Abstract

During the last 5 years European wholesale electricity markets have been confronted with a rapid increase in Renewable Energy Source (RES)-generation. RES-generation is characterized by (1) more decentralized production at typically dissimilar locations compared to traditional production and (2) more intermittent patterns of production depending on weather conditions. This chapter will focus on solar and wind energy, which have in common that they cannot be ordered to our disposal when we need them. However, the share of these renewables in the total energy supply in Germany has increased to such levels that the electricity prices on the day ahead spot market depend highly on the expected supply of solar and wind energy. In addition, regulations in favor of RES-generation in Germany have forced the Transmission System Operators (TSOs) to use all generated solar and wind energy. On windy and sunny days this has led to some exceptional cases of negative energy prices. This chapter identifies the influence of solar and wind energy supply on day ahead electricity prices.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

There are three main developments that have had a substantial impact on the energy market. The first development is the growing supply of shale gas and oil.Footnote 1 The second development is market coupling. In Europe we see that former nationally organised markets are linked together.Footnote 2

The third main development is the shift away from traditional power sources towards intermittent renewable sources of power, which is the topic of this chapter. In this chapter we discuss the impact of the growing emphasis on supply of wind and solar energy. Wind and solar energy are fundamentally intermittent and unpredictable sources of power due to their dependence on the weather. Wind turbines are currently designed to withstand maximum wind speeds of about 25 m per second. At higher wind speeds, the turbines are switched off for safety reasons (Laughton 2007).

The price of electricity is very volatile. Market coupling reduces price volatility, while RES-generation has the opposite effect. In this chapter we will look at the impact of the shift from fossil fuels to renewables on day ahead energy prices.

In Europe, Germany is taking the lead in the switch from fossil and nuclear energy to renewables. This shift got a large push forward when the German government decided to slowdown nuclear energy as a reaction to the Fukushima nuclear disaster in 2011. In this chapter we will look at the influence of wind and solar energy on electricity prices in Germany.

In the past, electricity prices were higher during peak hours (between 08:00 and 20:00 h) than during off peak hours (other hours). The reason was that consumption during peak hours is substantially higher than during off-peak hours, while the supply of electricity is less flexible. However, the sun shines – if it shines – during daytime. Also, winds are mostly stronger during the day than during the night. In other words, during peak hours the supply of wind and solar energy may be very large, which would result in lower electricity prices.

During sunny and windy days the peak price can be lower than the off-peak price. The consequences are clear. Up to now we had futures that could be exercised only during the peak hours and futures that could be exercised only during the off-peak hours. Now that we are no longer sure that the peak price will be higher than the off peak price, the price difference between both types of futures will diminish or even disappear.

The structure of this chapter is as follows. In Sect. 10.2 we discuss general developments in future energy supply. Section 10.3 describes the developments of RES-generation and market developments. In Sect. 10.4 we present the data. Section 10.5 contains the empirical results and -Sect. 10.6 the conclusion.

2 Developments

Due to the increased production of shale gas and oil, the U.S. will be self-supporting in gas in several years from now and in oil at the end of this decennium. The U.S. Energy Information Administration (EIA) estimates that the United States possesses more than 2,500 trillion cubic feet of technically recoverable natural gas resources, of which 33 % is held in shale rock formations. According to the EIA (2013a), natural gas from shale has grown to 25 % of U.S. gas production in just a decade and will reach 50 % by 2035. Developing this resource can help the U.S. to enhance its energy security and strengthen its economy. The economic consequences might be substantial if energy-intensive industries relocate their production capacity back to U.S. territory.

For fear of environmental consequences, Europe has been hesitant to follow the U.S. in the production of shale gas and oil by means of hydraulic fracturing (fracking).Footnote 3 This method is used to extract natural gas from shale rock formations in which it is trapped. The process requires engineers to drill a hole deep into the rock where the gas is trapped, and then inject a mixture of sand, water and chemicals into the hole at an extremely high pressure (EIA 2013b). This causes the rock to split, releasing the gas into the well so that it can be brought up to the surface. The use of chemicals might bring a risk of contaminating the supply of drinking water, which makes fracking a subject of debate in many European countries.

An important difference between the U.S. and Europe is the ownership of the shale gas. In the U.S., the land-owners will benefit from the revenues of winning shale gas, and there usually are not too many incentives for them to investigate the environmental consequences thoroughly. However, in Europe, governments own the shale gas. Therefore, in many European countries both the benefits and the drawbacks of extracting shale gas are subject to lively political debates, and a lot of environmental research is done before decisions are taken.

