Abstract

Long wave chronologies are generally established by identifying phase periods associated with relatively higher and lower average growth rates in the world economy. However, the long recognition lag typical of the phase-growth approach prevents it from providing timely information about the present long wave phase period. In this paper, using world GDP growth rates data over the period 1871–2016, we develop a system for long wave phases dating, based on the systematic timing relationship between cyclical representations in growth rates and in levels. The proposed methodology allows an objective periodization of long waves which is much more timely than that based on the phase-growth approach. We find a striking concordance of the established long waves chronology with the dating chronologies elaborated by long wave scholars using the phase-growth approach, both in terms of the number of high- and low-growth phases of the world economy and their approximate time of occurrence. In terms of the current long wave debate, our findings suggest that the upswing phase of the current fifth long wave is still ongoing, and thus the recent financial/economic crisis only marks a flattening in the current upswing phase of the world economy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The recent financial crisis and the subsequent long-lasting downturn in global economic activity have generated renewed interest in the long wave theory,Footnote 1 a long tradition approach to the long-term development of capitalist economies (Bernard et al. 2014). Since the industrial revolution in the late eighteenth century, five long waves of economic development have been identified in the literature, each associated with fundamental structural changes in the economy, society, and institutions (Freeman and Louca 2001; Perez 2002). Thus, the introduction of a specific technological revolution - early mechanization and textile innovations, steam power and railways, electrical and heavy engineering, mass production and automotive industry, information and telecommunications - represents a process of transformation of the economy that gives rise to long waves of economic growth and determines a change in the structure of the economy, i.e. a new techno-economic paradigm (Freeman 1983; Freeman 2009; Perez 2010).

Among long wave researchers, the general consensus in terms of the number and driving forces of technologically driven observed long waves contrasts with the substantial disagreement about several basic issues, such as their exact periodization and where we are presently in the framework of the long wave theory. Beyond the substantial agreement about the timing of the first three Kondratiev waves, both the start and end of the fourth are largely disputed (Gore 2010). Highly controversial is also the ongoing long wave phase: some scholars suggest that the recent financial crisis and global recession marked the beginning of the downturn of the fifth long wave (Gore 2010), while others believe that we are still in the second half of the upswing phase of the fifth wave (Devezas 2010).

Given the difficulty and the high degree of uncertainty in assessing where we are now in the long-term global development cycle, the aim of the present study is to provide an accurate and timely recognition of long waves patterns of economic activity. The main difficulties in establishiing a long wave chronology are twofold. First, the contemporaneous presence, in the dynamics of capitalist economies over long historical periods, of sharp and sudden changes due to war and crisis episodes as well as of smooth structural changes due the overlapping nature of technological innovations (Kohler 2012; Swilling 2013). Second, the long delay with which the growth-phase approach is able to provide information on a specific long wave phase, the occurrence of which can be detected only after the end of the following phase.

In the present paper, the dating chronology is established by first identifying through wavelet and band-pass filtering methods the long-term growth pattern of the world output, that is, the “structural” growth rate cycle (Berry 1991),Footnote 2 and then using the phase difference properties of different cyclical representations (see Mintz 1969; Anas and Ferrara 2004; Anas et al. 2008) to detect automatically peaks and troughs as those periods where the historical long wave pattern crosses the zero-line from above and below, respectively.

The historical long wave pattern of the World GDP growth rate is robust to alternative methods (wavelet, band-pass and spectral filtering), subsets of countries (Western European), and variables (GDP per capita). New historical evidence on the long-term pattern of economic growth is provided for the interwar period, when, during the long downswing of the third wave, there is clear evidence of a minor upswing occurring in the 1920s in coincidence with the “roaring twenties”, a period of unprecedented growth in a number of developed countries, and especially in the US. As to the long waves chronology, we find that our dating, in terms of the number of high- and low-growth phases of the world economy and their approximate time of occurrence, yields a striking concordance with the dating chronologies provided in the long-wave literature, and, in particular, with Maddison’s phases of growth chronology. Finally, in terms of the discussion about which long wave phase the world economy is currently going on, our findings shows that only developed countries have entered the deployment period of the ICT-based techno-economic paradigm, while for the world as a whole, the upswing phase of the current fifth long wave is still ongoing.

The paper is organized as follows: in section 2 we discuss several issues related to long waves of economic development. Section 3 discusses methodological issues related to long waves detection. Section 4 presents the proposed methodology for a timely chronology of long waves of economic development and applies it to worldwide economic growth. Section 5 compares the consistency of the established long wave phases chronology with the dating schemes presented in the long-wave literature. Section 6 provides several robustness checks of the results for the historical long wave pattern and section 7 concludes the paper.

2 Long waves of economic development

The link between technological innovation and long cycles of economic development, first theorized by Schumpeter (1939) in his theory of economic development, is common to the most widely accepted theoretical frameworks within long wave research. Kondratiev (1935) type long wave patterns and Schumpeter’s (1939) clusters of innovation are the constituting elements of the techno-economic paradigm (TEP) shift framework developed by Freeman and Perez (1988), where great surges of development induce socio-economic transformation effects across all economic activities and provide the key driving force of each long cycle of economic development (Freeman 2009, and Perez 2010).Footnote 3

The diffusion of each great surge of development, characterized by an installation period and a deployment period (see Perez 2002, 2007), is described by the typical S-shaped pattern also within the Multi-level Perspective (MLP) theory of socio-technical transitions (Geels 2002; Geels et al. 2012; Grin et al. 2010), the other most influential existing theoretical framework for the explanation of major long-term socio-technical shifts.Footnote 4 An attempt to establish a synthesis by combining TEP and MLP approaches in a new conceptual framework, called Deep Transitions, has been recently proposed by Schot and Kanger (2018) and Schot (2016) with the aim of providing a more comprehensive explanation of the great surges of development and transformation pathways that characterizes the evolution of socio-technical systems over the past two centuries.

