Abstract

Purpose

Out-of-pocket expenses (OOPE) can have a significant impact on patients’ experiences of cancer treatment. This cross-sectional study sought to quantify the OOPEs experienced by rural cancer patients in Western Australia (WA), and determine factors that contributed to higher OOPE.

Methods

Four hundred people diagnosed with breast, lung, colorectal or prostate cancer who resided in selected rural regions of WA were recruited through the WA Cancer Registry and contacted at least 3 months after diagnosis to report the medical OOPE (such as surgery or chemotherapy, supportive care, medication and tests) and non-medical OOPE (such as travel costs, new clothing and utilities) they had experienced as a result of accessing and receiving treatment. Bootstrapped t tests identified demographic, financial and treatment-related factors to include in multivariate analysis, performed using log-linked generalised linear models with gamma distribution.

Results

After a median 21 weeks post-diagnosis, participants experienced an average OOPE of AU$2179 (bootstrapped 95% confidence interval $1873–$2518), and 45 (11%) spent more than 10% of their household income on these expenses. Participants likely to experience higher total OOPE were younger than 65 years (p = 0.008), resided outside the South West region (p = 0.007) and had private health insurance (PHI) (p < 0.001).

Conclusions

Rural WA cancer patients experience significant OOPE following their diagnosis. The impact these expenses have on patient wellbeing and their treatment decisions need to be further explored.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Background

There is a growing awareness of the financial burden that cancer treatment can have on patients [1,2,3]. Hardship caused by treatment and related expenses, termed ‘financial toxicity’, is considered an overlooked dimension of cancer management that can have significant consequences for patients and their families [3, 4]. Gordon et al. have proposed three ways of defining financial toxicity, using (1) monetary measures, examining the costs and percentage of cost to income ratios; (2) objective measures, examining tangible solutions patients implement to ease financial burden and (3) subjective measures that examine patient perceptions and the psychological impact of cancer-related financial burden [3]. US research indicates cancer patients face significant out-of-pocket expenses (OOPE) for healthcare, which are not unusual in their healthcare system [1, 5]. However, even in nations with universal healthcare systems, such as Australia and Canada, OOPE can be burdensome in both relative and absolute terms [6, 7]. In 2015–16, Australians’ OOPE accounted for 17.3% of total health expenditure, and this figure is likely an underestimate of the true OOPE incurred by patients [8]. Whilst people with certain chronic diseases [9] and multiple co-morbidities [10] have been found to pay more for their healthcare, cancer survivors reportedly experience greater financial distress compared to other chronic health conditions [3]. A recent systematic review found that factors most commonly associated with higher financial toxicity in cancer patients were sex (being female), age (being younger), having a low income and adjuvant therapies [3]. Furthermore, distance from treatment location has a significant impact on cancer patients’ access to services and OOPE, as patients in regional areas incur higher OOPE associated with travelling to and staying near treatment centres [11, 12]. Zucca et al. found that travelling more than 2 h to treatment and living away from home for treatment were significantly associated with greater patient reported financial difficulties during the first year post-diagnosis [12]. The financial disadvantage faced by rural Australians is concerning as outcomes for cancer patients in rural and remote areas remain worse compared to those of urban Australians [13].

There is little peer-reviewed data describing the costs and associated impacts of cancer treatment on patients in regional Western Australia (WA). The aim of this study was to quantify the OOPE experienced by WA cancer patients and determine factors contributing to higher OOPE.

Methods

Setting

WA is Australia’s largest state, covering 2.5 million square kilometres, or 33% of Australia. In spite of its size, it has a small population of 2,590,259; 78% of whom reside within the capital city, Perth. People residing in the rural and remote areas of WA need to travel great distances to access appropriate medical care. Figure 1 illustrates regions involved in the study, and hospital locations accessed by participants in this study. Travel-related financial aid is provided through a government funded Patient-Assisted Transport Scheme (PATS), and Non-Government Organisations (NGOs) such as the Cancer Council. In 2013, a Comprehensive Cancer Centre was opened in the South West region of WA—the most populated region outside of Perth—to provide cancer services locally. Whilst this allow some regional cancer patients to receive care closer to home, others still needed to travel to tertiary cancer centres. The greatest travel distance reported in this study was 819 km (straight line distance estimate).

