Abstract

Traditionally, research focuses on individual taxpayers that—when faced with a decision under uncertainty—are assumed to maximize their profits through rational decision processes. However, economic psychology and behavioral economics reveal several anomalies where the observed effects are opposite to the theoretical predictions. Moreover, psychological research provides evidence for the importance of factors such as the understanding of the tax law, attitudes toward taxes and tax morale, personal and social norms, and perception of distributive and procedural justice. In this paper, we provide a review of the research on tax compliance decisions. We address traditional approaches to study compliance decisions and anomalies as well as the psychological determinants of compliance. Since different research methods reveal different results, we describe the arsenal of research methods and their strengths and weaknesses. We pay specific attention to results from process tracing approaches in tax compliance research. We conclude with practical implications for policymakers and researchers in the field.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Tax

- Tax compliance

- Tax evasion

- Tax morale

- Attitudes toward tax

- Tax compliance decisions

- Slippery slope framework

- Tax compliance anomalies

- Tax compliance research

- Tax policy

Introduction

Most countries levy duties and taxes to finance public goods and services. Taxes also serve to regulate individuals’ behaviors and market dynamics. Unwanted behaviors of citizens and businesses (e.g., smoking and consumption of unhealthy food) are taxed, whereas desired behaviors (e.g., carbon emission versus environmentally friendly production) are promoted (Bristow, Wardman, Zanni, & Chintakayala, 2010; Haavio & Kotakorpi, 2011). Moreover, progressive taxation aims to correct excessive differences in income and wealth, which seems to positively affect national happiness (Oishi, Schimmack, & Diener, 2012).

Citizens value the provision of public goods and services (e.g., healthcare system, education, infrastructure, national security, and defense). Nevertheless, they complain about levies and are reluctant to pay taxes (Kirchler, 1997). Thus, it is questionable whether tax compliance would be high if the government would not enforce it.

Which strategies are most effective in ensuring tax honesty? For decades, researchers in social sciences, especially in economics, have addressed tax compliance decisions and investigated strategies to deter evasion. Traditionally, research focuses on individual taxpayers who face a decision under uncertainty when filing their income tax. If they follow the law by paying their full share, they can be certain to keep their net income, independent of future audits. However, when they pay less than the amount due, the outcome depends on whether they are audited or not: if audited and punished, they face a loss; if not audited, they remain with more than the net income. Consequently, the decision to act honestly or to cheat depends predominantly on the following factors: audit probability, audit efficiency, and the severity of fines.

Economic theory assumes that individuals maximize their profits through rational decision processes. However, taxpayers who act only in their selfish interest and maximize their personal utility harm the community. If the majority or all individuals free ride, they will act not only to the disadvantage of other taxpayers but also eventually to the disadvantage of themselves. The tension between individual benefit maximization and collective interests gives rise to a social contribution dilemma (Dawes, 1980). According to the social dilemma perspective, taxpayers consider not only audit probability and fines but also the behavior of other taxpayers. Assuming that others cheat on taxes is likely to fuel individual dishonesty as well.

The assumption that taxpayers are rational utility maximizers in risky decisions and social dilemma situations leads to the theoretical premise that the income level, tax rate, and especially audit probability and fine rate, as well as the contributions of other taxpayers, impact individual tax compliance. Research both in the laboratory and in the field lends support for the relevance of these variables. However, they explain only part of the tax behavior. Sometimes the observed effects are opposite to the theoretical predictions. Economic psychology and behavioral economics reveal several “anomalies” (i.e., effects going into the opposite direction as theoretically predicted). For instance, the “bomb crater effect,” the “echo effect,” mental accounting strategies, and the impact of windfall gains on tax behavior contradict neoclassical assumptions. Moreover, psychological research provides evidence for the importance of factors, such as the understanding of the tax law, attitudes toward taxes and tax morale, personal and social norms, and perception of distributive and procedural justice since the late 1970s. Moreover, the quality of the relationship between citizens and the state authorities also affects willingness to cooperate.

Feld and Frey (2007) referred to an implicit psychological contract between citizens and authorities that implies duties and rights for each party. Tax authorities can violate the psychological contract and undermine taxpayers’ willingness to pay in two ways: through frequent checks or heavy penalties that do not appear legitimate or credible or by the lack of retributive fairness considerations that can adversely affect subsequent compliance with tax regulations. The “slippery slope framework” (Kirchler, Hoelzl, & Wahl, 2008) integrates empirical findings from economics (e.g., audits and fine rates) and social psychology (e.g., social norms and fairness considerations) into a coherent frame explaining individual tax compliance behavior. The framework comprises two dimensions: power of authorities and taxpayers’ trust in the authorities that determine the interaction climate between the taxpayers and the authorities. Power refers to the authorities’ capacity to audit taxpayers, to detect evasion, and to punish evaders. Trust refers to taxpayers’ belief that the authorities are trustworthy and act in the interest of the commons. Trust builds on competence, benevolence, and integrity (Mayer, Davis, & Schoorman, 1995) and is positively related to fair procedures (Tyler, Goff, & MacCoun, 2015). Trust and perceptions of power result also from communication about the use of tax money, the perceived behavior of other taxpayers, and the appropriateness of audits and fines (Alm, Jackson, & McKee, 2009). According to the slippery slope framework, high perceptions of tax authorities’ power lead to enforced compliance, whereas perceptions of trust lead to voluntary motivation to comply.

In this chapter, we provide a review of the research on tax compliance decisions. We address traditional approaches to study compliance decisions and anomalies as well as the psychological determinants of compliance. Since different research methods reveal different results, we describe the arsenal of research methods and their strengths and weaknesses. We also pay specific attention to results from information processing techniques in tax compliance research, which are typically applied in laboratory experiments. The results suggest that the irrational behavior observed in experimental settings arises because the participants do not always search for the provided information on audit probability and fines but consider other aspects relevant. This chapter is structured into four sections. In the first section, we provide an overview of rational and behavioral economic models of tax behavior and describe the selected anomalies. Further, we present sociopsychological insights and the “slippery slope framework.” Section “Tax compliance: theoretical models and determinants of compliance” gives an overview of the research methods applied in the field of tax research. The strengths and weaknesses of various methods and convergence of results from different methods are discussed. In section “Methods in tax research”, we address new methodological approaches that aim to understand the underlying cognitive processes of tax decisions. The most popular process tracing techniques and insights in economic decision making are presented. Finally, we conclude our chapter with practical implications for policymakers and researchers in the field.

Tax Compliance: Theoretical Models and Determinants of Compliance

Rational Choice Model

Based on the economic model of criminal activity (Becker, 1968), Allingham and Sandmo (1972) and Srinivasan (1973) developed seminal models of tax decisions. When filing taxes, taxpayers face a decision under uncertainty as they do not know whether they will be subject to a tax audit. The resulting decision problem is assumed to be solved according to the expected utility theory (von Neumann & Morgenstern, 1947). Allingham and Sandmo (1972) and Srinivasan (1973) assumed that taxpayers are motivated to maximize their expected utility by rationally considering the value and probability of decision outcomes. On the one hand, taxpayers can declare the total gross income (i.e., pay the tax due). Alternatively, they can conceal some of their income or unauthorized expenditures (i.e., pay less than the tax due). If taxpayers pay the tax due, then they have chosen the sure option. They get to keep their net income independently of future audits. If taxpayers cheat on taxes, then they will be faced with uncertainty: in case of no audit, their income will be higher than the net income; in case of an audit, they will have to not only reimburse the tax due but also pay a fine, which eventually results in less than the net income.

According to Allingham and Sandmo (1972) and Srinivasan (1973), taxpayers consider four central parameters in their model of tax compliance: income, tax rate, audit probability, and fine rate. They compare the value of the sure option with the expected value of the uncertain options. Figure 13.1 shows the decision tree under these assumptions. In a nutshell, taxpayers pay the tax due depending on the economic consequences of detection probability and punishment (Alm, 2012). If deterrence resulting from a high audit probability and harsh fines, in case of detected evasion, is high, tax compliance is high too.

