Abstract

When full competition prevails in product, labor, and capital markets, positive or negative external trade shocks may be accommodated by the migration of jobs between sectors; the negative impact on some households’ income of lower nominal wages will be more than offset by lower prices of imported final goods. Unemployment, if any, will be temporary, unless labor market rigidities prevent the necessary adjustment. By contrast, we argue that trade shocks trigger a process of creative destruction that necessarily causes distortions in the structure of productive capacity and, hence, market disequilibria. Therefore, the structural change that follows trade shocks can no longer be analyzed within an equilibrium framework. The transition following a shock may be characterized by increasing imbalances, and create scope for policy intervention. The model presented in this paper, which focuses on the time dimension of production and market imbalances, allows us to clarify the debate.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Developed economies exposed to competition from large emerging countries such as China or India experience significant reductions of exports, increases of imports, relocation, outsourcing and job destruction in manufacturing and in tradable services. Emerging countries are exposed to a symmetric shock: an increase of exports that implies deep changes in the industrial structure and may hurt workers with lower skill levels. This feeds a recurrent debate between the tenants of the free market and those who plead for increasing protection.

According to the elementary theory of international trade, which rests on the law of comparative advantages, an increase of exchanges between countries is systematically beneficial to all partners. Importing new goods and services, even when these goods were previously domestically produced, creates new opportunities and allows the use of productive resources in a more efficient way. The loss of manufacturing jobs due to the growing import penetration is generally offset by the job creation effect of growing exports. Penetrating international markets by exporting new goods and services purchased by the consumers of more advanced countries allows emerging countries to take advantage of larger productivity gains associated with export sectors (Lucas 1993). International trade is thus a positive sum game and cannot be held responsible for increasing unemployment, waste of resources, and low growth.

However, old as well as more recent analyses demonstrate the possibility of losses for some participants to the exchange. These losses would be essentially due to differences in productivity gains among countries, which result in differences in real income (Hicks 1953; Krugman 1985; Gomory and Baumol 2000; Samuelson 2004). These models deal with the welfare effects for a country when domestic production is taken over by its trading partner, generally a less advanced country.

This paper is not concerned by the final welfare effects of changing trading patterns, but with the positive implications of the transition process. We focus on the complementary issue of the adjustment that has to take place following a trade shock. One cannot deny that changes in international trade entail social and distributional costs. “Trade can generate sizable benefits only by restructuring economies—that is the essence of specialization according to comparative advantage—and in the real world restructuring does not happen without someone bearing costs. The flip side of the gains from trade is the losses that have to be incurred by adversely affected workers and enterprises (...). Simply put: no pain, no gain. It makes little sense to pretend otherwise” (Rodrik 1998, p. 5). Thus, it is not enough to focus on the distribution of gains between countries or, within countries, among different skills and between wages and profits. In the following, we will argue that the restructuring mentioned by Rodrik is an intrinsic feature of globalization and relocation processes. In fact, increasing openness is a form of structural change and, hence, analytically equivalent to technical progress; as such, it entails the destruction of existing productive capacity (and of the corresponding jobs), and the construction of something new to replace it (Hicks 1973; Amendola and Gaffard 1998). Thus, distortions are not an impediment to a smooth transition to the new equilibrium, as argued by the tenets of free market paradigm; they are an intrinsic and unavoidable feature of the structural change process. We push Rodrik’s argument even further, by arguing that this process of restructuring does not necessarily converge to the new equilibrium: the ex ante benefits from increased openness may ex post fail to materialize, if something goes wrong with the co-ordination process. Thus, the process of restructuring needs not to be successful.

We will conclude that the viability of the transition and the recovery of coordination crucially hinge upon the right mix of institutional and policy factors, notably in access to credit.

The remainder of the paper is structured as follows: Section 2, contrasting the standard neoclassical framework with an evolutionary one, is an attempt to identify which domestic distortions matter in a country facing a change in conditions of international competition. Sections 3 and 4 then propose a model that allows us to both reproduce neoclassical results and introduce an analytical framework suited to dealing with structural change. By using the model and simulating out-of-equilibrium paths, Section 5 shows how real domestic distortions influence the evolution of the economy, and, hence, why and how international trade matters. Section 6 concludes.

2 Which domestic distortions matter?

Changes in international trade result in widespread gains if there are no obstacles to prevent the redistribution of productive resources among sectors that allows the convergence toward the full employment equilibrium. Thus, the low-wage country will be able to use an abundant amount of labor in the production of new goods. The high-wage country will be able to increase productivity by reallocating its labor force in high value-added services and high-tech sectors, where it has a comparative advantage. It will also be able to shift some workers from manufacturing to service jobs even if the latter require lower skill and, hence, involve lower nominal wages (compensated by the decrease of prices of imported goods).

