Abstract

Rationale

Intertemporal choice has provided important insights into understanding addiction, predicted drug-dependence status, and outcomes of treatment interventions. However, such analyses have largely been based on the choice of a single commodity available either immediately or later (e.g., money now vs. money later). In real life, important choices for those with addiction depend on making decisions across commodities, such as between drug and non-drug reinforcers. To date, no published study has systematically evaluated intertemporal choice using all combinations of a drug and a non-drug commodity.

Objectives

In this study, we examine the interaction between intertemporal choice and commodity type in the decision-making process of cocaine-dependent individuals.

Methods

This study of 47 treatment-seeking cocaine addicts analyzes intertemporal choices of two commodities (equated amounts of cocaine and money), specifically between cocaine now vs. cocaine later (C-C), money now vs. money later (M-M), cocaine now vs. money later (C-M), and money now vs. cocaine later (M-C).

Results

Cocaine addicts discounted significantly more in the C-C condition than in M-M (P = 0.032), consistent with previous reports. Importantly, the two cross-commodity discounting conditions produced different results. Discounting in C-M was intermediate to the C-C and M-M rates, while the greatest degree of discounting occurred in M-C.

Conclusions

These data indicate that the menu of commodities offered alter discounting rates in intertemporal choice and that the greatest rate is obtained when the drug is the later available commodity. Implications for understanding intertemporal choices and addiction are addressed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Understanding the addicted individual’s valuation of drugs as compared with other commodities is an important objective. To understand the valuation process of those with addiction requires an understanding not only of the choice of drug but also how that choice interacts with other real-world options consisting of different rewarding commodities delivered after varying delays. One method to measure that valuation of drug versus other commodities would be with the discounting of delayed reinforcers.

The discounting of delayed reinforcers, an economics concept referring to the decrease in behavioral effects of a reinforcer as a function of the delay to its receipt (Logue 1988), has been frequently studied in addiction research (Bickel and Marsch 2001). For example, excessive discounting relative to controls has been demonstrated among alcoholic-dependent individuals (Bjork et al. 2004; Dom et al. 2006; Mitchell et al. 2006; Petry 2001), cocaine-dependent individuals (Coffey et al. 2003; Heil et al. 2006; Kirby and Petry 2004), methamphetamine-dependent individuals (Hoffman et al. 2006), the obese (Weller et al. 2008), opioid-dependent individuals (Madden et al. 1997; Kirby et al. 1999), pathological gamblers (Petry 2001), and tobacco smokers (Baker et al. 2003; Bickel et al. 1999; Mitchell 1999; Odum et al. 2002). These results suggest that abnormally high rates of discounting may function as a trans-disease process (Bickel and Mueller 2009).

Studies that have examined the valuation of drugs of dependence (now vs. later) in addition to the discounting of money typically observe that the drug of dependence is discounted considerably more than money even when the amount of drug selected is equivalent to the ascribed money value (Madden et al. 1999). These results are in contrast to standard economics theory. Standard economic specifies that all commodities are evaluated in terms of a common currency (Glimcher 2008), that is, they are translated on to the same dimension of valuations. This view suggests that all commodities should discount at the same rate once they have been translated into the common currency. This belief is inconsistent with the observation that drugs tend to be discounted at a steeper rate than money and may reflect the difference between a consumable and non-consumable reinforcer. This explanation is supported by two studies in normal adults that found that a consumable item (food) was discounted more than an equally valued monetary amount (Estle et al. 2007; Odum and Baumann 2007).

Discounting studies have been almost exclusively conducted with the same reinforcer available both now and later. We will refer to this as single-commodity discounting (SCD). However, most choices in life are more complex and entail choosing between different commodities (e.g., smoke now vs. health later). Unfortunately, little is known about discounting when choices are made across different commodities, which we will refer to as cross-commodity discounting (CCD). Only two published studies, both looking at smokers, have examined CCD, and they used only a limited set of the possible conditions.