The assumptions of the traditional economic model have been empirically tested in a myriad of empirical studies. Survey studies, laboratory and field experiments, and analyses of aggregate data yielded evidence that audit probability and fines positively affect tax compliance. However, the effects vary in size and are generally weak (Andreoni, Erard, & Feinstein, 1998; Fischer, Wartick, & Mark, 1992; for an overview, see Kirchler, Muehlbacher, Kastlunger, & Wahl, 2010). Moreover, the standard economic model vastly overpredicts tax evasion. The generally small audit probability in most countries (ranging from below 1% to 3%; e.g., the Internal Revenue Service (IRS) audited 0.84% of individual filers in 2015; Internal Revenue Service, 2016) and rather low fines in case of evasion (0.5–2 times the evaded amount) hardly explain the high compliance rates, observed in many countries (Alm, Kirchler, & Muehlbacher, 2012; Alm, McClelland, & Schulze, 1992).

Rational choice models assume that people know all alternatives of a decision, weigh the alternatives, and choose the alternative that yields the highest prospect. However, this seems to be highly unrealistic. First, in reality, not all alternatives are always known to taxpayers. Second, people are limited in their cognitive abilities and are, thus, unlikely to calculate the exact expected values when filing their tax return (e.g., Simon, 1956). Third, even when explicit information about the expected value of each alternative is provided, this does not seem to lead to more rational choices (Colbert, Murray, & Nieschwietz, 2009; Li, 2003; Lichtenstein, Slovic, & Zink, 1969). Lastly, many observations of taxpayer behavior in real-life situations challenge assumptions and predictions of the standard model of tax evasion.

Rationality and Anomalies

Deviations from the standard model suggest that behavior is shaped by more variables than the audit probability and fine rate. Before describing additional determinants of behavior, we will address some anomalies that underline the need to extend the theoretical perspective on taxpaying.

Bomb Crater Effect

During bombardments in World War I, soldiers hid in the craters of recent explosions. They assumed that it would be very unlikely that the same crater gets hit again. This behavior is eponymous for a comparable effect objected during tax decisions: the bomb crater effect (Mittone, 2006). This effect describes the phenomenon that participants in repeated rounds tax experiments tend to evade more taxes immediately after an audit. Two different psychological explanations have been postulated to explain this deviation from the standard model: misperception of chance and loss repair (Kastlunger, Kirchler, Mittone, & Pitters, 2009; Maciejovsky, Kirchler, & Schwarzenberger, 2007). Misperception of chance describes individuals’ tendency to overestimate the probability of an event to occur if it has not happened in a while and to underestimate it if it happened recently (Maciejovsky et al., 2007). Thus, taxpayers might underestimate the chance of an audit to occur in two consecutive rounds. The second possible explanation states that participants who were caught evading and were fined are likely to experience a loss that they will try to repair in future rounds.

Several laboratory experiments tried to disentangle these two different explanations (Kastlunger et al., 2009; Maciejovsky et al., 2007). However, none of them was able to fully explain the mechanism, and it still remains unclear what really drives the phenomenon. Maciejovsky et al. (2007) found in a laboratory study that taxpayers underestimate the probability of two audits occurring after one another; thus, they were less compliant in subsequent rounds and even more so if they had to pay a fine for cheating in the previous round. Similarly, Kastlunger et al. (2009) concluded that misperception of chance might be the main driver of this effect. The bomb crater effect was confirmed in the field by Bergman and Nevarez (2006), who analyzed Argentinian and Chilean value-added tax (VAT) data from individual tax returns between 1997 and 2000. Overall, audits had no effect on the compliance rates. However, taxpayers who were found evading their VAT duties were less compliant after the audit compared to non-audited taxpayers.

Echo Effect

Mittone (2006) audited participants in the laboratory either in the first half of the experiment (1st to 30th round) or in the second half (31st to 60th round). Audits in the first half impacted compliance positively, and compliance remained at a high level throughout the experiment. If no audits were experienced in the first rounds, compliance decreased and remained low even if, at a later stage of the experiment, taxpayers experienced repeated audits. This effect was coined the “echo effect” and describes the phenomenon that one overestimates the probability of an audit on the basis of the early experiences of audits. Consequently, the experience of an audit early in one’s “taxpayer life” results in higher tax compliance in the following years. The effect might be caused by the availability heuristic (Tversky & Kahneman, 1973): audits at the beginning of a business life make tax duties salient, which affects decisions and behavior. The echo effect found support in a similar experiment by Kastlunger et al. (2009). However, they could also show that once high compliance was established by early audits, discontinuing audits weakened compliance in the long run.

Source of Income

According to economic assumptions, the source of income should not influence preferences. Whether income was easily earned or earned through hard work should not make a difference for taxpayers’ behavior. However, studies on windfall gains (i.e., endowments that participants receive in an experiment without any effort) show that money earned without effort is less evaluated (Loewenstein & Issacharoff, 1994) and more readily spent than money earned through great effort or particular skills (Arkes et al., 1994). Moreover, the source of income has been found to influence decisions in a variety of economic game experiments, such as the ultimatum game (Ruffle, 1998), the dictator game (Cherry, Frykblom, & Shogren, 2002), and the public goods game (Muehlbacher & Kirchler, 2009). In line with the source dependence theory and sunk cost effect, participants tend to be less cooperative if their funds are earned rather than provided as a windfall gain. Putting effort toward earning income is likely perceived as a sunk cost. Therefore, a greater effort to earn income (i.e., sunk cost) leads to a higher subjective evaluation of one’s income and, thus, to an increase in the willingness to take risks (Arkes & Blumer, 1985; Thaler, 1980; Thaler & Johnson, 1990), resulting in lower tax compliance.

Although these predictions are straightforward, Zeelenberg and Van Dijk (1997) found effects pointing in the opposite direction. Participants were asked to imagine that they had put effort and time into a job. Afterward, they were invited to gamble over their payment. Participants without prior investments (i.e., sunk cost) were more willing to take the risk of gambling, whereas those who had imagined high work investments were more risk-averse. Those who imagined that they had to work hard for their income had already invested too much to risk a gamble. Transferred to the tax context, taxpayers could be more risk-averse in case of hard-earned income than in case of easily earned income (e.g., capital gains).

Kirchler, Muehlbacher, Hoelzl, and Webley (2009) found that participants who earned their income through great effort were more compliant than those who received it with little effort (i.e., windfall income). These results are in line with the reverse sunk cost effect. Other studies reported interaction effects between effort and income level (Durham, Manly, & Ritsema, 2014) and between effort and tax rates (Boylan & Sprinkle, 2001).

Behavioral Choice Model

Consider two self-employed taxpayers, A and B, who are about to file their tax returns. Both have the same income and are taxed at the same rate, resulting in $20,000 in total taxes. While Taxpayer A has withheld $19,000 in anticipation of a tax payment during the year, Taxpayer B has withheld $21,000. Taxpayer A has to pay $1000 and Taxpayer B gets a refund of the same amount. According to the standard neoclassical theory, both should behave the same as they have to pay the same amount of tax with the same probability of getting audited. However, Taxpayer A is much more likely than Taxpayer B to claim deductions in order to reduce his tax liability (cf. Engström, Nordblom, Ohlsson, & Persson, 2015). This observation is not consistent with the neoclassical theory but can be explained with the prospect theory (Kahneman & Tversky, 1979).