Within the standard analytical framework, these considerations lead to focus on the role played by wage adjustments and distortions associated with them. For the gains from trade and relocation to materialize, it is essential that no domestic distortion prevents the necessary adjustment (i.e. the convergence towards the full employment equilibrium). Changes in fundamentals (technology and preferences) must be accommodated by relative prices (in particular wages). In this case, relocation and outsourcing only correspond to a better allocation of resources at the international level without harmful consequences on employment. Increasing imports will be matched by increasing exports.

The only obstacle that would prevent from capturing the gains from trade is the downward rigidity of wages paid to low-skilled workers that could on the one hand, increase unemployment, and, on the other, distort the flows of international trade. Brecher (1974) shows, for example, that if minimum wage applies in the high-wage and capital abundant country, the labor-intensive sector both dismisses too many workers and sets free a too large amount of capital. As a consequence, both exports of capital-intensive goods and imports of labor-intensive goods grow beyond what is considered their optimal size. This view leads to policy prescriptions that focus on supply conditions, with the objectives of increasing competitive advantages for an economy with respect to its external competitors. Reducing wage differentials, improving labor market flexibility, and reducing taxes, seem to be the only viable policies aimed at avoiding domestic distortions and their effects on the structure of international trade, thus favoring full employment. This view is nevertheless partial, focusing on the functioning of the labor market and ignoring the systemic nature of the process of change and its time dimension. There is no reference to the creation of resources. Price and wage distortions, when occurring, only affect the utilization of productive resources (labor). This is why policy makers have to correct distortions by reducing direct and indirect labor costs.

This paper takes the different view that distortions are intrinsically built into structural change processes. As a matter of fact, economies subject to international trade shocks are concerned with distortions other than wage stickiness. Changes in international trade go hand-to-hand with the breaking-up of the pre-existing industrial and spatial structure of productive capacity, which results in unavoidable disequilibria between supply and demand of final goods, all along the transition towards the new adapted structure of the economy. Thus, the supply side, in particular investment, becomes crucial for the transition to a new steady state. The problem does not consist in the reallocation of existing resources but in the creation of a new productive capacity; it is hence pointless (and may be harmful) to try to bypass the transition and the associated turbulence by eliminating price distortions. Policy should rather accompany the process of change, progressively removing or softening the constraint faced by the economy.

Indeed, as a consequence of trade liberalization, imports are substituted for goods locally produced, while local exporters do not necessarily have the capacity to expand supply, and may even end up having to decrease it. Thus, “liberalization seems to result in labor temporarily going from low-productivity protected sectors to zero-productivity unemployment” (Stiglitz and Charlton 2006, p. 26). This may happen both in developing and developed countries, leading to a reduction of income, and, hence, in the demand for final output, which will be more or less pronounced depending on the level of social insurance. Opposite to the conclusion of standard analysis, a high level of social protection can help to avoid global damages associated with a cumulative process of depression.

In this perspective, international trade matters, but not only with respect to initial endowments or existing externalities. In fact, for an open economy, balanced growth results from the harmonization of external and internal demand with productive capacity. Trade and openness may be very important both in increasing the long-run growth potential, and in smoothing fluctuations triggered by country-specific shocks. But this positive role is fulfilled only if the economy has internal resources to match the increase in demand and to keep the balance that is necessary to complete successfully a transition process.

Thus, openness and the emergence of new countries do not create difficulties per se. Market disequilibria and distortions in the productive capacity that necessarily emerge both in the emerging and developed countries call for local co-ordination of economic activities, which cannot amount to reducing production costs in the hope of re-establishing competitiveness. Co-ordination should consist in creating the conditions for firms to deal with these real distortions, which are the unavoidable consequences of structural change.

The crisis that is unfolding shows the importance of coordination and policy interventions to guarantee the smooth functioning of an economy. First, in the countries hit by the financial crisis, the transmission to the real sector happened through a credit restriction, depriving firms of the external resources they needed. In a second phase, the crisis spread to other countries, where markets did not malfunction, through an external demand shock, to which they had to adapt through a recomposition between domestic an external demand. Absorbing this type of shocks requires active policy interventions, and coordination within and across countries, to provide both the financing and the sustaining of aggregate demand that allows the productive sector to undergo the necessary restructuring.

Summing-up, what is at stake is not how to prevent real domestic distortions inherent to the process of change, but how to smooth them thanks to appropriate policies. Thus, we need a model that highlights these distortions and allows us to identify the required remedies.

3 The benchmark model

The model we present in this section does not directly address issues related to growth and trade, but is an attempt to analyze how an external shock (an increase in competitiveness of a foreign country) affects the composition of goods produced in the economy, and the trajectory of the economy towards a new equilibrium.