Map of Western Australia—regions in which participants in the out-of-pocket expenses study resided and location of the hospitals participants accessed for treatment are indicated in bold. Image adapted from Government of Western Australia (2012) [14]

In Australia, residents are entitled to a rebate on many medical services and pharmaceuticals, and free hospital treatment as a public patient, through Medicare—the universal health scheme. Medicare is funded by taxpayers paying a 2% Medicare levy in addition to their income tax (for which low-income earners are exempt). An additional surcharge is applied to high-income earners without private health insurance (PHI). More than half of Australians have PHI, which subsidises ancillary health services and private in-hospital care. Private service providers are able to define their own service fees, creating variably sized OOPE that patients need to pay.

Design and sample

This cross-sectional study utilised data collected for the rural out-of-pocket expenses study (ROOPES), an ambi-directional cohort study. WA residents with a pathologically confirmed diagnosis of breast, lung, prostate or colorectal cancer between April 2014 and July 2016 were recruited through the Western Australian Cancer Registry (WACR). Patients ≥ 18 years, who did not have a previous cancer diagnosis and whose residential postcode was in one of the four rural regions of interest (Great Southern, Goldfields, South West and Midwest) (Fig. 1) were eligible.

Eligible participants were identified monthly by the WACR and sent opt-in invitations and an initial questionnaire. Participants who returned consent and the initial questionnaire were invited to complete an expenses diary (if undergoing treatment) and/or a final questionnaire (following completion of primary treatment, or if receiving palliative treatment). This study reports data from the initial questionnaire.

Human research ethics approval was obtained from the WA Country Health Service Ethics Committee (#2014:10) and the Department of Health WA Human Research Ethics Committee (#2014/26).

Measures

Our initial questionnaire was a modified version of Paul et al.’s [15] and included additional questions regarding participants’ expected treatment plans, and the cost of medical and non-medical items. The cost items comprised direct medical OOPE incurred for treatments (surgery, chemotherapy, radiation therapy), doctors’ appointments, tests (biopsies, blood tests, imaging performed in the lead up to and following diagnosis), supportive care, and medications and direct non-medical OOPE related to accessing and managing cancer treatment such as travel, fuel, accommodation, parking, clothes, additional utilities costs and complementary and alternative medicine. These definitions are built on those identified in the literature [16, 17].

Analyses

Statistical analyses were undertaken using IBM SPSS Statistics 24. Descriptive statistics were generated for demographic, financial, and treatment characteristics (Table 1). All ‘costs’ are the self-reported OOPE participants paid for treatment-related goods and services after subtracting any rebates received from the total value. The OOPE were adjusted for inflation using the Consumer Price Index to 2016 Australian dollars [18]. To quantify the monetary aspect of financial toxicity experienced by participants, proportions of each OOPE category to total cost were calculated, and total OOPE was examined as a proportion of patient-reported household income to assess the magnitude of OOPE and its relative impact on participants [3]. The World Bank has defined OOPE higher than 10% of the annual household income as a financial catastrophe [19].

Few participants had OOPE of $0, and the costs were heavily right-skewed for all OOPE categories. Hence, boot strapped t tests were utilised for univariate analysis of demographic, financial and treatment characteristics [17, 20, 21]. Those with p < 0.05 were entered as covariates in log-linked generalised linear models with gamma distribution for medical, non-medical and total OOPE to identify significant predictors associated with high OOPE [21,22,23,24]. The models were adjusted for age and gender. Covariates included are indicated in Table S1. Whilst ‘employment prior to diagnosis’, ‘employment post-diagnosis’, and ‘change in employment’ were all significant, due to the moderate sample size and co-linearity between these variables, only the former was entered as it has been used in previous research examining predictors of higher OOPE [25]. Predicted means were generated for variables significantly associated with higher OOPE.

Data availability

The authors have full control of the primary data and are able to provide access upon request if deemed appropriate by all investigators.