In a series of experiments, Kahneman and Tversky (1986) observed that whether a situation is framed as a gain or a loss alters people’s judgments and leads to choices that differ from the predictions of the standard economic model. For example, McCaffery and Baron (2006) showed that people are more likely to accept a tax that is framed as a bonus for people with children rather than a penalty for childless people. Contrary to the expected utility theory, prospect theory postulates that an individual’s happiness depends not on the final state of wealth but on the changes in the wealth level (i.e., income) in relation to a reference point. If the individual’s income is above the reference income, it is considered as a gain; if it is below the reference income, it is seen as a loss. This distinction is important because individuals are more sensitive to losses than to equivalent gains, as depicted by the value function (Fig. 13.2).

The value function according to prospect theory (Kahneman & Tversky, 1979, p. 279). The function depicts the relationship between the objective outcome and the subjectively perceived outcome

Because losses are perceived as greater in absolute terms than equivalent gains, the value function is steeper for losses than for gains. Additionally, the value function is concave for gains and convex for losses; thus, monetary losses weigh more than equivalent gains. Consequently, people tend to be risk-seeking in the loss domain (i.e., try to avoid a loss), whereas they are risk-averse in the gain domain. Moreover, the weighting function shows that low probabilities are overestimated, whereas high probabilities are underestimated. Indeed, there is much evidence that taxpayers overestimate the probability of being subject to a tax audit (Alm et al., 1992; Bobek, Hageman, & Kelliher, 2013). Prospect theory helps to explain decision anomalies in compliance behavior that are not accounted for by the standard economic model, such as framing effects, withholding phenomena, effects of prior audits on subsequent compliance, and mental accounting practices.

Gain and loss framing effects have been shown empirically in a number of studies in the domain of taxes (Engström et al., 2015; Kirchler & Maciejovsky, 2001; Rees-Jones, 2018; Robben et al., 1990). Given the rather loose specification of a gain or loss frame in prospect theory, there is, however, an ongoing debate regarding which reference point is relevant for taxpayers. Based on the status quo bias (see Kahneman, Diener, & Schwarz, 1999), the reference point usually corresponds to the decision maker’s current position. If we assume that self-employed taxpayers pay taxes out of their pockets, their reference point should be the pretax level of income (i.e., gross income). As this implies that a taxpayer would view any tax paid as a loss, everyone would be risk-seeking regarding their tax deduction.

Alternatively, the reference point may be the taxpayer’s net income (Elffers & Hessing, 1997; Rees-Jones, 2018). In this case, the taxpayer is either under-withheld and in the domain of losses or he is overwithheld and in the domain of gains. In the previous example, Taxpayer A, who had a preliminary deficit, perceives a higher marginal value of extra income than Taxpayer B, who had a preliminary surplus of the same amount. Those with a deficit would consequently be more inclined to take (legal or illegal) actions in order to reduce their tax liability. Under this frame, following Schepanski and Shearer (1995), one might also use the model to explain the so-called withholding phenomenon, the evidence that taxpayers who are under-withheld at filing exhibit lower rates of compliance than those who are over-withheld. Engström et al. (2015) found that Swedish taxpayers claim a deduction for “other expenses for earning employment income” more likely than those who have a preliminary surplus, a finding consistent with loss aversion. Thus, policymakers should encourage slight overwithholding of preliminary taxes to increase tax revenues. Such a policy might also strengthen tax morale and reduce tax auditing costs. However, the overwithholding strategy should be applied cautiously because taxpayers can feel treated unfairly (Elffers & Hessing, 1997).

Another line of reasoning argues that, at least in some situations, gains and losses may be influenced by aspirations, expectations, norms, and social comparisons (Bernasconi & Zanardi, 2004). In this case, the reference point may be determined by expectations about outcomes or the income of people with similar socioeconomic characteristics. Some studies lend support to the expectation-based model (e.g., Crawford & Meng, 2011; Marzilli Ericson & Fuster, 2011), while others do not (Heffetz & List, 2014). The literature on sources of income suggests that taxpayers’ reference may depend on the amount of effort invested in the income. In two laboratory experiments, Kirchler, Muehlbacher, Hoelzl, and Webley (2009) showed that taxpayers who invested effort in obtaining their income showed more compliant behavior compared to those who gained their income with little effort. This suggests that the aspiration level both is influenced by effort and serves as a reference point. Depending on the exact position of the aspiration level, greater effort can lead to more or less evasion. Consequently, tax administrations are advised to think about possible ways to change taxpayers’ reference points to moderate aspiration levels (e.g., their net income).

Mental Accounting

Regarding financial decisions, the reference point is also influenced by different mental accounting strategies. In a business context, accounting describes the process of recording, summarizing, analyzing, and reporting a company’s financial transactions. Individuals and private households are not required to keep track of their financial activities; however, in order to keep track of their finances, it seems advisable to at least mentally keep track of income and expenditures. As in a company’s budget, individuals assign specific sums of money to specific matters (e.g., rent, groceries). Money is easily spent if the category’s budget is still full, even if the purchases are not very prudent at all (Heath & Soll, 1996). By contrast, further purchases and investments are made tentatively if the budget for a specific category is empty. The effects of mental accounting in consumer decisions have already been studied in a large number of studies (e.g., Prelec & Loewenstein, 1998; Ranyard, Hinkley, Williamson, & McHugh, 2006; Thaler, 1985, 1999).

More recently, mental accounting has also been considered in the context of tax decisions. Adams and Webley (2001) interviewed 27 small-business owners in the UK about relevant factors involved in VAT compliance. The majority of the participants reported that they perceive that they have to pay the VAT from their own money (“VAT takes about twelve thousand a year from my business, (…),” p. 208), whereas only a few business owners believed that the customers pay the VAT and they just store it till the tax payment (“It is not a cost to the business, we are just looking after the money for the government.” pp. 208–209). The results imply that there are two different mental accounting strategies to handle gross income. Segregators distinguish between their revenues and the related taxes. By contrast, integrators perceive taxes as some sort of expense that they have to pay from their revenues.

Based on these results, Muehlbacher and Kirchler (2013) interviewed 30 self-employed Austrian taxpayers on their behavior toward gross income. The participants either separated the gross income into taxes and personal money (“I transfer about 40% of revenues immediately to an extra bank account (…),” p. 419) or just kept it in one account (“I am not putting anything aside for paying my [income] tax (…),” p. 419). Based on the result of the interview, the authors developed a 10-item questionnaire and surveyed 172 Austrian participants. The results indicated three main factors of mental accounting: (1) mental segregation, (2) physical segregation, and (3) perceived ownership of tax money. Additionally, a relationship between the different mental accounting strategies and tax morale was found. Segregation strategies are related to more positive views of the tax system (Braithwaite, 2003) and to a more positive view on voluntary tax compliance (Kirchler et al., 2008). Further, the participants who preferred segregation strategies reported less frequently evading taxes in the past. The results of Muehlbacher, Hartl, and Kirchler (2017) also showed that those participants who used segregation as a mental accounting strategy were more compliant. In line with prospect theory (Kahneman & Tversky, 1979), the authors argue that segregation of income goes along with a shift of the reference point toward the net income, resulting as a consequence in higher tax compliance.

Olsen, Kasper, Kogler, Muehlbacher, and Kirchler (2019) showed further that individuals practicing mental accounting for one tax are also likely to apply it to other taxes. In their study, they looked at factors related to mental accounting. A high score on mental accounting, which indicates segregation strategies, is positively connected to tax knowledge. The strongest relationships between mental accounting and personality factors were observed for impulsivity, attitudes toward taxes, and financial scarcity. Highly impulsive taxpayers tend to use segregation strategies less, whereas attitudes toward taxes are positively correlated. Experiencing financial scarcity, which was used as a measure for business prosperity, was also found to be negatively related to segregation strategies. By contrast, a positive connection between tax planning and mental accounting has been found.

