Abstract

More than half of the bioethanol plants in operation today use corn or grains as raw materials. The downstream processing of mash after fermentation to produce ethanol and distiller grains is an energy-demanding process, which needs retrofitting for optimization. In addition, the fluctuation in the ethanol and grain prices affects the overall profitability of the plant. For this purpose, a process simulation was performed in Aspen Plus® based on an existing industrial plant located in Sweden. The simulations were compared using different scenarios including different concentrations of ethanol, using the stillage for biogas production to produce steam instead of distiller grains as a by-product, and altering the purity of the ethanol produced. Using stillage for biogas production, as well as utilizing the steam, reduced the overall energy consumption by 40 % compared to the plant in operation. The fluctuations in grain prices had a high impact on the net present value (NPV), where grain prices greater than 349 USD/ton reached a zero NPV. After 20 years, the plant in operation producing 41,600 tons ethanol/year can generate a profit of 78 million USD. Compared to the base case, the less purified ethanol resulted in a lower NPV of 30 million USD.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The global depletion of oil and environmental concerns has led to the search for renewable fuel sources. Today, several forms of alternative energies exist of which, the contribution of biofuels ethanol, biodiesel, and biogas is significant. Ethanol was introduced in the transportation sector in the early 1900s in the United States from corn as a raw material [1]. Similarly, ethanol production from sugarcane was introduced in Brazil by the Brazilian Alcohol Program systematized in 1975. In 2012, Brazil and the United States together produced about 85 % of the total ethanol production in the world, equivalent to 72.7 million cubic meters [2, 3].

The majority of ethanol producing plants use food or arable crops including sugarcane, corn, or grains [4]. The choice of this raw material depends on the excess amount of crops generated in the country. For instance, the sugarcane production in Brazil exceeded 721 million tons in 2012, leaving it as a potential substrate for producing ethanol [5]. Correspondingly, in Sweden, the wheat production was about 2.3 million tons in 2012, leaving it as a potential source for ethanol production [5]. In 2011, the overall ethanol generation in Sweden was about 300 tons/day [6].

Ethanol production from food crops is a matured technology and produced as follows depending on the raw material: for instance, corn or grains are ground either by wet or dry milling, followed by the addition of enzymes such as α-amylase and gluco-amylase to release the sugars, and thereafter, the temperature of the fluid is increased to liquefy the feed. Furthermore, the liquefied feed is sent to the fermentor, where by the action of the yeast, ethanol is obtained after fermentation. Unlike, corn and grain, ethanol production from sugarcane is obtained after steps such as extracting the sugarcane juices, followed by the addition of sulfuric acid, lime, and thickeners, and the removal of impurities before it is fermented. The fiber residue of the cane, after cane juices have been extracted, called bagasse is sent to the boilers for electricity production. The ethanol produced after fermentation is sent to the distillation columns for downstream processing and purification. The residue from the distillation process, called as stillage contains organics and proteins, is centrifuged, evaporated, and dried to produce dried distillers grains with solubles (DDGS) as a by-product. However, depending on the raw material, milling type, etc., different by-products can be generated. For instance, the wet milling of corn results in gluten feed and gluten meal, which are used in the poultry industries; corn oil and corn steep liquor are other valuable products obtained apart from ethanol [1, 7–12].

Though this technology is commercialized, today many plants face operational problems and need a retrofitting. For instance, some plants are not equipped with a dehydration column when designed or need to be retrofitted by adding or removing a dehydrator. In addition, the evaporation of the stillage is a high energy consuming process, which demands the innovation of a better technology or alternatives. Previously, some techno-economic studies were proposed for sugarcane, grains, or corn [8–11, 13]. Quintero et al. [11] compared the ethanol production from sugarcane and corn, based on Colombian conditions, and evaluated the economic and environmental performance for both the processes. In another study, ethanol production from the corn dry milling process was evaluated using SuperPro Designer, considering different costs for corn, [9] while Sokhansanj et al. [13] studied the effect of the cost on feedstock and supply logistics in the ethanol production. The studies so far, however, do not consider any changes to the plant, which could be a critical factor during the course of time. The main novelty of this work is to study the different retrofit options available for the first generation ethanol production and the effect of economic sensitivities on ethanol and grain prices.

