Abstract

Information technology (IT) innovation is rapidly reshaping organisations, affecting fundamental aspects of their everyday business activities and processes. This development is accompanied by benefits as well as challenges. In this article, we focus on a specific distributed ledger IT called blockchain which has been heralded as possessing the capability to radically transform a multitude of industries. However, there is a dearth of research which has coalesced the important considerations that organisations should consider prior to adopting blockchain technologies. Consequently, using innovation theory, which has been extensively used to examine the adoption of IT in organisations, we identify salient technological, organisational and environmental (TOE) considerations which influence the adoption of blockchain by organisations. We anchor our discussion using the top three organisational considerations which emerged from our research: top management support, organisational readiness and organisational support. We also provide an overview of the blockchain concept and outline the advantages and potential use cases that organisations contemplating adopting the technology can leverage.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Blockchain

- Organisational adoption

- Innovation theory

- Blockchain benefits

- Blockchain use cases

- TOE considerations

Introduction

“Change is inevitable … progress is optional.” John C. Maxwell

In the past decade, distributed ledger technologies (DLT) have revolutionised approaches to decentralised decision-making. Instead of keeping data centralised in a traditional ledger, DLT encompasses the use of independent computers, often referred to as ‘nodes’, to record, synchronise and share individual transactions in their respective electronic ledgers. Blockchain is one example of a DLT. Transactions can include the exchange of data (e.g., personal identification records) and assets (e.g., tokens, digital currency). Blockchain is a digital ledger which allows for the brokering of trust on a decentralised peer-to-peer network. Blockchain first came to prominence in 2008 as the technology which underpinned the Bitcoin cryptocurrency (Nakamoto 2008). Blockchain, however, is a far more versatile technology! It is anticipated to disrupt a multitude of industries (e.g., health, food, financial, government, tourism) in the next decade (Ito et al. 2017; Önder and Treiblmaier 2018). Blockchain provides adopters with advantages such as anonymity (Zyskind et al. 2015), immutability (Pilkington 2015), transparency (Kosba et al. 2016), security (Mendling et al. 2017) and fast transactions (Kiayias and Panagiotakos 2016). In 2018 the global blockchain technology market is predicted to reach 548 million US dollars in size and is forecast to grow to 2.3 billion US dollars by 2021 (Mehta and Striapunia 2017). Although the global blockchain adoption rate is increasing gradually, as reported by IT analysts such as McKinsey (2017) and Accenture (Treat et al. 2017) and multinational technology company IBM (Bear et al. 2016), the adoption rates in developed countries appear to be rather low. Motivated by blockchain’s potential to transform sociotechnical systems, the lack of systematic inquiry pertaining to blockchain adoption, we propose the following research question:

What significant technological, organisational and environmental considerations influence blockchain adoption in organisations?

To investigate this research question, we operationalised innovation theory, which has been extensively used to examine information technology (IT) innovation adoption in organisations (Rogers 1995; Yu and Hang 2010; Van de Weerd 2016; Treiblmaier et al. 2006). Consequently, we conducted a comprehensive review of the blockchain literature using the technology, organisational and environmental (TOE) framework (Tornatzky and Fleischer 1990) to identify significant considerations which influence blockchain adoption in organisations.

This chapter is structured as follows. The next section provides an overview of the blockchain concept and outlines the benefits associated with the technology. Next, we introduce our research approach. Then, the findings from our study are delineated. Finally, we discuss our findings and the study’s implications and limitations and present our conclusions.

The Blockchain Concept

This section will first provide an overview of the blockchain concept. Next, we discuss the benefits that can be derived from adopting blockchain technologies. Then, we provide an overview of the TOE framework which we used as a lens to investigate our research question.

The New Technology Kid on the Block

In the past, commerce on the Internet has relied solely on trusted third parties, such as financial institutions, to process any electronic payments. However, in 2008 the introduction of Bitcoin led to a paradigm shift in how transactions are processed worldwide (Nakamoto 2008). Although often going hand in hand, many believe that the success of Bitcoin is not in the service it offers but in the underpinning technology: blockchain (Ross 2017). As can be seen in Fig. 2.1, the term ‘blockchain’ peaked in December 2017 (Google 2018). This peak coincided with the increasing price appreciation for the Bitcoin cryptocurrency whose price index reached an all-time high of $19,783.21 on December 17, 2017. Blockchain is defined as an open-source dataset, distributed across millions of computers, utilising avant-garde cryptography (Tapscott et al. 2016). Ultimately, blockchain is a secure, decentralised, public ledger, in which every person can view the transaction history in totality, removing the need for a trusted third party (Pilkington 2015).

Google trends result for the search term ‘blockchain’ (Google 2018)

Using Bitcoin as an example, we will now provide an overview of how blockchain technology works. Each block in the chain is an acknowledgement by network participants that the transaction took place and was not fraudulent. Each block contains information from the previous block, thus ordering chronologically, creating a chain of blocks (Nakamoto 2008). To add a block to the chain, it is necessary to solve a cryptographic puzzle, with the solution being included in the block (Wright and De Filippi 2015). It takes approximately ten minutes for the entire network of miners to solve this cryptographic puzzle (Ito et al. 2017). The new transactions must be verified by most users before being added to the ledger. This operation results in approximately a one-hour processing period, which is still a significantly shorter period than that of current financial institutions.

However, solving this puzzle takes specially created computers and consumes vast amounts of energy; hence this task is usually completed by miners. Miners are participants in the blockchain network that solve cryptographic puzzles in the hope of being the first to do so. If the miner is successful in solving the puzzle, they will be awarded 25 Bitcoins. This value halves periodically, as a maximum number of Bitcoins of 21 million has been assigned to control inflation (Nakamoto 2008; Vlasov 2017). Eventually, miners will not be awarded any coins for their work. This design could potentially result in network users refusing to mine cryptographic puzzles, as the cost of doing so is too high. To overcome such an issue, it is possible for the payer to assign a reward to the puzzle themselves, to encourage miners to work on this puzzle promptly. This is usually 1 micropayment, called a Satoshi, or 0.00000001 Bitcoin (Ron and Shamir 2012). In the future, when the maximum limit of 21 million Bitcoins is reached, the rewards of such Satoshis will be the only incentive for miners (Nakamoto 2008).

