Abstract

This chapter explores the geopolitical risk of Turkey’s crude oil and natural gas diversification portfolios. We use the methodology of Chaterjee (Strateg Anal 36(1):145–165, 2012) to forecast the Geopolitical Market Concentration (GMC) risk of Turkey’s diversification portfolios under worst and best case scenarios. Our analysis is based on the market shares and the political stability of countries supplying crude oil and natural gas to Turkey. The results are robust to the choice of parameters in the double exponential smoothing method, which we use for forecasting.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Middle East

- Energy Security

- Diversification Portfolio

- International Country Risk Guide

- Double Exponential Smoothing

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Energy is a key input into all economic processes. That makes energy security – the uninterrupted physical availability of energy at an affordable price – a fundamental necessity for any economy. Factors that instigate energy insecurity reside mostly in countries exporting energy. These factors include political instability, geopolitical rivalries, regional supply shortfalls, higher energy prices, imminent depletion of reserves and bottlenecks in the supply chain. However, in the long-run, fiercer competition for oil and natural gas among energy-importing nations is likely to contribute to energy insecurity (Isenberg et al. 2002).

Ideally, to ensure access to crude oil and natural gas, importing countries must assure the continuity, consistency and adequacy of supply at a reasonable cost in not only short but also long run. In the long run, energy security entails access to affordable sources of energy with protections against price and volume risks. Less dependence on imports, lower degree of import concentration, higher ratio of domestic inventories to imports and greater diversity of exports are essential for energy security in the long term.

The short term, on the other hand, is a period of time during which no radical change occurs in the quality of the factors deployed. Therefore, short term energy security involves the ability to react promptly to sudden changes in energy supply and demand, such as disruptions in energy supply resulting from geopolitical, military or civil developments.

The surge in oil prices in 2007–2008 emphasized that long-term energy security calls for sound policy actions by importing nations. From a long term perspective, we can classify risks confronting energy importing nations as systematic risks and unique risks. Systematic risks concern common risks related to international crude oil and natural gas markets, whereas unique risks are associated with dependence on specific regions supplying them. Diversification of crude oil and natural gas supply does not provide energy security by eliminating systematic risks, but by reducing unique risks by diversifying among sources that supply energy. Therefore, diversification provides energy security for importing countries by decreasing their exposure to country-specific risks of energy supplying countries. By diversifying among suppliers of energy, an energy importing country aims to secure a stable supply of oil and natural gas that might otherwise be endangered by over-dependence on a single import source (Koyama 2004).

However, there are limits to diversification. These limits include the following (Vivoda 2009):

-

Availability of transportation infrastructure and capacity to transport oil and natural gas from alternative exporters;

-

Geographic conditions, such as freight costs, relative distance from major exporting regions and security of transport routes;

-

Economic and political ability to meet the costs to secure access to alternative oil supplies; and

-

Political relations with energy-exporting countries.Footnote 1

Energy security is a continuing concern for Turkey, which is heavily reliant on energy imports. Specifically, Turkey depends on imports for 92 % of its crude oil needs, while its natural gas dependency rate is 98 %. Further, Turkey’s demand for energy has been increasing in direct proportion to the increase in its GDP at an average of 6 % per year and is expected to reach 130 billion MW by 2023 (Dereli 2013). Rising demand for imported natural gas and crude oil contributes to the wide current-account deficit in Turkey, which totals to around 6 % of the country’s GDP. The deficit has been financed mainly with flows from foreign funds, which has left the economy vulnerable to the whims of international investors (Wall Street Journal 2013). We should also note that a $10 per barrel drop in the oil price cuts as much as $4 billion off Turkey’s annual current account deficit, which is around $65 billion (Financial Times 2012). Cohen, Joutz and Loungani (2011) calculate a country-specific index (CSI) for the concentration in crude oil suppliers. Smaller values of the CSI indicates more diversification and hence lower risk – in the case of only one supplier, the CSI takes on its maximum value of 100 and if CSI is above 10, then the country is classified as being highly vulnerable to disruptions in energy supplies. Their results show that the CSI for Turkey has risen from 13.52 in 1990 to 21.59 in 2008.

