Abstract

This paper estimates the impact of a recent expansion in Canadian paid family leave from 25 to 50 weeks on maternal employment and transfer income. It finds the expansion coincided with increases in transfers to mothers of children age zero to one relative to mothers of children age three to four, and with decreases in returns to work in the year after birth. These changes were concentrated among economically advantaged groups of women, defined by marital status, education, and non-wage income. Despite these changes, there was no evidence of a decrease in returns to work or relative employment for mothers of children age one.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper examines the impact of the expansion of Canadian paid family leave from 25 to 50 weeks on December 31, 2000 on women’s post-birth employment dynamics and transfer receipt. To do so, the analysis draws on data from the National Longitudinal Survey of Children and Youth from 1998–1999, 2000–2001, and 2002–2003.

This analysis finds that the expansion was associated with a substantial increase in family leave and social assistance payments to women with children age zero to one relative to women with children age three to four. It was also associated with a decrease of 20 percentage points (40%) in the share of mothers returning to work within 1 year after birth. Despite this increase in leave time, returns to work converged to earlier levels once paid leave eligibility expired. In addition, there was no evidence that women with children age one suffered a decrease in relative employment rates compared to those with children age three to four.

While the paid leave expansions increased resources to women with children, the gains were not distributed equally. Whether measured in terms of maternal time at home or transfer payments, the increase was larger for women from more advantaged socioeconomic groups, as defined by education, non-wage income, and marital status.

2 Policy context

Canada first began providing paid family leave when it introduced a 15-week maternity leave benefit in 1971. In 1990, it added 10 weeks of paid parental leave. In December 31, 2000, Canada further expanded parental leave from 15 to 35 weeks, which increased combined family leave benefits from 25 to 50 weeks.

Table 1 presents information on the family leave program. As shown, benefits equal 55% of base earnings to a maximum of $413 per week. Families with incomes under $25,921 are also eligible for a family supplement, which increased benefits to up to 65% of insurable earnings in 1997 and to up to 80% of insurable earnings in 2000. These benefits are provided through Employment Insurance, which is financed by a payroll tax on employers and employees.

At the time of the expansions, many provinces revised their labor codes to expand mandated job-protected leave. Eight of Canada’s ten provinces increased job-protected leave from 18 to 35 weeks to 52 to 54 weeks. Quebec was the exception, since it maintained 72 weeks of job protection throughout this period.

Prior to the expansion, Canada introduced other reforms which may have affected maternal work and welfare receipt. In 1995, the federal government converted Social Assistance from a matching to a block grant, and it reduced funding levels (Jenson 2003). In 1998, Canada introduced a supplement to the Canada Child Tax Credit for low-income families, which it expanded in 1999–2001. At the time, many provinces reduced social assistance and child benefits by the amount of the supplement, and invested in other programs for the working poor (National Council of Welfare 2002).

During this period, Quebec phased in its universal $5 per day child care program, which initially covered children age four in 1997, and then was expanded to children age three in 1998, and to children age two or younger in September 2000. This expansion has been associated with a substantial increase in maternal work (Baker et al. 2005).

While many of these changes pre-dated the paid leave expansions, they may have affected work and welfare receipt during the measurement period. Thus, where possible, this analysis uses a comparison group that includes women with children age three to four to net out the effects of changes in other social welfare policies. In addition, the analysis also generates estimates which allow for differential impacts in Quebec.

3 Anticipated impacts

3.1 Aggregate impacts

Under the inter-temporal model of labor supply, new mothers optimize utility from time spent with their child versus market goods, given their returns from work and their other family resources (Klerman and Leibowitz 1999; Ronsen and Sundström 2002). This model implies that an expansion in paid leave should delay returns to work because it increases resources to mothers on leave. While paid leave should decrease returns to work while mothers are eligible for leave, it may also decrease returns to work after leave expires if it reduces human capital accumulation or if it alters preferences for work. This is an argument for welfare reform in the United States.

In Canada, the expansions in paid leave were accompanied by expansions in job-protected leave. This may have further decreased returns to work during the mandated leave period because it enabled women to take longer leaves without losing their jobs. However, it also may have encouraged some women to return to work more quickly, if they otherwise would have left their employer to spend more time at home (Klerman and Leibowitz 1999). This should primarily have affected leaves in the post-one year period, since most women who are induced to remain with their employer by the legislation are likely to take full advantage of the expanded leave protections.