Proof of work is a key component of this system. As the decision of adding a block to the chain is a majority vote, it was important to decide what type of vote users would have. Instead of one-IP-one-vote systems, blockchain votes are determined by the pool operator and application-specific integrated circuits (abbreviated as ASICS) in large mining pools. This proof-of-work method ensures that the majority vote will always lie with the longest chain, as it has the majority of the computing power invested in it (Nakamoto 2008). Suggestions have been made in the past about substituting proof-of-work for a proof-of-stake method, which splits the blocks proportionally to miners’ wealth. It is suggested that this new method would increase the speed of blockchains, as well as reduce the chance of 51% attacks. At the same time though, this new method has not been incorporated into blockchain technology, which has remained unedited since its outset (Pilkington 2015; King and Nadal 2012).

Blockchain Benefits

Blockchain is anticipated to be a core foundational technology spanning multiple industries in the next ten years (Ito et al. 2017). This success of blockchain technology is down to its inherent characteristics and the benefits it provides to its users which include:

Anonymity

Anonymity is a key feature of this infrastructure which attracts individuals and organisations alike to implement it (Zyskind et al. 2015; Reid and Harrigan 2012). Blockchains allow users to only be identified by public keys, an essential element of the cryptosystem. It is encouraged that users generate as many public keys as necessary, with some users creating a new key for each transaction (Nakamoto 2008; Reid and Harrigan 2012). This feature allows any person or organisation to transact any sum of money to any place in the world, with no government intervention and extremely low transaction costs. This has seemed to attract many multinationals to the technology, with blockchain firms receiving $1 billion in investment from global companies such as American Express, Deloitte, Goldman Sachs and the New York Stock Exchange (Crosby et al. 2016).

Immutability

Immutability is a fundamental characteristic of blockchain and has been identified repeatedly as one of the reasons of its success thus far (Pilkington 2015; Tapscott et al. 2016; Iansiti and Lakhani 2017). By virtue of its design, changing one block in the chain would involve changing each subsequent block, as each block contains information of the previous (Nakamoto 2008). This is infeasible to the linear rate at which the chain expands, with new blocks being issued approximately every ten minutes (Böhme et al. 2015). Although this is seen widely as a strength, it could also be considered a disadvantage as it also means that it would be impossible to edit an entry to the chain, for example, to carry out a remedy or refund (Surujnath 2017). However, the majority believe this is a leading attribute of the system, redefining trust, not in people but in the mathematics behind the technology (Underwood 2016; Nofer et al. 2017).

Transparency

Blockchains can be categorised as being private or public. The sole distinction between a private and a public blockchain is that in a private blockchain context, also referred to as a permissioned blockchain, access to the network is restricted (e.g., an access-restricted platform controlled by a commercial entity, a private equity tracking tool for private equity agreements etc.). Conversely, public blockchains are a completely transparent distributed ledger, with all the users in the network being able to view all transactions that have occurred (Nakamoto 2008; Underwood 2016; Kosba et al. 2016). The allowance for all users to view previous transactions is largely linked to the immutability factor, thus protecting the chain from alterations and tampering (Iansiti and Lakhani 2017). Although it is argued that the lack of privacy could be considered an issue for some users, the transparent nature of the system has been more widely commended than not (Kosba et al. 2016). With multinationals like Deloitte, JP Morgan and Chase and Goldman Sachs investing in blockchain, it may soon become apparent if the transparency of their financial activities is less advantageous as initially thought (Garrod 2016). Blockchain technology has been proven to show characteristics of a disruptive technology, with many applications of the infrastructure being suggested. There has been considerable debate in the technology field as to whether blockchain technology can survive as its own entity, with many experts believing that it will not survive without a monetary value (Pilkington 2015). However, with many potential uses of such a concept, it is unlikely that it will only be utilised in the financial industry. The following are examples of potential blockchain use cases.

Blockchain Use Cases

Smart Contracts

The discussion of smart contracts was in existence long before the advent of blockchain, being first introduced in 1994 by Nick Szabo; however, it is one of the most deliberated uses of the technology to date (Surujnath 2017; Nofer et al. 2017; Kosba et al. 2016; Garrod 2016; Wright and De Filippi 2015). Smart contracts are defined as computer programs that automatically execute the terms of a contract, or contracts that are executed when user interfaces are combined with computer protocols (Crosby et al. 2016; Nofer et al. 2017). It has been argued that Szabo’s creative idea can turn into a reality as conducting smart contracts through a decentralised cryptosystem allows unknown and untrusted parties to transact securely, without the need of a third party (Kosba et al. 2016). Pilkington (2015) acknowledges the potential of the application of blockchain technology, discussing Ethereum as a model featuring this idea; however, the lack of transactional privacy has since been identified as a possible flaw to the implementation of smart contracts (Kosba et al. 2016). Potentially suitable contracts that could be created using blockchain include marriage contracts and transnational lending programs (Garrod 2016). A number of risks are involved with the use of smart contracts, such as volatility creating possible market bubbles, as well as the lack of regulation, and the irrevocability of agreements (Piazza 2017). In contrast to this, the risks incurred by smart contracts are greatly reduced in comparison to traditional because they are autonomous, self-sufficient and decentralised (Ross 2017). Because of smart contract’s infancy, the advantages and disadvantages may not be clearly defined yet (Surujnath 2017).

