Abstract

Recent real estate literature has not only proposed a few theories to explain the puzzling macro feature of the positive correlation between price and transaction volume, but also attempted to identify the causal relationships between them. However, there is little empirical evidence to explicitly illustrate how housing price dynamics measured by both past price changes and price volatility at housing unit level affect housing turnovers. Using a unique housing transaction database from Singapore condominium market, this paper reveals an interesting housing turnover pattern in response to past housing price dynamics. The results illustrate that the rise and fall of a dwelling’s price can significantly affect housing turnovers in the same direction. Higher volatility reduces housing turnovers. The effects are stronger in the domain of losses and are weakening as the cumulative housing equity rises, implying that a seller withholds the sale in the downswing of a real estate cycle in the hope that the market will rebound. The findings offer some additional micro empirical evidence to the interactions between housing price and transaction volume and imply upwardly biased repeat sales indexes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

A puzzling positive correlation between price and transaction volume has long been observed in asset markets. Real estate literature in this area falls into two streams. One stream of literature focuses on explaining the puzzle observed in housing markets, for example, Wheaton’s search model (Wheaton 1990), Stein’s down-payment constrained housing consumption model (Stein 1995), and nominal loss aversion approach proposed and tested by Genesove and Mayer (2001). Recently, some researchers attempt to find the common factors that drive the movements of both housing transactions and housing prices (Ortalo-Magné and Rady 2004, 2006; Jin and Zeng 2004; Iacoviello 2005).

The other stream of literature attempts to investigate how price and transaction volume interact. At the macro level, Leung et al. (2002) empirically identify a robust positive correlation between the housing price and the transaction volume in Hong Kong housing market, and show that transaction volume Granger causes property price movements. This is despite that Leung and Feng (2005) find weak evidence for Granger causality in Hong Kong commercial property market. The macro lead-lag relationship found in housing markets can be explained by the search theoretic model in Berkovec and Goodman (1996). They argue that a demand shock affects the number of buyers and their willingness to pay initially, but has no immediate impact on both buyers and sellers’ price expectations. The mismatch between a buyer’s offer price and a seller’s reservation price lengthens the seller’s time-on market. Sellers who have lower holding power may have to lower the reservation price in order to sell the unit. A demand shock is then transmitted into price changes. Hort (2000) further empirically tests the model against the Swedish data. Thus, the fact that transactions lead to price changes after a demand shock, is established, this is despite the finding by Andrew and Meen (2003) that transactions respond to shocks faster than prices but do not Granger cause price movements in the UK.

At the micro level, price related housing equity gains or losses can accelerate or delay a motivated seller’s decision to sell. Case et al. (2005) point out that rising housing prices generate positive wealth for households, which is conveyed into positive housing and non-housing consumption. This may enhance household mobility as mobility is one of the vehicles for a household to adjust their housing consumption to the changes in circumstances (Rossi 1955). Falling housing prices may have a lock-in effect to constrain residential mobility (Chan 2001; Engelhardt 2003) or to incur a longer time-on-market due to down-payment constraint (Stein 1995; Genesove and Mayer 1997) or nominal loss aversion (Genesove and Mayer 2001). The micro theories suggest that increasing or decreasing housing prices reinforce the movements of transaction volume in the same direction. However, Wheaton and Lee (2008) conclude that higher volume generates higher subsequent prices, while higher prices generate lower subsequent volume, implying some inconsistency between their macro results and the existing micro theories. Hence, it is necessary to further quantitatively investigate how turnovers respond to the different levels of past housing price dynamics at the housing unit level.

The answers to the question are important. First, explicitly uncovering the relationship between turnovers and the price related housing equity changes at housing unit level provides a new channel to understand the macro interactions between price and transaction volume, which can improve our understanding on housing market fundamentals (Iacoviello 2005). Second, if a unit that has experienced higher housing price appreciations is traded more frequently, repeat sales indexes may be upwardly biased (Kiel 1994). The empirical relationship between turnovers and price changes may aid us to correct the bias. The constant-liquidity price index developed by Fisher et al. (2003) has shown the importance of incorporating ‘ability to sell’ into a price index. Third, policy makers are interested in the speculation related characteristics in a housing market. The relationship to be uncovered can lead us to have a better understanding on housing price bubbles or cycles.

The reminder of this paper is organized as follows: the next section summarizes the related literature. Data and variable selection are presented in the third section. Empirical results are reported in the fourth section, followed by a concluding section.

