the recommendation of Mitchell and Carson (1988), who highlight the advantages of such an approach over telephone and mail surveys, which tend to suffer from low response rates and other sampling problems.

The structured questionnaire had several sections which included: personal data of respondent; questions relating to water, sanitation and environment; questions relating to housing costs; questions relating to travel cost; and contingent valuation questions. The administration of the questionnaire consisted of an overall supervisor, 20 fieldworkers and four coordinators. Fieldworkers were provided with appropriate training, including two pilot surveys, to prepare them for effective administration of the questionnaire. The data collection took place between March and May, 2014.

Descriptive statistics for the survey data are presented in Tables 10 and 11 of the Appendix. There, we see that the average age of respondents is around 39 years. We also see that 83% of respondents have other family members staying with them. This reflects the communal living nature of the study area. 91% of households have no access to garage facilities in their homes. 28% have no access to toilet facilities. Over 48% of households have access to reservoirs in their dwellings (such as wells and boreholes). This supports the rationale for households to demand reliable supply of piped water in residences.

3.1 The hedonic pricing method (HPM)

The hedonic pricing method (HPM; Rosen 1974) is an indirect valuation method based on revealed preference theory, which is very useful for estimating the value of a non-market good such as the one of interest in this study. Conceptually, this method defines a housing unit as a vector z whose elements are its attributes, including structural, neighbourhood and environmental attributes. The model assumes a perfectly competitive market with perfect observability of attributes. It then specifies the market price of the housing unit as a function of the attributes:

The parameters of (1) have the interpretation as the marginal valuation of an attribute. It is conventional to estimate the parameters using log-linear regression, so that the marginal valuations are expressed in proportional terms.

In this study, instead of using the log of the market price as the dependent variable, we use the log of monthly rent. This is because in Ghana, as in most African countries, apart from the fact that transaction price or assessed value of housing is extremely difficult to come by, most households live in rented properties. The same approach has been used in most related studies, including North and Griffin (1993), Quigley (1982), Jimenez (1982), Knight et al. (2004), Gulyani and Talukdar (2008), Choumert et al. (2014a), Choumert et al. (2014b) and Amoah (2018).

In the log-linear regression, the coefficient on the attribute of interest (i.e. access to piped water) is interpreted as the valuation of the attribute as a proportion of monthly rent. To convert this into a money valuation, we multiply by a measure of average monthly rent. Hence the money valuation is obtained in two stages, and this approach has been followed previously by Choumert et al. (2014b) and Amoah (2017).

3.2 The travel cost method (TCM)

Similar to the HPM, TCM is an indirect non-market valuation method which is based on revealed preference theory. One of our survey questions asks for the location of the household’s main water source. Another question asks for the location of the next nearest water source. With these two responses, we computed the distance from the household’s location to each of the two sources, and the implied travel times. Households are also asked how many round trips they make to their main water source per month. The resulting variables are the key components of the TCM.

TCM amounts to the estimation of a “trip generating function” (Garrod and Willis 1999) which takes the form:

where \({T}_{i}\) is the number of round trips made by household \(i\) to its main water source, \({C}_{i}\) is the travel cost (measured as travel time) incurred by household \(i\) when visiting its main source\(,\) \({S}_{i}\) is the travel cost incurred when visiting the next nearest source, and Zi is a vector of household controls.

Similar to the case of HPM, economic theory is not emphatic on the appropriate functional form for the TCM. However, this is a situation in which the nature of the dependent variable determines the choice of econometric model. The dependent variable, being the number of trips made over a 1-month period, is an example of what is known as a count variable, since it can only take non-negative integer values. It is well known that OLS estimation is inappropriate when the dependent variable is of this form, and Poisson regression is required instead, or Negative binomial regression if the count data exhibits over-dispersion (see Winkelmann 2008). The application of these sorts of models to the estimation of equations of the form (2) has been considered by Bateman (1993), Wattage (2002), Perman (2003) and many others.

We present the Poisson regression model and negative binomial regression model as:

3.2.1 Poisson regression model

where \(v\) and \(\lambda\) denotes a non-negative integer outcome and the Poisson mean respectively.

3.2.2 Negative binomial regression model

A key assumption of the Poisson regression model is that the conditional mean and variance are equal. In many count data applications, this assumption is violated, and we instead see over-dispersion, with the conditional variance is greater than the conditional mean. The negative binomial regression model (NB) is a generalisation of the Poisson regression model with an additional parameter (\(\alpha\)) that allows for over-dispersion. When \(\alpha\) approaches zero, the NB model becomes equivalent to the Poisson model. Hence a test of \({H}_{0}: \alpha =0\) against \({H}_{1}: \alpha >0\) is a test of over-dispersion, and is hence a test of the validity of the Poisson regression model. If H0 is rejected, the NB model should be used instead.