The traditional practice of presenting long waves dynamics as consecutive cycles has been recently questioned by Gore (2010) and Kohler (2012). They argue that successive technological revolutions, instead of running consecutively, tend to overlap with the deployment phase of a previous cycle and the installation of the new cycle, thus acting as co-drivers of growth-oriented processes. The effect is that the long-wave rhythm of production generated by these overlapping technological revolutions can determine a smooth transition process where the effects of overlapping regime changes on economic growth can be gradual and result in a smooth transition process, rather than taking the form of a sudden or instantaneous structural change.Footnote 5 As a result, the effects of major technology shifts on the long-run dynamic pattern of economic growth can be better represented by smooth rather than instantaneous sharp and sudden changes or breaks.

What all these theories have in common is that technological revolutions are the key, although not exclusive, drivers of economic development and that each paradigm shift requires a fundamental adaptation of the socio-institutional framework. However, the validity of a theory of long waves based on the process of technological innovation rests on the fulfillment of a set of severe interdependent requirements (see Rosenberg and Frischtak 1983). These conditions include, among others, causality running from innovations to investment, peculiar timing requirements for the introduction of new technologies to display their effects on economic growth, and strong interindustry linkages with sizable macroeconomic effects. These mechanisms should be at work in order for technological innovations to generate productivity improvements and their consequent impact upon macroeconomic performance.

The question of what constitutes a valid indicator for the long wave phenomenon is also crucial to the empirical research on long waves. Initially, price data have provided the strongest supporting evidence for the long wave hypothesis,Footnote 6 but when the trending behavior of the price level after WWII led to difficulties in detecting long cycle movements in prices, they have been progressively replaced by production variables in long waves studies (e.g. Lewis 1978, Kuczynski 1978, van Duijn 1983, Tylecote 1991, Chase-Dunn and Grimes 1995, and, more recently, Korotayev and Tsirel 2010).

The definition of “structural” cycles as long wave patterns related to the structural analysis of the process of economic development and, in particular, to structural changes (Berry 1991; Devezas and Corradine 2001) makes it more convincing to use long time series of aggregate time series of overall economic activity. This is not surprising for a phenomenon generated by waves of innovative activities the process of diffusion of which across the economy depends on the development of a corresponding set of new organizational models. Therefore, in this study we investigate the long wave pattern in World production dynamics using data for the World GDP annual real growth rates between 1851 and 2016. The highly irregular pattern of World aggregate dynamics is presented in Fig. 1.Footnote 7

World GDP annual real growth rates (%), 1851–2016 (data source: Maddison Project Datbase, version 2018, Bolt et al. 2018)

3 Long waves detection: Methodological issues

Historical datasets generally exhibit short-lived transient components such as abrupt changes, jumps, and volatility clustering, typical of war episodes or global crisis episodes, as well as structural changes in the trend function because of policy changes or paradigm shifts.Footnote 8 These complex, non-stationary features of historical datasets make the problem of extracting long-term smooth components from the secular movements in macroeconomic time series a critical one (e.g. Gallegati et al. 2017; Gallegati et al. 2017).

Standard break-testing methodologies examine the implications of structural breaks that take the form of abrupt jumps in the mean or in the slope of the process. Recently, Becker et al. (2006) and Enders and Lee (2009) have shown that a Fourier approximation using the lowest frequency component does reasonably well for the types of breaks often encountered in economic analysis and is especially suitable to mimicking smooth breaks. In particular, these authors have developed a variant of Gallant’s (1981) Flexible Fourier Form where a small number of low-frequency components from a Fourier approximation are used to capture the essential characteristics of an unknown functional form in the presence of smooth gradual breaks.Footnote 9

Since the Fourier transform uses a linear combination of basis functions ranging over ± ∞, all projections in Fourier analysis are globals, and thus a single disturbance affects all frequencies for the entire length of the series. Thus, if the signal is a nonperiodic one, the summation of the periodic functions, sine and cosine, does not accurately represent the signal. Such a feature restricts the usefulness of the Fourier transform to the analysis of stationary processes, whereas most economic and financial time series display frequency behavior that changes over time, i.e. they are nonstationary (Ramsey and Zhang 1996).

A solution to the stationarity problems of filtering in the frequency domain is provided by those pass-band filters that are performed in the time domain, but the desired properties of which are still formulated in the frequency domain, such as Baxter and King (1999) and Christiano and Fitzgerald (2003) approximate band-pass filters.Footnote 10 They differ in the assumptions about the spectral density of the variables and the symmetry of the weights of the filter. Regarding the first assumption, the approximation by Baxter and King (BK from now on) assume independent and identically distributed variables, whereas Christiano and Fitzgerald (CF from now on) assume a random walk. As to the latter, BK develop an approximate band-pass filter with symmetric weights on leads and lags in order to avoid the filter introducing phase shift in the cycles of filtered series, whereas CF’s asymmetric filter has the advantage of avoiding losing observations at the beginning and end of the sample.Footnote 11 Therefore, since a random walk puts more weight on lower frequencies, whereas independent and identically distributed variables weight all frequencies equally, the filter by BK approximates the ideal band-pass filter for shorter business cycles with higher accuracy than the filter by CF. Vice versa, the filter by CF is expected to approximate the ideal band-pass filter for cycles with long durations better than the filter by BK (Everts and Filters 2006). In sum, the optimizing criteria adopted by band-pass filter approximations implicitly define the specific class of model for which the approximating filter is optimal.

Approximate pass-band filters, although mainly developed in the context of business cycle analysis, have been also applied for extracting lower frequency components of economic time series. The BK filter has been used by Baxter (1994) to study the relationship between real exchange-rate differentials and real interest rates at low frequencies, and recently by Kriedel (2009) for the analysis of long waves of economic development with a length between 30 and 50 years in six European countries. Christiano and Fitzgerald (2003) have examined the Phillips curve relationship between unemployment and inflation in the short- and the long-run, as well as the correlation between the low-frequency components of monetary growth and inflation with their own asymmetric band-pass filter. Recently, Heap (2005), Jerret and Cuddington (2008) and Erten and Ocampo (2013) have used the CF filter to isolate the range of cyclical periodicities that constitute super cycles, that is, cycles between 20 and 70 years, in metals and commodity prices, respectively.

