Abstract

The paper investigates the effect of financial development and institutional quality on the environment in South Asia. Other determinants of environmental quality included are economic growth, energy consumption, FDI, trade openness and institutional quality. For empirical analysis, panel data is used for the period 1984 to 2015. The estimated results indicate that Environmental Kuznet Curve (EKC) hypothesis holds in South Asia, i.e., environment first deteriorates with economic development and then it starts improving. Empirical results reveal that 1% increase in economic growth worsens environment by 1.709%. However, further increase in economic growth improves environment by 0.104%. Energy consumption has deteriorating effect on environment. Financial development has degraded the environment in the region, which indicates that South Asian countries have used financial development for capitalization and not to improve technology. The estimated results show that 1% increase in financial development deteriorates environment by 0.147%. FDI, which is a measure of financial openness, has mitigating effect on pollution. In turn, trade openness has worsened the environmental quality in the region. Institutional quality has significant negative effect on carbon emissions. It also has significant negative moderating effects on carbon emissions. The findings show that 1% improvement in institutional quality will decrease pollution by 0.114%. The study suggests that South Asian countries should focus more on technology effect and not on scale effect of financial development.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Natural resources like minerals and fossil fuels are essential for economic growth of an economy as they are important inputs for production of goods and services. The use of these resources has increased the emission of greenhouse gasses (GHGs) after industrialization era. It has especially quadrupled in the last four decades. The emission of GHGs has deteriorated the environmental standards necessary for human living. However, it is considered as the cost of economic growth. Economic growth, therefore, is considered to be an important factor of environmental degradation. In the last two decades, researchers have tried to formulate models to examine the linkages between economic growth and environment performance. In their seminal work, Grossman and Krueger (1991, 1995) proposed the environmental Kuznets curve (EKC) hypothesis to explain the connection between income and pollution. According to this hypothesis, there is an inverted U-shaped association between income and pollution, i.e., pollution first increases with the increase in income and then it starts declining with the further increase in income.

Stern (2004) has critically evaluated the EKC hypothesis and argued that this hypothesis has omitted variables bias issue. As a result, many studies have used energy consumption as another important determinant of environmental degradation as pollution is mainly created by burning of fossil fuels (Ang 2008; Tamazian et al. 2009; Tamazian and Rao 2010; Shahbaz 2013). Rapidly increasing pollution and resulting changes in environment necessary for human living have put attention on other factors of pollution especially those factors which can reduce pollution. Recent literature has pointed out financial development (Tamazian et al. 2009) and institutional quality (Ibrahim and Law 2014, 2016) as key factors to improve environment quality. Literature has also shown foreign direct investment (FDI), trade openness, industrial value added, broad money, urbanization, population density, etc. as important variables to be included in pollution models (Nasreen and Anwar 2015; Jalil and Feridun 2011; Yazdi and Shakouri 2014; Omri et al. 2015; Saidi and Mbarek 2016; Shahbaz et al. 2015; Tamazian and Rao 2010; Tamazian et al. 2009; Sharma 2011).

It is argued that environment is more clean in countries which have well developed and efficient financial markets than those countries which have less efficient financial system (Dasgupta et al. 2001). Some recent studies have shown that financial development may play an important impact on environmental quality (Tamazian et al. 2009). Proponents argue that financial development is beneficial for environment. Firstly, an efficient financial system attracts foreign investment, which enhances research and development (R&D) activities in host countries, it helps to reduce pollution (Eskeland and Harrison 2003). Secondly, financial development may help firms to adopt cleaner technology in industries, which will help to improve environment (Birdsall and Wheeler 1993; Frankel and Rose 2002). Thirdly, a well-developed financial system provides loans at low costs for environment-friendly projects (Tamazian et al. 2009; Tamazian and Rao 2010), which help to improve environment. Fourthly, financial development increases technological innovations (Tadesse 2005), which help to reduce carbon emissions (Kumbaroglu et al. 2008). Fifthly, financial market provides loans only to those companies which comply national environmental laws and regulations. This helps to reduce environmental degradation (Capelle-Blancard and Laguna 2010). Thus, a well-developed financial system helps to reduce pollution. Opponents argue that financial development has detrimental effects on environment. Firstly, financial development degrades environment by increasing economic growth (Jensen 1996). Secondly, financial development increases industrial activities by providing easy financing, which increases carbon emissions and pollution (Sadorsky 2010).

