Abstract

The goal of this study is to analyze the impact of Internet use, employed as a proxy for information and communications technologies (ICTs), on CO2 emissions. Using a panel of 20 emerging economies spanning the period 1990 to 2015, this paper finds that increased Internet access results in lower levels of air pollution. Moreover, panel causality test results highlight a unidirectional causality running from Internet use to CO2 emissions. This result also has crucial policy implications for the governments in emerging markets. For instance, increased investment in the ICT sector could be a plausible channel to reduce air pollution level.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Environmental pollution has been a major public health problem, particularly since the advent of the industrial age in the late eighteenth century. The employment of labor-saving machines in production has substantially contributed to economic development, but this extensive mechanization has also generated significant carbon dioxide emissions (CO2). Due to the negative health and environmental effects of these emissions, governments have started to take precautions to attain a more sustainable world, particularly in the aftermath of the two oil price shocks of the 1970s. Since then, there has been an increased emphasis across countries on how to reduce energy consumption and CO2 emissions through the expansion of information and communications technologiesFootnote 1 (ICTs) (Sadorsky 2012; Salahuddin and Alam 2015). Moving from physical resources to information resources in the advent of the computer age is expected to reduce resource and pollution intensities in economic growth process (Toffel and Horvath 2004).

Information technologies (ITs) are shown to produce more efficient economic growth with less energy demand (Sadorsky 2012). Moreover, it is known that less energy consumption generates lower greenhouse gas (GHG) emissions. The phrase “IT for green” (Cai et al. 2013; Dedrick 2010) acknowledges the IT sector as a potential solution to reduce CO2 emissions through more efficient energy use across all sectors of the economy. ICT investments can generate substitution effects as they reduce the demand for electricity through the replacement of an old energy-intensive production technology with a new one (Cho et al. 2007). The shift in the industrial structure away from iron and steel, chemicals, and other smokestack industries towards electronics, communications, and other IT industries clearly display the best example of the presence of substitution effect (Takase and Murota 2004).

In addition, ICTs are able to enrich environmental quality through the dematerialization of production, which indicates a less resource-intensive and weightless economy (Fuchs 2008; Ishida 2015). The shifts from books to bytes, from compact discs to MP3s, from snapshots to JPEGs, and from checkbooks to clicks, are the products of the dematerialization process in which electrons are substitutes for atoms (Sui and Rejeski 2002). The products of the dematerialization process, such as online shopping, e-commerce, tele-conference, and tele-working may significantly reduce air pollution. For instance, online shopping consumes less energy, while it emits less CO2 emissions than shopping by car (Romm 2002); e-commerce can substantially reduce the need for wasteful products, such as printed catalogs via marketing by pixels, instead of packages (Sui and Rejeski 2002); and tele-conference and tele-working activities could reduce fuel consumption and GHG emissions through demobilization, i.e., with less traveling and less work trips (Coroama et al. 2015; Fuchs 2008).

However, there are also negative effects of ICTs on environmental quality. Given that both the production and the disposal of ICTs generate waste and toxic emissions, the knowledge society is not an immaterial society, but just a new stage within the material reality of capitalism (Fuchs 2008). Moreover, ICTs can generate compensation effects that work against the substitution effects (Cho et al. 2007). In particular, both the installation and the operation of new ICT devices are characterized as highly energy intensive, resulting in an increased electricity demand. For instance, the electricity consumption relating to ICT devices is rising at a rate of nearly 7% per annum (Salahuddin and Alam 2015) while both the production and the use of ICT devices are estimated to be responsible for about 1 to 3% of global CO2 emissions (Houghton 2010; Peng 2013).

Further, ICTs can generate potential rebound effects, counteracting their positive impacts on energy demand and the environmental quality. Such rebound effects denote the paradox that energy efficiency gains, resulting from the deployment of ICTs, can generate additional pressure on the use of ICT products (Coroama et al. 2012; Hilty et al. 2006). The new technologies, such as LCDs, laptops, and tablets, are smaller and more energy efficient, but the associated improvements in their energy efficiencies are outweighed by a fast growth in their demand (Heddeghem et al. 2014). Thus, it is premature to paint too rosy a picture for the positive environmental impacts of the emerging digital economy (Sui and Rejeski 2002). In this regard, the notion of “green IT” (Peng 2013; Salahuddin et al. 2016) could be used to define the dark side of IT. According to this view, the ICT sector should do more to implement environment-friendly devices to combat its own carbon footprint.

Given the myriad of possible effects of technology on the environment, the goal of this paper is to explore whether ICTs alleviate or aggravate air pollution in emerging markets, which deserve a special research interest due to their high levels of energy demand, CO2 emissions, and increased usage of ICTs. The demand for energy in many emerging markets has been increasing continuously in recent years as a result of their rapid population growth and urbanization rates. The center of gravity of energy demand is moving away from developed economies to countries like China, India, and the Middle Eastern economies, which have increased global energy demand by a third (IEA 2013). Moreover, emerging markets have a large responsibility for the increased global CO2 emission levels. Four major emerging economies—Brazil, China, India, and South Africa—are among the world’s largest carbon emitters. Emerging countries such as China and India are also prominent global users and providers of ICT devices and services (Osorio et al. 2013). The percentages of the Internet users increased from 1% in the 1990s to 50% in China and to 26% in India in 2015 (World Bank 2017).

Based on the abovementioned explanations, this study is expected to contribute to the related literature in the following ways: First, there is a scarcity of related research. There are only few studies (see Al-Mulali et al. 2015; Salahuddin et al. 2016; Zhang and Liu 2015) in the economics literature analyzing the ICT-air pollution nexus. Second, to the best of our knowledge, there is only one related panel study (see Salahuddin et al. 2016) that investigates the Internet use-air pollution nexus. However, Salahuddin et al. (2016) analyze the case of the OECD countries, whereas we perform the analysis for the case of emerging economies. In addition, their model does not include the variable of energy consumption that is an important determinant of CO2 emissions, and the unit root, cointegration, and causality tests they used are different from ours. In this respect, we aim to fill a void in the literature by focusing on emerging markets and using novel panel data analyses that allow for both cross-sectional dependence and heterogeneity in slope parameters.

The remainder of the paper is organized as follows. The “Literature review” section presents the literature review while the “Data and model” section provides data and model used. Methodological issues and the empirical results are reported in the “Methodology and empirical results” section. Finally, the “Conclusion and policy implications” section concludes and offers policy implications.

Literature review

The environmental implications of ICTs were not analyzed until the early 1990s. Since then, a number of studies have used a macro framework to investigate the ICT-energy/environment nexus (Salahuddin et al. 2016). The current literature is primarily based on two main research categories: The first category analyzes the impact of ICTs on energy demand (particularly electricity demand) (Cho et al. 2007; Collard et al. 2005; Ishida 2015; Sadorsky 2012; Saidi et al. 2015; Salahuddin and Alam 2015; Romm 2002; Ropke et al. 2010; Takase and Murota 2004; Tunali 2016; Wang and Han 2016) while the second category evaluates the effects of ICTs on the environmental quality, and mostly on air quality (Al-Mulali et al. 2015; Chavanne et al. 2015; Coroama et al. 2012, 2015; Fichter 2003; Matthews et al. 2001; Matthews et al. 2002; Reichart and Hischier 2003; Salahuddin et al. 2016; Siikavirta et al. 2003; Toffel and Horvath 2004; Zhang and Liu 2015).

