Abstract

Since the global economic crisis of 2007–08 an increasing amount of attention has been directed to the links between the financial system and the real estate industry. This paper ties to this discussion insofar as it focuses on the relationship between the methodology of property valuation and the recent non-agency or subprime crisis. After a brief discussion of the crisis various questions are raised concerning both the theoretical background and the application of property valuation, property management and automated valuation modelling. Despite the magnitude of the crisis in terms of the financial loss suffered, our observation is that the mainstream real estate academia is still essentially preoccupied with the task of integrating financial and property markets. Apparently, after the crisis financial models based on the concept of perpetual increasing income are still used, and deterministic relations between value and property characteristics still constitute the dominant paradigm. In the hope of avoiding repeating the errors that led to the crisis we identify the need to analyse this crisis from a property valuation point of view. We contend that in-depth analysis of the tools used in property valuation is necessary to understand why and how valuation methods should be improved given recent experiences.

Although the work was carried out in strict cooperation between the two authors, we may approximate the following share of responsibilities between the authors: Sects. 1 and 4 were written by Tom Kauko whereas Sects. 2 and 3 were written by Maurizio d’Amato.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

When the global financial crisis and economic downturn begun 2007–08 attention was directed to the ways in which the financial system was attached to real estate—a hitherto forgotten sector within the world economy. Suddenly property price indices had stopped growing and in many countries a downward turn was a new, frightening reality (see Martin 2011; Kušar 2012). That the property prices will always grow in the long run, was a conventional wisdom; that in the long term property is the safest investment, was another one. Greed however is always about short term, and, as most of the industrialised world would find out soon, greed combined with market ignorance and liberal regulations has devastating consequences—perhaps even in the long term.Footnote 1 While the situation caught many real estate investors ‘with their pants down’, also the actions of intermediating real estate analysts—in particular, the relationship between brokers and the appraisers—became embarrassing to follow. Brokers often made the choice of a specific appraiser conditional upon a specific valuation result. The erroneous idea of an ever growing and stable property price trend had become a fundamental perception and basis for the most part of the methodological income approach to property valuation. At the time of writing the crisis is still going on, has worsened and is getting worse (for reasons that go beyond the scope of this contribution). This has implications for the real estate industry in general and valuation procedures in particular. The new question we want to air is as to whether the crisis has stimulated the real estate industry to be more humble towards ‘getting the valuations right’. At the same time valuation automata has become increasingly widespread and is already an established tool in mortgage appraisal as well as tax assessment. The legitimate worry is that such new valuation and mass appraisal tools launched will only replicate the old mistakes made. Given this tendency, two research questions can be formulated: why and how should valuation methods be improved to cope with extreme magnitudes of cyclical market fluctuations? What then exactly went wrong? What would be such a ‘better’ valuation tool? Are the prospects of developing something entirely different yet feasible realistic at all? This paper raises some issues concerning the relation between real estate appraisal methods and the real estate market crisis. Our contribution focuses on a specific aspect of the so called non-agency mortgage crisis (or subprime crisis). Non-agency mortgages are mortgages borrowed by persons who do not normally have the requisites to obtain financial funds from a bank (through agency mortgages). In several articles, books and documentary TV-programs the origin of the crisis is explained in such a way that it appears to be related only to the financial world. We consider this proposition incorrect; namely, we strongly believe that this crisis may stimulate a discussion on the role of real estate to the extent the (global) financial system is being supported by valuation and automated valuation modelling. The text is organized in four sections as follows. After this introduction Sect. 2 deals with the origin and the characteristics of the crisis. Section 3 takes issue with the inherent limitations of appraisal methods and automated valuation modelling methodologies. Final remarks will be offered at the end (in Sect. 4).

