Abstract

The performance of different policy design strategies is a key issue in evaluating programmes for water quality improvement under the Water Framework Directive (60/2000). This issue is emphasised by information asymmetries between regulator and agents. Using an economic model under asymmetric information, the aim of this paper is to compare the cost-effectiveness of selected methods of designing payments to farmers in order to reduce nitrogen pollution in agriculture. A principal-agent model is used, based on profit functions generated through farm-level linear programming. This allows a comparison of flat rate payments and a menu of contracts developed through mechanism design. The model is tested in an area of Emilia Romagna (Italy) in two policy contexts: Agenda 2000 and the 2003 Common Agricultural Policy (CAP) reform. The results show that different policy design options lead to differences in policy costs as great as 200–400%, with clear advantages for the menu of contracts. However, different policy scenarios may strongly affect such differences. Hence, the paper calls for greater attention to the interplay between CAP scenarios and water quality measures.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction and Objectives

The Water Framework Directive (60/2000) (WFD) is currently the reference water management directive in Europe. One of its distinguishing features is the prominent role assigned to economics in order to achieve environmental and ecological objectives. It calls for the application of economic principles such as the polluter pays and the full cost recovery (FCR) principle. The WFD also emphasises the role of economic tools (such as cost-effectiveness analysis and volumetric pricing) in the policy design process and in achieving good water status objectives efficiently. The identification of practical applications for such concepts is still a work in progress (WATECO 2003).

In many areas, measures intended to reduce water pollution under the WFD target agricultural-related sources of pollution, such as nitrogen leaching. While pollution reduction, at the cost of limiting agricultural activity, is an issue that is widely dealt with in WFD-related literature, the way that different policy instruments allow such an objective to be achieved, in a more or less cost-effective manner, has so far received less attention. More specifically, to the best knowledge of the authors, the issue of designing measures in cases where the regulator holds incomplete or asymmetric information is almost absent in the WFD literature. On the contrary, there is a growing amount of literature on contract design to mitigate non-point pollution from farms (Bontems and others 2005; Bontems and Thomas 2006; Wu 2000; Wu and Babcock 1996; Xepapadeas 2004).

The problem arises when the regulator does not know, for example, the pollution abatement costs of agents (farmers), so that the “standard” optimal policy does not lead to the desired results. A further element of complexity lies in the fact that such costs, in agriculture, are closely linked to implemented policies, i.e., the Common Agricultural Policy (CAP) for European Union countries.

The objective of this paper is to compare the cost-effectiveness of different ways of designing measures for agricultural nitrogen pollution reduction under situations of asymmetric information. The analysis was conducted before and after the 2003 CAP reform in order to examine the interaction between the CAP and water policy.

The paper is structured as follows. Section 2 illustrates the connection between WFD implementation and reduction of agricultural pollution under asymmetric information. Section 3 describes the method and Section 4 presents the case study, whilst Section 5 illustrates the results of the study. The paper concludes with a discussion in Section 6.

Background: The WFD and Reduction of Agricultural Pollution Under Asymmetric Information

The WFD differs from previous EU water norms on many levels. A major feature is that, by defining the good water status to be achieved by 2015, it is primarily focused on objectives rather than measures. It sets out a number of steps to achieve this objective: by 2004 all river basins should have been characterised (Article 5) through an assessment of the economic significance of the water use and the current level of cost recovery. In subsequent years, the work will mostly concentrate on the selection of cost-effective programmes of measures to achieve the environmental objectives in the WFD (Article 11 and Annex III). Programmes of measures must be identified at the basin level and their definition should be completed by 2008.

The main elements of the economic analysis are included in Articles 4, 5, and 9 and Annex III. The most evident economic element of the WFD is the introduction of the FCR principle. However, the emphasis placed on the selection of programmes of measures based on the cost-effectiveness criteria is equally important (WATECO 2003).

The ex-ante evaluation of the cost-effectiveness of the measures requires an understanding of the compliance cost function of the agents involved. However, this is not sufficient. Different policy instruments may provide different results in terms of pollution reduction, policy cost, or both. In many cases, appropriate incentives cannot be implemented because of a lack of information or because of the difficulties in identifying the agents responsible for the environmental impact targeted by the policy. These problems usually apply to non-point pollution (Shortle and Abler 2001).