The Related Literature

Households are heterogeneous and their moving decisions can be triggered or held up by some unexpected events, but are not simply a response to ‘triggers’ or ‘push–pull’ factors. Their responses to housing market changes are different and complicated (Kan 1999; Hickman et al. 2007). Rising housing prices may constrain first time-buyers’ housing affordability. But, for housing ladder climbers, rising housing prices may accelerate their decision to sell their unit because rapid housing price appreciations enable homeowners to accumulate the equity required to trade up to a more valuable house more quickly, which is likely to intrigue an earlier optimal timing of move (Nakagami and Pereira 1991). This is also consistent with the down-payment constrained consumption model (Stein 1995), the housing ladder or life cycle models in Ortalo-Magné and Rady (2004, 2006) and the housing wealth approach in Case et al. (2005). Lee and Ong (2005) use Singapore public owner occupied resale housing market transaction data to test how rising housing prices boost households’ upward mobility (from public owner occupied housing market to private owner occupied housing market). Their results are consistent with the findings in Sing, Tsai and Chen (2006) using Singapore macro economic data. Rising housing prices may also significantly increase mortgage debt for some upgraders, which may constrain their mobility. This is true if housing prices in the upper end of a housing market rise faster than housing prices in the lower end of the housing market.

For down-graders who want to liquidize part of their housing equity, rising prices may also precipitate an earlier sale. Housing is both a consumption commodity and an investment asset. Housing price appreciations affect homeowners when they consider whether to change the housing portion of their investment portfolio by moving to another unit. Kiel (1994) shows that rapid housing price appreciations increase mobility because homeowners choose to use the equity gained to finance higher consumption of either housing or other goods, or choose to capture the gains in case housing prices fall in the future.

Thus, the investment aspect of buying a house plays an important role in household mobility decisions. The number of ‘vertical’ transactions along housing ladders accounts for the fluctuations of housing transactions in response to price changes. The ‘horizontal’ movers, who move within the same housing price ranges, do not fluctuate much over time (Ortalo-Magné and Rady 2000).

In the down-swing of a housing price cycle, falling housing prices can subsequently constrain household mobility. The down-payment constrained consumption model (Stein 1995; Lamont and Stein 1999) illustrates that falling housing prices constrain the potential movers. These movers may try ‘fishing’ by listing their current house at above market price in the hope of getting luck to raise enough money to pay a new down-payment. The conjecture is supported by the empirical evidence from a volume of international literature (Genesove and Mayer 1997; Benito 2006; Lee and Ong 2005). An alternative approach by Genesove and Mayer (2001) models the relationship between listed housing price, time-on-market and potential loss, proving that loss aversion affects sellers’ behavior in a housing market. Losers are likely to stay in the market longer as they typically set an above market asking price. Thus, sellers’ loss aversion drives the phenomenon of low transactions during the market downturn. The approach is then supported by a stream of housing literature (Engelhardt 2003; Wong 2008). The work of Ong et al. (2008) distinguishes loss aversion from disposition effect using Singapore housing transaction data including both foreclosure sales and non-foreclosure sales in Singapore condominium market. They prove the disposition effect among non-foreclosure sales and homeowners are reluctant to sell when they suffer losses.

Chan (2001) finds that there are severe constraints to mobility as a result of negative housing market shocks. The constraints arise from households not being able to repay their existing mortgage or raising sufficient funds for a new down-payment when the price substantially falls. There is also evidence of loss aversion contributing lower mobility rates. However, Engelhardt (2003) claims that household mobility is significantly influenced by nominal loss aversion and there is little evidence that low equity caused by falling price constrains mobility.

Krainer (2001) argues that financial constraints undoubtedly play an important role in a seller’s decision to sell. However, without observing a seller’s portfolio of debts and assets, we can not be sure if a longer time-on-market is due to down-payment constraint or due to loss aversion. The search theory, proposed by Wheaton (1990), further developed by Berkovec and Goodman (1996) and Krainer (2001) suggests that housing market trade friction contributes to the positive correlations between price and transaction volume. The trade friction is high in the down-swing of a housing price cycle because of the mismatch between a seller’s reserve price and a buyer’s offer price.

Some facts are established from the literature. A positive (or negative) demand shock initially increases (or decreases) the probability to sell which subsequently causes the rising (or falling) housing prices (Wheaton 1990; Berkovec and Goodman 1996; Krainer 2001). Falling housing prices decrease housing turnovers (Stein 1995; Genesove and Mayer 2001; Chan 2001), while rising housing prices increase housing turnovers (Case 1992; Case, Quigley and Shiller 2005; Ortalo-Magné and Rady 2004, 2006). Rising or falling transactions create boom or bust housing market sentiments which may further affect buyers and sellers’ behaviors further. Hence, housing transactions and housing prices reinforced each other in the same direction.

The impacts of past price dynamics on turnovers depend on the magnitude of past housing price movements. For example, a moderate price fall may not necessarily constrain a seller’s ability to pay a new down-payment, especially for an equity rich seller. Hence loss aversion is a better approach to explain why falling housing price delays a seller to sell the unit. When housing price falls dramatically, a seller is likely to face both loss aversion and down payment constraint as the proceeds from the sale of his home may be insufficient to repay the outstanding mortgage loan or to raise funds for a new down-payment. In both cases, search theory plays a role in interpreting how housing market trade friction links falling housing prices to low transactions.