This chapter aims to find out the geopolitical market concentration (GMC) risk of Turkey’s crude oil and natural gas diversification portfolio and to assess whether its portfolio is concentrated to several countries or dispersed. To do this, we follow the methodology of Chatterjee (2012). We evaluate the GMC risk of Turkey’s current (2010–2011) and future (2012–2016) diversification portfolios. We use the exponential smoothing method of trend fitting and forecasting with time series data to estimate the concentration of suppliers. For the political risk parameters, in our analysis we use the Blyth and Lefèvre (2004) model. We also analyze and compare the GMC risk of the Middle East, which holds 59.9 % of the world’s crude oil and 36 % of the world’s natural gas reserves, and other regional suppliers in the diversification portfolio of Turkey over past, present and future time periods. We show that our results are robust to the choice of parameters in the double exponential smoothing model that we use for forecasting.

Our chapter is structured as follows: Sect. 7.2 describes the data and explains our methodology and the model for the GMC risk. In Sect. 7.3 we provide our results and discussions on Turkey’s oil and natural gas imports. Section 7.4 presents the robustness checks. Finally, the last section concludes.

2 Data and Methodology

We obtained the data for our study from the Energy Market Regulatory Authority’s (EPDK) official website.Footnote 2 In our forecast, we use longitudinal data from 2005 to 2011.

2.1 Forecast

We use the double exponential smoothing technique, which provides a good fit when data shows a trend, to forecast Turkey's future imports and production. This method involves updating two parameters, level E t and trend T t , at each time period. The level is a smoothed estimate of the value of the data at the end of each period t. The trend is a smoothed estimate of the average growth at the end of each period. The following is the formula for double exponential smoothing:

where, U and V are arbitrarily chosen smoothing constants ranging from 0 to 1. We present all sets of results for U = V = 0.4 and discuss other choices. X t is the observed value of time series at time t. There are several ways to choose the initial values for the trend and the level. We choose \( {E}_{t_0}={X}_{t_0} \) and \( {T}_{t_0}=0 \) , where subscript t 0 refers to the first year of the time series. An h-step forecast combines estimates of the level and trend at the last available data point:

Thus in year 2011, to forecast Turkey’s oil import in 2016, we first estimate level E t , and trend T t for t = 2011 recursively starting from the origin of the time series and then compute the future value for import as \( {\widehat{I}}_{2011+5}={E}_{2011}+5{T}_{2011} \).

2.2 Model for Geopolitical Market Concentration Risk (GMC)

We evaluate the geopolitical market concentration risk (GMC) using the model of Blyth and Lefèvre (2004), which is based on Hirschman (1945) and Herfindahl (1950). This model has been applied by Chatterjee (2012) to forecast the GMC of the crude oil diversification portfolio of India. The inputs for this model are market shares of oil supplying countries and a proxy for the country risk:

where S ti = I ti /(I t + P t ) is the market share of the i-th crude oil supplier in year t. I ti is the import from the i-th supplier in year t. P t is the total oil production of Turkey in year t. Further, \( {I}_t={\displaystyle \sum_i{I}_{ti}} \) is the total import and \( {r}_{ti}=\frac{100}{R_{ti}} \) is a modified risk of the i-th supplier.

The squaring of market shares S ti results in assigning higher risk to countries with larger shares in the total oil portfolio. For example, the more suppliers the importing country has and the higher the equality of shares, the less risky is the oil import portfolio. However, if the share of a supplier doubles, the risk of this supplier’s contribution quadruples.

The International Country Risk Guide (ICRG) composite rating R i has been estimated by the PRS group and is shown in Table 7.1. Countries are rated on a scale of 1–100 by the ICRG – the higher the rating, the safer the country and thus the lower the risk. This rating is based on an assessment of 22 variables for three types of risk: political, financial and economic (The PRS Group, Inc. 2012). The total score ranges from 0 to 100. Accordingly, countries with scores from 80 to 100 are put into the Low Risk group. Scores from 0 to 49.9 correspond to the ‘very high risk’ group. Noteworthy, Eq. 7.4 uses the reciprocal of R i multiplied by 100. Thus, in this paper, higher levels of the GMC correspond to higher risk.

