Abstract

The industrialization of agriculture is associated with tighter supply chains where vertical coordination between farmers and processors is facilitated by the use of agricultural contracts. An overview is provided on the recent trends in the use and structure of agricultural contracts followed by an examination of how the competition among processors may affect agricultural contracts. Many reasons exist for using agricultural contracts, including improved risk management and reduced transaction cost. On the other hand, the growing use of agricultural contracts and processor concentration raises concerns that processors may exercise market power, for example by offering lower contract prices in absence of local competition. Previous studies using the new empirical industrial organization models show that processing industries are not perfectly competitive but the price distortions are very small. The focus here is on examining price competition from a farmer’s instead of an industry’s point of view. Recent studies using farm-level data that show that the absence of other contractors or spot markets in producers’ areas does not lead to statistically significant price differences in agricultural contracts for most commodities. These findings provide evidence that most agricultural processors do not exercise market power by reducing prices when other local buyers are not available. Therefore, the recent trends of industrialization and increased vertical coordination in agriculture are likely occurring for reasons other than processors exercising market power.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

The industrialization of US agriculture is typically associated with tighter supply chains that include greater concentration of production on a decreasing number of farms, more vertical coordination in the production and marketing system, and significant concentration downstream from the farm (Ahearn et al. 2005). These structural changes are partially motivated by consumer demands for specific attributes of agricultural products. More vertical coordination in the supply chain facilitates farmer-processor interactions and ensures that the desired quality and quantity of products will be provided to consumers as demanded. The increased coordination and concentration of the production and marketing systems are facilitated by the use of agricultural contracts between farmers and downstream processors.

The use of agricultural contracts, which is one of the major structural changes in the agricultural sector, has been generally increasing over time. For example, in 2008 producers used marketing and production contracts to market 39% of the value of US agricultural production, up from 36% in 1991 and 11% in 1969 (MacDonald and Korb 2011). According to USDA statistics, the concentration of the food manufacturing industry has also been increasing with the mean industry four-firm concentration ratio increasing from 35% in 1982 to 46% in 1997. An important policy question is whether the increased concentration in the processing industry and the increased use of agricultural contracts are a desirable result of cost efficiencies in production or the undesirable effect of market power from agribusiness processors (Ahearn et al. 2005).

Several questions are important to consider when examining industrialization, consolidation, and contracting trends, which affects competition in the agricultural sector. For example, farmers may have different reasons for using agricultural contracts or for marketing independently in the spot markets. Processors may have different reasons for locating in a specific geographic area, competing with other local buyers in that area, selecting an appropriate size of their operations, and structuring their contracts with local producers. Agricultural markets have unique characteristics due to the nature of agricultural production, marketing, and processing which often occur in a narrow geographic region. Consequently, the market structure and competition in a local market for agricultural commodities have important implications for processors’ pricing behavior and interactions with farmers.

The main focus here is on examining price competition from a farmer’s instead of an industry’s point of view. Studies using farm-level data that show that the absence of other contractors or spot markets in producers’ areas does not lead to statistically significant price differences in agricultural contracts for most commodities. These findings provide evidence that most agricultural processors do not exercise market power by reducing prices when other local buyers are not available. Therefore, the recent trends of industrialization and increased vertical coordination in agriculture are likely occurring for reasons other than processors exercising market power.

This chapter begins by describing the vertical coordination in the agricultural sector and the most commonly used types of agricultural contracts. It then discusses current trends in agricultural contracting, as well as reasons for and concerns about the use of agricultural contracting. It next defines and examines various types of market power that can be exercised by agricultural processors especially when agricultural contracts are used. Several studies on agricultural contracts are discussed, followed by studies examining the price competitiveness of agricultural contracts when farmers have limited marketing options. The final section concludes and provides policy recommendations.

2 Vertical Coordination in the Agricultural Sector

Agricultural production can be organized in several ways depending on how commodities are transferred from the farm to the next player in the supply chain: spot (cash) markets, vertical integration, and agricultural (marketing and production) contracts. When farmers deliver their products to the spot markets, they are paid the prevailing market price for their commodities when the ownership is transferred. When using spot markets, farmers make production, financial, and marketing decisions and retain full control and ownership of the commodities until an agreement is reached at or after harvest when the commodities are delivered. There may be premiums or discounts paid based on commodity attributes but such characteristics have to be observable and easily measurable.