The Social Contribution Dilemma

Even though individual choice models have considerably contributed to explaining tax decisions, viewing individuals as isolated decision makers ignores the notion that they are also part of a group. As such, their individual interests may not always align with the collective interests of the group. Some individuals may put themselves at a financial advantage by free riding their contribution. In a scenario where all individuals try to maximize their utility at the cost of others, the financing of public goods and services can no longer be guaranteed. Thus, not only the community but also the selfish individuals themselves are harmed.

A social dilemma (Dawes, 1980) is defined as a conflict in which the interests of individuals are opposed to the goals of the community. Although taxpayers may acknowledge the necessity of their contribution to society through taxation, they may suspect that other taxpayers contribute and be tempted to reduce their contribution. Tax compliance may, thus, depend on not only audit probability and fines but also the cooperative behavior of others. If taxpayers doubt others’ willingness to pay their fair share of taxes and perceive loose social norms toward cooperation, willingness to pay taxes is likely to be low (Rothstein, 2000).

Social dilemma research aims to explain why people do not cooperate, even though everyone would be better off by cooperating. Social dilemmas can be experimentally simulated in the laboratory through public goods games. In public goods games, the experimenter provides the participants with a starting capital, from which they can contribute any amount into a joint account. The experimenter promises to multiply the contributed sum (e.g., double it) and then distribute the total sum evenly among all players. If all players contribute their total starting capital, all players receive double their starting capital. However, each player can try to take advantage of the situation and maximize the outcome by paying nothing and hoping that the other players will contribute large shares of their own starting capital. If all players are uncooperative, everyone keeps only their starting capital. Because the participants do not know what the other participants are going to do, rational and selfish individuals are considered not to contribute anything. However, in public goods experiments, people cooperate much more than the standard economic theory predicts (Fischbacher, Gaechter, & Fehr, 2001).

Economic and Psychological Determinants of Compliance

Most taxpayers acknowledge the value of public goods that are financed by taxes (Kirchler, 1997). However, taxes are often perceived as a burden and are met with distrust. Taxpayers may doubt that their money is managed frugally, that tax-funded projects are in the best interest of taxpayers, and that a person’s tax burden is fair in relation to other people’s tax burdens and their own ability to make use of public goods. As described above, some taxpayers may conclude that it is in their best interest to withhold their own contribution to the common good, whereas the vast majority of taxpayers pay their statutory contribution. In order to gain a better understanding of how individuals form their taxpaying behavior, sociopsychological factors, such as taxpayers’ knowledge and understanding of tax laws, their attitudes toward taxes, tax morale, personal values and norms, social norms, perceived fairness, and trust in the tax system, have to be taken into account (Kirchler, 2007). We review these factors below.

Knowledge, Attitudes, and Tax Morale

As the tax law is overly complicated, it comes as no surprise that taxpayers have difficulties complying with it. In a survey administered to Australian taxpayers by Sakurai and Braithwaite (2003), only a small percentage of the respondents considered themselves as fully competent to file their tax reports. Thus, it is not surprising that most taxpayers hire a tax agent (Sakurai & Braithwaite, 2003). Moreover, complicated tax laws may reduce taxpayers’ perceived fairness of the tax system (Cuccia & Carnes, 2001) and result in unintentional noncompliance (McKerchar, 2001). Alm, Cherry, Jones, and McKee (2010) reported experimental evidence indicating that uncertainty reduces compliance but that the impact is mitigated when the tax agency provides information at a low cost to the taxpayer.

Additionally, tax knowledge has been shown to influence attitudes toward taxes (Eriksen & Fallan, 1996; Fallan, 1999), which are important predictors of tax compliance behavior (Jackson & Milliron, 1986). Social representation theory (Moscovici, 1961) offers a framework to explain the shared social understanding underlying the abstract concept of taxes. Social representations help make sense of the world and interact with other members of the community. In a survey assessing social representations about taxes, Kirchler (1998) asked the responders to describe a typical taxpayer, an honest taxpayer, and a tax evader. Typical taxpayers were rated most negatively and honest taxpayers most positively. Surprisingly, tax evaders were evaluated as quite positive as well. They were considered as being intelligent (even more intelligent than the typical taxpayer) and hardworking, whereas honest taxpayers were described as lazy and not very intelligent.

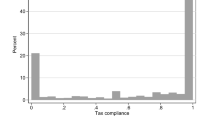

The concept of social representations is closely related to tax morale, moral obligation, or intrinsic motivation to pay taxes (Torgler & Schneider, 2007). Tax morale, among many other concepts, is assessed in the World Value Survey (WVS) or the European Value Survey (EVS). These large-scale surveys assess the basic value and beliefs of citizens. Tax morale is measured with one item: “Please tell me for each of the following statements whether you think it can always be justified, never be justified, or something in between: […] Cheating on tax if you have the chance.” The question is answered on a 10-point-scale index ranging from 1 (“never justified”) to 10 (“always justified”). Most individuals report having high tax morale, indicated by the high number of responses on 1 (“never justified”). The reported high rates of tax morale could explain the high tax compliance rates as higher tax morale is connected to lower tax evasion (Frey & Torgler, 2007).

Personal Characteristics: Demographics, Personal Values, and Norms

Taxpayers differ in their attitudes and moral views toward taxes. For instance, tax morale has been shown to be higher among older taxpayers, people with higher income, more religious people, female taxpayers, people with more financial experience, taxpayers who trust politicians, and employed taxpayers (Alm & Torgler, 2006; Grundmann & Graf Lambsdorff, 2017; Lago-Peñas & Lago-Peñas, 2010; Torgler, 2004, 2006). In particular, the group of self-employed entrepreneurs has received considerable attention in tax research. Self-employed taxpayers have to collect all the income and often also the VAT throughout the year. Then, at the end of the year, they have to pay their tax dues “out of their pocket.” As already discussed earlier in this chapter, the reference point may be the gross income collected throughout the year. Consequently, all taxes should be perceived as a loss. As people are risk-seeking in the domain of losses, self-employed taxpayers are assumed to be more prone to tax evasion.

The beliefs and behaviors of the social group can represent implicit rules that act as a guide of what behavior is appropriate or socially desired in different situations. Personal norms include one’s own behavior and attitudes toward paying taxes. As such, they are very similar to the concept of tax morale (Muehlbacher & Zieser, 2018). At the group level, social norms refer to the perception of common behavior and the notions of which behavior is right and which is wrong.

Social Norms

In tax research, social norms are commonly considered as the frequency (i.e., descriptive social norms) and acceptance (i.e., injunctive social norms) of tax evasion in a social group (Wenzel, 2005). Alm and Torgler (2011) highlighted that the experience of psychological loss by breaking moral standards might explain the impact of tax ethics on compliance decisions. For example, Bobek et al. (2013) showed that personal norms directly influence tax compliance decisions, whereas descriptive and injunctive social norms have an indirect influence. Similarly, Jimenez and Iyer (2016) concluded that social norms influence tax compliance indirectly through internalization as personal norms. In a laboratory experiment, Alm, Bloomquist, and McKee (2017) provided the participants with information regarding their “neighbors” tax compliance behavior. Their results suggested that introducing this descriptive norm had a significant effect on tax compliance. However, depending on the specific content of the information, it could also have a negative effect. While information regarding the actual prior behavior encouraged the participants to adjust their behavior to the social norm of compliance, just the mere presence of the information lowered the propensity to file and did not affect tax reporting. Thus, policymakers are encouraged to carefully adjust normative appeals in their pursuit to establish a compliance social norm.

Perceived Fairness and Trust

For taxpayers, it is important to be treated fairly, especially when being committed to pay their fair share of taxes. Wenzel (2004) differentiated among distributive, procedural, and retributive fairness:

-

(i)

Distributive fairness concerns the fair distribution of the tax burden and the fair allocation of benefits and costs with the government.

-

(ii)

Procedural fairness refers to the overall fairness of the process of tax collection, such as how taxpayers are treated by the tax authorities.