In this work, an industrial ethanol plant using grains as raw materials was simulated to study the techno-economic perspective. Having this as the base simulation, several retrofit scenarios were compared and the energy consumption was studied including the effect of evaporators, usage of a dehydration column to remove the excess moisture, different yeast strains for ethanol production, and sensitivity analyses were performed for the cost of ethanol, grains, and DDGS, etc. The profitability indexes, investments, energy consumptions, technical variations between the base simulations and the modified scenarios were compared and analyzed.

Methods and modeling

Process description (base case)

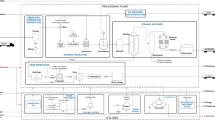

The base simulation was performed with reference to the data obtained from the ethanol plant in Norrköping (Lantmännen Agroetanol AB, Sweden). All the equipment was modeled using Aspen Plus® (version 8.4). Figure 1 shows the process flow sheet of the ethanol production from grains. The grains were transported to the plant using trucks and stored in a silo. From the stored silo, it was transported through the conveyor belts for milling. About 18.8 t/h grains with TS of 86.5 % were milled using a dry mill process to obtain coarse flour, which contains 66 % starch, 12 % proteins, and 22 % others. Furthermore, the flour feed was sent to a slurry tank of volume 40 m3, to be mixed with the incoming process water and α-amylase. After that, the feed was sent to two liquefaction tanks, which were operating at 73 and 88 °C to dissolve as much as possible and initiate the conversion of starch to its monomeric form, glucose. The retention times for the liquefaction tanks were 2.2 and 2.1 h, respectively. Once the liquefaction was complete, the feed was cooled down to 33 °C, to facilitate the fermentation process.

About 58.8 t/h cooled feed was pumped into the five fermenters with a retention time of 2.78 days. In the fermentation process, gluco-amylase is added before the mash enters fermentor where yeast is present. The yeast converts the newly released sugars into ethanol and carbon dioxide. Approximately, 5.1 t/h carbon dioxide was released from the fermentor, while 5.4 t/h ethanol was obtained after fermentation. The fermented mash with the ethanol, the residues such as proteins, other glucose based materials, and other non-fermentable dissolved solids were sent to the distillation column for the purification of ethanol. The detailed information about the distillation column data is provided in Table 1. In total, three distillation columns were used, where the initial heat was supplied to the third columns’ reboiler. Subsequently, the heat from the third columns’ condenser was sent to heat the second columns reboiler and it was continued for the first column. The feed from the fermentors was split equally between the distillation columns one and two, respectively, and the ethanol was purified between 45 and 50 %. The top from both the distillation columns was sent to the third column, where the ethanol was purified to about 91 %.

The residue remaining after the distillation process called “stillage,” contains the leftovers such as proteins, other glucose-based materials and other non-fermentable dissolved solids (NFDS) that were sent to a decanter where the solid wet cake contain about 32 % TS. The solid stream was sent to the dryer for the production of DDGS. For the thin stillage stream, about 19 % was recycled back to liquefaction, and the remaining feed was sent to the evaporator, which was a 5-stage evaporator operating between 80 and 85 °C. The concentrated thin stillage called syrup from the evaporator were sent along with the solids from the centrifugation for the production of DDGS. In addition, the condensed water from the evaporators was collected and recycled back to the first mixing tank, as processing water. The dryers were operated at 115 °C and then pelletized to produce DDGS. About 7.7 t/h DDGS was produced, which contained 90 % TS. The DDGS is stored in silos, before it is sold to the market.

The purified ethanol stream, resulting after the distillation process, contains excess water, which cannot be removed due to azeotropic nature of ethanol/water mixtures. Therefore, a so-called pressure swing adsorption is used to purify the ethanol according to the specification. When the first dehydration column was in operation, the feed was added from the bottom, where water is retained, while purified ethanol can pass though the column filled with a zeolite. About 70 % of the purified stream was sent to the storage tank as a final product, while the other 30 % was sent to the second dehydration column which is under regeneration. This regeneration product called purge is given back to the rectification column. About 5.2 t/h ethanol was produced as a final product, which was sold to the market.

