Abstract

Continuous innovation is one of the pharmaceutical industry’s most defining characteristics. New medications can be crucial for maintaining the quality of human life, and may even affect its duration. The sales potential is staggering: the global pharmaceutical market is expected to reach $1.1 trillion by 2015. The pressure to succeed is tremendous. Yet, pharmaceutical innovation is hardly an orderly, predictable process. It follows a technology-push model dependent on a meandering path of scientific breakthroughs with uneven timing and hard to foresee outcomes. Technological competency, decades of rigorous research, and profound understanding of unmet customer needs, while necessary, may prove insufficient for market success as the critical decision for commercialization remains outside the firm.

Drug innovation as a business process requires savvy strategic, organizational, and managerial decisions. It is already enjoying intensive research coverage, giving rise to abundant but relatively dispersed knowledge of the mechanisms driving drug discovery and development. In this chapter, we present a comprehensive overview of the process of drug innovation from a business and academic perspective. We discuss the evolving organizational forms and models for collaboration, summarize significant empirical regularities, and highlight differences in market positions related to firms’ strategic orientation, innovation emphasis, attitudes to risk, and specialized resources. As a guide to future research, critical drivers and modes for drug innovation are systematized in a unifying framework of characteristics and process decisions, and multiple areas in need of further scrutiny, analysis, and optimization are suggested. Because of its rich potential and high significance, research on drug innovation seems poised to gain increasing momentum in the years to come.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

2.1 Introduction

The pharmaceutical industry is essentially defined by innovation. Research on the forefront of science, the creation of new knowledge bases, the invention of new medicines, and the improvement of existing drugs constitute the fuel that propels the firms in this industry. The occasional triumph of creating a novel therapy in an area with no prior treatments counts among the pharmaceutical industry’s most defining hallmarks. This is the only industry whose output can make a difference by affecting the very molecules we are made of.

Modern era medications can influence the quality and the duration of human life in ways that were never possible before. As recently reported by the Pharmaceutical Research and Manufacturers of America (PhRMA), over the last 25 years prescription drugs have successfully improved the wellbeing of arthritis and Alzheimer’s sufferers around the world, and have significantly reduced deaths from heart disease, several types of cancer, and HIV/AIDS. The death rate for cardiovascular disease has fallen by a dramatic 28 % between 1997 and 2007, while the average life expectancy for cancer patients has increased by 3 years since 1980. Most of these gains are attributable to new medicines. In the USA, since the approval of antiretroviral treatments in 1995, the death rate from HIV/AIDS has dropped by more than 75 %. As predicted by IMS Health, innovative treatment options for stroke prevention, arrhythmia, melanoma, multiple sclerosis, breast cancer, prostate cancer, and hepatitis C are also imminent.

Successful and continuous new drug introductions constitute the source of sustainable competitive advantage for the firms in this industry. The sales potential is gigantic: the global pharmaceutical market was estimated at $837 billion in 2009 and was expected to reach $1.1 trillion by 2015. As reported by the IMS Institute for Healthcare Informatics (www.imshealth.com), in the USA alone, a total of $307 billion dollars, or $898 per capita, was spent on ethical drugs in 2010, representing 2.1 % of the GDP. The USA is poised to remain the single largest pharmaceutical market, with four billion dispensed prescriptions and a total revenue of $380 billion expected by 2015. Some estimates indicate that 46 % of the people living in the USA take at least one prescription drug.

Not only is the USA the largest market for ethical drugs, but it is also recognized as the world leader in drug discovery and development, as well as a global hub for scientific and medical research. The pharmaceutical sector is the second largest US export sector, just behind the aerospace industry. It is also a major employer, estimated to provide jobs to 655,000 people. In total, directly and indirectly, the sector supports over 3.1 million jobs nationwide. It is also one of the few industries that are projected to keep adding jobs in the years to come despite the recent slowdown in the economy (PhRMA and the Bureau of Labor Statistics).

Although innovation is the lifeblood of any industry, the discovery and development of new medicines is accompanied by a host of unique challenges, ethical implications, and social responsibilities. One will be hard pressed to think of another industry where meticulous research, rigorous testing, and stringent product standards (or the lack thereof) can have such a profound impact on human wellbeing. The fundamental role of the pharmaceutical industry in maintaining and enhancing human life is further reflected in the magnitude of its R&D activity. By some accounts, pharmaceutical R&D holds an impressive 19 % share of all business spending on R&D worldwide—an impressive financial commitment for a single industry. The USA is accountable for the lion’s share of pharmaceutical innovation as it finances about 36 % of the global expenses in pharmaceutical R&D.

In 2010, the US-based pharmaceutical firms had a total budget of about $67 billion designated for research. Another $31 billion was earmarked by the National Institutes of Health (NIH) to fund research in public sector institutions (primarily government labs and universities).Footnote 1 The total pharmaceutical R&D spending in the USA has been steadily rising at an average rate of about 12 % a year, not adjusting for inflation (Cockburn 2007).

PhRMA members allocate about 20 % of their domestic sales to R&D, which makes the pharmaceutical industry the most research-intensive one in the USA. The industry’s R&D spending per employee is estimated at $105,430, which is 40 % higher than the second highest research-intensive industry (communications equipment), and 60 % higher than other technology-driven industries such as semiconductors, computers, and electronics.

PhRMA companies currently boast rich pipelines of drug candidates. In the USA there are nearly 3,000 different medicines in various stages of product development, representing a whopping 45 % of all drugs in development worldwide. Of those 3,000 new drugs in the pipeline of the US-based firms, an assortment of anticancer drugs holds the lead with 861 medicines in development, followed by 334 for respiratory diseases, 300 for rare diseases, 299 for cardiovascular disorders, 252 for mental and behavioral disorders, 235 for diabetes, 100 for HIV/AIDS, 98 for Alzheimer’s disease and dementia, 74 for arthritis, and 25 for Parkinson’s disease.Footnote 2

Despite the ubiquitous presence of medications in our lives, to many of us laypersons, the actual drug innovation process seems arcane. As customers or patients, we tend to focus on the end outcomes, just like we do with other high-tech, increasingly complex and specialized fields of innovation. And yet, as human beings, we are often fascinated by the possibilities the latest advances in life sciences (e.g., genomics, molecular biology, neuroscience, biotechnology) open to us. Drug innovation converts these new opportunities into drugs that can directly impact our physiology. This realization prompts a closer examination of the methods, steps, and processes associated with the genesis of ethical drugs.

Surely, some aspects of the drug innovation process are well-known and widely discussed. The industry is perhaps less of an enigma these days due to the unfaltering attention given it in the media. But creating efficacious drugs is also a multibillion dollar business, and there is a need to integrate the abundant yet rather compartmentalized extant knowledge about drug innovation. Such synthesis can enable us to view the process systematically and discuss it in more depth, richer detail, and with a clear emphasis on its business aspects.

It is well known that drug creation finds itself on the leading edge of the latest scientific and technological breakthroughs. Revolutionary discoveries in various disciplines are often employed to assist in the selection among myriads of naturally occurring compounds, in the design of new ones, or in the transformation of existing ones. The economic aspects related to the colossal amounts of effort and dedication germane to drug innovation are no less deserving of attention.

Drug innovation emerges at the confluence of state-of-the-art discoveries in the life sciences, aided by cutting-edge advancements in other fields such as engineering, informatics, and optimization. Thriving in the wake of the latest achievements in these disciplines, it often brings them together to intersect and interact in a way geared to ultimately improve human health and extend human life. In the process of finding the most effective structures and the most efficient strategies, novel decision opportunities and challenges arise, and new organizational forms and arrangements emerge to address them.