The work of Chan (2001) addresses the impacts of past housing price dynamics on mobility, but the use of aggregate price indexes limits Chan’s study to further quantitatively investigate how past returns affect mobility as well as to investigate the impacts of past price volatility on mobility. Han (2005) presents strong evidence to show that, when housing turnovers are modeled, using disaggregate housing price indexes to measure past housing equity changes can significantly improve the overall model fit. In her results, Pseudo R 2 has been significantly increased from 0.0493, when aggregate price indices are used, to 0.2452, when disaggregate price indices are used. The rest of the paper attempts to construct a set of building-based disaggregate housing price indexes, upon which we examine empirically how past returns and price volatility affect turnovers.

Data and Variable Selection

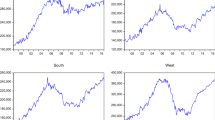

Our primary database is from Singapore Institute of Surveyors and Valuers (SISV) housing transaction database, including all condominium transactions from the 1st of July of 1992 to the 30th of June, 2003. This period covers two real estate cycles of different magnitudes (Fig. 1). After deleting uncompleted records, compulsory foreclosed transactions, as well as collective sales, we obtain 65,589 observations for this study, out of which, 49,724 (75.8%) observations are right censored. 15,865 (24.2%) observations have at least one subsequent sale during the period, out of which, 76% has only one subsequent sale. The database includes the details of address, dwelling related hedonic factors as well as contract dates. The date of temporary occupancy permit (TOP) is obtained from a variety of published books about Singapore condominiums. This date is used to calculate the age of a unit. The condominium project and neighborhood related spatial information is obtained from Singapore Street Directory and some published books. All data are geo-coded at the building level. It is noted that each condominium may have a few buildings and each building corresponds to one pair of x–y coordinates.

Housing transaction data allows us to explicitly construct past housing price dynamics for each individual housing unit. Hence, we can test the effects of past housing price dynamics on turnovers at the macro level. The disadvantage is that such dataset does not typically have household information, which may incur estimation biases, or heterogeneity. To minimize the problem, we adopt a probit model with heteroscedasticity (Greene 2000; Parikh and Sen 2006) and we have also constructed a few variables to proxy household social economic background.

The dependent variable (‘y’) in our study is a dummy variable with one indicating that a property is sold before the censored date, otherwise zero. The independent variables consist of three sets of variables reflecting past housing price dynamics, submarket effects and owner’s information.

Past Housing Price Dynamics

The literature review presented in the previous section has illustrated that the price related housing equity change (indicated by ‘PRICE_EQUITY’) may affect a homeowner’s decision to sell a unit. In addition, housing price volatility (indicated by ‘PRICE_VOLATILITY’) during a holding period may also have an impact on the decision to sell.

To construct ‘PRICE_EQUITY’ and ‘PRICE_VOLATILITY’, the value of a housing unit in each quarter during a holding period needs to be estimated. Han (2005) has proved that using aggregate index numbers to estimate housing equity changes for a housing unit is not accurate, which can significantly reduce the overall model fit. Conventional hedonic or repeat sales models are not appropriate in predicting housing values across a space. Instead, a hedonic housing price Geo-statistical model (Dubin 2003) allows us to predict the value of a unit located in any site defined by a pair of x–y coordinates.

The present study adopts Singapore condominium transaction data, where each building has one pair of geo-codes. Hence, a hedonic price Geo-statistical model is used here to construct price indexes for each building in Singapore condominium market. Zhou (2007) uses Singapore condominium transaction data and illustrates that a hedonic price Geo-statistical model with annual transaction data outperforms the spatial-temporal autocorrelation model (Sun et al. 2005) as well as the conventional hedonic models in out-of-sample predictions.

The building_based price indexes constructed by a Geo-statistical model can better capture small area housing price dynamics. However, in a multi-story housing market, housing prices also vary with floor levels (along the vertical direction). The current Geo-statistical models cannot capture the price volatilities along the vertical direction. Hence, in this study, the units within one building share the same price volatilities indicated by the building_based housing price indexes. This is the disadvantage of the model. The empirical hedonic price geo-statistical models are not presented in this paper, but available at request.

‘PRICE_EQUITY’ is measured by the percentage change of the building_based index numbers between the time of sale or the censored date and the time of purchaseFootnote 1. The present study does not use the difference between the selling price and the purchasing price for those sold dwellings to measure ‘PRICE_EQUITY’, because a seller is assumed to have myopic price expectation. His self-estimation on the value of his property is typically based on the recent and past nearby transactions. The building_based price indexes constructed by a hedonic price Geo-statistical model reflect this feature.

To capture the pattern of turnovers in response to past returns, we further divide the price related housing equity changes (‘PRICE_EQUITY’) into 19 price increments or intervals. ‘PRICE_EQUITY’ is then transformed into a set of 19 dummy variables, each indicating a price range of 5% to 10% (see Table 4 of the Appendix)Footnote 2.

