Abstract

This chapter aims to examine the effect of different financial development indicators (i.e., overall financial development index, banking development index, stock market development index, and bond market development index) on environmental degradation for the period from 1991 to 2013 in 17 emerging economies. For this purpose, the relationship between financial development indicators, real income, urbanization, energy consumption, and ecological footprint is investigated using second-generation panel data methodologies to take into account the cross-sectional dependence. The empirical result reveals that increasing overall financial development index reduces environmental degradation. In addition, it is concluded that stock market development reduces environmental degradation while banking development and bond market development have no significant effect on environment.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

In recent decades, the sustainable development goal, particularly environmental sustainability has gained importance as never before, and many countries have funded investments toward these goals. After the pioneering works of Grossman and Krueger [12, 13], the basis of environmental degradation has often been associated with economic growth of countries based on fossil fuel-dependent production structures. In this direction, governments of many countries have turned to renewable energy sources that reduce carbon dioxide emissions in order to prevent environmental degradation and have supported projects that serve to improve renewable energy technologies. However, it is more preferable that such projects are financed by the private sector rather than the public sector. Because if the clean energy projects are directly financed by public financing instruments, the assumption that public financing will often be less costly than private financing may lead to a risk of the crowding-out private sector, even if it is more appropriate for private sector [14]. On the other hand, the role of finance sector on environmental quality is still ambiguous.

The possible positive effect of financial sector development has been explained with the view that financial openness encourages the investors to invest in eco-friendly technologies with high energy efficiency, thus promotes environmental quality [17]. However, Sadorsky [27] argues that financial development increases the credit supply and reduces financial costs which encourages consumption and the investments of both households and firms, thus increases the carbon emissions. Based on these contradictory allegations, it is a crucial issue that investigates the role of finance sector on environmental quality.

The other problematic and crucial issue is how to measure the level of environmental degradation. Most of the researchers have utilized with some atmospheric emissions (CO2, NOx, and SOx) as an indicator of environmental degradation. However, reducing atmospheric emissions does not mean that environmental degradation will decline as well. For instance, measures to reduce carbon dioxide emissions may lead to degradation in forest land, grazing land, or water resources. Therefore, ecological footprint developed by Wackernagel and Rees [41] may potentially be more suitable for measuring the level of environmental degradation. Because the ecological footprint is the sum of six subcomponents, i.e., cropland, grazing land, fishing grounds, forest land, built-up land, and carbon footprint [9].

Based on above discussions, the aim of this chapter is to investigate the effect of financial development on ecological footprint in emerging economies. The main reason for the selection of emerging economies is due to the lack of public funds of these countries in financing of green projects when compared to the developed countries. The contributions of this chapter to the existing literature are as follows: (i) Unlike previous studies, this study examines the impact of financial development with different dimensions (i.e., stock market development, bond market development, and banking sector development) on environmental degradation and this situation gives a chance to policy implications in detail. (ii) This study utilizes with the ecological footprint as an indicator of environmental degradation while most of the previous studies used atmospheric emissions. (iii) In order to prevent the possible omitted variable bias, some control variables (i.e., economic growth, energy consumption, and urbanization) are included to the empirical models. (iv) This study employs the second-generation panel data methodologies to take into account the possible cross-sectional dependence among emerging economies.

2 Literature Review

In environmental economics literature, there are many studies that examine the linkage between economic performance and environmental degradation and it is mostly argued that high growth performance reduces environmental degradation with the influence of technological progression. On the other hand, the funding process of these high-cost environmental friendly technologies is generally ignored. Based on the argument that the finance sector may play a key role in financing clean energy projects, we observe the studies that examined the nexus between financial development and environmental quality.