Under vertical integration, the farm is jointly owned by a producer and the next player in the production process. Decisions are made internally as a part of the same control unit rather than by using contracts. Considering different types of vertical coordination, spot markets and vertical integration lie at the opposite ends in terms of grower independence to make decisions and bear production and marketing risk.

Finally, the production of commodities can be coordinated through marketing or production contracts. Marketing contracts represent an agreement between a farmer and a contractor that specifies a price or price mechanism, a delivery outlet, and a quantity to be delivered of a given commodity. Paulson et al. (2010) examine these characteristics for corn and soybean marketing contracts used by Midwest farmers. They find that 13% of the contracts specify a price formula, 21.4% of the contracts specify a premium or discount for commodity attributes, and 76.2% specify a quantity to be delivered. Marketing contracts are predominantly used to reduce price risk for farmers. The farmer owns the commodity during the production process and exercises control over managerial decisions. Marketing contracts are used predominantly in crop production.

Production contracts specify farmer and contractor responsibilities in terms of production inputs and practices and a fee payment for the farmer. The contract specifies the services that will be provided by the farmer, the contractor provision of inputs, and the payment mechanism for the farmer’s services. The farmer’s payment in production contracts is in the form of a fee or compensation for his/her services, instead of a payment for the commodity value, as is the case for marketing contracts. Under production contracts, farmers do not have ownership of the commodity and have limited decision making power throughout the production process. Production contracts are predominantly used in livestock production.

3 Current Trends in Agricultural Contracting

The primary data source for studying agricultural contracting in the US is the USDA’s Agricultural Resource Management Survey (ARMS). It is conducted annually by the US Department of Agriculture and provides comprehensive statistics on marketing and production contract use by US farm businesses. ARMS is the USDA’s primary source of information on financial conditions, marketing practices, and resource use by US farms and the economic well-being of US farm households. The ARMS questionnaire includes questions on marketing and production contracts, including the quantity contracted and the price or fee received for each commodity under contract. In select years, the ARMS questionnaire also includes information on contract design regarding price formulas, quantity and attribute specifications, type of contractor (a cooperative or an investor-owned firm), and availability of other marketing options in the farmers’ area.

Farmers have been using agricultural contracts for the last few decades. While the proportion of farms using contracts has remained relatively stable between nine and 12% since 1969, the value of production under contract has increased from 11% in 1969 to 39% in 2008 (MacDonald and Korb 2011). This increasing trend has stabilized and even reversed in the last decade, with 36–41% of agricultural production being under contract. This is partially due to the recent commodity price trends in which the prices of five major field crops (corn, soybeans, wheat, cotton, and rice) have increased but these commodities are less likely to be produced under contract. According to the ARMS data, the percent of farms using contracts was 11.2% in 2001, 11% in 2005, and 10.4% in 2009, while the volume of production under contract was 38.4% in 2001, 40.7% in 2005, and 37.4% in 2009 (see Table 9.1). Therefore, contracting activities have remained relatively stable during the most recent decade.

The use of contracts varies depending on farm size; larger farms are more likely to use contracts and contract higher proportion of their production (Katchova and Miranda 2004). ARMS defines rural residence farms as family-operated farms with less than $250,000 in gross sales whose primary occupation is not farming; intermediate farms as family-operated farms with less than $250,000 in gross sales whose primary occupation is farming; and commercial farms as those with sales exceeding $250,000 and all non-family farms. Table 9.1 shows that rural residence farms are not very actively involved in agricultural contracting; only 3.4% of rural residence farms used contracts and they contracted 11.2% of their production in 2009. On the other hand, commercial farms are actively using contracts; 46.9% of commercial farms used contracts and they contracted 42.6% of their production in 2009. Therefore, larger farms are more involved with contracting both in terms of percent of farms contracting as well as the proportion of production contracted.

