Abstract

We develop a new multistep monotone map approach to characterize minimal state-space recursive equilibrium for a broad class of infinite horizon dynamic general equilibrium models with positive externalities, dynamic complementarities, public policy, equilibrium indeterminacy, and sunspots. This new approach is global, defined in the equilibrium version of the household’s Euler equation, applies to economies for which there are no known existence results, and existing methods are inapplicable. Our methods are able to distinguish different structural properties of recursive equilibria. In stark contrast to the extensive body of existing work on these models, our methods make no appeal to the theory of smooth dynamical systems that are commonly applied in the literature. Actually, sufficient smoothness to apply such methods cannot be established relative to the set of recursive equilibria. Our partial ordering methods also provide a qualitative theory of equilibrium comparative statics in the presence of multiple equilibrium. These robust equilibrium comparison results are shown to be computable via successive approximations from subsolutions and supersolutions in sets of candidate equilibrium function spaces. We provide applications to an extensive literature on local indeterminacy of dynamic equilibrium.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since the work of Lucas et al. (1971) and Prescott and Mehra (1980), recursive equilibrium (RE, in short) has been a key focal point of both applied and theoretical work in characterizing sequential equilibrium for dynamic general equilibrium models in such fields as macroeconomics, international trade, growth theory, industrial organization, financial economies, and monetary theory.Footnote 1 When dynamic economies are Pareto optimal, in the case of homogeneous agent models with standard concavity conditions, RE is unique and can be computed using standard dynamic programming algorithms. In this case, equilibrium comparative statics analysis is reduced to either application of local or global implicit function theorem-based smooth dynamical systems or applications of dynamic lattice programming methods to the social planner’s problem. In nonoptimal economies, even the existence of dynamic equilibrium becomes complicated to prove, let alone obtain equilibrium comparative statics results. Although some recent extensions of dynamic lattice programming methods have been made for nonoptimal economies (including those with heterogeneous agents) in Mirman et al. (2008) and Acemoglu and Jensen (2015), there are important nonoptimal homogeneous agent economies in which these tools are difficult to apply. Further, an extensive literature on monotone map methods has stemmed from the pioneering work of Coleman (1991, 1997, 2000) and Greenwood and Huffman (1995), but these methods are also known to fail in some nonoptimal models (see Santos 2002, Sect. 3.2).Footnote 2

In this paper, we propose a new method for obtaining existence as well as equilibrium comparison in a well-studied class of nonoptimal homogeneous agent economies with dynamic complementarities. Our method extends the scope of parameterized fixed point methods to models with local indeterminacy, multiple equilibrium, and discontinuous minimal state-space RE. We focus on dynamic general equilibrium models studied extensively in the literature with externalities and nonconvexities in production, public or monetary policy, monopolistic competition, and some models with credit constraints on firms under incomplete markets and/or adverse selection.Footnote 3 Very importantly, our results are based on global methods and make no appeal to local analysis, in contrast to the literature studying dynamic models with complementarities using the methods of smooth dynamical systems to characterize sequential equilibrium near steady states as in the seminal work of Benhabib and Farmer (1994), among numerous others.Footnote 4

Our method involves a new class of “two-step” monotone maps defined on partially ordered sets. The key intuition underlying these multistep methods is simple: In the first step, we construct solutions to a parameterized fixed point problem that guarantee necessary structural restrictions implied by household optimization relative to individual state variables. Then, using a fixed point monotone comparative statics result on “first-step” fixed points, we define a second-step monotone operator, which verifies necessary aggregate state consistency conditions for a RE. The second-stage fixed point structure allows us to compute state asymmetric RE, which is critical in the class of models with local indeterminacy for example. As the two-step procedure verifies the existence of RE via a monotone operator, robust equilibrium comparative statics can be delivered in some deep parameters. An important implication is that the set of state asymmetric RE could be huge—consistent with results on local indeterminacy of sequential equilibrium in the literature. Note that, we do not need monotone RE for these methods to work, we need monotone operators defined on suitable chain complete partially ordered sets. Further, we do not need continuous RE. Indeed, our methods are designed specifically to allow for and construct discontinuous RE that are consistent with solutions to the household dynamic program.

It is, perhaps, important to point out that we obtain a rich set of robust RE comparative statics/dynamics without appealing directly to the lattice programming machinery of Topkis (1978, 1998) and Veinott (1992). Our methods can be interpreted as an iterative class of parameterized dynamic lattice programming problems built on the household program, not that of the social planner. Our work builds also on Acemoglu and Jensen (2015), where a new approach to the existence of robust equilibrium comparative statics is proposed for large dynamic models, and where they make significant progress in obtaining sufficient conditions for robust distributional equilibrium comparative statics. Although their methods are powerful for many important classes of dynamic economies (including situations where our methods do not apply), as we show in this paper, their sufficient conditions cannot be checked even in certain homogeneous agent economies. They apply dynamic lattice programming methods to the individual agent problem and obtain sufficient partial monotonicity of decision rules which are then exploited to deduce aggregate equilibrium comparative statics. In this sense, even though their results are more general, in some applications, they suffer from limitations similar to that of Mirman et al. (2008).

The differential approach to equilibrium comparative statics goes far back to Samuelson (1941), and is best illustrated in the seminal work of Debreu (1970), who used differential topology tools to bear on the question.Footnote 5 This method has been extended to dynamic economies by Kehoe et al. (1990), and Santos (1992), among others. Interesting application of smooth equilibrium comparative statics is found in the extensive literature on the indeterminacy of equilibrium in models of one-sector production with externalities, e.g., see papers following the approach taken in Benhabib and Farmer (1994), Boldrin and Rustichini (1994), Benhabib and Perli (1994), and Farmer and Guo (1994).Footnote 6 These papers study determinacy of sequential equilibrium dynamics around a proposed hyperbolic point (e.g., the unique positive steady state), and it is shown that if a smooth sequential equilibrium is present, the local dynamics would be consistent with a continuum of equilibrium paths leading to the steady state. An important new approach to the study of global indeterminacy via topological dynamical systems methods is found in the Euler equation branching approach of Stockman (2010) and Raines and Stockman (2010). Our methods are very much in the spirit of these latter papers, but we ask different questions (i.e., we are concerned with existence of RE dynamics, and characterizing RE comparative statics; not a theory of the resulting RE dynamical system). Further, in Stockman (2010) and Raines and Stockman (2010), the question of sufficient conditions for the existence of continuous dynamic equilibria is not addressed.Footnote 7 We should remark our results make no appeal to the tools of topological dynamical systems. Further, we are not able to prove the existence of continuous recursive equilibrium within the class of economies with study. But in principle, our methods seek to complement the results and methodological approach taken in these latter two papers.

The rest of the paper is laid out as follows. In Sect. 2, we describe the class of homogeneous agent models analyzed in this paper. In Sect. 3, we construct the RE operator and prove existence. In Sect. 4, we develop equilibrium comparative statics results. In Sect. 5, we conclude with examples and discussion of our results in comparison with the literature.

2 The framework

We study a general class of homogeneous agent dynamic general equilibrium models with externalities and complementarities with reduced-form production function that embeds numerous other nonoptimal dynamic economies with complementarities including Benhabib and Farmer (1994) and Liu and Wang (2014), among others. Time is discrete and indexed by \(t\in \{0,1,2,\ldots \}\). The economy has a unit mass of identical (or a representative) infinitely lived household with separable preferences over lifetime streams of consumption and leisure, \(\{c_{t}\) \(\}_{t=0}^{\infty }\) and \(\{l_{t}\) \(\}_{t=0}^{\infty },\) respectively. The household’s lifetime utility is:

where \(\beta \in (0,1)\) is the discount factor.

The following regular assumptions are imposed on period utility functions (omitting time subscript).

Assumption A1

The returns from consumption and leisure, \(u\,{:}\,\mathbf {R}_{+}\rightarrow \mathbf {R}_{+}\) and \( v\,{:}\,[0,1]\rightarrow \mathbf {R}_{+}\) are continuous, strictly increasing, strictly concave, and twice-continuously differentiable on \( \mathbf {R}_{++}\) with \(u(0)=0\), \(v(0)=0\) and Inada-type conditions are satisfied, i.e.,

Households are endowed with an initial holding of capital denoted by \( k_{0}>0 \) and one unit of productive time in each period. Factor and goods markets are perfectly competitive. Households own factors of production and rent them to firms. A unit mass of firms (or one representative) face production technologies given by \(F(k,n,K,\hat{N})\). Technology has constant returns to scale (CRS) in private factors (k, n), where k is the individual firm’s decision on capital, n its decision on labor inputs, but we also allow for the social externalities that depend on the aggregate levels of capital K and labor \(\hat{N}\), respectively. We assume the following conditions on the production technology.

Assumption A2

The production function \(F{:}\, \mathbf {R}_{+}\times \mathbf {R}_{+}\times \mathbf {R}_{+}\times \mathbf {R} _{+}\rightarrow \mathbf {R}_{+}\)is multiplicatively separable in private returns and social externalities: \(F(k,n,K,\hat{N})=\) \( f(k,n)e(K,\hat{N})\); in addition, (a) \(f{:}\,\mathbf {R}_{+}\times \mathbf {R}_{+}\rightarrow \mathbf {R}_{+}\) is constant returns to scale, supermodular, increasing (but increasing strictly with each argument for the positive input of the other), weakly concave jointly (but strictly concave with each argument separately for the positive input of the other), and twice-continuously differentiable in both arguments (on \(\mathbf {R} _{++}\times \mathbf {R}_{++}\)) with \(f(0,n)=0=f(k,0)\); (b) the marginal products of f in capital and labor satisfy Inada-type conditions:

and (c) the social externality \(e{:}\,\mathbf {R}_{+}\times \mathbf {R} _{+}\rightarrow \mathbf {R}_{+}\) is increasing and C\(^{1}\)jointly with \(e(0,\hat{N})=0\) \(=e(K,0)=0\). In addition, (d) there exists a \(k_{\max }>0,\) such that \(F(k,1,K,1)\le k_{\max }\) for all \(k,K\ge k_{\max }\).

Here, \(k_{\max }\) stands for the maximal sustainable level of capital. Define \(\mathbf {K=}[0,k_{\max }]\). We postpone further remarks on assumptions A1 and A2 till Sect. 2.1.

2.1 Household dynamic program

In this subsection, we describe household and firm decision making: Within-period choices and prices are expressed as functions of aggregate capital in that period. The law of motion or the mapping between current aggregate capital and future aggregate capital depends on individual choices. Given a level of aggregate capital, K, the maximal level of output that can be generated in any period is given by \(f^{M}(K)=f(K,1)e(K,1),\) using all available labor in the production. This is an upper bound for feasibility of household consumption (and/or investment) and allows us to define a space of socially feasible consumption functions:

and, endow \(B^{f}\) with the topology of pointwise convergence, as well as its pointwise partial order.Footnote 8 We develop a representation of the aggregate economy parameterized by \(C\in B^{f}\).

