Abstract

This study investigates the pollution halo and natural resources blessing phenomenon in Brazil, Russia, India, China, and South Africa (BRICS) economies at the disaggregated level over 1995–2018. The study applies panel techniques useful in endogeneity, autocorrelation, heteroscedasticity, and crossectional dependence. Our study's results partially supported the natural resources curse phenomena and resource blessing for BRICS countries. The empirical results further substantiated that total natural resource rents help decrease CO2 emissions, while the mineral, forest, and oil rents substantially increase CO2 emissions of the BRICS economies. The causality results further indicated that fossil fuels, economic growth, and CO2 emissions have feedback effects. Similarly, mineral resources have bidirectional causal impacts on CO2 emissions and fossil fuel consumption. The unilateral causal linkages are also found to forest resources from all the chosen variables. Finally, a significant causal relationship originates from GDP, fossil fuel to natural resource rents, and the BRICS economies' oil rents. Since the study outcomes are unique, it has reliable policies for the theory and practice of the BRICS economies.

Graphical Abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

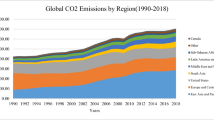

In the recent economic growth race, every country wants to achieve high economic growth aligned with prosperity for its population. The enormous growth process's reflection has a vital share in energy consumption in this race, transmitting CO2 emissions into the natural climate. This process has widely affected the non-renewability of the natural environment. In particular, the emerging countries of BRICS have become more prosperous in the last three decades (Azevedo et al. 2018). The gross domestic product of these countries has risen many folds from 2187 billion US$ in 1985 to 16,266 billion US$ in 2017, with an estimated growth rate of 6.5% annually. This rise in economic activities is not without any cost, specifically in CO2 emissions to the environment (Dong et al. 2017). Brazil, Russian, India, China, and South Africa are up-and-coming emerging economies that constitute BRICS. They do not only have a significant impact on global affairs due to their pace of economic growth, foreign reserves, and large population (Wang et al. 2016; Cheng et al. 2019), but their role in global CO2 emissions is also significant (Dong et al. 2017; Cheng et al. 2019; Khan et al. 2020d). Similarly, including Indonesia, the British petroleum has estimated that the CO2 emissions of BRICS economies reached 14,110 mt (million tons) in 2013 (excluding Indonesia, it was estimated to be 13,768 million tons in 2016), and it contributes to 40% of global CO2 emissions since 2009 (Cheng et al. 2019). This continuous rise in CO2 emissions has shown tremendous threats to the environment's natural resources, specifically the BRICS economies.

Because of natural resources and their sustainable use, it is mandatory to study resource rents, which are the surplus values after costs and returns (Huang et al. 2020). Most countries utilize available natural resources to uplift the countries' economic progress; more formally, the natural resources have improved economic development (Lashitew and Werker 2020). There is another linkage between growth and natural resources, a resource curse that negatively links natural resources and economic growth. This literature relationship has been discussed, which states that resource-rich countries perform less than resource-poor countries (Tiba 2019). This has been justified by the human and institutional qualities of the countries. The contradictory claims have been aimed at natural resources and environmental degradation.

On the one hand, the continuous use of fossil-based “energy consumption” in exploring natural resources have subject to environmental degradation (Hussain et al. 2020); similarly, human activities in mining and deforestation are significant activities to exploit natural habitat, and resource depletion, water, and air pollution (Sarkodie 2018; Ahmed et al. 2020). On the other hand, abundant natural resources discourage fossil-based energy's massive imports (Balsalobre-Lorente et al. 2018). Based on the given arguments, we believe the empirical understanding of “natural resources and environmental sustainability” has not reached any conclusive consensus. For example, the study (Hussain et al. 2020; Ahmed et al. 2020), while some researchers have contradicted these outcomes (Zafar et al. 2019b; Danish 2020).

The current topic is significant in the BRICS economies, based on their continuous and non-stop economic activities and rising extraction of “natural resources” due to mounting demand in manufacturing and other production sectors. BRICS countries are rich in natural resources; for example, Russia constitutes 20% of the global natural resources, accounting for 95.7% of the national wealth of the Russian economy (Danish et al. 2019). Similarly, China, Brazil, and India have good bauxite and iron ore sectors. At the same time, Russia is rich in oil and gas reserves, whereas Brazil has major coal industries; therefore, the BRICS countries are labelled with resource powers (Wilson 2015). The clear outlook of the BRICS economies' resource situation is given in Table 1.

The study contributes to the literature by adding the empirical relationship of natural resource rents (oil rents, mineral rents, forest rents, total natural resource rents) on economic growth and the environment for the natural resource-rich BRICS economies. The study's second objective is to test the impression of fossil fuel and foreign direct investment (FDI) on the economic growth and environmental quality of BRICS economies using estimators that account for heteroscedasticity endogeneity and crossectional dependence, which have been overlooked in past research. The study's ultimate purpose is to offer significant policy proposals to achieve economic growth by not harming the region's environmental quality understudy.

After the introduction, the study continues with a literature review in the second section. The third section explains the methodological framework and the data. In the fourth section, econometric methods are discussed. Similarly, in the fifth part, the empirical results are discussed, and finally, the research concludes with conclusions and recommendations for the future of the BRICS economies.

Literature Review

Based on the current study's objectives, we have distributed the literature into three sub-strands. The first strand of the research sheds light on “natural resources and economic growth literature”. The second sub-strand explains the relevant literature on natural resources and the environment. Finally, the research's third sub-strand explains the pollution haven hypothesis/ halo hypothesis in economic growth in the empirical models.

