Abstract

This study investigates the impact of initial financial conditions on the post-entry performance of firms in a sample of 16,185 Japanese joint-stock companies. We examine whether initial financial conditions, including entry regulations, affect the duration of survival among Japanese start-up firms, distinguishing between failure and merger. We provide evidence that start-up firms that rely more on equity than on debt financing are less likely to fail within a shorter period, although we find little evidence that initial equity size has a significant effect on the time to failure of start-up firms in our sample. Moreover, we find the negative effect of equity financing on the time to failure to be greater for start-up firms founded following the abolition of regulations for minimum capital requirements. Furthermore, the results reveal that start-up firms with larger initial equity capital are more likely to exit through merger, indicating that the effects of initial financial conditions depend on the type of exit route.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

With the progress made in biology and biotechnology, the knowledge of gene sequences can now provide scholars with important clues for the treatment or cure of genetic diseases. It is a well-established fact that human behavior and diseases are determined not only by the environment, but also by the genes. Analogously, initial conditions can provide scholars with important clues to the behavior and performance of firms, and indeed, the impact of initial conditions on post-entry performance has been examined in extant literature (e.g. Levinthal 1991; Cooper et al. 1994). If initial conditions are seen as the gene sequences of start-up firms, they would influence post-entry performance and determine the future of start-up firms.

To date, the impact of initial conditions has been debated in the literature. As Hurwicz (1946) argued, initial conditions impose certain restrictions on the future of firms, including their expectations. Most, if not all, entrepreneurs recognize that financing is one of the greatest obstacles when starting their businesses. In fact, entrepreneurs often face difficulties in raising sufficient funds from capital markets. Owing to the limited access to capital markets, some entrepreneurs are obliged to start their businesses with insufficient capital, and these businesses are then more susceptible to the probability of failure within a short period of time. In this respect, improving initial financial conditions for firm survival has been proven effective. Hence, some policymakers and scholars often emphasize the need for public support for the improvement of initial financial conditions, which is expected to promote successful new businesses.

In Japan, regulations aiming at the improvement of initial financial conditions for legal incorporations were introduced by the amendment of the Commercial Act in April 1990. More precisely, when a joint-stock company was newly founded, capital stock (stated capital) of 10 million yen was at least required at founding due to regulations for minimum capital requirements. These regulations deterred new entrants with insufficient equity capital, and entrepreneurs could not establish joint-stock companies with less than minimum capital stock until the abolition of regulations for such requirements. Given that initial equity capital is inevitable for sustaining a new business, regulations regarding initial financial conditions are expected to improve the performance of small- and medium-sized enterprises (SMEs). Nevertheless, the regulations for minimum capital requirements were then removed when the new Companies Act, superseding the Commercial Act, was introduced in May 2006. Since initial conditions are recognized as critical to sustaining a new business, some empirical studies have focused on whether initial conditions generate long-lived start-up firms (e.g., Geroski et al. 2010; Coad et al. 2013). However, how initial financial conditions, including entry regulations, matter for the post-entry performance of firms―especially the type of exit route―is far from being well adequately understood. There is a paucity of evidence on how regulations regarding initial financial conditions affect the exit routes of start-up firms.

This study investigates the impact of initial financial conditions on the post-entry performance of firms in a sample of 16,185 Japanese joint-stock companies. We examine whether initial financial conditions, including an entry regulation, affect the duration of survival among Japanese start-up firms, distinguishing between failure and merger. We provide evidence that start-up firms that rely more on equity than debt financing are less likely to fail within a shorter period, although we find little evidence that initial equity size has a significant effect on the time to failure of start-up firms in our sample. Moreover, we find the negative effect of equity financing on the time to failure to be greater for start-up firms founded following the abolition of regulations for minimum capital requirements.

The findings shown in this study suggest that initial financial conditions―more specifically, initial equity capital―determine the fate of start-up firms; further, they are also a critical determinant of the exit route. Additionally, this study reveals that regulations regarding initial financial conditions reduce the effect of initial capital structure on firm survival. Indeed, start-up firms founded after the abolition of regulations for minimum capital requirements are more likely to survive longer in the market. Although such regulations are expected to prevent start-up firms from being short-lived, they also distort debt and equity balance at founding, thereby resulting in the reduction of the effect of initial capital structure on firm survival.

Furthermore, we pay more attention to possible exit routes while examining the factors affecting firm survival. In general, exit due to failure (bankruptcy) is typical post-entry performance, but some firms exit without failure. In particular, a merger can be regarded as an exit route, even though the business still exists in the market. Not surprisingly, the impact of initial financial conditions may differ across these alternative exit routes. It is plausible that initial financial conditions are a determinant not only on whether start-up firms exit the market but also on how they exit. Thus, we clarify differences in the effects of initial financial conditions on firm survival between exit routes. The results reveal that start-up firms with larger initial equity capital are more likely to exit through merger in our sample, indicating that the effects of initial financial conditions depend on the type of exit route.

The remainder of the article is organized as follows. The next section discusses the research background, including a literature review. Section 3 provides hypothesis development. Section 4 explains the data and method used in the article. Section 5 presents the estimation results. Finally, we provide some concluding remarks.

2 Research background

2.1 Post-entry performance

The post-entry performance of firms has been addressed in a rich stream of literature (e.g. Audretsch 1995; Parker 2009). As survival is a precondition for firm growth, exhaustive attention has been paid to the ways in which start-up firms survive in the market.Footnote 1 The extant literature has also explored whether some factors affect firm survival in the market (e.g. Audretsch and Mahmood 1995; Mata et al. 1995). To summarize these factors, for example, Storey and Greene (2010) proposed five approaches: gambler’s ruin, population ecology, resource-based theory (view), utility, and entrepreneurial learning.Footnote 2 In the resource-based view, the availability of resources and capabilities, rather than the environment, is a central focus of the post-entry performance of firms. Based on this view, a deficiency of financial and human resources at founding has a harmful influence on firm performance.

There are many arguments concerning the post-entry performance of firms. In the field of industrial organization, some studies have found a positive effect of initial conditions―especially, initial size―on firm survival (e.g. Audretsch and Mahmood 1995). For instance, Agarwal and Audretsch (2001) provided evidence that small firms are confronted with a lower likelihood of survival than their larger counterparts, using data on US manufacturing firms. Others have examined whether initial or current size affects firm survival and exit. For instance, Mata et al. (1995) found that current size is a better predictor of failure than initial size, using data on Portuguese manufacturing firms (plants). However, Disney et al. (2003) showed a positive impact of initial size on the exit hazard for single establishments, although a negative impact with respect to current size, using data on UK manufacturing firms (establishments). Coad et al. (2013) identified the significant negative impact of initial size on survival when controlling for lagged size. Moreover, Geroski et al. (2010) concluded that the impact of initial conditions on survival does not diminish rapidly over the first 5–10 years of a new firm’s life, using data on Portuguese firms. Together, these findings suggest that, whereas the impact of initial conditions may gradually disappear over time, initial conditions continue to play a critical role in the post-entry performance of firms.