Both of these studies employed the SCD of money and the CCD of cigarettes now and money later. In the first study (Mitchell 2004), smokers completed the discounting procedures following normal smoking and after 24 h of cigarette abstinence. Note that the values of cigarettes and money were equated. The deprivation condition resulted in no effect on single-commodity (money vs. money) discounting but did increase frequency of selection of cigarettes when it was available before a delayed amount of money in the CCD procedure. This result could be interpreted to indicate that the immediate drug was of more value than the later monetary amount and therefore consistent with the SCD procedures where drug vs. drug choices were discounted to a greater extent than money vs. money choices (Bickel et al. 1999; Madden et al. 1997). However, this study did not look at cigarettes with a SCD procedure (i.e., cigarettes now vs. cigarettes later). Thus, we do not know if the level of discounting in the CCD comparison was the same for cigarettes when it was the only commodity available or if the discounting rate in the CCD procedures was either intermediate to or greater than the discounting rate in the cigarette SCD and money SCD procedures. The second study examined two groups; in one, participants abstained from cigarettes for 1 day, and in the other, participants abstained from cigarettes for 14 days (Yoon et al. 2009). Yoon et al. found that monetary delay-discounting (SCD) did not show any changes from baseline or between groups. However, they found that, when the CCD was implemented at the 7- and 14-day points of the 14-day abstinence condition, participants in the 14-day group selected the immediate cigarettes less frequently and selected the later monetary amount more frequently. These CCD results were also predictive of choices in a laboratory setting where actual cigarettes or real monetary amounts were concurrently available. SCD of cigarettes was not examined in this study. Collectively, these two studies may suggest that CCD is more sensitive to the manipulated variables than SCD of monetary outcomes. Unfortunately, to date, no study has examined delay-discounting of two commodities under the full range of conditions available with both SCD and CCD methods. This study design would allow testing to determine whether the type of the delayed commodity influences the discounting rate, and whether the steeper discounting rate of drug–drug versus money–money choices can be accounted for by a change in either the immediate or delayed commodity alone.

Here, we report on a study we conducted to address that gap in the field by examining delay-discounting among cocaine-dependent subjects of two commodities under the full range of SCD (cocaine now vs. cocaine later and money now vs. money later) and CCD (cocaine now vs. money later and money now vs. cocaine later) conditions. Specifically, we will examine whether: (1) hyperbolic curves well-describe CCD data; (2) changing the delayed commodity (e.g., from money to drug) while holding the immediate commodity constant alters discounting; (3) discounting differs between the CCD conditions (e.g., money now vs. drug later and drug now vs. money later), (4) the effects of changing the immediate commodity and the effects of changing the delayed commodity interact; and (5) the discount rate for one condition provides information about a person’s average discounting across other conditions.

Methods

Participants

The data in this study were taken from a subset in a larger study of novel treatment for cocaine and methamphetamine use. We selected the participants who met DSM-IV criteria for cocaine dependence and indicated that cocaine was their drug of choice (41 male, six female). Exclusion criteria for the present study included age less than 18 years old, psychiatric disorders that interfered with informed consent, proximate plans to move from the region, or pregnancy. Individuals whose primary drug of dependence was methamphetamine were not included in this analysis. The participants reported here were 42.9 years old on average (SD = 8.8), with a median education of 12 years (interquartile range (IQR), 12–14) and median annual income of $7,000 (IQR, $500–$15,000). African Americans comprised 74% of the sample, and whites, the remainder. The sample was composed of 47% single participants, 26% divorced, 19% married, and 8% legally separated.

Delay-discounting procedure

Participant responses to delay-discounting measures were recorded during the first session of the overall study, prior to any treatment intervention. Participants completed the delay measures as part of a series of other assessments. In this analysis, we compare only the data from the two SCD and the two CCD measures that were collected at that time. Delay-discounting measures were presented using a computer program similar to that in previous studies of delay-discounting (Johnson and Bickel 2002) with the addition of a cross-commodity condition. All measures used hypothetical amounts of money or hypothetical amounts of cocaine. Prior to starting the discounting procedure, participants were asked to give their estimate of what number of grams of cocaine or methamphetamine would be worth $1,000 to them. The question presented to them was similar to the following example:

What is your primary stimulant of choice? (circle a choice below) cocaine (powdered or crack) or methamphetamine

I want you to imagine that you have a choice of receiving some money and receiving a certain amount of your stimulant of choice. In the following question, fill in the amount of your stimulant of choice (in grams) that would make the two choices equally attractive to you.

Receiving $1,000 right now would be just as attractive as receiving ___________________ grams of ___________________.

Only data collected from participants who selected cocaine as their preferred stimulant were used in this study. For each delay-discounting measure that included cocaine, the estimated equivalent $1,000 value of cocaine for each participant was entered into the discounting program. Next, each participant completed four delay-discounting measures in a counterbalanced order: money now versus money later (M-M), cocaine now versus cocaine later (C-C), cocaine now versus money later (C-M), and money now versus cocaine later (M-C).

Each discounting task consisted of a series of trials where participants chose between an amount of the commodity available immediately and an amount of the commodity available after a hypothetical delay. Trials in the SCD conditions (M-M and C-C) were presented in a format identical to previous studies of discounting: money and drugs (Madden et al. 1999). The novel CCD (C-M and M-C) conditions looked similar to the following example:

C-M example: Would you rather have _________ grams of cocaine now or $1,000 after a 6-month delay?

M-C example: Would you rather have $500 now or _________ grams of cocaine after a 6-month delay?

