Abstract

This paper address optimal operational problem of smart distribution systems (SDS) encompassing uncertainties and demand response (DR). Information gap decision theory (IGDT) is adpoted in this work to model the uncertainties in grid prices and power from renewables. The SDS operation is analyzed for opportunity (risk-seeker) framework of IGDT. The proposed risk-seeker IGDT based SDS operational management problem is modeled as a multi-objective optimization approach to simultaneously optimize radius of uncertainty of both grid prices and power from renewables. The \(\epsilon \)-constraint method is utilized to solve the multi-objective IGDT problem. Moreover, impact of different participation levels of load shifting type DR on SDS operation is also presented. In order to demonstrate the efficacy of the proposed work a modified 33-bus distribution system is adopted. The results illustrate the effectiveness of proposed multi-objective IGDT model for SDS operational problem.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Smart grid is emerging as a revolutionized transformation of traditional grid owing to greenhouse gas emissions, eroding fossil fuel reserves and surging demand of load. The smart grid facilitates the integration of two-way cyber communication and computer intelligence across the entire spectrum of power systems from generation to consumer end. Subsequently, the envisioned smart grid will be versatile and robust. Another feature of smart grid is efficient deployment of distribution energy resources (DERs) such as demand response (DR) and distributed generation (DGs). Most of these DERs will be located at the distribution end of smart grid. Thus, the integration of these DERs will transform the conventional distribution network into a smart distribution systems (SDS). However, the unpredictability associated with time varying electricity prices and renewable based DGs such as wind turbine (WT) challenges the secure operation of SDS. The potential of SDS can, therefore, be leveraged only through optimal management of DERs in presence of uncertain resources.

In this regard, various methods such as robust method [2, 15], probability method [2, 10] and fuzzy set [1] are reported by authors in literature to incorporate the input parameter’s uncertain nature in SDS operation. These methods, however, have some drawbacks. Robust method, for example, necessitate the exact uncertainty set; probability-based methods necessitate the accurate probability functions and fuzzy methods are computationally expensive and require membership functions. Recently, information gap decision theory (IGDT) which is a non-probabilistic method has shown great promise in managing uncertainties. IGDT method differentiates between actual value and forecasted value.

Uncertainty in demand for a low-voltage distribution system using IGDT is addressed in [9]. Uncertainty in grid prices of renewable integrated microgrid is modeled using IGDT in [6]. Problem of voltage and congestion management in presence of WT uncertainty is studied using IGDT in [7]. Scheduling of flexible loads using IGDT to manage uncertainty in grid electricity prices is proposed in [16]. Two IGDT based functions, robustness function and opportunity function are presented in [3] to evaluate the risk associated with uncertain parameters while economically scheduling the resources of power system. Comparison of risk-neutral plan with risk-seeker (RS) and risk-averse (RA) IGDT strategies in controlling the uncertainties of market price in a smart microgrid is provided in [14]. AC load flow equations are not considered in [6, 11, 16]. Moreover, only one uncertain parameter is modeled using IGDT in [3, 6, 7, 9, 14, 16].

Very few works such as [4, 8, 12, 13] have simultaneously optimized multiple uncertainties using IGDT for operational problem of SDS. Weighted-sum based multi-objective IGDT model for energy management problem of microgrid without inclusion of grid constraints and DR is presented in [8]. Multi-objective RA-IGDT based day ahead scheduling of SDS using enhanced \(\epsilon \)-constraint method is illustrated in [4]. Though, the authors have considered DR through flexible loads, but a sensitivity analysis of DR participation levels is not investigated. An IGDT model formulated as mixed-integer non-linear programming (MINLP) for power management of SDS is proposed in [13]. Multi-objective RA-IGDT based operation of SDS using \(\epsilon \)-constraint method to simultaneously tackle uncertian wind and grid prices is studied in [12]. However, [4, 8, 12, 13] have only addressed RA strategy of IGDT. In other words, multi-objective RS-IGDT strategy for optimal operation of SDS has not been attempted.