Abbasi and Riaz [1] examined the financial development and environmental degradation nexus for the period from 1971 to 2011 in emerging economies using with ARDL-bound test and concluded that financial development increases carbon dioxide emissions. Saidi and Mbarek [28] investigated the impact of economic growth, trade, urbanization, and financial development on environmental degradation in 19 emerging economies for the period of 1990–2013 using with panel GMM estimation and found that increasing financial activities reduce carbon dioxide emissions. Koengkan et al. [17] probed the relationship between financial openness and carbon dioxide emissions in MERCOSUR countries for the period from 1980 to 2014 with panel ARDL approach and found that financial development increases environmental degradation. Omri et al. [18] looked at the relationship between financial development, economic growth, trade openness, and environmental degradation for the period from 1990 to 2011 in 12 MENA countries using with panel GMM method and concluded that financial development has no statistically significant effect on environmental degradation. Ozturk and Acaravci [19] investigated the nexus between financial development and environmental degradation for the period from 1960 to 2007 in Turkey and concluded that financial development has not significant effect on carbon dioxide emissions. Salahuddin et al. [29] examined the effect of economic growth, electricity consumption, foreign direct investment, and financial development on environmental degradation in Kuwait for the period of 1980–2013 using with ARDL-bound test approach and concluded that financial development reduces carbon dioxide emissions for the long run. Shahbaz et al. [30] searched the nexus between financial development, economic growth, energy consumption, international trade, and environmental degradation in Indonesia for the quarterly period from 1975 q1 to 2011 q4 using with ARDL-bound test and the results show that financial development reduces environmental degradation. Shahbaz et al. [31] probed the effect of financial development on carbon dioxide emissions for the period from 1971 to 2011 in Malaysia utilizing with ARDL-bound test approach and found the reducing effect of financial development on environmental degradation. Shahbaz et al. [32] investigated the impact of financial development, coal consumption, economic growth, and trade openness on environmental quality for the period from 1965 to 2008 in South Africa with ARDL-bound test and the study confirmed the reducing effect of financial development on emissions. Tamazian et al. [36] searched the association between stock market development, banking development, and environmental degradation for the period of 1992–2004 in BRIC countries and the results show that both stock market development and banking sector development reduce environmental degradation. Boutabba 4] examined the impact of financial development, energy consumption, and trade on carbon emissions for the period from 1971 to 2008 in India using with ARDL-bound test approach and found that financial development deteriorates environment. Charfeddine and Khediri [7] probed the nexus between financial development and environmental quality in United Arab Emirates for the period of 1975–2011 and found an inverted U-shaped relationship between financial development and environmental degradation. Shahbaz et al. [33] searched the relationship between financial development, globalization, energy consumption, and carbon emission in India spanning the period from 1970 to 2012 and the results show that financial development accelerates environmental degradation. Dogan and Turkekul [10] applied the ARDL-bound testing approach to determine the impact of financial development on CO2 emissions in the USA. They found that financial development affects carbon emissions insignificantly. By apply DOLS, Katircioğlu and Taspinar [16] reported that financial development impedes environmental quality by increasing carbon emissions. Solarin et al. [35] examined the impact of foreign direct investment and financial development on CO2 emissions in Ghana by applying the bound testing approach. They found that foreign direct investment and financial development increase carbon emissions. Jalil and Feridun [15] investigated the effect of economic growth, financial development, and energy consumption on environment for the period of 1953–2006 in China using with ARDL-bound test approach and concluded that financial development reduces carbon emissions.

Paramati et al. [20] focused on the impact of stock market development on environment and examined the impact of foreign direct investment and stock market development on carbon emission for the period of 1991–2012 in emerging economies and the study concluded that stock market development increases environmental degradation. Paramati et al. [21] compared the effect of stock market development on carbon emission observing the period from 1993 to 2012 in EU, G-20, and OECD countries, respectively. The findings of this study show that stock market development increases environmental degradation in OECD countries while it reduces the degradation in EU and G-20 countries. Paramati et al. [22] examined the connection between stock market development and environmental degradation for the period from 1991 to 2012 in G-20 countries and concluded that stock market development increases the carbon emissions in developing G-20 countries while stock market reduces the emission in developed G-20 countries.

As seen from mentioned literature, the environmental degradation level is generally indicated by CO2 emissions while the level of environmental degradation cannot be captured by only the carbon emissions. In addition, most of these studies examined the effect of financial development on environment and the different dimensions of the financial sector were not considered. These deficiencies constitute the main motivation of the study that investigating the impact of banking sector development, stock market development, and bond market development as well as the overall financial development on ecological footprint.

