Abstract

This paper examines the continuous-time mean-variance optimal portfolio selection problem with random market parameters and random time horizon. Treating this problem as a linearly constrained stochastic linear-quadratic optimal control problem, I explicitly derive the efficient portfolios and efficient frontier in closed forms based on the solutions of two backward stochastic differential equations. Some related issues such as a minimum variance portfolio and a mutual fund theorem are also addressed. All the results are markedly different from those in the problem with deterministic exit time. A key part of my analysis involves proving the global solvability of a stochastic Riccati equation, which is interesting in its own right.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In 2008, Blanchet-Scalliet, El Karoui, Jeanblanc and Martellini [3] observed a discrepancy between finance theory and practice. Most of classical financial economics is based on the hypothesis that, the investors know with certainty the time of eventual exit when they make investment decisions. But in practice, most investors would acknowledge the fact that, when they enter the market, they are uncertain about the time of exit. It is of both theoretical and practical interests to develop a comprehensive theory of financial economics under random time horizon.

In many existing literature on this subject, the random time horizon was assumed to be independent of risky security prices, such as Yarri [30], Hakansson [10, 11], Merton [24] and Richard [27]. On the contrary, in the papers of Karatzas and Wang [14] and Kharroubi et al. [15], the randomness of time horizon was assumed to be fully dependent on the asset prices in the market and did not induce new uncertainty in the economy. This is a stylized assumption on the other extreme. Blanchet-Scalliet et al. [3] are the first to consider a general situation of uncertainty of time horizon, which covers the above two extreme assumptions. Roughly speaking, the random exit time not only depends on asset prices, but also on other factors. In their paper, a sufficient condition for an optimal investment problem in the presence of an uncertain time horizon was obtained by martingale approach, and was applied to solve the optimal investment problem in a setting with constant relative risk aversion (CRRA) preferences, constant expected return and drift parameters, and a deterministic distribution function of time horizon. This problem with CRRA preferences was also studied through backward stochastic differential equation (SDE) approach by El Karoui, Jeanblanc and Huang [8]. Bouchard and Pham [4] proved that the problem admits a solution using duality method.

In this paper, I study a continuous-time mean-variance portfolio selection model with a general random time horizon which was formulated by [3, 8], and derive the closed form solutions for efficient portfolios and efficient frontier. The mean-variance portfolio selection model was first proposed and solved in the single-period setting by Markowitz in his Nobel prize winning work [23]. In this model, the return is measured by the mean of terminal wealth, and the risk is measured by the variance of terminal wealth. An investor is assumed to allocate assets in financial market so as to achieve the optimal trade-off between the return and the risk. This approach became one of the foundations of modern finance theories and inspired many extensions and applications. One of them is to investigate continuous-time mean-variance optimization problems. There is large literature on this subject, such as Duffie and Richardson [6] and Schweizer [28].

Among the methods studying the continuous-time mean-variance optimization problems, is the stochastic linear-quadratic (LQ) optimal control approach, which was originally introduced by Li and Ng [18] and Zhou and Li [33]. In this approach, the mean-variance problem is reduced to a linearly constrained stochastic LQ problem and can be solved by LQ theory. Such an approach establishes a natural connection between the mean-variance problems and the standard stochastic optimal control models. In [18], a discrete-time multiperiod mean-variance problem was investigated. In [33], the authors studied the mean-variance problem with deterministic market parameters in continuous-time model. Along this line, other researchers explored the continuous-time mean-variance problem with more complicated situations. For example, a portfolio selection problem with random coefficients was solved by Lim and Zhou [21] using LQ theory and backward SDEs, a problem with short sales constraint was studied in Li, Zhou and Lim [19] via LQ and viscosity solution theories, a problem with Markov-modulated random coefficients that are independent of the stocks was solved by Zhou and Yin [34], a problem with bankruptcy prohibition was considered by Bielecki, Jin, Pliska and Zhou [1], and so on. Most of these results are summarized by Zhou [32]. All the works mentioned in this paragraph are with a deterministic exit time.

In this work, I focus on a continuous-time mean-variance portfolio selection problem with random market parameters and random time horizon, and this work generalizes the setting of Lim and Zhou [21] in which random parameters and deterministic exit time are assumed. However, we emphasize that this generalization does bring more difficulties. When we apply the LQ approach to the mean-variance problem as done in [21, 33, 34], the key difficulty is to prove the global solvability of the so-called stochastic Riccati equation (SRE) associated with the problem. This brings us the crucial difference between the mean-variance problem with random time horizon and that with deterministic time horizon. when the time horizon is deterministic and other market parameters (including the interest rate of the bond, the appreciation and volatility rates of the stocks) are deterministic too, the SRE reduces to a linear deterministic ordinary differential equation (ODE). The existence and uniqueness follow immediately from the standard results. For example, the SRE in Zhou and Li [33] is in this case. Moreover, by assuming the Markov-modulated market parameters are independent of stock prices, the related SRE in Zhou and Yin [34] is also in this case. When the time horizon is deterministic and the market parameters are random, however the SRE is a fully nonlinear singular backward SDE for which the usual assumptions (such as the Lipschitz and linear growth conditions, see Pardoux and Peng [25] or Yong and Zhou [31]) are not satisfied. Fortunately, the SRE is one dimensional and has a nice structure. By fully exploiting these two features of the SRE, Lim and Zhou [21] obtained the existence and uniqueness of the solution of the SRE in the case. When the time horizon and the market parameters are both random which is the case concerned in this paper, the corresponding SRE is more complicated. In detail, there is an additional item destroying the nice structure, so the method of [21] is invalid. In the paper, we use a truncation technique to transform the SRE into a one-dimensional backward SDE with quadratic growth. With the help of the existence theorem and the comparison theorem of one-dimensional backward SDEs (see Kobylanski [16] or Lepeltier and San Martin [17]) and the result of Lim and Zhou [21], we overcome the difficulty. In the literature, the truncation technique was also used to deal with other backward SDEs (see, e.g. Kobylanski [16] and El Karoui et al. [8]). It is worth emphasizing that studying such a nonlinear backward SDE is interesting in its own right.