Inventing novel drugs is ultimately a business process in need of strict fiscal discipline and effective strategic, organizational, and managerial decisions. Various aspects of pharmaceutical innovation have been the object of intense scrutiny in diverse fields such as economics, business strategy, and marketing. Still, the obtained findings and inferences have remained somewhat insular, limited to the originating discipline despite their broader applicability and significance. There are many areas that warrant further analysis and optimization. This is why a comprehensive overview of the business processes, strategies, and practices related to pharmaceutical innovation seems necessary and timely. A compilation of this kind can be a useful reference source for various future streams and areas of research.

Hence, the intention with this chapter is to present recent findings related to the organization and the outcomes of the innovation process in the pharmaceutical industry, and concisely yet systematically review them from a business perspective. We hope that a more integrated and informative picture of the currently dispersed fragments of knowledge will arise in this process. Such an outlook will be of interest to business students, fellow researchers, and pharmaceutical executives alike, as well as to anybody with a keen curiosity about the exciting domain of drug innovation.

We start by presenting some facts and figures related to the economics of drug innovation, and briefly describe the evolution of drug discovery from a historical perspective. We proceed with a comprehensive overview of the modern process of drug innovation. To highlight the nature and the sources of its inherent complexity, we provide succinct but hopefully informative descriptions of some of the latest technologies involved. Next, we discuss the mechanisms of intellectual property protection pertinent to the industry, and outline the distinction between patents and market exclusivity. Then we move on to discuss me-too and follow-on drugs. The foray of generic drugs, the market conditions most conducive to their entry, and the drastic market changes triggered by such entry are detailed next. This discussion is followed by a review of theoretical arguments and empirical findings related to economies of scale and scope in the pharmaceutical industry. We then proceed by presenting the fundamental types of organizations that operate in this industry and discuss the modes of collaboration that have emerged in drug innovation, with a particular focus on alliances. Next, we present a summary of recent findings and insights from the academic literature. We touch upon the precursors to the current industry structure in the USA, the synergistic and preemptive benefits of investing in own R&D, the implications of early and late timing for market entry, the dynamics of market adoption in the case of pent-up demand, and the key factors that affect the market diffusion of a new drug. Then we outline the most recent trends related to pharmaceutical innovation. We conclude the chapter by suggesting directions for future research.

2.2 An Overview of Innovation in the Pharmaceutical Industry

The nature of the pharmaceutical industry makes it a veritable standout compared to others. Profound understanding of market needs is necessary but woefully insufficient for a firm to succeed. Even when finding effective medications is vitally important for the wellbeing of millions of patients, decades of painstaking research may still fail to produce a satisfactory new product.

No other industry is expected to affect how long people can live or how fast they can recover from an illness. No other industry is focused on relieving the physical pain and other discomforts everyone gets to experience in life. Consequently, no other industry is under such tremendous pressures to innovate. Still, no other industry can burn through billions of dollars and man-hours only to end up empty-handed, with not much to show for its vast expenditure, dedication, and effort.

Unlike many other market-driven industries, the pharmaceutical industry follows the so-called technology-push model. Life sciences are at the center of its endeavors to alter or reverse the processes in the human body. The onus of creating value for patients is squarely dependent on a meandering path of scientific advances and technological breakthroughs with largely unpredictable results and uneven timing.

From a business perspective, the positive momentum created by successful innovation can have dramatic, long-lasting implications for the pharmaceutical firm. The impact of a new drug launch often goes beyond the hefty profits associated with patent protection and first-mover advantage. Incremental, follow-up improvements involving greater efficacy, fewer or less severe side effects, a more convenient dosage regimen, changes in the application method, modified formulations, or new indications can significantly expand the market potential for the firm by making the drug appropriate for new patients (e.g., patients who can benefit from different dosage protocols). Notably, more than half of the new brands of drugs introduced in 2010 were not novel chemical entities or biopharmaceuticals, but improved versions and altered formulations. Incremental drug modifications of this type can ensure improved treatment, may induce better patient compliance (by interfering less with the patients’ routines or lifestyle), or enable a more convenient drug delivery (e.g., weekly instead of daily regimen). Importantly, newly released improved versions of a drug can ensure cash-flow continuity, bring in additional streams of revenue for the firm, and increase shareholders’ returns.

Besides, the options for making incremental drug modifications or the chance to manufacture bioequivalent low-cost generics present coveted new opportunities to scores of eager industry rivals seeking to enter a new market. Thus, in addition to the creation of new product value affecting millions of patients, there is also the immense social and economic benefit from the thousands of new job positions created to handle the research, manufacturing, and marketing of novel drugs in multiple formulations and variations. This realization highlights the role of drug innovation as a powerful engine of economic progress.

But the creation of new drugs is hardly an orderly, predictable process. There are enormous difficulties associated with the making of a safe and efficacious drug. Despite unprecedented recent advances in science and technology, serendipity and chance still play a role in the discovery and synthesis of effective compounds. There is practically no way of ensuring that years upon years of intense R&D efforts and huge costs will pay off handsomely in the end as the rates of success in drug discovery remain steadily low. Importantly, the performance uncertainty is amplified by the presence of stringent regulations and intense scrutiny over the entire development process. The critical decision to go to market is essentially outside the control of the firm. The market approval for a new drug ultimately rests with the Food and Drug Administration (FDA), the government agency entrusted to exercise regulatory and control functions over the pharmaceutical industry. These idiosyncrasies combine to make the development and the life cycle of drugs different from the innovation process in any other technology-intensive industry.

2.2.1 The Economics of Pharmaceutical Innovation in Facts and Figures

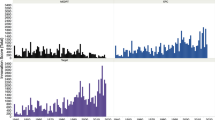

Creating new drugs is a complex, laborious, lengthy, and costly process with very uncertain outcomes. For instance, in the USA, the total number of new drugs approved between 2000 and 2010 was only 333, which seems surprisingly low given the colossal effort and cost expended by large pharmaceutical companies and numerous biotech firms alike. To explore the economics of drug innovation more closely and to size up the gravity of the issue, we will focus on the USA as the leading powerhouse in pharmaceutical research worldwide.Footnote 3

The odds of creating a marketable drug are minuscule: only 1 in every 5,000–10,000 potential compounds investigated by the US-based pharmaceutical companies is granted FDA approval. Even if the initial screening and testing have shown favorable indications, the chances of a promising drug candidate to make it through the sequential stages of the drug development process remain around one in five. About 30 % of the failures are associated with unacceptable toxicity. Another 30 % stem from lack of efficacy, while the remaining failures can be related to issues with the drug’s rate of action, the duration of its effects, or problems with the absorption, distribution, metabolism, or excretion of the drug by the human body.

On average, obtaining FDA approval and the rights to market a drug take about 15 years, with the majority of that time dedicated to clinical trials. In 2005, the average cost of a new drug successfully introduced in the USA was estimated to be $1.3 billion—a hefty 62 % increase over the last known estimate of $803 million in 2000. The opportunity cost of capital, related to the time the drug is winding its way through the discovery and development process, accounts for about 50 % of the total cost. Hence, the estimated out-of-pocket R&D expenditure for a new drug is approximately half of the amount mentioned above (DiMasi et al. 2003). Also, it must be noted that these frequently cited cost estimates are the fully capitalized cost per approved drug, which includes the cost of investigating compounds that fail to make the cut.

