Abstract

China has the world’s largest renewable energy market. It has one-third of the global wind power capacity and a quarter of the global solar capacity. Although the Chinese government is continuing to expand its investment in renewable energy, the share of renewable energy in China’s total energy consumption remains small. This chapter investigates the future growth in China’s renewable energy, with a focus on solar and wind energy. It examines the current status of renewable energy deployment in China and how the policy framework for supporting renewable energy deployment has been evolving. It also discusses factors that could further advance renewable energy expansion in China, including the pressure to improve air quality and reduce coal consumption, climate change mitigation, energy security and promotion of clean, indigenous energy sources, and economic transition and the development of clean energy industry. Major barriers to renewable energy deployment, such as social costs of replacing coal and concerns about grid reliability, are also discussed in this chapter. How to improve grid integration and stability and develop transmission infrastructure to effectively connect supply and demand is critical to renewable energy expansion. Thus this chapter also explores grid integration and transmission issues. With improved power system flexibility and stability and better institutional and policy support, renewable energy is expected to further expand in China in the coming decade.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

China has the world’s largest renewable energy market. It has one-third of the global wind power capacity and a quarter of the global solar capacity. The Chinese government is continuing to expand its investment in renewables and is expecting to add $360 billion investment on renewable power generation between 2017 and 2020. Meanwhile, the demand for energy in China grows rapidly, and the impact of renewable energy is still small in the overall energy mix. Non-fossil energy, including non-hydro renewables, hydro, and nuclear, only accounts for 12% of China’s primary energy consumption today.

In this chapter, we will investigate the future growth of renewable energy in China, with a focus on solar and wind energy. On the one hand, China is accelerating its renewable deployment on several fronts: alleviating air pollution and phasing out coal, reducing dependence on imported fossil energy and improving energy security, and further expanding its clean energy industry. These factors, along with proactive climate policies such as the national cap-and-trade system, create favourable conditions to further advance renewable energy deployment in China. On the other hand, China still lacks adequate regulatory structures to support the clean energy transition, which could become bottlenecks to renewable deployment in the future. The Chinese government is considering phasing out renewable subsidies. Renewable power generators in China face the worst curtailment rates in the world, with the national average curtailment rate at 17% for wind and 10% for solar in 2016. This raises several questions about the growth in renewable energy in the future. How would the market perform when the government removes subsidies for renewables? How would the current power sector reform in China improve electricity dispatch and reduce curtailment? Moreover, the majority of China’s large-scale wind and solar projects are in the resource-rich northern and western regions with low electricity demand. How would China develop inter-regional transmission capacity to allow for further growth in renewable energy? This chapter will discuss the dynamics of renewable energy in China and how different drivers and policies interact and shape the future of renewable energy in China. In addition, it will examine the current power sector reform and how improved regulatory structures can create enabling conditions for renewable deployment in China.

2 Background

This section describes what the renewable energy landscape is in China and how the policy framework has evolved to support the Chinese renewable industry, with examples of challenges to be discussed in later sections.

2.1 Renewable Energy in China

China has considerable potentials in renewable energy, where hydropower, biomass, wind power and solar energy are the four technologies of the most promise. By the end of 2018, installed renewable capacity in China, including hydro, marine, wind, solar, bioenergy and others, reached 729 GW, which takes 38.4% of the country’s total generating capacity and around 30% of the world’s total renewable capacity. Of China’s renewable capacity, 184.3 GW is from wind, accounting for 32.8% of global wind capacity; and 174.5 GW is from solar, which is 36.3% of the world’s total solar capacity (China Renewable Energy Engineering Institute 2019; IRENA 2019).

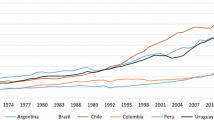

Behind China’s large renewable capacity is its fast growth. Between 2009 and 2018, China more than tripled, while the world only doubled, its renewable capacity (Fig. 6.1). Wind and solar capacity of China in 2018 are over ten times and 400 times than those in 2009, respectively (Fig. 6.2). By comparison, the world increased by around four and 21 times during the same period of time in wind and solar capacity, respectively. In 2018, more than 40% of the world’s additions in wind, solar and total renewable capacity came from China (IRENA 2019).

Chinese and global RE capacity in GW, 2009–2018. (Source: IRENA 2019. Note: RE stands for renewable energy. The left and right axes start with non-zero values, and are different yet presented in proportion in order to compare the growth instead of the value of the renewable capacity of China and the world. For the China, there are two sources of data on 2018 capacity, namely 729 GW from the China Renewable Energy Engineering Institute and 696 GW from IRENA. For consistency with other data in the comparison figure, the IRENA data is used here)

China wind (left) and solar (right) capacity in GW, 2009–2018. (Source: IRENA 2019)

There is substantial demand as well as potential for China to continue expanding its renewable capacity. In its nationally determined contribution (NDC), China is committed to lowering the emissions intensity by 60–65% compared with 2005 levels and increasing the share of non-fossil fuels in primary energy to 20% by 2030 (National Development and Reform Commission of China 2015). These would all require further rise of renewables. It is estimated that wind energy available in China totals 1.0 TW, more than forty times the size of the Three Georges Project (i.e. the world’s largest power station with installed capacity of 22,500 MW). In terms of solar, over two thirds of the Chinese land enjoys an annual sunshine time of 2200 hours or more, where gross radiation intensity reaches 5000 MJ/m2 (National Development and Reform Commission of China 2007; Hou and Li 2018).