The wavelet method provides a systematic way of performing band-pass filtering (Proietti 2011) in the sense of being optimal under any time series representation of the process. Indeed, much of the appeal of this method, in contrast to band-pass filtering techniques, stems from it not being committed to any particular class of model.Footnote 12 The wavelet transform uses a local, not global, basis function that is dilated or compressed (through a scale or dilation factor) and shifted (through a translation or location parameter) to decompose a signal into a set of timescale components, each associated with a specific frequency band and with a resolution matched to its scale. The advantages of wavelets are twofold. First of all, by using a set of orthogonal basis functions that are local, not global, a variety of non-stationary and complex signals can be handled.Footnote 13 Second, the multiresolution nature of the wavelet decomposition analysis attains an optimal trade-off between time and frequency resolution levels. In particular, the wavelet transform provides a flexible time-scale window that narrows when focusing on small-scale features and widens on large-scale features, thus displaying good time resolution (and poor frequency resolution) for short-lived high-frequency phenomena and good frequency resolution (and poor time resolution) for long-lasting low-frequency phenomena.

For wavelet analysis there are two basic wavelet functions: father and mother wavelets, φ(t) and ψ(t), respectively. The former integrates to 1 and reconstructs the smooth part of the signal (low frequency), while the latter integrates to 0 and captures all deviations from the trend.Footnote 14 The wavelet functions φj,k(t) and ψj,k(t) are generated from father and mother wavelets through scaling and translation as follows:

where j indexes the scale, so that 2j is a measure of the scale, or width, of the functions (scale or dilation factor), and k indexes the translation, so that 2jk is the translation parameter.

Given a signal f(t), the wavelet series coefficients, representing the projections of the time series onto the basis generated by the chosen family of wavelets, are given by the following integrals:

where j = 1,2,...,J is the number of scales and the coefficients djk and sJk are the wavelet detail and scaling coefficients representing, respectively, the projection onto mother and father wavelets. In particular, the detail coefficients dJk,....,d2k, d1k represent progressively finer scale deviations from the smooth behavior (capturing high-frequency oscillations), while the smooth coefficients sJk correspond to the smooth behavior of the data at the coarse scale 2J (capturing low-frequency oscillations).

Finally, given these wavelet coefficients, from the functions.

we may obtain what are called the smooth signal, SJ,k, and the detail signals, Dj,k, respectively. The sequence of terms SJ, DJ,..,Dj,...,D1 for j = 1,2,...,J represents a set of signal components that provide representations of the original signal f(t) at different scales and at an increasingly finer resolution level. Each signal component has a frequency domain interpretation. As the wavelet filter belongs to the high-pass filter with passband given by the frequency interval [1/2j + 1,1/2j] for scales 1 < j < J, inverting the frequency range to produce a period of time we have that wavelet coefficients associated to scale j = 2j-1 are associated with periods [2j,2j + 1].

The discrete wavelet transform (DWT) discussed above re-expresses a time series in terms of coefficients that are associated with a particular time and a particular dyadic scale. Empirical applications apply the Maximal Overlap Discrete Wavelet Transform (MODWT) rather than the DWT because the first posseses several interesting properties. The MODWT can be applied to any sample size, not only to datasets of length multiple of 2J as with the DWT, and returns at each scale a number of wavelet and scaling coefficients equal to the length of the original series.Footnote 15 Although the MODWT is highly redundant, so that transformations at each scale are not orthogonal, the offsetting gain is that applying the transform leaves the phase invariant, a very useful property in analyzing transformations (Percival and Walden 2000).

Wavelet analysis has been recently used to extract long-term components in Gallegati et al. (2017), and Marco Gallegati (2018). The first, studying the dynamics of long-term movements in wholesale prices for the United States, the United Kingdom and France, detects long waves in prices not only from the late eighteenth century to the mid-1930s, but also after World War II, with the reported turning points in the pre-World War II period being aligned with the chronology reported in the long waves literature. The latter investigates the phase relationships between the long-term global components of external imbalances, credit booms and equity price returns to develop a global crisis index aimed at detecting periods of increasing risk of macroeconomic and financial instability at the global level.

-

1.

Detecting and dating long waves of economic development

Long wave chronologies are generally identified using the phase-growth approach (Goldstein 1988). The turning dates, i.e. periods corresponding to the beginnings and ends of different phases, are selected so that, in each phase, the growth rate is significantly higher or lower than that of the adjacent phase.Footnote 16 Thus, the downturn is defined as the end of a period of relatively high growth, and the upturn the end of a period of relatively low growth. Since average growth rates in three successive time periods are needed to provide a historical chronology, given that the average rate during a high growth phase must exceed the average rates during the preceding and succeeding low growth phases, the information on a specific long wave phase period can be detected only after the end of the following phase. As a consequence, the phase-growth approach is characterized by a relatively long interval between occurrence and recognition of turning points.

Business cycle dating procedures detect peaks and troughs using two different definitions of business cycles, classical and growth (or deviation) cycles, corresponding to the traditional and modern definitions of business cycles, respectively. Classical and growth (or deviation) cycles are identified using two different measures: fluctuations in the level of aggregate economic activity, and fluctuations of aggregate economic activity around a long-run trend. Phases in classical and growth cycles are closely related: the high-growth phase of a growth cycle coincides with business cycle recovery and middle expansion, whereas the low growth phase coincides with late expansion and contraction. Each type of cycle possesses its own turning points that are characterized by a regular sequence: a peak in the classical cycle is necessarily preceded by a peak in the growth cycle, and a trough in the growth cycle is necessarily preceded by a trough in the classical cycle (Harding and Pagan 2016).

Beyond the classical and growth cycles, the empirical literature has also focused on the growth rate cycle, sometimes referred to as the acceleration cycle, that is, the cycle described by increases and decreases in the growth rate of economic activity. These alternations of periods of varying length characterized alternatively by high and low average rates of growth have been termed “step cycles” in business cycle analysis (Mintz 1972).Footnote 17 Since economic activity decelerates before its growth rate falls below its tendencial growth rate, growth rate cycle peaks precede growth (and classical) cycle peaks quite regularly. Analogously, growth rate cycle troughs precede classical and growth cycle troughs quite consistently. Even if the sequence of turning points is always respected in practice, cycles in growth rates are subject to more pronounced volatility. As a result, growth rate cyclical fluctuations are hardly employed due the unreliability of their turning points signals.