-

(iii)

Retributive fairness relates to the proper use of rewards and punishment in the system.

Fairness promotes the legitimacy of political processes that can strengthen trust in the authorities (Tyler, 2006). For instance, when citizens feel that their preferences are considered in a fair decision process, this can increase the perceived procedural fairness of the political system, ultimately increasing trust in the government. Switzerland is often regarded as being the country with the highest tax morale within Europe (Alm & Torgler, 2006). One difference between Switzerland and other European countries is that the political system has a high degree of direct democracy, with citizens voting regularly on a wide range of issues. Indeed, those cantons in Switzerland that are characterized by a higher degree of direct democracy also show higher levels of tax morale (Frey, 1997). The positive impact of voting on tax compliance was also confirmed by Wahl, Muehlbacher, and Kirchler (2010). In a public goods game, they observed a positive effect of voting on perceived procedural fairness, which translated into higher trust in the government, ultimately increasing tax compliance. However, if taxpayers perceive procedural fairness to be low, sanctions or punishments can undermine the authorities’ legitimacy.

Retributive fairness not only includes financial punishment but also can involve public shaming of tax offenders. Coricelli, Rusconi, and Villeval (2014) investigated the influence of public shaming on tax compliance. In a group experiment, they displayed pictures of the participants caught evading on all screens. In one group, the picture was only displayed for a single round, whereas in the other condition, it was displayed over multiple rounds. If the picture was only displayed once, the participants had the opportunity to restore their reputation by being compliant for the remaining rounds of the tax game, whereas this was not possible in the second condition. The results showed that public shaming increases tax compliance only if cheaters are successively reintegrated. If they are not immediately reintegrated, public shaming has no positive effect on tax compliance. Thus, public shaming may be an effective policy tool but should be handled with care as shaming could backfire if not implemented correctly.

Motivational Postures

Taxpayers are not a homogeneous group but show great diversity in their beliefs and attitudes toward paying taxes. As individuals and groups evaluate the authorities in terms of what they stand for and how they perform, they develop positions toward the authorities. These positions are reflected in the social distance that individuals want to place between themselves and the authorities. When individuals have positive attitudes toward the tax authorities, they wish to associate more with the authorities. In contrast, taxpayers that have negative attitudes toward the authorities try to disengage and distance themselves further from them. Social distance can be conveyed into motivational postures (Braithwaite, 2003). Braithwaite identified five different motivational postures relevant for tax compliance:

-

(i)

Commitment. Committed taxpayers feel a moral obligation to taxpaying and believe in the benefits of the tax system.

-

(ii)

Capitulation. Capitulated taxpayers accept the tax authorities’ legitimate authority.

-

(iii)

Resistance. Resistant taxpayers have doubts regarding the benevolence of the tax authorities and challenge their authority.

-

(iv)

Disengagement. For disengaged taxpayers, the tax system is beyond repair; as a consequence, they try to detach themselves from it.

-

(v)

Game playing. Game playing taxpayers seek to bend the rules and take advantage of loopholes to suit their own benefits. While commitment and capitulation reflect a generally positive orientation to tax authorities, resistance, disengagement, and game playing reflect a posture of defiance toward tax authorities.

Braithwaite proposed for tax authorities to be responsive to these differences in motivational postures (see Fig. 13.3). As most taxpayers show a positive attitude toward tax authorities, harsh regulatory strategies should be handled with caution. Instead, taxpayers should be treated in accordance with their motivational postures. For instance, deterrence is not necessary to motivate already committed taxpayers but could erode the established trust between both parties. Instead, tax authorities should follow an approach of service orientation and only refer to deterrence when taxpayers are already disengaged. Hartner, Rechberger, Kirchler, and Schabmann (2008) investigated the relationship between taxpayers’ procedural fairness perceptions and motivational postures. When people feel treated in a procedurally fair manner by the tax authorities, and procedurally fair decision rules are employed, motivational postures of deference increase, whereas motivational postures of defiance decrease.

Australian Taxation Office compliance model. (Adapted from Braithwaite, 2003, p. 3)

Integration of Economic and Psychological Insights: The Slippery Slope Framework

While individuals’ beliefs, feelings, and attitudes influence their perception of taxes (Kirchler, 2007), taxpayer decisions are not exclusively driven by individual perceptions. Not only do taxpayers have to consider other taxpayers in their tax compliance decisions but they are also subject to the influence of the government and the tax authorities. This relationship can take the form of an implicit contract, implying duties and rights for each contracting party (Feld & Frey, 2007). The quality of the relationship and the interactions between the different actors (i.e., taxpayers, tax practitioners, tax authorities, and the government) affect taxpayers’ decisions.

The influence of economic factors on tax decisions has been shown in some, but not all, situations. Depending on interpersonal and situational factors, sociopsychological determinants are sometimes weighted more strongly in tax decisions. The slippery slope framework (Kirchler et al., 2008) provides an integration of economic and sociopsychological factors. This framework consists of two dimensions: trust in the authorities and power of the authorities (Fig. 13.4). Trust describes the taxpayers’ belief in the benevolence of the authorities, which is based on attitudes, social norms, fairness perceptions, and services provided for taxpayers. Power is defined as the authority’s capacity to detect and punish tax evasion. Trust and power may interplay with each other; however, the exact nature of this interaction is not clear (Kirchler & Hoelzl, 2017). If audits are too frequent and fines too severe, taxpayers may interpret such behavior from tax authorities as distrust toward them and react with distrust themselves. However, power can also positively affect trust, if the audit scheme is perceived as a means to guarantee retributive fairness and enforce societal norms. The term “slippery slope” refers to the potential downward spiral that may happen if power and trust are both low. When trust in the authorities is low, audits are seen as a signal of a “cops and robbers” attitude on behalf of the tax authorities and create even more distrust.

Slippery slope framework of tax compliance. (Adapted from Kirchler et al., 2008, p. 212)

The manifestation of the power and trust dimensions determines the prevailing interaction climate between tax authorities and taxpayers. When the authorities are predominantly perceived as powerful, we find an antagonistic climate, whereas a synergistic climate is described as a climate in which tax authorities are experienced as trustworthy and benevolent. On an individual level, the slippery slope framework differentiates between two qualities of tax compliance dependent on the interaction climate. In an antagonistic climate, taxpayers are presumably compliant because of the fear of detection and punishment; hence, they show enforced compliance. In a synergistic climate, on the contrary, compliance stems from a desire to contribute to society, and taxpayers show voluntary compliance. Deterrence strategies can be effective in enhancing enforced compliance, whereas voluntary cooperation is best encouraged through sociopsychological factors, such as norms and fairness. Recent empirical studies support the basic assumptions of the slippery slope system (e.g., Batrancea et al., 2019; Kastlunger, Lozza, Kirchler, & Schabmann, 2013; Kirchler, Kogler, & Muehlbacher, 2014; Kogler, Muehlbacher, & Kirchler, 2015). Thus, the slippery slope framework offers a possible integration of economic and sociopsychological determinants of tax compliance decisions.

Methods in Tax Research

The key challenge of research on tax compliance is that noncompliant behavior is by nature covert as individuals are prone to conceal such behavior. Thus, for researchers, the main challenge is to get reliable measures of noncompliant behavior (Hallsworth, 2014). There is an arsenal of research methods available, each having advantages but also suffering from shortcomings. Researchers, particularly from the field of economics, have traditionally relied on econometric models, simulations, and aggregate data. However, the limitations of these approaches have led to the increased use of surveys as well as laboratory and field experiments to measure tax evasion. As these approaches are especially influential in the field of tax psychology, we will focus on these methods in the following section, provide an overview of each method, highlight their advantages and weaknesses, and compare the results between them.