This discussion does not account for second order effects of the leave expansions. Expansions in paid leave could increase women’s labor supply by increasing the non-wage benefits to working. On the other hand, they also could increase firms’ costs of accommodating family leaves, and thus reduce maternal wages and employment.

3.2 Distributional effects

The impact of the expansions on incentives to return to work depends on both the structure of family leave payments and the way leave payments interact with other transfer programs. Table 2 provides sample calculations to illustrate how the gains from expanding family leave vary with women’s earnings and family income. These calculations assume the mother worked for a year, left her job in the first week of January 2000, and started receiving paid leave in week three. They show the impact of expanding paid leave from 25 to 50 weeks on weekly transfers starting in week 28. Estimates are shown for three groups of women: a single mother with one child, a married woman with two children and a spouse earning $15,000 per year, and a married woman with two children and spousal earnings of $35,000.

As shown in Table 2, family leave benefits replace a much larger share of insurable earnings for low-income, low-wage women. For single parents with one child, family leave benefits represent 73% of base earnings for women earning $200 per week, and 64% for women earning $400 per week. In comparison, women with spousal earnings of $15,000 have a matching rate of 58% at base earnings of $200 per week, falling to 55% at $400 per week, while women with spousal earnings of $35,000 have matching rates of 55% at both wage levels. For all three groups of women, the matching rate declines for weekly wages above $750, due to the $413 cap on weekly leave payments.

Estimates from the Canadian Census suggest that of women working 49–52 weeks in 2000, over 40% had weekly earnings under $500, which made them potentially eligible for the family supplement. In addition, nearly 30% had earnings over $750, which put them in the region where benefits are constrained by the $413 cap on leave payments (Statistics Canada 2003).

Despite the redistributive structure of leave payments, an expansion in the duration of paid leave may generate fewer benefits for low-income women due to offsets in other transfers. Under Social Assistance, benefits are decreased dollar for dollar with increases in family leave payments received in the prior month. Under federal and provincial child benefits, benefits are reduced more gradually, and they start to phase out at higher income levelsFootnote 1 (Jenson 2003). In addition, any offsets in child benefits are delayed because child benefits are adjusted in July of each year based on the prior calendar year’s income.

The third column of Table 2 shows the estimated reduction in social assistance and child benefits that would result from an expansion in paid leave from 25 to 50 weeks, while the fourth column shows the replacement rate, after netting out these transfer offsets. For single parents, the net replacement rate ranges from 0% for women earning $200 per week to 27% for women earning $800 per week, while it fluctuates between 36% and 40% over this wage range for married women with spousal earnings of $15,000. By contrast, the net replacement rate ranges from 49% to 46% for the higher income group of married women. As before, the net replacement rate declines for all three groups of women for wage rates over $800.

These calculations suggest that the net impacts of the paid leave expansions on transfer income and leave time is likely to be smaller for low-wage, low-income women than for women in the middle of the wage and income distribution. It also suggests that these impacts could decline for high wage women, due to the $413 cap on leave payments.

This analysis does not account for potential variations in the value of job-protected leave. For example, while high skilled, high wage women may have proportionately lower benefits from paid leave, they also may gain more from the accompanying expansions in job-protected leave because they have more job-specific human capital.

4 Prior research

Early research on the impacts of family leave in Europe found that both short (3 months) and long (9 months) paid leaves increased relative employment rates of women of child-bearing age, while long paid leaves decreased relative wage rates (Ruhm 1998). Because this research was based on aggregate data, it did not explore how family leave affects post-pregnancy work patterns, which is the main focus of this research.

In the USA, research has found that the introduction of 12 weeks of unpaid job-protected leave under the Family and Medical Leave Act had small or inconsistent impacts on the length of leaves (Baum 2003a; Han and Waldfogel 2003; Waldfogel 1999; Klerman and Leibowitz 1997), while it did not affect post-pregnancy employment or wages (Klerman and Leibowitz 1997; Baum 2003b; Waldfogel 1999).