This regular sequence of turning points among classical, growth and growth rate cycles is at the basis of the αABβCD approach,Footnote 18 an empirical approach that enables successive real-time signals in terms of turning points and is used for monitoring purposes within the business cycle clock framework (Anas and Ferrara 2004; Anas et al. 2008). An interesting feature of this systematic difference in turning points among different cyclical representations is that the inflection points in the growth rate series correspond to extremal points in the levels. When the growth rate cycle crosses the zero-line from above (below), a peak (trough) in the underlying series in levels is always consistently detected. As an illustration of this feature we present in Fig. 2 the cyclical representations in growth rates and in levels during the 2011–12 recession in the Eurozone using real GDP quarterly data from 2010:1 to 2014:2. Points α and β are the extrema of the growth rate cycle, while B and C are the extrema of the classical cycle. When the growth rate cycle crosses the zero-line from above (below), a peak (trough) in the underlying series in levels is clearly detected.

In attempting to provide a timely chronology of long waves of capitalist development, the present paper exploits the property discussed above that the inflection points in the growth rate series correspond to extremal points in the levels. In particular, we use longer cyclical movements in World GDP annual growth rate to provide a timely detection of the shift from high- to low-rate phases, when the growth rate crosses the zero-line from above below, and from low- to high-rate phases, when the growth rate crosses the zero-line from below.

With respect to the phase-growth approach, the advantage of the proposed procedure is threefold. First, the periodization of the growth process does not depend on the subjective subdivision of the timescale. Second, this method, by providing a timely signal about the current growth phase, has the ability to lessen consistently the so-called recognition lag, that is, the relatively long interval between the occurrence and recognition of turning points and growth phases. Lastly, using longer cyclical movements in World GDP annual growth rate, we avoid the problem related to the high variability of growth rates fluctuations. Indeed, highly irregular movements and short-live fluctuations due to transitory events are likely to generate many false signals and imply a more complex real-time detection.

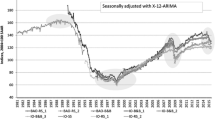

Based on long wave researchers’ definition of long wave cycles, i.e. cycles with an average length of about 50 years, we identify the frequency range between 32 and 64 years, with its average cycle length around 48 years, as the frequency band most closely corresponding to Kondratiev-type long wave cycles (e.g. Gallegati et al. 2017). Figure 3 shows two smoothed lines representing the long-term components of the World GDP growth rate from mid-XIXth century to present, extracted using wavelet and CF band-pass filters. The black smooth line corresponds to the D5 wavelet detail component extracted using the MOWDTFootnote 19 with the Daubechies least asymmetric (LA) wavelet filter of length L = 8 (Daubechies 1992) and periodic boundary conditions. The grey smooth line represents the corresponding component extracted using the Christiano-Fitzgerald (CF) approximate band-pass filter with the World GDP growth rate assumed to be an I(1) unit root process without drift. Grey shaded areas reported in Fig. 3 represent growth phases dating based on the average and median values of the historical chronologies presented in Table 1, i.e. 1873–4, 1893–4, 1915–6, 1940–3, 1972–3, 1992–3.

The D5 (black line) and CF (grey line) long term components of annual World GDP real growth rates. Grey shaded areas represent growth phases dating based on historical chronologies presented in Table 1: 1873–4, 1893–4, 1915–6, 1940–3, 1972–3, 1992–3

The sequence of upswings and downswings of the two long wave components, although highly irregular, traces smooth cycles yielding very similar patterns. They exhibit a high degree of variability over time in terms of both amplitude and duration, with amplitude considerably increasing in the second half of the twentieth century. This good pattern of similarity is evident not only in terms of the amplitude of cyclical movements, but also with respect to the timing alignment of upper and lower turning points, and the points at which the indexes cross the zero line.

The application of the methodology presented in the previous section to the long waves pattern shown Fig. 2 gives the following long wave periodization: 1874 (peak) - 1892 (trough) - 1913 (peak) - 1953 (trough) - 1975 (peak) - 1997 (trough). After the first long wave associated with the “First Industrial Revolution”,Footnote 20 four long waves are identified, each related to the occurrence of a technological revolutions:

-

the upswing phase of the second wave (railway and steel industries) from 1850 to mid 1870s followed by the downswing phase from the 1870s until early 1890s, a period in which the world economies experience a great depression (see Gordon 1978);

-

the third wave (chemical and electrical industries) combines a long wave upswing between the early 1890s and the pre-WWI period, and the long decline beginning before WWI and ending immediately after WWII (from 1913 to 1953), interrupted in the “golden 1920s” by a temporary upswing ending with the Great Depression;

-

the fourth wave (petrochemicals and automobiles industries) combines the post-war growth upswing phase period between early 1950s and mid-1970s and the downswing phase from mid-1970s until the end of the twentieth century. The first is characterized by the reconstruction effect of the 1950s along with the “economic miracle” in the European countries, the latter by class struggles and structural adjustments;

-

the upswing phase of the fifth wave (information technology), beginning at the end of the previous centuryFootnote 21 and driven by the boom experienced by many developing countries (Gore 2010), which is still ongoing and is currently under scrutiny.

In terms of the debate on what the recent financial crisis and the great economic recession represent in terms of the fifth Kondratiev cycle our findings support the interpretation that the recent global crisis episode does not mark the beginning of the downturn of the fifth long wave. The definitive peak of the fifth long wave and the subsequent downswing have not happened yet, although they seem to be imminent. In that respect, and in terms of the Perez-Freeman innovation paradigm framework,Footnote 22 the upsurge of investments in renewable energies, energy efficiency and clean technologies that is currently underway suggests that we could be entering into the development period of a techno-economic paradigm shift where technologies and innovations in resource efficiency are likely to be drivers of the next sixth long wave of innovation and technology by triggering long-term productivity increases for the global economy.