Regarding the impacts of ICTs on energy demand, several time series studies modeled electricity demand by adding a proxy for ICTs (Cho et al. 2007; Collard et al. 2005; Ishida 2015; Romm 2002; Ropke et al. 2010; Sadorsky 2012; Salahuddin and Alam 2015; Takase and Murota 2004). Among them Ishida (2015) estimates a long-run relationship between ICT, energy consumption, and economic growth in Japan, spanning the period 1980–2010. His results indicate that ICT investments contribute to a moderate reduction in energy consumption. Similarly, Salahuddin and Alam (2015) estimate both the short- and the long-run effects of the Internet usage and economic growth on electricity consumption in the case of Australia over the period 1985–2012. Their findings document that Internet use stimulates electricity consumption along with a unidirectional causality running from the Internet usage to electricity consumption. Collard et al. (2005) find that electricity intensity in production increases along with computers and software in the French services sector for the period 1986–1998. Romm (2002) concludes that Internet use leads to decreases in energy intensity and increases in energy efficiency in some US sectors. In the case of South Korean industries, Cho et al. (2007) investigate the impact of ICT investments on electricity consumption by using a logistic growth model over the period 1991–2003. Their results indicate that ICT investments reduce electricity consumption only in the manufacturing sector, while increasing electricity consumption in five other sectors. Based on a case study carried out for Denmark, Ropke et al. (2010) conclude that the integration of ICTs in everyday practice raises residential electricity consumption for the years 2007 and 2008. Takase and Murota (2004) analyze the effects of IT investments on both energy consumption and CO2 emissions for the USA and Japan. Their results indicate that Japan could conserve more energy, whereas USA could consume more energy through IT investments.

In this research line, there are also some dynamic panel data studies (see Sadorsky 2012; Saidi et al. 2015; Tunali 2016; Wang and Han 2016). Of them Sadorsky (2012) illustrates that ICTs raise electricity consumption in 19 emerging economies over the period 1993–2008 while Saidi et al. (2015) investigate the impact of both ICTs and economic growth on electricity consumption for a global panel of 67 countries. Their findings support the presence of a positive and statistically significant effect of ICTs on electricity consumption. For a panel of 20 European Union countries, Tunali (2016) finds that ICTs raise electricity consumption, spanning the period 1990–2012. In a dynamic panel data framework, Wang and Han (2016) explore the impact of ICT investments on energy intensity by using 30 provincial data sets in China, spanning the years 2003 to 2012. Their results indicate that ICT investments significantly reduce energy intensity on a nationwide level in the long-run.

As a second research category, some panel data studies analyze the effect of ICTs on environmental quality. For instance, using provincial panel data for China over the years 2000–2010, Zhang and Liu (2015) find that ICT intensity curbs CO2 emission levels on the national level. Salahuddin et al. (2016) estimate both the short- and the long-run effects of Internet usage and economic growth on CO2 emissions across OECD countries for the period 1991–2012; their findings show that a 1% rise in Internet usage increases CO2 emissions by 0.16%. Additionally, studies particularly from other disciplines, such as industrial engineering, environmental engineering, and informatics, evaluate the effects of tele-conferencing, digital media, and online retailing on environmental pollution. Of them, based on a field experiment, Coroama et al. (2012) provide evidence that tele-conferences decrease travel-related GHG emissions by 50% while Coroama et al. (2015) conclude that electronic media and videoconferencing represent energy-efficient alternatives to their traditional counterparts. Chavanne et al.’s (2015) results also indicate that teleconferencing permits some electricity saving thanks to the substitution for its physical counterpart. Toffel and Horvath (2004) show that wireless technologies have lower environmental impacts than traditional technologies. Matthews et al. (2001) prove that e-commerce logistics are less costly and lead to lower environmental impacts than traditional retailing while Fichter (2003), in a theoretical framework, concludes that e-commerce is inherently neither environment-friendly nor environment-hostile. Matthews et al. (2002) document that e-commerce book sales in the USA and Tokyo require more energy than traditional retailing; however, they reach the opposite results in the case of rural Japan. Reichart and Hischier (2003) show that printed newspapers have a very high environmental burden relative to watching TV news or reading online news. Finally, Siikavirta et al. (2003) find that the GHG emission reduction potential of e-grocery in Finland is relatively small because the transportation sector is responsible for only 15% of the GHG emissions. The only economic study in this research vein is that by Al-Mulali et al. (2015), who explore the influence of Internet retailing on CO2 emissions across 77 countries over the period 2000–2013. Their findings reveal that Internet retailing reduces CO2 emissions in the case of developed countries, while it does not have any significant impact in the case of developing countries.

Data and model

For the current study, the country sample includes the following 20 emerging markets economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, Indonesia, India, Greece, Mexico, Malaysia, Peru, Philippines, Poland, Russia, South Africa, South Korea, Thailand, and Turkey. The Morgan Stanley Capital International (MSCI) classification (2017) is used for the selection of the emerging markets. Although they are listed on the MSCI classification, Qatar, United Arab Emirates, and Taiwan were excluded due to insufficient data span. The timeframe is from 1990 to 2015. As regards the proxy for ICT, the number of Internet users per 100 people is used. We added one to each data point to make the log value of zero Internet users to be zero as well (Lin [2015] also utilizes this measure). Air pollution is measured by CO2 emissions reported in metric tons per capita while economic growth is measured as real per capita GDP (2010 US dollar). In addition, three control variables are included into the empirical model: financial development (represented by domestic credit to private sector as a share of GDP), trade openness (the sum of exports and imports divided by GDP), and energy consumption (measured by kg of oil equivalent per capita). All data come from the World Development Indicators database of the World Bank (2017). However, World Bank contains data for CO2 emissions only till 2013. Therefore, this variable has been supplemented by data from the European Commission’s Emissions Database for Global Atmospheric Research (EDGAR 2017) for the years 2014 and 2015.

Based on previous studies in the relevant literature (Ozturk and Acaravci 2013; Sadorsky 2014; Salahuddin et al. 2016; Zhang and Liu 2015), we specified the model as in Eq. (1):

where i = 1, 2, . . …, 20 denotes the number of countries in the panel; t = 1990, . ……, 2015 is the time period; α i and δ i t indicate country-specific fixed effects and deterministic trends, respectively; and ε it represents idiosyncratic errors. All variables are used in their natural logarithms. Thus, the coefficients β 1, β 2, β 3, β 4, and β 5 correspond to the long-run elasticities of CO 2 with respect to Internet users (lnINT it ), per capita real GDP (lnGDPC it ), financial development (lnFD it ), trade openness (lnTRD it ), and energy consumption per capita (lnENC it ), respectively. The signs of β 1, β 3, and β 4are not certain; they could be positive or negative. However, the signs of β 2 and β 5are expected to be positive. These two variables (GDP and energy consumption) are used in the studies testing for the environmental Kuznets curve (EKC) hypothesis (see, inter alia, Al-Mulali 2011; Apergis and Payne 2010). This hypothesis assumes that increases in income raise emission levels until a threshold level of income is reached after which emissions start to decline (Acaravci and Ozturk 2010).Footnote 2 Moreover, energy consumption is a key source of CO2 emissions because higher energy consumption leads to more CO2 emissions. However, the effect of trade openness on environmental quality is not certain. First, trade openness may aggravate environmental pollution in emerging countries. Through the movement of factors of production, trade openness may direct dirty industries from home countries to developing countries, where environmental laws and regulations are lax (Shahbaz et al. 2011). This situation is called as the “pollution haven” hypothesis, indicating that developing countries are expected to become pollution havens, while the developed countries are expected to be more intensive in clean production activities (Cole 2006). In contrast to this argument, there is a second hypothesis, the “pollution halo” hypothesis, suggesting that foreign firms use better management practices and advanced technologies, resulting in more clean environments in host countries (Asghari 2013).