In order to generate the path for aggregate capital \(\{K_{t}\}_{t=0}^{\infty }\), we further restrict the set of consumption and investment functions to reflect that labor supply is endogenous in this economy. This restricts the space of possible investment/consumption functions we can consider. Anticipating the equilibrium conditions that govern the labor-leisure choice for a household in any RE, we posit the existence of a “contingent” aggregate labor supply, given by \(N(C,K)\in [0,1]\). Here N(C, K) represents a static or within-period labor-leisure choice, and is parameterized by both current aggregate state K, and consumption function C.Footnote 9

The aggregate labor supply mapping implies restriction on the attainable level of output and hence restricts the possible laws of motion for the aggregate state variable in any RE. In particular, when developing the household’s dynamic program for a candidate RE consumption function \(C\in B^{f},\) aggregate labor supply N, households assume the law of motion on the aggregate capital stock to be:

This law of motion generates the sequence of aggregate capital \( \{K_{t}\}_{t=0}^{\infty }\) from \(K_{0}>0.\)

Next, we specify household income process as a function of aggregate capital, K. Prices of capital (r) and labor (w) are set to equal their respective marginal products,

That is, firms are price-takers and hire capital and labor such that their individual or private marginal returns equal rental rates given aggregate \( (K,\hat{N})\). Appealing to zero profits under constant returns to scale, household income process y(k, n, K; N(C(K), K)) is given by:

where for \(K>0\), the income process is real-valued. The feasible budget correspondence is,

where x denotes the household level of investment. Under Assumptions A1 and A2, as r, w are each continuous, the feasible correspondence \(\varPhi \) is a continuous correspondence, when \(K>0\).

Households use (C, N) to calculate factor prices for any \(K\in \mathbf {K} _{*}=\mathbf {K\backslash }0\). The household’s dynamic program can be stated as follows: Given \(C\in B^{f}\) and the law of motion, \(g(K;C,N)>0\), with aggregate labor supply given by N, and the household’s value function \(V^{*}(\cdot ;C,N){:}\,\mathbf {K}\times \mathbf {K}_{*}\mathbf { \rightarrow R}_{+}\) satisfies the following parameterized Bellman equation:Footnote 10

Let the optimal solutions for consumption and labor supply be given by \( c^{*}(k,K;C,N)\) and \(n^{*}(k,K;C,N)\).

2.2 A minimal state-space recursive equilibrium

Now, we are ready to formally define a minimal state-space recursive equilibrium for this economy.

Definition 1

A minimal state-space recursive equilibrium is a list of functions \( C^{*},N^{*}\) for consumption and aggregate labor supply, as well as the associated value function \(V^{*}(\cdot ;C^{*},N^{*})\), law of motion \(g^{*}\), the optimal solutions \(c^{*}\) and \(n^{*}\) and prices w, r for any \(K>0\) such that

-

1.

\(V^{*}(\cdot ;C^{*},N^{*})\) satisfies (6) with \((c^{*}(k,K;C^{*},N^{*}),n^{*}(k,K;C^{*},N^{*}))\) being the arguments that solve the right-hand side of the Bellman equation, for each k.

-

2.

Taking prices w, r and aggregate states K, \(N^{*}(C^{*}(K),K)\) as given firms maximize profit:

$$\begin{aligned} \max _{k,n\ge 0}F(k,n,K,N^{*}(C^{*}(K),K))-r(K)k-w(K)n. \end{aligned}$$ -

3.

Consistency:

$$\begin{aligned} c^{*}(K,K;C^{*},N^{*})= & {} C^{*}(K), \\ n^{*}(K,K;C^{*},N^{*})= & {} N^{*}(C^{*}(K),K), \end{aligned}$$with \(C^{*}(0)=N^{*}(0,0)=0\).

-

4.

Market clearing:

$$\begin{aligned} g^{*}(K;C^{*},N^{*})+c^{*}(K,K;C^{*},N^{*})= & {} F(K,N^{*}(C^{*}(K),K),K,N^{*}(C^{*}(K),K) \\= & {} y(K,N^{*}(C^{*}(K),K),K;N^{*}(C^{*}(K),K)). \end{aligned}$$

For the sake of notation, the list of functions in the definition of the RE, we often simplify and denote using just \(C^{*}\) for consumption with the corresponding law of motion for capita \(g^{*}\), and \(N^{*}\) for labor supply.

We end this subsection by characterizing the first-order conditions for maximization problem in (6) along any RE. Observe that by a standard argument, \(V^{*}(\cdot ;C,N)\) is strictly concave and at least once-continuously differentiable in its first argument k (e.g., Coleman (1991) and the Mirman–Zilcha Lemma). This implies under Assumptions A1 and A2, objective function on the right-hand side of (6) is strictly concave in its control variable. Therefore, we can characterize the optimal solutions in (6) by the first-order conditions, which are necessary and sufficient. In particular, noting the Inada conditions, if \(K>0,\) \( g(K;C^{*},N^{*})>0,\) the optimal consumption \(c^{*}=c^{*}(k,K;C^{*},N^{*})\) must satisfy the following functional equation,

where \(y_{c^{*}}=y(k,n^{*}(k,K;C^{*},N^{*}),K,N^{*}(C^{*}(K),K))-c^{*},\) and where \(r=f_{1}e\) has been substituted in the Euler equation.

Similarly, the first-order condition associated with labor supply \(n^{*}(k,K;C^*,N^*)\) in any RE is

and where we have used the assumption of homogeneity of production function in private returns (Assumption A2).

2.3 Necessary properties of a minimal state-space recursive equilibrium

We now characterize some necessary properties of household policies along a recursive equilibrium. These arguments put restrictions that constitute the basis of further construction in Sect. 3. In particular, along any RE, the household optimal solutions have continuity on individual or private capital (k) but not on aggregate capital (K).

Lemma 1

Under Assumptions A1 and A2, for any \(C\in B^{f}\), N such that \(N(C,K)\in (0,1]\) for any \(K\in \mathbf {K}_{*}\) and \( g>0,\) household’s optimal consumption, \(c^{*}\) and labor supply, \(n^{*}\) are continuous in k.

Proof

Given \(C\in B^{f},N\) such that \(N(C,K)\in (0,1]\) with \(K\in \mathbf {K}_{*},\) \(g(K;C,N)>0\) household’s dynamic program (6) is

Under A1 and A2, by a standard argument \(V^{*}(k,K;C,N)\) is continuous and strictly concave in k. As the feasible correspondence \(\varPhi (k,K;N(C(K),K))\) is nonempty, compact and convex valued, and continuous in k, each (K, C, N), and the objective on the right-hand side of the Bellman equation at \(V^{*}(k,K;C,N)\) in (6) is continuous and strictly concave in c each (k, K, C, N), by Berge’s maximum theorem, \(c^{*}(k,K;C,N)\) and \(n^{*}(k,K;C,N)\) are both continuous in k, each (K, C, N). \(\square \)

Therefore, by Lemma 1, all RE must necessarily have structural properties in individual state. Aside from resource feasibility, there are no required structural properties for a RE in aggregate state K. Our two-step methods of RE construction heavily exploit this fact and decompose our fixed point arguments relative to individual versus aggregate state variables and isolate the discontinuities of RE to only aggregate states. This means that although multiplicities of RE might be easy to construct, obtaining sufficient conditions for RE smoothness is difficult. This casts concerns about applying smooth dynamical systems methods in characterizing multiplicity of equilibrium paths near any steady state associated with our model.

Also, it bears mentioning, Lemma 1 seems to pose serious challenges in developing rigorous applications of existing correspondence-based approaches to generalized Markov equilibrium in the literature to compute RE in dynamic models (e.g., Kubler and Schmedders 2003; Feng et al. 2014). For example, it is not clear how these existing generalized Markov methods can be applied to the models studied in this paper. In fact, we claim any sequential equilibrium has to satisfy a version of Lemma 1. In particular, any sequential equilibrium that is written recursively as in a generalized Markov equilibrium on an enlarged state space involving endogenous state variables such as “envelopes” or “shadow values for capital” must deliver RE decision rules that are consistent with household value functions that are also once-continuous differentiable in individual states along a sequential equilibrium.Footnote 11

3 Construction of the RE

A roadmap of our construction of RE is as follows: First, we solve for the equilibrium labor supply, contingent on a candidate RE consumption policy. Then, in the second subsection, we propose suitable function spaces for a candidate RE that guarantee requisite continuity properties per Lemma 1. Next, the existence of equilibrium is proved using two-step operator. Specifically, we define a mapping (say, A) on a product function space (say, \(H_{1}\times H_{2}\)) such that one subspace (\( H_{2}\)) is at least chain complete. The “first-step” operator treats the chain complete subspace as fixed, and study fixed points of the partial map \( h_{1}\rightarrow A(h_{1},h_{2})\) in \(H_{1}\). In the last subsection, we define a “second-step” operator that uses domain \(H_{2},\) and maps to a subset of \(H_{2}\), where we prove a RE exists.

3.1 Contingent RE labor supply

We construct “contingent” equilibrium representations of labor supply N that we assume in the development of the household’s dynamic program in (6). It represents the “static” necessary and sufficient condition for RE labor supply. It bears mentioning this static equilibrium relationship between consumption and labor supply is generally not unique in our model; thus, in effect, we have an RE labor supply correspondence say, \(N^{*}\). The least and greatest selections from this correspondence, each exhibiting monotone comparative statics in \((\hat{C},K)\) are used to parameterize “upper” and “lower” Euler equation operators.