While many studies have focused on initial size, some have paid attention to the impact of initial conditions (endowments), including initial stock of organizational capital, on firm survival (e.g. Fichman and Levinthal 1991; Levinthal 1991; Le Mens et al. 2011; Coad et al. 2016). These studies indicate how initial conditions are predictable for survival over time. In the literature, special attention has been paid to the impact of initial financial conditions on firm survival. Cooper et al. (1994) found that the level of capitalization, as measured by the total amount of capital invested at the time of first sale, contributes to marginal survival and growth using data on US firms (entrepreneurs). Fotopoulos and Louri (2000) also revealed that initial financial conditions, such as a firm’s initial financial capital and debt ratio, affect hazard, using data on Greek manufacturing firms. In addition, Huyghebaert and Van de Gucht (2004) argued that the interaction between the nature of industry competition and a firm’s initial debt ratio is highly important for explaining an exit. Using data on Belgian firms, Huyghebaert and Van de Gucht found that entrepreneurial start-ups in highly competitive industries are more likely to exit and that leverage compounds this exit risk. Elsewhere, Huynh et al. (2010, 2012) investigated the impact of initial financial conditions―more precisely, the debt-to-asset ratio―on the duration of new entrants in the Canadian manufacturing industry. They also identified a non-monotonic relationship between firm hazard and leverage (as measured by the debt-to-asset ratio). Furthermore, Stucki (2014) found that firm survival and the achievement of profit break-even are negatively correlated with financial constraints, using data on Swiss firms. Overall, these studies suggest that initial financial conditions, including financial constraints, are relevant to the post-entry performance of firms.Footnote 3

2.2 Start-up financing

Generally, firms with a greater demand rely on external suppliers of capital to secure funding. If capital markets were perfect, firms with growth potential could raise necessary funds from capital markets. However, in reality, capital markets are far from perfect, such that, even if an entrepreneur has a good ability to expand the business, the entrepreneur cannot necessarily obtain sufficient funds. This situation arises due to information asymmetry between entrepreneurs and external suppliers of capital. Not surprisingly, the cost of financing from external suppliers of capital becomes higher because transaction costs arise more commonly. Moreover, information asymmetry invites adverse selection and moral hazard problems in capital markets, which generate agency costs, in addition to monitoring costs.Footnote 4

Start-up firms, which are the focus of this study, have a shorter operating history and lack a financial track record. Most, although not all, start-up firms do not expect to generate positive cash flow as soon as they are founded, prior to getting their businesses on track. Such firms often rely on external financing. However, the cost of financing from external suppliers of capital tends to be higher―compared to incumbent firms―due to severe information asymmetry between entrepreneurs and external suppliers of capital. In addition, external suppliers of capital, such as banks, often require high risk premiums or collateral to start-up firms. Therefore, these firms prefer to rely on internal rather than external suppliers of capital to reduce the cost of financing. However, even if start-up firms were to rely on internal suppliers of capital, including entrepreneurs, the amount of funds available for the business is often limited, except for affluent individuals. Accordingly, many entrepreneurs are obliged to use funds from external suppliers of capital, such as bank loans.

As Berger and Udell (1998) stated, small businesses are thought of as having a financial growth cycle in which financial needs and options change as the business grows, gains further experience, and becomes less informationally opaque. Most start-up firms do rely on limited sources of finance, which primarily comprise the personal wealth of the founders (entrepreneurs) and that of their family and friends (e.g. Storey and Greene 2010). As is well known, initial equity financing tends to be restricted to internal suppliers of capital, such as founders, family, and friends. On the other hand, start-up firms with a greater demand rely on external suppliers of capital, and bank loans are the most common sources of external financing (e.g. Storey and Greene 2010). In particular, start-up firms rely on bank loans in countries, including Japan, where private equity capital, including individual investors, is not yet fully developed.Footnote 5

When raising funds from internal and external suppliers of capital, firms generally face the decision to issue debt and/or equity. Generally, the combination of debt and equity firms used for financing is called capital structure. As Leary and Roberts (2005) argued, firms strive to maintain an optimal capital structure that balances the costs and benefits associated with varying degrees of financial leverage. Traditional arguments suggest that firms choose an optimal capital structure by trading off the benefits of financing, such as tax reductions, against the cost of financial distress.Footnote 6 This is because while debt financing creates a tax shield for the firm, it also increases the possibility of bankruptcy, which induces the cost of financial distress. Accordingly, to remain solvent, firms would typically use equity rather than debt financing. However, there has been relatively little research into the capital structure of start-up firms.

Debt financing from external suppliers of capital, including bank loans, generates interest payments and often places a financial burden on start-up firms beyond their expectations. Moreover, some start-up firms with insufficient capital may be obliged to use external sources of finance at a higher cost because external suppliers of capital require higher risk premiums. As start-up firms do not have an established relationship, external suppliers of capital may hesitate to expand repayment. Even if start-up firms require external suppliers of equity capital, the involvement in business start-up of private equity capital, such as venture capital, is not always prevailing. Due to the financial burden, start-up firms that rely heavily on debt financing are more likely to fail within a shorter period. In this respect, it is conceivable that initial capital structure has a more significant effect on firm survival and determines the fate of start-up firms.

2.3 Initial financial conditions and entry regulations

Initial conditions―especially, initial financial conditions, which are discussed in this study―are considered to play a critical role in the post-entry performance of firms. According to the resource-based view, a new business outcome is to a large extent determined by the nature of the sources the entrepreneurs can acquire (e.g. Dollinger 1999). Based on this perspective, initial financial conditions represent the capacity of entrepreneurs for financing, which may reflect the quality of the business. In this respect, it is conceivable that initial financial conditions determine the fate of start-up firms. Additionally, Aspelund et al. (2005) addressed the role of initial resources and path dependency of resource development. Aspelund et al. argued that initial resources are related to the organizational outcome of the entrepreneurial process for new technology-based firms; that is, initial resources are significant predictors of firm survival and exit. According to the perspective of path dependence, initial financial conditions may continuously dominate the post-entry performance of firms, even though their effects diminish over time.

The premise that initial financial conditions play a critical role in the survival of start-up firms could cause the reinforcement of initial equity capital, which may further lead to the introduction of regulations regarding initial financial conditions in Japan. In practice, capital stock of no less than 10 million yen for a joint-stock company was required at founding due to regulations for minimum capital requirements introduced in April 1990. While such regulations are forced to increase initial equity capital, they deter new entrants with insufficient capital. In fact, the number of new entrants decreased after the introduction of the regulations, along with the collapse of the bubble economy in Japan. Given that initial equity capital is inevitable for sustaining a new business, regulations regarding initial financial conditions are expected to improve firm performance. However, the regulations for minimum capital requirements were removed when the new Companies Act was enforced in May 2006, mainly because entry rates were so low in Japan; the regulations were in place from April 1990 through to April 2006.

To date, some scholars have argued that the regulation of entry has a negative impact on firm performance. As Klapper et al. (2006) and Branstetter et al. (2014) argued, the regulation of entry impedes new entrants and may discourage entrepreneurship. Djankov et al. (2002) emphasized that heavier regulations of entry are associated with greater corruption, while they are not associated with better quality of private or public goods. From the viewpoint of competition policy that promotes new entrants, the regulation of entry cannot be accepted as a tool to stimulate economic growth, and it may result in the distortion of the market mechanism. Even when equity capital is to some extent necessary, entrepreneurs possibly raise equity capital using their personal loans, simply to achieve minimum capital requirements. Such capital raising may generate the distortion of the debt and equity balance and diminish the effect of initial equity capital on firm performance.