Our economy is comprised of N > 2 firms, divided into the production of a basic (b) and an advanced (a) good. This production is sold to a representative domestic household, which inelastically supplies a quantity L of labor, and to a foreign household.

Demand The utility of the domestic household includes the basic and advanced good, plus an imported good (Z), and is written as follows:

where P a , P b and q are the prices of the advanced, basic, and imported good, respectively, and R is total revenues of the household. We assume that profits are distributed to the domestic household, so that household income R is equivalent to the revenues from sales of the two goods produced at home:

World demand for the two goods, W j (j = a, b), is exogenous (in other words, we assume that the country has given “export quotas”Footnote 1), so that the value of total demand is:

Demand for the imported good, qZ = (1 − γ)R, does not concern us, so we will neglect it in the following.

As a consistency check, from the budget constraint (Eq. 1) and the income equation (Eq. 2) we can obtain, as expected, the result that in equilibrium the external account is balanced:

where W ≡ W a + W b . Total revenues of the household are a function of external demand. As a consequence, from Eq. 3, we can define the value of production in the two sectors as

Notice that external demand of both goods enters into the two demand curves. This happens through the revenues effect.

Supply The α and β (with α + β ≡ N) firms produce in the advanced and basic sectors, respectively. They use a linear technology, transforming labor l j,i in output:

where A j is the number of workers per unit produced in each sector j = a, b. (In other words, we assume constant returns to scale.)

In each sector, firms compete in quantities, à la Cournot. We further assume that workers can work in any of the two sectors (i.e., that wages are equated: w a = w b = w), The standard solution of the problem gives

where of course we assume symmetry (x a,i = x a = X a /α, and x b,i = x b = X b /β).Footnote 2 We assume that firms can change sectors, but that their number is given for the economy as a whole. This is because we want to focus on the relative profitability of the two sectors, which would, of course, become irrelevant if we allowed for entry. Analyzing the long term effects of entry and exit of firms is left for future research.

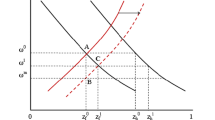

3.1 Equilibrium

The equilibrium relies on two conditions:

-

The first condition is equilibrium in the labor market, requiring that the quantity of labor L, inelastically supplied, be equal to labor demand:

$$ L=A_{b}X_{b}+A_{a}X_{a}=\frac{A_{b}\xi_{b}}{P_{b}}+\frac{A_{a}\xi_{a}}{P_{a}}. $$(5) -

The second equilibrium condition is the equality of profits across sectors, which implies that no firm will have an incentive to switch. Rewriting Eq. 4 as

$$ \begin{array}{rll} x_{a} & =&\frac{\alpha-1}{\alpha^{2}A_{a}w}\xi_{a},\qquad P_{a}=\frac{\alpha wA_{a}}{\alpha-1},\qquad\pi_{\alpha}=\frac{\xi_{a}}{\alpha^{2}}\\ x_{b} & =&\frac{\beta-1}{\beta^{2}A_{b}w}\xi_{b},\qquad P_{b}=\frac{\beta wA_{b}}{\beta-1},\qquad\pi_{b}=\dfrac{\xi_{b}}{\beta^{2}}, \end{array} $$(6)the condition π a = π b yields

$$ \frac{\xi_{a}}{\alpha^{2}}=\dfrac{\xi_{b}}{\beta^{2}} $$(7)

Putting together Eqs. 5 and 7, using the price equations (6), and the fact that β = N − α, equilibrium is defined by the solution to the following system:

where the unknowns are α and w. The system can be solved recursively to obtain the equilibrium number of firms in the advanced sector, α ∗ and the equilibrium wage w ∗ :

It is interesting to note that only external demand and the number of firms determine α ∗ and w ∗ ; since we define equilibrium through the equality of profits in the two sectors, the technology parameters do not affect the distribution of firms, nor the wage. We will see in the next section that these parameters become crucial when analyzing disequilibrium paths. Notice also that, as \((\xi_{b}+\xi_{a})-2\sqrt{\xi_{b}\xi_{a}}>0,\) the wage is always positive. On the other hand, Eq. 8a gives conditions on the parameters for the equilibrium to be meaningful:

The second inequality is certainly verified, while the first implies, with some manipulation,

This condition states, somehow trivially, that if external demand for the advanced sector is not large enough, the equilibrium number of firms in that sector may be lower than 1.