Supply Chain Management

It is often identified that supply chains are opaque to consumers, with it becoming increasingly difficult to identify where products originated and where they travelled to. Blockchain could be used in this instance as a transparent ledger that is available on each node and would create a formal log of tracking products in the supply chain (Pilkington 2015; Iansiti and Lakhani 2017). This idea of SCM through blockchain has been conceptualised by Walmart, who are employing the technology to track occurrences of bacteria in food and be aptly able to identify the source and limit the number of items needing to be recalled (Nofer et al. 2017). It has also been implemented in the diamond industry to end unethical behaviour (Nofer et al. 2017; Underwood 2016).

Voting Systems

The contemporary concept can also be extended beyond financial circles into online voting systems, as the anonymisation of data protects personal information, necessary for any voting technology (Zyskind et al. 2015; Extance 2015). By employing blockchain into voting systems, greater transparency would be in existence with each vote being accurately recorded (Pilkington 2015). It has also been suggested that in addition to voting politicians into power, it could also be used to change votes in the event of a political scandal, resulting in a politician no longer having the majority vote (Wright and De Filippi 2015). A blockchain voting system was utilised by the Danish political party Liberal Alliance for internal elections in 2014 (Pilkington 2015). In March 2018, Sierra Leone became the first country in the world to use blockchain to ensure trust and transparency in their presidential election process. Each vote cast in the election, which was monitored by an independent foundation called Agora, was recorded on a private permissioned blockchain (Kazeem 2018).

Micropayments

The use of blockchain technology is currently being incorporated into all Internet browsers and websites by expert programmers. However, it is feared that this may enable a ‘metered Internet’ in which micropayments may have to be paid (Wright and De Filippi 2015). A micropayment is defined as a very small payment, and in terms of cryptocurrency, this would be a Satoshi, or 10−8 Bitcoins (Ron and Shamir 2012; Hernandez 2017). It should be noted though that as the value of Bitcoins increases, a Satoshi may no longer be considered a micropayment and could potentially grow to be quite a large payment. This would be due to the volatility of the currency (Kiviat 2015; Richter et al. 2015). Micropayments would be most commonly sought after in relation to collecting royalties for musicians and artists for work distributed online (Wright and De Filippi 2015). One artist that collects such payments is Imogen Heap from the United Kingdom, who uses blockchain to sell her music (Tapscott et al. 2016). It has also been suggested that the implementation of micropayments would reduce the occurrence of spam mail, as each email would have a micropayment (Wright and De Filippi 2015). Bitcoin has become increasingly competitive in micropayments, but there is no reason to believe that more mainstream organisations would not reduce transaction costs to compete in this industry (Grinberg 2011).

Internet of Things

A suggested widespread utilisation of blockchain technology involves the Internet of things (IoT) in which all communications of smart devices are stored securely (Nofer et al. 2017). IBM and Samsung have already created a washing machine that uses IoT and blockchain technologies to order its own detergent when it is low, showing that what began as an experiment is now globally recognised (Garrod 2016). Blockchain enables IoT or smart devices to transact and communicate in real time, and with the rapid increase of ‘mobile wallets’, payments can be paid via mobiles (Wright and De Filippi 2015; Ross 2017). One suggested use of blockchain in IoT is as a settlement system. With millions of smart devices communicating and transacting with each other, it is not feasible for banks to process trillions of transactions in real time, and blockchain will come into play in these circumstances (Tapscott et al. 2016). Although not widely implemented yet, the potential is promising.

The Adoption of IT Innovations

IT innovations are now part of the popular business lexicon. Given the significant impact of IT innovations on organisations, IT innovation adoption has regularly been put under the spotlight over the past decades. There is a wealth of research demonstrating how IT innovations can influence every facet of a company and can lead to enhanced innovation, growth, performance, profitability efficiency and productivity (Barrett et al. 2015; Christensen et al. 2015).

According to Rogers (1995, p. 11), an innovation is “an idea, practice or object that is perceived as new by an individual or another unit of adoption”. Whereas innovation can allude to something abstract, like an idea, it can also manifest through new technology. An organisation’s decision to adopt an IT innovation can be conceptualised as “a decision to make full use of an innovative IT as the best course of action available” (Rogers 1995, p. 21). Many theories have been used to identify specific considerations that significantly or insignificantly impact the adoption of IT innovations in enterprises. Examples include the technology, organisational and environmental framework (Tornatzky and Fleischer 1990), the perceived e-readiness model (Molla and Licker 2005), the technology acceptance model (Venkatesh and Davis 2000), assimilation theory (Armstrong and Sambamurthy 1999) and theory of reasoned action (Ajzen and Fishbein 1980). For the purposes of this paper, we used the TOE framework as a lens to investigate our research question.

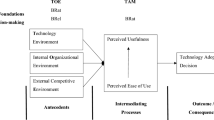

The main objective of the TOE framework (Tornatzky and Fleischer 1990) is to identify technological, organisational and environmental views that influence the adoption of IT innovations in organisations. These views can provide barriers and incentives to IT adoption. The technological view encompasses technological considerations such as complexity, relative advantage, privacy, security and compatibility which can impact existing IT systems in use or the new IT being considered for adoption (Rogers 1995; Treiblmaier and Pollach 2011). The organisational view refers to the internal considerations within an organisation such as prior IT experience, innovativeness, top management support, organisational size, information intensity and organisational readiness (Wang et al. 2010). The environmental view encompasses considerations which impact an organisation’s day-to-day business operations such as competitive and industry dynamics, government interactions and regulation (Lippert and Govindarajulu 2006).