Economic Growth and Natural Resources

The heterogeneous impact has been seen on economic growth from the natural resources, including mineral rents, forest rents, oil rents, total natural resources rents, and coal rents (Prljić et al. 2018). Similarly, two different relationships have been observed between natural resources and economic growth. For example, Studies exploring natural resources and economic development have a beneficial relationship grouped into the hypothesis of natural resources (Nawaz et al. 2019). This hypothesis is tested using quantile regression on the data from 1970 to 2018 for Asian countries (Haseeb et al. 2021) concluded the effect of natural resources on economic growth is positive, therefore supporting natural resource blessing for Asian countries except for India, where it refuted the natural resources blessing hypothesis. Similarly, (Wei et al., 2020), the AMG framework for G7 countries consisting of “Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States” found that the relationship between finance and natural resource rents concluded a positive relationship, thus supporting the natural resource blessing phenomena. Similarly, the study for several Indonesian districts (Hilmawan and Clark 2019) refuted the resource curse phenomena by accepting that natural resources are a blessing for Indonesia districts' economic growth. On the other hand, studies have shown natural resources, and economic growth has negative linkages due to the natural resource curse phenomenon (Sachs and Warner 1995). Following this hypothesis, in developing countries from 1990 to 2012, (Kim and Lin 2018) witnessed that natural resources have a curse phenomenon with economic growth. Employing the data from 1996 to 2014 of oil abundant in the Middle East and North Africa (MENA) countries using the GMM estimator (Matallah and Matallah 2016) has revealed the resource curse for the relationship between oil rents and economic growth. Along similar lines, (Tiba 2019) making the resources intensity index of various natural resource rents (oil rents, natural gas rents, forest rents, coal, and mineral rents) have found a negative relationship (resource curse) with economic growth in nonlinear form for 21 sub-Saharan countries over 1990–2015. They advised the analyzed countries to improve their institutional structure to improve natural resource rents in the long run. Similarly, many other studies, including (Khan et al. 2020a) for Belt and Road countries (Naseer et al. 2020) for the South Asia countries, (Guan et al. 2020), and (Wang et al. 2019) for China, supported the existence of natural resources curse hypothesis.

Environmental Degradation and Natural Resources

The relationship between natural resources and the environment is essential in empirical literature due to energy-intensive technologies adopted to explore the mineral resources for production and consumption. Therefore, many empirical studies show a negative and significant relationship with environmental quality (Hassan et al. 2019; Bekun et al. 2019; Khan et al. 2020d). Testing the natural resources, human capital, and FDI with ecological footprints in the United States (Zafar et al. 2019b) have found that human capital and natural resources help curtail ecological footprints. Similarly, (Balsalobre-Lorente et al. 2018) for EU-5 countries have found that natural resources significantly reduce CO2 emissions. Likewise, (Joshua and Bekun 2020) have found that natural resources negatively contribute to South Africa's pollutant emissions. For Chinese data, Ahmed et al., (2020) narrated those natural resources increased ecological footprints over 1970–2016 in the “Autoregressive Distributed Lag (ARDL)” framework. A similar study (Danish et al. 2019) using an “Augmented Mean Group estimator (AMG)” estimator found the insignificant impact of natural resources on CO2 emissions. Their results supported a significant positive relationship between the two variables for South Africa significant negative relationship for Russia. Further, using the Fully Modified-OLS (FM-OLS) and Dynamic-OLS (DOLS) for BRICS from 1992to 2016 (Danish 2020) have found that natural resource rents, urbanization, and renewable energy are acting as catalysts to reduce the ecological footprints.

FDI, Growth, and Environment

The impact of FDI on economic growth and the environment has been previously discussed. FDI's role is considered an efficient indicator to utilize natural resources in increasing the economic pace of growth (Huang et al. 2020). Many studies show that FDI inflows significantly contribute to the countries' economic growth (Li and Liu 2005; Gudaro et al. 2012; Bermejo Carbonell and Werner 2018). Similarly, FDI does not induce economic growth in the case of BRICS countries (Pao and Tsai 2011). Testing the data of “Organization for Economic Co-operation and Development” (OECD) countries using the GMM estimator over 1996–2013, Raza et al. (2019) revealed FDI has a positive effect on economic growth. In the case of the environment, FDI has two distinct relationships; the first is the pollution haven hypothesis (PHH), which states that an increase in FDI inflows to host countries further deteriorates the environment due to less stringent environmental policies (Sapkota and Bastola 2017). A recent study (Guzel and Okumus 2020) conducted for ASEAN-5 has supported PHH.

In comparison, another school believes that more FDI inflows tend to raise economic and environmental prosperity due to inflows of green technologies, unlike the host country's existing polluting technologies called the pollution halo hypothesis (Phalo) (Mert and Caglar 2020). A similar hypothesis is supported by Zafar et al. (2019b), testing the FDI, human capital, and natural resources and finding that these decrease the United States' ecological footprints. Along similar lines (Mert and Caglar 2020), using the data over 1974–2018, found supporting results for the "Phalo" hypothesis. The study conducted by Balsalobre-Lorente et al., (2019) for the “MINT countries” found inverted-U phenomena between FDI and environment, which in the initial phase supported both pollution haven after a certain level of investment through FDI have supported the pollution halo hypothesis.

In summary, from the discussion mentioned above, we found the insufficiency of previous literature on the relationship between economy, environment, and natural resources (mineral, oil, forest, and total rent of natural resources). Just a few studies use total natural resource rentals with various outcomes. No studies have used heterogeneous resource rents (mineral, oil, forest and total natural resource rents). However, only two studies (Huang et al. 2020; Tiba 2019) in literature, as per our knowledge, have evaluated the impact on economic growth while ignoring the environment. Differences in the characteristics of countries and natural resource production and management methods may explain different outcomes. The role of natural resources in the resource curse or resource blessing hypothesis has been investigated by some studies. Therefore, the current work explores the long-term relationship between natural resources, FDI, consumption of fossil fuels, economic development, and the environment and introduces minerals, forests, oil, and total resource rents. This can help explain some new potential aspects of sustainable use of resources, economic growth and environmental prosperity. More specifically, the purpose of using different resource rents in an analytical context is to provide accurate and sufficient direction for efficient use of resources and, in the long run, successful and prosperous environmental policies.

Economic Modelling and Data

Economic Modelling

Economic rents obtained from various natural resources (oil rents, mineral rents, total natural resources rents, and forest rents) are considered positive and significant elements of the economic growth process (Huang et al. 2020). Similarly, fossil-based energy use, natural resources, and foreign direct investment are significant economic growth components (Ishida 2011; Asafu-Adjaye et al. 2016; Bermejo Carbonell and Werner 2018; Anser et al. 2020). On the other hand, if all these factors significantly impact economic growth, we cannot deny the relevant impression on BRICS economies' environment. Since various past studies have disclosed that the role of natural resources, FDI, and fossil fuels are crucial to economic growth, their impact on environmental sources is also vital (Demena and Afesorgbor 2020; Gurney et al. 2009; Umar et al. 2020; Balsalobre-Lorente et al. 2018). In line with these arguments, we have established two different equations, each separately for economic growth and “environmental degradation”, similar to Huang et al., (2020) and Zafar et al., (2019a) as below;

From Eqs. 1 & 2, the linear growth and CO2 emission functions can be converted into linear econometric forms as below:

The subscripts \(i and t\) indicate the time (1995–2018), and cross-sections (BRICS), \(\varphi and \beth\) are the regression slope and residual of the regression equations. Where, \({\pi }_{1}\dots {\pi }_{7}\) are the coefficients of the chosen variables which have to be estimated.