2.2.2 A Brief Historical Perspective on Drug Innovation

Before WWII, the link between the pharmaceutical industry and the life sciences was relatively tenuous. Most new drugs were derived from natural sources (herbs) or were based on existing compounds, mostly of organic origin. Little formal testing was done to ensure their safety or efficacy. The war instigated an extraordinary need for antibiotics worldwide. Fueled by surging market demands, pharmaceutical firms invested in unprecedented R&D programs that changed forever the process of drug discovery and development. In addition to acquiring technical and managerial experience along with the organizational capabilities to produce massive drug volumes, pharmaceutical firms emerged from the war with the clear realization how highly profitable drug development could be. Large-scale investments in R&D followed suit.

After the war, the industry faced a vast set of diseases and disorders with no known cures. There was little detailed knowledge of the biological underpinnings of many ailments. The pharmaceutical companies had to resort to random screening, trying tens of thousands of diverse natural or chemically derived compounds in test tube experiments and on laboratory animals in search for potential therapeutic effects. This process resulted in the compilation of enormous libraries of chemical compounds with known structure and studied properties. Random screening was generally inefficient—serendipity played a major role in finding a promising substance as the various action mechanisms (the biochemical and molecular pathways responsible for the therapeutic effects of drugs) were not well understood at the time.

Through the mid-1970s, significant advances in physiology, pharmacology, enzymology, and molecular biology, stemming mostly from publicly funded research, had propelled the understanding of the biochemical and molecular mechanisms of many diseases and the action pathways of existing drugs (Cockburn and Henderson 2001a). Yet, as most of the drugs at that time were derived from nature or through organic synthesis and fermentation, they were not suitable for the production of complex macromolecules such as proteins, which consist of genetically encoded long chains of amino acids. In the late 1970s to early 1980s, the advent of biotechnology and the technological breakthroughs made possible by the more versatile tools of genetic engineering marked a second watershed moment for the industry.Footnote 4

2.2.3 The Genesis of a Drug: From Inception to Market

2.2.3.1 Creating a Drug by Discovery or Design

Human physiology is vastly complex, and there is a lot that is not known about the onset, the triggers, or the pathways of many diseases and disorders. For these reasons, interdisciplinary research spanning various scientific domains has become essential for modern drug discovery. Input from scientists competent in a broad range of disciplines is required in the process, e.g., skills and expertise in molecular biology, physiology, biochemistry, analytic and medicinal chemistry, crystallography, pharmacology, and even more distant areas such as information science and robotics. Advanced interpretative and integrative capabilities are critical for success. Collaboration transcending organizational, departmental, or therapeutic category boundaries has grown increasingly important for drug discovery (Henderson and Cockburn 1994). Thus, the combination of interdisciplinary competencies and openness to knowledge generated outside the firm can become the source of enduring competitive advantage for pharmaceutical firms.

Importantly, creating new drugs in the twenty-first century is no longer a series of accidental, serendipitous breakthroughs. Instead, a long and systematic process requiring steadfast commitment, diligence, and meticulous work has taken the place of the previous haphazard experimentation. The majority of modern new drugs have completed an involved and strictly regulated process to reach the market. We discuss the phases of this process next.

Prediscovery: understanding the disease and choosing a valid target molecule. In contrast to the old trial-and-error routines, nowadays the process starts with a clear understanding of the disease on a molecular level. Based on studies showing associations between biological mutations and disease states, pharmaceutical researchers formulate hypotheses about the action mechanisms involved—they study how genes have changed, how these changes affect the proteins encoded by the genes, how those proteins interact with each other in living cells, how the affected cells change the specific tissue they are in, and how all these processes combine to affect the patient.

Once scientists develop a good understanding of the underlying causes and pathways of a disease, a biological target for a potential new medicine is chosen. A biological target is most often a biomolecule (e.g., a gene or a protein), which is involved in that particular disease and can be modulated by a drug. For example, the focus in understanding autoimmune diseases such as cancer and HIV/AIDS is on discovering the proteins that affect the human immune system. The latest advances in genetics, genomics, and proteomics (studies of human genes and proteins) are employed in the process. Complicated experiments in living cells as well as tests on experimental animals are conducted to demonstrate that a particular target is relevant to the studied disease.

Drug discovery: finding promising leads for a drug candidate. Having developed a good understanding of the disease and its mechanism, scientists start looking for a drug. They search for a lead compound (an organic or other drug molecule) that may act on the target to alter the disease course, for example by inhibiting or stimulating the functions of the target biomolecule. If successful, the lead compound can ultimately become a new medicine.

Scientists turn to nature (plants, animals, or microorganisms) to find interesting compounds for fighting the disease. Microbes or bacteria, cells, tissues, and substances naturally produced by living organisms, or existing biological molecules can be used as a starting point, and then modified. An increasingly promising and flexible set of possibilities is furnished by the advancements in biotechnology, whereby scientists can genetically engineer living systems to produce disease-fighting biological molecules.Footnote 5 Rich drug source options are also provided by combinatorial chemistry, or the rapid actual or virtual synthesis of a large number of different but structurally related molecules. It enables the quick generation of new molecules to augment the chemical diversity of known molecule libraries. The method of high-throughput screening is the most common way for screening the already existing vast libraries to find those compounds that can modify the chosen target without affecting any off-target molecules. Advances in biorobotics, bioinformatics, and increased computational power allow researchers to test hundreds of thousands of compounds against the target to identify those that might have good potential.

Of late, thanks to advances in chemistry and pharmacology, scientists can abandon the generally inefficient method of systematic screening of existing molecules for a novel approach known as rational drug design. Applying analytical methods to figure out the genesis of the disease from its onset to chronicity, they come up with prototypes of a drug molecule designed from scratch. The structure of the target biomolecule can be identified with the assistance of X-ray crystallography or nuclear magnetic resonance. This information can then be used in computer modeling and simulation to predict the characteristics of potential drug candidates so that they can not only exhibit affinity and selectivity to the target biomolecule but also affect its biological and physical properties in the desired way. Designed drug molecules can be synthesized by researchers once they understand the molecular characteristics necessary for binding to the biological target. The designed drug molecules are then tested on the target biomolecule.

Next, scientists must learn how the generated compounds are absorbed into the bloodstream, if they are distributed to the proper site of action in the body, whether they can be metabolized efficiently and effectively, if they are being successfully excreted from the body, and whether they appear to be toxic in any way. Lead compounds that survive the initial testing can be optimized further or altered to make them safer and more effective. By changing the structure of a compound, scientists can change its properties to make it less likely to interact with other processes and mechanisms in the body, thus reducing the potential side effects. Hundreds of different variants of the initial leads are made and tested. Teams of biologists and chemists work closely together: the biologists test the effects of these variants on biological systems, while the chemists use that information to make additional alterations that are then retested by the biologists. After many iterations, the final compound becomes a drug candidate.

Even at this early stage, researchers attend to practical issues, considering the drug formulation (e.g., its right concentration as well as the inactive ingredients that will hold it together and make it dissolve at the desired rate), the administration route (e.g., oral application, injection, inhaler), even the details regarding the transition to large-scale manufacturing. Techniques for making the drug in the lab may not translate easily to large volume production. Still, before clinical trials can start, sufficient quantities of the drug will be needed.

