Abstract

Imatinib is an oral tyrosine kinase inhibitor and considered to be the most successful targeted anti-cancer agent yet developed given its substantial efficacy in treating chronic myeloid leukemia (CML) and other malignant diseases. In the USA and the European Union (EU), Novartis’ composition of matter patent on imatinib will expire in 2016. The potential impact on health system spending levels for CML after generic imatinib becomes available is the subject of significant interest among stakeholders. The extent of the potential savings largely depends on whether and to what extent prices decline and use stays the same or even increases. These are also empirical questions since the likely spending implications following generic imatinib’s availability are predicated on multiple factors: physicians’ willingness to prescribe generic imatinib, molecule characteristics, and health system priorities. This article discusses each of these issues in turn. We then review their implications for the development of country-specific cost-effectiveness models to predict the implications for cost and quality of care from generic imatinib.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Will the arrival of generic imatinib revolutionize the economics of treating chronic myeloid leukemia?

Imatinib (Gleevec, Novartis) is a tyrosine kinase inhibitor (TKI). It is considered to be the most successful targeted anti-cancer agent ever developed given its substantial efficacy in treating chronic myeloid leukemia (CML). Imatinib was first used to treat CML in 1998 and has been shown to produce a high cumulative incidence of complete cytogenetic responses (Table 1). Imatinib is also associated with improved survival, with the latest results from the 8-year follow-up of the International Randomized Study of Interferon versus STI571 (imatinib) [the IRIS trial] showing an overall survival of 85 % (Table 1). However, it has not been proven that imatinib cures CML. As a consequence, an ever-expanding cohort of CML patients are currently recommended to take this oral daily medication life-long. In 2013, Novartis’ worldwide revenue from imatinib amounted to nearly $4.7 billion, $1.7 billion from the USA alone [9]. Treatment for CML with imatinib currently commands a list price of $90,000 per year per patient in the USA.

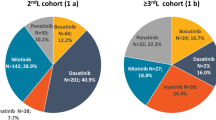

In the past decade, additional TKI-based treatment options for newly diagnosed chronic phase CML patients have become available. Four new TKIs have been introduced (nilotinib (Tasigna), dasatinib (Sprycel), bosutinib (Bosulif), and ponatinib (Iclusig)). Three (nilotinib, dasatinib, and bosutinib) have been individually compared prospectively with imatinib in newly diagnosed chronic phase CML patients. The newer TKI agents all produced more rapid responses than imatinib at the standard dose of 400 mg/day. They also launched with a higher list price than that of imatinib. Currently, the USA and European Union (EU) treatment guidelines recommend imatinib, dasatinib, or nilotinib for the initial treatment of chronic phase CML [10].

In the USA, Novartis’ composition of matter patent on imatinib was scheduled to expire in the first quarter of 2015. However, an agreement between Novartis and Sun Pharmaceutical Industries Ltd, the first to file generic manufacturer, has effectively shifted generic entry to the first quarter of 2016. In the EU, Novartis’ patent on imatinib runs out in 2016.

The potential impact on health system spending levels for CML after generic imatinib becomes available is the subject of significant interest among stakeholders in the USA and EU [11]. The extent of the potential savings largely depends on whether and to what extent price declines and the use stays the same or even increases. These are also empirical questions since the likely spending implications of generic imatinib’s availability in the USA and EU is predicated on multiple factors: physicians’ willingness to prescribe generic imatinib, molecule characteristics, and health system priorities. This article discusses each of these issues based on prior empirical work in turn. We then review their implications for the development of country-specific cost-effectiveness models that could be constructed to predict the cost and quality of care implications of generic imatinib availability.

Background on patent protection and generic entry

There are two types of prescription drugs: brand name, sometimes called “pioneer,” and generic. In the USA, pioneer drugs are approved for use in a given indication by the Food and Drug Administration (FDA) under New Drug Applications (NDAs) submitted by manufacturers typically based on the results of several phase III randomized controlled clinical trials [12]. These manufacturers are able to sell their products exclusively while the drug is patent protected. Patent protection length varies, but generally lapses 17 years from the time the pioneer manufacturer first files its investigational NDA with the FDA. In the EU, pioneer drugs are approved for use in a given indication by the European Medicines Agency (EMA). The pioneer manufacturer benefits from market exclusivity for approximately 10 years from the date of first authorization [13].

Loss of patent exclusivity in the USA and EU opens the market up to potential competition from multiple manufacturers previously limited to the sole pioneer producer [14]. In the USA, according to provisions of the 1984 Drug Price Competition and Patent Term Restoration Act (the Waxman-Hatch Act), other manufacturers apply to the FDA to obtain approval to market the “generic” drug under an Abbreviated New Drug Application (ANDA) in anticipation of patent expiration. Under the Waxman-Hatch Act, if a generic manufacturer successfully challenges the patent of a brand (a so-called Paragraph IV challenge), the entrant has exclusive ANDA marketing privileges for the molecule formulation and strength for 180 days.

