Abstract

The weakness of bank credit in the Eurozone reflects both a drop in business demand for funding and a more restrictive availability of funding from banks.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

The weakness of bank credit in the Eurozone reflects both a drop in business demand for funding and a more restrictive availability of funding from banks. However, in countries that have suffered to a greater extent due to the economic crisis, the criteria related to obtaining credit distribution have also been negatively affected by the increased risk involved in funding entrepreneurs and the number of deteriorated loans on bank balance sheets: various steps have been taken in response to this situation.

A first, fundamental response was the increased requirements regarding banks holding adequate capital. This process is still under way, solicited in some countries by supervisory authorities.

A second response was the reduction of deteriorated loans, which weigh on bank balance sheets, by yielding such exposure to specialized operators, as well as through interventions aimed to rationalize the management of deteriorated credit through dedicated structures. Similar structures allow banks to pursue efficiency earnings in the management of deteriorated credit (non-performing loans: NPLs) and an increased transparency in their evaluation. Special mention must be made of supervisory action, as in 2015 Banque Centrale Européenne (BCE) (European Central Bank: ECB) Asset Quality Review, as it favors improvement in both transparency and dependability of bank financial statements. The re-launch of bank credit is the specific objective pursued by targeted long-term refinancing operations (TLTROs). The BCE announced the first series of TLROs on June 5, 2014, and a second series (TLTRO-II) on March 10, 2016. The purpose of TLTROs is to provide an incentive to banks to issue loans to companies, tying the concession of BCE cash to the credit actually issued. On a longer-term basis, bank credit may benefit from the development of securitization transactions. The three principle options aimed to support and improve financing conditions for SMEs are:

-

direct loans from public institutions such as the Banque européenne d’investissement (BEI) (European Investment Bank: EIB), or public guarantees for loans issued by commercial banks;

-

a higher degree of securitization for loans to SMEs through pledged assets and the acquisition of assets by the BCE;

-

long-term financing issued by the BCE and an interest rate linked to the expansion of total loans; one option does not exclude another and may be applied at the same time.

In the field of SME financing, in addition to traditional methods we findFootnote 1:

-

asset-based finance: asset-based lending, factoring, purchase order finance, warehouse receipts and leasing;

-

alternative debt: corporate bonds, securitized debt, covered bonds, private placements and crowd funding debt;

-

hybrid instruments: subordinated loans/bonds, silent participation, participating loans, profit participation rights, convertible bonds, bonds with warrants and mezzanine finance;

-

equity instruments: private equity, venture capital, business angel, specialized platform for public listing of SMEs and crowd funding (equity).

We will now focus our attention on the aspects of securitization in relation to SMEs.

3.1 Securitization Models: A Brief Overview

Securitization operations have developed considerably in the last 30 years. Securitization is how a bank outsources one or more phases in the credit process: from funding to risk-taking in relation to loans requiring concise securitization. This evolution has implied a complete transformation of the banking model: a shift from the “Originate to Hold” (OtH) model to that of “Originate to Distribute” (OtD). The OtD model transfers the risk, potentially, to a multitude of investors. This action increases the degree of interdependence between banks and the capital market, allowing a shared risk, on the one hand, and, on the other, a heightened expansion and amplification of the risk itself.

In general terms, securitization is an operation that allows a body (bank, business, public entity) acting as the originator of a loan to:

-

1.

transfer non-cash and non-negotiable financial or non-financial activities to the market in exchange for cash (classic securitization);

-

2.

simply transfer the risk (concise securitization).

Figure 3.1 clarifies the base concept of the operation well: the originator of a loan is motivated to improve the liquidity of its assets and reduce its exposure to risk. In the capital market, there are investors willing to subscribe to bonds issued by special purpose vehicles (SPV: a legal entity created to fulfill narrow, specific or temporary objectives), providing the SPV with the necessary funds to buy the assets sold by the originator. The bonds will thus have a financial profile that the expected cash flow from the purchased asset will cover. The profitability and risk of this bond are a function of the tranching performed during issuance. There are diverse classes of bond, differentiated according to seniority – that is, the priority given to the issuing of cash flow generated by the asset (Fig. 3.1).

Figure 3.2 illustrates the “base structure” of a securitization operation on credit flow to SMEs. The originator (bank) selects a package of loans comparable in amount, expiration and reimbursement plan: this represents the core of the operation. The SPV specifically constitutes places in the market with different rating levels that range from investment grade to high yield that represent the first barrier capable of absorbing possible defaults in the loan portfolio.