To capture the past housing price volatilities (‘PRICE_VOLATILITY’) of a unit, we design two variables in the present study. ‘PRICE_MIN_MAX’ is the difference between the largest building_based price index number and the smallest index number during a holding period. ‘PRICE_σ 2’ is the variance of the price index numbers during a holding period.

Submarket Effect

Turnovers may vary across housing submarkets as the literature shows that housing prices vary across housing submarkets. Homebuyers’ housing preferences are not only different, but also change over time. This may affect housing demand and supply at the submarket level, resulting in different turnover rates across submarkets (Tu 1997, 2003). Hedonic housing attributes, as well as the number of times that a unit was ever sold before the current sale (or censored date) which indicates the activeness of a submarket, are therefore selected to indicate the impacts of submarkets on turnovers.

Owner’s Information

Previous literature and economic theory on mobility emphasize the role of demographics or households’ characteristics in the moving decision (Kan 2002, 2003; Rossi 1955). We generate three dummy variables to indicate a homeowner’s personal wealth group. They are ‘INC_LOW’, ‘INC_MIDDLE’ and ‘INC_HIGH’. A set of four dummy variables are created to indicate the time points along real estate cycles when an owner entered the market. They are ‘ENTERr_96q2’, ‘ENTER_96q3_98q4’, ‘ENTER_99q1_02q2’, and ‘ENTER_02q2_03q2’. An owner’s duration of ownership is indicated by ‘HOLDING_PERIOD’. To further control the affordability, we adopt GDP, unemployment rate as well as mortgage rate as explanatory variables.

The initial or contemporaneous loan to value ratio (‘LTV’) as an indicator of housing equity level has been proven to be an important variable affecting an owner’s decision to sell (Genesove and Mayer 1997; Stein 1995; Engelhardt 2003). High LTV ratio constrains an owner’s mobility. In Singapore, a minimum 10% cash down payment was required before May 1996, and 20% was required between May 1996 and September 2002. It went back to a 10% down payment after that. A dummy variable to indicate policy changes is used as a proxy to measure the general initial equity condition of a buyer during the investigated period. The definition of variables discussed above is given in Table 4 of the Appendix.

The descriptive analyses of some key variables are presented in Tables 5 and 6 of the Appendix. On average, there were 24.19% of turnovers out of all observations during 11 years, covering two real estate cycles. Between any two consecutive sales, the holding period was 8.1 quarters with a standard deviation of 7.4 quarters, while for the censored cases, the average holding period was 18.81 quarters with a standard deviation of 8.6 quarters. A unit was sold eight times at the maximum with a mean of 0.32 and a standard deviation of 0.66 prior to the most recent sale. For a holding period, the average housing price related equity accumulation was 12% with a standard deviation of 0.30 for the uncensored cases. The maximum loss was −51%, while the maximum gain was four times as much as the purchasing price. For the censored cases, the average change in housing equity was −10.6% with a standard deviation of 0.20. The maximum loss was 51% and the maximum gain was 2.3 times as much as the purchasing price.

Across the 19 ‘PRICE_EQUITY’ ranges (the definition of the ranges are given in Table 4 of the Appendix), the turnovers measured by the number of uncensored cases out of all observations in each range exhibited a clear upward trend when the housing price related equity accumulation varied from the maximum loss to the maximum gain (Table 1), demonstrating that a homeowner was unlikely to sell when he suffered nominal housing equity loss due to price changes, while an excessive price related housing equity change might induce a sale. For example, if an owner had experienced more than 50% capital gains (the range is indicated by ‘PRICE_EQUITY_19’), 74% of them might have sold the unit, compared with 46% sales for an owner who had experienced 40%-50% gains (the range is indicated by ‘PRICE_EQUITY_18’).

For the uncensored cases, the average ‘PRICE_MAX_MIN’ during a holding period was 44 percentage points with a standard deviation of 38.6, while for the censored cases, it was 59 percentage points with a standard deviation of 30.2. If price volatility is measured by variance (‘PRICE_σ 2’), the same pattern is observed, implying that higher volatility may lead to a lower turnover rate. In the next section, we will report the magnitudes of the impacts.

Empirical Results

The objective is to calibrate a binary discrete choice model to obtain a robust relationship between housing turnovers and past housing price dynamics measured by price related equity change and housing price volatility during a holding period. The main problem is that our database does not include household information. Such misspecification may produce inconsistent estimates in probit model (Yatchew and Griliches 1984). To address the impact, we re-run the models using alternative sub-datasets, as well as systematically adding or deleting independent variables. The results demonstrate that the coefficients on housing equity variables and housing price volatility variables are not only robust in sign but also significant at 1% across all models. The coefficient estimates have slight variations, but the pattern of turnovers in response to past price dynamics are robust and consistent across all models, suggesting that our results are not being driven by model misspecifications.