3 Empirical Strategy

3.1 Model and Data

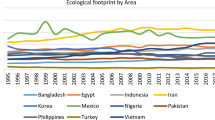

The annual data used in this chapter covers the period from 1991 to 2013 for 17 emerging economies: Brazil, China, Colombia, Czech Republic, Greece, Hungary, Indonesia, South Korea, Malaysia, Mexico, Peru, Poland, Philippines, Russia, South Africa, Thailand, and Turkey. To examine different financial development indicators on environmental degradation, the panel version of empirical models are constructed as follows:

where ln EF is the natural log of ecological footprint which indicates environmental degradation, ln GDP is the natural log of real gross domestic product which indicates economic growth, ln EC is natural log of energy consumption, ln URB is natural log of urbanization, ln FD is natural log of overall financial development index, ln BAD is natural log of banking development index, ln SMD is natural log of stock market development index, and ln BND is natural log of bond market development index. In addition, i, t, and uit refers to cross section, time period, and error terms, respectively.

The ecological footprint is measured in ecological footprint per capita, gross domestic product per capita is measured in constant 2010 US$, urbanization is measured in percentage of urban population in total population, and energy consumption is measured in kg of oil equivalent per capita. FD represents the financial development index which includes three sub-indices. The financial development index includes banking sector development index (BAD), stock market development index, (SMD) and bond market development index (BND). The banking sector development index is constructed with using deposit money bank assets to GDP, financial system deposit to GDP, liquid liabilities to GDP, and private credit by deposit money banks to GDP. The stock market development index covers the stock market capitalization to GDP, stock market turnover ratio, and stock market total value traded to GDP. The bond market development index includes the outstanding domestic private debt securities to GDP, the outstanding domestic public debt securities to GDP, the outstanding international private debt securities to GDP, and the outstanding international public debt securities to GDP. Following the studies of Tang and Tan [37], Shahbaz et al. [34], Topcu and Payne [38] and Destek [8], the financial development index and the sub-indices are computed with principal component analysis (PCA).

3.2 Methodology

3.2.1 Panel Unit Root Test

The stationary properties of variables are examined with the panel unit root test of Pesaran [24] to consider the cross-sectional dependence. The test which is called as second-generation panel data methodologies is characterized by the rejection of cross-sectional independence hypothesis, and therefore, the tests is suitable for the panel data, where cross-sectional dependence is present. Since the CIPS unit root test is based on CADF test, first the computation of the cross-sectional ADF (CADF) regression can be shown as follows:

where \(a_{i}\) is deterministic term, k is the lag order, and \(\bar{y}_{t}\) is the cross-sectional mean of time t. Following above equation, t-statistics are obtained with the computation of individual ADF statistics. Furthermore, CIPS is obtained from the average of CADF statistic for each i as follows:

The critical values of CIPS for different deterministic terms are given by Pesaran [24].

3.2.2 Common Correlated Effect Mean Group (CCE-MG) Estimator

In case of the existence of cross-sectional dependence, the impact of explanatory variables on the dependent variable should be examined with a second-generation panel data estimators. In this direction, this study utilizes the common correlated effect mean group (CCE-MG) estimator developed by Pesaran [26] to take into account the cross-sectional dependence. If we combined our main panel models as follows:

where \(Y_{it}\) is ecological footprint, \(X_{i,t}\) is the vector of explanatory variables, and the residual term \((e_{it} )\) is a multifactor residual term. The multifactor residual terms are constructed as follows:

where \({\text{UF}}_{t}\) is the \(m \times 1\) vector of unobserved common factors. In addition, Pesaran [26] utilizes with cross-sectional averages, \(\bar{y}_{t} = \frac{1}{N}\sum\nolimits_{i = 1}^{N} {Y_{it} }\) and \(\bar{X}_{t} = \frac{1}{N}\sum\nolimits_{i = 1}^{N} {X_{it} }\) to deal with cross-sectional dependence of residuals as observable proxies for common factors. In the next step, slope coefficients and their cross-sectional averages are consistently regressed as follows:

Pesaran [26] refers to the computed OLS estimator \(\hat{B}_{{i,{\text{CCE}}}}\) of the individual slope coefficients \(B_{i} = \left( {\delta_{1} ,.., \delta_{n} } \right)\) as the “Common Factor Correlated Effect” estimator:

where \(Z_{i} = \left( {z_{i1} ,z_{i2} , \ldots , z_{iT} } \right)^{\prime }\), \(z_{it} = \left( {X_{it} } \right)^{\prime }\), \(Y_{i} = \left( {Y_{i1} , Y_{i2} , \ldots ,Y_{it} } \right)^{\prime }\), \(\bar{D} = I_{T} - \bar{H}\left( {\bar{H}^{\prime } \bar{H}} \right)^{ - 1} \bar{H}\), \(\bar{H} = \left( {h_{1} ,h_{2} , \ldots , h_{T} } \right)^{\prime }\), \(h_{t} = \left( {1,\bar{Y}_{t} ,\bar{X}_{t} } \right)\) as the CCE estimators. The CCE-MG estimator is obtained with the average of the individual CCE estimators as follows:

3.2.3 Augmented Mean Group (AMG) Estimator

In panel data methodologies, in addition to the issue that cross-sectional dependence, one of the other problems is that assuming the homogeneous slope coefficient. Using the standard dynamic panel estimators may not be appropriate for macroeconomics panels since these estimators assume homogeneous slope coefficients across panels. In order to deal with this problem, Bond and Eberhardt [3] developed the augmented mean group (AMG hereafter) estimator which allows heterogeneity in slope coefficients and also allows for both cross-sectional dependence and non-stationary variables. The AMG estimator includes a common dynamic process which indicates unobservable common factors in the main model. To employ the AMG estimator, the main model of this study can be constructed as follows;

where i and t indicate the cross section and the time period, respectively. The AMG testing procedure includes two stages. In first stage, first differenced form augmented with T − 1 year dummies of Eq. (12) is estimated with pooled OLS regression and the parameters of the year dummies are collected as follows;

where \(\left( {\Delta D_{t} } \right)\) represents differenced T − 1 year dummies and \(p_{t}\) indicates parameters of year dummies. Estimated parameters \(\left( {\hat{p}_{t} } \right)\) are relabeled as \(\hat{\gamma }_{t}\) which implies the evolution of common dynamic process. The second stage is as following;

The group-specific regression model is augmented with \(\hat{\gamma }_{t}\) as shown in Eq. (14) and finally, the group-specific model coefficients are averaged across the panel.

3.2.4 Panel Heterogeneous Causality Test

Investigating the causal relationship between variables is also crucial for empirical studies. Therefore, we employ the panel heterogeneous causality test of Dumitrescu and Hurlin [11] to determine the possible causal connections and the directions of the causalities. There are some advantages of using this procedure. First, this methodology gives consistent results in case of both small samples and cross-sectional dependence. Second, the test is suitable if all the variables are stationary at same level. Third, the test is appropriate for the unbalanced panels and panels with different lag order for each individual. The panel heterogeneous causality method is constructed as follows:

where \(W_{i,t}\) is the Wald statistic for the country i, therefore the first statistic computed with the simple means of Wald statistic, individually. In addition, Dumitrescu and Hurlin [11] suggested another statistic with standardizing \(W_{N,T}^{\text{HNC}}\) statistic by using estimated values of mean and variance of each Wald statistic with a small sample for T. The computation of this statistic is as following:

In testing procedure, the null of there is not a homogeneously causality in the panel is tested against the alternative hypothesis.

4 Institutional Background

In order to observe the global importance of emerging economies, some macroeconomic variables related to this study are observed within global indicators. The global significance of emerging economies can be seen in Table 1. The statistics show that the national income of emerging economies constituted 17.18% of global income in 1991 and this share has been increased to 26.54% in 2013. As a common result of this economic achievement, the share of energy usage of emerging economies has increased from 30.20% in 1991 to 40.18% in 2013 and the share of ecological footprint of emerging economies has increased from 33.13% in 1991 to 41.60% in 2013. Surprisingly, as a shown in Table 1, in contrast to rapid economic growth and rapid environmental degradation, the share of the population of these countries in the global population dropped from 39.53% in 1991 to 36.20% in 2013.