Likewise, the impact of financial development on CO2 emissions is not certain either. On the one hand, by lowering financing costs, expanding financing channels, and dispersing operating risks, financial development helps firms to purchase new installations and to invest in new projects, which then increases both energy consumption and carbon emissions (Ozturk and Acaravci 2013). On the other hand, financial development can provide the opportunity to utilize new production technologies that are clean and environment-friendly and thereby prevent environmental pollution in developing countries (Tamazian et al. 2009). Moreover, financial intermediaries in a well-functioning financial system may mobilize the resources needed for investments in environment-friendly projects (Jalil and Feridun 2011).

Before moving to the main part of the empirical analysis, we first provide some statistical measures of the log values across all the variables in Table 1. The mean of CO2 emissions ranges from − 0.112 in Philippines to 2.524 in Czech Republic. Regarding Internet users, India has the least number of (1.093) Internet users per 100 people, whereas South Korea has the highest (3.005). In respect to GDP per capita, India is the poorest country (6.804), whereas Greece is the richest one (10.064). Regarding financial development, Mexico is the least financially developed (3.046) country, whereas South Africa is the most developed one (4.839). In respect to trade openness, the most open country considered is Malaysia (5.170), whereas Brazil is the least open one (3.098). Finally, concerning energy consumption per capita, India has the least energy consumption per capita (6.116), whereas Russia has the highest (8.454). In addition, Turkey has the least and Colombia has the highest fluctuations in GDP and energy consumption per capita. Philippines has the lowest variation in the Internet users and the highest volatility in trade openness. The most variations in CO2 emissions, Internet users, and financial development belong to China, India, and Indonesia, respectively. Finally, Mexico, Colombia, and South Africa have the lowest volatility in CO2 emissions, financial development, and trade openness, respectively.

Methodology and empirical results

Results of cross-sectional dependence test and panel unit root tests

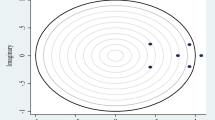

In the first step of the empirical analysis, we employ the cross-sectional dependence test developed by Breusch and Pagan (BP, 1980) to identify the best unit root test. It is well known that in case that T is larger than N as in our case, the BP test is favorable over other tests, such as the CD tests recommended by Frees (1995) and Pesaran (2004). The BP test follows a χ 2 distribution, with the null hypothesis being cross-sectional independence. The results reported in Table 2 indicate the presence of cross-sectional dependence across all variables. Therefore, the next step of the analysis employs the panel bootstrap unit root tests proposed by Smith et al. (2004).

Smith et al. (2004) allow for cross-sectional dependence through a bootstrap procedure and develop five unit root tests (\( L\overline{M} \),\( \overline{t} \),\( Mi\overline{n} \), \( Ma\overline{x} \), and \( W\overline{S} \) tests). \( L\overline{M} \) test is the mean of individual Lagrange multiplier test statistics (LM i ), proposed by Solo (1984). The second test \( \overline{t} \) is just a bootstrap version of the Im et al. (2003) test; the third test \( Ma\overline{x} \)=\( {N}^{-1}\sum \limits_{i=1}^N{\mathit{\operatorname{Max}}}_i \) has been developed by Leybourne (1995). The fourth test \( Mi\overline{n}={N}^{-1}\sum \limits_{i=1}^N{\mathit{\operatorname{Min}}}_i \) is a more powerful variant of the LM statistic. It is based on both forward and reverse ADF regressions, providing the statistics LM fi and LM ri based on their minima Min i = Min(LM fi , LM ri ). The final test \( W\overline{S} \) has been suggested by Pantula et al. (1994). These five tests have a unit root null hypothesis and allow for heterogeneous autoregressive roots under the alternative hypothesis. Therefore, the rejection of the null hypothesis implies that stationarity does hold for at least one panel member. The test results provided in Table 3 document that all variables are non-stationary in their levels, whereas they turn stationary in their first differences, i.e., they are integrated of order 1.

Results of cointegration test and long-run parameter estimates

After having defined the integration properties of the variables of interest, the next step is to ascertain the long-run relationship among the variables in Eq. (1). To this purpose, we make use of the panel bootstrap LM cointegration test recommended by Westerlund and Edgerton (WE 2007). The WE (2007) test seems to work well in small samples and takes the dependence both within and between the cross-sectional units into account. It is based on the Lagrange multiplier test suggested by McCoskey and Kao (1998) and the sieve-sampling scheme to implement the bootstrap procedure. It has the advantage of significantly reducing the distortions of the asymptotic test. Its null hypothesis is that all countries in the panel are cointegrated, whereas the alternative hypothesis indicates that some countries in the panel are not cointegrated.

As tabulated in Table 4, under the presence of cross-sectional dependence, the WE (2007) test does not reject the null hypothesis of cointegration.Footnote 3 Therefore, based on the existence of a cointegrating relationship, we estimate the long-run parameters in Eq. (1). First, we search for the heterogeneity in slope parameters through the Delta (\( \tilde{\Delta} \)) and adjusted-Delta (\( {\tilde{\Delta}}_{adj} \)) tests recommended by Pesaran and Yamagata (2008). Both Delta tests indicate the presence of heterogeneity in slope parameters involved in Eq. (1).Footnote 4 Therefore, we employ the Augmented Mean Group estimator (AMG) by Eberhardt and Teal (2010). In the case of a cointegrated panel with cross-sectional dependence and heterogeneous slope coefficients, the AMG estimator provides efficient estimates. In the AMG estimation, the set of unobservable common factors is treated as a common dynamic processes (Sadorsky 2014) and each regression model includes an intercept that captures time-invariant fixed effects, while the group-specific model parameters are averaged across the panel (Comunale 2016).