Preclinical testing. With one or more optimized compounds in hand, researchers turn their attention to extensive preclinical testing. Before any human subjects can be involved in the trials, a safe starting dose must be established. Scientists carry out in vitro and in vivo tests to check the safety profile, the toxicology and the efficacy of the studied compounds.Footnote 6 Starting with approximately 5,000–10,000 lead compounds, scientists winnow them down to between 1 and 5 molecules (candidate drugs), which then enter a series of clinical trials.

2.2.3.2 Drug Development and Clinical Trials

Upon completion of drug discovery, pharmaceutical firms prepare for the next critical stage in the innovation process—drug development through clinical trials on humans. Before clinical trials can begin, the researchers must file an Investigational New Drug (IND) application with the FDA. As part of the submission, the drug sponsor must provide clinical evidence in support of claims about the primary drug indication (the targeted medical condition).Footnote 7

Drug development is structured as a linear sequence of several phases (Fig. 2.1). The transition to each next phase is conditional on a favorable outcome from the one preceding it. Each phase of the clinical trials could end up with a decision to proceed, suspend, or terminate the testing. The firm may decide to halt or withdraw its application on financial or commercial grounds, or choose to stop the trials in the light of adverse new information. The FDA can mandate that the trials be terminated at any time if problems arise. In addition, in some cases a study may be stopped because the candidate drug is performing so well that it would be unethical to withhold it from patients receiving a placebo or an inferior drug for comparison purposes.

Clinical trials Phase 1: initial human testing on healthy volunteers to establish safety. In Phase 1 trials the candidate drug is tested in people for the first time. These studies are usually conducted with about 20–100 healthy volunteers. The main goal of Phase 1 trials is to discover if the drug is safe in humans and to determine the range of safe dosage. Researchers look at the pharmacokinetics of a drug: how it is being absorbed, metabolized, and eliminated from the body. They also study the drug’s pharmacodynamics: whether it appears to produce the desired effects and if any prominent side effects may occur. These closely monitored trials are designed to help researchers determine if the drug is safe to use with actual patients.

Clinical trials Phase 2: testing in a small group of patients to demonstrate efficacy. In Phase 2 trials researchers evaluate the candidate drug’s effectiveness in about 100–500 patients who have the investigated disease or disorder. Possible short-term side effects and risks associated with the drug are noted. Researchers strive to understand if the drug is working by the expected action mechanism and whether it improves the condition in question. The optimal dose strength and the appropriate application regimen are being established. If the drug continues to show promise, it can proceed to the much larger Phase 3 trials.

Clinical trials Phase 3: testing in a large group of patients to establish safety and efficacy. In Phase 3 trials researchers study the drug candidate in a large number of patients (about 1,000–5,000) to generate statistically significant data about safety, efficacy, rare side effects, and determine the ultimate tradeoffs between benefits and risks. This phase of the research is crucial for determining whether the drug will be both effective and safe. For establishing drug efficacy, comparative testing against placebo options or against other standard treatments can be performed. Phase 3 trials are both the costliest and the longest trials (Fig. 2.1). Hundreds of sites around the USA and throughout the world participate in these trials to get a large and diverse group of patients. Coordination and monitoring of this activity can get rather challenging.

Upon the completion of clinical trials, if the analysis demonstrates that the experimental drug is both safe and effective, the company files a New Drug Application (NDA) or Biologic License Application (BLA) with the FDA, requesting approval to market the drug. The NDA/BLA includes all of the information from the previous years of work, as well as the proposals for manufacturing and labeling of the new medicine, and can run 100,000 pages or more. The FDA studies the data to determine whether the benefits outweigh the risks, what information must be included in the drug label, whether the proposed manufacturing process is adequate, and if there is any need for certain prescription criteria or special physician training.

Scaling-up for manufacturing. The transition from producing small drug quantities for testing purposes to large-scale manufacturing by the ton is not a trivial task: new manufacturing facilities may have to be built, equipment will need to be installed and processes must be calibrated. Meticulous planning and coordination are necessary to ensure smooth operations.

Post-market monitoring and Phase 4 trials. Research on a new medicine continues even after the FDA approval is obtained and the drug has been launched. As a much larger number of patients start taking the drug, companies must continue to monitor it carefully for newly found adverse effects. Periodic reports to the FDA are submitted on a quarterly basis for the first 3 years, and annually thereafter.

Sometimes, the FDA requires additional studies on the already approved drug in what is known as Phase 4 trials. These trials can be set up to evaluate the long-term safety of the new medicine. The company itself may also choose to conduct such studies to assess the drug’s potential benefits in other disease areas or for more specific patient populations (e.g., children, the elderly), leading to extended uses and indications.Footnote 8

The distinct phases of the drug innovation process with their characteristics are presented in Fig. 2.1.

2.2.4 Protecting Intellectual Property: Patents and Market Exclusivity

Pharmaceutical organizations can file for a patent on a new drug molecule they have synthesized. In addition, they can obtain market exclusivity for the drug. Although both patents and market exclusivity confer protection from competition for a specific molecule, they are conceptually and functionally distinct from one another. A patent protects the intellectual property of the firm from the time of its invention and is unrelated to the drug’s eligibility for commercialization. In contrast, market exclusivity adds more years past the FDA approval for market launch and is meant to hold off the entry of generic drugs. Patents and market exclusivity may or may not run concurrently and may or may not encompass the same claims. While some drugs have concurrent patent and exclusivity protection, others may have either type, or none whatsoever.

Patents are typically issued on novel pharmacological compounds quite early in the drug development process. They cover the active compound in a specific formulation and for specific indications. Firms can file several patents associated with a single drug, the first of which typically protects the key compound (the core of the drug as a specific new biomolecule or a new chemical entity [NCE]), while the subsequent ones can be related to different indications or new formulations. In the USA, patents can be granted by the Patent and Trademark Office (PTO) anytime along the development lifeline of a drug. Regardless of where the firm is in its clinical trials or with the FDA approval process, patents expire 20 years from the date of filing.

In contrast, market exclusivity pertains to the marketing rights granted by the FDA upon its approval of the drug, and is conferred on the actual product, inclusive of its quality, indications, and dosage. The rationale for having FDA-mandated exclusivity that is separate from the patent protection mechanism stems from the independence between the patent status and the timing of the FDA approval. As the development process leading to an FDA approval is long and uncertain, patents can expire before the drug approval, can be issued after the drug approval, or anywhere in between. Still, firms need assurance that their products will not be reproduced by competitors soon after the market launch, which can happen if the patents have expired by the time FDA approval is granted. Market exclusivity is the tool that provides such assurance. Hence, although market exclusivity does not directly extend patent life, it prevents competitors from entering the market with the exact same formulation, quality level, indications, and dosage.

Essentially, both patent protection and market exclusivity are designed to place the firm into what is a temporary monopoly situation so that it can recoup the hefty costs incurred in drug discovery and development. In the USA, firms that manage to get patent protection and exclusivity rights stacked up in the most favorable way can obtain a window of protection lasting more than 23 years. The duration of market exclusivity for new drugs can vary with the type of the drug. For an NCE, the exclusivity horizon is 5 years. If the drug is redesigned for children, additional 6–12 months of pediatric exclusivity can be obtained upon the submission of specific pediatric studies. Orphan drugs (drugs for rare disorders or for diseases that affect a small percentage of the population) get 7 years of exclusivity. For them, the extended exclusivity horizon is intended to compensate for the small market. Original biopharmaceuticals can obtain 12 years of exclusive market rights pursuant to the Patient Protection and Affordable Care Act of 2010.