3.2 Reaction to shocks in equilibrium

The model is rather standard, and the comparative statics also yield standard results. Using Eqs. 8, and the fact that \(\frac{d\alpha }{dW_{j}}=\frac{\partial\alpha}{\partial\xi_{b}}\frac{\partial\xi_{b} }{\partial W_{j}}+\frac{\partial\alpha}{\partial\xi_{a}}\frac{\partial\xi_{a} }{\partial W_{j}},\) we can write

Two propositions are easy to prove simply by algebraic manipulation:

Proposition 1

\(\frac{d\alpha}{dW_{a}}>0\) and \(\frac{d\alpha}{dW_{b}}<0.\) An increase of external demand for a sector yields a larger equilibrium number of firms in that sector.

Proof

See Appendix. □

Proposition 2

\(\frac{d\pi_{a}}{dW_{a}}>0\) and \(\frac{d\pi_{a}}{dW_{b}}>0.\) An increase in external demand for any sector yields a larger equilibrium profit.

Proof

See Appendix. □

The reaction of wages to external demand shocks is harder to sign, because it depends on the size of the reallocation of workers between the two sectors.

Once studied the steady state properties of our model, we can introduce the dynamic elements that essentially involve capacity building and expectations, in the spirit of Amendola and Gaffard (1998).

4 Adding a time structure

This section extends to our two sector Cournot economy the dynamics introduced in Saraceno (2004). Section 2 argued that trade shocks are analytically equivalent to productivity shocks, in that they trigger a structural change with the associated distortions that have to be managed for the transition to be successful. To model structural change in a production economy, four ingredients are required: First, production takes time, and is often characterized by complementarity rather than substitutability in the factors. This is captured analytically by assuming a Leontief production function that uses labor inputed at different times. Second, agents have bounded rationality, especially when facing complex environments. Thus, expectations are adaptive. Third, as in temporary equilibrium models (e.g., Benassy 1982) , prices only adjust between periods; ex-ante disequilibria within the period are eliminated by rationing and stock accumulation. Fourth, agents are constrained, in their transactions, by financial availability. This credit or cash-in-advance constraint emerges because markets open sequentially.

4.1 The sequence

Each period begins with some state variables inherited from the previous one. First, labor embedded in production processes (as will be clear below); then, stocks that result from past disequilibria. Finally, prices and wages.

Within the period, we introduce a sequence that helps in defining the time structure of the model, and lets credit constraints emerge

-

Prices and wages change in response to market disequilibria, even if we do not assume them to clear markets.

-

Firms may also change sectors, based on realized profits in the previous period.

-

Then, agents form inter- and intra-period expectations, and, accordingly, desired demands and supplies. In particular firms form a demand for labor, and a demand for financial means (the wage fund)

-

The first market that opens is the financial market, in which demand for external funds may or may not be satisfied. Financial constraints may cause a downward revision of labor demand.

-

Total labor employed is determined once the second market, the labor market, opens. Disequilibrium in this market yields unemployment, or a human constraint for firms. Then wages are paid, and production is carried over. Households adjust their desired demands based on the actual wage perceived.

-

Finally, the product markets open, and, as in the other markets, the short side rule applies.

Next, we detail this sequence.

Wage dynamics Wages change early in the period, following previous disequilibria:

Thus ω is an indicator of wage flexibility; as the equation clarifies, this has nothing to do with market clearing behavior.

Firm dynamics Firms may change sector of activity. This happens when profits differ:

where I a is an indicator function taking a value of 1 only if α ∈ (1, N). Firms changing sectors still use the built productive capacity to carry on production in the original sector, but invest in the other sector.

Expectations Previous work (Amendola and Gaffard 1998; Saraceno 2004) has explored the role of expectations in this type of model. We showed that, when interacting with sunk costs and irreversibilities in the production process, adaptive expectations play an important role. We also argued at length that, in a complex environment, when collecting complete information may be impossible or extremely costly, agents may find it more convenient to form their day-to-day decisions following an adaptive rule. Long term expectations that drive investment decisions are, instead, independent of contingent conditions.

Coherently with these arguments, in this paper we make different assumptions regarding expectations: short term or intraperiod expectations are backward looking. Firms decide how much they wish to produce in the current period, based on their expectation of current demand, which in turn is determined by the expected level of employment. The latter is determined as an average between past employment and its “normal” value

where L ∗ = L is the steady state level of employment.

