Abstract

Introduction

Financial toxicity is common and pervasive among cancer patients. Research suggests that gynecologic cancer patients experiencing financial toxicity are at increased risk for engaging in harmful cost-coping strategies, including delaying/skipping treatment because of costs, or forsaking basic needs to pay medical bills. However, little is known about patients’ preferences for interventions to address financial toxicity.

Methods

Cross-sectional surveys to assess financial toxicity [Comprehensive Score for Financial Toxicity (COST)], cost-coping strategies, and preferences for intervention were conducted in a gynecologic cancer clinic waiting room. Associations with cost-coping were determined using multivariate modeling. Unadjusted odds ratios (ORs) explored associations between financial toxicity and intervention preferences.

Results

Among 89 respondents, median COST score was 31.9 (IQR: 21–38); 35% (N = 30) scored < 26, indicating they were experiencing financial toxicity. Financial toxicity was significantly associated with cost-coping (adjusted OR = 3.32 95% CI: 1.08, 14.34). Intervention preferences included access to transportation vouchers (38%), understanding treatment costs up-front (35%), minimizing wait times (33%), access to free food at appointments (25%), and assistance with minimizing/eliminating insurance deductibles (23%). In unadjusted analyses, respondents experiencing financial toxicity were more likely to select transportation assistance (OR = 2.67, 95% CI: 1.04, 6.90), assistance with co-pays (OR = 9.17, 95% CI: 2.60, 32.26), and assistance with deductibles (OR = 12.20, 95% CI: 3.47, 43.48), than respondents not experiencing financial toxicity.

Conclusions

Our findings confirm the presence of financial toxicity in gynecologic cancer patients, describe how patients attempt to cope with financial hardship, and provide insight into patients’ needs for targeted interventions to mitigate the harm of financial toxicity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Background

The financial hardship associated with cancer treatment—also known as “financial toxicity”—has been well-documented [1]. According to the National Cancer Institute, financial toxicity refers to the financial problems caused by out-of-pocket expenses [2]. Financial toxicity can result in negative outcomes across three domains: material (e.g., high out-of-pocket costs, housing/food insecurity, inability to work), psychological (e.g., distress, anxiety), and behavioral (e.g., delaying/forgoing treatment, treatment non-adherence) [3, 4]. Financial toxicity is common: as many as 72% of USA-based cancer patients report some form of financial hardship during or after treatment, and this is associated with increased risk for bankruptcy and asset depletion [1, 5, 6]. Although most of the literature relating to financial toxicity has been conducted in the USA, the issue is not unique to the US healthcare system, and there has been an emergence of research describing the experience of financial toxicity and attempts to measure and intervene upon financial toxicity in public healthcare systems throughout the world [7,8,9,10,11,12,13].

Documented risk factors for financial toxicity across disease sites include younger age, unemployment, lower level of education, inadequate insurance, and non-white race [1, 14]. Among gynecologic cancer patients specifically, recent studies have identified associations between financial toxicity and chemotherapy treatment, Medicaid or Medicare without supplemental insurance and more recent diagnosis [15, 16].

Studies suggest that gynecologic cancer patients experiencing financial toxicity are at increased risk for engaging in cost-coping strategies that may have harmful impact [3, 17, 18]. These include delaying or skipping treatment because of the cost, or forsaking basic needs such as food or shelter, in order to pay medical bills. Predictably, these actions are associated with negative consequences, including increased food insecurity, adverse clinical outcomes, and, in one analysis, increased mortality [15, 19]. Yet, little is known about patients’ preferences regarding interventions to address financial toxicity.

This survey-based analysis sought to (1) describe financial toxicity among gynecologic cancer patients, (2) delineate demographic and clinical factors associated with cost-coping, (3) solicit patient feedback regarding potential strategies to mitigate financial hardship during cancer treatment. The findings have been used to inform quality improvement efforts aimed at development of financial toxicity screening and interventions at our institution.

Methods

Setting and participants

Cross-sectional surveys were conducted over a 2-week period in August 2019 in a convenience sample of patients from an outpatient clinic waiting room at a single urban academic cancer specialty center, Memorial Sloan Kettering Cancer Center (MSKCC). Respondents were eligible for participation if they were over 18 years of age, received treatment for a gynecologic (ovarian, uterine, cervical, other) cancer within the previous two years, and spoke English or Spanish; all outpatient visit types were included. The survey was a part of a larger project to address affordability in gynecologic cancer care, and the MSKCC Institutional Review Board (IRB) determined the survey to be a quality improvement project and, as such, exempt from IRB approval.