If the original drug is reformulated for a different indication or for another dosage regimen, or if a modified version can demonstrate clinical superiority (e.g., greater safety, tolerability, or convenience of administration), an additional 3 years of exclusivity may be granted. However, this extension is contingent on the approval of a new application by the FDA, which requires reports on new clinical trials conducted to investigate the new formulation, indication, or dosage.

The clock on market exclusivity starts ticking at the time of obtaining FDA approval. In the USA, 74 % of all new drug sales tend to occur in the 5-year exclusivity window following drug approval, with additional 15 % of sales realized in the 3 years following the loss of exclusivity when cheaper generic versions enter the market (Higgins and Rodriguez 2006).

2.2.5 Late Entrants: Me-too and Follow-on Drugs

Despite patent protection and exclusivity, many pioneer, or first-in-class drugs do not remain the only “game in town” for too long. Even before generic alternatives enter the market, other branded drugs, also known as me-too and follow-on drugs, can make an incursion, essentially curtailing the uncontested reign of the pioneer drug over the market.

Me-too drugs. Typically, me-too drugs are minor variations of the original drug as they employ the same or similar action mechanisms, or have a related (although not identical) chemical structure. Compared to the pioneer drug, a me-too brand is a market follower, a late entrant offering a therapeutic solution that is very close to that of the pioneer drug. These drugs either replicate or provide a minor improvement over the breakthrough products in their class. Typically, they are priced at levels close to, or slightly lower than the price of the pioneer drug (reports place them in the range of 14 % below the price of the pioneer drug).

In reality, the vast majority of me-too drugs are not the product of brazen, deliberate imitation. Most of them have been in clinical development prior to the approval of the pioneer drug (DiMasi and Paquette 2004). By providing numerous viable leads, biomedical sciences create new opportunities for drug development. It stands to reason that different avenues can be simultaneously pursued by multiple firms.

The pharmaceutical industry is attractive to entrepreneurs because of its open access to fundamental knowledge, rapid information dissemination, opportunities for specialization, and connectedness to scientific networks. With the industry’s shift away from heuristics and random screening, and owing to the capabilities offered by targeted rational drug design, the discovery process has become more systematic. As a result, lots of new ventures, drawn by the alluring rewards and undaunted by the inherent risks, choose to enter. Inevitably, they engage in a race with a slew of competitors who are already working on compounds targeting an essentially finite set of publicly known diseases. As rivals get to work in parallel on similar targets, often applying the same fundamental knowledge sourced from open science, the solutions they come up with may not be all that different. Inevitably, when one of them is the first to obtain market approval, the successful rival products are going to fall in the me-too category as their market entry will be subsequent to that of the pioneer drug.

Vigorous efforts to win the innovation race are the norm as the first drug to reach the market will not only induce a significant reputation boost for the firm, but, in the absence of other alternatives, will be poised to dominate the market. For late entrants that are not well differentiated from the pioneer drug, this is no longer the case. While desperately needing to recoup their huge R&D costs, they can be left with a difficult choice: switch patients away from the pioneer drug, uncover new niches to tap into, or resort to an overall market expansion. To be lucrative, me-too brands need sufficient differentiation (actual or perceived) from existing alternatives in the market. If their market launch is at a price lower than that of the pioneer drug, price competition will ensue. Barring that, there is little reason why a patient happy with their treatment would want to switch to a me-too brand if it offers no extra therapeutic value. Moreover, prescription inertia may persist if physicians fail to perceive differential value in the me-too product, or are reluctant to interfere with an already successful therapy. Thus, marketing to physicians and direct to consumer advertising (DTC) tend to become the main battleground for share of mind and share of market for the me-too brands.

Me-too brands have been criticized primarily on the grounds of offering little or no additional advantages relative to the pioneer drug. However, clinical responses to different drugs in the same class can vary significantly by individual patient. Traditionally, physicians have adopted a trial-and-error process for finding the drug that works well for each patient. The availability of extra therapeutic options is not only clinically advantageous in case of adverse side effects induced by the pioneer drug, but is also economically and socially beneficial.

To the pioneer drug, the impending entry of me-too drugs is a threat that diminishes the incentives for costly breakthrough innovation. Despite the regulatory protection conferred upon FDA approval, the market dominance of the pioneer drug can be curtailed by the entry of closely positioned, yet differently formulated me-too alternatives. Due to relatively minor differences in formulation or action, me-too drugs can circumvent the mandated exclusivity that deters the generics, and can place the pioneer drug under intense competitive pressures much sooner, diluting its sales and eroding its market share.

Recent studies show that the effective period of marketing exclusivity enjoyed by the pioneer drug in a specific class has declined dramatically—from a median of 10.2 years in the 1970s to a mere 1.2 years in the late 1990s—due to the market entry of me-too alternatives (DiMasi and Paquette 2004). Insufficient value differentiation by the me-too brands is perhaps the worst case scenario: it can undermine the intent of patent protection and market exclusivity, and may effectively split the market without offering additional therapeutic benefits or lower price to patients. In this case, the vast resources firms have spent on R&D may never be recouped as the market proceeds are divided among multiple firms. Patients are not generally better off either except for those intolerant to the pioneer drug, as they will have extra options.Footnote 9

Follow-on drugs. In contrast to me-too drugs (the product of parallel development but belated launch, the timing of which can be beyond the firms’ control), the inception of follow-on drugs is rather deliberate and their launch is timed to occur after the pioneer drug. Even drugs that have gained FDA approval may have clinical shortcomings that are just not serious enough to terminate the project, but can nevertheless be improved upon by introducing minor alterations to the chemical structure of the breakthrough drug. Such incremental improvements are called follow-on drugs, and they constitute the majority of new drug introductions.

Developing breakthrough drugs that are safe and efficacious is very costly while the outcomes are unpredictable. In this case, another firm might see a modestly lucrative option in the incremental improvement of an existing drug. There is assurance that comes from exploiting an effective, tried-and-tested method of therapy. Besides, even the residual returns from a very large market can be rather substantial.

Overturning the conventional first-mover advantage, an improved follow-on drug may even surpass the pioneer drug through enhanced effectiveness, greater convenience, or weaker side effects, as done by Zocor®, Lipitor®, Symbicort®, and Xyzal® in their respective markets (Stremersch and van Dyck 2009). Still, the size of the market is essential as evidenced by the fact that late-market entry is less common for orphan drugs. The markets for orphan drugs are typically quite small and cannot support multiple treatments of a generally similar nature.

In some cases the opportunities for incremental changes (e.g., altered formulations, new combinations, different dosage, or novel administration routes) are well-known to the manufacturer of the breakthrough drug. If there are no compelling reasons to delay the launch, the firm can press on with the market release while simultaneously undertaking the development of improved follow-on versions to be launched soon thereafter.

It has been suggested that these two strategies—breakthrough invention with relatively short-lived first-mover advantages, and late entry with differentiated or incremental innovations—can be equally effective when examined over a 10-year horizon from their respective market introductions. Over time, breakthrough drug innovations are known to undergo drastic changes in market share—they tend to start with a systematic above-average growth, may even create a new market that they can effectively dominate for a while, but will experience a steep decline not too long after their release as other alternatives emerge. In contrast, the sales of their follow-on counterparts can be more stable overall and may quickly reach their long-term market position (Bottazzi et al. 2001). In Sect. 2.3.6.3, we outline additional findings from recent academic research on the benefits accruable to first and late market entrants.