In Europe, research has found that more extensive expansions in paid leave substantially reduce maternal work while the mother is eligible for leave (Ronsen and Sundstrom 2002; Lalive and Zweimüller 2005; Schönberg and Ludstec 2007; Ondrich et al. 2003). This research has found more mixed evidence on the impact of paid leave after leave expires. Schönberg and Ludstec (2007) found that German paid leave expansions had small or insignificant impacts on returns to work and employment 3 to 5 years after birth. By contrast, Lalive and Zweimüller (2005) found that expansions in paid leave from 1 to 2 years in Austria decreased maternal employment 8 years after birth. This may reflect the incentives under the Austrian system for mothers to compress their fertility to maintain eligibility for leave.

In Canada, Baker and Milligan (2005) focused on identifying the impact of job-protected leave, by exploiting variation in provincial dates of expansions of job-protected leave. As in the US, this research found that short unpaid mandates (12 to 18 weeks) had no impact on maternal work, while later expansions in 1990–1991 and 2000–2001 had larger impacts on maternal work during the period of eligibility for leave.

This research makes two contributions to the literature. First, it examines the impact of leave on employment patterns after leave expires. While recent research in Germany and Austria provides evidence on this question, it may not be representative of the North American case, where there may be differences in labor market institutions and norms with respect to work. Second, this study shows how the impacts of paid leave vary with socioeconomic status. This question is important since a full evaluation of family leave should consider its impacts on the distribution of resources available to children.

5 Data sources

This analysis uses the early childhood component of the National Longitudinal Survey of Children and Youth (NLSCY), which is a biennial survey of children under age six in Canada. The survey includes an initial cohort of children age zero to five that entered the survey in 1994–1995. In each subsequent period, a new cohort of children age zero to one enters the survey, and all children under age six from the prior survey are re-interviewed. As of 1998–1999, all children age four to five would have had two interviews, while children age two to three would have had one prior interview.

This analysis relies on interviews completed in September 1998 to May 1999 (cycle 3), September 2000 to May 2001 (cycle 4), and September 2002 to June 2003 (cycle 5). While it is conceivable that the 2000–2001 sample would have included some children born after the expansions, it does not contain any children born on or after January 2001. This is because of the lag between when a birth is identified and when an interview occurs. In our sample, at least 95% of the children in the 2000–2001 and the 2002–2003 cycles were not interviewed until they were at least 6 months old.

6 Estimated impact on transfer income

6.1 Analytical approach

The first part of the analysis estimates the impact of the expansions on transfers. It relies on a question that asked parents how much transfer income they received in the last year. The data is restricted to the 2000–2001 and 2002–2003 interview periods, because there is no data on transfers for earlier periods. The sample was restricted to children age zero to one who represent the treatment group, and children age three to four who serve as the comparison group.

To avoid repeated observations on the same family, the sample included only the youngest child in the family. While this restriction may change sample characteristics at a point in time, it may not influence estimated changes in transfer receipt, since it appears to have had a stable impact on sample characteristics in each sample period. For example, for children age three to four, this restriction reduced the average number of children in the family by 8–9% in 2000–2001 and 2002–2003, while it increased maternal age by 2% and decreased college graduation by 3% in both periods. The impacts were much smaller for children age zero to one.

To measure the impact of the expansions on transfers, the analysis reports “difference in difference” estimators, which are equal to the change in prior year transfers from the 2000–2001 to the 2002–2003 interview periods for women with a youngest child age zero to one minus the change for women with a youngest child age three to four. To the extent that both groups responded comparably to other social policy and economic conditions, this estimator should produce an unbiased estimate of the impact of the expansion in family leave. Although this analysis presents estimates based on differences in sample mean transfer payments, the results were also similar in linear regression models that controlled for age, education, immigration status, number of children, and non-wage income.

The analysis reports estimates of changes in family leave and social assistance benefits only. It does not include provincial or federal child benefits, because there can be up to a 16-month lag between when leave payments are received and any offset in child benefits. This exclusion may over-estimate net gains in transfers for families in the phase-out region for child benefits, particularly those with income between $20,000 and $30,000.

6.2 Estimated results

The first row of Table 3 reports estimates of the change in annual transfers from the 2000–2001 to the 2002–2003 interview periods for women with children age zero to one relative to women with children age three to four. As shown, the paid leave expansions were associated with a relative increase in family leave payments of $2,700 per year. This increase was offset by a relative decrease in Social Assistance payments of $400 per year, for a net increase of $2,300 per year in relative transfers to women with children age zero to one compared to women with children age three to four.