Research Approach

Literature Review

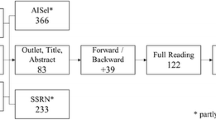

The primary objective of our literature review was to analyse the extant empirical research on blockchain to identify significant technological, organisational and environmental adoption considerations. An effective literature review not only makes a significant contribution to cumulative culture but also “creates a firm foundation for advancing knowledge. It closes areas where a plethora of research exists and uncovers areas where research is needed” (Webster and Watson 2002, p. 13). Our motivation was to produce a well-rounded understanding of blockchain adoption, which is currently lacking by carefully describing and then contrasting and comparing an array of sources on the topic. The first step in our analysis of the literature encompassed the sourcing of relevant research resources via scholarly databases and manual searches. To ensure the consistency and reliability of the search and data collection process, we used a three-stage literature mapping protocol (see Fig. 2.2) as prescribed by Kitchenham and Brereton (2013) to search, select, appraise and validate the literature. This mapping protocol ensured that we did not overlook relevant literature which may have been categorised under different headings. This protocol also helped the researchers to define the boundaries in which our review was conducted (e.g., inclusion and exclusion criteria). For the initial stage 1, we conducted a rigorous search of seven prominent databases to produce a research resource set which was representative of the status of personal analytics research: EBSCOhost, JSTOR, ProQuest, Google Scholar, PubMed, Scopus and Web of Knowledge. We selected these specific databases because of the multidisciplinary nature of blockchain research. We used the search strings ‘blockchain’ AND ‘adoption’, ‘blockchain’ AND ‘TOE’, ‘bitcoin’ AND ‘adoption’ and ‘bitcoin’ AND ‘TOE’. We included both theoretical and empirical studies and extracted significant considerations which influenced blockchain adoption.

Literature review mapping process. (Adapted from Kitchenham and Brereton (2013))

Given the dearth of research pertaining blockchain adoption, grey literature research resources (e.g., conference proceedings, research reports, issue papers, white papers etc.) were also included. Inaccessible research sources were excluded in cases where the library did not access to a full-text version or where the library was not subscribed to a publishing resource. All research resources were imported directly into an EndNote database. Using EndNote’s ‘find duplication’ feature, 70 duplicates were removed. The remaining research sources were further filtered using stage 2 and stage 3 of the mapping protocol. Stage 2 selection processes encompassed a decision-making process to include or exclude relevant research papers from the data extraction process. The “final decision took place when the research sources were read in parallel with data extraction and quality assessment. Stage 3 search and selection took place in parallel with data and quality extraction from the research sources identified in stages 1 and 2 and comprised three main tasks: search process validation, backward snowballing and researcher consultation” (Kitchenham and Brereton 2013, p. 8).

Table 2.1 presents an overview of the final 16 research resources which we used to identify salient technological, organisational and environmental blockchain adoption considerations.

Findings

Table 2.1 delineates blockchain studies which outline significant technological, organisational and environmental considerations which influence blockchain adoption. Table 2.1 was created based on a comprehensive literature review (Kitchenham and Brereton 2013). Table 2.1 enabled us to extract specific variables that were found to be significant in at least one of the studies, denoted by *. This process enabled us to then create Table 2.2 which provides a summary of the variables according to the number of times that were found to be significant.

As we can see in Table 2.2, specific TOE considerations stand out. From a technological perspective, several considerations emerged as important: perceived benefits, complexity and compatibility. Perceived benefits refer to the study’s/author’s perception of the benefits (e.g., immutability, security, fast transactions etc.) that will accrue by adopting blockchain technology. Complexity refers to the intrinsic challenges (e.g., validation algorithms, smart contract frameworks, DLT skills etc.) of developing blockchain technologies. Finally, compatibility refers to the ability of blockchain technologies to align with legacy systems (e.g., supply chain integration, system architectures, provider integration etc.). Next, three organisational considerations stand out: organisational readiness, top management support and organisational size. We provide a description of these three organisational considerations in relation to blockchain adoption in the next section. Finally, two environmental considerations emerged as important considerations: the regulatory environment and market dynamics. In terms of the regulatory environment consideration, with the advent of any new technology (e.g., cloud computing and safe harbour data agreement) that disrupts an industry, governments will need to review and resolve various related issues such as consumer protection, financial integrity and the lack of legislation which is specific to DLT. Market dynamics refers to the rapidly changing blockchain technological landscape which is forcing organisations to review their existing business processes to assess how they can use blockchain as a technology differentiator.

Discussion, Implications, Limitations and Conclusion

The research question at hand is, ‘What significant technological, organisational and environmental considerations influence blockchain adoption in organisations?’ Our work reveals important technological, organisational and environmental blockchain adoption considerations which can be used as a foundation for advancing the blockchain adoption research agenda. As a background for our subsequent discussion, we focus on how the significant blockchain adoption considerations identified in Table 2.2 can be used to catalyse the blockchain adoption research agenda. As can be seen in Table 2.2, the top three significant organisational considerations are (1) organisational readiness, (2) top management support and (3) organisational size. We will use the top three significant organisational considerations as mediating concepts to guide our discussion. Our reason for focusing on these three considerations is because organisational considerations are often viewed as the most significant determinants of IT innovation adoption in enterprises (Kimberly and Evanisko 1981; Tornatzky and Fleischer 1990; Damanpour 1991). As a result, organisational considerations, such as top management support, firm size, prior IT experience and innovativeness have been widely examined to ascertain the degree to which they constrain or act as a catalyst for the adoption of IT (Grandon and Pearson 2004; Van de Weerd et al. 2016).