In the EU, a pharmaceutical manufacturer can only develop a generic drug for marketing once the period of “exclusivity” on the pioneer (the so-called reference) drug has expired [15]. Generic drugs must obtain a marketing authorization from the EMA before they can be marketed.

FDA approval and EMA authorization of a generic drug do not require its manufacturer to repeat clinical or animal research on active ingredients or finished dosage forms already found to be safe and effective. Rather, to gain approval (or authorization), the generic drug manufacturer must only establish that the generic contains the same active ingredients; be identical in strength, dosage form, and route of administration; be bioequivalent; and be manufactured under the same strict standards as the brand-name drug. The generic drug manufacturer must provide evidence either substantiating bioequivalence and compliance with current good manufacturing practices at its own manufacturing sites or else indicate that portions of the manufacturing will be outsourced to another supplier or contract manufacturing organization. The FDA and EMA are responsible for enforcing these requirements and current good manufacturing standards among generic manufacturers both upon entry and via subsequent periodic routine inspections. Production facilities may be inspected and certified post-approval to verify they meet regulatory requirements. For oral tablets, such as imatinib, the direct costs of generic drug applications in the USA are modest (US$1–5 million) compared to potential profitability [11, 16].

Since the passage of the Waxman-Hatch Act in 1984, generic entry and price competition over all drug categories have been vigorous in the USA. In 2003, approximately, 43 % of all US prescriptions were filled with generic drugs. In 2008, over 63 % of the total pharmaceutical market volume was accounted for by generics. In 2013, this fraction had risen to 84 % [17]. In the USA, the magnitude of cost savings as a result of generic entry has increased over the past decade, due in part to virtually automatic generic substitution and other demand side and supply side prescription drug management policies we describe below. Whereas the Congressional Budget Office reported that the average generic entrant captured about 44 % of brand sales after 1 year in the early 1990s [18], it is not uncommon for a generic drug launched today to capture 80–90 % of brand sales within a year. Contemporaneous EU member country annual generic drug penetration rates are much more varied due to a variety of supply-side policies implemented on a county-specific basis we discuss below [19].

Molecule characteristics associated with generic drug “success”

The date of imatinib’s expected patent expiration and generic availability varies quite considerably between countries. For example, generic imatinib is already available in a number of countries. In April 2013, Health Canada approved two generic bioequivalent alpha crystal formulations of imatinib manufactured by Apotex and Teva, coinciding with Novartis’ patent expiration of its alpha crystal formulation of imatinib in Canada. In Canada, Novartis’ patent on the beta crystal formulation of imatinib expires in 2018. For several years, manufacturers in India have been selling unregistered forms of imatinib in domestic markets and throughout the developing world [20]. Generic imatinib is also currently available in Russia and Morocco [21].

When generic entry will actually occur in the countries where imatinib remains patent protected varies for several reasons. First, over the past two decades, the makers of branded pioneer drugs have devised numerous ways to extend patent exclusivity in the USA [22]. Novartis’s agreement with Sun Pharmaceuticals in the USA is a recent example of a “pay-for-delay” deal. A June 2013 Supreme Court ruling gave the Federal Trade Commission clear authority to investigate and prosecute pay-for-delay agreements, but stopped short of making such deals presumptively unlawful restraints of trade (http://www.supremecourt.gov/opinions/12pdf/12-416_m5n0.pdf). The June 2013 Supreme Court ruling will likely increase investigation and litigation of generic entry delay tactics among these drugs, effectively lengthening patent protection.

Second, in the USA, secondary patent challenges are quite common [23, 24]. Sampat and Hemphill suggest that the majority of successful patent challenges they surveyed occur in the context of secondary patents [25]. Novartis has an additional patent covering a variety of imatinib polymorphs that expires in 2018. Patent disputes tend to concentrate in drugs with significant market demand, creating high revenue risk from generic entry for the originating branded firms and high revenue reward for generic manufacturer challengers. Clearly, imatinib enjoys this type of market prominence in the USA.

In the EU, pioneer drug manufacturers can only use patent law to obtain further protection. This protection, if granted, applies to new uses of the drug, such as new clinical indications. While this “use patent” protection is in place, a generic drug cannot be marketed for the protected indication, even if the period of exclusivity on the reference drug has expired. Until the expiry of the use patent, generic drug can only be marketed for indications that are not still under patent protection. Generic manufacturers are allowed to develop a generic drug that is based on a reference drug but is presented as a different strength or with a different route of administration. They may also decide to develop a drug with a slightly different indication, such as a limited indication that will allow the drug to be used without a prescription. This type of generic drug is called a “hybrid,” because its authorization relies in part on the results of tests and trials on the reference drug and in part on new data.

The pricing implications of patent expiration and generic entry for oral cancer drugs such as imatinib are country and molecule specific. In the EU, generic drug prices are lower compared to their branded counterparts, but specific price drops may be determined by statute or other country-specific rules [26]. Generally, generic drug prices in well-developed EU markets are typically 10–80 % of brand prices after sequential entry by generic manufacturers [19].

