Abstract

The study examines the effect of remittance inflows on the effectiveness of monetary policy transmission channels in Nigeria using the New-Keynesian DSGE model. The study employs quarterly data spanning from 1986:1 to 2018:4. Four different channels are considered namely interest rate, exchange rate, credit and expectation channels. Results show that remittance inflows hinder the effectiveness of monetary policy channels. This implies the bulk of remittance inflows into the country do not pass through the financial system. Rather, the inflow is through the informal channels thereby making it difficult for the monetary authority to control the amount of inflow. Furthermore, given the impact of remittance on output gap, it shows that remittance has low persistence in the economy despite the inflow. This implies the bulk of remittance inflow is spent on consumption and not investment. Considering the effect of remittance inflow on inflation, the inflow is not inflationary. The study concludes that to better sterilize the effect of remittance inflow in the country, monetary policy authority should encourage the inflow through the financial system.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Remittance has become an alternative source of financing among the developing and emerging countries. This is evident in the increase of its inflows to these countries. According to the World Bank report of 2017, remittance inflows have risen gradually over the years. In 2001, the amount of remittance inflows to developing countries was $96.5 billion, out of which $14 billion was remitted to Africa. The amount increased to $331.7 billion in 2010 with $40 billion inflow to Africa. The total remittance inflows in 2013 and 2014 were $416.6 billion and $429.9 billion, respectively. The inflow to Africa in 2015 rose to $432 billion from which $52 billion was remitted to Sub-Saharan Africa (World Bank 2018). In 2017, the global remittance figure stood at $613 billion. Of this total, African countries alone received the sum of $72 billion, amounting to 11.74 percent of the total value (World Bank 2018).

In Sub-Saharan Africa, Nigeria is the highest recipient of remittance and the sixth largest in the world. Remittance inflows into Nigeria grew by 11.7 percent from $19.636 billion to $21.967 billion in 2017. Currently, remittance inflows into Nigeria made up 57.8 percent of total remittances to the Sub-Saharan African region, 4.2 percent to low-income countries and 3.5 percent to global remittances (World Bank 2018). Figure 1 shows remittance inflows into Nigeria between 2010 and 2017. The diagram shows that remittance inflows into the country fell significantly in 2016 and later increased in 2017 and 2018. This corroborates the claim that remittance inflows into the country have been on the increase in recent times.

Theoretically, remittance enters an economy through the financial institution. Therefore, an increase in remittance inflows into Nigeria could be attributed to financial development, which has increased the possibility of the inflows at reduced costs. According to Vacaflores, (2012), the significance of remittance inflows to the recipient countries is measured through the size of the inflow, the prospective and the real effect on the economy. The effect of remittance (whether prospective or real) on the recipient country depends on the cyclical nature of the inflows. The cyclical nature of remittance could be countercyclical or pro-cyclical. It is countercyclical, on one hand, when it acts as an automatic stabilizer in the face of extraordinary economic stress such as recession and natural disaster. The remittance, during this period, can thus promote economic growth through investment and consumption, thereby enhancing productivity, job opportunities and increase in national income (Durand et al., 1996; Widgren & Martin, 2002; Heilman, 2006; Vacaflores, 2012). On the other hand, remittance inflow is said to be pro-cyclical if it increases in the period of boom. During this period, the inflows would have a negative effect on the recipient countries if they are not sterilized by the authority (De Haas, 2006; Keely & Tran, 1989; León-Ledesma & Piracha, 2004). It has been argued that remittance inflows during this period can generate inflationary pressure, create Dutch Disease effects in the receiving economies, be detrimental to economic growth and be harmful to the implementation of monetary policy (Heilman, 2006; Vacaflores et al., 2011; Acosta et al. 2009; Mongardini & Rayner, 2009; Barajas et al. 2011; Guiliano and Ruiz Arranz, 2005). It can be deduced from the above discussion that pro-cyclical remittance is relevant to the conduct and transmission of monetary policy. For instance, an attempt by a developing country to achieve price stability by implementing a contractionary policy could be dampened and overturned in the face of pro-cyclical remittance inflows as the inflows would render interest rate ineffective. Therefore, the extent of effectiveness of monetary policy transmission channels under pro-cyclical remittance inflows is the focus of this study.