Top Management Support

Top management support has been identified as a key recurrent factor critical to the adoption of IT innovations (Sabherwal et al. 2006; Bajaj 2000; Dong et al. 2009; Kulkarni et al. 2017). According to Jarvenpaa and Ives (1991, p. 205), “few nostrums have been prescribed so religiously and ignored as regularly as top management support in the development and implementation of IT”. We define top management support as “managerial beliefs about technological initiatives, participation in those initiatives, and the extent to which top management advocates technological advancement” (Kulkarni et al. 2017, p. 7). High levels of top management support for a specific IT innovation ensure the long-term vision, commitment and optimal management of resources, creation of a favourable organisational climate, support in overcoming barriers and resistance to change (Wang et al. 2010; Gangwar, Date and Ramaswamy 2015). In the context of blockchain adoption, top management support plays an important role because blockchain adoption may involve new regulatory requirements, a high degree of complexity, the acquisition of new resources, the integration of resources, the re-engineering of business-to-consumer and business-to-business transactions and information exchanges and the development of new skills and competencies (Swan 2015; Pilkington 2016; Lansiti and Lakhani 2017). A study conducted by Clohessy et al. (2018) confirmed that organisations that had adopted blockchain demonstrated high levels of management support. Furthermore, this study identified that within adopting organisations, top management support for blockchain grew gradually and was influenced by employees who were able to demonstrate real-world value of adopting blockchain in terms of creating blockchain prototypes which were underpinned by viable business models (Clohessy et al. 2018).

Organisational Readiness

Organisational readiness is conceptualised as the availability of specific organisational resources to adopt new IT innovations (Lacovou et al. 1995; Weiner 2009; Wang et al. 2010). This conceptualisation is frequently categorised under several headings, including human resources, financial and infrastructure facets. Human resources facets refer to the presence of employees with the requisite knowledge, skill and experience to adopt new IT innovations (Wang et al. 2010). Next, financial facets refer to the allocated financial resources an organisation commits to new IT innovations (Weiner 2009). While certain research has focused on the financial resources from the perspective of a specific IT innovation (e.g., Lacovou et al. 1995), in general, many studies have focused on financial resources from the perspective of any new IT innovation. Finally, infrastructure facets refer to existing IT platforms on which new IT innovations can be developed (Lacovou et al. 1995). When organisational readiness for a new IT innovation is high, an organisation’s management and staff are more likely to initiate change, exhibit greater effort and persistence and engage in enhanced cooperative behaviour (Weiner 2009; Wang et al. 2010). Consequently, this results in a more effective adoption of the new IT innovation. The exact influence of organisational readiness on the adoption of blockchain is currently unclear. While existing theoretical research suggests that organisational readiness has a significant influence on the adoption of blockchain (Swan 2015; Wang et al. 2016), there is currently a dearth of empirical studies which have confirmed that this is the case. A study conducted by Clohessy et al. (2018) confirmed that the presence of sufficient organisational readiness in terms of the availability of financial and employee resources and access to IT infrastructure have a positive influence on a company’s decision to adopt blockchain. This research conducted by Clohessy et al. (2018) also identified that the blockchain skills required by organisations for developing blockchain technologies could be categorised under the following technological competency headings: (1) foundational technology (e.g., cryptography, public key architecture); (2) distributed ledger technology (e.g., mining, consensus algorithms); (3) forensics and law enforcement (e.g., money laundering, darknet); (4) markets, economics and finance (e.g., game theory, business modelling); (5) industrial design (e.g., supply chain, IoT) and (6) regulations and standards (e.g., smart contracts and frameworks). Furthermore, the study confirmed that the availability and functionality of cloud-based blockchain development platforms were pivotal in triggering an organisation’s decision to adopt blockchain.

Organisational Size

Organisational size is considered an important predictor of blockchain adoption (Tapscott et al. 2016; Mendling et al. 2017). Extant research (e.g., Swan 2015) and industry reports (Clohessy et al. 2018) suggest that large organisations are more likely to adopt blockchain than small and medium enterprises (SME). Many past studies suggest that an enterprises’ willingness to adopt a new innovative IT is positively influenced by organisational size (Damanpour 1992). The reasoning behind this is that large organisations possess more complex and diverse facilities which positively contribute to adoption (Lee and Xia 2006). Microenterprises and SMEs, on the other hand, are susceptible to many barriers which constrain their ability to adopt IT innovations such as resource poverty (e.g., lack of IS personnel and expertise) and small IT budgets (Thong and Yap 1995). However, our research indicates that in the case of specific IT innovations, because of the characteristics of the technology and the flexibility and adaptability of microenterprises and SMEs, the opposite has been found. For example, empirical studies have shown that SMEs were more suitable and more inclined to adopt cloud computing technologies (Clohessy et al. 2017; Van de Weerd et al. 2016). Consequently, further empirical research is necessary to establish a consistent relationship between organisational size and blockchain adoption.

Implications

Practitioner and academic interest in the evolving phenomenon of blockchain is intense. Although this review cannot claim to be exhaustive, our study has outlined the benefits of blockchain technologies, provided an overview of potential business use cases and most significantly coalesced salient technological, organisational and environmental considerations which impact the adoption of blockchain technologies. Furthermore, we have provided an overview of how three of the main organisational considerations relate to the adoption of blockchain technologies. Our study can provide a useful quality reference source for practitioners and academics with an interest in blockchain and suggestions for future lines of research that will have strong implications for the practitioner community.

Limitations

It is worth highlighting some limitations and areas which may represent fruitful direction for additional research. First, we discussed three specific organisational considerations which influence a company’s decision to adopt blockchain. As highlighted in Table 2.2, we also identified environmental, technological and other organisation considerations which also merit further investigation. We envisage that future research which investigates these categories of considerations might result in a more comprehensive analysis of blockchain adoption. Second, blockchain is a relatively young concept, and there are few well-established theoretical frameworks or unified discourses. While it is felt that the sample of publications is representative of the blockchain adoption literature, there may be some bias associated with the narrow focus of the research resources under review. Additionally, there are potential research resources that investigate similar phenomena but discuss it with different terms, and thus, were difficult to find. We found throughout our survey of the literature that the only consistency pertaining to the concept of blockchain adoption is inconsistency. This fluid state of the blockchain field, in conjunction with the subjective nature of the literature review filtering process—necessary due to the inconsistent use of the term across disciplines/fields—limits this work. However, at the same time, it seems that increasing the focus would not change the general conclusions or provide additional insights. Finally, we would also like to acknowledge the potential for researcher bias. Nevertheless, from the initial research design, through to the development of the methodology and the reporting of the findings, our research made use of an audit trail and audit process (Schwandt et al. 2007). This ensured that our research was underpinned by rigour, authenticity and neutrality.