For the generic versions of imatinib currently available, the price discount compared to branded imatinib appears to be significant. According to a recent report, the prices of generic imatinib in Canada are set at 18–26 % of the branded drug price [19]. In India, an April 2013 New York Times article reported treatment with generic imatinib costs approximately 3.6 % that of US costs (they assumed the Indian generic version costs about US$2500 a year compared to branded imatinib costing about $70,000 a year in the USA) [20]. A 2013 World Health Organization study reported stiff generic competition in India has resulted in private sector prices as low as US$3.5–18/g (compared to the US Federal supply schedule of US$240–330/g). The same report estimates Russia’s state maximum release price for generic imatinib manufactured by Teva is approximately US$145–226/g.

In the USA, previous economic research has examined entry and price competition among manufacturers of oral drugs after generic entry and generally finds price declines of 60–90 % off the pre-patent expiration price [27–30]. Furthermore, results of these analyses suggest that after loss of patent exclusivity, prices for oral solids initially fall quickly and then steadily as additional generic manufacturers enter the market. Notably, Reiffen and Ward find that generic drug prices fall with an increasing number of competitors, but remain above their costs of production until there are eight or more competitors. Thus, the number of generic manufacturers entering the market after loss of patent exclusivity is one important determinant of price declines.

Generally, this literature further suggests that a greater number of generic manufacturers enter and enter more quickly into markets when expected profits are greater. For example, Scott-Morton conducted a market-level analysis of 81 drugs undergoing loss of patent exclusivity between 1986 and 1992 and found that drugs that have higher pre-patent expiration revenues and that are used to treat highly prevalent chronic diseases experience greater generic entry. It is also important to note that the extent of the decline after generic entry depends on the formulation of the drug. Estimated price declines among physician-administered (injectable or infused) oncologics after generic entry are generally smaller than those commonly observed among oral solids, likely related to the greater production costs and a concentrated number of suppliers.

Furthermore, it is important to note that in the USA, price declines are not necessarily observed among pioneer drugs that have experienced loss of patent exclusivity and generic entry. Notably, several authors have reported very small changes in the pioneer drug’s price after generic entry and even price increases in some drug markets [31, 32]. Frank and Salkever developed a theoretical model to explain the anomaly of rising branded prices in the face of generic competition. Their model posits a segmented market where two consumer segments exist—a quality-conscious, brand-loyal segment that continues to buy the established branded drug after generic entry and a price-conscious segment that is less brand-loyal. Frank and Salkever report that branded prices rise and generic prices fall in response to loss of patent exclusivity and generic entry. Ellison et al. and Griliches and Cockburn also find that average prices of branded anti-infective medications rise with generic entry [33, 34]. Ellison et al. and Aitken et al. report similar findings and also document significant price responsiveness between branded and generic drugs [35]. Conti and Berndt document similar patterns among pioneer drugs used to treat cancer when they experience loss of patent exclusivity and generic entry in recent years (2001–2007).

In the specific case of imatinib, the FDA has awarded Sun Pharmaceuticals exclusive marketing of generic imatinib for 6 months following patent expiration (a so-called Paragraph IV challenge). As an exclusive generic entrant for 6 months, the successful Paragraph IV challenger can charge prices just under those of the pioneering brand. Thus, we should not expect generic imatinib’s price to drop precipitously in the USA after expected generic entry occurs in 2016, but rather follow a slower pattern of decline in the first year after entry.

Patient, physician, and health system factors determine the use of imatinib to treat CML after generic entry

Across the USA, Canada, and EU member countries, physicians write prescriptions for branded and generic drugs for their patients who then fill these prescriptions at retail (or hospital) pharmacies. Physicians may be generally ignorant of, or unconcerned about, pharmaceutical prices since they do not pay for the oral drugs they prescribe [36]. When a generic drug enters the market, pharmacists at retail pharmacies can substitute for the brand name drug with its generic equivalent. In the USA, generic substitution is allowed or even mandated, although in some states, pharmacists may need to contact the prescribing physician to request permission to substitute [37]. In most provinces in Canada, pharmacists are authorized (or even required) to switch a CML patient from branded imatinib to either generic formulation manufactured by Apotex or Teva. One exception is in the province of Quebec; physicians can write “do not substitute” on prescriptions that they order. This must be written in the doctor’s own hand on the actual prescription.

In the EU, member countries differ greatly in their policies encouraging generic dispensing. For example, in Denmark, Germany, the Netherlands, and the UK, generic substitution is possible with the doctor’s agreement and strongly encouraged. While generic substitution is allowed in Belgium, France, and Italy, these countries tend to have relatively low generic drug prescribing due in part to other incentives in the supply chain [38, 39]. Consequently, physician willingness to prescribe generic imatinib is a key determinant of whether branded imatinib use will be steady or decline after generic entry and whether generic imatinib use will increase substantially after entry.