2 A Glance at the 2008 Crisis

According to Garton (2009), the root cause of the crisis is that in 2007 panic occurred due to the lack of knowledge of the details about the institutional settings and design of the ‘shadow banking system’ which had emerged by the early 2000s. He concludes that this lack of detailed understanding has four elements: (1) the sensitivity of the chain of interlinked securities to house price trends; (2) the creation of symmetric information via complexity; (3) the opaque way of spreading the risk; and (4) the trade in asset backed security indices linked to subprime bonds. It could be said that the financial crisis begun when the real estate prices and price indices in the US—and later more globally—ceased to rise. As it were, irrational exuberance (Greenspan 1996; Shiller 2000) had exposed the limit of the false myth of forever increasing real estate market prices.Footnote 2 As is now well-known also for the lay person, the crisis escalated because investment banks, during the growing real estate price trend, discovered the real estate products, and decided to buy more and more real estate mortgages. All these mortgages were securitized in financial products called Collateralized Debt Obligations. Other similar financial vehicles were Collateralized Mortgage Obligations and Collateralized Loan Obligation. The name of the vehicle changed according to the nature of the underlying asset. For example in Collateralized Debt Obligations several kinds of debt from different sources (study loans, mortgages and so forth) were collected together and sold. Three rating agencies gave the highest reliability rating (triple A) for these collateral debt obligations; as a consequence, several financial institutions in the globalized financial market bought an enormous amount of these toxic assets. The high rating guaranteed the reliability of this kind of assets. Subsequently investment banks begun to collect money from investors for investing in these kinds of financial vehicles; this occurred through a procedure where the collateral was treated as a real estate asset that is always regularly paid by the borrower. However, in many cases there was no reasonable expectation of the borrower actually being able to complete the back-payment deal. When analysing the situation it is crucial to note that the rating of the importance of the abovementioned financial tools was tied to the real estate world. As a consequence, estate agents (realtors) begun to increase the volume of their mortgages. Under the pressure of benefiting from an improved profit opportunity they started buying more and more non-agency mortgages from the realtors. Under the same pressure the realtors manipulated non-agency mortgage relying on the implicit assumption that real estate is an ever growing sector. As a consequence the non-agency mortgage which are composed by three different categories: prime jumbo, alt-A and the well known subprime increased dramatically, especially the last of these categories. The dollar amount in subprime mortgage (one of the three non-agency mortgage types) passed from 332 Billion US Dollars in 2003 to 1.3 Trillion USD in 2007—thus the rate of increase was as high as 292 %.Footnote 3 In the meantime the Collateralize Debt Obligations were insured against a possible default by insurance companies. In particular, the insurance company AIG was one of the most important players in this field. In this company decisions were made based on an ever increasing property market price trend. This happened under the surveillance of the President of Federal Reserve. For this reason Abelson (2007) wrote the following statement: “Financial mischief on such a grand scale is not a one man job, and Mr. Greenspan, needless to say, had a lot of help from Wall Street, Washington…and just as the contempt for risk that made possible the gross extravagances in housing and the financial market was sustained by confidence that Mr G would always bail out the participants”. The fact that all the financial institutions had this kind of asset in their portfolio assisted to another important change: the introduction of a new accounting standard in 2007 and exactly the Financial Accounting Standard nr. 157 introducing the concept of mark to market value. This new criteria compelled the owner of this asset to adjust its value at the current—thus inflated—price of the asset. All the financial institutions with important quantities of these kinds of assets suffered heavy losses as the property market prices begun to fall. Lehman Brothers was one of them.