Measures

Survey items included patient demographics (age, preferred language, highest level of education, type of medical insurance), disease and treatment characteristics (diagnosis, stage, treatment, frequency of medical appointments, time since diagnosis), the 11-item Comprehensive Score for Financial Toxicity (COST) tool, assessment of cost-coping strategies, and patient-reported anticipated benefit from the potential interventions that were described [20]. A composite race/ethnicity variable was extracted from patients’ medical charts, if available, and categorized as non-Hispanic white, Hispanic, non-Hispanic Black, Asian, or unknown/other. Income was measured in three ways: report of personal annual income, report of household income, and a yes/no response to the following question, “Sometimes people find that their income does not cover their living costs. In the past 12 months, has this happened to you?”.

The COST is a validated tool used to assess financial toxicity in cancer patients. Participants select a response on a 0–4 scale (0 = “Not at all”, 4 = ”Very much”) for 11 questions related to cost of services and medications, resources and savings, and financial concerns [20]. For the purposes of this study, responses were reverse-coded as appropriate, and items were summed, with lower scores corresponding to worse financial outcomes. For incomplete COST tools with at least 50% item responses (N = 6), average scores were input for missing data [21].

Cost-coping strategies were modeled after questions from the Medical Expenditure Panel Survey and drawn from prior literature [16]. They included patient-self report of skipping or delaying any medical appointment/clinic visit (i.e., cancer care or other healthcare visits), not taking any prescribed medication, taking a smaller dose of any prescribed medication, or deferring recommended medical testing because of the cost; borrowing money, using savings, re-mortgaging a home, skipping rent payments, selling items, reducing leisure activities in order to pay for medical bills, or applying for financial assistance. Respondents indicated whether they had used any of these cost-coping strategies over the previous 12 months.

Respondents also indicated if they felt any of the following services would be useful for improving current financial hardship: access to free food before or during appointments, access to public transportation vouchers or low-cost/free transportation services to and from appointments, assistance with minimizing or eliminating co-pays and/or deductibles, assistance with childcare or eldercare during appointments, minimizing wait time at appointments in order to reduce time away from employment, and a comprehensive understanding of treatment costs up-front. Respondents could select as many options as were applicable. Intervention options were drawn from services available at our institution and our previous research addressing the essential needs of cancer patients [22, 23].

Data collection

A trained bilingual member of the research staff conducted the survey as an interview. Questionnaires were available in English and Spanish. Respondents were not paid for participation, and appropriate referrals (e.g., to social work, patient financial services, MSKCC Food Pantry) were made based upon responses. Responses were entered into a Research Electronic Data Capture (REDCap) database and exported for analysis [24].

Analysis

Descriptive statistics, including frequencies and measures of central tendency, characterized the dataset. A dichotomous variable to determine presence of financial toxicity, measured by the COST, was created by dividing scores as above or below 26, a threshold frequently cited as indicative of financial toxicity [15, 16]. A COST score of 14 or less was considered “severe” financial toxicity, as previously described [16, 25]. Univariate testing assessed clinical and demographic associations with the dichotomous experience of financial toxicity (chi-square test). Cost-coping strategies were categorized as related to medical services (skipping or delaying medical appointments or tests and/or taking less medication than prescribed), or material hardship (methods used to pay medical bills); dichotomized yes/no variables were created for each [16]. Univariate testing (chi-square, independent samples t test) was used to perform an initial assessment of demographic, clinical, and COST score relationships with cost-coping. A multivariate model was created to evaluate independent demographic and clinical associations with COST score. Experience of financial toxicity, and demographic and clinical variables not independently linked to COST score, were included in a multivariate model to determine predictors of any cost-coping strategies. Frequencies of potential interventions were reported, and unadjusted odds ratios (ORs) were calculated to explore the association with the dichotomous financial toxicity variable.