Although, domestic governments usually try to sterilize capital inflows to sustain a given policy, however, high levels of informality in some developing countries and the significant portion of remittances that continue to flow through informal channels make monetary targeting problematic (Vocaflores, 2012). Besides, it has also been established in the literature that the cyclical properties of a variable are not constant over time. This implies an economy can experience both the countercyclical and pro-cyclical nature of remittance over time (Ruiz and Vargas-Silva, 2010). Given these potential complications, remittance could potentially have a differential impact on transmission channels depending on the sizes of the inflow and the strength of the sterilization policy of the government.. Accounting for such influences thus became imperative for the effectiveness of monetary policy transmission channels. This study, therefore, intends to examine the pro-cyclical nature of remittance inflow on the effectiveness of monetary policy transmission channels in Nigeria given the size of remittance inflows into the country and the weak sterilization policy.

However, to the best of my knowledge, the pro-cyclical effect of remittance inflows on the effectiveness of monetary policy transmission channels has not been examined in the Nigerian context. This is important because transmission channels define various means through which remittance-induced changes affect the real economy. Therefore, evaluating the efficacy of these channels in a remittance-recipient country is important to the conduct of monetary policy. This is because a sound understanding of how fast and to what extent do remittance inflows affect the effectiveness of the transmission mechanism of monetary policy provide Central Banks with pertinent insight for better decision-making (Akinlo & Apanisile, 2019; Cevik & Teksoz, 2012; Kulkarni & Saxena, 2003). Therefore, this study contributes to the extant literature by investigating the effectiveness of monetary policy transmission channels in Nigeria under pro-cyclical remittance inflows using Dynamic Stochastic General Equilibrium (DSGE). The use of DSGE is informed by its advantages over all other methods used in the literature as explained by Peiris and Saxegaard, (2007) and Akinlo and Apanisile, (2019).

Given this introductory section, the remaining sections of the study are sub-divided into five sections. Section two provides the literature review while section three presents the methodology. Section four explains the technique of estimation, data description and measurement of variable. Section five provides the estimation while section six concludes.

2 Literature review

The increasing inflow of remittance into developing countries has attracted the attention of researchers in recent time. Studies in the literature have examined the potential effect of remittances on the recipient countries. Olayungbo and Quadri, (2019) investigated the relationship among remittances, financial development and economic growth between 2000 and 2015 using pooled mean group and mean group ARDL estimations for 20 sub-Saharan African countries. Results showed that remittances have positive effects on economic growth both in the short-run and long-run periods.

Ugwuegbe et al., (2018) studied the effect of migrant remittances on the depth, efficiency and stability of the financial sector development in the West African Monetary Zone between 1996 and 2016 using one-step generalised method of moment for a panel of six countries. Results revealed that while a positive relationship existed between migrant remittances and financial sector development, on one hand, the effect of remittances on depth, efficiency and stability, on the other hand, varies depending on the choice of the variable used.

Chowdhury, (2016) examined the effects of different level of financial development on economic growth in the top 33 remittance–recipient developing countries. The study employed a two-step GMM estimation technique to analyse data between 1979 and 2011. Financial variables were found to be insignificant in the remittances–growth nexus. Besides, remittances were found to be growth-enhancing during the period under study.

Furthermore, Issahaku et al., (2016) investigated the potential risk posed by remittances for macroeconomic management and also examined the effect of remittances on monetary policy in 106 developing countries from 1970 to 2013 using panel vector autoregressive model. Results showed that volatility in remittances reduced macroeconomic risk in developing countries. Also, the study provided evidence of a strong negative relationship between remittances and monetary policy in the developing countries in the period under study. The study concluded that developing countries should implement policies that will induce remittances inflow to reduce macroeconomic instability due to the positive effect of remittances on economic growth.

Vacaflores, (2012) examined the potential effect of a higher share of remittances on monetary policy in a small open economy that is operated under partial sterilization, using a limited participation model. The study employed the DSGE approach for analysing the data. Calibrations of specific parameters were carried out using 12 Latin American countries used in the study. Results showed that a positive shock to remittances increases the level of consumption and lowers the price of money, similarly, a positive shock to remittances also reduces work effort and consequently reduces the level of output.

Moreover, Giuliano and Ruiz-Arranz, (2005) studied the interactive effect of remittances and financial development on economic growth in 100 developing countries. This was done to test the hypothesis that remittance is a substitute for lack of financial development in promoting economic growth the developing countries. Using the Generalized Method of Moment, results showed that remittance is a substitute in less financially developed countries and that it has the capacity to enhance growth.