4 A comparison with historical chronologies of long wave phases

The methodology proposed in this paper allows a direct comparison with the dating chronology of the phase-growth approach, as the growth rate of production is the characteristic distinguishing the alternance of long wave phases. Hence, in order to evaluate whether the chronology established with our methodology provides a consistent dating of long wave cycles, in what follows we compare it with the historical chronologies provided in the long-wave literature. Table 1 offers a survey of dating schemes elaborated by several long wave scholars: Kuczynski (1978, 1982), Freeman and Louca (2001), Korotayev and Tsirel (2010), Maddison (1991, 2003), Perez (2007), Tyfield (2016), and, in the last column, the long wave chronology identified in the present paper.Footnote 23

In the phase periods chronology reported in Kuczynski’s (1978), the dates of the turning points are calculated using the average annual growth rates of capitalist world industry for the period 1850–1977, with phase-period growth rates being used to measure long wave expansion and stagnation phases. Freeman and Louca’s (2001) and Perez (2007) dating base schemes are based on the Freeman/Perez techno-economic paradigm shift framework, actually the most widely accepted theoretical framework with long wave researchers (Freeman and Perez 1988; Perez 2002). Furthermore, we consider three additional dating schemes that extend up to the present time. The first dating chronology is that obtained by Korotayev and Tsirel (2010) whose dataset is the same as ours. The second chronology is based on Maddison’s (1991, 2003) phases of capitalist development, where different phases of growth are identified by major changes in growth momentum. These turning points are identified by inductive analysis and iterative inspection of empirically measured variablesFootnote 24 and “systems characteristics” such as the policy-institutional framework and policy attitudes. The last dating chronology, Tyfield (2016, Tables A1), is based on the combination of Kondratiev waves with the dynamics of the political-cultural level and the geopolitical processes of the hegemony of the A-B (Arrighi-Braudel) cycles.

Both the number of growth phases and the approximate time of occurrence of high-rate and low-rate phases are convincingly identified with our system method. Indeed, despite minor differences, the zero-line crossing of the long-term growth rate cycle yields approximately the same dating of the growth-phase chronology reported in the literature on long waves: one-half coincide exactly (peaks), one-half roughly (troughs). The main differences emerge at the end of the third and fourth waves, where our chronology tends to postpone the beginning of the upswing phases by about a decade with respect to the dating provided by all alternative dating schemes.Footnote 25 The only exception is Maddison’s chronology, the phase growth changes of which are perfectly aligned with our dating from 1913 onwards.Footnote 26

Finally, beyond the chronologies reported in the long waves literature, our dating exhibits a high degree of dating conformity with that provided by the research division of the global banking group Standard Chartered. They refer to periods of “historically high global growth, lasting a generation or more” characterized by a nation that becomes a dominant economic driver for the world economy (Standard Chartered 2010). Two “supercycles”, roughly corresponding to periods of long waves upswings, are detected for the past, 1870–1913 and 1946–1973, with the global economy growing on average by 2.7% and 5%, respectively, and one for the current period, 2000–2030, where Asian countries are expected to drive future growth at the global level.

5 Further robustness checks

In order to provide additional strength to the results/analysis provided in the present paper, in what follows further robustness checks are presented. The top panel of Fig. 4 shows the long wave pattern presented by Korotayev and Tsirel’s (2010, p. 24, Fig. 7) applying spectral analysis and loess technique to the World GDP growth rate. Notwithstanding the different phase amplitude due to the different treatment of the trend component that is not eliminated in Korotayev and Tsirel’s (2010) procedure, the overall long wave pattern is remarkably similar. The only notable exception refers to the interwar period where the long downswing phase of the third wave is interrupted by the “golden 1920s” boom.Footnote 27 This is a period in which statistical methods have always encountered difficulties due to the treatment of war years and their influence on the identification of long waves (see Kleinknecht 1981; Metz 1992; Goldstein 1999). This is also evident in Korotayev and Tsirel (2010) where the interwar period complicates the detection of the turning points of the third long wave. Interestingly, the evidence presented in this section, and based on the interaction between WWI and the strong output growth during the “golden Twenties”, provides a straightforward solution for the detection of the turning points of the third long wave.

In the top panel, the long wave pattern of World GDP growth rate estimated by Korotayev and Tsirel’s (2010) using spectral and loess analyses. In the middle panel, the long wave components of the real growth rate of aggregate (black line) and per capita (grey line) World GDP. In the bottom panel, the long wave components of the GDP real growth rates of World (black line) and Western European countries (grey line)

Additional robustness checks of the estimated historical long wave pattern are provided in the middle and bottom panels of Fig. 4, where we present the long wave components of the growth rate for a different variable, World real GDP per capita (e.g. Maddison 2007), and for a subsample of countries, i.e. Western European countries.Footnote 28 The pattern displayed in the middle panel of Fig. 4 shows that the long wave component of the growth rate of World real GDP per capitaFootnote 29 is almost identical to that presented in Fig. 3, except for a slight anticipation with respect to its aggregate counterpart before the second half of the XXth century. In the bottom panel of Fig. 4 we present the estimated long term component for the Western European countries only. Two main differences emerge with respect to the long wave pattern of the World GDP growth rate: the first is a regular consistent anticipation of the downswing and upswing phases throughout the sample,Footnote 30 the latter is the presence of an additional long cycle between 1920s and 1930s as a result of the pre-armament and post-reconstruction booms experienced by those European countries directly involved in warfare.

6 Conclusions

A key question for businesses and investors is whether the recent financial crisis could mark the end of the fifth Kondratieff wave or the beginning of a new long wave of prosperity (Allianz Global Investors 2010). However, since the phase-growth approach needs the average growth rates in each of three successive phase periods in order to provide a historical chronology, the information on the current long wave phase will not be available before the end of the next phase period.

The aim of this paper is to develop a methodology for long waves dating with the ability to provide more timely information about the current growth phase by “lessening” the long interval between the occurrence and recognition of turning points and growth phases. Based on the phase difference between cyclical representations in growth rates and in levels, we establish a chronology of long wave cycles in the global economy starting from the identification of the long-term pattern of economic growth. What we find is a considerable degree of conformity, in terms of the number of growth phases and their approximate time of occurrence, with existing long waves dating schemes, and especially with Maddison’s chronology.