The initial amount offered for the immediate choice was 50% of the undiscounted value; the delayed amount was always the undiscounted amount. For example, if a participant completing a C-C measure indicated that $1,000 was subjectively worth 50 g of cocaine, the immediate amount of cocaine offered initially was 25 g in each trial while the amount of cocaine offered after a delay was always the undiscounted amount of 50 g. For conditions with money, the immediate value was initially set at $500 and the delayed value was fixed at $1,000.

The discounting measures employed a decreasing adjusting amount paradigm (Du et al. 2002) to determine the values offered in each successive trial. When the participants chose one of the two options, the immediate amount offered in the next trial was adjusted by +/− 50% of the current offer. If the participant chose the immediate amount, the immediate amount decreased by 50%; if s/he chose the delayed amount, the immediate offer increased by 50%. Participants made the choice between immediate and delayed amounts six times for each of the seven delays (1 day, 1 week, 1 month, 6 months, 1 year, 5 years, and 25 years). The sixth choice for each delay was used as the estimated indifference point, or the value at which the participant would be indifferent between immediate and delayed option. Thus, the estimated preference for each delayed commodity ranged between 0.8% and 100.08% of the undiscounted amount, describing those who always chose the immediate to those who always chose the delayed option, respectively. The discount rate for each measure was then calculated using these seven indifference points.

Data analysis

Using Mazur’s (1987) hyperbolic model (Eqs. 1a and 1b),

we estimated ln(k)—the discount rate k normalized with the natural logarithm transformation—with nonlinear regression of the seven indifference points, Y, on their corresponding delays, D for each discounting task completed. From each regression we also obtained the regression root mean square error (RMSE), an estimate of the standard deviation of Y given the model. Analyses were performed on the ln(k) estimates and RMSEs.

Standard economic theory states the value of the delayed option decreases by constant proportion over time, that is, discounting should follow an exponential decay model,

where k is the discount rate of the reward delayed by D days. In behavioral economics, the hyperbolic model (Eqs. 1a, 1b) has been found to better fit SCD data than the exponential model (Eq. 2) on numerous occasions (e.g., Madden et al. 1999; Kirby 1997; Green and Myerson 1996); and there have been no refutations to these findings to our knowledge. However, no studies to date have considered whether CCD data are better fit by the economic–theoretic exponential model or the empirically validated hyperbolic model. Hence, for both the CCD and SCD data types, we compared the RMSEs of Eqs. 1a, 1b, and 2 with a sign test. To resolve whether CCD data are orderly compared with SCD data, we compared the RMSEs from CCD conditions to those from SCD conditions using a signed-rank test. The precision with which an ln(k) is estimated varies by individual and condition. Since some ln(k)’s are known considerably less precisely than others, we needed to account for the heterogeneity of variance among the ln(k)’s. Weighting the ln(k) data with a function of their precision as recommended for discounting data in Landes et al. (2010), we compared means among the different discounting conditions. The four conditions under study can be framed in a 2 × 2 factorial framework (see Table 1), permitting a test of whether (a) discount rates change when altering the immediate commodity while holding the delayed commodity constant, (b) discount rates change when altering the delayed commodity while holding the immediate commodity constant, or (c) whether the alteration in (a) or (b) depends on the constant commodity. These three effects provide valuable insight into both the commodity types (money and cocaine) and times to obtaining the commodity (immediate and delayed). In addition, comparisons between the SCD conditions replicate previous findings and comparisons between CCD conditions are novel to this study. The two factors in the analysis of variance were both within-individual factors. We accounted for the repeated measures correlation using a general covariance structure and estimated the error degrees of freedom with the Kenward-Roger method as recommended in Littell et al. (2006). Type 1 error rates were controlled with Tukey’s honestly significant differences (HSD) method or Holm’s step-down method.

We used correlations to describe the relationships of the four discounting conditions among themselves and with demographics. To learn whether knowledge of one discounting rate informs knowledge of averaged discounting rates for the other commodities, we correlated the discounting rate from one condition (e.g., M-M) with the average discounting rate from the remaining conditions (e.g., C-C, C-M, and M-C).

Results

Hyperbolic and orderly discounting data

Comparing the RMSEs from fits of the hyperbolic (Eq. 1) and exponential (Eq. 2) models, the hyperbolic model better fit 76% of the 94 SCD datasets (35 of 47 from C-C combined with 36 of 47 from M-M; sign test, P < .001) and 79% of the 90 CCD datasets (30 of 45 for C-M combined with 41 of 45 for M-C; sign test, P < .001)Footnote 1. The former result has been observed elsewhere as previously noted; whereas the latter indicates for the first time that the hyperbolic model is more appropriate for describing CCD data than the exponential model (the economic-theoretic discounting model). Henceforth, we report results from the hyperbolic model.