Having reviewed the recent remittance literature, it can be deduced that the majority of the extant studies on the subject matter focused on the growth-enhancing ability of remittance through the development of the financial system. Few others examined the negative impact of remittance on the implementation of monetary policy. However, the effect of remittance inflows on the effectiveness of monetary policy transmission channels remains a gap to be filled in the literature. Therefore, this study intends to fill this gap by examining the effects of remittance and financial development on the effectiveness of monetary policy transmission channels in Nigeria. This is important because a clear and sound understanding of the effect of remittance on these channels will improve the conduct and the performance of monetary policy in Nigeria.

3 Methodology

The study adapts the methodology of Akinlo and Apanisile, (2019) and Apanisile and Osinubi, (2019) in which the New Keynesian model is explained as an extension of the real business cycle. The model is said to be characterised by imperfect competition and sticky prices. These features permit monetary policy to be central to macroeconomic fluctuations. Major assumptions of this model are imperfect competition in the goods market and a sticky price mechanism. The assumption of imperfect competition arises as a result of the fact that each firm is believed to produce differentiated good and for which it sets the price. Also, the assumption of sticky price arises because only a fraction of firms can reset their prices in any given period. Players in the New Keynesian Model are households that make consumption and labour supply decisions, demand money and bonds; firms that demand labour to produce goods and services and government that runs monetary policy.

3.1 Household

The model assumes a collection of identical and infinitely-lived households, each of which seeks to maximize:

where \({E}_{0}\) denotes expectation operator condition on time 0 information, \(\beta\) is the discount factor, \(\frac{{M}_{t}}{{P}_{t}}\) is the real money holding; subject to the budget constraint:

where \({C}_{t} \left(i\right)\) represents a quantity of good i consumed by the household in period t, for i \(\in \left[\mathrm{0,1}\right]\) for t = 0, 1, 2, …., \({P}_{t} (i)\) is the price of good i, \({N}_{t}\) denotes hours of work, \({W}_{t}\) is the nominal wage, \({B}_{t}\) represents purchases of one-period bonds at a price \({Q}_{t}\), \({B}_{t-1}\) is the number of bonds purchased last year, \({M}_{t}\) is money holding and \({J}_{t}\) is a lump-sum component of income. \(\in\) measures the intertemporal elasticity of substitution between the differentiated goods, which is equal to the price elasticity of demand. Using Kuhn–Tucker approach to obtain FOC conditions of Eqs. (1) and (2) and re-arrange, we have:

Equations (3), (4) and (5) determine the intertemporal consumption allocation (the Euler equation), the labour–leisure choice and the money demand respectively. The equations determine the rational forward-looking household’s allocation decision.

Under the assumption of a period utility given by:

The marginal utilities of consumption, labour and money become:

Substituting the marginal utilities into Eqs. (3)–(5), we have:

Log-linearize Eqs. (7)–(9) and denote log of variables in capital letter with small letters, we have:

3.2 Firms

The model also assumes a continuum of firms indexed by i \(\in \left[0, 1\right]\). Each firm produces a differentiated good, but they all use identical technology, represented by the production function:

\({Y}_{it}\) is the output produced by firm \(i\) in period \(t\), \({A}_{t}\) is the economy-wide technology level and \({N}_{it}\) is labor force used by the firm. One key ingredient in the New Keynesian model is price rigidity. When a firm sets its prices, it can do so freely. However, they do not know when the next opportunity to change price will emerge. Therefore, the probability of not knowing when to change the price in a given period is \(\theta\). This is the fraction of all firm that is stuck with the price they had last period while the remaining 1–\(\theta\) firms reset their prices. All firms face an identical elastic demand schedule with price elasticity \(\epsilon\) and take aggregate price level \({P}_{t}\) and aggregate consumption index \({C}_{t}\) as given. Besides, the aggregate price dynamics are described by the equation:

where \({\pi }_{t} \equiv \frac{{P}_{t}}{{P}_{t-1}}\) is the gross inflation rate and \({{P}_{t}}^{*}\) is the price set in the period t by firms that are re-optimizing their price in that period. Since all firms will choose the same price because they face an identical problem, the steady state with zero inflation will give \(\pi\) = 1. In that case, \({{P}_{t}}^{*}\) = \({P}_{t-1}={P}_{t}\). Therefore, a log-linear approximation to the aggregate price index around zero-inflation steady state gives:

Equation (15) above shows that inflation in the present period is as a result of re-optimizing firms that choose price that is different from economy’s average price in the previous period. Hence, to understand the evolution of inflation overtime, there is need to analyze the factors underlying firms’ price setting decision. This is done by considering a firm that is re-optimizing in period t that choose a price \({{P}_{t}}^{*}\) that maximizes the current market value of the profits generated while the price remains effective. The optimization problem is solved as follows:

Subject to the sequence of demand constraints

The first-order condition of the problem takes the form:

for k = 0,1,2,…….. where \({Q}_{t,t+k}\) is the stochastic discount factor for nominal payoffs, \({\varphi }_{t}(.)\) is the cost function and \({Y}_{t+k/t}\) denotes output in period t + k for a firm that last reset its price in period t, \({\theta }^{k}\) is the probability of being stuck with today’s price in K periods and M is the desired or frictionless markup. The optimal price \({P}_{t}^{*}\) becomes:

To solve for equilibrium in the goods market, the market clearing condition requires that

Aggregate output in the market is defined as

Substitute for (20) in (21), Eq. (21) then becomes

Taking log of both sides, we have

Equation (22) is the aggregate market clearing condition. In addition, market clearing in the labour market equals:

Re-arrange (13) by making \({N}_{it}\) the subject. Equation (13) becomes.

Substitute (22) and (24) into (23) and log-linearized the result. Equation (22) becomes:

3.3 Monetary authority

The monetary authority (government) implements monetary policy according to a simple rule. According to the objective of this study, we compare two types of alternative monetary policy rules which are Taylor-type interest rate rule and money growth rate rule. The Taylor-type rule takes the form:

where

3.4 Log-linearized model

Log-linearization allows a system of non-linear equations to be transformed into a system that is linear in terms of the log deviations of the variable around their steady state. This allows for the simultaneous computation of a more tractable and cohesive system of equations, which greatly reduces computational complexity. The log-linearized systems of the above model are as follows:

Equation (27) is the dynamic IS curve. The equation shows that the current level of output is a function of its expected future level of output and its ex-ante real interest rate. This is obtained by subtracting the expected inflation rate from the nominal interest rate. This equation corresponds to a log-linearized version of the Euler equation linking an optimizing household’s inter-temporal marginal rate of substitution to the real interest rate. Equation (28) is the New Keynesian Philip curve. The equation corresponds to a log-linearized version of the first-order condition describing optimal behaviour of monopolistically competitive firms that either face explicit costs of nominal price adjustment, as suggested by Rotemberg, (1982), or set the nominal prices in a randomly staggered fashion, as suggested by Calvo, (1983). Equation (29) is an interest rate rule for monetary policy proposed by Taylor, (1993). In this equation, the short-term interest rate is the policy instrument. The apex bank adjusts the instrument in response to movements in inflation and output. Equation (30) is the labour supply equation. The equation states that the number of hours worked positively related to equilibrium real wage and negatively related to consumption. Equation (31) is the equation of the demand for real money balances. It explains the amount of money that must be supplied by the apex bank at the nominal interest rate. Equation (32) is the aggregate market-clearing condition while Eq. (33) labour market clearing condition. The first three equations are important in the DSGE model. The equations involve four variables namely output gap (yt), inflation (\(\pi\) t) nominal exchange rate(et) and nominal interest rate (it). Migrant remittance is added to Eqs. (27), (28), and (29) as independent variable to capture its effects on monetary policy transmission mechanism. The estimated equations are presented in Appendix B.

4 Empirical analysis

This study employs the Bayesian technique in estimating DSGE models due to its advantages over other methods of estimating the models. The use of Bayesian approach requires calibration of some or all the parameters to solve the problem of identification that is associated with estimating DSGE models. Calibration, in this context, involves adding fixed parameters as a way of imposing a very strict prior. Parameters that define steady-state equilibrium are calibrated. This provides the opportunity for examining the extent to which available data closely reflect the prior in the analysis. By implication, parameters that are important to the achievement of steady states and that also replicate the major steady-state ratios for the economy must be calibrated. The Bayesian method allows the incorporation of prior or theoretical knowledge and the likelihood function through the specification of a prior distribution for the parameters to be estimated. The combination of prior and likelihood function produce the posterior distribution needed for the estimation.

