Abstract

In this study, we attempt to investigate the relationship between electricity consumption, foreign direct investment (FDI) and economic progress in Pakistan during the period from 1997 to 2017. We applied the unit root tests to cointegration approach with the vector error correction model (VECM) approach. We also authenticated the robustness of the outcomes with the help of the regression methods. The main findings indicated that variables are cointegrated in the long-run and the VECM approach verified long-run causal links among the variables. The short-run causality is running from electricity consumption and economic development to FDI. The results remained uniform under the fully modified ordinary least squares (FMOLS), dynamic ordinary least squares (DOLS), and the autoregressive distributed lag (ARDL) estimations. Correspondingly, these three methods ratified that there is a significant long-run linkage between electricity consumption and the economic development of Pakistan. Additionally, the diagnostic assessments fixed that results are free from correlations and models are stable. Thus, based on these results, electricity generation and consumption, as well as FDI, is crucial for the economic progress of Pakistan. The priority should be given to promote the optimum use of available resources to generate energy, and FDI in the energy sector should be attracted through various incentives to support the economic advancement of Pakistan. Renewable energy resources are recyclable springs that can cut the intensity of carbon emissions and encourage to the promising magnitude of FDI and also certify sustainable and economic progression of Pakistan.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

During the past three decades, the plentiful empirical research studies fixated on investigating the interrelationship among electricity use and economic progress for both developing and developed countries. The researchers familiarized the time variations and variables of interest to comprehend the causal association among electricity use and economic development. In the process, Ferguson (2000) matured that there is a strong positive interconnection among electricity use and economic progression in more than 100 countries; however, such dealings of interrelationships cannot term as causality because causality can take the direction either from electricity use to the gross domestic product or gross domestic product to electricity use. Even if causality can run in two directions, the other option of causality is not causality, and evidence on either direction of causality is essential for policy impact and its implications. Although some studies reveal a one-way causal relationship from economic progression to electricity use, the one-way causal relationship from electricity use to economic progression is a collective experience found in several Asian emerging countries (Ho and Siu, 2007).

We reviewed the empirical research works pertinent to Pakistan and examine electricity use in association to the variables: renewable energy use, financial development, trade openness, energy consumption, oil consumption, natural gas consumption, nuclear energy consumption, carbon emissions, agricultural energy consumption, access to electricity, population, and economic development (Alam and Butt, 2002; Aqeel and Butt, 2001; Chandio et al. 2019a; Hassan et al., 2018; Luqman et al., 2019; Mirza and Kanwal, 2017; Rehman et al., 2018; Rehman et al., 2019; Samiullah, 2014; Shahbaz and Feridun, 2012; Shahbaz et al., 2016; Shahzad et al., 2017; Siddique et al., 2016; Waleed et al., 2018; Wang et al., 2018). The above literature survey helps us to identify the variables not empirically tested concerning Pakistan. Therefore, this present empirical study differs from previous studies, and the study empirically inspects the electricity use, foreign direct investment (FDI) in the energy sector, and gross national income (GNI) nexus of Pakistan instead of gross domestic product (GDP).

Before leading to empirical outcomes, we developed a connection between foreign direct investment and energy production and use. During the past a few decades, globalization has facilitated to promote stable economic integration among nations. Emerging countries have changed their economic policies and removed barriers to foreign trade and investments. The FDI considered a very much important factor for developing economies like Pakistan. The FDI provides capital to generate positive external factors in the country, such as job creation, technology transfer, management skills, productivity gains, research and development, and new production methods. It also encourages to domestic investors to invest more in the country (Latief and Lefen, 2018). Despite many political and economic challenges, Pakistan is still being watched by foreign investors around the world. Pakistan receives foreign direct investments (FDI) from various developed and developing countries around the world including the USA, China, Saudi Arabia, the UK, Japan, and Switzerland. The target sectors for foreign direct investments are energy sector, financial operations, trade, construction, transport, textiles, agriculture, and trade, respectively. Pakistan’s electricity and energy sectors are one of the main sectors of access to more foreign direct investments. Currently, a new power policy provided more incentives to encourage domestic as well foreign investors to invest much more in the electricity and energy sectors (GOP, 2018). Pakistan is emerging in most of Asian countries; however, the infrastructure of the energy sector is undeveloped, and it is insufficient and poorly managed. Electricity is extensively demanded by both rural and urban populations and Pakistan uses forms of energy in most of the economic-related activities. In Asian economies, Pakistan is the least per capita electricity–using country (see Fig. 1).