Another problem is heteroscedasticity that is very common in micro economic data. Our empirical work has shown that a probit model with heteroscedasticity can significantly improve the overall model fit, compared with a probit model estimated under homoscedasticity assumption (see note 5 in Table 7 of the Appendix for details). After a series of heteroscedasticity tests, we find that housing price volatility (‘PRICE_σ 2’ or ‘PRICE_MIN_MAX’), the timing of an owner entering the market (‘PRICE_96q2’) as well as owners’ financial wealth measurement (‘INC_MIDDLE’, ‘INC_HIGH’) have significantly contributed to heteroscedasticity. And hence, probit model with heteroscedasticity is used. The macro economic variables (‘GDP’, ‘RIR’ and ‘ERATE’), policy variable indicating initial loan to value change (‘LTV’) and holding period (‘HOLDING_PERIOD’) are insignificant across all models, indicating that they are either not the appropriate proxies or do not have an impact on turnovers. After the insignificant variables are omitted, we choose two empirical models to report in Table 2. The other four models are presented in Tables 7 and 8 of the Appendix.

All six empirical models (Table 2, Tables 7 and 8 of the appendix) demonstrate the acceptable levels of Goodness-of-Fit that are measured by likelihood ratio, Aldrich–Nelson–R 2, Cragg–Uhler 1 − R 2, Cragg–Uhler 2–R 2, Estrella–R 2, Adjusted Estrella–R 2, McFadden’s LRI–R 2, Veall–Zimmermann–R 2 and McKelvey–Zavoina–R 2. The six models vary in term of the measurement of past price dynamics.

It is found that using a set of ‘PRICE_EQUITY’ dummy variables (Models-1 and 2 in Table 2) rather than using ‘PRICE_EQUITY’ as a continuous variable (Models-3 and 4 in Table 7 of the Appendix) can only slightly improve the overall model fit by 0.0005 (Veall–Zimmermann–R 2). However, using ‘PRICE_MIN_MAX’ (Model-2 in Table 2 and Model-4 in Table 7 of the Appendix) rather than using ‘PRICE_σ 2’ (Models-1 and 3 in Table 2 and Table 7 of the Appendix) can improve Veall–Zimmermann–R 2 by 0.03, implying that an owner’s self estimation on past price volatility is better represented by the difference between the maximum price and the minimum price during a holding period.

Across all six models, turnovers demonstrate a clear submarket pattern. Larger, younger and lower level leasehold condo units appear to have higher turnovers. The condo units associated with the facilities of Gym, Jacuzzi, Playground, Wadding pool and Security appear to have higher turnovers, while lower turnovers are observed in the condos with tennis court. Previously more frequently traded units are likely to have higher turnover rates. The results also show that the units in larger condo developments located near good schools but further away from the CBD have higher turnover rates. However, the impact of the CBD is not robust in our results (it appears to be insignificant in Model-6 in Table 8 of the Appendix). It has also been found that the units whose owners are wealthier homebuyers appear to have higher turnovers. This indirectly supports the down-payment constrained consumption model (Stein 1995). Our findings also show that the owners who entered the market between the second quarter of 1992 and the second quarter of 1996 have much higher turnovers. During the period, Singapore housing market experienced very fast price appreciation, and hence, many owners experienced a rapid housing equity accumulation through housing price appreciations, which might have led to the high turnovers.

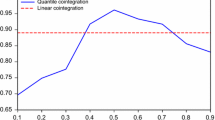

The pattern of turnovers in response to price related housing equity changes (dummy variables for ‘PRICE_EQUITY is constructed against Models 1 and 2 in Table 2. It is illustrated by Fig. 2, where the X-axis stands for the price related housing equity change (e.g. 0.6 means the equity gain is 60%) during a holding period and the Y-axis stands for marginal probability to sell. The marginal probability to sell of a dummy variable indicates how predicted probability changes when the dummy variable switches from 0 to 1. In the present study, it represents the change of the predicted probabilities when the price related housing equity change drops from the highest range (the price related equity gain is above 50%) to one of the lower ranges because the highest range is chosen as a base in Models 1 and 2 in Table 2. Hence, the marginal probabilities calculated against Models 1 and 2 are negative.

Figure 2 shows that marginal probability to sell is positively related to the price related housing equity change. Winners (with equity gains) have higher marginal probability to sell than losers (with equity loss). In the domain of moderate equity gains, a concave shape is observed. However, when an owner receives excessive equity gain (above 25% in the present study), the marginal probability to sell is accelerated, implying that higher equity gains may induce a sale as the realized capital gains can be used to finance consumption or re-invest into a larger property. These are broadly consistent with the conceptions of Case (1992), Case et al. (2005), and Ortalo-Magné and Rady (2004, 2006).

