Abstract

The wind power sector took off in Vietnam after the feed-in tariff was raised to 8.5 US cents/kWh for onshore projects in 2018. As of March 2021, 113 wind projects with total capacity 6,038 MW have signed a power purchase agreement. Most are expected to enter commercial operation before December 2021. We explore here three scenarios for wind power development in Vietnam through 2030. It argues that by 2030 the wind power installed capacity in the New Normal could be around 17 GW onshore and 10 GW offshore. In a Factor Three scenario, offshore wind reaches 21 GW by 2030. This has three policy implications. First, Vietnam’s next power development plan provides an important opportunity to increase at low costs the level of ambition of wind power development. Second, flexibility should be the guiding principle of the plan. Third, to realize the large potential of offshore wind power, infrastructure planning has to start soon.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Early 2021, Vietnam’s 2025 targets for installed wind power capacity in the Power Development Plan VIII (PDP 8) draft were: 11.3 GW for onshore and nearshore, zero offshore. For 2030, these numbers increased respectively to 16.0 GW onshore/nearshore, and 2 GW offshore [1]. These numbers are not final, as the administration is still revising the draft. This manuscript perspective argues that Vietnam rely more on its excellent wind resources, which potential has been overlooked in the PDP 8 draft. Considering the pipeline of projects in the country, the upcoming Power Development Plan 8 (PDP8) still has the opportunity to increase the target to have several GW of installed offshore wind capacity by 2030.

Our argument follows the scenario analysis method. The next section exposes the natural and technical potential of wind energy in Vietnam. Section 3 presents an original project-level inventory of the wind power sector in Vietnam. The pipeline is large enough to meet the government targets by far. Still using our inventory dataset, Sect. 4 reviews the stated costs of wind power projects in the country, and why they are expected to decline. Section 5 defines three scenario narratives to explore the range of possible futures. We quantified our scenarios with a top-down energy system modeling study led by the Institute for Sustainable Future, hereafter ‘ISF’ [2]. Sections 6 and 7 discuss, respectively, two implications of the expected surge in wind power: the need for flexibility in the whole system, and the urgency to plan the offshore transmission infrastructure. Section 8 summarizes our results and concludes by reviewing the specific Vietnamese policy changes called for by the wind power opportunities.

2 Vietnam Wind Resource is Excellent

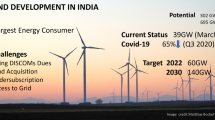

Vietnam’s wind resources mostly lie along its coastline of more than 3000 km, and in the hills and highlands of the northern and central regions. The Global Wind Atlas estimates that over 39% of Vietnam’s area has annual average wind speed over 6 m/s at a height of 65 m, and over 8% of Vietnam’s land area has annual average wind speed over 7 m/s (see Fig. 1 from [3]). This corresponds to wind resources physical potential of 512 GW and 110 GW.

In 2006 already, [4] found 3.5 GW economic potential at less than 6 US cents/kWh for onshore wind power. Figure 1 shows that Vietnam’s the offshore wind potential is much larger than the onshore wind potential. Winds over sea are stronger, more stable. Land use constraints to sit turbines and transmission infrastructure are also lower.

Sean and Whittaker [5] presented estimates of the wind offshore potential for Vietnam, accounting only for wind speed greater than 7 m/s and less than 200 km from the coast. they found a potential of 261 GW in waters less than 50 m deep, and an additional potential of 214 GW in waters 50 to 1000 m deep.

Using the Weather Research and Forecasting (WRF) model (10-km resolution for 10 years, from 2006 to 2015), Doan et al., [6, 7] estimated the energy potential in the offshore area around the Phú Quý island (Bình Thuận province). This area alone can provide 38.2 GW of offshore wind power generation capacity. [8] precised the analysis, estimating that the five-year capacity factor over 2007–2011 of a LW 8 MW wind turbine over Phu Quy was over 54%.

The Institute of Energy based its study for the official Power Development Plan VIII on technical potentials 47 GW for onshore wind, 162 GW for offshore ([9], ch. 8, tables 8.14 and 8.15 p 332, see annexes 8.4 and 8.5 pp 32–35 for the distribution by province). This is at 80 m hub height, for wind speed over 5.5 m/s onshore, 6 m/s offshore, filtering out unsuitable land use.

The present manuscript is based on our own resource analysis [2]. Taking into account land-use restriction – excluding mountain areas with slopes of more than 30%, fractured spaces with a size of less than 1 km2 and areas more than 10 km away from existing power lines – it found 42 GW of technical onshore wind energy potential for utility scale wind farms. It estimates the offshore wind resource to 609 GW, spreading over a total of 3000 km coastline and area of 150 000 km2. This takes into account only coastal areas with a maximum water depth of 50 m and a maximum distance to the shore of 70 km, and uses 2015 meteorological data. The ISF study further estimated the regional wind energy potential and capacity factors (for details, see [10] annexes). While being a variable energy source, the estimated capacity factor of wind energy in Vietnam is up to 36% for onshore and 54% for offshore wind.

3 Towards 5 GW of Wind Power Operational at the End of 2021

As we exposed in [10], the history of the sector shows fifteen years of growing pains. The Bạch Long Vĩ island hybrid diesel + wind project inaugurated on October 30th, 2004 was a false start, not appropriate to the local capacities at the time. Vietnam’s first high-capacity wind farm, 30 MW, was inaugurated by REVN, in the central province of Bình Thuận on April 18th, 2012. This is where the first turbine fire event in Vietnam happened on January 5th, 2020. The next two projects – the Phú Quý island hybrid grid with 6 MW and the near-shore Bạc Liêu phase 1 with 16 MW – both completed in 2013. These three pioneer projects had their lot of technical trouble: one turbine of the Phú Quý system has been broken for years; one turbine in the REVN wind farm caught fired on January 5th, 2020; and the construction of Bac Liêu phase 2 took was much slower than the norm today.