Electricity consumption (kWh per capita) of Asian countries. Source: World Development Indicators (2014)

The electricity sector consists of two vertically integrated public sector utilities: the Water and Power Development Authority (WAPDA) and the Karachi Electric Supply Corporation (now it is called K-Electric) in Pakistan. More than 20 IPPs (Independent Power Producers) contribute significant electricity generation of 8949 MW, and Pakistan Atomic Energy Commission (PAEC) generates 1117 MW from nuclear power in the country, whereas solar and wind energy contribute 356 MW (NEPRA, 2015). According to the report of NEPRA (2015), the installed capacities between these two public companies like WAPDA and KESC was 12,903 MW and 2359 MW. In current years, Pakistan’s electricity generation has fallen by 50% due to its over-reliance on hydropower. In 2008, the electricity supply was lower than the population’s demand, which was 15% in Pakistan (ET, 2008). Pakistan generates electricity from hydropower, thermal, and nuclear power plants. According to the energy report (GOP, 2017), it revealed that electricity generation by hydropower is 30%, the thermal system produces 64%, and the nuclear power plants contribute 6%.

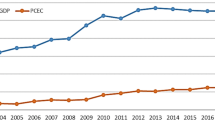

Regarding consuming pattern of electricity in the country, the share of households in electricity used comprises 50%, which is higher among other economic sectors for instance industry 26%, agriculture 10%, and commercial a share of 8% only (GOP, 2017). To meet the energy needs, Pakistan imported 29.4% of natural gas, 37.8% of oil, 29.4% of hydropower, and 0.26% of its natural gas, respectively. The share of coal and nuclear energy to its energy supply is presently quite limited to 0.1% and 3.02% (GOP, 2013; OSEC, 2010). During the past decade, the demand for electricity has gradually increased in the country. The leading cause behind this is the growth of economic-related activities with variations in trade and investments policies (Shahbaz and Feridun, 2012). Over the past few years, the installed capacity (MW) and generation (GW/h) of electricity are increasing, but still, the country is struggling to meet the demand for electricity. The trend of installed capacity (MW) and generation (GW/h) of electricity in Pakistan is dispatched in Fig. 2.

The trend of installed capacity (MW) and generation (GW/h) of electricity in Pakistan. Source: Government of Pakistan (GOP, 2017)

In the presence of the new power policy of Pakistan, we design this study to ascertain the long-run association among electricity use, FDI in the energy sector, and per capita GNI. Furthermore, we investigate the presence and direction of causal interaction among electricity use, FDI in the energy sector, and GNI to make effective policy decisions concerning electricity use and foreign direct investment in the energy sector. The study uses time series data from 1997 to 2017 which were gathered from the World Development Indicators (WDI 2017) and the State Bank of Pakistan (SBP 2017). We apply different techniques such as the Augmented Dickey-Fuller (ADF), Phillips and Perron (P-P), and the Kwiatkowski, Phillips, Schmidt, and Shin (KPSS) unit root tests to check the stationarity. Furthermore, we employ the VECM model to evaluate the interrelationship between amid study variables. To check the robustness of the outcomes, we use impulse response functions (IRF) and variance decomposition method (VDM).

Literature of review

The existing literature survey revealed that several studies conducted on electricity use, economic development, foreign direct investment, financial development, exports, imports, and environmental degradation and CO2 emissions in related issues, which can be divided into different categories with regard to the dissemination of studies discussed worldwide, economical energy conducted both at global and regional level, and by level of income, consumption, and investment (Almulali and Sheauting, 2014; Apergis and Payne, 2009; Khan et al., 2014; Nahman and Antrobus, 2005; Rauf et al., 2018; Udi et al., 2020; Yildirim et al., 2014). Electricity has played a vital role in human life’s evolution, and it has helped to advance and develop primary needs: transport, communication, and manufacturing (Hossain and Saeki, 2012; Jbir and Charfeddine 2012). Similarly, Ozturk (2010) and Payne (2010) carried out a study related to energy used and economic progress issues; the result based on the review exhibits that consumption of electricity has positive effects on economic progress through highly stylized facts. Furthermore, after the NAFTA agreement in between 1980 and 1991, Kaufmann et al. (1993) have explored the impact of economic progression and trade on the ecological condition of some countries like as the USA, Canada, and Mexico; empirical findings reveal that atmospheric condition was being to mitigate with such an increase in economic expansion and trade, while pollution was decreasing with such an increase in per capita income.