3 The Role of Property Valuation Methods Herein

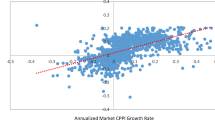

When we speculate about the real estate appraiser’s role in the type of market and behavioural context discussed above, a number of methodological issues stand out. Dealing with these issues also adds to the discussion after one of the most remarkable economic crises in the modern history of mankind. It is well known that property valuation relies on three different basic approaches: market-sales, income and cost. In this contribution three different problems are raised concerning property valuation both in the market-sales and the income approach. The first issue is related to the market approach. In this method the opinion of value is reached by observing the price and the characteristics of comparable properties (Appraisal Institute 2011); in particular, property valuers (appraisers) search for comparable data to document in the valuation report (appraisal report). Unfortunately “… [w]hen a broker orders a valuation (an appraisal), he provides an estimate or target value for the property to the appraiser. If the appraiser has problem consistently reaching this number, the broker will hire someone else…” (Bitner 2008, p. 92). In this way appraisers may be tempted to include only those comparables which would allow them to reach the broker’s target value in the appraisal. As a consequence, another interesting part of a valuation (appraisal) using the market approach concerns the excluded comparables. Normally, one is obliged to include sufficiently similar observations that are also situated near each other. However, the issue about which ones to leave out because of insufficient similarity is not formally specified.Footnote 4 Furthermore, the reason why an appraiser should exclude some of the collected market data from the appraisal report is not obvious. Showing both the comparable selected and the data excluded in the appraisal report may improve the transparency of the valuation, thereby giving a specific justification of the selection and exclusion process. A second issue can be raised about the income approach.Footnote 5 The application of income approach is based on different theoretical appraisal models whose background is the financial mathematics. Two models are based on the income approach (IVSC 2011, IVS230, C6-C21): one, direct capitalization which is a process that transforms an infinitive group of rents into a value, and two, yield capitalization which is a process that transforms a finite group of rents into a value (Appraisal Institute 2011). Furthermore, a discount cash flow analysis is an appraisal method which discounts a series of cash flows and then sums these to a direct capitalization (going out value) at the end of a holding period. Normally these methods are applied on income producing properties, when available comparable transactions are unavailable. The applications of the direct capitalization model are based on a constant or variable rent which is transformed into value using a capitalization rate normally extracted by the market. In this process there is a separation by time series analysis of the cycle which requires time and data and the day by day problem of appraising a property. This is particularly true in the commercial market. In some cases the direct capitalization technique is referred to a current rent. In other cases like in the calculation of scrap value,Footnote 6 the direct capitalization is often based on a capitalization rate calculated as the difference between the discount rate and a growth factor (g-factor). The value is assumed to increase into the infinity! Neither the direct capitalization nor the yield capitalization model takes the real estate market cycle into account, because of an ‘information gap’ between appraisal. In the scientific debate an immediate comparison among different approaches may be not the most important issue. We need to explore the limitation and the powerfulness of actual and perspective tools we have and we may decide to adopt or test in the future. Academia has different time horizon than AVM industry. The most important things in this book are not the research results but the attempt to increase our level of knowledge in this sector of research practice and real estate market cycle analysis.Footnote 7 The former usually operates in a static setting, despite being influenced by market dynamics too. This procedure is chosen because of convenience rather than theoretical or empirical insight. While such an attitude does not necessary produce incorrect point estimates, it perhaps justified to argue here that financial modelling in real estate appraisal should consider the role of real estate market cycles (d’Amato 2004). On the other hand, this would increase the complexity of the valuation task at hand. A third issue can be raised about the valuation that supported the REI Global, the real estate vehicle of Lehman Brothers. The failure of Lehman brothers in fact relates to the diversification techniques of REI Global, whose 80 % portfolio was composed by commercial property. In an article of the Wall Street Journal this is explained as follows: “When it failed the estates of the collapsed investment bank listed its real estate holding as valued at 23 billion of dollars…The 23 billion of dollars has been written down substantially. In all, Lehman expects to receive some of 13.2 billion dollars between 2011 and 2014…”. After reading this it would be interesting to understand how the large real estate position of one of the most important investment banks has been valued. At the moment we know that Lehman and brothers was one of the most important players in commercial property before it collapsed. At the third anniversary of its bankruptcy it still remains the most important owner and seller in this property market segment. Let us consider the problem from a different point of view. It is a simple overturn of the market—the omnipresent force; therefore we can go back to our everyday task without asking ourselves if the methodological tools we use have a ‘worm’? Can these big commercial buildings/portfolios be considered ‘too big to be valued’ with our present methodological valuation tools? These are interesting questions that can be raised in one of the most transparent property markets in the world. Probably we need a stronger integration between valuation methodologies and real estate market cycles (d’Amato 2015) in order to deal with market phases in a clear way, especially when dealing with large commercial assets. In this vein, a related question can be raised about the diversification of a property portfolio? Was the Lehman portfolio increased using a deal-by-deal approach? This means analysing the single risk return profile of each single property investment without analysing the general risk profile of the property portfolio. This approach unfortunately is also included in important institutional documents such as the European Property and Market Rating of TeGOVA (TeGOVA 2003; Renigier Biłozor et al. 2014a, b; Renigier-Biłozor and Biłozor 2016a, b; Biłozor and Renigier Biłozor 2016; Salvo et al. 2015; Kauko and d'Amato 2011). In this document each property in portfolio receives a rating; unfortunately the most important problem of the portfolio policy is the correlation among several assets belonging to the same portfolio which has been completed omitted. Lehman Brothers may teach us something here. Moreover, yet another question related to the application of multiple regression models as automated valuation methods comes up in this vein. It is to observe that the relationship between price and the property characteristics (including environmental and area specific attributes) is deterministic. Such models have been applied extensively in order to control the property valuation or in combination with the appraisal report, particularly in the valuation of portfolios and secondary mortgage markets (Downie and Robson 2007; Borst et al. 2008; Ciuna et al. 2014; d’Amato 2008, 2010) Probably there is a strong necessity to improve hedonic modelling performance in the downturn of a real estate market cycle, or perhaps a question may be raised as to the deterministic relation that links the property price to the building characteristics. Doubts are being raised as to whether research on the relationship between ‘heretic’ and ‘orthodox’ automatic valuation mass appraisal modelling, a term coined previously (d’Amato and Kauko 2008; d’Amato and Siniak 2008; Kaklauskas et al. 2012), leads to any helpful guidance for selecting the appropriate AVM methodologies in a downwards sloping phase of the real estate market. Given the relationship between market dynamics and valuation practice discussed above, it comes hardly as a surprise that the subprime crisis has raised efficiency problems for automated valuation modelling as a method to appraise property. In our view various plausible methodologies—both deterministic and non deterministic ones—ought to be explored, and try to adapt a valid method for a given institutional property context. This relationship furthermore varies significantly across different parts of the world. This stretches economic geographer Martin’s (2011) point about price bubbles and busts being highly unevenly distributed in space a step further. Indeed, the downturn makes it much more difficult to track value using any kind of existing automated valuation method—especially the method based on deterministic relation between price and characteristics. In the downturn phase of the market it may be more helpful to deal with relationships between price and the property characteristics in a flexible way than to chase a deterministic relationship within the confines of the current valuation/appraisal modelling methodology. The relationship between AVM and valuation (appraisal) indeed is an interesting one. Fleshing out this connection an article in the Washington Post noted opportunity of replacing all real estate appraisals with automatic valuation (Woodward 2008). However, the President of the Appraisal Institute, Wayne Pugh, countered this idea by noting that “no automated valuation system has successfully replaced human inspection and analysis” (Pugh 2008). Here the legislation has been coherent with Pugh’s point of view insofar as the Dodd Frank Act is concerned. Dodd Frank Act implements financial regulatory reform after the financial crisis of 2008. In particular the title XIV subtitle F distinguishes appraisal process from automated valuation modelling, reorganizing both. In particular it was stressed how the role of valuation (appraisal) cannot be replaced by AVM. Our point of view is coherent with the Dodd Frank act (and thereby also Pugh’s view but not Woodward’s): automated valuation modelling is increasingly adaptable in describing real estate market behaviour without succeeding in replacing local information and human inspection in the valuation (appraisal) procedure. In sum the market approach, the income approach and the AVM based portfolio appraisal approach all have their proponents and opponents. We have showed how each of these three problem areas involves room for error but also optimistic improvement. The last section offers some more philosophical thoughts along these lines.