No new capacity was added in 2014 or 2015. Provincial wind power development plans for eight provinces – Bạc Liêu, Bến Tre, Bình Thuận, Cà Mau, Ninh Thuận, Quảng Trị, Sóc Trăng and Trà Vinh – were published in 2016. That year the 24 MW Phú Lạc project in Bình Thuậnh province and the 83 MW Bạc Liêu phase 2 were completed. The following year, the 30 MW Hướng Linh 2 project in the Quảng Trị province was connected. By the end of 2018, the total installed wind power capacity in Vietnam had reached about 228 MW.

In 2019, Vietnam’s wind power industry began to take off, although not as spectacularly as the solar power industry. By 31 May 2019, seven wind power plants were in operation, for a total capacity of 331 MW. By February 2020, we count eleven projects in operation, for a total capacity of 425 MW. To take one example: the Trung Nam project in Ninh Thuận province inaugurated in April 2019 a hybrid facility, co-locating a 40 MW wind farm with a 204 MW solar PV plant. This plant was being extended by 112 MW in phase two, by installing 28 turbines of 4MW, and after phase 3 added another 48 MW by mid April 2021, it became the largest in Vietnam. Installing this class of machines demonstrates that the local market has now reached the technological frontier.

We maintain a database of wind projects in Vietnam. To the best of our knowledge, this is the most complete and up to date list, even including commercial offers. The full database is available online [11]. Table 1 summarizes the pipeline of projects in Vietnam by mid 2021. Projects are classified by phase. The Operation phase is after the commercial operation date. The Implementation phase is from the groundbreaking ceremony to the commercial operation date. The Development phase is before building but after the administrative Decision of Investment, which usually given by provincial authorities soon after the project is added to the national Power Development Plan. The preliminary phase is from exclusivity MoU to administrative Decision of Investment.

Our database includes has all projects authorized by the Government. They are in Operation/Implementation/Development phases. Between these three rows, our numbers are only indicative. They are based solely on publicly available sources, we are only able to record projects advances when they are reported.

Row four adds up projects at the Preliminary phase. This is a wide category. It includes projects already proposed for inclusion in the Power Development Plan, but also projects that have not yet started the pre-feasibility study, or projects seeking an active investor. The 20 525 MW of Onshore wind projects at the Preliminary phase include 14 422 MW of capacity signed in the Gia Lai province investment projects [12]. The 31 812 MW of offshore wind projects at the Preliminary phase is less than the 59 720 MW capacity of potential projects listed by Institute of Energy in Table PL9.3 in [9, pp. 52–53].

According to [13], in March 2021, Electricity of Vietnam (EVN) informed the Ministry of Industry and Trade that, up to now, they signed power purchase agreements (PPAs) with 113 wind power projects, with a total capacity of 6,038 MW. Based on reports of the investors, progress of construction investment and commercial operation of the wind power projects as follows:

-

1.

The number of projects that have already put into commercial operation as 12 projects with a total capacity of 582 MW.

-

2.

The number of projects that expect to be put into commercial operation before October 31, 2021 as 87 projects with a total capacity of 4,432 MW.

-

3.

The number of projects that cannot be put into commercial operation before December 31, 2021 as 14 projects with a total capacity of 1,024 MW.

The numbers from EVN confirms the main finding of Table 1, based only on public sources: over 4 GW of wind power projects are actively building by mid 2021.

The power development master plan PDP 7 revised, published in 2016, has set targets of 0.8 GW of wind power capacity by 2020, 2 GW by 2025 and 6 GW by 2030. Capacity in operation reached 538 MW at the end of 2020, so the 2020 target was missed [14]. However, EVN has signed PPA for more than 6 GW already, out of the 11 262 MW authorized by the government. It is certain that the 2025 objectives will be exceeded by the end of 2021.

The table confirms the potential estimates from the previous section: there is about 67.7 GW of wind power capacity in identified sites in Vietnam. Most of this potential comes from projects at the Preliminary stage. May will never be realized, but these numbers provide the best frame of reference to discuss 2030 scenarios for the sector.

The early 2021 draft of the Power Development Plan VIII proposed the revise the targets for wind power in 2030 as follows: In the low demand scenario, 16 GW onshore and 2 GW offshore. In the high demand scenario, increase the offshore target to 3 GW. ([9], ch 9, tables 1 and 2 pp 353–353). The analysis (Fig. 9.10, p 389) further examines several scenarios in which new wind power generation capacity substitutes for new imported coal generation capacities at the 2030 horizon.

Overall, the 16 to 19 GW target is realistic considering the amount of projects already accepted or proposed at the end of 2020. However, this draft of the plan does not include most large offshore projects under discussion at that moment.

In the offshore sector, the Ca Mau 1 (350 MW) project is under construction, while HBRE Vung Tau (500 MW) and Phu Cuong 1A, 1B (200 MW) are approved. But there are more than 31 GW of offshore projects at the preliminary stage. Offshore projects Phu Cuong 1C, 1D (200 MW) and Binh Dai Ben Tre (400 MW) are to be considered for PDP VIII. AIT and Mainstream’s project in Bến Tre (500MW) is also proposed to the Plan. Phase 1 (600 MW) of the Thang Long project by Enterprize Energy (UK) has obtained a full year of wind data and is continuing its site survey. The La Gàn project by Copenhaguen Infrastructure Partners (Denmark) started strong, as is the Binh Dinh project by PNE AG (Germany). History will judge the 600MW offshore project in Bình Thuận between PV Power and IMPSA, signed in April 2011 with Argentina, was only a diplomatic gesture.

4 Cost of Wind Power is Rapidly Falling, but FIT is Uncertain

Offshore wind becomes more and more economically viable due to its higher yields, larger turbines and clusters. The auctions conducted to lease the rights to build wind farms offshore Massachusetts illustrate the cost decline in the industry. In 2014, they did not receive any bids. When the auction ran again in December 2018, the winning developers paid 405 million USD for the right to build wind farms [15, 16].