3.3 The contingent valuation method (CVM)

The CVM is a stated preference method which has become hugely popular for the estimation of non-market values. This method expounds the idea that an individual’s behaviour can be observed through their responses to hypothetical questions.

Let \({\mathrm{WTP}}_{i}\) be the maximum amount household i is willing to pay for a proposed service improvement. It is conventional to assume that \({\mathrm{WTP}}_{i}\) depends linearly on the household’s characteristics, according to:

where \({\mathbf{X}}_{i}\) is a vector consisting of the household’s characteristics (including attributes of the household’s water sources), \(\alpha\) and \({\varvec{\upbeta}}\) denote parameters to be estimated, and \({u}_{i}\) is a normally distributed error term.

In the survey, the target commodity in the hypothetical market is presented to the respondent in two phases:

Phase 1: “I would want to find out from you -if you value the provision of an improved water supply system in Ghana particularly in the Greater Accra Region. By improvement we mean you are connected to the Ghana Water Company Limited (GWCL) main lines, water flows directly in your residence at all times, and the quality of the water is up to an acceptable international standard…”.

Phase 2: A pictorial version representing the scenario described in Phase 1 was shown and narrated to the respondent.

Having administered these two phases, the following question was then asked: “Generally, we know that every good thing comes at a cost and you may be required to pay a permanent amount that will be factored into your [monthly] water bills provided by GWCL. Suppose you are supplied with an uninterrupted (reliable) piped water as orally and pictorially described; how much would you be willing to pay to fetch a 34 cm bucket of water?”.

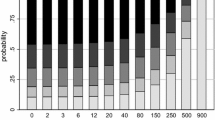

To elicit the response to this question, we used the double bound design used recently by Amoah et al. (2019). We started with an amount (either 0.20, 0.30, 0.40, or 0.50 GHS) that was determined randomly, and asked if the respondent was willing to pay this amount. The next question depended on their answer. For example, if the starting bid was 0.30 and they answered “yes”, the amount was raised to 0.40. If they said “yes” to 0.40, the amount was raised to 0.50; if they said “no” to 0.40, the amount was lowered to 0.35. If, instead, their answered “no” to the starting bid of 0.30, the amount was lowered to 0.20, and so on. The result from the sequence of questions is an interval of values, of width 0.05 or 0.10, in which WTP is known to lie.

In an attempt to control for possible starting point and anchoring effect biases, we used a randomized questionnaire sorting (RQS) procedure which applies the same principle as the card method. The face-to-face approach was used because it provides a stronger engagement with respondents in addition to reducing questionnaire misunderstandings.

4 Analysis of results

In this section, we present the results of the various valuation methods used.

4.1 Hedonic pricing method (HPM) valuation results

Descriptive statistics of the key variables used in the HPM are shown in Table 10 of the Appendix. There, we see that in the last month before the survey, the average rent paid by households was GHS 138.23, with the minimum and maximum rent being GHS 10 and GHS 1,000, respectively. At the district level, mean district monthly take-home income was GHS 636.18, which is very similar to the household take-home income of GHS 636.37. Both are quite close to the national estimate of GHS 544 for GAR (GSS 2008). The average rental value is found to constitute 22% of district income.

Households with a reliable supply of piped water are defined in this study as those households that have a regular supply of piped water (except for technical faults). Approximately 71% of respondents do not have a reliable supply of piped water, which underlines the importance of this research.

Table 1 presents the results of various functional forms for the HPM. To deal with the issues of heteroscedasticity usually found in cross-sectional data, robust standard errors were used. To assess the extent of the multicollinearity problem, the variance inflation factor was used. The mean VIF was found to be 1.12 and not significantly different from 1, indicating that multicollinearity is not a problem of concern in this study. The signs and significance of variables are broadly significant between the four specifications, and this demonstrates robustness. The log-lin model including district dummies (Model 4) is considered to be the preferred model on the basis of its high coefficient of determination (R-squared) and low value of Akaike’s information criterion (AIC).

Following Van Den Berg and Nauges (2012), in models 1 and 3 of Table 1, mean district income is used as a proxy for socio-economic characteristics such as awareness and perception of the neighbourhood and education levels. As expected, its effect is positive and significant. We also see that, as expected, rent is higher for households located closer to schools, financial institutions and highways.