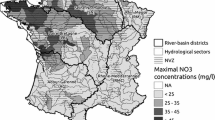

One major field of WFD application for which such concepts are relevant is the control of agricultural nitrogen pollution. Through its use of fertilisers and disposal of manure, agriculture contributes between 30 and 80% (depending on the country) of total nitrogen leaching to surface water (European Environmental Agency 2005).

One issue that appears to be little explored in the WFD literature is how the design of different measures and different information structures may affect the cost of pollution reduction in agriculture with regard to the selection of cost-effective programmes of measures. This cost, in particular the relative costs for different polluters, may clearly depend on the distribution of rights for the use of water as a receptor of pollutants and on the way policies are implemented to induce farmers to reduce pollution.

In most cases, it may be assumed that EU farmers retain the right to use a certain amount of fertilisers. This right is used to justify policies aimed at paying farmers compensation for fertiliser reduction below this amount, in spite of the conflict with the polluter pays principle. This position may require discussion in the long term. However, present policy instruments, in particular within the CAP, accept the retention of such rights by farmers. The main example is provided by agri-environmental schemes (AESs) included in the CAP rural development programmes under reg. EC 1257/99. The recent reg. EC 1698/2005 on rural development programmes actually strengthens this point by introducing compensatory payments for farms in areas affected by the implementation of the WFD (Article 38). This practice is also customary in those cases where water services companies establish private contracts to provide payments to farmers who reduce nitrogen use. Though there are no examples of such contracts in Italy, different cases are reported in the European literature (e.g. Mzoughi and others 2005). Given this, we will restrict our attention here to the measures for the reduction of agricultural nitrogen use based on payments to farmers.

The issue of different policy design options and the related transaction and incentive costs arises when such contracts are to be devised. This problem is magnified by asymmetric information conditions, such as the farmer having information about compliance costs that are not disclosed to the regulator. There has been considerable development in the economics literature of contract design under asymmetric information over the last twenty years (Laffont and Tirole 1993; Salanié 1998; Laffont and Martimort 2002). This issue also plays a major role in the literature on non-point pollution control (Xepapadeas 1997; Shortle and Abler 2001; Shortle and Horan 2001). Contracts for pollution reduction in agriculture seem to be a particularly pertinent field for the application of this approach. In fact, being based on public goods provision by numerous agents (farmers), diversified in terms of participation costs (transaction costs included) and the degree of compliance, and as these costs are farmer’s private information, the contracts proposed by public administrations are frequently designed on the basis of partial knowledge.

The problem could be examined in two different perspectives: the first is adverse selection and the second moral hazard. The adverse selection issue arises due to the variation in compliance costs among farmers so that the public decision maker is not able to differentiate between farmers belonging to different types. The moral hazard issue arises when the public decision maker is not able to control the degree of compliance with the contracts agreed and when there are incentives for the farmers to be completely or partially non-compliant. This paper focuses exclusively on the adverse selection issue.

The relevance of this issue is proven by empirical evidence. For example, the economic impact evaluation of integrated production schemes in Emilia Romagna (Italy) reveals that compliance costs are equal to, or less than, zero for peaches and wheat. This implies that it would generally be profitable for farmers to adopt the technology and participate in AESs even without any payment. For organic production, this is true only for wheat and not for peaches (Emilia Romagna Region 2003). These results may be caused, to some extent, by inadequate counterfactual evidence in the surveys. However, it may be reasonably assumed that they are mainly due to the small differentiation in payments compared to the variety of farmers’ costs of compliance. Clearly, if the results are accurate, the actual effectiveness of the incentives would be very low, because they would have a minor effect on cropping techniques. The very high compliance cost differentiation among farmers is confirmed by the monitoring results from Emilia Romagna. In fact, they provide evidence of compliance costs ranging from less than zero to more that 500 euros/ha (unpublished data from the Emilia Romagna Region 2003).

The agricultural economics literature has tackled the asymmetric information problem since the beginning of the 1990s (Fraser 1993; Richard and Trommeter 1994). A recent review of this issue in agri-environmental policies can be found in Latacz-Lohmann (2004). The adverse selection problem is treated by Moxey and others (1999), Bontems and others (2004), Turpin and others (2003), and Gren (2004) using a relatively standard approach derived from contract theory. Their models hypothesise the possibility of providing farmers with a menu of contracts, able to induce the farmer’s self-identification through contract choice. These models are based on the maximisation of a social welfare function provided by the amount of environmental improvement benefits: the benefit derived from the possibility of the farmer’s income increasing and the cost of the distortionary effect of taxation, necessary to provide public funds. Alternatively, the problem may be posed in terms of cost-effectiveness, thus eliminating the need to attribute monetary values to externalities and to quantify the distortionary effects of public funds (Havlik and others 2003). One alternative way of counteracting adverse selection is through contract auctions. This instrument was studied by Latacz-Lohmann and Van der Hamsvoort (1997, 1998) and by Bazzani and others (2000).