Results

Sample

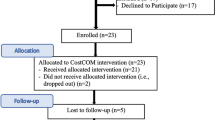

Over 2 weeks, 101 patients were approached and were eligible for participation: 89 completed the survey, and 12 patients either declined participation or opted out before completing the survey (88% response rate). Median age at completion of the survey was 66.0 years (interquartile range [IQR] 54–71 years); median time since diagnosis was 13.0 months (IQR: 4–40 months). Sixty-two percent of the sample identified as non-Hispanic white, 17% as Hispanic, 9% as Asian, and 8% as non-Hispanic Black; two interviews were conducted in Spanish. Sixty-nine percent of the sample had attained a Bachelor’s degree or higher, and 66% of the sample reported that their income was adequate to cover their treatment costs. Individual and household incomes were inconsistently reported, but among those who chose to respond, median annual individual income was $42,500 (IQR: $8250–86,000; N = 56) and median household income was $80,000 (IQR: $42,500–$138,000; N = 53). Most of the patients comprising this sample were either employed (42%) or retired (44%), and most were covered by Medicare (42%) or private health insurance (47%).

Clinically, the most frequently reported disease stage was stage IV (25%), followed by stage III (19%), although 17% of respondents stated that they did not know the stage of their disease. Forty-seven percent had undergone surgery, 65% received oral or intravenous chemotherapy, and 21% received radiation therapy; 61% received multi-modal therapy (i.e., any combination of the above treatments; treatment options were not mutually exclusive). The most frequently reported diagnosis was ovarian cancer (44%), followed by uterine cancer (29%). Table 1 shows complete baseline demographics.

Financial toxicity and difficulties

The median COST score was 31.9 (IQR: 21–38); 35% (N = 30) scored < 26, indicating they were experiencing financial toxicity. Of the 30 patients experiencing financial toxicity, 43% (N = 13; 15% of total sample) scored < 14, suggesting severe financial toxicity.

Financial toxicity scores did not vary in relation to diagnosis, time since diagnosis, race/ethnicity, education, employment status, insurance type, or treatment modality, but younger age and lower income were significantly associated with worse financial toxicity (Table 1). In a multivariate model, age (β = 0.28, p = 0.002) and income (β = − 10.46, p < 0.001) were found to be independent predictors of a patient’s COST score.

Cost-coping

Across the sample, medical cost-coping was infrequent. Only 10% of respondents reported delaying/skipping medical visits or tests because of the cost, or taking less medication than prescribed because of the cost. However, 58% of respondents reported that they had engaged in material cost-coping of some form within the past year. Figure 1 illustrates frequency of actions taken to cope with costs: the most common included reducing leisure spending to pay medical bills (40%), using savings to pay medical bills (38%), applying for financial assistance (14%), and skipping rent or mortgage payments to pay medical bills (10%). In univariate analyses, there were limited demographic and clinical associations with medical cost-coping on chi-square/Fisher’s exact testing; however, respondents who experienced financial toxicity (i.e., COST score < 26) were more likely to engage in medical cost-coping than those who did not (OR = 6.31, 95% CI: 1.13, 35.09). Income (OR = 5.12, 95% CI: 1.56, 16.79) and financial toxicity (OR = 4.60, 95% CI: 1.53, 13.82), but not other demographic or clinical variables, were associated with material cost-coping.

In multivariate analyses controlling for race/ethnicity, time since diagnosis, multi-model treatment, education, and diagnosis, financial toxicity was significantly associated with an increased risk of any cost-coping, material or medical (adjusted OR = 3.32 95% CI: 1.08, 14.34) (Supplemental Table 1).

Intervention preferences

All respondents were asked to endorse any of several potential resource interventions to improve current financial hardship. Figure 1 illustrates respondents’ preferences. The most frequently selected intervention was access to transportation vouchers or low-cost/free services for transportation to/from appointments (38%), having a comprehensive understanding of treatment costs up-front (35%), minimizing wait time at medical appointments in order to lessen time away from work (33%), access to free food provided at appointments (25%), and assistance with minimizing/eliminating insurance deductibles (23%).

In unadjusted analyses, respondents experiencing financial toxicity (COST score < 26) were more likely to select transportation assistance (OR = 2.67, 95% CI: 1.04, 6.90), assistance with co-pays (OR = 9.17, 95% CI: 2.60, 32.26), and assistance with deductibles (OR = 12.20, 95% CI: 3.47, 43.48) than respondents not experiencing financial toxicity. There were no significant differences between groups with respect to other potential interventions (Table 2).