The use of contracts also varies depending on the commodities that farmers are producing and contracting. Contracts are less commonly used for crops (25.8% of the crop production was under contract in 2009) than for livestock (52% of the livestock production was under contract in 2009) (see Table 9.2). Among crops, the highest shares of production under contracts are for sugar beets, peanuts, tobacco, potatoes, and vegetables. The lowest shares of production under contract are for wheat, corn, soybeans, rice, fruit, and cotton. Among livestock, contracting is most prevalent in the poultry industry, where 90.1% of the production was under contract in 2009, followed by hogs, dairy, and cattle.

The recent trends indicate that while contracting has been relatively stable in the last decade, contract use varies depending on the size of farms and commodities that the farms produce, among other factors. These factors need to be taken into consideration when examining agricultural contracting and competition.

4 Reasons for Agricultural Contracting

Producers may prefer to use contracts instead of spot markets to market their commodities for a variety of reasons, including improved risk management and reduced transaction costs. Specifically, farmers may use contracts in order to reduce the price and income risk that they face. When farmers enter marketing or production contracts, these contracts usually specify a price or fee to be paid to producers. Therefore, contracts allow for risk shifting from a farmer to a processor that may be better able to hedge against price risk.

Contracts also provide farmers with incentives to improve their incentives to lower production costs and deliver commodities with specific attributes. This transaction-cost approach may facilitate the process of coordination with downstream entities by increasing the information flow and sharing of management responsibilities and production decision making. The production of certain agricultural commodities requires extensive capital investments in new technology and/or specific assets. Farmers may be reluctant to invest in land and other agricultural assets when they have limited marketing options. In this case, contracts can be used to assure farmers of secure markets, and therefore a steady income stream to pay off new investments.

Three characteristics of agricultural production facilitate the trend toward increasing contract adoption and use: asset-, site-, and time specificity (Williamson 1985). Asset specificity indicates that assets employed in agricultural production are highly specialized for agricultural use, and therefore have limited options for alternative uses. Site specificity refers to the fact that the transportation of some agricultural commodities is costly, and therefore requires that the commodities be marketed in the geographic region where production occurs. Time specificity indicates that many agricultural products are perishable and must therefore reach processors within a specified, relatively limited period of time. Because of asset-, site-, and time specificity, contracts are an attractive way for farmers to market their commodities.

Farmers and processors may also use contracts to secure specific commodity attributes. Some attributes (such as using specific production practices or growing a specific variety of a commodity) cannot be observed or are hard to measure in spot markets. Farmers may not be willing to produce commodities with specific attributes unless they can be assured of a certain market and a price premium. In the case of unobservable or hard-to-measure attributes, processors may be willing to offer farmers contracts to guarantee the quantity and specified qualities for the commodities they need.

Another reason for using agricultural contracts is that it may be more cost efficient for a processor to offer contracts and thereby secure stable supply from farmers in order to realize economies of scale (Allen and Lueck 1998). This is especially true for markets characterized by limited competition and/or thin markets, where contracting may be the only option to secure stable supply for processor’s operations.

5 Concerns About Agricultural Contracting

Contracts have certain advantages for both producers and processors but they can also introduce new risks for producers. These risks include: (1) production-shortfall risks associated with the use of contracts, (2) hold-up risks because of asset-, site-, and time specificity and limited buyer competition, (3) thinning spot markets and decreasing price information transparency, and (4) market power that processors may potentially exercise (MacDonald et al. 2004).

Agricultural contracts typically specify price, quantity, quality, and a time frame for delivery of a commodity. While contracts can reduce price and income risks, they may also introduce other types of risks for farmers. For example, in case of production shortfall when the contract specifies a particular quantity to be delivered, farmers will have to obtain the additional quantity needed at the spot market at an uncertain price in order to fulfill their contract. Also, in case farmers are unable to meet the specific attributes in the contract, they may have to sell their products at a discount or not be able to deliver on the contract.

Contracts may help farmers make long-term investments by allowing farmers to obtain credit to finance such investments. However, it is often the case that contracts have much shorter terms than the time required to pay back these investments. At the time of contract renewal, farmers may incur hold-up risks where processors offer lower prices to them if farmers have limited alternative uses of agricultural assets and limited alternative marketing options for their commodities. Therefore, asset-, site-, and time specificity and limited regional competition facilitate the hold-up risks that farmers may face.