The experience garnered up to now highlights the importance of a more accurate policy design in view of the application of WFD and of the next generation of AESs. Furthermore, compliance costs are likely to be affected by the agricultural policy in place. The CAP was reformed in 2003 and its main points included decoupling of payments and the introduction of cross-compliance. Decoupling consists of the shift to a Single Farm Payment (SFP), separate from production, which replaces previous area-based payments attached to specific crops (e.g., cereals). Cross-compliance conditions affect payments depending on the farmers’ compliance with a minimum set of environmental requirements, mostly based on existing obligations derived from EU regulations. The impact of such changes on farming is still to be fully understood. To a large extent, cross-compliance remains to be implemented (in Italy) at the time of writing, though it promises to produce few changes to farming practices. On the contrary, decoupling could considerably affect the choice of crop mix and technology. Consequently, it could be expected that the 2003 CAP reform will also bring about changes to the costs of complying with environmental constraints, such as those potentially introduced in the application of the WFD. Restriction of nitrogen use is a particularly sensitive issue, as it is one of the most important factors determining agricultural pollution and farm productivity levels.

Method

The paper focuses on the design of optimal contracts under adverse selection. The type of instrument considered is a voluntary contract that the regulator proposes to the farmers. The contract consists of a payment in exchange for a restriction on the use of nitrogen. The restriction may be represented either as a quota on nitrogen use or as an obligation to reduce nitrogen with respect to the private optimum.

It is assumed that the area targeted by the scheme has heterogeneous characteristics in terms of farm compliance costs. The regulator knows of the existence of the different types of farmers, the compliance costs of each type, and the proportion of each type in the population. However, he or she cannot tell which type each individual farmer belongs to. This is where the information asymmetry arises. The potential result is an adverse selection effect in the participation in the proposed scheme.

In order to understand both the theoretical and practical issues, four policy options will be considered: (a) perfect information (the first best); (b) a menu of contracts, i.e., the best available solution given information asymmetries, according to the revelation principle (the second best); (c) a restriction based on a uniform (per hectare) quota on nitrogen use; and (d) a restriction based on a uniform reduction of nitrogen use with respect to the individual private optimum. In cases (c) and (d), the payment would also be uniform across farms. Case (c) is the option most commonly adopted in practice, including the case study area. The first best (a) represents the theoretical reference point, while option (b) is the best achievable option given asymmetric information.

In the following discussion, we assume that all options have the same degree of enforceability. In practice, they are usually enforced with an additional requirement that all farmers self-report their nitrogen use. The amount of nitrogen reported can be checked (through sample controls on the farm) by comparison with invoices for the purchase of fertilisers. This should also prevent nitrogen trade across farms, which is therefore excluded from the following discussion. Case (4) is close to the way public objectives are stated, but it is probably the most difficult to implement (i.e., with the highest transaction costs), as it would require the regulator to check both the amount of nitrogen used and the amount that would be used at the private optimum. However, in many cases the latter could be derived from past records if a system such as (4) were to be implemented.

It is worth noting that in cases (1) and (2), designing the contract with a restriction on nitrogen use or a minimum nitrogen reduction may be considered equivalent. Defining the constraint as a quota is simply more realistic. In contrast, with a flat rate constraint and payment (cases 3 and 4), the two constraints are not equivalent and the results may be expected to be different.

The paper aims to evaluate such contract options in the light of two main scenarios: Agenda 2000 and the 2003 CAP reform. Of the changes introduced by the 2003 reform, only decoupling has been considered here.

In order to take into account the changes from one policy setting to the other, compliance cost functions have been simulated using farm-level linear programming (LP) models.

The full method can be described in three steps: (1) simulation of farm reaction to nitrogen constraints, through LP, in the two policy scenarios; (2) adaptation of the results to a continuous compliance cost function through interpolation; and (3) identification of optimal contracts through a principal-agent model.