Examining the RMSEs from the hyperbolic model fits gives insight into whether discounting data are orderly, i.e., low in variability. The results of Friedman’s test, which accounts for the related nature of the four RMSEs coming from an individual, provided strong evidence that the distributions of RMSEs were different among the four discounting conditions (χ 2[df=3] = 12.695, P = 0.005). The pairs of RMSE distributions formed from conditions having the same delayed commodity (C-C vs. M-C, and M-M vs. C-M) were more similar than other possible pairings. Delayed cocaine conditions tended to be more orderly (i.e., have less variability) than the delayed money conditions, but this may be due to the fact that indifference points are closer to zero when the delayed commodity is cocaine. Discounting data from the M-C condition were more orderly than C-C data from the same individual (signed-rank test, P = 0.049), and though M-M distributions were estimated to be more orderly than C-M data, the distributions were not significantly different (signed-rank test, P = 0.335).

Effects of immediate and delayed commodities on discounting rate

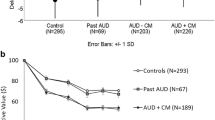

Figure 1 contains the mean ln(k) and back-transformed mean k for each discounting condition. The main effect of switching the immediate commodity from money to cocaine was a decrease in the mean ln(k) by 0.40 [95% CI (−0.22, 1.02)], but this was not significant (t [df=180] = 1.27, P = 0.205). On the other hand, the main effect of the delayed commodity changing from money to cocaine was a significant increase in the mean ln(k) by 1.82 [95% CI (1.04, 2.60), t [df=180] = 4.59, P < 0.001]. There was evidence, however, that the difference found between the two delayed commodities depended on the immediate commodity (immediate-by-delayed interaction, t [df=180] = 2.08, P =0.039). The nature of the interaction was that the discounting increase from delayed money to cocaine realized for immediate money [2.65, HSD-adjusted 95% CI (1.18, 4.11)] was significantly greater than the analogous increase realized for immediate cocaine [0.99, HSD-adjusted 95% CI (−0.46, 2.44)]. It is important to note that (1) the direction of discounting change between delayed money and cocaine was consistent for the two immediate commodities and (2) the differences were substantial. These two points give some validity to the interpretation of the “main effect” of delayed commodities reported above.

Mean ln(k) (a) and k (b), along with their standard errors are plotted for each discounting condition. Dashed horizontal lines indicate comparable points between the two graphs. M-M is money–money discounting, C-M is cocaine–money discounting, C-C is cocaine–cocaine discounting, and M-C is money–cocaine discounting

From the same analysis above, the mean ln(k) of C-C discounting was 1.42 [HSD-adjusted 95% CI (0.09, 2.75)] more than that of M-M discounting (t [df=180] = 2.76, adjusted P = 0.032). For the novel CCD comparison, we also found the mean ln(k) of M-C discounting to be 2.22 [HSD-adjusted 95% CI (0.92, 3.52)] more than that of C-M discounting (t [df=180] = 4.44, adjusted P < 0.001).

We note that participants were not required or even encouraged to be abstinent from stimulants at the first session. We compared mean discounting rates between those who were abstinent (n = 19) and those who were positive for either amphetamines or cocaine (n = 28). No difference was found between the two naturally selected groups of participants (F[1,176] = 0.83, P = 0.365); nor was there evidence that differences found among the four types of discounting (F[3,176] = 8.06, P < .001) depended on the participant group (interaction: F[3,176]=0.71, P = 0.544).

Correlation analyses of discounting rates

Correlating the ln(k)s obtained from the four discounting conditions found all six pairs of correlations to be statistically significant, even after adjusting for multiple tests with Holm’s step-down method (maximum P = 0.028). See Table 2 for the correlations.

Correlations of an ln(k) from one discounting condition with the mean of the ln(k)s from the remaining three conditions were all greater than 0.50 (see Fig. 2). Discounting rates from C-M condition best correlated with the mean of the other three conditions with r = 0.645 (P < 0.001); M-M was close behind with r = 0.624 (P < .001); the correlations associated with C-C and M-C were, respectively, 0.558 (P < 0.001) and 0.506 (P < 0.001).

Scatterplots of ln(k) from one condition plotted against the mean of the ln(k)s from the other three conditions. a ln(k) from C-C against mean ln(k) from C-M, M-C, and M-M; b ln(k) from M-M against mean ln(k) from C-C, C-M, and M-C; c ln(k) from C-M against mean ln(k) from C-C, M-C, and M-M; d ln(k) from M-C against mean ln(k) from C-C, C-M, and M-M

In terms of the amount of cocaine equivalent to $1,000 (i.e., cocaine equivalence), those who put a higher price on cocaine than others in the sample tended to also devalue delayed cocaine at a higher rates when money was available immediately: correlation of M-C ln(k) and cocaine equivalence r = −0.382 (P = 0.038). Discounting rates for the other three discounting conditions did not significantly correlate with cocaine equivalence (Table 3, P values adjusted for four tests). The demographic variables age, annual income, and years of education were not significantly correlated with any of the ln(k)s from the four discounting conditions (Table 3), though the −0.347 correlation of income and M-M ln(k) approached significance (P = 0.067).

