Abstract

Cross-border mergers and acquisitions (M&A) are inherently afflicted by additional complexities and “liability of foreignness” on account of the home-host distances, often influencing the strategic decisions involving the deals. Extant studies have often alluded to unidimensional reasons like culture and geographic distance, but have not focused enough on disaggregated multi-dimensional institutional distance approach which may expectedly provide a better understanding of the choices being made in the market for corporate control. This research seeks to investigate the impact of home-host distance on the acquirer’s ownership structure choices in an emerging market setting using measures of institutional distance including cultural, geographic, financial, administrative, global connectedness, knowledge, economic, demographic and economic distances. For this purpose, 1542 completed M&A deals involving Indian firms, as target or acquirer, constitute the sample for the study. The results confirm to the fact that (multi-dimensional) home-host country distances causing institutional dynamics are factored in choosing a foreign target.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Cross-border mergers and acquisitions bring with it a pack of peculiarities owing to home-host country differences and are conceivably more exposed to challenges vis-à-vis their domestic counterparts. Dealing with cross-border targets requires coordination across home-host differences, over a spectrum of dimensions, including but beyond the traditionally utilised geographic and cultural measures. Unfamiliarity with target environment or the lack of requisite skills to manage those may prove to be hazardous. Concerns over establishing legitimacy also increases with the increase in home-host distances, driving the “liability of foreignness” and hence causing performance difficulties and adding to costs [1,2,3,4]. As a strategic response to the external institutional risks and deal peculiarities, a firm may accordingly adjust its level of ownership acquired in the target firm, balancing with the desired level of control, resource commitment and risks [5]. Linked with survival, performance and stability, the choice of ownership level to be acquired represents a crucial decision and does warrant a special attention. The extant research in the area has majorly relied on the unidimensional traditional measures of geographic or cultural distance. The present study aims to provide an emerging market evidence, utilising dual perspective of both inbound and outbound deals, for the impact of institutional distance on the strategic choices involved in cross-border M&A.

Drawing from the institutional and resource-based theory, it is argued that foreign firms either conform to the pressures of local isomorphism or have to import firm-specific capabilities [2]. To meet the host country needs, a firm may choose to imitate the local organisational practices, hence motivating the partial ownership in the target to benefit from the local expertise and knowledge. While if a firm decides to gain competitive advantage through its organisational capabilities, majority or full ownership may seem to be incentivising. The efforts in managing the regulatory, cognitive and cultural differences, attaining local legitimacy and transferring practices also increase as the home-host nations get more distant [2]. Acquirers could comprehend and adjust more easily in case of similar home-host legal institutional environment [4]. In case of large home-host distances, acquirers are able to diversify their risks, while at the same time are exposed to higher uncertainties and lack of knowledge on host environment. The nine institutional distance dimensions, as proposed by Berry et al. [6], are utilised in this research. These include “economic, financial, political, administrative, cultural, demographic, knowledge, and global connectedness as well as geographic distance”. This study aims to contribute to the literature in at least three ways. First, utilising a disaggregated institutional distance framework, the study provides a more comprehensive insights on cross-country distance over the much prevalent unidimensional measures [7]. Second, given a significant chunk of extant M&A studies focused on the developed markets, it would be worthwhile to conduct the study in an emerging market context owing to their distinctiveness and growing role in the global landscape [8]. The emerging markets are arguably more prone to challenges posed by distance due to their dynamic and vulnerable home country conditions. While it might be convenient to assume all emerging nations to be facing similar institutional challenges, but practically, significant differences exist across emerging nations demanding a focused study [9]. Being credited with several big-ticket deals and having emerged as a significant player in the global M&A landscape, India warrants a special focus on the institutional determinants of strategic choices. Third, the study presents a broader understanding by providing a comparative view between the inbound and outbound deals involving Indian firm.

The paper proceeds as follows. The following section covers a brief review of the related literature on cross-border M&A, institutional distance and ownership structure. The detailed research methodology is followed by the results, discussions and implications. The final section concludes the paper and provides suggestions for future research.