Costs will also improve because the average rated capacity size of offshore turbine units is increasing. Though it is around 7 MW per turbine today, the first 12 MW turbines are already being field tested, and the capacity is expected to reach 15 MW per turbine in 2025. The average capacity factor of current projects also ranges from 50–57% [17]. From 2020 to 2022, the cost of electricity from newly commissioned offshore wind power projects could range from 60 USD/MWh to 100 USD/MWh based on current trends and the winning bids from 2018 auctions – a significant decline compared to 140 USD/MWh in 2017.

For example, France aims to have 10 GW of offshore wind power by 2028, and recently conducted an auction for a 600 MW offshore wind farm near Dunkerque, scheduled to open in 2025–2026. The eight candidates proposed to sell electricity for 20 years between 44 €/MWh to 60,9 €/MWh (equivalent to 48 to 67 USD/MWh), with an average at 51 €/MWh (equivalent to 56 USD/MWh). Germany has held just two offshore wind auctions, one in 2017 and one in 2018. In both tenders, capacity was won by investors who offered to build parks without subsidies.

There is no auction for offshore wind electricity delivered in Vietnam around 2025. But if the Government were to hold one, there would be important differences with France and Germany. The bidders would factor in the risks of being the first to develop the technology in the country. And the bidders would also have to factor in whatever costs of the transmission infrastructure is required from them. According to experts surveyed in GWEC [39], “With regards to support mechanisms for offshore wind, the current FiT level was seen as appropriate.” which means that the industry expects to be able to deliver under 98 USD/MWh.

Since 2011, the Feed in tariff (FiT) for wind power project in Vietnam was 78 USD/MWh and that was not commercially viable for developers. In November 2019, the FiT was raised to 85 USD/MWh for onshore wind power projects and 98 USD/MWh for offshore wind power projects [18]. The new electricity tariffs are applied to a part or whole of the grid connected wind power projects with commercial operation date before 1 November 2021 for 20 years from the date of commercial operation. Already operating projects will benefit from the tariffs retroactively from 1 November 2018 for the remaining period of the signed PPA.

Future tariffs for wind power projects completed after 1/11/2021 remain uncertain. In 2020, the Ministry of Industry and Trade (MOIT) proposed to extend the current FIT scheme to the end of 2021, effectively giving a two months extra time for developers to finish their projects [19]. Later that year, MOIT proposed to extend the FIT scheme for already registered projects by two more years (Letter 8159/2020/BCT-DL cited in [20]), reducing the rates as described in Table 2 below.

From our perspective, extending by two years seems preferable to rushing all projects to the end of 2021. This can be justified considering the administrative delays in 2019 and the COVID crisis. More time allows a better execution of projects. Time is also needed to alleviate grid congestion issues. Renewable energy projects do not contribute to the supply when they are curtailed. And the auction mechanism, which is prepared to follow the FIT scheme, has not started to be deployed by June 2021.

5 Scenarios for Wind Power in Vietnam

The previous sections have shown that in mid 2021, the pipeline of wind power projects in Vietnam is much larger than the government targets. In [2, 10] we examined three visions for the development of the power sector in Vietnam. We estimated future demand trajectories and looked at how various energy mixes could satisfy it. In these visions, the role of wind power is defined as follows (see Table 3).

The first scenario corresponds to the PDP7 revised, which planned for 6 GW of installed wind capacity in 2030, accounting for 2,1% of the power production. The other two scenarios respectively achieve that year a total installed wind capacity of 26 GW and 42 GW. In the most ambitious scenario, annual markets increase about 2 GW a year for both offshore and onshore wind during the next decade. While such annual market figures may seem ambitious, the country is expecting a high energy demand growth apparent from the PDP7 revised which planned to install 70 GW of additional generation capacity between 2020 and 2030 – mostly baseload plants. Indeed, high growth rates in the power supply infrastructure are required to lift a 100 million people from lower to higher middle income in ten years. Technological progress is rapidly reducing costs, leading to considerable shifts in investment patterns. For example the PDP7 solar PV objectives were 4 GW for 2025, but the installed capacity achieved more than 5 GW at the end of 2019. As explained in Sect. 3 above, a similar-sized wave of wind energy projects will arrive in 2021.

The following narratives flesh out the three scenarios, explaining various development rhythms:

In the Old Plan scenario, a wave of new wind farms connects to the grid in time to get the FIT before November 2021. After that, the government does not renew the FIT, and legal issues delay the first pilot auction to 2022. By then a global economic crisis affects Vietnam, reducing economic growth and, by extension, domestic electricity demand. International fossil fuels prices hit historical lows as global demand dips, and producing countries try to sell their remaining reserves before they are made useless. Vietnam policy priority is on GDP growth by international trade rather than climate protection. Natural gas plays the first role in the 2020–2030 decade. A rapid improvement in energy efficiency and a strong development of solar, both utility scale and behind the meter rooftops, leave little room for wind energy to expand above the PDP7 targets revised in 2016.

In the New Normal scenario, after the initial wave of wind projects in 2021 there is no second FIT period due to concerns on the part of policymakers that the market will overheat. The market is driven by direct power purchase agreements –multinational companies in Vietnam procuring green electricity directly from wind project developers – and by government auctions – the 2021 DPPA pilot is a success. The government credibly commits to an auction program for 1 GW of offshore wind per year. During the 2021–2025 period, the technology develops as a progressive extension of the near-shore wind farms, while the “true offshore” projects scale up. The expected market size leads many industries to choose Vietnam as their Southeast Asia base for manufacturing equipment and operating wind projects. The offshore wind industry is organized around two hubs: the port of Vũng Tàu serves farms in the zone facing Bình Thuận and Cà Mau coasts; and the port of Hải Phòng serves zones facing Quảng Ninh coasts.