Data

The data on five BRICS are sourced from (World Bank 2019) from 1995 to 2018. The selection of the BRICS panel for these specific variables comes from various reasons. The first is the natural resource-rich panel (Wilson 2015); the countries in BRICS are comparatively high emitters of CO2 (Cheng et al. 2019), annexed with experiencing an increased pace of economic growth (Wang et al. 2016; Cheng et al. 2019). CO2 is the “Carbon dioxide emissions metric tons per capita” for the formal empirical analysis. Figure 1 exhibits the plot of CO2 for all five BRICS countries over the specified period. From the graphs, we note that when values turn to darker colors, it shows the intensity of increasing CO2 emissions in the BRICS economies. This is consistent with the graphs for all the variables chosen for the study. Compared to the five BRICS countries, Russia is the highest emitter of CO2, and India is the lowest emitter of CO2 to climate. This trend implies the diversity in CO2 emissions among the five BRICS countries.

GDP of a country is considered the nation's wealth; here, we had taken it at real per capita GDP at 2010 prices, widely recognized economic growth as a significant positive determinant of environmental degradation in various past studies (Khan et al. 2020c; Sarkodie and Strezov 2018; Destek et al. 2018). Figure 1 reveals that India is the poorest (2.829), and Brazil is the wealthiest (4.0789) country based on the share in GDP per capita in logarithmic form. The intensity of the GDP increase can be depicted from the figure that lighter values are smaller, and the darker the colour, the GDP rises exponentially.

FDI indicates nonresident investors' volume inflows in domestic countries. The relevance of FDI to CO2 emissions and GDP has a special relationship. First, FDI inflows accelerate the economic growth while upsurges CO2 emissions postulating the Pollution haven hypothesis (PHH), which implies that the FDI inflows are not environmental friendly and deteriorate the environment (Yildirim 2014; Sapkota and Bastola 2017); while if these investments are centralized on the clean energy industries, tends to rise economic growth, and improves the environment by declining the severity of CO2 emissions into atmosphere which is termed to be pollution halo hypothesis (Phalo) (Balsalobre-Lorente et al. 2019; Mert and Caglar 2020). By knowing the nature and distinct impact of FDI, we adopted it as a controlled variable in the study. Figure 1 indicate that FDI inflows are highest in China and lowest in South Africa (− 0.6393) based on the transition of colour from darker to lighter in a panel of BRICS countries, which indicates the heterogeneity of inflows of FDI into BRICS.

Fossil fuel energy consummation (FF) is used in the study as the share of fossil fuel in total energy consumption (%). Figure 1 shows the time series plot of FF for BRICS energy. Overall, the value of 4.0935 in China implies the highest consumption of fossil-based energy in logarithmic form, while Brazil (3.0244) has the lowest consumption. This shows the disparities of fossil-based fuel consumption alongside BRICS economics, which may have heterogeneous environmental and economic growth impacts.

The pictorial view of natural resource rents is exhibited in Fig. 2; the study employed four heterogeneous resource rents in the model to explore the relevant impact on economic growth and CO2 emissions simultaneously. To this end, we used oil rent, forest rents, mineral rents, and natural resource rent, all as a percentage of GDP. In addition, the sum aggregate of these resources as total natural resources rent (% of GDP) is also taken as the main variable of the study. Based on these indicators, the highest rent is paid for oil in Russia (1.16137), where lowest in South Africa (-2.29222); similarly, mineral rents in South Africa (0.606951) remain highest, as compared to -1.6964 in China. The economic rents paid for forests remain highest in South Africa (0.087558) and lowest in China (-1.08303). Finally, the economic rents for total natural resources were 1.33659 in Russia compared to 0.082684 in Brazil. The differences in the rents paid for various natural resources were heterogeneous across the BRICS economies, thus having a vital significance in studying their economic and environmental impacts to showcase sustainable economic development's reliable policies.

Before the empirical study's formal analysis, the current study variables are converted into logarithmic to reduce measurement errors due to outliers. Similarly, the present study indicators may have several similar issues, simultaneously affecting the policy and planning mechanisms. Therefore, we may face the problems of crossectional dependence in the residuals. Standard OLS can provide inefficient estimates; hence, we developed long-run relationships between the variables using different estimators.

Methodological Framework

To apply the most suitable estimators for the data before estimating the long-run relationship coefficients, some mandatory econometric procedures have to be conducted, such as crossectional dependence (CD), unit root analysis, and cointegrating relationships, to apply the most suitable estimators for the data (Danish 2020).

Crossectional Dependence (CD)

The recent developments in econometrics have raised the problem of crossectional dependence stemming from the spillover effects; for example, a shock, un-observed components, and spatial dependence to one country may spill over to another, which may affect the long-run policy implications (Pesaran 2004; Westerlund and Basher 2008; Danish 2020). Hence not accounting for CD may lead to biased and inconsistent results (Breitung 2005; Dong et al. 2018). Following these arguments, the current study first tests CD in the data (Pesaran 2004). The test's null hypothesis elaborates that cross-sections are independent, while the alternative explains there is dependence in cross-sections.

Unit Root Analysis

The next step in panel data econometrics is to identify the integration order in the variables, so the current study, by keeping in mind the CD, applies (Pesaran 2007) "crossectional Im-Pesaran-Shin (CIPS) and Crossectional augmented Dickey-Fuller (CADF)" in the study on the chosen sample of panel data. Since the “first-generation unit root tests” are not capable of addressing the issues of CD. The null of no unit roots is rejected if the variables are integrated of order one for both the tests.