China’s energy consumption structure, however, does not correspond to that of its power generation. By the end of 2018, renewables supply 13.8% of primary energy in China, below its 2020 commitment of 15% (Chen and Zhang 2018). The national average curtailment rates for wind and solar PV in 2018 are 7% and 3%, respectively, whereas in Europe the curtailment rate was normally below 1% when wind and solar PV generated around 10% of power (Zhu 2019).

There are several challenges. For example, a large proportion of renewables in China locates in the west (National Development and Reform Commission of China 2007), which is less developed. On the one hand, local demand is relatively low; on the other hand, it is expensive to transmit the renewable power generated in the west to the developed east where demand is high. Besides that, existing energy system and regulatory structure do not work with China’s renewable transition, causing conflicts of interests and barriers against wider employment of renewables. Moreover, as subsidies phase out, non-technical costs may play a more important role in renewable projects. The lags in land policy and financing mechanisms, for instance, could lead to the postponing or even cancellation of a wind or solar project. Finally, the scaling up of renewables with volatile nature requires larger extent of system flexibility as well as reliability, which also raises the costs (Zhu 2019).

Given China’s great renewable potential, capacity and growth, it is having and will continue to have substantial impact on global renewable energy. Adding China’s significance in global climate change mitigation and how renewables would contribute to it, Chinese renewables also have a role to play in global climate actions. Therefore, how China addresses these challenges draws much attention from all over the world. The following Section summarizes key strategies China has been taking to promote renewable energy.

2.2 Policies on Renewables

In 1995, the Chinese government developed the Outline for New and Renewable Energy Development between 1996 and 2010, setting development targets for new and renewable energy with tasks and measures during the 9th, 10th and the 11th Five-Year Plans (FYPs). Yet at that time, there was no independent and self-sustained renewable industry in China due to the non-market nature of renewables and the absence of a renewable energy law. For a period of time, provisions to promote renewables scattered in relevant laws such as the Power Law, the Energy Conservation Law, the Buildings Law and the Air Pollution Prevention and Treatment Law (National Energy Administration of China; Energy Research Institute; Chinese Renewable Energy Industries Association; China Renewable Energy Society Industry Committee 2007).

The policy framework for renewables in China (Fig. 6.3) started to form with the establishment of the Renewable Energy Law of February 2005, which went into effect in 2006. This Law set basic principles and infrastructure for renewable development on a large scale in China. Key principles put out in this Law include (1) setting renewable capacity targets, (2) mandatory purchase and connection (which requires grid companies to purchase power generated by renewable sources and provide grid-connection services), (3) differentiated pricing, (4) cost allocation, (5) special fund for renewable development and others (National Energy Administration of China; Energy Research Institute; Chinese Renewable Energy Industries Association; China Renewable Energy Society Industry Committee 2007).

To ensure concrete enforcement of the Renewable Energy Law and realization of the principles above, the Chinese government designed 12 supporting tasks for the implementation of the Law in April, 2005, and assigned these tasks to specific national departments. Most of the tasks resulted in specific, supporting policies for the Law. These policies can be categorized into two groups. One includes the policies without which the Law cannot be feasibly implemented, such as policies on the plans and capacity targets for the national renewable development, feed-in tariffs, establishing special funds for renewables with corresponding administrative rules, and how to share the extra costs in wholesales of renewable capacity compared with conventional power. The other includes the policies that could be absent at the very beginning of the implementation of the Law, yet to phase in along its enforcement; for example, the policies on tax incentives, national standards and technical protocols and capacity building (National Energy Administration of China; Energy Research Institute; Chinese Renewable Energy Industries Association; China Renewable Energy Society Industry Committee 2007).

In addition to the policies mentioned above on the overall development of renewable energy in China, there are policies by the national government on the development and utilization of specific renewables, like the policy to promote wind energy industry, the rules on how to use the special fund for renewable deployment in buildings and the technical specifications for solar thermal systems in residential buildings, for instance. In provinces and cities such as Shanghai, Shenzhen, the Yunnan Province and the Hainan Province, the local governments accommodated requirements of the Law and other national renewable policies to their local situations, coming up with local regulations that comply with the national Renewable Energy Law and national policies with local feasibility (National Energy Administration of China; Energy Research Institute; Chinese Renewable Energy Industries Association; China Renewable Energy Society Industry Committee 2007).

Despite the Renewable Energy Law and supporting policies, renewable energy has served only as complements to fossil fuels for a long period of time. The three FYPs between 2000 and 2015, i.e. the 10th to 12th FYPs, valued fossil fuels as major impetus for the Chinese economy. The Chinese economy expanded rapidly with the leap in coal consumption, bringing up issues such as environmental problems, lack of energy efficiency and energy security. This was when China turned to renewables and started to develop them on a large scale, yet only as a clean complement to the existing fossil fuel-based energy system (Energy Research Institute; China National Renewable Energy Center 2018).

This trend lasted till around 2015 as China takes lead in addressing climate change and specified renewable energy targets as part of its climate mitigation strategies in its NDC (discussed in the previous section). The 13th FYP specified the long-term development goal for the energy system of China as “establishing a clean, low-carbon, secure and efficient energy system and ensuring energy security”. In 2017, the Chinese government published the Energy Production and Consumption Revolution Strategy (2016–2030), calling for energy revolutions in terms of consumption, supply, technology and institutions. Renewables play a significant role in the energy supply revolution, which aims for the decarbonization of the existing energy system as well as the Chinese economy with alternative energy sources. In late 2017, the Chinese president Xi Jinping pointed out in the 19th National Congress of the Communist Party of China, that the Chinese economy needs sustainable transition with ecological civilization and clean energy industry. These together mark a new era for renewable energy in China when it is becoming mainstream in the energy system (Energy Research Institute; China National Renewable Energy Center 2018).