In the domain of losses, we observe a nearly linear curve in the range of initial losses (between −5% and 0), then it becomes concave when the losses fall into the range of −40% and −5%. As property value decreases to nearly half of the original value, the marginal probability to sell rises slightly, this is despite that our sample has excluded those foreclosed sales. Owners are typically reluctant to realize the losses as explained by the down-payment constrained consumption model or loss aversion approach (Stein 1995; Genesove and Mayer 2001). When losses are accumulated, the impacts are stronger. For example, a minor equity loss may result in an owner losing some housing equity but not affect his ability to pay a new down-payment. However, a major loss may make an owner not only unable to afford a new down-payment, but also unable to cover the mortgage after selling the property. Hence his marginal probability to sell is further decreased. When the losses go beyond 45% in this study, we observe that the marginal probability to sell slightly rises. One possible explanation is that some owners who have been holding up the sale may psychologically lose hope that the market may rebound in the short run. They sell the property to avoid further losses or to serve his housing consumption changes.

Higher housing price volatility reduces housing turnovers. The results in Model 1 of Table 2 and Model 3 of Table 7 in the Appendix show that marginal probability to sell decreases by −0.001 for each additional increment in volatility measured by σ 2, or by −0.007 (Model-2 of Table 2) or −0.008 (Model-4 of Table 7 in the Appendix) for each additional increment in volatility measured by the difference between the largest building_based index number and the smallest index number during a holding period.

Table 3 shows that in all ranges of the price related housing equity changes, higher volatility reduces marginal probability to sell. The effects are stronger in the domain of losses and are weakening as the cumulative housing equity rises, implying that sellers withhold their property when prices fall in the hope that the market will rebound eventually.

Main Conclusions and Remaining Concerns

The present paper represents one of the few attempts to empirically model housing turnovers in response to past housing price dynamics. One important contribution is that, with the help of hedonic price Geo-statistical model, we are able to explicitly reveal the links between housing turnovers and the price related housing equity changes (Fig. 2), verifying the observed macro feature of the positive correlation between housing price and trading volume. The findings are broadly consistent with the predictions of the existing theories (Wheaton 1990; Stein 1995; Genesove and Mayer 2001; Case 1992; Case et al. 2005; Ortalo-Magné and Rady 2004, 2006). Figure 2 also shows that, when a market has experienced excessive price inflations, the turnovers are accelerated, implying the possibility of real estate bubbles from positive feedbacks. The findings also support the conclusion in Kiel (1994) that repeat-sales indexes may produce biases in an upward direction. Finally, the impact of price volatility on turnovers indirectly provides evidence on a seller’s withholding behavior in the down-swing of a housing price cycle.

One puzzling fact arises from the present paper. In the literature of loss aversion, almost all work on loss aversion adopts utility as a measurement of loss aversion (Schmidt and Zank 2005). If we use marginal probability to sell to measure loss aversion, the shape of Fig. 2 should have the features illustrated by the asymmetric S-shaped value function proposed in prospect theory (Kahneman and Tversky 1979; Tversky and Kahneman 1992). For example, the curve has diminishing sensitivity and it is concave in the domain of gains and convex in the domain of losses. However, Fig. 2 does not show these features. The puzzle may be due to two reasons. First, marginal probability to sell may not be an appropriate measurement of loss aversion. Second, the value function of housing as an asset may be different from the one in prospect theory, suggesting that housing as an asset may have fundamental differences from other financial assets.

The present paper has three limitations. First, the rationale of the paper stems solely from sellers’ viewpoint, thus implicitly assuming buying side liquidity. The problem is that a seller wishes to sell but cannot find a buyer, as addressed in search theory (Wheaton 1990; Berkovec and Goodman 1996). The use of transaction data cannot fully reflect this selling constraint, hence, the marginal probabilities estimated in this paper may be upwardly biased. Using ‘time-on-market’ is perhaps a better way to model marginal probability to sell, but such data is not available for this study. Second, in this study, Singapore condominium transaction data is used, where, the objective of owners may lean more towards investment than consumption. Since investors may behave differently from owner occupiers, the results may be biased. Singapore public resale market is an owner occupier housing market which should be a good sample for this study, but the data is not available. Third, the empirical results in the paper are derived from a probit model under a time-constant probability distribution assumption. Kan (1999, 2000, 2002, 2003, 2007) all find strong evidence that time-varying probability distribution assumption is important. Besides, our empirical work also finds that a probit model with heterosedasticity can significantly improve the overall model fit. However, to embed the heterosedasticity and model specification into a probit model with time-varying probability distribution is difficult, at least for now. The limitations and the puzzle require further study in this area.

Notes

\({\text{PRICE\_EQUITY}}\left( {s{}_{0,}v,t} \right) = \frac{{PI_{t - 1} \left( {s_0 } \right) - PI_{t - v + 1} \left( {s_0 } \right)}}{{PI_{t - v + 1} \left( {s_0 } \right)}}\), where, v is the holding period (quarter). PI is the index number at location s0, t is the sale’s or censored date.