4.1 Data

The study employs quarterly data from 1986:1 to 2018:4 on seven macroeconomic indicators namely: output gap, nominal interest rate, domestic inflation rate, nominal exchange rate, credit to private sector, remittance and terms of trade. Data are filtered to eliminate outliers, trend and non-stationarity in the series. It is important to do this so as to achieve stability of the model. Besides, two other samples are considered for robustness check, 1990:1–2018:4 and 2000:1–2018:4. The former sample was considered because it was a post liberalization period in Nigeria. The latter sample was considered because inflation targeting approach was in place during that period, although it was implicit. Since we have four structural shocks in the model, we use four observable variables to avoid stochastic singularity (Li & Liu, 2013).

4.2 Methodology

Bayes’ theorem defines the posterior density as

where \(\theta \mathrm {and} {Y}_{1}^{T}\) denote the whole set of model parameters and the observed data, respectively. \(L\) denotes the likelihood function. \(p(\theta |{M}_{1})\) and \(p({Y}_{1}^{T}|{M}_{1})\) are the prior density and the marginal data density conditional on \({M}_{1}\), respectively. The study constructs and evaluates \(L\left(\theta |{Y}_{1}^{T},{M}_{1}\right)\) by Kalman filter. The posterior kernel, \(L\left(\theta |{Y}_{1}^{T},{M}_{1}\right)p(\theta |{M}_{1})\), is simulated by random-walk Metropolis–Hastings(MH) algorithm, which is a Markov chain Monte Carlo (MCMC) simulation method commonly used in the current literature of Bayesian estimation of DSGE models. The models of the study are estimated using MATLAB and Dynare, version 4.3.3.

4.3 Calibration

Specific parameters of the models are calibrated. Calibrated parameter is called a prior. Prior selection is by researcher’s personal introspection in line with economic theories. It reflects the importance of the importance and the location of structural parameter of the model. In reality, priors are chosen based on observation, facts and from existing empirical literature (Akinlo & Apanisile, 2019; Apanisile & Osinubi, 2019). Based on the foregoing, economic theories, stylized facts about the economy, observations, facts and extant literatures inform the selection of priors for these models. In addition, estimates of studies (Adebiyi & Mordi, 2011; Mordi et al., 2013; Akinlo & Apanisile, 2019; Apanisile & Osinubi, 2019) on DSGE with Bayesian estimation technique, help in setting priors for most of the parameters. Table 1 below shows the priors of the estimated parameters and standard errors of shocks.

The study is interested in four different shocks namely monetary policy shock, aggregate demand shock, aggregate supply shock and remittance shock. Prior values in Table 1 are used to simulate the models. The whole essence of simulation is to confirm whether steady state exists for the system of equations. Result of the simulation is presented in Appendix A. The results show that solution exists for the system of equations and that steady state exists as all the variables return back to zero after responding to various shocks in the models.

5 Presentation of results

The study generated the posterior density using the Bayesian estimation technique which combines the priors with the likelihood. A random walk MH algorithm was used to generate 10,000 draws from the posteriors. The log data density of the model is − 46.344778. Result of the estimation is presented in Table 2. The table shows the prior mean, posterior mean, prior standard deviation, confidence interval of the estimated parameters and the standard deviation of shocks.

Looking at the IS (output-gap) equation, the inflation expectation parameter \(({\alpha }_{3})\), which is estimated to be 0.3196 is lower than the assumed prior mean of 0.320. Also, measures of impact of interest rate (\({\alpha }_{1})\) and credit to private sector (\({\alpha }_{2})\), estimated as 0.2295 and 0.2897 are lower than their assumed prior means (0.230 and 0.290). The values of the measures of impact of remittances and exchange rate parameters (0.6197 and 0.5144) differ in their effects on output gap. While the measure of impact of remittance is less than its assumed prior mean, the measure of impact of exchange rate is greater than its assumed prior mean (0.620 and 0.500). Therefore, the results of the estimates of the components of output gap equation show that expectation, interest rate and credit channels are less effective in the face of remittance inflow. However, exchange rate channel is the only channel that remains effective in an economy that is characterized with high inflow of remittance. This is because its posterior mean is greater that the assumed prior means. Overall, given the performance of the posteriors of the parameters of output gap, it shows that estimated parameters draw important information from the data.