In the Factor Three scenario, the Party decides to steer Vietnam into green development. The national oil and gas company PVN is redefined as a sustainable energy provider that mobilizes its offshore work capacities and the complementarity between gas and variable renewables. All projects meet their initially announced targets, which are extremely unlikely considering the situation today. The Thang Long Wind power project by Enterprize Energy, which intends to develop large-scale offshore near the Kê Gà area in Bình Thuận province, starts operating its first 600 MW phase at the end of 2022, and extends by 600MW every year. The three other projects – in Bac Lieu by KOSY group, in Vung Tau by HBRE group and in Phu Cuong by Mainstream – add 1.7 GW of offshore wind power capacity by 2024. By end of that year, the total offshore capacity is 2.9 GW, and the sector is competitive. This convinces the government to adopt a regional leadership strategy in the wind energy sector. A national scale offshore transmission infrastructure – power centers hubs and under sea lines – starts by connecting the existing projects. Starting in 2025, the backbone strategy to meet the power demand expansion in Vietnam is to auction 3 GW of offshore wind every year.

The key early signpost indicating which scenario Vietnam is heading towards will be the government’s next decision about for wind power incentives. Feed In Tariff (FIT) is by far the proven policy mechanism, it worked in Germany between 1991 and 2018, and it is working in Vietnam now. Recent experience in Germany is also an example for the Old Plan scenario: auction design problems can cool down the wind market. Alternatively, a decision to offer FIT over 90 USD/MWh for offshore wind after 2022 would steer towards the third scenario. Costs would be high but tendering the rights to use offshore wind development zones could recover a portion of these costs.

Most previously published Vietnam power system development scenarios are close to the Old Plan scenario when it comes to wind power. The Renewable Energy scenario [21, p. 39] sees 8.5 GW of wind installed capacity in 2030. The Danish Energy Agency [22, p. 45] scenarios project wind power capacity to grow to 6.2 – 6.4 GW in 2030, which is close to the PDP7 revised. The 2019 update to this Vietnam Energy Outlook [23] sees more wind power generation than solar in 2030 in all cases; offshore wind enters at 2.5 GW in 2030. The ECA Made in Vietnam Energy Plan 2.0 [24, p. 11] assumes that a doubling of the PDP7A target is possible, for a 12 GW of installed wind power by 2030, not mentioning offshore wind. The low-carbon development pathway report for Vietnam by the Asian Development Bank [25, p. 35] targets 16 GW of wind capacity by 2050, giving a preference to solar, nuclear and biomass energy. To sum up, up to 2018 even the most progressive previously published scenario for Vietnam targeted a maximum of 12 GW in 2030, way below the new trajectories assessed by ISF, while still overlooking the offshore wind potential. Only the Renewables-Led Pathway [26] foresees 39 GW of wind capacity installed in 2030.

World Bank published an Offshore Wind Roadmap for Vietnam [27] to argue that building 10 GW in 2030 is much cheaper in the long run than building only 5GW. This provocative result arise because the cost of electricity in the high growth scenario reach grid parity earlier. It drops to 7 US cent/kWh in 2030 as opposed to 8 US cent/kWh in the low growth scenario. Two reasons explain the economies of scale. One is capital expenditure reduction with learning by doing and increased competition. The other is the cost of capital reduction with increased market confidence and less risk.

GWEC [28] reports that “2020 saw global new wind power installations surpass 90 GW, a 53% growth compared to 2019, bringing total installed capacity to 743 GW, a growth of 14% compared to last year. The world’s top five markets in 2020 for new installations were China, the US, Brazil, Netherlands and Germany.” The share of offshore installations is growing [28, p. 51]. Offshore wind installation reached its first GW in 2007. According to REN21 [29] globally about 6 GW of offshore wind capacity was connected in 2020, half of it in China. In this growing market, there are opportunities to develop domestic manufacturing and engineering capacities. Although the result is surprising, the World Bank arguments that the economic policy objectives are as important as energy policy objectives has some value. The question is not just how to produce the cheapest possible electricity, but also how to integrate Vietnam in the global value chain of a growing sector.

Now that Taiwan and Japan have both announced that they will install more than 5 GW of offshore wind power, manufacturers are already redesigning their machines and platforms to resist the typhoons and earthquakes prevalent in the Pacific area.

The Old Plan scenario (and previously published studies) neglects the role that offshore wind could play in 2030 in Vietnam, while the Factor Three scenario might seem extremely ambitious today: the commission of 42 new offshore wind farms in ten years. Both scenarios are extreme and unlikely. The most plausible future scenario is something in between. Connecting the realm of possible with extreme cases is useful for analysis.

Party resolution 55 orienting the national energy development strategy of Vietnam [30] prioritize wind and solar energy for electricity generation, and mentions building 8 billion m3 of LNG import capacity by 2030. This suggests that the middle scenario is the most plausible of the three. Given the worldwide trends, the abundance of wind in Vietnam, the full pipeline of projects and the urgent need to increase electricity supply, we believe that the government will revise upwards the wind targets in the next PDP and commission several 500 MW offshore wind farms over the next ten years.

6 Variability and Flexibility Needs

Wind power is a variable energy source: wind speed varies by day, region and season. The high wind speed season is during the north-eastern monsoon months (December, January, February) and low wind speed seasons is during the inter-monsoon months (March, April, and May). [6] observed that the seasonal variabilityFootnote 1 in Vietnam associated with monsoon onsets and the daily variabilityFootnote 2 associated with the wind diurnal cycles is in the 30−50% range, and the inter-annual variabilityFootnote 3 can reach up to 10%.

