Abstract

Rationale

Characterisation of drug dependence using principles from behavioural economics has provided a more detailed understanding of the disorder. Although questionnaires assessing economic demand for cigarettes have extended these principles to nicotine addiction, aspects of the reliability and selectivity of these questionnaires remain uncertain.

Objective

Across two experiments, we attempted to reproduce significant associations of the cigarette purchase task with nicotine dependence in a young adult population of smokers and contrasted this measure with a novel chocolate purchase task. We also examined the association between these measures and performance on a preference task, measuring preference for cigarettes and chocolate.

Methods

Questionnaire measures were used within a university setting.

Results

In experiment 1, we observed associations between nicotine dependence and measures of behavioural economic demand for cigarettes, particularly O max. In experiment 2, we replicated these findings again and extended them to show that similar correlations between nicotine dependence and demand for chocolate were not observed. Moreover, the indices of demand and choices on a concurrent choice cigarette task were moderately associated with each other and independently associated with nicotine dependence.

Conclusions

The two experiments clearly supported previous findings regarding the association between nicotine dependence and economic demand for cigarettes. We extend these observations by showing that the generalisation of economic demand across different commodities is relatively weak, but that generalisation across different procedures is strong. Our results therefore support behavioural economic models of nicotine addiction which emphasise a robust proximal role for the incentive value of cigarettes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Principles of behavioural economics are well established as a means of measuring the reinforcing properties of drugs of abuse, both in humans and experimental animals (Murphy et al. 2012). In particular, demand curve analysis provides a comprehensive assessment of a drug’s relative value by quantifying the degree to which consumption is reduced in the face of increasing cost—its elasticity (Hursh et al. 2005). Experimental research has profitably used behavioural economic demand curve analysis to measure and compare motivation for different drug classes or doses, as well as to provide a framework for quantifying the severity of drug dependence.

The most widely used method of quantifying drug demand is the progressive ratio schedule, which, when conducted in vivo, requires multiple sessions that are long in duration, can only assess behaviour using a relatively restricted number of response costs, and provides a limited number of performance metrics per session. Recently, however, there has been progress in developing commodity-specific measures of drug demand in humans, termed as purchase tasks (Jacobs and Bickel 1999; Murphy and MacKillop 2006). These measures assess estimated consumption of the drug at an array of prices and permit assessment of individual variation in demand in considerably larger samples across a wide range of prices. There are areas of difference between purchase tasks and progressive ratio tasks: most importantly that the costs and commodities are hypothetical in the former case rather than experienced; in addition, the contingency between responses and outcomes varies markedly between the two preparations. Nevertheless, the grounding of both preparations in behavioural economic theory has meant that similar models (e.g. Hursh and Silberberg 2008) can provide effective quantitative descriptions of each.

A rapidly growing literature provides support for the use of a cigarette purchase task (CPT) for characterising the reinforcing value of tobacco and nicotine dependence. Indices of tobacco demand have been shown to be temporally reliable (Few et al. 2012) and significantly associated with quantitative levels of smoking, severity of nicotine dependence, treatment motivation and in vivo smoking behaviour (MacKillop et al. 2008; MacKillop and Tidey 2011; Murphy et al. 2011). Compatible findings are observed using an alcohol purchase task (MacKillop 2006; Murphy et al. 2012). Estimated consumption for hypothetical alcohol was shown to correspond with choices that determined actual alcohol consumption, further validating the approach (Amlung et al. 2012).

Similar findings have also been emerging from studies employing very different methodologies. In a recent study, Hogarth and Chase (2011) observed that operant performance for cigarette points on a concurrent choice task was significantly positively associated with greater levels of nicotine dependence and that such preference could be modified by altering satiety or via exposure to health warnings. Thus, whether drug value is characterised by drug demand or operant output, these experimental assays putatively capture important variability in individual differences in the incentive value of tobacco.

Although these initial studies have been promising, a number of limitations accompany the progress to date. First, from a geographic standpoint, all research using the CPT has been conducted in the USA to our knowledge, although it would be predicted to be valid in any country in which cigarettes are sold akin to the USA. Second, the purchase task methodology is commodity specific (e.g. consumption of cigarettes, consumption of alcohol, etc.) but may also capture domain-general reward sensitivity (overall preferences about the value of consumable goods). In other words, responses on a CPT may index both general value-based preferences and cigarette-specific preferences, and it remains unclear as to what extent the previously observed associations reflect either of these possibilities. Sensitivity to natural rewards in experimental animals is linked to nicotine dependence vulnerability (Diergaarde et al. 2009) indicating that a similar relationship may be observed in human participants. Finally, although the construct of reinforcing efficacy is sometimes treated as unidimensional, the lack of agreement among measures suggests that is not the case (Bickel and Madden 1999; Bickel et al. 2000). Instead, it has been argued that a unitary construct of reinforcing efficacy should be replaced with indices of demand (Bickel et al. 2000), which reflect conceptually related but nonetheless independent measures of reinforcer value. The relationship between different metrics of demand and nicotine dependence was assessed in the present work.

