Abstract

Per definition, cliometric studies of innovations use statistical methods to analyze large quantities of data. That is why historical patent statistics have become the standard measure for innovation. I first discuss the advantages and shortcomings of patent data and then show that the distribution of patents across countries, regions, or inventors is characterized by two salient features: its skewness and its persistence over time. To explain these features, the influence of various supply-side, demand-side, and institutional factors will be discussed. I will stress the importance of path dependency. This chapter ends with a closer look at technological transfer that came along with patent assignments and foreign patenting.

Access provided by Autonomous University of Puebla. Download reference work entry PDF

Similar content being viewed by others

Keywords

- Patent

- Patent statistics

- Human capital

- Skewed distribution

- Technological transfer

- Path dependency

- Innovation

- Region

- Patent law

- Access to market

Introduction

Economic historians agree on the stylized fact that innovations are the main driver of long-run economic growth. For example, Greg Clark (2007, pp. 197–202) estimates, on the basis of a growth accounting exercise, that about three quarters of long-term growth of output per worker in the industrialized world has to be directly attributed to the permanent increase in productivity which, in his opinion, mainly resulted from the myriad of smaller and larger innovations that were developed to improve the efficiency of production processes. An important corollary of this empirical observation is that the unequal geographical distribution of innovations might be the key factor for explaining why some nations became rich and others stayed poor. That is why cliometric studies of innovations usually concentrate on two main tasks. First, they aim for measuring the distribution of innovations across space and time. Second (and based on this measurement), they try to identify those factors that have influenced the innovation of nations, regions, or firms. To perform this task with the method that differentiates cliometric studies of innovations from other research projects in innovation history – advanced statistical analysis –mass data are needed, the collection of which is at the same time one of the major methodological challenges. The epistemic interest of this research program is clearly related to the field of development economics: underdeveloped countries of today might learn from historical experience how to foster their own innovative capabilities and therefore their future economic performance. In the following, I will discuss the problems and results of measuring innovations under the headings “quantifying innovations” and “skewed distribution.” The cliometric approaches to elucidate the development and diffusion of innovations are presented under the subtitles “explaining innovations” and “technological transfer.”

Quantifying Innovations

In the early twentieth century, Schumpeter (1934, p. 66) provided his famous and still very instructive definition of innovation by distinguishing five different cases: the introduction of a new good or a new quality of a good, the introduction of a new method of production, the opening of a new market, the conquest of a new source of supply of raw materials or half-manufactured goods, and the carrying out of the new organization of any industry. The practical research problem of economic historians who aim at basing their empirical research on Schumpeter’s definition is how to collect complete data about these rather different types of innovations in a way that allows consistent comparisons across space and time. Compilations of historical innovations that are usually provided by scholars of the history of technology are by no means comprehensive and frequently show a considerable selection bias because historians tend to prefer both basic innovations to incremental innovations and product innovations to process and organizational innovations. That is why economic historians usually rely on patent statistics as the standard measure to quantify past innovations. This preference is obviously based on the implicit assumption that, in comparison to the compilations of innovations by historians, patent statistics offer a more complete and less biased overview of the universe of innovations. In general, two types of patent statistics have to be distinguished. Patents applied for are a measure for innovations that were appraised to be new and potentially profitable by the applying inventor. In patent systems, where the patent office is vested with the task to reject patent applications because of lack of novelty, patents granted can be interpreted as a measure for the subset of innovations which were additionally judged to be new by the impartial technical experts of this administration. Both groups of patents can differ considerably. In pre-First World War Germany, for example, only about 40 % of patent applications successfully passed the technical examination by the patent office (Burhop and Wolf 2013, p. 76).

Patent statistics have obvious shortcomings too. Griliches (1990, p. 1669) highlights the three most important of them: “Not all inventions are patentable, not all inventions are patents and the inventions that are patented differ greatly in ‘quality’, in the magnitude of innovative output associated with them.” The first part of this statement points out that patent statistics can only contain information about product and process innovations but fully neglect, as most of the compilations of innovations, the last three types of innovations on Schumpeter’s list that are in general not patentable. To close this gap of knowledge, survey-based studies in modern innovation economics sometimes explicitly ask for information about organizational innovations in marketing, procurement, or internal organization of a company. In economic history, however, comparable mass data are usually not available. The same is true for input indicators, such as R&D expenditures by private firms or public research organizations, which are also often used in nonhistorical studies of innovations, which concentrate on the development in the last decades.

The second part of Griliches’ statement refers to the fact that the propensity to patent varies considerably across industries. Whereas some industries try to appropriate the return of their innovations with the help of patenting activities, others prefer keeping them secret instead. The formula for Coca-Cola, for example, has never been patented because its public disclosure in a patent application would have allowed competitors to imitate this product after the end of the patent protection. Given these differences in industries’ patenting activities, it could be misleading to interpret a particular industry’s comparatively low number of patents automatically as a sign for its alleged below-average level of innovation. To assess the magnitude of this measurement problem in cliometric studies of innovations, Moser (2012) uses an alternative source to identify them. She looks at the number of British and American exhibits presented at world’s fairs between 1851 and 1915. The historical catalogues used to guide the visitors through the exhibition of a particular world’s fair comprise information about the exhibitor’s name, location, and a description of the innovation. The latter allows Moser to assign every exhibit to exactly one of ten different industries. Because the catalogues also provided information about whether or not the exhibit was patented, she can also calculate the patenting rates of the exhibits. At the Crystal Palace exhibition in London in 1851, for example, about 89 % of British exhibits and 85 % of the American ones were without patents. In the light of this observation it is hard to maintain the general claim that historical patent statistics offer a sufficiently precise overview of innovative activities. In addition, Moser identifies considerable differences in industries’ propensity to patent. In 1851, industry-specific patenting rates of British exhibits ranged from 30 % in manufacturing machinery and 25 % in engines to a mere five percent in mining and metallurgy. Moser concludes that patenting rates were especially low in those industries where innovations were difficult to imitate. In the middle of the nineteenth century, this argument also applied to chemicals, because modern methods of chemical analysis that allowed chemical products to be “reengineered” had not yet been developed. Even though patenting rates gradually increased over the course of the second half of the nineteenth century, Moser’s analysis clearly shows that patent statistics are by no means a perfect measure for historical innovations. On the other hand, patent statistics are often the only source of mass data available for cliometric studies of innovations. When using this second-best measure, researchers are therefore well advised to control for industry effects in their regression analysis.