Cointegration Analysis

In the next step to determine the existence of the cointegration relationship, this study first applies residual-based cointegration introduced by Pedroni (2001) and Kao (1999), and then (Westerlund 2005) cointegration based on the Durbin-Hausman principle. The Westerlund (2005) approach is robust in panel heterogeneity and crossectional dependence in the residuals; similarly, it does not require correcting temporal dependence (Westerlund 2005). To test the null hypothesis of no-cointegration, the following panel form of cointegration is considered;

Westerlund (2005) proposes two variance ratio (VR) test statistics obtained by testing for a unit root in the predicted residuals using the DF regression given in Eq. (5). Those are panel variance ratio statistics (PVR) and group mean–variance ratio (GVR). Panel variance ratio (PVR) statistics and group mean–variance ratio (GVR). These two VR tests are based on Phillips et al. (1990) and Breitung (2002), in which the test statistics are constructed as a variance ratio. One difficulty is intended to test the alternative statement that the panel is co-integrated. The others measure the positive alternative for a fraction of cointegrated individuals. The test extracts the restrictive distributions of the experiments and demonstrates that nuisance parameters are free. The findings of a small Monte Carlo study indicate that even in small samples, the experiments have small size distortions and retain strong power against strongly autoregressive alternatives at the same time.

Long-Run Estimators

Knowing the cointegration relationship in the models infers establishing the long-run relationship between how and to what extent an explanatory variable affects the dependent variable in the long run. In forming a long-run relationship, Pedroni (2000) adjusted fully modified-OLS (FM-OLS) to estimate the coefficient for the long-run relationship in panel data models. They used the following test statistics to gauge the FM-OLS;

where \(m, and b\) are dependent and independent variables, \({\widehat{\Delta }}_{eu}\) is used to denote the estimated value covariance term with the Kernel estimator, which accounts for the serial correlation. Similarly, the N and T in the equation indicate the time and cross-sections taken in the study.

The power of FM-OLS is good, as it can eliminate heteroscedasticity by allowing the Bartlett and Kernel procedures from the data (Kiefer and Vogelsang 2000; Danish 2020). Similarly, the \({\widehat{\Delta }}_{\text{eu}}\) term in FM-OLS corrects for possible effects of endogeneity, and autocorrelation therefore to estimate robust estimates (Funk and Strauss 2000). Although they are unable to address the problem of crossectional dependence, but their superior powers in estimating the cointegrated panels, this estimator got huge attention in econometric studies (Ozturk and Al-Mulali 2015; Danish 2020). In addition to FM-OLS, as a second estimator, the study intends to apply the (Driscoll and Kraay 1998) (DK) regression, as it gives good results in balanced and unbalanced data (Danish 2020). Similarly, it averages the explanatory variables' products with residuals in the HAC weighted approach to generate robust standard errors, which remain free from CD's problem (Danish et al. 2019; Khan et al. 2020b).

Panel Granger Non-causality Test

The ability of long-run estimators is that they can identify the impact of the independent variable on the dependent and shows the sign of a relationship; however, they have no power to determine the short-run causal direction between the variables, which has significant importance in policy formulation (Zafar et al. 2019a). To this end, we apply the (Dumitrescu and Hurlin 2012) test to analyze the causal linkages between the variables. This test works in a vector autoregressive (VAR) framework, which allows for the data's unobserved heterogeneity. Similarly, it has good small sample properties and can control the possible effects of CD (Destek and Sarkodie 2019). Dumitrescu and Hurlin (2012) produce the most consistent and robust causal results (Danish 2020).

Results and Discussions

The foremost thing to consider in modern econometrics is crossectional dependence in an empirical estimation of panel data. To diagnose the possibilities of the crossectional dependence in the residuals, in line with the studies (Dong et al. 2017; Zafar et al. 2020), the variables here are tested with (Pesaran 2004), and the outcomes are portrayed in Table 2. From the given results, the null hypothesis of “crossectional independence” is rejected at a 1% level by accepting the alternative inferring crossectional dependence between the variables chosen in the study.

Due to the failure of first-generation unit root tests, current literature in environmental economics focuses on the second-generation unit root tests, accounting for crossectional dependence. Keeping this property in mind, we tested stationarity variables with (Pesaran 2007) CIPS and CADF in the study, and the results are summarized in Table 3. From the results, we found that variables are non-stationary at levels. In contrast, after converting them to the first difference, the variables turned stationary, implying that they have an integration order of one. These characteristics of variables have provided guidelines to examine the cointegration relationship between the variables.

Cointegration Results

In the next estimation step, we have performed various cointegration tests to examine the equilibrium relationship between the variables by accommodating the crossectional dependence for each model. First, we adopted the Pedroni and Kao cointegration approaches; after knowing the results, we again applied the Westerlund cointegration; both models are given in Tables 4 & 5. In Table 4, Pedroni, Kao, and Westerlund's results supported a cointegration relationship between the variables for the CO2 model. Similarly, the results in Table 5 for the GDP model also explore that the given probability values are smaller than 0.01, which rejects the null hypothesis of non-cointegration at 1% or less, supporting the presence of a cointegration relationship. The distinct nature of the cointegration relationship guides us to determine the long-run relationship between the variables using appropriate long-run estimators in the following steps.

Long-Run Estimates

The study analyzes the “long-run relationship” between the variables using the two most attractive approaches, the FM-OLS and Driscoll & Kraay (DK) estimator. Both the approaches are best for their distinct advantages. The FM-OLS is best in heteroscedasticity, autocorrelation, and endogeneity, while later is reasonable to account for crossectional dependence, adjust the data with missing observations, and handle balanced and unbalanced panel data sets. We have applied these estimators to the current data in line with these advantages, and estimated coefficients are given in Tables 6 & 7.