An important but somewhat neglected factor which also affects environmental performance is institutional quality (Lau et al. 2014; Dutt 2009; Cole 2007; Ibrahim and Law 2014, 2016). This stream of research suggests that certain institutional conditions like rule of law, bureaucratic quality, corruption, and risk of expropriation affect pollution. The quality of institutions reduces environmental degradation even if a country has low level of income (Panayotou 1997). It implies that environment will improve with high future income as institutional quality can decrease environmental cost of high economic growth (Panayotou 1997). The intuition is that when economic growth increases, environmental regulations will also increase in parallel (Yandle et al. 2004). If government institutions are strong enough to implement environmental rules and regulations, then environmental quality will improve. Thus, institutional quality is important for environmental quality.

Empirically, several studies have been conducted to explore the impact of financial development on environment in different countries and regions of the world. For instance, see among others, Zhang (2011), Al-mulali and Sab (2012a, b), Tamazian et al. (2009), Tamazian and Rao (2010), Shahbaz et al. (2013a, b), Al-mulali et al. (2015), Jalil and Feridun (2011), Yang et al. (2015), Yuxiang and Chen (2010), Saidi and Mbarek (2016), Yazdi and Shakouri (2014), Ozturk and Acaravci (2013), Omri et al. (2015), etc. For South Asian countries, limited research is available only for India (Boutabba 2014; Shahbaz et al. 2015) and Pakistan (Muhammad and Fatima 2013; Shahbaz 2013; Abbasi and Riaz 2016; Javid and Sharif 2016) which have explained the effect of financial development on environment. No empirical study has been conducted so far to investigate the impact of financial development on other countries of South Asia and South Asian region as a whole. Previous studies have also ignored the effect of institutional quality on environment. Institutional failure is an important factor for degradation of environment and the ecosystems. Thus, the contribution of the present study to the existing literature is many folds. Firstly, it will examine the impact of financial development on environmental quality of South Asian region. Secondly, it will investigate the impact of institutional quality on environment. Thirdly, this study will use several measures of financial development for robustness analysis as previous studies have used only one measure of financial development mainly credit to private sector. It will help us to gage both scale and efficiency effects of financial development on environment. The outcome of this study will provide some suggestions for policy-makers to improve environmental quality in the region.

The rest of the paper is organized as follow. “Carbon emission in South Asia” discusses the pattern of carbon emissions in South Asian countries. “Theoretical framework” describes the theoretical framework. “Data overview and estimated results” provides the estimated results. The final section concludes the paper.

Carbon emission in South Asia

South Asian countries are enjoying high economic growth rates. All countries have shown tremendous growth in the last two decades (Table 1). Presently, India has the highest economic growth in the region followed by Bangladesh and Pakistan. The high economic growth in the region has increased energy consumption in these countries (Fig. 1). Pakistan remained the highest energy consumer (per capita metric tons) till 2006, after that, energy consumption declined due to energy shortage in the country. Presently, India is the highest energy consumption country while Bangladesh is the lowest energy consumption country in the region. This high-energy consumption has increased the carbon emissions in the region which has polluted the environment (Fig. 2). India is the highest carbon emitting country followed by Pakistan, Sri Lanka, and Bangladesh. Nepal is the lowest carbon-emitting country in the region. Pollution has become an important issue in South Asia. According to World Health Organization (WHO), due to air pollution each year, about 2.4 million people die in South Asia. Rapid population growth, urbanization, transportation needs, and industrialization are increasing the pollution in the region.

Theoretical framework

Based on both theoretical and empirical literature, we have taken economic growth, energy consumption, financial development, foreign direct investment (FDI), and trade openness as important determinants of pollution (CO2 emission) in South Asia (Nasreen and Anwar 2015; Jalil and Feridun 2011; Yazdi and Shakouri 2014; Omri et al. 2015; Saidi and Mbarek 2016; Shahbaz et al. 2015; Tamazian and Rao 2010; Tamazian et al. 2009; Sharma 2011). The study will also explore the direct and moderating effects of institutional quality on environment (Lau et al. 2014; Dutt 2009; Cole 2007; Ibrahim and Law 2014, 2016). To empirically assess the effect of financial development and other variables on environment, we will estimate the following model:

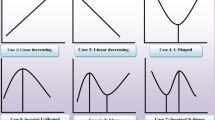

where ce is the dependent variable carbon emission (CO2), y is economic growth, y2 is square of economic growth, ec is energy consumption, fd is financial development, fdi is foreign direct investment, and to is trade openness. Both dependent and independent variables are expressed in natural logarithm form. Therefore, parameters (β′s) represent elasticities. Thus, β1 is the elasticity of income which is expected to be positive because pollution increases with the increase in income in developing economies. β2 is the elasticity of the income squared term. This term is included in the model to check the validity of the EKC hypothesis. If β1 > 0 and β2 < 0 then EKC hypothesis will hold otherwise not. In this case, we can calculate the elasticity of income as follows:

Pollution increases with the increase in energy consumption, therefore, the elasticity of energy consumption β3 is expected to be positive.