In the first step, a linear programming model is used to simulate farm adjustment to possible environmental constraints and to generate the farm’s compliance cost function. Linear programming is a well-known maximisation tool and has been used in this paper in the standard mathematical formulation:

-

$$ {\rm max}\,\,{GM}\,=\,{\sum\limits_{k = 1}^n}\,{gm}_k x_{k}\,\,{\rm for}\,\,k\,=\,1,... ,n $$

s.t.:

$$ {\sum\limits_{k = 1}^n}\,a_{hk}x_{k}\le b_{h}\,\,{\rm for}\,\,h\,=\,1,...,m $$$$ x \ge 0 $$where:

-

GM = total gross margin;

-

gm k = gross margin per unit of production process k;

-

b h = total availability of factor h;

-

a hk = quantity of factor h necessary to activate one unit of production process k;

-

x k = level of activation of production process k.

The constraints considered include land availability, land quality, labour availability, crop rotation, and commercial constraints. Linear programming models are a suitable tool to simulate how farms adapt to external factors through changes in the combination of production processes (crops and technologies). Different models have been constructed for the different relevant farm types. The farm types mainly differ in the availability of family labour and access to specific product markets.

The restriction on nitrogen use has been designed as an average per hectare restriction, which applies to the whole farm, and not a restriction per crop. Hence, it works as a constraint on average nitrogen use per hectare of farm area. Consequently, the farm may react by adjusting the crop mix. The adaptation to a hypothetical nitrogen quota has been estimated by parametrising on a constraint on nitrogen input.

In the second step, in order to comply with the properties of the cost function required by the principal-agent model, the resulting points on the compliance cost curve generated by the LP model have been interpolated using Ordinary Least Squares. This solution may be considered satisfactory as long as the linear programming model is interpreted as a simplification of the real world, where the rigidities and the discontinuities brought about by the linearity of the model do not correspond fully to reality. On the other hand, the interpolation is itself a simplification that can produce satisfactory approximated results and be consistent with the mathematical characteristics of the following model.

In the third step, a principal-agent model under adverse selection has been applied, where the public regulator does not explicitly know the monetary value of the externalities produced by the sector. Consequently, his or her aim is to minimise the use of nitrogen given the budget available. As mentioned before, the constraint may be expressed either as a maximum amount of nitrogen allowed per hectare (i.e., a quota) (q) or as a minimum reduction of nitrogen use (r) with respect to the private optimum. The two terms are related, as \( r_{j} + q_{j} = q^{*}_{j} \), where \( q_{j}^{*} \) is the private optimum use of nitrogen by farm j. When q is the chosen policy parameter, the derived r represents the reduction in nitrogen use. Conversely, when r is the policy parameter, the derived q represents the amount of nitrogen used.

As most of the literature in this field, we shall consider only two types of farmers. The main results may be extended to a greater number of types. We denote farm type by j. j = (1, 2), where 1 is the more efficient in production and the less efficient in environmental protection, while farm 2 is the opposite. The regulator’s problem takes the following form: max

s.t.

-

z = objective function expressed as the sum of the quota (use of nitrogen) across farm types;

-

λ j = percentage of farmland belonging to each farm type;

-

P j = amount paid to each farm type;

-

B = public budget available.

The idea of the model is that the regulator tries to minimise the amount of nitrogen used by farmers (objective function) given the budget available. The implementation of the regulator’s programme relies on the farmer’s decision to participate and the programme is differentiated according to the information conditions and to the form of payments.

In the case of perfect information (the first best), it is assumed that the regulator knows the costs of compliance for each single farmer and that, consequently, this is sufficient to guarantee that the payment is higher than the compliance costs (individual rationality constraint). Assuming a reservation utility equal to zero:

where c j (r j ) represents the compliance cost as a function of r, defined as:

where:

\( \pi_{j} (q_{j}) \) = farm profit as a consequence of the quota/reduction assigned corresponding to an amount of nitrogen used equal to q;

\( \pi_{j} (q^{*}_{j}) \) = unconstrained profit.

We also assume that \( \pi_{1}(q) > \pi_{2}(q) \) for all q, \( \pi_{j}^\prime(q_{j})\ge 0 \) and \( \pi_{j}^{\prime\prime}(q_{j}) < 0 \). As the values of q are concerned, we additionally assume in the first instance that \( q^{*}_{1} > q^{*}_{2} \).