In addition, the New Keynesian Phillip’s curve equation reveals that the prior and posterior estimations show that the data provide useful information in explaining the effectiveness of monetary policy transmission channels. In Table 2, the effectiveness of the transmission channels is shown by the prior and posterior values of measures of impact of interest rate on inflation (\({\beta }_{3})\), measures of impact of exchange rate on inflation (\({\beta }_{5}\)), measures of impact of credit to private sector (\({\beta }_{6})\) and measures of impact of inflation expectation (\({\beta }_{7})\). Results of the estimates show that interest rate and credit channels are effective in a remittance dominated economy as their posterior means (0.2601 and 0.3203) are greater than their prior means (0.260 and 0.320). However, exchange rate and expectation channel are not effective in the face of high remittance inflow into the economy. This is because the posterior means of the two parameters (0.1699 and 0.2979) are less than their prior means. Furthermore, the posterior mean of the measures of impact of remittance on inflation (0.3199) is less than its prior mean (0.320). This implies remittance inflow into the economy is not inflationary in nature.

Table 2 also presents the results of the estimates of the monetary policy reaction function that is employed in the implementation of monetary policy by the Central Bank of Nigeria. The posterior means provide an overview of the conduct of monetary policy in the country. The primary objective of price stability with corresponding objective of sustainable growth is shown in the result. With regards to the persistence of the estimated standard deviations, it can be deduced that the most volatile shock considered in the model is interest rate shock (1.1336) while the least volatile is remittance shock (0.0340).

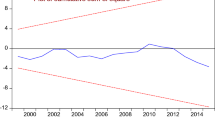

The priors (initial values) and the posterior (estimated values) of the parameters are shown in Figs. 2. The diagram contains two colours namely; grey and black. The grey colour represents the initial values of the parameter while the black colour represents the estimated values of the parameters. The initial values are selected from similar studies in the literature which is a pre-requisite for estimating DSGE using Bayesian approach. The vertical green line in each chart identifies the estimated parameter mode from the optimization simulations. The optimization mode is usually similar to the posterior mode with only a few exceptions. This implies that both the data and the selected priors are informative about the parameters. The diagram also shows that the model perfectly fits the performance of the Nigeria economy as the priors and the posteriors are very close and they do not deviate from normality (Fig. 3).

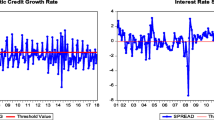

5.1 Viability of the estimation

Diagnostic tests are used to confirm the suitability and statistical integrity of Bayesian estimation results. The responsiveness of the Metropolis–Hastings simulations procedure is investigated using the Monte Carlo Markov Chain (MCMC) diagnostics test. The MCMC comprises of both the univariate and the multivariate approach. The two approaches are carried out in this study. The sensibility of the MH algorithm requires that the simulations are similar within and across the chains. Both lines should display little variability and eventually converge (Apanisile & Osinubi, 2019; Akinlo & Apanisile, 2019; Modi et al., 2013). The diagrams are presented in Figs. 6 and 7 below. The diagrams show that the moments for all the parameters of the model are stable and the converge level is accurate.

The multivariate MCMC diagnostic tests are demonstrated and the results are presented in Fig. 4. As for the MH sampling algorithm, a diagnosis of the overall convergence is summarized in three graphs, with each graph representing specific convergence measures and having two distinct lines that represent the results within and between chains. Those measures are related to the analysis of the parameters mean (interval), variance (m2) and third moment (m3). Convergence requires that both lines, for each of the three measures, become relatively constant and converge to each other. The chart supports the stability and convergence of the MH solver for all the models as both lines of the diagrams converge at the tail end of the diagram.

5.2 Bayesian impulse response

This section examined the impulse responses of the transmission channels to structural shocks in the model. These show how shocks relative to the steady states propagate. The Bayesian impulse response functions of different shocks are presented with their respective graphical representation in Figs. 5, 6, 7, 8.

In Fig. 5, responses of monetary policy transmission channels to a 1% remittance shock was provided. Results showed that in the short-run, interest rate, exchange rate and credit channels responded negatively to remittance shock as their values reduced to negative. However, in the medium-run, the magnitude of impulses transmitted through these channels increased and equal to zero. Expectation channel also responded negatively as the magnitude of the impulses transmitted fell from 0.03 to 0.00. These results indicated that in the short-run, remittance shock had negative effect on the monetary policy transmission mechanisms.

Figure 6 above presented the responses of monetary policy transmission channels to a 1% policy shock in Nigeria, a remittance recipient country. The implementation of monetary policy follows Taylor’s rule where interest rate is the policy instrument. During the period under study, results showed that exchange rate, credit and interest rate channels responded negatively as the magnitude of impulses transmitted through these channels reduced except expectation channel. Although expectation channel responded negatively, however, it did not assume negative value before the effect of the shock went off. Looking at the responses of output and prices to 1% policy shock, it could be deduced that the shock has negative effect on both variables.

