Abstract

This paper investigates whether time-series data from 11 West-German states (Länder) provide evidence in accord with the implication of the permanent-income hypothesis (PIH) for the stochastic relationship between consumption and income innovations. The empirical results do not support this hypothesis, in the sense that the response of consumption to income innovations is found to be much weaker than is predicted by the PIH. Moreover, for each individual state as well as for Germany as a whole, the response was found to be asymmetric, being stronger for negative than positive income innovations. This evidence of asymmetry is consistent with a model in which consumers are liquidity constrained.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In Germany, as in most developed economies, personal consumption expenditures account for approximately two-thirds of its gross domestic product during the post-war period. This suggests that understanding consumption behavior is crucial for understanding the evolution of the German economy. In addition, many observers of the German current economic conditions have argued that slackness of consumption noted for this country may be one of the key factors for its growth rates to be lagging behind those of other economies in the European Union. Therefore, understanding various causes of this phenomenon is relevant not only from a theoretical perspective but also from an economic policy point of view.

Despite the immense influence of consumption on aggregate economic activity, there is no consensus among economists on how best to model the household’s consumption behavior. One leading theory, the so-called permanent-income hypothesis (PIH) of consumption, which was originally developed by Friedman (1957), posits that households base their consumption decisions not on income received in the current period but rather on expected income over a number of years, perhaps even over the entire lifetime. With the refinement of rational expectations, the PIH yields strong testable implications on the stochastic relation between consumption and income. One of these implications, first noted by Flavin (1981), is that news about income should induce a revision in consumption exactly equal to the revision in permanent income.

A number of studies have tested this implication using national-level data but the empirical evidence to this date has been mixed at best. For instance, Bilson (1980), using aggregate quarterly time-series data from the US, UK, and Germany, finds support for the implication. In contrast, Flavin (1981) and Kotlikoff and Pakes (1984) report that aggregate US consumption responds much more strongly to income innovations than is warranted by the PIH. Weissenberger (1986) obtains a similar result using seasonally unadjusted quarterly data for the UK and Germany. Recently, Dawson, DeJuan, Seater and Stephenson (2001) conduct a cross-country study and find that data from industrial countries support the PIH but data from developing countries do not. However, they present evidence that the developing countries’ rejections of the PIH are artefacts of systematic cross-country variations in the quality of Penn World Table data. They further suggest that such data quality problems are the major force behind rejections of the PIH frequently reported in tests using cross-country data. More recently, DeJuan, Seater and Wirjanto (2004) extend the empirical analysis for the US states and find evidence in support of the PIH.

In this paper, we investigate the consumption revision-income innovation implication of the PIH using time-series data from 11 West-German states (Länder) over the period 1970–1997. To this date, there appears to be no empirical research relating to this issue in Germany at the state level.Footnote 1 However, such a research can both broaden our understanding of consumption behavior and provide a context in which to evaluate the findings of previous research based on national-level data. Our empirical results strongly reject the PIH across West-German states. In particular, we find that the size of the revision in consumption due to an income innovation is smaller than the size of the revision in permanent income due to the same innovation. Further examination reveals that consumption responds significantly to negative income innovation but not to positive innovation. Such asymmetry suggests that the failure of the PIH can be attributed to liquidity-constrained consumption behavior in the West-German states.

The rest of this paper is structured as follows. Section 2 reviews the permanent-income model and its testable implication. Section 3 discusses the data and Section 4 presents the empirical results. Section 5 examines asymmetries in consumption behavior and Section 6 offers concluding remarks.

The permanent-income model of consumption

We begin this section by illustrating the PIH model in its standard formulation. Suppose that an infinitely-lived representative consumer in state i (i=1,2,...11) chooses consumption in period t, C it , to solve the following optimization problem:

subject to the sequence of budget constraints:

and the constraint that rules out the possibility of Ponzi game-type behavior (i.e., borrowing to finance consumption and then borrowing indefinitely in order to service the increased debt):

Here, E it represents the mathematical expectation conditional on the information set available in period t, W it is nonhuman wealth at the beginning of the period, r is the constant real interest rate, ρ is the constant rate of time preference, Y it is labor income, and u(.) is the instantaneous utility derived from consumption. Substituting recursively in Eq. (2) and taking expectations leads to the infinite horizon budget constraint:

Equation (4) states that the present value of lifetime consumption is equal to the present value of expected future (capital and labor) income. The solution to the foregoing optimization problem yields the familiar first-order condition:

which implies that marginal utilities of consumption follow a first-order Markov process. This relation also ensures that reallocating consumption across periods t and t+1 does not yield improvements in expected intertemporal utility.