The first best problem for the regulator is solved by maximising (1) constrained to (2) and (3). At the optimum level, (3) will hold equally for both farms, hence the optimal payment will be determined by:

By substituting (5) in (2) and taking the Lagrangian of the resulting optimisation problem, we obtain, after some elaboration:

where μ is the Lagrangian multiplier for (2). (6) states that the optimal solution is found when the marginal profit forgone is the same for the two farm types. As \( \pi^{\prime}_{1}(q_{1})\ge 0 \), μ ≥ 0 and (2) will hold with equality. The payments calculated in (5) are related each other through the budget constraint:

Equation (7) shows that the payment to farm 1 depends on the budget available (divided by the share of land expected to belong to farm type 1) minus the payment allocated to farm type 2 (corrected by the ratio between the proportion expected for the two farm types).

In the case of asymmetric information, (3) still applies, but the payment cannot be calculated directly on the cost of each farm, as it is not known by the regulator. However, we can assume that the regulator knows the value of compliance costs for each type of farmer and has some prior expectation about the frequency of each type. In this case, the best theoretical solution (revelation principle) is a menu of contracts achieved using the mechanism design (Laffont and Martimort 2002). The menu of contracts is given, in this case, by a combination of p and r for each farm type so that:

or, equally:

which represents the incentive compatibility constraints. Assuming that the Spence-Mirrleess property holds (Laffont and Martimort 2002, p.35), at the optimum level only one of the two inequalities (8’), notably the one for the more efficient farm in producing the environmental good (farm 2), will apply with equality, while only one of the inequalities (3) will hold with equality, notably the one referring to the less efficient farm in producing the environmental good (farm 1). This yields:

Substituting (9a and 9b) in (2) and taking the Lagrangian of the problem defined by maximising (1) subject to (2), (3) and (8’), the optimal first order conditions yield, after some rearrangement:

This implies an increase in the wedge between q 1 and q 2 , which translates into a concomitant increase of the quota for farm 1 (less restrictive contract) and in a reduction of the quota for farm 2 (more restrictive contract). This difference also results in a reduction in efficiency with respect to the first best. The payments will follow the same course, with a further increase for farm 1 and a decrease for farm 2. Option c, listed at the beginning of this section, is represented by an input reduction to be obtained with an undifferentiated payment associated to an undifferentiated quota across farm types. In this case, the problem is solved again by maximising (1) constrained to (2) and (3), but by using a p and a q that are not indexed on farm types. Given the previous assumptions about the shape of the profit functions, it is straightforward to demonstrate that only constraint (3) referred to farm type 1 will apply. As a consequence, constraint (2) collapses to:

Taking the Lagrangian of the problem determined by the maximisation of (1) subject to (2’), the first order conditions yield:

This means that q will be paid on the basis of the higher marginal costs among the different farms, which implies a further reduction in efficiency with respect to the first best and the second best. Looking at the problem the other way round, as q = q 1 = q 2 , the results will translate into a higher total amount of allowed nitrogen use. The same may be said even if the condition \( q^{*}_{1} > q^{*}_{2} \) is removed, as the permitted design flexibility is reduced anyway.

When the reduction has to be equal across farms (instrument d), the problem may be set out as in case (a), but the payment is unique and the following additional constraint is introduced:

Assuming well-behaved functions, only inequality (3) concerning farm type 1 will hold with equality, and (2) becomes:

Taking the Lagrangian of problem (1) constrained to (2’’), the first order conditions will yield:

This is equivalent to the flat rate option on q, but in this case q is different across farms, as r is the same. If \( q^{*}_{1} > q^{*}_{2} \), then q1 > q2; if q 1 is the same as in the case of the flat rate on q, the result will be a stronger reduction by r on farm 2 compared to the case of the flat rate on q.

On the other hand, if \( q^{*}_{2} > q^{*}_{1} \) while the other conditions remain the same, then q1 > q2 and the resulting policy will be less efficient than with the flat rate on q.

The Case Study

The model has been applied to an illustrative case study using data from the “Comune” (Municipality) of Argenta (Ferrara, Emilia Romagna). Two farm types, which differed in their technical and economic setup, were examined: farm 1 produced mainly cereal crops, while farm 2 produced mainly vegetables. The two farm types were identified on the basis of the presence of vegetables in the crop mix according to the 2000 census data. The proportions of the two farm types are, respectively, λ1 = 0.23 and λ1 = 0.77. In order to extend the results to other areas, a sensitivity analysis has been carried out in the \( 0.1 \le \lambda_{1} \le 0.9 \) range.