Results

Of the 1501 patients diagnosed with cancer who resided in the regions of interest, 1323 (88%) met all eligibility criteria, and 400 (30% of eligible patients) returned the initial questionnaire. Participant demographic, financial and treatment characteristics are reported in Table 1. The weekly household income for participants was a median AU$700 ($497–$1183), and 59% of participants had a weekly household income lower than AU$1009, the average household income in 2015–16 [26].

At the time of completing the questionnaire, 132 participants (33%) were working in a full- or part-time role, and 53 (14%) were self-employed. Seventy-six (19%) participants experienced a change in employment circumstances post-diagnosis (Table 1).

Out-of-pocket costs

Of the 400 respondents, 387 (97%) reported cost data, of whom 363 (94%) experienced > $0 OOPE (Table 2). After median 21 weeks post-diagnosis, participants spent a net total of AU$843317 across all items relating to their diagnosis and accessing or receiving treatment (mean $AU2179, SD = $3077). The most commonly reported OOPEs were for surgery (61%), doctors’ appointments (63%) and fuel (56%).

Surgery and tests expenses accounted for the greatest proportion of total OOPE (22 and 20%, respectively). These were followed by accommodation (12%) and fuel (8%). Medical OOPEs accounted for a greater proportion of patient OOPEs than non-medical OOPEs (58 vs 42%, respectively).

Approximately 1 in 10 participants experienced catastrophic spending on healthcare, with 28 (7%) reporting OOPEs that equated to 10–20% of their total annual household income, 15 (4%) reporting 20–40% and two (1%) spending more than 40% (Table 1).

Univariate analyses identified several factors associated with higher OOPE (Table S1). Participants who were male, resided outside the South West, had PHI, experienced a change in employment post-diagnosis, were younger than 65 years, working prior to or after their diagnosis, were in a relationship, had a higher household income, did not take on a caring role for any friends or family, had undertaken studies further than year 12 and were receiving treatment for prostate, lung, or colorectal cancer were likely to have higher direct medical, non-medical and/or total OOPE than their counterparts (Table S1).

The results from the log-linked generalised linear models with gamma distributions are presented in Table 3. Participants who were most likely to experience higher total OOPE were younger than 65 years (AU$2598 vs $1410, p < 0.001), resided outside the South West (AU$2239 vs $1636, p = 0.012) and had PHI (AU$2776 vs $1319, p < 0.001).

Participants likely to experience higher medical OOPE were younger than 65 years (AU$1562 vs $894, p < 0.001), with PHI (AU$1954 vs. $715, p < 0.001) and had prostate cancer (AU$1743 vs $802, p = 0.002).

Participants most likely to have higher non-medical OOPE were those residing outside the South West (AU$1171 vs $687, p < 0.001), with PHI (AU$1071 vs $751, p = 0.011), female (AU$1223 vs $657, p = 0.010), working prior to diagnosis (AU$1241 vs $648, p < 0.001) and did not have breast cancer (AU$1328 vs $606, p = 0.001).

Discussion

Our study indicates that Western Australian respondents diagnosed with one of the four most common cancers and residing in the South West, Great Southern, Goldfields and Midwest spent a total average of AU$2179 (SD = $3077) on direct medical (mean AU$1290, SD = $2251) and non-medical (mean AU$1117 SD = $1766) items relating to their diagnosis and treatment. These costs were accrued in the first median 21 weeks (5.25 months) post-diagnosis.

It is difficult to compare these findings directly with other OOPE studies due to variance in cost data items collected and reported, patient populations examined, technological advances in treatment and diagnostics and time since diagnosis in which the costs were accrued. Findings from other studies are presented in Table 4. The cost items collected in these studies are not synonymous with ours as we collected data on a broader range of medical and non-medical items. Despite this, our participants’ mean OOPEs are comparatively lower, likely due to the data being collected at an earlier time post-diagnosis. The complete total OOPEs were not captured for 65% of participants who were undergoing treatment at the time of completing the initial survey.