If the statistics are evaluated in terms of the growth rates, it seems the significance of the emerging economies in global income has increased by 54.45% and the energy consumption share of these countries in global energy consumption has increased by 33.04%. In addition, the responsibility of emerging economies for increasing environmental degradation has increased by 25.57% spanning the period from 1991 to 2013. Moreover, the share of the population of these countries has decreased by 8.42%. To sum up, if the emerging economies maintain their growth rates for mentioned variables, they will increase their economic importance for the global economy as well as they will be responsible for accelerating the environmental degradation in the near future. Based on this, the successful implementation of effective energy policies by these countries is crucial to the achievement of targets to reduce global environmental degradation.

Table 2 presents the mean values of observed variables as well as the summary statistics of emerging economies for the period of 1991–2013. It seems that there is a huge variation of per capita income among emerging economies with the highest 24,017 US dollars in Greece and the lowest 1767 US dollars in Philippines. In the similar direction, Greece, Czech Republic, and Russia have the highest ecological footprint while lowest ecological footprint values belong to Philippines, Indonesia, and Colombia. In addition, the most energy consumer countries are Russia and South Korea. In case of urbanization, the share of urban population in total population of emerging economies ranges from 35.92% in Thailand to 81.04% in Brazil.

5 Empirical Results

In order to investigate the effect of different financial development indicators on environmental degradation, we first examine the validity of cross-sectional dependence among emerging economies using with Lagrange multiplier (LM) test of Breusch and Pagan [5], cross-sectional dependence (CD) and Lagrange multiplier for cross-sectional dependence (CDLM) test of Pesaran [23], and LMadj test of Pesaran et al. [25]. As illustrated in Table 3, the null hypothesis of cross-sectional independence is rejected by all tests. Therefore, it is concluded that a shock in one of the emerging country may be easily transmitted to the other countries.

Although utilized coefficient estimators do not require pretesting procedures such as unit root and cointegration tests, the stationarity of the variables is examined by CIPS unit root test because the causality test to be used can be applied to stationary variables. The results from Table 4 shows that the null hypothesis of unit root is not rejected for the level form of all variables. However, in the first differenced form, the null hypothesis is strongly rejected and the variables have become stationary. This results mean that the variables are integrated of order one and denoted I(1).

The validity of cross-sectional dependence requires the second-generation panel data estimation method that allows cross-sectional dependence among countries. Hence, we first utilize with CCE-MG estimator and the results are shown in Table 5. First of all, based on the results from all models, we found that increasing real income and energy consumption increases environmental degradation in emerging economies. A 1% increase in real income increases ecological footprint by 0.570–0.672% and a 1% increase in energy consumption increases ecological footprint by 0.390–0.401%. The findings that increasing real income increases ecological footprint is also found by Al-Mulali et al. [2], Ulucak and Bilgili [40], and Destek et al. [9]. This result means that observed countries pay more attention to the economic sustainability than environment. Moreover, the findings that ecological footprint increasing effect of energy consumption is also consistent with the study of Charfeddine [6]. This finding can be interpreted as the production activities of emerging economies have still depended on fossil fuel energy consumption. In addition, it seems that the coefficient of urbanization on environmental degradation is positive for all models while it is statistically significant only for Model II and Model III. In case of financial development, the result reveals that financial development reduces environmental degradation. All else is same, a 1% increase in overall financial development index reduces ecological footprint by 0.007%. The obtained evidence that financial development reduces ecological footprint is consistent with Uddin et al. [39]. In addition, our results show that only stock market development index is efficient to reduce environmental degradation among sub-indices of financial development. A 1% increase in stock market development index reduces ecological footprint by 0.005%. On the other hand, the coefficient of both banking development index is statistically insignificant.