Surveys

Surveys are a cost-effective way to collect quantitative data on tax decisions. Thus, they are widely used to measure tax-related behavior, attitudes, and beliefs (i.e., perceived audit probability, trust in authorities, or perceived social norms). The validity of the results may, however, be limited. Since most people only have to do their tax returns once a year, they may have difficulties remembering their past behavior when asked in a survey. Inaccurate memories can also be the result of trying to keep congruence between the personal and the ideal self or to reduce concerns about social disapproval (Elffers, Weigel, & Hessing, 1987). As a consequence, the effects of overreporting and underreporting can be observed.

In a study by Bell and Buchanan (1966), the participants were asked if they had voted in a Los Angeles mayoral election. While 80% of the sample answered that they did, in fact, only 50% were eligible to do so, effectively overreporting their voting behavior. By contrast, an effect of underreporting was shown by Farrington (1973). Teenagers’ self-reports significantly correlated with official records on their delinquency. However, when asked again 2 years later, the teenagers denied nearly half of the seriously delinquent acts (e.g., theft and physical aggression).

Since tax evasion is illegal and tax avoidance is at least morally questionable, it remains unclear whether the responses of the survey participants are consistent with their behavior, even if they accurately recall the taxpaying situation (“Why should one be honest about not being honest?”). To circumvent this, surveys on tax decisions often focus on indirect questions, for example, in the WVS (Inglehart et al., 2014): “Please tell me for each of the following actions whether you think it can always be justified, never be justified, or something in between (…). Cheating on taxes if you have a chance.” However, Torgler and Schneider (2009) criticized that even indirect measurements such as the WVS do not eliminate socially desirable responses.

Experiments

The limitations of survey data have led researchers to increasingly use laboratory experiments. The main advantage of experiments is that behavior can be observed directly; thus, tax evasion becomes overt. Another advantage lies in the high validity of laboratory experiments (e.g., Brewer & Crano, 2000; Roe & Just, 2009; Shadish, Cook, & Campbell, 2002), which allows a researcher to manipulate and measure each individual parameter of the tax decision. This advantage of laboratory experiments is especially valuable for tax evasion studies as it is not easily possible to exogenously vary, for instance, the penalty rate or the provision of public goods (Hallsworth, 2014).

The underlying experimental design has not changed much since Friedland, Maital, and Rutenberg (1978) who set up the first “tax game experiment.” Usually, a tax experiment in the laboratory consists of multiple money-earning and taxpaying rounds. In every round, the participants earn or receive fixed or variable income. Afterward, they have to declare their income to a fictional tax administration. The participants can freely choose the amount of income they want to declare. Their declaration is audited with a given probability (which is usually higher than in reality). If the participants underreport their income and are audited, they have to pay a fine (usually a multiple of the evaded sum). All parameters from the standard economic model of tax evasion (i.e., income, tax rate, audit probability, and fine) can be varied by the experimenter to test their effects on tax compliance. Usually, laboratory experiments are incentivized, and participants are paid depending on their performance in the experiment.

Applying experiments in tax research has its advantages but does not go without critique (for an overview, see Muehlbacher & Kirchler, 2016). While internal validity is considered high, the external validity and generalizability of experimental results are often put into question (e.g., Levitt & List, 2007; Roe & Just, 2009). Criticism is primarily directed at the fact that the complexity and relevance of the real tax payment situation cannot be reproduced in laboratory experiments. For instance, the experimental setting only provides one possibility to evade taxes (i.e., declare less income), whereas in reality there are many possible ways (i.e., undeclared work). Additionally, in reality, taxes are necessary for social investments (e.g., education, infrastructure), but tax money in the laboratory is commonly wasted (Muehlbacher & Kirchler, 2016).

The extensive use of computers and the Internet in private households in the past decades enabled researchers to conduct experiments outside the laboratory in a web-based environment. Web experiments reduce personal and organizational costs as there is no need for guidance by the investigator and no need for the participants to be present in the laboratory. Thus, a wider group of individuals can participate. However, individuals are free to participate using different devices. They can participate in a potentially disturbing environment or at times of the day when their level of concentration may be low. Individuals can participate multiple times or show other nefarious behavior to undermine the integrity of the experiment (Kraut et al., 2004). Consequently, the high control of the laboratory setting and, as a result, the internal validity and reliability of the experiment could decrease.

Field Experiments

In contrast to laboratory experiments, field experiments allow researchers to investigate tax decisions in real-world settings. The underlying processes, relevant influencing variables, and heuristics can be observed directly. For instance, the impact of tax policy decisions on taxpayers’ behavior can be measured directly, which can significantly improve the efficiency of the policy (Blumenthal, Christian, Slemrod, & Smith, 2001). “The result is external validity at the highest level” (Wenzel & Taylor, 2004, p. 2798).

Despite the advantages of field experiments, they are comparably seldom implemented in tax research. From an academic view, one explanation lies in the high costs of field experiments, which are a multiple of a laboratory experiment or a survey. Researchers have to invest time in identifying partners, building relationships, understanding the context, and discovering the best opportunity to run the study (Feld, Frey, & Torgler, 2006). While field experiments have high external validity, they suffer from low internal validity. Tax decisions can be investigated under real conditions, but it is difficult to manipulate and compare specific parameters.

Further, tax authorities may have few incentives to participate in tax research projects. Regarding the strict data policies in most countries, careful work and great effort would have to be invested in guaranteeing anonymity. Additionally, officials could be concerned about disclosing too much information about their processes (Mascagni, 2018).

Comparison of Methods

Surveys, laboratory experiments, and field experiments all have their advantages and disadvantages. Therefore, we will now take a closer look at the comparability of the results obtained by these different methods. Because there are only very few field experiments in tax research, the following section focuses on a comparison between surveys, laboratory experiments, and real-world tax behavior.

As it is quite complicated to carry out a study together with a tax administration, the work by Elffers, Weigel, and Hessing (1987) and Elffers, Robben, and Hessing (1992) has received particular attention in the literature. They compared whether “honest taxpayers” and “evaders” (classified by the Dutch tax administration on the basis of the income tax return) show the same behavior in a tax experiment and report it honestly in a survey. Their results were notable because they found no significant correlation between the three measures.

However, not all results concerning the external validity of tax research are as devastating. Alm, Bloomquist, and McKee (2015) compared data of self-reported tax declarations from the North American IRS with results from a laboratory experiment comprising participants who also self-reported their tax declarations. On average, the participants were slightly more compliant in the experiment, but the compliance rate was bimodal in both datasets. This finding implicates that the absolute level of compliance in tax experiments cannot easily be transferred to the real-world. Still, evasion strategies seem to be similar (i.e., either being completely honest or evading the whole tax).

A review by Kirchler, Muehlbacher, Kastlunger, and Wahl (2010) allows for a more differentiated comparison. The authors reviewed a total of 31 studies (16 experiments, 6 surveys, and 9 aggregate data points) concerning results about the four parameters of the standard economic model (Allingham & Sandmo, 1972; Srinivasan, 1973). The results of the various methods show similar trends to a large extent but are also partly inconclusive (for detailed results, see Table 13.1).

-

(i)

Level of Actual Income. The results are as ambiguous as the predictions of the model. Regardless of the method, higher income was found to have either a positive, negative, or no effect on compliance.

-

(ii)

Tax Rate. The model predicts two counteracting effects. A higher tax rate leads to less individual net income and makes tax evasion more profitable. In contrast, less net income should lead to higher risk aversion; as a result, evasion should decrease. Both effects find empirical support in the studies reviewed, although most studies reported that higher tax rates decrease compliance. All three methods show similar tendencies.

-

(iii)

Audit Probability. According to the standard model, individuals weigh the risk of being audited and fined against the gain of successful evasion (resulting in an expected value of tax evasion). Consequently, a higher audit probability should increase tax compliance. Most of the considered studies support this assumption, although a few found weak effects or no effects at all. All studies containing analyses of aggregate data and the majority of experimental studies show positive but weak effects. Only one of the three surveys included in the review found a negative effect on tax compliance.