The wind regime in the North differs from the wind regimes in the South and Center. The central and southern regions have high correlation (<80%), while the northern region shows weak correlation with the south (<5%). These fairly low correlations suggest that the wind generation would not peak at the same time within the country, as Fig. 2 illustrates. Distributing wind generation deployment across the region and across intra-regional exchanges creates balancing effects that considerably reduces the variation of wind power output. The maximum change of wind generation within the central region from one hour to the next is 30%, but the Vietnam-wide maximum change is 2%.

To illustrate how the power system copes with variability, we compared simulations of the power supply under the Factor Three scenario in 2030 for the Red River Delta region during a windy and a windless week. By choosing this area, we want to stress that while the southern and central provinces attracted most solar and wind energy projects to date, the power grid must be balanced, and increasing power generation from renewable sources in the northern regions is an option.

In a windy week in May 2030 (Fig. 3), wind and solar provide a major share of electricity generation, while fossil fuels make up only a minor share. In this case, wind power gets shunted from the windy Northeast and/or North Central Coast to the Red River Delta and displaced coal generation in three evenings.

Figure 4 shows the windless week simulation, in August 2030. Most of the power supply during this week comes from coal and gas, while solar photovoltaic and wind have minor contributions. The Red River Delta region is self-sufficient for almost the entire week, importing only minor amounts of electricity from other regions during evening hours.

The variability of the two situations described in these figures is already being experienced by countries that have a much larger share of wind power in their energy mix than Vietnam does. In 2019, wind power represented 55% of the electricity produced in Denmark; and 20% in Germany according to IEA statistics. Because of intra-annual variability, the maximum share of wind at monthly and weekly time scale is higher in some months. For example, wind satisfied 30% of Germany’s electricity demand in January 2019 and only 18% in June 2019.

These simulations only aim to showcase the potential magnitude of the variability issue, in the hope that solutions will be found. The major flexibility solutions include pumped storage, battery storage, more flexible thermal and interconnection. Experience from Europe shows that anti-correlation of the seasonal weather patterns of monthly onshore wind and PV generation yields a more stable total variable renewable energy output. There is also a seasonal-scale balancing effect between variable renewables in Vietnam. Statistically, from November to February wind speed is high, from February to June solar radiation reaches a peak, and during the wet season from July to November the water inflows are high [31].

Researchers have observed that offshore wind has more stable output throughout the year than onshore. This alleviates the variability issue and contributes to reliable capacity in the medium and long term. Another lesson from these countries is that variable renewable energy capacity is faster to install than flexibility solutions, in particular those involving additional grid infrastructure. That can lead to system congestion, high level of curtailment and sub-optimal period of negative electricity prices.

Between 2008 and 2018, China increased its renewable power generation capacity from 15 GW to 370 GW [32], but failed to keep the same pace in transmission capacities. As a result, wind farms across China had an average curtailment rate of 17% in 2011 and 20% in 2012 [33]. Increased investment in transmission in recent years succeeded to bring down curtailment rates significantly, to 17.1% in 2016 and further in 2018 to only 7% [32].

This challenge also occurs in the Vietnam energy system. Over 30% curtailment rates are frequent in provinces where installed solar capacity exceed grid capacity [34]. Looking at the ability to release power from wind and solar sources up to 2022, [35] found that in the Central Highlands area, only 40% of the total available capacity of wind power plants could be used, and there are also acute curtailment issues in the South Central area. The increasing penetration of solar and wind power requires the adoption of technical and economic flexibility solutions. The flexibility solutions are not a distant hypothetical; they are a clear and near-term need. It is time to adapt the system now. Flexibility should be the guiding principle for Vietnam’s 2020–2030 power development strategy.

Economic flexibility solutions aim to level the playing field for all technologies, replacing must-run and priority dispatch rules with competitive electricity markets. Mature markets include liquid intra-day trading, the balancing and ancillary services market, and the future and derivative markets. It is paramount that curtailment decisions remain transparent.

Technological flexibility solutions include: the flexible operation of thermal power plants; smart demand management; stronger interconnections with neighboring provinces and countries; hydro or chemical storage; and switching from coal to gas.

All the solutions cited above are or should be considered the PDP8. In preparation for 2050, Vietnam must also consider more innovative technical solutions such as power-to-gas; power-to-hydrogen; or vehicle to grid storage. Floating gas power plants, although not a part of the Masterplan, offer high flexibility at multiple timescales and complement offshore wind well at low investment cost.

7 Infrastructure Requirements

The rapid development of Vietnam electricity grid needs national-scale infrastructure investment. The next power development plan is an opportunity to optimize the conceptual design and prepare the financing of this infrastructure. The plan serves to coordinate the anticipations of the government, the State owned enterprises EVN and PVN and the private sector, towards the prospect of having many GW of offshore wind generation capacity installed in the next decade.

According to the IEA Wind, the 2017 baseline infrastructure cost for an existing offshore project was around 638 €/kW, with total capital expenditure of 3500 €/kW. At the scale of a 500 MW farm, this translates into 320 million euros for infrastructure and 1.75 billion euros capital expenditure. At the national scale, 10 GW capacity by 2030 means to invest 6.4 billion euros in offshore infrastructure. It is thus highly profitable to find ways to optimize these costs. Besides link capacity, distance from shore and technological progress, network topology is a key driver of the cost.

The naive approach is to connect each offshore wind farm to the inland grid independently. The ISF study [2] argues that the new infrastructure should not only be seen as East-West transmission lines from wind farms offshore to the land. As an alternative topology, consider the offshore busbar approach. An undersea cable runs parallel to the coast line, and wind farms connect to it. In any case, Vietnam needs to reinforce its electricity transmission network integrating the North, Center and South electric systems to accommodate its expansion. Part of the new network North-South capacity could be submarine. This National Offshore Power Link would transport the power to the two load centers in the north and south and – with lower capacity interconnects – to the other coastal provinces in between.

Figure 5 shows a possible position of this offshore wind cable which has interconnections with six currently existing grid knots to each of the six coastal regions. The total length of this cable would be 1775 km, including land connections.