Conclusion

Using innovation theory (e.g., TOE framework), which has been extensively used to examine the adoption of IT in organisations, our research identified salient technological, organisational and environmental considerations which influence the adoption of blockchain by organisations. We also provided an overview of the blockchain concept and outlined the advantages and potential use cases that organisations contemplating adopting the technology can leverage. Every organisation is unique and has a different structure, culture, industry sectors, number of employees and so on. The combination of these factors affects an organisation’s approach to blockchain adoption. We hope that our research endeavours in this article to coalesce the significant blockchain adoption considerations will ignite the spark for both researchers and organisations to investigate these considerations further. Having “stood on the shoulders of giants” by reviewing the extant research on blockchain adoption, like many scholars and IT analysts, we strongly believe that the blockchain concept has the potential to become the new frontier of competitive differentiation. Janus was the roman god of beginnings and endings. We believe that blockchain also encapsulates that duality. It will put an end to traditional ways of doing things and usher in a new era for business and for the world at large. It will be divisive, pervasive and transformational all at the same time. It is time that organisations look ahead.

References

Ajzen, I., & Fishbein, M. (1980). A theory of reasoned action. Englewood Cliffs: Prentice-Hall.

Armstrong, C. P., & Sambamurthy, V. (1999). Information technology assimilation in firms: The influence of senior leadership and IT infrastructures. Information Systems Research, 10(4), 304–327.

Bajaj, A. (2000). A study of senior information systems managers decision models in adopting new computing architectures. Journal of the AIS, 1(1es), paper 4, 1–58.

Barrett, M., Davidson, E., Prabhu, J., & Vargo, S. L. (2015). Service innovation in the digital age: Key contributions and future directions. MIS Quarterly, 39(1), 135–154.

Bear, K., Drury, N., Korsten, P., Pureswaran, V., Wallis, J., & Wagle, L. (2016). Blockchain rewires financial markets: Trailblazers take the lead. IBM Institute for Business Value. Retrieved from: https://public.dhe.ibm.com/common/ssi/ecm/gb/en/gbp03469usen/GBP03469USEN.PDF. Accessed 26 July 2017

Böhme, R., Christin, N., Edelman, B., & Moore, T. (2015). Bitcoin: Economics, technology, and governance. Journal of Economic Perspectives, 29(2), 213–238.

Chen, G., Xu, B., Lu, M., & Chen, N. S. (2018). Exploring blockchain technology and its potential applications for education. Smart Learning Environments, 5(1), 1–10.

Christensen, C. M., Raynor, M. E., & McDonald, R. (2015). What is disruptive innovation. Harvard Business Review, 93(12), 44–53.

Clohessy, T., Acton, T., & Morgan, L. (2017). The impact of cloud-based digital transformation on IT service providers: Evidence from focus groups. International Journal of Cloud Applications and Computing (IJCAC), 7(4), 1–25.

Clohessy, T., Acton, T., Godfrey, R., & Houston, M. (2018, Forthcoming). The adoption of blockchain in Ireland: Examining the influence of organisational factors (A National University of Ireland Galway and Blockchain Association of Ireland Report).

Crosby, M., Nachiappan, P., Verma, S., & Kalyanaraman, V. (2016). Blockchain technology: Beyond bitcoin. Applied Innovation Review, 1(2), 6–10.

Damanpour, F. (1991). Organisational innovation: A meta-analysis of effects of determinants and moderators. Academy of Management Journal, 34(3), 555–590.

Damanpour, F. (1992). Organisational size and innovation. Organisation studies, 13(3), 375–402.

Dong, L., Neufeld, D., & Higgins, C. (2009). Top management support of enterprise systems implementations. Journal of Information Technology, 24(1), 55–80.

Extance, A. (2015). Bitcoin and beyond. Nature, 526(1), 21–23.

Eyal, I., & Sirer, E. G. (2013). Majority is not enough: Bitcoin mining is vulnerable. International Conference on Financial Cryptography and Data Security, pp. 436–454.

Folkinshteyn, D., & Lennon, M. (2016). Braving bitcoin: A technology acceptance model (TAM) analysis. Journal of Information Technology Case and Application Research, 18(4), 220–249.

Gangwar, H., Date, H., & Ramaswamy, R. (2015). Understanding determinants of cloud computing adoption using an integrated TAM-TOE model. Journal of Enterprise Information Management, 28(1), 107–130.

Garrod, J. Z. (2016). The real world of the decentralised autonomous society. tripleC; Communication, Capitalism & Critique. Open Access Journal for a Global Sustainable Information Society, 14(1), 62–77.

Google. (2018). Blockchain, Google trends. Retrieved from https://trends.google.com/trends/explore?date=2011-03-27%202018-03-27&q=blockchain. Accessed 27 Mar 2018.

Grandon, E. E., & Pearson, J. M. (2004). Electronic commerce adoption: An empirical study of small and medium US businesses. Information Management, 42(1), 197–216.

Grinberg, R. (2011). Bitcoin: An innovative alternative digital currency. Hastings Science & Technology Law Journal, 4(1), 159–208.

Guo, Y., & Liang, C. (2016). Blockchain application and outlook in the banking industry. Financial Innovation, 2(1), 1–12.

Hernandez, K. (2017). Blockchain for development-hope or hype? Institute for Development Studies, Rapid Response Briefing, 17, 1–4.