We attempted to address each of these issues in the current experiments. In experiment 1, we sought to examine the relationship between cigarette demand and nicotine dependence in a sample of young adult smokers in the UK, aiming to demonstrate significant associations between cigarette demand and nicotine dependence, consistent with the US studies.

Method

General methods

Participants were recruited from the University of Nottingham and surrounding community. Participation involved individual assessment under quiet neutral conditions. Within each study, participants were remunerated for their time, typically at UK £5/h. Both studies received ethical approval from the University of Nottingham ethics committee, and participants provided signed consent before each study.

Participants

In study 1, a total of 287 participants enrolled. However, participants were only included in the present analysis if they were aged between 18 and 25 because of the relative small number of participants older than 25 and the very wide distribution of their age (n = 26), making that portion of the sample nonrepresentative. An additional 20 participants were excluded on the basis of their pattern of responses (see below). Thus, the final sample comprised 241 participants. Of these participants, 118 (49.0 %) were male and 123 (51.0 %) were female, while 114 (47.3) smoked 7 days per week and the remaining participants (52.7 %) smoked less than 7 days. One (11.2 % of the entire sample) or two (13.3 % of the entire sample) days smoking per week was most common in the latter group. Further details of the demographic characteristics of the participants can be found in Table 1.

Measures

The cigarette purchase task is an estimation task administered via pencil and paper. The following instructions are given: “Imagine a TYPICAL DAY during which you smoke. The following questions ask how many cigarettes you would consume if they cost various amounts of money. The available cigarettes are your typical brand. Assume that you have the same income/savings that you have now and NO ACCESS to any cigarettes or nicotine products other than those offered at these prices. In addition, assume that you would consume cigarettes that you request on that day; that is, you cannot save or stockpile cigarettes for a later date. One more thing: please pay close attention to the prices and costs per pack for each item because they change by different amounts”. The number of cigarettes that would be purchased was recorded at the following price intervals (per cigarette): 2p, 4p, 6p, 8p, 10p, 12p, 14p, 16p, 18p, 20p, 22p, 24p, 26p, 28p, 30p, 32p, 34p, 36p, 38p, 40p, 42p, 44p, 46p, 48p, 50p, 52p, 56p, 58p, 60p, 70p, 80p, 90p, £1, £1.50, £2, £2.50, £3, £4 and £5. Alongside these prices per cigarette, the relevant price per pack of 20 cigarettes was shown, ranging from 40 UK pence to UK £100 per pack.

The cigarette dependence scale (Cigarette Dependence Scale 5 (CDS-5)) (Etter et al. 2003) consists of five questions in which participants rated their level of tobacco addiction, cigarettes smoked per day, time to first cigarette in the morning, expected difficulty quitting and expected craving following a few hours of abstinence. The scales were scored on five-point scales with total scores varying between 5 and 25.

Data analysis

Of note, we excluded individuals where the demand curve could not be modelled, as they reported very low levels of demand (i.e. zero demand at the lowest prices) and had fewer data points than parameters to fit (four participants).With the exception of elasticity, we applied an “observed values” approach based on evidence of greater temporal reliability. Intensity was defined as (hypothetical) consumption at zero cost (y-axis intercept). Breakpoint was defined as the price that first achieves complete suppression of consumption. O max (i.e. output maximum) was defined as the value of peak expenditure and was determined directly from the participant’s responses rather than via the demand curve. P max was defined as the price at which maximum output (O max) was achieved. Elasticity was defined in terms of α and was derived through the following nonlinear equation:

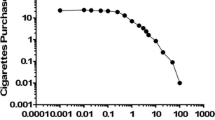

where Q = consumption at a given price, Q 0 = consumption intercept, k = a constant across individuals denoting the range of consumption values in log10 units (in this case, 3), C = cost (price) and α = the derived demand parameter reflecting the rate of decline of consumption in standardized price. This approach assesses relative decreases without undue influence of the commodity-specific units. The model provided a good fit for the data: participants had a mean R 2 (reflecting model fit) of 0.75 (S.D. = 0.18, interquartile range (IQR) = 0.66–0.87).