Retrofitting analysis

The current ethanol production methods result in fewer by-products; moreover, utilizing the stillage after fermentation can result in different by-products, which can improve the overall economy of the process [14]. With reference to the base case simulation, different retrofitting alternatives were considered in the current flow sheet. Figure 2 shows the block flow diagram for the different retrofits considered in this study. The energy consumption, economical investments, revised payback period, etc., were recalculated. The different retrofits were as follows:

-

Retrofit 1: In the base case simulation, three distillation columns were used followed by two dehydrator columns to reach a final purity of 99.5 %. In this retrofit, the dehydrator columns were replaced by a fourth distillation column. The final purity of ethanol was 93 %, and the ethanol was sold at a reduced cost of 775 USD/ton (http://www.alibaba.com).

-

Retrofit 2: The concentration of ethanol obtained after the fermentation in the base simulation was 10 %. However, this concentration was increased to 17 % ethanol (retrofit 2A), as there are certain commercial strains of the baker’s yeast that can tolerate this concentration. On the other hand, a 4 % ethanol concentration strain (retrofit 2B) was considered to check its effect on energy and economics. The different concentrations of ethanol reflects the amount of water usage in the process, thereby reducing or increasing the effect on the distillation column and the overall size of the equipment considered.

-

Retrofit 3: Currently, the evaporators are used for the stillage to produce DDGS, and process water is recycled. However, in the developing countries, evaporation is often not used, as it is an energy-intensive process. The stillage contains leftover organics, and proteins, which can be used for the biogas production. Biogas is a combination of methane and carbon dioxide, formed due to the anaerobic digestion of organics (stillage). In this retrofit, the stillage was used to produce biogas, which can be used to produce steam for the process. Even though the DDGS by-product revenue is absent, the cost of the utilities would be considerably low. For this purpose, the biogas process was modeled according to Rajendran et al. [15, 16].

Energy and economics

Table 2 shows the list of assumptions made to carry out the simulation in this study. All the equipment considered in this study was made of stainless steel. The economic analysis was carried out using Aspen Process Economic Analyzer (8.4). The economic calculations were carried out based on the pricing from the first quarter of 2013. The ethanol is sold at a price of 875 USD/ton, before tax. All the profitability indexes such as the capital investment, net present value (NPV), payback period (PBP), revenue, utilities, operational costs, cash-flow diagrams, and cost of raw materials for all the different retrofits were performed and analyzed according to Turton et al. [17]. Here, the PBP refers to the recovery of the investment and working capital, after the operation of the plant.

The energy consumption calculations were performed using the Aspen Process Energy Analyzer (8.4). The energy consumption was summarized in terms of sections in the process flow sheet. Here, the liquefaction section includes the energy consumption for grinding the grains and adding water and enzymes to the liquefaction tanks (1 and 2), where the reactor is heated to liquefy the feed. The second section is the fermentation section, where the energy consumption for cooling the feed as well as the fermentation process is considered. The downstream processing is divided into two sections, namely: evaporation and drying as well as distillation and dehydration. In evaporation and drying, the energy consumption for the centrifugation, evaporation, and drying to produce the by-product DDGS was taken into account. The distillation and dehydration section includes the purification of ethanol through distillation and molecular sieves to remove the moisture until a final product is obtained.

Sensitivity analysis

A sensitivity analysis was carried out on the base case simulation, by varying the annual processing capacity from 10 to 600 %. Here, 100 % refers to the base case with a processing capacity of 150,400 tons of grains/year. The sensitivity analysis was carried out to a processing capacity between 15,000 and 902,000 tons/year. The investment parameters such as capital investment, cash flow analysis, NPV, PBP, operating cost, raw material cost, and utilities cost were calculated for each of the processing capacities. Varying the process capacity shows the effect of having a divergence scale for the plant, suitable for different countries and the availability of raw materials. The fluctuation in the cost of ethanol, grains and DDGS were the other economic parameters, which affects the overall profitability of the plant. For this purpose, from the preliminary assumptions, the cost of ethanol, grains, and DDGS was altered by ±50, ±100 USD/ton. The minimum selling price of ethanol and DDGS, and the maximum cost of the grains at which the NPV becomes zero were estimated.