Iansiti, M., & Lakhani, K. R. (2017). The truth about Blockchain. Harvard Business Review. Retrieved from https://hbr.org/2017/01/the-truth-about-blockchain. Accessed 5 July 2017.

Ito, J., Narula, N., & Ali, R. (2017). The blockchain will do to the financial system what the internet did to media. Harvard Business Review. Retrieved from https://hbr.org/2017 /03/the-blockchain-will-do-to-banks-and-law-firms-what-the-internet-did-to-media?re ferral=03758&cm_vc=rr_item_page.top_right. Accessed 5 July 2017.

Jarvenpaa, S. L., & Ives, B. (1991). Executive involvement and participation in the management of information technology. MIS Quarterly, 15, 205–227.

Kazeem, Y. (2018). The world’s first blockchain-supported elections just happened in Sierra Leone. Retrieved from https://qz.com/1227050/sierra-leone-elections-powered-by-blockchain/. Accessed 29 Mar 2018.

Kiayias, A., & Panagiotakos, G. (2016). On trees, chains and fast transactions in the blockchain. IACR Cryptology, ePrint Archive, 1–30.

Kimberly, J. R., & Evanisko, M. J. (1981). Organisational innovation: The influence of individual, organisational, and contextual factors on hospital adoption of technological and administrative innovations. Academy of Management Journal, 24(4), 689–713.

King, S., & Nadal, S. (2012, August 1–19). PPCoin: Peer-to-peer crypto-currency with proof-of-stake (Self-published paper).

Kitchenham, B., & Brereton, P. (2013). A systematic review of systematic review process research in software engineering. Information and Software Technology, 55(12), 2049–2075.

Kiviat, T. I. (2015). Beyond bitcoin: Issues in regulating blockchain transactions. Duke LJ, 23(November), 569–608.

Kosba, A., Miller, A., Shi, E., Wen, Z., & Papamanthou, C. (2016). Hawk: The blockchain model of cryptography and privacy-preserving smart contracts. In M. Locasto & K. Butler (Chairs), 2016 IEEE Symposium on Security and Privacy (pp. 839–858), The Fairmont, San Jose, California, 23–25 May, IEEE Computer Society, Washington, DC. Retrieved from https://doi.org/10.1109/SP.2016.55. Accessed 4 July 2017.

Kulkarni, U. R., Robles-Flores, J. A., & Popovič, A. (2017). Business intelligence capability: The effect of top management and the mediating roles of user participation and analytical decision-making orientation. Journal of the Association for Information Systems, 18(7), 516–541.

Lacovou, C. L., Benbasat, I., & Dexter, A. S. (1995). Electronic data interchange and small organisations: Adoption and impact of technology. MIS Quarterly, 19(14), 465–485.

Lansiti, M., & Lakhani, K. R. (2017). The truth about blockchain. Harvard Business Review, 95(1), 118–127.

Lee, G., & Xia, W. (2006). Organisational size and IT innovation adoption: A meta-analysis. Information Management, 43(8), 975–985.

Lindman, J., Tuunainen, V. K., & Rossi, M. (2017). Opportunities and risks of blockchain technologies–A research agenda. Proceedings of the 50th Hawaii International Conference on System Sciences, Hawaii.

Lippert, S. K., & Govindarajulu, C. (2006). Technological, organisational, and environmental antecedents to web services adoption. Communications of the IIMA, 6(1), 147–160.

McKinsey. (2017). Blockchain technology in the insurance industry. Retrieved from https://www.treasury.gov/initiatives/fio/Documents/McKinsey_FACI_Blockchain_in_Insurance.pdf. Accessed 10 Aug 2017.

Mehta, D., & Striapunia, K. (2017). FinTech 2017, market size, business models, blockchain and company profiles (Statista report). Retrieved from https://www.statista.com/study/45600/statista-report-fintech/. Accessed 5 Aug 2017.

Mendling, J., Weber, I., van der Aalst, W., Brocke, J. V., Cabanillas, C., Daniel, F., et al. (2017). Blockchains for business process management-challenges and opportunities. arXiv preprint arXiv:1704.03610.

Molla, A., & Licker, P. S. (2005). Perceived e-readiness factors in e-commerce adoption: An empirical investigation in a developing country. International Journal of Electronic Commerce, 10(1), 83–110.

Morabito, V. (2017). Blockchain value system. In Business innovation through Blockchain. Cham: Springer International Publishing.

Nakamoto, S. (2008). Bitcoin; a peer-to-peer electronic cash system (Self-published paper), pp. 1–9.

Nofer, M., Gomber, P., Hinz, O., & Schiereck, D. (2017). Blockchain. Business and Information Systems Engineering, 59(3), 183–187.

O’Dair, M., Beaven, Z., Neilson, D., Osborne, R., & Pacifico, P. (2016). Music on the blockchain (Blockchain for creative industries research cluster report, pp. 1–29). Middlesex University.

Önder, I., & Treiblmaier, H. (2018). Blockchain and tourism: Three research propositions. Annals of Tourism Research, 72(C), 180–182.

Piazza, F. S. (2017). Bitcoin and the blockchain as possible corporate governance tools: Strengths and weaknesses. Penn State Journal of Law & International Affairs, 5(2), 262–301.

Pilkington, M. (2015). Blockchain technology: Principles and applications. Research Handbook on Digital Transformations (pp. 225–253). Retrieved from https://doi.org/10.4337/9781784717766.00019. Accessed 5 July 2017.

Pilkington, M. (2016). Chapter 11. Blockchain technology: Principles and applications. In Research handbook on digital transformations (p. 225). Cheltenham: Edward Elgar Publishing.

Reid, F., & Harrigan, M. (2012). An analysis of anonymity in the bitcoin system. In A. Pentland, J. Clippinger, & L. Sweeney (Chairs), 2011 IEEE Third International Conference on Privacy, Security, Risk & Trust/2011 IEEE Third International Conference on Social Computing, MIT Media Lab, Boston, Massachusetts, 9–11 October, IEEE, Washington DC, 1318–1236.