If we are not at full employment, we have to write expected revenues as the sum of paid wages, plus distributed profits

where Π = Π a + Π b . Notice that we add an additional term (H h): if in the previous period households had been rationed in the goods markets, they would be left with unspent money balances, which concur to form current revenues. Expected demand then becomes

It is important to remark that agents take into account the fact that firms having switched sectors do not possess productive capacity (otherwise, α t and β t would have been used instead of α t − 1 and β t − 1); we assume, in other words, that agents use all the information they possess in order to be as close as possibly allowed, in this context, to rational expectations. The amount firms will actually attempt to produce depends also on stocks of goods left from disequilibria in past periods (see Eq. 11 below):

Finally, interperiod expectations determine how much firms invest, i.e. how many workers are hired today to put in place tomorrow’s production. We assume that these decisions are not influenced by short term considerations:

Production and labour demand The two elements of complementarity and time-to-build are introduced by assuming that the production function takes the form of a Leontief function with dated labor input

where j = a, b denotes the sector. Thus, dated and current labor concur in fixed proportions to the determination of production; this formulation is equivalent to assuming production to be undertaken with capital built in the previous period that fully depreciates. Thus, current production is constrained by, among other things, past “investment”. If firms do not possess the appropriate amount of capital/dated labor, they will not be able to produce as much as they wish. As a consequence, firms will only demand the labor they really need:

Labour demand is therefore given by

The financial sector: demand and supply for external funds Demand for external funds comes from whatever of the wage bill is not covered by past profits. Money demand may then be written as the difference between the wage fund and internal resources.

where S is the value of past sales in the two sectors, and H f denotes involuntary monetary hoardings by firms (see Eq. 10 below). Equation 9 embeds the credit constraint: the firm system needs additional funds for whatever of the wage pool it cannot finance out of internal resources. As profits are distributed to households at the end of the period, they are not available for firms.

The behavior of the supply side in the financial market is not explicitly modeled. In fact, we adopt a very stylized representation, in which the supply of external funds can be interpreted as credit made available by the financial sector. We simply assume that the supply of credit by financial sector is adversely affected by turbulent times (proxied in our model by the variability of profits), and by the strength of the economy, proxied by the unemployment rate):

where μ ∈ [0, 1], and Var[π j ] is the past variance of π j . In words, we assume that the financial sector will react to increasing variability of profits, or to deteriorating macroeconomic conditions, by tightening the flow of credit. Larger values of the parameter μ will capture a more accommodating credit market, while credit constraints will be more important at low levels of μ. At the steady state, with no unemployment and constant profits, credit demand \(F_{j}^{d}\) will be accommodated.

The credit market is the first to open. This modeling trick allows to implicitly introduce a financial constraint. If firms are unable to access to the needed external funds, they will not be able to carry on their planned investment. The parameter μ, that we leave exogenous, is the crucial variable to help understand the effect of credit rationing on the path followed by the economy.

The labour market If \(F_{t}^{s}<F_{t}^{d},\) then firms will not be able to hire as many workers as they desire. Total labor demand is then equal to

where hats denote constrained quantities. In the simulations below, we will assume that firms, in an attempt to maximize cash flows, first reduce investment, i.e. labor demand for the construction phase. If funds are still not enough, then current production has to be curtailed as well.

The second market to open is the labor market. If \(L>\hat{L}_{t}^{d},\) we have unemployment; otherwise a human resource constraint will occur. Effective employment will thus be determined by the short side of the market:

Rationing affects firms in the two sectors proportionally, i.e. \(\hat{L} _{j,t}=L_{j,t}^{d}\frac{L}{\hat{L}_{t}^{d}}.\) Footnote 3

Production and the goods market Once the labor market is closed, wages are paid, and production is carried on. The last market to open is the goods market. Supply depends on the constraints previously faced by the firms, all embedded in l j,t :

On the demand side, actual employment determines the resources, and total demand

The short side rule applies to the goods market as well, so that we have

where the equation for H h implicitly assumes that external demand W j is satisfied in priority.

The period ends at this point. The state variables that link it to the other periods are the stocks H and O, the wage level w, and the capacity (the quantity of labor stocked to carry on production in the following period).

4.2 Steady state properties

As we are in a static setting, in the steady state, all variables are constant over time. In the labor market we have

Similarly, in the steady state, the allocation of firms between sectors is constant:

Furthermore, expectations are fulfilled

where L ∗ = L is the steady state level of employment. Expected production and revenues are equal to their equilibrium values:

As demand is equal to supply, no unwanted stocks appear:

The demand for external finance in steady state is zero, as past revenues are enough to finance current production. In Eq. 9,

Thus, when the economy is in the steady state, the dynamics described in Section 4.1 above is “transparent”. The time structure becomes irrelevant, and the system is completely characterized by its equilibirum relationships. Nevertheless, out of equilibrium, the constraints and the irreversibilities play a role in shaping the path of the economy, the undesired stocks link the period in a sequence, and the problem of stability arises.

The next section will investigate, by means of simulations, the effects of an external trade shock. In particular, we will focus on the joint role of credit, wage flexibility, and sectoral mobility, in facilitating the transition between different equilibria.