Results and discussion

Retrofitting analysis on the ethanol production from grains was performed using Aspen Plus. The energy calculations were performed using Aspen Energy Analyzer, and the economics of the plant was calculated based on Aspen Process Economic Analyzer. The techno-economic performance and the energy utilization studies were compared for the different retrofits and sensitivities.

Base case

For the base case, the plant that is in operation today was considered. All the unit operations were mass- and energy-balanced based on the data obtained from Lantmännen Agroetanol AB, Sweden. The fermentor to produce the ethanol was modeled based on the NREL model [18, 19]. Table 3 shows the allocation of the energy consumption for the different sections of the plant. In the distillation column, the heat was transformed between the condensers in the third column, to the reboiler of the second column. This heat integration reduced the amount of energy consumption in the plant. However, about 40 % of the total energy consumption of the plant was consumed for the downstream processing of the ethanol, which includes the distillation and dehydration processes. The annual ethanol production and DDGS is equivalent to 41,600 and 61,600 tons, respectively. This ethanol production capacity is equivalent to ~40 % of the total ethanol production in Sweden [6].

In terms of economics, the total capital investment required for the plant was 69 million USD (Fig. 3). Arifeen et al. [10] reported a capital investment of 48 million USD for the capacity to produce 30,000 tons ethanol/year. The results in the current study were in accordance with Arifeen et al. and Lang et al. [10, 20], considering the inflation and capacity. The products and the by-products due to the fermentation of the grains include ethanol, carbon dioxide, and DDGS, which resulted in the annual revenue of 63 million USD, while the operating costs were 56 million USD, respectively. The investments and the working capital could be gained back in 13 years, and the NPV after 20 years of operation was 78 million USD. It is a positive investment; however, the cumulative cash position (CCP), i.e., capital investment to the NPV ratio was 1.13, suggesting that it is not economically attractive to the fullest. It would be interesting to compare the proposed retrofitting scenarios to the existing scenario in the plant.

Sensitivity analysis for different processing capacities

With reference to the base case of the capacity of processing 150,400 tons grains/year, a wide range of plant capacities was considered, namely, from 10 % of the base case to 600 % of the base. Figure 3 shows the cash flow diagram and other economic parameters for the different capacities considered in the sensitivity analysis. The results suggest that reducing the plant capacity has adverse effects on the plant profitability and that reducing the capacity less than 75,200 tons/year, i.e., 25 % of the base case, is not profitable. Increasing the plant capacity had an overall positive effect on the economics; however, the PBP of the plant remains around 11 years. It could be that increasing the plant capacity also means a higher investment, which could not be recovered for at least 10 years with the current processing methods. For a plant processing 902,400 tons/year, the NPV obtained after 20 years was 641 million USD, while the capital investment was 258 million USD. This resulted in a CCP of 2.48, which is 120 % higher than the base case.

The cost of ethanol, grains, and DDGS is one of the important factors, which affect the profitability of the plant. A sensitivity analysis was carried out for different prices of raw materials and products, suggesting how the market fluctuation affects the economics of the plant. Figure 4 shows the NPV and PBP for different sensitivity analyses carried out on the ethanol producing plant from the grains. Compared to the selling price of ethanol and DDGS, the purchase price of the grains affects the economics of the plant adversely. Increasing the grains price to 350 USD/ton lowers the NPV to less than ‘0,’ and the maximum price for the grains for the NPV to have a positive NPV was 349 USD/ton. Although the decreasing prices of ethanol and DDGS had a negative effect on the NPV, reducing the product cost to less than 100 USD/ton, respectively, for ethanol and DDGS from the base case, still had a positive NPV. The minimum cost of ethanol to be sold for a zero NPV was 702 USD/ton, whereas for DDGS it was 250 USD/ton. A 59 % increase in the NPV could be obtained by increasing the ethanol price from the base case by 100 USD/ton.