The demand curve indices were determined to be non-normally distributed and all variables were log-transformed. Then, outlier exclusion was used to compute Z scores and exclude individuals with an absolute Z score of greater than 3.29 on any of these variables (16 participants). Examination of the data distributions suggested that, despite log transformation and exclusions, the demand variables were leptokurtic; therefore, Spearman’s rho was used as the measure of association. However, as we wanted to examine the variables simultaneously, we employed robust regression (robustfit) implemented in MATLAB (The MathWorks, Inc., Natick, MA). A Huber distribution was used to downweight outliers, with the parameter set to 1.2. This combination was selected as it was most comparable to non-parametric analysis. The r statistic, reflecting the strength of association between variables, was computed from the robustfit t statistic output using the following method: \( r={t \left/ {{\left[ {{{{\left( {df + {t^2}} \right)}}^{0.5 }}} \right]}} \right.} \), where df is the degrees of freedom of the regression model. For multiple regression analyses, only t statistics are presented. The primary analyses focused on zero-order and regression-based associations between the CPT indices and nicotine dependence. Statistical significance was conventionally defined (p < 0.05).

Results

Statistics describing the key dependent variables obtained from the CPT are displayed in Table 1 (see also Fig. 1). These are broadly comparable with data from previous studies. Correlations between the dependent measures are displayed in Table 2. Consistent with previous studies, highly variable associations were observed between the metrics, ranging from no association (e.g. intensity and P max) to effectively colinearity (e.g. α and O max, and O max and P max). Statistically significant associations of medium to large magnitude were present between all CPT metrics and nicotine dependence (Table 2). Of the CPT metrics, the largest magnitude index was O max. Multiple (robust) regression analysis was performed with three CPT variables (O max, intensity, breakpoint). P max and α were excluded due to colinearity. O max significantly predicted variation in CDS5 (t = 5.82, p < 0.001). There were also weaker associations between CDS-5 and both intensity (t = 2.48, p = 0.014) and breakpoint (t = −2.01, p = 0.046).

Interim discussion

Our findings in experiment 1 were highly compatible with prior reports (MacKillop et al. 2008; Murphy et al. 2011), suggesting reliable cross-cultural validity, at least in the context of a similar industrialised first-world country with a shared first language. The similarity between our results and previous findings exists on several levels. First, the population means were similar to previous reports, as were the magnitude of the correlation coefficients between measures of nicotine dependence and all five of the metrics derived from the CPT. Notably, O max was the most effective predictor of variation in dependence, while the intercorrelations of the different CPT metrics were similar to a previous factor analysis (MacKillop et al. 2009). The degree of model fit was good, validating both our choice of model and the prices used. A final strength of these initial findings was that the observed relationships were present in a substantially larger sample size than previously studied.

Our focus then turned to addressing further empirical questions previously introduced. We developed a second purchase task to evaluate chocolate demand (ChocPT), an alternative consumable reinforcer, in order to evaluate both non-tobacco and tobacco-specific attributions of value (i.e. discriminant validity). First, we examined the association between nicotine dependence and chocolate demand and the correlation between metrics obtained by both the cigarette and chocolate demand tasks. In addition, we also examined the degree to which there was an interrelationship between estimates of value obtained using the demand task measures and tobacco preference using a concurrent choice procedure (Hogarth and Chase 2011, 2012). This procedure required the participant to select between two buttons, one of which lead to cigarette points and the other to chocolate points, each on a 50 % schedule. The validity of this measure as an index of the reward value of tobacco is supported by its sensitivity to smoking satiety, health warnings against smoking (Hogarth and Chase 2011) and nicotine replacement therapy (Hogarth 2012). This procedure was included to provide further evidence of the validity of the demand measure, in its ability to predict variation in choice preference on a very different task.

Method

Sample

We recruited a second sample (n = 157) from a similar population to that reported in experiment 1. Following exclusions (see below), 100 cases were analysed in this experiment. The same restriction of age (18–25 years) and the requirement of complete, valid data sets led to the exclusion of 57 participants (seven due to age and 50 due to incomplete data or outliers). Of these participants, 53 (53 %) were male and 47 (47 %) were female, while 50 (50 %) smoked every day (7 days per week) and the remaining participants (50 %) did not. One (10 % of the entire sample), two (13 % of the entire sample) or three (10 %) days smoking per week was the most common in the latter group. Further demographic variables are presented in Table 4.