The AMG approach involves three steps: (i) a pooled regression model, augmented with year dummies, is estimated by first difference ordinary least squares, and the coefficients on the year dummies are obtained. These coefficients stand for a cross-group average of the evolution of unobservable factors over time; (ii) the group-specific regression model is then augmented with this estimated common dynamic process, either as an explicit variable, or imposed on each group member with a unit coefficient by subtracting the estimated process from the dependent variable, and (iii) the group-specific model parameters are averaged across the panel (Bond and Eberhardt 2009; Eberhardt and Teal 2011). Furthermore, as a robustness check, we additionally utilize the Mean Group (MG) estimator, recommended by Pesaran and Smith (1995), as well as the heterogeneous Group Mean-Fully Modified ordinary least squares (GM-FMOLS) estimator of Pedroni (2000). The FMOLS estimator has an advantage as it corrects for both endogeneity bias and serial correlation. It is also the most suitable technique to be applied in the presence of heterogeneous cointegrated panels as asserted by Haggar (2012).The GM-FMOLS estimator can be specified as \( {{\widehat{\beta}}^{\ast}}_{GFM}={N}^{-1}\sum \limits_{i=1}^N{\beta^{\ast}}_{FMi} \), where \( {\beta^{\ast}}_{FM_i} \) is obtained from a time series FMOLS estimation of Eq. (1) for each country. Both the MG and GM-FMOLS estimators allow for heterogeneity in slope parameters across countries; however, they do not take cross-sectional dependence explicitly into consideration. Thus, we correct them against dependence problems by using their demeaned variables to control for common effects.Footnote 5

As tabulated in Table 5, the findings from AMG indicate that Internet usage has a negative and statistically significant effect on carbon dioxide emissions. A 1% increase in the Internet users decreases CO2 emissions by 0.02%. Despite the small impact, ICT use in general and the Internet use in particular appear to improve air quality in the case of emerging markets. These results show that ICT-induced higher energy saving in some areas of life is likely to surpass ICT-induced additional energy consumption in other areas. The gains in energy efficiency derived from the substitution effects of ICTs appear to surpass the additional energy demand derived from both the compensation and the rebound effects. Along with the rising number of Internet users, many emerging economies produce more energy-saving and smaller ICT devices, such as laptops, smartphones, and others. In particular, China, India, and South Korea are the new hubs for high-tech manufacturing. For instance, South Korea has its own brands in smartphones and smart TVs markets, such as Samsung and LG. Moreover, most emerging markets (e.g., Brazil, China, India, Indonesia, Malaysia, Mexico, Philippines, Poland, Thailand, and Turkey) are the producers of mobile phones. In this respect, the ICT sector has continued to improve at an increasing pace in emerging economies. Furthermore, as the use of the Internet becomes more widespread, inhabitants in emerging economies may attend teleconferences than traveling, stay at home, and work online than go to their workplaces, buy online than go to the shopping malls, read online news than buy newspapers, and order food online than cook at home. All these ICT-related transformations in daily life result in less energy demand and less carbon emissions.

As regards the other variables, both GDP and energy consumption have expected positive and significant effects on CO2 emissions. Economic growth leads to more air pollution in the case of emerging countries. Based on the EKC hypothesis, many studies report that both economic growth and energy consumption raise CO2 emission levels (Halicioglu 2009; Narayan and Narayan 2010). Economic growth leads to environmental degradation during the early stages of the development process. In this respect, emerging countries probably could not reach the threshold income level after which emissions start to decline. Moreover, emerging countries heavily depend on non-renewable energy sources, such as oil, coal, and other fossil fuels. Thus, it is reasonable that energy consumption leads to more air pollution in these countries.

Financial development does not seem to have any statistically significant impact on air pollution. In other words, financial development in emerging markets has not taken place at the expense of environmental pollution. The beneficial and harmful environmental impacts of financial development cancel each other. This result is in line with that reached by Ozturk and Acaravci (2013), Dogan and Turkekul (2016), and Omri et al. (2015). Finally, trade openness has a statistically significant and positive effect on CO2 emissions, indicating support of the pollution haven hypothesis. In the literature, there is a general argument underlining the presence of three types of effects in relevance to the link between free trade and environmental quality (Copeland and Taylor 1994). The first is the technique effect, resulting in increases in environmental good consumption due to an improvement in people’s interest in environmental issues. The second is the scale effect, leading to the environmental deterioration as a result of increasing world trade volumes. The third is the composition effect, emphasizing that developed countries push pollution-intensive industries away so as to attract foreign direct investments, whereas developing countries are likely to attract such industries (Choi et al. 2010). Our findings indicate that trade openness is harmful for the environment in the case of emerging markets since the technique effect is smaller than the sum of both the composition and scale effects. This result is in line with that reached by Choi et al. (2010), Mongelli et al. (2006), and Halicioglu (2009).

In terms of robustness checking, the results from the MG and GM-FMOLS approaches are also provided. As seen in Table 5, the variable of Internet users keeps its negative and significant effect; trade openness, GDP per capita, and energy consumption all lead to more carbon emissions as obtained in the AMG estimation. However, we obtain different results only for the financial development variable: it reduces air pollution in the case of GM-FMOLS, whereas it does not have any effect on emissions in the case of MG.

Further, we provide some residual diagnostic tests to evaluate whether the model described in Eq. (1) fits well. Therefore, we check the stationarity of residuals by employing Smith et al.’s (2004) panel unit root test since the presence of stationarity in residuals is a measure of goodness of fit in econometric models (see Sadorsky 2014). The results from Table 6 provide strong evidence of stationarity in all regression residuals. Besides, as another residual diagnostic test, we employ Pesaran’s (2004) CD test to define cross-sectional dependence among residuals. However, the results from each specification show that there is no dependence among residuals at 1 and 5% significance levels. Lastly, the root mean square error (RMSE) values from each regression seem fairly low. As is known, lower values of RMSE indicate better fit.

Panel causality test results

As a final step, we examine the directions of causality across the variables of interest. For this purpose, the panel bootstrap causality test by Emirmahmutoglu and Kose (EM 2011), which is based on the meta-analysis by Fisher (1932) in heterogeneous mixed panels, is used. The EM (2011) test adapts the lag-augmented vector autoregressive (LA-VAR) approach recommended by Toda and Yamamoto (1995), which uses a level VAR model with extra dmax lags. The cross-sectional dependence is taken into account with a bootstrap procedure, and there are two test statistics: the first is the individual Wald statistics, which are calculated to test the non-causality null hypothesis separately for each individual country. They follow an asymptotic chi-square distribution with ki degrees of freedom. The individual p values are computed by using these individual Wald statistics. Then, based on these individual p values (pi) that correspond to the Wald statistic of the ith individual cross section, the Fisher test statistic \( \left(\lambda =-2\sum \limits_{i=1}^N\ln \left({p}_i\right),\kern0.5em i=1,2,..\dots, N\right) \) that has a chi-square distribution with 2 N degrees of freedom is obtained. Moreover, EM (2011) shows that the performance of the LA-VAR approach is quite satisfactory for the entire values of T and N under both the cross-sectional independence and the cross-sectional dependence cases. Its null hypothesis indicates that X does not homogenously Granger causeY, whereas its alternative hypothesis refers to X does heterogeneously Granger causeY.Footnote 6 The results of the EM (2011) test are reported in Table 7.

Based on the causality test results, the Internet use variable Granger causes CO2 emissions. In addition, as provided in the long-run estimation results, Internet use decreases CO2 emission levels. This result is similar to that reached by Al-Mulali et al. (2015) and Zhang and Liu (2015). However, it is in sharp contrast with that by Salahuddin et al. (2016), who confirm the neutrality hypothesis for the case of OECD countries. As regards the relationship between GDP and CO2 emissions, there appears a feedback relationship, indicating that curbing CO2 emissions cannot be successful without sacrificing economic growth. Most studies in the EKC literature obtain results similar to those reached here (see, inter alia, Dogan and Aslan 2017; Jebli et al. 2016). Another feedback relationship obtained is that for the case of financial development and energy consumption. This result is consistent with that of Shahbaz et al. (2010) and Tang and Tan (2014). On the one hand, firms demand more energy due to higher volumes of production and investments as a result of financial development. On the other hand, higher volumes of production, investments, and energy consumption necessitate a deeper financial market. Financial development also has reciprocal relationships with economic growth and trade openness. In this regard, financial markets develop as a result of economic growth, which in turn feeds back as a stimulant to the growth process (Al-Yousif 2002). There is a complementary relationship between trade openness and financial development (see, inter alia, Islam et al. 2013; Omri et al. 2015). Financial development encourages the inflows of foreign direct investments and trade volumes across countries while international trade transactions and payments require an advanced financial market.