For simplicity, we assume that r=ρ and that marginal utility is linear in consumption (i.e., utility is quadratic).Footnote 2 We also assume that there are no taste shifting variables. Taste shifters, such as changes in household size, seem to be important in explaining household behavior (e.g., Attanasio and Browning, 1995), but it is not clear what changes might have occurred in Germany that would cause systematic deviations from the formulas we derive.Footnote 3 Under these conditions, Eq. (5) can be rewritten as:

Substituting Eq. (6) into Eq. (4) yields the following optimal consumption function:

where

Thus, according to this formulation of the model, consumption should equal permanent income where permanent income is defined as a constant annuity stream of income from the consumer’s lifetime wealth.

Following Flavin (1981), the first difference of Eq. (7) can be written as:

where

Equation (9) represents a sharp, empirically testable implication of the PIH. According to it, the magnitude of the revision in consumption should be exactly equal to the magnitude of the revision in permanent income warranted by new information about the expected future path of income, represented by (E it −E i,t−1 )Y i,t+j .

To test this prediction, we need to specify a model for the stochastic process generating income and express the innovation in permanent income as a function of the innovation of the observables. The typical approach in the consumption literature—as exemplified in the work of Bilson (1980), Flavin (1981), Deaton (1992), and others—has been to assume that income follows a linear stochastic process, for which there is a well-developed theory of estimation, inference, and prediction. In particular, suppose that ΔY it is a stationary process with an autoregressive-moving average (ARMA) representation:

where \(\Delta Y = Y_{{it}} - Y_{{i,t - 1}} \), \(A{\left( L \right)} = 1 - \Sigma a_{{ij}} L^{j} \), \(B{\left( L \right)} = 1 + \Sigma b_{{ij}} L^{j} \), a ij are the autoregressive parameters, b ij are the moving-average parameters, L is the lag operator, and ɛ it represents the innovation or news in state i’s current income. Using Eq. (11) to calculate the sequence of revisions in expected incomes, (E it −E i,t−1 )Y i,t+j , and substituting the result into Eq. (10), yields the formula for the change in permanent income:

where b and a are vectors with typical elements given by [b ij ] and [a tj ] respectively. Conditional on the stochastic-income process and an assumed value of r, \(\chi _{i} \)measures the size of the revision in permanent income associated with the realization of an innovation in current income ɛ it . If the PIH is true, the marginal propensity to consume out of an income innovation should be equal to \(\chi _{i} \).

A straightforward way of testing the PIH involves estimating the following system of equations for each state i:

and

both unconstrained and constrained by a nonlinear equation:

where α i is the intercept term, β i is the marginal propensity to consumption out of an income innovation, and \(\xi _{{it}} \)is the zero-mean random disturbance term. In the above, Eq. (13) specifies the time-series process for income, Eq. (14) describes the relation between consumption revision and income innovation, and Eq. (15) is a cross-equation restriction implied by the PIH. It is apparent that our interest is in ascertaining and testing whether this restriction is true for each state i. To this end, we use a likelihood-ratio (LR) statistic to test the null hypothesis of \(\beta _{1} = \chi _{i} \).Footnote 4 If the null hypothesis is not rejected, then the response of consumption to income innovation is taken to be consistent with the prediction of the PIH.

Before closing this section, we discuss some caveats that may apply in testing the β i =\(\chi _{i} \)hypothesis. First, the theoretically-appropriate measure of consumption is consumption of nondurables, services, and the services yielded by the existing stock of durable goods. However, reliable estimates of each of these components are not available at the state level. As is common in empirical research, we use total consumption expenditure as a measure of consumption. Using this imperfect measure of consumption may bias the estimate of β i away from its true value. For example, Bernanke (1985) argues that the presence of convex costs to adjusting durable stocks and the irreversible nature of durable purchases can lead to the observation that consumption is less sensitive to income innovations and hence, the estimate of β i may be biased downward. Second, Y it should be labor income but, in practice many studies use gross domestic product (GDP) as a proxy variable. Although GDP is expected to be highly correlated with labor income, any deviation from a one-to-one relationship can prevent β i from being exactly equal to \(\chi _{i} \). Third, the univariate income generating process assumes that consumers use only their income history to predict future incomes. West (1988), Quah (1990), and Flavin (1993) among others, however, have noted that consumers may also use other information in predicting their future incomes. In such a case, the estimated income innovation, ɛ it , is an errors-in-variable measure of the true income innovation. The use of ɛ it as a regressor in Eq. (14), therefore, will yield a downward biased estimate of β i . Fourth, the empirical measure of \(\chi _{i} \)requires the imposition of an assumed constant real interest rate. If the chosen rate is too high (low), then the estimate of \(\chi _{i} \)will be biased downward (upward). In view of all these concerns, testing the equality of β i and \(\chi _{i} \)may be too restrictive but we still can expect β i and \(\chi _{i} \)to be positively related across states if the PIH is true. Thus, in the next section, aside from testing the strict equality of β i and \(\chi _{i} \), we also implement a cross-sectional method to determine whether β i and \(\chi _{i} \)are positively related across states.