With the income from the bonds subscribed to by investors, the SPV buys the package of loans from the originator, acquiring the patrimonial rights so that the relative cash flow becomes usable to cover the debt originated by the banknotes in circulation. The fact that the originator (bank) usually carries out the function of a servicer ensures that the liaisons with clientele are not subject to specific negative impacts.

For the sake of simplicity, in the framework presented below, other bodies are not present. Examples of such bodies are rating agencies, the servicer bank and, especially, those entities that carry out a role relating to guarantees (in many cases there are public and para-public forms of guarantee).

The advantage for the originator (bank), which can improve funding that, alone, is of primary relevance, lies in the opportunity to widen the offer of credit to the SME market.

An aspect of market development is the articulation of operations based on large technical typologies. Asset-based securities (ABSs) are a versatile form of security and are divided into a range of segments (see Fig. 3.3). Thus, there is a segment of the market which assesses mortgage loans; another large sector, more relevant to ABS in the strict sense, includes different forms of credit (credit cards, leasing, etc.), in addition to assets that are not strictly financial, such as insurance and royalties. So-called collateral debt obligation (CDO) represents another large field and, in turn, comprises collateralized loan obligation (CLO) and collateralized bond obligation (CBO). Collateral debt obligation has grown significantly from 1996 and is often highlighted as a category of operations involved in the 2007–2008 financial crisis.

3.2 Securitization in Europe and the USA: A Comparison

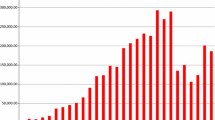

In terms of issuances, the securitization market registered a constant rise until 2007, although inferior in volume compared with the USA. In 2008, in conjunction with the explosion of the financial crisis, the volume of issuances was still strong (€800 billion). From 2009 to 2013, issuances dropped significantly (€180 billion in 2013). An approximately 40 % drop has taken place in issuances since 2009. In 2014, there was an increase of issuances, bringing the value to approximately €216 billion. In the meantime, the USA has witnessed broader signs of resilience in securitization activities during 2009–2013, registering a decline in 2014, approximately €1000 billion (−28 % compared with 2013) (Fig. 3.4).

3.3 Securitization in Europe according to Country and Typology

Briefly presented below are securitization data and composition pertaining to a limited number of European countries according to various typologies.

The principle type of securitization, according to AFME, comprises asset-backed securities:

-

Collateralized debt obligation (CDO);

-

Commercial mortgage-backed security (CBMS);

-

Residential mortgage-backed security (RMBS);

-

Securities backed by small and medium-sized enterprises (SME);

-

Whole business securitization (WBS).

Figure 3.5 presents the sum of the volume of securitization (expressed in € billions) of Belgium, France, Germany, Greece, Ireland, Italy, Holland, Portugal and Spain for the period 2008–2014.

Figure 3.6 presents the percentage of the six different types of securitization in operation in Europe in 2014 (representing a value of approximately €216 billion).

Finally, we present the sum of securitization according to typology and country for the first quarter of 2015 and the last quarter of 2014 in Table 3.1.

3.4 Securitization in Europe for SMEs

We can consider the economies of Europe and the USA as comparable. Europe, however, has a smaller pool of available funds compared with the USA. The number of activities in which to invest in Europe total just half of the number the USA can offer: €30,000 billion of activities compared with the €49,000 billion of the USA. A similar picture applies to financial activities invested in the stock market: the share capital quotes in Europe (€10,000 billion) is equivalent to approximately half the share capital quoted in the USA (€19,000 billion). The comparison with the USA demonstrates that the structure and the sources of funding are a key problem for Europe. Most financing in Europe is provided by regulated entities, such as banks and insurance companies; in the United States, there is a higher degree of diversification and flexibility in financing sources.

On the US market, private pension plans, investment fund managers and other categories of investor (angel investors, hedge funds, private equity and risk capital) offer a greater proportion of financing to companies compared with Europe. However, as illustrated in Table 3.2

, in certain sectors – that is, those affecting SMEs – there seems to be greater funding in Europe as opposed to in the United States.

The total stock of funds available in Europe for SMEs amounts to €2000 billion compared with €1200 billion available in the USA.

The term “Banks” refers to the set of:

-

Loans

-

Securities loans

-

Bonds/equity.