Discussion

Our findings highlight the financial difficulties facing patients in active treatment for gynecologic cancers at a comprehensive cancer center. The study is novel in that it offers data to support patient-preferred strategies for minimizing treatment-related financial toxicity, which has not been previously evaluated. It confirms previous studies suggesting that financial toxicity exists in gynecologic cancer patients, and it demonstrates an association between financial toxicity and medical and material cost-coping. Despite the fact that nearly 90% of patients had private healthcare insurance or Medicare, in this sample of 89 patients, we found that over one-third were experiencing financial toxicity, with 46% of those experiencing severe financial toxicity (defined as COST score < 14). Financial toxicity was associated with medical and material cost-coping strategies, and it influenced patient preferences for potential resource interventions. Potential resource interventions identified by patients included assistance with transportation and insurance deductibles, availability of food at clinical appointments, and obtaining up-front estimates regarding cost of treatment.

Financial toxicity in this sample was slightly higher, although comparable, to that reported for patients undergoing treatment for other cancers. In a study of 106 melanoma patients at our institution, the mean COST score was 30.0 (standard deviation [sd] = 9.46), with 23% of patients indicating financial difficulties on the European Organization for Research and Treatment of Cancer (EORTC) QLQ30 tool [26]. In an unpublished quality improvement analysis using proxy measures, we found that 25% of patients across our institution were experiencing financial difficulty. Our findings add to a growing body of literature assessing financial toxicity in gynecologic cancer patients: financial toxicity was reported in as many as 54% of patients on COST survey analysis, with significant associations between financial toxicity and quality of life; similar to our findings, financial toxicity was associated with material cost-coping strategies [15, 16, 18, 27, 28]. Cost-coping among gynecologic cancer patients, as described in the literature, includes borrowing money to pay bills, reducing spending on basic goods, delaying/avoiding cancer care, and seeking institutional financial assistance [15, 18]. Our findings support recent calls in the literature to include financial hardship screening and management as part of oncology practice quality metrics [29, 30].

Despite a growing awareness of financial toxicity and the development of screening processes within cancer centers, interventions to minimize the material, psychological, and behavioral financial burdens associated with cancer treatment remain under-developed and under-studied [31]. Given the multisystemic nature of financial toxicity, interventions must be implemented across multiple levels of the healthcare system in order to have a meaningful impact [32, 33]. At the patient level, pilot efforts toward developing financial navigation, and counseling interventions, are promising in terms of acceptability and feasibility, with some leading to improvements in financial anxiety [34,35,36,37]. At the provider level, conversations with patients about the anticipated cost of treatment have been shown to reduce out-of-pocket costs [38].

There is limited exploration of patient preferences for intervention during treatment, and little understanding of how a patient’s experience of financial toxicity impacts these preferences. Qualitative research has explored the financial intervention needs of long-term breast cancer survivors, noting their desire for comprehensive, affordable insurance and insurance-related educational programming; discussions about the costs of treatment; psychosocial and domestic support; access to direct financial aid programs; and employment protection [39, 40]. While these themes found among long-term survivors would likely apply to patients on active treatment, little is known regarding patients’ immediate needs for mitigating hardship during their cancer treatment. Our findings provide important insight into patients’ need for tangible financial assistance during treatment and can serve as a foundation for future intervention across systems. For example, nearly 40% of the patients in our sample indicated that assistance with transportation costs would be helpful in mitigating financial hardship; this finding is consistent with previous work suggesting that transportation and parking costs are a primary non-medical financial hardship for patients [41, 42]. One-quarter of the sample indicated that having free food available at appointments would be helpful, and respondents who screened positive for food insecurity were referred to appropriate institutional resources, including counseling and access to the MSKCC Food Pantry program. Given that recent studies of cancer patients demonstrate an association between food insecurity, depressive symptoms, and non-adherence to treatment, and with approximately 10.5% of American households experiencing food insecurity, it is essential that healthcare organizations conduct assessment of each patient’s basic needs and provide appropriate referrals to ensure food security [43,44,45,46].

Patients experiencing financial toxicity were more likely to endorse benefits such as assistance with co-pay and deductibles than patients who did not experience financial toxicity, highlighting the need for direct assistance. Among young adult patients, direct monetary grants have been shown to improve access to care, paying of bills, and mitigation of transportation difficulties and general financial challenges [47]. However, accessing grants and other financial assistance is often time-consuming and complicated; survivors note that there are stringent eligibility criteria for such assistance [39]. Future research should explore the use of institutional financial navigators or commercially based financial navigation software to connect patients with these resources, and provide them with assistance in applying [48].