Table 6 for CO2-model results implies that gross domestic product is the positive determinant of the environment; for example, a one per cent increase in the GDP of the BRICS economies raises the CO2 emissions by 0.1825% in the long run. This relationship between the variables is not surprising; many studies have previously verified the ties for the BRICS economies (Shahbaz et al. 2013; Bakhsh et al. 2017; Cheng et al. 2019). Similarly, the consumption of fossil-based energy is also liable to emit more, which implies that a one per cent rise in fossil-based energy consumption raises 0.6779% emissions in BRICS economies; this relationship is also robust and has been verified by many known scholars for the BRICS economies (Pao and Tsai 2010; Ahmad et al. 2019; Muhammad 2019; Arora and Kaur 2020). While the policies in energy conservation tend to improve the environment in the long run (Nejat et al. 2015). Similarly, the role of FDI in CO2 emissions is negative yet insignificant, which implies that the role of FDI in environmental degradation is turned to be beneficial from the contributor. Similarly, the role of mineral rents, oil rents, and forest rents are continuously contributing to environmental degradation based on CO2 emissions. These results proposed that a 1% rise in oil rents increases CO2 emissions by 0.0366%, and forest rents escalate the CO2 emissions by 0.0652%, respectively. While natural resource rents' role in CO2 emissions is negative, a one per cent increase in “total natural resource rents" tends to reduce the CO2 emissions by 0.0783% respectively, in the long run. The varied nature of resource rents with the environment is because the energy-intensive capital is employed to extract oil and forest resources, increasing CO2 emissions instead of declining. Similarly, the use of energy-intensive capital in total natural resource rents is comparatively lower, which reduces the burden on CO2 emissions compared to other forms of natural resources.

While turning to the growth model results given in Table 7, the value of fossil fuel is positive and strongly significant with both estimators, which indicates that a one per cent increase in fossil fuel consummation improves economic growth in BRICS economies by 0.8317% annually. This correlation between economic growth and fossil fuels is not surprising. At the same time, in most of the previous studies, the researchers have found similar relationships (Ishida 2011), who disclosed that fossil-based fuels are low-entropy natural resources that are very effective for economic prosperity, and any decline in the consumption of fossil energy may hamper the economic growth process. The findings were also supported by Asafu-Adjaye et al. (2016), who said that conserving fossil resources might hinder economic growth. The role of FDI with FM-OLS and DK has non-significant results, indicating that the FDI inflows to these countries on average do not support economic growth. Similarly, mineral rent and oil rents are significant positive determinants of economic growth; this indicates that a one per cent increase in mineral rent and oil rent tends to increase economic growth by 0.0927% and 0.0257%, respectively, with each other estimator. In the BRICS economies, the mineral and oil rents contribute significantly and positively to the economic growth process compared to the other forms of natural resources, which indicates the natural resources blessing hypothesis for minerals and oil resources. Our results endorse the past findings of Prljić et al. (2018), Huang et al. (2020). The forest rents and total natural resources rents are supporting negatively the economic growth of the BRICS economies, which disclosed that a one per cent increase in forest rent and total natural resources rents tend to decrease the economic growth of BRICS economies by − 0.177, and − 0.2411% respectively. The negative relationship between these indicators with economic growth supports the natural resources curse hypothesis (Sachs and Warner 1995). The natural resources curse theory analyzes that most resource-rich countries tend to grow slower than resource-poor countries, primarily due to institutional failures, political instabilities, and most probably corruption (Naseer et al. 2020), and in the countries where institutions are good. Our results are endorsed by Kim and Lin (2018) for the case of developing countries.

Causality Results

Finally, the long-run estimators have no potential to explain the direction of causality flowing; therefore, we have tested the chosen variables for crossectional augmented causality using D-H Granger non-causality test, and the results are summarized in Table 8. The causality results reject the non-causality between GDP and CO2 emissions below the 1% level by supporting the feedback effect, which is endorsed by the previous study (Chaabouni and Saidi 2017). Similarly, the results supported the bidirectional causality between fossil-based energy and CO2 emissions for BRICS economies (Magazzino 2014). Like the given results in long-run estimates, the causality results between FDI and CO2, FDI, and GDP are not significant, making the results for long-run estimators robust. Further, the calculated coefficients of causality imply two-way causal linkages between mineral resources and CO2 emissions. In contrast, unilateral causality was exposed from NR to emissions of CO2 and from CO2 emissions to FOR. The empirical results also supported the feedback effect between fossil fuels and economic growth for BRICS (Asafu-Adjaye et al. 2016). The one-way causal linkage was observed from GDP to MIN, OIL, NR, and FOR. The next bidirectional causal relationship is revealed between fossil fuel and MIN, where the unidirectional causal relationship is detected from FF to OIL, NR, and FOR in the short run. Similarly, only a causal relationship from FDI to FOR is observed for the short run in BRICS economies. The one-way causal relationship has been observed from MIN to FOR, OIL to FOR, and finally from NR to FOR in RBICS. For easy understanding, the pictorial view of the summary of causal linkages is provided in Fig. 3.

Conclusion and Recommendations

The study attempted to heterogenous the role of four kinds of natural resources in the environment and economic growth by accounting for fossil fuel and foreign direct investment from 1995 to 2018 in BRICS countries. To this end, the study incorporated crossectional dependence and panel heterogeneity to reach efficient outcomes. We employed multiple sets of unit roots and long-run estimators to control for CD, heteroscedasticity, autocorrelation, and endogeneity in the data. The results obtained from the CIPS and CADF unit root tests reveal that the variables considered are integrated of the first order, hence negating the null of no unit roots at the level. While the cointegration test results supported the long-run relationship between the variables is constructed, models. The empirical results obtained from the long-run estimators concluded the heterogeneous effects of natural resources on the environmental and economic growth process. For example, oil and forest resources tend to increase environmental degradation, where total natural resource rents diminish. Similarly, the mineral and oil rents improve economic growth by supporting resources as a blessing phenomenon.

In contrast, the total rents and forest resources tend to decline in the BRICS economies' economic growth, which supports the natural resource curse phenomenon in the BRICS economies for the given period. Moreover, FDI in both the environment and growth model has no response, where fossil fuel consumption increases economic growth and environmental degradation. The findings are further confirmed using the crossectional augmented causal test, which supported the feedback hypothesis between economic growth and CO2 emissions, similarly to FF, GDP, and CO2 emissions. Similarly, the feedback hypothesis also supported the FF, CO2 emissions, and MIN and CO2 emissions, which indicates that the extraction of minerals utilizes more fossil fuels that lead to environmental waste generation. Simultaneously, the unidirectional causal relationship was revealed to FOR for the RBICS economies from all the chosen variables. Similarly, natural resources and oil rents are simultaneously caused by GDP and fossil fuels.