If me-too drugs are sufficiently well-differentiated, and if follow-on drugs present incremental innovations, they can cumulatively raise the standard of patient care in the category, yield substantive treatment benefits, and enhance the value to patients.Footnote 10 The presence of multiple drugs in a category may not only address the increasing price sensitivity in the market, but can enable greater choice and thus, foster intense rivalry. The availability of alternatives can also provide leverage to health insurance companies to extract higher rebates from the drug manufacturers.

To branded drug manufacturers, though, a considerable downside of operating in a therapeutic category populated with me-too drugs is that collectively, they all become more vulnerable to each other’s fate: the loss of patent protection or market exclusivity by one member in the category can have a ripple effect on all competitors if their brands are close substitutes in terms of indications, applications, side effects, and dosage. These dynamics are discussed in more detail in Sect. 2.2.7.

2.2.6 Watch Out: Here Come the Generics!

Patent expiration or the end of the exclusivity period (whichever comes last) is the dreaded moment for every pioneer brand. Although in practice market exclusivity can extend past the loss of a patent, for brevity purposes hereafter we refer to the loss of all regulatory protection collectively as patent loss.

When the market opens up to generic entrants, aggressive price competition ensues and the original brand quickly loses market share. It is worth noting that by then, the brand might have been competing with me-too or follow-on drugs for some time. However, the competition with branded alternatives is likely to be more quality-based than price-centered. If marketing efforts emphasizing differentiation have been effective in expanding the market, the loss of market share for the pioneer brand might have been relatively limited. But when the drug patent expires, exact generic clones appear promptly at prices that can be as much as 50 % lower than those of the original brand (Griliches and Cockburn 1994).

Generally, the average price of the first generics to enter the market is about 25 % lower than that of the original brand. Over time and with increases in generic entry, generic drug prices stabilize at levels close to the long-term marginal cost of production and distribution, which is about 20 % of the original brand’s price. For example, in 2006 the average price of a brand name prescription in the USA was $111, whereas the average price for a generic prescription was $32 (Kanavos et al. 2008). Given that two-thirds of the global pharmaceutical market, currently valued at about $1 trillion, consists of molecules that are already subject to generic competition or whose patents have already expired (Kanavos et al. 2008), generic drugs offer an option for significant savings and cost-containment. Yet, generics represent a formidable threat to incumbent brands and their entry introduces a major turbulence in the markets they enter.

The selection of new markets for entry by generic drug manufacturers is driven primarily by economic factors and considerations. Empirical findings demonstrate that markets of large revenue potential, markets with a greater proportion of hospital sales relative to pharmacy sales, markets defined by chronic conditions, markets offering high profit margins to incumbents, and treatment forms or therapeutic areas with which the generic drug manufacturer has prior experience constitute the most attractive conditions for entry by generics (Morton 1999, 2000; Hudson 2000; Magazzini et al. 2004). Therefore, product/market characteristics conducive to greater price elasticity of demand, in conjunction with provisions associated with functional efficiency (scale and scope effects, experience, concentration of effort, business sustainability) have a preeminent role in the market entry strategies of generic drug manufacturers.

Brand-name manufacturers typically eschew price competition with the generic drugs. The price competition is left to the generics, which, due to insufficient differentiation, tend to experience a strong downward price pressure over time. By contrast, the price of the original brand remains higher and may even rise in nominal terms after the generic entry. This counterintuitive move is justified by the strategic decision to focus on its most loyal segment and harvest the market by maintaining premium pricing (Grabowski and Vernon 1992). However, the average market price for the molecule with the lost patent will decrease over time as the lower-priced generic alternatives achieve significant gains in market share.

Generic drugs are required to have the same active ingredients, strength, safety, quality, route of administration, and dosage form (e.g., capsule, tablet, liquid) as the brand name product, but may or may not contain the same inactive ingredients as the original brand (e.g., binders, coating, fillers), and must differ in appearance (most often, by shape or color). As the company that makes the original drug has already proved during extensive clinical trials that the drug formula is both safe and effective, the FDA approval process may not require the same rounds of clinical trials from the generic candidates, but will nevertheless demand evidence of sufficient bioequivalence.

The complex biomolecular and chemical processes involved with the action of a drug suggest that often, demonstrating identical active ingredients and concentrations may not be sufficient for a generic alternative to be approved by the FDA. With the more common small-molecule drugs, an exactly identical generic drug can be reliably produced and marketed, and minor differences in inactive ingredients may be largely inconsequential. But this is not the case with biopharmaceuticals (macromolecule drugs produced with the complex tools of biotechnology). Even a slightly different manufacturing process may result in large variations in the effects of biopharmaceuticals. The generic drug manufacturer may not have the same cell bank or compound library as the brand name manufacturer. Nearly undetectable differences in impurities and/or breakdown products have been known to incur serious health complications. This is why the generics must show that they are, within acceptable limits, bioequivalent to the original brand.

A bioequivalence test is a study to determine whether the administration of the same dosage of the generic brand will result in the same release pattern, i.e., whether, over time, it will produce the same levels of concentration in the bloodstream as the original brand. Although acceptable deviations are not disclosed by the FDA, many experts seem to believe that the generic drug must fall within an 80–125 % range of bioequivalence to the original brand.Footnote 11 Besides, all manufacturing, packaging, and testing sites for the generic drugs are held to the same quality standards as those of the original drug.

Often, generic drug manufacturers can reverse-engineer the original brand, or reproduce it by getting access to its patent documentation that discloses the active ingredients. If generic drug manufacturers choose to press on with filing for approval from the FDA before the expiry of the exclusivity period for the original drug, they would have to carry out all requisite clinical trials. For obvious economic, practical, and ethical reasons, generic entrants are often unlikely to attempt to reproduce the entire set of test data. The costs associated with replicating the rigorous clinical trials seem prohibitively dissipative and the wasted time would only extend the monopolistic reign of the original drug.

In 1984 new legislation enabled the extension of the original NDA process to all generic drugs, effectively allowing generic drug manufacturers to gain marketing approval by relying on the safety and efficacy data from the original drug’s NDA, but only after the expiration of the 5-year exclusivity period and any further extensions granted by the FDA. Thus, the mechanism of exclusive rights bestowed on the original drug prevents generic drug manufacturers from relying on its clinical data, or denies them the so-called right of reference for the duration of the exclusivity period, effectively deterring their entry.

If generic drug manufacturers can get access to the results of the original brand’s clinical trials, all they would need to do is demonstrate that the generic alternative is released in a similar way in the human body. In that case, the testing of the generic drug is performed on a sample of healthy volunteers, which is far less costly than conducting the full cycle of clinical trials. The results are then compared to those obtained in the original brand’s Phase 1 trials. For the generics, this approach represents a shortcut to market that is sanctioned by the FDA as it demonstrates the criteria for safety and efficacy are met. Formally, the generic drug manufacturer submits an Abbreviated New Drug Application (ANDA). When it is approved, the FDA adds the new alternative to its Approved Drug Products list (also known as the Orange Book), and annotates the list to show the equivalence between the original brand and the approved generic. The first generic drug that obtains FDA approval may be granted 6 months of market exclusivity.

2.2.7 Market Changes Following Generic Entry

The FDA reports that 70 % of all filled prescriptions are presently filled with generic drugs. However, the overall cost of dispensed generic drugs is only about 20 % of the total drug spending in the USA (Kanavos et al. 2008). The cumulative annual savings from generic drugs bought instead of their original branded counterparts are estimated to be in the range of $8–10 billion in the USA alone. These facts suggest that generic entry triggers dramatic shifts in the competitive landscape of a therapeutic class.