The consequences of the differences in shale gas and oil production between the U.S. and Europe are visible today. The spread between WTI (West Texas Intermediate), indicator for oil prices in the U.S., and Brent Oil, indicator for oil prices in Europe, is now larger than before, as shown in Fig. 10.1.

The difference between WTI and Brent Oil prices (EIA 2012)

Van der Hoeven (2013) writes that the sale of US crude overseas is governed by the Export Administration Act of 1979, which allows the president of the US to prohibit or to curtail the exports of commodities – namely crude oil – deemed to be in “short supply”. However, the increasing supply of shale gas and oil has made that “short supply of crude” disappear. Nevertheless, the export of gas and oil from the U.S., is still forbidden, which causes lower gas and oil prices in the U.S.

Another imperfection in the U.S. gas and oil market is the infrastructure. The shale fields of North Dakota, for example, are far from places where shale gas is consumed in the U.S. The rapid growth in the supply of shale gas and oil exceeds the pace at which the infrastructure can be improved.

A second major development is market coupling. Since the beginning of the twenty-first century European wholesale electricity markets have been in transition towards free markets (liberalization & privatization) and market integration (the development from individually organized trading markets per country toward one integrated European energy market). Especially the developments of market integration, by means of so-called market coupling, have demonstrated that enlarged and integrated trading regions lead to fewer market imperfections, more price convergence and lower market volatility (Dorsman et al. 2011, 2012).

EU policy goals to lower CO2 emissions, lower dependency on fossil fuels, technological developments and falling production costs contribute to the rapid increase in RES-generation. However, there are fundamental differences between the locations of traditional power generation and RES-generation. Transmission systems that need to ensure that electricity production is at any moment in balance with electricity consumption are nowadays challenged to keep on meeting this technical requirement under changed circumstances.

For the Transmission System Operators (TSOs), the shift from fossil and nuclear fuels towards renewables is not complicated in all situations. For renewables like hydropower and biomass there are storing possibilities. However, these possibilities are not directly available for wind and solar energy. The highest growth rate in energy production is in wind and solar energy, which makes the tasks of the TSOs difficult.

As this shift occurs, there are some concerns. One concern is where wind turbines are made. Wind turbines are necessary for the production of wind energy. In some years, Chinese companies have taken the lead in the production of wind turbines.

Table 10.1 shows that the largest manufacturer of wind turbines is the Danish company Vestas. However, the market share of Vestas is decreasing rapidly and its survival is at stake. Despite the below-average quality of their wind turbines, government subsidies have allowed Chinese companies to offer lower prices and to increase their market shares very rapidly. It seems that Chinese companies will take over the wind market as they did the solar market. Europe’s increasing dependence on Chinese products for renewables is also decreasing the certainty of delivery.

Another concern is maintaining the grid in balance. Figure 10.2 gives an overview of the German transmission grid. Over the last 10 years, the grid has become heavily loaded and congested due to the tremendous increase of RES-generation – especially large wind parks – being connected to the grid in Northern Germany. On windy days, production significantly exceeds consumption in the North of Germany. Consequently, the surplus needs to be transmitted to other regions. However, in an increasing number of cases, connections with adjacent transmission grids lack the required capacity. The system simply was not designed with RES-generation in mind, but with the expectation that within a grid demand would always be balanced via ‘traditional’ and more controllable generation methods (coal, nuclear, gas, hydro, etc.).

German power corridors (Bach 2012)

Bach (2012) points out that most of German wind power is installed in the north, while solar capacity is mainly installed in the south. The reduction in the supply of nuclear energy has caused problems mostly in the south. However, as Bach (2012) notes, in the winter solar energy cannot satisfy the need for electricity during the evening peak load.

There are basically two main alternatives to address the situation described above:

-

1.

Increase transport capacities between (and within) transmission- and distribution grids.

This is the quick and theoretically obvious alternative. In practice, however, it cannot be implemented easily and certainly not in a timely manner – it is already needed today. The technology and the planning needed for adding grid capacity is very complex, investments required are very high (billions of euros), and spatial planning procedures are very lengthy, etc. Given such big and time consuming hurdles for increasing transmission capacities, this is a topic high on political agendas because a strong grid infrastructure, which facilitates the electricity flows coming from RES-generation, is a key and indispensible element of the ongoing ‘Energy Transition’.Footnote 4

-

2.

Manage the production-consumption balance within a grid.