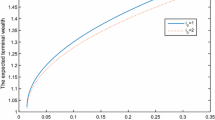

Besides the SRE, I also introduce another backward SDE, which is used to handle the nonhomogeneous terms involved in the LQ problem. These two backward SDEs lead to the analytic expressions of the efficient portfolios in a feedback form as well as the efficient frontier. In fact, the solutions of the two backward SDEs completely determine the efficient portfolios/frontier of the underlying mean-variance problem. In addition, we also derive the minimum variance explicitly. It is interesting that the efficient frontier is no longer a straight line in the mean-standard deviation diagram (compared with Lim and Zhou [21]). As a consequence, one is not able to achieve a risk-free investment. This, however, can be explained by the fact that there are two sources of uncertainty in our setting, one stemming from the randomness of the asset prices (named market risk), the other from the randomness of the exit time (named timing risk), and the latter cannot be perfectly hedged by any portfolio consisting of the bond and stocks in the market. This phenomenon has also arisen in Zhou and Yin [34] since in their setting there was also a kind of risk (stemming from the Markov chain) cannot be hedged by any portfolio.

The rest of this paper is organized as follows. In Sect. 2, we construct a model of an economy with a random time horizon and formulate the corresponding mean-variance problem. Section 3 is concerned about the feasibility issue of the underlying model. In Sect. 4, we show the global solvability of a singular Riccati backward SDE. In Sect. 5, we give the solution of the unconstrained optimization problem. The efficient portfolios and efficient frontier are obtained in Sect. 6. Finally, Sect. 7 presents the conclusion.

2 Economy and Problem Formulation

In this section, we introduce a model of economy with the presence of a random time horizon, and formulate the related continuous-time mean-variance optimal portfolio selection problem in the economy.

Let T>0 is a constant and [0,T] denotes the finite time span of the economy. \((\varOmega,\mathcal{A},\mathbb{F},\mathbb{P})\) describing the uncertainty in the economy is a complete filtered probability space, on which is defined an n-dimensional standard Brownian motion W=(W 1,W 2,…,W n)′ with W(0)=0, where the superscript ′ denotes the transpose of vectors or matrices. We further assume that the filtration \(\mathbb{F} = \{ \mathcal{F}_{t}; \ t\geq 0 \}\) with \(\mathcal{F}_{T}\subset \mathcal{A}\) is generated by W, augmented by all the \(\mathbb{P}\)-null sets in \(\mathcal{A}\) so that \(t \mapsto \mathcal{F}_{t}\) is continuous (see for example, Karatzas and Shreve [13, Corollary 2.7.8]). Now, we introduce some spaces of stochastic processes and random variables.

-

\(L^{q}_{\mathbb{F}}(0,T;\mathbb{R}^{m})\) where 1≤q<∞, the set of \(\mathbb{R}^{m}\)-valued \(\mathbb{F}\)-predictable processes f defined on [0,T] such that

$$\mathbb{E}\int_0^T |f(t)|^q dt < \infty; $$ -

\(L^{2,loc}_{\mathbb{F}}(0,T;\mathbb{R}^{m})\), the set of \(\mathbb{F}\)-predictable processes such that

$$\int_0^T |f(t)|^2 dt < \infty, \quad \mathbb{P}\mbox{-}a.s.; $$ -

\(L^{\infty}_{\mathbb{F}}(0,T;\mathbb{R}^{m})\), the set of \(\mathbb{F}\)-predictable, uniformly bounded processes;

-

\(S^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{m})\), the set of \(\mathbb{F}\)-predictable, continuous processes such that

$$\mathbb{E} \Bigl[\sup_{t\in [0,T]} |f(t)|^2 \Bigr] < \infty; $$ -

\(S^{\infty}_{\mathbb{F}}(0,T;\mathbb{R}^{m})\), the set of \(\mathbb{F}\)-predictable, uniformly bounded, continuous processes;

-

\(L^{\infty}(\varOmega,\mathcal{F}_{T},\mathbb{P};\mathbb{R}^{m})\), the set of \(\mathbb{R}^{m}\)-valued, \(\mathcal{F}_{T}\)-measurable, bounded random variables.

In the market, the basic securities consist of n+1 assets which are traded continuously. One of them is a risk-free asset (the money market instrument or a default-free bond without coupons) with price per unit B governed by the ordinary differential equation (ODE)

where the interest rate r is a nonnegative, \(\mathbb{F}\)-predictable, uniformly bounded stochastic process. In addition to the bond, there are n risky securities (stocks). The price process S i for one share of the i-th stock is modeled by the linear stochastic differential equation (SDE)

(i=1,2,…,n). For notations convenience, we set S=(S 1,S 2,…,S n )′, μ=(μ 1,μ 2,…,μ n )′, and the matrix composed by the numbers σ ij (i,j=1,…,n) is denoted by σ. Once again, we assume that μ and σ are \(\mathbb{F}\)-predictable, uniformly bounded stochastic processes. We further assume that there exists a constant δ>0 such that

where I

n

is the n×n identity matrix. Under the above assumptions, the market is complete and arbitrage-free (see for example, Karatzas [12]). We denote by  for all t∈[0,T], which is then also an \(\mathbb{F}\)-predictable bounded process, where

for all t∈[0,T], which is then also an \(\mathbb{F}\)-predictable bounded process, where  is the vector whose every component is 1.

is the vector whose every component is 1.

Consider now an agent who invests at time t the amount \(\tilde{\pi}_{i}(t)\) of the wealth x(t) in the i-th stock (i=1,…,n). If the strategy \(\tilde{\pi}= (\tilde{\pi}_{1},\tilde{\pi}_{2},\dots,\tilde{\pi}_{n})'\) is used in a self-financing way, i.e. the wealth invested in the riskless asset is \(x(t)-\sum_{i=1}^{n}\tilde{\pi}_{i}(t)\), then the wealth process x(⋅), with the initial endowment x 0, evolves according to the following SDE

where \(\pi(t) = \sigma(t)' \tilde{\pi}(t)\). Of course, the agent’s decisions can only be based on the current information \(\mathcal{F}_{t}\), i.e. the processes π (equivalently, \(\tilde{\pi}\)) is \(\mathbb{F}\)-predictable. Precisely, we give the following definition.

Definition 2.1

A scaled portfolio amount π(⋅) is said to be admissible if and only if  . From the classical SDEs theory, for any admissible π(⋅), the corresponding SDE (3) admits a unique solution \(x(\cdot)\in S^{2}_{\mathbb{F}}(0,T;\mathbb{R})\). In this case, we refer to (x(⋅),π(⋅)) as an admissible (wealth-portfolio) pair.

. From the classical SDEs theory, for any admissible π(⋅), the corresponding SDE (3) admits a unique solution \(x(\cdot)\in S^{2}_{\mathbb{F}}(0,T;\mathbb{R})\). In this case, we refer to (x(⋅),π(⋅)) as an admissible (wealth-portfolio) pair.

Remark 2.2

In many literature, a portfolio named u(⋅) is defined as the fractions of wealth allocated to the different assets, i.e.