The term “Non-banks” refers to the set of:

-

Mutual funds

-

Segregated mandates

-

Pension funds

-

Insurance

-

Sovereign wealth funds (SWFs)

-

Private equity funds

-

Venture capital funds

-

Family and friends

-

Crowd funding

-

Angel investing.

The term “Government” refers to the set of:

-

Government guarantees and sponsored loans.

Regardless of the importance the sector holds (of course, not in huge terms of volume as demonstrated in Table 2.17, due to its specific function), just a small proportion of the amount of funds is employed in the securitization of SMEs. The principle reason for this apparent contradiction relates to the financial gap that weighs heavily on this category of business; this expresses itself, essentially, as the risk of insufficient capital, an absence of stable sources and a high likelihood of default. The utilization of the instruments listed above would not only be advantageous to originators (collection of liquidity and risk transfer), but could also be beneficial for SMEs. The effect of growth in the credit capacity of banks could mean an increase in the volume of loans to SMEs. At the same time, the more advantageous conditions involved in the costs of funding would act as stimuli for the supply of loans to SMEs offering interest rates that were more competitive.

Because SMEs are small businesses and because collecting information on their projects is expensive, they have limited access to capital markets. In this context, securitization offers the holders of large European savings funds – that is, insurance companies and pension funds – the opportunity to direct resources to SMEs. From this point of view, the efforts made by the Prime Collateralized Securities (PCS) Initiative deserve support.Footnote 2

The PCS has defined the common criteria of normalization, quality, simplicity and transparency with the aim of improving the depth of the market and liquidity for ABSs. The PCS also includes specific measures in relation to ABSs and SMEs. Prudential reforms may even contribute to the relaunching of securitization.

A fundamental initiative in this direction is found in the insurance sector: the Solvency II Directive. This initiative proposes the alignment of the patrimonial requirements with the risks that insurance companies have actually taken on in their investment activity. The present Solvency II Directive came into force on January 1, 2016.

3.5 European Union Reform of Stock Markets

On September 30, 2015, the European Commission began a project to free funds in favor of European businesses and to stimulate growth within the EU through the creation of a single stock market. The unification of stock markets involves all 28 EU Member States being in concordance and the integration of the EU Bank (which is concerned with the Euro area), and is closely connected with and supports the objectives of the “Junker Plan” on strategic investments. Inserted in the framework of the Green Paper of February 18, 2015, the program proposed by the EU represents the most important European integration project promoted by the new Commission and by the new European Parliament Legislation.

Companies, however, still rely heavily on banks: companies draw upon stock markets seldom and to a lesser extent (as previously mentioned). The purpose of the Commission’s project is to remove the obstacles in cross-border EU investments that prevent companies from accessing alternative forms of funding. The Commission has thus committed to the preparation, by 2019, of the constitutive elements that form the foundation of stock markets. The Commission’s task is to ensure that these elements are well-organized, integrated and involve all Member States in order that the entire economy may benefit from the advantages offered by stock markets and financial entities other than banks.

A fully functional unified stock market could offer many opportunities for growth. According to European Commission estimates, if EU risk capital markets were to have the degree of importance of those of the Unites States during the period 2008–2013, European companies could obtain supplementary financing amounting to approximately €90 billion. The unification of stock markets could also facilitate access to funds for businesses that are incapable of reaching investors, thus directing funds in the most efficient way possible. With regard to the Green Paper of February 18, 2015, the Commission has acceded to a three-month consultation the result of which will be fundamental in defining a road map capable of contributing to the unblocking of funds from entities other than banks in order to allow start-ups to prosper and to support further expansion of larger companies. The Green Paper differentiates between two groups of measures: those that are already mature and therefore require immediate action; and those that are more complex and require more time to mature. Among the latter, the Green Paper includes measures of legislative reform that should regulate revenue, bankruptcy, stock markets, pension funds, corporate governance and consumer protection.

There are various key points in relation to the group of measures requiring immediate action:

-

Development of proposals in favor of high-quality securitizations and the decongestion of bank balance sheets in order to foster and implement lending capacity. An EU initiative assessing the subject of securitization (simple, transparent and standardized securitization, STS) should have the effect of improving the standardization of products thus securing thorough procedural regulations, legal certainty and full comparability of securitization instruments. This would allow, in particular, an increase in transparency, consistency and the fundamental information available to investors not only to the benefit of the SME sector, but also beneficial to the promotion of an increase in liquidity. The process would therefore simplify the issuing of securitized products, which would allow institutional investors to exercise due diligence with regard to products that meet their needs, terms of asset diversification, profitability and term horizon.