Discussion

These data from the present study found that the type of commodity and its temporal location alters intertemporal choices with the greatest rate of discounting obtained when the drug is the later available commodity. Additionally, we found that (1) hyperbolic curves well-described CCD data; (2) changing the delayed commodity (e.g., from money to drug) while holding the immediate commodity constant altered discounting; (3) discounting differed between the CCD conditions (e.g., money now vs. drug later and drug now vs. money later), (4) there was an interaction between the effects of changing the immediate commodity and the effects of changing the delayed commodity; and (5) knowing the discount rate for one condition provided information about a person’s average discounting across other conditions. The interaction between effects of immediate and delayed commodities points to the importance of framing effects in drug-related choices, with significant implications for understanding the addiction process. Below, we address several points about our findings.

First, by finding that C-C discounting rates were higher than M-M, we systematically replicate previous findings (Coffey et al. 2003). Next we found that M-C discounting rates were steeper than single-commodity (C-C and M-M) rates and were also steeper than those rates observed in the other cross-commodity (C-M) measure. Cocaine now versus money later (C-M) discounting rates were in between the two SCD rates, but were not significantly different from either. Implications for understanding the observed behaviors will be addressed.

First, discounting rates from CCD conditions were positively and significantly correlated with those from SCD conditions, indicating that steep discounters in SCD conditions also tend to steeply discount in CCD conditions (Table 2). Furthermore, we found that knowing only one discounting rate from any of the conditions studied provides insight into whether an individual tends to discount other conditions steeply or not (Fig. 2). This latter finding supports the idea that a person who discounts one valued commodity steeply (alternatively, slower) will tend to discount other valued commodities steeply (slower). Hence, if a person can slow the way he or she discounts one commodity as the result of an intervention (e.g., Bickel et al. 2011), he or she may begin to discount other valued commodities at a slower rate.

Second, these findings have implications for drug treatment programs. We showed that a delayed drug is discounted more than when the drug is immediately available, no matter what the other option is. In other words, drug users are less likely to use drugs when the choice to use is presented only as a future outcome rather than an immediately available one. Thus, for treatment programs for which abstinence is reinforced immediately and drug consumption is available only after a delay, the incentive to abstain may outweigh future drug consumption. This finding may explain the relatively high rate of success in incentive-based treatment programs like contingency management (Bickel et al. 1997; Budney et al. 2003; Chopra et al. 2009; Higgins et al. 1994). Abstinence-based contingency management treatment programs provide small rewards in the form of vouchers for immediate and continuous abstinence (Higgins et al. 1994). These small rewards increase with each negative drug screen and provide immediate reinforcers to promote abstinence.

Before, we consider the implications of this study, we wish to make clear its weaknesses. First, the study comprised only treatment-seeking participants. They may value cocaine differently than cocaine-dependent individuals who are not seeking treatment. Also, consistent with the epidemiology of drug dependence our sample was predominately male. Unfortunately, the number of females is too small to have sufficient power to examine male–female differences and therefore such a comparison will wait additional studies. Lastly, this study used only hypothetical rewards. However, given that direct comparison of real and hypothetical rewards have shown no differences in discounting behavior or brain activity (Baker et al. 2003; Bickel et al. 2009; Johnson and Bickel 2002) and that hypothetical discounting has been shown to predict real economic behavior (Bickel et al. 2010), there is little empirical reason to question these results. However, only continued systematic replication will establish whether the lack of difference between real and hypothetical rewards discounting are ubiquitous.

Implications for understanding decision making and addiction

Standard models of decision making suggest that when multiple choices are available, a value is calculated for each choice, and these values are compared with select the best option (e.g., Glimcher 2010; Kable and Glimcher 2009). An objective reward magnitude (e.g., 10 g of cocaine, $500) is first transformed into a subjective value through a utility function. Utility functions are usually assumed to be concave, that is, the extra benefit of increasing a reward magnitude by a fixed amount decreases as the reward grows larger (e.g., Bernoulli 1954; Kahneman and Tversky 1979). After transformation by the utility function, the subjective value is then discounted by the expected delay to reward receipt. This notion of calculating a value through utility transformation and temporal discounting can be formalized as V = u(A) · disc(D), where A is the objective reward magnitude, D is the expected delay, u is the utility function, disc is the discount function, and V is calculated value of the choice. The values of multiple choices can then be quantitatively compared: if u 1(A 1) · disc 1(D 1) > u 2(A 2) · disc 2(D 2), then option 1 is preferred over option 2. This formulation permits each commodity to have a unique utility function and a unique discount function.