-

(iv)

Magnitude of Fines. As the second important deterrence parameter, fines are closely linked to the audit probability. Combined, they should influence individuals’ tax decisions, as long as one determinant is not set to zero. As higher fines make evasion more hazardous, they should lead to higher tax compliance. Barely half of the considered studies support the model’s assumption, finding partly weak effects. All other studies report no effect of fines on compliance rates. Regarding the different methods, the results obtained by experiments and aggregate data are almost equally distributed, whereas the only survey considered found no effect.

As outlined above, laboratory experiments, in particular, have been increasingly implemented in tax research in recent years. In laboratory experiments, participants are usually provided with all the information necessary to make a rational decision, and it is assumed that they react to this information accordingly. However, it is hardly investigated whether participants also perceive and process all this information as traditional outcome-focused experiments usually do not provide information on the underlying decision making processes. This is a fundamental shortcoming of classic tax experiments, as attending to all relevant information of a decision problem is an important (implicit) process assumption of the rational or neoclassical model of decision making (Orquin & Mueller Loose, 2013). Moreover, outcome-focused analyses cannot convincingly differentiate between different decision theories. For instance, Glöckner and Herbold (2011) showed in an eye tracking study that while cumulative prospect theory (Kahneman & Tversky, 1979) predicts choices well, it fails to account for the underlying decision processes.

Furthermore, process tracing data help to understand how sociopsychological factors (e.g., social norms and fairness perceptions) might affect the perception and influence of economic factors of tax decisions. Understanding when and why people deviate from rationality might help improve currently existing economic and behavioral theories on tax compliance behavior. Finally, outcome-focused experiments do not account for differences in processing strategies between individuals (Schulte-Mecklenbeck, Kühberger & Ranyard, 2011; Willemsen & Johnson, 2011). As individual differences and heterogeneity between taxpayers are important determinants to explain tax compliance behavior, a better understanding of the differences in individuals’ decision making processes would allow policymakers to tailor incentive structures and control schemes for different target groups.

Information Processing in Tax Decisions

A relatively recent development in the judgment and decision making (JDM) literature promises to overcome the limitations of outcome-data-based experiments by applying process tracing methods like mouse tracking (Mouselab; Bettman, Johnson, & Payne, 1990; MouselabWeb; Willemsen & Johnson, 2011), eye tracking (Rayner, 1998), or brain imaging (i.e., functional magnetic resonance imaging [fMRI]; Bennett, Wolford, & Miller, 2009). All these process tracing methods rely on the assumption that the overt information acquisition process and the underlying covert cognitive processes are connected (Schulte-Mecklenbeck, Kühberger, Gagl, & Hutzler, 2017). More precisely, the information that an individual looks at is assumed to be processed at a cognitive level, which reflects the notion that this information is necessary for the decision (Svenson, 1979). Schulte-Mecklenbeck et al. (2017) suggested structuring process tracing methods on two axes. On the first axis, they differentiated between the minimal temporal resolutions (i.e., precision of measurement with respect to time), whereas on the second axis, they distinguished between methods that are more or less likely to distort the measured process (distortion risk). This results in four distinct groups, as depicted in Fig. 13.5. In this section, we focus on the most widely used techniques in economic research: interactive measures (Mouselab, mouse tracking, and eye tracking) and peripheral psychophysiology and neural techniques (e.g., fMRI, positron emission tomography [PET], electroencephalography [EEG], repetitive transcranial magnetic stimulation [rTMS], heart rate variability [HRV], and electrodermal activity [EDA]).

Map of process tracing techniques. (Adapted from Schulte-Mecklenbeck et al., 2017, p. 445)

Eye Tracking

In order to make complex decisions, humans have to acquire and process information from their surrounding environment constantly. By investigating visual attention, it is assumed that cognitive processes underlying decision making can be uncovered. As such, the assumption behind eye tracking is that attention and eye movements are connected and that changes associated with eye movements are preceded by shifts of attention (Franco-Watkins & Johnson, 2011; Rayner, 1998). Eye trackers enable researchers to reveal these shifts in visual attention by recording a series of fixations (resting of gaze on a piece of information) or saccades (rapid micromovements between pieces of information) on different available information of a decision. Over the last decade, eye trackers have become cheaper and more precise, and thus the field of economics witnessed a rapid rise in research papers that are based on eye tracking data (Sickmann & Ngan, 2016).

While a fixation tells the researcher where participants are looking, it does not tell much about the mental processes underlying the decision. Thus, the biggest challenge is to interpret the recorded set of fixations. A common way to do so is by focusing on the frequencies and lengths of fixations. More fixations and, related to that, longer fixation times on a particular piece of information have been shown to correspond to the relative importance that information plays in decision making (Jacob & Karn, 2003; Poole, Ball, & Phillips, 2005). For example, Kim, Seligman, and Kable (2012) were able to confirm the preference reversal phenomenon (Lichtenstein & Slovic, 1971; Slovic & Lichtenstein, 1983). When faced with a decision between two gambles with the same expected value, the participants systematically chose the higher probability option but placed a higher bid on the option with the higher outcome. This preference reversal could be observed in the eye tracking data. The outcomes of gambles were fixated more frequently during bidding, whereas the probabilities were fixated more often during choices.

In an experiment by Hochman, Glöckner, Fiedler, and Ayal (2016), the participants had to do a simple task: answering which side of the screen showed more dots. By giving a false response (i.e., cheating), the participants could increase their payoff. Pupillary responses indicated that arousal has increased in the initial stage of a cheating attempt. At the same time, attention was turned away from unwanted information, indicating potentially unconscious avoiding processes. This means that people are aware of their ethical misbehavior but, at the same time, try to reduce the cognitive effort caused by the increased tension through avoidance strategies (Hochman et al., 2016).

Mouse Tracking: Mouselab and Mouse Tracker

Tracking of computer-mouse movements is regarded as an analogous tool to eye tracking, as mouse and eye movements have been shown to correlate (Chen, Anderson, & Sohn, 2001). Mouse tracking methods can be distinguished by how researchers make inferences on the underlying processes of decision making. Mouselab system (Bettman et al., 1990) and MouselabWEB (Willemsen & Johnson, 2011) record the frequency, opening time, and sequence of box openings, which have been shown to serve as proxies for the subjective importance that information receives (Schulte-Mecklenbeck, Sohn, de Bellis, Martin, & Hertwig, 2013; Willemsen & Johnson, 2011). The mouse tracker (Freeman & Ambady, 2010), on the other hand, builds on the principle of response dynamics recording, by tracing the trajectories of mouse movements in choice tasks.

Mouselab

Mouselab (Bettman et al., 1990) is the computerized version of the information board (Payne, 1976), in which the participants have to open envelopes that contain information during decision making tasks. In Mouselab, all information is hidden behind boxes labeled with the corresponding parameter. Moving the mouse cursor over a box displays the underlying information. After moving the cursor outside of the box, the information is hidden again. The successor of Mouselab, MouselabWEB (Willemsen & Johnson, 2011), applies the same principle to a Web-based software package. Figure 13.6 depicts an example of a MouselabWEB display used by Pachur, Schulte-Mecklenbeck, Murphy, and Hertwig (2018). As the evidence for loss aversion has recently been questioned (see Gal & Rucker, 2018), researchers have looked into what role loss attention plays in loss aversion (Ashby, Yechiam, & Ben-Eliezer, 2018; Lejarraga, Schulte-Mecklenbeck, Pachur, & Hertwig, 2019; Pachur et al., 2018). Pachur et al. (2018) found that loss aversion is associated with relative attention to losses versus gains. By manipulating the participants’ attention to losses or gains, they observed that more exposure to losses increased subsequent loss aversion in comparison to exposure to gains. While loss aversion is likely preceded by attention to losses, loss attention is not sufficient to indicate subsequent loss aversion. Lejarraga et al. (2019) observed a robust pattern of increased attention to losses relative to gains, even though the vast majority of participants showed no loss aversion in their choices. They argued accordingly that loss attention is always present, but loss aversion seems to be state-dependent (e.g., if someone can afford to give up on potential gains).