Based on the ICRG rating we can assess the individual risk of countries supplying oil to Turkey. None of the suppliers belongs to the ‘very high risk’ group. The ‘safest’ oil supplier is Saudi Arabia, which belongs to the Low Risk group. However, the import share of this country is gradually decreasing (see Sect. 7.3.1). In contrast, Iraq has the highest risk score, but the import share of Iraq is increasing.

3 Results and Discussion

3.1 Forecast of Turkey Oil Import

Table 7.2 shows the total oil import and production of Turkey in metric tons, through the years 2002–2011. It can be seen from the table that, through the years, although the domestic production of crude oil is stable, there is a steady decline in imports, namely around 24 % from year 2002 to 2011.

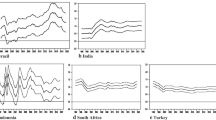

From the data provided in Tables 7.2 and 7.3, Fig. 7.1 shows that the composition of crude oil imports of Turkey has changed dramatically towards more dependence on the Middle East. In 2006, the total share of Middle Eastern countries was 0.54, while in 2011 this share rose to 0.81. The forecasts for 2012 and 2016 are 0.86 and 0.88. In addition, diversification also suffers from the negative trend in the number of oil suppliers. Although Turkey seems to increase number of oil suppliers at the beginning (from 5 in 2006 to 11 in 2009), by 2011 Turkey’s supply of crude oil is dominated by only eight countries in 2011. Based on our forecast, the number of suppliers falls to seven in 2016. Moreover, the shares of Iran and Iraq are gradually increasing, while the contribution of Saudi Arabia is significantly diminishing. Figure 7.2 shows the detrimental trend in the diversification of oil suppliers in the long run. As we show later, all of these tendencies lead to an increase in GMC risk.

3.2 Geopolitical Market Concentration Risk of Turkey’s Crude Oil Import Portfolio

This section is based on the model for evaluating geopolitical market concentration risk that is described in Sect. 7.2.2. Table 7.4 presents the current and the forecasted crude oil market concentration, which is based on predicted imports shown in Table 7.3. These values are used as inputs in Eq. 7.4.

Results in Table 7.5 show that the geopolitical market concentration risk of Turkey is increasing in both scenarios. For example, the total Middle East risk is about 0.3496 in 2011, and by 2016 it rises to 0.4426 in the best-case scenario and 0.6263 in the worst-case scenario. Importantly, Iran accounts for 81 % of the total geopolitical market concentration risk of the oil import portfolio of Turkey in 2011.

3.3 Forecast of Turkey’s Natural Gas Imports

This section repeats the analysis of Sect. 7.3 for the natural gas import portfolio. Table 7.6 provides the total natural gas import and production of Turkey in millions of cubic meters, through the years 2002 to 2011. The table shows that domestic production of natural gas in Turkey is rather stable through the years. However, at odds with oil imports, Turkey’s natural gas imports surge by around 125 % from 2002 to 2011.

Figures 7.3 and 7.4 and Tables 7.7 and 7.8 demonstrate the dynamics of the composition of Turkey’s natural gas imports is somewhat different from those of crude oil imports. First, due to more complicated natural gas logistics, number of suppliers and their shares do not change dramatically over the years. Second, Middle Eastern countries do not dominate natural gas imports and Iran is the only gas supplier from the Middle East. In 2005, the share of Iran in total imports was 0.16, while in 2011 this share rose slightly to 0.19. The forecasts for 2012 and 2016 are 0.21 and 0.26. Importantly, Turkey’s gas import portfolio mostly depends on Russia, with this dependence slightly decreasing over years. In 2005, Russia’s share in total imports was 0.66 while in 2011 its share was 0.59. As shown in Table 4.3 of Chap. 4, the forecast of market concentration of gas suppliers shows a slight increase by 2016, which is not enough to raise concern. In 2010, the market concentration for Middle East and other countries was 0.0485 and 0.2782. In 2016, these values are 0.0660 and 0.3061.

3.4 Geopolitical Market Concentration Risk of Turkey’s Natural Gas Import Portfolio

This section is based on the model for evaluating geopolitical market concentration risk described in Sect. 7.2.2. Table 7.8 presents the current and the forecasted natural gas market concentration, which is based on predicted imports. These values are used as inputs in Eq. 7.4.