2 Literature Review

2.1 Institutional Distance

The world is turning into a level playing field with the advancements in information technologies and reducing national barriers [10]. Yet it still would be dangerous to undermine the influence of cross-country distance. While entering a foreign land, companies are faced with challenges caused by distance resulting in increased costs and risks [11]. A range of cross-country distance measures needs to be recognised and used as explanatory variables to gain meaningful insights on distance effect. Despite much criticism, Geert Hofstede’s dimensions of cultural distance remain at the heart of cross-country research ever since it was made available through his book “Culture’s consequences: International differences in work-related values” in 1980 [12]. A crucial assumption underlying these measures was the highly time unvarying nature of it. Kogut and Singh [13] proposed a method of calculating composite culture distance index using the underlying cultural dimensions by adapting the Euclidean distance metric. The Kogut and Singh index has since gained much popularity, albeit not without criticism [14].

The power of unidimensional approach in studying distance stays limited; hence, a multi-dimensional approach, simultaneously studying multiple distance dimensions, is recommended [15]. Over the time, institutional distance has catapulted as a leading approach for investigating the cross-country differences and often delved in to study its influence on various dependent variables such as strategic decision, costs and performance. It has been propounded as a complementary rather than a replacement to the individual constructs like culture, to capture the broader spectrum of national differences [13]. Multiple attempts have been made at defining and operationalising it. One such momentous attempt was at underlining the three pillars of institutional framework, encompassing normative, regulatory and cognitive pillar [16]. Yet another classification adopted in studies is of informal and formal institutional distance [17]. While providing as a simplistic approach, it misses out on the detailed and comparative analysis for encompassing individual dimensions. The CAGE Framework proposed cultural, administrative, geographic and economic dimensions [11, 18]. Delineating the multi-dimensional nature of distance with a nine-dimensional disaggregated measure, Berry et al. [6] proposed an institutional framework for cross-country distance. It included cultural distance, geographical distance, administrative distance, financial distance, global connectedness distance, knowledge distance, economic distance, demographic distance and political distance. These nine dimensions can be looked at as accommodating and rather extending the previously proposed measures. His contribution has been widely acknowledged and utilised for further studies.

2.2 Cross-Border M&A, Institutional Distance and Ownership Structure

The studies have often considered national characteristics as a salient determinant of cross-country deal flows [19]. Supported by theories like “cost of doing business abroad”, “Liability of Foreignness”, “Liability of origin” and “Liability of multi-nationality”, cross-country institutional distance constitutes a crucial source of risk for companies venturing on to foreign lands. More the host country be institutionally distant from the home country, higher the liability of foreignness faced by a firm and hence higher are the efforts in managing [3]. Also, being a “stranger in a strange land” involves unfamiliarity hazards, discrimination hazards and relational hazards [3, 20]. A possible remedy to these hazards can be continued involvement of the local partner to benefit from its legitimacy, knowledge and expertise [21]. Hence, the possible hazardous institutional pressures may favour a minority stake for the acquirer firm. The strategic choice of the level of ownership stake, minority versus majority ownership, to be acquired in a deal represents one of the most crucial decisions. Minority acquisition represents “distinct organisational strategy” and comes up as a favoured option to gain more insights into the anticipated synergies and keep target managerial incentives intact [22]. Demanding lower levels of resource commitments, it provides an edge over contractual relationships facilitating cooperation between two firms [23]. It is well connected to the level of control desired by the acquirer firm [24] and requires to strike a balance among the levels of resource commitment and risk. Higher stakes may be only preferred when the acquirer is confident about the post-acquisition performance as well as its management abilities. Firms are often argued to prefer a lower ownership strategy as the home-host institutional distance increases, though the results far from being conclusive and varying for each of the distance dimensions [3, 25]. Also, in cases of uncertainty like in case of doubtful target valuation, partial acquisition is often a preferred strategy taking assurance from the targets continued stakes [26].