Since the assumption is that the regulation of entry hampers the creation of start-up firms, scholars of entrepreneurship should pay more attention to whether firm performance improves through regulation or deregulation of entry. Branstetter et al. (2014) examined the effects of a regulatory reform regarding the reduction of the cost of entry in Portugal. They showed that reform increases the number of new entrants, but that marginal firms having entered the market in the absence of the reform are less likely to survive their first two years. Moreover, the regulations for minimum capital requirements implemented in Japan are a valuable case in order to examine the effects of regulation and deregulation of entry. Nevertheless, to our understanding, little attention has been paid to whether the regulations are associated with the post-entry performance of firms. The investigation of minimum capital requirements could be useful for a better understanding of not only the impact of regulation and deregulation of entry on firm performance, but also the role of initial financial conditions.

3 Hypothesis development

How start-up firms raise initial capital plays a critical role in firm survival. Capital market imperfections based on information asymmetry between entrepreneurs and external suppliers of capital enable start-up firms, including those with growth potential, to commence business with insufficient capital. In this case, these firms may be particularly susceptible to a cost disadvantage through diseconomies of scale. In addition, transaction and agency costs arising from information asymmetry are arguably more severe for smaller start-up firms. Conversely, it is conceivable that start-up firms with sufficiently large capital are more likely to survive in the market because they do not suffer from such cost disadvantages. In fact, some studies have found that initial size exerts a positive effect on firm survival (e.g. Audretsch and Mahmood 1995; Agarwal and Audretsch 2001). In line with previous studies, using the sample of Japanese join-stock companies, we examine the impact of initial capital size on the survival of start-up firms as follows:

-

H1: Start-up firms with larger initial equity capital are less likely to fail within a shorter period.

However, other studies identified the negative effect of initial size on firm survival (e.g. Disney et al. 2003). It is unclear whether initial capital size negatively affects firm survival. In addition, the results concerning initial size have used the size of employment or sales, and so we may find different results when using initial equity capital.Footnote 7

With respect to initial financial conditions, the debt ratio (leverage) is considered an important determinant of survival and exit. Although not focused on start-up firms, Zingales (1998) found that highly leveraged firms are less likely to survive. As for start-up firms, Huynh et al. (2012) observed a positive relationship between initial leverage (the debt-to-asset ratio) and hazard rates, indicating that firms with higher levels of initial leverage are more likely to go bankrupt. To achieve sufficient capital size, start-up firms with less equity financing are compelled to rely on debt financing. As Robb and Robinson (2012) argued, start-up firms certainly tend to rely heavily on outside debt. However, if start-up firms achieve a sufficient capital size through debt financing, they may also have a higher probability of bankruptcy due to the additional financial burden of interest payments and credit constraints. For this reason, it is predicted that the probability of bankruptcy increases with initial debt ratio. To reduce this possibility, start-up firms should use equity financing, rather than debt financing. In this respect, we consider that the initial leverage structure―conversely, initial equity ratio―has a significant impact on the survival of start-up firms; hence, we test the following hypothesis:

-

H2: Start-up firms that rely more on equity than debt financing are less likely to fail within a shorter period.

As already explained, the regulations for minimum capital requirements were in place in Japan from April 1990 through to April 2006. However, the regulations were removed when the new Companies Act was enforced in May 2006. As the regulations enable entrepreneurs to raise equity financing intentionally, they may weaken the effect of the initial equity ratio on the post-entry performance. Some entrepreneurs without sufficient funds may be able to raise equity capital through their personal loans. In this case, it is likely that the regulations for minimum capital requirements create the distortion of debt and equity balance. By contrast, the abolition of regulations for minimum capital requirements accelerates the right balance between debt and equity. Therefore, the negative effect of the initial equity ratio on failure may be greater following the abolition of regulations for minimum capital requirements. In this study, we investigate the impact of minimum capital requirements on the post-entry performance of firms and test the following hypothesis:

-

H3: The negative effect of the initial equity capital on the likelihood of failure is greater following the abolition of regulations for minimum capital requirements.

In contrast to survival, there are several forms of exit other than failure (bankruptcy), such as voluntary liquidation and merger. Indeed, several studies on firm survival have examined different exit routes (e.g. Harhoff et al. 1998; Cefis and Marsili 2011; Coad 2014). For instance, Grilli et al. (2010) found the different antecedents of the effects of firm size and age between closure and merger and acquisition (M&A) using data on Italian high-tech firms. As for the case of Japanese start-up firms, Kato and Honjo (2015) identified differences in the effect of entrepreneurs’ human capital on firm survival between exit routes comprising failure (bankruptcy) and nonfailure (voluntary liquidation and merger) outcomes, although they did not mainly focus on the impact of financial capital. In particular, exit through a merger differs substantially from failure, even though the firm in either case is extinct. Taking into account another exit route, we could provide additional insights into the impact of initial financial conditions on firm survival.

Not surprisingly, some firms pursue the possibility of exit to avoid bankruptcy. Especially for start-up firms with large equity capital, shareholders have more incentive to avoid the loss of their equity investments. In this respect, start-up firms raising more equity financing are more likely to seek an opportunity to exit through merger. At the same time, mergers are more preferable for such start-up firms than those raising debt financing. Given that initial financial conditions dominate subsequent capital structure, we infer that initial financial conditions determine the exit route. While debt financing increases the probability of bankruptcy, equity financing may induce the possibility of a merger. In other words, start-up firms raising more equity financing may be subject to a takeover and merger. We consider that, while start-up firms that rely more on equity than debt financing are more likely to survive longer in the market, such firms are also more likely to be targeted as merger candidates. It is plausible that initial financial conditions affect another exit route.

Similar to the hypothesis testing on failure, we investigate the impact of initial financial conditions on the merger of start-up firms, although we do not identify hypotheses on exit through a merger. To our understanding, few empirical studies have examined the differences in the impact of initial financial conditions on the post-entry performance of firms across a variety of possible exit routes. An investigation of the impact of initial financial conditions on merger alternative to failure will provide a better understanding of how start-up firms raise their initial capital and survive in the market.

4 Data and method

4.1 Data source

The data used in the analysis come from a database compiled by Teikoku Databank, Ltd. (TDB), which is one of the major credit investigation companies in Japan (comparable to Dun & Bradstreet in the US). This database is composed of financial statements prepared using the Japanese Generally Accepted Accounting Principles (GAAP). We obtained data on unconsolidated financial statements in the first accounting year when firms commenced business. Using this database, we constructed a data set to identify those factors affecting the survival and exit of start-up firms. We also obtained data on real gross domestic product (GDP) growth rate from the National Accounts for 2015 (System of National Accounts 2008; benchmark year = 2008), calculated by Cabinet Office, Government of Japan.

In Japan, there are several legal forms of business, such as sole proprietorship, partnership, limited liability company (LLC), and joint-stock company. Of these, joint-stock company is the most typical legal form for general business purpose, while sole proprietorship, partnership, and LLC are generally considered to be privately held. Accordingly, we target joint-stock companies, mainly because the database does not sufficiently provide accounting data for sole proprietorships, partnerships, and LLCs.Footnote 8 Simultaneously, this enables us to examine how the regulations for minimum capital requirements, which applied to joint-stock companies founded in Japan until the abolition of the regulations, affect the duration of firm survival. It is also important to note that the results of this study are presented based on the sample of joint-stock companies, which tend to have larger sizes than sole proprietorships.

