Abstract

We estimate linear regressions with dummy variables for the rates of return, spreads and volumes of stocks included in the main Warsaw Stock Exchange index WIG 20 to reveal the intraday trading patterns after the Universal Trading Platform was introduced in April 2013. In doing so we use the data rounded to nearest second and aggregated into that of 1 h frequency. The analysis shows that the spreads and volumes exhibit either the day of the week or the hour of the day effect or both. The spreads resemble the reversed J and the volumes are U-shaped. The rates of return are mostly positive but eventually decline at the end of the trading day. Some of them exhibit the hour of the day but not the day of the week effect.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Introduction

In this paper we shed light on the intraday trading patterns on the Warsaw Stock Exchange (WSE) after the Universal Trading Platform (UTP) was launched in April 2013 which many times speeded the processing of market orders, lowered the transaction costs and may attract large institutional investors who are involved in the algorithmic trading. To this end we first characterize empirical distributions of the rates of return, spreads and volumes of the most liquid stocks from the main WSE index WIG 20. Then we run regressions for the rates of return, spreads and volumes on dummies to test for whether they exhibit the day of the week and the hour of the day effects and if they do we evaluate their magnitude. In doing so we use the data on trade rounded to the nearest second from 15 April 2013 to 31 December 2016. The data comes from the Bank Ochrony Środowiska (BOS, Bank for Environmental Protection) brokerage house.Footnote 1 To the best of our knowledge this is the first report on the issue for the period covering operation of the new trading system.Footnote 2

The analysis shows that the spreads are shaped as the reverse J or close to that while the volumes remain U-shaped. They all exhibit the day of the week and the hour of the day effects. Most of the rates of return are positive and elevated at the beginning of daily trade and become negative as the trade continues during the day. They also rise and end positive at the Fridays’ close. Many of them exhibit the hour of the day effect but not the day of the week effect. These findings are in line with those of Wood et al. (1985), Smirlock and Starks (1986), Jain and Joh (1988), McInish and Wood (1991, 1992), Foster and Viswanathan (1993), Chan et al. (1995a, 1995b), Lee et al. (1993) as well as Chung and Zhao (2003) to name few who first have documented their patterns on the NYSE, NASDAQ and CBOE. They also accord with those on the stock market patterns in the UK (Kleidon and Werner 1995; Levin and Wright 1999; Chelley-Steeley and Park 2011; Ibikunle 2015), Canada (Mclnish and Wood 1990), Australia (Kalev and Pham 2009; Viljoen et al. 2014), France (Louhichi 2011; Tilak et al. 2013), Italy (Gerace and Lepone 2010), Spain (García-Machado and Rybczyński 2017); Greece (Panas 2005), Japan (Ohta 2006), South Korea (Ryu 2011), Taiwan (Chiang et al. 2006; Huang et al. 2012), Brazil (Da Costa et al. 2015), and Turkey (Bildik 2001; Köksal 2012).

We argue that wider spreads and elevated volumes during the first and the last trading hours on the WSE are due to an interplay between informed and liquidity traders and may be explained on the asymmetric information [(Madhavan 1992) and the inventory imbalance (Amihud and Mendelson 1987)] basis.

The remainder of the paper proceeds as follows. In Sect. “Model” we introduce a model to capture the intraday trade patterns on the WSE and sketch the way it is estimated and validated for stocks included in the WIG 20 index. In Sect. “Results” we discuss the results we arrived to. Section “Conclusion” briefly concludes.

Model

Since the trade at the main WSE market is continuingly effected from 9 a.m. through 4.50 p.m. we split each trading day into 8 time spells of the equal 1 h length but the last which we equal to 50 min. Then we fix variables exhibiting the intraday trade as follows. We compute the rate of return on stock for time spell t as its log difference of the close and the open. The spread for time spell t is a difference between the spell’s high and low. The volume for time spell t is equal to the aggregated volume of all within 1 h transactions. The model we use to reveal the intraday trade patterns becomes

where: y t —time spell t rate of return (spread, volume) on the stock in question, d it = 1 for day i of the week and 0 otherwise (i = 1 for Tuesday, …, i = 4 for Friday), h jt = 1 for time spell j of the trading day and 0 otherwise (j = 1 for 10–11 a.m., …, j = 7 for 4–4.50 p.m.), α, β i , γ j , θ ij —structural parameters, ϵ t —random error, t = 1, 2, …, T. As the sample observations begin on 15 April 2013 at the 9–10 a.m. time spell and run through 31 December 2016 until the 4–4.50 p.m. time spell T = 7414. For each time spell from Monday through Wednesday we have 187 observations, and for those of Thursday and Friday we have as much as 183 observations. Thus model (1) is the analogue to a 2-factor unbalanced ANOVA with interactions.