If this type of valuation process is used to make decisions in a behavioral task such as the one examined in this paper, then the measured discount rate would be a consequence of both the utility function of the immediate commodity and the actual discount function of the delayed commodity. As the actual discount function for the delayed commodity becomes faster, the measured discount rate would also become faster. Changing the discount function of the immediate commodity would not affect the apparent discount rate. As the utility function of the immediate commodity becomes more concave, it would take relatively more of the smaller–sooner reward to match the larger–later reward’s subjective value when the larger–later reward is less discounted. Thus, as the utility function of the immediate commodity becomes more concave, the effect of delay would be exaggerated and discounting would appear faster. Changing the utility function of the delayed commodity would not affect the apparent discount rate.

This decision-making framework makes explicit predictions for subjects’ behavior in the cross-commodity discounting task reported above. If cocaine and money have the same utility function and the same discount function, then each of the four CCD conditions would have equal apparent discount rates (Fig. 3a). This is not compatible with the present data (cf. Fig. 1b).

Patterns of apparent discounting predicted by different utility functions or different discount functions for cocaine versus money. a Cocaine and money have the same utility function and the same discount function. b Cocaine and money have the same utility function but cocaine has a faster discount function. When cocaine is the delayed commodity, the apparent discount rate is faster. c Cocaine has a more concave utility function than money but the same discount function as money. When cocaine is the immediate commodity, the apparent discount rate is faster. d Cocaine has a more concave utility function and a faster discount function than money. C-M and M-C are faster than M-M, while C-C is the fastest. e Cocaine has a less concave utility function and a faster discount function than money. M-C is faster than C-C by a greater degree than M-M is faster than C-M

If cocaine and money have the same utility function but cocaine has a faster discount rate, then when cocaine is the delayed commodity, discounting would appear faster than when money is the delayed commodity (Fig. 3b). The idea that drugs have a faster discount function than money has been suggested previously based on SCD studies where drug–drug discounted faster than money–money (Madden et al 1997; Petry 2001). However, a faster discount rate for cocaine is not sufficient to explain the present data (cf. Fig. 1b). In the present data, there is a significant interaction between the effect of changing the immediate commodity and the effect of changing the delayed commodity. Such an effect cannot arise from a difference only in the discount rates of the two commodities.

Another possibility is that cocaine and money have different utility functions. If cocaine has a more concave utility function (i.e., faster diminishing returns), then when cocaine is the immediate commodity, discounting would appear faster than when money is the immediate commodity (Fig. 3c). Again, this is not sufficient to account for the observed data (cf. Fig. 1b), because a change in utility function alone cannot produce an interaction between immediate and delayed commodities.

The final possibility is that both discount functions and utility functions are different between cocaine and money. If cocaine has a faster discount function than money and a more concave utility function than money, then C-M and M-C would both appear to discount faster than M-M, while C-C would discount faster yet (Fig. 3d). This pattern is once again inconsistent with the observed data where M-C > C-C (cf. Fig. 1b).

The only way to account for the observed data within the quantitative decision-making framework described above is to assume that cocaine has a faster discount function than money, and cocaine has a less concave utility function than money (Fig. 3e). In this case, both CCD conditions with cocaine as the delayed commodity have faster discounting than the corresponding conditions with money as the delayed commodity. Additionally, M-C would discount faster than C-C. The extent to which M-C would discount faster than C-C is larger than the extent to which M-M would discount faster than C-M because of the nonlinear interaction between discount and utility curves. Thus, if cocaine has a faster discount function and a less concave utility function than money, it would produce an interaction between the immediate and delayed commodities, as observed in the empirical data. This pattern of apparent discounting cannot be statistically distinguished from the actual data.

What can we conclude? Either (1) cocaine has faster discounting and a less concave utility function than money, or (2) standard models of decision making do not describe subjects’ behavior in this task. We suspect that the latter is the case. If cocaine has a less concave utility function than money, then M-M must discount faster than C-M. To the contrary, in the observed data, there is a trend toward C-M discounting faster than M-M, although it is not statistically significant. Additionally, a previous study found that immediate cigarettes vs. delayed money produced faster discounting than immediate money vs. delayed money (Mitchell 2004). It would be possible to explicitly test the relative concavity of the utility functions for cocaine and money by asking subjects how much immediately available cocaine they would consider equivalent to varying immediately available amounts of money.

We think it is more likely that subjects’ behavior in this task is not adequately described by standard decision-making models. In particular, subjects may not be evaluating each choice independently. Psychologists have shown that, in general, the context and format of the available options influence how each option is perceived (e.g., Kahneman and Tversky 1979; Tversky and Kahneman 1981), a phenomenon called framing. One possible explanation for this influence is that there are two decision-making systems in the brain: an impulsive decision system to which drugs are highly valuable and an executive decision system to which drugs are less valuable (Tiffany 1990; Bickel et al. 2007). The balance between these systems may be influenced by the availability of drugs as one of the options. For example, the C-C condition may exhibit slower discounting than the M-C condition because in C-C, the cognitive system recognizes ‘I’ll only get drugs either way,’ and thus produces choice closer to an economic comparison between the magnitudes and delays of each cocaine option.