Recall that the household decision problem defined in (6), and (7). Next, for any contingent equilibrium consumption \(\hat{C}\) and aggregate labor supply \( \hat{N},\) define a new mapping:

and a second mapping \(\hat{n}^{*}(\hat{N};\hat{C},K)\) implicitly from (8):

for \(\hat{C}>0,\) all \(K>0.\) Noting, the Inada conditions on v and \(f_{2}\) plus the strict concavity conditions, this root is well defined and unique; then extend it to include the boundaries by setting \(\hat{n}^{*}(\hat{N}; \hat{C},K)=1\), when \(\hat{C}=0,K>0\) and set \(\hat{n}^{*}(\hat{N};\hat{C} ,K)\) \(=0\) otherwise. Lemma 2 characterizes solutions to the equation:Footnote 12

Lemma 2

Say Assumptions A1 and A2 are both satisfied. Then, (a) \(\hat{n}^{*}\) is single-valued, and continuously differentiable jointly for \((\hat{C},K)>>0\), \(\hat{N}\in (0,1)\). Further, (b) \(\ \hat{n}^{*}(\hat{N};\hat{C},K)\) is increasing in \(\hat{N}\) and K, and decreasing in \(\hat{C}.\) Finally, (c) for each \((\hat{C},K),\) \(\hat{n} ^{*}(\hat{N};\hat{C},K)\) has a nonempty compact set of fixed points \( N^{*}(\hat{C},K)\subset [0,1],\) with the greatest selection \(\vee N^{*}(\hat{C},K)\) and the least selection \(\wedge N^{*}(\hat{C},K)\), both continuous, increasing in K, decreasing in \(\hat{C}\), and strictly positive, when \(\hat{C}>0,K>0\).

Proof

(a) Note \(Z_{n}\) is strictly increasing in n, \(\hat{n}^{*}(\hat{N}; \hat{C},K)\) is unique for each \((\hat{C},K)\). By the Inada conditions on v and f in n, for all \(\hat{N}\in [0,1],\) when \(\hat{C}>0,\) \(K>0 \mathbf {,}\) \(\hat{n}^{*}(\hat{N};\hat{C},K)\in (0,1).\) Further, when \( \hat{C}>0,\) \(K>0,\) \(\hat{N}\in (0,1),\) as \(|\partial _{n}Z_{n}(n^{*}(\hat{N};\hat{C},K),\hat{N},\hat{C},K)|\ne 0\) by strict concavity of v and f, by the global implicit function theorem, root \(\hat{n}^{*}(\hat{N}; \hat{C},K)\) is also globally continuously differentiable (e.g., see Phillips 2012, Lemma 2).

(b) The comparative statics result follows from the fact that under Assumptions A1 and A2, \(Z_{n}\) is strictly increasing in \((\hat{N},\hat{C})\) and strictly decreasing in K.

(c) The set [0, 1] is a complete lattice, \(\hat{N}\rightarrow \hat{n}^{*}(\hat{N },\hat{C},K)\) is a increasing function on [0, 1] for each \((\hat{C},K);\) hence, by Tarski’s theorem (Tarski 1955, Theorem 1), the fixed points of \(\hat{n}^{*}(\cdot ,\hat{C},K)\) denoted by \(N^{*}(\hat{C},K)\) form a nonempty complete chain for all \((\hat{C},K).\) As \(\hat{n}^{*}\) is decreasing in K and increasing in \(\hat{C}\), by Veinott fixed point comparative statics theorem (Veinott 1992, Chap. 4, Theorem 14), the greatest fixed point \(\vee N^{*}(\hat{C},K)\) and least fixed point \( \wedge N^{*}(\hat{C},K)\) are well defined selections, increasing in K and decreasing in \(\hat{C}\).

Finally, for positivity of each selection, when \(\hat{C}>0\), \(K>0,\) we have \(n(0;\hat{C},K)>0\) by the Inada conditions in Assumption A1. The continuity of the least and greatest selections \(\vee N^{*}(\hat{C},K)\) and \(\wedge N^{*}(\hat{C},K)\) follows from a modification of the transversality argument in Raines and Stockman (2010, Propositions 4 and 5), and continuous differentiability of u. \(\square \)

To slightly shorten notation, let us denote: \(n_{\vee }^{*}(\hat{C} ,K){:=}\vee N^{*}(\hat{C},K)\) and \(n_{\wedge }^{*}(\hat{C},K){:=}\wedge N^{*}(\hat{C},K)\). We make a few remarks on Lemma 2.

First, the existence of a sunspot equilibrium does not require capital externalities. By a simple modification of the transversality argument (Raines and Stockman 2010, Proposition 4 and 5), for economies satisfying Assumptions A1 and a stronger version of A2 with specific Cobb–Douglas technologies (as in Benhabib and Farmer 1994; Liu and Wang 2014) for the indeterminacy parameters, there are two continuous selections for contingent equilibrium labor supply \(N^{*}\). This implies that RE in our case is not unique even if each branch of our Euler equation operators we define in the next section of the paper has unique fixed points. Further, sunspot equilibria exist without capital externalities driven by only labor externalities.

Second, under assumption A2, without the Cobb–Douglas technology specification, the Raines–Stockman result cited above implies the existence of an even number of solutions for contingent labor supply \(N^{*}\). The problem of studying RE with each these selections is that only the least and greatest selections are known to exhibit monotone comparative statics in \((\hat{C},K)\); thus for other remaining selections, constructing a monotone map method (traditional or two-step methods) is more challenging.

Finally, it is important to note that for a finite horizon version of our model, in the terminal period T, when equilibrium wage rate, \(w(K;\hat{N})=f_{2}(K,\hat{N})e(K,\hat{N})\) is decreasing in \(\hat{N},\) the solution for the “lower bound” for RE labor supply, denoted by \(N_{f}^{*}(K),\) is unique, where \(N_{f}^{*}(K)\) is the unique n solving \(Z_{n}(n,n,f(K,n)e(K,n),K)=0\). This is the case in models with elastic labor supply studied in Coleman (1997) and Datta et al. (2002). In those papers, the (unique) RE can be computed as the “limit” of policy iteration type methods from (nonstationary) RE for finite horizon economies of length T. Then, the equilibrium for the terminal period economy implies a “lower bound” for RE labor supply, hence RE output, namely \(f^{*}(K)=f(K,N_{f}^{*}(K))e(K,N_{f}^{*}(K))\), which is used as the “upper” bound for RE consumption in the infinite horizon case, where the one period equilibrium labor supply \(N_{f}^{*}(K)\) is the unique lower bound for labor supply in any RE for the infinite horizon economy. This is not true in this paper with assumptions A1 and A2. That is, we have multiple equilibrium in the terminal period for any finite horizon economy of length T.

This fact requires us to be careful in constructing the maximal level of output possible (given contingent labor supply) for the definition of function spaces where RE can be shown to exist. That is, RE consumption cannot exceed the level of output \(f^{*}(K)=f(K,N_{f}^{*}(K))e(K,N_{f}^{*}(K))\) but, we have multiple candidates for \( N_{f}^{*}(K)\). To see this, observe that under Assumptions A1 and A2, we can compute the set of terminal period equilibrium labor supplies \( N_{f}^{*}(K)\) as the fixed point of the mapping \(\hat{n}_{f}^{*}\) defined implicitly by \(Z_{n}^{f}(\hat{n}_{f}^{*}(\hat{N},K),\hat{N},K)=0\) for all \(\hat{N}\in [0,1],\) \(K>0\), where

and where we set \(\hat{n}_{f}^{*}(\hat{N},0)=0\). Thus, equilibrium wages \(f_{2}(K,n)e(K,n)\) could be rising in n, we can have multiple (but finite) number of terminal period equilibria, each continuous in K. Again, we denote the greatest and least of them as \(\vee N_{f}^{*}(K)\) and \(\wedge N_{f}^{*}(K)\).

We must also parameterize the space of feasible RE consumption function. In particular, we need to impose a restricted version of the upper bound for output contingent on candidate RE consumption. We use the modified production function evaluated at \(n_{\vee }^{f}(K)=\vee N_{f}^{*}(K)\) and \(n_{\wedge }^{f}(K)=\wedge N_{f}^{*}(K)\):

where \(\nu \in \{\vee ,\wedge \}\). Observe that \(f_{\nu }^{*}(K)\le f^{M}(K)\) and we have a strict inequality if \(K>0\) (as \(n_{\wedge }^{*}(\hat{C},K)\le n_{\vee }^{*}(\hat{C},K)\le 1\) for all \(K\in \mathbf {K},\) with equality when \(K>0).\) Then, under Assumption A2, we also have \(f_{\vee }^{*}(K)\ge f_{\wedge }^{*}(K)\) for all \(K\in \mathbf {K}\).

3.2 Some useful function spaces

Note that an RE is defined on the diagonal of the household’s state space \( \mathbf {K\times K}\),

Thus, \(\mathbf {D}\) is the space \(\mathbf {K}\) embedded into \(\mathbf {K\times K }\). Recall the space \(B^{f}\) defined in Eq. (2). Then, our “first step” operators will always use as their domain the following space: \(H_{\nu }\subset B^{f}\) for \(\nu \in \{\vee ,\wedge \}\) where

Endow \(H_{\nu }\) with its pointwise partial order, and the topology of uniform convergence. Notice also, by Assumption A2, we have for any \( h_{1}\in H_{\nu }\), \(f_{h_{1},\vee }^{*}(k)\ge f_{h_{1},\wedge }^{*}(k)\).

The space \(H_{\nu }\) has desirable chain completeness and compactness properties, noted in the following Proposition.

Proposition 1

Under Assumption A2, \(\ H_{\nu }\) is compact in the space of bounded, continuous functions endowed with the topology of uniform convergence (hence, chain complete under pointwise partial orders).

Proof

The compactness of \(H_{\nu }\) follows from Coleman (1997, Lemma 8), noting in Coleman’s Lemma, relative to our space \(H_{\nu },\) \(u^{\prime }(h_{1}(k))\) is falling in k for \(h_{1}\in H_{\nu }.\) The chain completeness of \(H_{\nu }\) follows as any compact partially ordered metric space is chain complete (e.g., Amann 1976, Corollary 3.2). \(\square \)

Although we often use \(B^{f}\) as our second-step domain, we will also use the following subset of \(B^{f}\) to prove the existence of RE where the aggregate consumption function h is decreasing in the aggregate state K, and the implied RE investment is increasing in K:

We specify the ranges of our second-step mappings for the different domains \(B^{f}\) or \(B_{m}^{f}.\) In particular, we shall prove RE policies exist in the function space \(\mathbf {C}_{\nu }^{*}\) defined as follows:Footnote 13

for \(\nu \in \{\vee ,\wedge \}\). Notice, RE policies in any of the spaces \(\mathbf {C}_{\nu }^{*}(B)\) with \(B\in \{B^{f}\mathbf {,}\) \(B_{m}^{f}\mathbf {\}}\) is consistent with the necessary properties of any RE in Lemma 1. The following Lemma is useful.

Lemma 3

Under Assumption A2, (a) \(B^{f}\) and \(B_{m}^{f}\) are complete lattices. In addition, (b) \(\mathbf {C}_{\nu }^{*}(B^{f})\) is a complete lattice, while \(\mathbf {C}_{\nu }^{*}(B_{m}^{f})\) is subcomplete sublattice.