Surgery (22%) and tests (20%) accounted for the greatest proportion of the net total OOPE, followed by accommodation (12%), fuel (8%), doctor’s appointments (6%) and travel (4%). Our results are similar to Gordon et al.’s findings that travel (71%), medical appointments (10%) and medications (9%) accounted for a large proportion of rural cancer patients’ OOPE [11]. A small yet alarming proportion of our participants reported OOPE considered as a ‘financial catastrophe’ (11%). Predictors for financial catastrophe (such as ineligibility for assistance, etc.) should be explored further to ensure equitable distribution of the limited financial support to cancer patients through government and NGO initiatives.

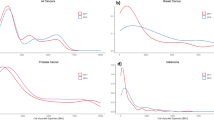

Seven predictors were significantly associated with higher medical, non-medical and total OOPE in our study—younger age, having PHI, having prostate cancer, residing in the Midwest/Great Southern/Goldfields, being female, working prior to diagnosis and having a diagnosis other than breast cancer (Fig. 2).

Several studies have found younger cancer patients face higher OOPE [17, 25, 28]. Young patients are likely to have more aggressive cancers, requiring more tests and services. Furthermore, in Australia, their higher costs could be due to a lack of subsidised support, as they are working, have savings, accrued leave or income protection to draw from before they are eligible for subsidies or assistance. This is concerning for patients whose cancer diagnosis and treatment compromise their ability to continue working in their pre-diagnosis capacity and to support themselves and their families.

PHI was the only significant predictor for higher OOPE across all three categories. Previously, PHI has been associated with lower OOPE in American settings [29], no impact on OOPE reported by rural Australian cancer patients [11], and with higher OOPE for Australian prostate cancer patients [7, 27]. Johar et al. identified that in Australia, specialists charged patients with PHI more than those without PHI [30]. In their study, PHI was investigated as a proxy indicator for income, which did not retain significance in our multivariate analyses. We note that several participants in our study received care in the recently established privately owned hospitals with public-private partnerships, where private billing may have been preferentially undertaken for participants with PHI. This could potentially explain why income was not a significant predictor of patient OOPE. The relationship between patient OOPE, capability to pay and PHI could be further explored in these settings. Furthermore, a 2017 report observed higher OOPE for breast cancer patients with PHI compared to those without [31]. They suggested these patients may experience higher costs due to (1) a supply induced demand created by clinicians recommending more tests due to the patients’ PHI coverage; (2) the presence of an insurance misalignment, in which clinicians direct patients to private services due to their PHI status without their policy coverage taken into account; (3) higher prices being charged in the private system, resulting in greater OOPE to the patient and (4) individual preference to use private services, regardless of insurance status and policy coverage. Unfortunately, our data lack the level of detail required to explore these suggestions.

As initially anticipated, residing in the South West region was a significant predictor of lower non-medical and total OOPE. The opening of a Comprehensive Cancer Centre in this region, providing specialised surgery, chemo- and radiation therapy, has most likely reduced non-medical expenses such as travel, food, accommodation and fuel. Patients residing in other regions need to travel further to access facilities providing cancer services. This is indicative of the size of the financial burden caused by travelling to treatment.

Females in our study were likely to experience higher non-medical OOPE, yet participants diagnosed with breast cancer were likely to have lower non-medical OOPE than those with other cancer diagnoses. Of the 196 female participants, 149 had breast cancer, 15 had lung cancer and 32 had bowel cancer. The lower non-medical expenses reported by breast cancer patients could be explained to some extent by services provided by Breast Cancer Nurses supported by an NGO that enables them to offer financial support to breast cancer patients with assorted non-medical fees, such as household bills and car registration as part of their care. This additional support would not have been as readily available to female lung and colorectal cancer patients.

Our results suggest prostate cancer patients are experiencing higher medical OOPE than other cancer patients. Diagnostic investigations and treatment for breast, lung and colorectal cancer are well-established, and hence, the majority are covered by public or private insurance. Certain imaging and surgery options for prostate cancer are not on the MBS. Magnetic resonance imaging can incur an OOPE of AU$480, and robotic surgery with the Da Vinci robot, only available in the state’s private sector, costs upwards of AU$5000 anecdotally. Furthermore, approximately 70% of prostate cancer patients access care privately (private communication with the Chief Medical Officer of the WACR). Previous research has identified Australian prostate cancer patients incur substantial OOPE from both patient and Medicare perspectives [7, 27].