By comparison, there was only one Renewable Energy Development Plan during the 11th FYP; in the 12th FYP, the national government added four specific plans on hydro, wind, solar and biomass; now in the 13th FYP, there is one overall renewable development plan, six specific plans with the two additions on geothermal and rural biogas, plus one on the power sector specifying the target energy structure for China in the near future. In the overall Renewable Energy Development Plan during the 13th FYP Period, it is consistent with NDC goals and requires the share of non-fossil fuels (mostly renewables) in primary energy reaching 15% and 20% by 2020 and 2030, respectively. Specifically, the installed renewable capacity by 2020 should take 27% of the country’s total capacity (National Development and Reform Commission of China 2016a, b).

Compared with two decades ago, there are now renewable industries of scale in China, which was largely due to government support. Moving forward, however, China needs a better regulatory structure (discussed in the following sections), including utilization mechanism for the renewable capacity produced, and further, a self-sustained renewable market with healthy pricing, purchase and competitions, for example. The Chinese government has started targeting these issues with several policies. For instance, the Renewable Energy Law Amendment of 2009 features guaranteed purchase among others (The Central Government of China 2009); the Renewable Energy Development Plan during the 13th FYP Period sets objectives to address curtailment of hydro and reduce curtailment of wind and solar by 2020 (National Development and Reform Commission of China 2016a, b); and the Action Plan on Clean Energy Utilization (2018–2020) deals specially the problems that renewable capacity cannot be sufficiently utilized (National Development and Reform Commission of China 2018). The government is changing the name of the “benchmark price” into the “guide price”, giving way to market functioning. Policymakers are turning their eyes to the near future when subsidies phase out, and thinking of solutions.

3 Drivers and Barriers to Renewable Energy Deployment

This section focuses on the key drivers that have contributed to the increase of renewable energy deployment in China, and analyses possible barriers that may hinder further growth and therefore need to be addressed.

3.1 Drivers of Renewable Energy Deployment in China

One of the most important drivers for growth in renewables in China is alleviating air pollution. Coal-dominant energy system has resulted in significant environmental issues and health concerns. The Action Plan on Prevention and Control of Air Pollution released in 2013 initiated policy discussion on coal retirement and transition to clean energy. Currently, advanced end-of-pipe control technologies have already been widely applied, but in 2018 the majority of Chinese cities still exceeded the national PM2.5 standard of annual average emissions of 35 μg m−3 in 2018. To further improve air quality and prevent adverse health impact of air pollution, energy system transition and renewable energy expansion are essential (Wang et al. 2015).

Climate change mitigation also helps promote renewable energy development in China. As discussed above, China sets targets of non-fossil energy use in its NDC and is expected to continue enhancing these targets in its mid-century strategy for deep decarbonization and 14th FYP.

Energy security concern can also prompt transition to renewable energy. As China continues to expand its economy and energy consumption, it would become increasingly dependent on fossil fuel imports and more vulnerable to price fluctuations in the international market. Using indigenous renewable energy becomes important for supporting China’s growth and energy security.

China is also restructuring its economy, transitioning from low-value added manufacturing facilities to high-value added manufacture. Renewable investment and expansion in China allow new industries to scale up and reduce costs, which creates favourable conditions for Chinese renewable industries to compete in the international market. China has expanded its share in global solar panel manufacture dramatically in the past decade, growing from 15% in 2006 to more than 70% in 2017, and eight out of top 10 solar manufacturers in 2019 are Chinese enterprises (Hanada 2019).

3.2 Barriers Preventing Large-Scale Renewable Energy Deployment

Although there are favourable conditions to facilitate renewable energy deployment in China, there are still substantial real-world constraints limiting renewable expansion. High social cost is one of the barriers. China is heavily dependent on coal. Replacing coal with renewable energy could face social trade-offs and negatively affect local economy. Shutting down coal power plants could contribute to local job losses and increase unemployment rate. In addition, shifting away from coal might impact local government’s budget in a negative way, as it could reduce financial revenue from industrial taxes (de Oliveira Vasconcelos 2018). The social impact could be even more substantial against the backdrop of a slowing Chinese economy.

The more imminent barrier preventing large-scale renewable deployment is the current power system setup in China. One of the most pressing challenges for renewable energy in China is the mismatch between renewable energy supply and demand – while most renewable capacity is located in resource-rich western provinces, demand centres are in eastern provinces. How to improve grid integration and stability and develop transmission infrastructure to effectively connect supply and demand is critical to renewable energy expansion. The electricity market reform is currently underway in China, with a focus on increasing grid integration and stability. The next Section focuses on the power system reform and how the two critical issues – grid integration and transmission are addressed by Chinese policies.

4 Issues Need to Be Addressed for Extensive RE Growth

In response to the barriers that prevent the renewable energy deployment in China from further and better growth, key challenges for China include marketization and curtailment reduction. This section examines three approaches that China has been taking, namely the power sector reform, integration of distributed capacity with grids and inter-regional transmission capacity expansion.

