Abstract

This article analyses how long-run pay-as-you-go public pensions react to a change in fertility in the Diamond overlapping generations model. While it might seem well established both in academic and political debates that the decline in fertility represents a “demographic time bomb” for the sustainability of public pensions, it is shown that a falling birth rate need not necessarily cause the fall of pensions in the long run.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

In the past few decades, population ageing and the decline in fertility, experienced especially in Europe, have raised several serious concerns about the sustainability of existing social security programmes, notably the pay-as-you-go (PAYG) pension system. The current debate between economists and politicians starts out with the shared conviction that the fertility drop represents a “demographic time bomb” and tries to find appropriate ways of reforming public pensions to disarm it. Conclusions are therefore essentially in favour of a reduction in pension payouts, a rise in both the contribution rate and retirement age and/or the switch to fully funded systems (see, e.g. Boeri et al. 2001).

The current debate may be summarised in the words of some authoritative scholars. For instance, Bovenberg (2007, p. 23) believes that “Whereas both funded and PAYG pension systems are vulnerable to increased longevity, PAYG pension schemes are especially vulnerable to lower fertility because they rely on the human capital of the young to finance the pensions of older generations.” Cigno (2007, p. 37), instead, observes that “The combined effect of fewer births, longer lives and sluggish retirement age is putting public pension systems, all essentially pay-as-you-go, under increasing strain. Several governments are responding to this by either raising contributions or cutting benefits.” Finally, Sinn (2007, p. 9), with reference to several western countries, claims that “Roughly speaking, these countries will experience a doubling in the number of elderly relative to the young within the next thirty years. Consequently, the implication for the pay-as-you-go system is straightforward. Either we double the contribution rate if we want to keep the pensions in line with wages, or we halve the pensions relative to wages.”

Though the rapid change in economic and social environments is sure to give rise to the need to change pension rules in developed countries, it is striking that the theoretical effects of both low and falling fertility on PAYG pensions have not yet received in-depth attention in the economic theoretical literature. The question we pose in this paper is simple: is the public PAYG system actually vulnerable to a falling birth rate? To answer this question we rely on the textbook overlapping generations (OLG) model by Diamond (1965), which has been widely used to study several aspects of social security (see, e.g. Burbidge 1983; van Groezen et al. 2003; Fanti and Gori 2010; Fenge and von Weizsäcker 2010). In particular, we use the double Cobb-Douglas economy model as we think the simplest case could aid researchers to better understand the key economic forces at work, while also representing a useful abstraction and a good starting point for future theoretical analyses.

In line with the neoclassical growth model, we assume the rate of fertility is exogenously given (due, for instance, to biological reasons, religious beliefs, unchecked sexuality and so on). Nevertheless, whatever the reasons why a positive fertility rate exists, raising children is costly.Footnote 1 Unlike previous studies, it is shown that a falling birth rate may cause the rise of pensions in the long run. As a consequence, (1) policies aiming at recovering fertility could unexpectedly reduce the size of public pensions, and then (2) pension reforms aiming at tackling the fertility-drop effect might not be necessary.

The rest of the paper is organised as follows. Section 2 describes the model. Section 3 analyses how a change in fertility affects long-run PAYG pensions. Section 4 concludes with our main policy implications.

2 The model

Consider a general equilibrium OLG closed economy with identical two-period lived individuals and an exogenous number of children, n (i.e., n − 1 is the constant rate of population growth). Life is divided into youth and old age. Individuals of generation t draw utility (U t ) from young age (c 1,t ) and old age (c 2,t + 1) consumptions. The young people (N t ) join the workforce. They are endowed with one unit of labour inelastically supplied to firms and receive the wage w t per unit of labour. Although the number of children is exogenous, we assume that raising children is costly, and the amount of resources needed for parents to care for each child is qw t , with 0 < q < 1 (see, e.g., Wigger 1999; Boldrin and Jones 2002). Therefore, the budget constraint of the young at t is:

that is, wage income—net of contributions paid to transfer resources from work time to retirement time at the rate 0 < θ < 1—is used to consume, save (s t ) and take care of n descendants. When old, individuals retire and live with the amount of resources saved when young plus expected interests accrued from t to t + 1 at the rate \(r^{e}_{t + 1}\), and the expected pension benefit, \(p^{e}_{t + 1}\). Hence, the budget constraint of the old born at t reads as:

The representative individual at t chooses how much to save out of her disposable income to maximise the lifetime utility function

subject to Eqs. 1 and 2, where 0 < β < 1. Maximisation of Eq. 3 therefore gives:

Firms are identical and act competitively on the market. The representative firm at t hires capital (K t ) and labour (L t = N t ) to produce output Y t according to the Cobb-Douglas production function \(Y_t =AK_t ^\alpha L_t ^{1-\alpha}\), where A > 0 and 0 < α < 1. Assuming that capital fully depreciates at the end of each period and output is sold at unit price, profit maximisation implies:

where k t : = K t /N t .

The government redistributes between generations through unfunded pensions financed with labour income taxes. Therefore, the pension expenditure at \(t\left({P_t =p_t N_{t-1} } \right)\) is constrained by the amount of tax receipts θw t N t . As N t = nN t − 1, the (per pensioner) budget constraint of the government can then be written as:

Inserting the one-period-forward pension accounting rule Eq. 7 into Eq. 4 gives:

Given Eq. 7 and knowing that N t + 1 = n N t , market-clearing in the capital market implies:

Combining Eqs. 8 and 9 yields:

Exploiting Eqs. 5, 6 and 10 and assuming that individuals are perfectly foresighted the dynamics of capital is described by the following equation:

Steady-state is defined as \(k_{t+1} =k_t =k^\ast \). Therefore,

From Eq. 12 it can easily be seen that a rise in n reduces the capital stock. Of course, \(n<\left( {1-\theta } \right)/q:=\bar {n}\) must hold to ensure \(k^\ast \left( n \right)>0\).

3 Fertility and PAYG pensions in the long run

We now study how long-run public pensions react to a change in fertility. It is shown that when the cost of children is realistically taken into account in the OLG model, a negative relationship between PAYG pensions and fertility may emerge in the long run.

From Eq. 7, the long-run pension benefit as a generic function of the number of children can be written as

and the total derivative of Eq. 13 with respect to n gives:

Equation 14 reveals that the final effect of a reduction in fertility on long-run pension payments is ambiguous and depends on two opposite forces: a positive direct effect and a negative indirect general equilibrium feedback effect. The former effect causes PAYG pensions to shrink because the number of young contributors is now lower. The latter one instead implies a rise in the capital stock and, hence, in both the wage (tax base) and pension benefit. If the latter effect dominates, a fall in the birth rate increases pensions.

We now combine Eqs. 6, 7 and 12 to obtain the following steady-state pension formula:

From Eq. 15 therefore the following proposition holds:

Proposition 1

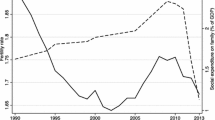

(1) Let 0 < α < 1/2 hold. Then \(p^\ast \left( n \right)\) is inverted U-shaped with n = n p being the pension-maximising number of children. (2) Let 1/2 < α < 1 hold. Then a reduction in the number of children always causes the rise of PAYG pensions in the long run.

Proof

The proof uses the following derivative:

If 0 < α < 1/2, \(\frac{\partial p^\ast \left( n \right)}{\partial n}\frac{>}{<}0\) if and only if \(n\frac{<}{>}n_p \) where

being an interior global maximum and \(n_p <\bar {n}\). If 1/2 < α < 1, \(\frac{\partial p^\ast \left( n \right)}{\partial n}<0\) for any \(n<\bar {n}\).□