Limitations

This analysis is limited by several factors. The demographic composition of our sample and our small sample size may limit the generalizability of the findings. The setting was a single academic cancer center located in an urban environment (New York, New York). By virtue of being at a stand-alone cancer center, nearly all patients completing our survey were insured, which might not be the case at general hospitals providing cancer care. However, the rate of insured patients in our population mirrored the rates reported by a study conducted at two other regionally diverse academic medical centers [8]. Additionally, there were only 8% Black patients in our study sample, which does not reflect the proportion of Black patients with gynecologic cancers nor in the general population. Prior studies assessing financial toxicity in gynecologic and colon cancers show race-based differences in financial toxicity, although the effect did not persist in multivariate analysis [15, 49]. However, even in the crude analysis, we found no association between race/ethnicity and financial toxicity or patients’ intervention preferences. This may be due to the fact that non-Hispanic white patients were overrepresented in our sample; and/or that in an urban cancer hospital, the racial/ethnic minority patients in our sample were not representative of racial/ethnic minority patients elsewhere. Lastly, our survey was administered only in the English and Spanish languages, which further limits the generalizability of the sample and may impact its demographic distribution. Notably, however, none of the patients who were approached for participation requested interpretation into another language. Our small sample size was the result of this analysis being a part of a larger quality improvement conducted within a pre-specified timeframe; as such, we were unable to collect additional data outside of our 2-week data collection period. Despite these limitations, as previously mentioned, our findings regarding rates of financial toxicity concur with those reported in prior studies. We believe the preferences expressed by patients for interventions to mitigate financial hardships are reliable and can be used as a starting point for future research aimed at developing systems-based intervention strategies.

Conclusion

Our findings confirm the presence of financial toxicity in gynecologic cancer patients, provide insights into patients’ experience of financial hardship during cancer treatment, describe the ways in which patients attempt to cope with financial hardship, and provide insight into patients’ needs for targeted interventions to mitigate the harm of financial toxicity. Interventions most likely to mitigate financial burden include assistance with transportation, addressing food insecurity, assistance with co-pays and deductibles, and providing accurate estimates of the cost of treatment up-front. There is a pressing need for pilot studies to evaluate the impact of these interventions on financial toxicity, cost-coping strategies, and cancer-specific outcomes. In light of mounting evidence demonstrating the value of financial assistance, more institutions and payers should be motivated to provide these services to patients in need.

Data availability

Relevant data are available upon reasonable request.

Code availability

Not applicable.

References

Gordon LG, Merollini KMD, Lowe A, Chan RJ (2017) A systematic review of financial toxicity among cancer survivors: we can’t pay the co-pay. Patient 10(3):295–309. https://doi.org/10.1007/s40271-016-0204-x

National Cancer Institute. Financial Toxicity (Financial Distress) and Cancer Treatment (PDQ®)–Patient Version. 2021. https://www.cancer.gov/about-cancer/managing-care/track-care-costs/financial-toxicity-pdq. Accessed 9/1/2021

Altice CK, Banegas MP, Tucker-Seeley RD, Yabroff KR (2017) Financial hardships experienced by cancer survivors: a systematic review. J Natl Cancer Inst 109(2). https://doi.org/10.1093/jnci/djw205

Zafar SY, Abernethy AP (2013) Financial toxicity, Part I: a new name for a growing problem. Research Support Non-U S Gov’t. Oncology 27(2):80–1

Pak TY, Kim H, Kim KT (2020) The long-term effects of cancer survivorship on household assets. Health Econ Rev 10(1):2. https://doi.org/10.1186/s13561-019-0253-7

Ramsey S, Blough D, Kirchhoff A et al (Jun 2013) Washington State cancer patients found to be at greater risk for bankruptcy than people without a cancer diagnosis. Health Aff (Millwood) 32(6):1143–1152. https://doi.org/10.1377/hlthaff.2012.1263

Bygrave A, Whittaker K, Paul C, Fradgley EA, Varlow M, Aranda S (2021) Australian experiences of out-of-pocket costs and financial burden following a cancer diagnosis: a systematic review. Int J Environ Res Public Health. 18(5). https://doi.org/10.3390/ijerph18052422

Honda K, Gyawali B, Ando M et al (2019) Prospective survey of financial toxicity measured by the Comprehensive Score for Financial Toxicity in Japanese patients with cancer. J Glob Oncol 5:1–8. https://doi.org/10.1200/jgo.19.00003