As described above, if it is not possible to increase transportation capacities in the short term, it is unavoidable that the production-consumption balance be managed within a grid. Electricity cannot be stored and production consumption must be in balance at all times. Otherwise, grid stability will be at risk (‘black-out’). Given that the energy generation sector no longer is a centrally operated (semi-governmental) activity, but a full free-market activity, management of the supply-side ideally should be market-based whereby market forces lead to demand and supply balance. In a liberalized market, it is not desirable for the TSO (not being a market player, but a regulated activity) to intervene with security measures (such as remedial actions) if it is no longer possible to guarantee system balance.

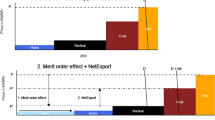

Currently, in European energy markets there are mechanisms in place that contribute to the production-consumption balance. For example, in Germany, where the main issues are with RES-generation (see earlier example), RES-generation gets a priority above conventional generation methods. In cases of high RES-generation, German wholesale prices drop to very low levels because marginal costs of RES-generation are much lower than conventional generation. There also can be so much overproduction due to the RES-generation that negative energy prices may be required to restore the production-consumption balance. In this case there is so much overproduction that parties get paid to consume electricity or get paid to not produce (conventional) energy they already sold (and for which they still will be paid, even without delivery).

This chapter discusses the problems of market integration due to the developments in RES-generation. The shift from conventional power production (such as nuclear, coal and gas) to wind and solar energy influences market integration. Likewise, the degree of market integration influences the shift from conventional to renewable power generation.

3 RES-Generation and Market Developments

After the earthquake of Japan on March 11, 2011 the nuclear plant in Fukushima was damaged seriously and for many weeks a meltdown was a real threat. Countries reacted differently. Germany decided to close down several nuclear plants and to increase RES-generation to 80 % of total supply of electricity by 2050, while at this moment (2012) it is only 12 %. Turkey, on the other hand, decided to build new nuclear power plants because, Prime Minister Erdogan claimed, the country needs all the available supply of energy to sustain economic growth. These different reactions to the Japanese problems are special, because the probability of an earthquake in Germany is very small and in Turkey it is very large.

From the beginning of this century Germany had the lead in renewables in Europe. A new industry developed around the supply of renewable energy. German companies became world leaders as producers of solar energy and many wind mill parks were developed. After the change in energy policy in 2011, the so-called Energiewende (energy shift), Germany wants to speed up this process of switching from nuclear and fossil energy to renewables. This switch is causing some problems that we will describe in this chapter.

Currently, the development of RES-generation is continuing, whilst the required increases in transmission capacities are not expected within the very short term. Together with some other factors that we elaborate below, this has an effect on price formation in wholesale energy markets that one could observe already over the last half-decade.

The two main drivers of changes in energy price formation over the last decade (with increasing impact during that period) are the following:

-

1.

Increase of RES-generation via solar electricity production.

In Europe, over the last 5 years, solar energy production has increased very rapidly. In some markets production increased significantly more. In the German market, in particular, the stimulation of RES-generation, combined with technological improvements and the lower cost of building solar production facilities, has led to a major increase in solar power production over the last 5 years (see Fig. 10.3).

Given the link between the level of solar energy production and the amount and intensity of sunshine, solar energy production reaches its maximum in the early afternoon and is highest during the summer.

Before the advent of solar energy, wholesale energy prices would peak around the times when the production of solar energy reaches a maximum. Today, however, peak prices are much lower on sunny days and there are even instances when peak prices drop below base-load prices. Growing RES-production can therefore reduce the price-differences between peak and off peak prices.

The level of solar- and wind-production facilities in Germany at this time is such that on windy days with a lot of sunshine that coincide with days when traditionally demand is low (for instance, on Sundays or bank-holidays), the amount of energy produced by RES-generation exceeds consumption. Such situations affect not only technical transmission, but also price formation.

-

2.

The unexpected shut-down of nuclear generation facilities in Germany.

After the nuclear disaster in Japan in March 2011, the German Parliament decided to shut down immediately eight big nuclear power plants and has planned to shut down the remaining German nuclear power plants in the period 2012–2022. As one can expect, this decision affects wholesale energy market price formation: Until the shut-down, due to its technological characteristics (it is not a flexible production method) and price characteristics (it has low marginal costs), nuclear power generation had been a significant and stable base contributor to energy production.