The third part of Griliches’ statement addresses the problem that patent counts allocate the same weight to every patent, no matter whether it had a high or a low economic value for the patentee or society. This is an additional reason why inferring the level of innovation from the raw number of patents can lead to considerable measurement error. For this particular problem, however, scholars found various ways to deal with it. Ideally, one would like to assign each patent an individual weight that quantifies its technological or economic significance. Townsend (1980), for example, rated historical patents related to coal mining according to their importance, on a scale from 1 to 4. This procedure might be recommendable for specific industry studies, but does not work for large patent populations where the careful evaluation of every single patent would be very time-consuming and would require engineering competence in a wide range of technological fields. In order to address this problem, economic historians use three other methods to identify patents with a high economic value. Figure 1 illustrates these methods. We already know that the set of patents filed in a particular country is only a more or less large subset of all innovations that have been developed there in a given time period. Among all patents filed in the home market are in turn three non-disjoint subsets that, for different reasons, all might represent valuable patents. These are the subsets of foreign patents, long-lived patents, and most-cited patents.

An inventor can apply for a patent not only in his home market, but also in foreign countries. Getting a foreign patent, however, imposes additional costs in the form of expenses for patent lawyers and translators, fees for filing and renewing, and the longer-term costs of international disclosure of the underlying technology. Future returns on a foreign patent can arise from two major sources. A patentee can use the temporary patent protection to increase his profits either by exporting the innovative good or by licensing foreign producers to manufacture and sell it in their respective home markets. After weighing the costs and benefits of foreign patenting, most inventors decide to file a patent only in their home country. Only the most promising innovations will also be patented abroad. That is why foreign patents might represent an especially valuable part of a country’s patent stock. Today, the so-called triadic patents that are simultaneously filed at the European Patent Office (EPO), the United States Patent and Trademark Office (USPTO), and the Japanese Patent Office (JPO) are used to identify a country’s best innovations.

Economic historians usually concentrate on foreign patenting in the United States for two reasons. First, early on the United States established a large and developed market in which only excellent foreign innovations could take hold. Second, the USPTO provides comparatively detailed and long-term historical patent statistics. The most comprehensive cliometric analysis is provided by Cantwell (1989) who analyzes the patenting activities in the United States of 17 industrialized countries and 27 sectors for the years 1890–1892, 1910–1912, and 1963–1983. A shortcoming of this kind of identification strategy is that the volume and structure of foreign patents are probably not independent of the characteristics of the foreign country where they are filed. In general, firms will seek patent protection only in those foreign countries where two preconditions hold: first, the potential market for their innovation is large, and second, the probability of imitation is high. What is more, some countries might even discriminate against foreign inventors by delaying or even declining the granting of their patent applications (Kotabe 1992). As a result, the portfolio of a country’s foreign, and therefore valuable, patents might look very different depending on whether it has been derived from foreign patenting activities in, for example, Germany, Japan, Spain, or the United States.

In historical patent systems like those of Germany or the United Kingdom, where patent holders had to renew their patents regularly by paying a renewal fee, valuable patents can alternatively be identified by their individual life span (Schankerman and Pakes 1986; Sullivan 1994). Legislators had introduced patent renewal fees in the hope that many patent holders who were not able to profitably exploit their patents would give them up early and thereby make the new knowledge that was documented in the patent file publicly usable long before the maximum possible patent duration would have elapsed. If this mechanism worked as intended, a long life span of a historical patent can be seen as a reliable indicator of its comparatively high private economic value. In the German Empire, for example, a patent holder had to decide annually whether he wanted to prolong his patent by another year. The renewal fee amounted to 50 Marks at the beginning of the second year and then grew steadily up to 700 Marks at the beginning of the fifteenth and final possible year of patent protection. The resulting cancellation rate was high. About 70 % of all German patents that were granted between 1891 and 1907 had already been cancelled after just 5 years. About 10 % of all patents were still in force after 10 years and only about 5 % reached the maximum age of 15 years. Streb et al. (2006) interpreted those German patents that survived at least 10 years as the valuable patents within the German Empire.

However, the method of identifying valuable patents by their individual life span has three shortcomings. First, it can only be employed if the respective patent law stipulated the obligation to renew patents annually or, as in the British case, after 3 (later on: 4) and 7 years of patent protection, respectively. This was not the case in the often-researched US patent system, where patentees only had to pay a registration fee. Second, in industries with a high rate of technological progress, even patents representing important basic innovations might have been cancelled after just a few years as the technological frontier moved on. Third, in a world with imperfect financial markets, private inventors and smaller firms with limited financial capacity might have been forced by comparatively high renewal fees to give up their patents even though they still represented a high economic value (Macleod et al. 2003). Both types of short-lived but valuable patents will be systematically ignored by the life-span approach.

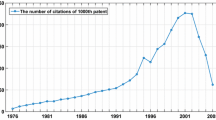

In academics, the value of a scientific article is often measured by the numbers of citations it received in following publications. A similar measure can be used to identify valuable patents. The idea is that the more often a particular patent is cited in subsequent patent specifications, the higher inventors evaluate its technological and economic significance (Jaffe and Trajtenberg 2002). Unfortunately, before the First World War, it was not common practice to refer to a preceding patent for defining prior state of the art. Even though most citations appear within one decade of patent issue, Nicholas (2011b) found that some British patents of the interwar period were still cited in US patents in the decades after the Second World War. Nuvolari and Tartari (2011) identified another way to make use of the concept of most-cited patents in cliometric studies. Their basic research design is to exploit Bennet Woodcroft’s “Reference Index of Patents of Invention” published in 1862. This volume provides a list of references to technical and engineering literature, legal proceedings, and commentaries in which a patent is mentioned for each English patent granted between 1617 and 1841. Nuvolari and Tartari assume that the absolute number of references assigned to a particular patent shows its visibility in the contemporary technical and legal discussions and is therefore a reasonable indicator for its underlying value.