Proof

(a) To see \(B^{f}\) is a complete lattice, consider any subset \(B_{1}\subset B^{f}.\) As the pointwise inf and sup operations on the elements of B preserve pointwise bounds, we have 0\(\le \inf _{x}B_{1}\le f^{M},\) and 0\( \le \sup _{x}B_{1}\le f^{M};\) hence, \(\wedge B_{1}\in B^{f}\) and \(\vee B_{1}\in B^{f}.\) Therefore, \(B^{f}\) is a complete lattice. For \(B_{1}\subset B_{m}^{f}\mathbf {,}\) as the pointwise sup (resp, inf) operation preserves monotonicity, \(\wedge B_{1}\in B_{m}^{f}\) and \(\vee B_{1}\in B_{m}^{f}\). (b) For \(B_{1}\subset \mathbf {C}_{\nu }^{*}(B^{f}_m)\) as monotonicity in K (resp, equicontinuity at k), when \(k=K\) are preserved also under arbitrary pointwise sup and inf operations on the compact set \(\mathbf {D}\), \(\wedge B_{1}\in \) \(\mathbf {C}_{\nu }^{*}(B_{m}^{f})\) and \(\vee B_{1}\in \mathbf { C}_{\nu }^{*}(B_{m}^{f})\). Similarly, for \(B_{1}\subset \mathbf {C} _{\nu }^{*}(B^{f})\).\(\square \)

As will be evident soon, to define our first-step operator, we also need to choose a suitable upper bound for the second-step iterations, i.e., \( \bar{h}_{2}\in B^{f}\) (resp., \(\bar{h}_{2}^{m}\in B_{m}^{f}\)), in order to evaluate the externality mapping. For the space \(B^{f},\) take \(\bar{h} _{2}\in B^{f}\) such that

with equality when \(k>0.\) For the space \(B_{m}^{f},\) as the greatest contingent labor supply \(n_{\vee }^{*}(\hat{C},K)\) is decreasing in \( \hat{C},\) for any \(h_{2}\in B_{m}^{f},\) we have \(n_{\vee }^{*}(h_{2}(K),K)\) is increasing in K. So, simply choose any \(\bar{h} _{2}^{m}\in B_{m}^{f},\) such that \(n_{\vee }^{f}(K)\le n_{\vee }^{*}(\bar{h}_{2}^{m}(K),K)\le 1,\) with equality when \(K>0.\) Then, for example, we may take

with equality when \(k>0\).

3.3 The first step

We now construct our Euler equation operators. To do this, we first rewrite the equilibrium version of the household Bellman equation in (6) on the collection of functions \((h_{1},h_{2})\in H_{\nu }\times (B^{f}\cap [0,\bar{h}_{2}]).\) For the rest of this section, fix the index \(\nu \in \{\vee ,\wedge \}\).Footnote 14

For \(k,K>0,\) \(h_{1}>0\), consider the following mapping:

where the distorted return on capital is given by:

Here, for \(h_{1}\in H_{\nu }\), \(\bar{r}\) is increasing and continuous in \( \hat{c},\) and decreasing in \((h_{1},h_{2}),\) noting we have defined

For \(K>0\), \(h_{1}\in H_{\nu },\) \(h_{1}>0,\) \(h_{2}\in (B^{f}\cap [0, \bar{h}_{2}]),\) define the mapping \(\hat{c}_{\nu }^{*}\) implicitly as follows:

Then, when \((h_{1},h_{2})\in H_{\nu }\times (B^{f}\cap [0,\bar{h} _{2}]):\)

We first study the monotonicity and order continuity properties of the operator \(A_{\nu }\) using Proposition 3. Recall, for a mapping \( f{:}\,X\rightarrow Y,\) where X and Y are each countable chain complete partially ordered sets, we say f is order continuous if \(f(\vee X^{\prime })=\vee f(X^{\prime })\) and \(f(\wedge X^{\prime })\)=\(\wedge f(X^{\prime })\) for all countable chains \(X^{\prime }\subset X.\) If X and Y are additionally Banach spaces, say f is a compact operator if it is (a) continuous (relative to the norm topologies on X and Y), and (b) for any bounded \(X^{\prime }\) \(\subset X,\) \(f(X^{\prime })\subset X\) is relative compact. We have the following result:

Lemma 4

Let \(\bar{h}_{2}\in B^{f}\) be given as above. Then, under Assumptions A1 and A2, (a) for any \((h_{1},h_{2})\in H_{\nu }\times \{B^{f}\cap [0,\bar{h}_{2}]\},\) \(A_{\nu }(h_{1},h_{2}(K))\in H_{\nu }\). Further, (b)\((h_{1},h_{2})\rightarrow A_{\nu }(h_{1},h_{2}(K))\) is order continuous on \(H_{\nu }\times \{B^{f}\cap [0,\bar{h}_{2}]\}.\)

Proof

(a) We first prove for any \(\bar{h}_{2}\in B^{f},\) \(0\le \bar{h}_{2}\le f^{M}\), with \(\bar{h}_{2}(k)<f^{M}(k)\) when \(k>0,\) for the order interval \( [0,\bar{h}_{2}]\subset B^{f},\) \((h_{1},h_{2})\in H_{\nu }\times [0, \bar{h}_{2}],\) \(A_{\nu }(h_{1},h_{2}(K))\in H_{\nu }\).

Fix \(h_{2}\in [0,\bar{h}_{2}]\) . By the continuity and monotonicity properties of \(h_{1}\in H_{\nu },\) under Assumption A1 and A2, when \(k>0,\) \( h_{1}>0,\) \(Z_{\nu }(\hat{c},k,K,h_{1},h_{2}(K))\) is decreasing and continuous in \(\hat{c},\) increasing and continuous in k, for each \( (K,h_{1},h_{2}).\) Further, noting the Inada conditions on u and f and the fact that for \(h_{2}\in [0,\bar{h}_{2}],\) \(\bar{h} _{2}(k)-h_{2}(k)>0,\) we therefore have (i) the existence of a unique root \( \hat{c}_{\nu }^{*}(k,K,h_{1},h_{2}(K)) \) such that \(Z_{\nu }(\hat{c} _{\nu }^{*}(k,h_{1},h_{2}(K)),k,K,h_{1},h_{2}(K))=0\), such that (ii) \( \hat{c}_{\nu }^{*}\) is increasing and continuous in k for fixed \( (K,h_{1},h_{2})\). Therefore, noting the definition of \(A(h_{1};h_{2}(K))\) when \(k=K=0,\) we have \(k\rightarrow A_{\nu }(h_{1};h_{2}(K))(k)\) continuous and increasing in k.

Further, if \(k_{1}\ge k_{2},\) \(A_{\nu }(h_{1};h_{2}(K))(k)\) is increasing in k, we have

This implies, by the definition of \(\hat{c}_{\nu }^{*}(k,K,h_{1},h_{2}(K)),\) the second term of \(Z_{\nu }\) must decrease when \( k_{1}\ge k_{2}.\) That is, \(A_{\nu }(h_{1};h_{2}(K))(k)=\hat{c}_{\nu }^{*}(k,K,h_{1},h_{2}(K))(k) \) must be such that

is increasing in k. Noting the definition of \(A_{\nu }(h_{1},h_{2}(K))(k)\) elsewhere, \(A_{\nu }(h_{1};h_{2}(K))\in H_{\nu }\) for each \(h_{2}\in [0,\bar{h}_{2}]\). As \(\bar{h}_{2}\in B^{f}\), \(\bar{h}_{2}(k)<f^{M}(k)\) when \( k>0 \) was arbitrary, that proves (a).

(b) Consider a function\(\ A{:}\,X_{1}\times X_{2}\rightarrow Y,\) where \(X_{1},\) \(X_{2}\) and Y nonempty and chain complete. We begin by mentioning two facts about order continuous operators. First, the operator A is order continuous jointly in \(x=(x_{1},x_{2})\) if and only if it is order continuous in each argument (see Stoltenberg-Hansen et al. 1994, Proposition 2.4). Therefore, to prove claim (b), it suffices to check the order continuity of \(A_{\nu }\) in each argument separately. Second, an order continuous operator is necessarily isotone (e.g., see Dugundji and Granas 1982, p. 15).

For any \(\bar{h}_{2}\in B^{f},\) \([0,\bar{h}_{2}]\subset B^{f},\) consider \((h_{1},h_{2})\in H_{\nu }\times [0,\bar{h}_{2}].\) We first show \((h_1,h_2)\rightarrow A_{\nu }(h_1,h_2(K))\) is isotone on \( H_{\nu }\times [0,\bar{h}_{2}]\). To see this, observe for \(k=K>0,\) \( h_{1}>0\), \(h_{2}\in [0,\bar{h}_{2}]\), as \(Z_{\nu }\) in (14) is decreasing and continuous in \(\hat{c},\) and increasing in \((h_{1},h_{2})\), the operator \(A_{\nu }\) is isotone in \( (h_{1},h_{2}).\) Noting the definition of A elsewhere in (16), \( A_{\nu }\) is isotone on \(H_{\nu }\times \{B^{f}\cap [0,\bar{h}_{2}]\}.\)

By Lemma 3, \(H_{\nu }\times \) \(B^{f}\) is a complete lattice and hence, countably chain complete. It follows that \(H_{\nu }\times [0,\bar{h}_{2}]\) is countably chain subcomplete for any \(\bar{h} _{2}\in B^{f}\) that satisfies conditions of this lemma.

We first show \(A_{\nu }\) preserves the supremum of countable chains in \( H_{\nu },\) for each \(h_{2}\in [0,\bar{h}_{2}]\). When \(h_{2}\in [0,\bar{h}_{2}]\mathbf {,}\) \(k=K>0,\) consider the countable chain \( \{h_{1}^{n}\}\) each \(h_{1}^{n}\in H_{\nu }.\) For each \(h_{2}\in [0, \bar{h}_{2}]\), \(h_1\rightarrow A_{\nu }(h_{1};h_{2}(K))\) is simply a special case of the nonlinear operator studied by Coleman (1997) (e.g., see Coleman 1997, Eq. (9), Lemmas 5, 6, and 8). Therefore, by a result in Coleman (1997, Lemma 9), \(h_1\rightarrow A_{\nu }(h_{1};h_{2})\) is a compact operator (therefore, continuous in both the topology of uniform and in the topology of pointwise convergence). Then, by Proposition 3, \(h_1\rightarrow A_{\nu }(h_{1};h_{2}(K))\) is order continuous.