There are four possible effects of financial development on carbon emissions (Yuxiang and Chen 2010). These effects are Capitalization Effect, Technology Effect, Income Effect, and Regulation Effect. According to capitalization effect, financial development may stimulate growth of small scale industries, which have few benefits of economies of scale and pollution reduction. It will increase pollution. Technology effect stipulates that financial development encourages environment-friendly projects (Tamazian et al. 2009) and technological innovations (Tadesse 2005) by providing low-cost financing, which helps to reduce pollution (Kumbaroglu et al. 2008). Income effect postulates that financial development stimulates long-run economic growth (Yuxiang and Chen 2010), which can affect environment positively or negatively. The regulation effect argues that in the presence of environmental regulations, financial development is beneficial for environment. Thus, the sign of the elasticity of financial development (β4) is equivocal. It depends upon which effect is dominant.

Foreign direct investment (FDI) has two effects on environmental performance, i.e., Pollution Haven Hypothesis, and Pollution Halo Hypothesis. According to pollution haven hypothesis, FDI attracts foreign polluting industries to developing countries due to their lax environmental regulations, which harms environment quality. Thus, developing countries turn into the “pollution haven.” In turn, according to pollution halo hypothesis, FDI brings efficient technology industries which yield environmental benefits to developing countries. Thus, the effect of FDI on environmental quality can go either way depending upon which hypothesis dominates. The sign of β5 cannot be determined a priori.

Trade openness has three effects on environment, i.e., scale effect, technique effect, and composition effect (Antweiler et al. 2001). Scale effect is based on the concept that trade openness will increase exports which will result in greater economic activity. It will generate emissions, which deteriorates environment. In turn, technique effect reduces emissions because trade openness helps to import advanced technology, which improves environment. The composition effect stipulates that trade openness will improve environment if a country has comparative advantage in environment-friendly industries. Thus, the effect of trade openness on environment is equivocal as it depends upon which effect dominates the other. The sign of β6 cannot be determined a priori.

An important but somewhat neglected factor which also affects environmental performance is institutional quality (Lau et al. 2014; Dutt 2009; Cole 2007; Ibrahim and Law 2014, 2016). Institutional quality improves environment. The coefficient β7 is expected to take a negative sign. The quality of institutions reduces environmental degradation even if a country has low level of income (Panayotou 1997). It means that environment will improve with higher future income because economic growth and environmental regulations move together as environmental regulations are weak at low level of economic development and become strong when economic development increases (Yandle et al. 2004). Thus, to examine the moderating effect of institutional quality on carbon emissions via economic growth, an interaction term (yi, t ∗ iqi, t) is included in the model (Leitao 2010; Masron and Subramaniam 2018). Thus, β8 is expected to take negative sign if institutions are strong. Further, in the presence of strong institutional structure and regulations energy can be used efficiently which will decrease pollution. To capture this effect, an interaction term eci, t ∗ iqi, t is included in the model. The sign of β9 is also contemplated to be negative.

Claessens and Feijen (2007) have shown that financial development improves environment through better governance. Thus, to explore the moderating effect of institutional quality on the relationship between financial development and environment degradation, we have included the interaction term between institutional quality and financial development (fdi, t ∗ iqi, t) in the model. The coefficient on this interaction term β10 is likely to appear with negative sign. A strong institutional structure will discourage FDI in polluting industries and it will encourage foreign investment in high-tech industries. It will improve environmental quality. To bring this effect into analysis, the interaction term fdii, t ∗ iqi, t is included in the model. The coefficient on this interaction term is also expected to be negative, i.e., β11 < 0.