Depending on both data availability and the particular research agenda, a researcher is free to choose the most appropriate among the aforementioned methods for identification of valuable patents. However, to sharpen the definition it might be worthwhile to employ two or more methods simultaneously and concentrate on those valuable patents which lie in intersections of the three subsets of foreign patents, long-lived patents, and most-cited patents depicted in Fig. 1.

Summing up, due to the scarcity of alternative sources for mass data, the vast majority of cliometric studies of innovations are studies of patenting activities. The main problem with this approach is that patent statistics neglect all innovations that were never patented, either because inventors preferred secrecy to patenting as a means to appropriate the return of their innovations or because the patent law did not provide for patenting particular innovations. Organizational innovations are an example of the latter problem. On the other hand, the use of patent statistics has the important advantage that researchers can choose between different sophisticated methods of identifying the valuable innovations within the set of all patents granted.

Skewed Distribution

A striking (and often neglected) feature of patent statistics is that the distribution of patents across countries, regions or inventors is highly skewed. Figure 2, for example, displays the number of long-lived German patents that were held by firms and private inventors located in the 20 most innovative foreign countries before the First World War. This represents the intersection between each country’s long-lived patents and its patents filed in Germany, indicating a subset of particularly valuable patents.

Long-lived German patents of the 20 most innovative foreign countries before the First World War (Source: Degner and Streb 2013, p. 24)

Before the First World War, the United States dominated foreign patenting activities in Germany, with 29 % of all long-lived foreign patents. Overall, the respective shares of the three (five) most innovative countries came to 63 (82) percent. This ranking of technological leadership has been persistent over time. On a world scale, the United States, Great Britain, France, and Germany (which, by definition, cannot show up in Fig. 2) have dominated foreign patenting activities for more than 120 years (Cantwell 1989; Hafner 2008). The only country that was able to join this exclusive club of technological leaders was Japan in the second half of the twentieth century. Cantwell suggests that we should explain the inability of most backward countries to achieve a similar level of innovation by the fact that in most industries new knowledge is generated as an incremental, cumulative and path-dependent process. As long-term paths of research and development provide no major shortcuts for latecomers, the technological leaders are in general far ahead of their followers when it comes to the development of major innovations.

Assuming that transaction costs (search and information costs, bargaining costs, monitoring, and enforcement costs) generally increase with distance, so-called gravity models predict that geographical (and cultural) proximity fosters bilateral foreign trade flows. Burhop and Wolf (2013) show that the same was true for international trade in German patents during the pre-First World War period. All other things being equal, the frequency of patent transfers decreased with growing distance between the buyer and the seller of a particular German patent. In addition, similar evidence can be found for the more general case of foreign patenting activities. In particular, the comparatively high number of long-lived German patents that countries such as Austria or the modern-day Czech Republic possessed (see Fig. 2) might have resulted from direct proximity to this large neighboring economy. In contrast, these two countries played no major role in the American patent market, where Canada held a relative high number of patents.

The very uneven distribution of innovation across countries is mirrored within the innovative countries themselves; an observation that is reminiscent of the self-similarity of fractal geometry. In an influential paper that triggered many cliometric studies of innovations, Sokoloff (1988) points out that in the early nineteenth century, the level of patents per capita in southern New England and New York surpassed those of the rest of the United States by a factor of 20. Between 1890 and 1930 most Japanese independent inventors lived in the areas around Tokyo and Osaka (Nicholas 2011b). Streb et al. (2006) reveal that the long-lived German patents granted to domestic patentees before the First World War were also not uniformly distributed across the different German regions but were, as shown in Fig. 3, geographically clustered in the districts along the Rhine as much as in Greater Berlin and Saxony. A particularly high level of innovation, it seems, is a characteristic of regions rather than countries. For that reason, scholars have concentrated recently on the analysis of regional innovation systems (Malmberg and Maskell 2002).

The geographical distribution of high-value patents in Germany, 1878–1914 (Source: Streb et al. 2006, p. 364)

Firm-level data indicate that above-average innovation of regions, in turn, is often based on achievements of just a few very innovative firms. Degner (2009), for example, presents the astonishing result that from 1877 to 1900 two thirds, and from 1901 to 1932 between 40 % and 55 %, of all long-lived German patents granted to domestic firms were held by only the 30 most innovative firms. That this distribution of innovation across firms was extremely skewed is emphasized by the fact that more than 266,000 firms with more than five workers existed in Germany in 1930. Many of the firms on Degner’s list, such as Siemens or BASF, are also among the most innovative German firms of the early twenty-first century.

To conclude, many empirical observations lead to the conclusion that innovation, measured by the number of (valuable) patents, is a rare and persistent characteristic both at the macroeconomic and the microeconomic level. Surprisingly, most cliometric studies of innovations do not address these features explicitly.

Explaining Innovations

Traditionally, scholars have argued about whether an observed increase in innovations was primarily evoked by supply-side or demand-side factors. Mokyr (1990), for example, takes the view that demand-side factors might influence the direction of innovative activities but cannot explain the absolute level of technological creativity in a society. In his opinion, the latter was historically determined by various supply-side factors such as geography or the availability of basic technological knowledge. He also believes that demography and its influence on labor costs and popular preferences like the degree of risk aversion or the openness to new (technological) information were important. More recently, researchers also explored how the detailed anatomy of patent legislation influences the volume and structure of innovations. Figure 4 depicts the relationship of these three approaches.

Supporters of the view that it is the supply side of the economy that drives innovation stress the importance of human capital. In general, human capital comprises the stock of all qualifications and skills that increase an individual’s productivity in economic activities. It can be acquired by formal education and learning by doing and therefore accumulates over the lifetime of a worker or researcher. Like physical capital, however, human capital can also be devaluated. Such a scenario is likely to occur in the aftermath of technological shocks. Handloom cotton weavers, for example, were highly paid specialists at the end of the eighteenth century, but were quickly replaced by unskilled adults and even children after Edmund Cartwright invented the power loom in 1785. Unfortunately, exact measures for human capital do not exist. Researchers therefore often rely on imperfect proxies like literacy rates, years of schooling, formal degrees, or even the Whipple index, which measures the extent of age heaping in a society (Baten and Crayen 2010).