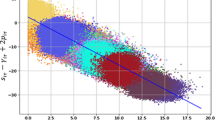

Our decisions regarding the specification of model (1) are undertaken both on the empirical and theoretical basis. Having sorted the aggregated data by the day of the week and the hour of the trading day accordingly we reveal for nearly all stocks from the WIG 20 index the inverted J intraday spreads as well the U-shaped volumes, and for many of them the elevated rates of return at the market open and close. We plot the exemplary intraday patterns for KGHM on Fig. 1.

We argue that the observed intraday trade patterns on the WSE can be explained on the asymmetric information and the inventory imbalance basis. Following Madhavan (1992) we assume that informed traders can benefit from the informational handicap at the onset of trading. As the trading continues and private information is impounded into prices the handicap declines and the spreads narrow. Moreover, wider spreads at the open and close, as pointed by Amihud and Mendelson (1987), enable traders to avoid overnight inventory imbalances. It is also noticed that high trading volume at the open and close can be attributed to portfolio holders who attempt to unwind positions at the start and end of the trading day (Chelley-Steeley and Park 2011).

In order to ascertain that model (1) properly exhibits the DGP for the stocks of interest we test for whether errors ϵ t are normally distributed and homoscedastic. To this end we use the Jarque-Bera and the Brown-Forsythe tests.Footnote 3 Since for all stocks we find strong departures from normality (see Table 1)Footnote 4 we decide to estimate our model by the OLS but on transformed y t variables. In doing so we apply the logarithmic (rate of return, spread) and the Box-Cox transformations (volume). Additionally, despite we transform variables accordingly the variances of ϵ t ’s for most stocks remain unequal across the days of the week and the hours of the trading day. In such circumstance to correct the OLS estimator for heteroscedasticity we use the Huber-White structural parameters variance-covariance estimator. Then we test for the following hypotheses of interest:

-

(A)

Nonexistence of all effects including the day of the week effect, the hour of the trading day effect and the joint effect, ∀ ij β i = γ j = θ ij = 0

-

(B)

In case hypothesis (A) is rejected the hypotheses of nonexistence of the day of the week effect and the joint effect, (Ba) ∀ ij β i = θ ij = 0, the hour of the trading day and the joint effect, (Bb) ∀ ij γ j = θ ij = 0, as well as the hypothesis of nonexistence of both effects, (Bc) ∀ ij β i = γ j = 0, are tested for

-

(C)

In case either hypothesis (Ba), hypothesis (Bb), or hypothesis (Bc) is rejected the hypotheses of nonexistence of the joint effect, (Ca) ∀ ij θ ij = 0, and individual effects, (Cb) ∀ i β i = 0 and (Cc) ∀ j γ j = 0, are tested for

-

(D)

Monday through Friday averages of y t are equal

-

(E)

9–10 a.m. through 4–4.50 p.m. time spell averages of y t are equal

-

(F)

9–10 a.m. and 4–4.50 p.m. time spell averages of y t are equal

The test statistics we use to test for hypotheses (A)–(F) are of the Wald type. Under the relevant null they are all distributed as χ2 variates with the number degrees of freedom equal to 39 (A), 32 (Ba), 35 (Bb), 11 (Bc), 28 (Ca), 4 (Cb), 7 (Cc), 4 (D), 7 (E) and 1 (F), respectively. We perform all computations in Stata 14.2.

Results

The estimation results for model (1) are similar in kind for all stocks included in the WIG 20 index.Footnote 5 We visualize the results for KGHM on Fig. 2 displaying the 1 h rate of return (top panel), spread (middle panel) and volume (bottom panel) predictive margins with 95% confidence intervals for the consecutive trading days. They resemble in shape those exhibited on Fig. 1. While the predictive margins for the rate of return for all trading days are almost the same across the 1 h time spells, the confidence intervals for the open are the widest and those around the lunch time are the narrowest. The predictive margins for the spread are like the inverted J. They are elevated at the open, fall as the trade continues during the day, reach their minima around the lunch time and then rise towards the end of the trading day. The predictive margins for volume behave similarly. Nonetheless, they almost equate those of the open.