According to Ibrahim and Law (2016), the effect of trade on environment depends upon institutional setting of a country. Trade openness deteriorates environmental quality in countries which have weak institutional structures while it improves environment in countries which have good quality institutions (Ibrahim and Law 2016). To examine whether institutional quality is a complementary or a mitigating factor in the trade-environment relation, we have also included an interaction term between institutional quality and trade openness (toi, t ∗ iqi, t) in the model. The coefficient β11 is contemplated to be negative, i.e., β12 < 0.

Data overview and estimated results

Data overview

For empirical analysis, data is taken for the period 1984 to 2015 for five South Asian countries, i.e., Bangladesh, India, Nepal, Pakistan, and Sri Lanka. Due to data unavailability, the remaining three South Asian countries, i.e., Afghanistan, Bhutan, and Maldives are not included in the analysis. Dependent variable carbon emission is proxied by carbon dioxide (CO2) emissions (metric tons per capita). Economic growth is measured by per capita real GDP. Energy consumption is per capita kilogram of oil equivalent. Financial development is measured by the ratio of domestic credit to private sector scaled by GDP. It is the most commonly used measure of financial development. Some researchers have used liquid liabilities (M2 or M3, % of GDP) as proxy for financial development. But Shahbaz and Lean (2012) have shown that these variables represent volume of financial sector, not financial development. Therefore, we have not used this variable to proxy financial development. FDI is taken as percentage of GDP. Trade openness is measured by total trade (exports plus imports) percentage of GDP. Institutional quality is proxied by corruption. Corruption is an index ranging from zero to six with zero indicating the maximum corruption. Data for these variables is taken from World Development Indicators (WDI) and Penn World Table (PWT), and International Country Risk Guide (ICRG) of PRS.

Table 2 provides the descriptive statistics of the variables. Carbon emission has mean value of 0.55 and has a range of 0.03 to 2.02 metric tons per capita. Per capita income has an average value of 2820.13 million US dollars but has a large variation as given by a standard deviation of 1928.94. The range of income stands from 892.92 to 11,735.40 million US dollars. Energy consumption also has high variation as shown by high value of standard deviation (125.40). Its range lies between 103.91 and 638.94 per capita kilogram of oil equivalent. A similar interpretation holds for all other variables. In contrast to standard deviation, coefficient of variation (CV), which is unit-less measure, shows that FDI has the highest variation in data (0.99) followed by carbon emissions (0.80) and income (0.68), while energy consumption has the least variation in data (0.35).

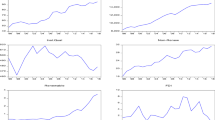

The scatter diagrams of carbon emissions with income, energy consumption, and financial development show that emission is positively associated with income (Fig. 3), energy consumption (Fig. 4), and financial development (Fig. 5). It is also evident from the scatter diagrams that carbon emission has nonlinear relationship with income and linear relationship both with energy consumption and financial development. It shows that financial development policies in South Asian countries are associated with higher carbon emissions. Therefore, we can say that financial development in South Asia has degraded the environment, ceteris paribus.

Estimated results

Estimation and discussion of results

An important issue which previous literature has ignored while estimating the carbon emission model is potential endogeneity (Stern 2004). Endogeneity may arise in our model due to dynamic nature of the model as lagged term of dependent variable is included in the model. Further, it arises due to potential reverse causality between some independent variables like income and energy consumption. In other words, endogeneity issue originates because some variables are endogenous in the model and therefore may correlate with residual term. The model cannot be estimated using ordinary least squares (OLS) method as in the presence of endogeneity OLS results are inconsistent and biased. Thus, to get unbiased and consistent results, Two-Stage Least Squares (2SLS) estimation technique will be applied (Wooldridge 2002). This is an instrumental variable method. Lagged terms of the variables are taken as instruments as correlation may exist between independent variables and residual term, while there may not be correlation between lagged variables and residual term. To overcome cross section heteroscedasticity, we will estimate our model using Generalized least squares (GLS) method. Correcting cross section heteroscedasticity improves the statistical significance level of the estimated coefficients. The model is estimated using panel fixed effect technique.

The estimated results are provided in Table 3. Income has significant positive effect on carbon emissions (column 1). The value of the estimated coefficient implies that 1% increase in economic development will increase carbon emission by 1.709%. This result is inconsistent with the phenomenon of “economic growth and carbon emissions decoupling”. It implies that economic development in South Asia is occurring at the cost of polluted environment. To check the curvilinear effect of economic development on carbon emission, a squared term of income is included in the model. The coefficient of this squared term is negative and statistically significant (− 0.104). It indicates that carbon emission declines when threshold level of income is achieved. These results validate environmental curve (EKC) hypothesis in South Asia, i.e., there is an inverted U-shaped relationship between income and carbon emission in South Asia. These results support Grossman and Krueger (1995) that an inverted U-shaped relationship exists between income and pollution.