Next, we show that \(A_{\nu }\) preserves the supremum of countable chains of \(\{h_{2}^{n}\}\) each \(h_{2}^{n}\in [0,\bar{h}_{2}],\) for each \(h_{1}\in H_{\nu }.\) For fixed \(h_{1}>0,\) \(k=K>0,\) by the continuity assumptions on the derivatives of the primitives in A1 and A2, for all \(k=K>0,\) we have

where the first line follows from the fact that under assumption A2, Z is continuous pointwise in \(h_2(K)\) \(n_{\nu }^{*}(\hat{C},K)\) is continuous in \(\hat{C}\) for \(\nu =\{\vee ,\wedge \}\), and \(\vee (f-h_{2}^{n})(K)\) =\( (f-\vee \) \(h_{2}^{n})(K),\) for each K; the last line follows from the fact that under Assumptions A1 and A2, as for \(h_{1}\in H_{\nu },\) Z is continuous in \(\hat{x}\). Therefore, we have

The fact that \(A_{\nu }\) preserves infimum of countable chains in \(H_{\nu }\times [0,\bar{h}_{2}]\) for all \(\bar{h}_{2}\in B^{f},\) \(\bar{h} _{2}<f^{M}\) follows from a dual argument.

Next lemma shows that for each \(h_{2}\in B^{f}\mathbf {,}\) the operator \( h_{1}\rightarrow A_{\nu }(h_{1};h_{2}(K))\) has a nontrivial strictly positive greatest fixed point, and this greatest fixed point is isotone in \( h_{2}\in [0,\bar{h}_{2}]\).

Lemma 5

Under Assumptions A1 and A2, for \(h_{2}\in [0,\bar{h}_{2}],\) and \(\nu \in \{\vee ,\wedge \},\) (a)\(\ h_1\rightarrow A_{\nu }(h_{1};h_{2}(K))\) has a greatest fixed point \(h_{\nu }^{*}(h_{2}(K))\in H_{\nu }\), with \(h_{\nu }^{*}(h_{2}(K))(k)>0\) when \(k>0;\) (b) this fixed point can be computed by successive approximation from \( f_{\nu }^{*}\) as

where \(\inf _{n}A_{\nu }^{n}(f_{\nu }^{*};h_{2}(K))(k)=\lim _{n}A_{\nu }^{n}(f_{\nu }^{*};h_{2}(K))(k).\) Finally, (c) \(h_2\rightarrow h_{\nu }^{*}\) is isotone on \([0,\bar{h}_{2}].\)

Proof

(a) Existence of greatest fixed point of \(h_1\rightarrow A_{\nu }(h_{1};h_{2}(K))\): For each \(h_{2}\) \(\in \) \([0,\bar{h}_{2}],\) as \(A_{\nu }(\cdot ;h_{2}(K))\) is an isotone transformation of \(H_{\nu },\) and \(H_{\nu }\) is a nonempty complete lattice, hence by Tarski (1955, Theorem 1) the set of fixed points of \(h_1\rightarrow A_{\nu }(h_{1};h_{2}(K))\) is a nonempty complete lattice.

(b) Computation of greatest fixed point \(h_1\rightarrow A_{\nu }(h_{1};h_{2}(K))\): For given \(h_{2}\) \(\in \) \([0,\bar{h}_{2}]\), as \(h_1\rightarrow A_{\nu }(h_{1};h_{2}(K))\) is order continuous on \(H_{\nu },\) consider the iterations \(A^{n}(f_{\nu }^{*};h_{2}(K)).\) Then, \(\{A_{\nu }^{n}(f_{\nu }^{ *};h_{2}(K))\}_{n=0}^{\infty }\) is a decreasing chain. As pointwise and uniform convergence coincide in \(H_{\nu }\), and pointwise convergence implies order convergence in \(H_{\nu }\) by Proposition 3, we have for each k:

where \(\varPsi _{A_{\nu }}(h_{2}(K))\subset H_{\nu }\) for each \(h_{2}\in [0,\bar{h}_{2}]\) is the fixed point set of \(h_1\rightarrow A_{\nu }(h_{1};h_{2}(K))\), with a trivial least fixed point \(\wedge \varPsi _{A_{\nu }}=0.\) Strict positivity of \(h_{\nu }^{*}(h_{2}(K))(k)\), when \(k>0\) follows from a modification of a standard argument involving the Inada conditions and iterations along RE paths (e.g., Coleman 1997, Lemma 11 and Theorem 12).

(c) Isotonicity of \(h_{\nu }^{*}\) follows from Veinott’s fixed point comparative statics result (i.e., Topkis 1998, Theorem 2.5.2), noting \( h_2\rightarrow A_{\nu }(h_{1};h_{2}(K))\) is increasing on \([0,\bar{h} _{2}].\) \(\square \)

3.4 The second step: existence of RE

Using Lemma 5, we can now define the RE operator \( A_{\nu }^{*}\) based on the greatest fixed point of the first-step operator. For \(\bar{h}_{2}\in B^{f}\) \((\bar{h}_{2}\in B_{m}^{f})\) as specified above, let the “second-step” operator be defined as:

where the restriction of \(A_{\nu }^{*}\) to the space \(h_{2}\in [0, \bar{h}_{2}]\subset B_{m}^{f}\) is denoted by \(A_{m,\nu }^{*}(h_{2})\). Then, a RE is any fixed point \(h^*\) of \(A_{\nu }^{*}\) such that, when \(k>0,\) \(h^{*}(k)>0\), and \(g^{*}>0\mathbf {.}\) Further, any such RE of that is a fixed point on \(B^f_m\) will additionally have RE investment \(g^{*}\) monotone. Recall, the RE investment is given by

for any \(C^{*}\in B^{f}\). Similarly, define \(g_{m,\nu }^{*}\) for any \(C^{*}\in B_{m}^{f}\). Recall \(C^*\) is a candidate RE consumption function, while \(n_{\nu }^{*}\) are the fixed points defined in Lemma 2.

Our first main theorem of the paper which concerns the existence of RE using the operator \(A_{\nu }^{*}\) in Eq. (17) in each of the spaces \([0,\bar{h}_{2}]\) (resp, \([0,\bar{h}_{2}^{m}])\) where the upper bounds \(\bar{h}_{2}\) \(\in B^{f}\) (resp., \(\bar{h}_{2}^{m}\in B_{m}^{f})\) are given by Eq. (12) (resp., 13). Recall, although for each \(h_{2}\in [0,\bar{h}_{2}]\) and any K, we have \(h_{\nu }^{*}(h_{2}(K))\in H_{\nu }\), in general, \(K \rightarrow h_{\nu }^{*}(h_{2}(K))(K)\not \in H_{\nu }\).

Theorem 1

Under Assumptions A1, A2, for \(h_{2}\in [0,\bar{h}_{2}]\subset B^{f}\), we have for \(\nu \in \{\vee ,\wedge \}\):

-

(a)

\(A_{\nu }^{*}:[0,\bar{h}_{2}]\rightarrow [0,\bar{h} _{2}]\) has a nonempty complete lattice of fixed points \(\varPsi _{A_{\nu }^{*}}\subset [0,\bar{h}_{2}]\subset B^{f}\), each fixed point is a RE,

-

(b)

operator \(A_{\nu }^{*}\) is order continuous on \([0,\bar{h} _{2}]\) \(\subset B^{f}\);

-

(c)

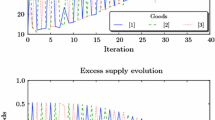

the least \(C_{\nu ,L}^{*}\) and the greatest \(C_{\nu ,G}^{*}\) RE can be computed as follows-for each k,

$$\begin{aligned} \vee (A_{\nu }^{*})^{n}(0)(k)= & {} C_{\nu ,L}^{*}(k)\le C_{\nu ,G}^{*}(k)=\wedge (A_{\nu }^{*})^{n}(\bar{h}_{2})(k,k) \\ n_{\nu }^{*}(C_{\nu ,L}^{*}(k),k)\ge & {} n_{\nu }^{*}(C_{\nu ,G}^{*}(k),k); \end{aligned}$$ -

(d)

for \(h_{2}\in [0,\bar{h}_{2}^{m}]\subset B_{m}^{f}\), for the mapping \(A_{m,\nu }^{*}:[0,\bar{h}_{2}^{m}]\mathbf {\rightarrow }[0, \bar{h}_{2}^{m}]\) claims (a)–(d) hold for its nonempty complete lattice of RE \(\varPsi _{A_{m,\nu }^{*}}\subset [0,\bar{h}_{2}^{m}]\subset B_{m}^{f}\).

Moreover, RE policies \(c^{*}(\cdot ,\cdot ,C_{\nu }^{*})\in \mathbf {C }^{*}(B^{f})\) (or, \(\mathbf {C}^{*}(B_{m}^{f})\) if we consider subspace \(B_{m}^{f}\), respectively).

Proof

We prove parts (a–c) for RE in \([0,\bar{h}_{2}]\). The proof of (d) for RE in \([0,\bar{h}_{2}^{m}]\) relative to the claims in parts (a–c) for \( A_{m,v}^{*}\) follows from a similar construction.

(a) First, observe by the Inada conditions on u and f, and the definition of the range of the first-step fixed point, by construction, we have \(0\le A_{\nu }^{*}(0)\le \) \(A_{\nu }^{*}(\bar{h}_{2})\le \bar{ h}_{2}\) with strict equality with \(k=K>0\), where \(\bar{h}_{2}\) is defined in Eq. (13). Then, by Lemma 5(c), as \( A_{\nu }\) is isotone, and by Lemma 3 \(B^{f}\) is a nonempty complete lattice, the fixed point set \(\varPsi _{A_{\nu }^{*}}\subset [0,\bar{h}_{2}]\) is a nonempty complete lattice by Tarski’s Theorem.

(b) From Lemma 4, \(A_{\nu }\) is order continuous on \(H_{\nu }\times [0,\bar{h}_{2}]\mathbf {.}\) We first show this implies greatest fixed point of the partial map \(h_{1}\rightarrow A_{\nu }(h_{1};h_{2}(K)),\) is order continuous in \(h_{2}\in [0,\bar{h} _{2}].\) To see this, consider the iterations from an initial point \( h_{1}^{0}{:=}\vee H_{\nu },\) with the iterations given by \(\{A_{\nu }^{n}(h_{1}^{0};h_{2}(K))\}_{n=0}^{\infty }.\) As order continuity is closed under composition, and evaluation maps and projections are order continuous in chain complete partially ordered sets, we conclude by the Tarski–Kantorovich theorem (Dugundji and Granas 1982, Theorem 4.2):

where the convergence to \(\vee \varPsi _{A_{\nu }}(h_{2}(k))\) is uniform, and \( \vee \varPsi _{A_{\nu }}(h_{2}(k))\) is order continuous in \(h_{2},\) each k.