Most importantly, our system allows answering the question where we are within the fifth long wave. The findings presented in this paper support the interpretation that the recent global financial crisis marked a flattening in the current upswing phase of the World economy, with the global economy now approximating the end of a period of a relatively high growth associated with the early phase of decline of the current dominant paradigm. The definitive peak of the fifth long wave and the subsequent downswing have not happened yet, but should not be too far away. Perhaps not surprisingly, the leading role of newly developed countries in sustaining the World GDP growth rate in the new century is postponing the occurrence of the downswing phase at the global level.

Notes

See, for example, the popular book recently published by the Marxist economist Paul Mason (2015) on post-capitalism which has brought long wave thinking into a much wider audience than the typical specialist academic audience.

The term techno-economic paradigm instead of “technological paradigm” (Dosi 1982) reflects the idea that such changes do not merely involve engineering trajectories for specific products or process technologies.

The most important novel feature of the MLP is that a transition of a socio-technical system stems from the interaction of events in its basic components, that is, (innovation) niches, socio-technical regimes, and landscapes (Grin et al. 2010).

The transition to a new techno-economic regime is a period of structural change in which the process of transformation in the economy cannot proceed smoothly, not only because it implies massive transformation and much destruction of existing plant, but mainly because the prevailing pattern of social behavior and the existing institutional structure are shaped around the requirements and possibilities created by the previous paradigm (Perez 2002).

Price series have been for a long time the only economic data available and consistently measured. Indeed, annual data on price indexes go back to late eighteenth century, allowing researchers to use the longest possible time span as well as a number of observations greater than any corresponding international dataset. By contrast, output variables have been reconstructed by economic historians relatively recently and mostly back to the mid-nineteenth century.

The data source is the Maddison Project Database, version 2018 (Bolt et al. 2018). World GDP before 1950 is computed by summing real GDP across different subsets of countries (each country’s real GDP is preliminarily obtained by multiplying real GDP per capita in 2011$ by population in mid-year thousands). The country coverage before 1950 changes as follows: 1850- (Australia, Belgium, Chile, Denmark, France, Germany, Great Britain, Greece, Indonesia, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, US), 1870- (Finland, Canada, New Zealand, Japan, Brazil, Uruguay, Venezuela, Sri Lanka), 1884- (India), 1900- (Argentina, Bolivia, Colombia, Ecuador, Mexico and Per√π), 1902 (Cuba, Philippines), 1906- (Panama), 1920- (Costa Rica, Guatemala, Honduras, El Salvador, Nicaragua, Ireland, Romania, Former USSR), 1923- (Turkey). Country coverage, in terms of World GDP, goes from 62% in 1870 to 78% in 1929. After 1950 regional data for the World aggregate are used. All data are available at www.ggdc.net/maddison.

For example, between the late 18th and early 20th centuries the level of wholesale prices tends to display a very large amount of variation over time around a trendless or slightly declining trend, whereas after WWII, prices start increasing as a consequence of a change in the process of price determination (van Ewijk 1982), the effect being the emergence of a strong positive trend (Gallegati et al. 2017).

These filters are derived by approximating the frequency domain properties of the ideal band-pass filter. Since the exact band-pass filter is a moving average of infinite order, a finite order approximation is necessary in practical applications.

The ideal band-pass filter can be better approximated with the longer moving averages. Using a larger number of leads and lags allows for a better approximation of the exact band-pass filter, but makes unusable more observations at the beginning and end of the sample.

Wavelets, their generation and their potential usefulness are discussed in intuitive terms in Ramsey (2010, 2014). A more technical exposition with many examples of the use of wavelets in a variety of fields is provided by Percival and Walden (2000), while excellent introductions to wavelet analysis with many interesting economic and financial examples are given in Gencay et al. (2002) and Crowley (2007).

Since the data need not be detrended nor are corrections for war years needed anymore, with wavelet analysis we can avoid the practice of studying history by erasing part of the history (Freeman and Louca 2001).

The mother wavelet plays a role similar to sines and cosines in the Fourier decomposition. They are compressed or dilated, in the time domain, to generate cycles to fit actual data.

For the DWT, where the number of observations is N = 2J, the number of coefficients at each dyadic scale is: N=N/2J + N/2J + N/2J-1 + ... + N/4 + N/2, that is, there are N/2J coefficients sJ,k, N/2J coefficients dJ,k, N/2J-1 coefficients dJ-1,k ... and N/2 coefficients d1,k.

The two phases are generally called Phase A and Phase B in the long waves literature.

Step cycles, first analyzed by Friedman and Schwartz (1963) in their work on money, were initially proposed with deviation cycles to identify growth cycles.

The letters refer to the sequence of turning points for different classification of business cycles: α and β are peaks and troughs for growth rate cycles, B and C peaks and trough for classical cycles, A and D peaks and troughs for growth cycles.

The application of the MODWT with a number of levels J = 5 with annual time series produces five wavelet details vectors D1, D2, D3, D4 and D5 which correspond to fluctuations between 2 and 4, 4–8, 8–16, 16–32 and 32–64 years, respectively. Wavelet decomposition analysis was carried out with R package waveslim from B. Whitcher.

The first wave (steam engine) and the upswing of the second wave cover the first half of the nineteenth century and thus are excluded from our sample.

According to the paradigm of technological innovation, there are two periods within an innovation paradigm with the diffusion of innovation preceded by a technological development period occurring during the downswing phase of a long wave.

A complete list of existing long wave chronologies may be found in Bosserelle (2012).

Maddison employs several macroeconomic indicators, namely the rate of growth of the volume of output, the output per head and exports, the cyclical variations in output and exports, unemployment, and the rate of change in consumer prices.

That the end of the fourth wave did not expire in the 1990s is also argued by Mason (2015), although in his view the downturn of the fourth wave prolonged until 2008.

Before WWI Maddison’s dating fails to detect a phase change in the early 1890s probably because his methodology aims at identifying major changes in growth momentum.