Data

Annual data on real GDP, real consumption expenditure, and population for the 11 West-German states over the period 1970–1997 were collected from the Arbeitskreis Volkswirtschaftliche Gesamtrechnungen der Länder, Statistisches Landesamt Baden - Württemberg, Stuttgart.Footnote 5 Real per-capita consumption and real per-capita GDP are used as measures of consumption (C it ) and income (Y it ), respectively.

Empirical results

As a first step in our empirical analysis, we examine the stationarity properties of the state-level consumption and income series, using the Augmented Dickey–Fuller (ADF) test for a unit root developed by Said and Dickey (1984). An issue that arises with the implementation of this test is the choice of the order of autoregression, p. Many previous studies have pre-set the order of p, depending on the frequency of the data. Yet, studies by Hall (1994) and Ng and Perron (1995) indicate that data-dependent methods for selecting the value of p are superior to making an a priori choice of a fixed p. In this regard, we follow the general-to-specific procedure advocated by Ng and Perron (1995), by starting with an upper bound on p. If the last included lag is significant, then we choose the upper bound. Otherwise, we reduce the order of p by one until the last lag becomes significant. If no lags are significant, then p is set equal to zero. Using Said and Dickey’s (1984) T 1/3 rule (where T is the sample size), we set the upper bound on p to equal 3 and use the 5% value of the asymptotic normal distribution to assess the significance of the last lag.

Table 1 summarizes the results of the ADF tests. On the basis of the critical values calculated from the response-surface procedure advocated by MacKinnon (1991), the null hypothesis of at least one unit root for C it cannot be rejected at the 5% level. Similarly for Y it , the null hypothesis cannot be rejected except for West Berlin whose t-statistic is marginally significant at the 5% level but not at the 1% level. For completeness, we also carry out the ADF tests for the first difference of C it and Y it . As shown in columns 3 and 5, the unit-root null hypothesis can be rejected at the 5% level for C it and Y it . Together these results suggest that state-level C it and Y it can reasonably be characterized as first-order integrated processes. In what follows, we carry out our empirical analysis using first-difference data.

The system of Eqs. (13) and (14) are jointly estimated using nonlinear least squares. Given the limited number of time-series observations available for each state, the income generating process in first difference is parsimoniously set to follow a first-order autoregressive process, i.e., the income process itself is assumed to be generated by an ARIMA(1,1,0) process. As a robustness check, we also tried out specifications with longer autoregressive lags as in the ARIMA(p,1,0) process for finite p>1, as well as the ARIMA(1,1,1) process, but they did not materially change the test results.Footnote 6 As noted earlier, estimates of \(\chi _{i} \) depend on the choice of interest rate. We present estimates based on a 2% rate, but similar results are obtained using the alternative values of 1 and 3%.

Table 2 reports the estimation results for each state. The estimate of β i ranges from 0.093 for Hamburg to 0.351 for Schleswig–Holstein. Moreover, β i is significantly different from zero at the 5% level for all states except for Hamburg and Saarland. This implies that consumers in most states revise their current consumption as a result of innovations to current income. As for the estimate of \(\chi _{i} ,\) it is significantly positive and varies considerably across states, ranging from 0.907 for Schleswig–Holstein to 1.756 for Hesse. This implies that current-income innovations contain information about future income that leads consumers to revise their estimated permanent income.