5 Out-of-equilibrium paths

The technology parameter values we chose show a basic sector in which very few workers are needed in the construction phase, while a substantial amount of labor concurs in the production phase. By contrast, the advanced sector is capital intensive, in the sense that most of the labor has to be applied in the construction phase. We further chose the technology parameters in such a way that overall steady state labor productivity (X j /L j , j = a, b) is larger in the advanced sector.Footnote 4 We stated in the introduction that our original motivation was to study the effect on the different sectors of developed economies, of the appearance on the world trade scene of emerging countries (see also footnote 1). In particular, we were interested in the structural effects of a loss of export capacity for the basic sector. Consistent with this motivation, we investigate the path followed by the economy following a negative external shock to the basic sector (specifically, at time t = 10, the export quota of the basic sector is reduced: W b,t ≥ 10 = 0.8W b,t < 10). The new steady state will then be characterized by lower wages and profits, and an increase in the number of firms in the advanced sector.

We consider the three institutional variables that affect the transition towards the new equilibrium, notably the degree of wage stickiness ω, the speed of firm migration from less profitable to more profitable sectors θ, and the degree of accommodation of the financial sector, μ.

We begin with a low rate of firm migration (θ = 0.05), and we simulate three series of scenarios that correspond to different and alternative degree of reaction of wages to labor market disequilibria: fixed (ω = 0), sticky (ω = 0.05), and flexible wages (ω = 0.5). With fixed wages (Figs. 1 and 2) the economy will converge towards a sort of Keynesian equilibrium characterized by a constant rate of unemployment. Because wages do not fall, unemployment is not reabsorbed. This has an effect on aggregate demand, and supply in both sectors decreases. What is interesting is that whether the credit sector accommodates investment or not does not make a difference, as we can observe by comparing Fig. 1 with Fig. 2.

If we introduce a moderate reactivity of wages (ω = 0.05, Fig. 3; the corresponding figure with non-binding credit constraints is available upon request), the system converges towards equilibrium. After the initial drop in profits and production, due to the negative shock on employment, the decrease in wages allows unemployment to be reabsorbed, while aggregate demand increases again. This gives the firms the resources they need to carry on production and investment, and to converge to the new steady state. Not surprisingly, then, even in this case, there are no major differences related to the intensity of the credit constraint. In fact, the transition is financed out of internal funds.

The existence of a credit constraint becomes crucial when wages are very sensitive to labor market disequilibria. Figures 4 and 5 show the dynamics corresponding to ω = 0.5 In this case, and with a tight credit constraint, the sharp reduction in wages following the initial unemployment affects aggregate demand. Even as unemployment initially drops, the wage fund is reduced, and firms face decreasing demand and profits. As a consequence investment will be constrained, and the resulting evolution of the system becomes non-viable (Fig. 4). If credit markets accommodate the investment needs of firms, as in Fig. 5, then the lack of internal resources can be compensated by external money, and the economy converges towards a new steady state with full employment.

If firms change sector more easily (i.e., with θ = 0.1), the tendency of the system to instability naturally increases. In fact, as firm migration means investment effort without a corresponding output (productive capacity has to be built beforehand), if too many firms migrate at the same time, the disruption in productive capacity will feed back in lower employment, demand, and again in production, in a vicious circle. Then, when wages are fixed (the figures, with μ = 0 or μ = 1, are similar and available upon request), the fall in aggregate demand will be limited, and the system will be able to recover coordination (albeit in a pseudo equilibrium with persistent unemployment).Footnote 5 But as soon as we introduce wage variability, even moderate (Fig. 6), the migration of firms will disrupt the productive capacity of the economy, and the fall of wages will affect aggregate demand, revenues and the financing capacities of firms. As a consequence, only an accommodating credit policy will allow investment to be financed, and the new equilibrium to be reached (Fig. 7).

This set of results shows that the natural tendency of the system to converge to the new equilibrium may be hampered by excessive variations in wages and/or by too fast migration between sectors; these may trigger, via aggregate demand effects, an important drop in the investment capacity of firms. In turn, if this lack of resources is not compensated by the credit sector, the insufficient investment disrupts the productive capacity of the economy, and triggers a cumulative explosive process. Therefore, re-establishing the coordination between investment and consumption and reabsorbing unemployment requires an accommodating credit policy.

5.1 Robustness

The time series results reported above need to be generalized to make sure that they do not depend on the particular set of parameters used for the simulations. To this end, we thoroughly investigated the relevant parameter space to assess whether our results are robust or not.