Another concern about agricultural contracting is that as more volume is produced under contract, too few transactions would take place in the spot markets for these markets to function. This trend further encourages more contracting because farmers need to find a reliable market for their production, especially when there are a limited number of buyers. The poultry industry is an example where most of the production is under contract and spot markets are no longer viable. While contracts have many advantages, spot markets play an important role in providing price information and transparency. Contract prices remain confidential or they are hard to observe, which makes it easier for processors to exercise market power.

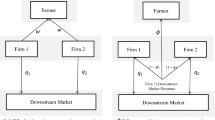

6 Contracting, Market Power, and Local Competition

In economics, market power is defined as the ability of a firm to affect either the total quantity or the price of a good or service in the market. A monopsony is defined as having only one buyer, and an oligopsony is defined as having only a few buyers in the relevant market. When there are a limited number of processors in the market (increased concentration and consolidation), there is a concern that buyers make take advantage of the lack of competition and act anti-competitively, by offering lower prices to farmers or restricting the quantity of commodities purchased.

Processors may use several strategies to exercise market power: (1) contractors may deter entry by other local buyers, (2) they may limit price competition among existing buyers, (3) they may use captive supplies, (4) they may engage in discriminatory pricing, and (5) they may offer lower prices when farmers have limited other options to market their commodities to other contractors or spot markets in the farmers’ area (MacDonald and Korb 2011; Katchova 2010a; Ward 2005). When processors have secured a large share of the local production under agricultural contracts, it may be costlier for new processors to enter the local market. The reason is that processors need to be large enough to realize economies of scale and operate their businesses profitably. When one processor has contracted a substantial portion of the local production, a potential entrant will have to pay substantially higher prices to secure an adequate supply for their processing facilities.

Contracts may also be structured to incorporate pricing mechanisms that limit competitive bidding for commodity prices. For example, the top-of-the-market pricing used in cattle contracts sets the base price at the highest spot market price paid for cattle during the established period. This pricing clause may limit aggressive price bidding by contractors in the spot markets as they procure additional local supply, because they have to offer this price on all existing contracts. If there are only a few contractors in the farmer’s area, the contractors may collude to bid less aggressively and offer farmers lower prices.

Packers may also engage in captive supplies in order to procure livestock for their operations. Captive supplies are slaughter livestock that are committed to a specific buyer (meatpacker) through a contract or marketing agreement 14 or more days prior to slaughter. Packers may exercise market power by reducing competition on the spot markets and offering lower prices on the spot markets when they hold a captive supply of cattle.

Contractors may also offer different prices to farmers for commodities of the same quality and attributes. It may be hard to detect if price differences are due to differences in quality and attributes of the marketed commodity or due to the exercise of market power if prices are not completely transparent in the market. This is particularly true when there are confidentiality clauses that forbid farmers from disclosing details of their contracts to others. If contractors have monopsony power, they can offer lower prices to secure most of the local supply and then pay marginally higher prices only on the additional supply that they need.

Contracts can be designed in a way that allows buyers to exercise market power by offering lower prices to farmers. Because of the spatial nature of agricultural production, transportation costs, and commodity perishability, many farmers are restricted to selling their production within their geographic areas. Therefore, competition from other buyers located near the farm business, such as other contractors and spot markets in the farmer’s area play an important role. Where farmers do not have such alternative marketing options, it is easier for contractors to exercise monopsony market power.

7 Studies on Agricultural Contracts

Agricultural contracting is typically studied using the principal-agent economic framework, where the contractor is the principal and the farmer is an agent. In the principal-agent framework, the principal contracts with the agent to pursue the principal’s interest. However, because of incomplete and asymmetric information, the agent may not fully act in the principal’s interest (moral hazard), making the principal’s return risky. The principal-agent model is frequently used to explain the reasons farmers choose to use agricultural contracts, because of the risk shifting from a farmer to a contractor.

The two most common reasons for using contracts are improved risk management and reduced production and transaction costs. The empirical research is mixed on which reason is more important but there is evidence of farmers using both reasons to justify using contracts (Allen and Lueck 1995; Key 2004). On the other hand, the increased use of agricultural contracts raises concerns that processors may exploit market power. For example, contracting in the livestock industry is especially controversial where a few meatpackers handle most of the livestock purchases while quantities sold on the spot markets continue to decrease. In response to these concerns, Congress has passed laws in an effort to regulate livestock contracts and require mandatory price reporting for the processing industry.