Participants who were working prior to diagnosis had significantly higher total non-medical OOPE compared to those who were not working, a finding previously observed in an Irish OOPE study [25]. This could be due to working patients being ineligible for rebates; or, with a greater household income, they may have been more willing to pay for additional services and items and utilise PHI. The impact of this OOPE needs to be explored to discern the effect it can have on working cancer patients post-treatment. Literature suggests cancer patients that needed to change or reduce their work hours are more likely to be financially distressed than those able to continue working [32].

Limitations

In this study, population-based sampling minimised the potential for selection bias. The low recruitment (30%) and resultant moderate sample size limited our study’s power and generalisability, and increased susceptibility to non-response bias. However, there were no significant differences between participants and non-participants in terms of age, gender, region of residence and diagnosis. Additionally, the proportion of patients from each region is not significantly different to the actual population proportions between the regions of interest, and the proportion of Australian adults with PHI in 2014–15 is also comparable (57%, vs our study’s 63%) [33]. Our data was self-reported at least a month after initial treatment, which could contribute to recall bias. Despite potential for over or under-reporting of costs, self-reported cost data has been identified as a reliable measure of service utilisation [34]. Whilst previous studies have indicated that patients with advanced cancers and those treated in the private sector experience higher OOPE [17, 25], our data lack this information.

Whilst we attempted to standardise reported costs by listing each cost item and using standard definitions, within our sample, the time period for which the OOPE were reported varies greatly. Participants were contacted at the same time post-diagnosis, yet some took up to 52 weeks to return their surveys. In spite of this, the univariate analysis did not reveal participant OOPE to differ significantly for those returning surveys more or less than 6 months post-diagnosis.

Future research in this area would benefit from discerning the objective (coping strategies) and subjective (perceptions of financial burden) impact of financial toxicity on rural cancer patients to complement these monetary findings, and develop a more comprehensive understanding of how OOPE affect rural cancer patients’ wellbeing and their treatment decisions.

Conclusion

Rural cancer patients in Western Australia accrue considerable OOPE in the first median 21 weeks following their diagnosis. The majority of these OOPE are attributable to treatment costs (predominantly surgery and tests) and travel-related expenses. Cancer diagnosis, treatment and related OOPE resulted in a financial catastrophe for 1 in 10 participants. Several factors were associated with higher patient OOPE, with PHI being the only significant factor for medical, non-medical and total OOPE. A greater understanding of the impact these costs have on patients is necessary to understand how well financial support services are catering to the needs of rural patients.

References

Altice CK, Banegas MP, Tucker-Seeley RD, Yabroff KR (2017) Financial hardships experienced by cancer survivors: a systematic review. J Natl Cancer Inst 109(2):djw205. https://doi.org/10.1093/jnci/djw205

Brooks J, Wilson K, Amir Z (2011) Additional financial costs borne by cancer patients: a narrative review. Eur J Oncol Nurs 15:302–310

Gordon LG, Merollini KMD, Lowe A, Chan RJ (2017) A systematic review of financial toxicity among cancer survivors: we can’t pay the co-pay. Patient 10(3):295–309. https://doi.org/10.1007/s40271-016-0204-x

Ubel PA, Abernethy AP, Zafar SY (2013) Full disclosure—out-of-pocket costs as side effects. N Engl J Med 369(16):1484–1486

Zafar YS, McNeil RB, Thomas CM, Lathan CS, Ayanian JZ, Provenzale D (2015) Population-based assessment of cancer survivors’ financial burden and quality of life: a prospective cohort study. J Oncol Pract 11(2):145–150

Currow D, Aranda S (2016) Financial toxicity in clinical care today: a “menu without prices”. MJA 204(11):397