The remainder of this table clearly shows that the net gains from the expansions were larger for women with higher socioeconomic levels, defined by marital status, non-wage income, and maternal education. The relative increase in combined social assistance and family leave payments to women with infants was $900 per year for single parents compared to $2,400 for two-parent families. The increase was $1,200 for women with non-wage incomes under $20,000 compared to $2,100 to $3,400 for the two higher income groups. Finally, the relative increase in transfers was $900 for women with less than a high school degree, compared to $1,900 to $3,200 for higher skilled women. These differentials reflected both larger increases in leave payments and smaller offsets in social assistance for more economically advantaged women.

These differentials persist when measured in percentage change terms relative to the baseline difference in transfer payments between women with children age zero to one and women with children age three to four. One exception is that college graduates no longer have larger gains than women with a high school degree or some college, although both groups still had larger percentage increases than high school drop outs.

7 Estimated impact on time until return to work

7.1 Empirical approach

The second part of this analysis focuses on a question that asks mothers with children age zero to one when they started to work after their child was born. The sample was restricted to women who had a birth in 1997 or 1998 who were interviewed in September 1998 to May 1999, women who had a birth in 1999 or 2000 who were interviewed in September 2000 to May 2001, and women who had a birth in 2001 or 2002 who were interviewed in September 2002 to June 2003 (see Appendix Fig. 3). The sample also excluded women with younger children. This restriction affected 3% of the sample and has a negligible impact on the results.

To estimate the impact of demographic and economic characteristics on the timing of returns to work, the analysis uses the complementary log–log model for continuous processes described in Allison (1995). This model can be interpreted as one in which there is a continuous process determining the probability of returning to work, which is observed at discrete monthly intervals. It assumes that the probability that a mother returns to work in a given month, given that she has not yet returned to work in any prior month, P ijt , takes the following form:

where i indexes the mother, j indexes months since birth, and t indexes time. In this model, X it represents potentially time-varying economic and demographic factors which affect the probability of returning to work. These factors are assumed to have a proportional impact on the hazard rate from the underlying continuous process.

In this model, γ jt represents a set of duration parameters that reflect the way mothers’ preferences and opportunities to return to work vary with time since birth and sampling period. This analysis uses a flexible specification that allows γ jt to take on a separate value for each of the first 15 months since birth, and to take a constant value after month 16. It also allows the 16 monthly parameters to take on a different value in each of the three sampling periods.

This model does not allow for unmeasured heterogeneity, which might influence the time pattern of returns to work. To the extent that the impact of unmeasured heterogeneity changes over time, it may bias the estimated impact of the expansions.

7.2 Estimated results

Appendix Tables 5 and 6 show the estimates from this model. Model 1 presents estimates without economic controls, while Model 2 includes the monthly provincial employment rate for women age 25–54. As shown, the employment rate is positive and significant, suggesting that mothers return to work more quickly during strong economic conditions. Other estimates not reported here also found the provincial service sector wage and social assistance benefit levels to be insignificant.

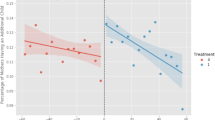

To interpret the magnitude of these results, Fig. 1 presents the monthly hazard rates for returning to work using estimated parameters from Model 1 and sample mean characteristics. As shown, there is a large spike in the hazard rate after family leave expired in month 7 for children born in 1997–1998 and 1999–2000. For children born in 2001–2002, the spike at month 7 largely disappears, and a new spike is introduced in month 13, reflecting the new termination date for family leave.

Figure 2 shows the cumulative return to work probabilities implied by these estimates. As shown, the paid leave expansion was associated with a 19 percentage point (37%) decrease in returns to work within 1 year from the 1999–2000 to the 2001–2002 birth cohorts. It also shows that, by month 16, the return to work probability was 0.6 percentage points higher in 2001–2002 than in 1999–2000, a difference that was not significantly different from zero, based on delta method calculations which found that the difference in survival probabilities at month 16 had a standard error of 0.012. This suggests that the family leave expansions did not have sustained impacts on returns to work once family leave expired.