South Asian countries are net energy importers. Thus, energy consumption is increasing in this part of the world. Energy consumption has significant positive effect on carbon emission. The estimated value of the coefficient on energy consumption implies that 1% increase in energy consumption will increase per capita carbon emission in South Asia by 0.246%. This finding supports Tamazian et al.’s (2009) argument that inclusion of energy variable in the model may explain most of the carbon emissions. We have found that the inclusion of energy consumption and other variables in the model have decreased the effect of income on carbon emissions (see columns 2 to 8). However, the income variable maintained its sign and statistical significance. Further, income has the highest effect on carbon emissions followed by energy use and financial development.

In estimation, we are mainly concerned about the relationship between financial development and carbon emissions. The coefficient of financial development is positive and statistically significant (column 2). The estimated value of the coefficient implies that when financial development increases by 1%, carbon emission increases by 0.147%. It indicates that financial development has worsened the environment in South Asian countries. This result is robust to alternative equation specifications. It supports the findings of some previous studies that financial development degrades environment in developing countries (Zhang 2011; Nasreen and Anwar 2015; Moghadam and Dehbashi 2018). These results also support the previous findings for South Asia that financial development deteriorates environmental quality. For instance, see Javid and Sharif (2016), Shahbaz (2013), and Muhammad and Fatima (2013) for Pakistan and Shahbaz et al. (2015) for India. A possible justification could be that these countries have used financial development for capitalization, i.e., to stimulate growth of small-scale industries. These small industries have few benefits of economies of scale in resource use and pollution abatement. Therefore, pollution has increased in these countries after financial development. In other words, our results confirm that in South Asian countries, capitalization effect dominates the technology effect. The results imply that in South Asia, financial sector is not mature enough to allocate resources to environment-friendly projects and do not encourage investment in high-tech fuel-efficient industries. Further, financial institutions in South Asian countries are not providing loans to investments that can encourage energy savings, energy efficiency and renewable energy. So our results do not conform to Tamazian and Rao (2010) and Tamazian et al. (2009) that financial development reduces pollution through technology effect. This finding is also in contrast to Abbasi and Riaz (2016) in Pakistan, and Boutabba (2014) in India as these studies have found that financial development decreases carbon emissions.

FDI, which is a measure of financial openness, also affects carbon emissions. Sadorsky (2010) has taken FDI as financial development indicator. The significant negative coefficient on FDI suggests that FDI reduces environmental pollution. It supports pollution halo hypothesis, which stipulates that FDI brings advanced technologies and an efficient environment management system which yield environmental benefits to less developed countries. Although this result is statistically significant, economically, this is a little bit weak as the magnitude of the estimated coefficient is small. Economically speaking, 1% increase in FDI will decrease pollution by 0.011%. It suggests that FDI can be used as an instrument to mitigate pollution by encouraging foreign investment in high-tech industries in South Asian countries. This result supports Tamazian et al. (2009) argument that FDI helps to reduce pollution by bringing efficient technology in the host country.

In contrast to FDI, trade openness has a significant positive effect on pollution, which implies that trade liberalization has degraded the environmental quality in South Asia. The value of the coefficient implies that 1% increase in trade openness increases carbon emissions by 0.023%. This result validates scale effect hypothesis in South Asia, which stipulates that trade openness has generated emissions by increasing export volumes, which has deteriorated the environment. This result also implies that South Asian countries do not have comparative advantage in cleaner industries, which have polluted the environment. Thus, composition effect also does not hold in these countries. This result endorses Grossman and Krueger (1995) view that developing countries have comparative advantage in polluting industries at the beginning of transition. Indeed, this is more relevant in the case of South Asia. Our results also corroborate the findings of Jalil and Feridun (2011), Antweiler et al. (2001), Sharma (2011), and Ozturk and Acaravci (2013). Statistically, this result is not significant in alternative specifications.

Institutional quality has statistically significant negative effect on carbon emissions. Coefficient on institutional quality implies that 1% increase in institutional quality will decrease per capita carbon emissions by 0.114% (column, 3). It means that strong institutions improve environment, while weak institutions degrade environment. It corroborates the findings of Zhang et al. (2016) and Zugravu et al. (2009) that more corruption deteriorates environment and that institutional quality improves environment.