These developments make the need for additional transmission and production capacity within Germany more immediate. Wind production, which is concentrated in northern Germany, is the major contributor to overproduction, whereas the nuclear power shut-down mainly takes place in the south. The shut-down of a very significant, stable and low cost source of energy has created needs for extra production and interregional transmission capacity. The fact that the southern part of Germany has a problem that can be solved with a problem that occurs in the north (or vice versa), but currently is blocked by the sufficient availability of transmission capacity within the country, creates much political pressure in Germany to quickly resolve these production and transmission bottlenecks.

For a long time, Germany had a more-or-less predictable supply of electricity (nuclear, oil, gas and coal). However, due to the closing of German nuclear power plants and the increased share of RES-generation, the supply of electricity has become more volatile and the task of the TSO to keep the grid in balance has become more complicated. Figure 10.3 shows the installed capacity of wind and solar energy in Germany. This graph shows that installed capacity – especially in solar energy – increased very rapidly after 2007.

Mulder and Scholtens (2013) look at the influence of wind and solar energy in the Dutch day-ahead electricity market APX (Amsterdam Power Exchange) for the period 2006–2011. They argue that German climate conditions (wind and sun) are important because the magnitude of the cross-border transport capacity between the Netherlands and Germany is large and is the equivalent of 15 % of Dutch peak demand. Based on their data and the fact that the supply of wind energy in the Netherlands is very limited, they conclude that the wind speed in Germany is more important for the Dutch electricity price than the wind speed in the Netherlands. Mulder and Scholtens did not find significant influence of solar irradiation in the Dutch electricity price. They conclude that although there is a strong increase in wind and solar energy in Germany, conventional power plants remain the decisive factor.

In their analysis, Mulder and Scholtens use daily data. In this chapter we are using (adjusted) hourly data. This difference is important because the supply of solar energy as well as wind energy changes throughout the day. Therefore, we are able to research issues in greater detail.

4 Data

In our research we use the realized German day-ahead pricesFootnote 5 and the expected day-ahead supply of wind and solar energy. The period of observation spans 2011 and 2012. On the day-ahead power exchange, the prices for day t + 1 are fixed on day t. By doing so, the TSO (Transmission System Operator) – who is responsible for the demand and supply on the grid being in balance – is able to manage the positions on the grid the following day. To facilitate the price formation process, detailed predictions for solar and wind energy production for day t + 1 are released on day t. Consequently, expected solar and wind energy supply may influence day-ahead prices.

On the day-ahead power exchange, spot prices are fixed for every hour of the next day. However, the expected solar and wind energy dataset contains the day-ahead predictions for every quarter of an hour. In our analysis, we calculate hourly data for the expected solar and wind energy supply by averaging four quarters of data.

Table 10.2 contains the descriptive statistics of the price of electricity, the expected supply of solar energy, the expected supply of wind energy and the total electricity volume traded on the day ahead market (total volume). The supply of wind energy is more than twice the supply of solar energy, despite the fact that the installed (maximum) capacities for wind energy and for solar energy were more or less the same (see Fig. 10.3). This is caused by the fact that the sun shines no more than 50 % of the time.

5 Empirical Research

For the years 2011 and 2012, we estimated the equation (Table 10.3)

where

P t = the realized day-ahead electricity price in hour t

sun t = the expected supply of solar energy in hour t in GW

wind t = the expected supply of wind energy in hour t in GW

vol t = the realized trade volume of energy in hour t in GWh

With these coefficients, our estimated model becomes:

This equation shows how every extra expected MWh of solar and wind energy supply influences price. Both types of supply have a significant negative influence on energy prices. The impact of wind energy on the electricity price is larger than the impact of solar energy. Although the adjusted R2 is only 0.188, this model shows that yields from wind and solar sources do influence the price of electricity. Figure 10.4 shows the regression standardized residual. The deviations of this distribution from the normal distribution are non-problematic.

Table 10.4 presents the correlations between the variables of Eq. 10.1. The correlation between the (expected) supply of wind energy and the price of electricity is negative. This is what one would expect, since a higher supply of wind energy will lead to lower prices. However, the correlation between the (expected) supply of solar energy and the price of electricity is positive. At first sight, this seems strange, but it isn’t. For the electricity market we distinguish between peak and off-peak hours. The peak hours are from 8:00 (a.m.) to 20:00 (p.m.) and the remaining hours are off-peak hours. Demand during peak hours is substantially larger than during off-peak hours, which causes higher prices during peak hours. The sun shines during the daytime (mostly peak hours) and not during the night time (mostly off peak hours). Therefore, we find a positive correlation between the (expected) price of solar energy and energy prices.