Comparison of different retrofits

The base case was compared to different retrofits such as removal of the dehydrator column to the distillation column, different ethanol-tolerant yeast strains, utilization of biogas to steam instead of producing DDGS, and fungal bio-refinery of stillage to produce fish feed. Figure 5 shows the different economic parameters for the retrofits considered in this study. In the past, some of the ethanol producing industries did not produce a 99.5 % pure ethanol; instead, they produced a lower grade, for instance 93 %. For this purpose, one retrofit scenario was to consider replacing the dehydrator with a distillation column. Compared to the base case, adding a distillation column instead of a dehydrator is a 30 % capital-intensive process. In addition, the purity of the ethanol is lower, resulting in a lower NPV of 30 million USD, compared to 78 million USD in the base case. Thanks to the development in chemical engineering, this resulted in an efficient processing through dehydration, increasing the final purity of the ethanol.

The common yeast strain used today in ethanol production is baker’s yeast. However, there are certain other strains, which can produce ethanol at higher or lower concentrations. Two different ethanol concentrations were considered, i.e., 4 and 17 % to test the sizing and energy consumption of the plant. In principle, the water consumption of the process was altered, resulting in the varying sizes of the different unit operations in the process. For the 4 % ethanol concentration, the sizing of the equipment was increased by 1.5 times compared to the base case, in terms of the direct cost for the equipment; however, a high yeast-tolerant strain could reduce the overall sizing by 10 %. Considering the energy consumption, a 4 % ethanol strain consumes more than double the energy compared to that of the base case. The NPV for 4 % ethanol strain was 51 million USD, while for 17 % ethanol tolerance, the NPV was 60 % higher compared to the base case. In terms of the energy consumption, 4 % ethanol tolerance could use 67 % more energy compared to that of the base case, whilst 17 % ethanol tolerance case could use 4 % less energy.

Currently, in the plant, the stillage is sent to produce the DDGS, which is used as an animal feed after evaporation and drying. From the base case, we could identify that the energy consumption for evaporation and drying of the stillage was 5.5 GW h/year. This is an energy-intensive process, and in retrofit scenario 3, we evaluated the outcome if an anaerobic digester was used instead to produce heat, which can be utilized for the process. The results suggest that using the heat for the process is economically attractive compared to the current scenario today. Barta et al. [21] have utilized biogas from thin stillage in a second generation ethanol production from soft-wood, and showed that it was about a 12 % energy efficient process. In this study, the energy consumption has gone down by 7.4 GWh, compared to the base case, which could be due to the processing of the stillage for evaporation and drying to produce the DDGS. Nonetheless, the total product sales went down by 8 million USD/year, as the by-product DDGS was not produced.

Conclusion

Retrofitting analyses of first generation ethanol production was modeled using Aspen Plus, and it was analyzed based on techno-economic perspectives. The results suggest that the purchase price of grains plays an important factor in the profitability of the plant, while decreasing the ethanol to less than 702 USD/ton is not profitable. The retrofitting comparisons revealed that using the stillage for biogas reduced the overall energy consumption by 39 % compared to the base case. Reducing the plant size to less than 75,000 tons grains/year is not profitable, while increasing the plant size more than 300,000 tons grain/year did not decrease the PBP to less than 11 years.