4.1 Power Sector Reform

The power sector in China has experienced complex evolution. It used to be fully administered by the government and planned by the Chinese Ministry of Power Industry (hereinafter referred to as “the Ministry”)Footnote 1 before people found such planning-centred mechanism no longer worked with China’s leaping growth and soaring power demand. The Chinese government then decided to let the market in following successive steps; in the 1980s, it started to open power generation to multiple players like local governments and enterprises (rather than the national government alone), and to allow for conditional tariff variations.Footnote 2 In 1997, the government founded the State Power Corporation of China (hereinafter referred to as “the State Power”).Footnote 3 This was a giant state-owned power company that had both generation and grid capacities, meaning it covered the power industry in China almost from head to toe (Wang and Chen 2015; Zhang 2018).

Since late 1990s, people have been discussing about further marketization of the power sector and addressing issues like monopoly of the State Power, for instance. Meanwhile, the Ertan Hydropower Station, the most attention-drawing hydro station of that time, faced an unexpectedly high curtailment rate, which pushed further the existing discussion on power sector institution. These, together with other concerns, contributed to Phase I of China’s power sector reform, marked by the release of the Power Sector Institutional Reform Plan (hereinafter referred to as “the Plan”) in 2002 (Zhang 2018).

Phase I of the reform features breaking the monopoly and partially introducing market competition in the power sector. To achieve these objectives, the Plan set tasks to (1) separate generation, grid and ancillary services from the State Power, (2) break power tariff into the on-grid tariff, transmission and distribution tariff and the retail tariff and (3) to explore possibility of on-grid tariff bidding by generation companiesFootnote 4 (State Council of China 2002). In 2014 at the end of Phase I, there were five generation corporations and two grid corporations (the State Grid and the Southern Grid) in China. Phase I of the reform broke up the monopoly landscape in China’s power sector and prepared basic infrastructure for a competitive power market (Zhang 2018).

The marketization in Phase I, however, was not enough. First, there is a lack of direct trading mechanism between power suppliers and consumers, causing inefficient allocation of the power resource and high curtailment rate of wind and solar energy, for example. Second, the pricing mechanism, especially the transmission and distribution tariff, is not transparent. Existing government-led power pricing does not correctly and/or timely reflect costs, demand-supply relationships, and environmental externalities and so on. It also creates difficulties for the clarification of cross subsidization. Third, existing power infrastructure does not work with the distributed and unstable nature of renewables like wind and solar, making it hard to generate and utilize power out of these energy sources. China therefore carried out Phase II of its power sector reform since 2005, when the national government published the Chinese Communist Party Central Committee’s and the State Council’s Opinions on Further Deepening the Power Sector Institutional Reform, to transform the power sector in China for further marketization (hereinafter referred to as “the Opinions”) (Chinese Communist Party Central Committee; State Council of China 2015).

In the Opinions, the government plans to (1) gradually introduce bidding for the on-grid and retail tariffs while examining and revising the transmission and distribution tariffFootnote 5 (known as “open up the two ends and regulate the middle”), (2) gradually open up non-public power generation and consumption plans (i.e. minimize the role of government plans), and let in the private sector in power selling business with additions of local distribution grids, (3) build independent exchanges and thorough trading mechanisms in the power market and (4) ensure adequate and fair grid access to promote distributed energy (Chinese Communist Party Central Committee; State Council of China 2015).

Different from the Plan, the Opinions is more of an instructive guide rather than a concrete action plan. Following the Opinions, various supporting actions and policies have come out and been taking effect:

-

Since 2016, the Chinese government has launched four batches of pilot additions of local distribution grids to engage more players on the distribution and demand side (National Development and Reform Commission of China; National Energy Administration of China 2019a, b).

-

By 2017, the government completed the first-round examination and revision of the transmission and distribution tariffs in provinces and regions. The revised transmission and distribution tariffs will be in practice since 2019, hopefully contributing to a more market-reflective power price (Liu 2019).

-

In 2018, China piloted spot power markets in eight regions for the first time (TrendForce Corp 2019).

-

Having tested the water in four power-consuming industries, the national government published a notice in June 2019 to fully let go of government control on the generation and utilization plans of non-public power consumers, contributing to the increase in power market turnover (TrendForce Corp 2019; National Development and Reform Commission of China 2019).

-

Chinese power market exchanges, both national (i.e. belonging to the State Grid) and local ones, are undergoing shareholding transformation with non-grid enterprises sharing no fewer than 20% of the capital stock (TrendForce Corp 2019).

As a result of all the efforts, 30% of China’s total capacity is tradable by the end of 2018, compared with 19% in 2016 (Liu 2019).Throughout the reform, the regulatory structure of the Chinese power sector has also evolved along the progress. Before the 1990s, there was only one regulation – the Regulations on the Protection of Power Facilities of 1987, which focuses on the infrastructure as a reflection of power sector development stage at that time. Entering the 1990s when discussions over the power sector reform started, several regulations on different facets of the power sector, including dispatch, supply and utilization, were put in force. Most importantly, China enforced its first power sector framework law, the Electric Power Law, in 1996. It sets basic principles for the power sector to facilitate power industry development, ensure secure operation of the power system and protect rights of stakeholders. Nearly a decade later in 2005, the by-far last piece of the regulatory structure – the Regulations on Electric Power Supervision – was implemented as a regulatory complement to the marketization reform and aims to regulate the power market (Li and Dai 2006). Meanwhile, the Electric Power Law and other regulations have gone through several amendments to reflect development and updates in the power sector, including those due to the power sector reform, of course, and thus created an enabling policy environment for the marketization reform. The most recent amendment was to the Electric Power Law in December 2018.