In addition, clinical trial data suggest there are differences in how a CML patient responds to specific TKIs according to their Sokal or Euro risk factors (Table 1). Patients with low- or intermediate-risk scores appear to do nearly as well with imatinib as with one of the second-generation TKIs in terms of acute and longer term tolerance and survival. However, patients with high-risk scores seem to have better outcomes if they start with a more potent, second-generation TKI rather than with imatinib. Nevertheless, patients who achieve an early molecular response (i.e., quantitative RT-PCR analysis of BCR/ABL1 transcript levels <1–10 % (IS) in leukocytes at 3 or 6 months) have had excellent outcomes regardless of whether the initial TKI was imatinib or a second-generation TKI. Follow-up of patients enrolled on frontline trials now exceeds 5 years, and late complications, particularly vascular events, have been observed. Since patient may need to take these TKIs life-long, an increasing rate of these adverse events over time will likely impact prescribing patterns.

Physicians’ willingness to prescribe generic imatinib may also be influenced by its perceived quality [40]. Unlike other brand-name drugs in the same therapeutic class, generic drugs cannot be portrayed as being therapeutically different than their parent pioneer drug. This is due to rigorous requirements enforced by the FDA and EMA. The enforcement activities of these agencies essentially act to ensure that generics are essentially identical to their branded counterparts. In the words of the FDA, a generic drug is “identical – or bioequivalent – to a brand name drug in dosage form, safety, route of administration, quality, performance characteristics and intended uses” [41]. One potential rationale for generic drug use variation between EU member countries is their potential susceptibility to generic drug supply sources with different (lower) quality standards.

Nevertheless, concerns have been raised based on individual case reports and small case series that the bioavailability and potency of some generic imatinib is not equivalent to the branded drug. For example, clinical trial data submitted by the manufacturers of the generic formulations to Health Canada in order to obtain approval for sale of their products is the same data used to obtain approval for branded imatinib since the Canadian government does not require generic manufacturers to conduct extensive clinical trials to prove the efficacy of their drugs. The Canadian government has de facto accepted that the beta and alpha formulations of imatinib are comparable, as well as the two alpha versions, and has consequently designated the two generics and the branded molecules as “bioequivalent”. Nevertheless, some have claimed that the alpha crystal formulation may be less stable in the body than the beta crystal. Bioequivalence studies done at McGill University in Canada indicate that the alpha and beta formulations are bioequivalent and therefore should work in the body just as well as branded imatinib. Another recent meta-analysis by de Lemos and Kyritsis concluded that anecdotal concerns regarding the bioequivalence of generic imatinib distributed for sale in non-Western countries were not confirmed when formulations of imatinib approved and registered by Western health authorities were examined.

In addition, each generic version of imatinib available in Canada (the Apotex and the Teva versions) uses different bulking agents (sometimes called excipients) added to imatinib for the purpose of aiding in the manufacturing and/or helping with drug solubility and absorption. Differences in the use of excipients may alter a patient’s response to generic imatinib if they have been receiving the branded formulation. In Canada, pharmacists have been instructed to advise the CML patient that the drug has been switched from the branded formulation to a generic formulation. It remains the responsibility of the patient to advise their treating physician that they have been switched to generic imatinib.

These issues suggest to us that unlike in Canada, in the USA, the two CML populations most likely to use imatinib when it is available in generic form are newly incident chronic phase cases in a given year and prevalent cases of CML who have been treated with branded imatinib for 1 year or longer and have responded well to treatment. Note that the group that is excluded from this categorization is prevalent CML cases currently treated with a second-generation TKI (i.e., nilotinib, dasatinib, or bosutinib). It is unlikely that a patient tolerating and responding well to one of the more potent TKIs will switch to the less potent TKI imatinib unless required to do so by personal or health system financial pressures. We suspect prevalent CML patient experiences with switching from branded imatinib to generic when it becomes available will likely vary considerably between EU member countries.

Finally, supply-side incentives largely acting upon pharmacists through third-party payer policies may substantially influence the use of generic imatinib when it becomes available. In the USA, third-party payers and pharmacy benefit managers (PBMs—firms that manage pharmaceutical benefits on behalf of third-party payers) often reimburse pharmacies more generously for generic drug dispensing and reward high rates of generic substitution with bonuses and other incentives [42]. Pharmacists thus have an incentive to fill a prescription for a multisource drug with generic equivalents even if it is written for a brand name drug. Some PBMs also contact physicians directly to encourage prescribing of a new generic.

On the demand side, in the USA, insured consumers typically pay higher copayments for brand-name drugs compared to generic drugs under tiered formulary arrangements, which encourages them to use generics when available. This has important implications for treatment adherence to TKI-based CML treatment when imatinib’s generic entry occurs. A recent study by Dusetzina et al. found that among a national, commercially insured CML patient population, patients with higher copayments were more likely to discontinue or be nonadherent to imatinib-based therapy [43]. Approximately 17 % of patients with higher copayments and 10 % with lower copayments discontinued TKIs during the first 180 days following initiation. Similarly, patients with higher copayments were 42 % more likely to be nonadherent to the recommended daily dosing.