Horizontal setup of a gamble decision in MouselabWEB with two outcomes and probabilities each. (Adapted from Pachur et al., 2018, p. 150)

Kogler, Olsen, Müller, and Kirchler (2020) tested the assumptions of the model of Allingham and Sandmo (1972) in an experiment, using MouselabWEB. The authors investigated whether higher audit probabilities and fine levels predict tax compliance in line with the theoretical model. However, the compliance rates were not well predicted by the model. In a between-subjects manipulation, they provided one group with additional information about the sure outcome of compliance and the expected value of evasion. Explicitly presenting expected values did not lead to more rational choices. Regarding the process data, almost all participants acquired all of the presented information (i.e., income, tax rate, audit probability, and fine level), but the choice patterns were inconsistent with the implicit process assumptions of the rational model (Orquin & Mueller Loose, 2013). Furthermore, when expected values were not provided, those participants who acquired information about income more frequently were also more compliant. The authors suggested an interpretation for this observation based on prospect theory. An increased focus on income makes a potential gain more salient; as a result, it is expected that the participants will show more risk-aversive behavior (i.e., compliance).

Mouse Tracker

Mouse tracking is based on the assumption that motor movements during a decision contain a signal of the cognitive processes during the decision process (Spivey & Dale, 2006). Specifically, it is assumed that the direction of movement toward or away from alternatives reflects their relative attraction at a given time point during the decision process. In a typical computer-mouse tracking experiment (see Fig. 13.7), the participants have to click a start button at the bottom center of the screen, which will reveal a stimulus. Usually, there are two options (although more than two options are accessible) presented at the top left and top right of the screen. The participants have to decide between the options by moving the computer-mouse toward the preferred option. By recording the cursor position with a high frequency, hand movements can be indirectly assessed and inferences about the underlying cognitive processes drawn accordingly.

Standard mouse tracking setup. Response buttons appear after the participants click on the start button. For visualizing the trajectories, they are remapped to one side and aggregated and time-normalized. (Adapted from Kieslich, Henninger, Wullf, Haslbeck, and Schulte-Mecklenbeck (2019, p. 121))

In the first mouse tracking study in the field of judgment and decision making, Koop and Johnson (2011) presented the participants with different gain and loss gambles. The participants showed a direct trajectory toward the less risky gain, when this option was chosen, indicating that this option was more attractive to them. However, when the riskier gain was chosen, the participants first showed a slight tendency toward the less risky option before moving to the riskier one, which they finally decided on. Though less pronounced, this effect was reversed in the loss domain. In another mouse tracking experiment, Kieslich and Hilbig (2014) investigated whether defection in social dilemmas induces cognitive conflict. The participants played simple two-person social dilemma games with two options (cooperation and defection). Indeed, when the individuals defected rather than cooperated, a cognitive conflict could be observed, indicated by response trajectories being more curved toward the nonchosen option. This observation confirms previous literature that considered cooperation to be characterized by spontaneous behavior, whereas defection is defined by effortful deliberation.

Neural Techniques and Peripheral Psychophysiology

Although eye and mouse tracking are useful tools to observe the processes underlying decision making, the brain is often considered to be the ultimate “black box” (Camerer, Loewenstein, & Prelec, 2005). Examining brain activity allows for the direct measurement of human thoughts and feelings, challenging our understanding of the relationship between cognition and behavior. Consequently, measuring brain activity helps to improve cognitive models (Frame, 2019), especially because it was demonstrated that neural activation could often predict outcomes better than what is possible with behavioral measures alone (Berns & Moore, 2012; Venkatraman et al., 2015). A relatively new discipline that utilizes such neural techniques is called neuroeconomics. Neuroeconomics is an interdisciplinary research field in which economists, neuroscientists, and psychologists try to develop more accurate models of human behavior by examining physical processes in the brain during economic decision making tasks (for an overview, see Camerer, Cohen, Fehr, Glimcher, & Laibson, 2015; see also chapters in the first part of this book). The premise of this approach is to better explain human decision making, especially in the face of the various anomalies from the rational model.

fMRI is currently the most popular neural technique (Camerer et al., 2015), which works by utilizing the increased oxygenation of brain regions that are responsible for a specific task by measuring the changes in the magnetic properties of oxygenated and deoxygenated blood (i.e., the BOLD signal). Thus, it is possible to obtain an indirect and correlative measure of local neuronal activity (Venkatraman & Reeck, 2019). For example, Sanfey, Rilling, Aronson, Nystrom, and Cohen (2003) used fMRI to study reactions to fair and unfair offers in the ultimatum game. They observed increased activity in the anterior insula (related to emotion) for rejected unfair offers, suggesting that emotions play an important role in decision making behavior (Sanfey et al., 2003). Harbaugh, Mayr, and Burghart (2007) reported from a tax compliance experiment that even mandatory tax-like transfers turn out to elicit neural activity in the ventral striatum, a key part of the brain’s reward system. The authors speculated that a better understanding of the conditions under which taxation elicits these “neural rewards” could prove useful for evaluating the desirability of different tax policies.

One drawback of the fMRI method is its limited temporal and spatial resolution (Schulte-Mecklenbeck et al., 2017). Thus, social psychologists often apply a variety of other peripheral psychophysiological and neural techniques, such as EEG, PET, rTMS, HRV, and EDA. For instance, EEG offers better temporal precision in comparison to fMRI (Frame, 2019). Electrodes are placed along the scalp to measure the electrical activity of the brain. Gangl, Pfabigan, Lamm, Kirchler, and Hofmann (2017) measured the EEG activity in a tax experiment in which they manipulated the description of tax authorities as either legitimate or coercive. When the tax authorities were perceived as legitimate, the participants showed higher decision conflict (indicated by higher cognitive control) compared to when they were perceived as coercive. In another tax experiment, Coricelli, Joffily, Montmarquette, and Villeval (2010) measured skin conductance responses (SCRs) as well as self-reported emotional arousal and valence. SCRs are the phasic component (discrete and short fluctuations) of the EDA, measured alongside the skin conductance levels (SCLs), which is the tonic component (overall conductivity of the skin). Both measurements are associated with emotional arousal. Participants who evaded had higher SCRs compared to those that were compliant. Additionally, being audited was associated with higher self-reported arousal and negative affect. When pictures of evaders were displayed at the end of a taxing round, compliance increased. Hence, the authors concluded that people are feeling anxious not only because of the monetary risk involved in the risky decision to evade but also because of the risk of getting publicly shamed. Contrary to the findings of Coricelli et al. (2010), evidence from an HRV study suggests that the intention to evade taxes generates anxiety and guilt or leads to a reduction of self-esteem in the taxpayer, which in turn increases tax compliance (Dulleck et al., 2016).

Furthermore, personality traits and testosterone levels have been linked to tax evasion (Arbex, Carre, Geniole, & Mattos, 2018). In a series of tax evasion experiments, the authors could observe a negative effect for the testosterone level, as well as dominance and self-construal, on tax evasion. In a recent study integrating neural techniques and peripheral psychophysiology, Balconi, Crivelli, Castiglioni, and Lozza (2019) applied EEG, HRV, and EDA in a public goods game concerning tax payment. They reported increased SCRs and theta EEG activity in the social condition, compared to the individual one, as well as increased HRV when there was no audit. Their findings highlighted the importance of psychological and social-affective variables in explaining the decision making process underlying tax compliance decisions (Balconi et al., 2019).

Practical Implications