At least since the Second Industrial Revolution, human capital has become an indispensable input in industrial innovation processes. In the late nineteenth century, chemical and electrical engineering companies invented the new organizational concept of the R&D department. Thus, for the first time in history, scientists and engineers collaborated to search systematically for new goods that could be profitably sold by their employer. In other industries such as mechanical engineering, drawing offices, and experimental departments, which also had to be equipped with well-trained employees, became an increasingly familiar sight. Human capital was now needed even for the purely imitating activities of firms. Reverse engineering, for example, meant in practice that workers had to have the skills to disassemble complex machinery, to record each component with the help of engineering drawings, and to produce replica parts and fully functional copies. That is why Benhabib and Spiegel (1994) hold the view that human capital is essential for enlarging a country’s level of technology by making possible either the imitation of foreign superior technology or the development of its own innovations. In their empirical approach, they measure a country’s capability to innovate by its human capital stock, which they estimate by enrollment rates in primary, secondary and higher education. Specifically, a country’s potential to imitate is approximated by the gap between the productivity level of the technological leader and its own inferior productivity level. The extent to which this potential can actually be used for catching up depends again on the available human capital stock. Analyzing the reasons for cross-country variation in growth rates of GDP per capita of 79 countries between 1965 and 1985, they confirm that in order to grow economically, emerging countries could rely on adopting foreign technology while industrialized countries had to develop better technology. These different growth strategies might also demand different strategies of human capital formation. Acemoglu et al. (2006) suggest that backward countries that want to catch up by imitating foreign technology should invest primarily in secondary education, whereas countries at the technological frontier should concentrate on increasing the quality and quantity of tertiary education.

Comparing the development of the synthetic dye industry in Great Britain, Germany, and the United States before the First World War, Murmann (2003) identifies the relative abundance of well-trained domestic chemists as one of the key factors that explain why German firms came to dominate the industry, as measured by both innovations and share in worldwide sales. From this observation arises the question whether the availability of an appropriate stock of human capital also influences innovation on a more disaggregated level. To answer this question, Baten et al. (2007) analyze the patenting activities of 2,407 firms located in the 52 districts of the state of Baden, Germany, around 1900. They measure regional human capital formation as the number of students in technical and commercial schools of secondary and tertiary level per 1,000 inhabitants. If the efficiency of a firm’s R&D primarily depended on locally available human capital, firms that were located in districts with many students should have displayed more innovations than firms in districts with a below-average number of well-educated people. The econometric results suggest that Baden’s small- and medium-sized firms relied on hiring graduates from technical and commercial schools in their geographical neighborhood. By contrast, Baden’s large innovative firms were apparently able to cross geographical boundaries and acquire new researchers and engineers from distant German and foreign regions.

Principal-agent theory assumes that a worker’s productivity depends not only on his human capital but also on the personal effort he is willing to make on the job. If the employer cannot observe the exact effort level because of asymmetric information and is therefore not able to reward diligence or punish sloth, a worker is not likely to do more than what is necessary to keep his job. This hypothesis might also be true for employees in industrial R&D departments, especially if they receive their pay in the form of a fixed salary. If a researcher does not participate in the company’s additional profits generated by his own innovations, he has no incentives to dedicate himself to the development of new goods and processes with all his heart and mind. Theoretically, an employer can set such incentives by paying a variable salary that increases with a researcher’s output. Burhop and Lübbers (2010) explore whether this kind of incentive scheme worked in the R&D departments of German chemical and electrical engineering industries around 1900. They analyzed the contents of individual researchers’ working contracts and found that among the three firms Bayer, BASF, and Siemens, only Bayer offered ex-ante contracted bonus payments that depended on the profits resulting from the employed researcher’s inventions. In contrast, BASF and Siemens implemented discretionary reward schemes with no clear link between the level of bonus and a researcher’s individual achievements. Regression analysis reveals that a high share of bonus payments in total compensation significantly increased the number of long-lived patents granted to a firm. Moreover, individual experience also mattered: total patent output rose with the average tenure of researchers.

If human capital has been the decisive bottleneck of innovating activities in history, its unequal distribution across countries and regions might help to elucidate the even more skewed geographical distribution of patents. Sokoloff and Khan (1990) disagree with this supply-side argument. They assume that during early American industrialization the skills and knowledge that were needed for successful patenting activities were widely spread among the general population. In their view, it was the unequal access to mass markets for innovative goods that explains why some regions became innovative and others did not. This demand-side argument is based on the assumption that the expected profitability of a patent increases with the size of the market in which the patented innovation might be sold. As land transport was prohibitively expensive before the introduction of railways, firms that were either located near highly populated metropolitan areas or able to transport their innovative goods at low costs on navigable waterways to distant markets had arguably much higher incentives to take out patents than did firms in more remote areas. To support this hypothesis, Sokoloff (1988) demonstrates that previously non-innovative northeastern American regions in the neighborhood of canals increased their patenting activities considerably after the completion of these waterways. Analyzing the biographical information on 160 “great American inventors,” Khan and Sokoloff (1993) show that men of great technological creativity who did not already live in the traditional centers of innovation in New England and New York tended to move there. Interestingly enough, New England and New York kept their above-average level of innovation even after other American regions had gained similar market access due to the large extension of the railway network. This observation implies the likelihood of path dependency, which we will address below in more detail.