Questionnaire variables

The questionnaire variables obtained were identical to those reported in experiment 1, with the addition of a questionnaire assessing chocolate demand. This was structured identically to that employed to measure cigarette demand, including the same range of prices as before. The questionnaire instructions were altered as follows: “Imagine a TYPICAL DAY during which you eat chocolate. The following questions ask how much chocolate you would eat if it cost various amounts of money. The available chocolate is Cadbury Dairy Milk or similar, available in bags of 20 bars. Assume that you have the same income/savings that you have now and NO ACCESS to any chocolate other than that offered at these prices. In addition, assume that you would consume the chocolate that you request on that day; that is, you cannot save or stockpile chocolate for a later date. One more thing: please pay close attention to the prices and costs per bar for each item because they change by different amounts”.

Concurrent choice task

A computerised concurrent choice task was administered, assessing the preference for cigarette and chocolate tokens. At the start of concurrent choice training, participants were presented with the following on-screen instructions: “This is a game in which you imagine winning up to 15 cigarettes and 15 chocolate bars. In each round, either ¼ of a cigarette or ¼ of a chocolate bar will be available, but you will not be told which. Choose either the D or H key in each round to try and win the reward. You will only win if you select the correct key. Good luck. Press the space bar to begin”. Participants were informed verbally at this stage that they would not keep the rewards they earned during the task. Each trial began with the centrally presented text, “Select a key”, which remained until the D or H key was pressed. A response on one key replaced this text with the outcome, “You win ¼ of a cigarette”, whereas a response on the other key produced the outcome, “You win ¼ of chocolate bar”. The key-outcome assignment was counterbalanced between participants. Only one outcome was scheduled to be available in each trial, such that each key had only a 50 % chance of yielding its respective outcome. On non-rewarded trials (in which the incorrect key was selected), the text “You win nothing” was presented. These three potential outcomes’ texts were presented for 2,000 ms, followed by a random inter-trial interval between 1,000 and 2,500 ms prior to the next trial. Earned outcomes were summed across trials, and at the end of each 12-trial block, a “totalizer” screen reported the quantity of each reward type earned. Where whole cigarettes or chocolate bars (Cadbury Dairy Milk Treatsize chocolate bars (15 g, 80 calories each)) had been earned, participants were instructed to move that many units from the loaded containers into “their” boxes present on the desk, such that the rewards were actually contacted. Any remainder of each reward type was added to the sum of the next block. The percent choice of the tobacco versus the chocolate key was recorded as the dependent measure.

Data analysis

A similar approach to data analysis was taken as experiment 1. We performed a log transformation on the CPT and ChocPT variables and conducted outlier detection and exclusion in a similar manner. For the CPT, 12 cases were excluded due to very low levels of demand (i.e. fewer data points than parameters to be estimated) and 15 cases were classified as outliers (Z > 3.29). For the ChocPT, the numbers were 20 and 7. Ten cases were missing concurrent choice data. In total, as some of these cases overlapped, 100 participants had complete CPT, ChocPT and concurrent choice preference data. For simplicity, analyses were restricted to this sample of 100 but similar results were obtained using all available data for the CPT and ChocPT.

As with experiment 1, we performed robust regression to test the significance of associations between variables. Similar variables were examined, including relationship between the five CPT metrics and nicotine dependence. In addition, we examined the effect of nicotine dependence on ChocPT metrics and also on the difference between CPT and ChocPT variables (CPT − ChocPT), and the relationship between these measures and preference assessed by the concurrent choice procedure. We also performed non-parametric analysis of the difference between absolute scores of the CPT and ChocPT metrics. Model fits for the CPT (R 2 = 0.79, S.D. = 0.15, IQR = 0.73–0.89) and ChocPT (R 2 = 0.79, S.D. = 0.16, IQR = 0.69–0.91) were comparable with previous studies (including experiment 1).

Results

Cigarette and chocolate demand in relation to nicotine dependence

Mean values and standard deviations of the dependent measures obtained from these are displayed in Table 3 (see also Fig. 2). These are very similar to those observed in experiment 1. Moreover, we observed a similar magnitude of associations between these measures and dependence (CDS-5, Table 4) and a similar pattern of correlations among the CPT indices (Table 4). A slight difference was that we observed a significant association between breakpoint and intensity, which was not observed in the first experiment. Multiple regression using the three CPT variables (O max, intensity, breakpoint) as before to predict variation in CDS-5 scores yielded similar results to experiment 1: O max was established as a significant predictor of CDS-5 (t = 5.49, p < 0.001), whereas other variables were not significant (p values > 0.5). Dependent measures arising from this metric are presented in Table 3. Associations among ChocPT metrics are displayed in Table 4. We observed a similar pattern of intercorrelations as what we have observed in the CPT, a negative correlation between intensity and P max notwithstanding. There were no significant associations between level of nicotine dependence measured by the CDS-5 and any of the measures obtained from the ChocPT.