Furthermore, Giannias et al. (2003) quantify the environmental impacts of per capita income on European countries that have observed that low per capita income countries have low environmental protection levels, while higher per capita income countries have favorable environmental conditions. As like, in fifty-eight provinces of Turkey from 1968 to 2003, Akbostanci et al. (2009) empirically examined the interactions among per capita income and climate change; findings display that there was a long-term link between pollution and per capita income, while air emissions increase with an increase in income. Moreover, Lantz and Feng (2006) evaluated the per capita income, population, and technology impacts of gross domestic product (GDP) on Canadian CO2 emissions from 1970 to 2000; they observed that GDP per capita has a negligible impact on CO2 emission levels; however, there was a reversed U-shaped connection between population and CO2 emissions, so there was also another U-shaped connection between technology and CO2 emissions. Comparatively, Mozumder and Marathe (2007) clarify the interrelationship between use of electricity and economic progress for Bangladesh using the Granger causality approach stipulated in the vector encryption model. The results suggest that, without reverse causality, there was unidirectional causality from economic progress to use of electricity.

Some researchers (Jobert and Karanfil, 2007; Payne, 2010) demonstrate that there was no causal connection among energy use and economic development, which is consistent with the “neutrality hypothesis.” Within this case, energy use and growth progress will not affect each other. Some studies have explained the energy use to the foreign direct investment (Khan et al., 2014; Komal and Abbas, 2015; Pao and Tsai, 2011; Shahbaz et al., 2013) which studied the unidirectional link between FDI and energy use, whereas, in a sample of G-20 emerging countries, Mielnik and Goldemberg (2002) analyzed the positive link between the FDI and energy use nexus. Correspondingly, in 22 developing economies, Sadorsky (2010) also presents evidence of the numerically positive link between the FDI and energy use. Anwar and Nguyen (2010) investigated the FDI and energy consumption link for the panel of 61 provinces of Vietnam over the time of 1996–2005. The results suggest that in all provinces of Vietnam, there was bidirectional causality between FDI and energy consumption.

Moreover, Khan et al. (2014) estimated that gross domestic product (GDP) and the FDI also have a positive influence on energy consumption in low-income countries. For Pakistan, few empirical studies have inspected the nexus between energy use and economic development (Aqeel and Butt, 2001; Hye and Riaz, 2008; Khan and Qayyum, 2007; Shahbaz and Feridun, 2012; Siddiqui, 2004).

Aqeel and Butt (2001) assessed the causal interrelationship among energy used and economic progress in Pakistan for the period 1995–1996 (electricity, gas, coal, etc.); empirical outcomes revealed that there was no causality between economic progress and gas consumption. For instance, studies emphasize by (Islam et al., 2013; Shahbaz and Lean, 2012) that the FDI has indirect influences on energy consumption through economic progress which effect can be either positive or negative depending on whether economic progress is useful. Similarly, financial sector growth enhances funding accessible for investment projects resulting in industrial growth, leading to the development of manufacturing practices. As a result, Khalil and Inam (2006) examined deep-term and short-term interaction in Pakistan from 1972 to 2002 as among international trade and environmental sustainability; they observed that there is a deep-term relationship that exists between international trade and environmental sustainability. The FDI inflows play a pivotal role in economic development of all economies, especially developing economies (Wang and Wang, 2015). The past several studies have examined the determinants of the FDI inflows in emerging economies. They have stated some central drivers of the FDI inflows, for instance, market size, the exchange rate, tax policies, financial development, trade openness, capital structure, natural resources, labor costs, unemployment, and the inflation rate (Amal, 2016; Bekhet and Alsmadi, 2015; Boateng et al., 2015; Jadhav, 2012; Rashid et al., 2016; Tang et al., 2014). Nevertheless, their outcomes on the association between the FDI and its determinants are not consistent.

Okafor et al. (2015) empirically attempt to inspect the FDI inflows to sub-Saharan African countries; results show that trade openness, market size, capital returns, and human capital have positive effect on the FDI; on the other hand, natural resources, inflation, and fuel costs have negative impact on the FDI. Likewise, as studied by Boateng et al. (2015), they reported that trade openness exchange rate and economic progression promote the FDI while money supply, unemployment, interest rate, and inflation reduce the FDI in Norway. Also, exploration has been conducted on a comparative analysis of Malaysia and Kenya by Kinuthia and Murshed (2015) who explored that inflation has positive effect on FDI only in Malaysia. Currently, in energy sector, Pakistan has been facing the central issue of energy unavailability due to rising demand for economic activities and low supply of energy (Aman et al., 2013; Baloch et al., 2016; Khalil and Zaidi, 2014).