Based on above discussion, this paper presents a multi-objective RS-IGDT based SDS operation encompassing AC power flow constraints and DR. The proposed multi-objective approach simultaneously considers uncertain grid prices and uncertain WT power in operation of SDS. The multi-objective model is investigated for RS decision maker using opportunity function of IGDT. \(\epsilon \)-constraint method is developed in this work to solve the proposed multi-objective IGDT problem. Moreover, impact of different DR participation rate on opportunistic operation of SDS is also presented in this work. The proposed multi-objective frameworks are applied and investigated on the modified 33-bus system radial distribution system under various operating scenarios and performance indices have been analyzed in this work.

2 Problem Formulation

2.1 Deterministic Framework

One of the priorities of smart grid operator is to efficiently operate the network. Towards this goal, the objective function considered from smart grid operator’s perspective is to minimize cost of operating dispatchable DGs (DDGs) and cost of importing power from sub-station. This objective is mathematically expressed as follows:

Here, \(OC^{o}\) is SDS operating cost when uncertainty is not considered; \(N_{DDG}\), \(N_{T}\) and \(N_{sbs}\) are number of DDGs, time intervals and sub-stations respectively; \(P_{DDGj,t}\) and \(P_{sbs,t}\) are power from DDG j and sub-station respectively; \(c_{DDGj}\) and \(c_{sbs,t}\) are cost of power from DDG and price of power from sub-station respectively.

\(OC^{o}\) defined in above equation is subjected to AC load flow equations (2)–(7), DR constraints (8)–(12) and DDGs power limit constraint (8) respectively.

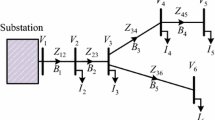

Here, c and d are index for nodes; bc and cd are index for lines; \(\varOmega ^{T}\), \(\varOmega ^{N}\), \(\varOmega ^{L}\) and \(\varOmega ^{DDG}\) are sets for time, nodes, lines and DDG respectively; \(Z_{cd}\), \(R_{cd}\) and \(X_{cd}\) are impedance, resistance and reactance of line respectively; \(\overline{V}\) and \(\underline{V}\) are maximum and minimum voltage limit respectively; \(\underline{P_{DDGj}}\) and \(\overline{P_{DDGj}}\) are minimum and maximum power limit of DDG respectively; \(\overline{\kappa _{c,t}}\) is maximum flexibility of load; \(\overline{I_{cd}}\) is maximum current through line; \(QD_{c,t}^{o}\) and \(PD_{c,t}^{o}\) are reactive and active load before DR; \(QD_{c,t}\) and \(PD_{c,t}\) are reactive and active load after DR; \(QG_{c,t}\) and \(PG_{c,t}\) are reactive and active power injected; \(QL_{cd,t}\) and \(PL_{cd,t}\) are reactive and active power flowing in lines; \(I_{cd,t}\) is current flowing in line; \(V_{c,t}\) is voltage magnitude; and \(\kappa _{c,t}\) is flexibility of load.

2.2 IGDT Framework

IGDT assists the decision makers to handle systems having uncertain parameters. Unlike other methods, this method does not require any kind of statistical data pertinent to uncertain parameter. IGDT consists of two approaches, namely, risk-seeker (RS) and risk-averse (RA) strategies. In RS-strategy, the decision maker aims to maximize its profit through favorable variations in uncertain parameters whereas in RA-strategy, the aim of decision maker is to minimize the risk due to unfavorable deviation in forecasted values of uncertain parameters. In context of IGDT, the favorable or unfavorable deviations are represented using immunity functions. Robust function defines the immunity against failures whereas minimum horizon of uncertainty while ensuring that a pre-defined profit is met is expressed using opportuneness function. In RS-strategy an opportuneness function is defined which has positive effects on the objective of decision maker. In contrast, a robust function is expressed for RA-strategy. In this paper, the SDS operation intends to be a RS model that brings about positive effects for decision maker. The opportunity function \(\eta ^{RS}\) is defined as shown in Eq. (14).