As a sample, we define start-up firms as those founded during the period from January 1995 to December 2010. To observe the event of exit, we set up an observation window in the period from January 1995 to January 2011, that is, we observe the duration of survival from one month (for firms founded in December 2010) to 192 months (for firms founded in January 1995). This observation window covers the timing of the abolition of regulations for minimum capital requirements when the new Companies Act was enforced in May 2006. This observation window is also set before the Great East Japan Earthquake in March 2011. Using the classification in TDB, we divide the exit routes into three types: failure, merger, and others.Footnote 9

Several measurement issues arise when we construct our data set. First, we use financial statements in the first accounting year to measure initial capital structure because we were unable to obtain financial statements at the date of founding.Footnote 10 Second, the data set contains some subsidiaries and affiliated firms. From the data set, therefore, we exclude firms regarded as subsidiaries and affiliated firms by TDB because these firms may have very different capital structures from independent firms.Footnote 11 Third, the data set contains only a few large-sized firms. Although these firms might be de novo entrants, we consider firms with no fewer than 100 employees in the first accounting year as outliers and exclude them from the data set. Fourth, we exclude a few firms whose capital stock is no less than 10 million yen, although they were founded before the abolition of regulations for minimum capital requirements. Finally, we treat some firms as outliers because equity finance was zero, the total of capital stock and treasury shares was zero, fixed assets were negative, or total assets were zero, and thus these firms are excluded from the data set.

As a result, the sample of start-up firms contains 16,185 joint-stock companies founded between January 1995 and December 2010 in Japan. The date set covers firms in the industrial sectors of construction, manufacturing, information and communications, wholesale and retail trade, and business services. This contrasts with previous studies that focused only on start-up firms in the manufacturing sector (e.g. Huyghebaert et al. 2007). However, as the manufacturing sector is progressively contracting in most developed countries, including Japan, recent studies tend to focus industries other than the manufacturing sector (e.g. Grilli 2011; Coad et al. 2013). We thus focus not only on manufacturing, but also on other sectors and industries.Footnote 12

Table 1 details the distribution of start-up firms in the sample, which also shows the trend in the number of failures and mergers. Table 1 shows that the number of start-up firms in the sample increases from 2006, mainly because the regulations for minimum capital requirements were removed when the new Company Act was enforced in May 2006.Footnote 13 Table 1 also indicates that 832 firms (5.1%) in the sample experienced failure (bankruptcy), while 438 firms (2.7%) exited the market through merger until January 2011.Footnote 14 While 5672 firms (35%) were founded before the abolition of regulations for minimum capital requirements (from January 1995 to April 2006), 10,513 firms (65%) were founded after it (from May 2006 to December 2010). Among the firms founded from May 2006 to December 2010, capital stock for 9409 firms in the first accounting year was less than 10 million yen.

4.2 Method

Not surprisingly, many firms do not exit the market during the observation window; right censoring is the most common in the analysis of exit because, generally, the time to an event—failure or merger in this study—is not always observed for all firms in the observation window. We thus apply a survival analysis approach to estimate the determinants of firm survival. By doing so, we investigate the time to an event while tracing the history of firms from founding.

Let Ti denote the time to an event (failure or merger) from founding for firm i, that is, Ti indicates how long it takes for firm i to survive in the market. Let Ci denote the censoring time, which is the duration of the observation window for firm i, and the time to the event, Ti, is observed if Ti ≤ Ci. Suppose that Ti is observed for n firms in the sample and T1 ≤ T2 ≤ … ≤ Tn. In this case, the cumulative hazard function proposed by Nelson (1972) and Aalen (1978) is given by

where dj is the number of firms that experience the event at time Tj, and nj is the number of firms that have not yet experienced the event at that time.

In this study, we examine the factors affecting the time to the event by applying a proportional hazards model proposed by Cox (1972). In the proportional hazards model, the hazard is assumed to be written by

where xi is the vector of covariates affecting the time to the event, β is the estimated parameter, and h0(t) is the baseline hazard. By estimating β, we specify the likelihood function, L, as follows:

where Ri is a risk set at Tj, and firm k satisfies the condition that Tj < Tk.

There are two types of events of interest, failure and merger, in this study. Using the survival analysis approach, we identify the factors affecting the time to failure and merger for start-up firms.Footnote 15

4.3 Covariates

Following the hypotheses discussed in Section 3, we define covariates affecting firm survival and exit. To capture initial capital size, we measure a covariate for initial equity size (lnE) by the logarithm of equity finance in the first accounting year, and this covariate is used to test H1. However, because reported equity in financial statements includes retained earnings, it is likely that such equity reflects profitability in the first accounting year and that it overestimates the effect of initial equity size on failure. Therefore, following Huyghebaert and Van de Gucht (2004), we do not include retaining earnings in equity financing. On the other hand, liabilities include various accounting items, such as accrued expenses and allowances, which differ considerably from debt financing as raised from capital markets. Accordingly, we restrict debt financing to short- and long-term loans, commercial paper, and corporate bonds, but not total liabilities.Footnote 16

To test H2 and H3, we use a covariate for initial equity ratio (E/TF) as measured by the ratio of equity finance to total finance in the first accounting year. Although we do not use the covariate for the initial debt ratio, the initial equity ratio represents the opposite effect of the initial debt ratio.

As discussed, the regulations for minimum capital requirements were in place in Japan during the period of April 1990 through to April 2006. To examine the impact of minimum capital requirements on firm survival, we define a dummy variable that represents the period when the regulations for minimum capital requirements were in effect (MCR). More importantly, we include an interaction term between equity finance and this dummy variable in the regression model to specify the differences in the effect of equity financing before and after the abolition of regulations.

In addition to debt and equity financing, we employ a covariate for initial capital expenditures (CAPEX) in order to identify the effect of asset structure on firm survival, as measured by fixed assets, including intangible fixed assets. This is because, given that capital expenditures tend to generate illiquid assets, it is plausible that start-up firms with higher capital expenditures have a higher risk of failure in the market.

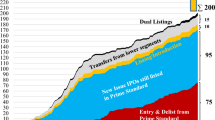

Moreover, the sample comprises start-up firms for which the year of entry differs across firms. Since start-up firms in the sample do not necessarily commence business at the same time, they face different macroeconomic conditions. Figure 1 describes the trend in corporate bankruptcies in Japan. As Fig. 1 shows, the number of bankruptcies is the highest in 2001 during the observation period. Since the Japanese economy was stagnant in the early 2000s, it is likely that the survival of start-up firms depends heavily on macroeconomic conditions. To control for the different macroeconomic conditions based on entry timing, we use a covariate for market conditions (GDP), which is defined as the quarterly real GDP growth rate. This covariate is required to identify the effect of the abolition of regulations for minimum capital requirements on firm survival and exit because it controls for macroeconomic conditions start-up firms face.

Furthermore, it is possible that industry conditions, such as industry growth and demand, affect the post-entry performance of firms. To control for the difference in industry conditions, we specify dummy variables for construction, manufacturing, ICT, and wholesale and retail sectors in the regression model.