Underlining the choice of ownership structure as a strategic response to the uncertainties of operating in an institutionally distant country, a recent study by Ferreira et al. [5] investigated the impact of institutional distance on the ownership strategy for the Brazilian acquisitions during the period of 2008–2012. The financial, cultural and geographic distances were found to be significant factors influencing ownership levels. Utilising informal and formal institutional distance dimensions, Ellis et al. [27] examined the institutional determinants of ownership structure in the African context for the period 2008–2014. While the informal distance was found to be negatively related to the ownership position, the formal institutional distance was reported to be positively related. Even while focusing on similar distance dimensions, conflicting results have been reported. Like, of the studies focusing on the cultural distance, a few have reported larger cultural distance to be encouraging full ownership [5, 28], while some found otherwise [25, 29]. Partial ownership in case of culturally distant nations is seemed preferable given the increasing need to preserve the high-powered incentives for integrating target firm managers and incentivising tacit knowledge sharing [30]. However, with the peculiarities of deals involving emerging market firms, the motivations for majority ownership vs. minority ownership may differ [31] and hence may impact the ownership choices differently. M&A deals emerging out of emerging market often aim synergistic gains through taking control of tangible as well as the intangible resources motivating majority or full ownership. Some of the synergistic benefits can only be realised through nothing less than a majority acquisition.

3 Methodology

3.1 Data Collection and Sample

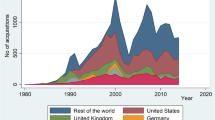

The sample for the study comprises completed Indian cross-border M&A deals announced from 1 January 2010–31 December 2015 as listed on Thompson Reuters Eikon database (now Refinitiv Eikon). For comparison, the sample was bifurcated as inbound and outbound deals. To avoid misleading results, the deals wherein only the remaining interest was being acquired have been eliminated. Further, each deal was individually matched with the set of nine home-host country distance dimensions by the year and country pair. The distance data for eight out of nine measures are sourced from Berry et al. [6], available through their official Website. Due to the limited availability of cultural data in Berry et al. [6], the Traditional Euclidean Hofstede-based cultural distance index, given by Beugelsdijk et al. [32], was utilised for measuring cultural distance. Few observations had to be dropped due to non-availability of data, resulting in the final sample of 1542 deals, of which 422 are of outbound deals and 1120 inbound deals. The top five inbound acquirer countries, for the completed deal count, are the USA, Singapore, Mauritius, Japan and the United Kingdom, whereas the top target countries are the USA followed by the United Kingdom, Germany, Singapore and Australia.

3.2 Measures

The acquirer ownership level post-M&A deal forms the dependent variable of the study. In line with the previous research [22, 33] and the objective of the present research, the dependent variable takes dichotomous form with a cutoff at 50% of the stakes acquired. Majority ownership (more than 50% in target), signifying greater control, is accompanied with higher resource commitment and risk. Taking brackets of equity ownership which defines distinct strategic choices is an appropriate method since the motive of the study is to study the choice of ownership structures (and not predict the exact percentage of stake acquired) [34]. It takes the value of “1” if the more than 50% of the stakes are acquired indicating majority ownership, and “0” otherwise.

The impact of home-host country distance is studied using disaggregated institutional distance measures, thus recognising their varying impacts. The nine-dimensional approach as given by Berry et al. [6] is utilised for the study. These include cultural distance, geographical distance, administrative distance, financial distance, global connectedness distance, knowledge distance, economic distance, demographic distance and political distance. Each of the nine dimensions of institutional distance, presenting the extent of inter-country differences, is studied individually for its impact on the acquirer ownership levels to provide a comparative as well as a broader view. A dummy variable for relatedness is also included in the analysis.

4 Results and Discussion

The dependent variable used for the study is of dichotomous nature, viz. majority ownership vs. minority ownership. Hence, binary logistic regression has been used to meet the requirements of the data [35]. The sample size requirements are satisfied with over fifteen hundred observations included in the analysis. Table 1 presents the collinearity diagnostic test results. Variance inflation factor (VIF) values all below five and none of the variables had a tolerance level below 0.2. Hence, the problem due to multicollinearity could be ruled out [36, 37]. The analysis is carried on in three sections with the sample of cross-border M&A deals involving: inbound deals, outbound deals and all deals combined. Table 2 presents the results for the binary logistic regression.