2.2.7.1 Changes in the Within-Molecule Competitive Dynamics

Upon patent expiration and in the presence of generic alternatives that replicate its formulation on a molecular level, the original brand starts losing market share relatively fast. Brand name recognition and the secured loyalty of patients or physicians remain its only sources of leverage. In the USA, drug formularies (lists of drugs that are covered by the health insurance companies) would only include the cheapest bioequivalent drug, which is typically a generic. The difference to the original brand’s price is not reimbursed by insurance companies and has to be paid out-of-pocket by patients who want to retain their original treatment. Although the vast price differential causes the original brand to lose much of its market share, it may still retain a decent stream of revenue from prescriptions to patients who perceive its quality as superior. On occasion, physicians can refuse to allow substitutions to generic drugs for fear that switching medication may interfere with their patients’ treatment, or apprehension that the cheaper alternatives may contain inactive ingredients that can cause allergies or other unwanted side effects.

It is precisely because of their bioequivalence to the original drug that, when finally given access to the market, generic drugs have a limited set of marketing tools to differentiate themselves. The lack of unique identity can prevent a generic brand from vertical differentiation based on quality, as the ANDA process has proven it equally effective and safe, but not superior to the original brand. This results in predominantly horizontal product differentiation. Parity in quality, however, seems to be questioned by some patients and physicians, and these qualms give rise to the segment that remains loyal to the original brand.

The most prominent characteristic of a generic brand is its low price relative to the original brand.

Offering a huge price advantage relative to the much more expensive branded drug is not problematic for the generics as they don’t need to recoup the significant R&D cost associated with the discovery and the development of the original molecule, and can get by on a fairly limited marketing budget. Besides, generic drugs can take a ride on the coattails of the existing market awareness for the pioneer drug they replicate, and often set out to exploit its brand recognition. Some generics openly reference the original brand on their product labels, trying to gain from favorable price comparisons and direct associations with an already familiar brand name.

Yet, overreliance on low price in a fairly competitive market can trigger a price war that can quickly annihilate the profits for the generic drug manufacturers. Occasionally, to remain viable, generic drug manufacturers turn to offering preferential arrangements and better terms to distributors (Kanavos et al. 2008). Branding their products in an effort to enhance recognition and build credibility can be an alternative strategy. Branded generics are prescription products that are either novel dosage forms of off-patent products, or a molecule copy of an off-patent product with a trade name. In either case, branded generics are produced by a manufacturer that is neither the originator nor is licensed by the originator of the molecule. By dispensing with the anonymity often associated with such products, generic drug manufacturers can create recognition and differentiation through a perception of better quality, which can also translate into higher prices.

In some countries, the original drug manufacturer may resort to a multi-branding strategy and introduce what is essentially a fighting brand by licensing its own subsidiary or an independent third party to sell a generic drug, sometimes known as a pseudo-generic or authorized generic, under the original patent. Sometimes the pseudo-generic drug is still manufactured by the originator firm, but is marketed under a different brand name. The introduction of pseudo-generics is usually a preemptive strategy originator firms may undertake pending the invasion of true generics (Hollis 2002, 2003). The intention is to ward off the significant loss of market share upon patent expiry and to retain greater market control by being the first firm to offer a generic option. However, the practice of introducing pseudo-generics is sanctioned differently across countries. As national regulators may find it objectionable enough to challenge it, it has not become routinely used yet.

As the differentiation value of generics is associated with their low price, the first generic entrant in a market seems poised to capture a considerable part of the price-sensitive segment and can essentially lock it in, ensuring long-lasting market domination. Late generic entrants would have to overcome pharmacy inertia and patient switching costs to displace the first generic entrant. Therefore, if a pseudo-generic is the first generic drug to enter a market previously dominated by the originator firm, the firm can retain more of its market power, although its sales revenue will inevitably plummet. Hollis (2002) points out that in Canada, where the practice of originator firms offering pseudo-generics is legal, it may cost about $1 million to introduce the first generic drug in the market. Still, the benefits are certainly worthwhile as the first generic can reach a sustainable market share advantage of 20–35 % relative to late generic entrants (Hollis 2002).

2.2.7.2 Changes in the Between-Molecule Competitive Dynamics

The incursion of generic drugs in the wake of a major patent loss will almost certainly affect the sales of the other branded, non-bioequivalent drugs in that class, even if they are still under patent protection. Price-sensitive physicians may increase the prescription incidences of generic drugs to the detriment of most branded drugs in a therapeutic class, regardless of their patent status. Moreover, the branded drug that has lost its patent will often scale back on its detailing efforts, enabling the drug representatives of rival non-bioequivalent brands to more easily switch detailing-sensitive physicians to their own brands. Gonzalez et al. (2008) find empirical evidence that with generic entry, the ensuing within-molecule price competition and the reduced marketing support of the firm losing its patent can also affect the between-molecule, non-bioequivalent competition in the same class. The overall effect on the sales of patent-protected non-bioequivalent drugs in that class will depend on: (a) their own marketing response in the wake of the patent loss; (b) the size of the price-sensitive and the size of the detailing-sensitive physician segments; and (c) the already established patient loyalties to the brand that is under attack because of patent loss.

In summary, the competitive landscape will get irreversibly altered when a major pioneer brand loses its patent protection, giving rise to interesting dynamics within the affected therapeutic class. In addition to the within-molecule rivalry instigated by the bevy of generic drugs, the between-molecule competition can also intensify, fostered by changes in the marketing efforts of rival non-bioequivalent brands. Over time, as incumbent firms or new entrants release novel and improved branded alternatives in the same class, physicians and patients will gradually move away from the older active molecules and the associated branded or generic drugs. Thus, the market share of an old molecule (regardless of its branding) will gradually decline over time at the expense of new active molecules launched in the same class.

2.3 Business Models in Drug Discovery and Development

2.3.1 Scale and Scope Effects in Innovation

The lengthy, costly, unpredictable, and research-intensive process of drug innovation calls for organizational settings that can help streamline operations, defray part of the costs, and enhance process efficiency. Two concepts from economics are often invoked to address such issues.

Economies of scale refer to reductions in unit cost as the size of the firm’s operations and the usage level of inputs increase. In contrast, economies of scope arise when, due to diversification in the product portfolio of the firm and in the presence of synergies across processes and activities, the same set of outcomes can be attained more efficiently, i.e., with less resources such as time, effort, or expenditure.

Economies of scale in drug discovery. Pharmaceutical companies typically organize their R&D efforts by therapeutic category based on the key systems in the body (e.g., respiratory, cardiovascular, digestive, central nervous system), then by research program (disease area), and ultimately, by specific project. Large research efforts tend to become less costly per program (and consequently, by project) in the presence of economies of scale from a large portfolio of research programs. In this case, the enormous R&D cost of drug discovery can be spread over a greater number of related research programs and projects.

Large pharmaceutical firms often invest in 10–15 distinct research programs run simultaneously. Several programs in the same therapeutic category can tap into the same pool of knowledge about the pathways related to particular biotargets or molecular processes. The new findings can be applicable across multiple programs. The more intensive use of the firm’s research talent and resources, the shared lab facilities and expertise, along with the enhanced rates of equipment utilization and reduced downtime can ensure reduction in the marginal cost of R&D. In turn, the declining marginal R&D cost of the firm makes the undertaking of risky new projects more affordable because of lower incremental costs.