Renewables benefited from the reform for sure. Although renewable energy is rarely a focus in Phase I,Footnote 6 it is within roughly the same period from 2005 to 2015 that renewables rapidly developed and formed its own industry in China. Along with the breakup of monopoly and the engagement of more players on the generation side, there grew more opportunities for renewables. Generation companies were thinking of ways to enhance their competitiveness and get equipped for the upcoming competitive market; they explored new, clean, sustainable energy sources (renewables included) and pushed for technology advancement to lower the costs. As a matter of fact, the renewable industry benefited from Phase I of the power sector reform.

There are two critical moves for renewables in Phase II of the reform, namely the Administrative Regulation on Guaranteed Full Purchase of Renewable Generation Capacity (herein after referred to as “the guaranteed purchase”) in 2016, and the Notice to Establish and Strengthen the Guaranteed Power Utilization Mechanism for Renewable Energy (hereinafter referred to as “the guaranteed utilization mechanism”) in 2019.

The guaranteed purchase makes sure that non-hydro renewable power has priority over other-sourced power to be purchased by grid companies within their capacities (National Development and Reform Commission of China 2016a, b). This policy fostered renewable energy development in the power sector reform and pushed forward the transition of energy structure in China, by mandating grid companies to purchase as much renewable energy as they could. In other words, renewable generators had no worry about the buyer, though grid companies might need to think where to sell the renewable capacities.

The guaranteed utilization mechanism later serves a similar purpose, but in a smarter way; it sets a five-year timeframe when the national government mandatorily assigns a minimum proportion of renewable energy in the total energy demand to each provinceFootnote 7 (National Development and Reform Commission of China; National Energy Administration of China 2019a, b). This is more of a habit cultivation policy for province consumers to switch their energy structure and consumption behaviour. This way, renewables are not to neglect when a province is making its next-year energy strategy and plan. The guaranteed utilization mechanism, though just put into implementation for a short time year, is expected to have profound impact on renewable energy utilization.

Entitling privileges to renewables is in line with the principles stated in the Opinions, yet as the power sector reform goes on, there are more challenges for renewables. First, existing power sector reform does not yet reflect explicit environmental and ecological consideration, meaning there is limited support that renewables could gain. This is also reflected in the Electric Power Law, which was born as a power sector facilitation law, then turned into a marketization law (Huang and He 2019a, b), and may evolve to be a renewable supporting law. Second, there is still a gap to bridge towards a highly marketized power sector (e.g. the power industry still relies on the transmission and distribution tariff to make profits), as well as a lack in effective regulatory structure that does not only follow the reform, but also lead it by cultivating a competitive market (Huang and He 2019a, b). Only in a competitive market can distributed, naturally unstable renewables be efficiently utilized, through flexible loads and demand response for example. Third, as the reform moves forward, the role of government would be minimized, where comes the tricky part for renewables – renewables do need a flexible market, but are still benefiting from government support; whether the renewable industry in China could prepare itself to be self-sustained remains the key. After years of development, generation is barely a problem for renewables, yet utilization is quite tough – the high curtailment rate. Apart from the guaranteed utilization policy and other policies to shift China’s energy structure and social energy consumption behaviour, technologies like smart grid, smart metering and Internet of Things may also help to allocate renewable capacity efficiently according to real-time demands across regions – grid additions and integration necessary. This is a long way to go for both renewables and the power sector in China, yet also a tremendous opportunity.

4.2 Integration of Distributed Capacity with Grids

It is among the most pressing challenges for renewable energy in China that part of its generation capacity cannot reach the demand side. Wind farms and solar PV power stations are in most cases distributed due to the nature of wind and solar energy, whereas regions rich in energy sources may not always be consumers with high demand, causing spare or waste in generated renewable capacity. Grid integration is therefore the first step as the solution to this issue – to connect distributed renewable energy power plants, also known as independentFootnote 8 plants, with power grids.

Grid integration provides a solution to both excess (flexibility after meeting local demand) and fluctuations of distributed renewable energy. The electricity grid has new sources of excessive energy (i.e. flexible loads) from distributed renewable plants, and can dispatch them to regions in need. It also allows for the backup of local supply with other in-grid capacity when renewable capacity fluctuates and becomes insufficient, and stabilizes the grid overall in terms of power quality, generating efficiency and others. This way, distributed renewable energy also helps the grid achieve its renewable utilization assignment (e.g. as in the guaranteed purchase and guaranteed utilization mechanism) mentioned in Sect. 6.4.1.

Government support for grid integration dates back to the Renewable Energy Law, which explicitly encourages grid integration of distributed renewables and urges the development of relevant technical standards (The Central Government of China 2009). Following the Renewable Energy Law there are by far 16 enterprise standards, eight industry standards and eight national standards on grid integration of specific renewables and distributed energy as a whole, as well as toolkits like contract templates between the grid and distributed energy. In 2013, the State Grid published an official document on providing better services for grid integration of distributed energy, to clarify actions the company would take to ensure better grid integration (State Grid Corporation of China 2013). In the national policy document (referred to as “the Opinions” in Sect. 6.4.1) that marks the start of Chinese power sector reform, Phase II, there are provisions about improving grid integration of renewables as well (Chinese Communist Party Central Committee; State Council of China 2015). By 2018, grid-connected (including both centralized and distributed) wind and solar PV installed capacity in China amount to 184 GW and 174 GW (124 GW centralized and 50 GW distributed); national average curtailment rates for wind and solar are 7% and 3%, 5 and 2.8 percentage points lower than the last year, respectively (National Energy Administration of China 2019a, b).

