Abstract

Impact of foreign direct investment (FDI) on economic growth varies across economies. The strength and pattern of impact depend on the nature of FDI (green-field versus M&A) as well as country-specific issues (such as domestic investment, inflation, infrastructure, external trade, among others). The characteristics of these factors could even change the role of FDI on economic growth. Thus, exploring the nature of FDI inflow as well as the identification and measurement of these country-specific factors is important. It will contribute further towards informed policy formulation to obtain the desired benefits of FDI. Using panel data, this study offers a holistic assessment of FDI-economic growth dynamics for South Asian countries.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

JEL Classification

1 Introduction

Economic liberalization has opened the door for flow of foreign capital investment in the majority of developing nations. Foreign investment, especially foreign direct investment (FDI), is a prime source of foreign exchange reserves which eases out the balance of payment constraint of economic growth. Additionally, it complements and/or substitutes domestic investment necessary for economic growth. In the last couple of decades, some of the developing countries including South-East Asian countries achieved significant economic growth by efficiently utilizing the large amount of FDI. However, South Asian nations primarily adopted restrictive policies post-independence. The success of other economies and persistence of low level of economic growth, high level of unemployment and infrastructure bottlenecks induced them to change their policy regime through economic reform. From the late 80s, most of the nations in the South Asian region adopted a market-oriented policy framework and opened their door to welcome foreign investors to integrate the domestic economy with other economies.

The unutilized potential of the huge consumer market, availability of skilled resources, strengthening financial systems, emerging but limited entrepreneurial class are some of the reasons making South Asian countries attractive destination for foreign investors. However, despite being the prime destination of investment, neither the investment pattern nor the economic growth experience is homogeneous across South Asian countries. Thus, it is interesting to analyse the differential impact of FDI inflows on the economic growth in these countries. This may help the policymakers to accommodate this differential aspect in the policy framework and focus on more sustainable and suitable strategy.

1.1 Trends in FDI—Global and South Asian Region

Global FDI inflows increased five folds in the last two decades and stood at USD 1.76 trillion in 2015. The relative share of developing countries increased up to 2014 in the total FDI inflows globally. In 2000–2014, the share of developing countries has increased from around 17% to 55%, while it has declined to 43% in 2015. During the 2010–15, the average growth rate of global FDI was 6.2%, while the growth rate for developed and developing countries was 12% and 4.2%, respectively. Post-1990s, Asian developing countries used to attract more than 50% of the FDI inflows among all developing countries. In the Asian region, South-East Asian region becomes the most preferred FDI destination. South Asian nations witnessed FDI inflows at the rate of 8.5% in this period.

Among South Asian countries, due to economic size and other factors such as infrastructure, India continues to be the ‘most important’ FDI hub followed by Bangladesh and Sri Lanka. Nearly 80% of South Asian FDI inflow destined towards India. The share (within South Asian FDI inflow) of Afghanistan, Bhutan, Nepal and Pakistan is less than 1%. Among other countries, Bangladesh (21%) witnessed the highest growth rate of FDI inflows followed by Maldives (19%) and India (13%) in the last five years.

Per capita FDI inflow was highest for developed countries at USD 474.4 in 2014 compared to USD 129.2 for developing countries while the global average was at USD 180.6. Among South Asian countries, it is the highest in Maldives at USD 1033.3 per capita. In case of India, per capita FDI inflow (USD 27.2) was slightly higher than that of South Asian Region (USD 23.2). In 2014, the contribution of FDI inflow in global GDP stood at 1.7% compared to 2.6% and 1.1%, respectively, for developing and developed countries. In the same year, FDI contributed approximately 1.4% to South Asian regional GDP while 12.2 and 1.7% to GDP of Maldives and India, respectively. Global FDI inflow was about 6.9% of global merchandise trade (in 2014). The corresponding figure was 8.6% for South Asia and 10.7% for India, while it was 111% for the Maldives. In gross capital formation, the contribution of FDI inflows was about 8–9% (average of 2010–14) at the global level, while it was approximately 4–5% for the South Asian region with an exceptional figure of more than 50% for the Maldives. The next section discusses some important and/or recent literature related to FDI-economic growth nexus.