The literature examining agricultural contracts is relatively limited mostly due to the fact that data on commodity contracts are scarce. Furthermore, because contract types and characteristics vary widely across commodities, it is difficult to generalize results from individual commodities to the entire agricultural sector. In addition to collecting data on the contracts themselves, it is useful to collect relevant data on contracting parties, contract outcomes, and the economic environment, since relatively little is known about how observed producer and contractor characteristics influence the design of marketing contracts (Hueth et al. 2007).

Paulson et al. (2010) use contract theory to investigate the existence of a link between the principal (contractor) and agent (farmer) characteristics and the resulting contract between the parties, after accounting for the endogenous matching between agents, contractors, and activities. In the case of corn and soybeans, they find evidence of producer characteristics (such as the use of crop insurance, farm size, leverage, and whether the farm is a hobby farm) having an impact on the decision to enter contract agreements. However, they find almost no evidence of observed producer or contractor characteristics influencing contract attributes such as pricing, quality, and quantity provisions of their contracts. Katchova and Miranda (2004) find similar results where producer characteristics such as farmer’s age and education affect their likelihood of adopting marketing contracts but not do influence the quantity contracted, number of contracts, or type of contracts that farmers use. Their findings indicate that factors other than the proxies used for farmer risk preferences may play a more dominant role in determining the specific structure of agricultural marketing contracts. Another explanation is that monopsony market power of the contractor might also limit the menu of contract options available to producers as well as the producers’ bargaining power with respect to contract terms.

Some empirical studies have examined farmers’ decisions to adopt marketing and production contracts and the types of contracts they adopt. Some farmers use marketing contracts to respond to price risk, while others use marketing contracts for price enhancement (Harwood et al. 1999). Marketing contracts can reduce income risk and improve access to credit, particularly when used jointly with crop insurance. However, despite the benefits associated with marketing contracts, surveys have found that farmers use fewer marketing contracts than implied by theoretical optimal hedge models (Goodwin and Schroeder 1994; Musser et al. 1996; Sartwelle et al. 2000). Contracting is also found to be positively associated with the scale of production for farm businesses (Key 2004).

Other studies have compared contract and independent producers to identify distinguishing characteristics and reasons for contracting. These studies discuss the effects of risk, transaction costs, and autonomy when selecting marketing arrangements (Davis and Gillespie 2007). Key (2005) further shows that farmers’ decisions to contract or produce independently depend on the distribution of income and the attributes associated with both contract and independent production arrangements.

Studies have also examined market prices in livestock spot markets in the presence of captive supplies and contracts with pricing clauses. The principal-agent model is used within a market equilibrium model of contract and cash markets to analyze the impact of contracting on spot market prices, finding that the formula-price contracts can theoretically increase or decrease cash market prices (Wang and Jaenicke 2006). Empirically, top-of-the market pricing has been shown to have anticompetitive consequences when the same buyers who purchase contract cattle with top-of-the-market clause also compete to procure cattle in the spot market (Xia and Sexton 2004). Zhang and Sexton (2000) further show that the spot price is inversely related to the incidence of contract use in the market, but this effect is not significant in markets where the spatial dimension is less important.

Numerous studies have examined market power in the processing industries, typically using the new empirical industrial organization (NEIO) structural models with aggregate industry-level data. The conceptual models include non-cooperative games, Nash’s equilibrium, and various forms of dynamic games. Many interactions in agriculture can be represented as a game when production, pricing, and consumption are set in the first stage and players receive payoffs in the second stage. A key consequence of the industrialization of agriculture is that market power can be present at multiple stages of the market chain including processors and retailers. Most of these studies find that while processors exercise market power, the resulting price distortions are small in magnitude (Sexton 2000).