We gather the testing results for hypotheses (A)–(F) for 5 most liquid stocks from the WIG 20 index in Table 2. The estimates from column A indicate that for all stocks we are to reject hypothesis (A) stating the nonexistence of all effects for the spreads and volumes but not for the rates of return. This is to say that the spreads and volumes of stocks of interest exhibit at least one such effect. The opposite applies to the rates of return except for ORLEN and PZU. More interestingly, the volumes show both effects, while the spreads display the hour of the day effect alone (see the estimates in columns Ca–Cc). The estimates from column D yields that the Monday through Friday averages of spreads and volumes are unequal, while those from column E indicate the same for the 9–10 a.m. through 4–4.50 p.m. time spells. Finally, the estimates from column F show that the spreads and volumes at the open and those at the close differ from each other. In sum, the testing results are supportive for the ad hoc conclusions we arrived to while we plot the aggregated data on the rates of return, spreads and volumes against time on Fig. 1.

Conclusion

We aggregate the data rounded to the nearest second on stocks included in the main WSE index WIG 20 from the period 15 April 2013–31 December 2016 into that of 1 h frequency. Then we run regressions for the rates of return, spreads and volumes on dummy variables to reveal their intraday patterns in times the Universal Trading Platform is operated. The analysis shows that the spreads resemble reverse J while the volumes remain U-shaped. They all exhibit the day of the week and the hour of the day effects. The rates of return behave differently being positive and elevated at the beginning of daily trade. They eventually become negative as the trade continues during the day. Many of them exhibit the hour of the day but not the day of the week effect. These findings are in line with those for the US, UK, Canada and other mature stock markets as well as for Turkey and Brazil.

Notes

- 1.

We extract the relevant information on stocks included in the main WSE index WIG 20 from the BOS brokerage house data bank at http://bossa.pl/notowania/, accessed on 15 Jan 2017.

- 2.

The earlier papers report on the WIG 20 intraday returns and the stealth trading (Będowska-Sójka 2010, 2014), the volatility smile (García-Machado and Rybczyński 2015) as well as on the intraday variability of stock market activity (Gubiec and Wiliński 2015) but for the antecedent trading system Warset.

- 3.

- 4.

The departures from normality are mainly due to the extremely fat tails and the right skew.

- 5.

They are available from the authors upon a request.

References

Amihud Y, Mendelson H (1987) Trading mechanisms and stock returns: an empirical investigation. J Financ 42(3):533–553

Będowska-Sójka B (2010) Intraday CAC40, DAX and WIG20 returns when the American macro news is announced. Bank i Kredyt 41(2):7–20

Będowska-Sójka B (2014) Intraday stealth trading. Evidence from the Warsaw Stock Exchange. Pozn Univ Econ Rev 14(1):5–19

Bildik R (2001) Intra-day seasonalities on stock returns: evidence from the Turkish stock market. Emerg Mark Rev 2(4):387–417

Brown MB, Forsythe AB (1974) Robust tests for the equality of variances. J Am Stat Assoc 69:364–367

Chan KC, Christe WG, Schultz PH (1995a) Market structure and the intraday pattern of bid-ask spreads for NASDAQ securities. J Bus 68(1):35–60

Chan K, Chung YP, Johnson H (1995b) The intraday behavior of bid-ask spreads for NYSE stocks and CBOE options. J Financ Quant Anal 30(3):329–346

Chelley-Steeley P, Park K (2011) Intraday patterns in London listed exchange traded funds. Int Rev Financ Anal 20:244–251

Chiang MH, Huang CM, Lin TY, Lin Y (2006) Intraday trading patterns and day-of-the-week in stock index options markets: evidence from emerging markets. J Financ Manag Anal 19(2):32–45

Chung KH, Zhao X (2003) Intraday variation in the bid-ask spread: evidence after the market reform. J Financ Res 26(2):191–206

Da Costa AS, Ceretta PS, Müller FM (2015) Market microstructure – a high frequency analysis of volume and volatility intraday patterns across the Brazilian stock market. Br J Manag 8(3):455–462

Foster FD, Viswanathan S (1993) Variations in trading volume, return volatility, and trading costs: evidence on recent price formation models. J Financ 48(1):187–211