Existing undersea projects confirm that such infrastructure is technically possible. To date, Ultra High Voltage cables have the largest transmission capacity of around 1 GW with voltage levels of typically 1000 kV per cable. The NordLink between Norway and Germany is over 620 km long, has a 1400 MW capacity, and is estimated to cost 1.5 to 2 billion euros (Skopljak 2019). The North Sea Link between Norway and UK at 730 km long and a 1400 MW capacity is estimated to cost 2 billion euros (North Sea Link 2019). The EuroAsia Interconnector cable will have 2000 MW capacity and a submarine segment of 1208 km. The construction cost of stage 1, with half capacity, is expected to cost 2.5 billion euros (EuroAsia interconnector 2019).

Having a strategic infrastructure, not only may decrease the offshore projects cost efficiency, it would also send signal that Vietnam is committed to generate electricity from offshore and near shore wind farms, and increase the’ confidence of investors to build up a local industry. Diminishing returns due to the scarcity of the good onshore site will be felt in the long term, which increases the attractiveness of offshore wind. An undersea cable to reinforce the North-Center-South power system interconnection does not require sensitive discussions about land-use. The undersea interconnectors may feed discussions about the regional ASEAN super grid, which stands to be an important source of system flexibility and reliability at the 2050 planning horizon.

8 Conclusion and Policy Implications

Vietnam is in the early stage of forming a marine economic development strategy in general and an offshore wind development plan in particular. Near-shore and offshore wind development is one of the key levers to boost the marine economy and protect the sovereignty of Vietnamese seas and islands. The following national plans define the role and orientation of wind offshore development strategies:

-

The National Marine Spatial Plan for 2021–2030 with a view to 2050. This plan provides the legal basis for the management and exploitation of offshore wind potential, for many aspects (i) the development and selection of marine spatial exploitation scenarios, to co-construct the near-shore and offshore power generation policies; (ii) maps for resource exploitation and maps for infrastructure development within marine space, to allocate zones for near-shore and offshore wind farms, for undersea cables and for seaports that serve the energy sector.

-

The National Power Development Plan for 2030 with vision to 2045 should specify annual targets for offshore wind development, consider the needs and opportunities of having submarine segments in the power transmission network, and coordinate the new offshore infrastructure with the new LNG power centers to maximize their complementarity.

-

The National Seaports Plan for 2030 with a vision to 2045 should improve the capacity of the seaport systems to support the energy sector. The plan should have specific goals for the development of seaports that provide services for the energy sector such as offshore wind combined with logistics and business services for other energy types.

There is economic and technical potential to build dozens of GW of wind power generation capacity in Vietnam. After fifteen years of growing pains, the sector is taking off decisively. By mid 2021, only 538 MWp of wind power are operating, but 6 GW have signed PPA. And the total potential capacity based on projects is over 67.7 GW, of which 32.9 GW offshore. EVN expect to have about 5 GW of wind power connected by the end of 2021, before November to benefit from the preferential FIT of 85 USD/MWh.

Previously published studies, the Old plan scenario and the third draft of the Power Development Plan VIII underestimate the role of offshore wind power. Offshore wind energy can contribute significantly to the mid- to long-term Vietnamese energy mix. We believe that the government will auction several 500 MW offshore wind farms during the next decade. The most plausible of the three scenarios discussed in this paper is the New Normal: an installed capacity in 2030 of 15 GW for wind onshore and 10 GW for wind offshore. Wind offshore in the scenario includes two actions: a phase of progressive seaward extension of existing near-shore projects, and the construction of new large-scale “true offshore” projects delivering from 2025.

While offshore has more potential in the long run, in the next few years the onshore and near-shore will dominate installations because the technology is more mature and smaller scale projects are easier to conduct and integrate in the grid.

These numbers are orders of magnitude, more detailed analysis is needed to better understand how they will fit into Vietnam’s fast moving energy supply and demand landscape. Moreover, one must identify the policy mechanisms for implementing the scenario at a reasonable cost to consumers [36] The two actions in the New normal scenarios may require two different mechanisms. For “true offshore projects” the industry [39] proposes a FIT with a 2026 deadline and a 4–5 GW capacity cap, before moving into an auction system. This negotiated tariff would compare to the negotiated PPAs terms given to thermal power projects. The land-use constraints for onshore wind require innovative solutions that respect agricultural needs. Finally, the reliability of offshore wind turbines in East Asian conditions must be demonstrated.

When it comes to policy discussion for 2030, while a scenario can be a useful anchor, the indication of a plausible range instead of a point estimate allows for more robust planning. To propose such ranges, we have to keep in mind a few points. First, today’s pipeline recognizes 67.7 GW of potential wind power projects. Second, offshore has more potential to scale up than onshore. Third, 2030 is in ten years, while it takes 2 to 5 years to realize a projects. Considering these, we propose that the target for wind power in Vietnam disregards the old objectives in the PDP7, and focuses on 2030 installed capacity ranges of: 12–15 GW for onshore, 10–12 GW for offshore.

If the government sets an ambitious goal for 2030, we propose a few elements for the roadmap to get there, see [36,37,38] for more detailed studies. To help the pioneer true offshore wind projects in Vietnam, they should be located in priority in the most windy area shown on Fig. 1 [7], the South Central coast. However the Northern region also has attractive conditions for offshore wind power generation, they should be considered as soon as the technology is demonstrated.

To conclude, we offer three recommendations for the PDP8. First, wind energy targets for 2030 should be increased considerably over those in previous plans. Second, considering the amount of variable power generation sources already under construction and the number already in planning, increased flexibility of the electric system must be paramount in PDP8. Third, an infrastructure development plan for deploying several additional GW of offshore wind energy per year should start immediately.

Notes

- 1.

Normalized standard deviation of the monthly mean values of wind power density at 105 m height.