Probability mother has returned to work. Note: Based on estimates from hazard model in Appendix Table 5, Model 1. Probabilities are evaluated at weighted sample means for the entire sample

These estimated changes from 1999–2000 to 2001–2002 are not sensitive to the inclusion of controls for female employment rates. For example, the parameter estimates from Model 2 of Appendix Table 5 imply a 20 percentage point (40%) decrease in returns to work within 1 year, and a 1.3 percentage point decrease in returns by month 16, a difference that is again not significantly different from zero.

7.3 Subgroup analysis

Table 4 shows how changes in return to work probabilities from 1999–2000 to 2001–2002 varied by socioeconomic group. The estimates are based on models that are equivalent to Model 2 of Table 4, except that they include interaction terms that allow the duration parameters γ jt to vary across socioeconomic groups. These models assume that each characteristic has a constant impact within months 1 to 6, 7, 8–12, 13, 14–15, and all months over 15, and that this impact could vary across the three sample periods. For example, the first two rows are based on a model that is the same as Model 2, but also includes 18 interactions between Quebec, month-group, and sample period.

The first three rows of Table 4 show that the legislation had a smaller impact on returns to work in the first year in Quebec, with returns to work within a year decreasing by 11 percentage points in Quebec from 1999–2000 to 2001–2002 compared to 22 percentage points in other provinces. This differential persisted when leave expired, with Quebec maintaining a 10 percentage point greater increase in returns to work in month 16. As noted above, this may reflect both the incremental impact of expanded job-protected leave in other provinces, and the extension of Quebec’s universal child care in September 2000. These estimates are similar in magnitude but smaller in proportionate terms than Baker and Milligan (2005), which found that Quebec had a 12 to 14 percentage point (39–45%) larger increase in work among married women with children under age one than the other nine Canadian provinces. This may reflect the fact that the current study includes both single and married mothers, rather than married mothers only.

The remainder of Table 4 makes it clear that the expansions had larger impacts on women from more economically advantaged groups. The share of women returning to work within 1 year decreased by 12 percentage points for single parents compared to 21 percentage points for two-parent families, by 12 percentage points for women with non-wage incomes under $20,000 compared to 21 to 25 percentage points for higher income women, and by 5 percentage points for women without a high school degree, compared to 19 to 25 percentage points for higher skilled women. When measured as a proportion of base returns (shown in column 2), these differentials narrow but remain substantial.

It is interesting to note that, even though highly skilled women are more likely to be constrained by the cap on leave payments, they were no less likely to take advantage of the extension in paid leave. The share of women with a university degree returning to work within 1 year decreased 25 percentage points (41%) compared to 19 percentage points (40%) for women with a high school degree or some college. This may reflect the greater value of the accompanying expansions in job-protected leave for highly skilled women. It also might reflect the greater tendency for employers to “top up” paid leave for high skilled women.

Finally, this table shows that these socioeconomic differentials in returns to work largely dissipated in month 16. This suggests that groups which made the most use of leave within the first 12 months did not have persistently lower rates of return to work after leave expired.

8 Estimated impact on employment rates

To explore whether the paid leave expansions affected maternal employment in the year after leave expired, a separate analysis (available from the authors upon request) estimated regression-adjusted changes in employment rates for women with a youngest child age one relative to women with a youngest child age three to four from 1998–1999 to 2000–2001 and from 2000–2001 to 2002–2003. These regressions controlled for province, number of siblings, immigrant status of parent, parental education, number of parents in family, age of mother, and the monthly provincial employment rate and log wage rate.

These models found that the employment rate of women with children age one increased more from 2000–2001 to 2002–2003 than it did for women with children age three to four. It also found that the relative employment rate increases for women with children age one were larger for women with some college or a college degree than for women with a high school degree or less, while there was not a significant difference between two-parent and single-parent families. This is consistent with the findings from the return to work analysis that suggested that the expansion in paid leave did not reduce returns to work once paid leave expired, and that groups that made greatest use of the paid leave expansions did experience long run decreases in returns to work.

9 Conclusion

This research has documented that the expansions in paid family leave from 25 to 50 weeks in Canada in December 2000 substantially increased the length of time before mothers return to work. The estimates imply a decrease in returns to work of approximately 20 percentage points both 7 and 12 months after birth, or 60% and 40%, respectively, of base level returns. This effect is on the same order of that found for expansions in paid leave from 6 to 10 months in Germany, and from 1 to 2 years in Austria (Schönberg and Ludstec 2007; Lalive and Zweimüller 2005).Footnote 2

Despite the large decreases in returns to work during the first year, this study found little evidence that the expansions in paid leave decreased women’s work effort once paid leave expired. The study found that there was an insignificant change in returns to work by the 16th month after birth from before to after the expansions. It also found that groups with the largest increases in leave time did not have decreases in returns to work or relative employment once their child reached age one.