Gordon LG, Walker SM, Mervin MC, Lowe A, Smith DP, Gardiner RA, Chambers SK (2017) Financial toxicity: a potential side effect of prostate cancer treatment among Australian men. Eur J Cancer Care 26:e12392. https://doi.org/10.1111/ecc.12392

Australian Institute of Health and Welfare (2017) Health expenditure Australia 2015–16. Health and welfare expenditure series no. 58. Cat. no. HWE 68. AIHW. https://www.aihw.gov.au/reports/health-welfare-expenditure/health-expenditure-australia-2015-16/data. Accessed 20 Nov 2017

Islam MM, Yen L, Valderas JM, McRae IS (2014) Out-of-pocket expenditure by Australian seniors with chronic disease: the effect of specific diseases and morbidity clusters. BMC Public Health 14(1):1008. https://doi.org/10.1186/1471-2458-14-1008

McRae I, Yen L, Jeon Y-H, Herath PM, Essue B (2013) Multimorbidity is associated with higher out-of-pocket spending: a study of older Australians with multiple chronic conditions. Aust J Prim Health 19:144–149

Gordon LG, Ferguson M, Chambers SK, Dunn J (2009) Fuel, beds, meals and meds: out-of-pocket expenses for patients with cancer in rural Queensland. Cancer Forum 33(3):204–210

Zucca A, Boyes A, Newling G, Hall A, Girgis A (2011) Travelling all over the countryside: travel-related burden and financial difficulties reported by cancer patients in New South Wales and Victoria. Aust J Rural Health 19(6):298–305

Australian Institute of Health and Welfare (2017) Cancer in Australia 2017. Cancer series no. 101. Cat. no. CAN 100. AIHW. https://www.aihw.gov.au/reports/cancer/cancer-in-australia-2017/contents/table-of-contents. Accessed 18 May 2017

Government of Western Australia, Department of Water (2012) Regional Western Australia. Department of Water, Spatial Services and GIS Section. http://www.drd.wa.gov.au/Publications/Documents/Regional_Map_WA_A4.jpg. Accessed 29 Oct 2017

Paul C, Boyes A, Hall A, Bisquera A, Miller A, O’Brien L (2016) The impact of cancer diagnosis and treatment on employment, income, treatment decisions and financial assistance and their relationship to socioeconomic and disease factors. Support Care Cancer 24(11):4739–4746. https://doi.org/10.1007/s00520-016-3323-y

Direct costs (2008) Direct Costs. In: Kirch W (ed) Encyclopedia of public health. Springer, Dordrecht, pp 267–267. https://doi.org/10.1007/978-1-4020-5614-7_799

Gordon L, Scuffham P, Hayes S, Newman B (2007) Exploring the economic impact of breast cancers during the 18 months following diagnosis. Psychooncology 16(12):1130–1139. https://doi.org/10.1002/pon.1182

Australian Bureau of Statistics (2018) Consumer price index, Australia, Dec 2018. ‘TABLES 1 and 2. CPI: all groups, index numbers and percentage changes’, time series spreadsheet. cat. no. 6401.0. http://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6401.0Jun%202017?OpenDocument. Accessed 16 Aug 2017

World Health Organisation (2010) Monitoring the building blocks of health systems: a handbook of indicators and their measurement strategies. WHO. http://www.who.int/healthinfo/systems/WHO_MBHSS_2010_full_web.pdf. Accessed 20 Aug 2017

Barber JA, Thompson SG (2000) Analysis of cost data in randomized trials: an application of the non-parametric bootstrap. Stat Med 19(23):3219–3236

Thompson SG, Barber JA (2000) How should cost data in pragmatic randomised trials be analysed? BMJ 320(7243):1197–1200

Malehi AS, Pourmotahari F, Angali KA (2015) Statistical models for the analysis of skewed healthcare cost data: a simulation study. Heal Econ Rev 5(1):11

Manning WG, Mullahy J (2001) Estimating log models: to transform or not to transform? J Health Econ 20(4):461–494. https://doi.org/10.1016/S0167-6296(01)00086-8