By this definition, the wealth equation (3) is rewritten as

From the standard SDE theory, it is well known that the above equation admits a unique positive solution when the initial endowment x 0 is positive. In other words, with the definition of portfolio (4), the corresponding wealth process must be automatically positive. However, in this paper we would like to adopt another view (stated in Zhou and Yin [34] for example), that a wealth process with possible non-positive values is also sensible at least for some circumstances. Therefore the positive condition of the wealth process is better imposed as an additional constraint, rather than as a built-in feature of the model.

In this paper, we use the formulation of random time horizon similar to Blanchet-Scalliet et al. [3]. We assume that the agent’s time horizon τ is a positive random variable measurable with respect to the sigma-algebra \(\mathcal{A}\). It should be noted that τ is not assumed to be a stopping time of the filtration \(\mathbb{F}\). We are instead interested in the situations under which the presence of a random time horizon brings some new uncertainty to the economy.

With the presence of a random time horizon, there exist two kinds of uncertainties in the economy. One stems from the randomness of the asset prices (market risk), and the other stems from the randomness of the exit time τ (timing risk). Generally, these two kinds of uncertainties are not independent. Blanchet-Scalliet et al. [3] introduced an operation to separate these two kinds of uncertainties as follows: Conditioning up \(\mathcal{F}_{t}\) contains the information of the asset prices up to time t. We denote by \(F(t) = \mathbb{P}(\tau\leq t | \mathcal{F}_{t})\), the conditional distribution function of timing uncertainty. It is easy to verify that F(t) is an \(\mathbb{F}\)-submartingale and the function \(t\mapsto \mathbb{E}[F(t)]\) is right-continuous. Then F(t) has a right-continuous modification (see [13, Theorem 1.3.13]). From the Doob-Meyer decomposition theorem, we have F(t)=M(t)+A(t), where M is a martingale and A is an increasing process. We further make the following assumption.

Assumption (H.1.1)

The precess A is absolutely continuous with respect to Lebesgue’s measure, with a bounded nonnegative density denoted by a, i.e.

Under Assumption (H.1.1), we get at once the boundedness of A, and then of the martingale M. From the martingale representation theorem, there exists a unique process \(m(\cdot)\in L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\) such that

Actually, by the boundedness of M and the Burkholder-Davis-Gundy inequality, for any given p>1, there exists a constant c p such that

However, we strengthen the above conclusion to the following

Assumption (H.1.2)

There exists a constant C such that

Furthermore, we need

Assumption (H.1.3)

There exists a positive constant ε, such that

For convenience, we call the conditional distribution function F satisfies Assumption (H1) if and only if, it satisfies Assumptions (H.1.1), (H.1.2) and (H.1.3).

Remark 2.3

Blanchet-Scalliet et al. [3] assumed that the martingale M≡0. Here, we weaken this condition.

The agent’s objective is to find an admissible portfolio π(⋅), among all such admissible portfolios whose expected terminal wealth \(\mathbb{E} [x(\tau\wedge T)] = z\), for some given \(z\in\mathbb{R}\), so that the risk measured by the variance of the terminal wealth

is minimized. The problem to identify such a portfolio π is referred to as the mean-variance portfolio selection problem with a random horizon. In words, the solution of a mean-variance portfolio selection problem minimizes the terminal risk while satisfying the targeted mean payoff at the terminal time.

In order to further formulate our problem, let us state a consequence of the Burkholder-Davis-Gundy inequality without proof, which is a standard result.

Proposition 2.4

Let \(\varphi \in L^{2,loc}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\) such that

Then \(\{ \int_{0}^{t} \varphi(s)'dW(s),\ 0\leq t\leq T \}\) is a uniform integrable martingale. In particular, for each t∈[0,T], the random variable \(\int_{0}^{t} \varphi(s)' dW(s)\) is integrable, and

Lemma 2.5

Let Assumption (H.1.2) holds. Let \(x(\cdot)\in S^{2}_{\mathbb{F}}(0,T;\mathbb{R})\), and \(z\in\mathbb{R}\). Then we have:

-

(i)

The stochastic integral \(\int_{0}^{T} x(s)m(s)' dW(s)\) is integrable. Moreover,

$$\mathbb{E}\int_0^T x(s)m(s)' dW(s) =0. $$ -

(ii)

The stochastic integral \(\int_{0}^{T}(x(s)-z)^{2} m(s)' dW(s)\) is also integrable. Moreover,

$$\mathbb{E}\int_0^T \bigl(x(s)-z \bigr)^2 m(s)' dW(s) =0. $$

Proof

By Proposition 2.4, we only need to verify (6) holds true for φ(⋅)=x(⋅)m(⋅) and φ(⋅)=(x(⋅)−z)2 m(⋅), respectively. Firstly, since \(x(\cdot)\in S_{\mathbb{F}}^{2}(0,T;\mathbb{R})\) and \(m(\cdot)\in L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\), from the Schwarz inequality, we have

Secondly, because \(x(\cdot)-z \in S^{2}_{\mathbb{F}}(0,T;\mathbb{R})\) and m(⋅) satisfies Assumption (H.1.2), we have

This finishes the proof of the lemma. □

From the definition of \(F(t) = \mathbb{P}(\tau\leq t | \mathcal{F}_{t})\), its decomposition F(t)=M(t)+A(t), a result of Dellacherie [5] and Lemma 2.5, we have

Similarly, noting that \(z=\mathbb{E}[x(\tau\wedge T)]\), we have

Similar to Zhou [32], we have the following formulation.

Definition 2.6

Under Assumption (H1), the mean-variance portfolio selection problem with a random time horizon is formulated as a linearly constrained stochastic optimization problem, parameterized by \(z\in\mathbb{R}\):

Moreover, an admissible portfolio  is said to be a feasible portfolio for Problem (7) if it satisfies the constraint J

1(π(⋅))=z. If there exists a feasible portfolio, then Problem (7) is said to be feasible. Problem (7) is called finite if it is feasible and the infimum of J

MV

(π(⋅)) over the set of feasible portfolios is finite. If Problem (7) is finite and the infimum of J

MV

(π(⋅)) is achieved by a feasible portfolio π

∗(⋅), then Problem (7) is said to be solvable and π

∗(⋅) is called an optimal portfolio. Finally, an optimal portfolio to Problem (7) is also called an efficient portfolio corresponding to z, and the corresponding pairs \((\mathop {\mathrm {Var}}x(\tau\wedge T),z)\in\mathbb{R}^{2}\) and \((\sigma_{x(\tau\wedge T)},z)\in\mathbb{R}^{2}\) are interchangeably called an efficient point, where \(\sigma_{x(\tau\wedge T)}=\sqrt{\mathop {\mathrm {Var}}x(\tau\wedge T)}\) denotes the standard deviation of x(τ∧T). The set of all the efficient points is called the efficient frontier.