Institutional quality has moderating effect on environment performance as all the interaction terms are negative and statistically significant. First, institutional quality has a moderating effect on carbon emission through economic growth. While the direct impact of economic growth is to increase pollution, its interaction with institutional quality decreases this impact as the interaction term (yit ∗ iqit) is negative and statistically significant (− 0.013). It also supports the findings of Sahli and Rejeb (2015) that corruption has direct positive effect on pollution and indirect negative effect on pollution through income. The same holds with the energy consumption variable. Energy consumption increases carbon emission while it reduces emission when it is complemented with institutional quality variable. The coefficient on interaction term ecit ∗ iqit is statistically significant and appears with a negative sign (− 0.021).

The significant negative coefficient (− 0.037) of interaction term between financial development and institutional quality (fdit ∗ iqit) indicates that when institutions are strong, financial development will decrease carbon emission. In turn, if institutions are weak, then carbon emission will increase after financial development. This validates regulation effect hypothesis that in the presence of (environmental) regulations, financial development is beneficial for environment. The intuition is that in the presence of strong institutions, financial sector will give loans to environment-friendly projects. It suggests that positive effect of financial development on carbon emissions needs to be complemented by high quality institutions. Thus, the significant negative coefficient of interaction term shows a “complementary effect” of both financial development and institutional quality on carbon emissions.

Like FDI, interaction term of FDI with institutional quality also has mitigating effect on carbon emissions. The statistically significant negative coefficient (− 0.010) on interaction term fdiit ∗ iqit indicates that in the presence of institutional quality, FDI has reinforcing effect on emissions. Although trade openness increases pollution, however, when it is interacted with institutional quality, it reduces carbon emissions as the coefficient on interaction term toit ∗ iqit is negative and statistically significant (− 0.034). It again highlights the complementary role of institutional quality in developing countries (Chousa et al. 2005).

The model fits the data well as the values of R-squared (R2) and Adjusted R-squared\( \left({\overline{R}}^2\right) \) are quite high. To check the autocorrelation problem, Durbin- h test is applied. Autocorrelation problem does not exist in the model as almost all values of Durbin ∣h∣ test are greater than |1.96|. Statistically significant values of F-statistics also indicate that the models fit the data well. To test the validity of the instruments, J test, also known as “Sargan test” is used. High p values of J statistics show that the instruments are valid.

Table 4 provides the marginal effects of the variables. Marginal effects are calculated by taking first-order partial derivatives of carbon emissions with respect to each of the interactive variables. Sample mean of institutional quality variable (2.28) is used in calculating marginal effects. The marginal effects indicate that income has the highest effect on carbon emissions followed by energy consumption and financial development.

Scale and efficiency effects

Following Zhang (2011), we have also examined the scale and efficiency effects of financial development and stock market development. Scale effect of financial development is measured by total credit (% of GDP) while private sector credit (% of GDP) is used for efficiency effects. Further, market capitalization (% of GDP) is used for scale effect and total value of stock traded (% of GDP) is used for efficiency effect of stock market development.

Table 5 provides the estimated results. Both financial development indicators, i.e., total credit (tc) and private credit (pc) have statistically significant positive effects on carbon emissions. This supports our previous findings that financial development has environmental deteriorating effect in South Asia. This result does not support the findings of Abbasi and Riaz (2016) who have found significant negative effect of total credit (% of GDP) on carbon emissions in Pakistan. Column (2) in Table 5 is same as column (3) in Table 3. Efficiency effect of financial development outweighs the scale effect as the coefficient of efficiency effect (0.240) is higher than the coefficient of scale effect (0.199). Moreover, efficiency effect is highly statistically significant compared to scale effect. This result contrasts the findings of Zhang (2011) who finds that in China, scale effect of financial development outweighs the efficiency effect.

Coefficient on stock market capitalization (mc) is positive and statistically significant while the coefficient on stock traded (st) is negative and statistically significant. It implies that scale effect of stock market development increases carbon emissions while efficiency of stock market decreases carbon emissions. It supports the findings of the Zhang (2011) and Abbasi and Riaz (2016) that both the scale and efficiency of financial intermediation matter for carbon emissions. Column (5) provides the combined effects of financial variables on emissions. All variables maintain their signs and statistical significance. However, private credit variable has become statistically insignificant due to multicollinearity issue as this variable is highly correlated with total credit and the correlation coefficient between these two variables is 0.80. Table 6 provides the correlation values between all financial and stock market development indicators.