4 Final Remarks

As the discussion so far has shown, a number of issues concerning appraisal methodology need to be dealt with in order to improve the body of knowledge that govern this important and systemic crisis. This role of the subprime crisis is yet unexplored. However, this paper does not want to offer instant solutions to the problem of sorting out how appraisal methods and the non-agency mortgage crisis are tangled into each other. After all, factoring in any new criteria such as corporate social responsibility will be subject to validation and calibration of the valuation/appraisal model and then we are back in square one. Instead, and as a first step towards an innovative and responsible agenda, we have raised some research questions for the appraisal world.

First we can ask why we have a responsibility to take into account the complexity of the sensitivity to macro cycles when applying a valuation method. After that we can ask how this complexity ought to be dealt with. Both questions should be helpful in understanding the plausible relationship between the way the appraisal world functions and the systematic properties of the crisis. In particular, in the market approach the appraiser could complete the appraisal report by also indicating which comparables were eventually selected and which comparables excluded, thereby offering a clear and transparent process of valuation. The income approach may require an effort to understand how our knowledge on real estate market cycles can be incorporated into financial modelling (cf. d’Amato and Kauko 2012). Yet another issue is the improvement of automated valuation modelling when the phases of the real estate market cycle change (see Downie and Robson 2007; see also AVM-News 2008; Allen 2011). The challenge here is to be able to perform self-correcting behaviour in an environment that may be conservative and demented. Garton’s (2009) identification of the difficulties to understand the structure of ‘the shadow banking system’ led to the panic of 2007. Elsewhere, complexity economics—an evolving subdiscipline that integrates complexity theory onto economics—is promoted as an improvement on the analysis of real estate and capital markets (e.g. Smith 2004; Miller and Page 2007). Other enlightened views surely exist too, but to what extent are they noted by the mainstream? Above all there is a risk we see and subsequently try to emphasize: namely, this great crisis may pass without seeing any change in the methodological background of appraisal process and automated valuation modelling. How this exactly is done is however another matter—one which only recently is beginning to emerge in discussions among the valuation community. Mooya (2011), for instance, argues for a new ontology to take over the current one, as this would be a response to the opportunities opened up in amidst the recent “alterations in the social reality” and that the real issue goes far beyond a comparison of AVM based and human valuation methodology; in fact, to involve alternative conceptualisations of market value. We strongly think that the real estate industry together with the realm of academic analysis needs these kinds of changes in thinking and perhaps many other changes too.