is said to be a feasible portfolio for Problem (7) if it satisfies the constraint J

1(π(⋅))=z. If there exists a feasible portfolio, then Problem (7) is said to be feasible. Problem (7) is called finite if it is feasible and the infimum of J

MV

(π(⋅)) over the set of feasible portfolios is finite. If Problem (7) is finite and the infimum of J

MV

(π(⋅)) is achieved by a feasible portfolio π

∗(⋅), then Problem (7) is said to be solvable and π

∗(⋅) is called an optimal portfolio. Finally, an optimal portfolio to Problem (7) is also called an efficient portfolio corresponding to z, and the corresponding pairs \((\mathop {\mathrm {Var}}x(\tau\wedge T),z)\in\mathbb{R}^{2}\) and \((\sigma_{x(\tau\wedge T)},z)\in\mathbb{R}^{2}\) are interchangeably called an efficient point, where \(\sigma_{x(\tau\wedge T)}=\sqrt{\mathop {\mathrm {Var}}x(\tau\wedge T)}\) denotes the standard deviation of x(τ∧T). The set of all the efficient points is called the efficient frontier.

3 Feasibility

Since the Problem (7) involves a linear constraint J 1(π(⋅))=z, in this section, we derive the conditions under which the problem is at least feasible. In fact, we have the following result on the feasibility of Problem (7).

Proposition 3.1

Let \((\psi,\xi)\in S^{2}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\) denote the unique solution of the following backward SDE:

Then Problem (7) is feasible for any \(z\in\mathbb{R}\) if and only if

Proof

First, from Pardoux and Peng’s theorem (see [25]), the backward SDE (8) admits a unique solution in the space \(S^{2}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\).

In order to prove the sufficiency, we construct a family of admissible portfolios π (β)(⋅)=βπ(⋅) for all \(\beta\in\mathbb{R}\), where

For any β, we denote by x (β)(⋅) the corresponding wealth process under π (β)(⋅). By linearity of the wealth equation (3), it follows that x (β)(t)=x (0)(t)+βy(t), where x (0)(⋅) satisfies

and y(⋅) satisfies

respectively. Then Problem (7) is feasible for any \(z\in\mathbb{R}\) if there exists a \(\beta\in\mathbb{R}\) such that

In other words, Problem (7) is feasible for any \(z\in\mathbb{R}\) if

However, applying Itô’s formula to ψ(t)y(t) on the interval [0,T], we have

Our result follows from the definition of π(⋅) in (10).

Conversely, if Problem (7) is feasible for any \(z\in\mathbb{R}\), then there exists an admissible portfolio π(⋅) such that

We can always decompose x(t)=x (0)(t)+y(t), where y(⋅) satisfies (12). This leads to

However x (0)(⋅), which can be interpreted as the wealth process corresponding to the agent putting all the money in the bond, is independent of π(⋅), thus it is necessary that there exists a π(⋅) such that

From (13),

This implies (9). □

Corollary 3.2

Let

We have:

-

(i)

if (9) holds, then for any \(z\in\mathbb{R}\), a feasible portfolio satisfying \(J_{1}(\bar{\pi}(\cdot))=z\) is given by

$$\bar{\pi}(\cdot) = \frac{z-z^{(0)}}{\gamma} \bigl( \theta(t)\psi(t) +\xi(t) \bigr); $$ -

(ii)

if (9) doesn’t hold, then for any admissible portfolio π(⋅), we have J 1(π(⋅))=z (0).

Proof

It is easy to see that (i) comes from the proof of the “sufficiency” part of Proposition 3.1, and (ii) comes from the proof of the “necessity” part of Proposition (3.1). □

Remark 3.3

The condition (9) is mild. On the one hand, since (8) is a linear backward SDE, its unique solution ψ has the following representation:

(see El Karoui, Peng and Quenez [7, Proposition 2.2] or Lim and Zhou [21, Proposition 4.1]). From Assumption (H1), we know that (1−F(T))≥ε>0 and a(s)≥0, s∈[0,T], and then ψ(t)>0 for any t∈[0,T]. So (9) is easily satisfied because (ψ,ξ) is independent of θ. In particular, if (9) does not hold, then there are “arbitrarily small” perturbations of θ that will give rise to a new problem that is feasible for every z. On the other hand, if (9) fails, then Corollary 3.2-(ii) implies that the mean-variance problem (7) is feasible only if z=z (0). This is a pathological and trivial case that does not warrant further consideration.

After considering the feasibility, we proceed to study the issue of optimality. The mean-variance problem with random time horizon (7) is a dynamic optimization problem with a constraint J 1(π(⋅))=z. In order to deal with the constraint, we employ the Lagrange multiplier technique. For each \(\lambda\in\mathbb{R}\), define

The first goal is to solve the following unconstrained problem parameterized by the Lagrange multiplier λ:

This is a stochastic linear-quadratic (LQ) optimal control problem, and we shall solve it in the next two sections.

4 Solvability of Stochastic Riccati Equation

When we study the unconstrained LQ problem (15), an equation known in the literature as the stochastic Riccati equation (SRE) will arise naturally. The existence and uniqueness of SRE play a fundamental role in the solution of the LQ problem (15) (and hence, the mean-variance problem (7)). In this section, the issue of solvability of SRE will be addressed.

We introduce the following backward SDEs (the argument t is suppressed):

and the following forward SDEs:

The backward SDE (16) is a special case (corresponding to the mean-variance problem (7)) of the SRE associated with general stochastic LQ optimal control problems. Equation (17) will be used to handle the nonhomogeneous terms involved in the problem (15). Equations (18) and (19) will be used to express the optimal wealth processes. Now we introduce a subset of \(S^{\infty}_{\mathbb{F}}(0,T;\mathbb{R})\) as follows:

Definition 4.1

A solution of SRE (16) is a pair of processes \((p,\varLambda)\in \hat{S}^{\infty}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\) satisfying the backward SDE (16).

The general SRE is a highly nonlinear, matrix-valued backward SDE, and there are many results on its solvability, for example, Bismut [2], Peng [26], Tang [29], Lim and Zhou [21], Yong and Zhou [31] and the references therein. But to our best knowledge, there are no results which cover the mean-variance situation (7) that we are considering in this paper. The SRE (16) studied in the paper has a good feature, that is, the variable p(t) is scalar-valued. With the help of the theory of scalar backward SDEs with quadratic growth introduced by Kobylanski [16] and Lepeltier and San Martin [17], and the result of Lim and Zhou [21], we shall prove the existence and uniqueness of solutions of SRE (16).