Conclusion

The study examines the impact of financial development on environmental performance in South Asian countries in the presence of institutional quality. For empirical analysis, panel data is used for the period 1984 to 2015. Other variables included are economic growth, energy consumption, FDI, and trade liberalization. The empirical findings show that EKC hypothesis holds in South Asia, that is, pollution first increases with economic development and then it decreases when economic growth further accelerates. Energy consumption also deteriorates environment. Financial development also worsens environmental quality in South Asia as the coefficient on this variable is positive and statistically significant. This result is consistent with various model specifications. This result shows that South Asian countries have used financial development for capitalization purpose, which has deteriorated the environment. FDI has mitigating effect on carbon emissions. It supports pollution halo hypothesis, which stipulates that FDI brings efficient technologies is the host country which helps to improve environment. In contract to FDI, trade liberalization degrades environment in South Asia. This result validates the scale effect hypothesis in South Asia, which stipulates that trade openness has generated emissions by increasing export volumes, which has deteriorated the environment. The analysis shows that institutional quality improves environment both directly and indirectly.

The empirical results have some important policy implications. South Asian countries are enjoying high level of economic growth at the cost of environmental degradation. These countries should adopt energy efficiency policies to decrease pollution without affecting their economic growth. Energy consumption is increasing in the South Asian region. Governments in these countries should introduce modern efficient technology in industries and encourage the use of renewable energy resources so that environmental quality may improve. To avoid the detrimental effect of financial development on environment, governments in South Asian countries should develop financial markets in such a way that funds should be allocated for investment in projects which help to introduce clean energy technologies. In other words, governments in South Asia should focus more on technology effect and not on scale effect of financial development. Since FDI has curbing effect on carbon emissions, governments in South Asia should adopt policies to attract foreign investment from technically advanced countries as it will help to reduce pollution via transfer of technology in environment-friendly projects in host countries. Since foreign trade has detrimental impact on environment, therefore, there is a need to impose environmental protection regulations on import and export of goods.

It is found that macroeconomic variables (except FDI) are detrimental to environment; however, when they are accompanied by strong high-quality institutions, they help to reduce pollution. Thus, governments in South Asian countries should strengthen their institutions as it may help to improve environment and to obtain green growth in the future. Improving institutional quality is a new and an excellent approach to improve environmental quality. The limitation of the study is that it has focused only on South Asian countries. However, some more countries with similar characteristics can be included in the analysis for further research.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114

Al-mulali U, Sab CNBC (2012a) The impact of energy consumption and CO2 emission on the economic growth and financial development in the sub Saharan African countries. Energy 39:180–186

Al-mulali U, Sab CNBC (2012b) The impact of energy consumption and CO2 emission on the economic and financial development in 19 selected countries. Renew Sust Energ Rev 16:4365–4369

Al-mulali U, Tang CF, Ozturk I (2015) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22:14891–14900

Ang JB (2008) Economic development, pollutant emissions and energy consumption in Malaysia. J Policy Model 30:271–278

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? Am Econ Rev 91(4):877–908

Birdsall N, Wheeler D (1993) Trade policy and industrial pollution in Latin America: where are the pollution havens? J Environ Dev 2(1):137–149

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

Capelle-Blancard G, Laguna MA (2010) How does the stock market respond to chemical disasters? J Environ Econ Manag 59(2):192–205

Chousa JP, Khan HA, Melikyan D, Tamazian A (2005) Assessing institutional efficiency, growth and integration. Emerg Mark Rev 6:69–84

Claessens S, Feijen E (2007) Financial sector development and the millennium development goals. World Bank, Washington, D.C

Cole MA (2007) Corruption, income and the environment: an empirical analysis. Ecol Econ 62:637–647

Dasgupta S, Laplante B, Mamingi N (2001) Pollution and capital markets in developing countries. J Environ Econ Manag 42:310–335

Dutt K (2009) Governance, institutions, and the environment-income relationship: a cross-country study. Environ Dev Sustain 11:705–723

Eskeland GS, Harrison AE (2003) Moving to greener pastures? Multinationals and the pollution haven hypothesis. J Dev Econ 70:1–23

Frankel J, Rose A (2002) An estimate of the effect of common currencies on trade and income. Q J Econ 117(2):437–466

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement. NBER Working Paper No 3914