Demand factors not only influence innovation, but also firms’ original choice of location. That is why it is necessary to distinguish clearly between a firm’s choice of location and its decision to patent. Sokoloff is well aware of this problem and therefore controls for the division of the labor force between agriculture and manufacturing. It turns out that the estimated positive relationship between a firm’s proximity to navigable waterways and the intensity to patent is robust to the inclusion of this variable, which is supposed to measure the level of industrial activity in a region. Hence, in Sokoloff’s sample, demand factors seem to influence the geographical distribution of patents independently of the original choice of location. The German case, however, suggests that the aggregated level of industrial activity might not be the adequate variable to distinguish between demand effects on firm location and on the decision to patent, respectively. German industries widely differed in their propensity to patent. The patent classes “electrical engineering,” “chemicals including dyes,” and “scientific instruments” together comprised more than one quarter of all long-lived patents granted between 1877 and 1918 (Streb et al. 2006). In addition, many valuable patents in the field of mechanical engineering were spread over several patent classes, such as “machine parts” or “steam engines” and less obvious ones like “weaving” or “agriculture” (which included textile machines and agricultural machines, respectively). The uneven propensity of industries to patent matters because of their simultaneous uneven geographical distribution across Germany. Obviously, the broad west-east strip of German regions with an above-average number of high-value patents, depicted in Fig. 3, was also the favored location of those industries in which most of the high-value patents originated. Long before the German patent law of 1877 actually came into force, the original choice of location for these industries might have been influenced by a variety of factors, such as the expected market volume or the availability of raw materials and intermediate products. Large (and later very innovative) chemical firms like BASF or Bayer, for example, preferred to settle on the banks of the Rhine, which was not only an important navigable waterway but was also used as a water source and a way to dispose of effluents. The great majority of chemical firms located themselves along waterways independently of their later decision to patent. Consequently, waterway areas had an above-average density of chemical firms, and because of this industry's high patenting activities, also had a higher number of patents than regions with a similar industrial activity level that were dominated by industries that patented less than the average. The same argument holds for mechanical and electrical engineering. Firms engaged in the field of mechanical engineering were especially concentrated in the geographical neighborhood of iron and steel producers, namely, in the Greater Ruhr area, and near textile firms, namely, in Saxony. Berlin was the center of German electrical engineering. To test the robustness of the relationship between a firm’s proximity to metropolitan areas or mass transportation infrastructure and the propensity to patent proposed by Sokoloff, it would therefore be advisable to control not only for the general level of industrial activity in a region but also for the respective activity levels of different industries located in it.

Another point is worth mentioning. Sokoloff and his coauthors concentrate on the period of the First Industrial Revolution in early nineteenth-century America when the comparatively low level of human capital needed to invent a new steam engine or textile machine was widely dispersed among merchants and artisans. That is why, in the early nineteenth century and before, it might have been the access to mass markets for innovative goods that made a potential inventor into an actual one. During the Second Industrial Revolution of the late nineteenth century, however, when basic innovations occurred in chemicals and electrical engineering, broadly dispersed general technical knowledge and skills might no longer have been sufficient for achieving a major technological breakthrough. This assumption is also supported by the fact that, in this period, the share of independent inventors among all patentees declined steadily while the respective share of researchers in industrial R&D departments increased (Nicholas 2011b, p. 1003). By then, the unequal geographical distribution of patenting has been rather determined by the unequal supply of higher education. It is therefore conceivable that the increasing importance of science and technology for innovation processes over the course of the nineteenth century shifted the main emphasis from demand-side factors to supply-side factors when it comes to explaining innovations.

Yet another argument in favor of the view that innovation is mainly driven by demand-side factors is the observation that upstream manufacturers’ search for innovations is often driven by the concrete needs of their downstream customers. Streb et al. (2007) observe a statistically significant bidirectional Granger causality between German net cloth exports and patents in the technological classes “dyes” and “dyeing,” which suggests that during the German Empire, the knowledge exchange between chemical and textile firms created an upward cycle of endogenous growth. Specifically, after the invention of many synthetic dyes in the last third of the nineteenth century, German chemical companies soon realized that textile manufacturers were not able to process synthetic dyes with their traditional equipment. That is why the former also engaged in the development of new chemical and mechanical procedures suitable for processing synthetic dyes. In a next step, this new knowledge was communicated to the downstream textile industry. The main channel of this knowledge transfer was the newly invented customer consulting service of the German dye manufacturers, which regularly informed textile firms about both new dyes and new dyeing methods. The German textile firms subsequently increased their international competitiveness to a considerable extent by exporting cloth colored with the innovative dyes. The increasing demand for synthetic dyes by the prospering textile firms in turn encouraged further R&D projects by the innovative chemical firms that led to new patents and again, via customer consulting, to additional economic benefits of the German textile industry. This upward cycle, however, was not infinite. It came to an end when the synthetic dyes technology had matured.

Various cliometric studies of innovations (Burhop and Lübbers 2010; Cantwell 1989; Khan and Sokoloff 1993) imply that the outstanding innovation of certain regions, companies, and independent inventors might have been built up in a path-dependent process. Degner (2012) elaborates on this hypothesis. The starting point of his theoretical considerations is the emergence of a new technology, such as the aforementioned chemical synthesis of dyes in the middle of the nineteenth century. Inspired by the economic opportunities that come along with a new technological field, in a first round of R&D, many newly founded companies with similar innovation capabilities will try to arrive at innovations. Given the high uncertainty of the innovation processes, however, only a few of these companies will succeed. Those firms will possess two advantages in the following second round of R&D. They can now build on the scientific and economic knowledge their employees have acquired during the first round of R&D. In addition, the sales of the innovations developed in the first round of R&D might have led to the establishment of large financial reserves that will allow the innovative firms to expand their R&D capacities and therefore carry out several innovation processes simultaneously in the second round of R&D. Both advantages taken together considerably increase the probability that the winners of the first round of R&D will also make innovations in the second round – which, in turn, will foster their level of innovation in the third round of R&D even more. In contrast, firms that failed in the first rounds of R&D will soon no longer have a chance to catch up to the growing advantage of the early innovators. In the longer run, a path-dependent process will split initially very similar companies into few very innovative and many non-innovative companies.

To test his theoretical model, Degner analyzes the patenting activities of more than 1,000 German firms between 1877 and 1932. His striking result is that a firm’s stock of valuable patents is a robust predictor of future patenting activities, whereas neither firm size, access to capital market, market structure, nor regional human capital endowment have a robust, significant influence on the number of valuable patents. Future research will show whether these empirical observations can be generalized. If this is the case, both the skewness of distribution of innovations across firms and regions (where innovative firms and individuals are clustered) and the persistence of innovation could be explained by the process of path dependency outlined by Degner.