Let us begin with another simpler scalar-valued stochastic Riccati equation introduced by Lim and Zhou [21] as follows:

Lemma 4.2

(Lim and Zhou [21, Theorem 4.1])

Suppose Assumption (H1) hold. Then there exists a unique solution \((\bar{p},\bar{\varLambda})\in\hat{S}^{\infty}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\) for the stochastic Riccati equation (20).

Theorem 4.3

Suppose Assumption (H1) hold. Then there exists a unique solution \((p,\varLambda)\in\hat{S}^{\infty}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\) for the stochastic Riccati equation (16).

Proof

From Lemma 4.2, the SRE (20) admits a unique solution \((\bar{p},\bar{\varLambda})\in\hat{S}^{\infty}_{\mathbb{F}}(0,T;\mathbb{R}) \times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\). Without loss of generality, we assume that \(k\leq\bar{p}(t)\leq K\) for any t∈[0,T] with two constants 0<k<K<∞. We consider the following backward SDEs:

and

Obviously, the unique solution \((\bar{p},\bar{\varLambda})\) of SRE (20) also satisfies the backward SDE (21). Since a(⋅), r(⋅) and θ(⋅) are bounded, the driver \(f(t,p,\varLambda) = 2a(t) +(2r(t)-\theta(t)'\theta(t))p-2\theta(t)'\varLambda -\frac{\varLambda'\varLambda}{p\vee k}\) of backward SDE (22) satisfies

where C is a constant. Therefore, from Lepeltier and San Martin [17, Theorem 1] (see also Kobylanski [16]), there exists a bounded maximal solution (p (k),Λ (k)) for (22). Here, a solution \((\tilde{p},\tilde{\varLambda})\) of (22) is said to be a bounded solution if \((\tilde{p},\tilde{\varLambda})\in S^{\infty}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\). Moreover, a bounded solution (p (k),Λ (k)) is said to be a maximal bounded solution if \(p^{(k)}(t)\geq \tilde{p}(t)\), t∈[0,T] for any bounded solution \((\tilde{p},\tilde{\varLambda})\) of (22). Next we apply the comparison theorem in [17, Corollary 2] and from

we deduce that \(p^{(k)}(t)\geq\bar{p}(t)\geq k\). Hence \((p^{(k)},\varLambda^{(k)})\in \hat{S}^{\infty}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\) is a solution of SRE (16). We get the existence.

To prove the uniqueness, let (p,Λ) and \((\tilde{p},\tilde{\varLambda})\) be two solutions of SRE (16) in \(\hat{S}^{\infty}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\) with k≤p≤K and \(k\leq \tilde{p}\leq K\) respectively, where k and K are two given positive numbers. Define (Y,Z)=(1/p,−Λ/p 2) and \((\tilde{Y}, \tilde{Z}) = (1/\tilde{p}, -\tilde{\varLambda}/\tilde{p}^{2})\). Obviously (Y,Z) and \((\tilde{Y},\tilde{Z})\) belong to \(\hat{S}^{\infty}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\). It can be directly verified, using Itô’s formula, that (Y,Z) and \((\tilde{Y},\tilde{Z})\) both solve, in terms of (h,ζ), the following backward SDE:

Therefore, \((Y-\tilde{Y}, Z-\tilde{Z})\) solves, in terms of (h,ζ),

Noticing that \(Y+\tilde{Y}\) is bounded, from the uniqueness of the above backward SDE (see Pardoux and Peng [25]), we have \((Y-\tilde{Y}, Z-\tilde{Z})=(0,0)\). We complete the proof. □

In the rest of this section, we show that the existence and uniqueness of solutions of (17), (18) and (19) are implied by Theorem 4.3. First, in the case of the backward SDE (17), since 0<k≤p(t)≤K<∞, t∈[0,T], the coefficients of variables g and η, the non-homogeneous term and the terminal condition are bounded, so (17) is a standard linear backward SDE. Pardoux and Peng’s theorem [25] is applied once again to guarantee the existence and uniqueness of a solution \((g,\eta)\in S^{2}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\). Moreover, we show that 0<g(t)≤1 for any t∈[0,T].

Proposition 4.4

Let Assumption (H1) hold. Then there exists a unique solution \((g,\eta)\in S^{\infty}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\) for the backward SDE (17). Moreover, we have 0<g(t)≤1 for any t∈[0,T]. Furthermore, if r(t)>0 a.e. t∈[0,T], then 0<g(t)<1 for all t∈[0,T).

Proof

The existence and uniqueness are discussed above. I now prove that 0<g(t)≤1 for any t∈[0,T]. Because backward SDE (17) is in a linear form, its unique solution g can be rewritten in a closed formula. For this aim, we introduce the following stochastic process:

which is called the adjoint process with respect to g and satisfies a linear SDE (the argument s is suppressed):

Applying Itô’s formula to g(s)Γ t (s) on the interval [t,T], we get g in closed form as follows:

Due to Γ t (s)>0 and \(2\frac{a(s)}{p(s)}\geq 0\), s∈[t,T], we obtain

Next we introduce an auxiliary linear backward SDE:

Obviously, \((\overline{g}(t),\overline{\eta}(t)) \equiv (1, 0)\), t∈[0,T] is the unique solution of (23). We denote by \(\hat{g}(t):= \overline{g}(t) - g(t)\) and \(\hat{\eta}(t) := \overline{\eta}(t) -\eta(t)\), then \((\hat{g}, \hat{\eta})\) satisfies the following backward SDE:

Similarly, we define the adjoint process \(\{\hat{\varGamma}_{t}(s);\ t\leq s\leq T\}\) with respect to \(\hat{g}\), explicitly,

which satisfies the following linear SDE:

Applying Itô’s formula to \(\hat{g}(s)\hat{\varGamma}_{t}(s)\) leads to

Due to r(s)≥0, g(s)>0 and \(\hat{\varGamma}_{t}(s)>0\), s∈[t,T], we obtain \(\hat{g}(t) \geq 0\). From the definition of \(\hat{g}(t) := \overline{g}(t)-g(t)\) and \(\overline{g}(t)\equiv 1\), we get

Moreover, if the interest rate r(t)>0 a.e. t∈[0,T], from (24), we have g(t)<1 for any t∈[0,T). □

Remark 4.5

g(⋅) has a financial implication: for fixed t∈[0,T], g(t) is a quantity representing the risk-adjusted discount factor at time t in the presence of a random time horizon. Let \((\tilde{g}, \tilde{\eta})\) denotes the unique solution of the following backward SDE:

Then \(\tilde{g}(t)\) represents the corresponding risk-adjusted discount factor at time t with the deterministic exit time T (see Lim and Zhou [21] for details). Using the comparison theorem of backward SDEs with Lipschitz continuous coefficients (see El Karoui, Peng and Quenez [7, Theorem 2.2]), we have \(g(t)\leq \tilde{g}(t)\) for any t∈[0,T]. The presence of uncertainty of time horizon decreases the values of the discount factor.