Associations and difference between CPT and ChocPT

We examined the shared variance between the CPT and ChocPT, by finding the correlation coefficients between corresponding metrics from the two questionnaires. Breakpoint (r = 0.26, t = 2.56, p = 0.012) and elasticity (r = 0.23, t = 2.40, p = 0.018) reached significance, while no other indices were significantly correlated (all other p values > 0.1).

Using Wilcoxon signed-rank tests, we tested the significance of the difference in magnitude between the corresponding measures (n = 100 in all cases). O max derived from CPT was clearly greater than that derived from the ChocPT (Z = 3.74, p < 0.001) as was intensity (Z = 2.32, p = 0.020). On the other hand, alpha (Z = 2.32, p = 0.020) was smaller for the CPT than ChocPT, while breakpoint and P max were similar between the two measures (Z < 1 in both cases).

Finally, we examined whether computing a difference score for a given metric (CPT−ChocPT) would lead to larger correlation coefficients with dependence. The resulting correlation matrix was comparable to that obtained with the CPT task alone (Table 4).

Association of CPT/ChoPT metrics with concurrent choice data

We next evaluated the relationship between concurrent choice and CPT data, ChocPT data and difference scores (CPT−ChocPT, Table 5). As expected, there was a positive correlation between increases in cigarette demand, as measured by the CPT and preference for cigarettes over chocolate on the concurrent choice task. Correcting CPT measures with the corresponding ChocPT measure yielded similar associations with concurrent choice preference.

For all ChocPT-dependent measures other than elasticity (t < 1), we observed a significant effect of a given ChocPT metric if it was included with the corresponding CPT measure using multiple (robust) regression to predict variation in concurrent choice (t < −2.04, p < 0.044 in all four remaining cases). When this was done, all CPT metrics remained significant predictors of concurrent choice (t > 3.39, p < 0.002 in all five cases).

We also performed multiple regression analyses to determine the extent to which the CPT variables and concurrent choice preference explained overlapping variability in our measure of nicotine dependence (see Table 6). Any of the five CPT variables, combined with concurrent choice, continued to predict a significant amount of variance in nicotine dependence (CDS-5), as did concurrent choice itself. The combination of O max and concurrent choice predicted a very large proportion of variance in dependence.

Summary

In experiment 2, we observed similar CPT data to that obtained in experiment 1, replicating the associations between CPT and nicotine dependence. Most importantly, these associations did not generalise to a measure of chocolate demand (ChocPT). There were modest associations between CPT metrics and their corresponding ChocPT metrics. Removing this shared variance, by calculating CPT/ChocPT difference scores, did not improve associations with dependence. In addition, we observed significant associations between these difference scores and a measure of preference in an instrumental concurrent choice paradigm, demonstrating that two different measures of nicotine value provide compatible and complementary information.

General discussion

Across two experiments, we present further evidence that diverse indices of the incentive value of tobacco are significantly and substantially associated with nicotine dependence. These findings were present in a considerably larger sample than previous reports and in a non-US sample for the first time, supporting the cross-cultural validity of the measure (at least in industrialised countries). Moreover, the patterns of correlations, both between CPT metrics and dependence, and the intercorrelations among CPT variables were similar to previous studies (MacKillop et al. 2008; Murphy et al. 2011), even in different drug classes (MacKillop et al. 2010; Murphy et al. 2009). Moreover, the present experiments also extend considerably beyond these previous investigations, providing further evidence of the convergent, discriminant and incremental validity of these indices. In experiment 2, we employed a similar purchase task measuring demand for chocolate rather than cigarettes. We were able to use this measure to test the degree as to which dependence was associated with a general reward hypersensivity—a non-specific increase in demand across different types of reinforcer—which may represent a risk factor for addiction. Across two studies, Diergaarde and colleagues observed that rats predisposed to high nicotine reinforcement also exhibited enhanced responding for sucrose (Diergaarde et al. 2009), compared to rats showing a weaker predisposition. In the context of the present study, a general hypervaluation of reward in more severely dependent smokers might cause them to inflate ratings across a variety of measures, and while this might reveal a vulnerability to addiction, it would undermine the use of CPT as a specific metric for tobacco valuation. Alternatively, other artefactual or otherwise non-specific factors, such as the perceived value of money or the amount of time taken to consume the commodity, might obscure estimates of value and generalise across measures. On the other hand, dependence might also plausibly be associated with a reduction in the value of non-drug reinforcers: we have acknowledged this hypothesis as a possible interpretation of previous findings (Hogarth and Chase 2012), and there is already an empirical support for this view from other sources of evidence (e.g. Buhler et al. 2010).