The unidirectional relationship from emissions to energy consumption indicates that emerging countries have been trying to curb their high emission levels by reducing dependency on non-renewable energy sources (Lean and Smyth 2010). The linkage between trade and growth supports the growth-led trade hypothesis (Koner and Purandare 2012). Additionally, the unidirectional causality running from energy consumption to trade openness indicates that any reduction in energy use will likely lower the potential benefits from trade, and thus energy conservation policies might conflict with trade policies (Erkan et al. 2010). Causality from energy consumption to the Internet users indicates that the availability of electricity to the inhabitants of emerging markets is a necessary condition for a well-organized ICT infrastructure and an increased number of ICT users.

Finally, the neutrality hypothesis was confirmed between some variables, e.g., for the financial development-emission nexus (see Omri et al. 2015) and the trade openness-emission nexus (see Karsalari et al. 2014). There is also no causality in either direction for the growth-energy consumption nexus, indicating that energy conservation policies may be pursued without adversely affecting economic growth (Payne 2009). Moreover, financial development and trade openness do not share any significant relationship with the Internet usage. The result regarding the relationship between finance and the Internet usage is similar to that reached by Pradhan et al. (2015). However, it is in sharp contrast with that by Salahuddin and Alam (2015), who find a one-way causality running from the Internet users to financial development for the case of Australia, and Salahuddin and Gow (2016), who obtain a causality running from financial development to the Internet use for South Africa. The finding regarding the direction of causality between trade openness and the Internet use is also in sharp contrast with Salahuddin et al. (2016), who support a feedback relationship for the OECD sample.

Based on the causal relationships stated above, we can deduce the following linkages: (i) The increased energy consumption will likely raise the number of the Internet users which will lead to less CO2 emissions. Then, energy consumption will go up again as a result of decreasing emission level. In this regard, there is a circle like energy consumption ↑→ Internet users ↑→ CO2 emissions ↓→ energy consumption ↑; (ii) despite the lack of direct causal effects of financial development and trade openness on emissions and the Internet users, they have some indirect effects through the channels of economic growth and energy consumption. In this respect, on the one hand, economic growth may increase the level of financial development, which results in more energy consumption; the more energy demand results in more Internet users, which in turn curbs carbon emissions (i.e., growth ↑→ finance ↑→ energy ↑→ Internet users ↑→ CO2 emissions ↓). On the other hand, economic growth may expand the trade volumes across emerging countries, which is likely to result in more developed financial markets. Likewise, financial development raises energy demand levels that will probably increase the number of the Internet users and this process will cut emissions (i.e., growth ↑→ trade ↑→ finance ↑→ energy ↑→ Internet users ↑→ CO2 emissions ↓).Footnote 7

Conclusion and policy implications

In this study, we analyze the impact of the Internet users on CO2 emissions for a panel of 20 emerging economies using a panel data framework. In our estimation procedure, we allow for cross-sectional dependence and slope heterogeneity across countries. We first establish that all variables are stationary in their first differences. The Westerlund and Edgerton (2007) cointegration test then provides evidence of a long-run relationship between the variables of interest. The long-run parameter results indicate that the more Internet users a country has, the lower emissions it will emit. Moreover, both economic growth and energy consumption appear to raise emissions as theoretically expected while financial development does not significantly affect CO2 emissions, and trade openness appears to push dirty industries towards emerging markets.

We also test for causality linkages across the variables of interest. We find feedback relationships between GDP and CO2 emissions, financial development and GDP, financial development and energy consumption, and financial development and trade openness. Additionally, we confirm some unidirectional causality linkages from the Internet users to emissions, from emissions to energy consumption, from GDP to trade openness, from energy consumption to trade openness, and from energy consumption to the Internet users. Finally, no causal relationship was found for the nexuses of finance-emissions, trade-emissions, Internet-growth, growth-energy, finance-Internet, and trade-Internet. These causality relationships indicate that both economic growth and the Internet users have direct effects on air quality, whereas financial development and trade openness have indirect effects on emissions through some channels.

Our results have the following crucial policy implications, in general for the ICT-emission nexus and in particular for the Internet-emission nexus. First, to compensate for high population growth rates and energy demand levels mainly supplied by fossil fuels, the emerging economies can use innovative ICT devices to reduce their carbon intensity levels. Energy-efficient ICT devices, such as smart TVs, smartphones, smart appliances, and others, are the important innovations of the post-industrial society that has the potential to curb global CO2 emissions. Emerging countries would do well to invest more in their ICT industries. Internet infrastructure should be developed more, and access to the World Wide Web should be facilitated, especially in rural and remote areas with no current Internet connection. Therefore, Internet accessibility will facilitate more online shopping, attending teleconferences and working remotely instead of commuting. Emissions will thereby be reduced as a result of less energy consumption.

The application of ICT-enabled technologies to the old sectors of emerging economies will cause new sectors to emerge, such as smart manufacturing, smart energy, smart buildings, and smart logistics, all of which have significant potential effects on reducing air pollution. Efficiency gains, such as engine optimization, improvements in process automation, less energy loss and the reduced use of energy in residential buildings, will also reduce energy intensity in emerging markets (BP 2016). In this regard, policy makers will need to harmonize policies to enable the smart infrastructure necessary for a low carbon economy and to integrate ICT requirements into building and transportation, energy, environmental, and innovation policies (GESI 2008).

Overall, emerging countries currently have high dependence on fossil fuels, but they have started to invest more in their renewable energy sectors to reduce their dependence on non-renewable energy sources. Given that emissions are a by-product of the economic growth process, environmental policies targeting CO2 emissions can have adverse effects on economic growth in the case of emerging economies. Investments and developments in ICT are a way to curb emissions while still promoting economic growth. Therefore, the preferred plan for development is one that aims to strike a balance between growth and environmental quality, and promotion of ICT is an essential ingredient of that plan.

Notes

Information and communications technologies (ICTs) refer to electronic computer equipment and concerned software to convert, store, process, communicate, and retrieve digitized information (Zadek et al. 2010).

We did not include square GDP into the model because our aim is not to test for the EKC hypothesis. The EKC hypothesis assumes that the signs of coefficients on GDP and square GDP should be positive and negative, respectively.

We should depend on the bootstrap probability value under the presence of cross-sectional dependence.

The values of test statistics are 18.925 and 21.989 with zero probability values.

We provide a detailed methodological explanation for the EM (2011) test in the Appendix.

The arrows →, ↑, and ↓ indicate the direction of causality, increases and decreases in the variables of interest, respectively.