Responses of monetary policy transmission channels to a 1% aggregate supply shock are presented in Fig. 7. It could be deduced from the figure that all the channels responded negatively to aggregate supply shock. While the negative effect of aggregate supply shock was intense on interest rate, exchange rate and credit channel on one hand, it was lesser on expectation channel as its value does not assume zero. Result also showed that output and inflation responded negatively to aggregate supply shock.

Responses of monetary policy transmission channels to a 1% aggregate demand shock were not different from other shocks in Nigeria as presented in Fig. 8. All monetary policy transmission channels considered in the model responded negatively to aggregate demand shock. Also, output and prices responded negatively to aggregate demand shock. These results confirmed aggregate demand shock had negative effect on output and prices and also limit the effectiveness of monetary policy transmission mechanism in Nigeria during the study period.

5.3 Robustness check

To check the robustness of the empirical results, two different measures were carried out. First, the baseline sample was divided into two (1990:1–2018:4 and 2000:1–2018:4) to capture two important historical events in the country. Second, some of the observable variables were changed and also different measures for the existing observable variables were used. For instance, short-term interest rate was used to represent nominal interest rate as against treasury bill. In addition, real effective exchange rate was also used to represent exchange rate as against nominal exchange rate. It turns out that our baseline results do not change qualitatively in the robustness check mentioned above.Footnote 1

6 Conclusion

Remittance inflows to the developing and low-income countries is said to have some welfare benefits to the recipient countries. It affects labour decision, promotes sectoral-export competitiveness, financial deepening, economic growth and consumption by satisfying basic needs. However, studies in the literature have argued that remittance inflows have the potential to alter the effectiveness of the monetary policy transmission mechanisms of the recipient countries if such inflow is pro-cyclical in nature. The pro-cyclical effect of remittances implies it promotes fluctuation in the economic cycle. This is done when remittance inflows is not sterilized. Given that Nigeria is the largest recipient of remittance inflow in Africa, it is imperative to examine the role it plays on the performance of the Nigerian economy. While the advantages of remittance inflows into the country have received adequate attention in the extant literature, the pro-cyclical effect of remittance on the effectiveness of monetary policy transmission channels has been overlooked in the Nigerian literature. This study therefore examines the effectiveness of monetary policy transmission channels in Nigeria under pro-cyclical remittance inflows using a New-Keynesian DSGE model. The study employs quarterly data spanning from 1986:1 to 2018:4. Four different channels were considered namely interest rate, exchange rate, credit and expectation channels. Results showed that pro-cyclical remittance inflows hinder the effectiveness of monetary policy channels. This implies the bulk of remittance inflows into the country do not pass through the financial system. Rather, the inflow is through the informal channels thereby making it difficult for the monetary authority to sterilize the inflow. Furthermore, given the impact of remittance on output gap, it shows that remittance has low persistence in the economy despite the inflow. The inflow reduces the level of output in the economy. This implies the bulk of remittance inflow is spent on consumption and not investment. Considering the effect of remittance inflow on inflation, the inflow is not inflationary. The study concludes that to better sterilize the effect of remittance inflow in the country, monetary policy authority should encourage the inflow through the financial system.

Notes

The results of the robustness check are available from us upon request.

References

Acosta, P. A., Baerg, N. R., & Mandelman, F. S. (2009). Financial development, remittances, and real exchange rate appreciation. Economic Review, 1(1), 1–12.

Adebiyi, M. A., & Mordi, C. O. (2011). Building dynamic stochastic general equilibrium models for monetary policy analysis. Economic and Financial Review, 49(1), 1–24.

Akinlo, A. E., & Apanisile, O. T. (2019). Monetary policy shocks and effectiveness of channels of transmission in nigeria: a dynamic stochastic general equilibrium approach. Global Business Review, 20(2), 1–23.

Apanisile, O. T., & Osinubi, T. T. (2019). Financial development and the effectiveness of monetary policy channels in nigeria: a DSGE approach. Journal of African Business. https://doi.org/10.1080/15228916.2019.1625021.

Barajas, A., Chami, R., Hakura, D., & Montiel, P. (2011). Worker’s remittances and the equilibrium real exchange rate: theory and evidence. Economia, 11(1), 45–94.