While we observed a small amount of shared variance between tasks on the same metrics, suggesting that commodity-independent factors might influence such demand curve measures, there was no clear evidence for an increase or reduction in chocolate motivation in nicotine dependence. Subtracting ChocPT metrics from corresponding CPT metrics did not enhance the level of association with CDS-5 scores, over and above the CPT metrics alone. Together, these findings suggest that nicotine dependence is associated with a relatively selective enhancement for demand for cigarettes. Moreover, evidence for the presence of a meaningful reward sensitivity trait or a measurement artefact of some form which generalises across different commodities was modest at best. Intensity of demand for chocolate was significantly lower than that of cigarettes. In addition, demand was relatively elastic across the entire range of values and a greater alpha parameter was observed, signifying greater elasticity and perhaps reduced essential value (Hursh and Silberberg 2008). On the other hand, cigarette demand appeared to be highly inelastic at low levels, with a more rapid decline as price increased and approached the breakpoint. Despite the different shapes of the demand curves, breakpoint did not significantly differ overall, between the commodities and across all participants in experiment 2. These findings also provide further support for the use of purchase tasks in measuring motivation for foods, an area that has only recently begun to be explored (Epstein et al. 2010). The relationship between measures of chocolate demand and usual consumption of chocolate might be fruitfully explored in future work, particularly as smoking dependence may interact with food consumption patterns.

In experiment 2, we also reported associations between both CPT and ChocPT measures and the degree of preference for cigarette over chocolate points in a concurrent choice procedure we have previously investigated (Hogarth and Chase 2011, 2012). As expected, level of demand measured by the CPT (all metrics) was associated with increased preference for cigarettes over chocolate. In addition, for all metrics aside from elasticity, the concurrent inclusion of equivalent CPT and ChocPT metrics in a multiple regression model led to enhanced modelling of the residual variance, with increasing chocolate demand leading to increased preference for chocolate as well as increasing cigarette demand increasing cigarette preference. These findings provide further validation for the demand task measures, demonstrating that they reflect a construct likely related to the incentive value of the commodity that can be readily measured using very different procedures.

A prevailing contemporary view is that there are two distinct components to reinforcement efficacy, as measured by purchase tasks, based on evidence that interrelationships among indices of demand exhibit a two-factor latent structure (Bidwell et al. 2012; MacKillop et al. 2009), and consistent with theoretical models of progressive ratio task behaviour (e.g. Bradshaw and Killeen 2012; Hursh and Silberberg 2008). One factor, associated with intensity of demand, reflects volumetric consumption and may be related to the ability to regulate drug intake (Bickel et al. 2000). The other, reflected by breakpoint, relates to the sensitivity of increasing price and hence the persistence of responding in the face of increasing cost. Certain procedures can have relatively selective effects on these different variables: treatment with varenicline can increase elasticity of tobacco demand, reducing breakpoint, without affecting intensity of demand (McClure et al. 2012). Although the magnitudes of the intercorrelations between CPT metrics were often consistent with a two-factor model in the present study, associations between these putative factors were nevertheless present and dependence was consistently associated with all metrics. Indeed, the most robust predictor of dependence, O max, reflects variance in both factors (MacKillop et al. 2009). Further individual variation in dependence could be explained by a combination of O max and concurrent choice. Consequently, although the number of metrics available affords a more detailed account of the properties of tobacco demand, our data suggest that all of these, to a greater or lesser extent, are relevant for explaining variation in dependence. This conclusion extends previous claims regarding specific interrelationships between demand variables and operant drug seeking (Bickel and Madden 1999; Bickel et al. 2000) and implies that treatment may benefit from an approach tailored to an individual’s behavioural economic profile, particularly if certain treatments can have selective effects on different parameters (McClure et al. 2012). Further clarification and validation of the multidimensional construct of reinforcing efficacy will have major implications for the diversity of fields that invoke operant theory and methods.