The results show that the coefficients of structural features such as access to potable water, toilet facilities, reservoir and garage(s) are, as expected, positive and significant. In line with the objective of the paper, we focus on the coefficient of the dummy variable representing access to reliable piped water. In column 4 of Table 1, we see that the coefficient of this variable in the preferred log-lin model is \(\widehat{\beta }=0.2803\). By applying the anti-log transformation to this coefficient, in line with Van Den Berg and Nauges (2012), we deduce the relative change in rental value, as follows:

The figure obtained in (5) is the proportional increase in rent that consumers are willing to pay for reliable piped water. Multiplying this number by the mean of monthly rent of GHS 139.23 (from Table 10 in the Appendix), we obtain an estimate of the absolute money amount that consumers are willing to pay on average, which is GHS 44.73, as shown in Table 2. In line with standard hedonic pricing theory, this estimate should be treated as an upper bound to the true WTP (Choumert et al. 2014b).

First, note that this estimate of WTP is similar to, but slightly lower than, the mean of current household expenditure on water per month, which is GHS 52.2 (see Table 11 of the Appendix). This just implies that the amount individuals are willing to pay for the improvement in water supply is lower than the amount they currently pay, which is loosely consistent with the concept of diminishing marginal utility. Second, if we divide this WTP estimate by the mean district income of 636.18, we obtain 0.0703, which indicates that WTP for the improvement is 7.03% of mean district income.

4.2 Travel cost method (TCM) results

Descriptive statistics for the variables used in the TCM are presented in Table 11 of the Appendix. There, we see that on average, households make approximately 100 round trips to their main water source per month. This is equivalent to three round trips per day. The cost of trips was estimated by computing the time taken to make the trip and multiplying this by the minimum wage. The average cost of a round trip to the main source is GHS 9.16, and to other sources GHS 55.52. A separate question revealed that 48% of round trips were made by children.

Table 3 presents the results from estimation of the TCM model. In line with the background on the TCM in Sect. 3.2 above, three different models have been estimated: OLS, Poisson, and negative binomial. Note that district dummies are included to account for district-specific characteristic with respect to their sources of water supply. We commence by checking for the problems of multicollinearity and heteroscedasticity. The mean VIF value of 1.34 reported in column 1 indicates the absence of multicollinearity. To remedy any problems of heteroscedasticity, all models were estimated with robust standard errors.

As explained in Sect. 3.2, the OLS model is unsuitable for modelling the number of trips. Count data models such as Poisson and NB are required instead. Also, the test which is useful in choosing between Poisson and NB is one which tests the null hypothesis \({H}_{0}: \alpha =0\) against \({H}_{1}: \alpha >0\). The result of this test is presented in Table 4. We see a strong rejection of the null hypothesis, implying strong evidence of over-dispersion, meaning that the NB model is the preferred model. In Table 3, we see that the AIC also lends support to the NB model. Once again, Poisson and OLS results are useful for robustness purposes.

Because coefficients of Poisson and NB models are not easy to interpret, we include marginal effects for our preferred model in the final column (4) of Table 3. The key result seen here is the strongly negative effect of the cost per trip on the expected number of trips per month. We see that a 1% rise in cost reduces the expected count by 0.047, holding other factors constant. We also see that, a 1% rise in cost per trip to the alternative source of water raises expected count by 0.071. The effect of cost per trip to the alternative source appears stronger but note that its standard error is also much higher.

The results show a negative and statistically significant coefficient for access to reliable piped water in residence. The marginal effect implies that holding all else constant, having access to reliable piped water supply reduces the expected number of trips by 11.224. The effect of reservoir in residence has a very similar effect on the number of trips. These results are expected: residences with a reliable piped water supply and/or a reservoir in the form of wells and boreholes as a source of water supply have no incentive to make trips to haul for water from an alternative source. These results underline the considerable benefits of having piped water systems in urban homes.

Another interesting result seen in the final column of Table 3 is that the presence of other family members in the household has the effect of increasing the expected number of trips by 16.321. This may be a consequence of the demand for water being higher for larger households. But it may also be a consequence of children being sent on trips. If this is the case, the implications for children’s academic life and personal development cannot be ignored.

Household income and household saving behaviour both have a strong negative effect on the number of trips. One explanation for these effects is that wealthier households can afford tanker services and therefore require less trips.

To deduce WTP for improved supply from the TCM results, we follow the approach of Creel and Loomis (1990) and Bateman (1993). This approach can be used to estimate consumer surplus per trip, and hence that WTP for reliable piped water supply. According to Creel and Loomis (1990), an estimate of consumer surplus per trip may be deduced from the TCM results as − 1/βTC, where βTC is the coefficient of the travel cost variable. The estimate of βTC for our preferred model is seen in Table 3 to be − 0.044, and hence the estimate of consumer surplus per trip is 1/0.044 = 22.72 (GHS). The delta method may be applied to obtain a standard error of this estimate. This gives rise to a 95% confidence interval of (19.99, 26.62). The point estimate of WTP represents 3.57% of households’ income (see Table 5).