Until now we have interpreted patent statistics as an admittedly imperfect but still objective measure for innovations. This view neglects the possibility that the introduction or change of a particular patent law itself might influence both the level and the direction of innovation activities. From a theoretical perspective, the introduction of formal intellectual property rights promises to foster innovation. The argument is that, in a world without patent protection, many inventors would have to fear economic losses because competitors would imitate innovations quickly and sell them at prices that only cover their own production costs but not the original inventor’s R&D costs. Expecting this ruinous competition in advance, many potential inventors might decide to forego R&D projects that would otherwise lead to socially useful innovations. To fight this underinvestment in R&D, governments introduced patent protection, which allow successful inventors to recover their R&D costs by selling their innovations as a temporary monopolist.

This simple textbook explanation of the beneficial effects of formal intellectual property rights might be misleading in a more complex historical setting in which emerging countries struggle to catch up to the technological leaders. Murmann (2003), for example, argues that German chemical companies owed their meteoric rise to world market dominance in the late nineteenth century to a large extent to the absence of a German patent law before 1877, which made it possible to imitate British and French synthetic dye innovations and sell them in the unprotected German market. During this period of ruthless imitation, German imitators learned to master the new technology, build up R&D departments, and develop their own innovations. Perhaps unsurprisingly, after learning by imitation was completed, German chemical firms began to lobby for the introduction of a domestic patent law because they now judged their newly acquired capability to innovate more profitable than their traditional imitating strategy. Richter and Streb (2011) confirm Murmann’s narrative for the case of German machine tool makers who, in the second half of the nineteenth century, used various channels such as reverse engineering, visiting international exhibitions and foreign firms, scrutinizing international patent applications, and hiring foreign craftsmen and engineers to imitate superior American technology. In the early twentieth century, many of these former product pirates became internationally renowned innovators of machine tools.

In the nineteenth century the Spanish government found an elegant solution to have the best of both worlds: a full-fledged national patent system while maintaining the possibility to imitate superior foreign technology for free. So-called patents of introduction could be granted to Spaniards who were the first to introduce a foreign innovation into the Spanish market. For this technological transfer, the authorization by the original foreign inventor was not needed (Sáiz and Pretel 2013).

To conclude, good imitators can become good innovators when unsecure intellectual property rights give them the time they need to adjust to international competition in innovation. There is, however, one important caveat: Degner (2012) has shown that it is in general very difficult to catch up to the accumulated stock of experience innovative firms in industrialized countries have already built up in many historical R&D projects. Nevertheless, developing countries may realize that it does not pay to be an early complier with international rules of law with respect to intellectual property rights. Doing so may not only amplify the dominance of the traditional technological leaders but can also slow down the speed of technological and economic progress in their domestic industries.

Moser (2005) questions the alleged innovation-stimulating effects of patent protection on a more general level. Based on her research on exhibits presented at world’s fairs between 1851 and 1915, she shows that countries without domestic patent laws did not display lower levels of innovation than countries with a long-standing tradition of patent protection. Switzerland, for example, which switched towards a fully functioning patent system only in 1907, regularly presented a comparatively high number of high-quality innovations at the world’s fairs as measured by the jury prizes they received for exceptional novelty and usefulness. Moser has to admit, however, that patent laws might have influenced the direction of innovation activities. According to her research, countries without domestic patent protection concentrated their R&D activities on industries for which secrecy was a comparatively efficient means to appropriate the return to innovation. Many innovations in food processing, for example, such as milk chocolate, baby foods, and ready-made soups, were developed by Swiss or Dutch inventors in periods when neither country had a patent law. From this perspective, the current leading position of Dutch and Swiss companies in international markets for consumption goods might be a legacy of a long-gone era without patent protection.

Nicholas (2011a) adopts another approach to test for the influence of patent protection on innovation. His starting point is the observation that international patent systems differed considerably with respect to the fees a patentee had to pay to keep a patent in force. At the end of the nineteenth century, the total costs of maintaining a patent for 15 years came to £265 in Germany, £84 in Belgium (for a 20 year term), £60 in France, and £54 in Italy. The important outlier was the United States where a mere £7 secured a 17-year patent protection, a fact which is believed to have promoted the “democratization” of innovation activities in this country (Sokoloff and Khan 1990). Nicholas does not exploit this cross-country variation, but concentrates on the English case where patent fees were reduced from £175 to £154 in 1883 for a 14 years’ term. To be precise, the English fee reduction did not affect the two renewal fees payable by the end of the fourth year (£50) and by the end of the seventh year (£100). Only the initial fee, which was due at the beginning of the patent protection, declined from £25 to £4.

Following the arguments by Macleod et al. (2003) a first payment of £25 might have been prohibitively expensive for many potential English inventors. From this group’s perspective, the fee reduction of 1883 represented the first affordable patent protection for their inventions. One would therefore expect an increase in English patenting activities after 1883, something which actually happened. Nicholas, however, wanted to know whether the 1883 reform also fostered innovation as measured by valuable patents, which he identified with the help of both the number of citations they received and their individual life span. Using a difference-in-difference regression to analyze changes in valuable English patents relative to the control group of valuable patents granted to English patentees in the United States, he concluded that the decrease in patent fees did not increase innovation. This finding has an important methodological implication. If the level of patent fees only influenced the number of total patents, but not the number of the valuable ones among them, an international comparison of the latter would be possible even when the variation of national patent fees was considerable.

National patent laws also differed with respect to other features. For example, some countries introduced technical examination or compulsory licensing clauses, while others did not. Moreover, some patent administrations discriminated against foreign inventors, while others did not (Khan 2013; Moser 2013). Because of these various differences, scholars should exercise a degree of caution when comparing patenting activities across different countries.

Technological Transfer

A major merit of patent laws is that they create a reliable legal framework for the diffusion of technology both within countries and between countries. The first channel through which the diffusion of technology can take place is the public disclosure of new knowledge. A patentee is required to provide a detailed technical description of his innovation in the patent specification that is then made available to the general public. Even though others are not allowed to exploit this information for the economic purpose specified in the patent during its period of validity, they can immediately use it as a starting point for related R&D projects. To prove that this diffusion mechanism already worked in the nineteenth century, Moser (2011) shows that innovation activities in the US chemical industry became less geographically concentrated after this sector’s propensity to patent had increased in the late nineteenth century.