We also use the AMG estimator to robustness check of the estimation results and present in Table 6. According to the AMG estimation, similar to the CCE estimation results, it is found that increasing real income and energy consumption increases environmental degradation. All else is same, a 1% increase in real income increases ecological footprint by 0.583–0.603% and a 1% increase in energy usage increases ecological footprint by 0.378–0.388%. Unlike the CCE-MG estimation, the coefficient of urbanization on ecological footprint is found as statistically insignificant. When the results are evaluated in terms of financial development, the result reveals a 1% increase in overall financial development index reduces ecological footprint by 0.005%. In the same way, as CCE-MG results, the AMG estimation results also show that only stock market development is efficient in reducing environmental degradation.

Next, the causal relationship between explanatory variables and ecological footprint is searched with Dumitrescu–Hurlin causality method and the results are shown in Table 7. According to the findings, there is bidirectional causal relationship between real income and ecological footprint. The bidirectional causality is also found between urbanization and ecological footprint. In addition, the unidirectional causal relationships are valid from energy consumption to ecological footprint, overall financial development index to ecological footprint, stock market development index to ecological footprint, and from ecological footprint to bond market development index. However, there is no causal connection between banking development index and ecological footprint.

To sum up, our results show that increasing real income and increasing energy usage are the main drivers of environmental degradation in emerging economies. In case of financial development, it seems that increasing overall financial development index and stock market development reduces environmental degradation while bond market development and banking development have not statistically significant effect on environment.

6 Conclusions and Policy Implications

This chapter examined the impact of financial development with different dimensions (banking development, stock market development, and bond market development) on environmental degradation for the period from 1991 to 2013 in emerging economies. In doing so, as proxy of environmental degradation, we used the ecological footprint; and overall financial development index, banking development index, stock market development index, bond market development index, real income, energy consumption, and urbanization are included as explanatory variables to the empirical models and the associations between variables are estimated using with second-generation panel data methodologies to take into account possible cross-sectional dependence among countries.

Our empirical findings show strong evidence of cross-sectional dependence among emerging economies thus it is concluded that a shock in one of the emerging economies may be easily transmitted to the other countries. The results also indicate that increasing income level and increasing energy consumption are the main triggers of environmental degradation in observed countries. In case of finance sector, it is found that overall financial development and stock market development reduce the ecological footprint while banking development and bond market development have no significant effect on environmental degradation. We also search the causal connection between variables and causality test results reveal that there is bidirectional causal relationship between real income and ecological footprint. The bidirectional causality is also found between urbanization and ecological footprint. In addition, the unidirectional causal relationships are valid from energy consumption to ecological footprint, overall financial development index to ecological footprint, stock market development index to ecological footprint, and from ecological footprint to bond market development index. However, there is no causal connection between banking development index and ecological footprint.

The empirical findings of this study have many policy implications. The most remarkable of which is that although carbon emissions is one of the most important components of the ecological footprint, addressing only carbon emissions reduction goals and steering the funds in the financial system solely for this purpose does not reduce ecological footprint. In this direction, it is important that these countries should adopt policies and measures to reduce the excessive exploitation of natural resources and increase the effectiveness in resource use in order to reduce the gap between their biocapacity and ecological footprint.

Moreover, it is a well-known fact that in countries where the financial sector is developed, financial resources are obtained at a lower cost. In this direction, the funds needed for the purchase of technologies that provide efficiency in energy consumption and for eco-friendly and renewable energy technologies can be provided from finance sector. However, our empirical findings suggest that such funds are provided from only stock market; banking sector and bond market does not have any role on environment in emerging economies. In this regard, new instruments and regulations for the finance sector can be developed. Governments of these countries should monitor the financial resources allocation mechanism of the banking sector through central banks or banking regulation agencies and tighten the credit conditions of the firms that are involved in the environmental degradation activities. For instance, the interest rates can be increased in the loans allocated to the firms having environmental degradation enhancing activities. In addition, the governments should encourage banks to enhance funding for development projects that promote energy efficiency and environmental friendly technologies.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114

Al-Mulali U, Weng-Wai C, Sheau-Ting L, Mohammed AH (2015) Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol Ind 48:315–323

Bond S, Eberhardt M (2013) Accounting for unobserved heterogeneity in panel time series models. Nuffield College, University of Oxford, mimeo