In the study area, the average payment for agri-environmental schemes under the programming period 1999–2006 was in the order of few euros/ha per year. A higher budget concentration is expected in the future as the area has been designated a priority area in terms of the nitrogen directive. For principal agent simulation, the reference value for payments was taken as 50 euros/ha, but a sensitivity analysis was carried out in the 25 to 200 euros/ha range.

For each farm type, a linear programming model was built and calibrated on structural data derived from the 2000 agricultural census and on technical data derived from interviews with local experts (specialists from farmers’ associations). The main crops in the area are wheat, maize, and sugar beet. Onions and industrial tomatoes represent the high-value crops. Fallow land is assumed to have a minimum cost linked to obligatory conservation practices. The only relevant constraints are crop rotations and labour availability for farm type 1. It is assumed that for personal attitudes or market constraints, farm type 2 cannot access the vegetable market.

Once calibrated, the results of the model have been parametrised to a nitrogen use constraint. The nitrogen constraint interacts with other constraints as long as nitrogen becomes the limiting factor and crop mixes tend to concentrate on crop combinations yielding the higher marginal value of nitrogen.

Tables 1 and 2 show the changes to the crop mix as a result of a different nitrogen quota and under the two policy hypotheses of Agenda 2000 and 2003 Reform.

An increase in the nitrogen quota decreases the amount of fallow land replaced by crops. In the case of farm type 1, the nitrogen is used in the first instance by a wheat–soya bean combination (thanks to the low nitrogen requirements of soya bean). This rotation is then partly substituted by an onion–tomato combination. Increasing nitrogen quota, under the 2003 reform scenario, vegetable cultivation replaces fallow land more slowly. The maximum use of nitrogen is the same in the two policy hypotheses and is produced by the same crop mix.

The abandonment of fallow land when the nitrogen quota is increased is faster in farm type 2, with a rotation based on wheat–soya beans in the first instance and wheat, sugar beet, and maize later. The main effect of the 2003 reform is the abandonment of maize, due to the replacement of the specific payment on maize for small farmers with the single farm payments. As for farm type 1, for increasing amounts of nitrogen quota under reform 2003 scenario, fallow land is abandoned more slowly.

The gross margin (which substitutes profit in this simulation according to the standard linear programming formulation) functions and the amount of nitrogen used at the optimum level are reported in Table 3.

The chosen form of profit function is a second-degree function, as it allows a better fit for the upper part of the curve. In all cases, the OLS yields a very good approximation of the points generated through the parameterisation of the farm model. Furthermore, while farm 1 does not change its optimal level of nitrogen use, farm 2 reduces it considerably. Notably, it shifts from a higher use than farm type 1 to a lower level than farm type 1. In other words, the reform in fact causes a shift from a \( q^{*}_{2} > q^{*}_{1} \) to a \( q^{*}_{1} > q^{*}_{2} \) situation.

Results

The optimal contract structure for the Agenda 2000 scenario shows clear differences between different contract design solutions (Table 4).

In particular, the contract menu shows the ability, with the same budget, to propose a nitrogen use quota that is very close to the first best and some 10% less than a uniform area quota. The flat rate payment on r performs even less well, with an additional 10% increase of the quota allowed. The unitary cost of nitrogen reduction (due to payments only) shifts from 0.99 euros/kg in the perfect information case to 2.14 euros/kg with the uniform payment on r.

The introduction of the 2003 CAP reform results in the lowering of the average quota achievable for the first best, for the menu of contracts, and for the flat rate on r (Table 5).

In contrast, the flat rate option on q is subject to an increase of the quota that can be imposed with the same budget, representing a deterioration of the results compared to the Agenda 2000 scenario. The main effect, however, is on the size of the nitrogen reduction achievable with respect to the private optimum which, in the 2003 reform scenario, is reduced by about 40% in the first best and second best, by a negligible amount in the flat rate on r, and by about 75% in the case of a flat rate on q. These differences are reflected in the cost of nitrogen reduction, which, in the 2003 reform hypothesis, increases sharply, reaching values from 1.52 euros/ha in the case of the first best to 6.93 in the case of a flat rate on q.