It is acknowledged that the key variable in the analysis, the cost to main source of water supply, could capture not only piped water supply but also other improved and acceptable sources in some cases. Of course, given that majority (over 64%)Footnote 3 in GAR depend on piped water sources, we do not expect there to be many other improved sources. Nevertheless, our estimate of WTP must be interpreted as WTP for improved water supply and not necessarily piped water supply.

It is also acknowledged that our estimate should be interpreted as a lower bound as a consequence of the opportunity cost of travel time being used to determine the cost per trip (see Czajkowski et al. 2015). Hence, it is reasonable to expect the WTP obtained using TCM to be the lowest of our three estimates.

4.3 Contingent valuation results

As explained in Sect. 3.3, the CVM is used to estimate the parameters of the linear Eq. (4) above, in which the dependent variable is willingness to pay (WTP) for a 34 cm bucket of water (18.75 L) from piped water sources in residence. Also as explained in Sect. 3.3, the double bound design was used for the CVM. Starting with a randomly selected starting amount, there is a sequence of WTP questions, the answers to which lead to an interval in which the respondent’s WTP is known to lie. Because the data are in the form of intervals, the preferred econometric model is an interval regression model, in which the intervals are defined in terms of log (WTP). For the purpose of robustness checking, we use two other estimation methods: OLS with dependent variable obtained from the log of the midpoints of each interval; and ordered probit, in which the intervals are treated as ordered alternatives.

Based on interval midpoints, the mean WTP for the 34 cm bucket of water is approximately GHS 0.40 which is greater than the average GHS 0.35 they currently pay in GAR. Further descriptive statistics for the data used for the CVM are presented in Tables 10 and 11 of the Appendix.

The results from estimation of the three models are presented in Table 6. Although we include the AIC, it is important to recognise that the AIC’s cannot be compared since the three models have dependent variables of different forms. It is useful to note that the adjusted R-squared of 21% for the OLS model is well above the 15% proposed by Mitchell and Carson (1989) as the minimum for reliable CV studies. All models control for district-specific fixed effects using district dummies, and all models are estimated with heteroscedasticity-robust standard errors.

Let us now interpret the results of the interval regression model. We first see that, all other things being equal, households with access to reliable main source of drinking water are willing to pay approximately 8% more than households without access. We also see that households with access to a reliable source of water for general use are willling to pay approximately 5% more than households without access. This indicates that households who are willing to pay most for an improvement in supply are the ones who are already enjoying a reasonably good supply.

The effect of household’s average expenditure on water per month is positive but not statistically significant. Willingness to pay for an improvement in the service does not appear to depend on current consumption.

The coefficients of age and age-squared indicate that the effect of respondent’s age on WTP is U-shaped, with a minimum WTP around 40 years (95% CI 35–45). According to Soto Montes de Oca et al. (2003) such U-shaped relationships reflect changing priorities over the respondent’s life-cycle. Cameron and Englin (1997) suggest that respondent’s age is a very crucial variable in WTP studies since it represents an upper bound on respondent’s “experience”. A 1% increase in household income level is seen to cause an increase of 0.08% in WTP for piped water supply, and this income effect is strongly significant. In economic terms, we are seeing here strong evidence that piped water supply is a normal good, and this result is in line with Soto Montes de Oca et al. (2003).

The number of households in a residence has a positive and significant effect: if the number of households in a residence rises by one, WTP rises by 0.7%. This can perhaps be attributed to the “communal living effect” which is a feature of most regions in Ghana where people live together and share household responsibilities. Also, residence fence type has a positive and significant effect. That is, fenced households are 3.8% more willing to pay for reliable piped water than unfenced households. Fenced houses suggest households avoiding the potential for the free-riding that is seen in communal living societies. By implication, why communal living and household water responsibilities are shared among households, it is important to mention that people are a bit cautious of free-riding from unwanted guests. Again, we used the dummy variable “other family members” to capture household size, but this variable does not have a significant effect.

One important control variable commonly used in the CVM literature is respondents’ awareness and knowledge of environmental issues (see Amoah et al. 2018). With this in mind, two such knowledge variables have been included: domestic environmental knowledge, and international environmental knowledge (see Amoah and Addoah 2020). In line with expectations, we observe that both knowledge variables increase WTP, suggesting that environmentally informed households appreciate improved services more. However, neither of these effects show significance in our preferred interval regression model.