In the EU, country-specific health authority policies will likely act to substantially influence the use of generic imatinib for the treatment of CML and other indications [44]. How much savings a health system will accrue depends on country-specific rules about the pricing of generic imatinib relative to the branded form and its formulary placement. Generally, larger health care payer markets will likely have the greatest leverage to reduce the price of generic imatinib if price and formulary placement bargaining with manufacturers is accomplished centrally [45]. However, there is also large variation in pharmacists’ remuneration for generic substitution across EU member countries [46]. Pharmacist remuneration consists of the combination of a fixed fee per item and a certain percentage of the acquisition cost or the delivery price of the medicines. This percentage component can act as a disincentive for dispensing generic medicines. On the demand side, in EU member countries, generally patients do not face any copayments or copayment differences between branded and generic drugs, suggesting consumers’ price response will not determine the use of generic imatinib when available.

The role of health technology assessment in the use of generic imatinib for CML

Given the importance of imatinib for the treatment of CML and other conditions, we expect multiple investigators are now or will be developing health technology assessments (HTA), such as cost-effectiveness models, that might predict potential cost savings and quality implications when generic imatinib becomes available in the USA and EU [39]. Across many health systems throughout the EU and North America, HTA is an important analytic tool used to make a business case for selecting alternative treatment approaches [47]. By calculating cost per measure of efficacy or effectiveness (i.e., cost-effectiveness analysis), it is possible to consider the economic outlook for TKIs relative to the same standard by which other therapeutics and health technologies are assessed after the generic entry of imatinib.

There is some precedent for the use of HTA to predict the benefits of generic imatinib entry into a given market. For example, Shih et al. examine a US-based national commercially insured population to compare the cost-effectiveness of the selective serotonin reuptake inhibitor anti-depressants (SSRIs) sertraline, citalopram, escitalopram, and fluoxetine with paroxetine to treat elderly patients with a diagnosis of major depression, before and after the entry of generic paroxetine [48]. Specifically, they followed users of these drugs for 6 months, starting from the date of their first prescription. For each patient, they measured costs as total medical costs and quantified effectiveness as the avoidance of treatment failure. They then calculated individual net benefit and employed both net benefit and Bayesian net benefit regression models to examine the impact of generic paroxetine on the cost-effectiveness of the other four SSRIs compared with paroxetine, while controlling for patients’ sociodemographic characteristics, comorbidities, and patterns of medication switching. Results of their deterministic analysis suggested that paroxetine was dominated by most other SSRI anti-depressants prior to the availability of generic paroxetine and that after the entry of generic paroxetine, citalopram and escitalopram were dominated by paroxetine. Net benefit regression analysis found that sertraline and escitalopram were more cost-effective than paroxetine in the pre-generic-entry period but not in the post-entry period, although the difference in net benefit between these two anti-depressants and paroxetine was not statistically significant in either period. The Bayesian net benefit regression analysis reached similar conclusions.

The importance of examining the total costs of care in such forecasting models, including but not limited to prescription drug costs, is illustrated by Paradis et al. 2009. They forecasted the economic impact of the generic anti-epileptic drug topiramate (Topamax) in France, Germany, Italy, and the UK using 2008 IMS Health data. Patients with epilepsy and more than two topiramate filled prescriptions were selected. An open-cohort design was used to classify observations into mutually exclusive periods of branded versus generic use of topiramate. Healthcare utilization, costs per person-year, and overall annual spending was estimated for each country. Interestingly, after covariate adjustment, generic-use periods were associated with increased drug dispensing, hospitalizations, and lengths of hospital stays in all European countries (adjusted cost differences per person-year 706–815 Euro, p < 0.001 for all comparisons). They concluded that system-wide costs would actually increase from 3.5 to 24.4 % 1 year after generic entry.

For imatinib, we believe important considerations in pursuing such forecasting models include a country-specific understanding of brand-generic pricing considerations, formulary restrictions, accurate assessment of utilities and all resource utilization across treatment modalities, disease-specific factors such as risk status, and physician preferences based on maturing outcomes data. We have outlined many of these considerations above. It is important to note that a priori, we do not expect utilization of medical resources, such as hospitalization, to be significantly altered when generic imatinib become available since additional medical resource use and associated costs are generally minimal after accounting for the use of TKI therapy itself. Yet, we do believe country-specific data is required to estimate treatment prevalence, treatment intensity using all available medical inputs, associated per unit spending (quantities × prices), and pricing alone, based on contemporaneous understanding of supply-side prescribing and demand-side adherence incentives. Given the inherent uncertainties of many of these inputs, multiple sensitivity analysis will likely be required.

In addition, the Paradis et al. analysis suggests that defining the perspective of any country-specific imatinib cost-effectiveness analysis conducted is critical to determining results. Multiple system-level perspectives exist such as societal and payer [49]. Depending on the function of the health system, societal or payer perspectives can have broad, national implications in the case of a national health system or national health insurance payer or more limited scope in the case of state-limited commercial or governmental payers. Operational-level perspectives also exist including providers and patients. These perspectives impact decision-making for cohorts where there is an assumed CML cohort seeking treatment in health systems with a substantial supply of hematologists and oncologists. At the operational-level, stakeholders are concerned with the impact of chronic disease on local resources and quality of life, such as the measured productivity loss of an individual during a period when chemotherapy diminishes the number of patient work-days [50].