In our study, we have tried from a set of 10 dummy variables (each represents a larger range of price growth) to a set of 40 dummy variables (each represents a smaller range of price growth). The empirical results are consistent. And the results from a set of 19 variables are chosen to report.

Reference

Andrew, M., & Meen, G. (2003). Housing price appreciation, transactions and structural change in the British housing market: A macroeconomic perspective. Real Estate Economics, 31, 99–116. doi:10.1111/j.1080-8620.2003.00059.x.

Benito, A. (2006). The down-payment constraint and UK housing market: Does the theory fit the facts. Journal of Housing Economics, 12, 1–20. doi:10.1016/j.jhe.2006.02.001.

Berkovec, J. A., & Goodman Jr., J. L. (1996). Turnover as a measure of demand for existing homes. Real Estate Economics, 24, 421–440. doi:10.1111/1540-6229.00698.

Case, K. E. (1992). The real estate cycle and the economy: Consequences of the Massachusetts Boom of 1984–1987. Urban Studies, 29, 171–183. doi:10.1080/00420989220080251.

Case, K. E., Quigley, J. M., & Shiller, R. J. (2005). Comparing wealth effects: The stock market versus the housing market. Advanced Macroeconomics, 5(1), 1–31.

Chan, S. (2001). Spatial lock-in: Do falling prices constrain residential mobility. Journal of Urban Economics, 49, 567–586. doi:10.1006/juec.2000.2205.

Dubin, R. A. (2003). Robustness of spatial autocorrelation specifications: Some Monte Carlo evidence. Journal of Regional Science, 43, 221–248. doi:10.1111/1467-9787.00297.

Engelhardt, G. V. (2003). Nominal loss aversion, housing equity constraints, and household mobility: Evidence from the United States. Journal of Urban Economics, 53, 171–195. doi:10.1016/S0094-1190(02)00511-9.

Fisher, J., Gatzlaff, D., Geltner, D., & Haurin, D. (2003). Controlling for the impacts of variable liquidity in commercial real estate price indices. Real Estate Economics, 31(2), 269–303. doi:10.1111/1540-6229.00066.

Genesove, D., & Mayer, C. J. (1997). Equity and time to sale in the real estate market. American Economic Review, 87(3), 255–269.

Genesove, D., & Mayer, C. J. (2001). Loss aversion and seller behavior: Evidence from the housing market. Quarterly Journal of Economics, 116, 1233–1260. doi:10.1162/003355301753265561.

Greene, W. H. (2000). Econometric analysis, 4th edn. Upper Saddle River: Prentice-Hall.

Han, Y. H. (2005). Price dynamics and turnovers: evidence from Singapore condominium market. A thesis for the degree of master of estate management. Department of Real Estate, National University of Singapore.

Hickmand, P., Robinson, D., Casey, R., Green, S., & Powell, R. (2007). Understanding housing demand: Learning from rising markets in Yorkshire and the Humber. Research report for Joseph Rowntree Foundation, UK.

Hort, K. (2000). Prices and turnover in the market for owner-occupied homes. Regional Science and Urban Economics, 30, 99–119. doi:10.1016/S0166-0462(99)00028-9.

Iacoviello, M. (2005). House prices, borrowing constraints, and monetary policy in the business cycle. American Economic Review, 95(3), 739–764. doi:10.1257/0002828054201477.

Jin, Y., & Zeng, Z. (2004). Residential investment and house prices in a multi-sector monetary business cycle model. Journal of Housing Economics, 13, 268–286. doi:10.1016/j.jhe.2004.08.001.

Kan, K. (1999). Expected and unexpected residential mobility. Journal of Urban Economics, 45, 72–96. doi:10.1006/juec.1998.2082.

Kan, K. (2000). Dynamic modeling of housing tenure choice. Journal of Urban Economics, 48(1), 46–69. doi:10.1006/juec.1999.2152.

Kan, K. (2002). Residential mobility with job location uncertainty. Journal of Urban Economics, 52, 501–523. doi:10.1016/S0094-1190(02)00531-4.

Kan, K. (2003). Residential mobility and job changes under uncertainty. Journal of Urban Economics, 54(3), 566–586. doi:10.1016/S0094-1190(03)00086-X.

Kan, K. (2007). Residential mobility and social capital. Journal of Urban Economics, 61(3), 436–457. doi:10.1016/j.jue.2006.07.005.

Kahneman, D., & Tversky, A. (1979). Prospect Theory: An analysis of decision under risk. Econometrica, XL(VII), 263–291. doi:10.2307/1914185.

Kiel, K. A. (1994). The impact of house price appreciation on household mobility. Journal of Housing Economics, 3, 92–108. doi:10.1006/jhec.1994.1002.