For the domain of policy proposals for the BRICS economies, we suggest the policymakers in these countries rethink natural resource consumption; there is still room for technical advancement and human capital investment, which can be reliable in the economic and environmental prosperity of the BRICS. Implementing such programs can prosper their people by not harming natural resources. Since fossil-based energy supports economic growth and contributes to the CO2 emissions of the BRICS, reliable policies in renewable energy are also mandatory to accelerate economic activities by reducing the discharge of environmental waste. The causal relationships revealed that all the variables are simultaneously causing the forest rents; therefore, in the RBICS countries, it is recommended to invest in plantations, thereby reducing the burden of environmental degradation but not decreasing the economic activities. This study has constraints in data availability or natural resource rents; future research could eliminate this barrier. Similar studies would also be extended based on the income group and resource potentials to explore more reliable policy awareness outcomes.

Abbreviations

- AMG:

-

Augmented mean group

- ARDL:

-

Autoregressive distributed lags

- ASEAN:

-

The Association of Southeast Asian Nations

- BRICS:

-

Brazil, Russia, India, China, and South Africa

- CADF:

-

Crossectional augmented ADF

- CD:

-

Crossectional dependent

- CIPS:

-

Crossectional Im, Pesaran, & Shin

- DK:

-

Driscoll & Kraay

- DOLS:

-

Dynamic OLS

- D-H:

-

Dumitrescu & Hurlin test

- EU:

-

European Union

- FDI:

-

Foreign direct investment

- FF:

-

Fossil fuel

- FMOLS:

-

Fully modified OLS

- FOR:

-

Forest rents

- G7:

-

Group of seven countries

- GDP:

-

Gross domestic product

- GMM:

-

Generalized method of moment

- GVR:

-

Group mean variance ratio

- MENA:

-

Middle East & North Africa

- MIN:

-

Minerals rents

- MINT:

-

Mexico, Indonesia, Nigeria, and Turkey

- NR:

-

Total natural resources rents

- OECD:

-

Organization of Economic Cooperation and Organization

- OIL:

-

Oil rents

- PHH:

-

Pollution haven hypothesis

- PVR:

-

Panel variance ratio

- VAR:

-

Vector autoregressive

- VR:

-

Variance ratio

References

Ahmad N, Du L, Tian XL, Wang J (2019) Chinese growth and dilemmas: modelling energy consumption, CO2 emissions and growth in China. Qual Quant 53:315–338. https://doi.org/10.1007/S11135-018-0755-0/TABLES/8

Ahmed Z, Asghar MM, Malik MN, Nawaz K (2020) Moving towards a sustainable environment: the dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Resour Policy. https://doi.org/10.1016/j.resourpol.2020.101677

Anser MK, Yousaf Z, Nassani AA et al (2020) Evaluating ‘natural resource curse’ hypothesis under sustainable information technologies: a case study of Saudi Arabia. Resour Policy 68:101699. https://doi.org/10.1016/j.resourpol.2020.101699

Arora R, Kaur DB (2020) Fossil fuel consumption, economic growth and CO2 emissions. Causality evinced from the BRICS world. Theor Appl Econ XXII 2020:131–142

Asafu-Adjaye J, Byrne D, Alvarez M (2016) Economic growth, fossil fuel and non-fossil consumption: a Pooled Mean Group analysis using proxies for capital. Energy Econ 60:345–356. https://doi.org/10.1016/j.eneco.2016.10.016

Azevedo VG, Sartori S, Campos LMS (2018) CO2 emissions: a quantitative analysis among the BRICS nations. Renew Sustain Energy Rev 81:107–115. https://doi.org/10.1016/j.rser.2017.07.027

Bakhsh K, Rose S, Ali MF et al (2017) Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: new evidences from 3SLS. J Environ Manage 196:627–632. https://doi.org/10.1016/J.JENVMAN.2017.03.029

Balsalobre-Lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 113:356–367. https://doi.org/10.1016/j.enpol.2017.10.050

Balsalobre-Lorente D, Gokmenoglu KK, Taspinar N, Cantos-Cantos JM (2019) An approach to the pollution haven and pollution halo hypotheses in MINT countries. Environ Sci Pollut Res 26:23010–23026. https://doi.org/10.1007/s11356-019-05446-x

Bekun FV, Alola AA, Sarkodie SA (2019) Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029. https://doi.org/10.1016/j.scitotenv.2018.12.104

Bermejo Carbonell J, Werner RA (2018) Does foreign direct investment generate economic growth? A new empirical approach applied to Spain. Econ Geogr 94:425–456. https://doi.org/10.1080/00130095.2017.1393312

Breitung J (2002) Nonparametric tests for unit roots and cointegration. J Econ 108:343–363. https://doi.org/10.1016/S0304-4076(01)00139-7

Breitung J (2005) A parametric approach to the estimation of cointegration vectors in panel data. Econ Rev 24:151–173. https://doi.org/10.1081/ETC-200067895

Chaabouni S, Saidi K (2017) The dynamic links between carbon dioxide (CO2) emissions, health spending and GDP growth: a case study for 51 countries. Environ Res 158:137–144. https://doi.org/10.1016/j.envres.2017.05.041

Cheng C, Ren X, Wang Z, Yan C (2019) Heterogeneous impacts of renewable energy and environmental patents on CO2 emission: evidence from the BRIICS. Sci Total Environ 668:1328–1338. https://doi.org/10.1016/j.scitotenv.2019.02.063

Danish UR (2020) The pathway toward pollution mitigation: does institutional quality make a difference? Bus Strateg Environ 29:3571–3583. https://doi.org/10.1002/bse.2597

Danish UR, Khan SUD (2020) Determinants of the ecological footprint: role of renewable energy, natural resources, and urbanization. Sustain Cities Soc. https://doi.org/10.1016/j.scs.2019.101996

Danish BMA, Wang B (2019) Analyzing the role of governance in CO2 emissions mitigation: the BRICS experience. Struct Chang Econ Dyn 51:119–125. https://doi.org/10.1016/j.strueco.2019.08.007

Danish BMA, Mahmood N, Zhang JW (2019) Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Sci Total Environ 678:632–638. https://doi.org/10.1016/J.SCITOTENV.2019.05.028

Demena BA, Afesorgbor SK (2020) The effect of FDI on environmental emissions: evidence from a meta-analysis. Energy Policy. https://doi.org/10.1016/j.enpol.2019.111192

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489. https://doi.org/10.1016/J.SCITOTENV.2018.10.017