2 Literature Review

Post-1990s, after the initiation of economic liberalization, the South Asian region witnessed significant growth in FDI inflows. However, FDI had a differential impact on individual countries depending on the domestic environment and the nature of FDI. Thus, it attracts the attention of researchers and policymakers and creates a demand for a proper and holistic analysis of FDI-economic growth dynamics.

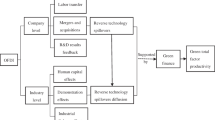

Globally, viewpoints differ regarding the impact of FDI on economic growth and largely two schools of thoughts exist. First, the modernization theory argues that FDI contributes positively to economic growth through capital investment and knowledge transfer. The second school of thought is the dependency theory, which emphasizes the negative relationship between FDI and economic growth. As per this view, FDI creates a monopoly in the market and prevents full utilization of domestic resources and weakens the potential multiplier effect.

Many studies (e.g. Blomstrom et al. 1994 and Borenzstein et al. 1998) argued that FDI inflow stimulates the economic performance of the destination country through technology transfer and spillover effects. The spillover efficiency happens when local firms absorb the tangible and intangible assets embodied in FDI. In contrast, some studies (like Bloomstorm & Kokko, 2003) argued that FDI inflow does not necessarily ensure the knowledge spillover to the local industry. FDI benefit in terms of spillover effect can be only realized when domestic firms have the potential to absorb such spillovers.

However, there are studies (e.g. Singer, 1950 and Griffin, 1970) that indicate the existence of a negative relationship between FDI and economic growth, especially for developing nations. Saqib et al. (2013) observed the negative impact of foreign investment on the economic performance of Pakistan whereas the positive impact of domestic investment. Herzer (2012) studied the data for thirty-five years time period for developing countries and found a negative relationship between FDI and economic growth due to factors such as distortionary market policies, economic and political instability and lack of natural resources. However, Minhaj et al. (2007) concluded that both in the short and long run, FDI inflows have the potential to improve the socio-economic condition of an economy.

Some studies also indicated FDI has an insignificant effect on economic growth. Lund (2010) examined the relationship for both developed and developing countries but found an insignificant impact of FDI in developing countries. This study indicated that a minimum level of development is necessary to take full advantage of FDI. Similarly, Uwubanmwen and Ajao (2012) and Asheghian (2011) found an insignificant impact of FDI on the economic performance of Nigeria and Canada, respectively.

There are many studies which have identified some other factors which influence FDI-economic growth nexus. Trade openness has been identified by many studies (e.g. Iqbal et al. 2014; Agrawal, 2000 and Balasubramanyam et al. 1996) as a pre-requisite condition to utilize the potential benefits of FDI. Iram and Nishat (2009) found that factors such as macroeconomic stability, privatization and export-oriented policies are critical to realizing the positive impact of FDI on the economic growth of Pakistan. On the other hand, Asheghian (2011) identified total factor productivity and domestic investment are key factors in economic growth for Canada. However, Blomstrom et al. (1994) and Blomstrom and Kokko (2003) identified a significant role of the educated workforce to influence the impact of FDI through technology spillovers.