Mahmud (2000) reported that energy shortages increase costs of production but does not affect the investments. Tang (2009) re-investigated the use of electricity function for Malaysia. He employed a study time frame from 1970 to 2005. The variables for the study were the use of electricity, income, FDI, population, and economic progression. He used the ARDL bounds test to explore the long-term interactions among variables. The study found a positive relationship between use of electricity and FDI and the study concluded that foreign investors prefer countries with a large power generation sector. A comparative study has been conducted for India and Pakistan by Alam (2013) who investigated the nexus between electric power consumption, FDI, and economic development. The study utilized a time frame from 1975 to 2008. The variables for the study were consumption of electric power, FDI, and economic progression. He applied a Granger causality test for estimating both the short- and long-run associations between construed variables of the study. The outcomes of the study revealed that the consumption of electric power leads to economic development and FDI. In Pakistan, several empirical studies have inspected the determinants of FDI (Aqeel and Nishat, 2004; Hakro and Ghumro, 2011; Shah et al., 2016). Hence, our study is different from previous studies. The present study examines the nexus between electricity consumption, FDI inflows in the energy sector, and per capita income in Pakistan from 1997 to 2017.

Data and methodology

This empirical study uses the annual time series data on electricity consumption in (GWh), FDI in the energy sector in (current USD millions), and per capita GNI in (constant 2010 US$) covering the time of 1997 to 2017. The detail of data source is reported in Table 1. Table 2 demonstrates the descriptive statistics and correlations of the studied variables. Table 2 displays a positive and significant correlation between electricity use, FDI in the energy sector, and per capita GNI. The trend of per capita GNI, electricity use, and FDI in the energy sector of Pakistan is depicted in Fig. 3.

Firstly, to check the stationarity of the time series data, we employed the ADF, the PP, and the KPSS unit root tests including with intercept and intercept with the trend. The equation of the ADF unit root test was formulated as follows:

where zt stands for the time series, e.g., GNI, ELE, and FDI; ∆ represents the first difference; and εt represents the error term. The general equation concerning to ELE, FDI, and GNI is expressed as follows:

In this paper, we used a multivariate framework to empirically examine the linkages among electricity consumption, FDI in the energy sector, and per capita GNI. Once the studied variables found stationarity, then the next step is to inspect whether the time series data are cointegrated. In order to check the long-term cointegration among the series, we applied the Johansen and Juselius cointegration (1990) technique. This approach provides two different likelihood ratio tests, such as trace statistic and maximum eigenvalue to determine the number of cointegration equations. We used both tests for the confirmation of long-term cointegration.

Empirical results and discussions

Unit root tests

In the “Empirical results and discussions” section, the present study reports the estimated outcomes from different methodologies. Conversion of non-stationary time series data into a stationary form is essential to avoid the problem of imitation assessment, and the estimated outcomes of various unit root tests are reported in Table 3. This study used the ADF and the PP unit root tests with intercept as well as with intercept and trend, and the outcomes of both unit root tests demonstrate that per capita GNI, electricity used, and FDI in the energy sector are non-stationary at their levels, but after taking first difference the series became stationary or are integrated at I (1). Further results of the KPSS and the DF-GLS tests support the results of the ADF and the PP unit root tests.

Johansen cointegration testing

Before using the VECM-based Granger causality approach, we performed the Johansen cointegration testing to investigate the long-term cointegration among the study variables of the model. The results of the Johansen cointegration testing are exhibited in Table 4. Based on both tests trace and maximum eigenvalue, the hypothesis of “none” cointegrating equation is rejected at the 5%. Therefore, these results suggest that electricity consumption, FDI in the energy sector, and per capita GNI have at least one cointegration equation, which demonstrates the existence of long-term cointegration among the study variables.

Results of the error correction model and Granger causality test

The long-run connection among the variables validates the use of the VECM-based causality test. The results of the causal links among the variables are exhibited in Table 5. The error correction terms of three variables are negative significant, indicating that variables share long-run causality. The short-run causality outcomes show that values of FDI and electricity used are insignificant and indicate no short-run association from both variables to per capita income. However, there is a significant short-run connection running from per capita income and electricity used to FDI. Finally, the causal link running from FDI and per capita income to electricity used is not significant. The findings are similar to the outcomes of Mozumder and Marathe (2007), suggesting that without reverse causality, there was unidirectional causality from economic progress to electricity used. Moreover, the nexus between FDI, electricity used, and economic progression also in line with the results of Khan et al. (2014) indicating that economic progression and FDI also have positive impacts on energy consumption in low-income countries.