Several studies examine agricultural contracting and price competitiveness from a farmers’ perspective using farm-level data rather than from a processing industry’s perspective supported by industry data. Katchova (2010a) has proposed a new approach to examine price distortions due to processor concentration, where competition from local buyers such as other contractors and spot markets play an important role. In addition, Katchova (2010b) has examined how the bargaining power of farmers affects contract price competitiveness depending on the organizational type of the contractor (cooperative or investor-owned firm). The price competitiveness of agricultural contracts is examined in greater detail in the next section.

8 Price Competitiveness of Agricultural Contracts

The recent trend of increasing processor concentration and the widespread use of contracts has resulted in reduced competition in many local markets. These conditions create an opportunity for processors to act anti-competitively and offer lower prices to farmers. However, it is an empirical question of whether or not processors take advantage of the situation when farmers have limited marketing options and offer them lower prices.

Katchova (2010a) examines the price competitiveness of marketing and production contracts depending on the availability of alternative marketing options (other local contractors or spot markets). Specifically, the study tests if prices on comparable agricultural contracts are significantly lower for farmers lacking alternative marketing channels. Unlike other studies that compare spot market with contract prices, this study compared only contract prices based on whether or not farmers have alternative options.

Contract data for six commodities (corn, soybeans, wheat, cotton, milk, and broilers) were obtained from the Agricultural Resource Management Survey for 2003–2005. The availability of alternative marketing options differs based on the commodities farmers produce. Most farmers producing crops have other local contractors as well as local spot markets. About two-thirds of the marketing contracts for corn, soybeans, wheat, and cotton were located in areas with other contractors, and even higher proportion of these contracts (about 83–95%) had local spot markets. About 77% of milk marketing contracts had other local contractors, but only 23% had local spot markets. About half of the contracts for broilers were located in areas with other contractors, while only 3% of them had local spot markets.

Katchova (2010a) compares the prices for contracts that have other local buyers in the area (such as other contractors or open markets) with contracts that do not have other marketing options in the area. The propensity score matching methods were used to estimate price differences in order to compare contracts with similar characteristics. The findings show that only a few commodities had statistical differences in commodity prices above 3–5%. Corn growers receive 3.5% statistically significant higher prices if other local contractors are present and corn growers receive 3.9% statistically significant higher prices if there are local spot markets. The rest of the commodities have estimated price differences that are smaller than the 3–5% level needed to detect statistical significance. Overall, results from the Katchova (2010a) study show lack of statistically significant price distortions exceeding 4–5% in agricultural contracts between producers and processors. These findings are consistent with the explanation that the upward trend in contract use is likely not due to the exercise of price setting market power by processors but may be due to other factors such as increased efficiency associated with the vertical coordination in the production and marketing of agricultural commodities.

In addition, Katchova (2010b) examines commodity price differences for agricultural contracts depending on the organizational form of the contractors. In particular, marketing and production contract prices are compared for farmers marketing their commodities with cooperatives versus investor-owned firms (IOF). The study addresses the question of whether farmers who are members of cooperatives receive market prices for their commodities as expected according to cooperative principles. The propensity score matching method is used to estimate price differences in agricultural contracts to ensure comparison of similar contracts.

The analysis was conducted for six commodities (corn, soybeans, wheat, cotton, milk, and broilers) using data from the USDA’s Agricultural Resource Management Survey for 2003–2005. Contracting with cooperatives differs based on the commodities farmers produce. Farmer contracting with cooperatives is most prevalent for milk contracts, with about 79% of the milk contracts being with cooperatives. A quarter to a half of the contracts for corn, soybeans, wheat, and cotton are with cooperatives. Only 6% of the broiler contracts are with cooperatives. The results in Katchova (2010b) show that the organizational form of the contractor generally does not lead to significant differences in contract prices for most commodities. The fact that prices received on contracts do not seem to be different based on the type of contractor provides indirect evidence of a cooperative benefit since the members do not have price penalties in contracting with cooperatives but retain the upside potential of a patronage payment.

The structure and performance of agricultural contracts are influenced by the competition among processors to offer farmers either more appealing terms or contract prices (Sykuta and Cook 2001). In comparison to most other industries, agriculture remains more heterogeneous in the organizational forms of contractors even though the contractors provide similar contracting services.