Krainer, J. (2001). A theory of liquidity in residential real estate markets. Journal of Urban Economics, 49, 32–53. doi:10.1006/juec.2000.2180.

Lamont, O., & Stein, J. (1999). Leverage and house price dynamics in U.S. cities. Rand Journal of Economics, 30, 498–514. doi:10.2307/2556060.

Lee, N. J., & Ong, S. E. (2005). Upward mobility, house price volatility and housing equity. Journal of Housing Economics, 14, 127–146. doi:10.1016/j.jhe.2005.06.004.

Leung, C. K. Y., & Feng, D. (2005). What drives the property price-trading volume correlation: evidence from a commercial real estate market. Journal of Real Estate Finance Economics, 31(2), 241–255. doi:10.1007/s11146-005-1374-9.

Leung, K. Y. C., Lau, C. K. G., & Leong, C. F. Y. (2002). Testing alternative theories of the property price-trading volume correlation. Journal of Real Estate Research, 23(3), 253–263.

Nakagami, Y., & Pereira, A. M. (1991). Housing appreciation, mortgage interest rates, and homeowner mobility. Journal of Urban Economics, 30, 271–292. doi:10.1016/0094-1190(91)90050-H.

Ong, S. E., Neo, P. H., & Tu, Y. (2008). Foreclosure sales: the effects of price expectations, volatility and equity losses. Journal of Real Estate Finance Economics, 36, 265–287. doi:10.1007/s11146-007-9049-3.

Ortalo-Magné, F., & Rady, S. (2000). The rise and fall of residential transactions in England and Wales. Research report, Council of Mortgage Lenders, London, UK.

Ortalo-Magné, F., & Rady, S. (2004). Housing transactions and macroeconomic fluctuations: a case study of England and Wales. Journal of Housing Economics, 13, 287–303. doi:10.1016/j.jhe.2004.09.005.

Ortalo-Magné, F., & Rady, S. (2006). Housing market dynamics: On the contribution of income shocks and credit constraints. Review of Economic Studies, 73, 459–485. doi:10.1111/j.1467-937X.2006.383_1.x.

Parikh, A., & Sen, K. (2006). Probit with heteroscedasticity: An application to Indian poverty analysis. Applied Economics Letters, 13(11), 699–707. doi:10.1080/13504850500402096.

Rossi, P. H. (1955). Why families move: A study in the social psychology of urban residential mobility. Glencoe: The Free Press.

Schmidt, U., & Zank, H. (2005). What is loss aversion. Journal of Risk and Uncertainty, 30(2), 157–167. doi:10.1007/s11166-005-6564-6.

Sing, T. F., Tsai, I. C., & Chen, M. C. (2006). Price dynamics in public and private housing markets in Singapore. Journal of Housing Economics, 15, 305–320. doi:10.1016/j.jhe.2006.09.006.

Stein, J. G. (1995). Prices and trading volume in the housing market: A model with down-payment effects. Quarter of Journal Economics, 110, 379–406. doi:10.2307/2118444.

Sun, H., Tu, Y., & Yu, S. M. (2005). A spatio-temporal autoregressive model for multi-unit residential market analysis. Journal Real Estate Finance Economics, 31(2), 155–187. doi:10.1007/s11146-005-1370-0.

Tu, Y. (1997). The local housing submarket structure and its properties. Urban Studies, 34(2), 337–353. doi:10.1080/0042098976203.

Tu, Y. (2003). Segmentation, adjustment and disequilibrium. In T. O’Sullivan, & K. Gibb (Eds.), Housing economics and public policy. UK: Blackwell.

Tversky, A., & Kahneman, D. (1992). Advances in Prospect Theory: cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323. doi:10.1007/BF00122574.

Wheaton, W. C. (1990). Vacancy, search and prices in a housing market matching model. Journal of Political Economics, 98(61), 1270–1292. doi:10.1086/261734.

Wheaton, W. C., & Lee, N. J. (2008). Do housing sales drive housing prices or the converse? Working paper in the MIT Centre for Real Estate.

Wong, G. (2008). Has SAS infected the property market? Evidence from Hong Kong. Journal of Urban Economics, 33, 74–95. doi:10.1016/j.jue.2006.12.007.

Yatchew, A., & Griliches, Z. (1984). Specification errors in probit models. Review of Economic Statistics, 66, 134–139.

Zhou, Q. (2007). Predicting house prices for Singapore condominium resale market: a comparison of two models. Thesis in the Department of Real Estate, National University of Singapore.

Acknowledgement

We thank the support from the academic research fund (AcRF) in National University of Singapore. We thank Dr Wee Yong Yeo and an anonymous referee for their constrictive comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Tu, Y., Ong, S.E. & Han, Y.H. Turnovers and Housing Price Dynamics: Evidence from Singapore Condominium Market. J Real Estate Finance Econ 38, 254–274 (2009). https://doi.org/10.1007/s11146-008-9155-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-008-9155-x