Mehlis K, Witte J, Surmann B et al (2020) The patient-level effect of the cost of cancer care - financial burden in German Cancer patients. BMC Cancer 20(1):529. https://doi.org/10.1186/s12885-020-07028-4

Mejri N, Berrazega Y, Boujnah R et al (2021) Assessing the financial toxicity in Tunisian cancer patients using the Comprehensive Score for Financial Toxicity (COST). Support Care Cancer 29(7):4105–4111. https://doi.org/10.1007/s00520-020-05944-6

Riva S, Arenare L, Di Maio M et al (2021) Cross-sectional study to develop and describe psychometric characteristics of a patient-reported instrument (PROFFIT) for measuring financial toxicity of cancer within a public healthcare system. BMJ Open. 11(10):e049128. https://doi.org/10.1136/bmjopen-2021-049128

Thamm C, Fox J, Hart NH, et al (2021) Exploring the role of general practitioners in addressing financial toxicity in cancer patients. Support Care Cancer. 1–8. https://doi.org/10.1007/s00520-021-06420-5

Yu HH, Yu ZF, Li H, Zhao H, Sun JM, Liu YY (2021) The comprehensive score for financial toxicity in china: validation and responsiveness. J Pain Symptom Manage 61(6):1297-1304.e1. https://doi.org/10.1016/j.jpainsymman.2020.12.021

Smith GL, Lopez-Olivo MA, Advani PG et al (2019) Financial burdens of cancer treatment: a systematic review of risk factors and outcomes. J Natl Compr Canc Netw 17(10):1184–1192. https://doi.org/10.6004/jnccn.2019.7305

Bouberhan S, Shea M, Kennedy A et al (2019) Financial toxicity in gynecologic oncology. Gynecol Oncol 154(1):8–12. https://doi.org/10.1016/j.ygyno.2019.04.003

Esselen KM, Gompers A, Hacker MR, et al (2021) Evaluating meaningful levels of financial toxicity in gynecologic cancers. Int J Gynecol Cancer. https://doi.org/10.1136/ijgc-2021-002475

Doherty M, Gardner D, Finik J (2021) The financial coping strategies of US cancer patients and survivors. Support Care Cancer. https://doi.org/10.1007/s00520-021-06113-z

Esselen KM, Stack-Dunnbier H, Gompers A, Hacker MR (2021) Crowdsourcing to measure financial toxicity in gynecologic oncology. Gynecol Oncol 161(2):595–600. https://doi.org/10.1016/j.ygyno.2021.01.040

Ramsey SD, Bansal A, Fedorenko CR et al (2016) Financial insolvency as a risk factor for early mortality among patients with cancer. J Clin Oncol 34(9):980–986. https://doi.org/10.1200/jco.2015.64.6620

de Souza JA, Yap BJ, Wroblewski K, et al (2016) Measuring financial toxicity as a clinically relevant patient-reported outcome: the validation of the COmprehensive Score for financial Toxicity. Cancer. https://doi.org/10.1002/cncr.30369

de Souza JA, Yap BJ, Hlubocky FJ et al (2014) The development of a financial toxicity patient-reported outcome in cancer: the COST measure. Cancer 120(20):3245–3253. https://doi.org/10.1002/cncr.28814

Ayash C, Costas-Muñiz R, Badreddine D, Ramirez J, Gany F (2018) An investigation of unmet socio-economic needs amonG Arab American breast cancer patients compared with other immigrant and migrant patients. J Community Health 43(1):89–95. https://doi.org/10.1007/s10900-017-0391-y

Gany F, Ramirez J, Nierodzick ML, McNish T, Lobach I, Leng J (2011) Cancer portal project: a multidisciplinary approach to cancer care among Hispanic patients. Journal of oncology practice 7(1):31–38. https://doi.org/10.1200/JOP.2010.000036

Harris PA, Taylor R, Minor BL et al (2019) The REDCap consortium: building an international community of software platform partners. J Biomed Inform 95:103208. https://doi.org/10.1016/j.jbi.2019.103208

De Souza JA, Wroblewski K, Proussaloglou E, Nicholson L, Hantel A, Wang Y (2017) Validation of a financial toxicity (FT) grading system. J Clin Oncol. 2021/06/18;35(15_suppl):6615-6615