In the case of the SDEs (18) and (19), the term \(\varLambda\in L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\) associated with the SRE (16) appears in the coefficients of the variable x in both drifts and diffusions. Although linear, the issue of existence and uniqueness of solutions of (18) and (19) no longer lies in the domain of standard theory, which requires the coefficients of x to be uniformly bounded. At the same time, the method of Lim and Zhou [21, Proposition 3.1] is also invalid. However, from the Basic Theorem of Gal’chuk [9, pp. 756–757] (see also Lemma 7.1 of Tang [29, p. 67]), we can directly get the desired results that the SDEs (18) and (19) admit unique strong solutions, respectively.

5 Solution to the Unconstrained Problem

Now we give the solution of the unconstrained problem (15).

Theorem 5.1

Under Assumption (H1), the Problem (15) is solvable. The unique optimal feedback control is given by

The corresponding optimal state trajectory is given by

where \(\tilde{x}(\cdot)\) and \(\bar{x}(\cdot)\) are the solutions to (18) and (19), respectively. The associated optimal cost is given by

where

Remark 5.2

Precisely, an admissible feedback control is a measurable mapping \(\varPi : \varOmega\times[0,T]\times\mathbb{R}\rightarrow\mathbb{R}^{n}\) such that, there exists a unique solution x(⋅) of the following equation:

(compare with (3)), and π(⋅)=Π(⋅,x(⋅)) is an admissible control. Moreover, Π is called an optimal feedback control if the pair (Π(⋅,x(⋅)),x(⋅)) is optimal, where x(⋅) is the solution of (30). Although there is a bit ambiguity, like most of the literature, we call π(⋅)=Π(⋅,x(⋅)) the feedback control directly (without introducing the mapping Π). For more details of feedback controls, please refer to the book of Yong and Zhou [31].

Before proving Theorem 5.1, let us give the following Lemma first, which shows that (26) is admissible.

Lemma 5.3

Let Assumption (H1) hold. π (λ)(⋅) defined by (26) is admissible.

Proof

Substituting the feedback control (26) into the wealth equation (3), we have

It is an equation as the same type as (18) and (19), so the Basic Theorem of Gal’chuk [9] or Lemma 7.1 of Tang [29] works again to guarantee the existence and uniqueness of the solution of (31). Because x

(λ)(⋅) is continuous, hence bounded on [0,T], \(\mathbb{P}\)-a.s. Since \((p,\varLambda)\in\hat{S}^{\infty}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\) and \((g,\eta)\in S^{\infty}_{\mathbb{F}}(0,T;\mathbb{R})\times L^{2}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\), we can guarantee that (26) belongs to \(L^{2,loc}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\), or is locally square integrable. Next, similar to the method of Lim [20], we prove that (26) belongs to  .

.

Applying Itô’s formula to (x (λ)(t)+(λ−z)g(t))2, we get

Applying Itô’s formula to p(t)(x (λ)(t)+(λ−z)g(t))2, we have:

where

For any given t∈[0,T] and any given \(\mathbb{F}\)-stopping time σ, we integrate to get

Since \(\int_{0}^{t\wedge\sigma} N^{(\lambda)} dW\) is a locally square integrable martingale, then there exists a sequence of stopping times \(\{\sigma_{i}\}_{i=1}^{\infty}\) which increase and diverge \(\mathbb{P}\)-a.s., as i→∞. It follows that

Because 0<k≤p(s)≤K by Theorem 4.3, and a(⋅), g(⋅) are bounded, then

where C is a constant. It follows from Fatou’s lemma that

Moreover, we have

i.e., for any t∈[0,T] and any stopping time σ, we obtain

Now, we show that (32) implies the admissibility of π (λ)(⋅). By Itô’s formula, we have

From the inequality \(-2x\theta\cdot \pi = -2(\sqrt{2}x\theta)\cdot(\pi/\sqrt{2}) \leq 2x^{2}|\theta|^{2} +|\pi|^{2}/2\), we have

Then

Because x (λ)(⋅) is continuous, it follows that \(2x^{(\lambda)}(\cdot)\pi^{(\lambda)}(\cdot)\in L^{2,loc}_{\mathbb{F}}(0,T;\mathbb{R}^{n})\). Therefore, there exists a localizing sequence of stopping times \(\{\tau_{i}\}_{i=1}^{\infty}\) which increase and diverge \(\mathbb{P}\)-a.s., such that

By virtue of (32), there exists a constant C such that

Fatou’s lemma works again to yield the desired conclusion

We get the admissibility of π (λ)(⋅). Consequently, the corresponding state trajectory \(x^{(\lambda)}(\cdot)\in S^{2}_{\mathbb{F}}(0,T;\mathbb{R})\). □

Proof of Theorem 5.1

Let  be any given admissible control and x(⋅) be the corresponding state trajectory of (3). Similar to Lemma 5.3, applying Itô’s formula to p(t)(x(t)+(λ−z)g(t))2, we obtain:

be any given admissible control and x(⋅) be the corresponding state trajectory of (3). Similar to Lemma 5.3, applying Itô’s formula to p(t)(x(t)+(λ−z)g(t))2, we obtain:

where

Since \(\int_{0}^{t} N dW\) is a locally square integrable martingale, then there exists a localizing sequence of stopping times \(\{\sigma_{i}\}_{i=1}^{\infty}\) which increase and diverge \(\mathbb{P}\)-a.s., such that

By virtue of the Lebesgue’s dominated convergence theorem, the two items on the left hand side of (33) and the last item on the right hand side of (33) are convergent as i→∞. Applying the monotone convergence theorem to the first item on the right hand side of (33) leads to

Then,

Since p(t)≥k>0 by Theorem 4.3, it follows immediately that the optimal feedback control is π (λ)(⋅) given by (26), and the optimal cost is given by

where Δ is defined by (29). We note that the above equation coincides with (28).