This study also documents that the benefits generated by the expansion in paid leave were not equally distributed. Women who were high school drop outs, who had non-wage incomes under $20,000, and women who were single parents had gains in relative annual family leave and social assistance transfers that ranged from $800 to $1,200, compared to $2,300 for the average woman. At the same time, the share of women in these groups who remained out of work for 1 year increased by 5 to 12 percentage points, compared to 19 to 25 percentage points for other women.

These results are relevant from a policy perspective because they suggest that expansions in paid leave may have differential impacts on maternal and child well-being. Thus, countries considering an expansion in paid leave may want to find other ways to ensure that they maintain consistent support for low-income women.

The results also suggest that the net redistributive impact of expansions in paid leave depends in part on how paid leave interacts with other transfer programs. This study found that the expansion in paid leave in Canada was accompanied by substantial offsets in means-tested transfers. These offsets are likely to be smaller in countries such as Germany and the UK, which explicitly exempt child and family allowances, than in other countries, such as Finland, Norway, and Denmark, which use a more complete income definition in determining social assistance and means-tested housing benefits (OECD 2006).Footnote 3

In addition, since expansions in paid leave appear to have differential impacts on maternal work following birth, they may affect the earnings distribution of women with children. This could shed light on recent research that is beginning to explore how motherhood wage gaps vary with maternal education and economic status (Sigle-Rushton and Waldfogel 2007).

Notes

On average, social assistance phased out at $9,600 of unearned income for a single parent with one child and $12,000 for a two parent family with two children. The federal child tax credit consists of two parts: a supplemental benefit that phased out from $22,000 to $33,000 and a basic benefit that phased out from $33,000 to $77,000. Most provincial child allowances phased out from $21,000 to $25,000 (Jenson 2003; National Council of Welfare 2002).

Schönberg and Ludstec (2007) found that when German paid leave expanded from 6 to 10 months, the share of women returning to work by month 7 decreased by 25 to 26 percentage points (56–58%). In Austria, Lalive and Zweimüller (2005) found that expansions from 12 to 24 months led to approximately a 23 percentage point (55%) decrease in the returns to work in month 12. Estimates from Austrian study based on author estimates from Fig. 7 of paper.

Unfortunately, most current comparative research on child and family benefit packages such as OECD (2006) and Bradshaw and Mayhew (2006) do not explicitly address interactions with family leave payments (Kershaw 2007). However, the OECD (2006) study indicated that eight countries (Austria, Germany, Iceland, Ireland, Luxembourg, Netherlands, Spain, and the UK) explicitly disregard child benefits and family allowances in determining social assistance and means-tested housing benefits, while four other countries (Finland, Norway, Denmark, and Sweden) did not do so. Other countries, such as France, exempted the first 4 months, and not the remaining 28 months of their “young child allowance”, from income under their guaranteed minimum income program.

References

Allison PD (1995) Survival analysis using SAS: a practical guide. SAS Institute, Cary

Baker M, Milligan K (2005) How does job-protected leave affect mothers’ employment and infant health? National Bureau of Economic Research Working Paper 11135

Baker M, Gruber J, Milligan K (2005) Universal childcare, maternal labor supply and family well-being. National Bureau of Economic Research Working Paper 11832

Baum CL (2003a) The effects of maternity leave legislation on mothers’ labor supply after childbirth. South Econ J 69(4):772–799

Baum CL (2003b) The effects of state maternity leave legislation and the 1993 Family and Medical Leave Act on employment and wages. Labour Econ 10(5):573–579

Bradshaw J, Mayhew E (2006) Family benefit packages. In: Bradshaw J, Hatland A (eds) Social policy, employment and family change in comparative perspective. Edward Elgar, Cheltenham, UK

Canada Employment Insurance Commission (2004) Employment insurance 2003 monitoring and assessment report. Human resources and social development Canada catalogue number SK-SP-102-04-04E http://www.hrsdc.gc.ca/en/ei/reports/eimar_2003.shtml