Thom B, Mamoor M, Lavery JA et al (2021) The experience of financial toxicity among advanced melanoma patients treated with immunotherapy. J Psychosoc Oncol 39(2):285–293. https://doi.org/10.1080/07347332.2020.1836547

Liang MI, Pisu M, Summerlin SS et al (2020) Extensive financial hardship among gynecologic cancer patients starting a new line of therapy. Gynecol Oncol 156(2):271–277. https://doi.org/10.1016/j.ygyno.2019.11.022

Liang MI, Summerlin SS, Blanchard CT, et al (2021) Measuring financial distress and quality of life over time in patients with gynecologic cancer-making the case to screen early in the treatment course. JCO Oncol Pract. Op2000907. https://doi.org/10.1200/op.20.00907

Bradley CJ, Yabroff KR, Zafar SY, Shih YT (2021) Time to add screening for financial hardship as a quality measure? CA Cancer J Clin 71(2):100–106. https://doi.org/10.3322/caac.21653

McLouth LE, Nightingale CL, Dressler EV et al (2021) Current practices for screening and addressing financial hardship within the NCI community oncology research prograM. Cancer Epidemiol Biomarkers Prev 30(4):669–675. https://doi.org/10.1158/1055-9965.Epi-20-1157

Patel MR, Jagsi R, Resnicow K, et al (2021) A scoping review of behavioral interventions addressing medical financial hardship. Popul Health Manag. https://doi.org/10.1089/pop.2021.0043

Zafar SY (2016) Financial toxicity of cancer care: it's time to intervene. J Natl Cancer Inst 108(5). https://doi.org/10.1093/jnci/djv370

Tucker-Seeley RD, Yabroff KR (2016) Minimizing the "financial toxicity" associated with cancer care: advancing the research agenda. J Natl Cancer Inst 108(5). https://doi.org/10.1093/jnci/djv410

Watabayashi K, Steelquist J, Overstreet KA et al (2020) A pilot study of a comprehensive financial navigation program in patients with cancer and caregivers. J Natl Compr Canc Netw 18(10):1366–1373. https://doi.org/10.6004/jnccn.2020.7581

Shankaran V, Leahy T, Steelquist J, et al (2017) Pilot feasibility study of an oncology financial navigation program. J Oncol Pract. Jop2017024927. https://doi.org/10.1200/jop.2017.024927

Kircher SM, Yarber J, Rutsohn J et al (2019) Piloting a financial counseling intervention for patients with cancer receiving chemotherapy. J Oncol Pract 15(3):e202–e210. https://doi.org/10.1200/jop.18.00270

Khera N, Kumbamu A, Langer SL et al (2020) Developing an educational intervention to address financial hardship in cancer patients. Mayo Clin Proc Innov Qual Outcomes 4(4):424–433. https://doi.org/10.1016/j.mayocpiqo.2020.04.004

Zafar SY, Chino F, Ubel PA et al (2015) The utility of cost discussions between patients with cancer and oncologists. Am J Manag Care 21(9):607–615

Dean LT, Moss SL, Rollinson SI, Frasso Jaramillo L, Paxton RJ, Owczarzak JT (2019) Patient recommendations for reducing long-lasting economic burden after breast cancer. Cancer 125(11):1929–1940. https://doi.org/10.1002/cncr.32012

Pisu M, Martin MY, Shewchuk R, Meneses K (2014) Dealing with the financial burden of cancer: perspectives of older breast cancer survivors. Support Care Cancer 22(11):3045–3052. https://doi.org/10.1007/s00520-014-2298-9

Lee A, Shah K, Chino F (2020) Assessment of parking fees at national cancer institute-designated cancer treatment centers. JAMA Oncol 6(8):1295–1297. https://doi.org/10.1001/jamaoncol.2020.1475

Houts PS, Lipton A, Harvey HA et al (1984) Nonmedical costs to patients and their families associated with outpatient chemotherapy. Cancer 53(11):2388–2392. https://doi.org/10.1002/1097-0142(19840601)53:11%3c2388::aid-cncr2820531103%3e3.0.co;2-a

McDougall JA, Anderson J, Adler Jaffe S et al (2020) Food insecurity and forgone medical care among cancer survivors. JCO Oncol Pract 16(9):e922–e932. https://doi.org/10.1200/jop.19.00736