Notes

- 1.

Munasinghe (2010) estimates the inflated financial values—toxic assets—at twice the annual global GDP.

- 2.

The phrase irrational exuberance was (to our knowledge) used for the first time by the then Federal Reserve Board Chairman, Alan Greenspan, in a speech given at the Annual Dinner of The American Enterprise Institute for Public Policy Research, in Washington, D.C., on 5 December, 1996. The phrase was interpreted as a warning that the market prices of stocks might be overvalued. (This is furthermore the title of one of the most important books of Robert Shiller.).

- 3.

Testimony of Emory W. Rushton, Senior Deputy Comptroller and Chief National Bank Examiner, Office of the Comptroller of the Currency (OCC), before the Senate Banking Committee (March 22, 2007). OCC’s primary mission is to charter, regulate, and supervise all national banks and federal savings associations, federal branches and agencies of foreign banks. OCC supervises banks and federal savings associations to control that “they operate in a safe and sound manner and in compliance with laws requiring fair treatment of their customers and fair access to credit and financial products”.

- 4.

To overcome a related methodological difficulty of comparable versus target cases was demonstrated by Kauko (2009), albeit not for valuation context but local housing market analysis.

- 5.

The general equation P = R/i, where P is price, R is rent and i is the reasonable rate of yield expected from the investment.

- 6.

Scrap value or terminal value is the final capitalization at the end of a holding period in a Discount Cash Flow Analysis.

- 7.

This can be seen as part of a broader ‘knowledge gap’ in market value analysis (see Mooya 2011).

References

Abelson, A. (2007). After the Greenspan Put…, Barron’s, August 13.

Allen, S. (2011). The Triage Approach To Estimating Value. Service Management, September, www.sm-online.com. Retrieved January 23, 2012.

Appraisal Institute. (2011). The Appraisal of Real Estate (13th ed.).

AVM News. (2008). e-newsletter. issue July, August.

Biłozor, A., & Renigier-Biłozor, M. (2016). The procedure of assessing usefulness of the land in the process of optimal investment location for multi-family housing function. In World Multidisciplinary Civil Engineering-Architecture-Urban Planning Symposium. WMCAUS 2016 Praga.

Bitner, R. (2008). Confessions of a subprime lenders. An insider’s tale of greed, fraud and ignorance. London: Wiley.

Borst, R. A., Des Rosiers, F., Renigier, M., Kauko, T., & d’Amato, M. (2008). Technical comparison of the methods including formal testing accuracy and other modelling performance using own data sets and multiple regression analysis. In T. Kauko & M. d’Amato (Eds.), Mass appraisal an international perspective for property valuers. Wiley Blackwell.

Brown, E. (2011). Lehman still loom large in commercial real estate. Wall Street Journal, September 12.

Ciuna, M., Salvo, F., & De Ruggiero, M. (2014). Property prices index numbers and derived indices. Property Management, 32(2), 139–153. doi(Permanent URL):10.1108/PM-03-2013-0021.

d’Amato. (2010). A location value response surface model for mass appraising: An “Iterative” location adjustment factor in Bari, Italy. International Journal of Strategic Property Management, 14, 231–244.

d’Amato, M. (2015). Income approach and property market cycle. International Journal of Strategic Property Management, 29(3), 207–219.

d’Amato, M., & Kauko, T. (2012). Sustainability and risk premium estimation in property valuation and assessment of worth. Building Research and Information, 40(2), 174–185.

d’Amato, M. (2004). A comparison between RST and MRA for mass appraisal purposes. A case in bari. International Journal of Strategic Property Management, 8, 205–217.

d’Amato, M. (2008), Rough set theory as property valuation methodology: The whole story. In Kauko & M. d’Amato (Eds.), Mass appraisal an international perspective for property valuers (Chap. 11, pp. 220–258). Wiley Blackwell.

d’Amato, M., & Kauko, T. (2008). Property market classification and mass appraisal methodology. In T. Kauko & M. d’Amato (Eds.), Mass appraisal an international perspective for property valuers (Chap. 13, pp. 280–303). Wiley Blackwell.

d’Amato, M., & Siniak, N. (2008). Using fuzzy numbers in mass appraisal: The case of belorussian property market. In T. Kauko & M. d’Amato (Eds.), Mass appraisal an international perspective for property valuers (Chap. 5, pp. 91–107). Wiley Blackwell.