Conclusion

Our results help fill in a gap in the current understanding of delay-discounting. While it has been established that using intertemporal choice conditions drugs are discounted at a rate more steeply than money, we are the first to examine all combinations of these two commodities. We find that changing the delayed reward from money to drugs has a much greater effect on discounting rates than changing the immediate reward from money to drugs. Further work will be needed to establish whether this result is found in other substances of abuse and whether it applies to non-addictive commodities with different discounting rates (e.g., Charlton and Fantino 2008).

Notes

One participant failed to complete both CCD tasks, and two participants failed to complete one CCD task; thus the expected 94 CCD datasets was reduced by 4.

References

Baker F, Johnson MW, Bickel WK (2003) Delay discounting in current and never-before cigarette smokers: similarities and differences across commodity, sign, and magnitude. J Abnorm Psychol 112:382–392

Bernoulli D (1954) Exposition of a New Theory on the Measurement of Risk. Econometrica 22:23

Bickel WK, Marsch LA (2001) Toward a behavioral economic understanding of drug dependence: delay discounting processes. Addiction 96:73–86

Bickel WK, Mueller ET (2009) Toward the study of trans-disease processes: a novel approach with special reference to the study of co-morbidity. J Dual Diagn 5:131–138

Bickel WK, Amass L, Higgins ST, Badger GJ, Esch RA (1997) Effects of adding behavioral treatment to opioid detoxification with buprenorphine. J Consult Clin Psychol 65:803–810

Bickel WK, Odum AL, Madden GJ (1999) Impulsivity and cigarette smoking: delay discounting in current, never, and ex-smokers. Psychopharmacology 146:447–454

Bickel WK, Miller ML, Yi R, Kowal BP, Lindquist DM, Pitcock JA (2007) Behavioral- and neuron-economics of drug addiction: competing neural systems and temporal discounting processes. Drug and Alcohol Dependence 90:85–91

Bickel WK, Pitcock JA, Yi R, Angtuaco EJ (2009) Congruence of BOLD response across intertemporal choice conditions: fictive and real money gains and losses. J Neurosci 29(27):8839–8846

Bickel WK, Jones BA, Landes RD, Christensen DR, Jackson L, Mancino M (2010) Hypothetical intertemporal choice and real economic behavior: delay discounting predicts voucher redemptions during contingency-management procedures. Exp Clin Psychopharmacol 18:546–52

Bickel WK, Yi R, Landes RD, Hill P, Baxter C (2011) Remember the future: working memory training decreases temporal discounting among stimulant addicts. Biol Psychiatry 69:260–265

Bjork JM, Hommer DW, Grant SJ, Danube C (2004) Impulsivity in abstinent alcohol-dependent patients: relation to control subjects and type 1-/type 2 like traits. Alcohol 34:133–150

Budney AJ, Higgins ST, Sigmon SC (2003) Contingency management in the substance abuse treatment clinic. In: Rotgers F, Morgenstern J, Walters S (eds) Treating substance abuse: theory and technique. Guilford Press, New York

Charlton SR, Fantino E (2008) Commodity specific rates of temporal discounting: does metabolic function underlie differences in rates of discounting? Behav Process 77:334–342

Chopra MP, Landes RD, Gatchalian KM, Jackson LC, Buchhalter AR, Stitzer ML, Marsch LA, Bickel WK (2009) Buprenorphine medication versus voucher contingencies in promoting abstinence from opioids and cocaine. Exp Clin Psychopharmacol 17:226–236

Coffey SF, Gudleski GD, Saladin ME, Brady KT (2003) Impulsivity and rapid discounting of delayed hypothetical rewards in cocaine-dependent individuals. Exp Clin Psychopharmacol 11:18–25

Dom G, D’haene P, Hulstijn W, Sabbe B (2006) Impulsivity in abstinent early- and late-onset alcoholics: differences in self-report measures and a discounting task. Addiction 101:50–59

Du W, Green L, Myerson J (2002) Cross-cultural comparisons of discounting delayed and probabilistic rewards. Psychol Rec 52:479–492

Estle SJ, Green L, Myerson J, Holt DD (2007) Discounting of monetary and directly consumable rewards. Psychol Sci 18:58

Glimcher PW (2008) Understanding risk: a guide for the perplexed. Cogn Affect Behav Neurosci 8:348–354

Glimcher PW (2010) Foundations of Neuroeconomic Analysis. Oxford University Press

Green L, Myerson J (1996) Exponential versus hyperbolic discounting of delayed outcomes: risk and waiting time. Am Zool 36:496–505