We recognise several limitations of the study that bear consideration. First, the current data are cross-sectional and thus cannot address the causality dimension of a behavioural economic account. As such, it is not possible to establish whether high incentive value of tobacco is an etiological factor, with a key causal role in the development and maintenance of tobacco dependence. There is evidence that behavioural economic measures of alcohol-related incentive value are indeed robust predictors of treatment response and disorder course (MacKillop and Murphy 2007; Tucker et al. 2002, 2006). Moreover, drug value has been shown to be a prospective marker for subsequent dependence (O'Loughlin et al. 2003) and drug exposure has been shown to augment drug value (Christensen et al. 2008). Thus, individual differences in nicotine dependence may arise from vulnerability to a feed-forward relationship, wherein an initial nicotine preferences leads to nicotine exposure which in turn enhances nicotine preference.

The second limitation of the current study is that the cigarette and chocolate task data required that a number of participants had to be excluded for extreme or inconsistent responding. This is a challenge when using an open response measure, but identifying strategies for reducing extreme or low effort performance is a priority for future studies. Finally, income was not assessed and could not be incorporated into the analyses. Here, this is potentially an issue because existing economic resources could systematically influence value preferences. However, we have not observed a substantial role for income previously: associations have typically been non-significant or of small magnitude (e.g. MacKillop et al. 2008; Murphy and Mackillop 2011).

Summary

Taken together, the goals of the current study were to establish the validity of CPT-based measures of tobacco demand in a novel population and then experimentally isolate the extent to which the demand indices were associated with nicotine dependence. Robust replication of previous findings was established. The relationship between demand indices and nicotine dependence was determined to be commodity specificity via a ChocPT. Finally, the demand indices were demonstrated to be related to a concurrent choice measure of value, and both measures were found to be substantially and not redundantly associated with nicotine dependence. These findings provide further support for the relevance of behavioural economic indices of value to nicotine dependence and suggest the need for longitudinal investigations into its putatively causal role.

References

Amlung MT, Acker J, Stojek MK, Murphy JG, MacKillop J (2012) Is talk “cheap”? An initial investigation of the equivalence of alcohol purchase task performance for hypothetical and actual rewards. Alcohol Clin Exp Res 36:716–724

Bickel WK, Madden GJ (1999) A comparison of measures of relative reinforcing efficacy and behavioral economics: cigarettes and money in smokers. Behav Pharmacol 10:627–637

Bickel WK, Marsch LA, Carroll ME (2000) Deconstructing relative reinforcing efficacy and situating the measures of pharmacological reinforcement with behavioral economics: a theoretical proposal. Psychopharmacology (Berl) 153:44–56

Bidwell LC, MacKillop J, Murphy JG, Tidey JW, Colby SM (2012) Latent factor structure of a behavioral economic cigarette demand curve in adolescent smokers. Addict Behav 37:1257–1263

Bradshaw CM, Killeen PR (2012) A theory of behaviour on progressive ratio schedules, with applications in behavioural pharmacology. Psychopharmacology (Berl) 222:549–564

Buhler M, Vollstadt-Klein S, Kobiella A, Budde H, Reed LJ, Braus DF, Buchel C, Smolka MN (2010) Nicotine dependence is characterized by disordered reward processing in a network driving motivation. Biol Psychiatry 67:745–752

Christensen CJ, Silberberg A, Hursh SR, Roma PG, Riley AL (2008) Demand for cocaine and food over time. Pharmacol Biochem Behav 91:209–216

Diergaarde L, Pattij T, Nawijn L, Schoffelmeer AN, De Vries TJ (2009) Trait impulsivity predicts escalation of sucrose seeking and hypersensitivity to sucrose-associated stimuli. Behav Neurosci 123:794–803

Epstein LH, Dearing KK, Roba LG (2010) A questionnaire approach to measuring the relative reinforcing efficacy of snack foods. Eat Behav 11:67–73

Etter JF, Le Houezec J, Perneger TV (2003) A self-administered questionnaire to measure dependence on cigarettes: the cigarette dependence scale. Neuropsychopharmacology 28:359–370

Few LR, Acker JE, Murphy CM, MacKillop J (2012) Temporal stability of a cigarette purchase task. Nicotine Tob Res 14(6):761–765

Hogarth L (2012) Goal-directed and transfer-cue-elicited drug-seeking are dissociated by pharmacotherapy: evidence for independent additive controllers. J Exp Psychol Anim Behav Process 38:266–278

Hogarth L, Chase HW (2011) Parallel goal-directed and habitual control of human drug-seeking: implications for dependence vulnerability. J Exp Psychol Anim Behav Process 37:261–276