Richter, C., Kraus, S., & Bouncken, R. B. (2015). Virtual currencies like bitcoin as a paradigm shift in the field of transactions. International Business & Economics Research Journal, 14(4), 575–586.

Rogers, E. (1995). Diffusion of innovations (4th ed.). New York: Free Press.

Ron, D., & Shamir, A. (2012, February 27–March 2). Quantitative analysis of the full bitcoin transaction graph. In A. D. Keromytis & R. Hirschfeld (Chairs), International Conference on Financial Cryptography and Data Security (pp. 6–24), Springer, Bonaire/Heidelberg/. Retrieved from: https://www.researchgate.net/publication/235976346_Quantitative_Analysis_of_the_Full_Bitcoin_Transaction_Graph. Accessed 12 July 2017.

Ross, E. S. (2017). Nobody puts blockchain in a corner: The disruptive role of blockchain technology in the financial services industry and current regulatory issues. Catholic University Journal of Law and Technology, 25(2), 353–386.

Sabherwal, R., Jeyaraj, A., & Chowa, C. (2006). Information system success: Individual and organisational determinants. Management Science, 52(12), 1849–1864.

Schwandt, T. A., Lincoln, Y. S., & Guba, E. G. (2007). Judging interpretations: But is it rigorous? Trustworthiness and authenticity in naturalistic evaluation. New directions for evaluation, 2007(114), 11–25.

Seebacher, S., & Schüritz, R. (2017, May). Blockchain technology as an enabler of service systems: A structured literature review. In International Conference on Exploring Services Science (pp. 12–23). Cham: Springer.

Shrier, D., Sharma, D., & Pentland, A. (2016). Blockchain & financial services: The fifth horizon of networked innovation. MIT Science Connection, 1–10.

Surujnath, R. (2017). Off the chain! A guide to blockchain derivatives markets and the implications on systemic risk. Fordham Journal of Corporate & Financial Law, 22(2), 256–304.

Swan, M. (2015). Blockchain: Blueprint for a new economy. O’Reilly Media, Inc. Californa, US.

Tapscott, D., Tapscott, A., & Kirkland, R. (2016). How blockchains could change the world. McKinsey&Company. Retrieved from http://www.mckinsey.com/industries/high-tech/our-insights/how-blockchains-could-change-the-world. Accessed 5 July 2017.

Thong, J. Y., & Yap, C. S. (1995). CEO characteristics, organisational characteristics and information technology adoption in small businesses. Omega, 23(4), 429–442.

Tornatzky, L. G., & Fleischer, M. (1990). The processes of technological innovation. Lexington: Lexington Books.

Treat, D., McGraw, L., Helbing, C., & Brodersen, C. (2017). Blockchain technology: Preparing for change. Retrieved from https://www.accenture.com/t20160608T052656Z__w__/us-en/_acnmedia/PDF-5/Accenture-2016-Top-10-Challenges-04-Blockchain-Technology.pdf. Accessed 5 July 2017.

Treiblmaier, H., & Pollach, I. (2011). The influence of privacy concerns on perceptions of web personalisation. International Journal of Web Science, 1(1/2), 3–20.

Treiblmaier, H., Pinterits, A., & Floh, A. (2006). The adoption of public E-payment services. Journal of e-Government, 3(2), 33–51.

Underwood, S. (2016). Blockchain beyond bitcoin. Communications of the ACM, 59(11), 15–17.

Van de Weerd, I., Mangula, I. S., & Brinkkemper, S. (2016). Adoption of software as a service in Indonesia: Examining the influence of organisational factors. Information Management, 53(7), 915–928.

Venkatesh, V., & Davis, F. D. (2000). A theoretical extension of the technology acceptance model: Four longitudinal field studies. Management Science, 46(2), 186–204.

Vlasov, A. V. (2017). The evolution of E-money. European Research Studies, 20(1), 215–224.

Wang, Y. M., Wang, Y. S., & Yang, Y. F. (2010). Understanding the determinants of RFID adoption in the manufacturing industry. Technological Forecasting and Social Change, 77(5), 803–815.

Wang, H., Chen, K., & Xu, D. (2016). A maturity model for blockchain adoption. Financial Innovation, 2(1), 1–5.

Webster, J., & Watson, T. (2002). Analyzing the past to prepare for the future: Writing a literature review. MIS Quarterly, 26(2), xiii–xxiii.

Weiner, B. J. (2009). A theory of organisational readiness for change. Implementation science, 4(1), 1–9.

Wright, A., & De Filippi, P. (2015). Decentralised blockchain technology and the rise of lex cryptographia. Retrieved from http://ssrn.com/abstract=2580664. Accessed 9 July 2017.

Yu, D., & Hang, C. C. (2010). A reflective review of disruptive innovation theory. International Journal of Management Reviews, 12(4), 435–452.

Zyskind, G., Nathan, O., & Pentland, A. (2015). Decentralising privacy: Using blockchain to protect personal data. In C. Irvine, & Z. Peterson (Chairs), 2015 IEEE Computer Society Security and Privacy Workshops, The Fairmont, San Jose, 21 May, IEEE, Washington DC, 180–184.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 The Author(s)

About this chapter

Cite this chapter

Clohessy, T., Acton, T., Rogers, N. (2019). Blockchain Adoption: Technological, Organisational and Environmental Considerations. In: Treiblmaier, H., Beck, R. (eds) Business Transformation through Blockchain. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-98911-2_2

Download citation

DOI: https://doi.org/10.1007/978-3-319-98911-2_2

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-319-98910-5

Online ISBN: 978-3-319-98911-2

eBook Packages: Business and ManagementBusiness and Management (R0)