Table 2 lists the definitions of the covariates, including those of debt and equity finance. We measure the covariates, lnE, E/TF, and CAPEX, based on the first accounting year after the date of the firm’s founding. Among the covariates, GDP is calculated based on the quarterly data, which is time-variant, while the others are time-invariant.

4.4 Descriptive statistics

Table 3 presents the distribution of equity finance of start-up firms in our sample. Figure 2 also describes the histograms of the logarithm of equity finance (lnE) before and after the abolition of regulations for minimum capital requirements. As shown in Table 3, we find that most firms started businesses with initial equity capital of just 10 million yen before the abolition of the regulations. By contrast, the initial equity capital of start-up firms tends to be more widely distributed after the abolition of the regulations.Footnote 17

Table 4 presents the descriptive statistics of the covariates used in the analysis, including the debt and equity finance. Table 4 indicates that the mean of debt finance (approximately 22 million yen) is larger than that of equity finance (approximately 14 million yen), while the mean of the initial equity ratio shows that debt financing accounts for more than half of total financing upon start-up.

Table 5 shows the descriptive statistics of debt and equity finance before and after the abolition of regulations for minimum capital requirements. While the initial equity ratio of firms founded before the abolition of regulations for minimum capital requirements is on average 66%, the initial equity ratio of firms founded after it is 52%. Even though debt financing for firms founded before the abolition of regulations for minimum capital requirements is higher, the initial equity ratio of these firms is higher than that of firms founded after the abolition of regulations. The findings suggest that start-up firms tend to raise more equity financing in terms of the regulations of minimum capital requirements, and it is possible that such regulations distort debt and equity balance at founding.

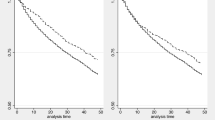

Before examining the effect of equity financing on the time to failure and merger with the use of the proportional hazards model, we show the differences in the cumulative hazard rates of start-up firms before and after the abolition of regulations for minimum capital requirements. Figure 3 describes the cumulative hazard estimates for failure before and after the abolition of regulations for minimum capital requirements. As shown in Fig. 3, we find that start-up firms founded under the regulations for minimum capital requirements are more likely to fail within a shorter period. Moreover, Fig. 4 depicts the cumulative hazard estimates for a merger. Regarding mergers, we also find that start-up firms founded under the regulations for minimum capital requirements are more likely to exit through merger. Regardless of the exit route, the results indicate that the deregulations of the requirements for minimum capital requirements generate long-lived start-up firms.

5 Estimation results

5.1 Failure

We estimate the determinants of failure, using the proportional hazards model based on firm age. Table 6 presents the estimated coefficients of the covariates for the time to failure. The estimated hazard ratios are presented in Table 10 of the Appendix. We use the covariate for capital expenditures (CAPEX), economic conditions (GDP), and minimum capital requirement (MCR) in column (i). While we estimate the effect of initial equity size (lnE) on the time to failure in column (ii), we estimate the effect of the initial equity ratio (E/F) on it in column (iv). Moreover, while the interaction term of lnE and MCR is included in column (iii), that of E/F and MCR is included in column (v).

As shown in column (ii) of Table 6, the coefficient of lnE is positive but insignificant for the time to failure. We find little evidence that start-up firms with larger initial equity capital are less likely to fail within a shorter period. We do not provide support for H1 using start-up firms in our sample, but this finding is consistent with Disney et al. (2003). This suggests that larger initial equity capital does not improve business longevity and that start-up firms cannot necessarily decrease the likelihood of failure by increasing their initial equity capital.Footnote 18 However, the findings about the effect of initial equity capital on the survival of start-up firms may be limited to start-up firms with a certain size because our sample consists of joint-stock companies.

In contrast, the coefficient of E/F is negative at the 1% significance level in column (iv). Based on the estimated hazard ratios shown in column (iv) of Table 10, the hazard of failure decreases approximately 0.6% as a start-up firm raises the initial equity ratio by 1%. We provide evidence that the likelihood of failure decreases with the ratio of equity finance, which supports H2. The results indicate that start-up firms that rely heavily on equity financing are less likely to fail within a shorter period, while those that rely heavily on debt financing are more likely to do so. This is presumably because interest payments are more likely to become a financial burden and to increase the probability of bankruptcy during the start-up period. To reduce this probability, start-up firms should secure equity financing rather than debt financing, which will result in more sustainable businesses.Footnote 19

The first-order terms of MCR are positive at least at the 1% significance level in all the columns in Table 6. The results reveal that start-up firms founded without the regulations for minimum capital requirements are less likely to fail within a shorter period under controlled macroeconomic conditions. Although regulations regarding initial financial conditions are expected to improve the performance of SMEs, such regulations may conversely distort debt and equity balance at founding, resulting in the reduction of the effect of initial capital structure on firm survival.

Moreover, while the interaction term of lnE and MCR is insignificant in column (iii), that of E/F and MCR is negative at the 1% significance level in column (v). We find that, although initial equity size does not affect the likelihood of failure, the negative effect of the initial equity ratio on the likelihood of failure decreases following the abolition of regulations for minimum capital requirements when using the sample of the Japanese joint-stock companies. We provide supportive evidence of H3 for the initial equity ratio. The results indicate that the negative effect of the initial equity ratio on the likelihood of failure is greater following the abolition of regulations for minimum capital requirements. Conversely, we can say that the initial equity ratio did not have a more effective impact on firm survival when the regulations for minimum capital requirements were in place. This implies that start-up firms intentionally raised equity financing to achieve minimum capital requirements, although we cannot identify how entrepreneurs raise initial equity capital, including personal bank loans. As a result, these findings suggest that start-up firms have an ability to raise equity financing more effectively without regulations regarding initial financial conditions.

Furthermore, the coefficients of CAPEX are positive at least at the 5% significance level in all the columns in Table 6. We find that start-up firms with higher capital expenditures are more likely to fail within a shorter period. The results indicate that, as capital expenditures increase at founding, start-up firms lose liquidity. Therefore, start-up firms that invest heavily in fixed assets are more likely to face difficulties in surviving.

Finally, the coefficients of GDP are negative at least at the 1% significance level in all the columns in Table 6. We provide significant evidence that start-up firms are less likely to fail within a shorter period when they face better macroeconomic conditions. The results indicate that the survival of start-up firms depend heavily on macroeconomic conditions, suggesting that start-up firms are more vulnerable to environmental risks.

5.2 Merger

Table 7 presents the estimated coefficients of the covariates for merger, corresponding to those for failure, shown in Table 6. The estimated hazard ratios are presented in Table 11 of the Appendix.

As shown in Table 7, the coefficient of lnE is positive at the 1% significance level in column (ii). We find that initial equity size has a positive effect on the time to merger of start-up firms in our sample, which differs from the findings of the time to failure shown in Table 6. The results indicate that start-up firms with larger initial equity capital are more likely to exit through merger within a shorter period. The findings suggest that start-up firms with larger initial equity capital are more likely to be targeted for merger. As M&A are considered an extension of equity financing, start-up firms that rely equity financing at founding may tend to choose such an exit route, implying that initial financial conditions determine the exit route.