The uncertainty in prices of power from sub-station and power from WT unit expressed as \(u_{t}\) = {\(c_{sbs,t}\),\(P_{wt,t}\)} is modeled using IGDT. Here, demand flexibility, power from DDGs and power taken from sub-station are decision variables of the optimization problem. They are represented as \(q_{t}\) = {\(\varkappa _{c,t}\),\(P_{DDGj,t}\),\(P_{sbs,t}\)}. It is assumed that forecasted values, denoted as \(\tilde{u}_{t}\) = {\(\tilde{c}_{sbs,t}\),\(\tilde{P}_{wt,t}\)} are accessible to smart grid operator. The RS-IGDT based SDS problem is presented in Eqs. (15)–(19).

s.t.

Here, \(\alpha \) and \(\beta \) are radius of uncertainty for WT power and prices for power from sub-station; \(\tilde{P}_{wt,t}\) is forecasted power from WT; \(\tilde{c}_{sbs,t}\) is forecasted price of power from sub-station; \(OC^{c}\) is critical/target SDS operating cost; \(\delta \) is deviation factor; and \(P_{wt,t}\) is power from WT. Equation (16) indicates that the minimum SDS operating cost should be less than equal to SDS target operation cost. The target operation cost of SDS is expressed as some percentange of deterministic SDS operation cost. Constraints (17) and (18) correspond to the range of uncertain grid electricity prices and wind power. Operating cost in Eq. (16) attains the minimum value when availability of wind power is maximum while value of grid electricity prices is minimum. Therefore, bi-level RS-IGDT problem can be translated into a single level optimization problem.

3 Solution Methodology

Numerous methods such as \(\epsilon \)-constraint method and weighted-sum approach are proposed in literature to handle the multi-objective optimization problems. In this repect, the \(\epsilon \)-constraint approach is adopted in this paper because of its wide range of benefits over weighted-sum method. In \(\epsilon \)-constraint method, the objective functions are classified into two categories, that is, main and secondary objective functions. In this method, optimization of main objective function is performed while restricting all the secondary objective functions by some amount. As a result, the multi-objective model is converted into a single-objective optimization model. The single-objective optimization model evaluated from \(\epsilon \)-constraint approach is expressed as [5]:

4 Simulation Results

The operation problem of SDS encompassing DR and uncertain parameters is demonstrated on a modified 33-bus system. The details of modified system are derived from [12]. The modified distribution system is assumed to be equipped with four DDGs. These controllable DGs are considered at node 25, 16, 13 and 8 respectively. The maximum power limit of DDGs are 300 kW, 300 kW, 500 kW and 500 kW respectively. In addition, WT of 500 kW and 750 kW are assumed to be installed at node 32 and 14 respectively. The input data pertinent to profile of wind power, load demand, forecasted grid prices and operating cost of DDGs is adopted from [10,11,12]. Following scenarios are framed in order to evaluate the effectiveness of proposed IGDT based SDS operation.

-

Scenario 1) In this scenario, it is assumed that only power from wind is uncertain.

-

Scenario 2) In this scenario, uncertainty of only grid electricity prices is considered.

-

Scenario 3) In this scenario, uncertainty of both grid electricity prices and power from WT is considered.

In the above scenarios, scenario 1 and scenario 2 are based on single objective optimization whereas scenario 3 is based on multi-objective optimization approach. Moreover, each scenario is evaluated for 0%, 10% and 20% participation levels of DR. The SDS operation cost amounts to 3969.55 $, 3696.79 $ and 3431.56 $ respectively when participation level of DR is 0%, 10% and 20%. These prices are obtained under deterministic case without taking into account the effect of uncertainty.

Results of Scenario 1. The variation of opportunity radius of uncertainty in wind generation \(\alpha ^{RS}\) with critical cost is depicted in Fig. 1. This figure shows variation of minimum deviation in wind power as compared to forecasted value for achieving minimum operation cost that is less than certain critical cost. It is observed that operation cost of SDS reduces due to favorable wind power deviations. For instance, the operation cost reduces from 3431.56$ to 2894.50$ when opportuneness value increases from 0 to 0.578 for 20% participation rate of DR. Thus, the risk seeking strategy provided by opportuneness function of IGDT assists in enduring financial benefit through possible increase in wind generation. It is also observed that the increase in participation level of DR gives lower radius of wind power uncertainty. For more clarity, the opportuneness value with critical cost of 3100$ under different DR levels is shown in Table 1. As compared with 0% and 10% DR participation rate, the opportuneness

value decreases by 62.60% and 44.61% when DR participation is 20%. This implies that certain critical cost can be obtained with less wind power when DR participation is high.