García-Machado JJ, Rybczyński J (2015) Three-point volatility smile classification: evidence from the Warsaw Stock Exchange during volatile summer 2011. Investigaciones Europeas de Dirección y Economía de la Empresa 21:17–25

García-Machado JJ, Rybczyński J (2017) How Spanish options market smiles in summer: an empirical analysis for options on IBEX-35. Eur J Financ 23(2):153–169

Gerace D, Lepone A (2010) The intraday behaviour of bid-ask spreads across auction and specialist market structures: evidence from the Italian market. Australas Account Bus Financ J 4(1):29–52

Gubiec T, Wiliński M (2015) Intra-day variability of the stock market activity versus stationarity of the financial time series. Phys A 432:216–221

Huang PY, Ni YS, Yu CM (2012) The microstructure of the price-volume relationship of the constituent stocks of the Taiwan 50 index. Emerg Mark Financ Trade 48(Supplement 2):153–168

Ibikunle G (2015) Opening and closing price efficiency: do financial markets need the call auction? J Int Financ Mark Inst Money 38:208–227

Jain PC, Joh GH (1988) The dependence between hourly prices and trading volume. J Financ Quant Anal 23(3):269–283

Jarque CM, Bera AK (1987) A test for normality of observations and regression residuals. Int Stat Rev 55:163–172

Kalev PS, Pham LT (2009) Intraweek and intraday trade patterns and dynamics. Pac Basin Financ J 17:547–564

Kleidon AW, Werner IM (1995) Effects of geography and stock-market structure: a comparison of cross-listed securities. Stanford Graduate School of Business Research Paper No. 1348

Köksal B (2012) An analysis of intraday patterns and liquidity on the Istanbul Stock Exchange. Central Bank of the Republic of Turkey. Working Paper No. 12/26

Lee CMC, Mucklow B, Ready MJ (1993) Spreads, depths and the impact of earnings information: an intraday analysis. Rev Financ Stud 6:345–374

Levin EJ, Wright RE (1999) Why does the bid-ask spread vary over the day? Appl Econ Lett 6(9):563–567

Louhichi W (2011) What drives the volume-volatility relationship on Euronext Paris? Int Rev Financ Anal 20:200–206

Madhavan A (1992) Trading mechanisms in securities markets. J Financ 47(2):607–641

McInish TH, Wood RA (1991) Hourly returns, volume, trade size, and number of trades. J Financ Res 14(4):303–315

McInish TH, Wood RA (1992) An analysis of intraday patterns in bid-ask spreads for NYSE stocks. J Financ 47(2):753–764

Mclnish TH, Wood RA (1990) An analysis of transactions data for the Toronto Stock Exchange: return patterns and end-of-the-day effects. J Bank Financ 14:441–458

Ohta W (2006) An analysis of intraday patterns in price clustering on the Tokyo Stock Exchange. J Bank Financ 30:1023–1039

Panas E (2005) Generalized beta distributions for describing and analyzing intraday stock market data: testing the U-shape pattern. Appl Econ 37:191–199

Ryu D (2011) Intraday price formation and bid-ask spread components: a new approach using a cross-market model. J Futur Mark 31(12):1142–1169

Smirlock M, Starks L (1986) Day-of-the-week and intraday effects in stock returns. J Financ Econ 17(1):197–210

Tilak G, Széll T, Chicheportiche R, Chakraborti A (2013) Study of statistical correlations in intraday and daily financial return time series. In: Abergel F et al (eds) Econophysics of systemic risk and network dynamics, New economic windows. Springer, New York, pp 77–104. ch. 6

Viljoen T, Westerholm PJ, Zheng H (2014) Algorithmic trading, liquidity and price discovery: an intraday analysis of the SPI 200 futures. Financ Rev 49:245–270

Wood RA, McInish TH, Ord JK (1985) An investigation of transactions data for NYSE stocks. J Financ 40:723–739

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this paper

Cite this paper

Miłobędzki, P., Nowak, S. (2018). Intraday Trading Patterns on the Warsaw Stock Exchange. In: Jajuga, K., Locarek-Junge, H., Orlowski, L. (eds) Contemporary Trends and Challenges in Finance. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-319-76228-9_6

Download citation

DOI: https://doi.org/10.1007/978-3-319-76228-9_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-76227-2

Online ISBN: 978-3-319-76228-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)