(c) By construction, we have \(0\le A_{\nu }^{*}(0)\le \) \(A_{\nu }^{*}(\bar{h}_{2})\le \bar{h}_{2}\) with strict equality with \(k=K>0.\) Then, as by part (b), \(A_{\nu }^{*}(h_{2}),\) \(h_{2}\in [0,\bar{h}_{2}]\) is order continuous, therefore, by the Tarski–Kantorovich theorem, we have

\(\square \)

First and foremost, there are no known results on the existence of either sequential or recursive equilibrium under these conditions.Footnote 15 In particular, no results are known on the existence of smooth sequential equilibrium. It bears mentioning that, in discrete time models without proving smooth sequential or recursive equilibria, at least locally near the steady state, one cannot apply smooth dynamical systems methods (as is typically done in the literature to characterize local indeterminacy of equilibria).Footnote 16 Further, as the “Santos’s economy” (Santos 2002, Sect. 3.2) is embedded in our class of economies, we know that continuous (let alone smooth) RE do not exist.

Second, Coleman (1997) or Datta et al. (2002) do not handle Assumption A2. In particular, these papers effectively do not consider the case of labor externalities, rather the case of elastic labor supply with income taxes and/or capital externalities under very strong restrictions. Further, Mirman et al. (2008) only consider inelastic labor supply and no labor externality.

Third, equilibrium responses for labor supply are in general a correspondence under assumption A2. This plays a key role in our analysis. In particular, our methods for verifying RE involve Euler equation branching methods [see Raines and Stockman (2010) and Stockman (2010)]. That is, we construct a least and greatest selections of equilibrium labor supply in each period (contingent on consumption and the capital stock), and then parameterize “upper” and “lower” Euler equation operators. In general, though, these Euler equation branches are not ordered.

Fourth, if we allow for \(e(K,0)>0\) when \(K>0,\) and \(e(0,\hat{N})>0\) when \( \hat{N}>0,\) our arguments still apply. The simplest case is \(e(K,\hat{N} )=(1-\tau (K)),\) for \(\tau (K)\in [0,1)\) is discussed in Sect. 5.

Next, we should mention, in Theorem 1, we characterize the comparative statics of any RE in individual and aggregate state variables for a fixed economy (under Assumptions A1 and A2). That is, we prove all RE has consumption and investment policies monotone in individual states (and continuous), as required by Lemma 1.

4 Equilibrium comparative statics

We now consider RE comparative statics on the space of deep parameters of the economy relative to the set of RE equilibrium in Theorem 1. The first question is related to “capital deepening” with respect to discount rate. We do the comparative statics for RE using the operator \(A_{\nu }^{*}\) in \(B^{f}\) and mention as a corollary the similar comparative statics in \(B_{m}^{f}\).

Theorem 2

Capital deepening in discount rates. Under Assumptions A1 and A2, for \(\bar{h}_{2}\in B^{f}\) given in expression (12), we have (a) for the least fixed point \(C_{\nu ,L}^{*}(\beta )\in [0,\bar{h}_{2}]\) (resp., greatest fixed point \(C_{\nu ,G}^{*}(\beta )\in [0,\bar{h} _{2}]\)) for \(\beta _{1}\ge \beta _{2},\) \(C_{\nu ,L}^{*}(\beta _{1})\le C_{\nu ,L}^{*}(\beta _{2})\) (resp, \(C_{\nu ,G}^{*}(\beta _{1})\le C_{\nu ,G}^{*}(\beta _{2})\)) with RE investment \(g_{\nu ,G}^{*}(\beta _{1})\ge \) \(\ g_{\nu ,G}^{*}(\beta _{2})\) (resp., \(g_{\nu ,L}^{*}(\beta _{1})\ge \) \(\ g_{\nu ,L}^{*}(\beta _{2})\)), and the associated labor supply \(N_{\nu ,L}^{*}(\beta _{2})(k){:=}n_{\nu }^{*}(h_{\nu ,L}^{*}(\beta _{2})(k),k)\ge \) \( n_{\nu }^{*}(h_{\nu ,L}^{*}(\beta _{1})(k),k)=:\, N_{\nu ,L}^{*}(\beta _{1})(k)\) (resp., \(N_{\nu ,G}^{*}(\beta _{2})\ge \) \(N_{\nu ,G}^{*}(\beta _{1})\)). Also, (b) the RE comparative statics can be computed by the successive approximations as follows:

Finally (c), the claims in (a) and (b) hold for the least and greatest fixed points of \(A_{m,v}^{*}\) on \(B_{m}^{f}\).

Proof

Noting its dependence on the parameter \(\beta ,\) we will do the case of RE in \(C_{\nu }^{*}(\beta )\in [0,\bar{h}_{2}]\). The exact same argument works for \(h_{2}\in [0,\bar{h}_{2}^{m}]\).

Noting the definition of \(A_{\nu }(h_{1},h_{2}(K);\beta )\), it is decreasing in \(\beta .\) As by definition, \(A_{\nu }^{*}(h_{2};\beta )\) is the greatest fixed point of the partial map \(h_1\rightarrow A_{\nu }(h_{1};h_{2}(K);\beta )\) by Veinott’s fixed point comparative statics theorem, \(A_{\nu }^{*}(h_{2};\beta )\) is decreasing in \(\beta \).

By Theorem 1(c), the mapping \(h_2\rightarrow A_{\nu }^{*}(h_{2};\beta )\) is order continuous in \(h_{2}.\) Then, by the Tarski–Kantorovich theorem, we have

Further, as \(n_{\nu }^{*}(c,k)\) is decreasing and continuous in c, we have for RE labor supply:

By a dual argument, we could proceed for the greatest fixed point. Noting the definition of RE investment associated with least and greatest RE consumption \(C_{\nu ,L}^{*}(\beta )\) and \(C_{\nu ,G}^{*}(\beta ), \) we have RE investment \(g_{\nu ,G}^{*}(\beta _{1})\ge \) \(\ g_{\nu ,G}^{*}(\beta _{2})\) (resp., \(g_{\nu ,L}^{*}(\beta _{1})\ge \) \(\ g_{\nu ,L}^{*}(\beta _{2})),\) which completes the proof. \(\square \)

Notice, in Theorem 2, we compare RE labor supply for different discount rate \(\beta \), as well as investment and consumption. Mirman et al. (2008) and Acemoglu and Jensen (2015) provide similar monotone comparison result for dynamic economies with inelastic labor supply, small capital externalities, and no labor externality. There is no obvious way to extend their results in models with elastic labor supply, labor externality, and especially, large capital externalities.

5 Applications and discussion

In this section, we relate our contribution vis-a-vis some classical results in the literature. In particular, we apply our methods to Romer (1986), Benhabib and Farmer (1994) economies and we conclude with a detailed discussion on Santos (2002).

5.1 Romer (1986)

In the spirit of Romer (1986) economy, we introduce inelastic labor supply and no leisure-labor choice in assumptions A1 and A2. That is, consider the following special case of our general assumptions:

Assumption Romer:

Modify Assumption A1 with \(v(l)=0\) for all \(l\in [0,1]\) and Assumption A2 with \( \tilde{e}(K){:=}\, e(K,1)\) rising in K.

If \(f_{1}(K,1)\tilde{e}(K)\) is falling in K, then there exists an unique RE by Coleman (1991, 2000) or Mirman et al. (2008). On the other hand, if \( f_{1}(K,1)\tilde{e}(K)\) is rising in K, Theorem 1 implies existence of the least and the greatest RE. Further, Theorem 2 provides RE comparative static results. We interpret \(f_{1}(K,1)\tilde{e}(K)\) is decreasing in K as the case of “small” externality and \(f_{1}(K,1) \tilde{e}(K)\) increasing in K as the case of “large” externality.Footnote 17 For example, consider \(f(k,1)=k^{\alpha }\) and \(\tilde{e}(K)=K^{a}\) for \( a,\alpha \ge 0\), with \(a+\alpha <1\) implying small externality and \( a+\alpha >1\) implying large externality. Notice that, in case of inelastic labor supply, we have a single Euler equation operator, with no Euler equation branching.Footnote 18

5.2 Benhabib and Farmer (1994)

The economies studied in Benhabib and Farmer (1994) provide another important application of our results, as well as the (case of symmetric RE in) dynamic models with heterogeneous firms and credit constraints found in recent paper by Liu and Wang (2014), or some heterogeneous agent economies with adverse selection (e.g., Benhabib and Wang 2014). To obtain Benhabib and Farmer (1994) style economies, we modify our assumptions as follows:

Assumption Benhabib-Farmer:

u(c) and v(l) are each power utility in consumption and leisure (or, \(u(c)=\ln c\) ) in Assumption A1, and technology is Cobb–Douglas: \(F(k,n,K,\hat{N} )=k^{a}n^{b}K^{c}\hat{N}^{d}\) with \(f(k,n)=k^{a}n^{b},\) \(e(K,\hat{N} )=K^{c}\hat{N}^{d},\) and \(a,b,c,d>0,\) such that \(a+b=1,\) \(a+c>1,\) \(b+d>1\) in Assumption A2.

By Theorem 1, a complete lattice of RE exists in both \([0,\bar{h}_{2}]\) and \([0,\bar{h}_{2}^{m}]\), while by Theorem 2, we can compare the least and the greatest RE in each of these function spaces in the discount rate. As Benhabib and Farmer (1994) show the equivalence of the “laissez faire” versions of their models to monopolistic competition, our results apply to these decentralizations also. Liu and Wang (2014) have recently produced a very interesting dynamic economy, where credit constraints on heterogeneous firms generate a set of sequential equilibrium conditions in a symmetric equilibrium that are observationally equivalent to the model of Benhabib and Farmer (1994) without appealing to increasing returns directly. See also Pintus (2006) for more recent analysis. Our results apply to that framework as well.

Finally, we can develop a global theory of comparisons of recursive sunspot equilibria as in Benhabib and Farmer (1994) by extending the approach of Spear (1991). Since our construction is global, the resulting theory of stationary sunspot equilibrium is global. It is not clear how such results are obtained with local approaches in standard methods available in the literature. For example, Spear’s results (Spear (1991)) for the existence of continuous stationary sunspots in models with positive externalities such as Romer (1986) are not easy to extend. The complication is clear from Lemma 2. As contingent labor supply is a correspondence, it does not generally admit smooth selections; rather, only continuous selection that depend on steady-state capital; hence, the implicit function theorem cannot be applied at the steady state. The global approach avoids this complication. Further, as we generate RE with monotone dynamics in capital, we can study the question of existence of stationary sunspot equilibria using monotone Markov process methods.