The last variable of interest, the starting point bid, shows a positive and statistically significant effect on WTP. This provides evidence that, all else held constant, a 1% increase in the starting point bid leads to a 0.4% increase in WTP. Even though this study has followed the literature in using the RQS to control for starting point bias and the “anchoring effect” (Boyle 2003), the evidence of such bias is strong. We remark that without the starting point controls applied, the bias could have been higher.

The estimates from the interval regression model reported in Table 6 have been used to predict the WTP for a 34 cm bucket of water by an average respondent. This prediction is GHS 0.4055 (95% CI 0.4014, 0.4095). On the basis that average consumption is equivalent to four 34 cm buckets per day (MWRWH 1998), and assuming that WTP is directly proportional to supply, we deduce that WTP for one month’s supply is GHS48.66 (95% CI 48.17, 49.14). Note that this sort of calculation does not allow for diminishing marginal utility and this is another reason why the monthly WTP estimate should be interpreted as an upper bound to true WTP.

As reported in Table 7, The estimate of WTP obtained here is 7.65% of monthly income. Studies on developing countries such as Whittington et al. (1991), Soto Montes de Oca et al. (2003), and Amoah et al. (2019) have reported shares of WTP to household income between 2 and 18%. Our own result is seen to fall well within this expected range provided in literature, and this lends credence to the external validity of the results.

4.4 Comparison of WTP estimates

For ease of comparison, the results of the various methods are quoted in both Ghana cedi (GHS) and United States dollars in Tables 8, 9

It is evident from Table 8 that the WTP estimate obtained using the CVM (GHS 47.80 or US$15.25) is slightly higher than that obtained using HPM (GHS 44.73 or US$14.27) and both are considerably higher than that obtained using TCM (GHS 22.72 or US$7.25. This ranking accords with the findings of Knetsch and Davis (1966), Bishop and Heberlein (1979), and Amoah (2017) where values obtained using stated preference method are higher than results from revealed preference methods. Also, our estimates of WTP as a share of household income for all three methods fall within the 2–18% range observed in previous literature (see Whittington et al. 1991 and Soto Montes de Oca et al. 2003).

Care should be taken in interpreting our three WTP estimates. Both HPM and CVM provide upper bounds to WTP, but they are actually measuring different things. CVM captures both use and non-use values while HPM measures use values only. Here, we have an explanation for why CVM is providing a higher estimate than HPM. Meanwhile, TCM is known to provide a lower bound to WTP and this explains why this estimate is the lowest of the three.

4.5 Cost and benefit analysis

In line with the second objective of this study, we now seek to ascertain whether the estimated demand for the improved service for the study area is sufficient to attract private sector involvement in the water sector. To achieve this objective, we start by arguing that determining prices is a principal objective of suppliers. For example a profit maximizing supplier will ensure that price at least exceeds average variable cost. For another example, for a good with no close substitutes and gence inelastic demand, higher prices generate higher revenue.

To estimate the level of demand, we shall use the CVM estimate reported in Sect. 4.3, because this estimate captures both use and non-use values unlike the HPM and the TCM. Table 7 shows that for the 34 cm bucket of piped water in their residence, households are willing to pay 40.55 pesewas (GHS 0.4055). Again assuming average consumption of four buckets per day, and using an estimate of the urban population (number of households) from the 2010 population census, setting a price equal to WTP will generate expected daily revenue of GHS 1,514,202.03 (US$483,030.45).

For the cost estimate, the United Nations (2004) has shown in an assessment of Freshwater Country Profile for Ghana revealed that to produce, transport and supply portable water requires an amount of US$0.80 per cubic metre (1,000 L). Hence the cost of supplying one household for 1 day (75 L) is US$0.06. Again, making use of the population estimate, we deduce that the total cost to produce, transport and supply 75 L of portable piped water per day to all urban households in Urban GAR is approximately GHS 180,563.84 (US$57,020.16) as shown in Table 9. This is considerably lower than the expected revenue of GHS 1,514,202.03 (US$483,030.45) reported above. The net benefit of the project (expected revenue minus expected cost) is GHS 1,333,638.19 (US$426,010.29) per day or GHS486.78million (US$155.49million) per annum. This is broadly consistent with the estimates of Whittington et al. (2002), and Soto Montes de Oca et al. (2003).

5 Conclusion

To the best of the authors’ knowledge, this study can be regarded as the first empirical study that applies three different valuation methods to estimate willingness to pay for access to reliable water in an African country. The use of three different methods has been stressed since it allows validation of results. This study complements existing literature that have combined more than one method, in both developed and developing countries, and provides validated evidence to inform policy decisions. The three methods have been applied to a sample of households from the Greater Accra Region of Ghana.