Results in Table 7.9 show that the geopolitical market concentration risk of Turkey is increasing in both scenarios relative to year 2011 but does not change much compared to year 2010. In contrast to oil imports, the risk from the Middle East is not the major component of the total GMC risk. Here, Russia is the major source of GMC risk due to its relatively large market share. For example, in 2016 both best case and worst case scenarios predict that Russia contributes almost 95 % to the total GMC risk.

4 Robustness Check

To verify the reliability of our results we perform forecasts using different smoothing parameters, namely, U and V in Eqs. 7.1 and 7.2. We also show how these parameters affect the forecasts for the most influential and typical import patterns from countries with largest import shares.

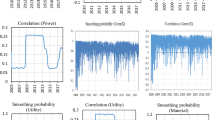

On average, imports from most countries display a steady upward or downward trends that are relatively easy to use to forecast if we believe that the same trend will prevail in the future. An example of such a steady trend is shown on the upper panel of Fig. 7.5 relating to Iraq. We can conclude that in this case all methods almost agree in their predictions. However, the bottom panel of the Figure demonstrates an important exception. Iran does not belong to this group of monotonic import dynamics. Specifically, there is one major outlier in 2009, which largely affects the prediction. The forecast using U and V = 0.3 is the highest because the double exponential smoothing method with lower smoothing parameters puts more weight on more recent data.

Actual oil imports from Iran and Iraq and several versions of smoothing and forecasts (Notes: The vertical axis shows imports in thousands of metric tons, whereas the horizontal axis shows the years. Forecasted values are shown as dots while actual and smoothed values of imports are displayed with solid lines. “Smoothed U, V = 0.3” refers to the fitted line estimated according to the double exponential smoothing method described in Sect. 7.2.1. U and V are smoothing parameters as in Eqs. 7.1 and 7.2)

To be conservative, we present and discuss all results for U and V = 0.4. For other cases, we report average GMC risk for the Middle East and other countries. Tables 7.10 and 7.11, Figs. 7.6 and 7.7 show that all models predict an overall increase in GMC risk for both BC and WC.

Crude oil imports and GMC risk for different forecasting models (Notes: U, V = 0.3 refers to parameters in the double exponential smoothing method described in Sect. 7.2.1 WC corresponds to the worst-case scenario, while BC relates to the best-case scenario according to the International Country Risk Guide, 2012, Current Risk Ratings and Composite Risk Forecasts. For details see Sect. 7.2.2 and Table 7.1)

Natural gas imports and GMC risk of for different forecasting models (Notes: U, V = 0.3 refers to parameters in the double exponential smoothing method described in Sect. 7.2.1. WC corresponds to the worst-case scenario, while BC relates to the best-case scenario according to the International Country Risk Guide, 2012, Current Risk Ratings and Composite Risk Forecasts. For details see Sect. 7.2.2 and Table 7.1)

For crude oil, all forecasting models predict an overall increase of GMC risk from the Middle East for both the worst-case and the best-case scenarios. Iran is the major oil supplier of Turkey and higly affects the risk of its aggregate oil import portfolio, which explains higher predicted imports from Iran and thus higher GMC risk in models with lower U and V.

Conclusion

To our knowledge, a comprehensive study of Turkey’s GMC risk forecast of its current crude oil and natural gas diversification portfolio has not been conducted.Footnote 3 We apply the methodology in Chatterjee (2012), which analyzes the geopolitical market risk of India’s crude oil diversification portfolio, to the case of Turkey, for both crude oil and natural gas. Moreover, we extend the study by Chatterjee (2012) through several robustness checks to verify our results. We show that Turkey’s crude oil and natural gas suppliers are highly concentrated to a few countries.

We conclude that Turkey’s future crude oil market is forecasted to be dominated by a single country—Iran. Iran is the major oil supplier of oil to Turkey, which higly affects the risk of its aggregate oil import portfolio. From 2011 to 2016, the share of the GMC risk of Turkey’s oil imports from the Middle East is forecasted to rise 26 % and 79 %, respectively, according to the best case and worst case scenarios. From the perspective of natural gas imports, the forecast of market concentration of gas suppliers shows a slight increase by 2016. However, once again a single country, Russia, contributes almost 95 % to the total GMC risk. We show that our results are robust to different forecasting methods.