5.3 Santos (2002) and relationship of our methods to the literature

A common approach to studying (local) structure of dynamic equilibrium in the literature is using methods of smooth dynamical systems and characterizing recursive or sequential equilibrium dynamics near a steady state. Unfortunately, these methods are not applicable if a locally smooth dynamic equilibrium does not exist. Upon ensuring existence of a sequential equilibrium, if the model is continuous time, then one can additionally prove the resulting sequential equilibrium is the solution of an autonomous differential equation having a smooth extension near steady states.Footnote 19 In this case, one can use the Grobman–Hartman Theorem, and/or versions of the stable manifold theorem to study the local properties of RE. We are not aware of similar results for the class of economies studied in this paper, even with continuous time.

For discrete time models, one requires to first prove the existence of a sequential equilibrium; then, to show one such sequential equilibrium can be smoothly extended over an open set of the steady state. First, multiplicity of contingent equilibrium labor supply in Lemma 2 does create difficulty in applying these methods even locally near steady states. Although at best the transversality argument yields a globally continuous selections for contingent RE labor supply, and not a smooth selection, at any point in the state space \(k^{*}>0\), equilibrium contingent labor supply is locally smooth by the implicit function theorem. So this is not problematic. The issue is the local invariant manifold near the steady state for which our extremal recursive competitive equilibrium dynamical systems form a selection does not necessarily admit a smooth selection. Actually, sufficient conditions under which a smooth selection exists are strong and require unique recursive equilibria (e.g., see Datta et al. 2002). Further, the Santos (2002, Sect. 3.2) counterexample (even with inelastic labor supply) proves smooth local equilibria need not exist. In other words, we have nonexistence of smooth local recursive equilibria near steady states. So it does not seem easy to apply the methods of smooth dynamical systems to characterize even the local structure of RE, let alone its global structure as we do in Sects. 3 and 4. Santos (2002) has been discussed extensively in the literature as it provides a striking example of where all known methods for existence of minimal state RE fail. It is also an important prototypical example of so-called policy-induced indeterminacy,Footnote 20 with identical features as in Coleman (1991, 2000) and Mirman et al. (2008), except for allowing regressive income tax as opposed to a progressive income tax. We elaborate these points in the remainder of this subsection.

Assumption Santos:

The household preferences are such that \( v(l)=0\) for all \(l\in [0,1]\), the period utility function u(c) is either satisfying Assumption A1 or \(u(c)=\ln c\) for \(c\in R_{++}\). Labor is supplied inelastically (normalized to 1). Production technology is given by f(k, n), where k stands for capital and n for labor hired by the firm. Function f satisfies conditions in Assumption A2 with \(e(K,\hat{N})=1\). In addition, there is a Lipschitz continuous and monotone income tax function, \(\tau {:}\,\mathbf {K}\rightarrow [0,1)\).

Coleman (1991) analyzes the case of progressive taxation in which \(\tau \) is a monotone increasing function of aggregate state. The case of regressive taxation (or, monotone decreasing \(\tau \)) includes the example in Santos (2002, Sect. 3.2). We should also mention that Peralta-Alva and Santos (2010) demonstrate (numerically) indeterminacy of sequential equilibria near the unstable steady state for the case of regressive taxation. Note that, under regressive taxation, a sequential equilibrium does exist by an argument following Crettez and Morhaim (2012).

The household enters any given period with an individual level of capital \( k\in \mathbf {R}_{+}\), facing an economy in aggregate state \(K\in \mathbf {R} _{+}\) where K is the per-capita capital stock and aggregate labor, \( \hat{N}=1\). Household income in state (k, K) is \(r(K)k+w(K)\), where \( r(K){:=}\, f_{1}(K,1)\) is the rental rate for capital and \(w(K){:=}\, f_{2}(K,1)\) is the wage rate. Profits are zero by constant returns to scale. The income tax proceeds are redistributed as lump-sum transfer J(K) back to households under a balance budget, \(J(K){:=}\,\tau (K)(r(K)k+w(K))\). Denoting investment by x, the agent or household’s budget constraint is,

With this notation, we formally define a minimal state-space recursive equilibrium as a list of functions \(C^{*},V^{*},c^{*},w,r,J\) such that for each \(K>0\):

-

1.

Taking prices w, r and law of motion \(C\in B^{f}(\mathbf {K})\) as given \(V^{*}:\mathbf {K}\times \mathbf {K\times }B^{f}\rightarrow \mathbf {R }\) satisfies the Bellman equation for the household problem,

$$\begin{aligned} V^{*}(k,K;C)=\max _{c\in [0,y_{\tau }(k,K)]}\{u(c)+\beta V^{*}(y_{\tau }(k,K)-c,g(K;C);C)\}, \end{aligned}$$(19)with \(c^{*}(k,K;C)\) as the solution.

-

2.

Taking prices w, r as given firms maximize profit,

$$\begin{aligned} \max _{k,n\ge 0}f(k,n)-r(K)k-w(K)n. \end{aligned}$$ -

3.

Aggregate and individual consistency,

$$\begin{aligned} C^{*}(K)= & {} c^{*}(K,K;C^{*}), \\ C^{*}(0)= & {} 0. \end{aligned}$$ -

4.

Government budget balance, \(J(K)=\tau (K)[r(K)k+w(K)]\) and,

-

5.

Market clearing: \(c^{*}(K,K;C^{*})+\) \(g^{*}(K,K;C^{*})= \) \(f(K,1)=y_{\tau }(K,K)\).

Next, for the sake of notation, list of function in the definition of the RE is simplified and denoted by using a consumption function \(C^{*}\) and the corresponding law of motion \(g^{*}\). The unique optimal solution \( c^{*}(k,K;C^{*})\) in (19) has strong structural properties in the individual state k (although not in aggregate state K). The next proposition is a counterpart of Lemma 1 from Sect. 2.3.

Proposition 2

Under Assumption Santos, (a) an RE consumption function \(k\rightarrow c^{*}(k,K;C^{*})\) is increasing and Lipschitz in k, and (b) an RE investment function \(k\rightarrow x^{*}(k,K;C^{*}){:=}\, y_{\tau }(k,K)-c^{*}(k,K;C^{*})\) is increasing and Lipschitz in k.

Proof

A standard argument shows that under our assumptions, the value function \( V^{*}\) is strictly concave and continuous in k, for each K, and has a smooth envelope

and \(V_{1}^{*}(k,K;C)\) is decreasing in k; hence, consumption \(c^{*}(k,K;C^{*})\) is increasing in k which proves one part of (a). To prove (b), notice that the necessary and sufficient first-order characterization of the unique optimal investment \(x^{*}=x^{*}(k,K;C^{*})\) is,

where \(g^{*}(K)=\tilde{f}(K)-C^{*}(K).\) From (a), a consumption \( c^{*}(k,K;C^{*})=(y_{\tau }-x^{*})(k,K;C^{*})\) is monotone increasing in k, as when k rises, the left-hand side of (20 ) falls in k. As the continuation consumption \(c^{*}(k^{\prime },K^{\prime };C^{*})=(y_{\tau }-x^{*})(k^{\prime },K^{\prime };C^{*})\) is also monotone increasing in k, this implies \(x^{*}(k,K;C^*)\) is increasing in k, which proves part of (b).

Finally, since \(y_{\tau }(k,K)\) is Lipschitz for \(K>0\), \(c^{*}(k,K;C^*)\) and \(x^{*}(k,K;C^*)\) are both Lipschitz with a Lipschitz constant bounded by the Lipschitz constant of \(y_{\tau }(k,K)\), namely \(F_{1}(K,1)\) when \(K>0\). \(\square \)

We make few remarks.

First, according to Proposition 2, any RE in this economy must be continuous in individual state k, so any discontinuities in a RE must occur only in aggregate states K.

Second, if we approach the question of existence and characterization of RE via dynamic lattice programming methods [e.g., as discussed in Mirman et al. (2008) and Acemoglu and Jensen (2015)], it is easy to see issues that arise under regressive taxation as the return on capital is not monotone in g. That is, a lattice programming argument cannot determine whether \(c^{*}(k,K;C^{*})\) is increasing or decreasing in \(C^{*},\) and without further characterization of equilibrium single-crossing properties; hence, existence of an RE would need to be verified, for example, by a topological argument. This complicates the question of constructing monotone equilibrium comparative statics in the deep parameters of the economy \((\beta ,\tau )\). Further, obtaining sharp characterizations of RE that have joint monotonicity properties of RE investment in both individual and aggregate states (i.e., monotonicity of \(K\rightarrow c^{*}(K,K;C^{*})\) in any RE \(C^{*} \)) directly via application of dynamic lattice programming, as in Mirman et al. (2008), is not possible as requisite single-crossing properties are not evident. Actually, single-crossing properties are only shown to be held in particular subclasses of RE.

Third, if we try to apply Coleman’s monotone map method to verify existence of any RE with regressive taxation, we also run into problems. To see that, following Coleman (1991), let us take a “guess” at future consumption function \(C:D\rightarrow D\) where

Next, we define a mapping \(Z_{c}(\hat{c},k,K,C)\) based on the Euler equation as follows - for \(C\in H,\) \(0<C(K)<\tilde{f}(K)\) , \(K>0\),

The Coleman monotone map operator is,

Under progressive taxation, everything works well: that is, \(A_{c}\) is single-valued, isotone and has a nontrivial fixed point, which is a recursive equilibrium.Footnote 21 Also, the fixed point can be computed by successive approximations as the limits of nonstationary recursive equilibria for finite horizon economies. Further, one can show that the fixed point is increasing in \(\beta ,\) and decreasing in \(\tau \).Footnote 22 However, under regressive taxation, the Coleman monotone map operator \(A_{c}\) is not single-valued; rather, it is nonempty upper semicontinuous correspondence and does not necessarily admit a continuous selection in its first argument k, for each K, let alone a Lipschitz section as in Proposition 2. Therefore, as Santos (2002) points out, the Coleman monotone map method cannot verify existence of an RE or characterize equilibrium comparative statics.

Our methods do work for the case of regressive taxation. Since we are interested in comparing RE, we specify explicitly how our new Euler equation operator depends on \((\beta ,\tau )\), the deep parameters of the economy. Let \(h_{1}\in H\), \(h_{2}\in B^{f}\), for \(0<h_{1}<\tilde{f},\) \(k>0\), define

Next, define the operator A as follows:

Notice, the operator defined in (24) differs from Coleman’s operator defined in (22) only by how it treats the “tax” in the second term of (21) versus (23). We add an additional step to the computation of the fixed point (compose \(\tau \) with \(h_{2}\in B^{f}\)) which allows us to study the complementarity structure of the household equilibrium Euler equation in “two steps”. In effect, the decomposition of the equilibrium fixed point problem deconstructs the single-crossing property for the household’s problem into a single-crossing property (in equilibrium) in two parts, one part isolating “individual” state dynamic complementarities, and a second part isolating “aggregate” state dynamic complementarities.