Health system perspectives also impact the types of effectiveness measures used for assessment. Many types of measures exist for different chronic diseases, including health utility (e.g., quality-adjusted life years, QALYs), mortality, remission, or disease-free time. Health utility is a measure of patient preference, risk, and uncertainty relative to living in an existing health state such as CML compared to a more desirable quality of life. QALYs are the gold standard unit of health utility in cost-effectiveness analysis for providing a single, quantifiable index of utility across transitioning joint health-states such as CML. The US Medical Expenditure Panel Survey (MEPS) utilized the EuroQOL 5-domain (EQ5D) instrument to index QALYs for US preference weights [51]. Other instruments from which QALYs are derived for chronic disease include the SF6D and HUI3 [52, 53]. The SF6D provides QALYs from the UK, and the HUI3 has been applied in Canada. Utilities not only offer useful societal-level measures of effectiveness but also can be used for other stakeholder perspectives such as patients and payers. Provider models may consider alternative effectiveness measures that impact clinical practice, such as mortality or periods of remission that reduce patient utilization.

Finally, perspective choice also requires decisions regarding the time frame of the analysis. While the patient “lifetime” perspective is appealing from a social perspective, such an analysis requires modeling assumptions regarding the generic entry dates and associated pricing changes of the competing, currently available TKIs. It also requires some assumptions about treatment innovation in the future. For example, in the case of CML, one large unknown is the fraction of newly diagnosed patients who might eventually be able to discontinue TKI therapy because their disease has been cured or at least suppressed to an undetectable level for a long period of time. Clearly, this treatment “alternative” holds the greatest potential for eventual cost savings from the patient lifetime perspective, even if a more expensive TKI were required for several years to achieve this stopping point. These concerns suggest the importance of time-based sensitivity analyses in the construction of generic entry budgetary forecasts.

In summary, the development of oral well-tolerated BCR/ABL tyrosine kinase inhibitors has revolutionized the treatment of CML and allowed thousands of patients over the past 15 years to live healthy and productive lives. This dramatic clinical benefit has come at a high cost to individual patients and health care systems around the world. The arrival of generic imatinib at a reduced price has the potential to markedly impact the cost of care for CML. It may also increase the access of patients to this remarkable drug that has previously been unaffordable to some. The potential cost savings and clinical benefits of generic imatinib availability in the USA and EU member countries will be predicated upon market forces, third-party payers, physicians, and regulatory authority behavior. We look forward to observing the responses of these stakeholders to imatinib’s loss of patent exclusivity over the next several years.

References

Saglio G, Kim DW, Issaragrisil S, le Coutre P, for the ENESTnd Investigators et al (2010) Nilotinib versus imatinib for newly diagnosed chronic myeloid leukemia. N Engl J Med 362:2251–2259

Larson RA, Kim DW, Jootar SS, Pasquini R et al (2014) ENESTnd 5-year (y) update: long-term outcomes of patients with chronic myeloid leukemia in chronic phase (CML-CP) treated with frontline nilotinib vs imatinib. J Clin Oncol 32:5s, suppl; abstr 7073

Jabbour E, Kantarjian HM, Saglio G, Steegmann JL et al (2014) Early response with dasatinib or imatinib in chronic myeloid leukemia: 3-year follow-up from a randomized phase 3 trial (DASISION). Blood 123(4):494–500

Kantarjian HM, Shah NP, Hochhaus A et al (2010) Dasatinib versus imatinib in newly diagnosed chronic-phase chronic myeloid leukemia. N Engl J Med 362(24):2260–2270

Radich JP, Kopecky KJ, Appelbaum FR, Kamel-Reid S et al (2012) A randomized trial of dasatinib 100 mg versus imatinib 400 mg in newly diagnosed chronic-phase chronic myeloid leukemia. Blood 120(19):3898–3905

Cortes JE, Kim DW, Kantarjian HM, Brummendorf TH et al (2012) Bosutinib versus imatinib in newly diagnosed chronic-phase chronic myeloid leukemia: results from the BELA trial. J Clin Oncol 30:3486–3492

Hehlmann R, Lauseker M, Jung-Munkwitz S, Leitner A et al (2011) Tolerability-adapted imatinib 800 mg/d versus 400 mg/d versus 400 mg/d plus interferon-alfa in newly diagnosed chronic myeloid leukemia. J Clin Oncol 29:1634–1642

Deininger MW, Kopecky KJ, Radich JP, Kamel-Reid S et al (2014) Imatinib 800 mg daily induces deeper molecular responses than imatinib 400 mg daily: results of SWOG S0325, an intergroup randomized phase II trial in newly diagnosed chronic phase chronic myeloid leukaemia. Br J Haematol 164:223–232

Authors’ calculations from Novartis worldwide sales data 2014. Available at: http://www.novartis.com/investors/financial-results/product-sales.shtml. Last accessed: July 2014