-

Re-examination of the prospectus of the plan to support companies, especially small businesses, in obtaining funding and in finding cross-border investors. A prospectus is a disclosure document used by companies in order to attract investments. If, on the one hand, these documents aid investors in the decision-making process concerning investments; on the other, they are often lengthy documents containing detailed information that involve companies in administrative costs and fees. In addition, it is not always easy for investors to orient themselves in relation to the vast amount of information provided.

-

Commence activities to improve the availability of information concerning the credit status of SMEs in order to facilitate investors willing to invest in these businesses. In Europe, the majority of SMEs resort to banks to obtain funding; on average, approximately 13 % of their requests are rejected. Often, the rejection is due solely to the fact that the risk profiles of these businesses do not meet the requirements set by banks, even though these requests are economically sustainable. Banks could be encouraged to provide detailed information to SMEs that have had loan requests rejected and help make them aware of alternative forms of funding available. In the field of disclosure, International Financial Reporting Standards (IFRS) have assumed a fundamental role in promoting an appropriate and standardized language within the EU that fosters easier access to global capital markets for large EU firms quoted on the Stock Exchange. Nonetheless, a full application of IFRS to smaller companies – in particular, to those seeking participation in trading venues – would result in an increase of supplementary costs. A high-quality, simplified international accounting standard appropriate for quoted companies could, in some trading venues, constitute a step forward in terms of transparency and comparability and, if applied proportionally, could make companies more attractive to cross-border investors.

-

Collaboration with the sector to put a private pan-European placement system into effect in order to encourage direct investment in smaller companies. December, 10 2016, the European Commission published a Green Paper on retail financial services and insurance in order to obtain opinions on how to increase competition and cross-border offers of retail financial products. In addition, in 2018 an all-encompassing evaluation of European markets for retail investment products is expected. The purpose of the evaluation is to identify the different ways retail investors can access products that are appropriate in terms of cost efficiency and equity. Moreover, the evaluation will also examine how to benefit fully from the new possibilities offered by online services and from financial technology (also known as “FinTech”).

-

Support resorting to new European long-term investment funds in order to channel investments in favor of infrastructures and other long-term investments – that is, European long-term investment funds (ELTIF), created at the end of 2014. In order to facilitate long-term funding for infrastructural investment, the Commission has presented, along with an action plan, a revision of calibrations in Solvency II to guarantee that insurance companies are subject to prudential treatment that better reflects the risk factor of investments in infrastructure and ELTIF. Additionally, the Commission is to complete the revision of the regulations concerning asset requirements. Also, when judged necessary, the Commission is to modify the risk calibration applicable to infrastructural investments for the banking sector. Jonathan Hill, former European Commissioner for Financial Stability, Financial Services and Capital Markets Union presenting a series of measures aimed to establish a Capital Markets Union concluded as follows: “the European Union’s commitment to a single market to capital dates back to the Treaty of Rome. Now is the time to drive it forward; to unlock the single market’s potential; and deliver more competitiveness, more jobs and more growth across Europe”.

Notes

- 1.

For a more detailed analysis of the listed methods, see OECD, New approaches to SME and entrepreneurship financing: Broadening the range of instruments, OECD, 2015.

- 2.

The Prime Collateralized Securities Initiative (PCS) is an independent, not-for-profit initiative set up to re-enforce the asset-backed securities market in Europe as a key to generating robust and sustainable economic growth for the region. At the heart of the PCS Initiative is the PCS Label, which is designed to enhance and promote good practice, and is awarded to specific asset-backed securities.

Author information

Authors and Affiliations

Copyright information

© 2017 The Author(s)

About this chapter

Cite this chapter

Oricchio, G., Lugaresi, S., Crovetto, A., Fontana, S. (2017). European Funding of SMEs through Securitization: An Introduction. In: SME Funding. Palgrave Macmillan, London. https://doi.org/10.1057/978-1-137-58608-7_3

Download citation

DOI: https://doi.org/10.1057/978-1-137-58608-7_3

Published:

Publisher Name: Palgrave Macmillan, London

Print ISBN: 978-1-137-58607-0

Online ISBN: 978-1-137-58608-7

eBook Packages: Economics and FinanceEconomics and Finance (R0)