As a robustness check of previous estimations, the long-run association has estimated using the FMOLS, the DOLS, and the ARDL approaches. The results are given in Table 6. The outcomes of three approaches confirmed a significant long-run connection between electricity used and per capita income. These findings are consistent with the current work of Dey (2019), Dey and Tareque (2019), Foon Tang (2009), and Shahbaz and Feridun (2012). Using the different regression approaches such as the ARDL, DOLS, FMLOS, CCR, and VECM, Dey (2019) explored the long-run interaction between electricity used and economic progression in Bangladesh over the period 1971 to 2014. Findings revealed that in the long-run, electricity used has positive impacts on economic progression in Bangladesh. Similarly, a recent study was conducted in Pakistan by Chandio et al. (2019b) who empirically attempted to investigate the effects of industrial energy used and economic development for the period of 1983 to 2017 by employing the ARDL model and the VECM technique. The findings showed that industrial energy used (electricity and gas) has positive significant effects on economic development in both the long- and short-run. Furthermore, the connection of FDI and income is relatively weak in the long-run. The significant and negative values of coefficients as well as the higher R-squared values endorse the reliability of estimations. However, multiple diagnostic tests were used to assure the stability of models.

We used several diagnostic tests to confirm the constancy of the VECM model. The outcomes are reported in Table 7. The F-statistics and corresponding p values indicate that the residuals are free from serial correlation and heteroscedasticity. Furthermore, the Jarque-Bera test confirmed that residuals are normally distributed.

The CUSUM and CUSUM squares’ graphs are within given significance level showing that the model is stable, and the outcomes are free from any technical issue (see Fig. 4).

Besides, we applied the GIRF for the confirmation of the outcomes of the study. The GIRF outcomes demonstrate a profound understanding of shocks to electricity consumption and foreign direct investment exaggerated per capita GNI. Figure 5 reports the generalized impulse responses for per capita GNI, electricity used, and FDI in the energy sector.

Impulse response and variance decomposition analysis

We also applied impulse response analysis to describe random innovations among the study variables. We employed the response of GNI, ELE, and FDI to find out random innovations. Figure 6 displays the impulse response of per capita GNI to Cholesky One S.D. innovations to other study variables. The results show that the response of per capita GNI to electricity consumption is significant and steadily increases within 10-period horizons. In contrast, the response of per capita GNI to foreign direct investment is insignificant within 10-period horizons. Figure 7 displays the response of electricity consumption and foreign direct investment to per capita GNI.

Table 8 illustrates the estimated outcomes of variance decomposition method. The estimated outcomes demonstrated that approximately 3.2% of the future fluctuations in GNI are due to shocks in the ELE, and 2.3% of future fluctuations in the GNI are due to shocks in FDI. Furthermore, Table 8 indicates that approximately 70.2% of future fluctuations in ELE are due to shocks in GNI, and 0.4% of future fluctuations in ELE are due to shocks in FDI. Lastly, the evidence from the Table 8 displays that approximately 8.6% of future fluctuations in FDI is due to shocks in GNI and 84.5% of future fluctuations in FDI is due to shocks in ELE, respectively.

Conclusion and policy implications

The present study aims to explore the long-run connection between economic progress, electricity used, and FDI in the energy sector for Pakistan. The annual time series data from 1997 to 2017 were used to estimate the possible association among these variables. The unit root tests and cointegration approach were used under the VECM causality method. The robustness of outcomes has confirmed with the FMOLS, ARDL, and DOLS techniques. Furthermore, the constancy of the model and reliability of estimated results have checked through various specification tests. The outcome of the cointegration test indicated that there exists the long-run connection economic progress, electricity consumption, and foreign direct investment. The long-run connection confirmation led to apply the VECM causality test. The results confirmed that the long-run causal associations of three variables as the associated values of all variables are negative and significant. The short-run results indicated that both economic development and electricity used increase the FDI in Pakistan. Based on economic theory, domestic market performance and stability brings more capital from the international market and in turn, enhances the overall development. The robustness outcomes through the FMOLS, DOLS, and ARDL also confirmed the long-run association between electricity used and economic development. Therefore, the study concluded that both electricity used and FDI are vital factors to drive the Pakistani economy; however, the impact of electricity used is more significant.