Figure 2 shows the ratio value of power from different sources and energy loss for 20% DR participation rate. Ratio value is ratio of energy in presence of uncertainty to without uncertainty. It is observed that the share of power injected from wind is increased as its uncertainty is now converted into opportunity for decision maker. The power input from sub-station continues to decrease on increasing opportuneness value due to large positive forecast errors in wind power. Moreover, there is no significant change in power from DDGs and energy loss.

Results of Scenario 2. The variation in opportuneness value \(\beta ^{RS}\) with target cost for different DR participation levels is presented in Fig. 3. The figure indicates that lower operating cost of SDS necessitates favorable deviations in grid electricity prices. For example - with DR participation rate of 20%, in order to reduce the operation cost of SDS by 15.65% (3431.56$ to 2894.50$) the uncertain grid prices in each hour should be 19.86% lower in comparison to forecasted grid electricity prices. In fact, this financial gain is attributed to the acceptance of risk linked with risk-taking strategies. Moreover, Table 2 shows that the performance of SDS becomes superior by integrating DR as the opportuneness value decreases with higher DR participation level. In other words, in order to obtain a critical cost of 3100$, 26.60% and 20.10% decrease in electricity prices is needed when DR participation rate is 0% and 10% respectively. On the other hand, only 12.5% reduction of prices is enough with 20% participation level of DR to obtain similar critical cost.

The ratio value of from multiple sources and energy loss for 20% DR participation level is presented in Fig. 4. It is found that in comparison to deterministic case (uncertainty neglected), more energy is preferred from grid due to favorable uncertain electricity prices. Moreover, with larger variations of prices the decision maker would raise power input from grid to take more advantage of uncertainties. Similarly, the share of DDGs reduces to avoid increase in operation cost since cheaper power from grid is available.

Results of Scenario 3. In this case, the uncertainties in both grid prices and wind power are modeled using RS-IGDT. The pareto-solutions (\(e^{\epsilon }\)) obtained consist of 10 points and are as shown in Table 3 for different participation levels of DR. It is worth to note that these solutions are relevant only when the operator decides to take risk. These pareto-solutions are determined for a critical cost of 3100$. In addition, the decision maker can easily obtain other strategies/pareto-solutions on varying deviation factor. For DR participation rate of 20%, solution #5 is the most comprising solution as evaluated using fuzzy criteria. The comparative relation between energy of DDGs and grid sub-station corresponding to most compromising solution and deterministic case is depicted in Fig. 5 and Fig. 6 respectively. The decrease in power generation of DDGs is due to increase in wind power injection. Similarly, as compared with deterministic case power scheduled from grid with preferred solution is reduced because of large positive forecast errors in wind power having negligible operation cost.

5 Conclusions

A multi-objective approach for optimizing radius of uncertainty of both sub-station electricity prices and power from wind is proposed in this paper. The uncertainty in both the input parameters is modeled using opportunity function of IGDT. SDS operation under different levels of load shifting type DR program is also investigated. The proposed model is tested on a modified 33-bus distribution system which is equipped with DDGs, WT and flexible loads. The results show that through opportunity function decision maker can make more economic profit through reduction in electricity prices and increase in wind power generation. Also, the opportuneness value increases on decreasing the operating cost. In addition, it is observed that economic performance of SDS is improved on increasing DR participation rate.