Madigan KE, Leiman DA, Palakshappa D (2021) Food insecurity is an independent risk factor for depressive symptoms in survivors of digestive cancers. Cancer Epidemiol Biomarkers Prev 30(6):1122–1128. https://doi.org/10.1158/1055-9965.Epi-20-1683

Coleman-Jensen A, Rabbitt M, Gregory C, Singh A (2020) Household Food Security in the United States in 2019, ERR-275

Gany F, Melnic I, Ramirez J et al (2021) Food Insecurity among Cancer Patients Enrolled in the Supplemental Nutrition Assistance Program (SNAP). Nutr Cancer 73(2):206–214. https://doi.org/10.1080/01635581.2020.1743867

Thom B, Benedict C, Zeitler M, Watson SE (2021) Addressing financial toxicity in young adult cancer: exploring the impact of one-time financial grants. presented at: Society of Behavioral Medicine Annual Conference; Virtual

Sherman D, Fessele KL (2019) Financial support models: a case for use of financial navigators in the oncology setting. Clin J Oncol Nurs 23(5):14–18. https://doi.org/10.1188/19.Cjon.S2.14-18

Shankaran V, Jolly S, Blough D, Ramsey SD (2012) Risk factors for financial hardship in patients receiving adjuvant chemotherapy for colon cancer: a population-based exploratory analysis. J Clin Oncol 30(14):1608–1614. https://doi.org/10.1200/jco.2011.37.9511

Funding

This study was funded in part through the NIH/NCI Support Grant P30 CA008748.

Author information

Authors and Affiliations

Contributions

EMA: study conception and design; acquisition of data; analysis and interpretation of data; drafting of article; revising article critically for important intellectual content; final approval of manuscript; accepts public responsibility for its contents. BT: study conception and design; acquisition of data; analysis and interpretation of data; drafting of article; revising article critically for important intellectual content; final approval of manuscript; accepts public responsibility for its contents. KB: acquisition of data; revising article critically for important intellectual content; final approval of manuscript; accepts public responsibility for its contents. AJC: acquisition and analysis of data; revising article critically for important intellectual content; final approval of manuscript; accepts public responsibility for its contents. BMG: analysis and interpretation of data; revising article critically for important intellectual content; final approval of manuscript; accepts public responsibility for its contents. FC: study conception and design; analysis and interpretation of data; revising article critically for important intellectual content; final approval of manuscript; accepts public responsibility for its contents. CLB: revising article critically for important intellectual content; final approval of manuscript; accepts public responsibility for its contents. NRA: study conception and design; analysis and interpretation of data; revising article critically for important intellectual content; final approval of manuscript; accepts public responsibility for its contents. FMG: study conception and design; analysis and interpretation of data; revising article critically for important intellectual content; final approval of manuscript; accepts public responsibility for its contents.

Corresponding author

Ethics declarations

Ethics approval

The MSKCC Institutional Review Board (IRB) determined the survey to be a quality improvement project and, as such, exempt from IRB approval.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

BT reports the following, outside the submitted work: an Immediate family member has stock and other ownership interests in Caladrius Biosciences, Mediwound, Sierra Oncology, Lipocine, Aduro Biotech, MEI Pharma, Oncternal Therapeutics, Avadel Pharmaceuticals, Chimerix, Avidity Biosciences, Sutro Biopharma, Adma Pharma, Concert Pharmaceuticals, Process Pharmaceuticals, Curis, IMV, Arcus Biosciences, Iovance Biotherapeutics, Qiagen, Revance Therapeutics, DermTech, Zimmer BioMet, Axonics Modulation Technologies, Halozyme, Mallinckrodt, Chinook Therapeutics, OncoSec, Stemline Therapeutics. NRA reports the following, outside the submitted work: grant from Stryker/Novadaq (paid to institution); grant from Olympus (paid to institution); grant from GRAIL (paid to institution). Memorial Sloan Kettering Cancer Center (MSK) has financial interests relative to GRAIL. As a result of these interests, MSK could ultimately potentially benefit financially from the outcomes of this research.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Bridgette Thom and Emeline M. Aviki are co-first authors.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Aviki, E.M., Thom, B., Braxton, K. et al. Patient-reported benefit from proposed interventions to reduce financial toxicity during cancer treatment. Support Care Cancer 30, 2713–2721 (2022). https://doi.org/10.1007/s00520-021-06697-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00520-021-06697-6