Downie, M. L., & Robson, G. (2007). Automated valuation models: An international perspective. The Council of Mortgage Lenders (CML). London, October.

Garton, G. (2009). The subprime panic. European Financial Management, 15(1), 10–46.

Greenspan, A. (1996). The challenge of central banking in a democratic society, speech at The American Enterprise Institute for Public Policy Research, in Washington, D.C., 5 December, http://www.federalreserve.gov/boarddocs/speeches/1996/19961205.htm. Retrieved January 27, 2014.

IVSC. (2011). International Valuation Standards. International Valuation Standard Committee.

Kaklauskas, A., Daniūnas, A., Dilanthi, A., Vilius, U., Lill Irene Gudauskas R., D‘Amato M. et al. (2012). Life cycle process model of a market-oriented and student centered higher education. International Journal of Strategic Property Management, 16(4), 414–430.

Kauko, T., d’Amato, M. (2011). Neighbourhood effect. In International encyclopedia of housing and home. Elsevier Publisher.

Kauko, T., & d’Amato, M. (2008). Introduction: Suitability issues in mass appraisal methodology. In T. Kauko, & M. d’Amato (Eds.), Mass appraisal an international perspective for property valuers (pp. 1–24). Wiley Blackwell.

Kauko, T. (2009). Policy impact and house price development at the neighbourhood-level—a comparison of four urban regeneration areas using the concept of ‘artificial’ value creation. European Planning Studies, 17(1), 85–107.

Kušar, S. (2012). Selected spatial effects of the global financial and economic crisis in Ljubljana, Slovenia. Urbani izziv, 23(2), 112–120.

Martin, R. (2011). The local geographies of the financial crisis: From the housing bubble to economic recession and beyond. Journal of Economic Geography, 11, 587–618.

Miller, J. H., & Page, S. E. (2007). Complex adaptive systems: An introduction to computational models of social life. Princeton, New Jersey: Princeton University Press.

Mooya, M. (2011). Of mice and men: Automated valuation models and the valuation profession. Urban Studies, 48(11), 2265–2281.

Munasinghe, M. (2010). Can sustainable consumers and producers save the planet. Journal of Industrial Ecology, 14(1), 4–6.

Pugh, W. (2008). Appraisal Institute Counters Washington Post’s Promotion of AVMs (p. 27). AVM News, September–October.

Renigier-Biłozor, M., Wiśniewski, R., Biłozor, A., & Kaklauskas, A. (2014a). Rating methodology for real estate markets—Poland case study. Pub International Journal of Strategic Property Management, 18(2), 198–212. ISNN. 1648-715X.

Renigier-Biłozor, M., Dawidowicz, A., & Radzewicz, A. (2014b). An algorithm for the purposes of determining the real estate markets efficiency in land administration system. Pub. Survey Review, 46(336), 189–204.

Renigier-Biłozor, M., & Biłozor, A. (2016a). Proximity and propinquity of residential market area—Polish and Italian case study. In 16th International Multidisciplinary Scientific GeoConferences SGEM. Bułgaria. (web of science).

Renigier-Biłozor, M., & Biłozor, A. (2016b). The use of geoinformation in the process of shaping a safe space. In 16th International Multidisciplinary Scientific GeoConferences SGEM Bułgaria.

Salvo, F., Simonotti, M., & Ciuna, M. (2015). Multilevel methodology approach for the construction of real estate monthly index numbers. Journal of Real Estate Literature, 22, 281–302. ISSN: 0927-7544.

Shiller, R. J. (2000). Irrational Exuberance. Princeton, Princeton University Press.

Smith, L. L. (2004). Complexity economics and alan greenspan. Post-Autistic Economics Review, 26, 2 August, article 2.

TeGOVA. (2003). European property and market rating: A valuer’s guide.

Woodward, S. E. (2008). Rescued by Fannie Mae. Washington Post, October, 14, p. 17.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

d’Amato, M., Kauko, T. (2017). Appraisal Methods and the Non-Agency Mortgage Crisis. In: d'Amato, M., Kauko, T. (eds) Advances in Automated Valuation Modeling. Studies in Systems, Decision and Control, vol 86. Springer, Cham. https://doi.org/10.1007/978-3-319-49746-4_2

Download citation

DOI: https://doi.org/10.1007/978-3-319-49746-4_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-49744-0

Online ISBN: 978-3-319-49746-4

eBook Packages: EngineeringEngineering (R0)