Destek MA, Ulucak R, Dogan E (2018) Analyzing the environmental Kuznets curve for the EU countries: the role of ecological footprint. Environ Sci Pollut Res 25:29387–29396. https://doi.org/10.1007/s11356-018-2911-4

Dong K, Sun R, Hochman G (2017) Do natural gas and renewable energy consumption lead to less CO2 emission? Empirical evidence from a panel of BRICS countries. Energy 141:1466–1478. https://doi.org/10.1016/j.energy.2017.11.092

Dong K, Sun R, Li H, Liao H (2018) Does natural gas consumption mitigate CO2 emissions: testing the environmental Kuznets curve hypothesis for 14 Asia-Pacific countries. Renew Sustain Energy Rev 94:419–429. https://doi.org/10.1016/j.rser.2018.06.026

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent panel data. Rev Econ Stat 80:549–559. https://doi.org/10.1162/003465398557825

Dumitrescu E-II, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29:1450–1460. https://doi.org/10.1016/J.ECONMOD.2012.02.014

Funk M, Strauss J (2000) The long-run relationship between productivity and capital. Econ Lett 69:213–217. https://doi.org/10.1016/s0165-1765(00)00281-0

Guan J, Kirikkaleli D, Bibi A, Zhang W (2020) Natural resources rents nexus with financial development in the presence of globalization: Is the “resource curse” exist or myth? Resour Policy. https://doi.org/10.1016/j.resourpol.2020.101641

Gudaro AM, Chhapra IU, Sheikh SA (2012) Impact of foreign direct investment on economic growth: a case study of Pakistan. MPRA Pap

Gurney KR, Mendoza DL, Zhou Y et al (2009) High resolution fossil fuel combustion CO2 emission fluxes for the United States. Environ Sci Technol 43:5535–5541. https://doi.org/10.1021/es900806c

Guzel AE, Okumus İ (2020) Revisiting the pollution haven hypothesis in ASEAN-5 countries: new insights from panel data analysis. Environ Sci Pollut Res 27:18157–18167. https://doi.org/10.1007/s11356-020-08317-y

Haseeb M, Kot S, Iqbal Hussain H, Kamarudin F (2021) The natural resources curse-economic growth hypotheses: quantile-on-quantile evidence from top Asian economies. J Clean Prod. https://doi.org/10.1016/j.jclepro.2020.123596

Hassan ST, Xia E, Khan NH, Shah SMA (2019) Economic growth, natural resources, and ecological footprints: evidence from Pakistan. Environ Sci Pollut Res 26:2929–2938. https://doi.org/10.1007/s11356-018-3803-3

Hilmawan R, Clark J (2019) An investigation of the resource curse in Indonesia. Resour Policy. https://doi.org/10.1016/j.resourpol.2019.101483

Huang Y, Raza SMF, Hanif I et al (2020) The role of forest resources, mineral resources, and oil extraction in economic progress of developing Asian economies. Resour Policy. https://doi.org/10.1016/j.resourpol.2020.101878

Hussain J, Khan A, Zhou K (2020) The impact of natural resource depletion on energy use and CO2 emission in Belt & Road Initiative countries: a cross-country analysis. Energy. https://doi.org/10.1016/J.ENERGY.2020.117409

Ishida H (2011) Causal relationship between fossil fuel consumption and economic growth in Japan: a multivariate approach. Discuss Pap Econ Bus

Joshua U, Bekun FV (2020) The path to achieving environmental sustainability in South Africa: the role of coal consumption, economic expansion, pollutant emission, and total natural resources rent. Environ Sci Pollut Res 27:9435–9443. https://doi.org/10.1007/s11356-019-07546-0

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econom 90:1–44. https://doi.org/10.1016/S0304-4076(98)00023-2

Khan A, Chenggang Y, Hussain J et al (2020a) Natural resources, tourism development, and energy-growth-CO2 emission nexus: a simultaneity modeling analysis of BRI countries. Resour Policy. https://doi.org/10.1016/j.resourpol.2020.101751

Khan A, Chenggang Y, Khan G, Muhammad F (2020b) The dilemma of natural disasters: impact on economy, fiscal position, and foreign direct investment alongside Belt and Road Initiative countries. Sci Total Environ. https://doi.org/10.1016/j.scitotenv.2020.140578

Khan A, Chenggang Y, Yi WX et al (2020) Examining the pollution haven, and environmental kuznets hypothesis for ecological footprints: an econometric analysis of China, India, and Pakistan. J Asia Pac Econ 26:462–482. https://doi.org/10.1080/13547860.2020.1761739

Khan A, Muhammad F, Chenggang Y et al (2020d) The impression of technological innovations and natural resources in energy-growth-environment nexus: A new look into BRICS economies. Sci Total Environ. https://doi.org/10.1016/J.SCITOTENV.2020.138265

Kiefer NM, Vogelsang TJ (2000) Heteroskedasticity-autocorrelation robust standard errors using the Bartlett kernel without truncation. Econometrica 70:2093–2095. https://doi.org/10.2307/3082033

Kim DH, Lin SC (2018) The resource curse hypothesis: dynamic heterogeneous approach. Emerg Mark Financ Trade 54:2698–2717. https://doi.org/10.1080/1540496X.2017.1372281

Lashitew AA, Werker E (2020) Do natural resources help or hinder development? Resource abundance, dependence, and the role of institutions. Resour Energy Econ. https://doi.org/10.1016/j.reseneeco.2020.101183

Li X, Liu X (2005) Foreign direct investment and economic growth: an increasingly endogenous relationship. World Dev 33:393–407. https://doi.org/10.1016/j.worlddev.2004.11.001

Magazzino C (2014) The relationship between CO2 emissions, energy consumption and economic growth in Italy. Int J Sustain Energy 35:844–857. https://doi.org/10.1080/14786451.2014.953160

Matallah S, Matallah A (2016) Oil rents and economic growth in oil-abundant MENA countries: governance is the trump card to escape the resource trap. Top Middle East andNorth African Econ 18

Mert M, Caglar AE (2020) Testing pollution haven and pollution halo hypotheses for Turkey: a new perspective. Environ Sci Pollut Res 27:32933–32943. https://doi.org/10.1007/s11356-020-09469-7