References

Acaravci A, Ozturk I (2010) On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 35(12):5412–5420. https://doi.org/10.1016/j.energy.2010.07.009

Al-Mulali U (2011) Oil consumption, CO2 emission and economic growth in MENA countries. Energy 36(10):6165–6171. https://doi.org/10.1016/j.energy.2011.07.048

Al-Mulali U, Ting LS, Ozturk I (2015) The global move toward Internet shopping and its influence on pollution: an empirical analysis. Environ Sci Pollut Res 22(13):9717–9727. https://doi.org/10.1007/s11356-015-4142-2

Al-Yousif YK (2002) Financial development and economic growth: another look at the evidence from developing countries. Rev Financ Econ 11(2):131–150. https://doi.org/10.1016/S1058-3300(02)00039-3

Apergis N, Payne JE (2010) The emissions, energy consumption, and growth nexus: evidence from the common wealth of independent states. Energ Policy 38(1):650–655. https://doi.org/10.1016/j.enpol.2009.08.029

Asghari M (2013) Does FDI promote MENA region’s environment quality? Pollution halo or pollution haven hypothesis. Int J Sci Res Environ Sci (IJSRES) 1(6):92–100. 10.12983/ijsres-2013-p092-100

Bond S, Eberhardt M (2009) Cross-section dependence in nonstationary panel models: a novel estimator. Paper presented at the Nordic Econometrics Conference in Lund, Sweden, 29-31 October 2009

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253. https://doi.org/10.2307/2297111

British Telecommunications plc (BP) (2016) The role of ICT in reducing carbon emissions in the EU. https://www.btplc.com/Purposefulbusiness/Ourapproach/Ourpolicies/ICT_Carbon_Reduction_EU.pdf. Accessed 15 March 2017

Cai S, Chen X, Bose I (2013) Exploring the role of IT for environmental sustainability in China: an empirical analysis. Int J Prod Econ 146(2):491–500. https://doi.org/10.1016/j.ijpe.2013.01.030

Campbell JY, Perron P (1991) Pitfalls and opportunities: what macroeconomics should know about unit roots. NBER Macroecon Annu 6:141–201. https://doi.org/10.1086/654163

Chavanne X, Schinella S, Marquet D, Frangi JP, Masson SL (2015) Electricity consumption of telecommunication equipment to achieve a telemeeting. Appl Energy 137:273–281. https://doi.org/10.1016/j.apenergy.2014.10.027

Cho Y, Lee J, Kim TY (2007) The impact of ICT investment and energy price on industrial electricity demand: dynamic growth model approach. Energ Policy 35(9):4730–4738. https://doi.org/10.1016/j.enpol.2007.03.030

Choi E, Heshmati A, Cho Y (2010) An empirical study of the relationships between CO2 emissions, economic growth and openness. Available via IZA discussion paper, no. 5304. http://ftp.iza.org/dp5304.pdf. Accessed14 may 2017

Cole MA (2006) Does trade liberalization increase national energy use? Econ Lett 92(1):108–112. https://doi.org/10.1016/j.econlet.2006.01.018

Collard F, Feve P, Portie F (2005) Electricity consumption and ICT in the French service sector. Energy Econ 27(3):541–550. https://doi.org/10.1016/j.eneco.2004.12.002

Comunale M (2016) Dutch disease, real effective exchange rate misalignments and their effect on GDP growth in the EU. Working Paper Series No 26 / 2016. https://www.lb.lt/lt/leidiniai/darbo-straipsniu-serija-2016-m-nr-26. Lietuvos Bankas. Accessed 21 April 2017

Copeland BR, Taylor MS (1994) North–south trade and the environment. Q J Econ 109(3):755–787. https://doi.org/10.2307/2118421

Coroama VC, Hilty LM, Birtel M (2012) Effects of Internet-based multiple-site conferences on greenhouse gas emissions. Telemat. Inform 29:362–374

Coroama VC, Moberg A, Hilty LM (2015) Dematerialization through electronic media? In: Hilty LM, Aebischer B (eds) ICT innovations for sustainability, advances in intelligent systems and computing. Springer International Publishing, Basel. https://doi.org/10.1007/978-3-319-09228-7_24

Dedrick J (2010) Green IS concepts and issues for information systems research. Commun Assoc Inf Syst 27:173–184

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213. https://doi.org/10.1007/s11356-015-5323-8

Dogan A, Aslan A (2017) Exploring the relationship among CO2 emissions, real GDP, energy consumption and tourism in the EU and candidate countries: evidence from panel models robust to heterogeneity and cross-sectional dependence. Renew Sust Energ Rev 77:239–245. https://doi.org/10.1016/j.rser.2017.03.111

Eberhardt M, Teal F (2010) Productivity analysis in global manufacturing production. Working papers 515. Available via University of Oxford, Department of Economics. https://www.economics.ox.ac.uk/materials/papers/4729/paper515.pdf. Accessed 12 April 2017

Eberhardt M, Teal F (2011) Econometrics for grumblers: a new look at the literature on cross-country growth empirics. J Econ Surv 25(1):109–155. https://doi.org/10.1111/j.1467-6419.2010.00624.x

European Commission’s Emissions Database for Global Atmospheric Research (2017) Global per capita CO2 emissions from fossil fuel use and cement production 1970-2015. http://edgarjrceceuropaeu/ Accessed 10 March 2017

Emirmahmutoglu F, Kose N (2011) Testing for Granger causality in heterogeneous mixed panels. Econ Model 28(3):870–876. https://doi.org/10.1016/j.econmod.2010.10.018

Erkan C, Mucuk M, Uysal D (2010) The impact of energy consumption on exports: the Turkish case. AJBM 2:17–23

Fichter K (2003) E-commerce: sorting out the environmental consequences. J Ind Ecol 6:25–41

Fisher RA (1932) Statistical methods for research workers, 4th edn. Oliver and Boyd, Edinburg

Frees EW (1995) Assessing cross-sectional correlation in panel data. J Econometrics 69(2):393–414. https://doi.org/10.1016/0304-4076(94)01658-M

Fuchs C (2008) The implications of new information and communication technologies for sustainability. Environ Dev Sustain 10(3):291–309. https://doi.org/10.1007/s10668-006-9065-0

GESI (2008) Smart 2020: enabling the low carbon economy in the information age. A Report by The Climate Group on Behalf of the Global e-Sustainability Initiative. Available via http://gesi.org/files/Reports/Smart%202020%20report%20in%20English.pdf. Accessed 5 May 2017

Haggar MH (2012) Greenhouse gas emissions, energy consumption and economic growth: a panel cointegration analysis from Canadian industrial sector perspective. Energy Econ 34(1):358–364. https://doi.org/10.1016/j.eneco.2011.06.005

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energ Policy 37(3):1156–1164. https://doi.org/10.1016/j.enpol.2008.11.012

Heddeghem VW, Lambert S, Lannoo B, Colle D, Pickavet M, Demeester P (2014) Trends in worldwide ICT electricity consumption from 2007 to 2012. Comput Commun 50:64–76

Hilty LM, Arnfalk P, Erdmann L, Goodman J, Lehmann M, Wager PA (2006) The relevance of information and communication technologies for environmental sustainability: a prospective simulation study. Environ Model Softw 21(11):1618–1629. https://doi.org/10.1016/j.envsoft.2006.05.007

Houghton JW (2010) ICT and the environment in developing countries: a review of opportunities and developments. In: Berleur J, Hercheui MD, Hilty LM (eds) What kind of information society? Governance, virtuality, surveillance, sustainability, Resilience. IFIP advances in information and communication technology, vol 328. Springer, Berlin, Heidelberg, pp236–247, DOI: https://doi.org/10.1007/978-3-642-15479-9_23