We now turn to our main empirical question: How is β i related to \(\chi _{i} \)? To answer this, we first look at the p-values of the LR statistics shown in column 4 of Table 2. It is apparent that the p-values are very low, mostly below 0.01, such that the null hypothesis of \(\beta _{i} = \chi _{i} \)can easily be rejected at conventional levels. Comparison of the estimates also reveals that \(\chi _{i} \)is, on average, four times the size of β i . Thus, the evidence shows that the adjustment of consumption to income innovation is too small to be compatible with the prediction of the PIH.

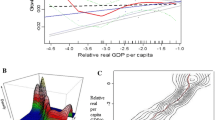

As discussed earlier, however, data limitations as well as specification issues may prevent β i from being exactly equal to \(\chi _{i} \)for each state, even if the PIH is true. For this reason, we also perform a less restrictive test of whether β i and \(\chi _{i} \)are positively related across states. Figure 1 displays the scatter plot of β i and \(\chi _{i} \). While there are a few unusually large observations, the scatter as a whole shows a weak positive relation between the variables. A more formal test would be to estimate a cross-section regression of β i on \(\chi _{i} \)and obtain the following result:

with R 2=0.002 and S.E. of regression=0.091, where the numbers in the parentheses in Eq. (16) are heteroskedasticity-consistent standard errors. As expected, the regression fit is extremely poor, with a meager R 2 of 0.002. The estimated coefficient of \(\chi _{i} \) is minuscule in magnitude and insignificantly different from zero at conventional levels. An alternative way of testing the relation between β i and \(\chi _{i} \)is to use the Spearman rank correlation. This statistic is of interest since it is nonparametric and, hence, does not rely on any specific distributional assumption of the data. Also and perhaps more important, it is robust to outlying observations and to the functional relation between the variables. The rank correlation between β i and \(\chi _{i} \)is 0.127 and, with a p-value of 0.709, it is statistically insignificant. Thus, the results from both parametric and nonparametric tests cast serious doubt on the hypothesis that the size of the revision in consumption is positively related to the size of the revision in permanent income across states.

Before we investigate the likely sources of the rejection of PIH for the West German states, we note that state of Hamburg and Schleswig–Holstein appear to be outliers in Fig. 1.Footnote 7 The problem of regional statistics in North Germany is that Hamburg is considered a “city” state with close economic linkages with neighboring states, such as Schleswig–Holstein and Lower–Saxony because of the busy inter-state commuting activities. This apparently creates difficulties in measuring the regional accounts adequately. The same thing occurs with the state of Bremen and Lower-Saxony. As a result, we merge these four states into one and report the results in the second last row of Table 2. The estimate of β i for the four states taken together is 0.325, which falls within the range of the estimates reported earlier for all the states, and is significantly different from zero at the 5% level. As for \(B{\left( L \right)} = 1 + \Sigma b_{{ij}} L^{j} \)it is estimated at 1.100, which again falls within the range of estimates reported earlier for all of the states and significantly positive. We also report the results for Germany as a whole in the last row of Table 2. The results are broadly in accord with the results obtained for individual states. In particular, the estimates of β i and \(B{\left( L \right)} = 1 + \Sigma b_{{ij}} L^{j} \)are both positive and statistically significant at the 5% level, and the estimate of β i is much smaller (in magnitude) than that of \(\chi _{i} .\) Footnote 8

Two alternatives to the PIH: myopia and liquidity constraint

Having established in the previous section that the West-German state-level data is not consistent with the PIH, we now explore whether myopia or liquidity constraints can explain consumption behavior across the West-German states. As alluded by Altonji and Siow (1987) and Shea (1995), these two well-known alternatives to the PIH have distinct testable implications for asymmetry in the adjustment of consumption to income innovations.Footnote 9

Under myopia, consumers simply set their current consumption equal to their current income. As a result, consumption should be equally responsive to positive and negative income innovations. Under liquidity constraints, on the other hand, consumers would like to follow their optimal consumption plan but are unable to do so because of the constraints on their ability to borrow against their future income. Given that liquidity constraints are binding only when consumers wish to borrow but not when they wish to save, consumption should respond more strongly to negative than positive income innovations. The intuition for this asymmetry is straightforward. Suppose that income is difference stationary with positively correlated first differences, such that innovations in income are expected to persist over time. Now if there is a positive income innovation, consumers would then want to increase their consumption by the size of the increase in their permanent income, which is more than the size of the innovation due to its persistence. In the presence of liquidity constraints, however, the increase in consumption will be limited by the size of the innovation.