To analyze the volume, direction, and impact of international technological transfer empirically, researchers traditionally rely on international data for bilateral trade flows or FDI. However, patent specifications can also serve foreigners as a source of new knowledge, especially when these patents were published in their native language. That is why Eaton and Kortum (1999) measure the direction of technological transfer by patenting activities in foreign markets. They conclude that since the end of the Second World War the world’s long-term productivity growth has been mainly driven by the foreign patenting activities of a few leading research economies. The United States has been the dominant source of new knowledge, followed by Japan and Germany. Khan (2013) changes the perspective from countries of origin to the recipient countries. Interestingly enough, the average share of foreign patents in all patents granted varied considerably across countries between 1840 and 1920, for instance, from 78 % in Canada, 59 % in Spain, 34 % in Germany, 22 % in the United Kingdom, to only 7 % in the United States. Based on this observation, she develops the hypothesis that lower rates of patenting by foreign inventors indicate a higher level of innovation of their domestic competitors. This might be true if inventors of any other country first and foremost engaged in those foreign markets where they did not fear the high technological creativity of the domestic population. Note, however, that Khan’s considerations contradict the traditionally held assumption that foreign patenting concentrates in countries where the probability of imitation is high due to a comparatively rich endowment of technical competencies and skills.

According to Khan’s statistics, the German patent market was a preferred destination of foreign inventors relative to other third markets. Using the concept of revealed technological advantage, Degner and Streb (2013) analyze the international patterns of technological specialization on the basis of foreign patenting activities of 21 countries from the European core, the European periphery, and overseas between 1877 and 1932 in Germany. It turns out that the countries of the European core revealed technological strength in the old technological fields of the First Industrial Revolution and in the new technological fields of the Second Industrial Revolution. Great Britain, for example, excelled in textiles, machine tools, electrical engineering, chemicals, and mass-consumption technology. In contrast, the Eastern and Southern European countries of the European periphery demonstrated technological strength only in the well-known technological fields of the First Industrial Revolution, such as Spain or Poland in the textile, coal, and steel industries. This difference suggests that a country’s technological advantages were significantly influenced by its current stage of economic development. While the economically advanced countries of the European core had already explored the prospects of the more science-based technologies of the Second Industrial Revolution, the less advanced countries were still engaged primarily in the traditional technological fields of the First Industrial Revolution. This finding supports Cantwell’s (1989) hypothesis that backward countries were not able to catch up to the superior level of innovation of the leading research economies.

A closer look at the performance of individual countries reveals further insights. The availability of domestic natural resources obviously influenced a country’s technological specialization. Most of the countries with their own natural deposits of coal, iron, or other nonferrous metals, especially Belgium, Luxembourg, the modern-day Czech Republic, Poland, Norway, and Spain, displayed strong advantages in the technological field of the coal and steel industry, which included mining technologies for nonferrous metals. France, the Netherlands, and Denmark used their advanced agriculture to concentrate on innovations that fostered the mass consumption of foodstuffs and drinks. It is not surprising that Italy and France displayed great technological strength in the field of motor cars. Canada, however, which is not renowned for manufacturing automobiles, also revealed some technological advantage in this field before the First World War. Therefore, historical patterns of technological specialization might also produce information about abandoned national paths of technological development that would be otherwise forgotten.

The second channel through which patent protection facilitates the diffusion of technology is by decreasing the transaction costs of information exchange. As long as intellectual property rights were insecure, inventors who wanted to sell new ideas always had to fear being cheated out of their financial compensation. After the introduction of patent protection, it became easier and less risky to transfer knowledge via patent assignments, and particularly creative inventors specialized in invention activities. Lamoreaux and Sokoloff (1999, 2001) claim that the particular features of the American patent system, namely, the very low registration fee and the requirement that only the “first and true” inventor was entitled to apply for patent protection, were the key behind the pronounced division of labor in American innovation activities. Specialized inventors concentrated on the creation of technical inventions and then sold their new knowledge via patent assignment to established firms that took over the task of manufacturing and selling the innovation. Patent agents or lawyers often acted as an intermediary between inventors and companies. The relative importance of this type of technological transfer is demonstrated by the fact that around 1900, about one third of American patents was fully or partly assigned after issue. The historical German patent market was less liquid than the American one which can be explained at least partly by insufficient inventor protection (Burhop 2010). The German patent law ruled that the first applicant, not the initial inventor, was entitled to a patent grant. As a result, many innovations that were created in industrial R&D departments were directly granted to the company and not to the employed researcher. This is another example of how the details of a national patent law can significantly influence the outcome of innovation processes and therefore patent statistics.

Future Research

Until now, most cliometric studies of innovations have concentrated on patenting activities in leading research economies such as the United States, the United Kingdom, Germany, or Japan. To learn more about imitating and innovating in less advanced countries, future cliometric research projects should take a closer look at patenting activities in the European periphery and overseas. The greatest challenge will be to harmonize the different national patent statistics and merge them into one unified data base that would allow for testing for the various determinants of patenting activities on the basis of a broad international panel. Given the obvious shortcomings of patent statistics, researchers should also keep on searching for alternative historical mass data which include information on innovations that have never been patented.

Another desideratum is to get more information about the microeconomics of historical R&D management. Here, the research idea of scrutinizing historical working contracts of employed researchers (Burhop and Lübbers 2010) might be a good starting point for further empirical analysis. Surprisingly enough, cliometric studies in innovations have widely neglected to research the impact of innovations on economic performance. It would be very interesting, however, to learn more about how the skewed (and persistent) distribution of innovations across countries, regions, and inventors affected the respective distributions of economic outcome indicators such as GDP per capita, productivity, or profit.