Hogarth L, Chase HW (2012) Evaluating psychological markers for human nicotine dependence: tobacco choice, extinction, and Pavlovian-to-instrumental transfer. Exp Clin Psychopharmacol 20:213–224

Hursh SR, Galuska CM, Winger G, Woods JH (2005) The economics of drug abuse: a quantitative assessment of drug demand. Mol Interv 5(1):20–8

Hursh SR, Silberberg A (2008) Economic demand and essential value. Psychol Rev 115:186–198

Jacobs EA, Bickel WK (1999) Modeling drug consumption in the clinic using simulation procedures: demand for heroin and cigarettes in opioid-dependent outpatients. Exp Clin Psychopharmacol 7:412–426

MacKillop J (2006) Factor structure of the alcohol urge questionnaire under neutral conditions and during a cue-elicited urge state. Alcohol Clin Exp Res 30:1315–1321

MacKillop J, Murphy JG (2007) A behavioral economic measure of demand for alcohol predicts brief intervention outcomes. Drug Alcohol Depend 89:227–233

MacKillop J, Tidey JW (2011) Cigarette demand and delayed reward discounting in nicotine-dependent individuals with schizophrenia and controls: an initial study. Psychopharmacology (Berl) 216:91–99

MacKillop J, Murphy JG, Ray LA, Eisenberg DT, Lisman SA, Lum JK, Wilson DS (2008) Further validation of a cigarette purchase task for assessing the relative reinforcing efficacy of nicotine in college smokers. Exp Clin Psychopharmacol 16:57–65

MacKillop J, Murphy JG, Tidey JW, Kahler CW, Ray LA, Bickel WK (2009) Latent structure of facets of alcohol reinforcement from a behavioral economic demand curve. Psychopharmacology (Berl) 203:33–40

MacKillop J, Miranda R Jr, Monti PM, Ray LA, Murphy JG, Rohsenow DJ, McGeary JE, Swift RM, Tidey JW, Gwaltney CJ (2010) Alcohol demand, delayed reward discounting, and craving in relation to drinking and alcohol use disorders. J Abnorm Psychol 119:106–114

McClure EA, Vandrey RG, Johnson MW, Stitzer ML (2012) Effects of varenicline on abstinence and smoking reward following a programmed lapse. Nicotine Tob Res. doi:10.1093/ntr/nts101

Murphy JG, MacKillop J (2006) Relative reinforcing efficacy of alcohol among college student drinkers. Exp Clin Psychopharmacol 14:219–227

Murphy CM, Mackillop J (2011) Factor structure validation of the Alcohol Dependence Scale in a heavy drinking college sample. J Psychopathol Behav Assess 33:523–530

Murphy JG, MacKillop J, Skidmore JR, Pederson AA (2009) Reliability and validity of a demand curve measure of alcohol reinforcement. Exp Clin Psychopharmacol 17:396–404

Murphy JG, MacKillop J, Tidey JW, Brazil LA, Colby SM (2011) Validity of a demand curve measure of nicotine reinforcement with adolescent smokers. Drug Alcohol Depend 113:207–214

Murphy JG, MacKillop J, Vuchinich R, Tucker J (2012) Behavioral economic concepts in the analysis of substance abuse. In: Walters S, Morgenstern J, Rotgers F (eds) Treating substance abuse, theory and technique. Guilford Press, New York

O'Loughlin J, DiFranza J, Tyndale RF, Meshefedjian G, McMillan-Davey E, Clarke PB, Hanley J, Paradis G (2003) Nicotine-dependence symptoms are associated with smoking frequency in adolescents. Am J Prev Med 25:219–225

Tucker JA, Vuchinich RE, Rippens PD (2002) Predicting natural resolution of alcohol-related problems: a prospective behavioral economic analysis. Exp Clin Psychopharmacol 10:248–257

Tucker JA, Vuchinich RE, Black BC, Rippens PD (2006) Significance of a behavioral economic index of reward value in predicting drinking problem resolution. J Consult Clin Psychol 74:317–326

Acknowledgments

This work was supported by a Medical Research Council grant G0701456 and NIH grant K23 AA016936.

Conflict of interest

The authors declare that they have no conflicts of interest.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Chase, H.W., MacKillop, J. & Hogarth, L. Isolating behavioural economic indices of demand in relation to nicotine dependence. Psychopharmacology 226, 371–380 (2013). https://doi.org/10.1007/s00213-012-2911-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00213-012-2911-x