We randomly drew (500 times) the three parameters θ ∈ [0, 0.2] ω ∈ [0, 0.5] and μ ∈ [0, 1] to lie between the extreme values of the simulations above. For each of these draws, we ran the dynamic system for 100 periods, always perturbing it with a negative external demand shock (ΔW b /W = − 0.2). We then recorded, along with the parameter values, the final level of unemployment and other variables of interest (variance of profits along the run, etc). The result of this Monte Carlo experiment strongly confirms the conclusions we drew from the analysis of time series. Figure 8 shows a plot of unemployment for the complete sample (500 draws). It shows that many runs are not viable, as they are clustered at a near 100% level. The linear trend lines show that the non viable processes are more frequent for high levels of ω and θ, thus confirming that excessive flexibility has a destabilizing effect on the transition process. (We also reported ‘total flexibility’, proxied by the sum θ + ω.) As for the effects of credit constraints, the Monte Carlo experiment shows that higher levels of μ -a more accommodating financial sector- are associated with lower unemployment, thus also confirming the findings of the time series analysis.

We made this impressionist statement more rigorous by building a binary regression model on the dataset created by the experiment, i.e. associating a 1 with each viable process (defined as a process that has a long run unemployment rate of less than 30%) and a 0 otherwise. According to this definition, around 25% of the processes (127 out of 500) were viable. The results of the probit regression are reported in Table 1, that, once again, confirms our findings. While it is well known that the coefficients do not represent the marginal effect of the regressors, their sign gives the direction of change. Thus, a positive coefficient for μ means that more accommodating financial markets make the viability of processes more probable, while the negative coefficients of ω and θ imply that excessive flexibility in the labor market or in the migration of firms reduces the probability. By looking at Fig. 9, we can finally notice that the pattern is clearer for ω than for θ: the distribution of wage flexibility parameters for viable processes is clearly skewed while, for firm migration, the pattern is less clear.

While the negative role of flexibility in what concerns the viability of transition emerges robustly from our analysis, excessive rigidity may also be a problem. Figure 10 shows the same plots as Fig. 8, for the subsample of 127 viable processes. As can be seen, larger ω now correspond to lower unemployment, while θ is still positively associated with unemployment. The latter effect being smaller, increasing total flexibility within the subset of viable processes, reduces unemployment. The subset of viable processes also highlights an interesting property of financial constraints, which shows a binary behaviour: either they guarantee viability (in combination with other parameters), or they do not.

Monte Carlo experiment. The figure reads like Fig. 8, but only viable runs are reported

Once viability is assured, there is no effect of μ on the performance of the economy. A regression analysis on unemployment within the subset of viable processes confirms our findings. Table 2 shows that μ is not significant in explaining unemployment, and that ω and θ interact in a nonlinear way. If we plot the coefficients for ω and θ in Table 2, assuming in each case that the other variable takes its median value, we obtain Fig. 11. The figure shows that, for very low values of ω, unemployment is large, while for values larger than around 0.1, it fluctuates around zero. By contrast, increasing the speed of migration of firms has a negative effect on unemployment even within the sample of viable processes.

Plot of regression coefficients from Table 2. Unemployment as a function of ω assuming that θ equals its median value θ = 0.08 (black dashed line); unemployment as a function of θ assuming that ω equals its median value ω = 0.12 (light continuous line)

Our simulations show that appropriate behaviors and policies should keep access to credit easy, in order to sustain the investment capacity of firms and to help prevent excessive disturbances in the structure of productive capacity that hamper the growth process. We further show that excessive flexibility in wage adjustment and in the speed of migration between sectors have a negative effect on viability. Nevertheless, once the particular combination of these three factors guarantees the overall success of disequilibrium transitions, we observe that excessive wage rigidity prevents the adjustment and hence delivers excessive unemployment, and that credit constraints do not play a major role in explaining unemployment. We conclude that their role is binary: either they make the process viable, or they do not. But once the process is viable, the performance of the economy is independent of the availability of financial means.

6 Concluding remarks

Changes in the geographical distribution of economic activities, which are in the nature of the growth process, may go hand-to-hand with internal distortions that emerge from an inevitable and powerful structural change and cannot be eliminated by simply liberalizing trade and allowing the economy to be as near as possible to a state of perfect competition. While public policies that would only focus on costs conditions and hence on competitiveness of territories could amplify these distortions, which are mistakenly attributed to international trade, gradual adjustments in an environment characterized by incomplete information and irreversibility (here defined as the existence of a time to build) should allow countries to re-establish full employment and capture productivity gains associated with specialization.

The different paths generated by the model, corresponding to different value of key parameters, confirm that the main issue does not lie in the dramatic changes of import and export flows, which simply reveal changes in comparative advantages. Rather, the problem lies in the way in which internal (and unavoidable) distortions are dealt. Loose monetary policies appear as the means required for reducing these distortions. But, the architecture of the financial system must also be considered insofar it is essential for determining transmission mechanisms. As a matter of fact, credit availability depends on the banks’ (and shareholders’) behavior, which will be different according to the sectors’ configuration, and which is affected by monetary policy in a complex way. Our purpose here is not to explore these transmission mechanisms, but simply to underline their extreme importance for the evolution of economies that may suffer or take advantage of market openness at the world level.