Suppose instead that there is a negative income innovation. In such a case, consumers would want to decrease their consumption by the size of the reduction in their permanent income, which is again more than the size of the innovation due to its persistence. Given that consumers are free to save or reduce their consumption, one would then observe consumption to be much more responsive to a negative innovation. Thus, according to the liquidity-constraint hypothesis, consumption should respond asymmetrically to positive and negative income innovations.

To shed light on which of these two alternative hypotheses can possibly explain the failure of the PIH, we modify Eq. (14) to allow income innovations to exert an asymmetric effect on consumption. Specifically, we estimate the following system of equations:

and

where POS is a dummy variable for periods in which the residuals, ɛ it , is positive, and NEG is a dummy variable for periods in which ɛ it is negative (or zero). If consumers are myopic, β 1 and β 2 are expected to be positive, significant, and of the same magnitudes. If consumers are liquidity constrained, on the other hand, β 2 is expected to be significantly positive and significantly greater than β 1.

The results of jointly estimating Eqs. (17) and (18) are shown in Table 3. In most states, the estimate of β 1 is small and statistically insignificant at conventional levels. In contrast, the estimate of β 2 is significantly positive in all but one state, Hamburg. Moreover, the magnitude of β 2 is greater than β 1 in nine out of 11 states, suggesting that negative income innovation affects consumption more strongly than positive innovation. For the four merged states, namely Bremen, Hamburg, Lower Saxony and Schleswig–Holstein, the estimates of β 1 and β 2 are significantly positive and about of the same size. For Germany as a whole, the estimate of β 1 is much smaller than β 2. This result, in line with the results for each individual state, suggests that negative income innovation affects consumption more strongly than positive income innovations. It should be noted, however, that due to the relatively small number of observations, our tests may have low power to detect asymmetry. Indeed, as shown in column 4, we can formally reject the null hypothesis that β 1=β 2 in favor of the one-sided alternative hypothesis that β 1<β 2 in only one state. Nevertheless, the estimates of β 1 and β 2 tell a reasonably clear story that, in most states, consumption responds significantly to negative income innovations but not to positive innovations. These results are qualitatively consistent with liquidity constraint hypothesis but not with myopic consumption behavior.

Two concerns with the liquidity constraint interpretation must be addressed. First, as we have noted earlier, the evidence in the literature seems more supportive of the PIH for US data than for our German data. Yet the saving rate in Germany is greater than that in the US, and the wealth distribution is more equal than that in the US. These facts suggest that liquidity constraint is likely to be less serious in Germany than in the US. A partial counter-argument is that US savings rates, as measured by the national income accounting, are less than in Germany, but it is less clear that the same relation holds when capital gains are added. Capital gains in the US have been huge over the last couple decades, but they are not included in the national income accounts. Similarly, wealth measures do not account properly for human wealth, which is the present value of labor income. Labor income in the US seems to vary more over the life cycle than in Germany, so that young families in the US may have substantially higher lifetime wealth than their tangible assets alone would indicate. These are the types of families traditionally used as examples of households likely to be liquidity constrained. Our conclusion here is that this issue is a valid cause for circumspection but is not decisive. Second, risk-averse individuals whose utility functions have positive third derivatives exhibit “cautious” behavior, tending to save more of any income shock than would be implied by the quadratic utility function that we use. Depending on the shape of the utility function, it may be that large changes in permanent income elicit consumption responses of different magnitudes when those changes are positive than when they are negative, thus producing the asymmetry we observe even in the absence of liquidity constraints. For infinitesimally small changes in permanent income, the changes in consumption do not depend on the direction of change. Since the change in permanent income is small relative to the level of current income—1.6% on average only—we would suggest that the situation with discrete changes in practice can be reasonably well approximated by the infinitesimal case.Footnote 10

Concluding remarks

This paper empirically investigated a key stochastic implication of the permanent-income hypothesis (PIH) that an income innovation generates the same size revision in consumption as in permanent income. Using time-series data from 11 West-German states (Länder) for the period 1970–1997, our results point to a strong rejection of the PIH. In particular, we find that in each individual state, the size of the revision in consumption due to an income innovation is considerably smaller than the size of the revision in permanent income due to the same innovation. Put differently, the response of consumption to news about income is too weak to be compatible with the PIH. Further examination reveals that, in many individual states, consumption reacts significantly to negative income innovations but not to positive innovations. This result was also obtained for Germany as a whole and the combined state of Bremen, Hamburg, Lower Saxony and Schleswig–Holstein.