Using a different approach to study competition uniquely from a farmer’s point of view, the findings by Katchova (2010a and 2010b) are also consistent with the limited evidence for market power in the processing industry found in other studies using the NEIO structural models. The two studies examined price competitiveness of agricultural contracts depending on the availability of alternative marketing options and the type of contractor finding and found limited evidence of contract price differences.

9 Concluding Remarks

The increased contracting use and processor concentration represent key trends in the industrialization of agriculture. Contract use has generally increased over time but its intensity still varies greatly among commodities. Contracts now dominate the exchange of several commodities such as tobacco, peanuts, sugar beets, broilers, and hogs. Other commodities such as corn, wheat, and soybeans continue to be sold predominantly on the spot markets. Because contracting is an alternative way to market agricultural production, producers may be more likely to switch to contracts when the markets are already thin; this further accelerates the trend of increased contracting. Contracts are more likely to be used in geographic areas which have a limited number of buyers, which raises concerns that processors may be exercising market power. Despite the prevalence of contracts in the agricultural sector, there is limited evidence that processors are exercising market power in terms of offering lower prices to farmers who may not have other marketing options in their areas. Farmers may also switch to contracting for other reasons such as guaranteeing a secure market outlet, obtaining credit, and making capital investments in agricultural specific assets.

The shift from spot markets to contracting also raises concerns about whether spot markets will be a viable option in the future or the majority of agricultural production will be produced under contract. When more output is marketed with contracts, the lower traded volume on the spot markets may induce a tipping point where the thinness and uncertainty of spot markets can force independent producers to accept contracts (MacDonald et al. 2004). Additional evidence by Katchova (2010a) shows that the absence of spot markets does not lead to lower commodity prices offered by the processing industry. This means that new regulations regarding the increasing concentration of processors may not be needed at this time, but government intervention may still be desirable to ensure that there is no loss in price information because of contracting. For example, the Livestock Mandatory Reporting Act of 1999 requires large packers and importers to report to USDA the details of all transactions involving purchases of livestock. Such regulations ensure transparency of commodity prices when the sector undergoes structural changes toward more contracting. Price transparency is of crucial importance for farmers since the consolidation in the processing industry may lead to a decreasing bargaining power for producers when negotiating prices and contract terms. Evidence shows that farmers marketing with investor-owned firms do not receive lower prices than those marketing with cooperatives (Katchova 2010b), indicating again that processors may not be exercising market power.

There may also be beneficial effects for moving toward increased contracting and reducing spot market transactions. From a government policy perspective, the shift away from spot markets toward contracting facilitates the traceability of food and food ingredients in the agricultural supply chain. The increased vertical coordination in the production and marketing of agricultural commodities is typically associated with ensuring food safety and delivering quality assurances to consumers, especially when commodity attributes are not easily observable.

The agricultural economics literature has examined market power using the NEIO structural models and aggregate industry-level data and has concluded that the processing industry is exercising market power but it is small in magnitude (for an overview, see Sexton 2000). Additional studies using farm-level data have examined imperfect competition among local processors uniquely from a farmers’ perspective by taking into consideration the spatial nature of agricultural production and marketing (Katchova 2010a). These new findings are also consistent with the limited evidence for market power in the processing industry found in other studies. While the absence of local competition from other buyers currently does not lead to lower prices, the bargaining power of farmers will likely continue to weaken as more production shifts to contracting with larger processors. Therefore, policy makers need to monitor these structural changes in agricultural contracting as more government intervention may be needed in the future to prevent anti-competitive behavior by processors in absence of local competition.

References

Ahearn, M.C., P. Korb, and D. Banker. 2005. The industrialization and contracting of agriculture. Journal of Agricultural and Applied Economics 37: 347–364.

Allen, D.W., and D. Lueck. 1995. Risk preferences and the economics of contracts. American Economic Review: Papers and Proceedings 85: 447–451.

Allen, D.W., and D. Lueck. 1998. The nature of the farm. Journal of Law and Economics 66: 343–386.

Davis, C.G., and J.M. Gillespie. 2007. Factors affecting the selection of business arrangements by U.S. hog farmers. Review of Agricultural Economics 29: 331–348.

Goodwin, B.K., and T.C. Schroeder. 1994. Human capital, producer education programs, and the adoption of forward-pricing methods. American Journal of Agricultural Economics 76: 936–947.