The findings indicated that electricity consumption is vital for the economic progress of Pakistan. Thus, the policies regarding electricity production and consumption should be given preferred consideration. Considering the capital constraints and the crucial role of FDI in energy growth nexus, the government should develop a domestic market to attract more international funds. Furthermore, both human and financial development is necessary to optimize the available natural resources and to promote sustainable development with energy consumption and foreign capital in Pakistan. Assessed outcomes flagged that ecological degradation is the fundamental root of economic progression so it is endorsed to reread strategies those are associated to economic development in Pakistan for monitoring the ecological deteriorations. Equally, non-renewable track sources of energy are exploited as a fueling and powering source for industrial manufacturing and domestic house usage energy consumption in Pakistani economy so it is suggested to espouse such energy bases that root for smallest ecological deterioration. To govern the ecological degradations in the long-run time span, the policy architects are acclaimed to implement such guidelines that reassure by luxuriating eco-friendly apparatus, equipment, instruments, automobiles, services, and utilities to curtail the ecological deterioration. This could be supplemented by financial and economic advancement policies those hearten to increase the consumption level of coal as another possibility font of energy that is low-priced relatively. Ultimately, the path of economic richness could be realized through suitable business speculation of the earnings from the inborn and natural sources of the state-run government. The régime policy draftsmen should warrant that the proceeds from the innate endowment is infused into the fruitful segment of the economy to guarantee thoroughgoing yields that will surpass to economic development.

References

Akbostanci E, Turutasik S, Tunc GI (2009) The relationship between income and environment in Turkey : is there an environmental Kuznets curve? Energy Policy 37:861–867

Alam A (2013) Electric power consumption, foreign direct investment and economic growth: a comparative study of India and Pakistan. World J Sci 10:55–65

Alam S, Butt MS (2002) Causality between energy and economic growth in Pakistan: an application of cointegration and error correction modeling techniques. Pac Asian J Energy 12:151–165

Almulali U, Sheauting L (2014) Econometric analysis of trade, exports, imports, energy consumption and CO2 emission in six regions. Renew Sustain Energy Rev 33:484–498

Amal M (2016) Foreign direct investment in Brazil: post-crisis economic development in emerging markets. Academic Press, San Diego

Aman MM, Jasmon GB, Ghufran A, Bakar AHA, Mokhlis H (2013) Investigating possible wind energy potential to meet the power shortage in Karachi. Renew Sustain Energy Rev 18:528–542

Anwar S, Nguyen LP (2010) Foreign direct investment and economic growth in Vietnam. Asia Pac Bus Rev 16:183–202

Apergis N, Payne JE (2009) CO2 emissions, energy usage, and output in Central America. Energy Policy 37:3282–3286

Aqeel A, Butt MS (2001) The relationship between energy consumption and economic growth in Pakistan. Asia Pac Dev J 8:101–110

Aqeel A, Nishat M (2004) The determinants of foreign direct investment in Pakistan. Pak Dev Rev 43:651–664

Baloch MH, Kaloi GS, Memon ZA (2016) Current scenario of the wind energy in Pakistan challenges and future perspectives: a case study. Energy Rep 2:201–210

Bekhet HA, Alsmadi RW (2015) Determinants of Jordanian foreign direct investment inflows: bounds testing approach. Econ Model 46:27–35

Boateng A, Hua X, Nisar S, Wu J (2015) Examining the determinants of inward FDI: evidence from Norway. Econ Model 47:118–127

Chandio AA, Jiang Y, Rehman A (2019a) Energy consumption and agricultural economic growth in Pakistan: is there a nexus? Int J Energy Sect Manage

Chandio AA, Rauf A, Jiang Y, Ozturk I, Ahmad F (2019b) Cointegration and causality analysis of dynamic linkage between industrial energy consumption and economic growth in Pakistan. Sustainability 11:4546

Dey SR (2019) Electricity consumption and income nexus: evidence from Bangladesh. Int J Energy Sect Manage 13:1020–1037

Dey SR, Tareque M (2019) Electricity consumption and GDP nexus in Bangladesh: a time series investigation. J Asian Bus Econ Stud 27(1):35–48. https://doi.org/10.1108/JABES-04-2019-0029

ET (2008). Energy tribune. Pakistan’s ongoing electricity shortage (Accessed 18 Nov 2011 from /http://www.energytribune.com/articles.cfm?aid=864S)

Ferguson R, Wilkinson W, Hil R (2000) Electricity use and economic development. Energy Policy, 28(13),923–934

Foon Tang C (2009) Electricity consumption, income, foreign direct investment, and population in Malaysia: new evidence from multivariate framework analysis. J Econ Stud 36:371–382

Giannias DA, Liargovas P, Alexandrovich CY (2003) Economic growth and the environment: the European Union case. J Dev Areas 37:1–11

GOP, (2013). Government of Pakistan, (2013). National Power Policy Pakistan

GOP, (2017). Pakistan economic survey 2016–2017; Ministry of Finance, Government of Pakistan: Islamabad, Pakistan