FDI inflow comes either via green-field mode (where the investment is utilized to build new facilities) or M&A route (where existing firms in the host country are acquired by the investor). But, it is well established (e.g. Blonigen (1997), Nocke and Yeaple (2004 and 2007)) that these modes are significantly different in nature. They are neither perfect substitute for each other nor have a similar impact on economic growth. While UNCTAD (2000) acknowledged that M&A FDI is less beneficial, there are studies which postulate that green-field FDI is less beneficial (Blonigen and Slaughter (2001)) or M&A is more beneficial (Bresman et al. (1999) and Conyon et al. (2002)). On the other hand, Liu and Zou (2008) found that positive contribution of green-field investment is more compared to M&A because the former induces both intra-industry and inter-industry spillovers while the latter one augments only inter-industry spillovers. But, their conclusion is based on a study of firm-level panel analysis for Chinese high-tech industries. However, Wang and Wong (2009) found that green-field investment has a significant positive impact on economic growth while the impact of M&A is negative using data for 84 countries over the period 1987–2001. On the other hand, using a cross-section analysis of 83 countries, Nanda (2009) concluded that not only M&A FDI is less beneficial for economic growth compared to green-field FDI, but M&A FDI may have an adverse impact on economic growth. Similarly, Neto et al. (2008) used panel data from 1996 to 2006 for 53 countries and concluded that green-field FDI has a significant positive impact both in developed and developing countries. They also found that M&A FDI has a significant negative effect on economic growth in developing countries but has an insignificant impact on developed countries.

Thus, there is no consensus in terms of the role of FDI and its composition (mode) in promoting economic growth in the existing literature. Moreover, there is a lack of recent data-based evidence especially in the context of South Asian countries. This study proposes to address this gap by conducting a holistic analysis of FDI-economic growth dynamics (role of FDI and its mode along with other factors) using the most recent data. The next section describes the methodology adopted to examine the FDI-economic growth nexus for South Asian countries.

3 Methodology

The paper has measured the contribution of FDI (overall and route-wise) to economic growth using panel data of eight South Asian countries for the period (1990–2014). We identified the factors which have significant potential to augment or retard the impact of FDI and analysed the role of those factors. However, ‘labour’ has been dropped from the list of explanatory variables considered in this study, because all South Asian countries are labour surplus economies. On the other hand, due to insufficient data on infrastructure (especially for Afghanistan and Bhutan), we have not considered ‘infrastructure’ as an independent variable and failed to measure its role. Since FDI like other investment requires a gestation period to contribute towards economic growth, we have considered the lagged values of FDI. Based on literature as well as statistical methods, the number of lags required has been identified. Moreover, the lagged FDI will also help to overcome the impact of economic growth on FDI. The next sections will describe the empirical model and the variables considered in the study.

3.1 Measure the Impact of Overall FDI

The study has used following empirical model to examine the nature and degree of FDI impact on economic growth:

where bi(i = 0, 1, 2 …) refers to coefficients and measures the impact of independent variables on economic growth and direction of impact is shown by the sign.

t and m refer to time period and lag (m = 1, 2, 3…), respectively

Yg refers to the economic performance of the country measured, i.e. a growth rate of GDP.

FDI refers to net FDI inflow-GDP ratio used as a proxy for total FDI inflows.

K refers to the gross domestic capital formation which is a proxy for capital investment.

P refers to inflation and measured by GDP deflator/change in WPI (wholesale price index) or CPI (consumer price index).

ET refers to total export/total import/net export which is used as a proxy for external trade.

CV refers to other independent variables such as HDI (Human development index used as a proxy for livelihood status) or gross enrolment ratio/mean year of school/literacy rate (used as a proxy for the level of education or human capital factor) and/or any health indicator such asper capita health expenditure/health expenditure-GDP ratio/health output like maternal mortality rate/infant mortality rate.

And Ɛ refers to the error term and explains the impact not being captured by any of the explanatory variables.

3.2 Measure the Impact of Green-Field Versus M&A FDI

The study has used following empirical model to examine the differential impact of M&A and green-field FDI:

where bi(i = 0, 1, 2 …) refers to coefficients and measures the impact of independent variables on economic growth and direction of impact is shown by the sign.

t and m refer to time period and lag (m = 1, 2, 3 …), respectively

Yg refers to the economic performance of the country measured, i.e. a growth rate of GDP.