The results for the sample of inbound deals confirm that the nine institutional distance parameters when considered together are able to significantly predict the choice of ownership structure with Chi-square = 172.369, df = 10, N = 1120, p < 0.001 exhibiting an excellent level of overall fit. The odds ratio or the exponential of “B” (log-odds) value indicates the change in odds resulting from a unit change in the predictor variable. The odds ratio presented in Table 2 should be interpreted as the change in odds of majority ownership as compared to minority ownership. In the model, financial, cultural, global connectedness, knowledge, economic and administrative distances are found to be significant predictors for the ownership structure choices. Financial, knowledge and cultural distances with lower than one value of odds ratio signify, ceteris paribus, decreasing odds of majority ownership with a unit increase in these predictor variables. The increased distance across these dimensions may motivate shared ownership with the local partners for utilising their expertise and overcoming the liability of foreignness. The political distance measure constituting of home-host democracy difference, stability and trade bloc memberships is reported to be insignificant and very close to zero indicating its indifference in influencing ownership structure choices for Indian inbound deals. India represents the largest democracy in the world with a high level of political stability as well as cordial trade relations with most of the nations around the globe. Robust Indian business environment and favourable policy regimes have ensured foreign capital inflows in the country (IBEF 2019), whereas with a greater-than-one and significant odds ratio, the likelihood of majority acquisition increases in case of increase in global connectedness, economic and administrative distance. This implies that when economic, administrative and global connectedness distance is higher between India and the acquirer nation, acquirer firms have a higher likelihood of majority acquisition. Correspondingly, a majority acquisition is much more likely in case of related acquisitions. Also, for all the three sample groups, none of the significant predictor variables had the threshold value of one included in the odds ratio (exponential of log odds) confidence interval (C.I.). Hence, the observed direction of relationships can be said to be true for the population [37].

The complete model for the sample, including both Indian acquirer and target firms, is also found to be significant with Chi-square = 336.717, df = 11, N = 1542, p < 0.001. A dummy variable for the direction of deal as either inbound or outbound was included for the analysis. Global connectedness and economic distance have a significant positive association with the majority acquisition, increasing the odds of majority acquisition with every unit increase in distance, whereas an increase in the financial and knowledge distance between the home-host nation decreases the likelihood of majority acquisition. Unrelated acquisitions are associated with significantly lower odds of majority ownership. The majority and minority ownership structure choices are equally likely in case of geographic distance with an odds ratio of one. Hence, home-host geographic distance is not an influencing factor for deciding upon the ownership structure choices in cross-border deals involving Indian firms.

However, in case of Indian acquirer firms only administrative distance, constituted of differences across colonial ties, language, religion and legal system, is found to be a significant predictor for the choice of ownership structure. The results support decreasing odds of majority ownership with an increase in administrative distance between India and the host nation. Given the differences across administrative parameters, Indian firms may be apprehensive about going in for a majority acquisition for the involved post-acquisition difficulties involved in managing the target operations. The overall model for Indian acquiring firms, including all predictor variables, was also not found to be significant.

5 Conclusion

The study commenced with a view to understand the impact of institutional distance on the strategic choices involved in cross-border M&A. Building upon the institutional theory, this research examines the impact on the acquirer’s choice of ownership structure in the emerging market setting of India. The country pair and year-wise disaggregated measures for nine-dimensions of institutional distance, involving cultural, geographical, administrative, financial, global connectedness, knowledge, economic, demographic and political distance, were utilised for empirically testing the impact of cross-country distance.

For the firms entering a foreign land, liability of foreignness poses a critical challenge. Adopting an optimal level of ownership level, balancing the risks and returns, the company might well be able to successfully enter, sustain and reap the benefits in distant nations. The dimensions of cross-country distance may have differing influence, the knowledge of which shall be crucial for the managers involved in potential cross-border deals involving Indian firms for managing the institutional uncertainties. By structuring ownership level choices for managing the cross-country differences, a firm may establish competitive advantage in foreign land or choose to leverage on the local partner's knowledge, getting an edge over contractual relationships.