In addition, the coefficient of E/F is positive at the 1% significance level in column (iv). While the initial equity ratio has a negative effect on failure in Table 6, it has a positive effect on merger in Table 7. The initial equity ratio increases the likelihood not only of survival but also of a merger. We provide evidence that start-up firms that rely more on equity than debt financing are more likely to exit through merger, while they are less likely to fail within a shorter period. The results indicate that start-up firms with a higher ratio of equity finance, as well as a larger equity size, are more likely to be targeted for merger. These findings also suggest that the determinants of exit depend on the exit route itself. We also conjecture that firms that can establish their capital structure using debt and equity financing at founding may have more opportunities to seek a strategic exit through a merger.

Overall, the first-order terms of MCR are positive and significant in Table 7. The sign of the estimated coefficients for merger is opposite to that for failure. The results reveal that start-up firms founded under the regulations for minimum capital requirements are more likely to exit through merger within a shorter period.

However, the interaction terms of lnE and MCR and of E/F and MCR are insignificant in columns (iii) and (v). We provide little evidence that the effects of the initial equity size of start-up firms in our sample, and the initial equity ratio depend on the presence or absence of minimum capital requirements. The results also indicate that start-up firms raising more equity financing are more likely to be targeted for mergers, irrespective of such regulations.

Moreover, the coefficients of CAPEX are negative at the 1% significance level in columns (i), (ii), and (v). The results indicate that start-up firms with higher capital expenditures are less likely to exit through merger. Accordingly, these findings suggest that start-up firms that invest heavily in fixed assets have fewer opportunities for mergers.

Furthermore, the coefficients of GDP are negative but insignificant in all the columns in Table 7. We provide little evidence that the likelihood of a merger for start-up firms depends on macroeconomic conditions faced. The results indicate that while the likelihood of failure depends heavily on macroeconomic conditions, a merger occurs, irrespective of the conditions, partly because mergers include both unsuccessful and successful exits, and that the timing is, instead, more important than economic conditions.

The above findings also imply that initial financial conditions determine the future exit route. More specifically, start-up firms raising more equity financing tend to be extinct through the purchase of equity, while those that rely more on debt financing tend to be extinct due to the burden of debt financing. In this respect, path dependence in financing structure is a significant feature in determining the post-entry performance of firms.

5.3 Robustness

When we examined the effects of equity financing shown in Tables 6 and 7, the sample included start-up firms with capital stock of less than 10 million yen in the first accounting year. These firms are among those founded after the abolition of regulations for minimum capital requirements. In this respect, the effects of initial financial conditions on firm survival may depend on the difference in initial equity size required by the regulations, and selection bias may occur due to the regulations for minimum capital requirements. It is possible that we find different results when using the subsample that does not include start-up firms with capital stock of less than 10 million yen.

For robustness, we examine the effects of equity financing on the time to failure and merger, using the subsample only with capital stock of no less than 10 million yen.Footnote 20 Table 8 presents the estimation results for failure and merger using the subsample. In Table 8, we show the results corresponding to columns (iv) and (v) of Tables 6 and 7. As a result, although the coefficients of MCR are insignificant, we obtain similar results shown in Table 8 to those shown in Tables 6 and 7, even when using a limited sample. We also provide supportive evidence that the negative effect of the initial equity ratio on the likelihood of failure decrease following the abolition of regulations for minimum capital requirements.

Furthermore, we use the proportional hazards model to obtain the estimation results, and a competing event is regarded as censored in the estimation in Tables 6, 7, and 8. For instance, in Table 6, we treat exit other than failure as a competing event and observe the duration of survival until the occurrence of the competing event. We can also use a competing-risks regression, where exit other than failure is included in the risk set, alternative to the proportional hazards model, to examine the determinants of the time to failure. We formalize the hazard, based on the approach of a competing risks regression (e.g. Gray 1988; Fine and Gray 1999).

In Table 9, we present the estimation results when using the competing-risk regression.Footnote 21 It is important to note that the covariate for macroeconomic conditions, which is time variant, is measured by the last available value in the regression model. Table 9 shows the results corresponding to the columns of Tables 8. While the interaction terms of lnE and MCR are insignificant for failure, they are significant for a merger. The results support the theory that start-up firms that rely more on equity financing are less likely to fail within a shorter period, while those firms are more likely to exit through merger.

6 Conclusions

This study investigated the impact of initial financial conditions on the post-entry performance of firms in a sample of 16,185 Japanese joint-stock companies. We examined whether initial financial conditions, including entry regulations, affect the duration of survival among Japanese start-up firms, distinguishing between failure and merger. We provided evidence that start-up firms that rely more on equity than debt financing are less likely to fail within a shorter period, although we found little evidence that initial equity size has a significant effect on the time to failure of start-up firms in our sample. Moreover, we found the negative effect of equity financing on the time to failure to be greater for start-up firms founded following the abolition of regulations for minimum capital requirements.

Furthermore, the results revealed that start-up firms with larger initial equity capital are more likely to exit through merger, indicating that the effects of initial financial conditions depend on the type of exit route. In the literature on the survival and exit of start-up firms, some studies have identified the determinants of different exit routes (e.g. Grilli et al. 2010; Cefis and Marsili 2011; Coad 2014; Kato and Honjo 2015). However, the effects of entry regulations on the exit routes of start-up firms have not been adequately examined. Thus, this study contributes new insights into the effect of regulations regarding initial financial conditions on the survival and exit of start-up firms, which would facilitate a better understanding of the impact of entry regulations on the type of exit route.

Of course, there are several limitations in this study. To start, we did not discuss the sources that firms select to obtain their initial equity capital. In other words, we could not pay any attention to corporate ownership and control because of the lack of information on ownership structure at founding. It would be interesting to classify equity financing according to the different types of ownership, such as individual investors and venture capital, if data were available. In addition, we focused only on initial financial conditions taken from financial statements in the first accounting year. Longitudinal data tracing changes in capital structure would be needed to elaborate upon these findings, although this may generate selection bias because firms are less likely to provide financial statements immediately prior to going bankrupt. Moreover, the findings of this study are based on the sample of joint-stock companies because the regulations for minimum capital requirements targeted join-stock companies, in addition to private limited companies, in Japan. Smaller start-up firms, such as sole proprietorships, are not included in our sample, and founding a private limited company may have been an alternative to starting a joint-stock company before the abolition of regulations for minimum capital requirements. In these respects, the findings about the effects of initial financial conditions on exit routes may be limited to start-up firms of a certain size owing to the sample chosen. Nonetheless, further development of this analysis would certainly provide greater insights into post-entry performance and precisely into how start-up firms raise funds for their survival.

Despite these limitations, we contribute to providing some implications on how regulations regarding initial financial conditions matter for the survival of start-up firms. Traditionally, much attention has been paid to the regulation and deregulation of entry in the literature (e.g. Djankov et al. 2002; Djankov 2009). It was thought that the regulation of entry could reduce high failure rates caused by the emergence of start-up firms with vulnerable financial positions. However, Klapper et al. (2006), for example, found that costly regulations hamper the creation of start-up firms, especially in industries that should naturally have high entry. We do not provide any evidence that the regulations for minimum capital requirements enable start-up firms to survive longer in the market, implying that the regulation of entry accomplishes nothing but entry deterrence. Rather, our findings indicate that initial financial conditions exert influence on the survival of start-up firms more effectively through relaxing unnecessary regulations on business start-ups. Hence, we provide support for the abolition of regulations so as to improve the post-entry performance of firms. This fact would allow for the deregulation of entry and encourage advocates of deregulation. Moreover, our findings suggest that initial capital structure, rather than initial capital size, is effective in avoiding failure. This suggests that how entrepreneurs raise funds is more important than the amount of funds for sustainable businesses. Thus, initial funding without regulations can provide an optimal debt and equity balance.