These correlations indicate that solar energy is usually sold at higher prices than wind energy, just because the sun happens to shine primarily during the peak hours. Therefore, it may be profitable to invest in storage facilities for renewable energy, which make it possible to sell most of it during peak hours. This is especially attractive for wind energy. Nowadays, in northern Germany, wind energy suppliers are already investing in facilities for this purpose. Most of these facilities use the technology of electrolysis in order to change water into hydrogen and oxygen. The energy stored in the hydrogen and oxygen gas can be released during peak hours by the inverse electrolytic process.

Since the demand for energy depends highly on the time of day, it makes sense to make a distinction between peak hours (8:00–20:00) and off-peak hours. For this purpose we added the dummy variable ‘Off Peak’ and the corresponding interaction variables ‘OffPeak*Sun’, ‘OffPeak*Wind’, and OffPeak*Volume. This leads to the model parameters in Table 10.5.

First of all, the increase of R2 (from 0.188 to 0.315) indicates a larger explanatory power of this extended model. In other words, the model explains 31.5 % of the price variance.

The value of the Off Peak dummy coefficient can be interpreted as a correction on the constant during off-peak hours. This correction turns out not to be statistically significant. However, the corrections on the slope coefficients during off peak hours are significant, as can be seen from the slope coefficients of the interaction terms. Especially the slope correction for the expected solar energy (OffPeak*sun) is so positive (3.278) that we must conclude that during off-peak hours there will be a positive influence of expected solar energy supply on energy prices (with slope coefficient −1.881 + 3.278 = 1.397). This appears to be unreasonable. If there is an increase in solar energy supply, one would expect the energy price to drop.

Another unwanted feature of this model is the collinearity between the OffPeak dummy and the Offpeak*Volume interaction variable, which is reflected in very high variance inflation factors of 89.574 and 108.036. This collinearity is caused by the fact that there is not much variation in the trade volume during off peak hours. We have to keep in mind that this volume does not equal the total demand. It is in fact only the amount of energy that has not yet been sold 1 day ahead of actual production and demand. Since accurate demand predictions are made a long time ahead of the delivery date, the majority of the demand for energy can and will be contracted a long time before the actual production and consumption date. Therefore, the (trade) volume on the day-ahead power exchange is by no means a good measure for the total demand and the scarcity of electrical energy.

In order to eliminate the collinearity and to analyse what is causing the positive slope coefficient during off-peak hours, we decided to leave out the interaction variables incurring trade volume, and to split up the off-peak hours into evening hours (20:00–24.00) and morning hours (0:00–08:00), which resulted in the model parameters in Table 10.6.

Again, the model fit has improved, as reflected in R2, which has increased from 0.315 to 0.375. The removal of the trade volume interaction variable has led to a complete elimination of all collinearity problems (all VIF values < 5). However, a remaining unwanted feature of this model is the large positive slope coefficient correction, reflected in Morning*Sun. This correction implies (an even larger) positive slope coefficient of −1.612 +4.935 = 3.323 for expected solar energy during the morning hours. On the other hand, during the evening hours the Sun slope coefficient does not differ significantly from its negative value during peak hours, which is reasonable. This indicates that the problem with the positive slope coefficient is caused during the morning hours. It is interesting to note that we do not have this problem with respect to expected wind energy.

During a thorough analysis of the raw data, we observed a significant difference between the transition from morning to peak hours as opposed to the transition from peak to evening hours. Energy prices increase extremely fast between 6:00 and 8.00 (a.m.), whereas the drop in prices in the evening is much more gradual. In fact, energy prices from 7:00 to 8:00 (a.m.) are almost at the same level as during peak hours. Therefore, we decided to add an extra dummy variable for hour 8 (from 7:00 to 8:00 a.m.) to correct for the steep energy price increase during this hour. This results in the model parameters in Table 10.7.

We observe a further increase in R2, which indicates that now 40.0 % of the price variance is explained by the model. Moreover, the slope coefficient for predicted solar energy that was positive during morning hours has turned negative, as it should be. We also observe that the constant for hour 8 has now become 53.623 − 19.835 (correction for morning) + 17.675 (correction for hour 8), which is in agreement with the fact that energy prices during hour 8 are almost as high as during peak hours.

To ascertain the influence of the rather abrupt price increase during hour 7, we also added a dummy variable for this hour in the model (Table 10.8).

Adding another dummy, now for hour 7, further increases the R2. Now 40.8 % of the price variance is explained by the model. We found out that adding more dummies for separate hours is not very useful, which is in agreement with the observation that hour 7 and 8 are the only hours with a relatively high energy price deviation (compared to the other off peak hours).