In spite of all the efforts and progress, there are obstacles. For grid companies, grid integration requires extra costs for grid construction and management. In order to coordinate with unstable wind or solar PV and to ensure reliable power supply all the time, the grid company has to make preliminary preparations before integration. The fluctuations in wind and solar energy also create additional difficulties for grids in peak shaving. In the meantime, rapid growth in wind and solar PV asks the grids for long-distance, large-capacity transmission (discussed in the next Section), which requires extra efforts (Gao 2012; Li 2012). All of these concerns have been hindering grid companies from willingly expanding integration of distributed energy. For the distributed players, things are not smooth, either. For example, solar PVs have to first raise its voltage in order to connect to the grid, and then lower it back to the original level to sell and be used by consumers, having to increase their investment in power transformation and transmission (Wang 2012). For further improvement and scale-up of grid integration, and finally for more efficient utilization of renewables and the energy system as a whole, these issues are to address by motivating grid companies, promoting technology innovations, developing a facilitating regulatory framework and so on.

4.3 Inter-regional Transmission Capacity Expansion

With in-grid renewable capacity either from centralized plants or through grid integration by distributed plants, the next step to utilize it efficiently is to transmit it across provinces and regions within the grid. As explained earlier, there is a mismatch between renewable resources (and thus supply) and demand; most Chinese renewables, especially wind and solar, are found in the north and west, whereas the central and eastern China need them more (Zhao 2016; State-owned Assets Supervision and Administration Commission of the State Council 2018). Inter-regional transmission copes with such situation (after grid integration) and helps to keep the national supply-demand balance overall. The West-to-East Power Transmission Project is a most famous practice. To some extent, it is the inter-regional transmission capacity that determines how much China could adjust the geographical supply-demand imbalance and how efficiently China could make use of its abundant renewable potential.

In 2003, the second year in Phase I of the power sector reform, the Chinese government released a document to regulate inter-regional and –provincial energy dispatch (former State Electricity Regulatory Commission of China 2003). The document sets basic principles for power distribution across regions and since created more need for inter-regional transmission. Later in 2017, China aims to add 130 GW of inter-regional transmission capacity in the 13th FYP period (2016–2020), accumulating to 270 GW by 2020 (National Development and Reform Commission of China 2017a, b). Phase II of the power sector reform also put a focus on inter-regional transmission. In November 2017, the national government called for efficient use and further development of existing inter-regional transmission infrastructure in the Implementation Plan of Addressing Hydro, Wind and Solar Curtailment (National Development and Reform Commission of China; National Energy Administration of China 2017). Just one month later, the Provisional Rules on Setting Transmission Tariff of Inter-regional Transmission Projects was published to complete the system with a pricing mechanism (National Development and Reform Commission of China 2017a, b). In 2018, another policy document, the Guiding Opinion on Improving Self-adjusting of the Power System, proposes to increase the share of renewables in total inter-regional transmission capacity, and sets a target to utilize 70 GW of new and renewable energy during the 13th FYP, of which 40 GW or more should be renewables from northern China. It also reminds to enhance the grid infrastructure for reliable inter-regional transmission (National Development and Reform Commission of China; National Energy Administration of China 2018).

By the end of 2018, inter-regional transmission capacity in China reached 140 GW (China Electricity Council 2019a, b), attributing to proactive policies and actions mentioned above. The capacity transmitted across regions and provinces in 2018 was 481 TWh and 1294 TWh, respectively, 13.5% and 14.6% more than the previous year (China Electricity Council 2019a, b). However, to achieve the 270 GW goal by 2020, the inter-regional transmission capacity needs to double in the next two years, posing pressure on the government and grids. Looking further, China sets targets to reach 680 GW of installed renewable capacity by 2020 and 20% of non-fossil share in primary energy demand by 2030 (National Development and Reform Commission of China 2015, 2016a, b) both requiring the country to continuously speed up expanding its inter-regional transmission capacity while reinforcing other utilization mechanisms. Moving forward with ongoing growth in economy and energy consumption, north-to-south transmission may be prompted on the agenda while stabilizing the West-to-East Power Transmission Project, as northern China is rich in wind energy and could add to inter-regional transmission sources with necessary capacity expansion (Wang 2019).

5 Conclusions

China has started its transition to a cleaner economy in the past decade and has been accelerating the deployment of renewable energy ever since. It now has the world’s largest renewable energy market and top manufacturers for solar panels and wind turbines. China is also leading in new installations of renewable energy.

The domestic needs for improving air quality, ensuring energy security, and developing renewable energy industry could sustain the growth in renewable energy. Meanwhile, there are emerging issues associated with increasing renewable energy deployment. The most substantial one is the mismatch between energy supply and demand, which lead to high curtailment rates. If issues on grid integration and inter-regional transmission could be fully addressed in the current power sector reform, it could significantly accelerate renewable energy deployment in China in the near future.

Power system flexibility is critical to renewable energy integration. Intermittent renewable energy technologies could create short-term supply fluctuations and pose challenges to the power grid. Having load-following services to the grid could help balance electricity supply and demand. Coal-fired power plants could be retrofitted to provide such services, and cleaner, more efficient options, such as gas fired power plants, can also be used for load following.

Demand side response and electricity storage are also crucial for unlocking grid flexibility. The Chinese government has developed several pilots on demand side management/response and tested out several measures, such as demand-side distributed energy storage system, load shifting, time-variant electricity prices, and different electricity prices by sector. To further improve power system flexibility and increase the share of renewable energy, more active demand response measures, beyond traditional demand side management and energy efficiency improvement, are needed. This would include dynamic load shifting and curtailment, as well as structural changes in electricity demand.