JFDI refers to net FDI inflow of specific routes to GDP ratio used as a proxy for different routes (green-field/M&A) of FDI inflow.

K refers to the gross domestic capital formation which is a proxy for capital investment.

P refers to inflation and measured by GDP deflator/change in WPI or CPI.

ET refers to total export/total import/net export which is used as a proxy for external trade.

CV refers to other independent variables such as HDI (used as a proxy for livelihood status) or gross enrolment ratio/mean year of school/literacy rate (used as a proxy for the level of education or human capital factor) and/or any health indicator such as per capita health expenditure/health expenditure-GDP ratio/health output like maternal mortality rate/infant mortality rate.

And Ɛ refers to the error term and explains the impact not being captured by any of the explanatory variables.

We have tested and rectified for the presence of any specification errors or if any occurred due to simple model specification. The results of the empirical analysis have been discussed in the next section.

3.3 Data Source and Data Period

The data is sourced from the database of World Economic Outlook spanning from 1990 to 2014 for variables such as GDP, inflation and exports. FDI flow data both overall, as well as route-wise (green-field and M&A), was retrieved from UNCTAD FDI statistics. Other data were collected from the database of World Development Indicators.

4 Empirical Results

STATA has been utilized to measure the impact of FDI using the panel data and model structure described in the previous sections. Regression results of FDI impact on economic growth for various combination of control variables were tabulated in the appendix section. This section will discuss the level and pattern of the impact of FDI and other determinants on economic growth. Prior to the regression analysis, the data was utilized to check for the presence of heteroscedasticity, auto-correlation and multi-collinearity using relevant statistical tests. Suitable statistical measures were applied on the data to get rid of any such issue if present.

4.1 Impact of Overall FDI

Previous year FDI (one year lagged) has a direct and significant effect on GDP growth of South Asian countries (as indicated in Appendix Table 1). The robustness of the finding confirmed by similarity in the nature of the impact even with several combinations of other control variables. Many other empirical studies (Germidis, 1977; Mansfield & Romeo, 1980 and Minhaj et al., 2007) found a similar positive significant effect of FDI on economic growth in the context of various developing countries. This study also found that domestic investment (measured by gross domestic capital formation) is another important determinant of economic growth in South Asian countries along with FDI. This study found that current year domestic investment has a consistent positive (but not statistically significant) impact on economic growth. Thus, it plays a complementary role of FDI in promoting economic growth. This study found that inflation has a significant inverse impact on economic growth in most cases. This finding indicates that the persistence of high inflation may harm economic growth and can even hinder the potential positive effect of FDI. Moreover, this study found a consistent positive (but not statistically significant) impact of HDI on the economic growth of South Asian countries. This indicates that improvement in HDI (in other words health and education) can promote economic growth and may induce a positive role of FDI. Finally, the role of export on economic growth is found to be ambiguous in the case of South Asian countries. The effect is mixed (positive and negative) across various cases. This indicates that the composition of exported items may determine economic growth.

4.2 Impact of M&A Versus Green-Field FDI

This study has found that previous year M&A FDI has an inverse effect on the economic growth of South Asian countries (as indicated in Appendix Table 2). The effect is not statistically significant but consistent across the choice of control variables. Based on a cross-country analysis, Nanda (2009) concluded that FDI inflow is not always beneficial for economic growth especially if FDI enters as M&A. The finding of the current study is not only in line with Nanda (2009), but a step forward to establish that in case of South Asian countries, FDI may even hinder economic growth when it flows as M&A. The study found that previous year domestic investment has neither significant nor unambiguous effect on economic growth in the context of South Asian countries. However, the current year domestic investment has a consistent significant positive effect on economic growth. The study found that in the South Asian context, domestic investment is relatively more important to promote economic growth when the nature of FDI flow is M&A. Thus, domestic investment has the potential to offset the detrimental effect of M&A FDI on economic growth. The influential role of domestic investment in economic growth was also highlighted by Saqib et al. (2013). This study failed to get any significant effect of inflation and HDI on the economic growth of the South Asian countries. However, the study found that, export (as a proxy of external trade) has a positive impact on economic growth, but not significant in all cases.