At last, the corresponding optimal state trajectory is given by (31). From the linearity of (31), λ can be separated off. In fact, x (λ)(⋅) has the following representation:

where \(\tilde{x}(\cdot)\) and \(\bar{x}(\cdot)\) are the solutions of (18) and (19) respectively. We finish the proof. □

6 Efficient Portfolios and Efficient Frontier

In this section, for the original mean-variance problem (7), we shall derive explicitly the efficient portfolios and the efficient frontier in closed forms based on the solutions of backward SDEs (16) and (17). In fact, we have the following

Theorem 6.1

Let Assumption (H1) and (9) hold. Then

Moreover, the efficient portfolio corresponding to z, as a feedback control of the wealth is

where

The corresponding optimal wealth process is given by

where \(\tilde{x}(\cdot)\) and \(\bar{x}(\cdot)\) are the solutions to (18) and (19), respectively. Furthermore, among all the wealth processes x(⋅) which satisfy the constraint \(\mathbb{E}[x(\tau\wedge T)] =z\), the optimal value of the variance of terminal wealth Varx(τ∧T) is given by

Proof

By condition (9) and Proposition 3.1, the mean-variance problem (7) is feasible for any \(z\in\mathbb{R}\). By Theorem 5.1, for every \(\lambda\in\mathbb{R}\), the problem (15) has a finite optimal value. Particularly, the problem (7) without the constraint \(\mathbb{E}[x(\tau\wedge T)] =z\) is just the problem (15) with λ=0, consequently it has a finite optimal value. Hence, (7) is finite for every \(z\in\mathbb{R}\). Since J MV (π(⋅)) is strictly convex in π(⋅) and the constraint J 1(π(⋅))−z is affine in π(⋅), it follows from the duality theorem (see, e.g. Luenberger [22, p. 224, Theorem 1]) that for any \(z\in\mathbb{R}\), the optimal value of (7) is

From Theorem 5.1,  is in a quadratic form (see (28)) with respect to λ−z. Noticing the finiteness of the supremum value of

is in a quadratic form (see (28)) with respect to λ−z. Noticing the finiteness of the supremum value of  (see (39)), we have

(see (39)), we have

However, if p(0)g(0)2/2+Δ−1=0, due to (28) and (39), we must have p(0)g(0)x 0−2z=0, for any \(z\in\mathbb{R}\), which is a contradiction. So we prove (34).

In view of (39), the optimal Lagrange multiplier λ ∗ is given by (36), and the optimal value of the variance Varx ∗(τ∧T) is given by (38). Finally the optimal control (35) and the optimal state trajectory (37) are obtained by (26) and (27) with λ=λ ∗, respectively. □

The expression (38) reveals explicitly the tradeoff between the mean and the variance at the terminal time. Different from the case studied by Lim and Zhou [21] where the exit time is deterministic, the efficient frontier in the present case with a random exit time is not a perfect square (or the efficient frontier is not a straight line in the mean-standard deviation diagram). As a consequence, the agent is not able to achieve a risk-free investment. This result is reasonable since now there are two sources of uncertainty related to our problem, one is the market risk and the other is the exit timing risk, and the latter cannot be perfectly hedged by any portfolio consisting of the bond and stocks, because the random exit time introduces some new uncertainty. In stead of a risk-free investment, the following Corollary 6.2 gives the minimum variance, which can be achieved by a feasible portfolio.

Corollary 6.2

Let Assumption (H1) and (9) hold. The minimum terminal variance is

which is achieved by the portfolio

Moreover, the corresponding expected terminal wealth is given by

and the corresponding Lagrange multiplier \(\lambda^{*}_{\min} =0\).

Proof

We can easily get (40) and (42) from the expression (38). From (36) and (42), we calculate \(\lambda^{*}_{\min} =0\). At last, (41) comes from (35). □

Remark 6.3

As same as [21, 34], due to the minimum variance, the parameter z can be restricted on the interval z∈[z min,+∞) when we study the efficient frontier to the mean-variance problem (7).

As a natural consequence of the mean-variance problem (7), we have the following result which is usually called the Mutual Fund Theorem.

Theorem 6.4

Let Assumption (H1) and (9) hold. Let \(\pi^{*}_{\min}(\cdot)\) denote the minimum variance portfolio defined in Corollary 6.2, and \(\pi^{*}_{1}(\cdot)\) is another given efficient portfolio corresponding to z 1>z min. Then a portfolio π ∗(⋅) is efficient if and only if there exists an α≥0 such that

Proof

For given z min and z 1, from (36), (37) and (35), we write the expressions of the corresponding Lagrange multipliers, wealth processes and efficient portfolios:

For any α≥0, we define z=(1−α)z min+αz 1. By the linearities of λ ∗ with respect to z, x ∗ with respect to λ ∗ and π ∗ with respect to x ∗, λ ∗ and z, we have

So a portfolio π ∗(⋅) defined by (43) is an efficient portfolio corresponding to z=(1−α)z min+αz 1.

On the other hand, when π ∗(⋅) is an efficient portfolio corresponding to a certain z≥z min, we can write z=(1−α)z min+αz 1 with some α≥0. The above analysis leads to that π ∗(⋅) must be in the form of (43). □

Remark 6.5

The mutual fund theorem implies that, any efficient portfolio can be constructed as a combination of the minimum variance portfolio \(\pi^{*}_{\min}(\cdot)\) and another given efficient portfolio (called the mutual fund) \(\pi_{1}^{*}(\cdot)\). In other words, the investor need only to invest in the minimum variance portfolio \(\pi^{*}_{\min}(\cdot)\) and the mutual fund \(\pi_{1}^{*}(\cdot)\) to achieve the efficiency. The fact α≥0 means that the investor cannot short-sell the mutual fund \(\pi_{1}^{*}(\cdot)\).

Remark 6.6

If we assume the interest rate r(t)≡0, the results obtained in this section can be simplified. In detail, a straightforward calculation suggests that the corresponding efficient frontier is in a perfect square form, because the unique solution of (17) is (g(t),η(t))≡(1,0), t∈[0,T] and then Δ=0. The corresponding minimum terminal variance is zero which is achieved by putting all the money into the bond. Finally, the mutual fund theorem (Theorem 6.4) can be stated as any efficient portfolio is a combination of the bond and a given efficient portfolio. For this phenomenon, we have a financial interpretation. When r(t)≡0, the timing risk issued from the uncertainty of τ can be avoided by cash stash, i.e. putting all the money to the bond (which produces no gain). On the other hand, even if r has no uncertainty, or more strongly, even if r is a positive constant, an investor cannot escape from the timing risk.

7 Conclusion

Motivated by an interesting financial phenomenon while still unexplained by any theories, we study a continuous-time mean-variance portfolio selection problem with a random time horizon. In our setting, an investor is uncertain about exit time.

A key part of our analysis is to prove the global solvability of a backward SDE called the stochastic Riccati equation. Although there exist many achievements on the Riccati type equations in the literature, but to our best knowledge, there are still no results which cover the mean-variance situation that we consider in this paper. Using a truncation technique, with the help of the existence theorem and the comparison theorem of one-dimensional backward SDEs with quadratic growth introduced by Lepeltier and San Martin [17] and a result belonging to Lim and Zhou [21], we make a progress.