Furthermore, the findings of this study indicate that initial financial conditions can predict the post-entry performance of firms. As Geroski et al. (2010) argued, initial conditions have long-lasting effects on survival and exit, and the subsequent reversal of initial decisions may be insufficient to produce the desired improvement in the probability of survival. Moreover, our findings suggest that the impact of initial financial conditions differ between failure and merger, and that initial financial conditions contribute significantly to explaining the variation in exit routes. More specifically, start-up firms raising more equity financing have opportunities to exit through merger, while those relying more on debt financing are obliged to exit due to bankruptcy. Our findings suggest that initial financial conditions determine the fate of start-up firms, including the exit route, as genes determine the fate of a human being.

Change history

04 July 2019

The original version of this article unfortunately contained mistakes. On page 18, the sentence “The first-order terms of <Emphasis Type="Italic">MCR</Emphasis> are positive at least at the 1% significance level in all the columns in Table 6.” "Moreover, while the interaction term of ln<Emphasis Type="Italic">E</Emphasis> and <Emphasis Type="Italic">MCR</Emphasis> is insignificant in column (iii), that of <Emphasis Type="Italic">E</Emphasis>/<Emphasis Type="Italic">F</Emphasis> and <Emphasis Type="Italic">MCR</Emphasis> is negative at the 1% significance level in column (v)." On page 21, the sentence "The sign of the estimated coefficients for merger is opposite to that for failure."

Notes

To date, a large number of studies have tested Gibrat’s law, which states that firm growth is independent of size, by empirically investigating the relationship between firm growth and size. In particular, some studies estimated the determinants of firm survival, in addition to firm growth, to avoid selection bias because firm exit relates to lower growth rates (e.g. Evans 1987).

Based on findings from new banks in the US, Bamford et al. (2000) emphasized that initial founding conditions and decisions have a long-lasting impact on performance.

Cassar (2004) investigated the determinants of capital structure and the use of financing around business start-ups using data on new businesses in Australia, and found that firm start-up size is positively related to the use of leverage, long-term leverage, outside financing, and bank financing. However, Cassar did not address the impact of initial financial conditions on the post-entry performance.

For more discussion on information asymmetry and cost of capital see, for example, Healy and Palepu (2001).

For more discussion on private equity capital in Japan, see Honjo and Nagaoka (2018).

In terms of the capital size of start-up firms in Japan, Honjo (2000) found the negative effect of capital stock (paid-in capital) on the time to failure. However, the covariate for capital stock was not initial but current size.

During the past, there were two typical legal forms of limited companies in Japan―joint-stock and private limited companies. For private limited company, capital stock of three million yen was at least required at founding due to the regulations for minimum capital requirements. However, although private limited company was available as a legal form of business until April 2006, this form was abolished when the new Company Act was enforced in May 2006. Instead of private limited company, LLC was introduced with the enforcement of the new Company Act.

TDB provides information on the date of failure (bankruptcy), and we measure the time to failure using the period from the date of foundation to the date of failure. Although failure is regarded as an exit route in the analysis, bankrupt firms do no always exit the market and a few may actually survive through debt forgiveness. However, in practice, most bankrupt firms are liquidated, and failure can be clearly regarded as an unsuccessful outcome.

Accounting months differ between firms, and therefore, the period of the first accounting year is not equal in length across firms. To identify whether debt and equity finance depends on the period of the first accounting year, we regress debt and equity finance on the number of months from founding to the first accounting date. As a result, we do not identify any significant effect of the number of months on debt and equity finance. In addition, the data set does not cover financial statements in the following accounting years so as to give priority to the collection of data in the first accounting year. Therefore, we cannot compare the impact of initial financial conditions with that of current financial conditions on firm survival.

TDB does not provide information on when the firm becomes a subsidiary or an affiliated firm. Therefore, there is the possibility that the firm was originally independent but subsequently became a subsidiary.

The percentages of start-up firms by industry are 52% (construction), 4% (manufacturing), 11% (ICT), 19% (wholesale and retail trade), and 14% (business services and others). There are a relatively large number of construction firms in the sample because the database complied by credit investigation companies (i.e. TDB) tends to target construction firms for credit investigation and construction firms tend to disclose their financial statements more readily to enable them to receive public works. It is also important to note that, from the data set, we exclude firms in highly regulated industries and those in relatively unimportant sectors, including agriculture, forestry, fisheries, mining, finance, insurance, and personal and public services.

Another reason for the increase from 2006 is that, as already mentioned, private limited company was not available as a legal form of business when the new Company Act was enforced in May 2006.

We classify 80 firms (0.5%) as “others,” which indicate voluntary liquidation without bankruptcy or a merger and include them in the sample. Unlike Kato and Honjo (2015), we do not examine the determinants of voluntary liquidation in this analysis.

It is important to note that firms that exit through the competing event other than the target event (i.e. failure or merger) are included in the data set, and these firms are observed only until the occurrence of the competing event.

Likewise, we do not include trade credit, such as accounts payable, in debt financing, because it is difficult to determine whether trade credit is debt financing as raised from capital markets.

Indeed, firms with capital stock of 10 million yen account for 71% of the sample firms founded between January 1995 and April 2006, but only for about 7% of those founded between May 2006 and December 2010. This implies that most firms raised equity financing simply to achieve the minimum capital requirements.

When we measure initial equity size using capital stock, we do not find a negative relationship between failure and initial equity size.

Musso and Schiavo (2008) found that financial constraints, as measured by a synthetic index, significantly increase the probability of exiting the market. We also measure financial constraints using the ratio of cash flow to total assets, and identify a negative relationship between failure and cash flow.

The date set obtained from the TDB tends to cover intensively the construction sector. Indeed, the percentage of firms in the construction sector is much higher in the data set. In this respect, the results may depend heavily on the post-entry performance of firms classified in the construction sector. For robustness, we estimate the determinants of the time to failure and merger, using the subsample without construction. Moreover, we estimate them using the subsamples based on start-up firms with initial capital size around the threshold level; specifically, those with capital stock of no more than 10 million yen, or those with capital stock of 10 million yen or more to less than 50 million yen. As a result, we obtain similar results to those shown in columns (iv) and (v) of Tables 6 and 7 when using these limited subsamples.

The competing event is still included in the risk set in the competing-risks regression, and the last available value for the time-variant covariate (GDP) is used in the estimation.