The asymmetry evidence obtained for each individual state and for Germany as a whole suggests the presence of liquidity-constrained consumers in West German states. In view of this, it is worthwhile, as an avenue for future research, to examine the cause(s) of liquidity constraints in the state economies.

Notes

Most of the consumption studies, which use West-German national-level data, typically focus on testing the sensitivity of consumption to predictable changes in income. See, for example, Campbell and Mankiw (1989) and Blundell, Browne and Tarditi (1995). In addition, Reimers (1997) examines the relationship between consumption, income and wealth using the seasonal cointegration technique.

The Appendix discusses the more general cases of time-varying interest rates and risk aversion without certainty equivalence. Time-varying interest rates complicate the mathematics but change nothing important. Absence of certainty equivalence in general prevents an analytical solution for consumption. In specific cases where a solution for C is possible, again nothing important is changed. Thus the simplifying assumptions of a constant interest rate and quadratic utility seem to be reasonable approximations.

Two possibilities are the influx of foreign (notably Turkish) workers and the unification of East and West Germany. Turkish workers' households have different characteristics with regard to the kinds of taste shifting variables identified as important to consumption behavior by other researchers, such as Attanasio and Browning (1995). Their immigration into Germany then could introduce biases in our measures. However, we lack adequate data to address this issue. As for the unification of Germany, our data are restricted to German states of the former West Germany. Only if there were major migrations from East German states to West German states might there be a problem with our estimates. Again, we lack the necessary data to check such a possibility.

The likelihood ratio test statistic is defined as LR=−2[L(c)−L(u)], where L(c) is the log-likelihood value of the constrained model and L(u) is the log-likelihood value of the unconstrained model.

Data prior to 1970 are not available at the state level. For West Berlin, data are available only until 1994.

The results are available upon request from the authors.

We thank the anonymous referee for pointing this out to us.

These results are consistent with Weissenberger (1986), who also rejects the PIH using national-level aggregate German data. Under the maintained assumption that income is stationary around a deterministic trend, he reports that consumption is excessively sensitive to income innovations.

Note however that these authors are concerned with the asymmetric response of consumption to predictable changes in income rather than to innovations in income.

From Eq. 12, the change in permanent income is estimated as \(\widehat{{\theta _{{it}} }} = \chi _{i} \widehat{{\varepsilon _{{it}} }}\)

References

Altonji J, Siow A (1987) Testing the response of consumption to income changes with (noisy) panel data. Quarterly Journal of Economics 102:293–328

Attanasio O, Browning M (1995) Consumption over the life cycle and over the business cycle. American Economic Review 85:1118–1137

Bernanke B (1985) Adjustment costs, durables, and aggregate consumption. Journal of Monetary Economics 15:41–68

Bilson J (1980) The rational expectations approach to the consumption function: a multi-country study. European Economic Review 13:273–299

Blanchard O, Fischer S (1989) Lectures on macroeconomics. MIT: Cambridge, MA

Blundell A, Browne F, Tarditi A (1995) Financial liberalization and the permanent income hypothesis. Manchester School 63:125–144

Campbell J, Mankiw NG (1989) Consumption, income and interest rates: reinterpreting the time aeries evidence. In Blanchard, O. J, Fischer, S (ed.) NBER Macroeconomic Annual, MIT, pp. 185–216

Campbell J, Deaton A (1989) Why is consumption so smooth? Review of Economic Studies 56:357–374

Deaton A (1992) Understanding consumption. Clarendon, Oxford

Dawson J, DeJuan J, Seater J, Stephenson EF (2001) Economic information versus quality variation in cross-country data. Canadian Journal of Economics 34:988–1009

DeJuan J, Seater J, Wirjanto TS (2004) A direct test of the permanent income hypothesis with an application to the US states. Journal of Money, Credit, and Banking 36:1091–1103

Flavin M (1981) The adjustment of consumption to changing expectations about future income. Journal of Political Economy 89:974–1009

Flavin M (1993) The excess smoothness of consumption: identification and interpretation. Review of Economic Studies 60:651–666

Friedman M (1957) A theory of the consumption function. Princeton University Press, Princeton

Gali J (1991) Budget constraints and time series evidence on consumption. American Economic Review 81:1238–1253

Hall A (1994) Testing for a unit root in time series with pretest data-based model selection. Journal of Business and Economic Statistics 12:461–470

Hansen L, Sargent T (1981) A note on Wiener–Kolmogorov prediction formulas for rational expectations models. Economics Letters 9:255–260