Accelerated deployment of renewable energy in China could bring significant benefits to China and the world. Expanding renewable power generation could help reduce greenhouse gases and air pollutant emissions in China and contribute to the Paris Agreement goals. It can also facilitate China’s transition towards low-carbon economy and high-quality growth, while lowering costs of clean energy technologies globally.

Notes

- 1.

The name of the Ministry changed several times, but the most commonly mentioned one is the Ministry of Power Industry.

- 2.

The power tariff in China had used to be fully set by the national government; conditional tariff variations allowed for price setting from the power company side under certain circumstances, yet the price needed review and approval by government departments.

- 3.

The State Power was initially staffed with workforce from the Ministry, i.e. a state-owned power company with some government administrative functions, but one year later the national government revoked the Ministry, separating government functions from enterprise management of the State Power.

- 4.

During Phase I of the reform, a pilot on-grid tariff bidding system was implemented in the northeast of China, yet stopped due to deficits of generation companies. Policymakers decided to postpone the bidding plan as it might not be the right timing, so the majority in the power market traded at the government benchmark price on the supply side, with some variations such as the step tariff, differential tariff and punitive tariff on the demand side. During this period, the government also piloted direct power purchase (from generation companies) by large power users.

- 5.

The transmission and distribution tariff has long been set by the grid companies with the retail tariff minus the on-grid tariff, creating a fuzzy zone in the pricing mechanism.

- 6.

The only provision in the Plan that relates to renewables is to work out a new pricing mechanism that internalizes environmental costs of power generation and encourages clean energy development.

- 7.

Renewable energy proportions may vary with provinces. And provinces may get incentives for consuming more renewable energy than their assigned proportions.

- 8.

Supplying only local energy demand as opposed to connected to grids.

References

Chen, X., and J. Zhang 2018. Expert: Renewables as China’s Inevitable Route to Energy Independence. [Online] Available at: http://www.xinhuanet.com/world/2018-12/12/c_1123842216.htm. Accessed 4 Sep 2019.

China Electricity Council. 2019a. Annual Report of China Power Industry Development 2019. Beijing: China Building Industry Press.

———. 2019b. National Power Supply-Demand Analysis and Projection Report 2018–2019. Beijing: China Electricity Council.

China Renewable Energy Engineering Institute. 2019. China Renewable Energy Development Report 2018. Beijing: China Water and Power Press.

Chinese Communist Party Central Committee; State Council of China. 2015. The Chinese Communist Party Central Committee’s and the State Council’s Opinions on Further Deepening the Power Sector Institutional Reform. [Online] Available at: http://tgs.ndrc.gov.cn/zywj/201601/t20160129_773852.html

de Oliveira Vasconcelos, D. 2018. The Stumbling Blocks to China’s Green Transition. [Online] Available at: https://thediplomat.com/2018/04/the-stumbling-blocks-to-chinas-green-transition/

Energy Research Institute; China National Renewable Energy Center. 2018. China Renewable Energy Outlook 2018 – Executive Summary. Beijing: China National Renewable Energy Center.

Former State Electricity Regulatory Commission of China. 2003. Provisional Rules on Optimal Inter-Regional and – Provincial Energy Allocation. [Online] Available at: http://www.gov.cn/gongbao/content/2003/content_62518.htm

Gao, L. 2012. Hard to Break the Bottleneck: Grid Integration of Clean Energy. [Online] Available at: https://newenergy.in-en.com/html/newenergy-1301523.shtml

Hanada, Y. 2019. China’s Solar Panel Makers Top Global Field But Challenges Loom. [Online] Available at: https://asia.nikkei.com/Business/Business-trends/China-s-solar-panel-makers-top-global-field-but-challenges-loom

Hou, X., and S. Li 2018. Annual Power Generation of Three Gorges Reaches 100 TWh for the First Time (in Chinese). [Online] Available at: http://www.xinhuanet.com/fortune/2018-12/21/c_1123886120.htm. Accessed 28 Aug 2019.

Huang, X., and J. He. 2019a. Examination of the Current Electric Power Law: Government Guide Tariff to Be Adjusted. [Online] Available at: http://shoudian.bjx.com.cn/html/20190222/964508.shtml

Huang, X., and He, J. 2019b. Necessities for Immediate Amendments to the Electric Power Law. [Online] Available at: http://shoudian.bjx.com.cn/html/20190218/963208.shtml

IRENA. 2019. Renewable Capacity Statistics 2019. Abu Dhabi: International Renewable Energy Agency (IRENA).

Li, C. 2012. Spare Wind Capacity in 2011 Reaches 10 TWh. [Online] Available at: http://finance.ce.cn/rolling/201204/12/t20120412_16857930.shtml

Li, L., and S. Dai. 2006. Electric Power Laws and Regulations. S.l.: China Higher Education Press.

Liu, G., 2019. Review of the Power Sector Reform Progress in 2018 and Vision of 2019. China Power Enterprise Management.

National Development and Reform Commission of China. 2007. Mid- to Long-term Plan of China Renewable Energy Development. Beijing: s.n.

———. 2015. China’s Nationally Determined Contribution: Enhanced Actions on Climate Change. [Online] Available at: https://www4.unfccc.int/sites/ndcstaging/PublishedDocuments/China%20First/China%27s%20First%20NDC%20Submission.pdf

———. 2016a. Renewable Energy Development Plan During the 13th FYP Period. Beijing: s.n.