Equation 17 shows that the higher the contribution rate (θ), the percentage of child-rearing cost on working income (q) and the output elasticity of capital (α), the likelier the rise of long-run PAYG pensions because of the reduced fertility. Moreover, simple numerical examples using the observed values of capital shares, children costs and contribution rates for several real economies also reveal that the current fertility drop may be beneficial to the size of public pensions: for instance, assuming θ = 0.15Footnote 2 and q ≅ 0.3,Footnote 3 when α is close to 0.33, a rise in n beyond 1.4 (the replacement fertility rate is roughly 2.1 births per woman in several industrialised countries, which corresponds to n = 1.05 in the present one single-parent model) is harmful to the PAYG system. However, when α is around 0.4 a fall in the birth rate below the replacement fertility rate (i.e., until n = 0.96) increases pensions. The intuition behind our result is simple (see Eq. 17): (1) the higher the output elasticity of capital, the larger the rise in wages due to the increased capital stock caused by the lower number of children; (2) the higher the cost of children, the lower the saving rate and the stock of capital as well; (3) the higher the contribution rate, the higher the percentage reduction in the agents’ disposable income (i.e. the wage net of both the contribution rate and cost of children). Intuitively, when the birth rate falls, there are fewer young workers to support old pensioners but they also need less income to support their children, thus favouring the rise in PAYG pensions.

4 Conclusions

This paper dealt with an important policy debate: the best way to redesign government pension programmes when fertility declines. For doing this, we used the Diamond OLG model augmented with the costs of children, and analysed how a change in fertility affects long-run public pensions. Our conclusions are clear-cut: the possibility that the recovery of fertility over the replacement rate may lead to higher pensions is found to be the exception rather than the rule. This suggests a rather paradoxical policy implication: the fertility drop may cause public pension payments to rise in the long run, or, alternatively, by keeping it unaltered, it may leave room for a reduction in both the contribution rate and retirement age.

Notes

“That children impose economic costs on their parents seems to be widely accepted.” (Deaton and Muellbauer, 1986, pp. 720–721).

The current average contribution rate is estimated to be around 0.16 in Europe and 0.11 in the USA (see, e.g., Liikanen 2007, p. 4).

For instance, Deaton and Muellbauer (1986, p. 720) found that “Sri Lankan and Indonesian data suggest that children cost their parents about 30–40% of what they spend on themselves,” while also arguing that such estimates “would not be appropriate for developed countries where children bring heavy non-food expenditures.” (p. 741) Therefore, q ≅ 0.3 is reasonable for developed economies.

References

Boeri T, Börsch-Supan A, Tabellini G (2001) Would you like to shrink the welfare state? A survey of European citizens. Econ Pol 16(32):7–50

Boldrin M, Jones LE (2002) Mortality, fertility, and saving in a Malthusian economy. Rev Econ Dynam 5(4):775–814

Bovenberg AL (2007) Grey new world: Europe on the road to gerontocracy? In: Europe and the demographic challenge. CESifo Forum 8(3):7–11

Burbidge JB (1983) Social security and savings plans in overlapping generations models. J Public Econ 21(1):79–92

Cigno A (2007) Low fertility in Europe: is the pension system the victim or the culprit? In: Europe and the demographic challenge. CESifo Forum 8(3):37–41

Deaton AS, Muellbauer J (1986) On measuring child costs: with applications to poor countries. J Polit Econ 94(4):720–744

Diamond P (1965) National debt in a neoclassical growth model. Am Econ Rev 55(5):1126–1150

Fanti L, Gori L (2010) Increasing PAYG pension benefits and reducing contribution rates. Econ Lett 107(2):81–84

Fenge R, von Weizsäcker J (2010) Mixing Bismarck and child pension systems: an optimum taxation approach. J Popul Econ 23(2):805–823

Liikanen E (2007) Population ageing, pension savings and the financial markets. Bank Int Settlements Rev 53:1–6

Sinn HW (2007) Introduction to: Europe and the demographic challenge. CESifo Forum 8(3):7–11

van Groezen B, Leers T, Meijdam L (2003) Social security and endogenous fertility: pensions and child allowances as Siamese twins. J Public Econ 87(2):233–251

Wigger BU (1999) Pay-as-you-go financed public pensions in a model of endogenous growth and fertility. J Popul Econ 12(4):625–640

Acknowledgements

We gratefully acknowledge the editor Prof. Alessandro Cigno and two anonymous referees for valuable comments on an earlier draft. Usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

Rights and permissions

About this article

Cite this article

Fanti, L., Gori, L. Fertility and PAYG pensions in the overlapping generations model. J Popul Econ 25, 955–961 (2012). https://doi.org/10.1007/s00148-011-0359-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-011-0359-7