Harwood, J., R. Heifner, K. Coble, J. Perry, and A. Somwaru. 1999. Managing risk in farming: Concepts, research, and analysis. Agricultural economic report 774. Washington, DC: Economic Research Service, U.S. Department of Agriculture.

Hueth, B., E. Ligon, and C. Dimitri. 2007. Agricultural contracts: Data and research needs. American Journal of Agricultural Economics 89: 1276–1281.

Katchova, A.L. 2010a. Agricultural contracts and alternative marketing options: A matching analysis. Journal of Agricultural and Applied Economics 42: 1–6.

Katchova, A.L. 2010b. Agricultural cooperatives and contract price competitiveness. Journal of Cooperatives 24: 2–12.

Katchova, A.L., and M.J. Miranda. 2004. Two-step econometric estimation of farm characteristics affecting marketing contract decisions. American Journal of Agricultural Economics 86: 88–102.

Key, N. 2004. Agricultural contracting and the scale of production. Agricultural and Resource Economics Review 33: 255–271.

Key, N. 2005. How much do farmers value their independence? Agricultural Economics 22: 117–126.

MacDonald, J., and P. Korb. 2011. Agricultural contracting update: Contracts in 2008. Economic information bulletin no. 72. Washington, DC: Economic Research Service, U.S. Department of Agriculture.

MacDonald, J., J. Perry, M. Ahearn, D. Banker, W. Chambers, C. Dimitri, N. Key, K. Nelson, and L. Southard. 2004. Contracts, markets, and prices: Organizing the production and use of agricultural commodities. Agricultural economic report number 837. Washington, DC: Economic Research Service, U.S. Department of Agriculture.

Musser, W.N., G.F. Patrick, and D.T. Eckman. 1996. Risk and grain marketing behavior of large-scale farmers. Review of Agricultural Economics 18: 65–77.

Paulson, N.D., A.L. Katchova, and S.H. Lence. 2010. An empirical analysis of the determinants of marketing contract structures for corn and soybeans. Journal of Agricultural and Food Industrial Organization 8(4): 1–23.

Sartwelle, J., D. O’Brien, W. Tierney Jr., and T. Eggers. 2000. The effect of personal and farm characteristics upon grain marketing practices. Journal of Agricultural and Applied Economics 32: 95–111.

Sexton, R.J. 2000. Industrialization and consolidation in the U.S. Food Sector: Implication for competition and welfare. American Journal of Agricultural Economics 82: 1087–1104.

Sykuta, M.E., and M.L. Cook. 2001. A new institutional economics approach to contracts and cooperatives. American Journal of Agricultural Economics 83: 1273–1279.

Wang, W., and E.C. Jaenicke. 2006. Simulating the impacts of contract supplies in a spot market-contract market equilibrium. American Journal of Agricultural Economics 88: 1062–1077.

Ward, C. 2005. Beef Packers’ captive supplies: An upward trend? A pricing edge? Choices 20: 167–171.

Williamson, O. 1985. The economic institutions of capitalism. New York: The Free Press.

Xia, T., and R.J. Sexton. 2004. The competitive implications of top-of-the-market and related contract-pricing clauses. American Journal of Agricultural Economics 86: 124–138.

Zhang, M., and R.J. Sexton. 2000. Captive supplies and the cash market price: A spatial markets approach. Journal of Agricultural and Resource Economics 25: 88–108.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer Science+Business Media Dordrecht.

About this chapter

Cite this chapter

Katchova, A.L. (2013). Agricultural Contracting and Agrifood Competition. In: James, Jr., H. (eds) The Ethics and Economics of Agrifood Competition. The International Library of Environmental, Agricultural and Food Ethics, vol 20. Springer, Dordrecht. https://doi.org/10.1007/978-94-007-6274-9_9

Download citation

DOI: https://doi.org/10.1007/978-94-007-6274-9_9

Published:

Publisher Name: Springer, Dordrecht

Print ISBN: 978-94-007-6273-2

Online ISBN: 978-94-007-6274-9

eBook Packages: Humanities, Social Sciences and LawPhilosophy and Religion (R0)