Mihaylova B, Briggs A, O'Hagan A, Thompson SG (2011) Review of statistical methods for analysing healthcare resources and costs. Health Econ 20(8):897–916. https://doi.org/10.1002/hec.1653

O'Ceilleachair A, Hanly P, Skally M, O'Leary E, O'Neill C, Fitzpatrick P, Kapur K, Staines A, Sharp L (2017) Counting the cost of cancer: out-of-pocket payments made by colorectal cancer survivors. Support Care Cancer 25(9):2733–2741. https://doi.org/10.1007/s00520-017-3683-y

Australian Bureau of Statistics (2016) 6523.0 - Household income and wealth, Australia, 2013–14. Australian Bureau of Statistics. http://www.abs.gov.au/AUSSTATS/abs@.nsf/Lookup/6523.0Main+Features312013-14?OpenDocument. Accessed 19 June 2017

Mervin MC, Lowe A, Gardiner RA, Smith DP, Aitken J, Chambers SK, Gordon LG (2017) What does it cost Medicare to diagnose and treat men with localized prostate cancer in the first year? Asia Pac J Clin Oncol 13(3):152–159. https://doi.org/10.1111/ajco.12663

Pisu M, Azuero A, Meneses K, Burkhardt J, McNees P (2011) Out of pocket cost comparison between Caucasian and minority breast cancer survivors in the Breast Cancer Education Intervention (BCEI). Breast Cancer Res Treat 127(2):521–529. https://doi.org/10.1007/s10549-010-1225-0

Narang AK, Nicholas L (2017) Out-of-pocket spending and financial burden among Medicare beneficiaries with cancer. JAMA Oncol 3(6):757–765

Johar M, Mu C, Van Gool K, Wong CYCHECR (2017) Bleeding hearts, profiteers, or both: specialist physician fees in an unregulated market. Health Econ 26(4):528–535. https://doi.org/10.1002/hec.3317

Deliotte Access Economics (2017) Financial impacts of breast cancer in Australia. Deliotte. https://www2.deloitte.com/au/en/pages/economics/articles/financial-impact-breast-cancer-australia.html. Accessed 27 Sept 2017

Gordon LG, Beesley VL, Mihala G, Koczwara B, Lynch BM (2017) Reduced employment and financial hardship among middle-aged individuals with colorectal cancer. Eur J Cancer Care 26:e12744. https://doi.org/10.1111/ecc.12744

Australian Bureau of Statistics (2017) 4364.0.55.002 - Health Service Usage and Health Related Actions, Australia, 2014–15. http://www.abs.gov.au/AUSSTATS/abs@.nsf/allprimarymainfeatures/CD8DB1EFA25F665DCA257B39000F371A?opendocument. Accessed 5 Feb 2017

Leggett LE, Khadaroo RG, Holroyd-Leduc J, Lorenzetti DL, Hanson H, Wagg A, Padwal R, Clement F (2016) Measuring resource utilization: a systematic review of validated self-reported questionnaires. Medicine 95(10):e2759. https://doi.org/10.1097/md.0000000000002759

Funding

This research was funded by the Cancer Council of Western Australia and Western Australian Government Department of Health through the WA Cancer and Palliative Care Network.

Author information

Authors and Affiliations

Contributions

CJ, AI, SM, VP, RM and CS designed the study; JN and HH conducted data collection; JN and MB performed statistical analysis; JN, NSA and CS contributed to the analysis and interpretation of the data; JN and NSA wrote the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Human research ethics approval was obtained from the WA Country Health Service Ethics Committee (#2014:10) and the Department of Health WA Human Research Ethics Committee (#2014/26).

Conflict of interest

The authors declare that they have no competing interests.

Electronic supplementary material

Table S1

(DOCX 50 kb)

Rights and permissions

About this article

Cite this article

Newton, J.C., Johnson, C.E., Hohnen, H. et al. Out-of-pocket expenses experienced by rural Western Australians diagnosed with cancer. Support Care Cancer 26, 3543–3552 (2018). https://doi.org/10.1007/s00520-018-4205-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00520-018-4205-2