GOP, (2018). Pakistan economic survey 2017–2018; Ministry of Finance, Government of Pakistan: Islamabad, Pakistan

Hakro AN, Ghumro IA (2011) Determinants of foreign direct investment flows to Pakistan. J Dev Areas 44:217–242

Hassan MS, Tahir MN, Wajid A, Mahmood H, Farooq A (2018) Natural gas consumption and economic growth in Pakistan: production function approach. Glob Bus Rev 19:297–310

Ho C, Siu KW (2007) A dynamic equilibrium of electricity consumption and GDP in Hong Kong: an empirical investigation. Energy Policy 35:2507–2513

Hossain MS, Saeki C (2012) A dynamic causality study between electricity consumption and economic growth for global panel: evidence from 76 countries. Asian Econ Financ Rev 2:1–13

Hye QMA, Riaz S (2008) Causality between energy consumption and economic growth: the case of Pakistan. Lahore J Econ 13:45–58

Islam SMF, Shahbaz M, Ahmed A, Alam MM (2013) Financial development and energy consumption nexus in Malaysia: a multivariate time series analysis. Econ Model 30:435–441

Jadhav P (2012) Determinants of foreign direct investment in BRICS economies: analysis of economic, institutional and political factor. Procedia Soc Behav Sci 37:5–14

Jbir R, Charfeddine L (2012) Short term relationships between European electricity markets. Asian Econ Financ Rev 2:276–281

Jobert T, Karanfil F (2007) Sectoral energy consumption by source and economic growth in Turkey. Energy Policy 35:5447–5456

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration—with applications to the demand for money. Oxf Bull Econ Stat 52:169–210

Kaufmann RK, Pauly P, Sweitzer J (1993) The effects of NAFTA on the environment. Energy J 14:217–240

Khalil HB, Zaidi SJH (2014) Energy crisis and potential of solar energy in Pakistan. Renew Sustain Energy Rev 31:194–201

Khalil S, Inam Z (2006) Is trade good for environment? A unit root cointegration analysis. Pak Dev Rev 45:1187–1196

Khan MA, Khan MZ, Zaman K, Arif M (2014) Global estimates of energy-growth nexus: application of seemingly unrelated regressions. Renew Sustain Energy Rev 29:63–71

Khan MA, Qayyum A (2007) Dynamic modelling of energy and growth in South Asia. Pak Dev Rev 46:481–498

Kinuthia BK, Murshed SM (2015) FDI determinants: Kenya and Malaysia compared. J Policy Model 37:388–400

Komal R, Abbas F (2015) Linking financial development, economic growth and energy consumption in Pakistan. Renew Sustain Energy Rev 44:211–220

Lantz V, Feng Q (2006) Assessing income, population, and technology impacts on CO2 emissions in Canada: where’s the EKC? Ecol Econ 57:229–238

Latief R, Lefen L (2018) The effect of exchange rate volatility on international trade and foreign direct investment (FDI) in developing countries along “one belt and one road”. Int J Financ Stud 6:86

Luqman M, Ahmad N, Bakhsh K (2019) Nuclear energy, renewable energy and economic growth in Pakistan: evidence from non-linear autoregressive distributed lag model. Renew Energy 139:1299–1309

Mahmud SF (2000) The energy demand in the manufacturing sector of Pakistan : some further results. Energy Econ 22:641–648

Mielnik O, Goldemberg J (2002) Foreign direct investment and decoupling between energy and gross domestic product in developing countries. Energy Policy 30:87–89

Mirza FM, Kanwal A (2017) Energy consumption, carbon emissions and economic growth in Pakistan: dynamic causality analysis. Renew Sustain Energy Rev 72:1233–1240

Mozumder P, Marathe A (2007) Causality relationship between electricity consumption and GDP in Bangladesh. Energy Policy 35:395–402

Nahman A, Antrobus G (2005) Trade and the environmental Kuznets curve: is southern Africa a pollution haven? South Afr J Econ 73:803–814

NEPRA 2015. National Electricity Power Regulatory Authority. 2015. State of industry report 2015. Web. http://www.nepra.org.pk/Publications/State%20of%20Industry%20Reports/State%20of%20Industry%20Report%202015.pdf

Okafor G, Piesse J, Webster A (2015) The motives for inward FDI into sub-Saharan African countries. J Policy Model 37:875–890

OSEC, 2010. Pakistan Power Sector (Accessed 18 Dec 2017 from/http://www.osec.ch/sites/default/files/Pakistan-Power%20sectorS.pdf)