Canada Federal–Provincial–Territorial Directors of Income Support (2005) Social assistance statistical report: 2004. Social development Canada catalogue number SP-626-09-05E. http://www.hrsdc.gc.ca/en/cs/sp/sdc/socpol/publications/reports/sp-626-09-05e/page00.shtml

Canadian Legal Information Institute (2007) Consolidated statutes of Quebec, family Benefits, an act respecting R.S.Q. c. P-19.1, Version Downloaded by CanLII on 2007-03-07. http://www.canlii.org/qc/laws/sta/p-19.1/20070307/whole.html

Cheal D, Kampen K (2000) EI family supplement & relative earnings for families with children. Human resources and social development Canada catalogue number SP-AH134-11-00E http://www.hrsdc.gc.ca/en/cs/sp/hrsdc/edd/reports/2000-000431/page00.shtml

Government of Canada (1999) Employment insurance act: regulations amending the employment insurance regulations. Canada Gazette 133(14) http://gazetteducanada.gc.ca/partII/1999/19990707/html/sor290-e.html

Han WJ, Waldfogel J (2003) Parental leave: the impact of recent legislation on parents’ leave taking. Demography 40(1):191–200

Jenson J (2003) Redesigning the “welfare mix” for families: policy challenges. Canadian Policy Research Networks Discussion Paper F-30

Kershaw P (2007) Measuring up: family benefits in British Columbia and Alberta in international perspective. IRPP Choices 13(2)

Klerman JA, Leibowitz A (1997) Labor supply effects of state maternity leave legislation. In: Blau F, Ehrenberg R (eds) Gender and family issues in the workplace. Russell Sage, New York, pp 65–85

Klerman JA, Leibowitz A (1999) Job continuity among new mothers. Demography 36(2):145–155

Lalive R, Zweimüller J (2005) Does parental leave affect fertility and return-to-work? Evidence from a ‘true natural experiment’. IZA Discussion Paper 1613

National Council of Welfare (2002) Welfare incomes 2000 and 2001. Minister of Public Works and Government Services Canada, Ottawa

National Council of Welfare (2005) Welfare incomes 2004. Minister of Public Works and Government Services Canada, Ottawa

Ondrich J, Spiess CK, Yang Q, Wagner GG (2003) The liberalization of maternity leave policy and the return to work after childbirth in Germany. Rev Econ Household 1(1–2):77–110

Organization for Economic Co-operation and Development (2006) Benefits and wages: gross/net replacement rates country specific files and tax benefit models (latest update: March 2006). OECD Social Policy Division, Paris. http://www.oecd.org/document/0/0,3343,en_2649_34637_34053248_1_1_1_1,00.html

Ronsen M, Sundstrom M (2002) Family policy and after-birth employment among new mothers: a comparison of Finland, Norway and Sweden. Eur J Popul 18(2):121–152

Ruhm CJ (1998) The consequences of parental leave mandates: lessons from Europe. Q J Econ 113(1):285–318

Schönberg U, Ludstec J (2007) Maternity leave legislation, female labor supply, and the family wage gap. IZA Discussion Paper 2699

Sigle-Rushton W, Waldfogel J (2007) Motherhood and women’s earnings in Anglo-American, continental European, and Nordic countries. Fem Econ 13(2):55–91

Statistics Canada (2003) Topic based tabulations for 2001 census: earnings of Canadians Table 23, catalogue no. 97F0019XCB2001044. http://www12.statcan.ca/english/census01/products/standard/themes/index.cfm

Waldfogel J (1999) The impact of the Family and Medical Leave Act. J Policy Anal Manage 18(2):281–302

Acknowledgements

Please send correspondence to Maria Hanratty. This paper was supported by a grant from the Canadian Embassy and the Statistics Canada Microdata Research Data Center Program. The research and analysis are based on data from Statistics Canada and the opinions expressed do not represent the views of Statistics Canada. The authors would like to thank three anonymous referees for their helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Deborah Cobb-Clark

Rights and permissions

About this article

Cite this article

Hanratty, M., Trzcinski, E. Who benefits from paid family leave? Impact of expansions in Canadian paid family leave on maternal employment and transfer income. J Popul Econ 22, 693–711 (2009). https://doi.org/10.1007/s00148-008-0211-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-008-0211-x