In terms of the example we are considering in this section: for any \( h_{2}\in B^{f}\), \(h_{1}\rightarrow A(h_{1},h_{2},K;\beta ,\tau )\) is isotone. Also, the partial map \(h_{1}\rightarrow A(h_{1},h_{2},K;\beta ,\tau )\) is precisely Coleman’s “monotone map” operator embedded as a “first-step” operator in a “two-step” procedure. As H is a complete lattice under pointwise partial order, by Tarski’s theorem, our first-step operator has a complete lattice of fixed points \(\varPsi _{A}\subset \) \(H\ \)for each \((h_{2},K,\beta ,\tau )\) with a trivial greatest fixed point at 0, and a unique (least) strictly “interior” fixed point \(h^{*}(h_{2},K,\beta ,\tau )\in H\).Footnote 23

Next, we use the least fixed point to define a second-step operator

By Veinott’s fixed point comparative statics result (e.g., Topkis 1998, Theorem 2.5.2), \(h^{*}(h_{2},K;\beta ,\tau )\) is increasing in \(h_{2}\) on \(B^{f}\) for each \((\beta ,\tau )\), with \(h^{*}(h_{2},K;\beta ,\tau )\) also increasing in \(\beta ,\) and decreasing in \(\tau \). By construction, \( A^{*}(h_{2};\beta ,\tau )\in B^{f}\) and \(B^{f}\) is a nonempty complete lattice. Therefore, by Tarski’s theorem, the fixed point set of operator \(A^{*}\) denoted by \(\varPsi _{A^{*}}(\beta ,\tau )\) is a nonempty complete lattice and each fixed point is an RE.

Importantly, by construction for any \(C^{*}(\beta ,\tau )\in \varPsi _{A^{*}}(\beta ,\tau )\subset B^{f}\) we have that the optimal solution to the household dynamic program \((k,K)\rightarrow c^{*}(k,K,C^{*};\beta ,\tau )\in \mathbf {C}^{*}(\mathbf {D},B^{f}(\mathbf {K}))\), where we recall that \(\mathbf {C}^{*}(\mathbf {D},B^{f}(\mathbf {K}))\) is the set of candidate RE consumption policy functions.

Further, as \(A^{*}\) is increasing in \(\beta \) and decreasing in \(\tau \), by a standard fixed point comparative statics argument, under either progressive or regressive taxation, the least RE, \(\wedge \varPsi _{A^{*}}(\beta ,\tau )\), and the greatest RE, \(\vee \varPsi _{A^{*}}(\beta ,\tau ) \), are increasing in \(\beta \) and decreasing in \(\tau \).

Notice that we can provide sharper characterization of some RE (namely, some RE has stronger monotonicity properties for investment). That is, assume additionally at function \(K\rightarrow \tilde{f}(K)-h_{2}(K)\) is increasing. Denoting by \(A_{m}^{*}(h_{2};\beta ,\tau )\) the restriction of the mapping \(A^{*}(h_{2};\beta ,\tau )\) to \(B_{m}^{f}\mathbf {.}\) Now \( A_{m}^{*}:\) \(B_{m}^{f}\rightarrow B_{m}^{f}\) and, as \(B_{m}^{f}\) is a subcomplete lattice of \(B^{f}\), the fixed point set of \(A_{m}^{*}\), by Tarski’s theorem, is nonempty complete lattice of RE consumption functions having an associated RE investment monotone increasing (but, in general, discontinuous). Finally, as \(A_{m}^{*}(h_{2};\beta ,\tau )\) restricted \( B_{m}^{f}\) is also increasing in \(\beta ,\) and decreasing in \(\tau ,\) we have the same robust equilibrium comparative statics relative to \((\beta ,\tau )\) obtained in Coleman (1991) and Mirman et al. (2008) not only for progressive taxes, but also for the case of regressive taxes. The difference between the cases is that, in general, we have multiple equilibria with regressive taxes as we show multiple subclasses of RE along with robust equilibrium comparative statics.

The main limitation of our approach is obtaining sufficient structure for the multistep monotone method to work. Specifically, if the tax structure is not monotone our methods cannot be applied. Also, the case of nonseparable preferences are complicated to handle even in models for which sequential equilibrium is known to exist, e.g., by Crettez and Morhaim (2012).

We conclude with a generalization of equilibrium comparative statics results for a class of distorted economies with elastic labor supply. First note that the economy with an income tax corresponds to a “reduced-form” production specification in the spirit of assumption A2. In particular, we rewrite the income process for our economy \(y(k,n,K;\hat{N})\) in Eq. (5) as a ”reduced-form” production function \(f(k,n)e(K,\hat{N})\) [e.g., see Greenwood and Huffman (1995), Coleman (2000) and Datta et al. (2002)]. In this case, you can define \(\hat{e}(K,\hat{ N})=e(K,\hat{N})(1-\) \(\tau (K))\) \(\in [0,1)\), where e satisfies assumption A2, and \(\tau \) is either progressive or regressive. Further, noting that under constant returns to scale, in equilibrium after imposing the balanced budget rule, we can define our operator as in the main section, and verify the existence of RE in Theorem 1 \( \mathbf {.}\)

We assume proceeds of the income tax are returned as lump-sum transfers J(K) to the household, where these transfers satisfy a balanced budget taxation rule

where \(N^{*}\) is any RE labor supply in Theorem 1. Then, when \(k=K,\) noting constant returns to scale and zero profits in private returns for the firms, the income process in a RE for a household is

Under Assumptions A2, an RE exists and can be computed by Theorem 1. To obtain our RE comparison results, we substitute the equilibrium relationship \(y_{\tau }(k,N^{*}(k),k;N^{*}(k))=f(k,N^{*}(k))e(k,N^{*}(k))\), into the definition of \(A_{\nu }\) in Eqs. (14), (15), and (16), noting the dependence of \(A_{\nu }(h_{1},h_{2}(K);\tau )\) on tax, we have the following important result:

Theorem 3

Policy Comparative Statics. Under Assumptions A1 and A2, for \(\bar{h}_{2}\in B^{f}\) (a) for the least RE \(C_{\nu ,L}^{*}(\tau )\in [0,\bar{h}_{2}]\) (resp., greatest RE \(C_{\nu ,G}^{*}(\tau )\in [0,\bar{h}_{2}]\) we have for \(\tau _{1}(K)\ge \tau _{2}(K)\) for all \(K\in \mathbf {K },\) then \(C_{\nu ,L}^{*}(\tau _{1})\ge C_{\nu ,L}^{*}(\tau _{2})\) (resp, \(C_{\nu ,G}^{*}(\tau _{1})\ge C_{\nu ,G}^{*}(\tau _{2}))\) with RE investment \(g_{\nu ,G}^{*}(\tau _{1})\le \ g_{\nu ,G}^{*}(\tau _{2})\) (resp., \(g_{\nu ,L}^{*}(\tau _{1})\le \) \(\ g_{\nu ,L}^{*}(\tau _{2})),\) and the associated RE labor supply \(n_{\nu }^{*}(C_{\nu ,L}^{*}(\tau _{2})(k),k)\le n_{\nu }^{*}(C_{\nu ,L}^{*}(\tau _{1})(k),k)\) (resp, \(n_{\nu }^{*}(C_{\nu ,G}^{*}(\tau _{2})(k),k)\le n_{\nu }^{*}(C_{\nu ,G}^{*}(\tau _{1})(k),k)).\) (b) these RE comparative statics can be computed as follows:

Finally (c), the claims in (a) and (b) hold for the least and greatest RE computed using \(A_{m,v}^{*}\) for \(h_{2}\in [0,\bar{h} _{2}^{m}]\subset B_{m}^{f}\).

Proof

We prove (b) first; then (a) follows from the argument directly. By the order continuity of \(h_2\rightarrow A^*_{m,v}(h_{2};\tau )\) on \(B^f_m\) by the Tarski-Kantorovich theorem, we have

with \(g_{m,\nu }^{*}\) increasing in (k) for each \(\tau ,\) and the last line follows from the fact that \(n_{\nu }^{*}(c,k)\) is continuous and decreasing in c. (a) For each \(h_{1}\in H_{\nu },\) \(h_{2}\in B_{m}^{f} \mathbf {,}\) using the fact that under lump-sum transfers, \(y_{\tau }(k,N^{*}(C^*(k),k),k;N^{*}(C^*(k),k))=\) \(f(k,N^{*}(C^*(k),k))e(k,N^{*}(C^*(k),k))\) is independent of \(\tau \) in any RE, when \(k>0,\) \(h_{1}>0,\) \(h_{2}<y_{f,v}^{*},\) by the definition \( A_{\nu }(h_{1},h_{2}(K);\tau )\) is increasing in \(\tau \). Then, as in the proof of previous theorem, by Veinott’s fixed point comparative statics theorem has \(A^*_{m,\nu }(h_{2};\tau )\) is increasing in \(\tau \). \(\square \)

5.4 Extension to stochastic models

We conclude with a short discussion on extending our results to stochastic models with Markov shocks denoted by \(z\in Z=[z_{L},z_{H}]\). Let \((Z, \mathcal {Z)}\) be a measurable space and \(\mathcal {Z}\), the Borel family of Z with shocks \(\{z_{t}\}_{t=0}^{\infty }\) following a first-order Markov process \(\varPhi (z,A)\) for measurable set \(A\in \mathcal {Z}\). Also, let \((\mathbf {K},\mathcal {K)}\) be a measurable space, \(\mathcal {K}\) the Borel sets of \(\mathbf {K,}\) and denote the state space \(\mathbf {S=K\times Z}\), with \((\mathbf {S,}\mathcal {S)}\) as its product measure space. Allow a random externality e(K, N, z) in production and in addition to Assumption A2, assume e smooth in the shocks (hence, measurable). We assume aggregate laws of motion for capital are parameterized by elements in \(B^{f}(\mathbf {S) }\) defined similar to \(B^{f}(\mathbf {K)}\) in Eq. (2), but modified to require each element of this function space to be jointly measurable in \((\mathbf {S,}\mathcal {S)}\). Now, to construct recursive equilibrium, first notice that the prices are measurable. Noting that the household’s problem in Eq. (6) becomes a stochastic dynamic program with appropriately measurable objective and aggregate laws of motion parameterized by elements of \(B^{f}(\mathbf {S),}\) whose unique fixed point is measurable, stochastic versions of households’ Euler equations and other first-order conditions are available.