The study on the impact of cross-country distance on the ownership decisions has both strong theoretical contribution and managerial implication. Interestingly, the results suggest that the home-host geographic distance does not influence the choice of ownership structure in any of the three sub-samples. The present era backed by advanced information technology developments has virtually shrunken the geographic barriers across nations. While geographical proximity may mean more face-to-face contact, but being geographically distant does not impede knowledge acquisition nor may be related to relational ties or social proximity [38, 39]. Hence, the strategic decisions of a firm are more influenced by factors other than geographic proximity. Further, for the inbound deals, most of the institutional distance dimensions (financial, cultural, global connectedness, knowledge, economic and administrative distances), except the demographic and political distance, are found to be significant predictors for ownership structure choices. The acquirer-target relatedness is also found to be significant predictor favouring majority acquisition. Further, institutional proximity does not largely impact the level of ownership to be acquired in the case of Indian companies targeting foreign firms. For Indian acquirer companies, only administrative distance was found to be significant predictor, indicating distinct motives and other potential factors apart from cross-country distance. Thereafter, in the sample including both inbound and outbound cross-border M&A deals, global connectedness, financial, knowledge and economic distances along with firm relatedness were found to be statistically significant predictors. The future research efforts may be directed toward linking the extant knowledge with deal motivations to espouse deeper insights.

References

Wan F, Williamson P, Pandit NR (2020) MNE liability of foreignness versus local firm-specific advantages: the case of the Chinese management software industry. Int Bus Rev 29:101623

Zaheer S (1995) Overcoming the liability of foreignness. Acad Manag J 38:341–363

Eden L, Miller SR (2004) Distance matters: Liability of Foreignness, Institutional Distance and Ownership Strategy. In: Hitt MA, Cheng JLC (eds) Theories of the Multinational Enterprise: Diversity, Complexity and Relevance. Adv Int Manage, vol. 16, Emerald Group Publishing Limited, Bingley, pp 187–221

Kostova T, Zaheer S (1999) Organizational legitimacy under conditions of complexity. Acad Manag Rev 24:64–81

Ferreira MASPV, Vicente SCDS, Borini FM, Almeida MIRD (2017) Degree of equity ownership in cross-border acquisitions of Brazilian firms by multinationals: a strategic response to institutional distance. Rev Adm 52:59–69

Berry H, Guillén MF, Zhou N (2010) An institutional approach to cross-national distance. J Int Bus Stud 41:1460–1480

Dong L, Li X, McDonald F (2019) Distance and the completion of Chinese cross-border mergers and acquisitions. Balt J Manag 14:500–519

Lebedev S, Peng MW, Xie E, Stevens CE (2015) Mergers and acquisitions in and out of emerging economies. J World Bus 50:651–662

Adeola O, Boso N, Adeniji J (2018) Bridging institutional distance: an emerging market entry strategy for multinational enterprises. In: Aggarwal J, Wu T (eds) Emerging issues in global marketing: a shifting paradigm. Springer, Cham, pp 205–230

Friedman TL (2005) The world is flat: a brief history of the twenty-first century. Farrar, Straus and Giroux, New York

Ghemawat P (2001) Distance still matters. Harv Bus Rev 79:137–147

Hofstede G (1980) Culture’s Consequences: International Differences in Work-Related Values. Sage, Beverly Hills, CA

Kogut B, Singh H (1988) The effect of national culture on the choice of entry mode. J Int Bus Stud 19:411–432

Konara P, Mohr A (2019) Why we should stop using the Kogut and Singh index. Manag Int Rev 59:335–354

Sousa CMP, Bradley F (2008) Cultural distance and psychic distance: refinements in conceptualisation and measurement. J Mark Manag 24:467–488