References

Acemoglu D, Aghion P, Zilibotti F (2006) Distance to frontier, selection, and economic growth. J Eur Econ Assoc 4:37–74

Baten J, Crayen D (2010) Global trends in numeracy 1820–1949 and its implications for long-term growth. Explor Econ Hist 47:82–99

Baten J, Spadavecchia A, Streb J et al (2007) What made southwest German firms innovative around 1900? Assessing the importance of intra- and inter-industry externalities. Oxf Econ Pap 59:i105–i126

Benhabib J, Spiegel MM (1994) The role of human capital in economic development: evidence from aggregate cross-country data. J Monet Econ 34:143–173

Burhop C (2010) The transfer of patents in imperial Germany. J Econ Hist 70:921–939

Burhop C, Lübbers T (2010) Incentives and innovation? R&D management in Germany’s chemical and electrical engineering industries around 1900. Explor Econ Hist 47:100–111

Burhop C, Wolf N (2013) The German market for patents during the ‘second industrialization’, 1884–1913: a gravity approach. Bus Hist Rev 87:69–93

Cantwell J (1989) Technological innovation and multinational corporations. Basil Blackwell, Oxford

Clark G (2007) A farewell to alms: a brief economic history of the world. Princeton University Press, Princeton/Oxford

Degner H (2009) Schumpeterian firms before and after World War I: the innovative few and the non-innovative many. Z Unternehm 54:50–72

Degner H (2012) Sind große Unternehmen innovativ oder werden innovative Unternehmen groß? Eine Erklärung des unterschiedlichen Innovationspotenzials von Unternehmen und Regionen. Jan Thorbecke, Ostfildern

Degner H, Streb J (2013) Foreign patenting in Germany, 1877–1932. In: Donzé P-Y, Nishimura S (eds) Organizing global technology flows. Institutions, actors, and processes. Taylor & Francis, New York/Oxford, pp 17–38

Eaton J, Kortum S (1999) International technology diffusion: theory and measurement. Int Econ Rev 40:537–570

Griliches Z (1990) Patent statistics as economic indicators: a survey. J Econ Lit 33:1661–1707

Hafner K (2008) The pattern of international patenting and technology diffusion. Appl Econ 40:2819–2837

Jaffe A, Trajtenberg M (2002) Patents, citations and innovation: a window on the knowledge economy. MIT Press, Cambridge, MA

Khan BZ (2013) Selling ideas: an international perspective on patenting and markets for technological innovations, 1790–1930. Bus Hist Rev 87:39–68

Khan BZ, Sokoloff KL (1993) ‘Schemes of practical utility’: entrepreneurship and innovation among ‘great inventors’ in the United States, 1790–1865. J Econ Hist 53:289–307

Kotabe M (1992) A comparative study of the U.S. and Japanese patent systems. J Int Bus Stud 23:147–168

Lamoreaux NR, Sokoloff KL (1999) Inventors, firms, and the market for technology: US manufacturing in the late nineteenth and early twentieth centuries. In: Lamoreaux NR, Raff DMG, Temin P (eds) Learning by doing in firms, organizations, and nations. University of Chicago Press, Chicago, pp 19–60

Lamoreaux NR, Sokoloff KL (2001) Market trade in patents and the rise of a class of specialized inventors in the nineteenth-century United States. Am Econ Rev 91:39–44

Macleod C, Tann J, Andrew J et al (2003) Evaluating inventive activity: the cost of nineteenth-century UK patents and the fallibility of renewal data. Econ Hist Rev 56:537–562

Malmberg A, Maskell P (2002) The elusive concept of localization economics. Towards a knowledge-based theory of spatial clustering. Environ Plann A 34:429–449

Mokyr J (1990) The lever of riches: technological creativity and economic progress. Oxford University Press, Oxford

Moser P (2005) How do patent laws influence innovation? Evidence from 19th-century world fairs. Am Econ Rev 95:1214–1236

Moser P (2011) Do patents weaken the localization of innovations? Evidence from world’s fairs, 1851–1915. J Econ Hist 71:363–382

Moser P (2012) Innovation without patents: evidence from world’s fairs. J Law Econ 55:43–74

Moser P (2013) Patents and innovation: evidence from economic history. J Econ Perspect 27:23–44

Murmann JP (2003) Knowledge and competitive advantage. The coevolution of firms, technology, and national institution. Cambridge University Press, Cambridge

Nicholas T (2011a) Cheaper patents. Res Policy 40:325–339

Nicholas T (2011b) Independent invention during the rise of the corporate economy in Britain and Japan. Econ Hist Rev 64:995–1023

Nuvolari A, Tartari V (2011) Bennet Woodcroft and the value of English patents, 1617–1841. Explor Econ Hist 48:97–115

Richter R, Streb J (2011) Catching-up and falling behind: knowledge spillover from American to German machine tool makers. J Econ Hist 71:1006–1031

Sáiz P, Pretel D (2013) Why did multinationals patent in Spain? Several historical inquiries. In: Donzé P-Y, Nishimura S (eds) Organizing global technology flows. Institutions, actors, and processes. Taylor & Francis, New York/Oxford, pp 39–59

Schankerman M, Pakes A (1986) Estimates of the value of patent rights in European countries during the post-1950 period. Econ J 96:1052–1076

Schumpeter JA (1934) The theory of economic development. Harvard University Press, Cambridge, MA

Sokoloff KL (1988) Inventive activity in early industrial America: evidence from patent records, 1790–1846. J Econ Hist 48:813–850

Sokoloff KL, Khan BZ (1990) The democratization of Invention during early industrialization: evidence from the United States, 1790–1846. J Econ Hist 50:363–378

Streb J, Baten J, Yin S (2006) Technological and geographical knowledge spillover in the German empire, 1877–1918. Econ Hist Rev 59:347–373

Streb J, Wallusch J, Yin S (2007) Knowledge spill-over from new to old industries: the case of German synthetic dyes and textiles 1878–1913. Explor Econ Hist 44:203–223

Sullivan RJ (1994) Estimates of the value of patent rights in Great Britain and Ireland, 1852–1976. Economica 61:37–58

Townsend J (1980) Innovation in coal-mining: the case of the Anderton Shearer Loader. In: Pavitt K (ed) Technical innovation and British economic performance. Macmillan, London, pp 142–158

Woodcroft B (1862) Reference Index of English Patents of Invention, 1617–1852. G. E. Eyre & W. Spottiswoode, London

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer-Verlag Berlin Heidelberg

About this entry

Cite this entry

Streb, J. (2016). The Cliometric Study of Innovations. In: Diebolt, C., Haupert, M. (eds) Handbook of Cliometrics. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-40406-1_18

Download citation

DOI: https://doi.org/10.1007/978-3-642-40406-1_18

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-40405-4

Online ISBN: 978-3-642-40406-1

eBook Packages: Economics and FinanceReference Module Humanities and Social SciencesReference Module Business, Economics and Social Sciences