———. 2016b. The Administrative Regulation on Guaranteed Full Purchase of Renewable Generation Capacity. Beijing: s.n.

———. 2017a. The 13th FYP for Power Sector Development (2016–2020). [Online] Available at: http://www.ndrc.gov.cn/zcfb/zcfbghwb/201612/P020161222570036010274.pdf

———. 2017b. The Provisional Rules on Setting Transmission Tariff of Inter-regional Transmission Projects. [Online] Available at: http://www.ndrc.gov.cn/zcfb/gfxwj/201801/W020180103518566822771.pdf

———. 2018. Action Plan on Clean Energy Utilization (2018–2020). Beijing: s.n.

———. 2019. National Development and Reform Commission’s Notice to Fully Open Up Generation and Consumptions Plans of Non-public Power Consumers. [Online] Available at: http://www.ndrc.gov.cn/zcfb/zcfbtz/201906/t20190627_939771.html

National Development and Reform Commission of China; National Energy Administration of China. 2017. The Implementation Plan of Addressing Hydro, Wind and Solar Curtailment. [Online] Available at: http://www.gov.cn/xinwen/2017-11/14/5239536/files/79efc0156c52423c909442dcb732d3f6.pdf

———. 2018. The Guiding Opinion on Improving Self-adjusting of the Power System. [Online] Available at: http://www.ndrc.gov.cn/zcfb/zcfbtz/201803/t20180323_880126.html

———. 2019a. The National Development and Reform Commission’s and the National Energy Administration’s Notice on the Fourth Batch of Pilot Additions of Power Distribution Business. [Online] Available at: http://www.gov.cn/xinwen/2019-06/26/content_5403305.htm

———. 2019b. The Notice to Establish and Strengthen the Guaranteed Power Utilization Mechanism for Renewable Energy. Beijing: s.n.

National Energy Administration of China. 2019a. Introduction to Grid-connected Operation of Renewable Energy in 2018. [Online] Available at: http://www.nea.gov.cn/2019-01/28/c_137780519.htm

———. 2019b. Statistics on Solar PV Generation in 2018. [Online] Available at: http://www.nea.gov.cn/2019-03/19/c_137907428.htm

National Energy Administration of China; Energy Research Institute; Chinese Renewable Energy Industries Association; China Renewable Energy Society Industry Committee. 2007. China Renewable Energy Industry Development Report 2006. Beijing: National Energy Administration.

State Council of China. 2002. Power Sector Institutional Reform Plan. [Online] Available at: http://www.gov.cn/zhengce/content/2017-09/13/content_5223177.htm

State Grid Corporation of China. 2013. State Grid Officially Publishes the Opinion on Providing Good Services for Grid Integration of Distributed Energy. [Online] Available at: http://www.cec.org.cn/yaowenkuaidi/2013-02-28/97882.html

State-owned Assets Supervision and Administration Commission of the State Council. 2018. State Grid: Inter-Regional and – Provincial Transmission Capacity to Reach 250 GW in 2020. [Online] Available at: http://power.in-en.com/html/power-2305412.shtml

The Central Government of China. 2009. The Renewable Energy Law, Amendment of 2009. [Online] Available at: http://www.gov.cn/flfg/2009-12/26/content_1497462.htm

TrendForce Corp. 2019. Seven Keywords to Summarize Power Sector Reform Progress in 2018. [Online] Available at: https://www.energytrend.cn/news/20190202-64386.html

Wang, L. 2012. Solar PV Industry Trapped in Institution. [Online] Available at: http://www.jjckb.cn/2012-02/10/content_357145.htm

Wang, Y. 2019. Dealing with Tight Supply-Demand in the Future: West-to-East to Stabilize and North-to-South to Increase. [Online] Available at: http://www.ce.cn/cysc/ny/gdxw/201906/21/t20190621_32413192.shtml

Wang, X., and W. Chen. 2015. News Background: Power Sector Reform Milestones in China Since the Opening-Up Policy. [Online] Available at: http://www.xinhuanet.com/politics/2015-03/25/c_1114763449.htm

Wang, S., B. Zhao, Y. Wu, and J. Hao. 2015. Target and Measures to Prevent and Control Ambient Fine Particle Pollution in China. China Environmental Management 7 (2): 37–43.

Zhang, G. 2018. Practice and Experience of Power Sector Institutional Reform in China. In Records and Narratives of Decisionmaking and Construction in Cross-Century Projects, 246–263. Beijing: People’s Publishing House of China.

Zhao, K. 2016. Key to Wind Energy Utilization in China: Inter-Regional Transmission and Energy Structure Transformation. [Online] Available at: https://newenergy.in-en.com/html/newenergy-2269506-2.shtml

Zhu, T. 2019. Phase of China Renewable Energy Development and Challenges Faced. China National Conditions and Strength 2019 (07): 8–12.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Tan, Q., Yu, S. (2021). Dynamics of Renewable Energy in China: Drivers and Challenges. In: Janardhanan, N., Chaturvedi, V. (eds) Renewable Energy Transition in Asia. Palgrave Macmillan, Singapore. https://doi.org/10.1007/978-981-15-8905-8_6

Download citation

DOI: https://doi.org/10.1007/978-981-15-8905-8_6

Published:

Publisher Name: Palgrave Macmillan, Singapore

Print ISBN: 978-981-15-8904-1

Online ISBN: 978-981-15-8905-8

eBook Packages: EnergyEnergy (R0)