Goldstein (1999, p.90) signals “as a source of potential difficulty for estimating long cycles the interaction between the impact of WWI and the rapid expansion of the 1920s”. Over the 1920s the US experienced an unprecedented period of sustained industrial and economic growth based on the implementation of standardized mass-production in industry and large-scale diffusion and use of new products such as the automobile, household appliances, and other mass-produced products (the US average annual growth rate of real GNP over the 1920–29 period equal to 4.6%). Moreover, over the same period, the relative international economic strength of the US economy increased considerably, both in terms of world industrial output and the share of the world market, at the expense of the European countries, the manufacturing industries, transport system and agricultural land of which had been greatly damaged during WWI.

We thank one of the two anonymous referees for suggesting these specific robustness checks. Wavelet estimated variables are presented in the middle and bottom panels of Figure 4.

Before 1950 real GDP per-capita is computed by summing real GDP across countries and dividing by population.

References

Allianz Global Investors (2010) Analysis and trends: the sixth Kondratieff-long waves of prosperity. Allianz Global Investors, Frankfurt

Anas J, Ferrara L (2004) Detecting cyclical. Turning Points: The ABCD Approach and Two Probabilistic Indicators. J Bus Cycle Meas Anal 12(2):193–225

Anas J, Billio M, Ferrara L, Mazzi GL (2008) A system for dating and detecting turning points in the euro area. Manch Sch 76(5):549–577

Baxter M (1994) Real exchange rates and real interest differentials. Have We Missed the Business-Cycle Relationship? J Mon Econ 33:5 37

Baxter M, King R (1999) Measuring business Cycles: approximate band-pass Filters for economic time series. Rev Econ Stat 81:575–593

Becker R, Enders W, Lee J (2006) A stationary test with an unknown number of smooth breaks. J Time Ser Anal 27:381–409

Bernard L, Gevorkyan A, Palley T, Semmler W (2014) Time scales and mechanisms of economic cycles: a review of theories of long waves. Review of Keynesian Economics 2(1):87–107

Berry BJL (1991) Introduction in long wave rhythms in economic development and political behavior. John Hopkins University Press, Baltimore

Bolt J, Inklaar R, de Jong H, van Zanden JL (2018) Rebasing, Maddison: new income comparisons and the shape of long-run economic development. Maddison Project Working Paper n:10

E Bosserelle (2012) La croissance economique dans le long terme: S. Kuznets versus N.D. Kondratiev - Actualité d'une controverse apparue dans l’entre-deux-guerres. Economies et Societes, Cahiers de l'ISMEA, serie Histoire economique quantitative, AF, 45 1655‑1688

Chase-Dunn C, Grimes P (1995) World-systems analysis. Annu Rev Sociol 21:387 417

Christiano LJ, Fitzgerald TJ (2003) The band pass filter. Intern Econ Rev 44(2):435–465

Crowley P (2007) A guide to wavelets for economists. J Econ Surv 21:207–267

Daubechies I (1992) Ten lectures on wavelets, CBSM-NSF regional conference series in applied mathematics, vol 61. SIAM, Philadelphia

Devezas TC, Corradine JT (2001) The biological determinants of long-wave behaviour in socioeconomic growth and development. Technol. Forecast. Soc. Change 68(1):57

Devezas TC (2010) Crises, depressions, and expansions: global analysis and secular trends. Technol Forecast Soc Change 77:739 761

Dosi G (1982) Technological paradigms and technological trajectories. Res Policy 11:147 162

van Duijn JJ (1983) The long wave in economic life. Allen and Unwin, Boston, MA

Enders W, Lee J (2009) A unit root test using a Fourier series to approximate smooth breaks. Oxf Bull Econ Stat

Erten B, Ocampo JA (2013) Super cycles of commodity prices since the mid nineteenth century. World Devel 44:14 30

Everts M, Filters B-P (2006) Munich Personal RePec Archive Paper no 2049

van Ewijk C (1982) A spectral analysis of the Kondratieff cycle. Kyklos 35(3):468 499

Freeman C (1983) Long waves in the world economy. Frances Pinter, London

Freeman C (2009) Techno-economic paradigms. Essays in honour of Carlota Perez. In: Drechsler W, Kattel R, Reinert ES (eds) Schumpeter’s business Cycles and techno-economic paradigms. Anthem Press, London

Freeman C, Perez C (1988) In: Dosi G, Freeman C, Nelson R, Silverberg G, Soete L (eds) Technical Change and Economic TheoryStructural crises of adjustment: business Cycles and investment behaviour. Pinter Publisher, London

Freeman C, Louca F (2001) As time Goes by: from the industrial revolutions to the information revolution. Oxford University Press, Oxford

Friedman M, Schwartz AJ (1963) A monetary history of the United States. NBER Publications. Princeton University Press, Princeton, pp 1867–1960

Gallant AR (1981) On the bias in flexible functional forms and an essentially unbiased form. the flexible Fourier form J Econom 15:211 245

Gallegati M, Gallegati M, Ramsey JB, Semmler W (2017) Long waves in prices: new evidence from wavelet analysis. Cliometrica 11(1):127 151

Marco Gallegati D (2018) Delli Gatti, long waves in history: a new global financial instability index. J Econ Dynam Control, 91 190:205

Geels FW (2002) Technological transitions as evolutionary reconfiguration processes: a multilevel perspective and a case-study. Res Policy 31(8):1257–1274

Geels FW, Kemp R, Dudley G, Lyons G (eds) (2012) Automobility in transition? A Socio-Technical Analysis of Sustainable Transport. Routledge, New York

Gencay R, Selcuk F, Whitcher B (2002) An introduction to wavelets and other filtering methods in finance and Economics. San Diego Academic Press, San Diego

Goldstein JS (1988) Long Cycles: prosperity and war in the modern age. Yale University Press, New Haven

Goldstein JP (1999) The existence, endogeneity and synchronization of long waves: structural time series model estimates. Rev Radic Polit Econ 31:61 101