Baccarani M, Deininger MW, Rosti G, Hochhaus A, Soverini S, Apperley JF, Cervantes F, Clark RE, Cortes JE, Guilhot F, Hjorth-Hansen H, Hughes TP, Kantarjian HM, Kim DW, Larson RA, Lipton JH, Mahon FX, Martinelli G, Mayer J, Müller MC, Niederwieser D, Pane F, Radich JP, Rousselot P, Saglio G, Saußele S, Schiffer C, Silver R, Simonsson B, Steegmann JL, Goldman JM, Hehlmann R (2013) European LeukemiaNet recommendations for the management of chronic myeloid leukemia: 2013. Blood 122(6):872–884

Conti RM (2013) Why are cancer drugs commonly the target of numerous schemes to extend patent exclusivity? Health Affairs webblog. December 4. Available at: http://healthaffairs.org/blog/2013/12/04/why-are-cancer-drugs-commonly-the-target-of-schemes-to-extend-patent-exclusivity/. Last accessed: July 2014

Scherer FM (1993) Pricing, profits, and technological progress in the pharmaceutical industry. J Econ Perspect 7(3):97–115

European Medicines Agency. Generic medicines. Available at: http://www.ema.europa.eu/docs/en_GB/document_library/Medicine_QA/2009/11/WC500012382.pdf. Last accessed: July 2014

Conti RM, Berndt ER (2014) Specialty Drug Prices and Utilization After Loss of U.S. Patent Exclusivity, 2001–2007. NBER Working paper 20016. Available at: http://www.nber.org/papers/w20016

http://www.ema.europa.eu/docs/en_GB/document_library/Medicine_QA/2009/11/WC500012382.pdf. Last accessed: July 2014

Berndt ER, Newhouse JP (2013) Pricing and reimbursement in U.S. pharmaceutical markets. In: Danzon PM, Nicholson S (eds) The Oxford handbook of the economics of the biopharmaceutical industry. Oxford University Press, New York, pp 201–265

IMS Institute for Healthcare Informatics (2014) Medicine use and shifting costs of healthcare: a review of the use of medicines in the United States in 2013. Available at: http://www.imshealth.com/cds/imshealth/Global/Content/Corporate/IMS%20Health%20Institute/Reports/Secure/IIHI_US_Use_of_Meds_for_2013.pdf. Last accessed: July 2014

Congressional Budgetary Office (1998) How Increased Competition from Generic Drugs Has Affected Prices and Returns in the Pharmaceutical Industry. July. Available at: http://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/6xx/doc655/pharm.pdf. Last accessed: July 2014

Simoens S (2008) Trends in generic prescribing and dispensing in Europe. Expert Rev Clin Pharmacol 1(4):497–503

Harris G (2013) Top Court in India Rejects Novartis Drug Patent. The New York Times. April 2. Available at: http://www.nytimes.com/2013/04/02/business/global/top-court-in-india-rejects-novartis-drug-patent.html?pagewanted=all&_r=0. Last accessed October 2014.

Kishore SP, Aisola M, Lopert R, Koney N. Proposal for the inclusion of imatinib mesylate for the treatment of chronic myelogenous leukemia in the WHO model list of essential medicines for adults. January. Available at: http://www.who.int/selection_medicines/committees/expert/19/applications/Imatinib2__8_2_A_Ad.pdf. Last accessed October 2014

Panattoni L (2011) The effect of paragraph IV decisions and generic entry before patent expiration on brand pharmaceutical firms. J Health Econ 30(1):126–145

Scott-Morton FM (1999) Entry decisions in the generic pharmaceutical industry. RAND J Econ 30(3):412–440

Grabowski H, Kyle M (2007) Generic competition and market exclusivity periods in pharmaceuticals. Manag Decis Econ 28:491–502

Hemphill CS, Sampat B (2013) Drug Patents at the Supreme Court. Science. Available at: http://www.sciencemag.org/content/339/6126/1386.short. Last accessed: July 2014

Puig-Junoy J (2010) Impact of European pharmaceutical price regulation on generic price competition: a review. PharmacoEconomics 28(8):649–663

Grabowski H, Vernon J (1992) Brand loyalty, entry and price competition in pharmaceuticals after the 1984 Drug Act. J Law Econ 35:331–350

Reiffen D, Ward MR (2005) Generic drug industry dynamics. Rev Econ Stat 87(1):37–49

Grabowski H, Vernon J (1996) Longer patents for increased generic competition in the U.S.: the Waxman-Hatch Act after one decade. PharmacoEconomics 10(Suppl2):110–123

Wiggins SN, Maness R (2004) Price competition in pharmaceuticals: the case of anti-infectives. Econ Inq 42(2):247–263

Frank RG, Salkever DS (1992) Pricing, patent loss and the market for pharmaceuticals. South Econ J 59:165–179

Frank RG, Salkever DS (1997) Generic entry and the pricing of pharmaceuticals. J Econ Manag Strateg 6(1):75–90

Ellison SF, Cockburn IM, Griliches Z, Hausman JA (1997) Characteristics of demand for pharmaceutical products: an examination of four cephalosporins. RAND J Econ 28(3):1–36