- 2.

Normalized standard deviation of hourly data.

- 3.

Normalized standard deviation of yearly mean from 10-year mean.

References

Ha-Duong, M.: Quy hoạch điện 8: Ưu tiên gì để không phải chịu hệ quả đắt giá? Tia Sáng, no. 6, pp. 8–12, 25 March 2021 (2021)

Teske, S., Morris, T., Nagrath, K.: Renewable Energy for Viet Nam - A proposal for an economically and environmentally sustainable 8th Power Development Plan for the Viet Nam Government. Institute for Sustainable Futures (ISF). University of Technology Sydney (UTS), Australia, October 2019. https://doi.org/10.5281/zenodo.3515786. Accessed 22 Oct 2019

Technical University of Denmark (DTU), “Global Wind Atlas 3.1. The Global Wind Atlas 3.1 is released in partnership with the World Bank Group, utilizing data provided by Vortex, using funding provided by the Energy Sector Management Assistance Program (ESMAP), 21 June 2021. https://globalwindatlas.info

Nguyen, K.Q.: Wind energy in Vietnam: resource assessment, development status and future implications. Energy Policy 35(2), 1405–1413 (2007). https://doi.org/10.1016/j.enpol.2006.04.011

Whittaker, S.: Global picture of offshore wind. Presented at the Consultation workshop on Developing Offshore Wind in Vietnam, Ha Noi, Viet Nam, 17 October 2019

Doan, V.Q., et al.: Usability and challenges of offshore wind energy in Vietnam revealed by the regional climate model simulation. SOLA 15, 113–118 (2019). https://doi.org/10.2151/sola.2019-021

Van Toan, D., Van, D.Q., Pham, D.A.L., Van Nguyen, D.: The zoning of offshore wind energy resources in the Vietnam sea. In: Proceedings of the 1st Vietnam Symposium on Advances in Offshore Engineering, vol. LNCE 18, pp. 1–7 (2019). https://doi.org/10.1007/978-981-13-2306-5_34

Quang, V.D., et al.: Evaluation of resource spatial-temporal variation, dataset validity, infrastructures and zones for Vietnam offshore wind energy. VJSTE 62(1), 3–16 (2020). https://doi.org/10.31276/VJSTE.62(1).03-16

Institute of Energy: Quy hoạch phát triển điện lực quốc gia thời kỳ 2021–2030 tầm nhìn đến năm 2045 - Báo cáo dự thảo Lần 3 - TẬP 1: THUYẾT MINH CHUNG. Ha Noi, Viet Nam: Ministry of Industry and Trade, February 2021

Minh, H.D., Teske, S., Dimitri, P., Mentari, P.: Options for wind power in Vietnam by 2030. VIET, October 2019. http://www2.centre-cired.fr/IMG/pdf/options_for_wind_power_vn_2030.pdf

Ha-Duong, M.: List of wind power projects in Vietnam. Zenodo, 23 January 2021. https://doi.org/10.5281/ZENODO.3698080

Thành, V.N.: Decision 68/QD-UBND on approving the list of investment of the province in the period 2020–2021. People’s Committee of the Province, Gia Lai, Decision 68/QD-UBND, February 2020

VietnamEnergy.vn: What situation of the wind power projects in 2021? http://nangluongvietnam.vn/, 27 March 2021. http://nangluongvietnam.vn/news/en/nuclear-renewable/what-situation-of-the-wind-power-projects-in-2021.html. Accessed 21 June 2021

Dũng, T.D.: Letter 196/2021/TTg-CN. Prime Minister, The Government of Vietnam, Letter 196/TTg-CN, February 2021

Gerdes, J.: Record-Breaking Massachusetts Offshore Wind Auction Reaps $405 Million in Winning Bids, 17 December 2018. https://www.greentechmedia.com/articles/read/record-breaking-massachusetts-offshore-wind-auction. Accessed 19 Oct 2019

Asimov, N.: In Race for Offshore Wind, Three New Bids. The Vineyard Gazette - Martha’s Vineyard News, 16 September 2019. https://vineyardgazette.com/news/2019/09/16/race-offshore-wind-farms-around-marthas-vineyard-continues. Accessed 19 Oct 2019

Noonan, M., et al.: IEA Wind TCP Task 26: Offshore Wind Energy International Comparative Analysis. IEA Wind, NREL/TP-6A20-71558, October 2018. www.nrel.gov/publications

Phúc, N.X.: Decision 39/2018/QD-TTg - Amending several articles of decision No.37/2011/QD-TTG dated June 29, 2011 of the prime minister on provison of assistance in development of wind power projects in Vietnam. The Government of Vietnam, Hanoi, Vietnam, Decision 39/2018/QD-TTg, September 2018. http://vanban.chinhphu.vn/portal/page/portal/chinhphu/hethongvanban?class_id=1&mode=detail&document_id=194743

Nangluongvietnam.vn: Bộ Công Thương trả lời kiến nghị VEA về ‘giá FIT cho điện gió, mặt trời’. Nangluongvietnam.vn, 06 January 2021. http://nangluongvietnam.vn/news/vn/dien-hat-nhan-nang-luong-tai-tao/nang-luong-tai-tao/bo-cong-thuong-tra-loi-kien-nghi-vea-ve-gia-fit-cho-dien-gio-mat-troi.html. Accessed 21 June 2021

Định Công: Đề xuất kéo dài cơ chế giá FIT điện gió đến hết năm 2023. Tạp chí Công Thương, 13 November 2020. http://tapchicongthuong.vn/bai-viet/de-xuat-keo-dai-co-che-gia-fit-dien-gio-den-het-nam-2023-76485.htm. Accessed 21 June 2021

GreenID: Analysis of future generation capacity scenarios for Vietnam. GreenID, Vietnam, June 2018. http://en.greenidvietnam.org.vn/view-document/5b13fb0a5cd7e89403c94bda