References

Aalen O (1978) Nonparametric inference for a family of counting processes. The Annals of Statistics 6:701–726

Agarwal R, Audretsch DB (2001) Does entry size matter? The impact of the life cycle and technology on firm survival. The Journal of Industrial Economics 49:21–43

Aspelund A, Berg-Utbya T, Skjevdal R (2005) Initial resources' influence on new venture survival: a longitudinal study of new technology-based firms. Technovation 25:1337–1347

Audretsch DB (1995) Innovation and industry evolution. MIT Press, Cambridge, MA

Audretsch DB, Mahmood T (1995) New firm survival: new results using a hazard function. The Review of Economics and Statistics 77:97–103

Bamford CE, Dean TJ, McDougall PP (2000) An examination of the impact of initial founding conditions and decisions upon the performance of new bank start-ups. Journal of Business Venturing 15:253–277

Berger AN, Udell GF (1998) The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. Journal of Banking & Finance 22:613–673

Branstetter L, Lima F, Taylor LJ, Venâncio A (2014) Do entry regulations deter entrepreneurship and job creation? Evidence from recent reforms in Portugal. The Econometrics Journal 124:805–832

Cassar G (2004) The financing of business start-ups. Journal of Business Venturing 19:261–283

Cefis E, Marsili O (2011) Born to flip. Exit decisions of entrepreneurial firms in high-tech and low-tech industries. Journal of Evolutionary Economics 21:473–498

Coad A (2014) Death is not a success: reflections on business exit. Int Small Buis J 32:721–732

Coad A, Frankish J, Roberts RG, Storey DJ (2013) Growth paths and survival chances: an application of Gambler's ruin theory. Journal of Business Venturing 28:615–632

Coad A, Frankish JS, Roberts RG, Storey DJ (2016) Predicting new venture survival and growth: does the fog lift? Small Business Economics 47:217–241

Cooper AC, Gimeno-Gascon FJ, Woo CY (1994) Initial human and financial capital as predictors of new venture performance. Journal of Business Venturing 9:371–395

Cox DR (1972) Regression models and life tables. J Royal Stat Society B34:187–220

Disney R, Haskel J, Heden Y (2003) Entry, exit and establishment survival in UK manufacturing. The Journal of Industrial Economics 51:91–112

Djankov S (2009) The regulation of entry: a survey. World Bank Research Observer 24:183–203

Djankov S, La Porta R, Lopez-de-Silanes F, Shleifer A (2002) The regulation of entry. Quarter J Econ 117:1–37

Dollinger MJ (1999) Entrepreneurship: strategies and resources. Richard D. In: Irwin. IL, Homewood

Evans DS (1987) The relationship between firm growth, size, and age―estimates for 100 manufacturing-industries. The Journal of Industrial Economics 35:567–581

Fichman M, Levinthal DA (1991) Honeymoons and the liability of adolescence: a new perspective on duration dependence in social and organizational relationships. The Academy of Management Review 16: 442–468

Fine JP, Gray RJ (1999) A proportional hazards model for the subdistribution of a competing risk. Journal of the American Statistical Association 94:496–509

Fotopoulos G, Louri H (2000) Determinants of hazard confronting new entry: does financial structure matter? Review of Industrial Organization 17:285–300

Geroski PA, Mata J, Portugal P (2010) Founding conditions and the survival of new firms. Strategic Management Journal 31:510–529

Gray RJ (1988) A class of K-sample tests for comparing the cumulative incidence of a competing risk. The Annals of Statistics 16:1141–1154

Grilli L (2011) When the going gets tough, do the tough get going? The pre-entry work experience of founders and high-tech start-up survival during an industry crisis. Int Small Buis J 29:626–647

Grilli L, Piva E, Lamastra CR (2010) Firm dissolution in high-tech sectors: an analysis of closure and M&a. Economics Letters 109:14–16

Harhoff D, Stahl K, Woywode M (1998) Legal form, growth and exit of west German firms―empirical results for manufacturing, construction, trade and service industries. The Journal of Industrial Economics 46:453–488

Healy PM, Palepu KG (2001) Information asymmetry, corporate disclosure, and the capital markets: a review of the empirical disclosure literature. Journal of Accounting and Economics 31:405–440

Honjo Y (2000) Business failure of new firms: an empirical analysis using a multiplicative hazards model. International Journal of Industrial Organization 18:557–574

Honjo Y, Nagaoka S (2018) Initial public offering and financing of biotechnology start-ups: evidence from Japan. Research Policy 47:180–193

Hovakimian A, Opler T, Titman S (2001) The debt–equity choice. Journal of Financial and Quantitative Analysis 36:1–24

Hurwicz L (1946) Theory of the firm and of investment. Econometrica 14:109–136

Huyghebaert N, Van de Gucht LM (2004) Incumbent strategic behavior in financial markets and the exit of entrepreneurial start-ups. Strategic Management Journal 25:669–688

Huyghebaert N, Van de Gucht L, Van Hulle C (2007) The choice between bank debt and trade credit in business start-ups. Small Business Economics 29:435–452

Huynh KP, Petrunia RJ, Voia M (2010) The impact of initial financial state on firm duration across entry cohorts. The Journal of Industrial Economics 58:661–689

Huynh KP, Petrunia RJ, Voia M (2012) Initial financial conditions, unobserved heterogeneity and the survival of nascent Canadian manufacturing firms. Managerial and Decision Economics 33:109–125

Kato M, Honjo Y (2015) Entrepreneurial human capital and the survival of new firms in high- and low-tech sectors. Journal of Evolutionary Economics 25:925–957

Klapper L, Laeven L, Rajan R (2006) Entry regulation as a barrier to entrepreneurship. Journal of Financial Economics 82:591–629

Le Mens G, Hannan MT, Pólos L (2011) Founding conditions, learning, and organizational life chances: age dependence revisited. Administrative Science Quarterly 56:95–126

Leary MT, Roberts MR (2005) Do firms rebalance their capital structures? The Journal of Finance 60:2575–2619

Levinthal DA (1991) Random walks and organizational mortality. Administrative Science Quarterly 36:397–420

Mata J, Portugal P, Guimarães P (1995) The survival of new plants: start-up conditions and post-entry evolution. International Journal of Industrial Organization 13:459–481

Musso P, Schiavo S (2008) The impact of financial constraints on firm survival and growth. Journal of Evolutionary Economics 18:135–149

Nelson W (1972) Theory and applications of hazard plotting for censored failure data. Technometrics 14:945–966

Parker SC (2009) The economics of entrepreneurship. Cambridge University Press, New York

Robb AM, Robinson DT (2012) The capital structure decisions of new firms. Review of Financial Studies 27:153–179

Storey DJ, Greene FJ (2010) Small Business and Entrepreneurship. Pearson Education, Essex

Stucki T (2014) Success of start-up firms: the role of financial constraints. Industrial and Corporate Change 23:25–64

Titman S, Wessels R (1988) The determinants of capital structure choice. The Journal of Finance 43:1–18

Zingales L (1998) Survival of the fittest or the fattest? Exit and financing in the trucking industry. The Journal of Finance 53:905–938

Acknowledgements

This study was supported by JSPS KAKENHI Grant Numbers 26285060 (for both authors) and JP17K03713 (for the first author). The authors would like to thank Koichiro Onishi, Konari Uchida, Haibo Zhou, and attendees at the International Joseph A. Schumpeter Society Conference held in Montreal, the Research in Entrepreneurship and Small Business (RENT) Conference held in Zagreb, and the Spring Meeting of the Japanese Economic Association held in Nagoya for their useful comments and suggestions. The authors also appreciate the reviewer’s helpful comments and suggestions. Any errors remaining are the authors’ own.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Honjo, Y., Kato, M. Do initial financial conditions determine the exit routes of start-up firms?. J Evol Econ 29, 1119–1147 (2019). https://doi.org/10.1007/s00191-019-00623-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-019-00623-0