Now that we know about the sudden increase in energy prices between 6:00 and 8:00 (a.m.), we can explain the positive slope coefficient for expected solar energy that we initially found for morning hours. This price increase is not caused by an increase in solar energy, but by a sudden increase in total demand. In fact, we are surprised that hour 8 is called an off-peak hour, since the average price level at this hour is much closer to the peak-hour price level. The occurrence of a positive slope coefficient for expected solar energy during morning hours is caused by the fact that both solar energy and energy prices increase suddenly from 6:00 to 8:00 (a.m.). Without total demand as an explanatory variable in our model, the model will incur a positive slope coefficient for solar energy to explain the sudden price increase. Since the price drop in the evening is much more gradual, we did not encounter this phenomenon during evening hours.

Summary and Conclusion

This chapter identified changes in electricity prices based on current developments within European energy markets. One current development is, among others, the increased intake of generation from Renewable Energy Sources (RES). We gathered and analyzed historical market prices and RES-generation volume data from Germany to show what impact this development had on the energy market. Our analysis shows that every extra unit of power generated by solar or wind has a negative influence on the price for electricity. All public and private participants in the markets should take this into account.

We found strong evidence that solar energy and wind energy have a negative impact on the electricity price in Germany. This result calls for more detailed studies. For example, the supply of solar energy is mostly limited to peak hours. In the past we saw that peak prices are higher than off-peak prices. However, a substantial supply of solar energy can push the peak price below the off-peak price. Another issue is the impact of renewables on electricity prices in adjacent grids. Due to market coupling, a number of European national grids are now linked. As a result, an additional supply of solar and wind energy in one European country may influence the demand/supply balance of electricity in another country.

Notes

- 1.

In Chap. 6, Kolb gives an analysis of the gas market.

- 2.

In the first CEVI books Financial Aspects in Energy and the second CEVI book, Energy Economics and Financial Markets, attention was paid to this topic by Dorsman, van Montfort and Pottuijt (2011) and Dorsman, Franx and Pottuijt (2011) respectively.

- 3.

For example, President Francois Hollande of France said in July 2013 that due to possible pollution effects, he will not allow any research on the possibility of producing shale gas in France during his presidency.

- 4.

Transition away from fossil fuels driven by a desire for lower dependencies on foreign fossil fuel suppliers, increased usage of renewable energy sources, concerns with climate change and the depletion of fossil fuels.

- 5.

We thank Mr. Khou, Powernext, for providing us is with the data necessary for this research.

References

Bach PF (2012) Germany faces a growing risk of disastrous power blackouts, Business Insider International. www.businessinsider.com. Accessed 06 Jan 2013

Dorsman AB, Franx GJ, Pottuijt P (2011) Imperfection of electricity networks. Energy Economics and Financial Markets. Springer, pp 215–234

Dorsman AB, van Montfort K, Pottuijt P (2012) Market perfection in a changing energy environment. Financial aspects in energy. Springer, pp 71–84

Laughton M (2007) Variable renewables and the grid: an overview. In: Boyle G (ed) Renewable energy and the grid: the challenge of variability. Earthscan, London, pp 1–29

Mulder M, Scholtens B (2013) The impact of renewable energy on electricity prices in the Netherlands. Renew Energy 57:94–100

U.S. Energy Information Administration (2012) Spot prices for crude oil and petroleum products. www.eia.gov. Accessed 31 Dec 2012

U.S. Energy Information Administration (2013a) Annual energy outlook 2013 early release overview. www.eia.gov. Accessed 03 Jan 2013

U.S. Energy Information Administration (2013b) What is shale gas and why is it important? Accessed 03 Jan 2013

van der Hoeven M (2013) US must lift export curbs to stop shale boom turning to bust. Financial Times, p 22, 7 Feb 2013

Acknowledgments

The authors thank the attendants of the fourth CEVI conference in May 2013 in Chicago and especially the discussant of the paper, Hillary Till, for their comments.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Adaduldah, N., Dorsman, A., Franx, G.J., Pottuijt, P. (2014). The Influence of Renewables on the German Day Ahead Electricity Prices. In: Dorsman, A., Gök, T., Karan, M. (eds) Perspectives on Energy Risk. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-41596-8_10

Download citation

DOI: https://doi.org/10.1007/978-3-642-41596-8_10

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-41595-1

Online ISBN: 978-3-642-41596-8

eBook Packages: EnergyEnergy (R0)