We have sought to provide an empirical justification for implementing the full-cost recovery programme in the water sector in Ghana. To achieve this goal, the guidelines and valuation design issues suggested by FAO (2000) and NOAA Blue Ribbon Panel Committee have been followed.

The study reveals that household WTP for the supply of reliable water per month is GHS 44.73 or US$14.27 (HPM), GHS 22.72 or US$7.25 (TCM) and GHS 48.66 or US$15.52 (CVM). This constitutes approximately 3–8% of the income of households. These results are broadly in line with previous findings in the literature. Since the study fulfils both internal and external validity, we are confident that the estimates are suitable for policy prescription.

The results lend support for the economic viability of private sector participation in the water sector as suggested by the World Bank (1993). Using cost–benefit analysis with our WTP estimates as inputs, we have established that a private supplier could earn considerable profits, without support from the government or other donors, from providing the improved service.

Notes

UNICEF/WHO (2012) “Millennium Development Goal drinking water target met.” Available at: https://www.who.int/mediacentre/news/releases/2012/drinking_water_20120306/en/.

The term “unplanned settlement” refers to any uncoordinated settlement on land without reference to any predetermined standards of planning.

Ghana Statistical Service (GSS 2012)2010 Population and Housing Census, pg. 30.

References

Amoah A (2017) Demand for domestic water from an innovative borehole system in rural Ghana: stated and revealed preference approaches. Water Policy J 19(1):46–68

Amoah A (2018) Is access to reliable improved water a determinant of urban rental values? Interdiscip Environ Rev 19(3–4):306–322

Amoah A, Addoah T (2020) Does environmental knowledge drive pro-environmental behaviour in developing countries? Evidence from households in Ghana. Environ Dev Sustain 23:1–20

Amoah A, Dorm-Adzobu C (2013) Application of contingent valuation method (CVM) in determining demand for improved rainwater in coastal savannah region of Ghana, West Africa. J Econ Sustain Dev 4(3):1–24

Amoah A, Hughes G, Pomeyie P (2018) Environmental consciousness and choice of bulb for lighting in a developing country. Energy Sustain Soc 8(1):1–9

Amoah A, Ferrini S, Schaafsma M (2019) Electricity outages in Ghana: are contingent valuation estimates valid? Energy Policy 135:110996

Anselin L, Lozana-Garcia N, Deichmann U, Lall S (2008) Valuing access to water-a spatial hedonic approach applied to Indian cities, vol 4533. World Bank Publications, Herndon

Barkatullah N (1999) Pricing, demand analysis and simulation: an application to a water utility. Universal-Publishers, Irvine

Bateman I (1993) Evaluation of the environment: a survey of revealed preference techniques. CSERGE Working Paper GEC 93-06

Berry J, Fischer G, Guiteras R (2012) Eliciting and utilizing willingness to pay: evidence from field trials in Northern Ghana. Unpublished manuscript. Accessed on the 12/11/2013 at http://personal.lse.ac.uk/fischerg/Assets/BFG-BDM-April-2012.pdf

Bishop RC, Heberlein TA (1979) Measuring values of extra market goods: are indirect measures biased? Am J Agric Econ 61:926–930

Boadu FO (1992) Contingent valuation for household water in rural Ghana. J Agric Econ 43(3):458–465

Bockstael NE, Hanemann WM, Kling CL (1987) Estimating the value of water quality improvements in a recreational demand framework. Water Resour Res 23(5):951–960

Boyle KJ (2003) Contingent valuation in practice. A primer on nonmarket valuation. Springer Netherlands, Dordrecht, pp 111–169

Briscoe J, de Castro PF, Griffin C, North J, Olsen O (1990) Toward equitable and sustainable rural water supplies: a contingent valuation study in Brazil. World Bank Econ Rev 4(2):115–134

Brookshire DS, Whittington D (1993) Water-resources issues in the developing-countries. Water Resour Res 29(7):1883–1888

Brookshire DS, Thayer MA, Tschirhart J, Schulze WD (1985) A test of the expected utility model: evidence from earthquake risks. J Polit Econ 93:369–389

Brown G Jr, Mendelsohn R (1984) The hedonic travel cost method. Review Econ Stat 427–433

Cameron TA, Englin J (1997) Respondent experience and contingent valuation of environmental goods. J Environ Econ Manag 33(3):296–313

Carson RT, Flores NE, Martin KM, Wright JL (1996) Contingent valuation and revealed preference methodologies: comparing the estimates for quasi-public goods. Land Econ 72:80–99