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econometrics 115(1):53–74. https://doi.org/10.1016/S0304-4076(03)00092-7

International Energy Agency (IEA) (2013) executive summary: world energy Outlook 2013. https://www.iea.org/Textbase/npsum/WEO2013SUM.pdF. Accessed 12 March 2017

Ishida H (2015) The effect of ICT development on economic growth and energy consumption in Japan. Telemat. Inform 32:79–88

Islam F, Shahbaz M, Rahman MM (2013) Trade openness, financial development energy use and economic growth in Australia: evidence on long run relation with structural breaks. Available via https://mpra.ub.uni-muenchen.de/52546/1/MPRA_paper_52546.pdf. Accessed 12 March 2017

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291. https://doi.org/10.1016/j.eneco.2010.10.003

Jebli MB, Youssef SB, Ozturk I (2016) Testing environmental Kuznets curve hypothesis: the role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol Indic 60:824–831

Karsalari AR, Mehrara M, Musai M, Mohammadi M (2014) Relationship between economic growth, trade and environment: evidence from D8 countries. IJARAFMS 4:320–326

Koner J, Purandare A (2012) Growth-led exports hypothesis: an empirical study among SAARC countries. JIMS 12:95–101

Lean HH, Smyth R (2010) CO2 emissions, electricity consumption and output in ASEAN countries. Appl Energy 87(6):1858–1864. https://doi.org/10.1016/j.apenergy.2010.02.003

Leybourne S (1995) Testing for unit roots using forward and reverse Dickey–Fuller regressions. Oxf Bull Econ Stat 57(4):559–571. https://doi.org/10.1111/j.1468-0084.1995.tb00040.x

Lin F (2015) Estimating the effect of the Internet on international trade. J Int Trade Econ Dev 24(3):409–428. https://doi.org/10.1080/09638199.2014.88190

Matthews HS, Hendrickson CT, Soh D (2001) The net effect: environmental implications of E-commerce and logistics. In: Proceedings of the 2001 I.E. International Symposium on Electronics and Environment, Denver, USA, 9 May 2001

Matthews HS, Williams E, Tagami T, Hendrickson CT (2002) Energy implications of online book retailing in the United States and Japan. Environ Impact Asses 22(5):493–507. https://doi.org/10.1016/S0195-9255(02)00024-0

McCoskey S, Kao C (1998) A residual-based test of the null of cointegration in panel data. Econom Rev 17(1):57–84. https://doi.org/10.1080/07474939808800403

Mongelli I, Tassielli G, Notarnicola B (2006) Global warming agreements, international trade and energy/carbon embodiments: an input-output approach to the Italian case. Energ Policy 34(1):88–100. https://doi.org/10.1016/j.enpol.2004.06.004

Morgan Stanley Capital International (2017) https://www.msci.com/market-classification. Accessed 10 May 2017

Narayan PK, Narayan S (2010) Carbon dioxide emissions and economic growth panel data evidence from developing countries. Energ Policy 38:661–666

Newey W, West K (1987) A simple, positive semi-definite, heteroscedasticity and autocorrelation consistent covariance matrix. Econometrica 55(3):703–708. https://doi.org/10.2307/1913610

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries? Energy Econ 48:242–252. https://doi.org/10.1016/j.eneco.2015.01.008

Osorio BB, Dutta S, Geiger T, Lanvin B (2013) The networked readiness index 2013: benchmarking ICT uptake and support for growth and jobs in a hyperconnected world. In: Osorio BB, Dutta S, Lanvin B (eds) The global information technology report 2013: growth and jobs in a hyperconnected world. World Economic Forum, Geneva

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267. https://doi.org/10.1016/j.eneco.2012.08.025

Pantula SG, Gonzalez FG, Fuller WA (1994) A comparison of unit-root test criteria. J Bus Econ Stat 12:449–459

Payne JE (2009) On the dynamics of energy consumption and output in the US. Appl Energy 86(4):575–577. https://doi.org/10.1016/j.apenergy.2008.07.003

Pedroni P (2000) Fully modified OLS for heterogeneous cointegrated panels. Adv Econom15:93–130

Peng GC (2013) Green ICT: a strategy for sustainable development of China’s electronic information industry. CIJ 11:68–86

Pesaran MH, Smith R (1995) Estimating long run relationships from dynamic heterogeneous panels. J Econ 68(1):79–113. https://doi.org/10.1016/0304-4076(94)01644-F

Pesaran MH (2004) General diagnostic tests for cross-section dependence in panels. Working Paper 0435. Available via Cambridge Working Papers in Economics. http://www.econ.cam.ac.uk/research/repec/cam/pdf/cwpe0435.pdf. Accessed 05 May 2017

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econometrics 142(1):50–93. https://doi.org/10.1016/j.jeconom.2007.05.010

Pradhan RP, Arvin MB, Norman NR (2015) The dynamics of information and communications technologies infrastructure, economic growth, and financial development: evidence from Asian countries. Technol Soc 42:135–149. https://doi.org/10.1016/j.techsoc.2015.04.002

Reichart I, Hischier R (2003) The environmental impact of getting the news a comparison of on-line, television, and newspaper information delivery. J Ind Ecol 6:185–200

Romm J (2002) The Internet and the new energy economy. Resour Conserv Recycl 36(3):197–210. https://doi.org/10.1016/S0921-3449(02)00084-8

Røpke I, Christensen TH, Jensen JO (2010) Information and communication technologies—a new round of household electrification. Energ Policy 38(4):1764–1773. https://doi.org/10.1016/j.enpol.2009.11.052

Sadorsky P (2012) Information communication technology and electricity consumption in emerging economies. Energ Policy 48:130–136. https://doi.org/10.1016/j.enpol.2012.04.064

Sadorsky P (2014) The effect of urbanization on CO2 emissions in emerging economies. Energy Econ 41:147–153. https://doi.org/10.1016/j.eneco.2013.11.007

Saidi K, Toumi H, Zaidi S (2015) Impact of information communication technology and economic growth on the electricity consumption: empirical evidence from 67 countries. J Knowl Econ 8(3):789–803. https://doi.org/10.1007/s13132-015-0276-1

Salahuddin M, Alam K (2015) Internet usage, electricity consumption and economic growth in Australia: a time series evidence. Telemat Inform 32:862–878

Salahuddin M, Alam K, Ozturk I (2016) The effects of Internet usage and economic growth on CO2 emissions in OECD countries: a panel investigation. Renew Sust Energ Rev 62:1226–1235. https://doi.org/10.1016/j.rser.2016.04.018

Salahuddin M, Gow J (2016) The effects of Internet usage, financial development and trade openness on economic growth in South Africa: a time series analysis. Telemat. Inform 33:1141–1154

Shahbaz M, Islam F, Islam MM (2010) The impact of financial development on energy consumption in Pakistan: evidence from ARDL bounds testing approach to cointegration. In: Proceedings of the Second International Conference on the Role of Social Sciences and Humanities in Engineering, Penang, Malaysia, 12–14 November 2010

Shahbaz M, Lean HH, Shabbir MS (2011) Environmental Kuznets curve and the role of energy consumption in Pakistan. Available via MPRA https://mpraubuni-muenchende/34929 Accessed12 March 2017