Griliches Z, Cockburn IM (1994) Generics and new goods in pharmaceutical price indexes. Am Econ Rev 84(5):1213–1232

Aitken ML, Berndt ER, Bosworth B, Cockburn IM, Frank RG, Kleinrock M, Shapiro BT (2013) The regulation of prescription drug competition and market responses: patterns in prices and sales following loss of exclusivity. National Bureau of Economic Research, Cambridge, MA, Working Paper No. 19487, October

Allan GM, Lexchin J, Wiebe N (2007) Physician awareness of drug cost: a systematic review. PLoS Med 4(9):1486–1496

Vivian J (2008) Generic substitution laws. US Pharm 33(6):30–34

Bennett S, Quick JD, Velásquez G (1997) Public-Private Roles in the Pharmaceutical Sector - Implications for Equitable Access and Rational Drug Use. World Health Organization, Health Economics and Drugs Series, No. 005. Available at: http://apps.who.int/medicinedocs/en/d/Jwhozip27e/10.3.html#Jwhozip27e.10.3. Last accessed: July 2014

Simoens S, De Coster S (2006) Sustaining generic medicines markets in Europe. K U Leuven, Leuven, Belgium. Available at: www.egagenerics.com. Last accessed: July 2014

Dunne S, Shannon B, Dunne C, Cullen W (2013) A review of the differences and similarities between generic drugs and their originator counterparts, including economic benefits associated with usage of generic medicines, using Ireland as a case study. BMC Pharmacol Toxicol 14:1

US Food and Drug Administration (2009) What are generic drugs? May 12. Available at http://www.fda.gov/Drugs/ResourcesforYou/Consumers/BuyingUsingMedicineSafely/UnderstaingingGenericdrugs/ucm144456.htm. Last accessed: July 2014

The National Institute for Health Care Management (2002) A primer: generic drugs, patents and the pharmaceutical marketplace. Washington, DC, pp 1–28

Dusetzina SB, Winn AN, Abel GA, Huskamp HA, Keating NL (2014) Cost sharing and adherence to tyrosine kinase inhibitors for patients with chronic myeloid leukemia. J Clin Oncol 32(4):306–311. doi:10.1200/JCO.2013.52.9123

Paradis PE, Latrémouille-Viau D, Moore Y, Mishagina N, Lafeuille MH, Lefebvre P, Gaudig M, Duh MS (2009) Projected economic impact of clinical findings of generic entry of topiramate on G4 European countries. Curr Med Res Opin 25(7):1793–1805

Padula WV, Breteler MJM (2013) Sharing perspectives on HTA from both sides of the pond. ISPOR Connect 19(1):15

Dylst P, Vulto A, Simoens S (2012) How can pharmacist remuneration systems in Europe contribute to generic medicine dispensing? Pharm Pract (Granada) 10(1):3–8, Review

Stephens JM, Handke B, Doshi JA (2012) International survey of methods used in health technology assessment (HTA): does practice meet the principles proposed for good research? Comp Eff Res 2:29–44

Shih YC, Bekele NB, Xu Y (2007) Use of Bayesian net benefit regression model to examine the impact of generic drug entry on the cost effectiveness of selectiveserotonin reuptake inhibitors in elderly depressed patients. PharmacoEconomics 25(10):843–862

Weinstein MC, Siegel JE, Gold MR, Kamlet MS, Russell LB (1996) Recommendations of the Panel on Cost-effectiveness in Health and Medicine. JAMA 276(15):1253–1258

Meltzer D, Johannesson M (1999) Inconsistencies in the “societal perspective” on costs of the Panel on Cost-Effectiveness in Health and Medicine. Med Decis Mak 19(4):371–377

Sullivan PW, Lawrence WF, Ghushchyan V (2005) A national catalog of preference-based scores for chronic conditions in the United States. Med Care 43(7):736–749

Brazier J, Roberts J, Deverill M (2002) The estimation of a preference-based measure of health from the SF-36. J Med Microbiol 51(3):269–272

Feeny D, Furlong W, Torrance GW, Goldsmith CH, Zhu Z, DePauw S, Denton M, Boyle M (2002) Multiattribute and single-attribute utility functions for the health utilities index mark 3 system. Med Care 40(2):113–128

Conflict of interest

The efforts of RMC were funded by a K07 CA138906 award from the National Cancer Institute to the University of Chicago. The efforts of WVP were funded by an Agency for Healthcare Research and Quality (AHRQ) T32 National Research Service Award. The funding sources had no role in the design and conduct of the study; collection, management, analysis, or interpretation of the data; and preparation, review, or approval of the manuscript for publication. RAL has been a consultant to and received honoraria from Ariad Pharmaceuticals, Bristol Myers Squibb, Novartis, and Pfizer. No financial support or proprietary information from the pharmaceutical industry was received for this work.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Conti, R.M., Padula, W.V. & Larson, R.A. Changing the cost of care for chronic myeloid leukemia: the availability of generic imatinib in the USA and the EU. Ann Hematol 94 (Suppl 2), 249–257 (2015). https://doi.org/10.1007/s00277-015-2319-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00277-015-2319-x