Gordon DM (1978) Up and down the long roller coaster? In: Economics P (ed) Union for Radical. U.S. Capitalism in Crisis, URPE, New York

Gore C (2010) The global recession of 2009 in a long-term development perspective. J Intern Dev 22(6):714–738

Grin J, Rotmans J, Schot J (2010) Transitions to sustainable development: new directions in the study of long term transformative change. Routledge, New York

Hamilton JD (1989) A new approach to the economic analysis of nonstationary time series and the business cycle. Econom. 57:357 384

Harding D, Pagan A (2016) The econometric analysis of recurrent events in macroeconomics and finance. Princeton University Press, Princeton

Heap A (2005) China - the engine of a commodities super cycle. Citigroup Smith Barney, New York City

Jerret D, Cuddington JT (2008) Broadening the statistical search for metal Price super Cycles to steel and related metals. Res Policy 33:188 195

Kleinknecht A (1981) Innovation, accumulation, and crisis: waves in economic development. Review (Fernand Braudel Center) IV 687 711

Kohler J (2012) A comparison of the neo-Schumpeterian theory of Kondratiev waves and the multi-level perspective on transitions. Environ Innov Soc Transit 3:1–15

Kondratiev ND (1935) The long waves in economic life. Rev Econ Stat 17(6):105–115

Korotayev AV, Tsirel SV (2010) A spectral analysis of world GDP dynamics: Kondratieff waves, Kuznets swings, Juglar and Kitchin Cycles in global economic development, and the 2008-2009 economic crisis. Struct Dyn 4(1):3–57

Kriedel N (2009) Long waves of economic development and the diffusion of general-purpose technologies: the case of railway networks. Economies et Societes, serie histoire economique quantitative. AF, 40 877:900

Kuczynski T (1978) Spectral analysis and cluster analysis as mathematical methods for the periodization of historical processes. Kondratieff Cycles - appearance or reality? In: Proceedings of the seventh international economic history congress, vol 2. International Economic History Congress, Edinburgh, pp 79–86

Kuczynski T (1982) Leads and lags in an escalation model of capitalist development: Kondratieff Cycles reconsidered, proceedings of the eighth international economic history congress. Vol. 3. International economic history congress. Budapest

Lewis WA (1978) Growth and fluctuations 1870–1913. Allen and Unwin, MA

Maddison A (1991) Dynamic forces in capitalist development. Oxford University Press, Oxford

Maddison A (2003) The world economy: historical statistics. OECD, Paris

Maddison A (2007) Fluctuations in the momentum of growth within the capitalist epoch. Cliometrica 1:145 175

Mason P (2015) PostCapitalism: A Guide to our Future. Allen Lane, UK

Metz R (1992) A re-examination of long waves in aggregate production series. In: Kleinknecht A (ed) New findings in long waves research. St. Martin’s Printing, New York

Mintz I (1969) Dating Postwar Business Cycles: Methods and their application to Western Germany: 1950-1967. In: Occasional Paper, vol 107. NBER, New York

Mintz I (1972) Dating American growth Cycles. In: Zarnowitz V (ed) The business cycle today. NBER, New York

Percival DB, Walden AT (2000) Wavelet methods for time series analysis. Cambridge University Press, Cambridge

Perez C (2002) Technological revolutions and financial capital: the dynamics of bubbles and Golden ages. Edward Elgar, UK, Cheltenham

Perez C (2007) Finance and technical change: a long-term view. In: Hanusch H, Pyka A (eds) The Elgar companion to neo-Schumpeterian Economics. Edward Elgar, Cheltenham

Perez C (2009) The double bubble at the turn of the century: technological roots and structural implications. Camb J Econ 33(4):779–805

Perez C (2010) Technological revolutions and techno-economic paradigms. Camb J Econ 34:185 202

Proietti T (2011) Trend estimation. In: Lovric M (ed) International encyclopedia of statistical science, 1st edn. Springer, Berlin

Ramsey JB (2010) Wavelets. In: Durlauf SN, Blume LE (eds) The new Palgrave dictionary of Economics. Palgrave Macmillan, Basingstoke

Ramsey JB (2014) Functional representation, approximation, bases and wavelets. In: Gallegati M, Semmler W (eds) Wavelet applications in Economics and finance. Springer-Verlag, Heidelberg

Ramsey JB, Zhang Z (1996) The application of waveform dictionaries to stock market index data. In: Kravtsov YA, Kadtke J (eds) Predictability of complex dynamical systems. Springer-Verlag, Berlin

Reati A, Toporowski J (2009) An economic policy for the fifth long wave. PSL quart. Rev, 62 143:186

Rosenberg N, Frischtak CR (1983) Long waves and economic growth: a critical appraisal. Amer Econ Rev 73:146–151

Schot J, Kanger L (2018) Deep transitions: emergence, acceleration, stabilization and directionality. Res Policy 47(6):1045 1059

Schot J (2016) Confronting the second deep transition through the historical imagination. Technol Cult 57(2):445–456

Schumpeter JA (1939) Business Cycles. McGraw-Hill, New York, NY

Standard Chartered, The super-cycle report. London: global research standard Chartered, 2010

Swilling M (2013) Economic Crisis, Long Waves and the sustainability transition: an African perspective. Environ. Innov. Soc. Transit. 6:96–115

Terasvirta T (1994) Specification, estimation, and evaluation of smooth transition autoregressive models. J Amer Stat Ass 89:208 218

Tyfield D (2016) On Paul Mason’s “post-capitalism”: an extended review. Mimeo

Tylecote A (1991) The long wave in the world economy. Routledge, London

Vogelsang TJ, Perron P (1998) Additional tests for a unit root allowing for a break in the trend function at an unknown time. Intern. Econ. Rev. 39:1073 1100

Acknowledgements

I’d like to thank two anonymous referees that with their comments contributed to greatly improve the paper. All errors and responsibilities are, of course, mine.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that he has no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

ESM 1

(CSV 24 kb)

Rights and permissions

About this article

Cite this article

Gallegati, M. A system for dating long wave phases in economic development. J Evol Econ 29, 803–822 (2019). https://doi.org/10.1007/s00191-019-00622-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-019-00622-1