Choe K, Whittington D, Lauria DT (1996) The economic benefits of surface water quality improvements in developing countries: a case study of Davao, Philippines. Land Econ 72(4):519–537

Choumert J, Kere EN, Lare AL (2014a) The impact of water and sanitation access on housing values: the case of Dapaong, Togo. CERDI Working Paper No. 201403

Choumert J, Stage J, Uwera C (2014) Access to Water as a determinant of rental values: a housing hedonic analysis in Rwanda. J Hous Econ 26:48–54

Creel MD, Loomis JB (1990) Theoretical and empirical advantages of truncated count data estimators for analysis of deer hunting in California. Am J Agric Econ 72(2):434–441

Cummings R, Schulze W, Gerking S, Brookshire D (1986) Measuring the elasticity of substitution of wages for municipal infrastructure: a comparison of the survey and wage hedonic approaches. J Environ Econ Manag 13(3):269–276

Czajkowski M, Giergiczny M, Kronenberg J, Englin J (2015) The individual travel cost method with consumer-specific values of travel time savings (No. 2015-12)

Dalhuisen JM, Florax RJ, De Groot HL, Nijkamp P (2003) Price and income elasticities of residential water demand: a meta-analysis. Land Econ 79(2):292–308

Devicienti F, Klytchnikova I, Paternostro S (2004) Willingness to pay for water and energy: an introductory guide to contingent valuation and coping cost techniques. Energy Working Notes, Energy and Mining Sector Board, 3

FAO [Food and Agriculture Organization of the United Nations] (2000) Applications of the contingent valuation method in developing countries: a survey. FAO Economic and Social Development Paper 146, Italy

Garrod G, Willis KG (1999) Economic valuation of the environment: methods and case studies. Edward Elgar, Cheltenham, p 384

Gottlieb M (1963) Urban domestic demand for water: a Kansas case study. Land Econ 39(2):204–210

Gramlich FW (1977) The demand for clean water: the case of the Charles River. Natl Tax J 183–194

GSS (Ghana Statistical Service) (2008) Ghana living standards survey report of the 5th round (GLSS 5)

GSS (Government of Ghana, Ghana Statistical Service) (2012) 2010 population and housing census, summary report of final results. Sakoa Press Limited, Accra

Gulyani S, Talukdar D (2008) Slum real estate: the low-quality high price puzzle in nairobi’s slum rental market and its implications for theory and practice. World Dev 36(10):1916–1937

Howe CW, Linaweaver FP (1967) The impact of price on residential water demand and its relation to system design and price structure. Water Resour Res 3(1):13–32

Jimenez E (1982) The value of squatter dwellings in developing countries. Econ Dev Cult Change 30(4):739–752

Katzman MT (1977) Income and price elasticities of demand for water in developing countries 1. J Am Water Resour Assoc 13(1):47–55

Knetsch JL, Davis RK (1966) Comparison of methods for resource valuation. In: Kneese AV, Smith SC (eds) Research water. The John Hopkins University Press, Baltimore, pp 384–389

Knight JR, Herrin WE, Balihuta AM (2004) Housing prices and maturing real estate markets: evidence from uganda. J Real Estate Financ Econ 28:5–18

MacNair DJ, Desvousges WH (2007) The economics of fish consumption advisories: insights from revealed and stated preference data. Land Econ 83(4):600–616

Metcalf L (1926) Effect of water rates and growth in population upon per capita consumption. J (Am Water Works Assoc) 15(1):1–21

Mitchell RC, Carson RT (1988) Evaluating the validity of contingent valuation studies. Venture Publishing, Inc., State College, p 16803

Mitchelll RC, Carson RT (1989) Using surveys to value public goods: the contingent valuation method. Resources for the Future, Washington, D.C.

MWRWH, [Ministry of Water Resources Works and Housing] (1998) Ghana’s water resources: management challenges and opportunities. Accra, 78p. In Abraham EM, Van Rooijen D, Cofie O, Raschid-Sally L (2007): Planning urban water-dependent livelihood opportunities for the poor in Accra, Ghana. SWITCH Scientific Meeting, University of Birmingham, UK

MWRWH, Ministry of Water Resources, Works and Housing; National Water Policy (NWP) (2007) Government of Ghana

Nauges C, Van Den Berg C (2009) Demand for piped and non-piped water supply services: evidence from Southwest Sri Lanka. Environ Resource Econ 42(4):535–549

North JH, Griffin CC (1993) Water source as a housing characteristic: hedonic property valuation and willingness to pay for water. Water Resour Res 29(7):1923–1929