Danish Energy Agency: Vietnam Energy Outlook Report 2017, MOIT (2017). https://ens.dk/sites/ens.dk/files/Globalcooperation/Official_docs/Vietnam/vietnam-energy-outlook-report-2017-eng.pdf. Accessed 5 Oct 2019

Lundsager, J.S., Venturini, G., Linh, N.H., Sørensen, S.S.: Vietnam Energy Outlook Report 2019, Hanoi, November 2019. https://ens.dk/en/our-responsibilities/global-cooperation/country-cooperation/vietnam

Economic Consulting Associates (ECA): Made in Vietnam Energy Plan 2.0. Report prepared for the Vietnam Business Forum, Power and energy working group, Ha Noi, Viet Nam, December 2019. http://auschamvn.org/wp-content/uploads/2016/10/Made-in-Vietnam-Energy-Plan-MVEP-v12.pdf

ADB: Pathways to low-carbon development for Vietnam (2017). https://www.adb.org/sites/default/files/publication/389826/pathways-low-carbon-devt-viet-nam.pdf

Breu, M., Castellano, A., Frankel, D., Rogers, M.: Exploring an Alternative Pathway for Vietnam’s Energy Future. McKinsey & Company (2019)

Tran, K.H., Kitchlu, R., Chu, T.B.: Offshore wind roadmap for Vietnam. The World Bank, Washington DC, June 2021. https://documents1.worldbank.org/curated/en/261981623120856300/pdf/Offshore-Wind-Development-Program-Offshore-Wind-Roadmap-for-Vietnam.pdf. Accessed 10 June 2021

Lee, J., Zhao, F.: Global Offshore Wind Report 2021. Global Wind Energy Council (GWEC), Brussels, Belgium, March 2021

REN21: Renewables 2021 Global Status Report. REN21 Secretariat, Paris, ISBN 978-3-948393-03-8, June 2021. https://www.ren21.net/reports/global-status-report/. Accessed 15 June 2021

Vietnam’s Politburo: Resolution 55-NQ/TW on the orientation of the National Energy Development Strategy of Vietnam to 2030, vision to 2045. Central Executive Committee, Communist Party of Vietnam, Resolution of the Political Bureau, February 2020

Intelligent Energy Systems Pty Ltd and Mekong Economics. Socialist Republic of Viet Nam Power Sector Scenarios, vol. 6. WWF (2016)

Richard, C.: Curtailment reduction ‘could double Chinese wind fleet’. Wind Power Monthly, 23 August 2019. https://www.windpowermonthly.com/article/1594722?utm_source=website&utm_medium=social. Accessed 30 Sept 2019

Liu, Z., Zhang, W., Zhao, C., Yuan, J.: The economics of wind power in china and policy implications. Energies 8(2), 1529–1546 (2015). https://doi.org/10.3390/en8021529

Kenning, T.: Vietnam leapfrogs Australia in solar deadline boom. PV Tech, 05 July 2019. https://www.pv-tech.org/news/vietnam-leapfrogs-australia-in-solar-deadline-boom. Accessed 19 Oct 2019

Le, Q.A., Duong, V.D.: Ability to release capacity for wind power and solar power up to 2022.VIET, Hanoi, Research report RR/04-VIET06.2020/ENG, June 2020

Nguyễn, Đ.V., Nguyễn, X.H., Nguyễn, T.T.H.: Cơ hội và thách thức trong phát triển điện gió ở Việt Nam - Opportunities and challenges to wind energy development in Vietnam. Tap Chi Khoa Hoc va Cong Nghe Viet Nam, May 2019. http://congnghiepcongnghecao.com.vn/tin-tuc/chinh-sach/t21907/co-hoi-va-thach-thuc-trong-phat-trien-dien-gio-o-viet-nam.html. Accessed 11 Oct 2019

Nguyen, H.P., Ngo, T.T.N., Nguyen, T.H.A.: Offshore Wind Integration Study – Review International Experience on Offshore Wind Integration. Vietnam Initiative for Energy Transition (VIET), April 2020. https://vietse.vn/en/publication/research-on-offshore-wind-power-integration-review-international-experience-on-offshore-wind-power-integration/

Tran, K.H., Kitchlu, R., Ba Chu, T.: Offshore Wind Roadmap for Vietnam. The World Bank, Washington DC, June 2021. https://documents1.worldbank.org/curated/en/261981623120856300/pdf/Offshore-Wind-Development-Program-Offshore-Wind-Roadmap-for-Vietnam.pdf

Li, C.-H., McCausland, A., Taylor, J., Stephenson, M.: Vietnam’s Future Transition to Offshore Wind Auctions. International Best Practices and Lessons Learned. Global Wind Energy Council (GWEC), 22 July 2021. https://gwec.net/vietnams-future-transition-to-offshore-wind-auctions-international-best-practices-and-lessons-learned/

Acknowledgements

Lead author HDM is responsible for the framing, data collection and the scenario narratives. The ISF study team is responsible for modeling simulations. All authors contributed to the reviewing. Authors declare no conflict of interest. We acknowledge financial support from the European Climate Foundation grants.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Ha-Duong, M., Teske, S., Pescia, D., Pujantoro, M. (2022). Planning, Policy and Integration for Sustainable Development of Offshore Wind Energy in Vietnam 2022–2030. In: Huynh, D.V.K., Tang, A.M., Doan, D.H., Watson, P. (eds) Proceedings of the 2nd Vietnam Symposium on Advances in Offshore Engineering. VSOE2021 2021. Lecture Notes in Civil Engineering, vol 208. Springer, Singapore. https://doi.org/10.1007/978-981-16-7735-9_4

Download citation

DOI: https://doi.org/10.1007/978-981-16-7735-9_4

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-16-7734-2

Online ISBN: 978-981-16-7735-9

eBook Packages: EngineeringEngineering (R0)