Kotlikoff L, Pakes A (1984) Looking for the news in the noise—additional stochastic implications of optimal consumption choice, National Bureau of Economic Research Working Paper 1492

MacKinnon JG (1991) Critical values for cointegration tests. In Engle RF, Granger CWJ (eds.), Long-Run Economic Relationships: Readings in Cointegration, Oxford University Press, Oxford, pp

Meghir C (2004) A retrospective on Friedman’s theory of permanent income. Economic Journal 114:293–306

Ng S, Perron P (1995) Unit root tests in ARMA models with data dependent methods for the selection of the truncation parameter. Journal of the American Statistical Association 90:268–281

Quah D (1990) Permanent and transitory movements in labor income: an explanation for “Excess Smoothness” in consumption. Journal of Political Economy 98:449–475

Reimers H (1997) Seasonal cointegration analysis of German consumption function. Empirical Economics 22:205–231

Said S, Dickey D (1984) Testing for unit roots in autoregressive moving average models of unknown order. Biometrika 71:599–607

Shea J (1995) Myopia, liquidity constraints, and aggregate consumption: a simple test. Journal of Money, Credit, and Banking 27:798–805

Weissenberger E (1986) Consumption innovations and income innovations: evidence from UK and Germany. The Review of Economics and Statistics 78:1–8

West KD (1988) The insensitivity of consumption to news about income. Journal of Monetary Economics 21:17–34

Acknowledgements

We thank an anonymous referee and the editor of the journal for a number of valuable comments. We also thank Dieter Bergen for the data. The remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Time-varying interest rates

With deterministic time-varying interest rates, the difference equation for W is

The value of W at any time after t is

Discounting both sides gives

The No-Ponzi condition is that the left side go to zero as i goes to infinity, which implies that

where A is total household assets. The general first-order condition is

For the quadratic utility function

the first-order condition is

In period t, the value of C t (i.e., for j=0) is known, so we can solve for E[C t+1 ] in terms of C t :

We then can iterate forward to obtain the solution for any future C:

We next substitute this solution into the budget constraint:

which can be expressed as

where

Finally, we solve for the optimal value of C t

From this expression, we can obtain the response of C t to a change in any future income:

Notice that, when r t+k =ρ for all k, then γ t,i reduces to the usual (1+r)−(t+1). Because ρ is an attraction for the interest rate, we expect to see r fluctuate closely around ρ in any time series sample of reasonable length with an average value of approximately ρ. Thus in any such sample, we expect γ t,i to be close to (1+r)−(t+1). If Y follows an ARIMA process, then the response of C t to an innovation in Y involves a weighted sum of the γ t,i , where the weights depend on the AR and MA coefficients. Because the γ t,i are time-varying, the weighted sum also will be time-varying, but because the γ t,i are close to (1+r)−(t+1), we expect the weighted sum of the γ t,i to be close to the expression given in Eq. (15) in the main text. For this reason, assuming that the interest rate equals ρ for all time periods is a reasonable simplification that does not alter the results in this paper in any important way.

Absence of certainty equivalence

The general household choice problem without certainty equivalence (i.e., quadratic utility) and uncertainty in labor income is typically not solvable analytically. We can obtain analytical solutions in special cases. For example, suppose that there is uncertainty only in interest rates. Labor income either has no uncertainty or any uncertainty in it can be diversified away through life insurance, unemployment insurance, and other such schemes. We then can obtain analytic solutions for C t for many forms of the utility function, such as members of the HARA class. For example, logarithmic utility yields the result (see Blanchard and Fischer, 1989)

The problem here is how to define permanent income. Permanent income is the annuity value of lifetime wealth, but it is unclear how to compute that value with a random interest rate. One solution is to use the risk-free interest rate, R. That rate may vary over time (deterministically) but should equal the time preference rate Δ on average. We can use the average value of R to define permanent income as

We then immediately have

implying that

which is the same result as that obtained in the main text with quadratic utility and constant interest rates. Admittedly, this case requires several strong restrictions, but it does show that our assumptions in the main text are at least defensible.

Rights and permissions

About this article

Cite this article

DeJuan, J.P., Seater, J.J. & Wirjanto, T.S. Testing the permanent-income hypothesis: new evidence from West-German states (Länder). Empirical Economics 31, 613–629 (2006). https://doi.org/10.1007/s00181-005-0035-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-005-0035-4