Calvo, G. A. (1983). Staggered prices in a utility-maximizing framework. Journal of Monetary Economics, 12(1), 383–398.

Cevik, S., & Teksoz, K. (2012). Lost in transmission? The effectiveness of monetary policy transmission channels in the GCC countries (International Monetary Fund WP/12/191). . USA: International Monetary Fund.

Chowdhury, M. (2016). Financial development, remittances and economic growth: evidence using a dynamic panel estimation. The Journal of Applied Economic Research, 10(1), 35–54.

De Haas, H. (2006). Migration, remittances and regional development in Southern Morocco. Geoforum, 37, 565–580.

Durand, J., William, K., Emilio, A. P., & Douglas, S. M. (1996). International migration and development in mexican communities. Demography, 33(2), 249–264.

Giuliano, P., & Ruiz-Arranz, M. (2005). Remittances, financial development, and growth. International Monetary fund Working Paper, WP/05/234.

Heilmann, C. (2006). Remittances and the migration-development nexus-challenges for the sustainable governance of migration. Ecological Economics, 59(2), 231–236.

Issahaku, H., Harvey, S. K., & Abor, J. Y. (2016). Does development finance pose an additional risk to monetary policy? Review of Development Finance, 6(1), 91–104.

Keely, C. B., & Tran, B. N. (1989). Remittances from labour migration: evaluations, performance and implications. International Migration Review, 23(1), 500–525.

Kulkarni, K. G., & Saxena, S. C. (2003). Have the monetary and fiscal policies been effective in India? Global Business Review, 4(2), 230–237.

León-Ledesma, M., & Piracha, M. (2004). International migration and the role of remittances in Eastern Europe. International Migration, 42(1), 66–83.

Li, B., & Liu, Q. (2013). Identifying monetary policy behavior in China: a Bayesian DSGE Approach. Retrieved from https://editorialexpress.com/cgibin/conference/download.cgi?db_name=AMES2014&paper_id=338

Mongardini, J., & Rayner, B. (2009). Grants, remittances, and the equilibrium real exchange rate in Sub- Saharan African Countries. IMF-Working Paper WP/09/75

Mordi, C. N. O., Adebiyi, M. A., Adenuga, A. O., Abeng, M. O., Adeboye, A. A., & Adamgbe, E. T. (2013). Dynamic stochastic general equilibrium model for monetary policy analysis in Nigeria. . Nigeria: Research Department, Central Bank of Nigeria.

Olayungbo, D. O., & Quadri, A. (2019). Remittances, financial development and economic growth in sub-saharan african countries: evidence from a PMG-ARDL approach. Financial Innovation, 5(9), 1–25.

Peiris, S. J., & Saxegaard, M. (2007). An estimated DSGE model for monetary policy analysis in low-income countries (International Monetary Fund Working Paper WP/07/282). Washington, DC: International Monetary Fund.

Rotemberg, J. J. (1982). Sticky prices in the United States. Journal of Political Economy, 90(1), 1187–1211.

Ruiz, I., & Varga-Silva, C. (2010). Monetary policy and international remittances. The Journal of Developing Areas, 43(2), 173–186.

Taylor, J. (1993). Discretion versus policy rule in action. Carnegie Rochester Conference Series on Public Policy, 39(1), 195–214.

Ugwuegbe, S. U., Onyeke, C. E., Nwonye, N. G., & Ibe, C. B. (2018). International migrant remittances and financial sector development: evidence from west african monetary zone (WAMZ). Journal of International Business and Economics, 6(2), 65–72.

Vacaflores, D. E. (2012). Remittances, monetary policy, and partial sterilization. Southern Economic Journal, 79(2), 367–387.

Vacaflores, D. E., Kishan, R. P., & Trinidad, J. (2011). Remittances’ impact on international reserves in latin America. Texas State University Working Paper

Widgren, J., & Martin, P. (2002). Managing migration: the role of economic instruments. International Migration, 40(5), 213–229.

World Bank. (2018). Migration and remittances: recent developments and outlook. Migration and development brief 30. World Bank Group

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Simulation results showing steady state of the variables.

Appendix B: Estimated equations

Rights and permissions

About this article

Cite this article

Apanisile, O.T. Remittances, financial development and the effectiveness of monetary policy transmission mechanism in Nigeria: a DSGE approach (1986–2018). Ind. Econ. Rev. 56, 91–112 (2021). https://doi.org/10.1007/s41775-021-00110-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41775-021-00110-z