Owusu ES, Lundehn C (2006) Consumer attitude and trust in Accra water supply (Ghana). Chalmers University of Technology, Gothenburg

Pattanayak S (2006) The use of willingness to pay experiments: estimating demand for piped water connections in Sri Lanka, vol 3818. World Bank Publications, Herndon

Perman R (2003) Natural resource and environmental economics. Pearson Education, London

Quigley JM (1982) Nonlinear budget constraints and consumer demand: An application to public programs for residential housing. J Urban Econ 12(2):177–201

Roe BE, Just DR (2009) Internal and external validity in economics research: tradeoffs between experiments, field experiments, natural experiments, and field data. Am J Agric Econ 91(5):1266–1271

Rosen S (1974) Hedonic prices and implicit markets: Product differentiation in pure competition. J Polit Econ 82:34–55

Salaam-Blyther T (2012) Global access to clean drinking water and sanitation: US and international programs. Congressional Research Service Report for Congress, Washington, D.C.

Smith VK, Desvousges WH (1985) The generalized travel cost model and water quality benefits: a reconsideration. South Econ J 52:371–381

Soto Montes de Oca G, Bateman IJ, Tinch R, Moffatt PG (2003) Assessing the willingness to pay for maintained and improved water supplies in Mexico City. CSERGE Working Paper ECM 03-11

UNICEF and WHO (2012) Progress on drinking water and sanitation-2012 updated. UNICEF, Division of Communication, 3 United Nations Plaza, New York, USA

United Nations (2004) Freshwater country profile for Ghana. Accessed on 01/02/ 2015 @ https://www.un.org/esa/agenda21/natlinfo/countr/ghana/waterghana04f.pdf

Van Den Berg C, Nauges C (2012) The willingness to pay for access to piped water: a hedonic analysis of house prices in Southwest Sri Lanka. Lett Spat Resour Sci 5:151–166 (published by Springer)

Vásquez WF (2013) An economic valuation of water connections under different approaches of service governance. Water Resour Econ 2:17–29

Water Aid (2005) National water sector assessment-Ghana. Accessed on the 16 Oct 14 @ http://www.wateraid.org

Wattage P (2002) Preference elicitation methods of wetland conservation. Final report submitted to the Centre for the Economics and management of aquatic resources (CEMARE), University of Portsmouth, UK, pp 1–25

White GF, Bradley DJ, White AU (1972) Drawers of water. University of Chicago Press, Chicago

Whittington D, Pagiola S (2012) Using contingent valuation in the design of payments for environmental services mechanisms: a review and assessment. The World Bank Observer, Oxford University Press, Oxford

Whittington D, Briscoe J, Mu X, Barron W (1990) Estimating the willingness to pay for water services in developing countries: a case study of the use of contingent valuation surveys in Southern Haiti. Econ Dev Cultural Change 38(2):293–311 (EconLit with Full Text, EBSCOhost, viewed 26 January 2014)

Whittington D, Lauria DT, Mu X (1991) A study of water vending and willingness to pay for water in Onitsha, Nigeria. World Dev 19(2/3):179–198

Whittington D, Lauria DT, Wright AM, Choe K, Hughes JA, Swarna V (1993) Household demand for improved sanitation services in Kumasi, Ghana: a contingent valuation study. Water Resour Res 29(6):1539–1560

Whittington D, Pattanayak SK, Yang JC, Bal Kumar KC (2002) Household demand for improved piped water services: evidence from Kathmandu, Nepal. Water Policy 4(6):531–556

Winkelmann R (2008) Econometric analysis of count data. Springer Science and Business Media, Berlin

World Bank (1991) Urban policy and economic development: an agenda for the 1990s. World Bank, Washington, D.C.

World Bank Water Demand Research Team (1993) The demand for water in rural areas: determinants and policy implications. World Bank Res Obs 8(1):47–70

Acknowledgements

The authors are grateful to the Chief Editor and the Co-Editor for handling the work with tolerance and professionalism. The constructive comments from the anonymous reviewers are very much appreciated. Again, a million thanks for all comments received at the 2015 EAERE Conference, and the seminar series of the School of Economics, University of East Anglia, UK. A special thanks to the Environment for Development (EFD) for their motivation and kind support. Lastly, we thank Rexford Kwaku Asiama, Jerry Seddor and Villy Asare for proofreading the initial draft.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

About this article

Cite this article

Amoah, A., Moffatt, P.G. Willingness to pay for reliable piped water services: evidence from urban Ghana. Environ Econ Policy Stud 23, 805–829 (2021). https://doi.org/10.1007/s10018-021-00303-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-021-00303-z