Long-term market presence and cumulative experience in a therapeutic category can bring about strong learning and reputation effects. Researchers have found that firms focusing on drug discoveries in therapeutic categories in which they already have expertise (e.g., Merck with cardiovascular and cholesterol problems, Eli Lilly & Co. with psychiatric disorders, or GlaxoSmithKline with infectious diseases) are more effective than the relative novices in the category at converting R&D efforts into approved drugs (Chandy et al. 2006).

Scale effects can accumulate over time. Specifically, the firm’s cumulative technological experience in a therapeutic category has been associated with increases in the first year sales of a new drug from that category (Nerkar and Roberts 2004). It remains to be examined whether: (a) technological experience confers market advantages due to measurable improvements in drug quality, safety, or efficacy; (b) the effects are reputation-based and largely perceptual (and if so, if it is the physicians’-, the pharmacists’-, or the patients’ impressions that are of greater consequence); or (c) the positive impact stems from largely intangible firm assets, e.g., tacit knowledge about the category, special expertise with the core technologies, effective professional contacts and network leverage, or greater familiarity with the market gained during the firm’s previous launches in these categories. As this is an area of immense significance to drug manufacturers, more research disentangling the possible determinants of an experience-based sales boost for a new drug will be rather welcome.

Economies of scope in drug discovery. Competent deployment of integrative knowledge spanning different therapeutic categories may give rise to a richer set of novel ideas. It can also foster ingenious approaches and problem solutions. Internal spillovers of new know-how may galvanize the process of drug discovery by leveraging the inimitable asset of tacit knowledge that is proprietary to the firm.

Substantial economies of scope can ensue if the same amount of R&D in one therapeutic class produces valuable findings with favorable implications for another therapeutic class or category. Such positive crossover effects can emerge when knowledge acquired in the course of studying one disease can propel the research done in another program. Cross-fertilization between therapeutic categories can also occur—e.g., research programs focused on cardiovascular issues have brought about therapies related to the central nervous system (Henderson and Cockburn 1996). Internal spillovers of know-how will depend, however, on the presence of sufficient breadth of knowledge at the firm. Such proficiency will facilitate the recognition of diverse opportunities for asset redeployment stemming from the new discoveries.

Developing the foresight to identify therapeutic potential outside of the focal research area can be of immense value to the firm. First, drug candidates can be repositioned and projects can be redirected instead of terminated.Footnote 12 Second, even if a project fails or gets terminated, the accumulated specific knowledge will not simply vanish. Such knowledge remains within the firm and can be internalized or assimilated in subsequent work, potentially aiding other innovation projects. Competencies, experience, and insights developed during failed projects can be as important as those associated with successful drug outcomes. Besides, it is no small feat if the pursuit of unproductive research trajectories can be detected early and avoided in the future.

Mitigating the uncertainties associated with the success or failure of any specific investigational project is another advantage of research efforts that are broad in scope. With sufficient project diversification, the individual project risks get attenuated. As this may lower the overall credit risk associated with the firm, it can improve its access to capital.

Abundant and varied research experiences can contribute to effective learning, and may strengthen the capacity of the firm to adopt external know-how. For example, experience with diverse projects can foster more discerning capabilities for evaluating the applicability of emerging technologies, and may ease the process of integrating those technologies within the firm’s own technological stock.

A firm with a fairly diverse portfolio of research programs is also in a position to build an extensive compound library, which in itself becomes a valuable proprietary asset of a certain market value. Large libraries can assist in generating the leads in drug discovery and, thanks to high-throughput screening, have become much easier to work with. Meanwhile, smaller firms with no extensive libraries of their own may need access to the information accumulated in existing libraries. In fact, large pharmaceutical firms have started to trade access to their chemical libraries in exchange for access to new technologies, highlighting the growing significance of a more open market for information and technology in the pharmaceutical industry (Thomke and Kuemmerle 2002).

Yet, there can be a significant downside to excessive diversification in drug discovery. For example, research has shown that the simultaneous pursuit of too many project ideas can exert a negative impact on the probability of converting them into successfully launched drugs (Chandy et al. 2006). Also, with too many leads in discovery, the suggested economies of scope can be squandered due to heightened coordination and monitoring costs. Therefore, lest they spread their resources too thin, firms might be better off focusing on a moderate number of promising ideas.

Economies of scale in drug development. Economies of scale in drug development can arise from expertise that is easily transferable across different therapeutic categories because of its more fundamental nature (e.g., knowledge in biostatistics, experience with organizing large-scale clinical trials, or with obtaining regulatory approval in foreign countries). Increasingly efficient operations can result from the availability of such portable expertise. The project-related cost of having it in-house (as opposed to seeking it outside the firm on an as-needed basis) will decline if the company plans to engage in multiple development projects requiring the same areas of expertise.Footnote 13

Economies of scope in drug development. Economies of scope can be expected in drug development too as it relies on a wide range of diverse skills—from clinical pharmacology to biostatistics and metabolic chemistry. The participation of scientists and technicians whose focus is to determine the best way to manufacture and deliver the new compound (e.g., process chemists, operations engineers, or packaging experts) is also required at this stage (Cockburn and Henderson 2001b). Hence, enhanced productivity can be attained if the firm has developed diverse yet synergistic competencies, has installed the needed infrastructure (systems, technology, equipment, software), has invested in inimitable resources shared across the firm’s various programs (specialized centers and units, expert knowledge, physician networks, sales contacts), and has established the right coordination mechanisms to efficiently manage a multitude of research activities and processes.

Just as with drug discovery, a diversified research portfolio can reduce the variation in firm’s procedures and outcomes and, through learning and experience effects, increase the likelihood of successfully completing clinical trials. For example, a firm might learn to better recognize projects that, based on initial test results, signal low probability of conversion into successful drugs, and terminate or modify them early in the process to save time and costs. Experience gained through numerous NDA filings may prompt the firm to institute organizational changes to facilitate the navigation of the FDA approval process. In result, key routines can be optimized and streamlined, while the high standards and rigorous procedures required by the FDA can be carried out expertly and more efficiently.

The advantages of a solid track record of successful innovation outcomes can in turn translate into steady cash flows and help the firm attain better visibility and credibility, bolstering its position in the market. The acquired market power and enhanced professional clout can make the firm more attractive for strategic alliances and partnerships, which can essentially perpetuate its advantageous position.

The empirical evidence largely supports the presence of economies of scale and economies of scope in drug discovery (DiMasi et al. 1995; Henderson and Cockburn 1996). However, there is some ambiguity regarding measurable scale and scope effects in drug development. Economies of scale effects in drug development have remained elusive. One possible explanation is that firms have only recently started to enact coordinated project management practices to facilitate smooth transfers of tacit knowledge across dispersed research sites. With the greater deployment of such practices, data will become available to better test the premise of economies of scale through coordinated project management.

Performance advantages associated with economies of scope in drug development have been found in Cockburn and Henderson (2001b). The analysis of Sorescu et al. (2003) also supports these findings. Specifically, Sorescu et al. (2003) demonstrate that maintaining a greater scope of products (measured by the entropy in the product portfolio) enhances the value of radical innovations launched by a firm. In contrast, Danzon et al. (2005) find that more focused firms are more likely to reach successful completion of Phase 3 clinical trials. They explain their result with diseconomies of scope.

This divergence in the empirical findings can be indicative of differential patterns in scope effects depending on capacity-related organizational characteristics such as firm size. Smaller firms may need to focus on fewer therapeutic areas as their limited resources can stymie effective diversification. For them, specialization and narrow focus could be the most effective strategies. Large firms, however, can afford to develop expertise in multiple categories as their greater resources enable more successful diversification.