Siikavirta H, Punakivi M, Karkkainen M, Linnanen L (2003) Effects of E-commerce on greenhouse gas emissions: a case study of grocery home delivery in Finland. J Ind Ecol 6:83–97

Smith V, Leybourne S, Kim TH (2004) More powerful panel unit root tests with an application to the mean reversion in real exchange rates. J Appl Econ 19(2):147–170. https://doi.org/10.1002/jae.723

Solo V (1984) The order of differencing in ARIMA models. J Am Stat Assoc 79(388):916–921. https://doi.org/10.1080/01621459.1984.10477111

Sui DZ, Rejeski DW (2002) Environmental impacts of the emerging digital economy: the E-for-environment E commerce? Environ Manag 29(2):155–163. https://doi.org/10.1007/s00267-001-0027-X

Takase K, Murota Y (2004) The impact of IT investment on energy: Japan and US comparison in 2010. Energ Policy 32:1291–1301

Tamazian A, Chousa JP, Vadlamannati C (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energ Policy 37(1):246–253. https://doi.org/10.1016/j.enpol.2008.08.025

Tang CF, Tan BW (2014) The linkages among energy consumption, economic growth, relative price, foreign direct investment, and financial development in Malaysia. Qual Quant 48(2):781–797. https://doi.org/10.1007/s11135-012-9802-4

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econometrics 66(1-2):225–250. https://doi.org/10.1016/0304-4076(94)01616-8

Toffel MW, Horvath A (2004) Environmental implications of wireless technologies: news delivery and business meetings. Environ Sci Technol 38(11):2961–2970. https://doi.org/10.1021/es035035o

Tunali CB (2016) The effect of information and communication technology on energy consumption in the European Union countries. J Econ Sustain Dev 7:54–60

Wang D, Han B (2016) The impact of ICT investment on energy intensity across different regions of China. J Renewable Sustainable Energy 8:5. https://doi.org/10.1063/1.4962873

Westerlund J, Edgerton DL (2007) A panel bootstrap cointegration test. Econ Lett 97(3):185–190. https://doi.org/10.1016/j.econlet.2007.03.003

World Bank (2017) World Development Indicators Database. http://data.worldbank.org/data-catalog/world-development-indicators. Accessed 20 May 2017

Zadek S, Forstater M, Yu K, Kornik J (2010) The ICT contribution to low carbon development in China. Prepared For The Digital Energy Solutions Campaign (DESC) China. Discussion Paper

Zhang C, Liu C (2015) The impact of ICT industry on CO2 emissions: a regional analysis in China. Renew Sust Energ Rev 44:12–19. https://doi.org/10.1016/j.rser.2014.12.011

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Appendix

Appendix

Methodology for the MG estimator of Pesaran and Smith (1995)

MG estimator of Pesaran and Smith (1995) allows for all coefficients to differ across countries. It estimates separate regressions for each country and calculates the coefficients as unweighted means of the estimated coefficients for the individual countries. If we define a model in Eq. (1),

where the number of countries i = 1, 2, …, N and the number of time periods t = 1, 2, . . …, T. y i, t is the log of per capita CO2 emissions, and X i, t is a vector of explanatory variables that includes ICT and other determinants of CO2 emissions. μ i is the time-invariant fixed effect for country i, τ t is the country-invariant time effect for time t, and ε i, t is the idiosyncratic error term. If y i, t − 1 is included into each side of Eq. (1), we obtain Eq. (2):

where \( {\lambda}_{i,j}={\alpha}_{i,j}{\forall}_j\ne 1 \) and λ i, 1 = α i, 1 + 1.

When we reparametrized Eq. (2) into the error-correction equation, Eq. (3) is obtained:

where

Equation (3) could be estimated for each country separately, and then an average of the coefficients might be calculated. This yields the results of the MG estimator proposed by Pesaran and Smith (1995). For instance, in the case of the MG estimator, the error-correction speed of adjustment term is defined as \( {\widehat{\phi}}^{MG}={N}^{-1}\sum \limits_{i=1}^N{\widehat{\phi}}_i \) along with the variance \( {\widehat{\Delta}}_{\widehat{\phi} MG}=\frac{1}{N\Big(N-1}\sum \limits_{i=1}^N{\left({\widehat{\phi}}_i-\widehat{\phi}\right)}^2 \).

Methodology for the Emirmahmutoglu and Kose (2011) panel causality test

The LA-VAR model (k i + dmax i ) in heterogeneous mixed panels is specified as

and

where i = 1, 2, …, N and t = 1, 2, . . …, T denote the number of countries in the panel and the time dimension, respectively. \( {\mu}_i^x \) and \( {\mu}_i^y \) are two vectors of fixed effects, and \( {u}_{i,t}^x \) and \( {u}_{i,t}^y \) are column vectors of error terms. The lag structure (k i ) of the process is assumed to be known and may differ across cross-sectional units. dmax i denotes maximal order of integration suspected to occur in the system for each i. Searching for the causality from x to y is described with the following steps (see Emirmahmutoglu and Kose 2011):

-

1.

Determine the maximum order (dmax i ) of integration of variables in the system for each cross-sectional unit based on the ADF unit root test, and select the lag orders k i s via some information criteria by estimating Eq. (2) by OLS for each individual.

-

2.

By utilizing dmax i and k i from step 1, re-estimate Eq. (2) by OLS under the non-causality null hypothesis and obtain the residuals for each individual.

-

3.

Then, the residuals are centered as

where \( {\widehat{u}}_{t=}\left({\widehat{\mathrm{u}}}_{1t},{\widehat{u}}_{2t},\dots, {\widehat{u}}_{Nt}\right) \), k = max(k i ), and l = max(dmax i ). After that, \( {\left[{\tilde{u}}_{i,t}\right]}_{NxT} \) is developed from the centered residuals. We choose randomly a full column with replacement from the matrix at a time to preserve the cross covariance structure of the errors. The bootstrap residuals is denoted as \( {\tilde{u}}_t^{\ast } \).

-

4.

Under the null hypothesis, a bootstrap sample of y is generated as in Eq. (5).

where \( {\widehat{\mu}}_i^y \), \( {\widehat{A}}_{21,\mathrm{ij}} \), and \( {\widehat{A}}_{22,\mathrm{ij}} \) are estimated from step 2.

-

5.

Wald statistics are calculated to test the non-causality null hypothesis for each individual by substituting \( {y}_{i,t}^{\ast } \) for y i, t and estimating Eq. (2) without imposing any parameter restrictions.

Finally, the Fisher test statistic \( \left(\lambda =-2\sum \limits_{i=1}^N\ln \left({p}_i\right),\kern0.5em i=1,2,..\dots, N\right) \) is derived by using the individual p values that correspond to the Wald statistic of the ith individual cross section. Additionally, the bootstrap empirical distributions of the Fisher test statistics are generated by repeating steps 3–5 10,000 times and specifying the bootstrap critical values by selecting the appropriate percentiles of these sampling distributions.

Rights and permissions

About this article

Cite this article

Ozcan, B., Apergis, N. The impact of internet use on air pollution: Evidence from emerging countries. Environ Sci Pollut Res 25, 4174–4189 (2018). https://doi.org/10.1007/s11356-017-0825-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-017-0825-1