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253

Charfeddine L (2017) The impact of energy consumption and economic development on ecological footprint and CO2 emissions: evidence from a Markov switching equilibrium correction model. Energy Econ 65:355–374

Charfeddine L, Khediri KB (2016) Financial development and environmental quality in UAE: cointegration with structural breaks. Renew Sustain Energy Rev 55:1322–1335

Destek MA (2018) Financial development and energy consumption nexus in emerging economies. Energy Sources Part B 13(1):76–81

Destek MA, Ulucak R, Dogan E (2018) Analyzing the environmental Kuznets curve for the EU countries: the role of ecological footprint. Environ Sci Pollut Res 25(29):29387–29396

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213

Dumitrescu EI, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460

Grossman GM, Krueger AB (1993) Environmental impacts of a North American free trade agreement. In: Garber PM (ed) The US–Mexico free trade agreement. MIT Press, Cambridge MA, pp 13–56

Grossman GM, Krueger AB (1995) Economic growth and the environment. Quart J Econ 110(2):353–377

Hussain MZ (2013) Financing renewable energy options for developing financing instruments using public funds. World Bank, Washington, DC

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291

Katircioğlu ST, Taspinar N (2017) Testing the moderating role of financial development in an environmental Kuznets curve: empirical evidence from Turkey. Renew Sustain Energy Rev 68:572–586

Koengkan M, Fuinhas JA, Marques AC (2018) Does financial openness increase environmental degradation? Fresh evidence from MERCOSUR countries. Environ Sci Pollut Res 25(30):30508–30516

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Paramati SR, Ummalla M, Apergis N (2016) The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Econ 56:29–41

Paramati SR, Apergis N, Ummalla M (2017) Financing clean energy projects through domestic and foreign capital: the role of political cooperation among the EU, the G20 and OECD countries. Energy Econ 61:62–71

Paramati SR, Mo D, Gupta R (2017) The effects of stock market growth and renewable energy use on CO2 emissions: evidence from G20 countries. Energy Econ 66:360–371

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. CESifo working paper 1229. IZA discussion paper, 1240

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Pesaran MH, Ullah A, Yamagata T (2008) A bias-adjusted LM test of error cross-section independence. Econ J 11(1):105–127

Pesaran MH (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74(4):967–1012

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535

Saidi K, Mbarek MB (2017) The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ Sci Pollut Res 24(14):12748–12757

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sustain Energy Rev 81:2002–2010

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sustain Energy Rev 25:109–121

Shahbaz M, Solarin SA, Mahmood H, Arouri M (2013) Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ Model 35:145–152

Shahbaz M, Tiwari AK, Nasir M (2013) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459

Shahbaz M, Mallick H, Mahalik MK, Loganathan N (2015) Does globalization impede environmental quality in India? Ecol Ind 52:379–393

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37(1):246–253

Tang CF, Tan BW (2014) The linkages among energy consumption, economic growth, relative price, foreign direct investment, and financial development in Malaysia. Qual Quant 48(2):781–797

Topcu M, Payne JE (2017) The financial development–energy consumption nexus revisited. Energy Sources Part B 12(9):822–830

Uddin GA, Salahuddin M, Alam K, Gow J (2017) Ecological footprint and real income: panel data evidence from the 27 highest emitting countries. Ecol Ind 77:166–175

Ulucak R, Bilgili F (2018) A reinvestigation of EKC model by ecological footprint measurement for high, middle and low income countries. J Clean Prod 188:144–157

Wackernagel M, Rees W (1998) Our ecological footprint: reducing human impact on the earth, vol 9. New Society Publishers

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Destek, M.A. (2019). Financial Development and Environmental Degradation in Emerging Economies. In: Shahbaz, M., Balsalobre, D. (eds) Energy and Environmental Strategies in the Era of Globalization. Green Energy and Technology. Springer, Cham. https://doi.org/10.1007/978-3-030-06001-5_5

Download citation

DOI: https://doi.org/10.1007/978-3-030-06001-5_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-06000-8

Online ISBN: 978-3-030-06001-5

eBook Packages: EnergyEnergy (R0)