For the mean-variance problem with random horizon, we obtain the efficient portfolios and efficient frontier in closed forms. Different from the case where the exit time is deterministic, the efficient frontier is no longer a perfect square. Consequently, a risk-free investment is not able to be achieved. This phenomenon is reasonable because the random exit time introduces new uncertainty, and the new uncertainty cannot be hedged by any portfolio consisting of the bond and stocks. In addition, we also give a minimum variance portfolio and a mutual fund theorem.

References

Bielecki, T.R., Jin, H., Pliska, S.R., Zhou, X.Y.: Continuous-time mean-variance portfolio selection with bankruptcy prohibition. Math. Finance 15, 213–244 (2005)

Bismut, J.M.: Linear quadratic optimal stochastic control with random coefficients. SIAM J. Control Optim. 14, 419–444 (1976)

Blanchet-Scalliet, C., El Karoui, N., Jeanblanc, M., Martellini, L.: Optimal investment decisions when time-horizon is uncertain. J. Math. Econ. 44, 1100–1113 (2008)

Bouchard, B., Pham, H.: Wealth-path dependent utility maximization in incomplete markets. Finance Stoch. 4, 579–603 (2004)

Dellacherie, C.: Capacités et Processus Stochastiques. Springer, Berlin (1972)

Duffie, D., Richardson, H.: Mean-variance hedging in continuous time. Ann. Appl. Probab. 1, 1–15 (1991)

El Karoui, N., Peng, S., Quenez, M.C.: Backward stochastic differential equations in finance. Math. Finance 7, 1–71 (1997)

El Karoui, N., Jeanblanc, M., Huang, S.: Random horizon. Working paper (2002)

Gal’chuk, L.I.: Existence and uniqueness of a solution for stochastic equations with respect to semimartingales. Theory Probab. Appl. 23, 751–763 (1978)

Hakansson, N.H.: Optimal investment and consumption strategies under risk, an uncertain lifetime, and insurance. Int. Econ. Rev. 10, 443–466 (1969)

Hakansson, N.H.: Optimal entrepreneurial decisions in a completely stochastic environment. Manag. Sci. 17, 427–449 (1971)

Karatzas, I.: Lectures on the Mathematics of Finance. CRM Monograph Series, vol. 8. CRM, Montréal (1996)

Karatzas, I., Shreve, S.E.: Brownian Motion and Stochastic Calculus, 2nd edn. Springer, New York (1991)

Karatzas, I., Wang, H.: Utility maximization with discretionary stopping. SIAM J. Control Optim. 39, 306–329 (2001)

Kharroubi, I., Lim, T., Ngoupeyou, A.: Mean-Variance Hedging on uncertain time horizon in a market with a jump. arXiv:1206.3693 [math.OC] (2012)

Kobylanski, M.: Backward stochastic differential equations and partial differential equations with quadratic growth. Ann. Probab. 28, 558–602 (2000)

Lepeltier, J.P., San Martin, J.: Existence for BSDE with superlinear-quadratic coefficient. Stoch. Stoch. Rep. 63, 227–240 (1998)

Li, D., Ng, W.L.: Optimal dynamic portfolio selection: multi-period mean-variance formulation. Math. Finance 10, 387–406 (2000)

Li, X., Zhou, X.Y., Lim, A.E.B.: Dynamic mean-variance portfolio selection with no-shorting constraints. SIAM J. Control Optim. 40, 1540–1555 (2002)

Lim, A.E.B.: Quadratic hedging and mean-variance portfolio selection with random parameters in an incomplete market. Math. Oper. Res. 29, 132–161 (2004)

Lim, A.E.B., Zhou, X.Y.: Mean-variance portfolio selection with random parameters in a complete market. Math. Oper. Res. 27, 101–120 (2002)

Luenberger, D.G.: Optimization by Vector Space Methods. Wiley, New York (1968)

Markowitz, H.: Portfolio selection. J. Finance 7, 77–91 (1952)

Merton, R.C.: Optimal consumption and portfolio rules in a continuous-time model. J. Econ. Theory 3, 373–413 (1971)

Pardoux, E., Peng, S.: Adapted solution of a backward stochastic differential equation. Syst. Control Lett. 14, 55–61 (1990)

Peng, S.: Stochastic Hamilton-Jacobi-Bellman equations. SIAM J. Control Optim. 30, 284–304 (1992)

Richard, S.F.: Optimal consumption, portfolio and life insurance rules for an uncertain lived individual in a continuous time model. J. Financ. Econ. 2, 187–203 (1975)

Schweizer, M.: Approximation pricing and the variance-optimal martingale measure. Ann. Probab. 24, 206–236 (1996)

Tang, S.: General linear quadratic optimal stochastic control problems with random coefficients: linear stochastic Hamilton systems and backward stochastic Riccati equations. SIAM J. Control Optim. 42, 53–75 (2003)

Yaari, M.: Uncertain lifetime, life insurance, and the theory of the consumer. Rev. Econ. Stud. 2, 137–150 (1965)

Yong, J., Zhou, X.Y.: Stochastic Controls: Hamiltonian Systems and HJB Equations. Springer, New York (1999)

Zhou, X.Y.: Markowitz’s world in continuous time, and beyond. In: Yao, D.D., Zhang, H., Zhou, X.Y. (eds.) Stochastic Modeling and Optimization, pp. 279–310. Springer, New York (2003)

Zhou, X.Y., Li, D.: Continuous-time mean-variance portfolio selection: a stochastic LQ framework. Appl. Math. Optim. 42, 19–33 (2000)

Zhou, X.Y., Yin, G.: Markowitz’s mean-variance portfolio selection with regime switching: a continuous-time model. SIAM J. Control Optim. 42, 1466–1482 (2003)

Acknowledgements

The author thanks the anonymous referee for his/her constructive and insightful comments and suggestions, which help to improve the quality of this work, and Prof. Monique Jeanblanc and Dr. Mingshang Hu for many helpful discussions.

Author information

Authors and Affiliations

Corresponding author

Additional information

The author acknowledges the financial support by the National Natural Science Foundation of China (11101242), the Natural Science Foundation of Shandong Province, China (ZR2010AQ004), and the Scientific Research Foundation for the Returned Overseas Chinese Scholars, State Education Ministry.

Rights and permissions

About this article

Cite this article

Yu, Z. Continuous-Time Mean-Variance Portfolio Selection with Random Horizon. Appl Math Optim 68, 333–359 (2013). https://doi.org/10.1007/s00245-013-9209-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00245-013-9209-1