We should point out that, our study is based on 6 years of longitudinal data versus 15 years of data in Chatterjee (2012). However, this limitation in data does not pose any drawback on our results given that the forecast based on double exponential smoothing depends on the most recent data, which is 5–6 years.

Our results underscore that for crude oil imports, Turkey must not only find suppliers from other regions, but it must also diversify its suppliers among other countries in the Middle East. The large bias towards Russia in natural gas imports also needs special attention due to the growing portion of natural gas in the overall energy sources for Turkey.Footnote 4

Energy security is a universal concern for all countries and this methodology can be applied to the geopolitical market risk concentration of any nation’s energy imports. However, a limitation of this study lies in the assumption that the pattern in past observations of crude oil and natural gas imports will also persist in the future. In other words, it is assumed that the trend in Turkey’s oil and natural gas imports will not change.

Notes

- 1.

For example, in October 2006, due to diplomatic pressure by the US, IMPEX, which is a Japanese oil company, had to pull out its majority stake in the Azedegan oil field in Iran (Dorraj and Currier 2008).

- 2.

- 3.

Except for the Ediger and Berk (2011)’s study that concludes the importance of crude oil import diversification for Turkey through the principal component analysis.

- 4.

The share of oil in overall resources fell from 46 % in 1995 to 26.7 % in 2010, whereas the share of natural gas rose from 9.9 % in 1995 to 31.9 % in 2010. More interestingly, the share of other alternative resources (excluding coal and hydroelectric) was 12.1 % in 1995 but fell to 6.7 % in 2010.

References

Blyth W, Lefèvre N (2004) Energy security and climate change policy interactions: an assessment framework. International Energy Agency Information Paper, Paris

Chatterjee N (2012) A time series forecast of Geopolitical Market Concentration (GMC) risk: an analysis of the crude oil diversification portfolio of India. Strateg Anal 36(1):145–165

Cohen G, Joutz F, Loungani P (2011) Measuring energy security: trends in the diversification of oil and natural gas supplies. Energy Policy 39(9):4860–4869

Dereli Z (2013) FPC briefing: Turkey’s pivotal role in energy supply. The Foreign Policy Centre, Feb 1. http://fpc.org.uk/fsblob/1533.pdf

Dorraj M, Currier CL (2008) Lubricated with oil: Iran-China relations in a changing world. Middle East Policy 15(2):66–80

Ediger VŞ, Berk I (2011) Crude oil import policy of Turkey: historical analysis of determinants and implications since 1968. Energy Policy 39(4):2132–2142

Financial Times (2012) Turkey’s current account deficit: good news and bad news, July 11. http://blogs.ft.com/beyond-brics/2012/07/11/turkeys-current-account-deficit-good-news-and-bad-news/#axzz2DlsKYmvW

Herfindahl OC (1950) Concentration in the steel industry. Doctoral dissertation, Columbia University

Hirschman AO (1945) National power and the structure of foreign trade, vol 18. University of California Press, Berkeley

Isenberg G, Edinger R, Ebner J (2002) Renewable energies for climate benign fuel production. Environ Sci Pollut Res 9(2):99–104

Koyama K (2004) Energy policies in Asia. In: Emirates Centre for Strategic Studies and Research (ed) Risk and uncertainty in the changing global energy market: implications for the Gulf. The Emirates Centre for Strategies Studies and Research, Abu Dhabi, pp 77–108

The PRS Group (2012) http://www.prsgroup.com/ICRG_Variables.aspx

Vivoda V (2009) Diversification of oil import sources and energy security: a key strategy or an elusive objective? Energy Policy 37:4617–4623

Wall Street Journal (2013) Turkish lira strengthens as current-account gap narrows, Feb 13. http://online.wsj.com/article/SB10001424127887324162304578302222156186846.html

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Arslan-Ayaydin, Ö., Khagleeva, I. (2014). Geopolitical Market Concentration (GMC) Risk of Turkish Crude Oil and Natural Gas Imports. In: Dorsman, A., Gök, T., Karan, M. (eds) Perspectives on Energy Risk. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-41596-8_7

Download citation

DOI: https://doi.org/10.1007/978-3-642-41596-8_7

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-41595-1

Online ISBN: 978-3-642-41596-8

eBook Packages: EnergyEnergy (R0)