These results depend on the fact that the 2003 reform of the Common Agricultural Policy generally tends to induce a reduction of input use due to the adjustments in the crop mix discussed above; it, therefore, has an effect in terms of a greater ability to meet restrictions in input use. However, it also increases the difference between opportunity costs in different farms with respect to agri-environmental constraints represented by the same nitrogen input quota. Therefore, only a higher payment differentiation is able to exploit the potential benefits of the new situation in terms of policy efficiency, while uniform contract solutions achieve only lower performances. On the other hand, the reform also leads to a reduction of the optimal amount of nitrogen, possibly making the policy less relevant in social terms.

In order to extend the results to different areas, we carried out a sensitivity analysis on the available budget and on the share of farm types (Tables 6 and 7).

As expected, the reduction of nitrogen rises sharply with the budget. However, the ability to exploit the available budget is strictly linked to both the proportion of different farm types and the type of instrument. In particular, for lower frequency levels of farm type 2 (less efficient in producing the environmental protection effect) all instruments perform almost equally and show an equivalent ability to adapt their performance to an increasing budget. On the other hand, for lower frequency levels of farm type 1, only differentiated payments achieve satisfactory results. In this case, the flat rate option on q performs, once again, slightly better than the flat rate on r. When the proportion of type 1 farms increases, the results of the flat rate on q tend to deteriorate in the Agenda 2000 scenario but improve in the 2003 reform hypothesis. This is due to the fact that in the former case, the private optimum is higher in farm type 2 whilst it is lower in the latter case.

Discussion

This paper shows how different ways of designing measures to reduce nitrogen use in agriculture may affect the policy’s cost-effectiveness. This result may be relevant in the evaluation of programmes of measures in applications of the WFD. Different ways of accounting for information asymmetries or, better, different policy design options may lead to differences in costs for the reduction of pollution from agriculture of up to three- or fourfold. This may strongly affect the overall evaluation of the cost-effectiveness of different measures and the assessment of disproportionate costs. Differentiated instruments perform generally better. Uniform instruments may be designed in different ways and the two solutions devised in this paper, uniform quota and uniform reduction, reveal conflicting results in the two policy hypotheses (Agenda 2000 and the 2003 reform). It should also be noted that the different solutions proposed may entail different control costs requiring practical comparison following a careful consideration of the implementation possibility.

The paper also calls for greater attention to the interplay between CAP scenarios, the pressures exercised by agriculture on water quality and water policy measures. This consideration increases in relevance in view of the application of cross-compliance, which has not been discussed in the current paper.

The possibility of improving contracts and incentive strategy is a function both of the differentiation of the costs for the production of environmental services among farms and of the effective degree of asymmetric information among participants. In practice, the greater complexity of the menu of contracts may be justified in areas with more varied agricultural systems, more heterogeneous farms and soil characteristics, and in cases where cheaper criteria for differentiation between farms are not available (e.g., targeting protected areas). On the other hand, fixed payments could remain the best solution in relatively homogeneous areas, where the costs and difficulties of differentiation are not counterbalanced by substantial savings on payments.

The model approach adopted in this paper could be developed in different ways. A first issue concerns those transaction costs that are additional to incentive and information costs. Transaction costs could affect the farmer and enter as fixed or proportional costs in the profit function. They may also affect the public side, representing an additional burden on the available budget. The effects expected from transaction costs could be a reduction of the overall effectiveness and a change of the shape of optimal contracts. Finally, the externality value and the opportunity costs of public funds should be included in order to shift from the cost/effectiveness approach towards a more complete analysis of social costs and benefits.

References

Bazzani GM, Ragazzoni A, Viaggi D (2000) Application of agri-environmental programs in Emilia Romagna Region. In Canavari P, Caggiati M, Easter KW (eds) Economic studies on food, agriculture and the environment. Kluwer Academic/Plenum Publishers, New York pp 339–353

Bontems P, Thomas A (2006) Regulating nitrogen pollution with risk adverse farmers under hidden information and moral hazard. American Journal of Agricultural Economics 88(1):57–72

Bontems P, Rotillon G, Turpin N (2004) Improvement of water quality as joint production of milk when dairy farms are heterogeneous, In 90th EAAE seminar Multifunctional Agriculture, Policies and Markets: Understanding the Critical Linkages, 28–29 October 2004, Rennes, pp 219–227