Heil SH, Johnson MW, Higgins ST, Bickel WK (2006) Delay discounting in currently using and currently abstinent cocaine-dependent outpatients and non-drug-using matched controls. Addict Behav 31:1290–1294

Higgins ST, Budney AJ, Bickel WK, Foerg FE, Donham R, Badger GJ (1994) Incentives improve outcome in outpatient behavioral treatment of cocaine dependence. Arch Gen Psychiatry 51:568–576

Hoffman WF, Moore M, Templin R, McFarland B, Hitzemann RJ, Mitchell SH (2006) Neuropsychological function and delay discounting in methamphetamine-dependent individuals. Psychopharmacol Berl 188:162–170

Johnson MW, Bickel WK (2002) Within-subject comparison of real and hypothetical money rewards in delay discounting. J Exp Anal Behav 77:129–146

Kable JW, Glimcher PW (2009) The neurobiology of decision: consensus and controversy. Neuron 63:733

Kahneman D, Tversky A (1979) Prospect Theory: an analysis of decision under risk. Econometrica 47:263–291

Kirby KN (1997) Bidding on the future: evidence against normative discounting of delayed rewards. J Exp Psychol Gen 126:54–70

Kirby KN, Petry NM (2004) Heroin and cocaine abusers have higher discount rates for delayed rewards than alcoholics or non-drug-using controls. Addiction 99:461–471

Kirby KN, Petry NM, Bickel WK (1999) Heroin addicts discount delayed rewards at higher rates than non-drug using controls. J Exp Psychol Gen Process 128:78–87

Landes RD, Pitcock JP, Yi R, Bickel WK (2010) Analytical methods to detect within-individual changes in discounting. Exp Clin Psychopharmacol 18:175–183

Littell RC, Milliken GA, Stroup WW, Wolfinger RD, Schabenberger O (2006) SAS® for Mixed Models, 2nd edn. SAS Institute Inc, Cary, NC, USA

Logue AW (1988) Research on self-control: an integrating framework. Behav Brain Sci 11:665–709

Madden GJ, Petry NM, Badger GJ, Bickel WK (1997) Impulsive and self-control choices in opioid-dependent patients and non-drug-using control participants: drug and monetary rewards. Exp Clin Psychopharmacol 5:256–262

Madden GJ, Bickel WK, Jacobs EA (1999) Discounting of delayed rewards in opioid-dependent outpatients: exponential or hyperbolic discounting functions? Exp Clin Psychopharmacol 7:284–293

Mitchell SH (1999) Measures of impulsivity in cigarette smokers and nonsmokers. Psychopharmacology 146:455–464

Mitchell SH (2004) Effects of short-term nicotine deprivation on decision-making: delay, uncertainty, and effort discounting. Nicotine Tob Res 6:819–828

Mitchell SH, Reeves JM, Li N, Phillips TJ (2006) Delay discounting predicts behavioral sensititation to ethanol in outbred WSC mice. Alcohol Clin Exp Res 30:429–437

Odum AL, Baumann AA (2007) Cigarette smokers show steeper discounting of both food and cigarettes than money. Drug Alcohol Depend 91:293–296

Odum AL, Madden GJ, Bickel WK (2002) Discounting of delayed health gains and losses by current, never-and ex-smokers of cigarettes. Nicotine Tob Res 4:295–303

Petry NM (2001) Pathological gamblers, with and without substance use disorders, discount delayed rewards at high rates. J Abnorm Psychol 110:482–487

Tiffany ST (1990) A cognitive model of drug urges and drug-use behavior: role of automatic and nonautomatic processes. Psychol Rev 97:147–168

Tversky A, Kahneman D (1981) The framing of decisions and the psychology of choice. Science 211:453

Weller RE, Cook EW III, Avsar KB, Cox JE (2008) Obese women show greater delay discounting than healthy-weight women. Appetite 51:563–569

Yoon JH, Higgins ST, Bradstreet MP, Badger GJ, Thomas CS (2009) Changes in the relative reinforcing effects of cigarette smoking as a function of initial abstinence. Psychopharmacology 205:305–318

Acknowledgments

This work was funded by NIDA Grants R01 DA 12997, R01 DA 024080; R01 DA030241, Wilbur Mills Chair Endowment; and in part by the Arkansas Biosciences Institute/Tobacco Settlement Proceeds Act of 2000. Computational work reported in this manuscript was funded by NIDA Grant DA 024080. This article was edited by the Office of Grants and Scientific Publications at the University of Arkansas for Medical Sciences.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bickel, W.K., Landes, R.D., Christensen, D.R. et al. Single- and cross-commodity discounting among cocaine addicts: the commodity and its temporal location determine discounting rate. Psychopharmacology 217, 177–187 (2011). https://doi.org/10.1007/s00213-011-2272-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00213-011-2272-x