Previous year FDI flow in the form of green-field investment has a positive and consistent (but not significant in all cases) effect on the economic growth of South Asian countries (as indicated in Appendix Table 3). This result reveals that FDI inflows will augment economic growth when FDI flows in the form of green-field investment (new business set-up, new job creation). This finding confirms the Nanda (2009) conclusion that green-field FDI is more valuable as it results in knowledge transfer and hence favourable for economic growth. However, Nanda (2009) concluded the constructive role of green-field FDI with cross-country data, while this study concluded the same using panel data in the South Asian context. On the other hand, this study failed to reach any definite conclusion about the role of domestic investment when FDI inflows in the form of green-field investment. Similarly, the role of inflation and HDI on economic growth are also mixed and ambiguous. However, this study found that export has consistent and positive (significant in many cases) effect on economic growth.

5 Conclusion

Using panel data, this study has analysed the role of overall FDI inflow and its nature (M&A versus green-field) on the economic growth of South Asian countries. FDI needs some gestation period to influence economic growth, while economic growth may have some causal influence on current year FDI flow. Thus, this study has considered the lagged period (previous year) FDI to avoid both the issues. The study has also identified some other factors which have a significant role in determining economic growth and measured the level and extent of their impact. The study found that previous year FDI has a significant effect on economic growth in South Asia, but the nature of FDI flow also plays an important role. FDI inflow in the form of M&A may have a detrimental effect on economic growth and failed to serve the desired purpose. However, FDI as green-field investment is favourable for economic growth through new employment generation and knowledge transfer. Domestic investment also plays an important role in supplementing the impact of FDI. Thus, policymakers need to distinguish between the nature of FDI as well as to channelize the available investment (both FDI and domestic investment) in a proper direction to ensure desired economic growth. Unavailability of suitable data for the selected period in case of Afghanistan and Bhutan (Nepal and Maldives also in some cases) is a shortcoming of the study. The presence of missing data led to lesser degrees of freedom in few cases which might have reduced the significance level of some of the estimates.

References

Agrawal, P. (2000). Economic impact of foreign direct investment in South Asia. In A. Mattoo & R. M. Stern (Eds.), India and the WTO. Washington: World Bank and Oxford University Press.

Asheghian, P. (2011). Economic growth determinants and foreign direct investment causality in Canada. International Journal of Business and Social Science, 2(11), 1–9.

Balasubramanyam, V. N., Salisu, M., & Dapsoford, D. (1996). Foreign direct investment and growth in EP and IS countries. Economic Journal, 106, 92–105.

Blomstrom, M., & Kokko, A. (2003) The. Economics of foreign direct investment incentives. National Bureau of Economic Research Working Paper 9489

Blomstrom, M., Lipsey, R., & Zejan, M. (1994). What explains growth in developing countries? Convergence of productivity: Cross-national studies and historical evidence (pp. 243–259)

Blonigen, B. (1997). Firm-specific assets and the link between exchange rates and foreign direct investment. American Economic Review, 87, 447–465.

Blonigen, B., & Slaughter, M. (2001). Foreign-affiliate activity and U.S. skill upgrading. Review of Economics and Statistics, 83, 362–376.

Bresman, H., Birkinshawand, J., & Nobel, R. (1999). Knowledge transfer in international acquisitions. Journal of International Business Studies, 30, 439–462.

Borenzstein, E., Gregorio, J. D. & Lee, J. W. (1998). How does Foreign direct investment affect economic growth? Journal of International Economics, 45, 115–35.