Scott WR (1995) Institutions and organizations. Sage Publications, Thousand Oaks

North DC (1991) Institutions. J Econ Perspect 5:97–112

Ghemawat P (2007) Redefining Global Strategy: Crossing Borders in a World Where Differences Still Matter. Harvard Business School Press, Boston, Massachusetts, pp 33–64

Luong TA (2018) Picking cherries or lemons: a unified theory of cross-border mergers and acquisitions. World Econ 41:653–666

Zaheer S (2002) The liability of foreignness, redux: a commentary. J Int Manage 8:351–358

Makino S, Delios A (1996) Local knowledge transfer and performance: implications for alliance formation in Asia. J Int Bus Stud Spec Issue 905–927

Ouimet PP (2013) What motivates minority acquisitions? The trade-offs between a partial equity stake and complete integration. Rev Financ Stud 26:1021–1047

Fee CE, Hadlock CJ, Thomas S (2006) Corporate equity ownership and the governance of product market relationships. J Financ 61:1217–1251

Erramilli MK (1996) Nationality and subsidiary ownership patterns in multinational corporations. J Int Bus Stud 225–248

Malhotra S, Lin X, Farrell C (2016) Cross-national uncertainty and level of control in cross-border acquisitions: a comparison of Latin American and U.S. multinationals. J Bus Res 69:1993–2004

Chen SFS, Hennart JF (2004) A hostage theory of joint ventures: why do Japanese investors choose partial over full acquisitions to enter the United States? J Bus Res 57:1126–1134

Ellis KM, Lamont BT, Holmes RM (2018) Institutional determinants of ownership positions of foreign acquirers in Africa. Glob Strateg J 8:242–274

Padmanabhan P, Cho KR (1996) Ownership strategy for a foreign affiliate: an emperical investigation of Japanese firms. Manag Int Rev 36:45–65

Brouthers KD, Brouthers LE (2001) Explaining the national cultural paradox. J Int Bus Stud 32:177–189

Chari MD, Chang K (2009) Determinants of the share of equity sought in cross-border acquisitions. J Int Bus Stud 40:1277–1297

Liou R, Lee K, Miller S (2017) Institutional impacts on ownership decisions by emerging and advanced market MNCs. Cross Cult Strateg Manag 24:454–481

Beugelsdijk S, Kostova T, Roth K (2017) An overview of Hofstede-inspired country-level culture research in international business since 2006. J Int Bus Stud 48:30–47

Makino S, Beamish PW (1998) Performance ventures and survival of joint with ownership structures. J Int Bus Stud 29:797–818

Prashant K, Puranam P (2004) Choosing equity stakes in technology-sourcing relationships: an integrative framework. Calif Manage Rev 46

Leech NL, Barrett KC, Morgan GA (2005) SPSS for intermediate statistics: uses and interpretation. LAWRENCE ERLBAUM ASSOCIATES, London

Landau S, Everitt BS (2004) A handbook of statistical analyses using SPSS. Chapman & Hall/CRC, UK

Field A (2018) Discovering statistics using IBM SPSS statistics. SAGE Publications Inc, New York

Ganesan S, Malter AJ, Rindfleisch A (2005) Does distance still matter? Geographic proximity and new product development. J Mark 69:44–60

Ben Letaifa S, Rabeau Y (2013) Too close to collaborate? How geographic proximity could impede entrepreneurship and innovation. J Bus Res 66:2071–2078

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Kukreja, S., Maheshwari, G.C., Singh, A. (2021). Institutional Distance in Cross-Border M&As: Indian Evidence. In: Singari, R.M., Mathiyazhagan, K., Kumar, H. (eds) Advances in Manufacturing and Industrial Engineering. ICAPIE 2019. Lecture Notes in Mechanical Engineering. Springer, Singapore. https://doi.org/10.1007/978-981-15-8542-5_77

Download citation

DOI: https://doi.org/10.1007/978-981-15-8542-5_77

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-15-8541-8

Online ISBN: 978-981-15-8542-5

eBook Packages: EngineeringEngineering (R0)