Abbreviations

- DDGS:

-

Dried distillers grains with soluble

- TS:

-

Total solids

- NPV:

-

Net present value

- PBP:

-

Payback period

- CCP:

-

Cumulative cash position

- NFDS:

-

Non -fermentable dissolved solids

References

Bothast RJ, Schlicher MA (2005) Biotechnological processes for conversion of corn into ethanol. Appl Microbiol Biotechnol 67(1):19–25

Global Agricultural Information Network (2012) Biofuels annual report 2012. USDA Foreign Agricultural Service, Sao Paulo

Renewable Fuels Association (2014). http://www.ethanolrfa.org/. Accessed 07 May 2014

Pieragostini C, Aguirre P, Mussati MC (2014) Life cycle assessment of corn-based ethanol production in Argentina. Sci Total Environ 472:212–225

Food and Agricultural Organization (2012) FAOSTAT

International energy statistics (2011) Fuel ethanol statistics. In: US Energy information administration

Perkis D, Tyner W, Dale R (2008) Economic analysis of a modified dry grind ethanol process with recycle of pretreated and enzymatically hydrolyzed distillers’ grains. Bioresour Technol 99(12):5243–5249

Kim Y, Mosier N, Ladisch MR (2008) Process simulation of modified dry grind ethanol plant with recycle of pretreated and enzymatically hydrolyzed distillers’ grains. Bioresour Technol 99(12):5177–5192

Kwiatkowski JR, McAloon AJ, Taylor F, Johnston DB (2006) Modeling the process and costs of fuel ethanol production by the corn dry-grind process. Ind Crops Prod 23(3):288–296

Arifeen N, Wang R, Kookos IK, Webb C, Koutinas AA (2007) Process design and optimization of novel wheat-based continuous bioethanol production system. Biotechnol Prog 23(6):1394–1403

Quintero JA, Montoya MI, Sánchez OJ, Giraldo OH, Cardona CA (2008) Fuel ethanol production from sugarcane and corn: comparative analysis for a Colombian case. Energy 33(3):385–399

Elander RT, Putsche VL (1996) Ethanol from corn: technology and economics. In: Handbook on bioethanol: production and utilization. pp 329–349

Sokhansanj S, Mani S, Tagore S, Turhollow AF (2010) Techno-economic analysis of using corn stover to supply heat and power to a corn ethanol plant-part 1: cost of feedstock supply logistics. Biomass Bioenergy 34(1):75–81

Liu K, Barrows FT (2013) Methods to recover value-added coproducts from dry grind processing of grains into fuel ethanol. J Agric Food Chem 61(30):7325–7332

Rajendran K, Kankanala HR, Lundin M, Taherzadeh MJ (2014) A novel process simulation model (PSM) for anaerobic digestion using Aspen Plus. Bioresour Technol 168:7–13

Rajendran K, Kankanala HR, Martinsson R, Taherzadeh MJ (2014) Uncertainty over techno-economic potentials of biogas from municipal solid waste (MSW): a case study on an industrial process. Appl Energy 125:84–92. doi:10.1016/j.apenergy.2014.03.041

Turton R, Bailie RC, Whiting WB, Shaeiwitz JA, Bhattacharyya D (2012) Analysis, synthesis and design of chemical processes. Pearson Education, Upper Saddle River

Wooley R, Ruth M, Glassner D, Sheehan J (1999) Process design and costing of bioethanol technology: a tool for determining the status and direction of research and development. Biotechnol Prog 15(5):794–803

Wooley R, Ruth M, Sheehan J, Ibsen K, Majdeski H, Galvez A (1999) Lignocellulosic biomass to ethanol process design and economics utilizing co-current dilute acid prehydrolysis and enzymatic hydrolysis current and futuristic scenarios. In: DTIC document

Lang X, Macdonald DG, Hill GA (2001) Recycle bioreactor for bioethanol production from wheat starch II. Fermentation and economics. Energy Sources 23(5):427–436

Barta Z, Reczey K, Zacchi G (2010) Techno-economic evaluation of stillage treatment with anaerobic digestion in a softwood-to-ethanol process. Biotechnol Biofuels 3(1):1–11

Acknowledgments

The authors would like to thank the Swedish Energy Agency for their financial support and Lantmännen Agroetanol AB, Sweden for sharing the data of the plant. We also acknowledge Thomas Södergren for his computer support.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Rajendran, K., Rajoli, S., Teichert, O. et al. Impacts of retrofitting analysis on first generation ethanol production: process design and techno-economics. Bioprocess Biosyst Eng 38, 389–397 (2015). https://doi.org/10.1007/s00449-014-1278-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00449-014-1278-2