Muhammad B (2019) Energy consumption, CO2 emissions and economic growth in developed, emerging and Middle East and North Africa countries. Energy 179:232–245. https://doi.org/10.1016/J.ENERGY.2019.03.126

Naseer A, Su CW, Mirza N, Li JP (2020) Double jeopardy of resources and investment curse in South Asia: Is technology the only way out? Resour Policy. https://doi.org/10.1016/j.resourpol.2020.101702

Nawaz K, Lahiani A, Roubaud D (2019) Natural resources as blessings and finance-growth nexus: a bootstrap ARDL approach in an emerging economy. Resour Policy 60:277–287. https://doi.org/10.1016/j.resourpol.2019.01.007

Nejat P, Jomehzadeh F, Taheri MM et al (2015) A global review of energy consumption, CO2 emissions and policy in the residential sector (with an overview of the top ten CO2 emitting countries). Renew Sustain Energy Rev 43:843–862. https://doi.org/10.1016/J.RSER.2014.11.066

Ozturk I, Al-Mulali U (2015) Natural gas consumption and economic growth nexus: panel data analysis for GCC countries. Renew Sustain Energy Rev 51:998–1003

Pao HT, Tsai CM (2010) CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 38:7850–7860. https://doi.org/10.1016/j.enpol.2010.08.045

Pao HT, Tsai CM (2011) Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 36:685–693. https://doi.org/10.1016/j.energy.2010.09.041

Pedroni P (2000) Fully modified OLS for heterogeneous cointegrated panels. Department of Economics, Williams College

Pedroni P (2001) Purchasing power parity tests in cointegrated panels. Rev Econ Stat 83:727–731

Pesaran M (2004) General diagnostic tests for cross section dependence in panels. University of Cambridge, Faculty of Economics

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econom 22:265–312. https://doi.org/10.1002/jae.951

Phillips PCB, Ouliaris S, Phillips P, Ouliaris S (1990) Asymptotic properties of residual based tests for cointegration. Econometrica 58:165–193

Prljić S, Nikitović Z, Stojanović AG et al (2018) Management of business economic growth as function of resource rents. Phys A Stat Appl 491:325–328. https://doi.org/10.1016/j.physa.2017.09.087

Raza SA, Shah N, Arif I (2019) Relationship between FDI and economic growth in the presence of good governance system: evidence from OECD countries. Glob Bus Rev. https://doi.org/10.1177/0972150919833484

Sachs J, Warner A (1995) natural resource abundance and economic growth. Cambridge

Sapkota P, Bastola U (2017) Foreign direct investment, income, and environmental pollution in developing countries: panel data analysis of Latin America. Energy Econ 64:206–212. https://doi.org/10.1016/j.eneco.2017.04.001

Sarkodie SA (2018) The invisible hand and EKC hypothesis: what are the drivers of environmental degradation and pollution in Africa? Environ Sci Pollut Res 25:21993–22022. https://doi.org/10.1007/s11356-018-2347-x

Sarkodie SA, Strezov V (2018) Empirical study of the environmental Kuznets curve and environmental sustainability curve hypothesis for Australia, China, Ghana and USA. J Clean Prod 201:98–110. https://doi.org/10.1016/j.jclepro.2018.08.039

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sustain Energy Rev 25:109–121. https://doi.org/10.1016/J.RSER.2013.04.009

Tiba S (2019) Modeling the nexus between resources abundance and economic growth: an overview from the PSTR model. Resour Policy. https://doi.org/10.1016/j.resourpol.2019.101503

Umar M, Ji X, Kirikkaleli D et al (2020) Environmental cost of natural resources utilization and economic growth: can China shift some burden through globalization for sustainable development? Sustain Dev 28:1678–1688. https://doi.org/10.1002/sd.2116

Wang Y, Li L, Kubota J et al (2016) Does urbanization lead to more carbon emission? Evidence from a panel of BRICS countries. Appl Energy 168:375–380. https://doi.org/10.1016/j.apenergy.2016.01.105

Wang R, Zameer H, Feng Y et al (2019) Revisiting Chinese resource curse hypothesis based on spatial spillover effect: a fresh evidence. Resour Policy. https://doi.org/10.1016/j.resourpol.2019.101521

Westerlund J (2005) New simple tests for panel cointegration. Econ Rev 24:297–316. https://doi.org/10.1080/07474930500243019

Westerlund J, Basher SA (2008) Testing for convergence in carbon dioxide emissions using a century of panel data. Environ Resour Econ 40:109–120. https://doi.org/10.1007/s10640-007-9143-2

Wilson JD (2015) Resource powers? Minerals, energy and the rise of the BRICS. Third World Q 36:223–239. https://doi.org/10.1080/01436597.2015.1013318

World Bank (2019) World development indicators (WDI) | Data Catalog. In: World Dev. Indic.

Yildirim E (2014) Energy use, CO2 emission and foreign direct investment: Is there any inconsistence between causal relations? Front Energy 8:269–278. https://doi.org/10.1007/s11708-014-0326-6

Zafar MW, Shahbaz M, Hou F, Sinha A (2019a) From nonrenewable to renewable energy and its impact on economic growth: the role of research & development expenditures in Asia-Pacific Economic Cooperation countries. J Clean Prod 212:1166–1178. https://doi.org/10.1016/j.jclepro.2018.12.081

Zafar MW, Zaidi SAH, Khan NR et al (2019b) The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: the case of the United States. Resour Policy. https://doi.org/10.1016/j.resourpol.2019.101428

Zafar MW, Saeed A, Zaidi SAH, Waheed A (2020) The linkages among natural resources, renewable energy consumption, and environmental quality: a path toward sustainable development. Sustain Dev 21:51. https://doi.org/10.1002/sd.2151

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors have participated in (a) conception and design, or analysis and interpretation of the data; (b) drafting the article or revising it critically for important intellectual content; and (c) approval of the final version. This manuscript has not been submitted to, nor is under review at, another journal or other publishing venue. The authors have no affiliation with any organization with a direct or indirect financial interest in the subject matter discussed in the manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sicen, L., Khan, A. & Kakar, A. The Role of Disaggregated Level Natural Resources Rents in Economic Growth and Environmental Degradation of BRICS Economies. Biophys Econ Sust 7, 7 (2022). https://doi.org/10.1007/s41247-022-00102-4

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s41247-022-00102-4