Bontems P, Rotillon G, Turpin N (2005) Self-selecting agri-environmental policies with an application to the Don watershed. Environmental and Resource Economics 31:275–301

Emilia Romagna Region (2003). Relazione sullo stato di attuazione del piano regionale di sviluppo rurale 2000–2006 in Emilia Romagna. Annualità 2002. Bologna

European Environmental Agency (2005) IRENA Indicator fact sheets, http://www.eea.eionet.eu.int/Public/irc/eionet-circle/irena/

Fraser I (1993) Agri-environmental policy and discretionary incentive mechanism: the countryside stewardship scheme as a case study. Manchester Metropolitan University. Department of Economics and Economic History, Manchester

Gren IM (2004) Uniform or discriminating payments for environmental production on arable land under asymmetric information. European Review of Agricultural Economics 31:61–76

Havlik P, Jacquette F, Boisson JM (2003) Agri-environmental agreements for enhancing biodiversity production by farmers in Bile Karpaty, Czech Republic: An empirical analysis of agency theory application. 81st EAAE Seminar. Copenhagen

Laffont JJ, Martimort D (2002) The theory of incentives. The principal-agent model. Princeton University Press, Princeton

Laffont JJ, Tirole J (1993) The theory of incentives in procurement and regulation. MIT Press, Cambridge, MA

Latacz-Lohmann, U. 2004. Dealing with limited information in design and evaluating agri-environmental policy. In 90th EAAE Seminar Multifunctional Agriculture, Policies and Markets: Understanding the Critical Linkages, October 2004, Rennes, pp 33–50

Latacz-Lohmann U, Van der Hamsvoort C (1997) Auctioning conservation contracts: a theoretical analysis and an application. American Journal of Agricultural Economics 79:407–418

Latacz-Lohmann U, Van der Hamsvoort C (1998) Auctions as a means of creating a market for public goods from agriculture. Journal of Agricultural Economics 49:334–345

Moxey A, White B, Ozanne A (1999) Efficient contract design for agri-environmental policy. Journal of Agricultural Economics 50:187–202

Mzoughi N, Déprés C, Grolleau G (2005) Contracting for environmental property rights: the case of Vittel, XIth Congress of the European Association of Agricultural Economists, Copenhagen, 24–27 August 2005

Richard A, Trommeter M (1994) The rationalization of contracts between public sector and farmer: The case of agri-environmental measures. In Aubert D (ed) Reforming the common agricultural policy: The contribution of economic research. INRA-Editions, Paris, pp 307–323

Salanié B (1998) The economics of contracts. A primer. MIT Press, Cambridge: MA

Shortle JS, Abler D (eds) (2001) Environmental Policies for Agriculture Pollution Control. CABI Publishing, Wallingford

Shortle JS, Horan RD (2001) The economics of nonpoint pollution control, Journal of Economic Surveys 15(3):255–289

Turpin N, Rotillon G, Bontems P, Bioteau T, Laplana R (2003) Mitigating non point source pollution from dairy farms: economic evaluation on the Don watershed. In 12th Nitrogen Workshop, Controlling Nitrogen Flows and Losses, Exeter, 24–26 September 2003, pp 54–62

WATECO (2003) Common implementation strategy for the Water Framework Directive (2000/60/EC). European Commission. Brussels

Wu J (2000) Input substitution and pollution control under uncertainty and firm heterogeneity, Journal of Public Economic Theory 2(2):273–288

Wu J, Babcock BA (1996) Contract design for the purchase of environmental goods from agriculture, American Journal of Agricultural Economics 78(4):935–945

Xepapadeas AP (1997) Advanced principles in environmental policy. Edward Elgar, Cheltenham

Xepapadeas AP (2004) Environmental policy under imperfect information: incentives and moral hazard. The Economics of Agri-Environmental Policy 1:267–280

Acknowledgments

The work is based on the outcome of the research “Strumenti di valorizzazione economica della multifunzionalità dell’agricoltura,” funded by the Emilia Romagna Region, L.R. 28. The authors wish to thank the anonymous referees for their useful comments. The responsibility for the paper, of course, remains that of the authors.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bartolini, F., Gallerani, V., Raggi, M. et al. Implementing the Water Framework Directive: Contract Design and the Cost of Measures to Reduce Nitrogen Pollution from Agriculture. Environmental Management 40, 567–577 (2007). https://doi.org/10.1007/s00267-005-0136-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00267-005-0136-z