Conyon, M., Girma, S., Thompson, S., & Wright, P. (2002). The productivity and wage effect of foreign acquisition in the UnitedKingdom. Journal of Industrial Economics, 50, 85–102.

Germidis, D. (1977). Transfer of technology by multinational corporations. Paris: Development Centre of Organization for Economic Cooperation and Development.

Griffin, K. B. (1970). Foreign capital, domestic savings and development. Oxford Bulletin of Economics and Statistics, 32, 99–112.

Herzer, D. (2012) How does FDI really affects developing countries growth? Review of International Economics, 20(2), 396–414

Iqbal, N., Ahmad, N., Haider, Z., & Anwar, S. (2014). Impact of foreign direct investment (FDI) on GDP: A case study from Pakistan. International Letters of Social and Humanistic Sciences, 16, 73–80.

Iram and Nishat. (2009). Sector level analysis of fdi-growth nexus: a case study of Pakistan. The Pakistan Development Review, 48(4), 875–882.

Liu, X., & Zou, H. (2008). The impact of Greenfield FDI and mergers and acquisitions on innovation in Chinese high-tech industries. Journal of World Business, 43(3), 352–364

Lund, M. T. (2010). Foreign direct investment: catalyst of economic growth? Doctoral Dissertation, Department of Economics. The University of Utah

Mansfield, E., & Romeo, A. (1980). Technology transfers to overseas subsidiaries by US-based firms. Quarterly Journal of Economics, 95(4), 737–750

Minhaj, S. Q., Ahmed, R., & Hai, S. S. (2007). Globalization, foreign direct investment and the human development index: The case of Pakistan. Department of Economics, University of Karachi. Pakistan. Unpublished Paper

Nanda, N.(2009). Growth effects of FDI: Is green-field greener? Perspectives on Global Development and Technology, 8(1), 26–47

Neto, P., Brandão, A., & Cerqueira, A. (2008). The impact of FDI, cross border mergers and acquisitions and Greenfield investments on economic growth. TheIUP Journal of Business Strategy, 24–44

Nocke, V., & Yeaple, S. (2004). Mergers and the composition of international commerce (No. w10405). National Bureau of Economic Research.

Nocke, V., & Yeaple, S. (2007). Cross-border mergers and acquisitions vs. greenfield foreign direct investment: The role of firm heterogeneity. Journal of International Economics, 72(2), 336–365.

Saqib, N., Masnoon, M., & Rafique, N. (2013). Impact of foreign direct investment on economic growth of Pakistan. Advances in Management & Applied Economics, 3(1), 35–45.

Singer, H. W. (1950). The distribution of gains between investing and borrowing countries. American Economic Review, 40, 473–485.

The World Factbook CIA. https://www.cia.gov/llibrary/publications/the-world-factbook/fields/2012.html. Retrieved on December 12, 2016

The World Factbook CIA. https://www.cia.gov/Library/publications/the-world-factbook/fields/2048.html. Retrieved on December 12, 2016

Uwubanmwen, A. E., & Ajao, M. (2012). the determinants and impacts of foreign direct investment in Nigeria. International Journal of Business and Management, 7(24), 67–77.

UNCTAD FDI Statistics data base

Wang, M., & Sunny Wong, M. C. (2009). What drives economic growth? The case of cross‐border M&A and Greenfield FDI activities. Kyklos, 62(2), 316–330

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Chaudhury, S., Nanda, N., Tyagi, B. (2021). Green-Field Versus Merger and Acquisition: Role of FDI in Economic Growth of South Asia. In: Lakhanpal, P., Mukherjee, J., Nag, B., Tuteja, D. (eds) Trade, Investment and Economic Growth. Springer, Singapore. https://doi.org/10.1007/978-981-33-6973-3_10

Download citation

DOI: https://doi.org/10.1007/978-981-33-6973-3_10

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-33-6972-6

Online ISBN: 978-981-33-6973-3

eBook Packages: Economics and FinanceEconomics and Finance (R0)