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

Ibrahim MH, Law SH (2014) Social capital and CO2 emission – output relations: a panel analysis. Renew Sust Energ Rev 29:528–534

Ibrahim MH, Law SH (2016) Institutional quality and CO2 emission-trade relations: evidence from sub-Saharan Africa. S Afr J Econ 84(2):323–340

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33:284–291

Javid M, Sharif F (2016) Environmental Kuznets curve and financial development in Pakistan. Renew Sust Energ Rev 54:406–414

Jensen AL (1996) Beverton and Holt life history invariants result from optimal trade off of reproduction and survival. Can J Fish Aquat Sci 53:820–822

Kumbaroglu G, Karali N, Arıkan Y (2008) CO2, GDP and RET: an aggregate economic equilibrium analysis for Turkey. Energy Policy 36(7):2694–2708

Lau L-S, Choong C-K, Eng Y-K (2014) Carbon dioxide emission, institutional quality, and economic growth: empirical evidence in Malaysia. Renew Energy 68:276–281

Leitao A (2010) Corruption and the environmental Kuznets curve: empirical evidence for sulfur. Ecol Econ 69(11):2191–2201

Masron TA, Subramaniam Y (2018) The environmental Kuznets curve in the presence of corruption in developing countries. Environ Sci Pollut Res 25(13):12491–12506

Moghadam HE, Dehbashi V (2018) The impact of financial development and trade on environmental quality in Iran. Empir Econ 54(4):1777–1799

Muhammad J, Fatima SG (2013) Energy consumption, financial development and CO2 emissions in Pakistan, MPRA Paper No. 48287

Nasreen S, Anwar S (2015) The impact of economic and financial development on environmental degradation: an empirical assessment of EKC hypothesis. Stud Econ Financ 32(4):485–502

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Panayotou T (1997) Demystifying the environmental Kuznets curve: turning a black box into a policy tool. Environ Dev Econ 2:465–484

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38:2528–2535

Sahli I, Rejeb JB (2015) The environmental Kuznets curve and corruption in the Mena Region. Procedia Soc Behav Sci 195:1648–1657

Saidi K, Mbarek MB (2016) The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-016-6303-3

Shahbaz M (2013) Does financial instability increase environmental degradation? Fresh evidence from Pakistan. Econ Model 33:537–544

Shahbaz M, Lean HH (2012) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479

Shahbaz M, Hye QMA, Tiwari AK, Leitao NC (2013a) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121

Shahbaz M, Tiwari AK, Nasir M (2013b) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459

Shahbaz M, Mallick H, Mahalik MK (2015) Does globalization impede environmental quality in India? Ecol Indic 52:379–393

Sharma SS (2011) Determinants of carbon dioxide emissions: empirical evidence from 69 countries. Appl Energy 88(1):376–382

Stern DI (2004) The rise and fall of the environmental Kuznets curve. World Dev 32(8):1419–1439

Tadesse SA (2005) Financial development and technology. Working Paper No. 749

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from Transitional Economies. Energy Econ 32:137–145

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37:246–253

Wooldridge JM (2002) Econometric analysis of cross section and panel data, MIT Press

Yandle B, Vijayaraghavan M, Bhattarai M (2004) The Environmental Kuznets curve: a review of findings, methods, and policy implications. PERC Research Study, Property and Environment Research, Montana

Yang J, Zhang Y, Meng Y (2015) Study on the impact of economic growth and financial development on the environment in China. J Sys Sci & Info 3(4):334–347

Yazdi SK, Shakouri B (2014) The impact of energy consumption, income, trade, urbanization and financial development on carbon emissions in Iran. Adv Environ Biol 8(5):1293–1300

Yuxiang K, Chen Z (2010) Financial development and environmental performance: evidence from China. Environ Dev Econ 16:93–111

Zhang Y-J (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39:2197–2203

Zhang Y-J, Jin Y-L, Chevallier J, Shen B (2016) The effect of corruption on carbon dioxide emissions in APEC countries: a panel quantile regression analysis. Technol Forecast Soc Chang 112:220–227

Zugravu N, Duchêne G, Millock K (2009) The factors behind CO2 emission reduction in transition economies. Rech Econ Louvain 75(4):461–501

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zakaria, M., Bibi, S. Financial development and environment in South Asia: the role of institutional quality. Environ Sci Pollut Res 26, 7926–7937 (2019). https://doi.org/10.1007/s11356-019-04284-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-04284-1