References

Abapour, S., Zare, K., Mohammadi-Ivatloo, B.: Evaluation of technical risks in distribution network along with distributed generation based on active management. IET Gener. Transm. Distrib. 8(4), 609–618 (2013)

Baharvandi, A., Aghaei, J., Nikoobakht, A., Niknam, T., Vahidinasab, V., Giaouris, D., Taylor, P.: Linearized hybrid stochastic/robust scheduling of active distribution networks encompassing PVs. IEEE Trans. Smart Grid 11(1), 357–367 (2019)

Dai, X., Wang, Y., Yang, S., Zhang, K.: IGDT-based economic dispatch considering the uncertainty of wind and demand response. IET Renew. Power Gener. 13(6), 856–866 (2018)

Khajehvand, M., Fakharian, A., Sedighizadeh, M.: A risk-averse decision based on IGDT/stochastic approach for smart distribution network operation under extreme uncertainties. Appl. Soft Comput. 107, 107395 (2021)

Mavrotas, G.: Effective implementation of the \(\varepsilon \)-constraint method in multi-objective mathematical programming problems. Appl. Math. Comput. 213(2), 455–465 (2009)

Mehdizadeh, A., Taghizadegan, N., Salehi, J.: Risk-based energy management of renewable-based microgrid using information gap decision theory in the presence of peak load management. Appl. Energy 211, 617–630 (2018)

Murphy, C., Soroudi, A., Keane, A.: Information gap decision theory-based congestion and voltage management in the presence of uncertain wind power. IEEE Trans. Sustain. Energy 7(2), 841–849 (2015)

Nasr, M.A., Nasr-Azadani, E., Rabiee, A., Hosseinian, S.H.: Risk-averse energy management system for isolated microgrids considering generation and demand uncertainties based on information gap decision theory. IET Renew. Power Gene. 13(6), 940–951 (2019)

O’Connell, A., Soroudi, A., Keane, A.: Distribution network operation under uncertainty using information gap decision theory. IEEE Trans. Smart Grid 9(3), 1848–1858 (2016)

Rawat, T., Niazi, K.R., Gupta, N., Sharma, S.: Impact assessment of electric vehicle charging/discharging strategies on the operation management of grid accessible and remote microgrids. Int. J. Energy Res. 43(15), 9034–9048 (2019)

Rawat, T., Niazi, K.R.: Risk averse energy management for grid connected microgrid using information gap decision theory. In: Kalam, A., Niazi, K.R., Soni, A., Siddiqui, S.A., Mundra, A. (eds.) Intelligent Computing Techniques for Smart Energy Systems. LNEE, vol. 607, pp. 465–473. Springer, Singapore (2020). https://doi.org/10.1007/978-981-15-0214-9_50

Rawat, T., Niazi, K., Gupta, N., Sharma, S.: Multi-objective information gap decision theory based operation of smart distribution grid integrated with demand response. In: 2020 21st National Power Systems Conference (NPSC), pp. 1–6. IEEE (2020)

Samimi, A., Rezaei, N.: Robust optimal energy and reactive power management in smart distribution networks: an info-gap multi-objective approach. Int. Trans. Electr. Energy Syst. 29(11), e12115 (2019)

Sriyakul, T., Jermsittiparsert, K.: Economic scheduling of a smart microgrid utilizing the benefits of plug-in electric vehicles contracts with a comprehensive model of information-gap decision theory. J. Energy Stor. 32, 102010 (2020)

Zhang, C., Xu, Y., Dong, Z.Y., Ma, J.: Robust operation of microgrids via two-stage coordinated energy storage and direct load control. IEEE Trans. Power Syst. 32(4), 2858–2868 (2016)

Zhao, J., Wan, C., Xu, Z., Wang, J.: Risk-based day-ahead scheduling of electric vehicle aggregator using information gap decision theory. IEEE Trans. Smart Grid 8(4), 1609–1618 (2015)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Rawat, T., Niazi, K.R., Sharma, S., Singh, J. (2022). Risk-Seeker Information Gap Decision Theory Based Smart Grid Operation Encompassing Demand Response. In: Mekhilef, S., Shaw, R.N., Siano, P. (eds) Innovations in Electrical and Electronic Engineering. ICEEE 2022. Lecture Notes in Electrical Engineering, vol 893. Springer, Singapore. https://doi.org/10.1007/978-981-19-1742-4_35

Download citation

DOI: https://doi.org/10.1007/978-981-19-1742-4_35

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-19-1741-7

Online ISBN: 978-981-19-1742-4

eBook Packages: EnergyEnergy (R0)