Ozturk I (2010) A literature survey on energy-growth nexus. Energy Policy 38:340–349

Pao H, Tsai C (2011) Modeling and forecasting the CO2 emissions, energy consumption, and economic growth in Brazil. Energy 36:2450–2458

Payne JE (2010) A survey of the electricity consumption-growth literature. Appl Energy 87:723–731

Rashid IMA, Bakar NAA, Razak NAA (2016) Determinants of foreign direct investment (FDI) in agriculture sector based on selected high-income developing economies in OIC countries: an empirical study on the provincial panel data by using Stata, 2003-2012 ☆. Procedia Econ Finance 39:328–334

Rauf A, Zhang J, Li J, Amin W (2018) Structural changes, energy consumption and carbon emissions in China: empirical evidence from ARDL bound testing model. Struct Chang Econ Dyn 47:194–206

Rehman A, Deyuan Z, Chandio AA, Hussain I (2018) An empirical analysis of rural and urban populations’ access to electricity: evidence from Pakistan. Energy Sustain Soc 8:40

Rehman A, Rauf A, Ahmad M, Chandio AA, Deyuan Z (2019) The effect of carbon dioxide emission and the consumption of electrical energy, fossil fuel energy, and renewable energy, on economic performance: evidence from Pakistan. Environ Sci Pollut Res 26:21760–21773

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38:2528–2535

Samiullah (2014) Energy consumption and economic growth: time series evidence from Pakistan. J Econ Sustain Dev 5:82–92

SBP (2017) State Bank of Pakistan. Available from: http://www.sbp.org.pk/

Shah SH, Ahmad MH, Ahmed QM (2016) The nexus between sectoral FDI and institutional quality: empirical evidence from Pakistan. Appl Econ 48:1591–1601

Shahbaz M, Feridun M (2012) Electricity consumption and economic growth empirical evidence from Pakistan. Qual Quant 46:1583–1599

Shahbaz M, Hye QMA, Tiwari AK, Leitao NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sustain Energy Rev 25:109–121

Shahbaz M, Islam F, Butt MS (2016) Finance–growth–energy nexus and the role of agriculture and modern sectors: evidence from ARDL bounds test approach to cointegration in Pakistan. Glob Bus Rev 17:1037–1059

Shahbaz M, Lean HH (2012) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479

Shahzad SJH, Kumar RR, Zakaria M, Hurr M (2017) Carbon emission, energy consumption, trade openness and financial development in Pakistan: a revisit. Renew Sustain Energy Rev 70:185–192

Siddique HMA, Majeed MT, Khalid A (2016) The relationship between energy consumption and economic growth in Pakistan. Bull Energy Econ 4:329–334

Siddiqui R (2004) Energy and economic growth in Pakistan. Pak Dev Rev 43:175–200

Tang CF (2009) Electricity consumption, income, foreign direct investment, and population in Malaysia. J Econ Stud 36:371–382

Tang CF, Yip CY, Ozturk I (2014) The determinants of foreign direct investment in Malaysia: a case for electrical and electronic industry. Econ Model 43:287–292

Udi J, Bekun FV, Adedoyin FF (2020) Modeling the nexus between coal consumption, FDI inflow and economic expansion: does industrialization matter in South Africa? Environ Sci Pollut Res:1–12

Waleed A, Akhtar A, Pasha AT (2018) Oil consumption and economic growth: evidence from Pakistan. Energ Source B 13:103–108

Wang J, Wang X (2015) Benefits of foreign ownership: evidence from foreign direct investment in China. J Int Econ 97:325–338

Wang Z, Zhang B, Wang B (2018) Renewable energy consumption, economic growth and human development index in Pakistan: evidence form simultaneous equation model. J Clean Prod 184:1081–1090

World Bank (2014) World development indicator. Available from: http://data.worldbank.org/

World Bank (2017). World development indicator. Available from: http://data.worldbank.org/

Yildirim E, Aslan A, Ozturk I (2014) Energy consumption and GDP in ASEAN countries: bootstrap-corrected panel and time series causality tests. Singap Econ Rev 59:1–16

Author information

Authors and Affiliations

Corresponding authors

Additional information

Responsible Editor: Muhammad Shahbaz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Chandio, A.A., Jiang, Y., Ahmad, F. et al. Investigating the long-run interaction between electricity consumption, foreign investment, and economic progress in Pakistan: evidence from VECM approach. Environ Sci Pollut Res 27, 25664–25674 (2020). https://doi.org/10.1007/s11356-020-08966-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-08966-z