Notes

We assume that these export quotas are not related to domestic factors. For example, the penetration of low cost goods from China and other emerging economies is based on cost differentials so wide in size that they reduce the capacity to export of some (basic) sectors regardless of domestic pricing policies.

Upper case variables usually denote economy-wide variables, while lower cases denote firm specific ones.

Notice that an issue of strategic behavior could arise here: knowing the rationing rule, firms could modify their behavior in order to obtain, once rationed, their optimal quantity. We overlook this issue, as it presupposes perfect knowledge by the firm of the behavior of its competitors in their own as well as in the other sector.

Specifically, we have κ b = 1.6, κ a = 0.8, λ b = 0.2, λ a = 10. Overall productivity in the two sectors is then X b /L b = 0.17 and X a /L a = 0.74. As the model that we build is strongly stylized, the parameter values we choose are simply meant to capture qualitative features of the system.

This simulation extends to a disequilibrium framework Keynes’ argument for wage rigidity as a means to avoid cumulative aggregate demand-aggregate supply downward spiraling (see the chapter on wages of Keynes 1936). For a detailed discussion of this argument, refer to Amendola et al. (2004) and Saraceno (2004).

References

Amendola M, J-L Gaffard (1998) Out of equilibrium. Clarendon Press, Oxford

Amendola M, J-L Gaffard, Saraceno F (2004) Wage flexibility and unemployment: the Keynesian perspective revisited. Scott J Polit Econ 51(5):654–674

Benassy J-P (1982) The economics of market disequilibrium. Academic Press, New York

Brecher RA (1974) Minimum wage rates and the pure theory of international trade. Q J Econ 88:98–116

Gomory RE, WJ Baumol (2000) Global trade and conflicting national interests. MIT Press, Cambridge

Hicks JR (1953) An inaugural lecture. Oxf Econ Pap 5:117–35

Hicks JR (1973) Capital and time. Clarendon Press, Oxford

Keynes JM (1936) The general theory of employment, interest and money. Macmillan, London

Krugman PR (1985) A technology gap model of international trade. In: Jungenfelt K, Hague D (eds) Structural adjustment in advanced economies. Macmillan, London

Lucas RE (1993) Making a miracle. Econometrica 61(2):251–72

Rodrik D (1998) The debate over globalization: how to move forward by looking backward. In: Conference on the future of the world trading system. Institute for International Economics, Washington, DC

Samuelson PA (2004) Where Ricardo and Mill rebut and confirm arguments of mainstream economists supporting globalization. J Econ Perspect 18(3):135–146

Saraceno F (2004) Wage regimes, accumulation, and finance constraints: Keynesian unemployment revisited. Document de Travail de l’OFCE, Paris, 2004-1

Stiglitz JE, Charlton A (2006) Fair trade for all. Oxford University Press, Oxford

Acknowledgements

This paper benefited of funding from the European Community’s Seventh Framework Programme (FP7/2007–2013) under Socio-economic Sciences and Humanities, grant agreement no. 225408 (POLHIA). We thank Mario Amendola, Uwe Cantner, and an anonymous referee for comments and suggestions on a previous draft. Our work also benefited from interaction with participants to the workshop on Openness and Innovation in Emerging Financial Markets, Beijing, March 2007, and to the International Economic Association Conference, Istanbul, June 2008. The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proof of propositions

Appendix: Proof of propositions

Proof of Proposition 1 \(\frac{d\alpha}{dW_{a}}>0\) and \(\frac{d\alpha}{dW_{b}}<0.\)

Proof

\(\frac{d\alpha}{dW_{a}}>0:\)

Substituting:

\(\frac{d\alpha}{dW_{b}}<0:\)

Substituting:

□

Proof of Proposition 2 \(\frac{d\pi_{a}}{dW_{a}}>0\) and \(\frac{d\pi_{a}}{dW_{b}}>0.\)

Proof

Equilibrium profit can be defined, from Eqs. 7 and 8a:

As ξ a and ξ b are positively affected by both W a and W b , we conclude that any increase in external demand increases equilibrium profits. □

Rights and permissions

About this article

Cite this article

Gaffard, JL., Saraceno, F. International trade and domestic distortions. J Evol Econ 22, 275–301 (2012). https://doi.org/10.1007/s00191-011-0244-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-011-0244-2

Keywords

- Globalization

- Trade

- Financial constraints

- Creative destruction

- Wage flexibility

- Time to build

- Firm migration